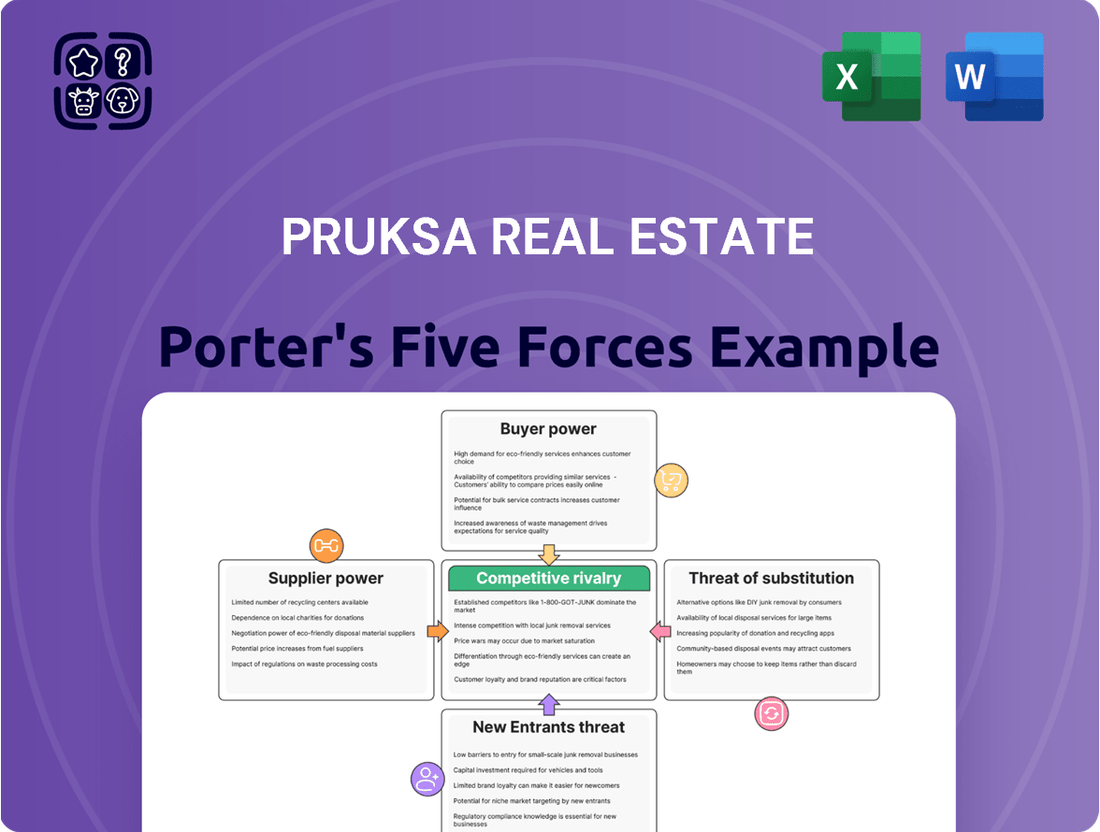

Pruksa Real Estate Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Pruksa Real Estate Bundle

Pruksa Real Estate operates in a dynamic sector where buyer bargaining power is significant, driven by numerous choices and price sensitivity. The threat of new entrants, while moderated by capital requirements, remains a constant consideration.

Suppliers hold moderate power, with specialized materials and skilled labor influencing costs. Rivalry among existing competitors is intense, characterized by aggressive pricing and product differentiation strategies.

The threat of substitutes, though less direct in housing, can emerge from alternative investment vehicles or rental markets. Understanding these forces is crucial for strategic planning.

The complete report reveals the real forces shaping Pruksa Real Estate’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of Pruksa Real Estate's key suppliers significantly shapes their bargaining power. For essential construction materials like cement and steel, or for specialized labor, if only a handful of major producers or providers exist, they can exert considerable influence on pricing. This concentration means Pruksa might face higher costs for critical inputs, directly affecting their cost of goods sold.

