Renault PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Renault Bundle

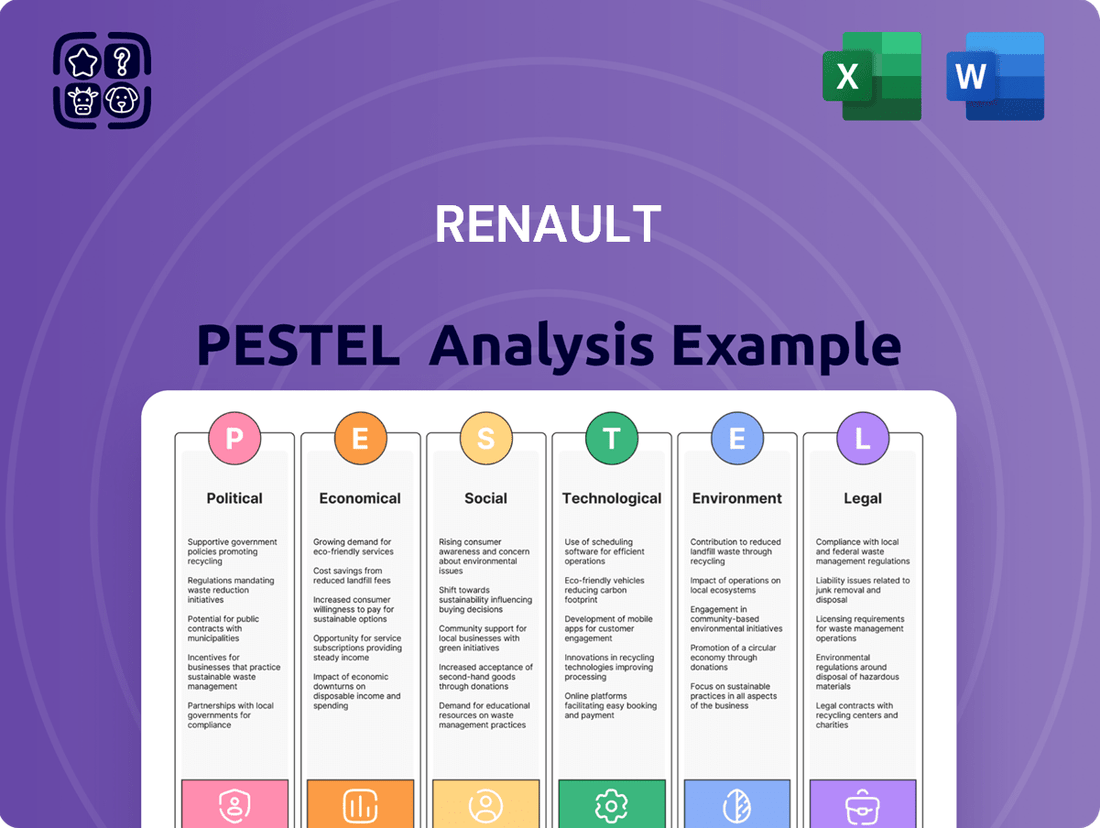

Renault operates in a dynamic global automotive market, constantly influenced by a complex web of external factors. Understanding the political, economic, social, technological, legal, and environmental forces impacting this iconic brand is crucial for strategic decision-making. Our comprehensive PESTLE Analysis of Renault offers a deep dive into these critical influences, providing you with the clarity needed to navigate the automotive landscape. Gain a competitive edge and make informed choices by accessing these actionable insights. Download the full PESTLE analysis now to unlock Renault's strategic landscape.

Political factors

Governments worldwide, particularly in Europe, are implementing stricter emission standards and CO2 targets, such as the upcoming Euro 7 regulations. Renault is compelled to significantly invest in electric and hybrid vehicle technologies to meet these requirements and steer clear of hefty fines, directly shaping its product development pipeline and sales approach.

For instance, the European Union's CO2 emission performance standards mandate a 15% reduction for cars and vans by 2025, and a 37.5% reduction for cars by 2030 compared to 2021 levels. Renault's commitment to electrifying its fleet, with plans to launch several new electric models by 2025, is a direct response to these evolving governmental mandates and the associated financial implications.

Renault's global operations are highly sensitive to shifts in international trade policies. For instance, the European Union’s trade relationship with countries like China and the United States, including any changes to tariffs on automotive parts or finished vehicles, directly impacts Renault's cost of production and the competitiveness of its offerings in key markets. In 2024, ongoing trade discussions and potential adjustments to existing agreements, such as those involving the UK post-Brexit, continue to create uncertainty.

