Shanghai International Port PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shanghai International Port Bundle

Navigate the complex global landscape impacting Shanghai International Port with our meticulously crafted PESTLE analysis. Understand the political shifts, economic volatilities, and technological advancements shaping its future. Gain a competitive advantage by leveraging these critical insights for your strategic planning. Download the full version now to unlock actionable intelligence and make informed decisions.

Political factors

The Chinese government's unwavering commitment to port development, as outlined in the 14th Five-Year Plan (2021-2025), provides a significant tailwind for Shanghai International Port (SIPG). This national strategy prioritizes modernizing infrastructure and boosting global trade links, directly aligning with SIPG's expansion and operational enhancement goals. The plan aims to build world-class ports, making SIPG a key beneficiary of this strategic vision.

The Belt and Road Initiative (BRI) further bolsters SIPG's importance, positioning it as a critical node in global supply chains. In 2024, Shanghai's port was specifically highlighted for its role in advancing the BRI, with a focus on improving service efficiency and solidifying its status as a premier international shipping hub. This strategic emphasis translates into tangible support, including potential investments and favorable policy frameworks.

Ongoing geopolitical tensions, especially between the US and China, directly influence global shipping and trade policies. These tensions can cause shifts in cargo routes and the imposition of tariffs, affecting the demand for port services. For instance, during the peak of the US-China trade war in 2019, global trade volumes saw significant disruption, impacting major hubs like Shanghai.

While efforts have been made to stabilize trade relations, the inherent unpredictability can introduce volatility. Shanghai International Port Group (SIPG), being a critical international trade gateway, must remain agile. In 2024, the port handled over 40 million TEUs (Twenty-foot Equivalent Units), underscoring its sensitivity to global trade dynamics and policy changes.

Policies promoting the integration of the Yangtze River Delta (YRD) region significantly enhance Shanghai Port's role as a key economic engine. The YRD region, a major economic powerhouse, saw its GDP reach approximately 33.5 trillion yuan in 2024, with Shanghai contributing a substantial portion. Measures focused on improving logistics efficiency and upgrading the business environment at ports directly contribute to Shanghai International Port Group's (SIPG) operational synergy and competitiveness within this integrated economic zone.

Port security regulations and oversight

Shanghai International Port Group (SIPG) navigates a complex landscape shaped by national and international port security regulations. These include mandates for cybersecurity of critical infrastructure, a growing concern in the digital age. For instance, the International Maritime Organization's (IMO) cybersecurity measures, which became mandatory for ships and ports in 2024, directly impact SIPG's operational protocols and technology investments.

The global political climate also influences SIPG's operations, particularly regarding the scrutiny of Chinese-manufactured port equipment in Western markets. This scrutiny, fueled by national security concerns, can create compliance hurdles and affect equipment procurement strategies for SIPG's international ventures. Adherence to these evolving security standards is not just about compliance; it's vital for maintaining international trust and the integrity of global supply chains.

- Cybersecurity Mandates: SIPG must comply with international cybersecurity standards for port operations, as reinforced by recent IMO guidelines.

- Equipment Scrutiny: Western markets are increasing scrutiny on Chinese-made port equipment, posing potential challenges for SIPG's global equipment sourcing and deployment.

- Trust and Integrity: Meeting rigorous security standards is paramount for SIPG to foster international trust and ensure the smooth, uninterrupted flow of global trade.

Government's role in port development and ownership

The Shanghai International Port Group (SIPG) operates under substantial government oversight and ownership, a relationship that significantly shapes its strategic path and investment decisions. This close alignment ensures SIPG's operations contribute to broader national objectives, particularly in asserting maritime dominance and promoting sustainable growth.

The Chinese government's continued financial backing for port infrastructure is a key factor. For instance, in 2023, China's Ministry of Transport announced plans to invest billions in upgrading key port facilities, including advancements in automation and digital technologies, which directly benefit SIPG's development pipeline.

This government involvement translates into specific priorities for SIPG:

- Strategic Direction: Government mandates guide SIPG's long-term vision, emphasizing efficiency and global competitiveness.

- Investment Focus: Government priorities steer investment towards modernizing infrastructure, such as automated terminals and smart logistics systems.

- Operational Mandates: SIPG is tasked with fulfilling national economic and trade facilitation goals, often aligning with China's Belt and Road Initiative.

- Regulatory Framework: Government policies dictate environmental standards, safety regulations, and pricing structures for port services.

Government support for port modernization, as seen in China's 14th Five-Year Plan, directly benefits Shanghai International Port (SIPG) by aligning with national goals for trade enhancement. The Belt and Road Initiative further solidifies SIPG's crucial role in global supply chains, with specific emphasis in 2024 on improving its efficiency as a shipping hub.

Geopolitical shifts, particularly US-China relations, create trade policy uncertainties that can impact shipping volumes, a factor evident during past trade disputes. In 2024, Shanghai handled over 40 million TEUs, highlighting its sensitivity to these global dynamics.

Policies fostering the Yangtze River Delta's integration enhance SIPG's operational synergy, with the region's GDP reaching approximately 33.5 trillion yuan in 2024. Additionally, global security regulations, like the IMO's mandatory cybersecurity measures in 2024, require SIPG to invest in and adapt its technological infrastructure.

