Pruksa Real Estate PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Pruksa Real Estate Bundle

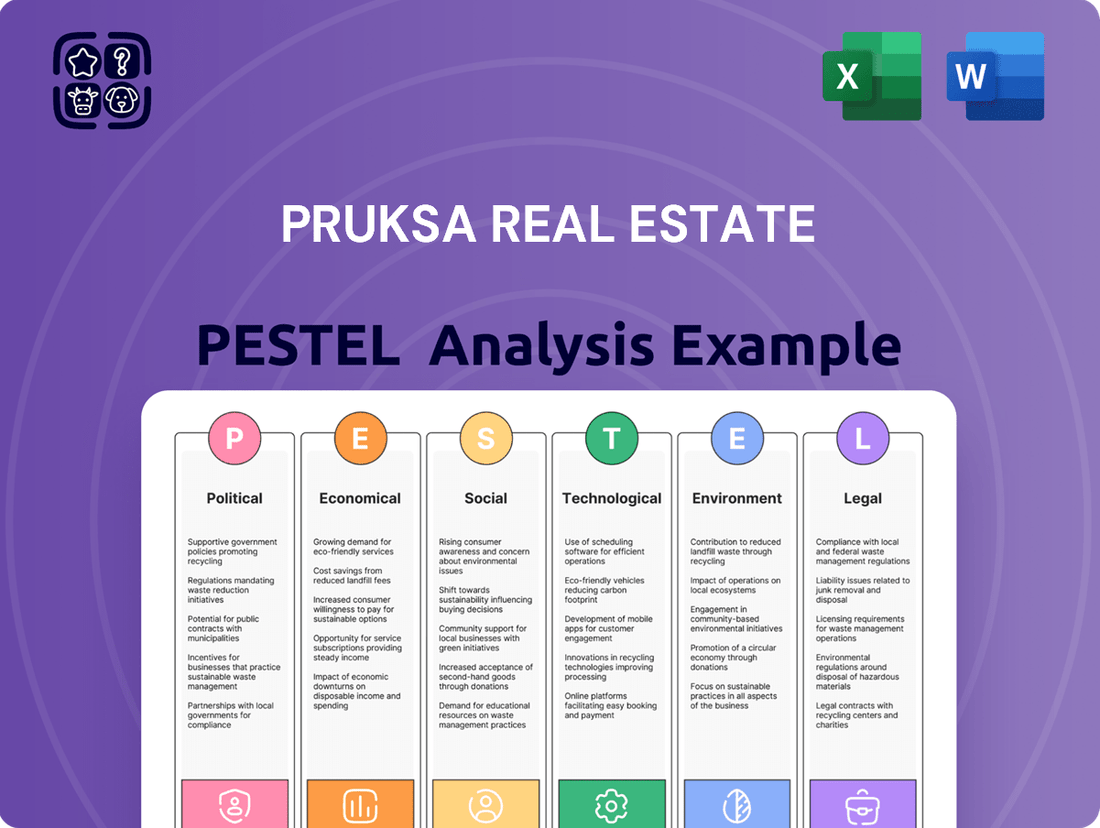

Gain a critical understanding of the external forces shaping Pruksa Real Estate's destiny. Our in-depth PESTLE analysis dissects the political, economic, social, technological, legal, and environmental factors that influence their operations and future growth. Discover how regulatory shifts, economic volatility, and evolving consumer preferences create both challenges and opportunities. Equip yourself with the knowledge to anticipate market changes and make informed strategic decisions. Download the full PESTLE analysis now and unlock actionable intelligence for your own business strategy.

Political factors

The Thai government is actively shaping the real estate market through various housing policies. In 2024, measures like reduced property transfer fees and mortgage registration fees, alongside government-backed low-interest loan schemes, were introduced to bolster demand. Pruksa Real Estate can leverage these incentives by focusing on its affordable housing segment, aligning its product development with government priorities.

These policies are designed to make homeownership more accessible, and Pruksa's strategic alignment with them is crucial for capturing market share. For instance, the government's emphasis on public-private partnerships for affordable housing projects presents a significant opportunity for Pruksa to expand its development pipeline and secure government support. This collaborative approach is expected to drive growth in the affordable housing sector through 2025.

Thailand is actively considering proposals to raise the foreign ownership limit in condominiums from the current 49% to 75%. This potential policy shift, alongside an extension of leasehold terms to 99 years, could unlock substantial new foreign capital for the real estate sector.

If these regulations are passed, developers like Pruksa Real Estate, particularly those with a strong presence in the condominium market and luxury segment, stand to gain significantly from heightened foreign buyer interest. For context, foreign property ownership in Thailand reached approximately 12.5% of total transactions in 2023, a figure that could see considerable growth with relaxed ownership caps.

Pruksa must maintain vigilant oversight of these evolving legislative discussions. Adapting business strategies to align with potential increases in foreign demand will be crucial for capitalizing on these prospective market opportunities, especially given the government's stated aim to attract more foreign investment into the Thai economy.

