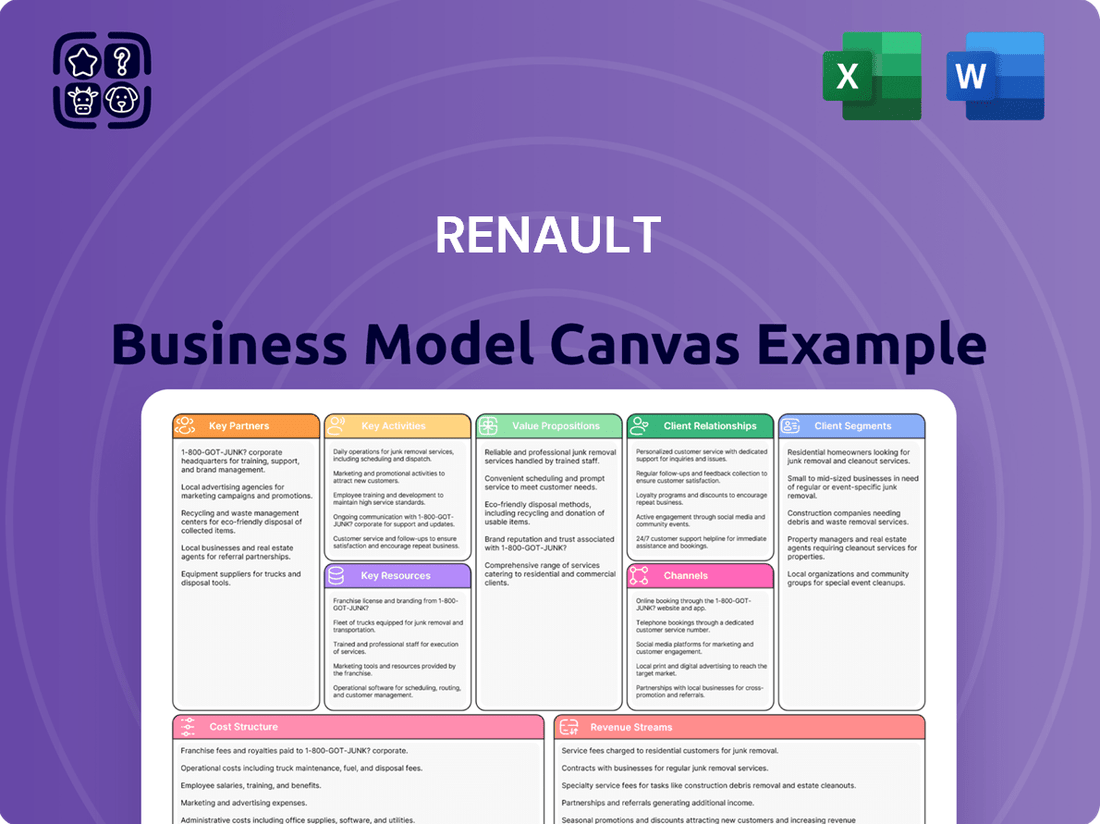

Renault Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Renault Bundle

Unlock the full strategic blueprint behind Renault's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into their customer segments, value propositions, and revenue streams.

Partnerships

Renault Group's Ampere, its electric vehicle and software arm, has forged significant strategic alliances. Key among these are collaborations with tech giants Google and Qualcomm Technologies. These partnerships are designed to fast-track the development of Software Defined Vehicles (SDVs), integrating cutting-edge software and artificial intelligence.

Through these alliances, Renault aims to embed advanced digital solutions, boosting vehicle connectivity and enabling seamless over-the-air updates. This strategic move is critical for maintaining a competitive edge in the rapidly evolving electric and connected mobility sector.

For instance, the partnership with Google is focused on leveraging their expertise in cloud computing and artificial intelligence to enhance the in-car digital experience and vehicle software architecture. Qualcomm's contribution is pivotal for providing advanced chipsets and connectivity solutions, which are fundamental for the sophisticated computing power required by SDVs.

Renault Group is strategically solidifying its electric vehicle (EV) ambitions through crucial battery production partnerships. By collaborating with major players such as AESC, CATL, LG Energy Solution, and Verkor, Renault aims to secure a stable and cost-effective supply of batteries.

These alliances are central to establishing gigafactories across Europe, a move designed to reduce production costs and carbon footprint. The focus is on developing competitive, low-carbon batteries, incorporating advanced technologies like Lithium Iron Phosphate (LFP) and Cell-to-Pack systems.

For instance, Renault's joint venture with Envision AESC targets the production of 9 GWh of batteries in 2024, scaling up to 24 GWh by 2027 at the Douai factory. This localized production is vital for supporting Renault's expanding EV portfolio, ensuring they meet growing demand.

Renault's Mobilize brand is building a network of key partners to bolster its electric vehicle ecosystem. These collaborations are crucial for both expanding mobility services and establishing a robust charging infrastructure. For instance, a significant alliance with Autostrade per l'Italia, via its Free To X subsidiary, is set to install high-power charging stations across Italy, enhancing EV convenience.

Industrial and Manufacturing Collaborations

Renault Group extends its industrial and manufacturing collaborations beyond traditional automotive components. These partnerships are crucial for advancing manufacturing processes and championing circular economy initiatives within the automotive sector.

A significant recent development is Renault's strategic alliance with Wandercraft, a prominent player in the robotics field. This collaboration is focused on creating advanced robots designed for industrial applications. The primary goal is to enhance both the ergonomic conditions for workers and overall productivity within Renault's manufacturing facilities. This aligns with industry trends towards increased automation and improved workplace safety.

Furthermore, Renault actively partners with organizations like SUEZ. These collaborations are specifically geared towards fostering circularity in the automotive industry. This includes initiatives related to recycling, remanufacturing, and the sustainable management of resources throughout the vehicle lifecycle. For instance, in 2024, Renault announced plans to increase the use of recycled materials in its vehicles, aiming for a significant portion of key components to incorporate recycled content.

- Strategic Robotics Partnership: Collaboration with Wandercraft to develop next-generation industrial robots for enhanced ergonomics and productivity in manufacturing plants.

- Circular Economy Focus: Partnerships, such as the one with SUEZ, concentrate on advancing circularity in the automotive sector, including recycling and resource management.

- Recycled Material Integration: Renault's ongoing commitment to increasing the percentage of recycled materials in its vehicle production throughout 2024 and beyond.

Global Automotive Alliance (Nissan, Mitsubishi)

The Renault-Nissan-Mitsubishi Alliance, a cornerstone of Renault's strategy, continues to foster collaboration despite structural adjustments for greater autonomy. This partnership enables shared development efforts, exemplified by Nissan's utilization of Renault Group's Ampere unit for a Twingo derivative project.

