Guangzhou R&F Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Guangzhou R&F Bundle

Guangzhou R&F's competitive landscape is significantly shaped by the bargaining power of buyers, who can drive down prices in the property market. The threat of new entrants, while potentially high due to capital requirements, is mitigated by established brand recognition and land acquisition challenges. Intense rivalry among existing developers, including major state-backed entities, further pressures profitability.

The complete report reveals the real forces shaping Guangzhou R&F’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The Chinese real estate sector, including developers like Guangzhou R&F, is significantly dependent on core materials such as steel, cement, and glass. The concentration of these raw material producers in the market directly impacts their leverage over buyers.

In 2024, the Chinese steel industry saw consolidation, with the top 10 producers accounting for over 40% of output. This concentration means fewer suppliers can dictate terms, potentially raising prices for developers.

Similarly, the cement and glass industries also exhibit a degree of supplier concentration. If a few dominant firms control a substantial portion of the market share for these essential building components, they gain considerable bargaining power.

This increased power for suppliers can translate into higher raw material costs for Guangzhou R&F. Such cost escalations directly squeeze profit margins for the developer, affecting overall financial performance.

The availability and cost of labor are crucial factors for Guangzhou R&F. In 2024, China's construction sector continued to grapple with labor shortages in certain skilled trades, putting upward pressure on wages. For instance, reports from early 2024 indicated a 5-8% increase in average construction worker wages in major metropolitan areas compared to the previous year, directly impacting project budgets.

A constricted labor market, where demand for workers outstrips supply, grants laborers increased bargaining power. This can lead to higher wage demands and potentially slower project timelines, particularly for specialized roles or in regions experiencing rapid development. Guangzhou R&F, like other developers, faces the challenge of securing sufficient skilled and unskilled labor at competitive rates to maintain project schedules and profitability.

Land is a fundamental resource for property developers like Guangzhou R&F, and its availability, particularly in prime urban locations, is often constrained and subject to government regulation in China. This scarcity can significantly enhance the bargaining power of land sellers.

When land is in high demand or subject to competitive auctions, sellers can command higher prices, directly increasing Guangzhou R&F's land acquisition costs. For instance, in 2024, land auction prices in major Chinese cities continued to show volatility, with some prime parcels seeing bids far exceeding initial valuations, directly impacting the economic feasibility of new projects for developers.

Financing Providers' Leverage

Guangzhou R&F's reliance on external funding, particularly from banks and financial institutions, grants these providers significant leverage. The property development sector is inherently capital-intensive, making consistent access to credit a vital necessity for ongoing operations and new projects.

In the current economic climate, characterized by a tightening credit environment, especially within China's real estate market, lenders hold increased bargaining power. This can translate into more stringent loan covenants, elevated interest rates, or demands for greater collateral from Guangzhou R&F. For instance, as of early 2024, many Chinese property developers faced difficulties in securing new financing, leading to renegotiations of existing debt terms.

- Financing Dependence: Guangzhou R&F's capital needs are substantial, making it reliant on external financial sources.

- Credit Environment Impact: A tightening credit market, prevalent in China's property sector, amplifies lenders' power.

- Lender Demands: Expect stricter loan terms, higher interest rates, and increased collateral requirements from financing providers.

- Market Data: Reports in late 2023 and early 2024 indicated a significant slowdown in new property financing approvals for Chinese developers.

Specialized Contractors and Technology Providers

Guangzhou R&F Properties, like many real estate developers, faces significant bargaining power from specialized contractors and technology providers. For critical, niche services such as bespoke architectural design, the implementation of advanced construction methodologies, or the integration of sophisticated smart building systems, R&F may find itself dependent on a select few highly skilled firms. These specialized suppliers possess unique expertise that is difficult to replicate, enabling them to negotiate favorable pricing. For instance, companies offering cutting-edge sustainable building materials or advanced energy management systems often operate in markets with fewer competitors, directly impacting project costs.

This reliance on niche expertise means these suppliers can often command premium rates. The developer’s need to ensure the quality, innovation, and timely completion of its projects, particularly in competitive urban markets like Guangzhou, often outweighs the desire to minimize costs on these specific inputs. In 2024, the demand for green building certifications and smart home technology continues to rise, further strengthening the position of providers in these specialized areas. Developers who fail to secure these capabilities risk delivering less competitive products.

Consider the following:

- Limited Supplier Pool: Developers often rely on a small number of firms for highly specialized construction techniques or innovative materials.