For instance, in 2024, global steel prices experienced volatility, with benchmarks like the TSI China Steel Price Index fluctuating throughout the year due to supply chain disruptions and demand shifts. Similarly, cement prices can be heavily influenced by regional production capacities and energy costs, which were also dynamic in 2024.

Pruksa's in-house precast concrete business offers a potential buffer against the bargaining power of external suppliers for this specific component. By controlling a significant portion of their precast production, Pruksa can reduce its reliance on third-party suppliers, potentially leading to better cost management and more predictable material availability for its projects.

The bargaining power of Pruksa Real Estate's suppliers is significantly influenced by switching costs. If Pruksa were to change its suppliers, it would incur expenses related to finding new partners, qualifying new materials, and potentially retooling its construction processes.

High switching costs, often stemming from specialized building materials or bespoke component designs, would grant suppliers greater leverage. For instance, if a supplier provides unique, custom-fabricated components that are not readily available from other sources, Pruksa's ability to negotiate prices or terms would be diminished.

However, Pruksa's substantial scale of operations, which allows for significant bulk purchasing power, can act as a countermeasure to high switching costs. By committing to large order volumes, Pruksa can negotiate more favorable terms and potentially reduce the impact of switching costs on its overall procurement expenses.

In 2023, Pruksa Real Estate reported total procurement costs that represent a substantial portion of its overall expenses, highlighting the importance of managing supplier relationships and the associated switching costs effectively to maintain profitability.

Suppliers offering highly specialized or proprietary components significantly enhance their bargaining power. For Pruksa Real Estate, if their innovative wellness residences depend on unique, patented smart home systems or sustainably sourced, rare building materials, the suppliers of these inputs gain considerable leverage. This is because alternative suppliers may not exist or cannot match the specific quality or features required, forcing Pruksa to meet the suppliers' terms.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Pruksa Real Estate's property development market could significantly enhance their bargaining power. This would mean suppliers, particularly those providing specialized construction services or even raw materials, could start developing their own projects, directly competing with Pruksa.

While direct raw material suppliers integrating forward is less probable, specialized subcontractors or service providers within the construction ecosystem represent a more tangible risk. For instance, a major electrical contractor could decide to develop its own housing projects, leveraging its expertise and existing supply chains. This move would shift them from a supplier role to a direct competitor.

Pruksa's strategic establishment of its own in-house construction subsidiary, 'InnoHome Construction,' serves as a direct counter-measure. This vertical integration aims to mitigate the risk of supplier power by bringing critical construction capabilities under Pruksa's direct control, potentially reducing reliance on external specialized providers and their potential for forward integration.

In 2024, the construction industry in Thailand, Pruksa's primary market, continued to see robust activity. For example, the value of construction projects awarded in Q1 2024 reached approximately THB 150 billion, indicating a strong demand for construction services and a potential for key service providers to consider diversification into development if margins are attractive.

- Supplier Forward Integration: Suppliers entering the property development market becomes a direct competitive threat.

- Specialized Service Providers: A more likely source of forward integration threat, such as large construction subcontractors.

- Pruksa's Counter-Strategy: The 'InnoHome Construction' subsidiary aims to internalize construction capabilities and reduce supplier leverage.

- Market Context (2024): Thailand's construction sector demonstrated significant activity, potentially incentivizing suppliers towards development.

Importance of Pruksa to Suppliers

Pruksa Real Estate's considerable scale as a leading property developer in Thailand significantly influences its suppliers. If Pruksa accounts for a substantial percentage of a supplier's annual revenue, that supplier's bargaining power is naturally reduced. This is because the supplier becomes more reliant on Pruksa for continued business, making them less likely to dictate terms or demand higher prices.

Pruksa's position as a key player in the Thai real estate market means many suppliers view the company as a vital client. This crucial relationship can lead suppliers to offer more competitive pricing and favorable terms to secure and maintain Pruksa's business. For instance, in 2023, Pruksa reported total revenue of approximately THB 37.5 billion, underscoring the significant volume of materials and services they procure.

- Supplier Dependence: A supplier whose income heavily relies on Pruksa's orders has less leverage.

- Pruksa's Market Share: As a major developer, Pruksa's purchasing power can command better deals from suppliers.

