PVH SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PVH Bundle

PVH, a global apparel powerhouse, navigates a dynamic market with distinct strengths like brand recognition and a vast retail footprint. However, it also faces challenges from intense competition and evolving consumer preferences.

Discover the complete picture behind PVH's market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Want the full story behind PVH's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Unlock PVH's untapped potential and understand its competitive edge. Our comprehensive analysis provides the strategic roadmap you need to make informed decisions.

Get the insights you need to move from ideas to action. The full PVH SWOT analysis offers detailed breakdowns, expert commentary, and a bonus Excel version—perfect for strategy, consulting, or investment planning.

Strengths

PVH Corp.'s strength lies in its powerful brand portfolio, featuring globally recognized names like Calvin Klein and Tommy Hilfiger. These brands are not just labels; they are powerful assets that command significant consumer loyalty and market presence across diverse apparel segments.

This strong brand equity translates into a substantial competitive advantage. For instance, Tommy Hilfiger's revenue reached approximately $4.6 billion in fiscal year 2023, showcasing the immense commercial power derived from its brand recognition and appeal.

PVH strategically invests in these flagship brands through innovative marketing initiatives and high-profile collaborations. These efforts are designed to amplify brand visibility and deepen consumer engagement, ensuring continued relevance and desirability in a dynamic market.

The ability to consistently drive new levels of visibility and engagement for Calvin Klein and Tommy Hilfiger is a testament to PVH's brand management expertise. This allows the company to maintain a robust market position and foster enduring customer relationships.

PVH's extensive global presence is a significant strength, with operations spanning over 40 countries and product sales reaching more than 170 nations. This broad international footprint diversifies revenue streams, reducing reliance on any single market and mitigating risks from regional economic downturns. The company's ability to tap into growth opportunities across diverse geographies, notably in EMEA and Asia Pacific, is a key advantage.

The company effectively utilizes a multi-channel distribution strategy, encompassing wholesale, direct-to-consumer retail, and licensing agreements. This approach ensures PVH's brands achieve widespread market penetration and accessibility for consumers worldwide. For instance, in the fiscal year 2024, PVH reported that its international business continued to be a substantial contributor to its overall revenue, underscoring the effectiveness of its global network.

PVH's strategic focus on its core Calvin Klein and Tommy Hilfiger brands, driven by the PVH+ Plan, is a significant strength. This plan prioritizes strengthening these key brands, improving product assortments, and boosting consumer connection.

The company is actively bringing licensed categories in-house, a move that enhances both profit margins and creative oversight. This strategic shift is central to the PVH+ Plan's objective of building a more robust and controlled brand ecosystem.

PVH's commitment to a demand- and data-driven operating model is another key strength. This approach allows for more efficient inventory management and targeted marketing, contributing to better financial outcomes.

The disciplined execution of the PVH+ Plan has already yielded positive results. For instance, PVH reported better-than-expected revenue in the first quarter of fiscal year 2025, alongside improved gross margins throughout 2024, underscoring the effectiveness of their strategic direction.

Strong Financial Position and Shareholder Returns

PVH Corp. has maintained a robust financial standing, even amidst a difficult economic climate. For the first quarter of fiscal year 2025, the company surpassed its own revenue and non-GAAP earnings per share projections, showcasing operational resilience.

A key strength lies in PVH's dedication to shareholder returns. The company actively engaged in share repurchases, buying back $500 million worth of stock in fiscal year 2024. Furthermore, PVH has committed to another $500 million in share repurchases for fiscal year 2025, underscoring management's confidence in the company's future prospects and financial health.

- Exceeded Q1 2025 Guidance: PVH topped revenue and non-GAAP EPS expectations, demonstrating strong operational execution.

- Significant Shareholder Returns: $500 million in stock repurchased in 2024 and a planned $500 million for 2025 highlight a commitment to enhancing shareholder value.