Political stability is a cornerstone for investor and consumer confidence in Thailand's real estate sector. A stable political environment encourages both domestic and foreign investment, as seen in the steady growth of the property market in recent years, with an estimated 1.5% GDP growth in 2024 driven partly by domestic consumption and tourism.

The Thai government's commitment to economic stimulus, particularly through ambitious infrastructure development, directly benefits real estate. Projects like the Eastern Economic Corridor (EEC) and high-speed rail expansions are set to significantly boost connectivity and unlock new development opportunities, potentially increasing property values in these areas.

Pruksa Real Estate must factor in the long-term ripple effects of these infrastructure investments. Improved accessibility and reduced travel times resulting from these projects will likely enhance land values and create sustained demand for housing and commercial spaces in strategically located regions across Thailand.

Bureaucracy and Permitting Processes

The efficiency of government permitting and approval processes directly impacts project timelines and costs for real estate developers like Pruksa. Delays in these bureaucratic procedures can significantly increase operational expenses and slow down the pace of development. In Thailand, for example, developers have been advocating for streamlined processes to accelerate project execution and reduce hurdles. Many companies, including Pruksa, have publicly called for timely extensions of property measures to foster a more predictable development environment.

Streamlining bureaucracy is crucial for companies like Pruksa to maintain competitive advantage. A report from the World Bank in 2023 highlighted that countries with more efficient building permit systems often see higher levels of construction activity. Specifically, developers in Thailand have frequently requested government intervention to expedite approvals, noting that lengthy processes can add substantial costs. The Thai government has acknowledged these concerns, with discussions around digitalizing permit applications and reducing processing times ongoing throughout 2024 and into early 2025.

- Bureaucratic efficiency: Delays in government permits and approvals directly impact Pruksa's project timelines and costs.

- Developer advocacy: Companies like Pruksa are actively calling for extensions of property measures to improve predictability.

- Impact on execution: Streamlining these processes is essential for faster project completion and reduced operational hurdles.

- Government response: Thailand's government is exploring digitalization and reduced processing times for permits, with initiatives expected to gain traction in 2024-2025.

Board of Investment (BOI) Incentives

The Board of Investment (BOI) in Thailand offers incentives that significantly influence the real estate sector. A key promotion allows foreign investors to own land freehold, particularly for industrial estates and projects deemed of high economic value. This policy directly supports large-scale developments, creating a more robust investment environment.

While Pruksa Real Estate primarily operates within the residential market, the broader positive impact of BOI incentives on the overall investment climate cannot be overlooked. By attracting foreign capital into various sectors, these policies can indirectly boost demand for residential properties, especially from high-net-worth individuals and expatriates seeking housing. For instance, the BOI's strategic focus on attracting investments in targeted industries, such as automotive and electronics, can lead to an influx of skilled foreign workers who then require housing solutions.

- BOI Land Ownership: Foreign entities can acquire freehold land for specific industrial and high-value investment projects, encouraging large-scale development.

- Indirect Residential Boost: A stronger overall investment climate, driven by BOI promotions, can indirectly benefit the residential market by increasing demand from expatriates and investors.

- Economic Diversification: BOI incentives aim to diversify Thailand's economy, which can lead to job creation and population growth in key urban centers, thereby supporting the housing sector.

- Attracting Talent: Policies designed to attract foreign direct investment often bring in skilled professionals who become potential buyers or renters in the residential market.

Government housing policies, including reduced property fees and low-interest loans introduced in 2024, aim to boost demand, benefiting Pruksa's affordable housing segment. The government's push for public-private partnerships in affordable housing presents a growth avenue for Pruksa through 2025.

Potential increases in foreign ownership limits for condominiums, from 49% to 75%, and extended leaseholds could significantly attract foreign capital, with foreign ownership already representing about 12.5% of Thai property transactions in 2023.

Political stability is key to investor confidence, contributing to Thailand's estimated 1.5% GDP growth in 2024. Infrastructure projects like the Eastern Economic Corridor (EEC) are expected to boost property values and demand.

Streamlining government permitting processes is crucial; delays increase costs, prompting developer calls for digitalization and reduced processing times, with ongoing government initiatives anticipated through 2024-2025.

What is included in the product

This Pruksa Real Estate PESTLE analysis examines the influence of political, economic, social, technological, environmental, and legal factors on the company's operations and strategic planning.

It aims to identify key external forces that present opportunities and threats, enabling informed decision-making for Pruksa Real Estate's future growth and sustainability.

Offers a clear, actionable overview of Pruksa Real Estate's external environment, simplifying complex PESTLE factors into digestible insights for strategic decision-making and proactive risk mitigation.

Economic factors

High levels of household debt in Thailand, a persistent economic challenge, directly affect consumers' capacity to obtain mortgages. This situation is exacerbated by increasingly strict credit conditions, making it harder for many, especially those in the middle-to-low-income brackets, to qualify for housing loans. Consequently, mortgage rejection rates have risen notably, particularly impacting the market segment for properties priced below THB 3 million.

For Pruksa Real Estate, which caters to a broad spectrum of buyers, these factors necessitate strategic adjustments. The company may need to shift its sales focus towards the more affluent segment of the market, where buyers are less likely to face loan rejections. Alternatively, partnering with government initiatives for affordable housing could provide a viable pathway, as these schemes often feature more accessible lending criteria for eligible buyers.