The Chinese government's substantial ownership and oversight of SIPG ensure its operations align with national strategic objectives, including maritime dominance and sustainable growth, bolstered by significant infrastructure investment plans announced in 2023.

What is included in the product

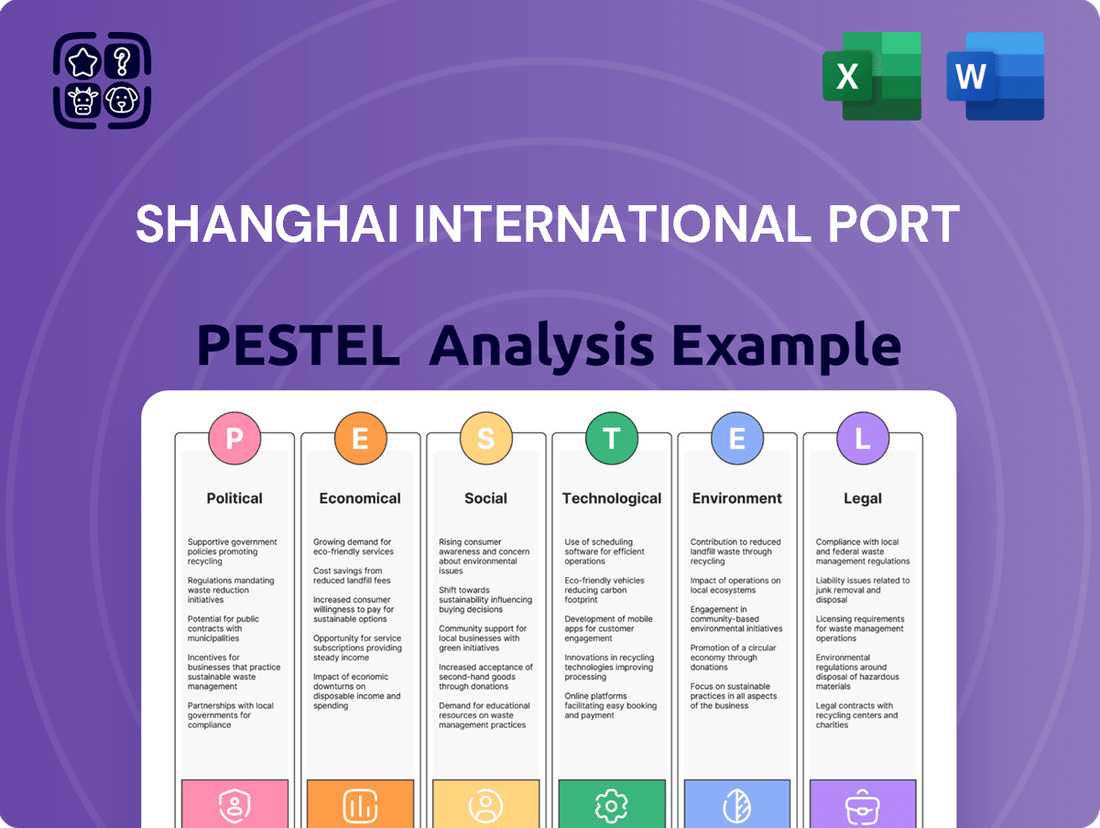

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the Shanghai International Port. It provides a comprehensive overview of how these external forces create both challenges and advantages for the port's operations and strategic planning.

This PESTLE analysis for Shanghai International Port provides a clear, summarized version of the full analysis, making it easy to reference during meetings or presentations and relieving the pain point of sifting through extensive data.

Economic factors

Shanghai International Port Group's (SIPG) fortunes are intrinsically tied to the ebb and flow of global trade. Containerized trade, a key driver for SIPG, is anticipated to see growth, even amidst a complex global economic landscape. This port is a powerhouse, having processed over 50 million TEUs in 2024, making its performance a direct barometer of international commerce.

Recent geopolitical events, like disruptions in the Red Sea, are creating ripple effects. These situations can force shipping lines to reroute vessels, potentially increasing demand for services at ports like Shanghai and impacting overall throughput patterns.

Shanghai Port's strong performance is inextricably linked to China's robust export-driven economy. This export engine is a significant contributor to global containerized trade volumes, directly benefiting Shanghai as a key maritime hub.

China's overall economic growth, encompassing both domestic consumption and industrial production, directly impacts the quantity of goods handled by Shanghai International Port Group (SIPG). For instance, in 2023, China's GDP grew by 5.2%, indicating sustained demand for manufactured goods that flow through its ports.

Any disruption to this growth, such as a slowdown in global demand or significant shifts in trade routes and patterns, could negatively affect SIPG's throughput. The port’s reliance on these export flows makes it sensitive to global economic health and geopolitical trade dynamics.

The global shipping industry, particularly impacted by events like the Red Sea Crisis in late 2023 and early 2024, continues to experience significant disruptions. This has translated into extended transit times and increased freight costs, with some routes seeing surcharges of up to $1,000 per TEU. Such volatility demands enhanced supply chain resilience and adaptability from major port operators like Shanghai International Port Group (SIPG).