- High Switching Costs: Transitioning to a different specialized supplier can involve significant delays, redesign efforts, and re-qualification processes.

- Value-Added Expertise: Suppliers with unique technological capabilities or design acumen can justify higher prices due to the enhanced value they bring to the final product.

- Project Dependency: The success of high-profile or technically demanding projects hinges on the specialized skills of these contractors, giving them considerable leverage.

The bargaining power of suppliers for Guangzhou R&F is influenced by the concentration of raw material producers and the availability of skilled labor. In 2024, consolidation in the steel industry meant the top 10 producers controlled over 40% of output, potentially allowing them to dictate terms and increase prices for developers like R&F. Similarly, labor shortages in skilled construction trades in China led to wage increases of 5-8% in major cities by early 2024, impacting project budgets.

Land scarcity in prime urban areas, coupled with government regulations, also empowers land sellers. In 2024, land auction prices in major Chinese cities saw volatility, with some parcels exceeding valuations, raising acquisition costs for developers. Guangzhou R&F's dependence on external financing, particularly in a tightening credit environment as seen in early 2024, further strengthens lenders' bargaining power through stricter covenants and higher interest rates.

Specialized contractors and technology providers also hold significant sway due to their niche expertise and limited competition. The demand for green building and smart home technologies in 2024 enhanced the leverage of firms in these areas, as developers like R&F need these capabilities to remain competitive, often leading to premium pricing for these specialized inputs.

| Supplier Type | 2024 Trend/Impact | Effect on Guangzhou R&F |

|---|---|---|

| Raw Material Producers (Steel, Cement) | Industry consolidation; Top 10 steel producers > 40% output | Increased potential for price hikes, reduced negotiation leverage |

| Skilled Labor | Shortages in urban construction sectors | Higher wage demands (5-8% increase in major cities); Potential project delays |

| Land Sellers (Prime Locations) | Volatility in auction prices; High demand | Increased land acquisition costs, impacting project feasibility |

| Financial Institutions | Tightening credit environment in China's property sector | Stricter loan covenants, higher interest rates, increased collateral demands |

| Specialized Contractors/Tech Providers | Growing demand for green/smart building solutions | Premium pricing for unique expertise; Essential for competitiveness |

