PVH Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PVH Bundle

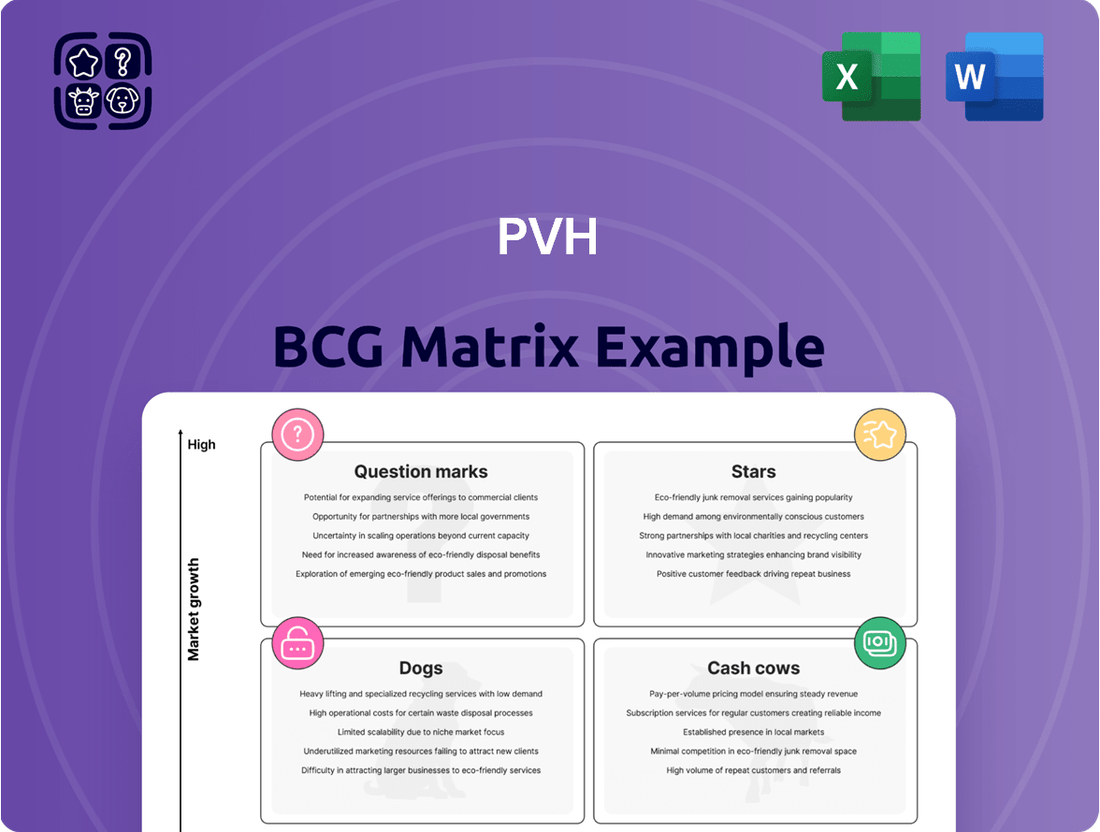

PVH's strategic positioning is illuminated by the BCG Matrix, offering a critical lens to understand its product portfolio's health and potential. This insightful framework categorizes PVH's brands into Stars, Cash Cows, Dogs, and Question Marks, providing a visual roadmap for resource allocation and future investments. Understanding which brands are driving growth and which require careful management is paramount for sustained success in the dynamic apparel industry.

This preview offers a glimpse into PVH's strategic landscape, highlighting key areas of opportunity and challenge. To truly unlock the power of this analysis and make informed decisions that will shape PVH's future, dive deeper into the complete BCG Matrix.

Purchase the full version for a comprehensive breakdown of each product's quadrant placement, coupled with actionable strategies tailored to PVH's unique market position. Gain a clear, data-driven understanding of where to invest, divest, or nurture for optimal performance and competitive advantage.

Stars

Calvin Klein's Icon Cotton Stretch franchise is a prime example of a 'Star' within PVH's portfolio. Its success, bolstered by high-impact marketing such as the Q1 2025 Bad Bunny collaboration, signifies robust product-led growth. This strong performance suggests a significant market share within a segment that continues to expand.

The franchise's ability to capture attention and drive sales, as seen with its campaign success, positions it favorably. Continued strategic investment in these core, high-performing products is essential. This focus will help maintain its current trajectory and pave the way for its potential evolution into a Cash Cow for PVH.