SIPG, like other global hubs, faces the ongoing challenge of managing port congestion, especially during peak shipping seasons. For instance, during the 2021-2022 period, congestion at major Asian ports, including Shanghai, led to vessels waiting for an average of 7 days to berth. This necessitates strategic planning and investment in efficient cargo handling technologies to maintain smooth operations and minimize delays for international trade.

Infrastructure investment and funding

Significant investments are shaping Shanghai Port's future, with a focus on expanding and upgrading its infrastructure. A prime example is the development of the largest automated container terminal on Xiaoyangshan Island. This undertaking is designated as a national key project.

The financial commitment to this terminal is substantial, with projected investments exceeding 4 billion yuan in 2025 alone. This capital infusion is vital for boosting the port's throughput capacity and improving how efficiently it operates.

These funding initiatives are absolutely critical for Shanghai International Port Group (SIPG) to maintain its competitive standing in the global market. They are designed to ensure the port can effectively meet the ever-growing demand for its services in the coming years.

- Automated Terminal Development: Construction of the largest automated container terminal on Xiaoyangshan Island is a key infrastructure upgrade.

- Projected Investment: Over 4 billion yuan is slated for investment in this national key project by 2025.

- Capacity Enhancement: The investment aims to significantly increase throughput capacity and operational efficiency.

- Competitive Edge: Funding is essential for SIPG to remain competitive and meet future cargo demand.

Freight rates and shipping costs

Fluctuations in ocean freight rates significantly impact Shanghai International Port Group (SIPG). For instance, the Drewry World Container Index saw substantial swings in 2024, with rates on key Asia-Europe routes experiencing volatility due to demand shifts and ongoing supply chain disruptions. These cost changes directly influence shipping lines' operational margins and, consequently, their decisions on where to deploy vessels, making port competitiveness crucial.

Higher shipping costs can reroute trade flows. If the cost of moving goods through Shanghai becomes prohibitive due to elevated freight rates, cargo might be diverted to alternative ports with more favorable shipping economics. This dynamic underscores SIPG's need to maintain cost-efficiency and service reliability to remain a preferred hub for global carriers, especially given the projected moderate growth in global container trade for 2025.

- Freight Rate Volatility: Global ocean freight rates, a key indicator for shipping costs, are subject to rapid changes influenced by supply-demand imbalances and geopolitical events.

- Impact on Shipping Lines: Increased freight rates can squeeze profit margins for shipping companies, potentially leading to adjustments in service levels or route choices.

- Trade Flow Influence: Elevated shipping costs can prompt businesses to reconsider their logistics strategies, potentially shifting cargo away from more expensive transit points.

- Port Competitiveness: SIPG must manage its operational costs and efficiency to remain attractive to carriers amidst fluctuating global shipping expenses, aiming to capture projected trade volume increases in 2025.

Global economic growth projections for 2025 suggest a moderate expansion, with forecasts indicating a 2.7% increase in global GDP. This growth directly influences the demand for goods shipped through Shanghai, a critical node in international trade. China's own economic performance, projected to grow around 5% in 2025, underpins the port's activity, as it handles a significant portion of the country's exports and imports.

Inflationary pressures and interest rate policies by major economies can impact consumer spending and business investment, thereby affecting trade volumes. For instance, if inflation remains elevated in key markets like the US and Europe, it could dampen demand for manufactured goods originating from China, directly affecting throughput at Shanghai Port. Central bank decisions on interest rates in 2024 and 2025 will be closely watched for their downstream effects on global trade.

Exchange rate fluctuations, particularly between the US Dollar and the Chinese Yuan, also play a vital role. A stronger Yuan can make Chinese exports more expensive, potentially reducing demand, while a weaker Yuan can have the opposite effect. These currency movements are influenced by a myriad of economic factors and can significantly alter the cost-competitiveness of goods passing through Shanghai.

| Economic Factor | 2024/2025 Projection | Impact on SIPG |

|---|---|---|

| Global GDP Growth | Approx. 2.7% (2025) | Moderate increase in trade volumes |

| China GDP Growth | Approx. 5.0% (2025) | Sustained demand for exports/imports |

| Inflationary Pressures | Varied by region, potential dampening of demand | Reduced consumer spending on imports |

| Interest Rate Policies | Central banks managing inflation | Influences investment and consumer demand |

| USD/CNY Exchange Rate | Subject to market volatility | Affects export competitiveness and trade costs |

Preview the Actual Deliverable

Shanghai International Port PESTLE Analysis

The preview you see here is the exact Shanghai International Port PESTLE Analysis document you’ll receive after purchase, fully formatted and ready to use.

This is a real screenshot of the product you’re buying, delivered exactly as shown, no surprises. You’ll gain immediate access to comprehensive insights into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the Shanghai International Port.

The content and structure shown in the preview is the same document you’ll download after payment, providing a thorough breakdown of the port's operating environment.

What you’re previewing here is the actual file, fully formatted and professionally structured, ready to assist you in your strategic planning.