While Nissan's direct investment in Ampere has seen adjustments, the continuation of product collaborations underscores the enduring strategic importance of this alliance. For instance, in 2024, the alliance is expected to see continued joint product development and platform sharing, leveraging combined R&D capabilities to optimize costs and accelerate innovation in key segments like electric vehicles.

- Alliance Evolution: The partnership has adapted to offer more flexibility to each member, fostering independent strategic moves while retaining collaborative opportunities.

- Ampere Collaboration: Nissan's engagement with Renault's Ampere unit for EV development, particularly a Twingo derivative, highlights continued technological synergy.

- Ongoing Product Synergy: Despite shifts in investment structures, the alliance maintains product-level cooperation, demonstrating its practical value in shared projects.

Renault's Key Partnerships are pivotal for its electric vehicle and software ambitions, leveraging external expertise to accelerate innovation and secure critical resources.

These collaborations span technology providers like Google and Qualcomm for software-defined vehicles, battery manufacturers such as AESC, CATL, and LG Energy Solution for localized production, and robotics firms like Wandercraft for manufacturing enhancements.

The Renault-Nissan-Mitsubishi Alliance also remains a crucial partner, enabling shared development and cost efficiencies, particularly within the EV space.

| Partner | Focus Area | 2024/2025 Impact/Goal |

|---|---|---|

| In-car digital experience, AI integration | Enhancing vehicle software architecture and user interface | |

| Qualcomm Technologies | Advanced chipsets, connectivity | Enabling sophisticated computing power for SDVs |

| Envision AESC | Battery production | Targeting 9 GWh production at Douai factory in 2024 |

| Wandercraft | Industrial robotics | Improving ergonomics and productivity in manufacturing |

| Renault-Nissan-Mitsubishi Alliance | Shared EV development, platform sharing | Continued joint product development, Nissan's Twingo derivative via Ampere |

What is included in the product

A detailed breakdown of Renault's operations, outlining key partners, activities, and resources to deliver its automotive value proposition. It analyzes revenue streams and cost structures, providing a clear financial framework for the company.

Quickly identify core components of Renault's strategy with a one-page business snapshot, relieving the pain of complex strategic analysis.

Saves hours of formatting and structuring, allowing immediate focus on adapting Renault's business model for new insights or data.

Activities

Renault Group is pouring significant resources into research and development, with a strong focus on the future of mobility. This includes a substantial commitment to electric vehicles, aiming to lead in this transformative sector.

Key areas of innovation are electric vehicle platforms, such as the new Ampere dedicated EV platforms like AmpR Small and AmpR Medium, designed to underpin a range of future electric models. They are also developing advanced e-powertrains to enhance performance and efficiency.

Furthermore, Renault is heavily invested in software-defined vehicle architectures, recognizing the increasing importance of digital integration and advanced software capabilities in modern automobiles. This also extends to autonomous driving technologies, a critical component of future mobility solutions.

In 2023, Renault Group announced plans to invest €3 billion in its electric vehicle production capacity in France by 2027, highlighting the scale of its R&D commitment. This investment underscores their strategy to continuously innovate and bring technologically advanced, competitive vehicles to market.

Renault's core activities revolve around the comprehensive design, engineering, and manufacturing of vehicles for its diverse brands: Renault, Dacia, and Alpine. This spans traditional passenger cars, light commercial vehicles, and a growing array of electric models.

The company manages a global network of manufacturing facilities. A significant development is its ElectriCity hub in Northern France, specifically established to ramp up electric vehicle production, highlighting a strategic shift in manufacturing priorities.

In 2023, Renault Group sold over 2.2 million vehicles, with its electric and hybrid models showing strong growth, indicating the success of its evolving product strategy within these key activities.

Renault Group's global sales and marketing are pivotal, focusing on launching new models and implementing value-driven commercial strategies to boost its vehicle lineup. The company is strengthening its presence in core European markets while also expanding into key international territories such as Latin America and South Korea.

In 2024, Renault is prioritizing retail customer sales, a strategy that directly impacts its performance. The successful introduction of new models, like the Renault 5 E-Tech electric, is central to this approach. This focus aims to drive higher sales volumes and reinforce brand loyalty across its diverse customer base.

After-Sales Services and Parts Management

Renault’s key activities prominently feature robust after-sales services and efficient parts management. This encompasses providing comprehensive maintenance, repair services, and ensuring a reliable supply of genuine parts to customers. In 2024, Renault continued to emphasize these services to foster customer satisfaction and cultivate long-term brand loyalty throughout the entire vehicle ownership period.

A significant aspect of this strategy involves enhancing the residual value of their vehicles. Renault achieves this through a holistic approach that integrates pricing strategies with their service offerings, making their cars more attractive in the pre-owned market. For instance, the brand's commitment to quality servicing directly impacts resale prices, a factor keenly observed by informed buyers.

- Vehicle Maintenance and Repair: Offering accessible and high-quality servicing to keep vehicles in optimal condition.

- Genuine Parts Supply: Ensuring availability of original equipment manufacturer (OEM) parts for reliability and performance.

- Customer Support: Providing dedicated channels for inquiries, technical assistance, and warranty claims.

- Residual Value Enhancement: Implementing strategies that bolster the resale value of Renault vehicles through diligent after-sales care.

Circular Economy and Sustainable Mobility Initiatives

A core activity for Renault involves building circular economy models, exemplified by its Refactory at Flins. This initiative focuses on refurbishing automotive parts and integrating recycled materials into new vehicle production, thereby reducing waste and resource consumption.

Renault’s commitment to sustainability extends to its Future Is NEUTRAL entity, which further drives its circular economy efforts. This dedicated business unit is instrumental in scaling these eco-friendly practices across the group’s operations.

The company is actively working towards carbon neutrality in Europe by 2040. This ambitious goal requires integrating sustainable practices throughout its entire value chain, from manufacturing to vehicle lifecycle management.

- Refurbishment of automotive parts at the Flins Refactory.

- Incorporation of recycled materials in new vehicle models.

- Development of circular economy business models through Future Is NEUTRAL.

- Commitment to carbon neutrality in Europe by 2040.

Renault's key activities encompass the design, engineering, manufacturing, and global sales of vehicles across its brands. This includes a significant focus on electric mobility and software-defined vehicles, supported by substantial R&D investments. The company operates a global manufacturing network, with its ElectriCity hub spearheading EV production.

