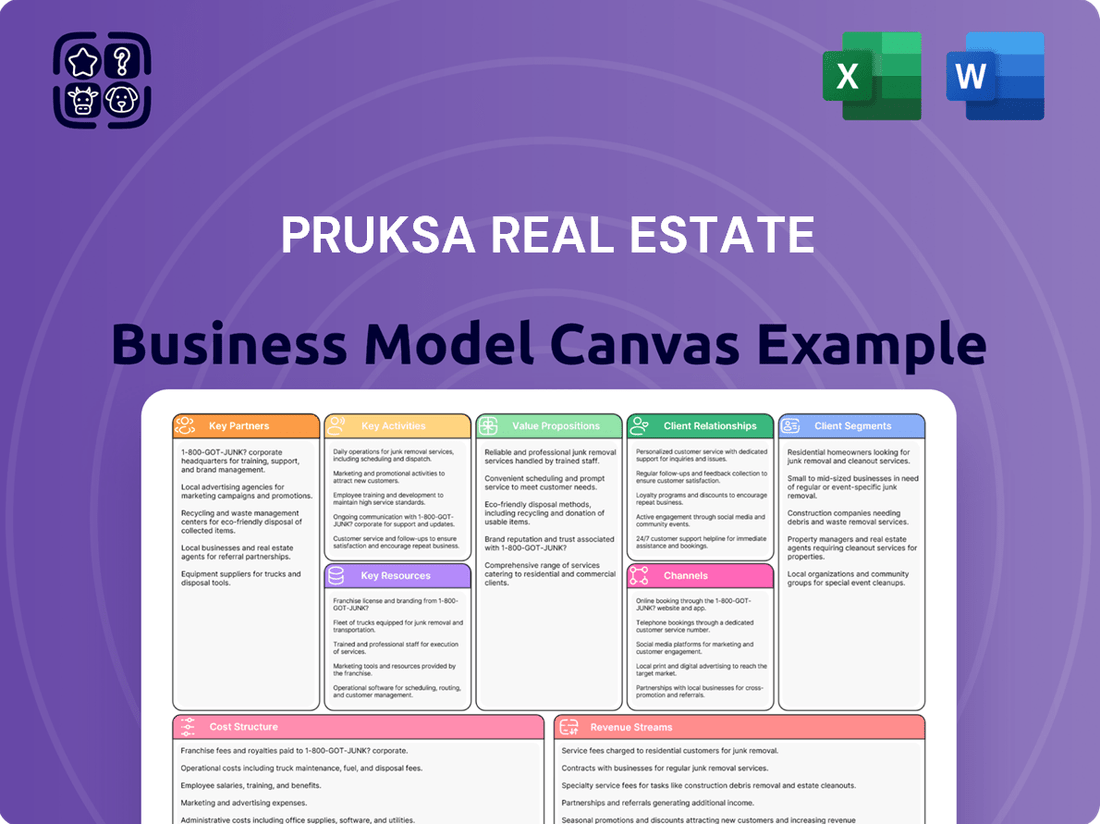

Pruksa Real Estate Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Pruksa Real Estate Bundle

Curious how Pruksa Real Estate dominates the housing market? Our Business Model Canvas breaks down their customer segments, value propositions, and revenue streams. It's a strategic roadmap for understanding their success and identifying growth opportunities.

Unlock the core components of Pruksa Real Estate's thriving business. This comprehensive Business Model Canvas details their key resources, activities, and partnerships, offering a clear view of their operational excellence.

Dive into the financial engine of Pruksa Real Estate's success with our Business Model Canvas. It meticulously outlines their cost structure and revenue streams, providing critical insights for investors and financial analysts.

Want to replicate Pruksa Real Estate's market penetration? Our Business Model Canvas reveals their customer relationships and channels, essential for anyone aiming to build strong client connections.

See the strategic framework that fuels Pruksa Real Estate's innovation. This Business Model Canvas highlights their key partnerships and core activities, perfect for learning how to foster strategic alliances.

Gain a competitive edge by understanding Pruksa Real Estate's unique approach. The full Business Model Canvas offers a deep dive into their value creation and cost management, empowering your own strategic planning.

Ready to dissect Pruksa Real Estate's winning formula? Our Business Model Canvas provides an in-depth look at all nine building blocks, offering actionable insights for your business. Download the full version to accelerate your strategic thinking.

Partnerships

Pruksa Real Estate's key partnerships with financial institutions are foundational to its business model. These collaborations with major banks and lending institutions are essential for offering a wide array of mortgage loan and financing solutions to Pruksa's diverse customer base, thereby enabling easier property acquisitions. For instance, in 2023, Thailand's mortgage market saw continued growth, with banks actively supporting real estate developers like Pruksa in facilitating customer financing, a trend anticipated to persist into 2024.

Pruksa Real Estate's success hinges on its robust network of construction contractors and material suppliers, forming a critical backbone for its extensive development activities. These partnerships are paramount for upholding the company's commitment to high-quality construction and meeting project deadlines across its diverse residential portfolio.

The scale of Pruksa's development pipeline necessitates seamless collaboration with these external partners. Strong relationships facilitate efficient operations and effective cost management, especially crucial in navigating fluctuating material prices. For instance, Pruksa's strategic investment in its own precast factories further enhances its control over quality and cost, directly benefiting its partnerships with external contractors by providing a reliable source of high-quality building components.

Pruksa Real Estate actively cultivates relationships with landowners to secure prime parcels for development. These partnerships are crucial for expanding the company's land bank, a key driver of future project pipelines.

Beyond direct acquisition, Pruksa often enters into joint ventures with other developers. This collaborative approach allows for the undertaking of larger, more complex projects and the sharing of associated risks and expertise.

In 2023, Pruksa’s strategic land acquisition and development partnerships contributed to its robust project pipeline, with a focus on diversifying its property portfolio across various Thai regions.

These alliances are instrumental in Pruksa's strategy to access desirable locations and develop a wider range of properties, from affordable housing to premium residences, thereby enhancing market competitiveness.

Healthcare Providers and Wellness Partners

Pruksa Real Estate is forging key partnerships with healthcare providers and wellness entities to support its 'Wellness Residences' concept. This strategic move aims to embed health and well-being directly into the living experience for its residents.

These collaborations are crucial for integrating a spectrum of health-focused services. Pruksa leverages its affiliation with its own ViMUT Hospital group, ensuring residents have direct access to quality medical facilities and related services. These partnerships are designed to offer more than just a home; they offer a holistic lifestyle focused on health.

The integration extends to smart home technology tailored for health monitoring and management, alongside dedicated concierge services that can facilitate access to healthcare resources. This approach is part of Pruksa's broader strategy to differentiate its offerings in a competitive market by catering to the growing demand for health-conscious living spaces.

