Shanghai International Port Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shanghai International Port Bundle

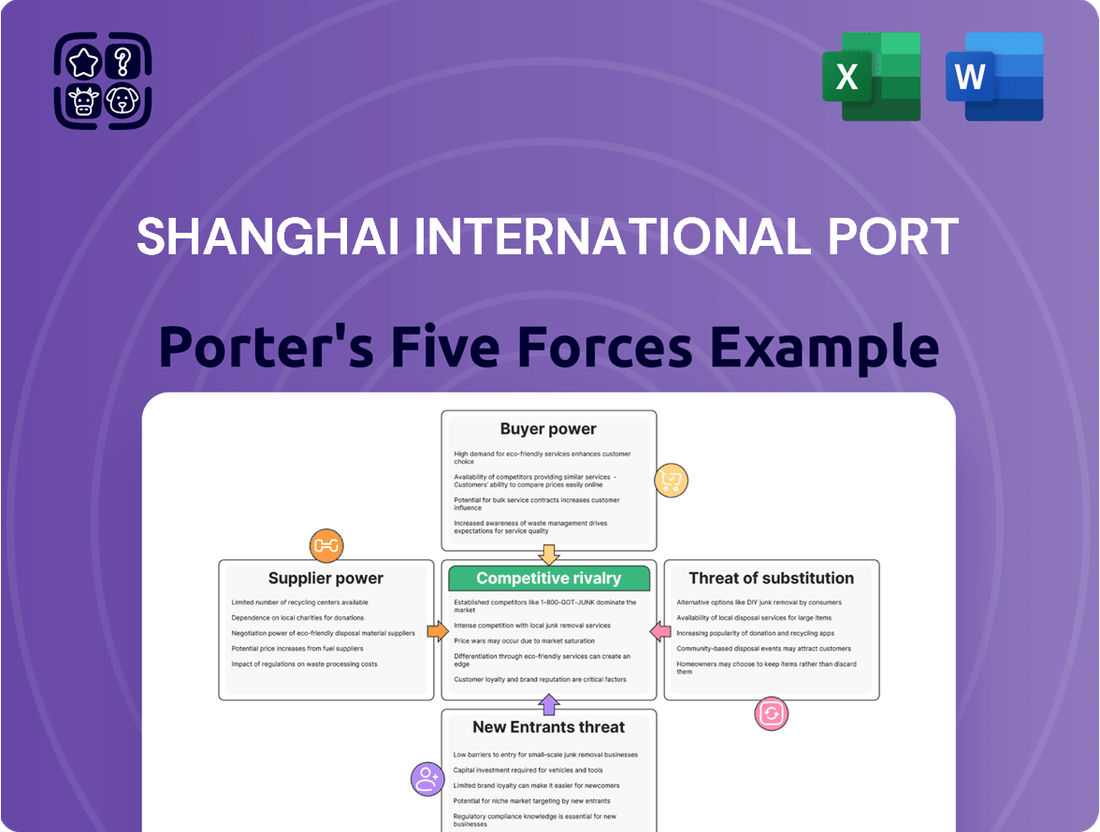

Shanghai International Port navigates a complex landscape shaped by intense competition and buyer power. Understanding the threat of substitutes and the bargaining power of suppliers is crucial for its strategic positioning. The overall industry rivalry is a significant factor, demanding constant adaptation.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Shanghai International Port’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers for Shanghai International Port Group (SIPG) is significantly influenced by supplier concentration. The global port equipment market is highly consolidated, with a few dominant manufacturers like Shanghai Zhenhua Heavy Industries (ZPMC), Liebherr, and Konecranes. ZPMC, in particular, holds a substantial share of the container crane market, often exceeding 70% globally. This dominance means port operators like SIPG have limited alternative suppliers for critical equipment.

This concentration directly translates into increased bargaining power for these key suppliers. When fewer companies control the supply of essential technologies, they can often dictate terms, including pricing and delivery schedules. For SIPG, this could mean higher acquisition costs for state-of-the-art cranes and other vital port machinery, impacting capital expenditure and operational efficiency. For instance, the significant investment required for upgrading quay cranes or automated systems often involves negotiating with these few established players.

