PVH Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

PVH Bundle

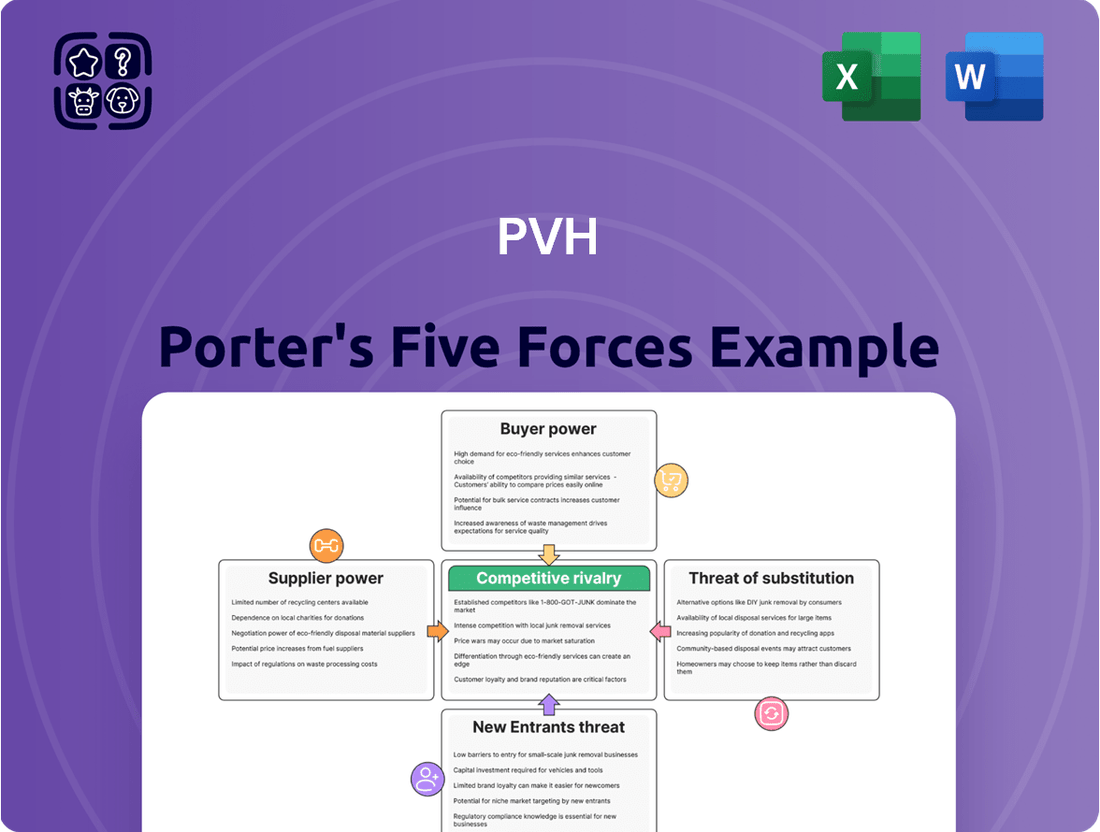

PVH, a prominent player in the apparel industry, faces a dynamic competitive landscape shaped by Porter's Five Forces. Understanding these forces is crucial for navigating the market effectively. We’ve touched upon the core pressures, but the true depth of PVH's strategic positioning lies beyond this brief overview.

The complete report reveals the real forces shaping PVH’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

PVH Corp. relies on a global network of roughly 500 textile suppliers. The top textile suppliers account for a significant 35% of PVH's total procurement volume.

However, the bargaining power of suppliers is amplified by the limited number of high-quality textile and fabric manufacturers, particularly for PVH's premium brands. Specifically, 12 specialized manufacturers are responsible for 45% of the manufacturing of premium products for brands like Tommy Hilfiger and Calvin Klein.

PVH's robust, long-standing relationships with its global supply chain partners are a significant factor in its operational stability. The average partnership duration stands at an impressive 7.5 years, with a substantial 87% of its top-tier suppliers having collaborated with PVH for more than five years.