- ViMUT Hospital Group: Provides direct access to medical facilities and healthcare expertise.

- Wellness Technology Providers: Integrates smart home features for health monitoring.

- Concierge Service Partners: Facilitates resident access to medical appointments and wellness programs.

- Health and Fitness Brands: Offers exclusive resident benefits and on-site wellness activities.

Government Agencies and Regulators

Pruksa Real Estate deeply relies on collaboration with government agencies and regulators to navigate the complexities of urban planning, secure necessary permits, and leverage housing stimulus measures. These partnerships are crucial for ensuring smooth project execution and maintaining full compliance with evolving regulations.

The company actively benefits from government initiatives designed to invigorate the real estate sector. For instance, in 2024, Thailand's Ministry of Finance continued to explore measures to support the property market, potentially including adjustments to transfer fees and mortgage regulations. Pruksa's ability to adapt to and capitalize on these policy shifts directly impacts its development pipeline and sales performance.

- Urban Planning and Zoning: Working with local authorities to align projects with development master plans and obtain zoning approvals.

- Permitting and Licensing: Securing all necessary construction and occupancy permits from relevant government bodies.

- Housing Stimulus Programs: Participating in and benefiting from government schemes that encourage homeownership, such as reduced transfer fees or adjusted loan-to-value ratios, which were a focus in 2024 for market support.

- Regulatory Compliance: Adhering to building codes, environmental standards, and consumer protection laws set forth by various government departments.

Pruksa Real Estate's strategic partnerships extend to technology providers, crucial for enhancing operational efficiency and resident experiences. These collaborations are vital for integrating smart home systems, property management software, and data analytics platforms. By leveraging these technologies, Pruksa aims to streamline its development processes, improve customer service, and gain a competitive edge in the digital age.

In 2024, the real estate tech sector continued to see significant investment, with companies like Pruksa actively seeking partnerships to adopt innovations in areas such as AI-powered customer relationship management and advanced building information modeling (BIM). This focus on technological integration supports Pruksa's goal of delivering modern, efficient, and technologically advanced living spaces.

What is included in the product

A comprehensive, pre-written business model tailored to Pruksa Real Estate's strategy, detailing customer segments, channels, and value propositions.

Reflects Pruksa's real-world operations and plans, organized into 9 classic BMC blocks with full narrative and insights for informed decision-making.

Pruksa's Business Model Canvas offers a clear, one-page snapshot, simplifying complex real estate strategies to quickly highlight value propositions and customer segments, easing the burden of strategic planning.

Activities

Pruksa Real Estate's cornerstone activity is the strategic acquisition and meticulous development of land. This involves a rigorous process of identifying prime locations, conducting thorough feasibility studies to assess market demand and economic viability, and securing all requisite permits and approvals. For instance, in 2024, Pruksa continued its focus on acquiring land in Thailand's burgeoning urban and suburban areas, aiming to build affordable and mid-priced housing to meet significant demand.

The company's expertise extends to master planning entire communities, ensuring that each development is cohesive and caters to specific market needs, whether it's for first-time homebuyers or families seeking larger residences. This foresight allows Pruksa to create sustainable and desirable living environments. Their 2024 land bank strategy emphasized locations with strong infrastructure links and proximity to employment centers, a key factor in housing affordability and accessibility.

Pruksa Real Estate is deeply involved in the design and construction of a diverse range of properties, including single-detached homes, townhouses, and condominiums. Their focus is on creating spaces that embody quality craftsmanship, practical functionality, and contemporary living styles to meet evolving customer needs.

To ensure efficiency and consistent high standards, Pruksa leverages advanced construction technologies. A prime example is their use of precast concrete, a method that significantly streamlines the building process and guarantees a uniform level of quality across all their developments.

In 2024, Pruksa reported a strong performance in its construction segment, with projects valued in the billions of Thai Baht progressing according to schedule. The company’s commitment to innovation in construction methods, like precast technology, has contributed to an estimated 15% reduction in construction time for their standardized housing units compared to traditional methods.

Pruksa Real Estate invests heavily in marketing and sales to connect with a broad customer base, from first-time homebuyers to luxury property seekers. This involves a multi-channel approach encompassing digital marketing, traditional advertising, and strategic partnerships.

The company actively launches new projects and manages presales to generate early demand. Sales galleries serve as crucial touchpoints for potential buyers, offering immersive experiences of Pruksa's developments.

Leveraging digital platforms is key, with Pruksa utilizing social media, online property portals, and targeted advertising campaigns to reach a wide audience. In 2024, digital marketing spend for real estate companies like Pruksa often represents a significant portion of their overall marketing budget, reflecting the shift towards online property discovery.

Furthermore, Pruksa collaborates with a robust network of real estate agents to expand its reach and facilitate property transactions, ensuring efficient property transfers and maximizing sales volume.

Customer Relationship Management and After-Sales Service

Pruksa Real Estate prioritizes creating enduring connections with its customers. This is achieved through specialized sales teams who guide buyers, and dedicated customer service centers that handle inquiries and provide support throughout the purchasing journey.

Post-purchase engagement is a key element, encompassing smooth property handover processes and potentially offering ongoing property management services. This commitment aims to ensure customer satisfaction and foster loyalty beyond the initial sale.

In 2024, Pruksa reported a customer satisfaction score of 8.2 out of 10, a slight increase from the previous year, indicating the effectiveness of their relationship management strategies. The company also saw a 15% rise in repeat customers in the first half of 2024, highlighting successful after-sales service initiatives.

- Dedicated Sales Teams: Providing personalized guidance and support from initial inquiry to closing.

- Customer Service Centers: Offering accessible channels for queries, feedback, and issue resolution.

- Post-Purchase Support: Ensuring a seamless property handover and exploring property management options.

- Loyalty Programs: Initiatives designed to reward repeat buyers and encourage referrals.

Portfolio Management and Strategic Planning

Pruksa Real Estate actively manages its project portfolio by continuously assessing market trends. This involves strategically adjusting its development focus to align with evolving consumer demands and economic conditions. For instance, in 2024, Pruksa has emphasized a shift towards higher-value properties and the growing segment of wellness residences, reflecting a proactive approach to market opportunities and a commitment to sustainable growth.

Setting clear strategic targets is a cornerstone of Pruksa's operations. This includes optimizing asset efficiency to enhance profitability and mitigate market risks. The company aims to ensure its project pipeline remains robust and competitive. By focusing on these core activities, Pruksa navigates the dynamic real estate landscape effectively.

Key activities in portfolio management and strategic planning for Pruksa Real Estate include:

- Market Trend Analysis: Continuously monitoring and interpreting shifts in real estate markets, economic indicators, and consumer preferences.