Governments worldwide are actively promoting electric vehicle (EV) adoption through various incentives, including direct purchase subsidies, tax credits, and investments in charging infrastructure. For instance, in 2024, many European nations continued robust EV subsidy programs. Renault's sales volume for its electric models, such as the Megane E-Tech, is significantly influenced by the persistence and enhancement of these policies, which directly address consumer cost concerns and fuel demand.

Geopolitical Stability in Key Markets

Geopolitical stability significantly impacts Renault's global operations. Instability in key markets can disrupt production, as seen with supply chain vulnerabilities exposed by regional conflicts. For instance, the ongoing geopolitical tensions in Eastern Europe have demonstrably affected automotive component sourcing and logistics throughout 2024, leading to temporary production adjustments at various European plants, including some supplying Renault.

Renault's strategic focus on emerging markets, particularly in regions like North Africa and South America, necessitates vigilant political risk assessment. These regions, while offering growth potential, are also susceptible to political shifts that can impact consumer spending and regulatory environments. For example, changes in trade agreements or import/export policies in key North African markets could directly influence Renault's sales volumes and manufacturing strategies in 2024-2025.

- Supply Chain Disruptions: Geopolitical events can interrupt the flow of parts and finished vehicles, impacting production schedules.

- Market Demand Fluctuations: Political instability often leads to reduced consumer confidence and spending on big-ticket items like cars.

- Regulatory Changes: Shifts in government policies, trade tariffs, or local content requirements can alter the cost and feasibility of operations in specific countries.

- Operational Continuity: Maintaining manufacturing and sales operations requires navigating complex and sometimes volatile political landscapes.

Industrial Policies and Support

Government industrial policies, particularly those promoting domestic manufacturing and innovation, significantly shape the automotive sector. France, Renault's home base, has historically implemented measures to bolster its automotive industry, aiming to secure jobs and technological leadership. These policies can include direct subsidies, tax incentives for research and development (R&D), and support for strategic partnerships, all of which can translate into a competitive edge for companies like Renault.

These initiatives often aim to foster innovation and maintain local employment, crucial aspects for a large employer like Renault. For instance, French government initiatives have supported the automotive sector through various programs focused on sustainable mobility and digital transformation. In 2023, the French government continued its commitment to the automotive industry's transition, with significant funding allocated towards electric vehicle (EV) production and related infrastructure, directly benefiting Renault's strategic investments in electrification.

Renault's operations are further influenced by industrial policies in other key markets. For example, in Spain and Portugal, where Renault also has substantial manufacturing presence, similar government support for the automotive sector, including R&D grants and incentives for advanced manufacturing, plays a vital role. These policies help Renault to:

- Invest in advanced manufacturing technologies to improve efficiency and product quality.

- Secure R&D funding for developing new vehicle platforms and powertrain technologies, especially for electric and hybrid vehicles.

- Benefit from preferential treatment or financial aid that supports job creation and retention within the domestic workforce.

- Navigate regulatory landscapes shaped by national industrial strategies, such as those promoting lower emissions and circular economy principles.

Governments globally are increasingly mandating stringent emission standards, pushing automakers like Renault to accelerate investment in electric and hybrid technologies to avoid penalties. For instance, upcoming Euro 7 regulations and the EU's CO2 targets for 2030 demand significant shifts in production and product offerings.

Trade policies and geopolitical stability directly impact Renault's cost structure and market access, with ongoing trade discussions and regional conflicts creating supply chain vulnerabilities and market uncertainties throughout 2024.

Government incentives for electric vehicle adoption, such as subsidies and charging infrastructure investments, remain crucial drivers for Renault's EV sales, directly influencing consumer purchasing decisions and market penetration for models like the Megane E-Tech.

National industrial policies, particularly in France and other key manufacturing hubs like Spain and Portugal, offer R&D support and incentives for advanced manufacturing, bolstering Renault's competitive edge in developing new technologies and securing local employment.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Renault, dissecting their influence across Political, Economic, Social, Technological, Environmental, and Legal dimensions. It offers strategic insights for navigating the complex automotive landscape and identifying key opportunities and threats.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for better strategic decision-making.

Easily shareable summary format ideal for quick alignment across teams or departments, ensuring everyone understands the political, economic, social, technological, environmental, and legal influences on Renault.

Economic factors

Global economic growth is a major driver for Renault's sales. When the world economy is expanding, people generally feel more secure about their finances, leading to increased spending on big-ticket items like cars. This higher consumer confidence directly translates into greater purchasing power for new vehicles, benefiting Renault's revenue streams.