- Revenue Impact: For many construction material suppliers, Pruksa represents a significant portion of their sales, diminishing their ability to push for higher costs.

- Client Importance: Pruksa's consistent demand makes it a highly sought-after customer, incentivizing suppliers to be accommodating.

Pruksa Real Estate's bargaining power with suppliers is significantly influenced by the concentration of suppliers in key input markets. When few suppliers dominate the market for essential materials like cement or steel, or for specialized labor, they can dictate higher prices, directly impacting Pruksa's costs. For example, in 2024, global steel prices showed considerable volatility driven by supply chain issues and demand fluctuations, affecting procurement costs for developers like Pruksa.

The threat of suppliers integrating forward into property development, thereby becoming direct competitors, also elevates their bargaining power. While raw material suppliers are less likely to do this, specialized subcontractors or service providers could pose a risk by developing their own projects. Pruksa's strategy of developing its in-house construction subsidiary, 'InnoHome Construction,' aims to mitigate this by internalizing capabilities and reducing reliance on external providers.

The sheer scale of Pruksa Real Estate's operations as a major developer in Thailand reduces supplier leverage. When Pruksa represents a significant portion of a supplier's revenue, that supplier is more dependent on Pruksa's continued business, leading to more favorable terms and pricing. In 2023, Pruksa's substantial revenue of approximately THB 37.5 billion highlights the significant purchasing volume that strengthens its negotiating position with suppliers.

| Factor | Impact on Pruksa | 2024 Context/Data |

| Supplier Concentration | Higher prices for essential inputs if few suppliers exist | Global steel price volatility impacting material costs |

| Switching Costs | Can increase supplier leverage if high for specialized inputs | Procurement costs in 2023 represented a significant portion of expenses |

| Supplier Forward Integration | Potential for competition from specialized service providers | Thailand's construction market activity in Q1 2024 (THB 150 billion in awarded projects) |

| Pruksa's Scale | Reduced supplier leverage due to dependence on Pruksa's business | 2023 Revenue: THB 37.5 billion |

What is included in the product

This Porter's Five Forces analysis unpacks the competitive intensity faced by Pruksa Real Estate, detailing the power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the Thai property market.

Effortlessly identify and mitigate competitive threats with a dynamic, interactive Porter's Five Forces model tailored for Pruksa Real Estate, offering actionable insights into market pressures.

Customers Bargaining Power

Pruksa Real Estate's customer base exhibits varied price sensitivities, a key factor in their bargaining power. For instance, in the affordable housing segment, where customers often grapple with high household debt and elevated mortgage rejection rates, their sensitivity to price increases significantly amplifies their ability to negotiate better terms. This financial pressure means they have more leverage when seeking the best possible deal.

In 2024, Thailand's household debt to GDP remained a concern, hovering around 85%, which underscores the continued price sensitivity in the lower-income segments of the property market. This persistent economic pressure grants these buyers substantial bargaining power when considering new home purchases from developers like Pruksa.

Recognizing this dynamic, Pruksa has strategically focused on expanding its presence in the mid-to-high-end property segments. This strategic pivot aims to attract buyers who are generally less susceptible to minor price fluctuations. By targeting these less price-sensitive customers, Pruksa seeks to mitigate the direct impact of buyer bargaining power driven by affordability concerns.

The ease with which Pruksa Real Estate's customers can find alternative housing options significantly boosts their bargaining power. When buyers can readily switch to existing properties, rental units, or homes from competing developers, they hold more sway over pricing and terms. This availability of substitutes is a key factor influencing customer leverage.

In 2024, certain condominium segments in Bangkok experienced an oversupply, a trend that directly empowers buyers. This surplus means developers, including Pruksa, face greater pressure to attract customers, giving buyers more room to negotiate. The rental market's growth also presents a viable alternative for many, further enhancing buyer bargaining power.

Buyer information availability significantly impacts the bargaining power of customers in the real estate sector. With widespread access to online property portals, including platforms like PropertyScout and HipFlat in Thailand, buyers can easily compare prices, features, and developer reputations. This transparency allows them to negotiate more effectively with developers such as Pruksa Real Estate.