Tommy Hilfiger's performance in the Asia-Pacific region, especially its 633% surge in Earned Media Value (EMV) during 2024, highlights its status as a Star in the PVH BCG Matrix. This remarkable growth, fueled by localized marketing efforts and key collaborations, underscores its strong potential in a rapidly developing market. Despite broader challenges faced by PVH in Asia Pacific during Q1 2025, Tommy Hilfiger's localized influencer strategies have created a significant opportunity for increased market penetration and dominance.

PVH's strategic push for digital commerce growth, aiming for over 20% compound annual growth in online channels by 2025, firmly places it in a high-potential market. This focus is a key component of their PVH+ Plan, designed to capture a larger share of the expanding digital retail space.

Despite a minor dip in direct-to-consumer revenue during Q1 2025, the company's sustained investment in digital transformation and e-commerce infrastructure signals a strong ambition to achieve Star status. This commitment underscores their belief in the future dominance of online sales for their brands.

Premiumization and Hero Product Development

PVH's strategy to 'Win with product' is heavily focused on developing standout hero products within key growth categories, a core component of its PVH+ Plan. This approach aims to tap into high-growth demand spaces by concentrating on premium offerings and innovative product development. For example, in 2024, PVH continued to invest in its core brands, Calvin Klein and Tommy Hilfiger, with a particular emphasis on premium denim and elevated sportswear, categories that have shown resilient consumer interest.

This strategic focus on premiumization is designed to capture significant market share within specific fashion niches. By offering high-quality, differentiated products, PVH seeks to create aspirational brands that resonate with consumers willing to pay a premium for perceived value and style. This is crucial for building brand loyalty and driving profitable growth in a competitive market.

- Hero Product Focus: PVH is prioritizing the development of best-in-class hero products in growth categories as part of its PVH+ Plan.

- Premiumization Strategy: The company aims to capture market share by focusing on premium offerings and product innovation.

- Brand Investment: In 2024, significant investment was directed towards Calvin Klein and Tommy Hilfiger, especially in premium denim and sportswear.

- Market Positioning: These efforts position new, successful product lines as leaders within their respective fashion niches.

Sustainable Product Lines and Initiatives

PVH's sustainable product lines are showing significant promise, aligning with a market trend of increasing consumer demand for eco-friendly apparel. This segment for women's wear is projected to grow at a compound annual growth rate of 3.6% between 2025 and 2034, highlighting a substantial opportunity.

Tommy Hilfiger's sustainable offerings, in particular, are a strong indicator of this potential. In the first quarter of 2024, these eco-conscious products contributed to 25% of the brand's total sales growth. This robust performance suggests that PVH's strategic focus on sustainability is translating into tangible commercial success within a rapidly expanding market segment.

- Growing Market Share: Consumer preference for sustainable fashion is a key driver, with the women's wear segment alone expected to see a 3.6% CAGR from 2025-2034.

- Strong Brand Performance: Tommy Hilfiger's Q1 2024 results show sustainable products accounting for 25% of its sales growth, demonstrating market traction.

- Future Growth Potential: Continued investment in eco-friendly materials and circular economy models can position these lines as PVH's future Stars.

- Strategic Alignment: This focus directly addresses evolving consumer values and regulatory landscapes, enhancing PVH's long-term competitive advantage.

Stars in the PVH BCG Matrix represent brands or product lines with high market share in high-growth industries. These are PVH's current successes, demanding significant investment to maintain their momentum and capitalize on expanding markets. For instance, Calvin Klein's continued strong performance, especially with its Icon Cotton Stretch franchise and collaborations like Bad Bunny in early 2025, exemplifies this. Tommy Hilfiger's remarkable 633% surge in Earned Media Value in Asia-Pacific during 2024, driven by localized marketing, also firmly places it in this category.

PVH's strategic focus on digital commerce growth, aiming for over 20% compound annual growth in online channels by 2025, positions its e-commerce operations as a potential Star. The company's commitment to developing premium hero products in growth categories, such as premium denim and elevated sportswear for Calvin Klein and Tommy Hilfiger in 2024, further solidifies these as Stars. Additionally, PVH's sustainable product lines, with Tommy Hilfiger's sustainable offerings contributing 25% to its sales growth in Q1 2024, are emerging Stars in a growing eco-conscious market.

| Brand/Segment | Market Growth | Market Share | BCG Category | Supporting Data |

| Calvin Klein Icon Cotton Stretch | High | High | Star | Q1 2025 Bad Bunny collaboration success |

| Tommy Hilfiger (Asia-Pacific) | High | High | Star | 633% EMV surge in 2024 |

| PVH Digital Commerce | High | Growing | Star | Targeting >20% CAGR by 2025 |

| Premium Denim/Sportswear | High | Growing | Star | 2024 investment in core brands |

| Sustainable Product Lines | High | Growing | Star | Tommy Hilfiger: 25% of Q1 2024 sales growth; Women's wear segment 3.6% CAGR (2025-2034) |

What is included in the product

This BCG Matrix overview highlights PVH's product portfolio, identifying which units to invest in, hold, or divest.