What is included in the product

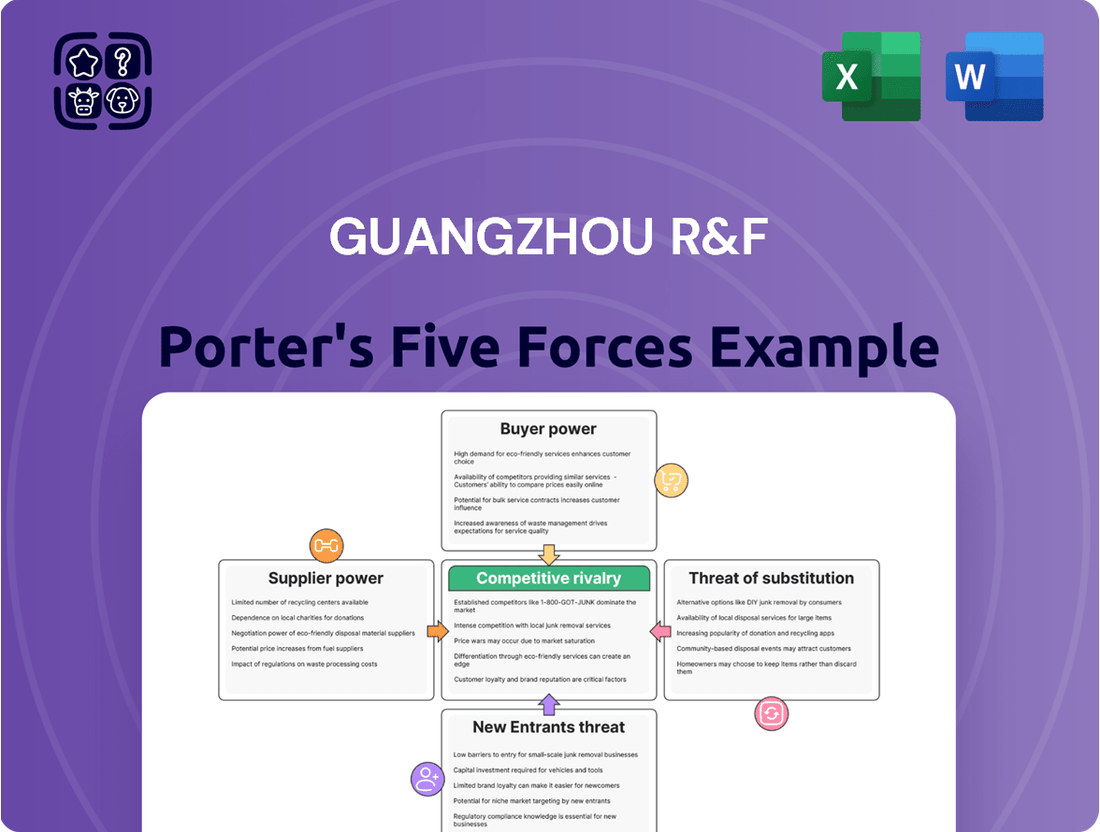

This analysis of Guangzhou R&F leverages Porter's Five Forces to dissect the competitive intensity, buyer and supplier power, threat of new entrants, and the impact of substitutes within its operating environment.

Visualize competitive pressures with an intuitive visual summary of Guangzhou R&F's Porter's Five Forces, simplifying complex market dynamics for actionable insights.

Customers Bargaining Power

Guangzhou R&F, like many developers in China, is navigating a challenging market marked by substantial property inventory and cautious buyer sentiment. This oversupply directly translates into increased bargaining power for potential customers, particularly concerning new, unfinished properties. Buyers are increasingly empowered to negotiate for more favorable pricing, flexible payment structures, or additional concessions.

In 2024, the Chinese property market has seen a notable slowdown, with reports indicating that unsold inventory in many major cities remains elevated. This situation intensifies buyer leverage, as developers are more motivated to secure sales amidst a competitive landscape. For instance, data from early 2024 suggested that the average sales cycle for new residential projects had lengthened, giving buyers more time and opportunity to negotiate terms.

The hesitancy among buyers, fueled by economic uncertainties and concerns about developer financial health, further amplifies their bargaining power. Potential purchasers are less willing to commit to purchases without significant assurances and attractive offers. This dynamic forces companies like Guangzhou R&F to offer more competitive pricing and enhanced incentives to move properties, directly impacting profit margins and sales strategies.

Customers looking at Guangzhou R&F's properties have a wide array of choices. They can opt for brand new developments, explore the second-hand market, or decide to rent instead of buy, all of which dilute the power Guangzhou R&F holds over any single customer.

The availability of government-subsidized housing, a growing segment in many urban areas, presents a more affordable alternative for a segment of the market. Furthermore, in 2024, the trend towards purchasing completed properties rather than off-plan units gives buyers more immediate options and reduces their reliance on any single developer's future pipeline.

Guangzhou R&F faces significant customer bargaining power, particularly due to heightened price sensitivity. In 2024, a challenging property market, marked by declining prices and economic headwinds, has made buyers acutely aware of affordability. This environment compels developers to offer concessions, impacting profitability.

The pressure to discount directly benefits customers, giving them a stronger hand in negotiations with Guangzhou R&F. For instance, reports from early 2024 indicated an average discount of 10-15% on new property launches in some Tier 1 cities to stimulate demand, a trend that Guangzhou R&F would likely have had to contend with.

Impact of Debt Restructuring on Confidence

Guangzhou R&F's ongoing struggles with offshore debt restructuring significantly impact buyer confidence. This financial instability creates an environment where customers, especially those considering pre-sold properties, feel empowered. They can leverage this uncertainty to negotiate better terms or seek out developers with a stronger financial standing, effectively increasing their bargaining power.

The company's 2024 financial disclosures, highlighting a substantial debt pile and ongoing restructuring efforts, directly fuel this buyer leverage. For instance, reports in early 2024 indicated that R&F was in talks to restructure billions in offshore debt. This situation prompts buyers to demand more favorable payment schedules, price reductions, or enhanced guarantees on project completion, as they perceive a higher risk associated with R&F’s ability to deliver.

- Eroded Confidence: Ongoing debt restructuring signals financial distress, making buyers hesitant.

- Increased Negotiation Power: Buyers can demand concessions due to perceived risk.

- Preference for Stable Competitors: Customers may shift to developers with stronger financial health.

- Impact on Sales: Uncertainty can lead to slower sales and pressure on pricing for Guangzhou R&F.