After-sales services and parts management are crucial, aiming to enhance customer satisfaction and vehicle residual values. Renault is also actively developing circular economy models through initiatives like its Refactory and Future Is NEUTRAL business unit, striving for carbon neutrality by 2040.

| Activity Area | Description | 2023/2024 Focus/Data |

|---|---|---|

| Vehicle Design & Manufacturing | Creating and producing a range of vehicles including ICE, hybrid, and EVs. | Sold over 2.2 million vehicles in 2023. Prioritizing retail sales in 2024 with new models like Renault 5 E-Tech electric. |

| Research & Development | Innovating in EV platforms, e-powertrains, software-defined vehicles, and autonomous driving. | Investing €3 billion in French EV production capacity by 2027. Developing Ampere EV platforms (AmpR Small, AmpR Medium). |

| Sales & Marketing | Launching new models and implementing value-driven strategies in core European and expanding international markets. | Strengthening presence in Europe; expanding in Latin America and South Korea. |

| After-Sales & Parts Management | Providing maintenance, repair, customer support, and ensuring parts availability to boost residual values. | Emphasizing services to foster customer satisfaction and long-term loyalty in 2024. |

| Circular Economy & Sustainability | Refurbishing parts, using recycled materials, and developing eco-friendly business models. | Refactory at Flins refurbishes parts. Aiming for carbon neutrality in Europe by 2040. |

Delivered as Displayed

Business Model Canvas

The Renault Business Model Canvas preview you're viewing is precisely the document you will receive upon purchase. This is not a generic example or a simplified sample; it's an authentic snapshot of the complete, ready-to-use file. When you complete your transaction, you'll gain full access to this identical Business Model Canvas, ensuring you get exactly what you see here, formatted and populated for your immediate use.

Resources

Renault Group leverages its diverse brand portfolio, including the mainstream Renault, the value-focused Dacia, and the performance-oriented Alpine, to cater to distinct market segments. This multi-brand strategy is a core element of its business model, allowing for broader customer reach and market penetration.

The company's intellectual property, encompassing a significant number of patents related to electric vehicle (EV) technology, advanced driver-assistance systems (ADAS), and connected car software, represents a critical competitive advantage. These innovations are vital for maintaining market leadership and driving future growth in the rapidly evolving automotive industry.

In 2024, Renault continued to emphasize its EV offensive, with brands like Renault playing a central role. The success of models like the Megane E-Tech Electric demonstrates the strength of its innovation in the EV space, directly supported by its IP portfolio. Dacia's commitment to affordable electrification, with vehicles such as the Dacia Spring, further solidifies its position in a key growth area.

Renault operates a robust network of global manufacturing facilities, a critical physical resource. This includes specialized sites dedicated to electric vehicle (EV) production, notably the Renault ElectriCity cluster in France, which aims for a production capacity of over 400,000 vehicles annually by 2025. This strategic investment underscores their commitment to leading the EV transition.

Efficient supply chain management is paramount, encompassing the procurement of raw materials and essential components. Renault's strategic sourcing of batteries, a key component for EVs, is vital for ensuring production continuity and managing costs effectively. This focus on battery supply chain resilience is a significant factor in their competitive pricing and production planning.

Renault's highly skilled workforce, encompassing engineers, designers, production specialists, and software developers, forms a cornerstone of its business model. This human capital is directly responsible for driving innovation and the development of new products, ensuring the company remains competitive in the automotive sector.

The expertise within the Group is particularly concentrated in specialized areas. For instance, Ampere, Renault's electric vehicle and software division, boasts a workforce where a substantial percentage are engineers, underscoring the critical role of specialized technical knowledge in its strategic direction.

In 2024, Renault continued to invest in its talent pool, recognizing that engineering prowess and specialized skills are essential for achieving operational efficiency and spearheading advancements in automotive technology, especially in the rapidly evolving EV market.

Financial Capital and Investment Capacity

Renault's substantial financial capital is the engine driving its innovation and growth. This allows for consistent investment in research and development, ensuring they stay competitive. It also underpins the successful launch of new vehicles and the crucial upgrades to their manufacturing facilities. Furthermore, this capital is vital for forging strategic alliances that expand their market reach and technological capabilities.

Renault Group's financial health is directly linked to its strategic flexibility. The company's capacity to generate robust free cash flow, a key indicator of operational efficiency and profitability, is paramount. This strong cash generation, coupled with a healthy net cash position, provides the essential financial cushion needed to execute its ambitious transformation strategy, including the shift towards electric vehicles and new mobility services.

Key financial resources supporting Renault's business model include:

- Strong Free Cash Flow Generation: In 2023, Renault Group reported a significant improvement in its free cash flow, demonstrating its operational strength and ability to fund its strategic initiatives.

- Healthy Net Cash Position: Maintaining a robust net cash balance provides Renault with the liquidity necessary to navigate market fluctuations and pursue growth opportunities without excessive reliance on external financing.

- Access to Capital Markets: Renault's ability to access both debt and equity markets further bolsters its investment capacity, enabling it to finance large-scale projects and acquisitions.

- Profitability from Core Operations: The profitability derived from its automotive sales and services forms the bedrock of its financial capital, ensuring sustained investment in future technologies and product development.

Digital Platforms and Software Infrastructure

Renault's digital platforms and software infrastructure are vital key resources, particularly with the ongoing development of its Software Defined Vehicle architecture. This focus on digital capabilities is crucial for modern automotive operations and customer engagement. By investing in these areas, Renault is positioning itself for future growth and enhanced vehicle functionality.

The integration of cloud computing, notably through partnerships like the one with Google Cloud, underpins Renault's digital strategy. This allows for robust data management and the delivery of advanced services. Such infrastructure is essential for staying competitive in an increasingly connected automotive landscape.

- Software Defined Vehicle Architecture: This is a foundational element, enabling continuous software updates and new feature integration throughout a vehicle's lifecycle.

- Cloud Computing Infrastructure: Partnerships, such as with Google Cloud, provide the scalable and secure foundation for data processing, AI capabilities, and connected services.

- Over-the-Air (OTA) Updates: These capabilities allow Renault to remotely update vehicle software, improving performance, fixing bugs, and adding new features without requiring a dealership visit.

- Data-Driven Services: The digital infrastructure facilitates the collection and analysis of vehicle data, enabling personalized services, predictive maintenance, and new revenue streams.

