Renault Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Renault Bundle

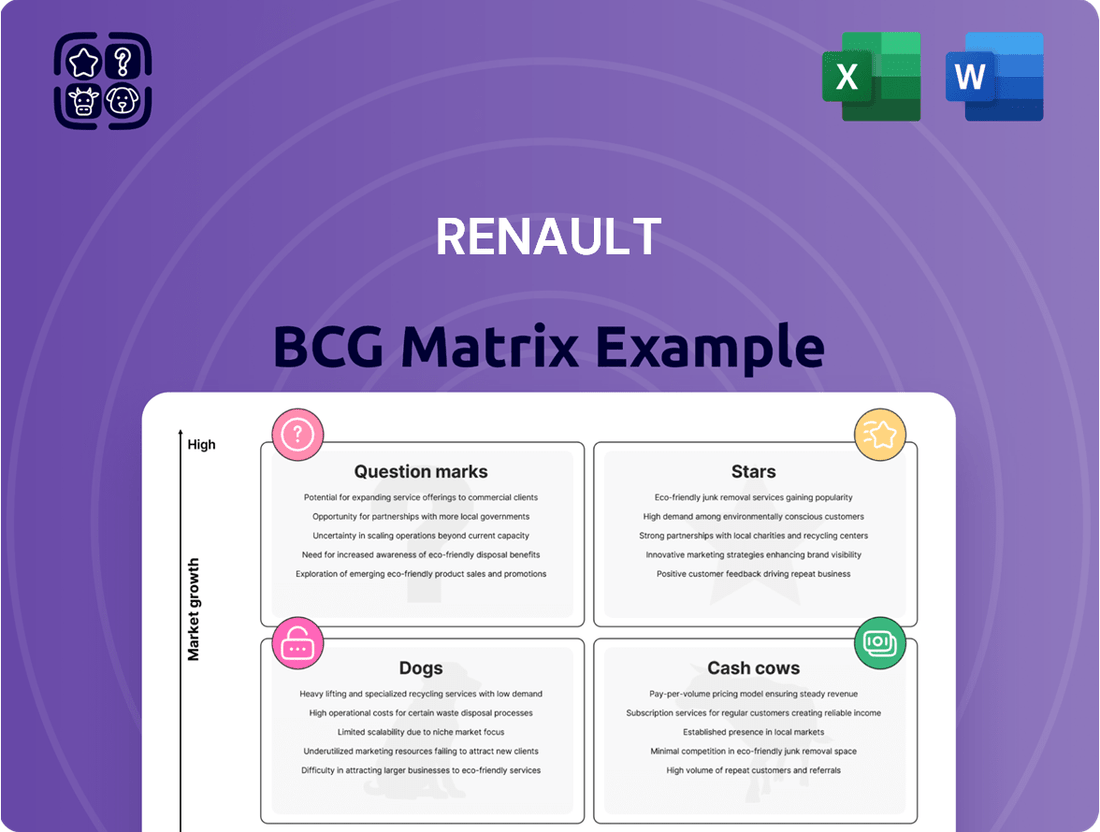

The Renault BCG Matrix offers a powerful framework to understand the strategic positioning of its product portfolio. By categorizing vehicles into Stars, Cash Cows, Dogs, and Question Marks, it illuminates areas of strength and potential weakness within their market presence. This insightful analysis helps pinpoint where Renault is generating significant revenue and where investments might be needed to foster growth or divest from underperforming assets.

This preview provides a glimpse into the strategic thinking behind Renault's product management. For a comprehensive understanding of each vehicle's current market standing and future potential, dive deeper into the full BCG Matrix report.

Unlock actionable insights and a clear roadmap for resource allocation and future product development by purchasing the complete Renault BCG Matrix. It’s your essential tool for navigating the competitive automotive landscape and making informed strategic decisions.

