Pruksa Real Estate Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Pruksa Real Estate Bundle

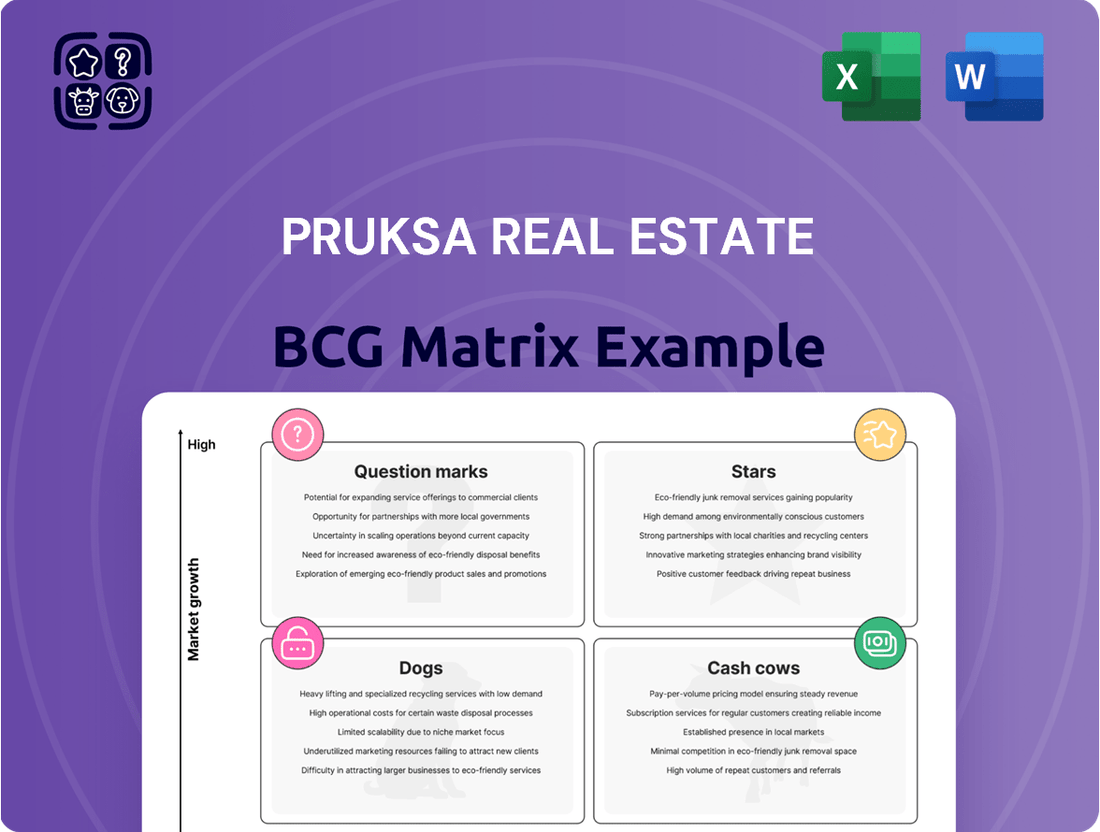

Curious about Pruksa Real Estate's strategic positioning? Our BCG Matrix analysis reveals their portfolio's potential, highlighting which projects are market leaders and which require careful consideration. Discover if their developments are Stars, Cash Cows, Dogs, or Question Marks.

This preview offers a glimpse into Pruksa's product landscape, but the full BCG Matrix report provides a comprehensive, data-driven breakdown. Unlock detailed quadrant placements and actionable insights that can inform your investment decisions and strategic planning.

Don't miss out on the complete picture. Purchase the full BCG Matrix to gain a clear understanding of Pruksa's market share and growth potential, empowering you to make informed choices about where to allocate resources for maximum impact.

The full report includes expert commentary and visual mapping, transforming raw data into strategic clarity. Get ready to evaluate, present, and strategize with confidence using our expertly crafted BCG Matrix.