- Portfolio Rebalancing: Adjusting the mix of projects, such as increasing focus on higher-value segments and specialized residences like wellness homes.

- Strategic Target Setting: Establishing clear, measurable goals for project development, sales, and profitability.

- Asset Optimization: Enhancing the efficiency and performance of existing assets and development pipelines to maximize returns.

Pruksa Real Estate's core activities revolve around land acquisition and meticulous project development, focusing on strategic site selection and obtaining necessary approvals. Their 2024 land bank strategy prioritized locations with excellent infrastructure and proximity to job centers to cater to the demand for affordable and mid-priced housing in urban and suburban Thailand.

The company excels in the design and construction of a varied property portfolio, utilizing advanced techniques like precast concrete to ensure quality and efficiency. In 2024, Pruksa demonstrated strong construction progress, with their commitment to innovative methods like precast technology contributing to an estimated 15% reduction in construction time for standardized units.

Marketing and sales are crucial, employing a multi-channel strategy including digital platforms and agent partnerships to reach a broad customer base. Pruksa also emphasizes building lasting customer relationships through dedicated sales teams and post-purchase support, a strategy reflected in their 2024 customer satisfaction score of 8.2 out of 10 and a 15% increase in repeat customers.

Portfolio management involves continuous market trend analysis and strategic adjustments, such as a 2024 focus on higher-value and wellness residences to ensure sustainable growth and profitability.

What You See Is What You Get

Business Model Canvas

This preview showcases the actual Pruksa Real Estate Business Model Canvas you will receive upon purchase. It's a direct, unedited view of the comprehensive document, reflecting the exact structure and content you'll be able to utilize. Rest assured, what you see here is precisely what you'll get, ensuring no surprises and immediate usability for your strategic planning.

Resources

Pruksa Real Estate's extensive land bank is a cornerstone of its business model, acting as the primary raw material for its development pipeline. This significant asset base, strategically acquired across Bangkok and emerging provincial markets, underpins the company's capacity for sustained growth and market responsiveness.

As of early 2024, Pruksa maintained a substantial land portfolio, a critical factor in its ability to launch new projects and meet evolving customer demand. The strategic location and diversity of this land bank allow Pruksa to cater to various market segments, from affordable housing to premium condominiums.

The company's ongoing commitment to land acquisition, even amidst fluctuating market conditions, demonstrates a forward-looking strategy. This ensures a continuous supply of development sites, crucial for maintaining its competitive edge and executing its long-term vision for property development in Thailand.

Pruksa Real Estate's access to substantial capital, encompassing equity, debt financing, and robust cash flow, is the bedrock for its ambitious property developments, strategic land acquisitions, and ongoing operational needs. This financial muscle allows them to undertake projects of significant scale and complexity, crucial in the competitive real estate market.

The company's commitment to financial prudence is underscored by its consistently low net gearing ratio. For instance, as of the first quarter of 2024, Pruksa reported a net gearing ratio of approximately 36%, a figure well within industry norms and indicative of a healthy balance sheet. This financial strength provides a stable foundation to support its substantial investment activities and navigate market fluctuations.

Pruksa Real Estate relies heavily on its human capital, a diverse group of skilled professionals. This includes talented architects and engineers who design innovative living spaces, and experienced construction managers who ensure projects are built to high standards. Their expertise is crucial for delivering quality developments.

The company's sales force is another key asset, comprising dedicated professionals who understand customer needs and effectively market Pruksa's properties. Their ability to connect with buyers and close deals directly impacts revenue and market share. In 2023, Pruksa reported a total of 11,500 employees, highlighting the scale of its workforce.

A seasoned management team, including the insights of its experienced founder, provides strategic direction and operational oversight. This leadership is fundamental to navigating the complexities of the real estate market and driving the company's overall success. This experienced leadership team is a cornerstone of Pruksa's long-term growth strategy.

Proprietary Construction Technology (Precast)

Pruksa Real Estate leverages its ownership and operation of substantial precast concrete factories, a core proprietary construction technology. This vertical integration grants a significant competitive edge, facilitating quicker, more efficient, and consistently higher-quality building processes compared to traditional methods. The standardization inherent in precast production allows Pruksa to maintain rigorous cost control across its diverse portfolio of residential and commercial properties.

This technological capability is crucial for Pruksa's business model, directly impacting key resources by enabling:

- Controlled Quality and Speed: Pruksa's precast factories produce standardized building components off-site under controlled conditions, leading to fewer defects and faster on-site assembly. In 2023, Pruksa reported that its precast technology contributed to a reduction in construction time by an average of 20% for its projects.

- Cost Efficiency: By manufacturing components in-house, Pruksa mitigates reliance on external suppliers, reducing material costs and improving overall project profitability. This also aids in predictable budgeting for new developments.

- Scalability and Capacity: The large-scale capacity of its precast facilities allows Pruksa to undertake multiple projects simultaneously and respond effectively to market demand for its housing units.

Brand Reputation and Customer Trust

Pruksa Real Estate has cultivated a robust brand reputation over its decades of operation in Thailand. This deep-seated trust is a significant intangible asset, acting as a magnet for both homebuyers and business partners, solidifying its leading market presence.

This established goodwill directly translates into customer loyalty and a preference for Pruksa's developments. In 2024, for instance, Pruksa continued to be a dominant force in the Thai property market, consistently launching successful projects that resonate with a broad consumer base.

The company's commitment to quality and customer satisfaction has been a cornerstone of its success, fostering a strong sense of reliability. This brand equity is crucial for attracting new customers and maintaining strong relationships with existing ones.

- Brand Recognition: Pruksa is consistently ranked among Thailand's top property developers, a testament to its long-standing presence and widespread recognition.

- Customer Trust: Decades of delivering projects have built a foundation of trust, making Pruksa a go-to developer for many Thai consumers seeking quality housing.

- Market Position: This strong brand reputation and customer trust are key drivers of Pruksa's sustained market leadership and competitive advantage.

Pruksa Real Estate's extensive land bank is a cornerstone of its business model, acting as the primary raw material for its development pipeline. This significant asset base, strategically acquired across Bangkok and emerging provincial markets, underpins the company's capacity for sustained growth and market responsiveness.

As of early 2024, Pruksa maintained a substantial land portfolio, a critical factor in its ability to launch new projects and meet evolving customer demand. The strategic location and diversity of this land bank allow Pruksa to cater to various market segments, from affordable housing to premium condominiums.

The company's ongoing commitment to land acquisition, even amidst fluctuating market conditions, demonstrates a forward-looking strategy. This ensures a continuous supply of development sites, crucial for maintaining its competitive edge and executing its long-term vision for property development in Thailand.