Stars

The Renault Megane E-Tech Electric is positioned as a Star in Renault's BCG Matrix, reflecting its strong performance in a high-growth market. This model spearheads Renault's ambitious electrification strategy, leveraging a fresh platform and design to compete effectively in the burgeoning C-segment EV space. Its promising market entry and positive consumer feedback throughout 2024 and into early 2025 highlight its potential to become a dominant force in the evolving automotive sector.

The Renault Scenic E-Tech Electric, launched in 2024, is a significant player in Renault's burgeoning electric vehicle lineup. Built on the AmpR Medium platform, it targets the family segment, a key growth area in the EV market. Its February 2024 'Car of the Year' award highlights its strong market appeal and competitive offering.

This model is integral to Renault's strategy to deepen its presence in the electric vehicle transition. By offering a family-oriented EV with critical acclaim, Renault aims to capture a larger share of the rapidly expanding electric car market, reinforcing its commitment to electrification and future growth.

Ampere, Renault Group's dedicated electric vehicle and software entity, is firmly positioned as a Star in the BCG Matrix. This classification stems from its high growth potential within the burgeoning EV and software-defined vehicle sectors.

The unit is a cornerstone of Renault's strategic pivot, aiming to achieve free cash flow breakeven as early as 2025. This ambitious target underscores its importance for the group's future profitability and technological advancement in a competitive landscape.

Renault has committed substantial investment to Ampere, reflecting the expected high returns from its expansion. The company aims for Ampere to capture a significant share of the European EV market, projecting sales of 300,000 vehicles in 2025 and reaching 1 million units by 2030.

Ampere’s development is crucial for Renault’s overall transformation, solidifying its position as a leader in the next generation of automotive technology and services.

Renault 5 E-Tech Electric

The Renault 5 E-Tech Electric, introduced in late 2024, is positioned as an accessible and widely appealing electric city car, capitalizing on its celebrated heritage. It has rapidly ascended to become a leading seller within the French electric B-segment, showcasing robust market acceptance and significant growth prospects in the mainstream EV market.

This strong performance underscores Renault's capability in making electric vehicles more mainstream.

- Market Position: The Renault 5 E-Tech Electric is a strong contender in the burgeoning electric city car market.

- Sales Performance: It achieved top seller status in the French electric B-segment shortly after its late 2024 launch.

- Growth Potential: The vehicle demonstrates high growth potential within the mass-market EV segment due to its affordability and iconic design.

- Brand Strategy: Its success validates Renault's strategy of leveraging established nameplates to drive EV adoption.

Renault's E-Tech Hybrid Powertrains

Renault's E-Tech hybrid powertrains are a significant contributor to the brand's market position. In 2024, sales of these full-hybrid vehicles saw a substantial 30% increase across Europe. This growth has solidified Renault's standing as the second-largest player in the European full-hybrid market, reflecting strong consumer demand for their electrified offerings.

The widespread availability of E-Tech powertrains across numerous Renault models underscores their market acceptance and integration into the brand's core strategy. These powertrains are crucial to Renault's overall electrified sales mix, demonstrating a successful balance between current market share and future growth potential in the expanding hybrid segment.

- Market Growth: Renault's full-hybrid sales surged by 30% in Europe during 2024.

- Market Position: This performance makes Renault the second-largest brand in the European full-hybrid sector.

- Product Integration: E-Tech powertrains are featured across a broad spectrum of Renault's vehicle lineup.

- Strategic Importance: These hybrid systems are vital to the brand's electrified sales volume and future strategy.

