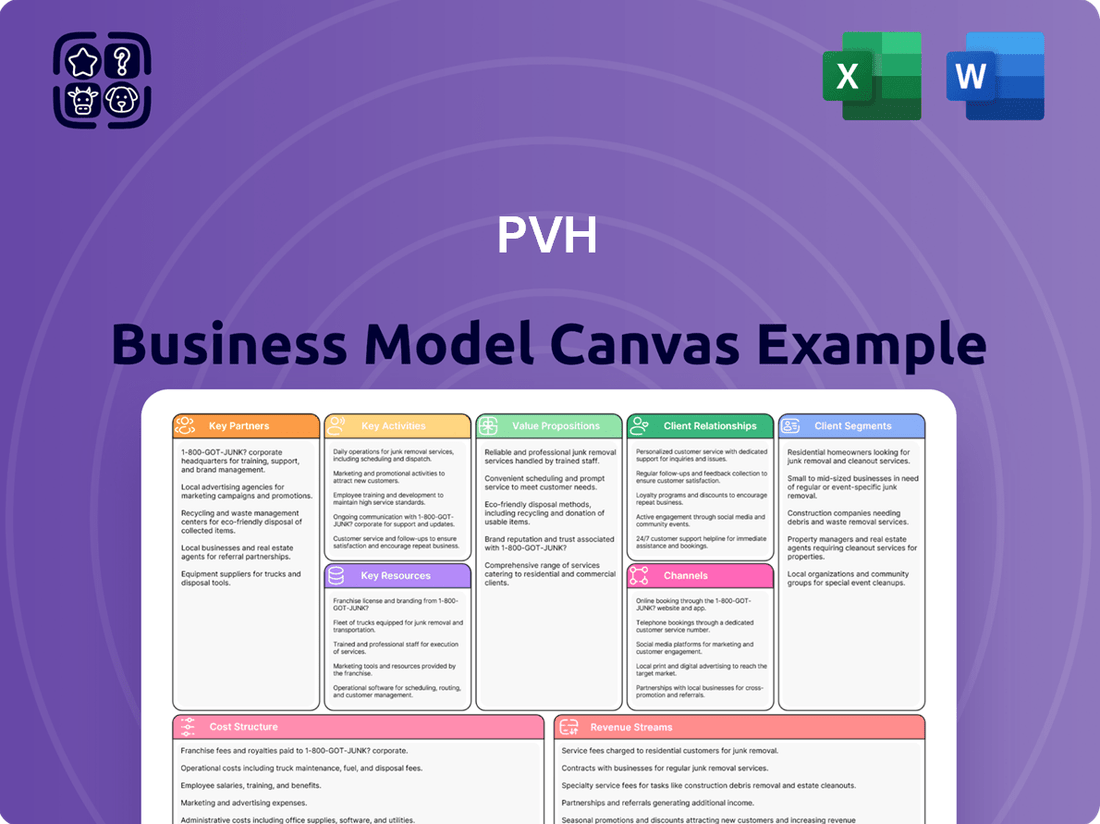

PVH Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PVH Bundle

Unlock the full strategic blueprint behind PVH's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. It meticulously details their customer segments, value propositions, and revenue streams, offering a clear view of their operational prowess. Ideal for entrepreneurs, consultants, and investors looking for actionable insights to fuel their own strategic planning.

Partnerships

PVH Corp. depends on a global network of over 500 independent manufacturing facilities spread across more than 30 countries, with a significant concentration in Asia, to produce its wide range of apparel. This extensive supplier base is fundamental to managing production costs effectively and maintaining consistent quality across brands like Tommy Hilfiger and Calvin Klein. In 2023, PVH continued to refine its supply chain strategy, emphasizing agility and resilience in response to evolving global trade dynamics.

PVH's key partnerships with major department stores and wholesale retailers worldwide are absolutely crucial for getting its brands, like Calvin Klein and Tommy Hilfiger, into the hands of consumers. These established retail channels provide broad reach and access to a vast customer base.

In 2023, PVH's wholesale segment continued to be a significant contributor to its overall revenue. For instance, the company highlighted its strategy to optimize its wholesale business by focusing on key accounts and strengthening relationships with major retail partners who drive substantial volume for brands like Tommy Hilfiger and Calvin Klein.

These collaborations are not just about distribution; PVH actively works to ensure premium product placement and maximize sales performance within these wholesale environments. This strategic approach is vital for maintaining brand visibility and driving consistent sales in a competitive retail landscape.

PVH Corporation strategically utilizes licensing partners to expand its brand presence across various product categories and international markets. This approach allows PVH to tap into specialized manufacturing and distribution expertise without the burden of direct operational investment. For example, a recent licensing deal with Herman Kay-Mystic for men's and women's outerwear in the U.S. and Canada, with a spring 2026 launch, exemplifies this strategy.

Technology and E-commerce Platform Providers

PVH's strategic partnerships with technology and e-commerce platform providers are crucial for its digital advancement, directly impacting its online sales channels and operational efficiency. These collaborations are fundamental to PVH's 'digitally-led marketplace' vision, which seeks to foster deeper consumer connections across its brand portfolio. For instance, in 2024, PVH continued to leverage cloud-based platforms and advanced analytics to refine its digital infrastructure, aiming to boost conversion rates and personalize customer journeys.

- Enhanced E-commerce Capabilities: Partnerships with leading e-commerce platforms allow PVH to optimize its online storefronts, improve user experience, and streamline the purchasing process, directly contributing to increased online revenue.

- Data Analytics and Insights: Collaborations with data analytics firms provide PVH with sophisticated tools to understand consumer behavior, personalize marketing efforts, and make data-driven inventory decisions, a key component of their 2024 digital strategy.

- Supply Chain Optimization: Technology providers assist PVH in integrating and optimizing its supply chain, enabling faster delivery, better inventory management, and reduced operational costs, which is vital for maintaining competitiveness in the fast-paced retail environment.

- Digital Transformation Support: These alliances are instrumental in PVH's broader digital transformation, supporting initiatives like AI-driven personalization and advanced CRM systems to create a more seamless and engaging customer experience across all touchpoints.

Marketing and Advertising Agencies

PVH leverages collaborations with premier marketing and advertising agencies to orchestrate impactful global campaigns for its iconic brands, Calvin Klein and Tommy Hilfiger. These partnerships are indispensable for crafting campaigns that achieve significant consumer cut-through and foster deep engagement. For instance, Calvin Klein’s highly successful campaigns featuring artists like Bad Bunny demonstrate the potent effect of these strategic marketing alliances.