A clear PVH BCG Matrix visualizes business unit performance, easing strategic decision-making pain points.

Cash Cows

Calvin Klein's core apparel, including underwear and denim, holds a significant market share in mature North American and European markets. These segments, characterized by low growth, are dependable sources of substantial cash flow for PVH. The strong brand recognition and established consumer loyalty mean these categories require minimal promotional spending to maintain their position.

Despite a flat revenue performance for Calvin Klein in Q1 2025, the foundational strength of these core apparel lines ensures they remain reliable cash generators for the parent company. This stability is crucial for funding other, more growth-oriented ventures within PVH's portfolio.

Tommy Hilfiger's classic sportswear, particularly in established markets such as Europe and North America, represents a significant cash cow for PVH. This segment consistently holds a high market share due to its well-recognized preppy aesthetic and stable consumer demand.

While PVH experienced an overall revenue decrease in fiscal year 2024, the core Tommy Hilfiger sportswear lines demonstrated resilience. A 3% revenue increase in the first quarter of fiscal year 2025, notably driven by performance in the EMEA and Americas regions, underscores the enduring strength of these offerings.

These mature product lines are crucial cash generators, contributing substantially to PVH's overall profitability. Their consistent performance provides a stable foundation, enabling investment in other areas of the business.

PVH's wholesale business in mature regions, like North America and Europe, functions as a classic cash cow. Despite facing some headwinds, such as an 8% drop in wholesale revenue in Q3 2024, these established channels continue to be a bedrock for the company.

These mature markets boast high market penetration, meaning PVH has deep roots and strong relationships with retailers. Even with a modest 6% increase in Q1 2025 wholesale revenue, the sheer volume of product moved through these channels generates substantial and predictable cash flow.

The efficiency of these wholesale operations is key. They require less investment in brand building and marketing compared to new direct-to-consumer initiatives, allowing them to contribute significantly to PVH's overall profitability with lower incremental costs.

Licensing Revenue Streams

PVH's licensing revenue streams act as significant cash cows within its brand portfolio. These agreements, covering products like fragrances, eyewear, and watches, tap into established markets where PVH brands already hold a strong presence. This strategy allows PVH to monetize its brand equity without the substantial capital investment and operational overhead associated with direct product manufacturing and distribution. The result is a consistent and high-margin cash flow, essential for funding other strategic initiatives.

In the first quarter of 2025, PVH reported a 2% decrease in licensing revenue. This dip is attributed to ongoing transitions as the company brings certain product categories back in-house. Despite this short-term reduction, the licensing segment continues to be a reliable generator of cash due to its nature of minimal operational involvement and its position in mature, high-share markets.

- Licensing Agreements: PVH utilizes licensing for categories such as fragrances, eyewear, and watches.

- Revenue Generation: These agreements provide stable, high-margin revenue with low operational investment.

- Market Position: PVH brands maintain high market share in mature segments through these licenses.

- Q1 2025 Performance: Licensing revenue saw a 2% decrease due to in-house transitions, but remains a cash cow.

Established Direct-to-Consumer (DTC) Brick-and-Mortar Stores

PVH's established direct-to-consumer (DTC) brick-and-mortar stores, particularly in mature markets, represent a classic cash cow in its business portfolio. These physical locations offer a stable, high-margin revenue stream, benefiting from the company's direct control over pricing strategies and the customer experience. This direct channel allows PVH to cultivate and maintain relationships with its loyal customer base, ensuring consistent sales even as the company emphasizes digital growth.

In the first quarter of 2024, PVH's physical stores demonstrated resilience, achieving a 3% growth on a constant currency basis. This growth underscores the enduring value of these established retail footprints. They continue to be a significant contributor to PVH's overall financial health, providing a reliable source of cash flow that can be reinvested into other areas of the business, such as digital expansion or new market ventures.

- Stable Revenue Stream: PVH's physical stores provide a predictable and consistent income.