For 2024, the International Monetary Fund (IMF) projected global economic growth at 3.2%, a slight slowdown from 2023 but still indicating a generally positive economic environment. This growth underpins consumer confidence and their ability to afford new vehicles, including Renault's diverse passenger and light commercial vehicle offerings.

In 2025, projections suggest a continued, albeit potentially more moderate, global economic expansion. This sustained growth environment is crucial for sectors like automotive, as it supports demand. Renault's performance will be closely tied to how effectively it can capture market share within this evolving economic landscape, leveraging consumer purchasing power.

Rising inflation in 2024 and early 2025 directly impacts Renault's operational expenses. For instance, if inflation averages 4% across key European markets, the cost of essential components like steel and semiconductors could surge, squeezing profit margins. This also translates to higher energy bills for manufacturing plants, further increasing production costs.

Higher interest rates, a common response to inflation, present a dual challenge for Renault. For consumers, increased interest rates on car loans can make purchasing a new vehicle less attractive, potentially reducing sales volumes. For Renault itself, borrowing costs for investment and operational needs rise, impacting its ability to finance new projects or manage its debt efficiently.

The automotive sector, including Renault, faces significant challenges from fluctuating raw material and component costs. For instance, the price of key metals like steel and aluminum, essential for vehicle manufacturing, experienced considerable volatility in late 2023 and early 2024, impacting production budgets.

Semiconductor shortages, a persistent issue since 2021, continued to affect automotive supply chains through 2024, driving up component prices and limiting production output for many manufacturers, including Renault. These price swings directly translate to higher manufacturing expenses for Renault, potentially hindering its ability to offer competitive pricing in key markets.

In 2024, the automotive industry saw continued upward pressure on battery raw materials like lithium and cobalt, crucial for electric vehicle production, impacting the cost structure of Renault's expanding EV lineup. Supply chain disruptions, whether from geopolitical events or natural disasters, can further exacerbate these cost increases and create production delays.

Currency Exchange Rate Fluctuations

Renault's status as a global automaker means currency exchange rate fluctuations are a constant consideration. When earnings from foreign markets are translated back into Euros, a weaker local currency can significantly reduce reported revenues and profits. For instance, in 2023, while specific impacts weren't detailed for Renault alone, broader automotive industry analyses indicated that significant currency headwinds could shave off percentage points from growth targets in regions experiencing sharp depreciations against the Euro.

These fluctuations directly influence Renault's financial health and strategic planning. A depreciating Euro, conversely, can make its vehicles more competitive in export markets, potentially boosting sales volume. However, the primary concern remains the impact on reported earnings from subsidiaries operating in countries with volatile currencies.

Consider these key impacts:

- Reduced Profitability: Devaluation in major markets like Turkey or Argentina can shrink the Euro value of profits repatriated from those regions.

- Impact on Reported Revenue: Even if unit sales remain stable, a weaker foreign currency translates to lower reported revenue when consolidated into Euro-denominated financial statements.

- Hedging Costs: Renault likely employs hedging strategies to mitigate currency risks, but these strategies themselves incur costs that affect profitability.

- Competitive Landscape: Exchange rate shifts can alter the price competitiveness of Renault vehicles relative to rivals in different markets.

Impact of Supply Chain Disruptions

Global supply chain vulnerabilities, notably the persistent semiconductor shortage, have significantly hampered vehicle production, directly affecting delivery schedules for automakers like Renault. These disruptions can lead to substantial reductions in output, impacting Renault's ability to meet demand and potentially eroding its market position.

For instance, in 2023, the automotive industry continued to grapple with component shortages, although the situation showed signs of improvement compared to the peak of the semiconductor crisis in 2021-2022. Renault's production volumes in early 2024 remain sensitive to these ongoing supply chain pressures.

- Impact on Production: Reduced availability of critical components like semiconductors directly limits the number of vehicles Renault can manufacture.

- Delivery Delays: Supply chain bottlenecks translate into extended waiting periods for customers, potentially affecting sales and customer satisfaction.

- Cost Increases: Scarcity of components can drive up their prices, increasing manufacturing costs for Renault and potentially impacting profitability.

- Market Share Risk: Inability to produce and deliver vehicles efficiently can allow competitors with more robust supply chains to gain market share.