- Financial Stability: These actions reflect a healthy balance sheet and management's positive outlook on the company's ability to generate cash flow and support its stock.

Commitment to Sustainability and Ethical Practices

PVH Corp.'s dedication to sustainability and ethical operations is a considerable strength. The company has actively integrated climate action, human rights, and diversity into its core strategy.

PVH has set ambitious targets, aiming for a 70% reduction in Scope 1 and 2 carbon emissions by 2030. Furthermore, the brand is working towards sourcing 100% of its cotton sustainably for its major brands by 2025, a significant step in responsible material procurement.

These commitments resonate strongly with today's consumers. A growing segment of the market actively seeks out brands that demonstrate a genuine commitment to ethical practices and environmental stewardship, thereby boosting PVH's brand image and market appeal.

Key initiatives include:

- Climate Action: Targeting a 70% reduction in Scope 1 and 2 carbon emissions by 2030.

- Sustainable Sourcing: Aiming for 100% sustainably sourced cotton by 2025 for key brands.

- Human Rights and Inclusion: Embedding these principles throughout its value chain.

PVH's core strength lies in its powerful, globally recognized brand portfolio, notably Calvin Klein and Tommy Hilfiger. These brands command significant consumer loyalty and market presence, driving substantial revenue. For example, Tommy Hilfiger generated approximately $4.6 billion in fiscal year 2023, demonstrating the immense commercial power of PVH's brand equity.

The company's extensive global reach, operating in over 40 countries and selling in more than 170, diversifies revenue and mitigates regional economic risks. PVH's multi-channel distribution strategy further enhances market penetration and accessibility.

PVH's strategic focus on strengthening its core brands through the PVH+ Plan, coupled with a commitment to a demand- and data-driven operating model, enhances efficiency and consumer connection. This disciplined execution has led to positive financial results, including exceeding Q1 fiscal year 2025 revenue and earnings guidance.

Financial stability and a commitment to shareholder returns are also key strengths. PVH repurchased $500 million in stock in fiscal year 2024 and plans another $500 million for fiscal year 2025, reflecting management's confidence in future cash flow generation.