Stars

Pruksa Real Estate is strategically focusing on its 'Wellness Residence' projects, like The Palm and The Reserve, which blend residential living with integrated healthcare services. This initiative directly taps into the burgeoning demand for health-conscious lifestyles. For example, in 2023, Pruksa reported substantial revenue growth in its premium segments, which include these wellness-focused developments, indicating strong market reception.

By leveraging its existing ViMUT hospital network, Pruksa is creating a unique value proposition. This synergy allows them to cater to a high-value niche market, anticipating significant growth and a strong competitive position. The company's 2024 outlook suggests continued investment in these integrated health and housing solutions, aiming to capture a larger share of this expanding market segment.

Pruksa Real Estate is making a significant pivot, directing more resources and development towards the high-end single-detached house market, with prices generally exceeding 7 million Baht. This strategic shift reflects a focus on segments offering stronger demand and greater purchasing power. For instance, their luxury projects like The Palm Residences Pattanakarn showcase this ambition, with units ranging from 45 to 80 million Baht.

The company's objective is to establish a dominant position within this lucrative segment. By concentrating on properties above the 7 million Baht mark, Pruksa is targeting a customer base less affected by economic fluctuations and more inclined towards premium housing solutions. This focus aims to bolster their market share in a segment where quality and exclusivity are key differentiators.

Pruksa Real Estate's healthcare venture, spearheaded by ViMUT Hospital, demonstrated robust growth, achieving a 20% year-on-year revenue increase in 2024.

The company is actively pursuing a strategic expansion, with plans to launch three new specialized hospitals to capitalize on the burgeoning healthcare market.

This sector's high-growth potential, combined with Pruksa's unique real estate integration strategy, positions ViMUT Hospital favorably with a significant market share in its specialized niche.

This integrated approach provides a strong competitive advantage, allowing Pruksa to leverage its existing infrastructure and brand recognition in the healthcare sector.

Inno Precast Business Expansion

Inno Precast, a key player in Pruksa Real Estate's portfolio, is poised for substantial growth. This business, which operates Thailand's largest green precast factory, anticipates reaching 2,100 million Baht in revenue by 2025.

Its strategic advantage lies in its dual function: supplying Pruksa's internal construction needs while also serving external clients. This dual approach capitalizes on the increasing demand for high-efficiency, sustainable construction technologies. The company's significant scale and advanced manufacturing processes position it as a leader with a strong market share in its specialized industrial niche.

- Target Revenue: 2,100 million Baht by 2025.

- Market Position: Operates Thailand's largest green precast factory.

- Business Model: Supports internal Pruksa projects and external clients.

- Growth Driver: Capitalizes on the growing construction technology market for sustainable solutions.

Prime Location Condominiums (New Launches)

Even though the condominium market is facing some headwinds, Pruksa Real Estate is strategically launching new projects in highly desirable areas. A prime example is Chapter Charoenkrung Riverside, which boasts sophisticated designs and premium amenities. This focus on high-end offerings targets a segment with strong growth potential, particularly as rental demand in central business districts continues to rise.

Pruksa's established brand reputation provides a significant advantage, enabling them to capture a substantial portion of this lucrative market. The company's commitment to quality and location is evident in these new developments, aiming to attract discerning buyers and renters.

- Prime Location Focus: Chapter Charoenkrung Riverside exemplifies Pruksa's strategy of developing condominiums in key urban centers with high growth potential.

- High-End Appeal: The emphasis on high-end design and amenities caters to a sophisticated buyer segment seeking quality and exclusivity.

- Rental Demand Driver: Increasing rental demand in central districts is a key factor supporting the potential success of these new launches.

- Brand Strength Advantage: Pruksa's strong brand recognition is expected to facilitate market share capture in a competitive environment.