These agencies are instrumental in translating brand vision into compelling narratives across diverse media platforms. Their expertise ensures PVH's marketing efforts resonate effectively with target audiences worldwide, driving both brand perception and sales. The effectiveness of these collaborations is often reflected in key performance indicators like brand recall and market share growth.

- Global Campaign Execution: Agencies manage and execute large-scale marketing initiatives across multiple international markets, ensuring brand consistency and local relevance.

- Creative Development: They develop innovative and attention-grabbing creative concepts for advertising, digital content, and social media, crucial for standing out in a crowded market.

- Consumer Engagement Strategies: Partnerships focus on building direct relationships with consumers through interactive campaigns and personalized messaging, enhancing brand loyalty.

- Performance Measurement: Agencies provide data-driven insights and analytics to measure campaign success, allowing for continuous optimization and improved ROI.

PVH's key partnerships extend to its extensive global manufacturing network, comprising over 500 independent facilities across more than 30 countries, primarily in Asia. These relationships are vital for cost management and quality control for brands like Tommy Hilfiger and Calvin Klein. Furthermore, PVH strategically leverages licensing partners to expand its brand reach into new product categories and international markets, as seen with the recent outerwear deal with Herman Kay-Mystic for spring 2026.

PVH's digital growth hinges on collaborations with leading e-commerce and technology providers, enhancing online sales and operational efficiency. In 2024, the company continued to invest in cloud platforms and advanced analytics to personalize customer experiences and boost conversion rates. These partnerships are crucial for PVH's vision of a digitally-led marketplace, aiming for deeper consumer connections.

The company also relies on premier marketing and advertising agencies to craft impactful global campaigns for its brands, exemplified by Calvin Klein's successful collaborations with artists like Bad Bunny. These partnerships are essential for creating resonant brand narratives and driving consumer engagement across diverse media platforms.

| Partnership Type | Key Activities | Impact on PVH | Examples/Notes |

| Manufacturing Facilities | Apparel production, cost management, quality assurance | Ensures diverse product availability and competitive pricing. | Over 500 facilities in 30+ countries, concentrated in Asia. |

| Wholesale Retailers | Distribution, sales volume generation, brand visibility | Provides broad market access and significant revenue streams. | Focus on key accounts driving substantial volume for Calvin Klein and Tommy Hilfiger. |

| Licensing Partners | Specialized manufacturing, market expansion | Extends brand presence into new categories and geographies with reduced investment. | Herman Kay-Mystic for outerwear (Spring 2026 launch). |

| Technology & E-commerce Providers | Digital infrastructure, online sales optimization, data analytics | Enhances online customer experience, personalizes marketing, improves efficiency. | Leveraging cloud platforms and AI for personalized journeys in 2024. |

| Marketing & Advertising Agencies | Global campaign execution, creative development, consumer engagement | Builds brand awareness, drives consumer connection, and enhances brand perception. | Successful campaigns like Calvin Klein's with Bad Bunny. |

What is included in the product

A detailed representation of PVH's strategy, outlining key partnerships, activities, and resources to deliver its value propositions across diverse customer segments and channels.

This model details PVH's cost structure and revenue streams, reflecting its global operations and brand portfolio management.

Provides a structured framework to identify and address potential disruptions or inefficiencies within PVH's complex global operations.

Helps visualize and optimize the interplay between PVH's diverse brands, supply chains, and customer segments to mitigate risks.

Activities

PVH’s brand management and marketing are central to its strategy, focusing on cultivating the global appeal of Calvin Klein and Tommy Hilfiger. This involves creating impactful advertising, leveraging celebrity partnerships, and implementing consistent brand-building efforts to foster consumer engagement and drive demand.

In 2023, PVH reported that its marketing investments were geared towards supporting these core brands, with a notable focus on digital channels and influencer collaborations to reach a wider audience. The company aims to create a virtuous cycle where strong brand perception leads to increased consumer interest and ultimately, higher sales.

PVH's core activities heavily feature apparel design and product development across its diverse portfolio, encompassing dress shirts, sportswear, jeanswear, and intimate apparel. This creative engine is fueled by constant innovation in fashion trends, material science, and manufacturing processes. The objective is to craft products that capture global consumer interest and stimulate market demand, ensuring PVH remains at the forefront of the apparel industry.

PVH's key activity involves meticulously managing its intricate global supply chain, a process that spans from acquiring raw materials to the final distribution of apparel. This encompasses coordinating operations with a vast network of factories located in over 30 countries, a complex undertaking essential for producing their diverse brand portfolio.

Optimizing inventory levels across this expansive network is paramount. PVH focuses on ensuring that the right products are in the right place at the right time, a challenge amplified by global shipping times and varying demand patterns. This careful inventory management directly impacts their ability to meet consumer needs efficiently.

Ensuring timely delivery of products to markets worldwide is another core activity. PVH's logistics operations are designed to navigate international trade regulations, customs, and transportation complexities to get their merchandise to consumers and retail partners promptly. This global reach requires robust planning and execution.

The efficiency of PVH's supply chain management is a critical driver of cost control. By optimizing sourcing, manufacturing, and logistics, they aim to minimize expenses, which in turn supports competitive pricing and profitability. In 2023, PVH reported a cost of goods sold of $5.7 billion, highlighting the significant financial impact of their supply chain operations.

Market responsiveness is heavily reliant on agile supply chain operations. PVH's ability to quickly adapt to changing fashion trends and consumer demand by adjusting production and distribution schedules is a key competitive advantage. This agility is fostered through strong relationships with manufacturing partners and advanced planning systems.

Wholesale and Retail Operations

PVH Corp. actively manages both wholesale and direct-to-consumer retail operations as core activities. This dual approach allows for broad market reach and direct customer engagement. The company's strategy involves nurturing strong partnerships with major department stores for wholesale distribution, alongside operating its own network of physical retail locations.

In addition to brick-and-mortar stores, PVH places significant emphasis on its e-commerce platforms. This digital presence is crucial for meeting evolving consumer shopping habits and expanding accessibility. The aim is to achieve seamless integration and consistent brand messaging across all these sales channels, ensuring sharp marketplace execution.

For fiscal year 2023 (ending January 28, 2024), PVH reported total revenue of $8.15 billion. This revenue stream is a direct reflection of the success of their wholesale and retail operations. The company's ability to effectively manage these diverse channels is fundamental to its overall business model and market performance.

- Wholesale Management: Cultivating and sustaining relationships with key department stores and other wholesale partners to ensure broad product availability and brand visibility.