Commercial and Hotel Segment Customer Power

The bargaining power of customers for Guangzhou R&F's commercial and hotel segments is notably high. This is largely driven by market conditions characterized by elevated vacancy rates and a plentiful supply of similar properties. For instance, in many prime commercial districts, vacancy rates can hover around 10-15% or even higher, giving tenants considerable leverage.

This environment directly translates into pressure on rental income and occupancy levels. Corporate clients and potential tenants are aware of the numerous alternatives available, allowing them to negotiate more favorable lease terms, request rent reductions, or seek concessions on service charges. Similarly, in the hotel sector, a saturated market means guests and corporate bookers can often secure better rates and packages by comparing options from competitors.

- High Vacancy Rates: Commercial property vacancy rates in major Chinese cities have seen fluctuations, with some periods exceeding 12% in key office markets, empowering tenants.

- Abundant Supply: The continuous development of new commercial and hotel projects in Guangzhou and other major cities means customers consistently have a wide array of choices.

- Tenant Negotiation Power: This surplus of options allows tenants to demand lower rents, longer lease terms, or improved fit-out allowances, impacting Guangzhou R&F's revenue potential.

- Guest Choice in Hospitality: For hotels, the ability for guests and corporate travel managers to easily compare prices and amenities across numerous brands amplifies customer leverage.

Guangzhou R&F faces substantial customer bargaining power, particularly due to high price sensitivity and a challenging property market in 2024. Economic headwinds and buyer hesitancy force developers to offer concessions, impacting profit margins.

The company's ongoing offshore debt restructuring and financial instability further empower buyers, who can leverage this uncertainty to negotiate better terms or opt for financially stable competitors. This situation directly impacts sales velocity and pricing strategies.

In the commercial and hotel sectors, high vacancy rates and abundant supply grant tenants and guests significant leverage to negotiate favorable lease terms, rent reductions, or better packages, directly affecting Guangzhou R&F's revenue streams.

| Factor | Impact on Bargaining Power | 2024 Relevance |

| Property Oversupply | Increases buyer leverage | Elevated unsold inventory in major cities |

| Economic Uncertainty | Heightens buyer caution and negotiation | Concerns about developer financial health |

| Debt Restructuring | Amplifies perceived risk, empowers buyers | Billions in offshore debt talks, impacting confidence |

| Market Saturation (Commercial/Hotel) | Grants tenants/guests negotiation power | High vacancy rates (e.g., 10-15% in some office markets) |

Same Document Delivered

Guangzhou R&F Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Guangzhou R&F, providing an in-depth examination of the competitive landscape within the real estate sector. The document you see here is the exact, professionally formatted analysis you will receive immediately upon purchase, ensuring no surprises. You'll gain immediate access to a detailed breakdown of buyer power, supplier power, the threat of new entrants, the threat of substitutes, and the intensity of rivalry faced by Guangzhou R&F. This is the complete, ready-to-use analysis file; what you're previewing is precisely what you get, fully formatted and ready for your strategic decision-making.

Rivalry Among Competitors

The Chinese property development landscape is intensely competitive and highly fragmented. Guangzhou R&F contends with a vast array of local, national, and state-owned developers, all actively pursuing market share. This crowded field means constant pressure on pricing and margins.

Major state-owned enterprises (SOEs) represent a significant competitive threat. These entities often benefit from government support, including preferential policies and easier access to financing, which can give them an edge over private developers like Guangzhou R&F. For instance, in 2023, SOEs continued to dominate land auctions in prime locations across major Chinese cities.

The sheer number of developers means that even smaller, agile players can carve out niches and challenge established companies. This diffusion of market power intensifies rivalry, forcing all participants to remain highly efficient and innovative to succeed.

China's property market slump, characterized by falling sales and prices, creates fierce competition. Guangzhou R&F faces pressure as developers slash prices and offer incentives to clear substantial unsold inventory, impacting profitability.

By the first half of 2024, many Chinese developers reported significant drops in revenue, with some experiencing double-digit percentage declines. This environment forces companies like Guangzhou R&F to aggressively compete on price, eroding margins.

Guangzhou R&F's competitive landscape is intensified by substantial fixed costs inherent in property development, encompassing land acquisition and construction expenses. These significant upfront investments create a high barrier to entry and also influence existing players' behavior.