Economic factors significantly shape Renault's operational landscape and market performance. Global economic growth, projected at 3.2% for 2024 by the IMF, directly influences consumer spending on vehicles, while inflation and interest rate hikes in 2024-2025 increase operational costs and borrowing expenses. Fluctuations in raw material and component prices, especially for semiconductors and battery materials, alongside currency exchange rate volatility, further complicate Renault's financial planning and pricing strategies.

| Economic Factor | Impact on Renault | 2024/2025 Data/Projection |

|---|---|---|

| Global Economic Growth | Drives vehicle demand and consumer confidence. | IMF projected 3.2% global growth in 2024. |

| Inflation | Increases operational and production costs. | Average inflation in key European markets expected around 4% in 2024. |

| Interest Rates | Affects consumer financing affordability and company borrowing costs. | Central banks maintained higher rates through early 2025 to combat inflation. |

| Raw Material Costs | Impacts manufacturing expenses, particularly for EVs. | Lithium and cobalt prices saw upward pressure in 2024. |

| Currency Exchange Rates | Influences reported earnings from international markets. | Significant currency headwinds observed in 2023 can continue impacting earnings translation. |

Same Document Delivered

Renault PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Renault PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the automotive giant. You'll gain insights into market trends, competitive landscapes, and strategic considerations for Renault's future. This detailed report is your complete guide to understanding the forces shaping Renault's operations and strategic direction.

Sociological factors

Consumers are increasingly prioritizing electric and sustainable vehicles, a significant shift driven by heightened environmental awareness and a changing public outlook on mobility. This trend is directly influencing purchasing decisions across the automotive sector.

Renault has strategically positioned itself to capitalize on this movement by expanding its E-Tech electric and hybrid vehicle lineup. For instance, in 2024, Renault Group reported a substantial increase in its electrified vehicle sales, with E-Tech models playing a pivotal role in this growth, demonstrating a clear alignment with evolving consumer demands for greener transportation options.

Sociological factors significantly shape the automotive landscape, with changing mobility trends being a prime example. The growing popularity of services such as car-sharing, ride-hailing platforms like Uber and Lyft, and flexible subscription models is altering how people view and utilize personal vehicles. This shift away from traditional ownership means fewer individuals may purchase cars outright, impacting sales volumes for manufacturers.

Renault is proactively addressing this evolution through its Mobilize brand, which aims to provide a spectrum of mobility solutions. Mobilize offers services that extend beyond just selling cars, encompassing charging, energy management, and even data services. This strategic pivot allows Renault to tap into new revenue streams and cater to a consumer base that prioritizes access and flexibility over outright ownership.

The demand for these new mobility services is substantial and growing. For instance, the global car-sharing market was valued at over $15 billion in 2023 and is projected to experience a compound annual growth rate of approximately 15% through 2030. Similarly, ride-hailing services continue to gain traction, with millions of rides completed daily worldwide, indicating a sustained behavioral change in transportation preferences.

Demographic shifts significantly influence car buying habits. In Europe, where Renault has a strong presence, the aging population in countries like France and Germany, with 21.2% and 17.4% of their populations over 65 respectively in 2023, often leads to a preference for smaller, more accessible vehicles. Simultaneously, global urbanization is on the rise, with projections indicating that 68% of the world's population will live in urban areas by 2050, increasing demand for compact, fuel-efficient cars suitable for city driving and for light commercial vehicles supporting urban logistics.

Brand Perception and Consumer Trust

Brand perception and consumer trust are absolutely vital in the automotive world, directly shaping whether someone chooses a particular car or sticks with a brand over time. Renault, like all major car manufacturers, actively works to cultivate a positive image. This involves focusing on tangible aspects such as the quality of their vehicles, the safety features they incorporate, and increasingly, their commitment to sustainability. These efforts are designed to build a strong foundation of trust, encouraging customers to remain loyal.

In 2024, consumer trust in automotive brands is being heavily influenced by factors like electric vehicle (EV) technology and the perceived reliability of these new systems. Renault's investments in its EV lineup, such as the Megane E-Tech, are central to this. Reports from early 2025 indicate that customer satisfaction with Renault's EV charging infrastructure and battery performance is a key differentiator. Furthermore, independent consumer surveys from late 2024 placed Renault among the top brands for perceived value for money in the European market, a significant boost to its brand perception.

Renault's brand perception is also shaped by its marketing and public relations. The company's focus on affordability and practicality, often highlighted in campaigns, resonates with a broad consumer base.

- Customer satisfaction with Renault's EV charging infrastructure and battery performance was noted as strong in early 2025 reports.

- In late 2024, consumer surveys indicated Renault was a top brand for perceived value for money in Europe.

- Product quality and safety features remain primary drivers of brand loyalty for Renault.