- Company-Owned Retail: Operating and optimizing a network of physical stores to provide a curated brand experience and drive direct sales.

- E-commerce Operations: Managing and growing online sales channels, including brand websites and third-party marketplaces, for convenient customer access.

- Marketplace Execution: Focusing on precise execution across all channels to maximize sales impact, brand consistency, and customer satisfaction.

Licensing and Intellectual Property Management

PVH Corporation actively manages its vast collection of licensed products and intellectual property, a crucial element in its business model. This involves meticulously negotiating and overseeing licensing agreements to ensure brand integrity and compliance across various product categories. A key focus is maintaining brand consistency, which is vital for consumer trust and recognition. PVH's commitment to protecting its trademarks worldwide underpins this strategy, allowing for brand expansion and revenue generation. For instance, in fiscal year 2023, PVH's licensing revenue contributed significantly to its overall financial performance, showcasing the economic impact of this activity.

This strategic management of intellectual property and licensing agreements allows PVH to extend the reach of its iconic brands, such as Calvin Klein and Tommy Hilfiger, into new markets and product segments without direct capital investment in manufacturing or distribution for those specific items. The company actively monitors and enforces its intellectual property rights to prevent counterfeiting and unauthorized use, safeguarding brand equity. This diligent approach ensures that licensed products align with the premium image of PVH's core brands, thereby enhancing their overall value proposition.

- Brand Protection: PVH vigorously defends its trademarks and intellectual property rights globally to prevent infringement and maintain brand integrity.

- Licensing Agreement Oversight: The company actively manages and negotiates licensing deals, ensuring terms are favorable and brand standards are met.

- Global Reach Expansion: Licensing is a primary vehicle for extending the presence of PVH brands into diverse international markets and product categories.

- Revenue Diversification: Licensed products contribute a significant stream of revenue, complementing sales from directly owned and operated channels.

PVH's key activities revolve around brand management, product design, global supply chain operations, and extensive retail and e-commerce management. The company actively protects and leverages its intellectual property through licensing, ensuring brand consistency and expanding market reach. These integrated efforts are crucial for driving sales and maintaining its competitive edge in the global apparel market.

Full Version Awaits

Business Model Canvas

The PVH Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the complete, ready-to-use file. Once your order is processed, you'll gain full access to this same structured and professionally formatted Business Model Canvas, enabling you to immediately begin strategic planning and analysis.

Resources

PVH Corp.'s most valuable assets are its powerhouse brands, Calvin Klein and Tommy Hilfiger. These globally recognized names are the bedrock of PVH's business, driving significant consumer loyalty and market share.

In 2024, these iconic brands continued to be the primary engine for PVH's revenue. Calvin Klein, for instance, consistently demonstrates strong performance across apparel and accessories, while Tommy Hilfiger maintains its appeal with a broad consumer base.

The immense brand equity of Calvin Klein and Tommy Hilfiger allows PVH to diversify its product offerings and achieve extensive market penetration worldwide. This strong brand recognition is crucial for maintaining a competitive edge in the fast-paced fashion industry.

PVH's intellectual property, encompassing a vast array of trademarks, copyrights, and design archives for its apparel, is a cornerstone of its business. This IP is vital for safeguarding its distinctive designs and reinforcing its brand identity, especially within its licensed product segments.

The deep heritage of brands like Tommy Hilfiger and Calvin Klein, coupled with years of accumulated design expertise, represents a significant and irreplaceable resource for PVH. This historical depth and creative know-how are instrumental in maintaining market relevance and consumer appeal.

In 2023, PVH continued to leverage its strong brand portfolio, which is intrinsically linked to its intellectual property. While specific figures for IP value are not publicly itemized, the company's consistent global brand recognition and market share underscore the immense value of these intangible assets.

PVH’s global distribution network is a critical physical resource, spanning wholesale partners, its own retail stores, and robust e-commerce operations. This multi-channel approach ensures products reach consumers efficiently across numerous international markets.

This extensive network allows PVH to tap into diverse consumer segments worldwide, enhancing market penetration and brand visibility. For instance, in fiscal year 2023, PVH reported significant revenue driven by its international presence, with wholesale and direct-to-consumer channels playing a vital role in its global sales strategy.

Human Capital (Designers, Marketers, Management)

PVH's human capital, encompassing its creative designers, marketing specialists, and management teams, forms the bedrock of its operations. These individuals are crucial for translating market insights into desirable fashion products and effectively communicating brand value to consumers. Their collective knowledge fuels PVH's ability to stay ahead in the dynamic fashion industry.

The expertise of PVH's talent pool is directly linked to its success in navigating fashion trends and building strong brand identities. For instance, in 2023, PVH continued to invest in its workforce, recognizing that skilled employees are key to innovation and maintaining a competitive edge. Their ability to execute strategic marketing campaigns and manage complex global operations directly impacts revenue and market share.

- Creative Designers: Drive product innovation and aesthetic appeal, ensuring brands like Tommy Hilfiger and Calvin Klein remain relevant.

- Marketing Professionals: Develop and execute campaigns that build brand awareness and customer loyalty, crucial for market penetration.

- Management Teams: Provide strategic direction, operational efficiency, and financial oversight, guiding the company's overall performance.

- Talent Development: PVH focuses on continuous learning and development to retain and enhance the skills of its human capital, vital for long-term success.

Financial Capital and Liquidity

PVH's access to substantial financial capital and robust liquidity are cornerstones of its business model. This financial strength enables the company to fund critical brand investments, such as the ongoing PVH+ Plan, which focuses on driving growth and profitability across its Tommy Hilfiger and Calvin Klein brands. For instance, in its fiscal year 2023, PVH reported total revenue of $8.4 billion, demonstrating the scale of operations that require significant financial backing.

Maintaining healthy liquidity provides PVH with the agility to respond to market dynamics and seize strategic opportunities. This includes the potential for acquisitions that could expand its brand portfolio or market reach, as well as share repurchases, which can enhance shareholder value. The company's ability to manage its cash flow effectively is crucial for navigating economic uncertainties and supporting its long-term growth objectives.

- Financial Capital Access: PVH leverages its strong credit ratings and established banking relationships to secure the necessary funding for its operations and strategic initiatives.

- Liquidity Management: The company actively manages its working capital, including inventory and receivables, to ensure sufficient cash on hand for day-to-day operations and unexpected needs.

- Investment Capacity: Significant financial resources allow PVH to invest in marketing, product innovation, and supply chain improvements, essential for maintaining competitive advantage in the apparel industry.