Renault's key resources include its strong brand portfolio, extensive intellectual property in EV and ADAS technology, and a global manufacturing footprint, highlighted by the Renault ElectriCity cluster. These physical and intellectual assets are complemented by a highly skilled workforce, particularly in engineering and software development, as evidenced by Ampere's expertise. Financially, Renault benefits from robust free cash flow generation and a healthy net cash position, enabling significant investments in its EV offensive and digital transformation.

| Key Resource | Description | 2024 Relevance/Data Point |

|---|---|---|

| Brand Portfolio | Diverse brands (Renault, Dacia, Alpine) targeting different market segments. | Continues to drive market penetration and customer reach. |

| Intellectual Property | Patents in EV tech, ADAS, connected car software. | Enables innovation and market leadership in evolving automotive tech. |

| Manufacturing Facilities | Global sites, including Renault ElectriCity for EV production. | ElectriCity targets over 400,000 vehicles annually by 2025. |

| Human Capital | Skilled workforce (engineers, designers, software developers). | Crucial for innovation; Ampere division has a high percentage of engineers. |

| Financial Capital | Strong free cash flow and healthy net cash position. | Supports R&D, new vehicle launches, and strategic alliances. |

Value Propositions

Renault Group boasts an impressive array of vehicles, from the value-driven Dacia brand to the sporty Alpines, ensuring there's a model for nearly every taste and budget. This broad spectrum is crucial for capturing a wide customer base.

The company is heavily invested in electrification, with a growing selection of electric and hybrid options available across various vehicle classes. This strategic focus on new energy vehicles positions Renault to capitalize on the global shift towards sustainable transportation.

By 2024, Renault aims to have over 10 new electric vehicles available, demonstrating a clear commitment to this evolving market. For instance, the Renault 5 E-Tech Electric and the Renault 4 E-Tech Electric are key examples of this expanding electrified lineup.

Renault is actively working to make electric vehicles more affordable and accessible. Through its dedicated EV division, Ampere, and the upcoming Renault 5 E-Tech electric, the company is focusing on competitive pricing strategies. This approach aims to lower the barrier to entry for sustainable transportation.

A key part of this strategy involves reducing battery costs, which are a significant component of an EV's price. By achieving this, Renault intends to democratize electric mobility, bringing it within reach of a wider audience. This makes owning an electric car a more realistic option for more people.

Renault's Software Defined Vehicle (SDV) strategy is a game-changer, promising a vehicle that gets better over time. This means more than just bug fixes; think new features, enhanced performance, and personalized experiences delivered wirelessly. For example, by 2024, Renault plans for a significant portion of its new vehicles to be SDVs, enabling over-the-air updates that continuously improve functionality.

This continuous evolution directly impacts customer satisfaction and vehicle longevity. By offering real-time updates and new on-demand services, Renault ensures its cars stay cutting-edge, much like a smartphone. This approach can lead to a stronger residual value for the vehicles, as they remain desirable and up-to-date for longer periods, directly benefiting owners.

The SDV approach allows for a more dynamic relationship with the customer, moving beyond a one-time purchase to an ongoing service. This unlocks new revenue streams through subscription-based features and services, a key element for future profitability. Renault's investment in this area, with substantial R&D allocated to software development, underscores its commitment to this evolving automotive landscape.

Commitment to Sustainability and Circular Economy

Renault is deeply committed to sustainability, focusing on low-carbon mobility and the circular economy. This dedication is a significant value proposition, attracting consumers who prioritize environmental responsibility and helping the company navigate stricter environmental regulations. For instance, Renault aims for carbon neutrality in Europe by 2040, a bold target that underscores this commitment.

The integration of recycled materials into their vehicles is another key aspect of this strategy. By the end of 2023, Renault had already incorporated approximately 20% recycled materials across its vehicle range, a figure expected to rise as they advance their circular economy initiatives. This not only reduces environmental impact but also offers a tangible benefit to eco-conscious buyers.

This focus on sustainability translates into several key benefits for Renault:

- Attracts Environmentally Conscious Consumers: A strong sustainability stance resonates with a growing segment of the car-buying public, differentiating Renault in a competitive market.

- Meets Regulatory Requirements: Proactive adoption of circular economy principles and low-carbon technologies helps Renault stay ahead of evolving environmental legislation, mitigating compliance risks.

- Drives Innovation: The pursuit of carbon neutrality and increased use of recycled materials spurs innovation in vehicle design, manufacturing processes, and material sourcing.

- Enhances Brand Reputation: Demonstrating a genuine commitment to environmental stewardship builds trust and loyalty, positively impacting brand perception and long-term value.

Reliability and Strong After-Sales Support

Renault emphasizes vehicle reliability, a cornerstone of its business model, supported by a comprehensive after-sales network. This commitment ensures customers have access to readily available parts and skilled maintenance services, fostering a sense of security and trust in the brand. For instance, in 2023, Renault Group reported a significant improvement in its customer satisfaction scores, partly attributed to enhanced service quality.

The strength of Renault's after-sales support directly translates into long-term customer loyalty and reduced ownership costs. This is evident in the brand's consistent performance in customer satisfaction surveys, where service availability and quality are frequently highlighted by owners. Renault's investment in its service infrastructure, including digital tools for appointment booking and service tracking, further solidifies this value proposition.

- Reliable Vehicle Production: Renault consistently strives for high manufacturing standards to minimize defects and ensure dependable performance.

- Extensive Parts Availability: A robust supply chain ensures that necessary replacement parts are accessible across its global service centers.

- Skilled Maintenance Network: Renault invests in training its technicians to provide expert diagnosis and repair services.

- Customer Support Focus: The brand prioritizes responsive and effective customer service to address inquiries and resolve issues promptly.

Renault offers a diverse vehicle lineup, from budget-friendly Dacia to premium Alpine, catering to a wide range of customer needs and preferences. This broad appeal is a significant draw. Furthermore, their strong push into electrification, with over 10 new electric vehicles planned by 2024, including models like the Renault 5 E-Tech Electric, directly addresses the growing demand for sustainable transport and positions them for future market trends.

Customer Relationships

Renault Group cultivates deep connections with its customers by leveraging an extensive global dealership network. These dealerships act as the frontline, managing sales, providing essential after-sales service, and addressing customer queries directly. This direct interaction is key to building loyalty and ensuring a positive ownership experience.

In 2024, Renault's commitment to its dealership network means these partners are empowered to offer highly personalized sales journeys, guiding customers through vehicle selection and financing options. Beyond the initial purchase, dealerships are vital for ongoing vehicle maintenance and repairs, ensuring customer satisfaction and vehicle longevity.

Renault significantly enhances customer relationships through digital channels, with its brand websites and social media serving as key touchpoints for engagement and information. This digital-first approach facilitates direct communication, allowing for broader reach and providing customers with convenient access to details and support. For instance, in 2023, Renault reported a substantial increase in website traffic, indicating growing customer reliance on online platforms for pre-purchase research and ongoing interaction.