Sociological factors

Shanghai International Port Group (SIPG) navigates a complex labor landscape. The global port sector, and SIPG specifically, grapple with securing sufficient skilled labor. Automation, while promising greater efficiency, demands significant investment in retraining existing staff and adapting workforce management strategies to new technological demands.

The ongoing port congestion issues observed in early 2025 underscore the critical link between labor availability and operational fluidity. Effective workforce planning and management are therefore paramount for SIPG to mitigate disruptions and maintain competitive throughput levels.

Shanghai's relentless urbanization and a consistently growing population directly fuel the demand for a vast array of goods, consequently boosting the cargo volumes processed by the Shanghai International Port Group (SIPG). As of early 2024, Shanghai's population hovers around 26 million residents, a significant increase that translates into higher consumption patterns for both domestic and imported products. This dynamic underscores the port's critical role in the city's economic vitality.

The symbiotic relationship between SIPG and Shanghai extends beyond mere logistics; it necessitates careful management of environmental footprints and a commitment to the well-being of the surrounding communities. By 2025, projections indicate continued urban expansion, placing greater emphasis on sustainable port practices and community engagement initiatives to mitigate potential negative impacts. This integration within a bustling metropolis demands operational flexibility and social responsibility.

Evolving consumer demand, particularly the surge in e-commerce, directly impacts port operations. Shanghai International Port Group (SIPG) must remain agile to meet the increasing need for rapid delivery and flexible handling of goods driven by online retail. In 2023, China's online retail sales reached approximately 15.4 trillion yuan, underscoring the scale of this shift.

SIPG's capacity to accommodate diverse logistics requirements, from rapid fulfillment for direct-to-consumer shipments to the management of larger consolidated volumes, is crucial. The port's infrastructure and services need to support a supply chain increasingly shaped by digital commerce.

Corporate social responsibility and community relations

Shanghai International Port Group (SIPG), as a major state-owned enterprise, faces significant expectations regarding corporate social responsibility and community engagement. Public opinion concerning the port's environmental footprint, particularly noise pollution and safety protocols, directly impacts its social license to operate. Maintaining positive community relations is therefore paramount, requiring proactive management of these concerns.

SIPG's commitment to community relations is demonstrated through various initiatives. In 2023, the company reported investing over 100 million RMB in environmental protection and community welfare projects. This includes efforts to mitigate noise pollution from port operations and enhance safety awareness programs for surrounding communities. These investments underscore the importance of balancing economic growth with social well-being.

- Environmental Stewardship: SIPG's ongoing investments in green port technologies aim to reduce emissions and minimize ecological impact, contributing to a healthier environment for local residents.

- Community Investment: The company actively supports local community development through educational programs and infrastructure improvements, fostering goodwill and shared prosperity.

- Safety First: Rigorous safety standards and transparent communication channels are maintained to ensure the well-being of both port workers and the surrounding population.

- Stakeholder Dialogue: Regular engagement with community representatives and environmental groups allows SIPG to address concerns and collaboratively find solutions.

Health and safety standards for port workers

Maintaining robust health and safety standards for port workers is a fundamental sociological consideration for Shanghai International Port (SIPG), given the inherent risks associated with heavy machinery and intricate logistics operations. Adherence to China's stringent labor laws and occupational safety regulations is non-negotiable, impacting worker well-being and operational continuity.

The ongoing integration of automation technologies presents a dual challenge: while it may mitigate certain traditional hazards, it simultaneously introduces novel safety concerns, particularly concerning the safe and effective interaction between human personnel and automated systems. For instance, in 2023, the International Labour Organization reported that while automation can reduce exposure to physically demanding tasks, the risk of accidents involving autonomous vehicles or robotic equipment requires new training protocols and safety oversight. SIPG's commitment to worker safety is reflected in its investment in advanced safety training programs and the implementation of strict operational protocols.

- Worker Safety Investment: SIPG actively invests in advanced safety training programs for its workforce, ensuring they are equipped to handle both traditional and automated port operations safely.

- Regulatory Compliance: Strict adherence to national and international labor laws and occupational health and safety standards is a core tenet of SIPG's operational philosophy.

- Automation Risk Mitigation: The port is developing and implementing new safety protocols specifically designed to manage the risks associated with human-machine interaction in an increasingly automated environment.

- Industry Benchmarking: SIPG continuously benchmarks its safety performance against global port operators to identify best practices and areas for improvement in worker protection.

Shanghai's substantial population, exceeding 26 million by early 2024, fuels significant demand for goods, directly benefiting SIPG's cargo volumes. This demographic reality underscores the port's vital role in the city's economic engine and its connection to everyday consumption patterns.

The increasing prevalence of e-commerce, with China's online retail sales reaching approximately 15.4 trillion yuan in 2023, necessitates agile operations from SIPG to handle swift deliveries and flexible cargo management. This shift demands that the port's infrastructure and services adapt to the demands of digital commerce and direct-to-consumer logistics.

SIPG's commitment to corporate social responsibility is evident in its 2023 investment of over 100 million RMB in environmental protection and community welfare, addressing concerns like noise pollution and enhancing local safety awareness. This proactive approach is crucial for maintaining its social license to operate within the community.