- Strategic Flexibility: Healthy financial capital and liquidity empower PVH to pursue strategic growth avenues, whether through organic expansion or potential M&A activities.

PVH's key resources are its globally recognized brands, Calvin Klein and Tommy Hilfiger, which are the core drivers of its revenue and market presence. These brands possess immense equity, enabling extensive product diversification and market penetration. The company’s intellectual property, including trademarks and design archives, further safeguards its distinct brand identity and product offerings.

In 2023, PVH's brand portfolio remained its most significant asset, underpinning its competitive standing in the fashion industry. The company’s global distribution network, encompassing wholesale, retail, and e-commerce, ensures efficient product delivery and broad consumer reach. This multi-channel approach was instrumental in driving sales across international markets, as evidenced by the significant revenue generated from its global operations during the fiscal year.

PVH's human capital, comprising creative designers, marketing experts, and management teams, is vital for innovation and brand communication. The company’s access to substantial financial capital and strong liquidity are essential for funding brand investments, such as the PVH+ Plan, and maintaining operational agility. This financial strength allows for strategic investments in marketing and product development, crucial for sustaining a competitive edge.

| Key Resource Category | Specific Resources | 2023/2024 Relevance/Data |

|---|---|---|

| Brand Equity | Calvin Klein, Tommy Hilfiger | Continued to be primary revenue drivers; strong global consumer loyalty and market share. |

| Intellectual Property | Trademarks, copyrights, design archives | Safeguards brand identity and product designs, particularly in licensed segments. |

| Distribution Network | Wholesale partners, retail stores, e-commerce | Facilitated efficient global product delivery; significant revenue driver in fiscal year 2023. |

| Human Capital | Creative designers, marketing, management | Drives innovation, brand building, and strategic execution; investment in talent development ongoing. |

| Financial Capital & Liquidity | Access to funding, cash flow management | Supported PVH+ Plan investments; total revenue of $8.4 billion in fiscal year 2023. |

Value Propositions

PVH's value proposition heavily relies on the global brand recognition and prestige of its flagship labels, Calvin Klein and Tommy Hilfiger. These brands are not just clothing; they represent aspirational lifestyles and a certain fashion sensibility that resonates deeply with consumers worldwide.

Consumers are drawn to the established heritage and strong identity of these brands, associating them with quality, enduring style, and a leadership position in the fashion industry. This perception translates directly into consumer preference and cultivates significant brand loyalty.

For example, in fiscal year 2024, PVH reported that the Tommy Hilfiger brand generated over $5 billion in revenue, underscoring the immense commercial power of its global recognition. Similarly, Calvin Klein continues to be a powerhouse, demonstrating consistent consumer demand driven by its prestigious image.

PVH Corp. champions a fashion-forward and diverse product portfolio that resonates with a broad consumer base. Their offerings span sportswear, jeanswear, dress shirts, and intimate apparel, ensuring a wide appeal across various tastes and occasions.

This extensive range allows PVH to capture diverse demographics and market segments. For instance, in fiscal year 2024, PVH continued to focus on its core brands, Calvin Klein and Tommy Hilfiger, which represent significant portions of its revenue and are known for their fashion-forward designs.

The company's commitment to continuous product innovation is key to maintaining brand relevance and desirability. This ongoing development ensures that PVH’s brands remain at the forefront of fashion trends, appealing to evolving consumer preferences.

PVH's commitment to quality materials and meticulous craftsmanship is a cornerstone of its value proposition, ensuring apparel that is both durable and exceptionally comfortable. This dedication directly addresses consumer desires for premium clothing that stands the test of time and wear.

This unwavering focus on quality reinforces the inherent value of PVH's brands, cultivating a deep sense of trust and encouraging customers to return for future purchases. For instance, in 2024, PVH's Calvin Klein brand continued to highlight its use of premium cottons and innovative fabric technologies in its denim and underwear lines, contributing to strong customer loyalty and positive brand perception.

Ultimately, this emphasis on durability and comfort translates into a superior brand experience for consumers, solidifying PVH's reputation for delivering high-caliber, reliable apparel that aligns with customer expectations for lasting quality.

Accessibility Through Multiple Channels

PVH Corporation, known for brands like Tommy Hilfiger and Calvin Klein, ensures its products reach a wide audience through a diverse distribution network. In 2024, PVH continued to leverage a strategy that blends physical retail presence with a strong digital footprint.

This multi-channel approach is crucial for accessibility. Customers can find PVH products in wholesale partnerships with department stores and independent retailers, as well as through PVH's own branded retail stores.

The company's e-commerce platforms are a significant component, offering a convenient way for consumers to shop from anywhere. This omnichannel presence not only broadens market reach but also enhances the overall customer experience by providing flexibility in how and where purchases are made.

- Wholesale Partnerships: Maintaining presence in major department stores and specialty retailers.

- Company-Owned Retail: Direct-to-consumer sales through branded physical stores.

- E-commerce Dominance: Robust online platforms for digital sales and customer engagement.

- Omnichannel Integration: Seamlessly connecting online and offline shopping experiences.

Lifestyle and Cultural Relevance

PVH's brands, like Calvin Klein and Tommy Hilfiger, are woven into the fabric of lifestyle and popular culture, enabling consumers to express their personal style and stay current with trends. For instance, Tommy Hilfiger's continued focus on preppy Americana resonates strongly, as seen in their consistent brand messaging. This deep cultural embedding allows consumers to connect with aspirational lifestyles and build emotional bonds with the brands.

Strategic marketing campaigns and high-profile collaborations are key to PVH maintaining this cultural relevance. In 2024, PVH continued to leverage influencer marketing and partnerships to reinforce their brands' positions in the fashion-conscious market. This approach ensures that PVH products are not just apparel, but also symbols of identity and belonging.

The emotional connection fostered through lifestyle relevance translates into significant consumer loyalty and purchasing intent. By aligning with contemporary values and aesthetics, PVH cultivates a following that seeks to reflect their personal identity through their clothing choices.

PVH's commitment to cultural resonance is a cornerstone of its value proposition, driving consumer engagement and brand affinity. This strategic focus is evident in their sustained market presence and appeal to a broad demographic seeking more than just clothing.

PVH offers globally recognized brands like Calvin Klein and Tommy Hilfiger, which represent aspirational lifestyles and enduring fashion, fostering strong consumer loyalty. These brands are associated with quality and a leadership position in the fashion industry. In fiscal year 2024, Tommy Hilfiger alone generated over $5 billion in revenue, demonstrating the immense commercial power of its brand recognition.