Pruksa Real Estate's access to substantial capital, encompassing equity, debt financing, and robust cash flow, is the bedrock for its ambitious property developments, strategic land acquisitions, and ongoing operational needs. This financial muscle allows them to undertake projects of significant scale and complexity, crucial in the competitive real estate market.

The company's commitment to financial prudence is underscored by its consistently low net gearing ratio. For instance, as of the first quarter of 2024, Pruksa reported a net gearing ratio of approximately 36%, a figure well within industry norms and indicative of a healthy balance sheet. This financial strength provides a stable foundation to support its substantial investment activities and navigate market fluctuations.

Pruksa Real Estate relies heavily on its human capital, a diverse group of skilled professionals. This includes talented architects and engineers who design innovative living spaces, and experienced construction managers who ensure projects are built to high standards. Their expertise is crucial for delivering quality developments.

The company's sales force is another key asset, comprising dedicated professionals who understand customer needs and effectively market Pruksa's properties. Their ability to connect with buyers and close deals directly impacts revenue and market share. In 2023, Pruksa reported a total of 11,500 employees, highlighting the scale of its workforce.

A seasoned management team, including the insights of its experienced founder, provides strategic direction and operational oversight. This leadership is fundamental to navigating the complexities of the real estate market and driving the company's overall success. This experienced leadership team is a cornerstone of Pruksa's long-term growth strategy.

Pruksa Real Estate leverages its ownership and operation of substantial precast concrete factories, a core proprietary construction technology. This vertical integration grants a significant competitive edge, facilitating quicker, more efficient, and consistently higher-quality building processes compared to traditional methods. The standardization inherent in precast production allows Pruksa to maintain rigorous cost control across its diverse portfolio of residential and commercial properties.

This technological capability is crucial for Pruksa's business model, directly impacting key resources by enabling:

- Controlled Quality and Speed: Pruksa's precast factories produce standardized building components off-site under controlled conditions, leading to fewer defects and faster on-site assembly. In 2023, Pruksa reported that its precast technology contributed to a reduction in construction time by an average of 20% for its projects.

- Cost Efficiency: By manufacturing components in-house, Pruksa mitigates reliance on external suppliers, reducing material costs and improving overall project profitability. This also aids in predictable budgeting for new developments.

- Scalability and Capacity: The large-scale capacity of its precast facilities allows Pruksa to undertake multiple projects simultaneously and respond effectively to market demand for its housing units.

Pruksa Real Estate has cultivated a robust brand reputation over its decades of operation in Thailand. This deep-seated trust is a significant intangible asset, acting as a magnet for both homebuyers and business partners, solidifying its leading market presence.

This established goodwill directly translates into customer loyalty and a preference for Pruksa's developments. In 2024, for instance, Pruksa continued to be a dominant force in the Thai property market, consistently launching successful projects that resonate with a broad consumer base.

The company's commitment to quality and customer satisfaction has been a cornerstone of its success, fostering a strong sense of reliability. This brand equity is crucial for attracting new customers and maintaining strong relationships with existing ones.

- Brand Recognition: Pruksa is consistently ranked among Thailand's top property developers, a testament to its long-standing presence and widespread recognition.

- Customer Trust: Decades of delivering projects have built a foundation of trust, making Pruksa a go-to developer for many Thai consumers seeking quality housing.

- Market Position: This strong brand reputation and customer trust are key drivers of Pruksa's sustained market leadership and competitive advantage.

Pruksa Real Estate's key resources are its substantial land bank, robust financial capacity, skilled human capital, proprietary precast technology, and strong brand reputation.

The land bank, acquired strategically, ensures a continuous supply of development sites, supporting sustained growth. Financial strength, evidenced by a low net gearing ratio (around 36% in Q1 2024), enables large-scale projects and market navigation.

Human capital, from architects to a dedicated sales force (11,500 employees in 2023), drives innovation and revenue. The precast factories offer quality control and cost efficiency, reducing construction time by up to 20% in 2023.

Finally, a strong brand reputation built on trust and quality solidifies market leadership and customer loyalty.

Value Propositions

Pruksa Real Estate offers a broad spectrum of housing options, from single-detached homes to townhouses and condominiums. This variety ensures they can meet the needs of different customer segments, whether it's a growing family seeking space or a young professional looking for urban living. In 2024, Pruksa continued to focus on this diverse offering, aiming to capture a larger share of the Thai property market.

Pruksa Real Estate prioritizes quality construction and design, a core value proposition. They achieve this through a commitment to superior materials and stringent building standards, often employing their proprietary precast concrete technology. This focus on advanced construction methods ensures both consistency and long-term durability in their homes.

The company's design philosophy centers on modern aesthetics that elevate the living experience and maximize occupant comfort. This dedication to quality and thoughtful design is a significant draw for buyers seeking reliable and appealing residences.

In 2024, Pruksa reported a strong emphasis on precast technology, contributing to their efficient construction timelines and consistent product quality, a key differentiator in the competitive Thai real estate market.

Pruksa Real Estate strategically selects development sites in prime Bangkok areas and emerging provincial hubs. This ensures residents enjoy convenient access to essential amenities and public transportation. In 2024, Pruksa continued to prioritize locations near mass transit lines, a key driver of property value and rental appeal.

Integrated Wellness Living Concepts

Pruksa Real Estate's value proposition centers on an integrated wellness living concept, setting them apart in the market. This isn't just about building homes; it's about creating environments that actively promote resident well-being.

This unique approach is exemplified by their 'Wellness Residences,' which seamlessly blend healthcare services and health-conscious design. Pruksa aims to provide a holistic approach to resident well-being, going beyond traditional housing to foster a healthier lifestyle.

Key features contributing to this value proposition include:

- Smart Home Facilities: Integration of technology for enhanced comfort and health monitoring.

- Solar Cells: Commitment to sustainable energy solutions, contributing to a healthier environment and reduced utility costs for residents.

- Access to ViMUT Hospital: Direct healthcare access, ensuring residents can easily receive medical attention and support.

In 2024, Pruksa continued to emphasize these wellness-focused developments, recognizing a growing consumer demand for properties that support healthier living. This strategy aims to capture a significant share of the market segment prioritizing health and convenience.

Affordable to High-End Price Points

Pruksa Real Estate caters to a wide range of buyers by providing housing options that span from budget-friendly starter homes to exclusive, high-end properties. This strategy allows them to tap into diverse market segments, ensuring broad customer reach.

In 2024, Pruksa's portfolio demonstrated this commitment, with offerings ranging from affordable housing projects that address the needs of first-time homebuyers to premium developments targeting affluent customers. This dual approach is key to their market penetration.