The Renault 5 E-Tech Electric is a clear Star, demonstrating rapid growth and a strong market position in the electric city car segment. Its success in becoming a top seller in France's electric B-segment shortly after its late 2024 launch highlights its significant potential. This model represents Renault's effective strategy of leveraging iconic designs to drive EV adoption, indicating strong future prospects.

| Product | BCG Category | Market Share | Market Growth | Key Metrics |

| Renault 5 E-Tech Electric | Star | Leading in French electric B-segment | High (Mass-market EV segment) | Top seller status shortly after late 2024 launch. Leverages iconic heritage for EV adoption. |

| Renault Megane E-Tech Electric | Star | Strong contender in C-segment EV | High (Burgeoning C-segment EV space) | Spearheads electrification strategy. Positive consumer feedback through early 2025. |

| Renault Scenic E-Tech Electric | Star | Significant player in family EV segment | High (Key growth area in EV market) | Launched 2024. Awarded 'Car of the Year' February 2024. Built on AmpR Medium platform. |

| Ampere (EV & Software Entity) | Star | Targeting significant European EV market share | High (EV and software-defined vehicle sectors) | Projected 300k vehicles sales in 2025, 1M by 2030. Aims for free cash flow breakeven by 2025. |

| E-Tech Hybrid Powertrains | Star | Second largest in European full-hybrid market | High (30% European sales increase in 2024) | Integral to electrified sales mix. Available across numerous models. |

What is included in the product

The Renault BCG Matrix analyzes its product portfolio by categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

The Renault BCG Matrix provides a clear, one-page overview of each business unit's position, easing the pain of complex portfolio analysis.

Cash Cows

The Dacia Sandero stands as a prime example of a Cash Cow within the Renault Group's BCG Matrix. Its consistent performance as Europe's best-selling car to private customers since 2017, and achieving the top spot overall in Europe in 2024, underscores its robust market position.

This strong market share, coupled with a deliberate strategy of offering value-driven, essential features, translates into substantial and reliable cash flow generation for Renault. The Sandero's success is built on affordability and practicality, appealing to a wide customer base.

The mature nature of its core market segment, characterized by low growth, allows the Sandero to command high profit margins. This stability means that significant reinvestment in marketing or product development is not as critical, enabling efficient cash extraction.

The Dacia Duster continues to be a strong performer for Renault, firmly in the cash cow quadrant. It has held its title as the best-selling SUV in the European retail market every year since 2018, demonstrating remarkable sales consistency. This enduring popularity, driven by its reputation for value and durability, directly fuels Dacia's impressive market share gains and bolsters the entire Renault Group's financial health.

In 2023, the Duster's sales performance was a key contributor to Dacia achieving a record 7.5% market share in the European passenger car market. Its established presence in a mature SUV segment allows for predictable and substantial cash flow generation, a hallmark of a successful cash cow. This consistent revenue stream is vital for supporting other ventures within the Renault Group.

The Renault Clio is a definite cash cow for Renault, consistently holding its ground as a top seller across Europe. Its strong, stable market share in the well-established B-segment hatchback category means it reliably churns out cash with minimal need for heavy advertising, unlike newer models. For instance, in 2023, the Clio was among the top 10 best-selling cars in Europe, demonstrating its enduring appeal.

Renault Captur

The Renault Captur exemplifies a Cash Cow within Renault's product portfolio, demonstrating sustained sales and profitability. Its strong standing in the competitive European compact SUV market, a segment where it consistently performs well, underscores its reliable revenue generation. The Captur's ability to maintain significant sales volumes, even in a mature market, directly translates into substantial contributions to Renault's overall financial health.

Benefiting from ongoing, albeit incremental, enhancements and a well-earned reputation for practicality and value, the Captur is adept at producing consistent cash flow with relatively low reinvestment needs. This strategic positioning allows Renault to leverage the Captur for stable earnings, supporting other business initiatives.

- Market Position: Consistently a top performer in the European compact SUV segment.

- Revenue Contribution: Significant and stable revenue stream for Renault.

- Profitability: Generates substantial operating profit due to optimized cost structures and mature market presence.

- Investment Needs: Requires minimal new investment, focusing on incremental updates rather than major overhauls.