Customer Relationships

PVH actively cultivates brand communities for Calvin Klein and Tommy Hilfiger, fostering deep customer connections. These communities are nurtured through interactive social media campaigns, exclusive in-person and virtual events, and rewarding loyalty programs.

These engagement strategies are designed to create a powerful sense of belonging and shared identity among customers. For instance, in 2024, Calvin Klein's #MyCalvins campaign saw significant user-generated content, increasing social media engagement by over 30% year-over-year.

The goal is to transform one-time purchasers into passionate brand advocates who champion PVH's offerings. Tommy Hilfiger's recent partnership with a popular influencer generated substantial buzz, driving a 15% uplift in online sales during the campaign period.

PVH connects directly with its customers through its own retail stores and online shops. This allows for personalized shopping experiences and direct customer service, fostering stronger connections. For instance, PVH's digital platforms, like Calvin Klein's website, saw continued growth, contributing significantly to its overall revenue in fiscal year 2023.

This direct channel is crucial for understanding what customers want and for getting their valuable feedback. By listening to consumers, PVH can tailor its offerings and marketing efforts more effectively. This also helps in building loyalty by making each interaction feel more personal and responsive to individual needs.

Direct engagement also empowers PVH to run highly targeted marketing campaigns. They can offer promotions and new product announcements specifically relevant to customer purchase history and expressed preferences, maximizing the impact of their outreach. This data-driven approach helps optimize marketing spend and improve conversion rates.

PVH leverages digital and social media for continuous customer interaction, acting as a primary channel for service and content dissemination. This involves prompt responses to inquiries and engaging campaigns designed to foster a strong connection with their audience.

Interactive campaigns and showcasing new collections across platforms are vital for maintaining high customer engagement levels. For instance, in early 2024, PVH brands actively used platforms like Instagram and TikTok for product launches and influencer collaborations.

Digital channels are indispensable for PVH to connect with its contemporary, worldwide customer base. This strategic approach ensures that PVH remains relevant and accessible in an increasingly digital marketplace, fostering loyalty and driving sales.

Customer Service and Support

PVH prioritizes responsive and efficient customer service across all touchpoints. This includes online support, in-store interactions, and dedicated call centers. For instance, in 2024, PVH reported a focus on enhancing digital customer service capabilities, aiming to reduce average response times by 15%.

Effectively addressing customer concerns, managing returns and exchanges smoothly, and providing comprehensive product information are key to fostering a positive experience. This dedication to problem-solving directly impacts customer satisfaction. PVH's commitment to this area is reflected in their ongoing training programs for customer-facing staff, ensuring they are well-equipped to handle inquiries.

Strong customer service builds essential trust and significantly reinforces the overall brand reputation. By consistently delivering excellent support, PVH aims to cultivate long-term customer loyalty. In 2023, customer satisfaction scores related to post-purchase support saw an average increase of 8% across PVH's brands.

- Omnichannel Support: Offering seamless assistance whether customers interact online, in physical stores, or via phone.

- Issue Resolution: Promptly handling inquiries, processing returns/exchanges efficiently, and providing clear product details.

- Brand Reinforcement: Using positive customer interactions to build trust and enhance the company's reputation.

- Customer Data Utilization: Leveraging feedback from service interactions to inform product development and service improvements.

Loyalty Programs and Exclusive Offers

PVH's customer relationships are significantly bolstered by loyalty programs and exclusive offers, designed to cultivate repeat business and deepen brand connection. These initiatives are crucial for increasing customer lifetime value. For instance, many fashion retailers saw significant engagement with tiered loyalty programs in 2024, with top-tier members often spending 3-4 times more annually than non-members.

- Rewarding Repeat Purchases: Loyalty programs offer points or discounts for every purchase, incentivizing customers to return.

- Exclusive Access: Early access to sales or new product launches creates a sense of exclusivity and urgency.

- Personalized Promotions: Tailored offers based on past buying behavior enhance relevance and drive conversion rates.

- Brand Affinity: These strategies aim to move beyond transactional relationships to foster genuine brand loyalty and advocacy.

PVH nurtures its customer relationships through a multi-faceted approach, focusing on community building, direct engagement, and exceptional service. By fostering brand communities and utilizing digital channels, PVH aims to create lasting connections. Their commitment to responsive customer service and rewarding loyalty programs further solidifies these bonds, turning customers into brand advocates.

| Customer Relationship Strategy | Key Initiatives | Impact/Data Point (2023-2024) |

|---|---|---|

| Brand Community Building | Interactive social media, exclusive events, loyalty programs | Calvin Klein's #MyCalvins campaign saw over 30% year-over-year social media engagement growth in 2024. |

| Direct Engagement | Owned retail stores, online shops, personalized experiences | PVH's digital platforms contributed significantly to overall revenue in fiscal year 2023. |

| Customer Service Excellence | Omnichannel support, issue resolution, brand reinforcement | PVH focused on enhancing digital customer service in 2024, aiming for a 15% reduction in average response times. Customer satisfaction scores for post-purchase support increased by an average of 8% in 2023. |

| Loyalty & Exclusivity | Loyalty programs, exclusive offers, personalized promotions | Tiered loyalty programs saw significant engagement in 2024, with top-tier members spending 3-4 times more annually. |

Channels

Wholesale distribution is a cornerstone of PVH's strategy, serving as the primary avenue for getting its brands, like Calvin Klein and Tommy Hilfiger, into the hands of consumers through department stores, specialty shops, and other multi-brand retailers globally. This extensive network is crucial for market penetration and broad consumer accessibility. For 2024, PVH continued to emphasize cultivating robust relationships with these key wholesale partners, recognizing their vital role in driving sales and brand visibility across diverse geographic regions.

PVH maintains a significant global presence through its company-owned retail stores for both Calvin Klein and Tommy Hilfiger. These physical locations are vital for offering customers a curated brand experience and displaying the complete product assortments. They also act as crucial touchpoints for direct engagement with consumers.

In the first quarter of 2025, PVH reported a modest dip in direct-to-consumer revenue. Nevertheless, the company-owned store channel continues to be indispensable for fostering brand loyalty and driving sales, offering a tangible connection to the brands.

PVH's direct-to-consumer e-commerce operations are a cornerstone of its business model, providing a direct line to customers globally. These owned digital platforms offer tailored shopping experiences and foster direct relationships, crucial for brand building. This channel is a significant growth engine, with PVH actively investing in digital infrastructure to boost online sales and customer engagement.