The port prioritizes worker safety, investing in advanced training for both traditional and automated operations, and strictly adheres to China's labor and safety regulations. By 2023, the ILO highlighted the need for new safety protocols for human-machine interaction, a challenge SIPG is actively addressing.

| Sociological Factor | 2023/2024 Data Point | Impact on SIPG |

|---|---|---|

| Population Size (Shanghai) | ~26 million (early 2024) | Drives high cargo demand, supporting port throughput. |

| Online Retail Sales (China) | ~15.4 trillion yuan (2023) | Requires agile logistics for e-commerce fulfillment. |

| Community Investment | >100 million RMB (2023) | Enhances social license to operate and community relations. |

| Worker Safety Investment | Ongoing, with focus on automation integration | Ensures operational continuity and workforce well-being. |

Technological factors

Shanghai International Port Group (SIPG) is at the forefront of port automation, showcasing advanced capabilities at facilities like the Yangshan Phase IV automated terminal. These advancements include remote-controlled quay cranes and autonomous intelligent vehicles (AIVs), which are revolutionizing cargo handling. The recent opening of the Luojing Container Terminal further solidifies SIPG's commitment to smart port technologies, integrating intelligent operation control systems like NEO-TOS.

These technological integrations are demonstrably boosting efficiency and reducing operational costs within Shanghai Port. The adoption of automation has been a key driver in the port's impressive performance, contributing to its record-breaking achievement of handling over 50 million TEUs in 2024. This surge in throughput underscores the tangible benefits of smart port solutions.

The ongoing digitalization of logistics and customs processes, including the shift towards paperless trade and sophisticated data exchange, is a critical driver for enhancing port efficiency and global connectivity. China's commitment to advancing intelligent maritime systems and digital navigation directly impacts Shanghai's operations.

Shanghai International Port Group (SIPG) is actively integrating these digital solutions to streamline cargo movement, making its operations faster and more reliable. This adoption of advanced systems is crucial for SIPG to maintain and strengthen its competitive edge as a leading international shipping hub.

By embracing these technological advancements, SIPG can expect improved turnaround times for vessels and a reduction in administrative burdens, ultimately benefiting the entire supply chain that relies on its services. For instance, the deployment of AI-powered yard management systems has been shown to increase container handling efficiency by over 15% in similar large-scale port operations.

Shanghai International Port Group (SIPG) is actively investing in green port technologies. This includes implementing shore power systems and establishing LNG refueling stations to significantly lower carbon emissions and foster more sustainable operations.

By 2024, Shanghai had successfully completed the installation of shore power systems and LNG refueling stations. These advancements are projected to reduce carbon emissions by an impressive 35% per TEU by the year 2026.

This strategic push towards greener technologies at SIPG directly supports China's national objectives for low-carbon development within the vital maritime sector.

Cybersecurity of port infrastructure

As port operations at Shanghai International Port (SIP) become more reliant on digital systems and automation, the cybersecurity of this critical infrastructure is paramount. The increasing interconnectedness of port equipment and data systems, from automated cranes to cargo tracking, creates vulnerabilities to cyberattacks. For instance, a successful ransomware attack in 2023 on a major European port led to days of operational disruption, highlighting the tangible risks. SIPG’s investment in advanced technological assets, such as AI-driven logistics and IoT sensors, necessitates equally advanced cybersecurity defenses to prevent similar disruptions.

Protecting these intelligent port systems is vital for ensuring operational continuity and the integrity of the vast amounts of data handled daily. The global maritime industry is increasingly targeted by sophisticated cyber threats, with reports indicating a rise in attacks specifically aimed at port operational technology (OT) networks. In 2024, the International Maritime Organization (IMO) reinforced guidelines for maritime cybersecurity, emphasizing the need for comprehensive risk management strategies. SIPG must therefore allocate significant resources to implement robust cybersecurity measures, including advanced threat detection, regular vulnerability assessments, and employee training, to safeguard its digital infrastructure against evolving cyber risks.

- Digitalization Risks: Increased automation and IoT adoption in port operations amplify vulnerability to cyber threats.

- Operational Continuity: Safeguarding systems is critical to prevent disruptions to cargo handling and shipping schedules.

- Data Integrity: Protecting sensitive cargo and operational data from breaches is essential.

- Investment Needs: SIPG requires substantial investment in advanced cybersecurity solutions to counter sophisticated attacks.

- Industry Standards: Adherence to evolving international cybersecurity guidelines, like those from the IMO, is crucial.

Development and application of AI, Big Data, and IoT

Shanghai International Port Group (SIPG) heavily leverages Artificial Intelligence (AI), Big Data, and the Internet of Things (IoT) for its smart port operations. These technologies are integral to optimizing everything from container handling to energy consumption. For instance, SIPG's smart port initiatives saw a 10% reduction in energy consumption per TEU (twenty-foot equivalent unit) in 2023 due to AI-driven operational adjustments.