Persistently high interest rates in 2024, with policy rates in many developed economies remaining elevated, directly impact Pruksa Real Estate by increasing monthly mortgage payments. This reduced affordability can dampen buyer demand, making potential customers more hesitant to commit to property purchases. For instance, a 1% increase in mortgage rates can add hundreds of dollars to a monthly payment, significantly affecting purchasing power.

While inflation is projected to moderate in 2025, its lingering effects continue to influence construction costs and land prices. This persistent upward pressure on input materials and land acquisition drives overall property price growth, posing a challenge for Pruksa to maintain competitive pricing. The cost of lumber, steel, and concrete, key components in housing construction, has seen significant fluctuations, impacting project profitability.

Pruksa Real Estate must therefore strategically manage its project costs, seeking efficiencies in construction and supply chain management to offset rising material expenses. Simultaneously, the company needs to carefully consider the impact of prevailing interest rates on the affordability for its target customer segments, potentially exploring more accessible product offerings or financing solutions.

Thailand's GDP growth trajectory, bolstered by a strong rebound in tourism and resilient export performance, directly fuels consumer confidence and spending capabilities. For Pruksa Real Estate, this translates into a more favorable environment for property purchases, as individuals feel more secure and financially able to invest in homes. For instance, Thailand's economy was projected to grow by 2.7% in 2024, a significant factor for consumer sentiment.

A robust economic recovery is a powerful driver for increased demand across all real estate segments, from affordable housing to luxury condominiums. Pruksa's sales figures are intrinsically linked to this broader economic health; when the economy is strong and consumers are optimistic, demand for new housing naturally rises, impacting Pruksa's revenue and market share.

Tourism Recovery and Foreign Demand

The robust rebound in Thailand's tourism sector is a significant tailwind for Pruksa Real Estate. In 2023, Thailand welcomed approximately 28 million international tourists, generating over 1.2 trillion Thai Baht in revenue, a stark contrast to the pandemic-affected years. This resurgence directly translates into increased demand for properties, particularly in popular tourist destinations.

Foreign investment, often linked to tourism's success, also bolsters the property market. Policy adjustments, such as the potential extension of leasehold rights for foreigners and the proposed increase in the foreign ownership quota for condominiums from 49% to 70% in certain areas, are expected to further stimulate foreign buyer interest. These changes aim to make property ownership more accessible and attractive to international investors.

Pruksa's condominium projects and its luxury segment are poised to capture a substantial share of this growing foreign demand. The increased rental yields driven by a recovering tourism market also enhance the appeal of these properties for investors. For instance, the average occupancy rate in Bangkok hotels saw a notable increase in late 2024, signaling a healthier rental market.

- Tourism Revival: Thailand's tourism sector saw a significant recovery in 2023, with tourist arrivals reaching 28 million, contributing over 1.2 trillion Thai Baht to the economy.

- Policy Support: Government considerations to extend leasehold periods and potentially raise foreign ownership quotas for condos are designed to attract more international investment.

- Segmental Benefit: Pruksa's condominium and luxury property lines are expected to benefit directly from increased foreign buyer interest and a stronger rental market.

- Market Indicators: Rising hotel occupancy rates in key tourist hubs in late 2024 suggest a positive trend for the broader property market, including rental demand.

Supply Overhang and Market Competition

Many areas, especially in Bangkok, are experiencing a significant buildup of unsold condominium units. This oversupply fuels fierce market competition, forcing developers like Pruksa to be highly strategic. In late 2023 and early 2024, the condominium market in Bangkok saw a substantial inventory of ready-to-transfer units, with some reports indicating over 100,000 units available in the metropolitan area alone.

To navigate this challenging environment, Pruksa Real Estate needs to prioritize market-driven project launches. This means closely analyzing demand trends and launching developments that directly address specific consumer needs rather than broad market assumptions. Differentiating their offerings through unique design, amenities, or target demographics becomes crucial.

Effectively managing this existing inventory requires a flexible approach to marketing and pricing. Developers may need to implement targeted promotional campaigns or offer attractive pricing adjustments to move units. For instance, in 2024, some developers were seen offering discounts of up to 15% on select projects to clear excess stock.

- Oversupply Concern: Bangkok's condominium market faced a significant overhang of unsold units as of early 2024, with estimates suggesting tens of thousands of units remaining on the market.

- Intensified Competition: The large inventory has led to heightened competition among developers, putting pressure on pricing and sales strategies.

- Strategic Imperatives: Pruksa must focus on launching projects aligned with current market demand and clearly differentiate its offerings to stand out.

- Inventory Management: Adjusting marketing tactics and pricing models is essential for Pruksa to effectively manage its existing stock and mitigate the impact of the supply overhang.

Thailand's economic growth, projected at 2.7% for 2024, significantly boosts consumer confidence and property demand. This economic vitality, supported by a strong tourism rebound and resilient exports, creates a favorable environment for Pruksa Real Estate as consumers feel more financially secure to invest in housing.