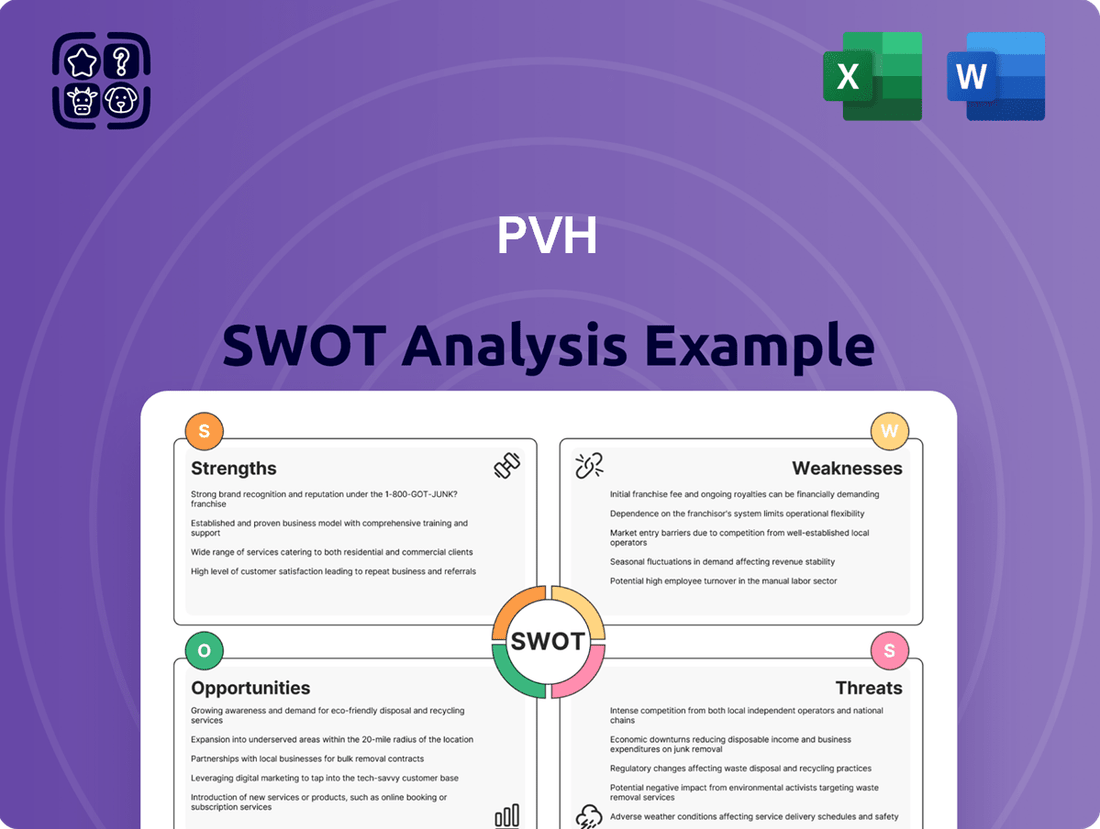

What is included in the product

Delivers a strategic overview of PVH’s internal and external business factors, analyzing its strengths, weaknesses, opportunities, and threats.

Facilitates rapid identification of critical threats and opportunities, enabling proactive strategy adjustments for PVH.

Weaknesses

PVH's significant reliance on its Calvin Klein and Tommy Hilfiger brands, while globally recognized, presents a notable concentration risk. This dependence means that any downturn affecting these specific brands can disproportionately impact PVH's overall financial health. For instance, in fiscal year 2023, while PVH reported total revenue of $8.1 billion, the performance of these core brands is paramount to achieving broader company targets.

Furthermore, PVH has faced persistent challenges in its crucial North American market. Both Calvin Klein and Tommy Hilfiger have experienced sales declines in this region in recent years, highlighting a vulnerability. The direct-to-consumer (DTC) channel in the Americas, in particular, has shown continued weakness, impacting revenue streams and demonstrating that even strong brands can struggle with regional market dynamics.

PVH experienced a notable dip in direct-to-consumer (DTC) revenue during the first quarter of 2025. This downturn was primarily fueled by reduced foot traffic in its brick-and-mortar stores across the Americas and Asia-Pacific regions, even though the European market showed some positive movement.

This trend suggests PVH is facing headwinds in aligning with shifting consumer preferences and effectively drawing shoppers into its physical retail locations. The impact is significant because retail stores typically offer better profit margins on sales compared to online channels, potentially affecting overall profitability.

PVH has been grappling with significant margin pressures. In Q1 2025, the company’s gross margin saw a decline, partly due to the impact of tariffs, more aggressive promotional strategies, and elevated freight expenses. This squeeze on margins directly affects the company's ability to retain earnings and reinvest in growth initiatives.

Supply chain vulnerabilities also pose a considerable challenge. Ongoing geopolitical tensions, particularly US-China trade friction, necessitate costly adjustments. The strategic shift towards supply chain diversification and nearshoring, while potentially mitigating future risks, currently adds to operational expenses and compliance overheads, further impacting profitability and introducing operational complexities.

Challenges in Specific International Markets

PVH has encountered notable headwinds in specific international markets, impacting its global performance. For instance, the first quarter of 2025 saw a significant 13% downturn in Asia Pacific revenue.

This decline was largely attributed to challenging consumer conditions in China and the influence of the Lunar New Year holiday timing. Further complicating matters, PVH's inclusion on China's Unreliable Entity list, stemming from cotton sourcing practices, poses a substantial risk of import, export, and investment limitations in a market critical for future expansion.

- Asia Pacific Revenue Decline: A 13% drop in Q1 2025 revenue in the Asia Pacific region.

- China Market Challenges: Difficult consumer environment and Lunar New Year timing impacted sales.