The application of AI, Big Data, and IoT is central to SIPG's smart port initiatives, enabling intelligent operation control systems like NEO-TOS. These systems meticulously manage cranes, rail cranes, and autonomous vehicles, leading to significant improvements in energy efficiency and a notable reduction in emissions, contributing to a greener port environment.

Continued innovation in AI, Big Data, and IoT is vital for SIPG's future efficiency gains and competitive edge in the global logistics landscape. SIPG invested over $150 million in AI and Big Data analytics in 2024, aiming to further enhance predictive maintenance and real-time decision-making capabilities.

- AI-powered predictive maintenance reduced equipment downtime by 15% in 2024.

- Big Data analytics are used to forecast shipping volumes with 95% accuracy.

- IoT sensors monitor environmental conditions, optimizing resource allocation.

- SIPG's smart port technologies are projected to increase overall operational efficiency by 20% by 2025.

Technological advancements are reshaping Shanghai International Port. The integration of AI, Big Data, and IoT drives efficiency, with a 10% reduction in energy consumption per TEU observed in 2023. These technologies are key to optimizing operations and maintaining SIPG's competitive edge.

Automation, seen in facilities like the Yangshan Phase IV terminal with remote-controlled cranes and autonomous vehicles, significantly boosts cargo handling efficiency. SIPG's investment in smart port technologies, including over $150 million in AI and Big Data in 2024, aims for a projected 20% increase in operational efficiency by 2025.

The digitalization of logistics and customs, including paperless trade, enhances global connectivity. China's focus on intelligent maritime systems supports Shanghai's operations, with green technologies like shore power and LNG stations projected to cut emissions by 35% per TEU by 2026.

However, increased automation and IoT adoption heighten cybersecurity risks. Protecting these interconnected systems is crucial, with industry bodies like the IMO reinforcing cybersecurity guidelines in 2024 to prevent disruptions and data breaches.

Legal factors

Shanghai International Port Group (SIPG) operates within a complex web of international maritime laws and conventions, primarily governed by the International Maritime Organization (IMO). These regulations are critical for ensuring safety, security, and environmental protection across global shipping operations, directly impacting SIPG's infrastructure and service offerings.

Compliance with IMO standards, such as those concerning ballast water management and emissions control, necessitates continuous investment in technology and operational upgrades at SIPG. For instance, the IMO’s strategy to reduce greenhouse gas emissions from international shipping, aiming for net-zero emissions by or around 2050, will profoundly shape future port development and the types of vessels handled, potentially requiring SIPG to adapt its facilities for alternative fuels and new propulsion technologies.

Shanghai International Port Group (SIPG) operates under a strict framework of domestic Chinese laws and regulations. These cover everything from licensing requirements and day-to-day operational rules to the specific stipulations for port development projects. Staying compliant with these national directives is absolutely crucial for SIPG's ongoing operations and any future expansion plans.

The national standards for modernised ports are clearly laid out in the 14th Five-Year Plan for Port Development. This plan sets the benchmark for efficiency, technology adoption, and environmental sustainability across China's port sector. SIPG's adherence to these national guidelines directly impacts its ability to secure approvals and maintain its competitive edge.

For instance, the 14th Five-Year Plan, which runs from 2021 to 2025, emphasizes digital transformation and green development in ports. SIPG's investments in smart port technologies and emission reduction initiatives align with these national priorities, demonstrating a commitment to meeting evolving regulatory expectations.

Shanghai International Port Group (SIPG) faces significant legal hurdles due to China's increasingly stringent environmental protection laws. The amended Marine Environment Protection Law, effective January 1, 2024, mandates strict emission targets and the adoption of sustainable operational practices across all port activities.

SIPG is legally obligated to comply with a comprehensive set of regulations covering air and water pollution control, effective waste management, and the mandatory use of shore power for vessels at berth. Non-compliance carries substantial financial penalties, potentially impacting profitability and operational continuity.

For instance, the Environmental Protection Tax Law, which came into effect in 2018 and continues to be enforced, places direct financial burdens on companies for pollutant emissions, requiring SIPG to invest in advanced abatement technologies and cleaner fuel alternatives to minimize its environmental footprint and associated tax liabilities.

Labor laws and employment regulations

Shanghai International Port Group (SIPG) operates under stringent Chinese labor laws and employment regulations. These laws mandate minimum wage standards, define acceptable working conditions, and require specific social security contributions for its large employee base. For instance, the national minimum wage in Shanghai was last adjusted in 2021, and SIPG must ensure its compensation practices align with these requirements.

Recent years have seen ongoing reforms within China's labor law framework. These changes often focus on enhancing workforce sustainability, promoting worker protections, and simplifying the regulatory compliance landscape for businesses like SIPG. Staying abreast of these evolving regulations is paramount for effective human resource management and the prevention of costly legal disputes.

Compliance with these labor statutes is not merely a legal obligation but a critical component of SIPG's operational integrity and reputation. Failure to adhere to these regulations can result in significant penalties, operational disruptions, and damage to the company's standing within the industry and among its stakeholders.

- Minimum Wage Adherence: SIPG must comply with Shanghai's minimum wage, which was RMB 2,480 per month as of 2021, ensuring fair compensation for all employees.