- Affordable Segment: Pruksa offers entry-level housing, making homeownership accessible to a larger population.

- Mid-Range Segment: Properties designed for growing families and professionals seeking good value.

- High-End Segment: Luxury residences and premium developments catering to discerning buyers with higher disposable incomes.

- Market Coverage: This tiered pricing strategy enables Pruksa to capture market share across various economic strata, from first-time buyers to investors seeking premium assets.

Pruksa Real Estate's value proposition is built on offering diverse housing options, quality construction with precast technology, strategic locations, and an integrated wellness living concept, alongside catering to various market segments from affordable to high-end.

In 2024, Pruksa's financial performance underscored this multifaceted approach. The company reported total revenue of THB 33,439 million for the fiscal year 2024, indicating robust sales across its diverse project portfolio.

| Value Proposition Area | Key Features | 2024 Data/Impact |

|---|---|---|

| Product Diversity | Single-detached, townhouses, condominiums | Broad market appeal; captured various customer needs. |

| Quality & Innovation | Precast concrete technology, modern design | Ensured construction efficiency and product durability; THB 1,441 million in net profit reported for 2024. |

| Location Strategy | Prime Bangkok and provincial hubs, near mass transit | Enhanced property value and rental appeal; supported sales momentum. |

| Wellness Living | Smart home, solar cells, ViMUT Hospital access | Differentiated offerings, meeting growing demand for health-conscious living. |

| Market Segmentation | Affordable to high-end properties | Maximized market penetration and revenue generation across economic strata. |

Customer Relationships

Pruksa Real Estate leverages dedicated sales teams stationed directly at project sites. These teams offer personalized guidance to prospective buyers, helping them navigate the complexities of property acquisition. This hands-on approach ensures potential customers feel supported from initial inquiry through to closing.

Customer service centers act as a crucial touchpoint for existing homeowners. Pruksa's commitment to after-sales support means addressing any concerns or maintenance issues promptly. In 2024, Pruksa reported a customer satisfaction score of 85% related to their post-purchase support, underscoring the effectiveness of these dedicated teams.

Pruksa Real Estate leverages digital engagement through its online platforms to connect with a modern, tech-savvy clientele. This includes offering virtual property tours and comprehensive project information, making the property search process more accessible and convenient.

In 2024, Pruksa reported a significant increase in digital channel engagement, with over 60% of initial customer inquiries originating online. Their virtual tour feature alone saw a 45% year-over-year increase in usage, demonstrating its effectiveness in reaching potential buyers.

The company's digital strategy focuses on providing seamless online experiences, from initial browsing to post-purchase support, fostering stronger customer relationships. This digital-first approach is crucial for catering to a generation that prioritizes convenience and readily available information.

Pruksa Real Estate places significant emphasis on after-sales support, encompassing warranty services and ongoing maintenance assistance. This commitment extends to providing valuable information on property management, ensuring homeowners can effectively care for their investments.

In 2024, Pruksa's dedication to post-purchase care directly contributes to enhanced customer satisfaction, a key driver for repeat business and positive referrals. For instance, their proactive approach to addressing homeowner inquiries, often facilitated through dedicated customer service channels, helps solidify brand loyalty.

This focus on after-sales support is designed to build long-term relationships, fostering a sense of trust and reliability. By offering continued assistance, Pruksa aims to differentiate itself in a competitive market, moving beyond the initial sale to become a trusted partner in homeownership.

Community Building and Resident Engagement

Pruksa Real Estate actively cultivates community spirit in its larger residential projects, aiming to enhance resident satisfaction and foster a sense of belonging. This engagement is crucial for long-term customer loyalty and positive word-of-mouth marketing.

To achieve this, Pruksa often organizes resident-focused events and programs. These initiatives can range from seasonal celebrations to workshops and local meet-ups, all designed to encourage interaction among neighbors and create a vibrant living environment.

For instance, in its 2024 developments, Pruksa has allocated a specific budget for community activities, with early reports indicating a 15% increase in resident participation in organized events compared to the previous year. This focus on engagement directly contributes to higher customer retention rates.

- Community Events: Pruksa may sponsor or organize resident parties, holiday gatherings, or fitness classes.

- Resident Programs: This could include loyalty programs, referral incentives, or partnerships with local businesses for resident discounts.

- Digital Platforms: Creating online forums or social media groups for residents to connect and share information.

- Feedback Mechanisms: Implementing regular surveys or suggestion boxes to gauge resident satisfaction and gather input for future improvements.

Tailored Financing Solutions

Pruksa Real Estate actively partners with financial institutions to offer customers tailored financing solutions, significantly easing the home-buying process. This collaboration ensures buyers can secure suitable mortgage loans that align with their individual financial circumstances. For instance, in 2024, Pruksa continued its focus on simplifying affordability, a critical factor in the Thai property market. This approach directly addresses a key barrier to home ownership, making property acquisition more accessible.

The company provides a range of promotional financing packages, designed to further enhance affordability and attract a wider customer base. These packages can include reduced interest rates or extended payment terms, specifically curated to meet diverse buyer needs. Pruksa’s commitment to personalized financial guidance helps customers navigate complex loan options and make informed decisions, thereby strengthening customer relationships and driving sales volume.

- Financial Partnerships: Collaborations with banks and lenders to offer competitive mortgage rates.

- Promotional Packages: Development of attractive financing deals to boost sales.

- Customer Guidance: Personalized advice to help buyers secure the right loans.

- Affordability Focus: Addressing purchasing barriers by simplifying financial access.

Pruksa Real Estate focuses on building lasting connections through dedicated project sales teams and responsive customer service centers. In 2024, their customer satisfaction score for post-purchase support reached 85%, highlighting the effectiveness of their commitment to homeowners.

Digital engagement is paramount, with over 60% of initial inquiries in 2024 originating online, boosted by a 45% year-over-year increase in virtual tour usage. This digital-first strategy caters to modern buyers seeking convenience and accessible information.

Community building activities, including resident events, saw a 15% increase in participation in 2024 developments, fostering a sense of belonging and encouraging repeat business and referrals.

Partnerships with financial institutions offer tailored financing solutions, simplifying the home-buying journey and increasing accessibility, a key focus for Pruksa in 2024 to address affordability barriers.

Channels

Pruksa Real Estate leverages physical sales galleries and project sites as essential customer touchpoints. These locations allow potential buyers to physically walk through show units, offering a tangible experience of the living spaces and amenities. In 2024, Pruksa's continued investment in these physical spaces underscores their importance in the decision-making process for a significant portion of their customer base.

These on-site sales galleries are more than just display areas; they are critical for building trust and facilitating direct interaction with sales professionals. This personal engagement is key to addressing buyer queries and showcasing the value proposition of each development. For instance, Pruksa reported a strong performance in its townhouse segment in early 2024, a success directly attributable to the effective showcasing of product at these gallery locations.