- High Profit Margins: Direct sales through owned stores often yield better margins than wholesale.

- Customer Loyalty: The brick-and-mortar experience fosters strong customer relationships.

- Q1 2024 Performance: Achieved 3% growth on a constant currency basis, demonstrating ongoing strength.

Cash cows, as identified in the BCG matrix, are established products or business units with a high market share in low-growth industries. For PVH, these segments represent reliable sources of substantial cash flow, requiring minimal investment to maintain their position.

These mature operations, such as core Calvin Klein and Tommy Hilfiger apparel lines and established wholesale channels, consistently generate significant profits. This financial stability is crucial for funding PVH's investments in emerging markets or new product development.

In fiscal year 2024, PVH's core businesses, despite overall market challenges, continued to be vital cash generators. For instance, Tommy Hilfiger sportswear saw a 3% revenue increase in Q1 2025, highlighting its enduring strength and contribution to PVH's financial health.

The company's licensing revenue, while experiencing a slight dip of 2% in Q1 2025 due to strategic shifts, fundamentally remains a high-margin cash cow. Similarly, PVH's direct-to-consumer brick-and-mortar stores, which grew 3% on a constant currency basis in Q1 2024, provide a stable and profitable revenue stream.

| PVH Business Segment | BCG Category | Market Share | Growth Rate | Cash Flow Contribution |

|---|---|---|---|---|

| Calvin Klein Core Apparel | Cash Cow | High | Low | Substantial |

| Tommy Hilfiger Sportswear | Cash Cow | High | Low | Substantial |

| Wholesale (Mature Markets) | Cash Cow | High | Low | Significant |

| Licensing Revenue | Cash Cow | High | Low | Consistent |

| DTC Brick-and-Mortar (Mature) | Cash Cow | High | Low | Stable |

Full Transparency, Always

PVH BCG Matrix

The PVH BCG Matrix preview you are viewing is the definitive document you will receive upon purchase, offering a complete and unwatermarked analysis. This strategic tool, meticulously crafted for clarity, will be delivered in its final, ready-to-use format, empowering your business decisions without any additional steps. You'll gain immediate access to a professionally designed BCG Matrix, perfectly structured for strategic planning and presentation. Rest assured, the content and formatting are precisely what you'll download, enabling you to seamlessly integrate this valuable market insight into your business operations.

Dogs

PVH's Heritage Brands segment, following the divestiture of its women's intimates business, experienced substantial revenue contractions. In fiscal year 2024, this segment saw a 57% revenue decline, and in the third quarter of 2024 alone, it dropped by 54%.

The remaining brands within Heritage Brands are likely positioned in markets with limited growth potential and hold a minor market share. This scenario suggests they are contributing minimally to PVH's overall profitability.

The strategic decision to divest parts of this segment indicates that these businesses were either already underperforming or were considered at high risk of becoming dogs within the portfolio. This action aims to streamline PVH's brand structure and focus resources on more promising areas.

Underperforming legacy product lines, such as certain denim collections within Tommy Hilfiger or older fragrance offerings from Calvin Klein, often fall into the Dogs category of the BCG Matrix. These are typically characterized by stagnant or declining sales, with Calvin Klein's Jeans division, for instance, facing increased competition from fast-fashion and direct-to-consumer brands, leading to a reduction in market share for some of its more traditional styles. In 2023, PVH reported a decline in its Heritage Brands segment, which often includes these older, less dynamic product categories, underscoring the challenges associated with maintaining relevance for established lines.

PVH Corp. experienced a strategic shift in its wholesale segment during the first quarter of fiscal year 2025. While overall wholesale revenue saw an increase, the company consciously reduced sales to lower-margin wholesale partners, especially in Europe. This move aims to enhance the quality of their sales rather than simply chasing volume.

This strategic pruning of lower-margin partnerships, particularly evident in European markets, suggests these specific regional wholesale segments might be considered Dogs within the BCG Matrix framework. PVH is actively managing down its exposure in these areas, prioritizing profitability over sheer sales figures.

For instance, PVH's Q1 2025 results indicated a focus on optimizing the wholesale channel. By shedding less profitable engagements, the company is reallocating resources and management attention to more promising growth avenues, aligning with the principles of divesting from low-growth, low-market-share assets.

Outdated Inventory from Past Seasons

Outdated inventory from past seasons, often seen in the fashion industry, represents a classic example of a Dog in the Boston Consulting Group (BCG) matrix. This means it has a low market share within a slow-growing or stagnant market for those specific items.