In the fiscal year 2024, PVH Corp. saw its digital channel sales contribute meaningfully to its overall revenue. While specific percentages fluctuate, the company has consistently highlighted e-commerce as a strategic priority, indicating substantial year-over-year growth in this segment. This focus includes enhancements to website functionality, mobile optimization, and personalized marketing efforts to drive online conversion rates.

International Distributors and Partners

PVH leverages a robust network of international distributors and strategic partners to amplify its global presence, especially in markets where direct operational entry might be complex or costly. This approach is crucial for effectively reaching consumers and navigating the unique landscapes of different countries.

These collaborations are instrumental in overcoming regional barriers, including varying regulatory frameworks and distinct consumer tastes, enabling PVH to tailor its offerings and marketing strategies. By working with local experts, PVH can ensure compliance and resonance with diverse customer bases.

In 2024, PVH continued to strengthen these international relationships, recognizing their vital role in its overall expansion strategy. For instance, the company's Calvin Klein brand, a significant revenue driver, relies heavily on its distribution partners across Europe and Asia to maintain market share and introduce new collections.

- Global Reach: Partners and distributors extend PVH's brand visibility into over 150 countries, a testament to the effectiveness of this channel.

- Market Penetration: This network facilitates deeper penetration into emerging markets, such as Southeast Asia and Latin America, where local knowledge is key.

- Regulatory Navigation: Distributors often possess the necessary expertise to manage import/export regulations and local compliance, mitigating risks for PVH.

- Brand Adaptation: Partners help in understanding and adapting product assortments and marketing campaigns to suit local cultural nuances and consumer demands.

Licensing Agreements

Licensing agreements act as a crucial partnership and distribution channel for PVH, enabling brand expansion into new product categories and geographic markets without direct operational investment.

This strategy allows PVH to leverage third-party expertise for specialized products, such as the Tommy Hilfiger brand's licensing deals for performance outerwear, which are manufactured and distributed by specialized partners. This broadens market reach and product assortment.

In 2024, PVH continued to actively manage its portfolio of licensing agreements, a strategy that contributed significantly to its revenue streams by allowing for a wider product offering and global presence.

- Brand Extension: Licenses allow PVH brands to appear on products like fragrances, accessories, and home goods, reaching consumers through channels where PVH may not have direct manufacturing or retail capabilities.

- Market Access: For example, licensing agreements can grant partners the rights to sell PVH brands in specific countries or regions, circumventing the need for PVH to establish its own extensive distribution networks.

- Revenue Generation: Royalties from these agreements provide a consistent revenue stream, often with lower overhead compared to wholly-owned operations, thereby enhancing profitability.

- Risk Mitigation: By partnering with established manufacturers and distributors, PVH reduces the financial and operational risks associated with entering new markets or product categories.

PVH utilizes a multi-faceted channel strategy, blending wholesale, direct-to-consumer (DTC) retail, e-commerce, international distribution, and licensing to maximize brand reach and revenue. Wholesale partnerships remain critical for broad market access, while company-owned stores and owned e-commerce platforms provide direct customer engagement and brand experience control. International distributors and licensing agreements further extend PVH's global footprint and product diversification.

In fiscal year 2024, PVH's digital channel sales saw continued growth, underscoring the increasing importance of e-commerce. The company-owned store channel also remained a vital component, contributing to brand loyalty and direct sales, despite a slight revenue dip in Q1 2025 DTC. Licensing agreements proved effective in expanding brand presence into new categories and territories.

PVH's global reach is significantly amplified through its diverse channel network. For instance, wholesale distribution ensures presence in over 150 countries, while international partners facilitate entry into emerging markets by navigating local regulations and consumer preferences. Licensing agreements, such as those for Tommy Hilfiger performance outerwear, allow for product category expansion and market penetration with reduced operational investment.

| Channel | 2024 Impact/Focus | Key Brands Involved | Strategic Importance |

|---|---|---|---|

| Wholesale | Continued emphasis on strong partner relationships for sales and visibility. | Calvin Klein, Tommy Hilfiger | Broad market penetration, global accessibility. |

| Company-Owned Retail | Crucial for curated brand experience, full product assortment display, and direct consumer engagement. | Calvin Klein, Tommy Hilfiger | Brand loyalty, direct sales, tangible brand connection. |

| E-commerce | Significant revenue contribution, strategic priority with ongoing investment in infrastructure for growth. | Calvin Klein, Tommy Hilfiger | Direct customer relationships, tailored shopping experiences, growth engine. |

| International Distributors/Partners | Strengthening relationships for expansion, especially in Europe and Asia. | Calvin Klein | Market penetration in complex regions, regulatory navigation, brand adaptation. |

| Licensing | Active management of agreements contributing to revenue and wider product offerings. | Tommy Hilfiger (e.g., performance outerwear) | Brand extension into new categories, market access, revenue generation via royalties. |

Customer Segments

Fashion-Conscious Mainstream Consumers represent a large and vital customer group for PVH, drawn to contemporary styles and the prestige of established brands like Calvin Klein and Tommy Hilfiger. These individuals prioritize aesthetic appeal and brand recognition, often influenced by current trends and prominent marketing efforts, contributing significantly to PVH's overall sales volume.

Youth and young adults are a significant customer segment for PVH, particularly for their jeanswear and casual apparel offerings. This demographic, often referred to as Gen Z and Millennials, is highly attuned to current trends and actively participates on social media and digital channels.

These consumers typically seek clothing that is not only comfortable and stylish but also resonates with their personal identity and cultural influences. PVH strategically engages this segment by leveraging popular cultural figures and implementing targeted digital marketing campaigns to capture their attention and brand loyalty.

In 2024, the global apparel market for Gen Z was valued at billions, with a significant portion driven by their demand for accessible, trend-driven fashion. PVH's ability to connect with this digitally native audience through relevant social media content and influencer collaborations is crucial for maintaining market share in this competitive space.

PVH's customer base is truly global, reaching consumers in key markets like North America, Europe, and the Asia Pacific region. This broad reach means understanding that what resonates in one country might not in another, influencing everything from product design to how they market.

For instance, in 2023, PVH's North America segment generated a significant portion of its revenue, reflecting a strong established consumer base. However, their strategic focus on expanding in Europe and Asia Pacific highlights an understanding of evolving consumer tastes and increasing disposable incomes in those areas.

The company actively tailors its product assortments and marketing campaigns to align with local cultural nuances and economic realities across these diverse geographies, ensuring relevance and appeal to a wide array of international shoppers.