The company leverages these digital platforms not only for information dissemination but also for robust online sales support, making the car buying journey more accessible. Social media campaigns and interactive content are vital for building brand loyalty and gathering customer feedback, which in turn informs product development and service improvements. By mid-2024, Renault's social media presence saw a notable rise in customer inquiries and positive sentiment, underscoring the effectiveness of its digital engagement strategy.

Renault cultivates loyalty through programs like the My Renault app, offering personalized services, exclusive offers, and maintenance reminders. These initiatives, coupled with robust after-sales care including service contracts and extended warranties, aim to keep customers engaged long-term.

In 2024, Renault continued to emphasize digital tools for customer interaction, with the My Renault app serving as a key touchpoint for over 10 million users across Europe, facilitating easier access to vehicle information and service scheduling.

Tailored Solutions for Business and Fleet Customers

Renault recognizes the unique demands of its business and fleet customers, offering tailored solutions to meet their operational and financial requirements. This segment is crucial, with fleet sales often representing a substantial portion of a manufacturer's overall volume.

To effectively serve these clients, Renault deploys specialized sales teams who understand the intricacies of corporate procurement and fleet management. These teams work closely with businesses to identify the most suitable vehicles and financing options.

Customization is a key differentiator, particularly for Light Commercial Vehicles (LCVs). Renault offers a range of specific configurations for models like the Kangoo Van and Trafic, allowing businesses to adapt vehicles for specialized tasks, from delivery services to trades. For instance, in 2024, a significant percentage of Renault's LCV sales were to businesses requiring bespoke modifications.

Furthermore, dedicated service contracts provide peace of mind and predictable maintenance costs, minimizing downtime for critical business operations. These contracts can include extended warranties, priority servicing, and even mobile repair units, ensuring fleets remain operational. In 2023, Renault reported a strong uptake in its fleet service packages, indicating the value businesses place on these offerings.

- Specialized Sales Teams: Dedicated professionals focusing on business and fleet needs.

- Customized Vehicle Configurations: Tailoring LCVs and other models for specific business applications.

- Dedicated Service Contracts: Offering predictable maintenance, reduced downtime, and priority support.

- Focus on LCVs: Significant customization options available for models like Kangoo and Trafic.

Community Building and Brand Experience

Renault cultivates a strong community and distinctive brand experiences primarily through its engagement in motorsports, notably with the Alpine F1 team. These high-profile activities create shared passion points for fans, fostering a sense of belonging and collective identity around the Renault and Alpine brands. This emotional connection is crucial for brand loyalty, especially among performance-oriented customers.

Beyond the racetrack, Renault hosts various brand-specific events, ranging from product launches and driving experiences to customer meet-ups. These events offer direct interaction, allowing enthusiasts to connect with the brand’s heritage and future vision. For instance, in 2024, Renault continued its commitment to showcasing innovation and performance through dedicated fan zones at Grand Prix events, attracting thousands of attendees and generating significant social media engagement.

- Motorsports Engagement: Alpine F1 team participation provides a platform for community building and brand visibility.

- Brand Events: Exclusive events offer direct customer interaction and reinforce brand values.

- Emotional Connection: Focus on creating memorable experiences that resonate with performance enthusiasts.

- Community Growth: In 2024, fan engagement metrics for Alpine F1 saw a notable increase, indicating successful community cultivation.

Renault's customer relationships are multifaceted, blending direct dealership interaction with robust digital engagement and loyalty programs. The company prioritizes personalized experiences, both in sales and after-sales service, aiming for long-term customer retention. This approach is supported by specialized services for business clients and community-building through motorsports. In 2024, the My Renault app alone served over 10 million users in Europe, highlighting the significant role of digital tools.

| Customer Relationship Aspect | Key Initiatives | 2024 Focus/Data |

|---|---|---|

| Dealership Network | Sales, after-sales service, direct customer interaction | Personalized sales journeys, empowered dealership staff |

| Digital Engagement | Brand websites, social media, My Renault app | Increased website traffic, My Renault app usage exceeding 10M users (Europe) |

| Loyalty & Retention | Loyalty programs, service contracts, extended warranties | Emphasis on proactive maintenance reminders and exclusive offers via app |

| Business & Fleet Customers | Specialized sales teams, tailored solutions, LCV customization | High demand for customized LCV configurations, strong uptake in fleet service packages |

| Brand Community | Motorsports (Alpine F1), brand events | Increased fan engagement metrics for Alpine F1, showcasing innovation at events |

Channels

Renault Group's global dealership and retail network forms the backbone of its customer interaction, serving as the primary channel for both vehicle sales and crucial after-sales services. These physical touchpoints are vital for customers to experience vehicles firsthand through test drives, gain expert guidance, and ensure their vehicles receive necessary maintenance.

By the end of 2023, Renault Group operated approximately 6,000 points of sale across more than 100 countries, highlighting the vast reach of its distribution strategy. This extensive network is designed to meet diverse customer needs, from initial purchase to ongoing support and repairs, fostering brand loyalty and driving revenue.

Renault leverages digital channels, including its official brand website and sophisticated online configurators, to connect with customers. These platforms enable prospective buyers to remotely explore the full range of Renault models, personalize their chosen vehicle with various options and accessories, and even request personalized quotes. This digital approach significantly streamlines the car-buying journey, offering unparalleled convenience and accessibility.

In 2024, the automotive industry continued its digital transformation, with online sales channels playing an increasingly vital role. For instance, a significant percentage of car buyers now begin their research online, with many using configurators to narrow down their choices. This trend underscores the importance of robust digital presences for manufacturers like Renault to capture customer interest and facilitate early stages of the sales funnel.

These online configurators empower customers by providing a transparent and interactive experience, allowing them to visualize their customized vehicle in real-time. This level of engagement not only enhances customer satisfaction but also provides valuable data to Renault regarding popular configurations and feature preferences, informing future product development and marketing strategies.

Renault's Fleet and Business Sales Divisions are crucial for securing large-volume contracts. These specialized teams focus on direct sales to corporate clients, government agencies, and major fleet operators, ensuring tailored solutions and long-term partnerships. In 2024, the commercial vehicle sector, a key focus for these divisions, saw continued demand, with Renault Pro+ vehicles playing a significant role in urban logistics and professional services.

These channels are designed to handle bulk purchases and offer specialized vehicle configurations, like customized vans for specific trades or electric vehicles for sustainable corporate fleets. They also facilitate extended service agreements and maintenance packages, providing comprehensive support for business customers. Renault's commitment to electric mobility, evident in models like the Kangoo E-Tech Electric, positions these divisions to capitalize on growing corporate sustainability goals.