Pruksa Real Estate's "Stars" in the BCG matrix are likely represented by its premium single-detached houses and its burgeoning healthcare segment, ViMUT Hospital. These segments demonstrate high growth potential and strong market demand, aligning with the characteristics of Stars. The company is investing heavily in these areas, aiming to solidify its market leadership.

| Business Segment | BCG Category | Key Characteristics | 2024 Outlook/Data |

|---|---|---|---|

| Premium Single-Detached Houses (>7M Baht) | Star | High demand, strong purchasing power, less economic sensitivity. Focus on quality and exclusivity. | Continued investment in luxury projects like The Palm Residences Pattanakarn. |

| Healthcare (ViMUT Hospital) | Star | High growth potential, integrated value proposition with real estate, strong competitive advantage. | 20% year-on-year revenue increase in 2024. Plans for three new specialized hospitals. |

What is included in the product

This BCG Matrix overview offers clear descriptions and strategic insights for Pruksa Real Estate's Stars, Cash Cows, Question Marks, and Dogs.

The Pruksa Real Estate BCG Matrix offers a clear, one-page overview, relieving the pain of complex portfolio analysis.

Cash Cows

Pruksa Real Estate's established mid-range single-detached houses, generally priced between 7 and 15 million Baht, represent their solid Cash Cows. This segment benefits from Pruksa's deep market penetration and trusted brand, ensuring consistent demand.

While the growth in this mature market might be moderate, these offerings are dependable profit generators. In 2024, Pruksa continued to leverage its efficient construction and established supply chains, allowing for healthy profit margins on these high-volume sales, contributing significantly to the company's overall financial stability.

Pruksa Real Estate's existing townhouse projects in the 3-5 million Baht segment are considered cash cows within their BCG matrix. These established developments benefit from Pruksa's strong market presence, ensuring a consistent generation of revenue and reliable cash flow. This segment demonstrates greater resilience compared to the lower-end townhouse market, which has experienced a general slowdown.

The company's strategic shift towards this more stable segment reduces the need for extensive marketing and new investment, allowing these projects to operate efficiently. For example, Pruksa's performance in 2024 reflects this focus, with continued contributions from its established townhouse portfolio in this price range, underpinning its financial stability.

Pruksa Real Estate's internal construction and precast production units function as a classic cash cow within their BCG matrix. These operations are primarily dedicated to fulfilling Pruksa's own extensive real estate development needs, creating a captive and consistent demand.

This stable, high-volume internal market insulates the precast and construction divisions from external market volatility and low growth, ensuring reliable revenue streams. For instance, Pruksa's 2024 project pipeline indicates a substantial volume of units requiring precast components, directly benefiting these internal units.

The efficiency gains from catering to a single, large client (Pruksa itself) allow for optimized production and cost control. This strategic advantage solidifies their position as a predictable internal cash generator, contributing significantly to the company's overall financial stability.

Long-Standing Residential Communities with Supporting Services

Pruksa Real Estate's portfolio features many established residential communities that serve as dependable cash cows. These communities generate consistent revenue through various supporting services such as property management, upkeep, and other resident-focused amenities.

These mature developments represent a stable, albeit not rapid, growth segment for Pruksa. Their primary value lies in the predictable and reliable cash flow they provide, which requires limited additional capital investment to maintain.

For instance, in 2024, Pruksa continued to benefit from the steady income generated by its established housing projects. These cash cows are crucial for funding the company's investments in newer, higher-growth ventures within its BCG matrix.

- Stable Income: Recurring revenue from management fees and maintenance services ensures consistent cash flow.

- Low Investment Needs: Mature communities require minimal new capital expenditure, maximizing profitability.

- Portfolio Balance: These cash cows provide financial stability, supporting growth initiatives in other business units.

Strategically Acquired Land Bank

Pruksa Real Estate's strategically acquired land bank acts as a significant Cash Cow within its BCG Matrix. This extensive portfolio, built through acquisitions at advantageous prices in prior periods, provides a robust foundation for future growth and consistent revenue generation.

This land bank isn't a direct product but a crucial asset that can be leveraged in multiple ways. It offers the flexibility to develop new projects or to simply monetize the land through sales, ensuring a steady influx of cash. Its value is less dependent on rapid market growth and more on its inherent strategic positioning and acquisition cost.

- Stable Asset Base: Pruksa's land holdings, acquired at favorable historical prices, offer a secure foundation for future real estate developments.

- Monetization Flexibility: The land bank can be converted to cash through direct sales or by serving as the basis for new, profitable construction projects.