This type of inventory ties up valuable capital that could be reinvested. For instance, in 2024, many apparel retailers grappled with excess stock from previous years, leading to increased warehousing expenses and the need for aggressive clearance sales. These markdowns significantly erode profit margins.

- Low Market Share: Such items are no longer in high demand, indicating a minimal slice of the current market.

- Stagnant Market: The specific trend or style associated with the inventory has passed, leaving little room for growth.

- Capital Tied Up: Funds are locked in unsold goods, preventing investment in more profitable ventures.

- Storage Costs: Warehousing and managing this old stock incurs ongoing expenses.

- Profit Erosion: The need for heavy discounts to clear the inventory drastically reduces profitability.

Non-Strategic or Disconnected Product Extensions

Non-strategic product extensions can become significant drains for companies like PVH. For instance, if a new apparel line or collaboration, such as a venture into a completely unrelated category, fails to connect with the core consumer base or dilutes the brand's established image, it's likely to underperform. These initiatives often require substantial marketing investment and operational support without generating commensurate returns.

Such disconnected ventures can lead to underperforming assets within the portfolio. For example, if PVH were to launch a line of home goods that didn't align with its fashion heritage, and sales figures remained stagnant, it would represent a classic example of a 'dog' in the BCG matrix. By mid-2024, many apparel companies were reporting significant write-downs on inventory from less successful product launches, highlighting the financial risk.

- Low Market Adoption: Ventures that fail to gain traction, like a poorly received limited-edition collaboration in 2023, result in minimal sales and brand engagement.

- Resource Drain: Continued investment in marketing and inventory for underperforming extensions diverts capital from more promising areas.

- Brand Dilution: Associating the core brand with products that don't resonate can weaken its overall appeal and market position.

- Financial Impact: Companies often face write-downs on unsold inventory, impacting profitability. For example, in Q4 2023, several retail giants reported a combined $500 million in inventory obsolescence charges, partly due to failed product extensions.

Dogs within PVH's portfolio represent brands or product lines with low market share in slow-growing industries. These units generate just enough cash to maintain themselves but offer little profit or growth potential. PVH's divestiture of certain Heritage Brands segments, which saw significant revenue contractions in 2024, exemplifies this category. The strategic decision to reduce sales to lower-margin wholesale partners in Europe also indicates a move away from potential dogs.

For instance, PVH's Heritage Brands segment experienced a 57% revenue decline in fiscal year 2024, highlighting its characteristics as a dog. Similarly, outdated inventory from past seasons ties up capital and incurs storage costs, representing classic dog assets. Non-strategic product extensions that fail to gain traction also fall into this category, draining resources without commensurate returns.

| PVH Segment/Category | Market Share | Market Growth | PVH Performance Indicator |

| Heritage Brands | Low | Stagnant/Declining | 57% revenue decline (FY24) |

| Lower-Margin Wholesale (Europe) | Low | Stagnant/Declining | Strategic reduction in sales |

| Outdated Inventory | Negligible | Declining | Ties up capital, incurs storage costs |

| Failed Product Extensions | Low | Stagnant | Resource drain, potential write-downs |

Question Marks

PVH's strategic pivot towards digital channels, including a notable investment in its direct-to-consumer (DTC) capabilities, positions it to explore new digital-first collections or sub-brands. These ventures would tap into the rapidly expanding e-commerce market, a segment experiencing robust growth. For instance, global e-commerce sales are projected to reach $7.4 trillion by 2025, indicating a substantial opportunity.

Launching digitally native offerings would place these new collections squarely in the Stars quadrant of the BCG matrix. While the e-commerce market itself represents high growth, these nascent sub-brands would likely begin with a relatively low market share. This necessitates substantial investment to build brand awareness, acquire customers, and establish a foothold against established online players.

PVH's commitment to digital transformation, evidenced by investments in technology and online infrastructure, supports the feasibility of such initiatives. The company aims to enhance its online presence and customer engagement, which are critical for the success of digital-first brands. This strategic focus is designed to capture a larger share of the evolving retail landscape.

PVH is likely eyeing specialized performance wear, advanced sustainable textiles, or hyper-personalized fashion. These represent new, niche segments with significant growth potential where PVH currently holds a minimal market share.

These ventures would be classified as Question Marks in the BCG Matrix. They require substantial investment to build brand recognition and scale operations within these dynamic, expanding markets.

For instance, the global activewear market was valued at approximately $334.5 billion in 2023 and is projected to grow significantly. Similarly, the sustainable fashion market is experiencing rapid expansion, driven by consumer demand for eco-friendly products.