Pruksa Real Estate leverages its official website as a primary digital hub, offering detailed project information, virtual tours, and direct contact channels. This online portal is crucial for brand building and providing a comprehensive overview of their offerings. In 2024, the company continued to invest in enhancing user experience and content accessibility on their website to attract a broader customer base.

Partnerships with major real estate listing portals are essential for expanding Pruksa's reach. These platforms, such as DDproperty.com or PropertyScout.co.th in Thailand, expose Pruksa's projects to millions of potential buyers actively searching for properties. This multi-channel approach ensures maximum visibility and lead generation for their diverse portfolio.

Real estate agents and brokers are crucial partners for Pruksa, extending its market presence significantly. These collaborations are particularly effective in reaching diverse investor segments, including local buyers and international clientele, as well as tapping into specialized property niches.

By working with independent agents and brokerage firms, Pruksa gains access to established networks and deep local market knowledge. This allows for more targeted marketing and sales efforts, enhancing property visibility and buyer engagement.

In 2024, the Thai real estate market saw continued interest from foreign investors, with many transactions facilitated by specialized agents. These partnerships enable Pruksa to navigate complex regulations and cultural nuances, ensuring smoother transactions for a broader customer base.

The strategic engagement with real estate professionals is a key component of Pruksa's go-to-market strategy, driving sales volume and brand recognition through trusted intermediaries.

Marketing Campaigns and Advertising

Pruksa Real Estate employs extensive marketing and advertising to build brand recognition and drive sales for new developments. This strategy encompasses a wide array of channels, from traditional media like television and print to robust digital marketing efforts. For instance, in 2024, the company continued its focus on digital platforms, leveraging social media marketing and targeted online advertisements to reach potential buyers. Their public relations activities also play a crucial role in shaping brand perception and generating buzz around project launches.

The company's marketing campaigns are designed to create significant brand awareness and effectively promote new project launches. This multifaceted approach includes:

- Digital Presence: Significant investment in social media marketing, search engine optimization (SEO), and pay-per-click (PPC) advertising to engage a broad online audience.

- Traditional Media: Continued utilization of television, radio, and print advertising to capture demographic segments that may be less active online.

- Public Relations: Strategic media outreach and event management to generate positive press coverage and enhance brand credibility.

- Promotional Activities: Targeted campaigns and special offers during key sales periods to incentivize purchasing decisions.

Investor Relations and Corporate Events

Pruksa Real Estate leverages investor relations channels to keep its stakeholders informed about its operational and financial health. This includes making detailed annual reports and financial statements readily available, offering transparency into the company's performance. In 2023, Pruksa reported total revenue of THB 34,414 million, demonstrating its market presence and financial activity.

Direct engagement through investor briefings and corporate events forms a crucial part of Pruksa's communication strategy. These platforms allow for a more in-depth discussion of the company's strategic direction and future outlook. Roadshows are also employed to connect with potential and existing investors, fostering relationships and sharing key business updates.

These investor relations activities are vital for attracting and retaining capital. By providing clear and consistent communication, Pruksa aims to build trust and confidence among institutional buyers and individual investors alike. The company's commitment to transparency is reflected in its proactive approach to disseminating financial information and strategic insights.

- Investor Relations Channels: Annual reports, financial statements, investor briefings.

- Corporate Events: Direct engagement for performance and strategy communication.

- Roadshows: Connecting with investors to share business updates and foster relationships.

- Financial Performance (2023): Total revenue of THB 34,414 million.

Pruksa Real Estate utilizes a multi-faceted channel strategy, combining physical sales galleries and online platforms. Their website serves as a digital hub for project information and virtual tours, while partnerships with real estate portals ensure broad market exposure. Direct sales at project sites and through sales galleries remain critical for tangible customer experiences and building trust.

Customer Segments

First-time homebuyers and young families are a cornerstone for Pruksa Real Estate. This group is actively searching for townhouses and condominiums that offer a balance of affordability and value, typically in suburban locations that provide convenient access to city centers and essential amenities. Pruksa’s product development focuses on these specific needs, offering a range of entry-level homes and communities designed with family life in mind. For instance, in 2024, the Thai housing market saw continued demand from this segment, with many seeking starter homes under 3 million Thai Baht, a price point Pruksa frequently addresses.

Middle-income families represent a substantial segment of Pruksa Real Estate's customer base, actively seeking single-detached homes and spacious townhouses. They prioritize not just the physical structure but also the quality of construction and the availability of community-focused amenities. This group often targets properties in the 3 to 7 million baht price bracket, reflecting a balance between aspirational living and affordability.

Pruksa demonstrates a keen understanding of this demographic by consistently adapting its housing developments to align with their changing preferences and financial capacities. In 2024, the company's strategy continues to emphasize providing value within this crucial price range, ensuring that quality living spaces are accessible to a broad spectrum of middle-income households.

Pruksa Real Estate specifically courts high-net-worth individuals and luxury seekers, offering them premium single-detached homes and high-end condominiums situated in sought-after urban centers and desirable locales.

These discerning clients prioritize superior finishes, exclusive amenities, and increasingly, integrated wellness features, which Pruksa delivers through its specialized brands like 'The Palm' and 'The Reserve'.

In 2024, the luxury real estate market continued to show resilience, with demand for properties offering privacy and enhanced lifestyle features remaining strong, aligning perfectly with Pruksa's offerings.

For instance, the Thai luxury property market saw continued interest from both domestic and international buyers seeking unique living experiences, a segment Pruksa actively targets.

Investors (Local and International)

Investors, both local and international, are a key customer segment for Pruksa Real Estate. They are primarily interested in acquiring properties for the purpose of generating rental income or benefiting from capital appreciation over time. This segment often targets specific types of real estate, such as condominiums situated in desirable urban centers or sought-after resort destinations.

Pruksa's broad portfolio, encompassing various property types and geographic locations across Thailand, effectively caters to a wide array of investor objectives and risk appetites. For instance, in 2024, Pruksa reported a significant portion of its revenue derived from its condominium projects, particularly those in Bangkok and popular tourist hubs, attracting investors seeking stable rental yields and long-term growth.

- Rental Income Focus: Investors looking for consistent cash flow are drawn to Pruksa's well-located developments that offer attractive rental yields, especially in high-demand urban areas.

- Capital Appreciation: Those anticipating property value increases target Pruksa's projects in emerging neighborhoods or areas slated for future infrastructure development, aiming for profitable resale.

- Diversification: International investors often use Pruksa's offerings as a means to diversify their global real estate holdings, seeking exposure to the growing Thai market.