The property market is influenced by both opportunities and challenges. While GDP growth supports demand, high household debt and rising interest rates, continuing into 2024, pose significant hurdles for affordability. For instance, a 1% rate hike can add hundreds to monthly mortgage payments, impacting purchasing power.

Pruksa Real Estate must navigate these economic crosscurrents by aligning projects with market demand and differentiating offerings amidst intense competition, particularly in the Bangkok condominium segment where unsold inventory was substantial in early 2024. Strategic cost management and exploring accessible product lines are crucial.

What You See Is What You Get

Pruksa Real Estate PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This detailed PESTLE analysis of Pruksa Real Estate offers a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors influencing the company. Understand the market dynamics and strategic considerations impacting Pruksa Real Estate with this insightful report.

Sociological factors

Thailand's demographic landscape is shifting dramatically, with slow population growth and an increasing elderly population. Projections indicate the nation will officially become a 'super-aged society' by 2029, meaning over 20% of its population will be aged 65 and above. This significant demographic change directly influences consumer needs and market demand, creating new opportunities for businesses attuned to these evolving societal structures.

This aging trend is a key driver for increased demand in specific sectors. We're seeing a growing need for healthcare facilities, specialized retirement living spaces, and properties designed to accommodate multigenerational households, reflecting a desire for seniors to remain close to family. This creates a fertile ground for real estate developers who can innovate in these areas.

Pruksa Real Estate is strategically positioned to benefit from these demographic currents. The company's established focus on wellness residences and the integration of healthcare services within its developments aligns perfectly with the rising demand for senior-friendly and health-conscious living solutions. This proactive approach allows Pruksa to capture a significant share of this expanding market segment.

Urbanization continues to reshape living patterns, with a growing number of people flocking to cities. This trend fuels demand for housing that offers convenience and reduces commute times, especially in major hubs like Bangkok. In 2024, Thailand's urban population was estimated to be around 50% of its total, a figure projected to climb.

This shift means consumers increasingly value properties that integrate living, working, and leisure spaces, often referred to as mixed-use developments. The emphasis is on quality of life and seamless connectivity to employment centers. For instance, Pruksa Real Estate's focus on developing diverse residential options that cater to these evolving urban lifestyles is crucial for meeting market expectations.

Consumers are actively seeking housing solutions that support a better work-life balance. This translates into a preference for well-located properties with access to amenities and efficient transportation networks. Pruksa's strategy to align its offerings with these preferences, such as developing projects near mass transit lines, directly addresses this sociological driver.

Economic headwinds, including persistent income inequality, are notably impacting Thailand's property market. The affordability gap is widening, particularly for younger generations like millennials and Gen Z, who are finding it increasingly difficult to enter the housing market, especially for properties priced under THB 3 million. This is a critical challenge for Pruksa Real Estate.

Data from 2024 suggests that a significant portion of Thai households struggle with homeownership aspirations due to the gap between income growth and rising property prices. This situation can lead to higher loan rejection rates for potential buyers in the affordable segment, forcing developers like Pruksa to carefully consider their product mix.

To navigate this, Pruksa Real Estate must strategically diversify its portfolio. Balancing the offering of affordable housing solutions with more premium or high-end properties is crucial to capture demand across different income brackets and mitigate the impact of reduced purchasing power in specific market segments.

Demand for Specific Housing Types

Sociological factors significantly shape housing demand. In 2024, urban centers continue to see robust demand for condominiums, particularly among younger demographics and first-time homebuyers, driven by their relative affordability and proximity to employment hubs. This trend is supported by data indicating that condominium prices in major metropolitan areas have remained more accessible compared to landed properties, making them an attractive entry point into the market. For instance, reports from early 2024 showed a steady absorption rate for new condominium projects in Bangkok's CBD, outperforming expectations.

Conversely, demand for traditional low-rise housing, such as detached houses and townhouses, has experienced a softening in some segments, especially in areas further from city centers. This shift is partly due to changing lifestyle preferences favoring convenience and reduced maintenance. However, there remains a consistent demand for larger family homes in well-established suburban communities. The appeal of low-rise housing is often tied to factors like perceived stability and space, which continue to resonate with families seeking a particular lifestyle.

Emerging sociological trends also highlight a growing interest in flexible living arrangements. This includes increased demand for rental properties offering shorter lease terms and greater adaptability, as well as a rise in co-living spaces. These models cater to a mobile workforce and individuals seeking community or cost-sharing opportunities. By 2025, projections suggest this segment will continue to grow, with developers increasingly exploring innovative rental models to capture this evolving market share.

Pruksa Real Estate's product development strategy must actively respond to these evolving preferences. Aligning the company's portfolio to meet the high demand for condominiums in prime locations, while also exploring opportunities in flexible rental and co-living concepts, will be crucial for sustained growth. Adapting to these shifts ensures Pruksa remains competitive by offering housing solutions that resonate with contemporary lifestyle choices and economic realities.

- Condominium demand in prime urban areas remains strong due to affordability and accessibility, especially for first-time buyers.

- Low-rise housing demand has seen a decline in some segments, particularly for properties located further from urban centers.