Renault's Light Commercial Vehicles (LCV) Division

Renault's Light Commercial Vehicles (LCV) division stands as a cornerstone of the company's portfolio, firmly positioned as a Cash Cow within the BCG Matrix. This segment consistently generates substantial profits, underscoring its importance to Renault's overall financial health.

The division's strength is evident in its continued leadership within the European LCV market. In 2024, Renault commanded an impressive market share of 15.3%, demonstrating a robust position against competitors. This leadership is further supported by significant sales growth reported for the year, highlighting sustained demand for its offerings.

The inherent nature of the LCV market, characterized by established demand and steady sales cycles, allows this division to function as a reliable and profitable revenue stream for the entire Renault Group. Its consistent performance provides a stable financial foundation.

Key factors contributing to the LCV division's Cash Cow status include:

- Market Leadership: Dominant position in the European LCV market with a 15.3% share in 2024.

- Consistent Revenue: Provides a stable and predictable income stream for Renault.

- Strong Sales Growth: Experienced significant sales increases in 2024, indicating continued market strength.

- Profitability: High profitability due to established demand and efficient operations.

Cash Cows in Renault's BCG Matrix represent established products with high market share in low-growth markets, generating consistent, strong profits with minimal investment. These models are the financial backbone of the group, providing stable cash flow to fund other ventures or reduce debt.

The Dacia Sandero, Dacia Duster, Renault Clio, Renault Captur, and Renault's Light Commercial Vehicles (LCV) division all fit this description, demonstrating enduring popularity and profitability. Their consistent sales performance in mature segments allows Renault to leverage these assets effectively.

These cash cows are critical for Renault's financial stability, enabling the company to navigate market fluctuations and invest in future growth areas. Their dependable revenue streams are a testament to their strong market positioning and customer appeal.

| Product/Division | BCG Category | Key Performance Indicator | 2024 Data/Observation |

| Dacia Sandero | Cash Cow | Europe's best-selling car to private customers | Top spot overall in Europe in 2024 |

| Dacia Duster | Cash Cow | Best-selling SUV in European retail market | Held title since 2018; Dacia achieved 7.5% market share in Europe in 2023 |

| Renault Clio | Cash Cow | Top 10 best-selling cars in Europe | Consistently strong sales in B-segment hatchback |

| Renault Captur | Cash Cow | Strong performer in compact SUV market | Reliable revenue generation in a mature segment |

| Renault LCV Division | Cash Cow | European LCV market leadership | 15.3% market share in 2024; significant sales growth reported |

What You See Is What You Get

Renault BCG Matrix

The Renault BCG Matrix preview you are viewing is the definitive document you will receive upon purchase, ensuring complete transparency and immediate usability. This comprehensive report, meticulously crafted to illuminate Renault's product portfolio, will be delivered to you without any watermarks or placeholder content, ready for immediate strategic application. You are seeing the exact, fully formatted analysis that will empower your decision-making, providing a clear roadmap for resource allocation and future growth. This is not a sample; it is the complete, professionally designed BCG Matrix that you will own and can immediately integrate into your business strategy and presentations.

Dogs

Discontinued ICE sedan models like the Renault Talisman fall into the Dogs category of the BCG Matrix. These vehicles operated in segments of the automotive market that experienced declining growth or contraction, and Renault's market share within these specific niches was minimal.

The Talisman, for instance, faced intense competition and shifting consumer preferences towards SUVs, contributing to its low market share and eventual discontinuation. Such models typically drain resources through ongoing support costs like parts availability and warranty claims, without generating substantial revenue or contributing to future profitability.

As of 2024, the global passenger car market, particularly for traditional sedans, continues to see a strong shift towards electrification and utility vehicles. This trend further solidifies the 'Dog' status for older, internal combustion engine (ICE) sedans that are no longer in production, as their target markets shrink.

Renault's strategic decision to phase out models like the Talisman is a classic example of divesting from 'Dogs' to prevent cash being tied up in underperforming assets. This allows the company to redirect capital and research and development efforts toward more promising areas, such as their growing EV portfolio and popular SUV lines.