This deep integration, while fostering collaborative innovation and potentially lowering switching costs, also creates notable interdependencies. Such reliance can amplify the bargaining power of suppliers, particularly when their specialized expertise or production capacity is concentrated and difficult for PVH to replicate elsewhere.

The fashion industry, including giants like PVH, is feeling the heat to use materials that are kinder to the planet and people. This shift means suppliers who can genuinely provide sustainable and ethically produced fabrics are gaining more leverage.

As consumer demand for transparency and responsibility grows, these specialized suppliers become critical partners, driving up the value of their offerings. For instance, by 2024, the global market for sustainable fashion was projected to reach over $9.1 billion, indicating a significant premium for compliant materials.

This increasing demand for certified organic cotton or recycled polyester, for example, can give these suppliers more power to dictate terms, potentially impacting PVH's cost of goods sold and supply chain flexibility.

Impact of Raw Material Price Fluctuations

The unpredictability of raw material costs, such as cotton, poses a significant challenge for apparel manufacturers like PVH. For instance, cotton prices in 2024 have shown volatility, influenced by factors such as global supply chain disruptions and climate patterns affecting crop yields. This volatility directly impacts PVH's cost of goods sold, potentially squeezing profit margins if not effectively managed.

Fluctuations in prices due to demand shifts, geopolitical concerns, or adverse weather conditions can increase the bargaining power of suppliers. When supply is constrained or demand surges, suppliers can command higher prices. This forces brands like PVH to adapt their pricing strategies or absorb higher costs, impacting overall profitability.

The bargaining power of suppliers is particularly evident when key raw materials are concentrated among a few providers or when the cost of switching suppliers is high. For PVH, this means that disruptions in the supply of essential fabrics or components can lead to significant operational and financial pressures.

Consider these points regarding supplier bargaining power for PVH:

- Raw Material Volatility: Cotton futures experienced significant price swings throughout 2024, impacting PVH's input costs.

- Supply Chain Dependencies: Reliance on specific regions for cotton or manufacturing can empower suppliers in those areas.

- Geopolitical Influences: International trade policies and regional instability can disrupt raw material availability and pricing.

- Weather Impacts: Unfavorable weather conditions in major cotton-producing regions directly affect supply and, consequently, supplier pricing power.

Supply Chain Diversification and Nearshoring Trends

Fashion brands are actively diversifying their production networks and accelerating nearshoring initiatives. This strategic pivot is driven by a desire to mitigate risks inherent in long, complex international supply chains and growing geopolitical uncertainties.

By diversifying, companies like PVH can reduce their reliance on any single supplier or region, thereby diminishing the bargaining power of individual suppliers. This increased sourcing flexibility allows for quicker responses to market changes and disruptions.

Nearshoring also plays a crucial role by shortening lead times and improving responsiveness. For example, a significant portion of apparel manufacturing has shifted closer to major consumer markets, reducing transit times and inventory holding costs.

This strategic move directly challenges suppliers who previously held considerable sway due to geographic distance and limited alternatives. The trend towards nearshoring aims to create a more resilient and agile supply chain.

- Diversification Strategies: Brands are exploring multiple sourcing locations to avoid over-reliance on any one country or supplier.

- Nearshoring Impact: Bringing production closer to home markets reduces transit times, potentially cutting lead times by 20-30% for some product categories.

- Risk Mitigation: Geopolitical instability and trade policy shifts are key drivers for these supply chain adjustments, aiming to secure more predictable operations.

- Supplier Power: Increased sourcing options and reduced dependency weaken individual suppliers' ability to dictate terms and prices.