- Unreliable Entity List: Inclusion on China's list due to cotton sourcing creates potential trade and investment barriers.

Impact of Macroeconomic Headwinds and Consumer Sentiment

PVH faces significant headwinds from a volatile macroeconomic climate. Persistent inflation and subdued consumer confidence, particularly in key markets like the US and Europe, directly impact discretionary spending on apparel. This dampens demand and puts pressure on PVH's sales volumes, even with ongoing strategic efforts to mitigate these effects.

The retail environment remains intensely competitive and promotional, further exacerbating the challenges posed by economic uncertainty. PVH must navigate this landscape, which limits pricing power and necessitates careful inventory management to avoid margin erosion. For instance, in Q1 2024, PVH reported a 3% decrease in total revenue compared to the prior year, underscoring the impact of these market conditions.

- Inflationary Pressures: Rising costs for raw materials and operations can squeeze profit margins if not passed on to consumers, who are already cutting back on non-essential purchases.

- Low Consumer Sentiment: Weak consumer confidence, influenced by economic instability, leads to reduced spending on discretionary items like clothing.

- Promotional Retail Landscape: Intense competition forces widespread discounting, impacting revenue and profitability for brands like PVH.

- Geographic Concentration Risk: Reliance on developed markets like the US and Europe makes PVH particularly vulnerable to economic downturns in these regions.

PVH's heavy dependence on the Calvin Klein and Tommy Hilfiger brands creates a significant concentration risk, meaning any issues with these key labels can severely affect the company's overall performance. This reliance was evident in fiscal year 2023, where PVH achieved $8.1 billion in revenue, with the success of these flagship brands being critical to meeting broader company objectives.

The company continues to struggle in its vital North American market, experiencing declines in sales for both Calvin Klein and Tommy Hilfiger. This regional weakness, particularly in the direct-to-consumer (DTC) channel in the Americas, highlights PVH's vulnerability to shifting consumer preferences and competitive pressures within its home market.

PVH faced a notable 13% revenue decline in the Asia Pacific region during the first quarter of 2025. This downturn was attributed to challenging consumer conditions in China, compounded by the timing of the Lunar New Year. Adding to these difficulties, PVH's placement on China's Unreliable Entity list due to cotton sourcing practices poses a substantial risk of trade and investment restrictions in a key growth market.

Margin pressures are a persistent issue for PVH, with gross margins declining in Q1 2025 due to factors like tariffs, increased promotions, and higher freight costs. These pressures directly impact the company's profitability and its capacity for reinvestment.

| Weakness | Description | Impact | Data Point |

| Brand Concentration | High reliance on Calvin Klein and Tommy Hilfiger. | Disproportionate impact of brand-specific downturns. | FY23 Revenue: $8.1 billion. |

| North American Market Weakness | Declining sales in the US and Canada, especially DTC. | Reduced regional revenue streams. | Continued weakness in Americas DTC sales. |

| Asia Pacific Decline | 13% revenue drop in Q1 2025. | Loss of market share and revenue in a key growth region. | Challenging consumer conditions in China. |

| China Market Risk | Inclusion on Unreliable Entity list. | Potential import/export and investment barriers. | Cotton sourcing practices cited as reason. |

| Margin Pressure | Declining gross margins in Q1 2025. | Reduced profitability and reinvestment capacity. | Impacted by tariffs, promotions, and freight costs. |

Full Version Awaits

PVH SWOT Analysis

This is the actual PVH SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It delves into the company's Strengths, Weaknesses, Opportunities, and Threats, offering a comprehensive overview. You'll gain insights into factors like PVH's brand portfolio and its market positioning. Understanding these elements is crucial for strategic decision-making.

Opportunities

The ongoing surge in e-commerce and digital adoption offers PVH a prime chance to broaden its market reach. In the first quarter of 2025, PVH saw positive momentum in its owned and operated e-commerce revenue within the Americas, indicating strong consumer engagement with digital channels.