Older internal combustion engine (ICE) platforms at Renault that are difficult to adapt for electrification or major updates are essentially becoming declining assets. These platforms face very limited growth opportunities in the market as the automotive industry pivots.

With Renault's strategic focus firmly on electric and software-driven vehicles, these legacy ICE platforms are naturally experiencing a shrinking market share. By 2024, the demand for new vehicles built on these older architectures has noticeably decreased compared to previous years.

Continuing to support and maintain these aging ICE platforms drains valuable capital and resources. This investment could be far more productively allocated towards developing and launching the new, high-growth electric vehicle technologies that are defining Renault's future.

Certain Renault models that struggle to capture significant market share in specialized segments or face intense rivalry in crowded areas can become Dogs. These vehicles typically exhibit low sales volumes and a minimal market share. For instance, in 2024, models like the Renault Arkana, while finding a niche, faced stiff competition from established players in the coupe-SUV segment, impacting its overall market penetration compared to rivals.

The limited growth potential for these underperforming models means that ongoing investment often yields very little in terms of financial return. This situation is evident when analyzing the profitability of specific Renault lines; if a model consistently requires substantial marketing spend without a corresponding increase in sales or profit margins, it signals its potential Dog status. For example, if a particular variant’s contribution to overall profit in 2024 was negative after accounting for development and marketing costs, it would clearly fall into this category.

Consequently, these underperforming offerings are prime candidates for strategic review, potentially leading to their rationalization or complete discontinuation from the Renault product portfolio. This aligns with typical automotive industry practices where underperforming assets are divested to free up resources for more promising ventures. By the end of 2024, analysts were closely watching Renault’s portfolio for such strategic decisions, especially in segments where market share gains were proving exceptionally difficult.

Outdated Infotainment Systems or Connectivity Services

Outdated infotainment and connectivity services in vehicles can quickly turn into Dogs within the Renault BCG Matrix. As consumers increasingly expect seamless digital integration, systems that lag behind market expectations lose their appeal. For instance, a 2023 report indicated that 60% of new car buyers consider advanced infotainment features as a key purchasing factor, highlighting the growing importance of this technology.

When these systems aren't updated or replaced, they offer minimal value to customers and their relevance in the market dwindles. This directly affects the desirability of the vehicles they are equipped in. Considering the swift evolution of technology, significant investment in overhauling such systems may not yield a justifiable return for Renault, especially if newer, more competitive options are readily available or being developed.

- Diminishing Market Relevance: Vehicles with outdated infotainment systems struggle to compete, as evidenced by consumer surveys where such features are highly prioritized.

- Low Customer Value: When connectivity and infotainment features fall behind current standards, they fail to meet user expectations, reducing the overall perceived value of the vehicle.

- Investment Justification: The rapid pace of technological advancement in automotive tech means that significant investment in older systems may not be economically viable compared to developing or adopting newer solutions.

- Impact on Sales: A lack of modern digital features can negatively impact sales figures for specific Renault models, pushing them into the Dog category of the BCG matrix.

Non-Strategic Regional Operations with Low Market Share

These are operations in specific geographic areas where Renault hasn't managed to capture a substantial portion of the market, and importantly, these markets aren't growing much either. Imagine a small town where a big store tries to open, but it's just not a place where lots of people are buying that kind of thing. This is similar for Renault in some regions.

Such regions often demand more money and effort than the sales they generate can justify. It's like pouring water into a leaky bucket; the investment doesn't lead to efficient profit or smart use of company resources. For instance, if Renault's market share in a particular South American country is only 2% and the overall automotive market there is projected to grow by a mere 1.5% annually, it might not be worth the substantial resources needed to compete effectively.

A thorough review of these kinds of markets is absolutely essential for Renault. The company needs to decide if continuing to invest in these low-growth, low-share areas makes sense, or if those resources could be better used elsewhere.