- Sustainability initiatives are increasingly important in shaping positive brand perception among car buyers.

Labor Force Dynamics and Talent Acquisition

The automotive sector's rapid shift to electric and software-defined vehicles necessitates a significant overhaul in workforce skills. Renault, like its competitors, must navigate the challenge of equipping its current employees with new competencies in areas such as battery management, advanced driver-assistance systems (ADAS), and artificial intelligence (AI). This transition is critical for the company's strategic pivot and ongoing technological development.

Attracting specialized talent is equally crucial for Renault's future. The demand for software engineers, battery chemists, and AI specialists is intense across the industry. For instance, by late 2024, the global shortage of skilled cybersecurity professionals alone was estimated to be around 3.4 million, impacting various tech-reliant sectors including automotive. Renault is actively investing in training programs and competitive recruitment strategies to secure these vital skill sets.

- Upskilling Initiatives: Renault is implementing internal training programs focused on electric vehicle (EV) technology and digital skills.

- Talent Acquisition Focus: Recruitment efforts are prioritizing candidates with expertise in software development, battery engineering, and data science.

- Industry-Wide Competition: Renault competes for talent not only with other automakers but also with the tech industry, which often offers higher compensation.

- Future Workforce Needs: Projections indicate a growing demand for roles in vehicle software integration and autonomous driving systems through 2025 and beyond.

Societal values are increasingly emphasizing sustainability and ethical consumption, pushing companies like Renault to adopt greener manufacturing processes and supply chains. This shift is not just about compliance but about building consumer trust and brand loyalty in a market where environmental consciousness is a significant purchasing driver.

Consumer preferences are also evolving towards personalized experiences and digital integration in vehicles. Renault's investment in connected car technology and user-friendly interfaces aims to meet this demand, offering features that enhance convenience and driver engagement. The company's focus on digital services, such as remote diagnostics and over-the-air updates, directly addresses this sociological trend.

The changing perception of vehicle ownership, with a rise in mobility-as-a-service (MaaS) and shared mobility solutions, is reshaping how people interact with transportation. Renault's Mobilize brand exemplifies this adaptation, offering flexible subscription models and integrated mobility services that cater to a society valuing access and convenience over traditional ownership.

Demographic shifts, particularly aging populations in key European markets and increasing urbanization globally, influence vehicle design and demand. Renault's product development, including a focus on compact, accessible city cars and efficient urban transport solutions, reflects an understanding of these evolving societal demographics.

Technological factors

Technological advancements in electric vehicle (EV) battery technology are rapidly improving, offering longer driving ranges and significantly quicker charging times. These improvements are essential for driving wider consumer adoption of EVs.

Renault is actively capitalizing on these trends by investing in specialized electric vehicle platforms, such as AmpR Small and AmpR Medium. This strategic focus is evident in their upcoming models, like the highly anticipated Renault 5 E-Tech electric, showcasing their commitment to integrating cutting-edge battery innovations.

The advancement of autonomous driving technology is a significant technological factor for Renault, presenting both avenues for growth and potential disruptions. Renault's strategy involves a pragmatic integration of these capabilities, with research concentrated on both personal vehicles and public transportation systems. This dual focus acknowledges the diverse market applications for autonomous driving.

By 2024, the automotive industry saw continued investment in autonomous driving R&D, with global spending projected to reach tens of billions of dollars annually. Renault is actively developing its own platforms and partnerships to stay competitive in this rapidly evolving landscape. Their approach prioritizes a step-by-step deployment, aiming to balance innovation with safety and regulatory compliance.

Renault is significantly investing in digitalization and connectivity, integrating features like Google built-in into its infotainment systems. This move aims to provide a seamless and intuitive user experience, a crucial factor for consumers in 2024 and 2025. These advanced systems are becoming a major selling point, helping Renault stand out in a competitive market.

The introduction of virtual avatars, such as Renault's own Reno, further enhances this personalized engagement. By offering interactive and intelligent in-car assistants, Renault is tapping into the growing demand for smart, connected automotive environments. This focus on user-centric technology is expected to drive customer loyalty and attract new buyers.

Manufacturing Process Innovations

Renault is actively integrating Industry 4.0 technologies and artificial intelligence into its manufacturing processes to boost efficiency and product quality. This strategic focus aims to significantly reduce operational costs and lower the company's breakeven point. For instance, Renault's Douai plant in France is a key site for electric vehicle production, leveraging advanced automation and digital tools to streamline assembly lines.