- There is a noticeable increase in consumer interest for flexible rental properties and co-living spaces, reflecting changing lifestyle priorities.

- Pruksa's product mix needs to adapt by focusing on high-demand segments like condominiums and exploring innovative rental solutions to capture market shifts.

Wellness and Well-being Focus

The post-pandemic era has significantly heightened public awareness regarding health, living conditions, and ecological impact. This shift in perspective directly fuels demand for residential properties that prioritize wellness and incorporate accessible healthcare solutions. For instance, a 2024 survey indicated that over 60% of potential homebuyers consider health and well-being features as a top priority.

Pruksa Real Estate's strategic direction actively embraces this trend, aiming for leadership in developing housing that seamlessly integrates well-being amenities and healthcare services. This proactive alignment with evolving consumer desires positions Pruksa to capitalize on the growing market segment seeking healthier and more supportive living environments.

The company’s focus on wellness isn't just a response to current sentiment; it’s a forward-looking strategy. By 2025, Pruksa plans to pilot several projects featuring integrated telehealth facilities and air purification systems, directly addressing the heightened concerns about indoor air quality and convenient medical access that emerged post-pandemic.

- Increased Health Consciousness: Post-pandemic, 70% of consumers report a greater focus on personal health and preventative care, impacting housing choices.

- Demand for Sustainable Living: A significant portion of the market (over 50% in recent polls) now seeks properties with eco-friendly features and lower environmental footprints.

- Integrated Healthcare Services: The concept of "health-tech" in residential properties is gaining traction, with consumers expecting features like smart home health monitoring and on-site wellness centers.

- Pruksa's Strategic Alignment: Pruksa's commitment to well-being and healthcare integration directly addresses these evolving sociological factors, aiming to capture market share in this growing segment.

Thailand's aging population is a significant sociological factor, with projections indicating it will become a super-aged society by 2029, impacting demand for senior-friendly housing and healthcare facilities. Urbanization continues, with around 50% of Thailand's population living in cities in 2024, driving demand for convenient, mixed-use developments.

The market sees strong condominium demand in urban areas, especially from first-time buyers, while low-rise housing demand softens away from city centers, reflecting changing lifestyle preferences. Emerging trends also show a growing interest in flexible living arrangements like rentals and co-living spaces. Pruksa's strategy must adapt to these shifts by focusing on high-demand segments and innovative rental solutions.

Post-pandemic, health and wellness are paramount, with over 60% of homebuyers in 2024 prioritizing these features. Pruksa's focus on well-being amenities and healthcare integration aligns with this, with pilot projects planned for 2025 to include telehealth facilities. This proactive approach positions Pruksa to capture market share in the growing segment seeking healthier living environments.

Technological factors

The Thailand PropTech market is booming, fueled by a strong push towards digitalization within the real estate industry. This growth is particularly noticeable as of 2024, with investments in PropTech solutions expected to continue their upward trajectory through 2025. Key technologies like artificial intelligence, the Internet of Things (IoT), and blockchain are actively reshaping how property transactions are conducted, making them smoother and more efficient. These advancements are also instrumental in boosting operational effectiveness and elevating the overall customer experience in real estate.

Pruksa Real Estate is well-positioned to capitalize on these technological advancements. By integrating solutions like AI-powered virtual property tours, they can offer immersive and convenient viewing experiences to potential buyers, regardless of their location. Furthermore, IoT devices can enhance property management by enabling remote monitoring and predictive maintenance, leading to significant cost savings and improved asset performance. The strategic use of data analytics, powered by these technologies, will also be crucial for Pruksa to gain deeper market insights and maintain a distinct competitive advantage in the evolving landscape.

Smart home technology is rapidly becoming a significant draw for homebuyers. We're seeing a strong push for features like integrated security systems, automated lighting, and smart thermostats, reflecting a clear consumer preference for convenience and efficiency. This trend is particularly evident in the 2024 market, where new residential projects are increasingly showcasing these tech-driven amenities to attract a younger, more tech-savvy demographic.

For Pruksa Real Estate, this presents a clear opportunity. By actively incorporating these smart home solutions into their developments, Pruksa can directly address evolving consumer expectations. This strategic move not only enhances the appeal of their properties but also has the potential to increase property value, as homes equipped with modern smart technology are often perceived as more desirable and future-proof.

Technological advancements are reshaping the construction industry, with innovations like prefabrication and the adoption of sustainable materials offering significant benefits. These technologies can lead to greater efficiency, lower costs, and improved development quality, which are crucial for real estate developers like Pruksa. Pruksa’s investment in its precast business, a key area of advanced construction, directly addresses these trends, aiming for quicker project timelines and more uniform quality across its developments.

Data Analytics and AI for Market Insights

The integration of advanced data analytics and artificial intelligence (AI) is revolutionizing how real estate developers like Pruksa Real Estate gain market insights. By leveraging big data, companies can uncover critical trends in property values, rental income potential, and consumer demand. This analytical power allows for more informed project planning, from site selection to the development of tailored pricing strategies that align with specific market segments.