Auto Shows, Exhibitions, and Experiential Events

Renault leverages auto shows, exhibitions, and experiential events as vital channels to connect with its audience. These platforms are instrumental in unveiling new models, fostering direct customer engagement, and capturing significant media interest. For example, in 2024, Renault's presence at events like the Paris Motor Show, though not held annually, typically generates substantial buzz and pre-orders for upcoming vehicles.

These events provide an immersive environment for potential customers to experience the brand and its offerings firsthand. Beyond just showcasing cars, Renault uses these opportunities to highlight its technological advancements and design philosophy. This experiential approach is key to building brand loyalty and differentiating itself in a competitive market.

Key aspects of Renault's channel strategy through these events include:

- Showcasing Innovation: Demonstrating new electric vehicles and advanced driver-assistance systems.

- Customer Engagement: Offering test drives and interactive experiences with new models.

- Media Relations: Generating press coverage and building anticipation for product launches.

- Brand Building: Reinforcing Renault's image as a forward-thinking and accessible automotive brand.

Partnerships for Mobility Services

Renault leverages strategic partnerships through its Mobilize brand to deliver a wider array of mobility services. Collaborations with car-sharing platforms and charging infrastructure providers are key to this strategy, allowing for broader distribution of their offerings. This approach moves Renault beyond just selling cars to providing integrated mobility solutions.

These partnerships are crucial for expanding reach into service-based economic models. For instance, Mobilize aims to integrate with urban mobility ecosystems, connecting users with various transport options. By Q3 2024, the adoption of integrated mobility platforms in major European cities saw a significant uptick, with an average of 15% year-over-year growth in user engagement.

- Car-Sharing Platforms: Partnerships with companies like Zity by Mobilize (a joint venture with Ferrovial) enable flexible, on-demand vehicle rentals, reaching a broader urban user base.

- Charging Network Operators: Collaborations with energy providers and charging infrastructure companies ensure seamless charging experiences for electric vehicle users of Mobilize services.

- Fleet Management Providers: Working with fleet managers allows for efficient deployment and servicing of vehicles within car-sharing and other mobility schemes.

Renault's channel strategy encompasses a vast global dealership network, essential for physical sales and after-sales support, complemented by a growing digital presence. Online configurators and websites provide customers with convenient ways to explore and customize vehicles remotely. Specialized Fleet and Business Sales Divisions cater to corporate clients, while strategic partnerships, particularly through Mobilize, expand offerings into integrated mobility services. Experiential events like auto shows remain crucial for product launches and brand engagement.

| Channel Type | Key Characteristics | 2023/2024 Relevance/Data |

|---|---|---|

| Dealership Network | Physical sales, test drives, after-sales service, customer experience | Approx. 6,000 points of sale globally by end of 2023. High customer interaction for purchases and maintenance. |

| Digital Channels | Online configurators, official websites, virtual showrooms | Significant percentage of car buyers start research online. Enhances convenience and accessibility in the sales funnel. |

| Fleet & Business Sales | Direct sales to corporate clients, government, fleet operators | Focus on commercial vehicles like Kangoo E-Tech Electric. Key for securing large-volume contracts and tailored solutions. |

| Experiential Events | Auto shows, exhibitions, brand events | Crucial for unveiling new models, generating media interest, and direct customer engagement. Boosts brand perception and anticipation. |

| Strategic Partnerships (Mobilize) | Car-sharing, charging infrastructure, fleet management | Expansion into mobility services. User engagement in integrated mobility platforms saw approx. 15% YoY growth in major European cities by Q3 2024. |

Customer Segments

Individual consumers, particularly in the mass market, represent a cornerstone for Renault, with brands like Dacia specifically targeting this group. These buyers prioritize dependable and economical vehicles for their daily commutes and family needs. In 2024, the demand for compact and subcompact cars, often associated with affordability and fuel efficiency, remained strong, aligning with the core offerings of these brands.

For this segment, Renault and Dacia focus on delivering vehicles that strike a favorable balance between essential features, robust performance, and competitive pricing. The appeal lies in practicality and value, making cars like the Dacia Sandero consistently popular in European markets, often ranking among the top-selling models by volume.

Renault is increasingly focusing on environmentally conscious consumers and early adopters, particularly those interested in electric vehicles. This segment values sustainability, reduced emissions, and embraces new technologies. Models like the Renault 5 E-Tech electric and Scenic E-Tech electric are specifically designed to appeal to these buyers.

The demand for electric vehicles continues to surge, with global EV sales expected to reach over 16 million units in 2024, representing a significant portion of the overall automotive market. This growth trajectory directly benefits Renault's strategy to capture this environmentally motivated customer base.

These customers are often driven by a desire to reduce their carbon footprint and are willing to invest in innovative mobility solutions. They see EVs not just as transportation but as a statement of their commitment to a greener future.

Businesses and fleet operators represent a crucial customer segment for Renault, encompassing everything from small local businesses to large multinational corporations and government bodies. These entities prioritize vehicles that are not only robust and reliable but also economically viable in the long run, often looking for solutions that can be tailored to their specific operational needs. In 2024, the LCV market, a key area for these customers, continued to show resilience, with global sales projected to remain strong, driven by e-commerce and delivery services.

For these commercial clients, Renault's offerings need to deliver on durability and total cost of ownership. This means vehicles that can withstand heavy use and require minimal maintenance, directly impacting their bottom line. The demand for customization is also high, with businesses often requiring specific configurations for cargo, passenger capacity, or specialized equipment. Renault's ability to provide these tailored solutions is a significant factor in securing these fleet contracts.

Financial performance for fleet operators is paramount, making fuel efficiency and resale value key considerations when choosing vehicles. Renault has been investing in technologies that improve fuel economy and exploring new powertrain options, including electric vehicles, to meet the evolving environmental and cost-saving demands of this segment. For example, the growing adoption of electric LCVs by delivery companies in Europe in 2024 underscores this trend.

Performance Enthusiasts and Premium Buyers (Alpine)

The Alpine brand is specifically crafted for a discerning group: performance car enthusiasts and premium buyers. This segment is drawn to vehicles that offer exhilarating driving dynamics, a unique and stylish design, and the cachet of a brand with a rich motorsports legacy.

These customers are not just looking for transportation; they seek an experience. They prioritize the feel of the road, the responsiveness of the engine, and the overall emotional connection with their vehicle. Brand prestige and heritage play a significant role in their purchasing decisions, distinguishing Alpine from more mainstream performance offerings.

- Target Audience: Affluent individuals, typically aged 30-55, with a passion for driving and an appreciation for automotive history and design.

- Key Motivations: Driving pleasure, exclusivity, brand heritage, distinctive styling, and superior performance.

- Purchasing Behavior: Often early adopters, influenced by expert reviews and brand reputation; they are willing to pay a premium for specialized, high-performance vehicles.