By bolstering investments in its digital infrastructure and customer-facing platforms, PVH can amplify its direct-to-consumer (DTC) sales worldwide. This strategic focus not only caters to evolving consumer preferences but also presents an opportunity to optimize operational costs by potentially reducing reliance on physical retail spaces, thereby improving overall profitability.

Emerging markets are poised to be a significant engine for global apparel market expansion, with forecasts indicating substantial growth in economies like China, India, and Brazil. This presents a compelling opportunity for PVH to tap into new customer bases and drive revenue.

Despite some recent headwinds, the Asia Pacific region, especially China, remains a vast and lucrative market for apparel companies. PVH can leverage this by developing strategies that specifically cater to the preferences and purchasing power within these dynamic economies.

Strategic focus on these high-growth regions, coupled with localized product offerings and marketing campaigns, can unlock considerable revenue streams for PVH. For instance, in 2023, the global apparel market was valued at over $1.7 trillion and is expected to see continued growth, with emerging markets contributing a disproportionate share.

PVH's strategic licensing agreements are a significant opportunity for brand expansion. For instance, their recent deal with Herman Kay-Mystic LLC for outerwear allows PVH to tap into specialized markets and introduce new product categories without the overhead of direct manufacturing. This model generates revenue via royalties, freeing up internal resources for core competencies and mitigating production risks.

Advancing Sustainability and Circular Economy Initiatives

PVH's focus on sustainability is a significant opportunity, aligning with increasing consumer demand for eco-friendly fashion. By actively reducing its carbon footprint and prioritizing responsibly sourced materials, the company taps into a market willing to spend more on ethical products. For instance, PVH's 2023 ESG report highlighted a 15% reduction in greenhouse gas emissions from its owned and operated facilities compared to a 2019 baseline, demonstrating tangible progress.

Further investment in circular economy models, such as piloting resale programs and footwear recycling initiatives, offers a chance to differentiate PVH and attract a growing segment of environmentally conscious consumers. This commitment can bolster brand reputation and potentially unlock new revenue streams through innovative business practices. The global sustainable fashion market is projected to reach $150 billion by 2030, indicating substantial growth potential for companies leading in this space.

- Growing consumer preference for sustainable products: Brands with strong ESG credentials are increasingly favored by shoppers.

- Reduced environmental impact: Lower carbon footprints and responsible material sourcing appeal to a wider audience.

- New market segments: Circular economy initiatives like resale and recycling can attract new customer bases and revenue.

- Enhanced brand loyalty: Demonstrating a commitment to sustainability can foster deeper connections with consumers.

Optimizing Supply Chain for Efficiency and Agility

PVH has a significant opportunity to optimize its supply chain for greater efficiency and agility. By continuing to build a data- and demand-driven supply chain, the company can better predict consumer needs and adjust production accordingly. This data-centric approach is crucial in today's volatile retail environment.

Diversifying sourcing locations, such as increasing reliance on countries like Vietnam and Bangladesh, presents a strategic advantage. This diversification helps mitigate risks associated with tariffs and geopolitical instability, allowing PVH to maintain a steadier flow of goods. For instance, by 2024, PVH aims to have a substantial portion of its production in Southeast Asia, reducing its dependency on any single region.

- Enhanced Inventory Management: A more agile supply chain allows for better control over inventory levels, reducing carrying costs and minimizing the risk of stockouts or overstocking.

- Reduced Lead Times: By streamlining processes and optimizing logistics, PVH can shorten the time from production to customer delivery, improving responsiveness to market trends.

- Cost Savings: Efficiency gains through data analytics and optimized sourcing can lead to direct cost reductions in production, transportation, and warehousing.

- Mitigation of Disruptions: Proactive diversification and risk management in the supply chain build resilience against unforeseen events, ensuring business continuity.