In 2024, the digital landscape continues to empower real estate consumers. Information on market trends, recent sales data, and even neighborhood amenities is readily accessible, leveling the playing field. Buyers armed with this knowledge can confidently demand better pricing or additional benefits, thereby increasing their leverage in transactions with Pruksa.

Low Switching Costs for Buyers

The bargaining power of Pruksa Real Estate's customers is amplified by low switching costs. Buyers can easily shift their attention to a different property developer or even a different type of housing if they find a more appealing offer or better terms elsewhere. This fluidity in the market directly empowers them to demand more favorable pricing or additional benefits.

In 2024, the Thai real estate market continues to be characterized by intense competition among developers. This competitive landscape further enhances the buyer's ability to switch, as numerous alternatives are readily available. For example, government initiatives such as reductions in property transfer fees, which were notable in certain periods of 2023 and are expected to continue influencing buyer decisions in 2024, effectively lower the financial barrier for buyers looking to change developers.

- Low Switching Costs: Buyers can easily choose alternative developers or properties without incurring significant financial penalties or effort.

- Competitive Market Influence: The abundance of choices in the 2024 Thai real estate market strengthens the buyer's position.

- Government Incentives: Policies like reduced transfer fees further decrease the costs associated with switching developers, boosting buyer power.

Threat of Backward Integration by Buyers

The threat of backward integration by Pruksa Real Estate's customers is generally minimal, particularly for individual homebuyers. These buyers typically lack the capital, expertise, and scale required to develop properties themselves, meaning they are unlikely to pose a significant threat by becoming their own developers.

While individual buyers pose little threat, institutional buyers or large corporate entities could theoretically possess the capacity for backward integration. However, these sophisticated buyers often focus on different market segments or have distinct strategic objectives that do not involve direct property development in the same way Pruksa does.

For example, in 2024, the vast majority of residential property purchases in Thailand, Pruksa's primary market, were made by individuals or families. Pruksa's business model is built around serving this large, fragmented customer base, where the threat of collective backward integration is practically non-existent.

- Individual Buyers: Lack of financial resources and development expertise.

- Institutional Buyers: Focus on different market segments or strategic goals.

- Market Concentration: Pruksa's target market is dominated by individual consumers.

Pruksa Real Estate's customers possess considerable bargaining power, primarily due to the availability of numerous alternatives and low switching costs in the Thai property market. The sheer volume of competing developers and readily available housing options, including rentals, means buyers can easily shift their preference if Pruksa's offers are not competitive. This dynamic is further amplified by government incentives that reduce the financial burden of changing developers.

| Factor | Impact on Pruksa | Supporting Data (2024) |

|---|---|---|

| Price Sensitivity | High, especially in affordable segments | Thailand's household debt to GDP ~85% |

| Availability of Alternatives | Significant, leading to buyer leverage | Condominium oversupply in some Bangkok segments |

| Switching Costs | Low, enhancing buyer negotiation ability | Reduced property transfer fees impacting buyer decisions |

| Information Access | High, empowering buyers with market knowledge | Widespread use of online property portals |

| Backward Integration Threat | Minimal for individual buyers | Individual home purchases dominate Pruksa's market |

Full Version Awaits

Pruksa Real Estate Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of Pruksa Real Estate, detailing the competitive landscape and strategic implications within the Thai property market. The document you see here is the exact, fully formatted analysis you will receive immediately upon purchase, providing actionable insights without any placeholders or alterations. It meticulously examines the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. You're looking at the actual document that will be yours to download and utilize, offering a complete understanding of Pruksa Real Estate's industry positioning.

Rivalry Among Competitors

The Thai real estate market, especially around Bangkok, is quite crowded. You've got big names like AP (Thailand), Sansiri, Supalai, and Land and Houses that have been around for a while and are substantial players. Pruksa is definitely one of the major developers, but it's not operating in a vacuum; it faces stiff competition from these well-established rivals.

The overall growth rate of the Thai real estate market significantly influences competitive rivalry. A decelerating growth environment, as anticipated for 2024 and 2025, fuels intense competition. This slowdown, driven by factors like elevated household debt levels and broader economic uncertainties, forces developers to vie more aggressively for market share. Consequently, Pruksa Real Estate faces heightened pressure from existing players.