Furthermore, high exit barriers, such as extensive land banks and ongoing projects that cannot be easily divested, force developers like R&F to persist even when market conditions are unfavorable. This commitment to existing assets intensifies competition as companies strive to generate necessary cash flow, often leading to aggressive pricing or sales tactics.

For instance, in 2023, the Chinese property market faced considerable headwinds, with many developers, including R&F, grappling with liquidity challenges. The sheer scale of unfinished projects and undeveloped land held by major players means they are compelled to continue sales efforts to manage debt and operational costs, directly fueling rivalry.

Brand Reputation and Project Delivery

In the current real estate climate, where buyers are understandably wary of project completion, a developer's brand reputation and proven track record of timely delivery become paramount competitive differentiators. Guangzhou R&F, navigating its debt restructuring, faces intensified rivalry as it strives to rebuild buyer confidence against more financially robust competitors.

This situation directly impacts competitive rivalry, as developers with stronger, more reliable brands can command greater buyer loyalty and secure sales more easily, even in challenging market conditions. For Guangzhou R&F, demonstrating a clear commitment to project completion and transparent communication is essential to counter negative perceptions and compete effectively.

- Brand Trust: A strong brand reputation can mitigate buyer concerns about project delays, allowing developers to maintain sales momentum.

- Delivery Prowess: Consistent on-time project delivery is a key indicator of financial stability and operational capability.

- Competitive Pressure: Guangzhou R&F's restructuring efforts heighten the competitive pressure from developers with unblemished delivery records.

- Market Perception: In 2024, market sentiment heavily favors developers with a demonstrated history of fulfilling their commitments.

Policy-Driven Market Dynamics

Government policies are a major force in the real estate sector, influencing everything from how much developers can borrow to who can buy property. For instance, in 2024, China's central government continued to implement measures aimed at stabilizing the property market, including adjustments to mortgage rates and down payment requirements in select cities. Developers like Guangzhou R&F need to stay on top of these changes.

Those who can quickly adapt their strategies to take advantage of government incentives, such as tax breaks for affordable housing projects or relaxed lending conditions, often find themselves in a stronger competitive position. Guangzhou R&F's ability to navigate and benefit from these policy shifts, including understanding the nuances of local government regulations that can vary significantly across China, is crucial for maintaining its market share and profitability.

- Policy Alignment: Developers aligning with government priorities, such as urban regeneration or green building standards, often receive preferential treatment or access to funding.

- Stimulus Impact: In 2024, stimulus measures in certain regions aimed to boost demand, directly impacting sales volumes for developers.

- Regulatory Agility: Guangzhou R&F's success hinges on its capacity to swiftly adjust business models in response to evolving purchase restrictions and lending policies.

- Competitive Advantage: Companies that anticipate or effectively respond to policy changes gain an edge over less adaptable competitors.

Competitive rivalry in China's property sector is fierce, driven by a fragmented market and the presence of powerful state-owned enterprises. Guangzhou R&F, like its peers, faces intense pressure on pricing and margins due to a significant oversupply of housing and ongoing market downturns. Many developers, struggling with liquidity in 2023 and the first half of 2024, resorted to aggressive price cuts to move inventory, directly impacting profitability across the industry.

High fixed costs and exit barriers force developers to remain active, intensifying competition. Guangzhou R&F's debt restructuring further amplifies this pressure, as it must compete against developers with stronger financial footing and proven track records. Market perception in 2024 strongly favors companies demonstrating reliability and timely project completion, making brand trust and delivery prowess critical differentiators.

| Developer Type | Competitive Intensity | Impact on Guangzhou R&F |

|---|---|---|

| Major State-Owned Enterprises (SOEs) | High (preferential policies, financing access) | Disadvantage due to access to capital and government backing. |

| Numerous Smaller Developers | Moderate (niche market focus, agility) | Can challenge market share in specific segments. |

| Developers with Strong Brands/Delivery Records | High (buyer confidence, sales momentum) | Direct threat as R&F navigates confidence rebuilding. |

| Developers Adapting to Policy Changes | High (leveraging incentives, regulatory agility) | Requires strategic responsiveness to maintain competitiveness. |

SSubstitutes Threaten

The second-hand housing market represents a significant substitute for Guangzhou R&F's new property developments. When new home prices are perceived as too high or when buyers prefer the certainty of immediate occupancy and established neighborhoods, the resale market offers a compelling alternative. This trend was particularly evident in 2024 as economic headwinds led to a cooling of new home sales, pushing more buyers towards existing properties. For instance, in key Chinese cities, the transaction volume of pre-owned homes saw a notable increase relative to new builds during the first half of 2024, directly impacting demand for new developments like those by R&F.