The adoption of AI in production is enabling predictive maintenance, which minimizes downtime and ensures smoother operations across Renault's facilities. This technological advancement directly contributes to higher output and better resource utilization. By embracing these manufacturing process innovations, Renault is positioning itself for greater competitiveness in the evolving automotive landscape.

Key areas of technological focus include:

- Smart Factories: Implementing connected systems and data analytics for real-time production monitoring and optimization.

- Robotics and Automation: Expanding the use of collaborative robots and automated guided vehicles (AGVs) to enhance precision and safety.

- AI-driven Quality Control: Utilizing machine learning algorithms for automated defect detection and improved product consistency.

- Digital Twins: Creating virtual replicas of production lines to simulate changes and identify potential improvements before physical implementation.

Cybersecurity and Data Privacy for Connected Cars

As cars become more like computers on wheels, keeping them safe from hackers and protecting the information they collect is super important. Renault needs to put a lot of effort into strong security to prevent breaches. For example, a 2023 report indicated that the automotive industry faced a significant rise in cyberattacks targeting connected vehicle systems, highlighting the urgent need for advanced defense mechanisms.

Sticking to data privacy rules, like GDPR in Europe, is also key. This means being upfront with customers about what data is collected and how it's used, and making sure it's stored securely. Failing to do so can lead to hefty fines and damage to Renault's reputation. By 2024, regulatory bodies are expected to increase scrutiny on how automakers handle sensitive customer data collected through in-car systems.

- Cybersecurity Investments: Renault's commitment to cybersecurity is crucial, with industry estimates suggesting that automotive cybersecurity spending could reach over $10 billion globally by 2025.

- Data Privacy Compliance: Adherence to evolving global data protection laws is non-negotiable to maintain customer trust and avoid legal repercussions.

- Threat Landscape: The increasing sophistication of cyber threats necessitates continuous adaptation of security protocols for connected car features.

Renault is heavily investing in battery technology for electric vehicles (EVs), a critical technological factor driving market adoption. By 2025, advancements are expected to further increase EV range and reduce charging times, making EVs more competitive with traditional internal combustion engine vehicles.

The company is also focusing on autonomous driving capabilities, with significant R&D investment globally. Renault's strategy involves a phased rollout of these technologies, balancing innovation with safety and regulatory adherence, as the industry sees billions invested annually in this area.

Legal factors

Renault faces stringent vehicle emission standards, notably the EU's CO2 targets. For 2024, the average CO2 emissions for new passenger cars sold in the EU must be below 93.6 g/km. Failure to meet these targets can result in substantial fines, impacting profitability and strategic planning.

These regulations directly influence Renault's product development, pushing investment towards electric vehicles (EVs) and hybrid technologies. In 2023, Renault's EV sales saw significant growth, with models like the Megane E-Tech Electric contributing to their emissions reduction efforts. The company aims for 90% of its sales to be electric by 2030 in Europe.

Compliance also affects Renault's sales mix, as manufacturers are incentivized to sell lower-emission vehicles. This means a strategic shift away from traditional internal combustion engine vehicles is necessary. The company's commitment to achieving carbon neutrality by 2050 is intrinsically linked to its ability to navigate and adapt to these evolving legal frameworks.

As vehicles become more connected and collect vast amounts of personal data, Renault must navigate a complex web of data protection laws like the EU's General Data Protection Regulation (GDPR). This means ensuring customer privacy and data security are paramount in all operations. Failure to comply can result in significant fines, with GDPR penalties reaching up to 4% of global annual turnover or €20 million, whichever is higher.

To address these challenges, Renault has established a robust regulatory compliance program. A key element of this is the appointment of a dedicated Data Protection Officer (DPO), who oversees adherence to these critical regulations. This proactive approach demonstrates a commitment to safeguarding sensitive customer information collected through connected car services and digital platforms.

Renault operates under strict product liability laws and recall regulations across its global markets, mandating the highest standards for vehicle safety and quality. Failure to meet these stringent requirements, such as the discovery of a critical defect, can trigger expensive recalls. For instance, in late 2023, a recall affecting over 150,000 vehicles globally due to potential fire risks highlighted the significant financial and reputational consequences such issues can incur.

These legal frameworks directly impact Renault's operational costs and strategic planning, necessitating substantial investment in rigorous quality control and comprehensive testing throughout the design and manufacturing processes. The potential for significant legal liabilities and substantial financial penalties underscores the critical importance of proactive risk management and continuous improvement in product development to maintain consumer trust and regulatory compliance.