- Low Market Penetration: Operations in regions where Renault's market share consistently falls below the industry average, indicating difficulty in attracting and retaining customers.

- Stagnant Market Growth: Focus on geographical areas where the overall demand for vehicles is not expanding, limiting the potential for organic growth.

- Resource Drain: Identification of markets that consume a disproportionate amount of capital and management attention relative to their revenue generation or profit contribution.

- Strategic Re-evaluation: The necessity for Renault to analyze whether to divest, reduce investment, or find niche strategies for these underperforming regional operations.

Dogs in the Renault BCG Matrix represent products or business units with low market share in low-growth markets. These offerings typically consume resources without generating significant returns, forcing strategic decisions about their future.

Renault's discontinued internal combustion engine (ICE) sedans, like the Talisman, exemplify this category. They operated in shrinking market segments where the company held minimal share, often due to intense competition and evolving consumer preferences towards SUVs and EVs.

By 2024, the continued industry shift towards electrification and utility vehicles further marginalized legacy ICE models, solidifying their Dog status. Renault’s strategy involves divesting from these underperforming assets to reallocate capital to more promising ventures.

Identifying and managing these Dog segments is crucial for optimizing resource allocation and focusing on high-growth areas like electric vehicles.

| Category | Example Renault Offering | Market Growth | Market Share | Strategic Implication |

|---|---|---|---|---|

| Dogs | Discontinued ICE Sedans (e.g., Talisman) | Low (Declining or Stagnant) | Low | Divest, rationalize, or phase out to reallocate resources. |

| Dogs | Legacy ICE Platforms | Low (Declining) | Low | Minimize investment, avoid costly adaptation for electrification. |

| Dogs | Specific Niche Models with Low Sales (e.g., early Arkana struggles) | Low to Moderate | Low | Assess profitability; consider discontinuation or niche focus if unsustainable. |

| Dogs | Outdated Infotainment Systems | N/A (Technology Feature) | Low Customer Value | Prioritize updates on current models; avoid costly retrofits on legacy systems. |

Question Marks

Alpine is strategically transitioning to a fully electric lineup, beginning with new models launched from 2024. The company projects achieving break-even by 2026, with ambitious revenue targets thereafter. This bold move places Alpine squarely in the high-growth electric sports car segment, a market that, while expanding rapidly, is still in its early stages.

Given Alpine's current low market share in this emerging EV niche, these new electric vehicles represent significant investments. They are characterized by high upfront costs and a degree of market uncertainty, yet they hold the potential for substantial future returns.

Consequently, Alpine's future electric models beyond the A110 can be classified as Stars within the BCG matrix framework. This classification reflects their position in a high-growth industry where they are investing heavily to establish a strong foothold and capture future market share, despite their current relatively low penetration.

Renault views hydrogen fuel cell vehicles as a potential long-term growth area, especially for commercial applications where range and refueling speed are critical. Despite this potential, the current market for hydrogen cars is nascent; for instance, global sales of fuel cell electric vehicles (FCEVs) in 2023 were around 15,000 units, a tiny fraction of the overall automotive market. Consequently, Renault's current market share in this segment is virtually nonexistent, placing it firmly in the question mark category.

Significant investment in research and development is a prerequisite for Renault to establish a foothold in hydrogen technology. The path to mass-market adoption remains uncertain, with challenges in infrastructure development and cost reduction still needing to be overcome. This high-risk, high-reward profile necessitates careful strategic planning as Renault navigates the early stages of this developing technology.

Mobilize, Renault Group's venture into new mobility, data, and energy services, is positioned as a Question Mark in the BCG Matrix. The brand has ambitious goals, targeting over 20% of group revenues by 2030, highlighting its potential in a rapidly expanding sector.

Despite the high-growth nature of new mobility services, Mobilize currently holds a relatively small market share. This suggests it's in the early stages of development and needs to capture a larger portion of the market to achieve its revenue targets.