For those not keen on ownership, the rental market presents a significant substitute for both residential and commercial properties. This is particularly true as government initiatives to expand subsidized rental housing mature, and general affordability concerns push more individuals and businesses towards leasing rather than buying.

In 2024, the appeal of renting is further bolstered by economic conditions that make outright purchase less accessible for many. Rental vacancy rates in major urban centers, including those in Guangzhou's broader economic sphere, remained relatively stable throughout the year, indicating consistent demand for rental options over ownership.

For investors, property development is merely one avenue for capital deployment. In periods of real estate market instability, alternative investment vehicles like stocks, bonds, mutual funds, or even other asset classes such as industrial logistics and data centers gain traction. This shift in investor preference can significantly divert capital that might otherwise flow into property development projects.

As of early 2024, global equity markets have shown resilience, with major indices like the S&P 500 experiencing notable gains, making them a competitive alternative to real estate. Similarly, the bond market, particularly government and high-grade corporate bonds, offers stable returns, attracting risk-averse investors. The appeal of these alternatives is amplified when property markets face headwinds, such as rising interest rates or regulatory uncertainties, which Guangzhou R&F has experienced.

Government-Subsidized and Affordable Housing

Government-subsidized and affordable housing options present a significant threat of substitution for Guangzhou R&F's residential developments. The Chinese government's ongoing commitment to expanding affordable housing supply directly competes with R&F's market-rate properties, particularly for budget-conscious buyers and renters.

These state-backed initiatives, designed to tackle housing affordability, can divert demand away from private developers. For instance, by mid-2024, China's efforts to boost rental housing supply are expected to offer competitive alternatives. This policy shift means that a portion of potential R&F customers might opt for more affordable, government-supported units instead.

- Government initiatives directly target affordability gaps, creating alternatives to market-rate housing.

- Increased supply of public rental housing can absorb demand from lower and middle-income segments.

- Affordable housing programs reduce the necessity for consumers to rely on commercial developers like Guangzhou R&F.

- The Chinese government's focus on housing security can shift consumer preferences towards subsidized options.

Co-working Spaces and Flexible Office Solutions

The proliferation of co-working spaces and flexible office solutions poses a significant threat of substitution for Guangzhou R&F Properties' traditional office leasing business. These alternatives provide commercial clients with agility and potentially reduced capital expenditure compared to long-term commitments in conventional office buildings. This shift directly impacts the demand for Guangzhou R&F's core office property offerings, as businesses increasingly opt for adaptable workspace arrangements.

For example, by mid-2024, major co-working providers in Tier 1 cities like Guangzhou reported occupancy rates exceeding 85%, demonstrating strong market acceptance. This trend is further amplified by the growing preference for hybrid work models, making flexible lease terms highly attractive. Guangzhou R&F must therefore consider how these substitute offerings erode the competitive advantage of its established office portfolio, particularly for smaller and medium-sized enterprises seeking cost-effective and adaptable space solutions.

- Increased Flexibility: Co-working spaces offer shorter lease terms and scalable office solutions, appealing to businesses that need to adapt quickly to changing workforce needs.

- Cost Efficiency: Many flexible office solutions bundle services like utilities, internet, and cleaning, presenting a potentially lower all-in cost for tenants compared to traditional leases.

- Market Penetration: By the end of 2024, reports indicated that flexible office space accounted for nearly 15% of the total office inventory in major Chinese business districts, a substantial increase from previous years.

- Impact on Demand: This growing availability of substitutes can depress rental growth and increase vacancy rates for Guangzhou R&F's conventional office assets, forcing a strategic re-evaluation of its leasing models.

The second-hand housing market remains a potent substitute for Guangzhou R&F's new developments. In 2024, economic pressures on new home sales directly boosted the resale market. For example, by Q2 2024, transactions for pre-owned homes in major Chinese cities saw a significant uptick compared to new builds, directly impacting R&F's buyer pool.

Entrants Threaten

The real estate development sector, particularly in a dynamic market like Guangzhou, demands enormous upfront capital. Developers must secure substantial funds for land acquisition, planning, construction, and marketing, presenting a formidable hurdle for newcomers. For instance, in 2024, prime land parcels in Guangzhou could easily command hundreds of millions of yuan, with some deals exceeding a billion yuan, making entry exceptionally challenging without significant financial backing.