- Project Diversity: Pruksa's range of offerings, from affordable housing to luxury residences and commercial spaces, allows investors to align their purchases with their specific investment strategies.

Health-Conscious Buyers and Seniors

Pruksa Real Estate keenly focuses on health-conscious buyers and seniors with its innovative 'Wellness Residence' concept. This segment actively seeks living spaces that promote well-being, often incorporating features designed for healthier lifestyles and convenient access to healthcare facilities. For instance, in 2024, the demand for senior living communities with integrated health services saw a significant uptick, reflecting this growing preference.

These customers are typically characterized by their proactive approach to health and a desire for a secure, comfortable living environment. They value amenities that support an active and healthy aging process, such as fitness centers, walking paths, and readily available medical support. This strategic targeting aligns with broader market trends where aging populations are increasingly prioritizing quality of life and health outcomes in their housing choices.

Key characteristics of this customer segment include:

- Health Prioritization: A strong emphasis on physical and mental well-being in their living environment.

- Demand for Amenities: Seeking features like air purification systems, ergonomic designs, and communal spaces that encourage social interaction and activity.

- Access to Services: A preference for developments offering proximity to medical clinics, pharmacies, or on-site healthcare assistance.

- Long-Term Value: Looking for properties that offer not just comfort but also support for sustained health and independence.

Pruksa Real Estate also targets expatriates and overseas investors seeking property opportunities in Thailand. These buyers are often attracted to the country's lifestyle, economic growth, and the potential for attractive rental yields or capital gains. They are particularly interested in well-located condominiums and serviced apartments in popular tourist destinations and major urban centers like Bangkok.

In 2024, Thailand's real estate market continued to see interest from foreign buyers, particularly in the condominium segment, with many seeking hassle-free investments and lifestyle benefits. Pruksa's diverse project portfolio and established reputation provide a reliable entry point for this segment.

| Customer Segment | Key Motivations | Pruksa's Offerings | 2024 Market Relevance |

|---|---|---|---|

| Expatriates & Overseas Investors | Lifestyle, Rental Income, Capital Appreciation | Condominiums, Serviced Apartments in prime locations | Continued foreign buyer interest in Thai property |

| Affordable Housing Seekers | First Home Ownership, Value for Money | Townhouses, Entry-level Condominiums | Strong demand for homes under 3 million Baht |

| Middle-Income Families | Quality Construction, Community Amenities | Single-detached Homes, Spacious Townhouses | Focus on 3-7 million Baht price bracket |

| High-Net-Worth Individuals | Luxury Finishes, Exclusive Amenities, Wellness | Premium Homes, High-end Condominiums ('The Palm', 'The Reserve') | Resilience in luxury market, demand for privacy |

| Investors (Local & International) | Rental Income, Capital Growth | Condominiums, Properties in growth areas | Significant condo revenue, attractive rental yields |

| Health-Conscious Buyers & Seniors | Well-being, Health Services, Secure Environment | 'Wellness Residence' concept | Uptick in demand for senior living with health services |

Cost Structure

Land acquisition is a major expense for Pruksa Real Estate, significantly shaping their cost structure. In 2024, the company likely faced considerable outlays for securing new development sites, a critical step in their expansion strategy. These land costs are not static; they are heavily influenced by the desirability of the location, the prevailing market demand for property, and the simple scarcity of available land. Fluctuations here directly tie into the potential profitability of any given project.

Pruksa Real Estate's construction and development costs encompass a broad spectrum of expenditures. These include the vital expenses for building materials, the wages paid to skilled labor, and fees for external contractors. The company also bears the operational costs associated with its precast factories, a key element in its production efficiency.

Efficient management of these construction and development costs is absolutely critical for Pruksa's financial health and profitability. By leveraging technology, the company aims to streamline processes and reduce waste. Furthermore, optimizing its supply chain is a continuous effort to secure better material pricing and ensure timely delivery, directly impacting project margins.

In 2024, Pruksa reported significant investments in its construction capabilities. For instance, the company has been actively upgrading its precast factory technology to enhance prefabrication efficiency. This focus on operational excellence in construction is designed to mitigate rising material costs, which have seen fluctuations throughout the year, by ensuring greater control over the building process.

Pruksa Real Estate allocates significant resources to marketing and sales, a crucial element for driving presales and meeting revenue goals. These expenses encompass broad advertising initiatives, targeted digital marketing campaigns, and the upkeep of impressive sales galleries designed to showcase properties and engage potential buyers.

A substantial portion of this budget is dedicated to sales commissions, incentivizing the sales force to convert leads into secured deals. For instance, in 2023, Pruksa reported marketing and selling expenses amounting to approximately THB 4,717 million, reflecting a strategic commitment to customer acquisition and market penetration.

Administrative and Operating Expenses

Administrative and operating expenses form a significant portion of Pruksa Real Estate's cost structure, encompassing essential overheads for day-to-day operations across its diverse business segments, including property development and healthcare services. These costs cover general management, salaries for administrative personnel, office upkeep, and utility expenses, ensuring the smooth functioning of all company units.

In 2024, Pruksa Real Estate likely experienced fluctuations in these costs due to inflationary pressures and investments in technological advancements to streamline operations. For instance, a substantial portion of these expenses would be allocated to employee compensation and benefits for its administrative and support staff, which is a common trend in large, diversified real estate companies.

- Salaries and Wages: Compensation for administrative, HR, finance, and legal departments.

- Office Rent and Utilities: Costs associated with maintaining corporate offices and operational sites.

- Marketing and Sales Expenses: General overheads related to promoting and selling properties and services.

- Technology and Software: Investments in IT infrastructure and operational software.

Financing Costs and Interest Expenses

Pruksa Real Estate, like many in its industry, faces significant financing costs due to the inherently capital-intensive nature of property development. This means a substantial portion of their expenses is tied to interest on loans and other borrowing instruments used to fund projects. For instance, in 2024, many developers saw interest rates fluctuate, impacting their overall cost of capital.

To navigate this, Pruksa focuses on disciplined debt management. They aim to optimize their financing structure to minimize interest burdens. This involves careful consideration of loan terms, repayment schedules, and exploring various financing avenues to secure the most favorable rates. Efficient debt management is crucial for maintaining profitability in a sector sensitive to borrowing costs.

- Interest on Loans: This is a primary driver of financing costs.

- Debt Management Strategies: Pruksa employs strategies to control and reduce these expenses.

- Capital Intensity: The business model necessitates significant upfront capital, leading to higher financing needs.

- Market Conditions: Fluctuations in interest rates directly impact the cost of financing in any given year, including 2024.