PVH's supplier bargaining power is moderate due to its large scale and diversified supplier base, though certain specialized suppliers, particularly for premium brands, hold more sway. The increasing demand for sustainable materials by 2024, with the market projected to exceed $9.1 billion, gives ethical suppliers greater leverage. Furthermore, raw material price volatility, such as with cotton in 2024, can empower suppliers when supply is constrained.

| Factor | Impact on PVH | Supplier Leverage |

|---|---|---|

| Supplier Concentration (Premium Brands) | Reliance on 12 specialized manufacturers for 45% of premium product manufacturing. | High |

| Sustainable Material Demand (2024 Projection) | Growing consumer preference for eco-friendly and ethically sourced fabrics. | Increasing for compliant suppliers |

| Raw Material Price Volatility (e.g., Cotton in 2024) | Directly impacts cost of goods sold and profit margins. | Moderate to High during price spikes |

| Long-Term Supplier Relationships (Avg. 7.5 years) | Fosters collaboration but creates interdependencies. | Moderate; reduces switching costs but can deepen reliance |

What is included in the product

This analysis dissects the competitive forces impacting PVH, examining threat of new entrants, buyer and supplier power, threat of substitutes, and industry rivalry to reveal strategic opportunities and challenges.

Quickly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces, enabling proactive strategic adjustments.

Customers Bargaining Power

Consumers in the apparel market, particularly those not buying luxury goods, are showing a growing awareness of price. Recent data indicates that over 75% of shoppers are actively choosing cheaper options because of ongoing inflation concerns. This significant shift means customers have more leverage when negotiating prices.

This elevated price sensitivity directly impacts companies like PVH. To remain competitive, brands are compelled to focus on offering attractive pricing and demonstrating clear value to their customer base. Failure to do so can lead to a substantial loss of market share as consumers readily switch to more budget-friendly alternatives.

Customers today have unprecedented access to information, thanks to the internet and the explosion of online shopping channels. This makes it incredibly easy for them to research products, compare prices across different brands, and discover a vast array of choices. This readily available information significantly boosts their bargaining power.

The digital marketplace empowers consumers by providing transparency. They can easily find reviews, check specifications, and even see competitor pricing in real-time. This knowledge shift means customers are less reliant on a single retailer and can demand better value.

The impact of this is substantial. The global e-commerce apparel market is expected to hit an impressive $779.30 billion by 2025. This growth highlights a major shift in how people shop for clothing and accessories, directly translating into increased leverage for the consumer.

While customers generally hold considerable sway, PVH's flagship brands, Calvin Klein and Tommy Hilfiger, foster substantial customer devotion. This brand equity allows PVH to stand out in a crowded market, lessening the pressure from price-sensitive shoppers who prioritize distinct styles or perceived quality.

Low Switching Costs for Consumers

The bargaining power of customers within the apparel sector, particularly for companies like PVH, is significantly influenced by low switching costs. Consumers can readily shift between different brands and retailers without incurring substantial financial or practical hurdles. This ease of transition means that if a customer finds a competitor offering a more attractive price point, a trendier style, or a superior shopping experience, they are likely to make the switch. This dynamic directly pressures brands to maintain competitive pricing and a strong value proposition.

This low barrier to changing brands means that customers have considerable leverage. They can effectively demand better value, which can manifest as lower prices, higher quality, or more appealing designs. For instance, the rise of fast-fashion retailers, which offer rapidly changing collections at accessible price points, exemplifies how easily consumers can pivot their spending. In 2024, the apparel market continued to see consumers prioritizing value, with many actively seeking out sales and discounts, further highlighting their power.

- Low Switching Costs: Consumers can easily switch between apparel brands without significant financial or time investment.

- Price Sensitivity: A large segment of consumers are highly sensitive to price, readily comparing options across different retailers.

- Brand Loyalty Erosion: The ease of switching can erode brand loyalty, forcing companies to constantly re-earn customer trust and preference.

- Impact on Margins: This customer power can put downward pressure on profit margins as companies compete on price and value.

Shift Towards Conscious Consumerism and Customization

Consumers are increasingly vocal about their preferences, pushing brands towards more sustainable and ethically sourced products. This shift means that companies failing to adapt risk losing significant market share. For instance, a 2024 survey indicated that over 60% of consumers consider sustainability a key factor in their purchasing decisions, directly impacting brand loyalty and sales.

The demand for customization further amplifies customer bargaining power. When consumers can personalize products, they feel a greater connection to the brand and are more willing to dictate terms. This is evident in the growing popularity of made-to-order apparel and personalized accessories, where customer input directly shapes production, giving them leverage.

- Shifting Consumer Values: A significant portion of consumers, estimated at over 60% in 2024 surveys, now prioritize sustainability and ethical sourcing.