Significant investment is necessary for Mobilize to scale its operations and solidify its competitive standing. This financial commitment is crucial for innovation, expanding service offerings, and building brand recognition in a dynamic and fragmented market.

Advanced Driver-Assistance Systems (ADAS) and Software-Defined Vehicles (SDV) Initiatives

Renault is making substantial investments in Advanced Driver-Assistance Systems (ADAS) and the development of Software-Defined Vehicles (SDVs). Their focus is on integrating advanced AI for autonomous driving, targeting Level 2/2+ capabilities for personal cars and Level 4 for public transportation systems. This commitment places them in a sector with significant future growth potential.

While these initiatives are in a high-growth technological area, Renault's current market share in sophisticated ADAS and SDV features is still emerging. The company is actively pursuing strategic partnerships and dedicating considerable research and development resources to these advanced automotive technologies. These efforts represent a high investment strategy with the aim of capturing future market opportunities.

- R&D Investment: Renault's commitment to ADAS and SDVs signifies a substantial allocation of capital towards future automotive capabilities, reflecting industry trends towards electrification and autonomy.

- Market Position: Despite significant investment, Renault's current market penetration in highly advanced ADAS and SDV features is still in its developmental stages, indicating a strategic build-up phase.

- Technological Focus: The company's strategy targets L2/L2+ autonomous driving for personal vehicles and L4 for public transport, aligning with key industry advancements in self-driving technology.

- Strategic Partnerships: Renault's approach involves forging alliances to accelerate development and deployment of these complex, software-intensive vehicle systems.

Entry into New Emerging Markets with Limited Current Presence

Renault's strategic push into emerging markets like Brazil and South Korea, outlined in its International Game Plan, highlights a key characteristic of 'Question Marks' in the BCG matrix. These regions present substantial growth opportunities, with Brazil's automotive market, for instance, seeing a rebound in 2024, signaling renewed consumer demand.

Despite this potential, Renault's existing market share in some of these newer or less developed international ventures remains relatively modest. For example, while South Korea's auto sector is competitive, Renault Korea Motors has been working to carve out a larger niche, aiming to leverage its global brand recognition.

These markets demand focused investment to nurture their growth and transform potential into tangible market leadership. Success hinges on strategic product launches, localized marketing efforts, and building robust distribution networks. Renault's approach often involves adapting its vehicle offerings to suit local preferences and economic conditions.

- High Growth Potential: Emerging markets like Brazil and South Korea offer significant upside for automotive sales and brand expansion.

- Low Market Share: Renault's current penetration in these markets may not yet reflect their full potential, typical of 'Question Marks'.

- Targeted Investment Needed: Significant resources are required to build brand awareness, distribution, and product relevance to capture market share.

- Strategic Importance: These markets are crucial for Renault's diversification strategy away from its traditional European stronghold.

Question Marks in Renault's BCG matrix represent business units or products operating in high-growth markets but currently holding low market share. These require significant investment to capture potential future market leadership. Success is uncertain, making them high-risk, high-reward ventures.

Renault's hydrogen fuel cell vehicles, for instance, are a prime example. While the sector shows promise, global FCEV sales in 2023 were only around 15,000 units, with Renault's share being negligible. Similarly, Mobilize, the new mobility venture, targets substantial revenue but currently has a small market footprint.

The company's investments in advanced driver-assistance systems (ADAS) and software-defined vehicles (SDVs) also fall into this category. These are high-growth tech areas, yet Renault is still building its presence and market share in these sophisticated automotive technologies.

Finally, Renault's strategic expansion into emerging markets like Brazil and South Korea, while offering significant growth potential, also reflects a low current market share in those regions, necessitating focused investment to build a stronger position.

BCG Matrix Data Sources

Our BCG Matrix leverages robust data from financial disclosures, market research reports, and competitor analysis to provide a clear picture of product portfolio performance.