PVH can capitalize on the growing demand for sustainable and ethically produced apparel. With consumers increasingly prioritizing brands that demonstrate strong Environmental, Social, and Governance (ESG) credentials, PVH's continued focus on reducing its carbon footprint and utilizing responsibly sourced materials offers a significant competitive edge. For example, PVH reported a 15% reduction in greenhouse gas emissions from its owned facilities by 2023 compared to a 2019 baseline, showcasing tangible progress in this area.

The company's strategic licensing agreements present another avenue for growth by allowing PVH to expand into new product categories and markets with reduced capital investment. Their agreement with Herman Kay-Mystic LLC for outerwear exemplifies this, generating royalty revenue and allowing PVH to leverage specialized expertise. Furthermore, PVH has the opportunity to enhance its supply chain for greater efficiency and agility. By diversifying sourcing locations, such as increasing reliance on countries like Vietnam and Bangladesh, PVH can mitigate risks associated with tariffs and geopolitical instability, aiming to have a substantial portion of its production in Southeast Asia by 2024.

Leveraging the digital transformation and the ongoing surge in e-commerce presents a prime opportunity for PVH to broaden its market reach. The company's positive momentum in owned and operated e-commerce revenue in the Americas during Q1 2025 highlights strong consumer engagement with digital channels. By investing further in its digital infrastructure and customer-facing platforms, PVH can amplify its direct-to-consumer (DTC) sales globally. This strategic move aligns with evolving consumer preferences and offers potential operational cost optimizations.

Emerging markets represent a significant engine for global apparel market expansion, with considerable growth anticipated in economies such as China, India, and Brazil. PVH can tap into these new customer bases to drive revenue, especially considering the global apparel market was valued at over $1.7 trillion in 2023 and is expected to continue growing. Strategic focus on these high-growth regions, supported by localized product offerings and marketing campaigns, can unlock substantial revenue streams.

Threats

The global apparel market is incredibly crowded, with giants like Ralph Lauren and Gap Inc. constantly battling for consumer attention. This intense rivalry means PVH faces significant pressure to differentiate itself and capture market share.

Consumers are increasingly seeking value, leading to more promotions and sales across the industry. This trend can force brands like PVH into price wars, potentially eroding their profit margins as they try to remain competitive.

Market saturation is a real concern; with so many brands available, it's harder for any single company to stand out. For instance, the fast fashion segment, while offering lower price points, also contributes to the sheer volume of choices consumers have, making it challenging for heritage brands.

Ongoing macroeconomic pressures, such as persistent inflation and a general dip in consumer sentiment, present a significant hurdle for discretionary spending on apparel. This uncertainty directly impacts PVH's revenue streams and profitability. For instance, if inflation continues to hover around 3-4% in major markets through 2025, consumers may further cut back on non-essential purchases like clothing.

The potential for economic downturns or recessions in key regions poses a substantial threat. This could translate to reduced foot traffic in stores and online, leading to lower sales volumes for PVH. Consequently, the company might need to resort to more aggressive discounting strategies to move inventory, further squeezing its profit margins in 2025.

Increasing geopolitical tensions and the possibility of tariff changes present a significant threat to PVH. For instance, the ongoing US-China trade disputes and PVH's past inclusion on China's Unreliable Entity list highlight how these shifts can complicate sourcing and drive up manufacturing expenses.

These policy shifts can result in substantial added costs, limit PVH's ability to access key markets, and create considerable disruption within its global supply chain. The need to adapt to such changes might necessitate expensive relocations of production facilities or the implementation of costly compliance measures.

Shifting Consumer Preferences and Fast Fashion Trends

Consumer tastes are changing incredibly quickly, and the rise of fast fashion means trends can be fleeting. This rapid evolution, coupled with a growing demand for sustainable and digital-first shopping experiences, presents a significant challenge for established apparel companies like PVH. If PVH's brands can't keep pace with these shifts, they risk becoming irrelevant and losing ground to nimbler competitors or newer direct-to-consumer brands that are more adept at adapting.