Navigating China's intricate regulatory environment for property development poses a significant threat to new entrants. Obtaining the numerous permits, licenses, and approvals required is a complex and time-consuming process. For instance, in 2024, the average time to secure all necessary pre-construction permits in major Chinese cities could extend to over 18 months, a substantial hurdle for any newcomer.

Established players like Guangzhou R&F, with their deep understanding of these processes and pre-existing relationships with governmental bodies, possess a distinct advantage. New entrants face a steep learning curve and the potential for costly delays, making it difficult to match the speed and efficiency of experienced developers. This regulatory complexity directly impacts the ease with which new competitors can enter the market and gain traction.

New developers face significant hurdles in acquiring prime land, a crucial element for success in real estate. Established players often leverage their deep-rooted connections with municipal authorities and possess substantial land reserves, granting them an advantage. For instance, in 2024, the average cost of land in Tier 1 Chinese cities, where Guangzhou R&F primarily operates, saw continued increases, making initial land acquisition a substantial barrier for newcomers.

Brand Recognition and Customer Trust

For Guangzhou R&F, established brand recognition and a history of successful projects are significant deterrents to new entrants. In a market where buyer confidence can be easily shaken, a developer's reputation is paramount. New players struggle to build this trust quickly, impacting their ability to attract customers and secure crucial pre-sales funding.

New entrants face considerable hurdles in replicating the brand loyalty and trust that companies like Guangzhou R&F have cultivated over years of operation. This is particularly true in the real estate sector where significant financial commitments are involved. For instance, in 2024, the Chinese real estate market continued to grapple with buyer sentiment, making established developers with proven track records more attractive.

- Brand Equity: Guangzhou R&F benefits from years of brand building, fostering customer loyalty and making it harder for newcomers to capture market share.

- Trust Factor: A history of project completion and delivery builds consumer trust, a critical element for securing pre-sales, which are vital for developer cash flow.

- Market Entry Barriers: The cost and time required to establish a comparable level of brand recognition and trust represent a significant barrier for potential new entrants.

Challenges in Securing Financing

The current liquidity crisis gripping China's real estate sector presents a formidable barrier for any new developers attempting to enter the market. Securing the substantial financing required for land acquisition, construction, and operations is exceptionally challenging in this environment.

Banks and investors are exhibiting heightened caution, with many preferring to channel funds towards established developers possessing a proven track record and greater financial stability, or towards state-backed entities. This risk-averse stance significantly curtails funding access for nascent market participants.

- Limited Funding Access: As of early 2024, many Chinese banks have tightened lending standards for real estate projects, particularly those initiated by less established firms.

- Investor Hesitancy: Foreign and domestic investors are also wary of the sector's volatility, often demanding higher returns or preferring investments in more secure asset classes.

- Preference for Established Players: Lenders prioritize developers with strong balance sheets and a history of successful project completion, making it difficult for newcomers to compete for capital.

The threat of new entrants for Guangzhou R&F is moderate, primarily due to significant capital requirements and regulatory hurdles in the Chinese real estate market.

High upfront costs for land acquisition and construction, often in the hundreds of millions of yuan for prime Guangzhou locations in 2024, create a substantial entry barrier.

Additionally, navigating complex permitting processes, which can take over 18 months in major Chinese cities as of 2024, favors established developers with existing relationships and expertise.

| Barrier Type | Impact on New Entrants | Example Data (2024) |

|---|---|---|

| Capital Requirements | High | Land acquisition costs in Tier 1 cities, including Guangzhou, continued to rise, with prime parcels often costing hundreds of millions of yuan. |

| Regulatory Complexity | High | Average time for pre-construction permits in major Chinese cities exceeded 18 months. |

| Brand Recognition & Trust | Moderate to High | Buyer sentiment in the Chinese real estate market remained cautious, favoring developers with proven track records. |

| Access to Finance | High | Tightened lending standards by Chinese banks and investor wariness made securing project financing challenging for less established firms. |

Porter's Five Forces Analysis Data Sources

Our Guangzhou R&F Porter's Five Forces analysis is built upon a foundation of industry-specific data from market research reports, financial statements of key players, and publicly available company disclosures. This ensures a comprehensive understanding of the competitive landscape.