- Low Market Growth Dependency: As a Cash Cow, its value is less tied to immediate market expansion, providing consistent financial returns.

- Strategic Location Advantage: Acquisitions in key, well-positioned areas enhance the land bank's long-term value and development potential.

Pruksa Real Estate's established mid-range single-detached houses, generally priced between 7 and 15 million Baht, represent their solid Cash Cows. This segment benefits from Pruksa's deep market penetration and trusted brand, ensuring consistent demand.

While the growth in this mature market might be moderate, these offerings are dependable profit generators. In 2024, Pruksa continued to leverage its efficient construction and established supply chains, allowing for healthy profit margins on these high-volume sales, contributing significantly to the company's overall financial stability.

Pruksa Real Estate's existing townhouse projects in the 3-5 million Baht segment are considered cash cows within their BCG matrix. These established developments benefit from Pruksa's strong market presence, ensuring a consistent generation of revenue and reliable cash flow. This segment demonstrates greater resilience compared to the lower-end townhouse market, which has experienced a general slowdown.

| Product Segment | BCH Matrix Category | 2024 Contribution | Key Characteristics |

|---|---|---|---|

| Mid-range Single-Detached Houses (7-15M Baht) | Cash Cow | Significant profit contributor, stable revenue | Established brand, deep market penetration, efficient operations |

| Established Townhouses (3-5M Baht) | Cash Cow | Reliable cash flow, resilient revenue | Strong market presence, lower marketing needs, stable demand |

| Internal Construction & Precast | Cash Cow | Predictable internal revenue, cost control | Captive demand, optimized production, insulation from market volatility |

| Mature Residential Communities | Cash Cow | Consistent income from services, low capital needs | Property management, upkeep services, stable cash generation |

| Acquired Land Bank | Cash Cow | Asset appreciation, flexible monetization | Favorable acquisition costs, strategic locations, future development potential |

Delivered as Shown

Pruksa Real Estate BCG Matrix

The Pruksa Real Estate BCG Matrix preview you are viewing is the complete, final document you will receive immediately after purchase. This ensures you see the exact strategic analysis and professional formatting that will be yours, with no hidden watermarks or demo content. The detailed breakdown of Pruksa's portfolio within the BCG framework is fully accessible and ready for your immediate use in strategic planning or presentations.

Dogs

Pruksa Real Estate is strategically scaling back its involvement in townhouse developments priced under 3 million Baht. This decision stems from the segment's current struggles, notably a decline in consumer spending power and elevated household debt levels, which are further compounded by more stringent mortgage approval processes. In 2024, this market segment has demonstrated a notable slowdown, with many developers reporting increased inventory and longer sales cycles for such affordable housing options.

These lower-priced townhouse projects are characterized by limited growth potential and a relatively small market share within Pruksa’s broader portfolio. Consequently, they often necessitate aggressive pricing tactics to attract buyers, a strategy that directly impacts profitability and shrinks profit margins. For instance, reports from early 2024 indicated that the profit margins for new housing units below this price threshold have compressed by as much as 5-7% compared to previous years due to these market pressures.

Pruksa Real Estate is facing challenges with older, unsold condominium inventory, especially in non-prime locations. The company noted a slowdown in new project launches after the pandemic, which has contributed to this backlog.

These unsold units are often in areas with less demand or are oversaturated with similar properties. To sell them, Pruksa has had to offer significant discounts and promotions. For instance, in 2023, the Thai property market saw a notable increase in unsold inventory, with some developers offering discounts of up to 20-30% on older projects to clear stock.

This situation ties up valuable capital that could be used for more promising ventures. The returns generated from selling these discounted units are typically low, reflecting limited growth potential in these specific market segments.

Pruksa Real Estate is strategically divesting certain land plots that no longer fit its updated portfolio strategy. These are previously acquired parcels that cannot be developed into projects aligning with current growth objectives. This move aims to unlock capital tied up in underperforming assets with low return potential.

These land holdings are candidates for divestiture because they do not contribute to Pruksa's current growth or market share expansion goals. By selling these underperforming plots, Pruksa can reallocate resources to more promising development opportunities. This strategic pruning is crucial for optimizing the company's asset base and enhancing overall financial performance.