These technologies enable Pruksa to move beyond traditional market research, offering a granular understanding of buyer behavior and investment opportunities. For instance, AI algorithms can predict future property price movements with greater accuracy, aiding in portfolio optimization and the identification of emerging high-growth areas. In 2024, the global AI in real estate market was valued at approximately USD 1.7 billion, with a projected compound annual growth rate (CAGR) of over 15% through 2030, underscoring its increasing importance.

Pruksa can utilize these sophisticated tools to:

- Identify optimal locations: Analyze demographic data, infrastructure development plans, and economic indicators to pinpoint areas with the highest potential for property appreciation and rental demand.

- Refine pricing strategies: Utilize predictive analytics to set competitive yet profitable prices for new developments, considering factors like local market conditions and competitor analysis.

- Enhance customer targeting: Leverage AI to understand buyer preferences and tailor marketing campaigns to specific customer profiles, improving conversion rates.

- Optimize portfolio performance: Continuously monitor market shifts and adjust investment strategies to maximize returns on existing and future real estate assets.

Digital Marketing and Sales Platforms

The real estate industry's reliance on digital marketing and sales platforms continues to grow. Online property portals and targeted digital advertising are now essential for Pruksa Real Estate to effectively reach potential buyers and showcase its developments. For instance, in 2024, digital ad spending in real estate was projected to exceed $10 billion globally, highlighting the shift towards online channels for lead generation and brand building.

The digital transformation of property transactions is accelerating. Prospective buyers increasingly expect to view properties virtually and complete aspects of the buying process online, making a robust digital interface a competitive necessity. Pruksa's investment in user-friendly websites and virtual tour technologies is therefore critical for customer acquisition and engagement in the 2024-2025 period.

To maintain market leadership, Pruksa Real Estate must prioritize the continuous enhancement of its digital presence and sales infrastructure. This includes optimizing its website for mobile, leveraging social media marketing, and exploring new digital sales tools to connect with a broader and more digitally-native customer base. The company's ability to adapt to these evolving technological factors will directly impact its sales performance and market share.

Key digital marketing and sales platform considerations for Pruksa Real Estate include:

- Enhanced Online Listings: Ensuring high-quality virtual tours, detailed property descriptions, and seamless navigation on their own website and major property portals.

- Data-Driven Marketing: Utilizing analytics to understand buyer behavior and personalize digital marketing campaigns for greater efficiency and ROI.

- Social Media Engagement: Building communities and driving interest through strategic content on platforms popular with target demographics, such as Instagram and Facebook.

- CRM Integration: Implementing advanced Customer Relationship Management systems to manage leads generated through digital channels effectively.

Technological factors are significantly impacting the real estate sector, driving efficiency and customer engagement. The global AI in real estate market, valued at an estimated USD 1.7 billion in 2024, is projected to grow at a CAGR exceeding 15% through 2030, highlighting the increasing adoption of AI for market insights and predictive analytics. Pruksa Real Estate can leverage these advancements for optimized site selection, refined pricing, and enhanced customer targeting. Furthermore, the digital transformation of property transactions, with a projected global digital ad spend in real estate exceeding $10 billion in 2024, necessitates a strong online presence and virtual sales capabilities.

Legal factors

Thai law generally restricts direct land ownership by foreign nationals, though exceptions exist. Foreigners can own condominiums, with a legal limit of 49% of the total unit area within a building. This means Pruksa must carefully manage its sales to foreign buyers to stay within this quota for condominium projects.

Long-term leasehold agreements are another avenue for foreigners to gain rights to use land, typically for periods of 30 years and renewable. While there are ongoing discussions about potentially increasing foreign condominium quotas and extending leasehold terms, Pruksa must operate under the existing legal framework. This necessitates adapting sales and marketing strategies to align with current land ownership regulations.

Pruksa Real Estate operates within a framework of strict building codes and zoning regulations that dictate everything from building height to how land can be used. These rules are not static; they are constantly being updated. For instance, recent environmental protection regulations in Phuket have introduced conditional permissions for building on hillsides, mandating specific requirements for preserving green areas.

Navigating these evolving legal landscapes is crucial for Pruksa. Compliance with these local and national building and zoning laws is paramount to avoid delays, fines, or even project cancellations. In 2024, Thailand's Department of Public Works and Town & Country Planning continued to emphasize sustainable development practices, impacting zoning decisions across major urban and tourist areas.

Consumer protection laws are critical for Pruksa Real Estate, ensuring fair treatment of property buyers. These regulations, covering everything from contract clarity to transparent disclosures and post-sale support, are vital for building and sustaining customer trust. Failure to comply can lead to significant penalties and reputational damage, impacting future sales and brand loyalty.

In 2024, Thailand's Department of Business Development reported an increase in consumer complaints related to property transactions, highlighting the ongoing importance of strict adherence to consumer protection legislation. Pruksa's commitment to these standards, including clear warranty provisions and dispute resolution mechanisms, directly influences buyer confidence and reinforces its market position.

Environmental Regulations and Impact Assessments

New eco-building codes are set to take effect in 2025, placing a significant emphasis on sustainability, energy efficiency, and mandatory environmental impact assessments for all new developments. This means Pruksa Real Estate must proactively adapt its project planning to meet these heightened standards.