- Market Position: Alpine competes in the premium sports car segment, appealing to those who might also consider offerings from brands like Porsche or Jaguar, but with a specific draw to Alpine's unique French sporting character.

Budget-Conscious and Value-Oriented Buyers (Dacia)

Dacia's core customer segment is the budget-conscious buyer who seeks dependable transportation without the premium price tag. These individuals and families are highly price-sensitive, looking for the best possible value proposition. They prioritize essential functionality and robust build quality over luxury amenities or cutting-edge technology.

This segment is actively seeking cost-effective solutions for personal mobility. For instance, Dacia's Sandero was a top-selling car in Europe in 2023, with over 200,000 units sold, underscoring its appeal to value-driven consumers. The brand's strategy directly addresses this demand by offering vehicles with a clear focus on affordability and practicality.

- Price Sensitivity: Customers in this segment are often making significant purchasing decisions and actively compare prices across different brands.

- Practicality Focus: They need vehicles that are functional for everyday use, whether for commuting, family transport, or light utility.

- Reliability Expectation: While prioritizing affordability, there's still a strong expectation for vehicles to be reliable and require minimal unexpected maintenance.

- Value for Money: The ultimate goal is to acquire a vehicle that offers the most features and utility for the lowest possible cost.

Renault serves a diverse range of customer segments, from mass-market individual consumers prioritizing affordability and dependability, as exemplified by Dacia's strong performance in 2023 with over 200,000 Sandero units sold in Europe, to environmentally conscious buyers drawn to electric vehicles like the Renault 5 E-Tech. The company also caters to businesses and fleet operators who value total cost of ownership and operational efficiency, a need highlighted by the resilience of the LCV market in 2024. Furthermore, the premium performance segment is targeted by the Alpine brand, appealing to enthusiasts seeking driving pleasure and brand heritage.

| Customer Segment | Key Characteristics | Renault's Offering Focus | 2024 Relevance/Data Point |

|---|---|---|---|

| Mass Market Individual Consumers | Price-sensitive, needs dependable daily transport | Affordable, practical, and reliable vehicles (e.g., Dacia Sandero) | Dacia Sandero consistently a top seller in Europe |

| Environmentally Conscious Buyers | Values sustainability, embraces new technology | Electric vehicles (e.g., Renault 5 E-Tech, Scenic E-Tech) | Global EV sales projected to exceed 16 million units in 2024 |

| Businesses & Fleet Operators | Seeks cost-efficiency, durability, and customization | Robust LCVs, focus on total cost of ownership, tailored solutions | LCV market showing strong sales driven by e-commerce in 2024 |

| Performance Enthusiasts | Desires driving dynamics, unique design, brand prestige | Premium sports cars with rich motorsports legacy (Alpine) | Alpine targets a niche market valuing exclusivity and performance |

Cost Structure

Renault dedicates substantial financial resources to Research and Development, a critical component of its business model. In 2023, the company announced plans to invest €3 billion in its future mobility initiatives, underscoring its commitment to innovation.

These investments are strategically focused on key areas like next-generation vehicle platforms, advanced electric powertrains, and cutting-edge battery technologies, aiming to secure Renault's competitive edge in the evolving automotive landscape.

Furthermore, significant R&D expenditure is directed towards developing sophisticated software-defined vehicle architectures and autonomous driving systems, essential for future vehicle functionality and market positioning.

This ongoing investment in R&D is not merely an expense but a vital strategy to drive future growth and maintain leadership in the automotive industry, particularly in the rapidly expanding electric vehicle sector.

Renault's manufacturing and production costs encompass the significant expenses tied to running its worldwide network of factories, maintaining assembly lines, and ensuring machinery is in top working order. These operational outlays also include substantial energy consumption, a key factor in automotive production. For instance, in 2023, Renault Group reported €44.7 billion in revenue, with cost of sales amounting to €36.7 billion, highlighting the scale of these production expenses.

Continuous efforts are made to optimize production efficiency and reduce these manufacturing overheads. This involves streamlining processes, adopting advanced manufacturing techniques, and managing energy usage more effectively across its global facilities. The company's focus on efficiency aims to directly impact profitability by controlling the direct costs associated with building vehicles.

Renault's cost structure is heavily influenced by the acquisition of raw materials like steel, aluminum, and lithium for electric vehicle batteries. These materials, along with the vast array of specialized components needed for vehicle manufacturing, are sourced from a sprawling international network of suppliers, representing a significant expenditure.

The price fluctuations of these essential commodities, such as the reported 30% increase in lithium prices during early 2024, directly impact Renault's procurement costs. Furthermore, disruptions within this intricate global supply chain, as seen with semiconductor shortages in previous years, can lead to unexpected cost escalations and production delays.

Marketing, Sales, and Distribution Costs

Renault's marketing, sales, and distribution costs are significant, reflecting the expenses involved in reaching customers and getting vehicles to them. These include costs for advertising campaigns designed to build brand awareness and promote new models, as well as promotional activities like special offers and events. Operating the extensive dealership network, which is crucial for sales and customer service, also represents a substantial portion of these expenses. Furthermore, the logistics involved in distributing vehicles from manufacturing plants to dealerships worldwide contribute to the overall cost structure, ensuring vehicles are available in markets. In 2024, the automotive industry, including manufacturers like Renault, continued to face inflationary pressures impacting marketing and logistics expenses.

Key components of these costs for Renault include:

- Advertising and Promotion: Investment in digital marketing, television commercials, and sponsorships to enhance brand visibility and drive sales.

- Dealership Network Operations: Costs associated with supporting and maintaining a global network of franchised dealerships.

- Vehicle Logistics and Distribution: Expenses for transportation, warehousing, and port handling of finished vehicles.

- Sales Force and Commissions: Costs related to the sales teams and commission structures that motivate sales performance.

Labor and Personnel Costs

Renault's labor and personnel costs are substantial, encompassing salaries, wages, and benefits for its extensive global workforce. This includes engineers, factory workers, sales teams, and administrative staff, all crucial to its operations. For instance, in 2023, Renault Group's workforce numbered around 105,000 employees worldwide.

Ongoing investments are made in reskilling and upskilling employees to adapt to evolving industry demands, particularly in areas like electric vehicle technology and digital transformation. These training initiatives are essential for maintaining a competitive edge and ensuring the workforce possesses the necessary skills for future production and innovation.

- Salaries and Wages: Covering compensation for approximately 105,000 global employees across various functions.

- Employee Benefits: Including healthcare, retirement plans, and other welfare programs provided to staff.

- Training and Development: Significant expenditure on reskilling and upskilling initiatives, especially for EV and digital technologies.