- Influence on Purchasing: This conscious consumerism allows customers to wield power by choosing brands that align with their values, often influencing decisions beyond mere price point.

- Demand for Personalization: The increasing desire for customized products further empowers consumers, enabling them to dictate product features and specifications.

The bargaining power of customers within the apparel industry is substantial, driven by increasing price sensitivity and readily available alternatives. With over 75% of shoppers actively seeking cheaper options due to inflation in 2024, companies like PVH must offer competitive pricing and clear value to retain market share.

The digital landscape further empowers consumers, providing easy access to price comparisons and product information, thereby increasing their leverage. While PVH benefits from brand loyalty with Calvin Klein and Tommy Hilfiger, the overall trend indicates a strong customer position, pressuring margins and demanding constant value proposition refinement.

| Factor | Impact on PVH | Supporting Data (2024/2025 Projections) |

|---|---|---|

| Price Sensitivity | High pressure on pricing strategies and margins. | Over 75% of shoppers seeking cheaper options due to inflation. |

| Information Access | Facilitates easy comparison shopping, reducing brand lock-in. | Global e-commerce apparel market projected to reach $779.30 billion by 2025. |

| Brand Loyalty (Calvin Klein, Tommy Hilfiger) | Mitigates some customer power for flagship brands. | Strong brand equity allows for differentiation and premium pricing. |

| Switching Costs | Low costs empower customers to switch easily for better value. | Consumers readily move between brands offering better styles or prices. |

| Shifting Values (Sustainability) | Requires adaptation to ethical sourcing and sustainability demands. | Over 60% of consumers consider sustainability in purchasing decisions (2024 survey). |

Preview Before You Purchase

PVH Porter's Five Forces Analysis

You're previewing the final version—precisely the same document that will be available to you instantly after buying. This comprehensive Porter's Five Forces analysis for PVH will detail the competitive landscape, including the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. Understand the strategic positioning of PVH within its industry through this exact, professionally formatted report. What you see is precisely what you'll receive, enabling immediate strategic assessment.

Rivalry Among Competitors

The global apparel market, a massive $1.9 trillion industry in 2024, is a battleground with many powerful brands vying for market share. PVH Corp. itself faces formidable rivals like Tapestry Inc. and Ralph Lauren, among many others.

This crowded landscape means that companies must constantly innovate and differentiate to stand out. The sheer number of established and emerging players intensifies the pressure to attract and retain customers, making aggressive pricing and marketing strategies commonplace.

The intense rivalry pushes companies to invest heavily in brand building and product development. Staying ahead requires a keen understanding of consumer trends and the agility to adapt quickly to changing fashion cycles.

Ultimately, this high degree of competition directly impacts profitability and forces companies like PVH to operate with extreme efficiency and strategic foresight.

The apparel market is robust, with projections indicating a global market size of $766.62 billion by 2025, signaling significant opportunity. This strong growth rate fuels intense competition as numerous players vie for market share.

However, this expansion occurs against a backdrop of economic uncertainties and inflationary pressures. These macroeconomic factors create a dynamic environment where companies must constantly adapt their strategies to navigate shifting consumer spending habits and maintain profitability.

PVH faces intense rivalry in the apparel sector, where its strong brands like Calvin Klein and Tommy Hilfiger offer a degree of differentiation. However, the fundamental nature of apparel means core products are often imitable. In 2023, PVH reported net sales of $8.2 billion, showcasing the scale of its operations but also the vastness of the competitive landscape it navigates.

Sustaining brand desirability through consistent design innovation and targeted marketing is therefore paramount. Competitors can readily replicate styles, making brand loyalty and perceived value the key battlegrounds. This ongoing effort is critical for PVH to maintain its market position against numerous players, from fast fashion giants to niche designers.

High Fixed Costs and Inventory Management Challenges

The apparel industry, including companies like PVH, faces intense competitive rivalry partly due to significant fixed costs in areas like design, manufacturing, and marketing. These substantial upfront investments create barriers to entry but also pressure existing players to maintain high sales volumes to spread costs, intensifying competition. For instance, setting up a global supply chain and marketing campaigns for new collections requires considerable capital, making it challenging for smaller players to compete on scale.