Pruksa Real Estate's ability to differentiate its residential offerings significantly impacts competitive rivalry. By emphasizing features like wellness integration, unique design elements, prime locations, and robust after-sales services, Pruksa aims to stand out in a crowded market. For instance, their 'Live well Stay well' concept, focusing on health and well-being, along with targeting specific customer segments, are key differentiation strategies.

Exit Barriers

High exit barriers can significantly intensify competitive rivalry within the real estate sector. These barriers, often involving substantial fixed assets, long-term land bank commitments, or specialized manufacturing facilities like precast concrete factories, can trap companies in markets even when they are not profitable. This situation means that firms may continue operating, adding to the competitive pressure on existing players.

Pruksa Real Estate, for instance, operates a large precast concrete factory. This significant investment represents a considerable fixed asset that would be difficult and costly to divest.

- High Capital Investment: Pruksa's precast factory requires substantial capital, making it an expensive asset to abandon.

- Specialized Nature: The factory's specialized function in construction limits its resale value to other industries.

- Operational Scale: Pruksa's commitment to a large-scale operation suggests a long-term strategic integration, making exit a complex decision.

- Impact on Rivalry: If Pruksa were to face profitability challenges, the difficulty in exiting this asset-heavy operation could force it to maintain market presence, thereby sustaining or even increasing competitive rivalry.

Market Share and Aggressiveness of Rivals

The competitive landscape for Pruksa Real Estate is intensely shaped by the market share and strategic maneuvers of its rivals. AP (Thailand) Public Company Limited, for instance, maintains a significant presence, particularly in the Bangkok Metropolitan Region (BMR), often leading in project launches and market penetration. This dominance forces Pruksa to constantly evaluate its own product offerings and pricing strategies to remain competitive.

Other major developers are also exhibiting aggressive tactics, including frequent new project introductions and dynamic pricing adjustments to capture market share. For example, during 2024, several large developers launched multiple high-profile projects across various segments, from affordable housing to luxury condominiums, directly vying for the same customer base as Pruksa.

These aggressive strategies directly impact Pruksa's ability to secure land for new developments and to attract buyers. The constant influx of new inventory and promotional activities by competitors necessitate a proactive approach from Pruksa, often requiring them to offer attractive incentives or differentiate their projects through unique features and value propositions.

- AP (Thailand) Public Company Limited: A key rival with substantial market share, particularly in the Bangkok Metropolitan Region, frequently launching new projects.

- Aggressive Market Tactics: Competitors are actively engaging in price wars, extensive promotional campaigns, and a high volume of new project launches throughout 2024.

- Impact on Pruksa: These rival actions necessitate strategic adjustments in Pruksa's pricing, product development, and marketing efforts to maintain its competitive edge.

- Market Dynamics: The overall market sees significant activity from large developers, intensifying competition for both customers and prime land acquisition opportunities.

The competitive rivalry within Thailand's real estate sector, particularly for Pruksa Real Estate, is intense due to the presence of established giants like AP (Thailand), Sansiri, Supalai, and Land and Houses. These developers are actively launching numerous projects and employing aggressive pricing strategies throughout 2024, intensifying the battle for market share and customer acquisition.

Pruksa's differentiation efforts, such as its focus on wellness concepts and targeted customer segments, are crucial for standing out. However, high exit barriers, exemplified by Pruksa's significant investment in a precast concrete factory, can compel companies to remain competitive even during challenging periods, further fueling rivalry.

The overall market growth slowdown anticipated for 2024 and 2025 exacerbates this rivalry, as developers are forced to compete more fiercely for a shrinking or slower-growing pool of buyers.

| Key Competitors | Market Focus (Examples) | 2024 Activity (General Trends) |

| AP (Thailand) | Bangkok Metropolitan Region (BMR) | High project launches, strong market penetration |

| Sansiri | Diverse segments, including luxury | Aggressive marketing, new project introductions |

| Supalai | Residential projects across various price points | Dynamic pricing, promotional campaigns |

| Land and Houses | Broad residential portfolio | Strategic land acquisition, competitive offerings |

SSubstitutes Threaten

The primary substitute for Pruksa Real Estate's new residential properties is the rental market. As affordability remains a key concern, especially for first-time buyers and those in lower to middle-income brackets, renting offers a more accessible housing solution. In 2024, for instance, many urban centers experienced a tightening of mortgage lending standards, pushing more individuals towards rental agreements.