- Global Workforce Management: Costs associated with managing a diverse and geographically dispersed employee base.

Renault's cost structure includes significant investments in research and development, manufacturing, raw materials, marketing, and personnel. For example, in 2023, the company reported €44.7 billion in revenue, with costs of sales at €36.7 billion, highlighting the scale of production and material expenses. Labor costs are also substantial, with around 105,000 employees globally in 2023, necessitating ongoing investment in training for new technologies like EVs.

| Cost Category | Key Components | 2023 Data/Relevance |

| Research & Development | Next-gen platforms, EV powertrains, battery tech, software, autonomous driving | €3 billion planned investment in future mobility |

| Manufacturing & Production | Factory operations, assembly lines, energy consumption | Cost of Sales: €36.7 billion (on €44.7 billion revenue) |

| Raw Materials & Components | Steel, aluminum, lithium, specialized automotive parts | Lithium prices increased ~30% in early 2024; supply chain disruptions impact costs |

| Marketing, Sales & Distribution | Advertising, dealership network, logistics, sales force | Industry-wide inflationary pressures in 2024 affect these costs |

| Labor & Personnel | Salaries, benefits, training for global workforce | ~105,000 employees globally in 2023; investment in EV/digital skills training |

Revenue Streams

Renault's core revenue generation stems from the sale of new passenger cars and light commercial vehicles (LCVs). This encompasses their diverse brand portfolio, including Renault, Dacia, and Alpine, offering a range of powertrain options from traditional internal combustion engines (ICE) to hybrid and fully electric vehicles.

In 2024, the company aimed to capitalize on evolving market demands, particularly the growing segment for electric vehicles. The sales volume and the specific mix of models sold, from budget-friendly Dacia to performance-oriented Alpine, directly impact the financial performance of this crucial revenue stream.

Renault is experiencing significant revenue growth from its expanding electric vehicle (EV) lineup. The introduction of highly anticipated models such as the Renault 5 E-Tech electric and the Scenic E-Tech electric is driving this increase. These new vehicles are key to capturing a larger share of the rapidly expanding EV market.

Beyond direct vehicle sales, Renault is diversifying its revenue streams through associated services. This includes revenue generated from battery leasing options, which lowers the upfront cost for consumers, and the provision of charging solutions. Furthermore, the company is exploring innovative income opportunities with vehicle-to-grid (V2G) services, a venture actively pursued through its Mobilize brand.

Renault generates significant revenue from after-sales services and spare parts. This includes income from routine vehicle maintenance, repairs, and the sale of genuine Renault parts and accessories. For instance, in 2023, the automotive aftermarket, which includes spare parts and servicing, was valued at over $400 billion globally, with a consistent growth trajectory.

This revenue stream is crucial for Renault as it provides recurring income and fosters customer loyalty throughout the entire ownership period of a vehicle. By offering reliable servicing and readily available genuine parts, Renault strengthens its brand reputation and encourages repeat business, which is vital for long-term profitability.

Financial Services (Mobilize Financial Services)

Mobilize Financial Services (MFS) is a vital revenue engine for the Renault Group, offering a comprehensive suite of financing, leasing, and insurance products. These services are crucial for customers acquiring Renault vehicles, directly contributing to sales volume and customer loyalty. MFS generates substantial income from interest earned on loans and fees associated with its leasing and insurance offerings, making it a significant contributor to the Group's overall profitability.

In 2023, Mobilize Financial Services demonstrated robust performance, achieving a net banking income of €2.8 billion, representing a 10% increase compared to the previous year. The total value of new business for MFS reached €20.7 billion, highlighting the strong demand for its financial solutions. This segment is a cornerstone for Renault's profitability, with its contributions often bolstering the Group's operating margin during periods of fluctuating vehicle sales.

Key aspects of Mobilize Financial Services' revenue generation include:

- Interest Income: Earnings generated from providing loans and credit facilities to customers for vehicle purchases.

- Leasing Revenues: Income derived from long-term rental agreements for vehicles, including residual value guarantees.

- Insurance Premiums: Revenue from offering various insurance products, such as vehicle damage protection and extended warranties.

- Service Fees: Charges for administrative services, processing, and other ancillary offerings related to financing and leasing.

Mobility Solutions and Data-Driven Services

Renault is expanding its revenue generation through Mobilize, its dedicated brand for new mobility solutions. This includes services like car-sharing, which offers flexible access to vehicles, creating a recurring income stream beyond traditional vehicle sales.

Looking ahead, the company anticipates significant growth from data-driven services, especially with the advent of Software Defined Vehicles (SDVs). These connected vehicles will allow for new revenue models.

These data-driven services are expected to include subscription-based features, offering customers ongoing access to advanced functionalities and personalized experiences. For example, in 2024, the automotive industry is seeing increased investment in connected car services, with projections suggesting a substantial market growth in the coming years.

- Car-sharing services from Mobilize provide flexible, on-demand vehicle access.

- Subscription-based features for SDVs will unlock new recurring revenue.

- Personalized services leveraging vehicle data will enhance customer experience and monetization.

- The automotive industry's focus on connected services is a key driver for these new revenue streams.

Renault's revenue streams are diverse, extending beyond new vehicle sales to include a robust financial services arm and emerging mobility solutions.

Mobilize Financial Services is a key contributor, generating income from financing, leasing, and insurance, with a net banking income of €2.8 billion in 2023.

Emerging revenue opportunities are being cultivated through data-driven services and subscription-based features for Software Defined Vehicles, a sector projected for significant growth in 2024.

| Revenue Stream | Description | 2023 Contribution (Illustrative) | Key Growth Drivers |

|---|---|---|---|

| New Vehicle Sales | Sales of passenger cars and LCVs across brands (Renault, Dacia, Alpine). | Primary revenue source. | EV adoption, model mix, market demand. |

| After-Sales & Parts | Maintenance, repairs, and sale of genuine parts. | Significant recurring income. | Customer loyalty, service quality. |

| Mobilize Financial Services | Financing, leasing, insurance products. | Net Banking Income: €2.8 billion (10% YoY growth). New Business: €20.7 billion. | Loan interest, leasing fees, insurance premiums. |

| Mobilize Mobility Services | Car-sharing, charging solutions, V2G services. | Nascent but growing. | New mobility trends, subscription models. |

| Data-Driven Services | Subscription features for connected vehicles. | Future growth area. | SDV development, personalized services. |

Business Model Canvas Data Sources

The Renault Business Model Canvas is built upon a foundation of extensive market research, internal financial data, and competitive analysis. These sources provide the necessary insights to accurately define customer segments, value propositions, and revenue streams.