Inventory management is another critical battleground. PVH must navigate the complexities of seasonal demand and fashion trends, where overstocking leads to markdowns and reduced margins, while understocking results in lost sales opportunities. The ability to forecast demand accurately and manage inventory efficiently is paramount for profitability and maintaining market share. In 2023, many apparel retailers reported significant challenges with excess inventory, leading to widespread discounting.

- High Fixed Costs: Apparel companies invest heavily in design, manufacturing infrastructure, marketing campaigns, and retail store operations, creating a high cost of doing business.

- Seasonal Inventory Management: The cyclical nature of fashion demands precise inventory control to avoid markdowns on unsold seasonal goods or stockouts on popular items.

- Supply Chain Optimization: Efficiently managing a global supply chain is crucial for cost control and responsiveness, directly impacting a company's ability to compete on price and availability.

- Impact on Profitability: Ineffective inventory management can lead to substantial financial losses through obsolescence, storage costs, and emergency markdowns, directly affecting PVH's competitive standing.

Impact of Digital Transformation and E-commerce Growth

The escalating digital transformation and e-commerce surge have significantly heightened competitive rivalry within the apparel sector. New entrants can now more easily access consumers through online channels, bypassing traditional brick-and-mortar limitations. This trend allows for direct-to-consumer (DTC) strategies, which can offer greater control over branding and customer relationships.

PVH, like its peers, faces intense pressure to innovate digitally. This includes leveraging technologies like virtual try-ons and AI for trend prediction to maintain relevance and capture the attention of today's digitally native consumers. For instance, the global e-commerce market for apparel reached an estimated $870 billion in 2023 and is projected to grow substantially, underscoring the critical need for robust online strategies.

- Increased Market Access: Lowered barriers to entry mean more brands, both established and emerging, can reach PVH's customer base online.

- DTC Model Impact: Brands adopting DTC models can offer competitive pricing and personalized experiences, directly challenging traditional retail models.

- Digital Innovation Race: Companies investing in advanced digital tools, such as AI-driven personalization and immersive online shopping, gain a competitive edge.

- Consumer Expectations: Digitally savvy consumers expect seamless online experiences, quick delivery, and engaging digital content, forcing all players to adapt.

The apparel industry is highly competitive, with PVH facing rivals like Nike, Adidas, and H&M. This intense rivalry is fueled by low switching costs for consumers and the presence of numerous players across various price points and styles.

| Competitor | 2023 Revenue (Approx. USD Billions) | Key Brands |

|---|---|---|

| Nike | 60.1 | Nike, Jordan |

| Adidas | 23.5 | Adidas, Reebok |

| H&M Group | 23.3 | H&M, COS, & Other Stories |

| Tapestry Inc. | 6.7 | Coach, Kate Spade, Stuart Weitzman |

| Ralph Lauren | 6.2 | Polo Ralph Lauren, Ralph Lauren Home |

The constant need to innovate in design, marketing, and supply chain management creates significant pressure. Companies must continually adapt to evolving fashion trends and consumer preferences to maintain market share.

SSubstitutes Threaten

The increasing popularity of second-hand and circular fashion platforms, such as Sellpy and local consignment shops, presents a significant threat of substitutes for traditional apparel retailers like PVH. These platforms offer consumers more affordable and environmentally conscious ways to acquire clothing, directly competing with the purchase of new items. For instance, the resale market for fashion experienced substantial growth, with some reports indicating a global valuation exceeding $100 billion by 2023, demonstrating a clear shift in consumer behavior towards pre-owned goods.

This broader circular fashion movement, emphasizing reuse and recycling, is gaining considerable traction. Consumers are becoming more aware of the environmental impact of fast fashion and are actively seeking alternatives. This growing consumer preference for sustainability and value means that products from these resale channels are becoming increasingly attractive substitutes, potentially eroding demand for PVH's new collections. The threat is considered moderate to high as this trend continues to mature and integrate into mainstream shopping habits.