For instance, the global apparel market saw a notable shift towards sustainability, with a significant percentage of consumers willing to pay more for eco-friendly products. In 2024, reports indicate that over 60% of consumers consider sustainability when making clothing purchases. This presents a direct threat if PVH's product lines and supply chains aren't perceived as sufficiently sustainable by a growing segment of the market.

- Rapid Trend Cycles: Fast fashion cycles shorten the lifespan of popular styles, requiring constant product updates.

- Sustainability Demand: Increased consumer focus on ethical sourcing and environmental impact pressures brands to adapt.

- Digital Experience Expectations: Consumers expect seamless online shopping, personalized recommendations, and efficient digital engagement.

- Agile Competitors: Smaller, more nimble brands can often react to trends and consumer demands faster than larger, more established companies.

Execution Risks of Strategic Initiatives

PVH's strategic initiatives, particularly the PVH+ Plan, face significant execution risks. The company's transition to new leadership, coupled with the ambitious nature of its cost-saving measures and strategic realignments, presents challenges. For instance, the plan to reduce expenses by approximately $100 million in fiscal year 2023 highlights the scale of these changes.

Failure to seamlessly integrate these new initiatives could derail PVH's financial objectives. The success of revitalizing direct-to-consumer (DTC) sales, a key component of the PVH+ Plan, is critical. If these DTC efforts, which saw digital sales contribute a notable portion of revenue in recent years, do not perform as expected, it could directly impact the company's ability to meet its projected financial targets and preserve investor confidence.

Managing complex supply chain adjustments alongside these strategic shifts also poses a threat. PVH's reliance on global manufacturing partners means that any disruption or inefficiency in adapting to new supply chain strategies could lead to delays and increased costs, further complicating execution.

- Cost Savings Target: PVH aimed to achieve approximately $100 million in cost savings in fiscal year 2023 through its PVH+ Plan.

- DTC Focus: Revitalizing direct-to-consumer sales is a cornerstone of the PVH+ Plan, crucial for future growth.

- Leadership Transition: Implementing large-scale changes under new leadership introduces inherent execution uncertainties.

PVH faces intense competition from established brands and agile newcomers, pressuring margins through frequent promotions. The rapid pace of fashion trends, particularly in fast fashion, challenges PVH's ability to stay relevant, especially as consumers increasingly demand sustainable and digitally-native experiences. For instance, in 2024, a significant portion of consumers, over 60%, actively consider sustainability in their apparel purchases, a trend PVH must address.

Macroeconomic headwinds, including inflation and potential economic downturns through 2025, could dampen consumer spending on discretionary items like clothing. Geopolitical instability and potential trade policy shifts, such as those impacting US-China relations, also pose risks to PVH's global supply chain and manufacturing costs.

| Threat Category | Specific Threat | Impact on PVH | Data Point/Example |

| Competition | Intense Market Rivalry | Pressure on pricing, need for differentiation | Global apparel market saturated with players like Ralph Lauren, Gap Inc. |

| Consumer Behavior | Demand for Value & Sustainability | Risk of price wars, need for eco-friendly initiatives | Over 60% of consumers consider sustainability in 2024 purchases. |

| Economic Factors | Inflation & Consumer Sentiment | Reduced discretionary spending, lower revenue | Inflation around 3-4% in major markets through 2025 could curb spending. |

| Geopolitics & Policy | Trade Disputes & Tariffs | Supply chain disruption, increased manufacturing costs | Past inclusion on China's Unreliable Entity list highlights sourcing risks. |

| Fashion Trends | Rapidly Changing Styles | Risk of obsolescence, need for agile product development | Fast fashion cycles shorten trend lifespans significantly. |

SWOT Analysis Data Sources

This PVH SWOT analysis is built upon a robust foundation of data, drawing from PVH's official financial reports, comprehensive market intelligence, and expert industry analysis to provide a well-rounded strategic perspective.