Co-living arrangements and short-term rentals also present growing substitutes. These options cater to a demographic seeking flexibility and community, often at a lower upfront cost than homeownership. The increasing popularity of these models, driven by lifestyle trends and economic pressures, directly impacts the demand for traditional new home sales.

The secondary property market presents a significant threat of substitution for Pruksa Real Estate. Buying an existing or resale property offers an alternative to new developments. This market can provide more affordable options, appealing to budget-conscious buyers.

Immediate occupancy is another draw of the secondary market, allowing buyers to move in without waiting for construction. Furthermore, buyers may find more room for negotiation on price and terms in the resale market, potentially securing a better deal than with a new build.

In 2024, the resale property market in Thailand saw continued activity, with some regions experiencing price increases in the secondary market, reflecting demand for established locations and properties. For example, in Bangkok, while new project launches might focus on specific segments, the resale market offers a broader range of price points and established neighborhoods.

Pruksa Real Estate faces the threat of substitutes from consumers choosing different housing types. For instance, a potential buyer might opt for a townhouse rather than a detached house, or even an apartment instead of a townhouse. This decision often hinges on factors like affordability, desired location, or evolving lifestyle needs. In 2024, the average price for a townhouse in many Thai urban areas remained significantly lower than detached homes, making them an attractive substitute for budget-conscious buyers.

Investment in Other Asset Classes

The threat of substitutes for Pruksa Real Estate is significant because real estate is just one of many investment avenues available to capital. Investors constantly compare potential returns across different asset classes. For instance, in early 2024, global equity markets showed robust performance, with the S&P 500 returning over 10% in the first quarter alone, making stocks an attractive alternative to property.

Bonds also present a competitive substitute, particularly as interest rate expectations shift. In mid-2024, yields on U.S. Treasury bonds offered competitive income streams, potentially drawing funds away from real estate investments that might offer lower or less predictable yields. This competition for investor capital directly impacts demand for Pruksa's developments.

Mutual funds and exchange-traded funds (ETFs) provide diversified exposure to various sectors, including real estate but also technology, healthcare, and more. The ease of access and professional management offered by these funds can make them more appealing than direct property investment for many. The total assets under management in U.S. ETFs surpassed $15 trillion by the end of 2023, highlighting their significant draw on investment capital.

- Real Estate as One of Many Investment Choices: Investors can allocate capital to stocks, bonds, mutual funds, commodities, or even alternative assets, each offering different risk-return profiles.

- Performance of Substitute Assets: In early 2024, the S&P 500's Q1 return exceeded 10%, demonstrating the strong performance of equities as an alternative investment.

- Bond Yield Competitiveness: Mid-2024 saw attractive yields on U.S. Treasury bonds, presenting a viable income-generating substitute for real estate investments.

- Diversification through Funds: Mutual funds and ETFs offer diversified investment opportunities, with U.S. ETF assets exceeding $15 trillion by late 2023, indicating substantial capital allocation away from single asset classes like direct real estate.

Geographical Relocation

While Pruksa Real Estate primarily operates within Thailand, a significant threat of substitutes can emerge from geographical relocation. Potential buyers, particularly those sensitive to cost, may opt to move to areas outside Pruksa's core development regions. This includes exploring properties in provincial areas of Thailand or even considering international locations if the overall cost of living and property ownership in Thailand, especially in prime areas where Pruksa focuses, becomes too high. This is particularly relevant as global mobility and remote work trends continue to evolve.