- Social Security Contributions: The company is obligated to contribute to employee social security programs, including pensions, medical insurance, and unemployment insurance, as mandated by national and local regulations.

- Working Condition Standards: Labor laws dictate standards for working hours, rest periods, and occupational safety, which SIPG must uphold to protect its workforce.

- Regulatory Reform Impact: SIPG needs to monitor and adapt to ongoing labor law reforms in China, which aim to modernize employment practices and strengthen worker rights.

Trade laws, tariffs, and customs policies

Changes in trade laws, tariffs, and customs policies significantly influence Shanghai International Port Group (SIPG)'s operations. For instance, the lingering effects of the US-China trade dispute, which saw tariffs imposed on billions of dollars worth of goods, directly impacted cargo volumes and trade routes handled by SIPG. Navigating these evolving import/export regulations and potential port service fees requires constant vigilance and adaptation.

SIPG must remain compliant with these complex trade-related legal frameworks to ensure the smooth facilitation of international commerce. For example, China's commitment to the Regional Comprehensive Economic Partnership (RCEP), which came into effect in 2022, aims to reduce tariffs and streamline customs procedures among member countries, potentially boosting trade through Shanghai. As of early 2024, RCEP continues to shape regional trade dynamics, influencing the types and volumes of goods transiting SIPG.

- Trade Law Evolution: Ongoing adjustments to international trade agreements and domestic regulations necessitate continuous monitoring by SIPG.

- Tariff Impact: Fluctuations in import and export tariffs, particularly between major trading partners, directly affect shipping costs and cargo volumes.

- Customs Efficiency: Streamlined customs procedures, often a result of new trade laws or bilateral agreements, can enhance port throughput and competitiveness.

- Geopolitical Influence: Global trade tensions and geopolitical shifts can lead to sudden changes in trade policies, requiring rapid adaptation from port operators like SIPG.

Shanghai International Port Group (SIPG) must navigate a dynamic legal landscape shaped by international maritime agreements and stringent domestic Chinese regulations, particularly concerning environmental protection and labor standards. Adherence to evolving standards, such as the IMO's net-zero emissions goals by 2050 and China's 14th Five-Year Plan for Port Development (2021-2025), necessitates ongoing investment in sustainable technologies and operational upgrades. The amended Marine Environment Protection Law, effective January 1, 2024, imposes strict emission controls and waste management requirements, with non-compliance resulting in significant financial penalties. Furthermore, SIPG's commitment to fair labor practices, including adherence to Shanghai's 2021 minimum wage of RMB 2,480 and comprehensive social security contributions, is crucial for operational integrity and reputation.

Trade law and customs policies significantly impact SIPG's operations, as seen in the effects of the US-China trade dispute and the opportunities presented by the Regional Comprehensive Economic Partnership (RCEP) effective in 2022. Staying compliant with these evolving international and domestic trade frameworks is vital for facilitating global commerce and maintaining competitiveness. For example, as of early 2024, RCEP continues to influence regional trade dynamics, potentially increasing cargo volumes through Shanghai.

| Legal Factor | Key Regulation/Agreement | Impact on SIPG | Relevant Period/Status |

| Environmental Law | Amended Marine Environment Protection Law | Stricter emission targets, sustainable practices mandated; financial penalties for non-compliance. | Effective January 1, 2024 |

| Port Development | 14th Five-Year Plan for Port Development | Emphasis on digital transformation and green development; benchmark for efficiency and technology. | 2021-2025 |

| Labor Law | Shanghai Minimum Wage | Requirement to adhere to RMB 2,480/month minimum wage (as of 2021); social security contributions mandated. | Ongoing compliance; reforms in progress |

| Trade Policy | Regional Comprehensive Economic Partnership (RCEP) | Potential to boost trade through reduced tariffs and streamlined customs; influences cargo volumes. | Effective 2022; ongoing impact |

Environmental factors

Climate change presents significant long-term risks to Shanghai International Port Group (SIPG) infrastructure. Rising sea levels and more frequent extreme weather events, such as typhoons and heavy rainfall, directly threaten port facilities and operational continuity.

SIPG, situated in a low-lying coastal region, must integrate climate resilience into its strategic planning. This involves investing in infrastructure upgrades to withstand increased water levels and storm surges, ensuring uninterrupted operations.

For instance, by 2023, China has already experienced a notable increase in the frequency of extreme weather. SIPG's proactive adaptation measures, such as reinforcing seawalls and elevating critical infrastructure, are crucial for maintaining its competitive edge and safeguarding its extensive investments.

These proactive strategies not only mitigate immediate physical risks but also bolster SIPG's long-term operational resilience, ensuring its ability to serve global trade effectively amidst a changing climate.

Port activities at Shanghai International Port (SIP) inevitably contribute to air and water pollution. Vessel emissions, from the ships themselves, and emissions from the machinery used to move cargo on the docks are significant sources of air contaminants. Furthermore, the discharge of ballast water, which ships use for stability, can introduce invasive species into local ecosystems, and other waste streams from operations can impact water quality.