Antitrust and Competition Laws

Renault operates under stringent antitrust and competition laws across its global markets, ensuring fair play and preventing monopolistic practices. These regulations are crucial for maintaining a competitive automotive landscape, impacting everything from pricing strategies to dealership agreements. For example, in 2024, the European Commission continued its scrutiny of automotive sector practices, reinforcing the need for compliance. Renault actively promotes free and fair competition through dedicated training for its employees and robust internal compliance programs, aiming to avoid any actions that could be construed as anti-competitive.

The company must steer clear of behaviors like price fixing or market allocation, which are strictly prohibited. Failure to comply can result in significant fines and reputational damage. In 2023, the automotive industry saw several investigations into potential anti-competitive behavior, underscoring the constant vigilance required.

- Regulatory Scrutiny: Renault faces ongoing oversight from competition authorities globally, including the European Commission and national bodies.

- Compliance Programs: The company invests in internal training and compliance measures to ensure adherence to antitrust regulations.

- Market Integrity: Adherence to these laws is vital for maintaining fair competition and preventing practices like price-fixing or market sharing.

- Potential Penalties: Non-compliance can lead to substantial fines, impacting financial performance and brand reputation.

Labor Laws and Union Relations

Renault must navigate a complex web of labor laws across its global manufacturing and sales hubs, encompassing regulations on working hours, minimum wages, and employee benefits. For instance, in France, the standard work week is 35 hours, with strict overtime rules. Compliance ensures operational continuity and avoids costly legal penalties.

Maintaining constructive relationships with labor unions is paramount for Renault's operational stability. In 2023, the company engaged in negotiations with various unions regarding wage increases and working conditions, reflecting the ongoing dialogue necessary to manage employee expectations and prevent disruptions. Positive union relations often translate to a more committed workforce and fewer industrial actions, which can significantly impact production schedules and financial performance.

The company's approach to labor relations directly influences its reputation and ability to attract and retain talent.

- Compliance with diverse labor legislation globally, covering wages, working hours, and safety standards.

- Negotiation and collaboration with labor unions to ensure fair labor practices and avoid industrial disputes.

- Impact of labor relations on workforce stability and overall operational efficiency.

Renault must adhere to evolving vehicle safety regulations globally, which mandate rigorous testing and compliance for all models. For example, the introduction of advanced driver-assistance systems (ADAS) requires adherence to specific performance standards, impacting R&D and manufacturing processes. Failure to comply can lead to product recalls, fines, and damage to brand reputation, as seen with past industry-wide safety investigations.

The company's commitment to sustainability is also shaped by legal frameworks, particularly those concerning environmental impact and waste management. Regulations like the End-of-Life Vehicles (ELV) Directive in Europe mandate specific recycling and recovery rates for vehicles, influencing design and material sourcing. Renault's 2023 sustainability report highlighted its progress in meeting these targets, demonstrating a proactive approach to environmental compliance.

Furthermore, intellectual property rights are crucial for Renault's innovation, requiring robust legal protections for its technologies and designs. Navigating international patent laws and licensing agreements is essential to safeguard its competitive edge. The company actively manages its IP portfolio to prevent infringement and leverage its innovations effectively in the global market.

Environmental factors

Automakers like Renault are facing intense pressure to become carbon neutral and embrace circular economy models. This means drastically cutting greenhouse gas emissions throughout their entire value chain, from manufacturing to vehicle end-of-life. Renault has set an ambitious target of achieving net-zero carbon emissions in Europe by 2040.

This commitment extends to conserving resources and safeguarding biodiversity. For instance, Renault is focusing on increasing the use of recycled materials in its vehicles and developing more energy-efficient production processes. The company's strategy aligns with global trends pushing for a more sustainable automotive industry, impacting everything from supply chain management to product design.

Effective waste management and recycling of end-of-life vehicles (ELVs) are paramount for environmental stewardship and resource conservation in the automotive sector. Renault is actively addressing this by integrating robust recycling strategies, notably through its subsidiary, The Future Is NEUTRAL. This initiative focuses on developing innovative remanufacturing programs for electric vehicle (EV) components, thereby extending their lifecycle and reducing the demand for virgin materials.

Renault's commitment extends to increasing the incorporation of recycled materials into the production of new vehicles. For instance, by 2023, the company aimed to achieve 30% recycled materials in its new vehicles, a figure that is expected to grow substantially in the coming years. This strategy not only minimizes waste but also contributes to a more circular economy within the automotive industry, aligning with stringent environmental regulations and consumer demand for sustainable products.