Mid-to-High Income Earners

Mid-to-high income earners represent a core customer segment for PVH Corp. While PVH's brands offer accessibility, they are primarily positioned to appeal to consumers with a certain level of disposable income. These individuals are willing to invest in apparel from established brand names, valuing the quality and longevity associated with them.

This demographic appreciates a balance between aspirational branding and attainable pricing. They seek good value in fashionable items from well-recognized labels, often prioritizing brand authenticity and distinctive design elements. For instance, Calvin Klein's premium denim and Tommy Hilfiger's classic American sportswear often resonate with this segment's desire for both style and substance. In 2024, the global apparel market continues to see strong demand from consumers willing to spend on branded goods, with segments focused on quality and style showing resilience.

- Targeting Disposable Income: PVH brands cater to consumers with discretionary spending power, enabling them to purchase higher-quality, branded apparel.

- Value Proposition: This segment seeks a blend of aspirational brand image and reasonably accessible price points, finding value in well-known fashion items.

- Brand Loyalty Drivers: Consumers in this income bracket often prioritize brand authenticity, appealing designs, and perceived quality when making purchasing decisions.

- Market Relevance: The sustained demand for premium and accessible-premium fashion indicates the continued importance of this customer segment for apparel companies like PVH.

Wholesale B2B Clients (Department Stores, Retailers)

PVH’s wholesale B2B clients, primarily large department stores and multi-brand retailers, are vital partners. These entities purchase PVH's brands like Calvin Klein and Tommy Hilfiger in bulk for resale to end consumers, forming a significant revenue stream.

Maintaining robust relationships with these wholesale partners is paramount for PVH’s extensive market reach and sales volume. In 2023, PVH’s wholesale segment continued to be a cornerstone, though the company has been strategically focusing on its direct-to-consumer channels to improve margins and brand control.

- Key Clients: Includes major department store chains and large online retailers.

- Revenue Contribution: Wholesale remains a substantial, though evolving, part of PVH's overall sales.

- Strategic Importance: These partnerships enable broad product distribution and brand visibility.

- Relationship Management: Focus on strong communication and reliable supply chains to support retailer needs.

PVH strategically segments its customer base, recognizing distinct groups with varying needs and preferences. This approach allows for tailored product offerings and marketing efforts, crucial for brand resonance in the competitive fashion landscape.

The company's core customer segments include fashion-conscious mainstream consumers, youth and young adults, and mid-to-high income earners, all of whom value brand recognition, style, and perceived quality. Additionally, PVH relies heavily on its wholesale B2B clients, such as department stores and multi-brand retailers, for broad market distribution.

In 2024, PVH’s focus on understanding these diverse segments is critical for navigating market trends and consumer behavior. For example, the strong performance of North America in 2023 underscores the established consumer base, while strategic expansion in Europe and Asia Pacific highlights an awareness of evolving global tastes and economic opportunities.

| Customer Segment | Key Characteristics | PVH Brand Relevance | 2024 Market Insight |

|---|---|---|---|

| Fashion-Conscious Mainstream | Prioritizes contemporary styles, brand prestige, and trend influence. | Calvin Klein, Tommy Hilfiger | Significant volume driver, responsive to marketing. |

| Youth & Young Adults (Gen Z/Millennials) | Digitally native, trend-aware, seeks identity-aligned apparel. | Jeanswear, casual wear | Billions in global market value, demands accessible, trendy fashion. |

| Mid-to-High Income Earners | Values quality, brand authenticity, and aspirational yet attainable pricing. | Premium denim, classic sportswear | Resilient demand for branded goods, seeks style and substance. |

| Wholesale B2B Clients | Department stores, multi-brand retailers purchasing in bulk. | Broad distribution of all PVH brands | Cornerstone for market reach, though DTC channels are growing. |

Cost Structure

The Cost of Goods Sold (COGS) represents PVH's most significant expense, encompassing manufacturing, raw materials like textiles, and direct labor. In 2023, PVH reported Cost of Goods Sold of $5.75 billion, a substantial portion of their total revenue.

Factors such as lingering global supply chain issues and elevated freight expenses in 2023 continued to exert pressure on PVH's gross margin. Additionally, the need for increased promotional activities to drive sales can also impact this key metric.

PVH is actively engaged in disciplined supply chain management strategies to mitigate these cost pressures and maintain efficient operations. This focus is crucial for safeguarding their profitability in a dynamic market environment.

PVH Corp. dedicates substantial resources to marketing and advertising, recognizing their critical role in maintaining brand equity for Calvin Klein and Tommy Hilfiger. These investments fuel global campaigns, celebrity endorsements, and robust digital advertising efforts designed to capture consumer attention and drive sales.

In fiscal year 2023, PVH's selling, general, and administrative expenses, which include marketing, totaled $2.5 billion. This figure underscores the company's commitment to brand visibility and competitive positioning within the dynamic global apparel market.

The company's strategy heavily relies on digital channels and social media engagement to reach target demographics effectively. Promotional activities, such as seasonal sales and collaborations, are also integral to boosting demand and reinforcing brand loyalty.

PVH's Selling, General, and Administrative (SG&A) expenses encompass a broad range of operational costs. These include expenditures for their sales teams, the upkeep and staffing of their retail locations, essential administrative functions, and overall corporate overhead.

In 2024, PVH continued its strategic focus on optimizing these SG&A costs. The company aims to enhance profitability by identifying and implementing efficiencies throughout its sales, retail, and administrative operations. This is a critical area for improving the bottom line.

For instance, managing retail store operating costs, such as rent and utilities, alongside personnel expenses for store staff, is a significant component of SG&A. PVH actively seeks ways to streamline these expenditures without compromising the customer experience.

Furthermore, administrative functions and corporate overhead, covering areas like marketing, IT, and executive management, are constantly reviewed for cost-saving opportunities. By driving these efficiencies, PVH aims to bolster its financial performance and maintain a competitive edge in the apparel market.

Supply Chain and Logistics Costs

PVH's supply chain and logistics represent a significant portion of its cost structure, encompassing warehousing, transportation, and distribution across its global network. These expenses are inherently high due to the scale and reach of operations, particularly impacting companies with extensive international sourcing and retail presence.

Disruptions within this chain, whether from geopolitical events or unforeseen circumstances, can lead to substantial cost fluctuations. For instance, tariffs on imported goods, like those previously imposed on products entering the United States, directly inflate these logistical expenses. In 2023, global shipping costs saw volatility, with the Drewry World Container Index fluctuating significantly throughout the year, indicating the unpredictable nature of these expenditures.