Outdated Design or Concept Projects

Outdated design or concept projects represent Pruksa Real Estate's "Dogs" in the BCG matrix. These are typically older developments whose architectural styles or layouts no longer align with current buyer demands. For instance, a project launched in 2018 with a focus on smaller, single-car garages might struggle in 2024 where buyers increasingly prefer larger, two-car garages or more adaptable spaces. This mismatch leads to sluggish sales and low absorption rates, meaning units aren't selling as quickly as anticipated.

These underperforming assets often require significant marketing investment to move inventory, yet they contribute little to Pruksa's overall revenue growth. Their market share remains stagnant or even declines as newer, more relevant projects capture buyer attention. In 2023, for example, Pruksa reported that older inventory, particularly those built before 2020 with less contemporary designs, accounted for a disproportionate amount of holding costs and marketing spend relative to their sales contribution.

- Slow Sales Velocity: Projects with outdated designs experience significantly lower sales conversion rates compared to modern offerings.

- High Marketing Spend-to-Revenue Ratio: These properties necessitate increased promotional efforts, yielding a poor return on marketing investment.

- Limited Market Share Growth: Their appeal is often niche or diminishing, preventing expansion within the broader market.

- Inventory Holding Costs: Unsold units from these projects tie up capital and incur ongoing expenses for maintenance and property taxes.

Mass-Market Housing Projects with High Competition

Pruksa Real Estate's mass-market housing projects, while foundational, now face intense rivalry and evolving buyer tastes that favor slightly higher-tier offerings. These older, high-volume ventures, often characterized by thin profit margins, are finding it harder to capture substantial market share or hit their growth targets.

The consequence is that some of these once-dominant projects are becoming cash traps, tying up capital without delivering the expected returns. This situation is particularly evident in Thailand's competitive housing sector, where developers are increasingly differentiating through features and amenities rather than solely on price.

- Increased Competition: The Thai mass-market housing segment saw a substantial increase in new project launches in 2024, with major developers vying for a similar customer base.

- Shifting Consumer Preferences: Surveys from early 2025 indicate a growing demand for homes with enhanced community facilities and smart home technology, even within the mass-market segment, moving away from basic affordability.

- Margin Squeeze: Rising construction material costs in late 2024 and early 2025 have further compressed the already tight margins on these low-cost housing units.

- Stagnant Growth: For instance, some Pruksa projects launched five years ago are reporting growth rates below the industry average for new developments in 2024, signaling a need for strategic recalibration.

Pruksa Real Estate's "Dogs" are projects with outdated designs or concepts, leading to sluggish sales and low absorption rates.

These underperforming assets require significant marketing investment but contribute little to revenue growth, with stagnant or declining market share.

In 2023, older inventory with less contemporary designs accounted for a disproportionate amount of holding costs and marketing spend relative to their sales contribution.

These projects are characterized by slow sales velocity, a high marketing spend-to-revenue ratio, limited market share growth, and significant inventory holding costs.

| Project Type | Market Position | Growth Potential | Profitability | Strategic Consideration |

|---|---|---|---|---|

| Outdated Design Condominiums | Low Market Share | Low | Low / Negative | Divestment / Repurposing |

| Affordable Townhouses (Pre-2020) | Low Market Share | Low | Low | Scale Back / Reposition |

| Older Unsold Inventory | Low Market Share | Low | Low | Aggressive Discounting / Write-off |

Question Marks

Pruksa Real Estate is expanding into the super-ultra-luxury residential market, exemplified by projects like The Reserve, with unit prices exceeding THB 50 million. This strategic move aims to tap into a segment demonstrating high growth potential, particularly in 2024 and into 2025, as demand for premium properties remains robust. For context, the Thai luxury property market, valued in the billions, has seen consistent demand, with specific ultra-luxury segments showing resilience even during economic fluctuations. Pruksa's entry requires a significant commitment to premium design, sophisticated marketing, and prime location selection to compete effectively with established players who have a long-standing reputation in this niche.