Compliance necessitates the implementation of robust pollution control systems and the allocation of dedicated green spaces within development sites. These requirements are not merely suggestions but legal obligations for developers operating in the current and upcoming regulatory landscape. For instance, recent reports indicate a growing trend in penalties for non-compliance with environmental standards, underscoring the financial risks associated with ignoring these mandates.

Pruksa Real Estate is therefore required to deeply integrate these environmental considerations into its core design and construction processes. This strategic integration is crucial not only for regulatory adherence but also for aligning with the company's own stated sustainability objectives. By proactively incorporating these elements, Pruksa can mitigate risks and potentially enhance its brand reputation as an environmentally conscious developer.

- 2025 Eco-Building Codes: Focus on sustainability, energy efficiency, and environmental impact assessments.

- Developer Obligations: Mandated pollution control systems and designated green spaces.

- Pruksa's Response: Integrate environmental considerations into design and construction for compliance and sustainability goals.

- Industry Trend: Increasing penalties for non-compliance with environmental regulations highlight financial risks.

Taxation and Fee Structures

Government fiscal policies, particularly concerning property taxes and transaction fees, significantly influence the real estate market's health and Pruksa Real Estate's sales performance. For instance, a reduction in ownership transfer fees or mortgage registration fees can directly lower the barrier to entry for property buyers, potentially boosting demand. In Thailand, measures like the reduction of transfer fees from 2% to 0.01% for properties under a certain value during specific periods have historically stimulated sales. Pruksa needs to closely monitor these adjustments to forecast demand and manage pricing strategies effectively.

Changes in tax structures can impact affordability and, consequently, Pruksa's sales volumes and revenue. For example, shifts in property tax rates or capital gains tax on property sales can alter investor sentiment and buyer purchasing power. Pruksa Real Estate must stay abreast of these evolving fiscal landscapes to adapt its business model and marketing efforts accordingly. The company's ability to navigate these tax and fee environments is crucial for maintaining competitive pricing and achieving sales targets, especially considering the sensitivity of the Thai property market to such governmental interventions.

Key considerations for Pruksa Real Estate regarding taxation and fee structures include:

- Impact of Transfer Fees: Reductions in ownership transfer fees, like those seen historically in Thailand to stimulate the market, directly improve buyer affordability.

- Mortgage Registration Fees: Changes in mortgage registration fees also affect the upfront costs for buyers, influencing purchasing decisions.

- Property Tax Rates: Fluctuations in property tax rates can impact long-term holding costs and investment attractiveness.

- Government Incentives: Pruksa must be aware of any government-led tax incentives or relief measures designed to boost the real estate sector.

Pruksa Real Estate must navigate Thailand's foreign ownership restrictions, which limit foreigners to 49% of condominium units by area. Long-term leaseholds, typically 30 years renewable, offer an alternative for land access.

The company operates under evolving building codes and zoning laws, with 2024 seeing increased emphasis on sustainable development by the Department of Public Works and Town & Country Planning. New eco-building codes effective in 2025 will mandate stricter environmental standards, including impact assessments and pollution control.

Consumer protection laws are vital, with a 2024 trend of increased property transaction complaints highlighting the need for Pruksa's strict adherence to clear contracts and transparent disclosures.

Government fiscal policies, such as property transfer and mortgage registration fees, directly influence buyer affordability and Pruksa's sales performance. For instance, historical reductions in transfer fees have stimulated market activity.

Environmental factors

Thailand faces significant climate change risks, with projections indicating rising temperatures and more extreme weather events like increased flooding, a critical concern for real estate development. For Pruksa Real Estate, this translates into a need for robust climate resilience in its projects, impacting everything from where they build to how they design.

The company must integrate climate resilience into its core operations. For instance, considering that Thailand's average temperature is projected to rise by 1.5-2.5°C by 2050, Pruksa's site selection process needs to carefully evaluate flood risk zones and water scarcity, while design and construction must prioritize materials and techniques that can withstand these environmental shifts.

This focus on resilience isn't just about mitigating physical damage; it's also about ensuring long-term property value and safety for residents. By proactively addressing climate impacts, Pruksa can enhance its brand reputation and appeal to a growing segment of environmentally conscious buyers and investors.

The global push towards carbon neutrality, with many governments setting ambitious targets, is significantly boosting the demand for green buildings. This trend is further amplified by a noticeable rise in environmental consciousness among property buyers, who increasingly prioritize eco-friendly features.

Developers are actively responding by integrating sustainable design principles, focusing on energy efficiency, and pursuing recognized green building certifications. For instance, the total number of LEED-certified projects globally surpassed 100,000 by early 2024, showcasing the widespread adoption of these standards.

Pruksa Real Estate's alignment with these environmental shifts, particularly through its 'Heart to Earth' sustainability framework, positions it favorably. This commitment resonates strongly with a growing segment of buyers actively seeking properties that reflect their environmental values, potentially leading to higher sales and brand loyalty.