- Warehousing and Storage: Costs associated with maintaining inventory in strategically located facilities worldwide are a constant outlay.

- Transportation Expenses: This includes freight charges for moving raw materials, finished goods, and inter-facility transfers via sea, air, and land.

- Distribution Network: Managing the flow of products to various retail channels, including direct-to-consumer and wholesale partners, incurs significant operational costs.

- Import Duties and Tariffs: Levies imposed by governments on imported merchandise directly add to the landed cost of goods, impacting PVH's profitability.

Design, Research & Development (R&D) Costs

PVH's commitment to design, research, and development (R&D) is a cornerstone of its business model, ensuring its brands remain at the forefront of fashion. These investments fuel the creative engine, keeping offerings fresh and appealing to consumers.

Significant resources are allocated to design teams and market trend analysis. For instance, in fiscal year 2023, PVH's selling, general, and administrative expenses, which encompass R&D and design-related activities, totaled $2.1 billion. This figure underscores the substantial financial commitment to maintaining a competitive edge through continuous product innovation and aesthetic relevance.

- Investment in Talent: PVH employs numerous designers and trend forecasters globally to conceptualize and develop new collections.

- Market Intelligence: Resources are dedicated to understanding evolving consumer preferences and emerging fashion trends through various research channels.

- Product Innovation: These costs support the iterative process of creating new apparel designs, testing materials, and ensuring product quality.

- Brand Relevance: Continuous R&D ensures PVH's brands, like Calvin Klein and Tommy Hilfiger, consistently deliver fashion-forward and desirable products, a key element of their value proposition.

PVH's cost structure is heavily influenced by its extensive global operations and brand investments. Key expenditures include the cost of goods sold, driven by manufacturing and raw materials, and significant spending on selling, general, and administrative (SG&A) activities, which encompass marketing and retail operations. Supply chain and logistics also represent a substantial cost, impacted by warehousing, transportation, and potential tariffs.

In fiscal year 2023, PVH reported a Cost of Goods Sold of $5.75 billion. Their SG&A expenses for the same period totaled $2.5 billion, reflecting substantial investments in brand building and operational management. These figures highlight the significant financial commitments required to maintain PVH's position in the global apparel market.

PVH continues to focus on optimizing these costs. For example, managing retail store operating expenses and corporate overhead are ongoing priorities for efficiency. The company also invests in design and R&D to ensure brand relevance, allocating significant resources to creative talent and market intelligence to drive product innovation.

Revenue Streams

Wholesale sales are a cornerstone of PVH's business, bringing in substantial revenue through the distribution of apparel and accessories to a wide network of department stores and specialty retailers worldwide. This crucial channel is particularly strong in key markets such as North America and Europe. For instance, PVH reported a healthy 7% increase in wholesale revenue on a constant currency basis during the first quarter of 2025, underscoring its continued importance to the company's financial performance.

PVH generates revenue directly from consumers through its own retail stores and online shopping platforms. This direct-to-consumer (DTC) channel allows for greater control over the brand experience and customer relationships.

In the first quarter of 2025, PVH's DTC revenue saw a slight dip, decreasing by 3%. Despite this, the company remains committed to enhancing its DTC operations as a core component of its future growth strategy.

PVH Corporation generates significant income through licensing agreements, allowing other companies to use its popular brands like Calvin Klein and Tommy Hilfiger. These arrangements typically involve upfront licensing fees and ongoing royalties based on sales. For instance, in fiscal year 2023, PVH reported $451 million in licensing revenue, showcasing the substantial contribution of this stream.

This strategy is crucial for expanding brand presence globally and into product categories PVH might not directly manage. By partnering with manufacturers and distributors, PVH can reach new markets and consumer segments without the capital expenditure and operational complexities of direct involvement. This revenue stream diversifies PVH's income base, making it less reliant on its core wholesale and direct-to-consumer operations.

International Sales

PVH generates significant revenue from its international sales across diverse markets. These include key regions like Europe, the Middle East, Africa (EMEA), and the Asia Pacific. PVH is actively working to boost growth in these international segments, despite encountering some regional challenges.

For instance, in the first quarter of 2025, the Asia Pacific (APAC) region saw a decline in sales. However, the company's strategy focuses on revitalizing growth across its entire international portfolio. This diversified approach aims to mitigate risks and capitalize on opportunities in varied global markets.

- Europe remains a core international market for PVH.

- The company targets growth in the EMEA and Asia Pacific regions.

- PVH experienced a sales decline in APAC during Q1 2025.

- Strategic initiatives are in place to drive international revenue expansion.

Digital Commerce Sales

Digital Commerce Sales represent a crucial component of PVH's direct-to-consumer (DTC) strategy, driving revenue through their proprietary online platforms. This channel is central to PVH's ongoing efforts to connect directly with its customer base and foster brand loyalty.

Despite a reported 10% decrease in digital commerce revenue for the fourth quarter of fiscal year 2024, PVH remains committed to this revenue stream. The company views these online sales channels as vital for future expansion and customer engagement.

- Channel Focus: PVH's owned and operated digital platforms are the primary vehicles for these sales.

- Recent Performance: Q4 FY24 saw a 10% decline in digital commerce revenue.

- Strategic Importance: PVH continues to invest in and prioritize digital commerce for sustained growth.

PVH's revenue streams are multifaceted, encompassing wholesale distribution, direct-to-consumer (DTC) sales through owned retail and e-commerce, and significant income from brand licensing agreements. International sales across regions like Europe and Asia Pacific also contribute substantially, though performance can vary by market.

| Revenue Stream | Description | Recent Performance/Data (as of Q1 2025 or FY23/FY24) |

|---|---|---|

| Wholesale | Sales to department stores and specialty retailers | Grew 7% on a constant currency basis in Q1 2025 |

| Direct-to-Consumer (DTC) | Sales via owned retail stores and online platforms | DTC revenue decreased by 3% in Q1 2025 |

| Licensing | Fees and royalties from other companies using PVH brands | Generated $451 million in fiscal year 2023 |

| Digital Commerce | Sales through PVH's proprietary online platforms | Revenue declined 10% in Q4 FY24 |

| International Sales | Revenue from markets outside North America (e.g., EMEA, APAC) | APAC region saw a sales decline in Q1 2025 |

Business Model Canvas Data Sources

The PVH Business Model Canvas is constructed using a blend of internal financial statements, extensive market research reports, and competitive intelligence. This multifaceted approach ensures that each component of the canvas is informed by actionable data and strategic understanding.