The attractiveness of relocation as a substitute is amplified by differing economic conditions and property values. For instance, while Bangkok and its surrounding areas, key markets for Pruksa, might experience rising property prices, other regions in Thailand or even neighboring countries could offer more affordable alternatives. In 2023, the average property price in Bangkok metropolitan area remained significantly higher than in many provincial regions, presenting a clear economic incentive for some buyers to look elsewhere.

- Relocation to lower-cost domestic regions: Buyers may seek more affordable housing options in Thailand's provinces, moving away from Pruksa's primary urban and suburban development zones.

- International relocation: The possibility of buyers choosing to live abroad due to cost or lifestyle factors represents another form of substitution, especially for expatriates or those with global investment interests.

- Economic sensitivity: Buyers prioritizing affordability are more likely to consider relocation if property prices in Pruksa's target markets become prohibitive.

The threat of substitutes for Pruksa Real Estate is multifaceted, encompassing both alternative housing solutions and different investment vehicles. The rental market remains a primary substitute, especially for budget-conscious buyers, as evidenced by tightening mortgage standards in urban areas during 2024. Additionally, co-living and short-term rentals offer flexible, lower-upfront-cost alternatives that appeal to a growing demographic. The resale property market also poses a significant threat, providing more affordable options and immediate occupancy, with continued activity in 2024 demonstrating buyer preference for established locations and negotiable pricing.

Beyond direct housing alternatives, capital itself can substitute for real estate investment. In early 2024, the S&P 500's robust performance, exceeding 10% in Q1, highlighted the allure of equities. Similarly, attractive yields on U.S. Treasury bonds in mid-2024 offered competitive income streams, potentially diverting investment from property. The vast scale of mutual funds and ETFs, with U.S. ETF assets surpassing $15 trillion by late 2023, further underscores the competition for investment capital, as these vehicles offer diversified and accessible alternatives to direct property ownership.

| Substitute Type | Key Characteristics | 2024/Recent Data Point | Impact on Pruksa |

|---|---|---|---|

| Rental Market | Affordability, Flexibility | Tightened mortgage lending standards in urban centers | Reduces demand for new home purchases, particularly for first-time buyers. |

| Resale Properties | Lower Price Points, Immediate Occupancy, Negotiation Potential | Continued market activity in Thailand, with some price increases in established areas. | Offers a direct alternative to new builds, potentially capturing buyers seeking value or faster occupancy. |

| Alternative Investments (Equities) | Higher Potential Returns, Diversification | S&P 500 returned over 10% in Q1 2024. | Draws capital away from real estate, impacting overall investment demand. |

| Alternative Investments (Bonds) | Competitive Yields, Income Generation | Attractive yields on U.S. Treasury bonds in mid-2024. | Presents an income-focused alternative for investors, potentially reducing real estate allocation. |

| Diversified Funds (ETFs/Mutual Funds) | Diversification, Professional Management, Accessibility | U.S. ETF assets exceeded $15 trillion by late 2023. | Captures significant investment capital, offering broader market exposure than single property investments. |

Entrants Threaten

The real estate development industry, particularly for large-scale projects like those Pruksa Real Estate undertakes, demands substantial upfront capital. This includes the hefty costs associated with acquiring prime land, covering extensive construction expenses, and significant marketing efforts to reach target buyers. For instance, in 2024, major residential developments often require hundreds of millions, if not billions, of dollars in initial investment, a figure that naturally deters smaller players lacking robust financial backing.

New entrants to the real estate market, particularly in Thailand, face significant hurdles in acquiring desirable land banks. Established developers like Pruksa Real Estate have cultivated strong relationships with landowners and possess extensive, strategically located land portfolios, making it difficult for newcomers to secure prime development sites. This limited access to land is a major barrier to entry.

Furthermore, gaining access to effective distribution channels for sales and marketing is a substantial challenge. Pruksa, with its long-standing presence, has developed robust sales networks, brand recognition, and customer loyalty. New entrants must invest heavily to build comparable channels, which can be costly and time-consuming, especially when competing against a developer that reported a net profit of 4.8 billion Thai Baht in 2023.

Pruksa Real Estate capitalizes on significant economies of scale across its operations, from bulk material procurement to large-scale marketing campaigns. This allows them to drive down per-unit costs, making their offerings more competitive.