The automotive industry, including Renault, is seeing a significant rise in consumer and regulatory demand for sustainably sourced materials. This trend is pushing companies to adopt practices that minimize environmental impact throughout the supply chain. For instance, the push for low-carbon steel and increased use of recycled plastics in vehicle manufacturing is becoming a critical factor for competitiveness and brand image.

Renault is actively addressing this by forging strategic partnerships with its suppliers. These collaborations aim to directly reduce the carbon footprint associated with producing vehicle components. A key objective is to steadily increase the proportion of recycled materials incorporated into new vehicles, which directly supports Renault's overarching environmental commitments and sustainability targets for 2025 and beyond.

Impact of Climate Change on Supply Chains

Climate change poses significant threats to Renault's global supply chains. Extreme weather events, such as floods and heatwaves, are becoming more frequent and intense, directly impacting manufacturing facilities and logistics. For example, the severe flooding in Thailand in 2011 disrupted automotive parts production worldwide, highlighting the vulnerability of such networks. Renault must actively assess and prepare for these disruptions to maintain production continuity and distribution efficiency.

Mitigating these environmental risks is crucial for Renault's operational resilience. The company needs to invest in adapting its production sites and logistics routes to withstand the effects of climate change. This includes diversifying sourcing locations and building more robust infrastructure. The automotive industry, in general, is facing increased pressure to reduce its environmental footprint, and adapting to climate change impacts is a key component of this strategy.

Renault's supply chain resilience is directly tied to its ability to navigate climate-related challenges. Consider these key areas of impact:

- Disruption to Raw Material Sourcing: Climate change can affect the availability and cost of key materials like rare earth metals, often mined in regions susceptible to environmental instability.

- Logistics and Transportation Challenges: Extreme weather can lead to port closures, damaged roads, and disrupted shipping routes, increasing transit times and costs for vehicle and parts delivery.

- Manufacturing Facility Vulnerability: Flooding, extreme heat, or water scarcity can directly impact the operation of automotive plants, leading to production halts and increased operational expenses.

- Increased Regulatory Scrutiny: Governments worldwide are implementing stricter environmental regulations, which may affect manufacturing processes and supply chain partners.

Environmental Impact Assessments for New Facilities

For any new manufacturing facilities or expansions, Renault must meticulously conduct environmental impact assessments and secure all required permits. This is a critical step to ensure compliance and minimize ecological disruption. For instance, the company's recent investments in electric vehicle production lines necessitate stringent evaluations of their environmental footprint.

Renault's dedication to sustainability is a key focus, aiming to significantly reduce the environmental impact of its industrial operations. This commitment is evident in their ongoing efforts to lower greenhouse gas emissions across all sites. In 2023, Renault announced a target to achieve carbon neutrality for its industrial sites by 2050, building on progress made in reducing CO2 emissions by 24% between 2013 and 2022.

Water consumption is another area of significant attention for Renault's environmental strategy. The company is actively implementing measures to decrease water usage at its manufacturing plants, recognizing its importance for resource conservation. By 2025, Renault aims to further reduce water withdrawal intensity by 25% compared to 2019 levels.

- Environmental Impact Assessments New facilities require rigorous EIAs and permit acquisition.

- Greenhouse Gas Emissions Reduction Renault targets carbon neutrality for industrial sites by 2050, having already achieved a 24% reduction in CO2 emissions between 2013 and 2022.

- Water Consumption Management The company aims for a 25% reduction in water withdrawal intensity by 2025 (vs. 2019).

Renault is heavily focused on reducing its environmental footprint, aiming for carbon neutrality in Europe by 2040 and for its industrial sites by 2050. The company is increasing the use of recycled materials in new vehicles, targeting 30% by 2023, and reducing water withdrawal intensity by 25% by 2025 compared to 2019 levels.

Climate change presents risks to Renault's supply chain through extreme weather events impacting sourcing, logistics, and manufacturing, necessitating adaptation strategies. The company also prioritizes environmental impact assessments for new facilities and stringent permit acquisition.

| Environmental Target/Focus | Current Status/Goal | Baseline/Reference |

|---|---|---|

| Carbon Neutrality (Europe) | Target: 2040 | N/A |

| Carbon Neutrality (Industrial Sites) | Target: 2050 | N/A |

| Recycled Materials in New Vehicles | Target: 30% | 2023 |

| Water Withdrawal Intensity Reduction | Target: 25% reduction | 2019 (Baseline) |

| CO2 Emissions Reduction (Industrial) | Achieved: 24% reduction | 2013-2022 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Renault is built on a robust foundation of data from international economic bodies like the IMF and World Bank, official government reports, and leading automotive industry research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting Renault's global operations.