Sustainable construction practices are increasingly vital for Pruksa Real Estate, focusing on efficient resource management. This includes implementing water recycling systems and minimizing waste generation throughout the development process. For instance, Thailand's construction sector generated an estimated 30 million tons of construction and demolition waste in 2023, highlighting the urgency for effective waste reduction strategies.

New eco-building codes are shaping the industry by setting minimum standards for energy consumption and material usage, aiming to significantly reduce the environmental footprint of buildings. Pruksa can leverage these codes as a framework for innovation. By adopting advanced techniques, such as prefabrication and modular construction, Pruksa can achieve a substantial reduction in on-site waste, potentially diverting up to 80% of construction waste from landfills, as demonstrated by leading international developers.

Air Quality and Pollution Control

Thailand's proposed Draft Clean Air Act signals a significant shift towards enhanced environmental regulations. This legislation is set to impose stricter controls on businesses, mandating the implementation of advanced pollution control systems and potentially requiring comprehensive environmental impact assessments for a wider range of operations. For Pruksa Real Estate, a leading developer, this means a heightened focus on ensuring all construction sites adhere to stringent air quality standards. The company must also consider how its finished developments contribute positively to the overall urban air quality, a factor increasingly important to homebuyers and regulators alike. This proactive approach to air quality management is crucial for maintaining regulatory compliance and building a reputation for environmental responsibility.

Meeting these evolving air quality standards presents both challenges and opportunities for Pruksa. The company is expected to invest in modern pollution abatement technologies for its construction phases, which could involve advanced dust suppression systems and emission controls for machinery. Furthermore, the design of Pruksa's residential projects may need to incorporate features that promote better air circulation and reduce internal air pollutants, aligning with the act's broader goals. For instance, the World Health Organization (WHO) reported in 2023 that air pollution remains a significant global health concern, with PM2.5 levels in many Southeast Asian cities, including Bangkok, frequently exceeding safe limits. This underscores the urgency and importance of Pruksa's commitment to clean air initiatives.

- Stricter Regulations: The Draft Clean Air Act will likely enforce more rigorous pollution control measures on businesses.

- Environmental Assessments: Mandatory environmental assessments may become a standard requirement for development projects.

- Construction Impact: Pruksa must manage air quality at its construction sites to comply with new standards.

- Urban Environment: The company's developments will be scrutinized for their contribution to overall urban air quality.

Sustainable Land Use and Biodiversity Protection

Environmental regulations are increasingly shaping real estate development, particularly concerning land use and biodiversity. In areas like Phuket, strict rules are in place to safeguard natural landscapes and protect ecosystems, limiting where and how construction can occur. For instance, developers might be mandated to preserve a substantial portion of their land as green space, impacting project feasibility and design.

Pruksa Real Estate, like other developers, must navigate these environmental considerations meticulously. Their expansion into new territories necessitates a thorough understanding of local land-use zoning and environmental protection laws. This ensures responsible development that integrates with, rather than harms, the surrounding ecology. Failure to comply can lead to significant penalties and reputational damage.

- Regulatory Scrutiny: Thailand’s Ministry of Natural Resources and Environment continues to enforce stricter guidelines on coastal development and forest conservation, impacting project approvals.

- Developer Obligations: Recent environmental impact assessment (EIA) requirements often stipulate that developers must allocate a minimum of 20% of project land for green spaces or ecological restoration.

- Biodiversity Impact: Projects in sensitive zones, such as those near national parks or marine reserves, face heightened scrutiny to prevent disruption to local flora and fauna populations.

- Sustainable Practices Adoption: Pruksa's commitment to sustainability, as highlighted in their 2023 annual report, includes investing in eco-friendly building materials and water management systems to mitigate environmental impact.

The increasing emphasis on sustainability and environmental protection in Thailand directly influences Pruksa Real Estate's operational strategies. As global climate change concerns intensify, developers are compelled to adopt greener construction methods and prioritize energy efficiency to meet evolving market demands and regulatory pressures. Pruksa's proactive approach through its 'Heart to Earth' framework aligns with this trend, fostering a positive brand image and appealing to environmentally conscious consumers.

The Draft Clean Air Act in Thailand signifies a stricter regulatory environment, necessitating enhanced pollution control measures at construction sites and a focus on the environmental impact of finished developments. Pruksa must invest in technologies that improve air quality, potentially incorporating features that promote better air circulation in its residential projects. This proactive stance is crucial for compliance and building a reputation for environmental stewardship, especially given that PM2.5 levels in cities like Bangkok frequently exceed safe limits as reported by the WHO in 2023.

Environmental regulations concerning land use and biodiversity are becoming more stringent, particularly in sensitive areas. Pruksa Real Estate needs to meticulously navigate these rules, ensuring responsible development that respects local ecosystems and adheres to zoning laws. For instance, developers may be required to designate a minimum of 20% of project land for green spaces, as stipulated in recent environmental impact assessment requirements, impacting project feasibility and design considerations.

PESTLE Analysis Data Sources

Our PESTLE analysis for Pruksa Real Estate is grounded in a comprehensive review of official government publications, reputable financial news outlets, and industry-specific market research reports. This ensures that all insights into political, economic, social, technological, legal, and environmental factors are derived from credible and current data.