Pruksa Real Estate's strategic move into specialized healthcare, exemplified by the planned Orthopedic Hospital in Thonglor, signals a significant investment in a sector poised for robust growth. This initiative taps into the increasing demand for niche medical services, a trend expected to continue through 2024 and beyond.

Establishing these three new specialized hospitals requires careful execution to capture market share. The healthcare market, while expanding, is competitive, and building patient trust and operational efficiency will be key to success. For instance, by the end of 2023, private hospitals in Thailand saw a revenue growth of approximately 10-12%, indicating a healthy market, but new entrants must differentiate themselves.

Pruksa Real Estate's strategic move with Inno Home Construction positions it to aggressively pursue the external B2B and B2C construction markets in Thailand. This expansion is a significant step towards their ambition of becoming the nation's leading horizontal housing construction provider, leveraging their expertise beyond Pruksa's internal development needs.

The target market for external construction services is experiencing robust growth, presenting a substantial opportunity for Inno Home Construction. However, the company faces the challenge of establishing its competitive edge and securing a meaningful share of this external market, which is crucial for its success beyond Pruksa's existing project pipeline.

In 2024, Thailand's construction sector showed resilience, with significant infrastructure projects and a growing demand for residential and commercial building. For instance, government spending on infrastructure development, projected to be around THB 1.9 trillion in 2024, indirectly fuels demand for construction services that Inno Home Construction can tap into.

Condominium Projects Targeting Foreign Buyers

Pruksa Real Estate is strategically targeting foreign buyers for its condominium projects, particularly those situated in prime city-center locations. This focus aims to tap into a high-growth segment driven by increasing international investment in Thailand’s real estate market. For example, in 2024, foreign ownership of Thai condominiums saw a notable uptick, with Bangkok and popular tourist destinations like Phuket and Chiang Mai attracting significant interest.

While the overall market for foreign condo buyers is expanding, Pruksa's current penetration within this demographic is understood to be relatively low. To effectively capture this demand, the company must implement specialized marketing campaigns and tailored sales approaches. These efforts are crucial for building brand awareness and trust among international clientele, who often have different purchasing preferences and require specific communication channels.

Key strategies for Pruksa might include:

- Targeted Digital Marketing: Leveraging international property portals, social media platforms popular in key target countries, and partnerships with overseas real estate agencies.

- Multilingual Sales Support: Providing sales representatives and marketing materials in languages relevant to major foreign investor groups, such as Chinese, English, and Japanese.

- Showcasing Lifestyle and Investment Potential: Highlighting the benefits of urban living, proximity to amenities, and the potential for rental yields or capital appreciation in city-center projects.

- Streamlined Purchasing Process: Simplifying the legal and administrative aspects of property acquisition for foreign buyers, often a point of concern.

E-commerce Integration for Real Estate and Healthcare Ecosystems

Pruksa Real Estate is strategically expanding its e-commerce capabilities to seamlessly link its property offerings with healthcare services. This initiative is designed to foster a holistic wellness living environment for its customers, blending residential convenience with health and well-being support.

This move places Pruksa within a rapidly expanding market characterized by technology-driven services. While the potential for increased market share and revenue is significant, the actual impact of these integrated e-commerce solutions is currently in its early phases, heavily dependent on widespread user engagement and uptake.

- Market Focus: Targeting the burgeoning tech-enabled wellness services sector.

- Strategic Goal: To offer a unified experience integrating real estate and healthcare.

- Growth Stage: Early adoption phase; direct impact on market share and revenue is developing.

- Key Driver: User adoption and seamless integration of digital platforms are crucial for success.

Pruksa Real Estate's expansion into the super-ultra-luxury market and specialized healthcare, alongside its B2B construction ambitions and focus on foreign condo buyers, positions these ventures as potential Question Marks in the BCG matrix. These areas represent significant investment opportunities with uncertain returns and require careful monitoring. The company's foray into integrating e-commerce with healthcare services also falls into this category, with success hinging on user adoption.

BCG Matrix Data Sources

Our Pruksa Real Estate BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable insights.