The burgeoning popularity of athleisure and casual wear presents a significant threat of substitutes for traditional apparel. Brands like Lululemon and Nike have capitalized on this trend, offering comfortable and versatile clothing that appeals to a broad consumer base.

This shift in consumer preference means that items like yoga pants, stylish leggings, and premium hoodies are increasingly replacing more formal or specialized attire for everyday activities. In 2024, the global athleisure market was projected to reach over $326 billion, underscoring its substantial impact on the broader apparel industry.

The rise of digital fashion and metaverse experiences introduces a novel threat of substitutes for traditional apparel. Virtual garments for online avatars and augmented reality applications are emerging as alternative ways for consumers to express themselves, potentially diverting spending from physical clothing. While the market for digital fashion is still developing, some estimates suggest the global metaverse market could reach $1.6 trillion by 2030, indicating significant future potential for these digital substitutes.

This trend could impact demand for PVH's physical products, particularly among younger, digitally native demographics who are increasingly engaging with virtual worlds. Brands are exploring these digital avenues for new revenue and customer connection, but it also means consumers might fulfill certain fashion desires in the metaverse instead of purchasing tangible items.

Shifting Consumer Preferences Towards Minimalism and Longevity

A significant trend impacting PVH is the rise of minimalism and a preference for longer-lasting goods. This directly challenges the traditional apparel model by reducing the perceived need for frequent purchases. Consumers are increasingly seeking quality over quantity, making durable items a substitute for the constant influx of new, less-durable clothing.

This shift influences demand for PVH's brands, particularly those associated with fast fashion cycles. For instance, a 2024 report indicated that 35% of consumers are actively seeking out durable, long-lasting clothing options, which directly curtails the demand for replacement items.

- Minimalist Lifestyles: Growing adoption reduces overall apparel consumption.

- Durability Focus: Consumers prioritize quality and longevity, viewing well-made items as substitutes for frequent replacements.

- Reduced Fast Fashion Demand: This trend directly counteracts the business model of high-volume, trend-driven apparel.

- Consumer Behavior Shift: A 2024 survey revealed 35% of consumers are prioritizing durable clothing, impacting purchase frequency.

Alternative Forms of Self-Expression and Spending

Consumers have a vast array of choices for how they express themselves and spend their discretionary income, extending far beyond just clothing. This means that activities like traveling, enjoying live entertainment, investing in the latest gadgets, or even pursuing hobbies can directly compete with apparel purchases for a share of the consumer's wallet. For instance, in 2024, the global travel and tourism market is projected to reach over $1.5 trillion, indicating a significant portion of consumer spending is directed towards experiences rather than tangible goods.

This broad competition for consumer dollars creates a substantial threat of substitutes for PVH and other apparel companies. When consumers allocate their budgets to these alternative forms of spending, it directly reduces the amount available for fashion items, especially those considered discretionary or trend-driven. The rise of the experience economy, where consumers increasingly value memorable events over material possessions, further intensifies this pressure. Data from 2024 suggests that while retail sales saw moderate growth, spending on experiences, particularly in areas like wellness and entertainment, outpaced traditional goods in many developed markets.

- Broad Competition for Discretionary Spending: Consumers can choose to spend on experiences (travel, entertainment), technology, or other consumer goods instead of apparel.

- Impact on Apparel Purchases: Money spent on these alternatives directly substitutes for potential clothing purchases, particularly for non-essential fashion items.

- Growth of the Experience Economy: In 2024, the global travel and tourism market is expected to exceed $1.5 trillion, highlighting a significant shift in consumer priorities.

- Shifting Consumer Preferences: Consumers increasingly value memorable events and personal development over acquiring new material possessions.

The growing popularity of rental and subscription services for clothing presents a significant threat of substitutes for traditional apparel retailers like PVH. These services offer consumers access to a rotating wardrobe without the commitment of ownership, catering to changing styles and occasions. By 2024, the online clothing rental market was estimated to be worth over $2 billion globally, demonstrating a clear alternative to purchasing new garments.