New, smaller players entering the market would find it incredibly difficult to match Pruksa's cost efficiencies. Without the sheer volume of projects Pruksa undertakes, these entrants would face higher per-unit expenses in construction, sourcing materials, and advertising, placing them at an immediate disadvantage.

For instance, in 2024, Pruksa's extensive pipeline of over 20,000 units across numerous projects enabled them to negotiate favorable terms with suppliers, a feat unattainable for a startup building only a handful of homes.

This cost advantage, stemming from their scale, acts as a substantial barrier to entry, deterring potential new competitors from entering the market effectively.

Government Policy and Regulations

Government policies and regulations significantly impact the threat of new entrants in the real estate sector. Zoning laws, building permits, and environmental regulations can create substantial hurdles, requiring new companies to invest heavily in compliance and expertise. For instance, in 2024, Thailand's government continued to implement measures aimed at boosting the property market, such as tax incentives for certain housing types. However, these same policies, while beneficial for the industry overall, also establish a complex regulatory landscape that can be challenging for nascent businesses to navigate effectively and affordably.

The complexity of obtaining necessary approvals and adhering to evolving building codes and land use rules acts as a natural barrier. New entrants often lack the established relationships and internal processes that existing firms possess to expedite these procedures. This can lead to extended project timelines and increased upfront costs, thereby deterring potential new competitors from entering the market.

- Regulatory Hurdles: Navigating zoning, permits, and environmental standards requires significant expertise and capital.

- Policy Impact: Government stimulus measures, while helpful, also define market rules that new players must master.

- Compliance Costs: Adhering to building codes and land use policies can be expensive and time-consuming for new entrants.

Brand Loyalty and Differentiation

Established developers like Pruksa Real Estate have cultivated strong brand loyalty, making it challenging for new entrants to gain traction. This loyalty is built through consistent quality, reliable delivery, and a deep understanding of customer needs, factors that require substantial time and resources for newcomers to replicate. For instance, in 2024, Pruksa Real Estate continued to leverage its established brand, which has been a cornerstone of its market position for decades.

New companies entering the market would need to invest heavily in marketing and product differentiation to even begin to challenge Pruksa's established reputation. Without a clear unique selling proposition and significant brand building efforts, potential customers are likely to stick with familiar and trusted developers. This barrier is amplified by the fact that real estate purchases are often significant life decisions, where trust and brand recognition play a crucial role.

- Brand Recognition: Pruksa's long-standing presence in the market has resulted in widespread name recognition among homebuyers.

- Customer Loyalty Programs: Loyalty is fostered through repeat business and positive word-of-mouth, often incentivized by developer programs.

- Differentiation Costs: New entrants must allocate significant capital to branding, unique project designs, and innovative features to stand out.

- Market Trust: Years of successful project delivery build trust, a critical factor that new entrants must earn from scratch.

The threat of new entrants for Pruksa Real Estate is significantly low due to the immense capital requirements for land acquisition and development. In 2024, major real estate projects often demanded hundreds of millions of dollars, a figure that naturally deters smaller, less capitalized competitors.

Established relationships with landowners and existing land banks held by developers like Pruksa create a formidable barrier. Newcomers struggle to secure prime development sites, a critical factor in market entry. Pruksa's strong sales networks and brand recognition, built over decades, also present a significant challenge for new players attempting to establish a market presence.

| Barrier | Impact on New Entrants | Pruksa's Advantage |

|---|---|---|

| Capital Requirements | High upfront costs for land and construction deter new firms. | Substantial financial resources and access to financing. |

| Land Acquisition | Difficulty securing prime land due to existing developer control. | Extensive, strategically located land portfolios and landowner relationships. |

| Brand Recognition & Sales Channels | Need for heavy investment in marketing and distribution to compete. | Established brand loyalty, robust sales networks, and customer trust. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Pruksa Real Estate leverages data from Pruksa's annual reports, investor presentations, and public financial filings to understand internal strategies and performance.

We supplement this with industry-specific market research reports from reputable firms, government housing statistics, and economic indicators to assess the broader competitive landscape and market trends.