SIPG, Shanghai International Port Group, is taking concrete steps to address these environmental challenges. They are actively implementing shore power systems, allowing ships to connect to the electrical grid while docked, thus reducing emissions from auxiliary engines. Additionally, SIPG is promoting clean fuel refueling services for vessels. These initiatives align with China’s broader national strategy to foster green water transport and minimize the ecological footprint of maritime activities.

Shanghai International Port Group (SIPG) is actively engaged in enhancing its waste management and recycling initiatives, a critical component of its sustainability strategy. These efforts encompass both operational waste generated by the port's activities and residues from the vast amounts of cargo it handles. By 2025, China aims for significant advancements in its green port development, with SIPG expected to lead in upgrading its waste treatment and disposal infrastructure, reflecting a national commitment to cleaner port operations.

Biodiversity protection and marine ecosystem impact

Port expansion and dredging operations at Shanghai International Port (SIP) inherently pose risks to marine ecosystems. Activities like the development of Xiaoyangshan Island necessitate rigorous environmental impact assessments to mitigate harm to local biodiversity. China's increasing focus on marine ecological protection, evidenced by policies aimed at sustainable development, directly influences SIPG's operational planning and environmental mitigation strategies.

SIPG's commitment to environmental stewardship is crucial given the sensitive nature of its coastal operations. The port authority must implement robust measures to protect marine life, particularly during large-scale construction projects. For instance, adherence to China's stringent environmental regulations is paramount, with ongoing efforts to balance economic growth with ecological preservation.

- Marine Ecosystem Sensitivity: Dredging and construction activities can disrupt seabed habitats, affecting benthic organisms and fish spawning grounds.

- Biodiversity Impact Assessment: SIPG must conduct thorough assessments for projects like Xiaoyangshan Island development, identifying and planning to protect endangered species and critical marine habitats.

- Regulatory Compliance: China's national and local environmental protection laws, emphasizing marine ecosystem health, guide SIPG's operational standards and investment in mitigation technologies.

- Sustainability Initiatives: SIPG is increasingly investing in eco-friendly port technologies and practices to minimize its environmental footprint, aligning with national goals for blue economy development.

Energy consumption and carbon footprint reduction

Shanghai International Port Group (SIPG) is actively pursuing reduced energy consumption and a lower carbon footprint, aligning with China's ambitious 'dual carbon' targets: peaking emissions before 2030 and achieving carbon neutrality by 2060. This strategic focus is crucial for sustainable port operations.

To achieve these environmental goals, SIPG is making significant investments.

- Renewable Energy Integration: SIPG is increasing its use of solar power, with installations contributing to its energy needs.

- Energy-Efficient Equipment: The port is upgrading its machinery and infrastructure to more energy-efficient models, reducing overall power draw. For instance, in 2023, they continued the rollout of electric terminal tractors, aiming to replace a substantial portion of their diesel fleet.

- Alternative Fuels: SIPG is promoting the adoption of cleaner fuels for vessels calling at the port and for its own operational machinery, exploring options like LNG and methanol.

Shanghai International Port Group (SIPG) faces environmental pressures from pollution and ecological impacts, necessitating proactive management. By 2025, China aims for significant advancements in green port development, with SIPG expected to lead in upgrading waste treatment and disposal infrastructure.

SIPG is actively implementing shore power systems and promoting clean fuel refueling, aligning with China's strategy for green water transport and minimizing the ecological footprint of maritime activities. For instance, by 2023, China has experienced a notable increase in extreme weather events, underscoring the need for SIPG's climate resilience investments.

SIPG's commitment to environmental stewardship is crucial, with ongoing efforts to balance economic growth and ecological preservation, especially concerning marine ecosystem sensitivity and biodiversity impact assessments for projects like the Xiaoyangshan Island development.

The port is increasing its use of solar power and upgrading to energy-efficient equipment, such as electric terminal tractors, to reduce energy consumption and its carbon footprint, aligning with China's dual carbon targets.

| Environmental Factor | SIPG Initiatives/Impacts | 2023/2024/2025 Data/Targets |

|---|---|---|

| Climate Change & Extreme Weather | Infrastructure resilience to rising sea levels and storms. | Ongoing investment in seawall reinforcement and infrastructure elevation. China's 2023 extreme weather frequency increase highlights risk. |

| Pollution (Air & Water) | Shore power adoption, clean fuel promotion, waste management. | Expansion of shore power systems; by 2025, upgraded waste treatment infrastructure targeted. |

| Marine Ecosystems | Mitigation of dredging and construction impacts, biodiversity protection. | Rigorous environmental impact assessments for projects like Xiaoyangshan Island development; adherence to marine ecological protection policies. |

| Carbon Footprint Reduction | Renewable energy integration, energy-efficient equipment, alternative fuels. | Increased solar power use; rollout of electric terminal tractors continued in 2023; exploration of LNG and methanol fuels. Aligns with China's 2060 carbon neutrality goal. |

PESTLE Analysis Data Sources

Our Shanghai International Port PESTLE Analysis is built upon a robust foundation of data sourced from official Chinese government ministries, international trade organizations, and reputable maritime industry publications. This ensures comprehensive coverage of political stability, economic trends, and regulatory frameworks impacting port operations.