These rental models provide a cost-effective and sustainable option for consumers, particularly for special events or those who enjoy frequent wardrobe updates. This directly competes with PVH's sales of new apparel, as consumers may opt to rent rather than buy, especially for items worn infrequently. The threat is considered moderate as these services continue to gain traction and broaden their offerings.

| Substitute Type | Description | Market Data (2024 Estimates) | Impact on PVH |

|---|---|---|---|

| Second-hand & Circular Fashion | Platforms offering pre-owned clothing | Global resale market > $100 billion | Moderate to High (reduced demand for new items) |

| Athleisure Wear | Comfortable, versatile casual wear | Global athleisure market > $326 billion | Moderate (replaces traditional apparel) |

| Digital Fashion | Virtual garments for online use | Metaverse market potential up to $1.6 trillion by 2030 | Low to Moderate (emerging threat) |

| Minimalism & Durability | Focus on fewer, higher-quality items | 35% of consumers prioritizing durable clothing | Moderate (reduces purchase frequency) |

| Alternative Spending | Experiences, travel, tech, hobbies | Global travel & tourism market > $1.5 trillion | Moderate (diverts discretionary income) |

| Rental & Subscription Services | Access to clothing without ownership | Online clothing rental market > $2 billion | Moderate (alternative to purchasing) |

Entrants Threaten

Establishing a global apparel company with the reach of PVH, which operates in over 40 countries, demands immense upfront capital. This includes funding for design, sourcing, manufacturing partnerships, extensive marketing campaigns, and sophisticated distribution logistics.

For instance, the initial investment in setting up supply chains, securing retail space, and building brand recognition globally can easily run into hundreds of millions, if not billions, of dollars. This financial hurdle significantly deters smaller or less capitalized new entrants from entering the market.

In 2023, the global apparel market was valued at over $1.7 trillion, indicating the scale of investment needed to capture even a small fraction of this market. New companies would need to match existing players' operational scale and marketing spend to be competitive.

Consequently, the high capital requirements serve as a formidable barrier to entry, protecting established players like PVH from direct competition by new, underfunded ventures.

PVH Corp. boasts a formidable defense against new entrants, largely due to its stable of powerhouse brands, most notably Calvin Klein and Tommy Hilfiger. These names are more than just labels; they represent decades of cultivated brand recognition and deep-seated customer loyalty.

For any new company aiming to break into PVH's market, replicating this level of brand equity and consumer trust presents a monumental hurdle. It's not simply about offering a similar product; it's about building a narrative and emotional connection that resonates with shoppers, a process that demands substantial investment in marketing, quality, and consistent brand messaging over many years.

Consider the impact of brand loyalty. In 2023, PVH's direct-to-consumer channel, which heavily leverages these brands, continued to be a significant revenue driver. This direct relationship with consumers, built on years of positive experiences and aspirational marketing, creates a powerful barrier. New entrants would need to not only match product quality but also invest heavily to even begin chipping away at the loyalty enjoyed by Calvin Klein and Tommy Hilfiger, a significant barrier to entry.

Newcomers face significant hurdles in securing prime shelf space within major wholesale retailers, a critical pathway for reaching a broad customer base. Building an effective direct-to-consumer (DTC) infrastructure, encompassing robust online platforms and strategically located physical stores, also demands substantial investment and time.

PVH's established relationships with a vast network of department stores and specialty retailers, a network honed over decades, presents a formidable barrier. For instance, in 2024, PVH's brands like Calvin Klein and Tommy Hilfiger maintained strong placements across numerous national chains, a distribution advantage that new entrants would struggle to replicate quickly.

The capital expenditure required to establish a comparable retail footprint and secure favorable terms with wholesale partners is immense, effectively deterring many potential new apparel brands. This deep-rooted distribution power is a key component of PVH's competitive moat.

Economies of Scale in Sourcing and Manufacturing

PVH, like many established apparel giants, leverages significant economies of scale in sourcing and manufacturing. This means their sheer volume allows them to negotiate better prices for raw materials, such as cotton and polyester, and secure more favorable terms with factories. For instance, in 2024, major textile producers often offer tiered pricing based on order volume, directly benefiting companies placing large, consistent orders.