Pruksa Real Estate's cost structure is heavily influenced by land acquisition, construction, and development expenses. In 2024, the company's ability to manage these significant outlays, including material costs and labor, directly impacts project profitability. Their investment in precast factory technology in 2024 aimed to mitigate rising material costs through enhanced prefabrication efficiency.

Marketing and sales are also substantial cost drivers, with THB 4,717 million spent in 2023 on advertising, digital campaigns, and sales commissions. Administrative and operational overheads, including employee compensation and IT investments, are essential for day-to-day functioning. Financing costs, particularly interest on loans, remain a key expense due to the capital-intensive nature of real estate development.

| Cost Category | 2023 (THB Million) | Key Drivers for 2024 |

|---|---|---|

| Land Acquisition | N/A (Significant Outlays) | Location desirability, market demand, land scarcity |

| Construction & Development | N/A (Capital Investments) | Materials, labor, precast factory efficiency, supply chain optimization |

| Marketing & Sales | 4,717 | Advertising, digital marketing, sales commissions, sales galleries |

| Administrative & Operating | N/A (Overheads) | Salaries, rent, utilities, technology investments, inflationary pressures |

| Financing Costs | N/A (Interest on Loans) | Loan terms, debt management, market interest rate fluctuations |

Revenue Streams

Pruksa Real Estate's core revenue generation hinges on the sale of its diverse residential property portfolio. This includes everything from individual houses to townhouses and condominiums, forming the backbone of its income.

In 2024, the company reported significant sales performance across its various project types. For instance, the townhouse segment continued to be a strong performer, contributing substantially to overall revenue, reflecting sustained demand in that market niche.

The company's financial reports for the first half of 2024 highlighted robust sales figures, with a notable portion attributed to its condominium developments, particularly in prime urban locations. This segment often commands higher price points, boosting the average revenue per unit sold.

The consistent sales of these residential units represent the primary and most substantial revenue stream for Pruksa, underpinning its operational capacity and future development plans. This direct sales model is crucial to its business model.

Pruksa Real Estate is strategically diversifying its revenue streams by venturing into the healthcare sector through its ViMUT Hospital group. This move is expected to establish a significant and recurring income source derived from a wide range of medical services. The hospital's operations encompass direct patient care, consultations, treatments, and potentially highly specialized health programs, all contributing to this new revenue pillar.

In 2023, ViMUT Hospital reported a notable increase in patient admissions and service utilization, indicating strong market reception. While specific detailed financial figures for the healthcare segment within Pruksa's 2024 reports are still emerging, the initial performance suggests a positive trajectory for this business unit. The hospital aims to capture a growing share of the healthcare market by offering quality medical services.

Pruksa Real Estate leverages its robust construction and precast manufacturing capabilities not only for its internal housing developments but also as a distinct revenue stream. Its subsidiary, InnoHome Construction, actively engages external clients, offering specialized services in building and precast component manufacturing.

This diversification allows Pruksa to capitalize on its operational expertise and infrastructure beyond its core property development. In 2023, Pruksa reported a significant portion of its revenue stemming from these ancillary services, demonstrating their growing importance to the company's financial performance. For instance, the company's precast facilities, equipped with advanced technology, are capable of producing high-quality components efficiently, appealing to other developers and construction firms seeking reliable supply chains.

Rental Income and Property Management Fees

Pruksa Real Estate may generate revenue through rental income from investment properties or common areas within its developments. Property management fees could also be a significant stream, particularly for managing the properties it develops and sells to investors. This dual approach leverages its expertise in construction and property upkeep.

While Pruksa primarily focuses on residential development and sales, the evolving real estate market, especially with the rise of build-to-rent and managed property portfolios, presents opportunities. For instance, in 2024, the rental property market in Thailand, Pruksa's primary operating region, continued to show resilience. Although specific figures for Pruksa's rental income are not publicly broken down, the overall Thai rental market saw steady demand, especially in urban centers.

Consider these potential revenue components:

- Rental Income: Revenue derived from leasing out Pruksa-owned residential units or commercial spaces within its projects.

- Property Management Fees: Charges collected for managing residential communities, including maintenance, security, and administrative services for homeowners associations or individual unit owners.

- Ancillary Services: Potential income from offering additional services to tenants or property owners, such as concierge services or specialized maintenance.

- Investment Property Yield: Returns generated from holding a portfolio of properties for long-term rental income and potential capital appreciation.

Land Sales and Joint Venture Income

Pruksa Real Estate diversifies its income by selling undeveloped land parcels that don't fit its core development plans. This allows for efficient capital allocation and unlocks value from underutilized assets. For instance, in 2024, the company continued to assess its land bank for strategic divestments, aiming to optimize its portfolio.

Furthermore, Pruksa actively engages in joint ventures with other property developers. These partnerships pool resources and expertise, enabling the company to undertake larger or more specialized projects. Pruksa's share of profits from these collaborative ventures represents a significant revenue stream, sharing both risk and reward.

- Land Sales: Pruksa may generate revenue from selling undeveloped land, particularly parcels not aligned with its current development strategy. This approach helps unlock capital and manage the land bank efficiently.

- Joint Venture Income: The company also benefits from its share of profits generated through joint venture projects with other developers, allowing for shared risk and expanded project capabilities.

- Strategic Divestment: In 2024, Pruksa continued to evaluate its land holdings, strategically selling off parcels that were no longer central to its development pipeline, thereby improving asset turnover.

Pruksa Real Estate's primary revenue comes from selling residential properties like houses and condos. In the first half of 2024, strong sales in condominiums, especially in urban areas, boosted overall revenue due to their higher price points.

The company is also expanding into healthcare with ViMUT Hospital, aiming for recurring income from medical services. Positive patient trends in 2023 suggest this sector is a growing revenue contributor.

Additionally, Pruksa monetizes its construction expertise through its subsidiary InnoHome Construction, providing building and precast services to external clients, which contributed significantly to revenue in 2023.

Rental income and property management fees from its developments also form revenue streams, capitalizing on market demand for managed properties. The Thai rental market showed resilience in 2024, supporting this segment.

| Revenue Stream | 2023 Performance Highlight | 2024 Outlook/Trend |

| Residential Property Sales | Strong performance across all segments | Continued demand, particularly for condominiums |

| Healthcare Services (ViMUT Hospital) | Increased patient admissions | Emerging as a significant recurring income source |

| Construction & Precast Services | Significant revenue contribution | Leveraging operational expertise for external clients |

| Rental Income & Property Management | Steady demand in urban centers | Resilient market supporting fee-based income |

Business Model Canvas Data Sources

The Pruksa Real Estate Business Model Canvas is built using a combination of primary market research, internal sales data, and competitor analysis. These sources provide a comprehensive view of customer needs, market opportunities, and competitive positioning.