Successfully capturing market share in these areas could transform them into future Stars for PVH, but the high investment needs and inherent market uncertainty make them risky propositions.

Emerging market digital expansion, particularly in APAC, places Tommy Hilfiger within the Question Mark quadrant of the PVH BCG Matrix. While Tommy Hilfiger experienced growth in emerging markets within Asia-Pacific, PVH's overall revenue in the region saw a decline in Q1 2025, highlighting a difficult market. This suggests that despite potential, the current environment presents significant challenges for broad-based expansion.

PVH's digital initiatives in rapidly developing yet volatile APAC regions are targeting high-growth potential markets. However, the company currently holds a low or inconsistent market share in these areas. This limited penetration, coupled with the inherent volatility, makes the immediate return on investment for these digital expansion efforts uncertain, thus classifying them as Question Marks.

Advanced Technology Integration in Retail Experiences

PVH's venture into advanced technology, such as augmented reality (AR) and personalized shopping, positions these initiatives as potential 'Question Marks' within its BCG Matrix. These innovations represent high-potential growth avenues in the evolving retail landscape. For instance, a 2024 report indicated that 60% of consumers find AR features in retail to be engaging, suggesting a strong underlying consumer interest.

However, their current market share for PVH is likely modest, with adoption rates still developing. This uncertainty, coupled with the substantial investment required for widespread implementation and consumer buy-in, firmly places them in the Question Mark category.

- Augmented Reality (AR) Integration: Enabling virtual try-ons or product visualization, aiming to enhance engagement and reduce returns.

- Personalized Shopping Experiences: Leveraging data analytics to offer tailored recommendations and promotions, boosting customer loyalty.

- Investment in Future Growth: These technologies require significant ongoing R&D and marketing to achieve critical mass and competitive advantage.

- Consumer Acceptance Curve: Success hinges on widespread consumer adoption and understanding of these new technological offerings.

Partnerships in Novel Distribution Models

Partnering with emerging retail platforms, subscription box services, and peer-to-peer fashion marketplaces allows PVH to tap into rapidly expanding and innovative distribution channels. These nascent channels represent opportunities for high growth, though PVH's initial market share within them would likely be minimal. This requires a strategic approach to nurturing these relationships and investing in their scalability.

In 2024, the direct-to-consumer (DTC) channel continued its strong trajectory, with the global online fashion market projected to reach over $1.5 trillion. Subscription box services, a key component of novel distribution, saw continued consumer interest, with market research indicating a steady growth rate of around 10-15% annually. Peer-to-peer marketplaces, particularly in the resale fashion segment, experienced significant expansion, with platforms like Depop and Poshmark reporting substantial user growth and transaction volumes.

- Emerging Platforms: Exploring partnerships with platforms like ASOS Marketplace or Zalando's growing influencer-driven sales features offers access to a younger, digitally native consumer base.

- Subscription Services: Collaborating with curated fashion subscription boxes can introduce PVH brands to new audiences and foster brand loyalty through personalized experiences.

- Peer-to-Peer Marketplaces: Engaging with resale platforms allows PVH to tap into the growing circular economy and potentially reach consumers seeking sustainable fashion options.

- Investment for Scale: Success in these channels hinges on PVH's willingness to invest in tailored marketing, inventory management, and logistical support to ensure these partnerships can scale effectively.

PVH's strategic exploration of niche markets, such as specialized performance wear or hyper-personalized fashion, positions these ventures as Question Marks. These segments offer high growth potential but currently represent a small portion of PVH's overall market share, necessitating significant investment for expansion.

The company's push into emerging digital channels in regions like APAC also falls into the Question Mark category. While these markets are expanding rapidly, PVH faces challenges with low or inconsistent market penetration, making the return on investment uncertain.

Technological innovations like augmented reality (AR) integration and personalized shopping experiences are also considered Question Marks. Despite strong consumer interest, as indicated by a 2024 report showing 60% of consumers find AR engaging in retail, PVH's current market share in these areas is modest, requiring substantial investment to achieve widespread adoption.

These initiatives are characterized by high market growth potential coupled with PVH's current low market share, demanding significant capital for development and market penetration. Their success hinges on effectively navigating consumer adoption curves and competitive landscapes, with the potential to become future Stars if managed strategically.

BCG Matrix Data Sources

Our BCG Matrix leverages a blend of financial reports, market research data, and competitor analysis to provide a comprehensive view of product performance.