This cost advantage is a substantial barrier for potential new entrants. A startup, unable to match PVH's purchasing power, would likely face higher per-unit costs for fabric and production. This could force them to either absorb those costs, impacting profitability, or pass them onto consumers, making their products less competitive against PVH's established brands like Tommy Hilfiger and Calvin Klein.

- Volume Discounts: PVH likely secures substantial discounts on textiles, with bulk purchases potentially reducing material costs by 10-20% compared to smaller orders.

- Manufacturing Efficiency: Large-scale production runs enable PVH to optimize factory capacity and labor utilization, lowering manufacturing overhead per garment.

- Logistics Optimization: Efficient global supply chains, built on high volumes, reduce transportation and warehousing costs for PVH.

- Competitive Pricing: The resulting lower cost structure allows PVH to offer competitive pricing, a crucial factor in the price-sensitive apparel market.

Regulatory Hurdles and Sustainability Demands

The apparel industry, particularly for a company like PVH, faces substantial threats from new entrants due to significant regulatory hurdles and escalating sustainability demands. Navigating complex international trade laws, labor regulations, and increasingly stringent environmental standards presents a steep learning curve and considerable upfront investment for newcomers. For instance, in 2024, the European Union's proposed Ecodesign for Sustainable Products Regulation will likely impose stricter requirements on material sourcing, durability, and recyclability, adding to the compliance burden. Established players like PVH have already invested in robust supply chain management systems and compliance teams to meet these evolving global standards, creating a significant advantage over emerging businesses that may lack the capital and expertise to do so efficiently.

These regulatory and sustainability pressures act as a considerable barrier to entry. New entrants must not only contend with the competitive landscape but also invest heavily in understanding and adhering to a patchwork of international regulations. This includes everything from fair labor practices, as highlighted by ongoing scrutiny of supply chains following incidents in prior years, to carbon footprint reduction targets. Companies that can demonstrate compliance and a commitment to sustainability, such as PVH's stated goals for reducing greenhouse gas emissions by 30% by 2030 across its value chain, are better positioned to attract conscious consumers and investors, further marginalizing less prepared competitors.

- Regulatory Complexity: New entrants must navigate diverse and evolving international trade laws, labor standards, and environmental regulations, which can be costly and time-consuming.

- Sustainability Demands: Growing consumer and governmental pressure for eco-friendly products and ethical production requires significant investment in sustainable materials and practices from the outset.

- Compliance Expertise: Established firms like PVH possess in-house expertise and established processes for compliance, offering a distinct advantage over startups lacking this experience.

- Capital Investment: Meeting stringent sustainability standards, such as those being implemented in regions like the EU, necessitates substantial capital for research, development, and supply chain transformation.

The threat of new entrants for PVH is moderate, primarily due to the substantial capital requirements for global brand building, supply chain establishment, and marketing, alongside the difficulty in replicating PVH's established brand equity and extensive distribution networks. Economies of scale in sourcing and manufacturing also create a cost advantage for PVH. For instance, in 2024, the global apparel market continues to demand significant investment to achieve competitive scale and reach.

| Barrier to Entry | Impact on New Entrants | Relevance to PVH |

|---|---|---|

| Capital Requirements | High upfront investment needed for global operations, marketing, and logistics. | Significant deterrent; PVH's scale requires hundreds of millions, if not billions, to match. |

| Brand Equity & Loyalty | Difficult and time-consuming to build consumer trust and recognition comparable to established brands. | Formidable barrier; Calvin Klein and Tommy Hilfiger have decades of cultivated loyalty. |

| Distribution Channels | Securing prime retail shelf space and building a robust direct-to-consumer infrastructure is challenging. | PVH's established relationships with retailers and DTC capabilities are hard to replicate quickly. |

| Economies of Scale | New entrants face higher per-unit costs for materials and manufacturing due to lower purchasing power. | PVH benefits from lower costs, enabling competitive pricing against smaller players. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for PVH is built upon comprehensive data from PVH's annual reports and SEC filings, alongside industry analysis from market research firms like Euromonitor and Statista. We also incorporate insights from financial news outlets and competitor public statements to capture a full spectrum of competitive dynamics.