Switching suppliers for major port equipment, like those operated by Shanghai International Port (Group) Co., Ltd. (SIPG), is a significant undertaking. The costs associated with replacing large-scale machinery such as gantry cranes or automated terminal systems are substantial, encompassing procurement, complex installation, staff retraining, and the inevitable disruption to ongoing operations. This financial and operational burden means SIPG faces high switching costs when considering alternative vendors.

These elevated switching costs directly translate to increased bargaining power for SIPG's existing, established suppliers. Given that port infrastructure has a long operational life, often spanning decades, operators like SIPG become deeply entrenched with their current equipment providers. This long-term commitment further solidifies the suppliers' leverage in price negotiations and contract terms.

Suppliers of advanced port technologies, such as automation software, AI logistics systems, and green energy solutions like LNG bunkering equipment, provide unique and critical inputs for Shanghai International Port Group (SIPG). As SIPG focuses on smart and green initiatives, its dependence on these specialized technology providers grows, thus increasing their bargaining power. These specialized inputs are essential for maintaining modern operational efficiency and competitiveness.

Threat of Forward Integration

The threat of forward integration by suppliers for Shanghai International Port is generally low, especially concerning core port operations. While a technology or logistics solutions provider might integrate into specialized services like digital platform management or advanced cargo handling, the significant capital investment and stringent regulatory hurdles for operating a major port limit this possibility. For instance, the total asset value of Shanghai Port Group in 2023 was substantial, requiring immense upfront capital for any competitor to replicate its infrastructure. This forward integration is more likely to manifest in niche, value-added services rather than the fundamental port infrastructure itself.

However, it's important to consider the potential for technology providers to offer integrated logistics solutions that could bypass traditional port services in certain segments. Such scenarios are more about enhancing efficiency and data flow rather than taking over physical port operations. The regulatory environment in China, particularly for critical infrastructure like ports, also acts as a strong deterrent against widespread forward integration by external suppliers.

- Low Likelihood of Core Integration: Major port equipment suppliers are unlikely to integrate forward into full port operations due to massive capital and regulatory barriers.

- Niche Service Integration: Technology and logistics solution providers may integrate into specialized port services, such as offering advanced digital platforms or unique cargo handling solutions.

- Capital & Regulatory Hurdles: The significant financial investment and complex regulatory landscape for port operations in China severely restrict the threat of forward integration.

- Value-Added Services Focus: Any forward integration by suppliers is more probable in specific value-added services rather than the core port infrastructure itself.

Importance to Supplier's Business

Shanghai International Port Group (SIPG) stands as a colossal customer for global port equipment and technology suppliers. Its immense operational scale, handling over 47 million TEUs in 2023, translates into substantial orders for machinery and services. This makes SIPG a highly desirable client, potentially limiting supplier pricing power.

However, the global nature of the port industry offers suppliers alternatives. Many manufacturers cater to multiple international ports, meaning the loss of SIPG as a client, while significant, may not be catastrophic. Furthermore, ongoing global port modernization efforts create consistent demand, allowing suppliers to maintain a degree of leverage.

- High Volume Impact: SIPG's massive throughput means suppliers depend on its business, reducing their ability to dictate terms.

- Global Market Diversification: Suppliers serving multiple ports worldwide can absorb the loss of a single client.

- Industry Growth: The persistent need for port upgrades globally gives suppliers ongoing opportunities and bargaining strength.

The bargaining power of suppliers to Shanghai International Port Group (SIPG) is shaped by supplier concentration and high switching costs. Key equipment manufacturers like ZPMC, holding over 70% of the global container crane market, possess considerable leverage due to the limited number of alternatives for SIPG. These high switching costs, stemming from the substantial investment and operational disruption involved in replacing large-scale port machinery, further enhance supplier influence.

| Factor | Impact on SIPG | Key Suppliers | Example Data (2023/2024) |

|---|---|---|---|

| Supplier Concentration | Increases supplier power due to limited alternatives. | ZPMC, Liebherr, Konecranes | ZPMC's global container crane market share: >70% |

| Switching Costs | High due to significant capital and operational disruption. | Major port machinery manufacturers | Complex installation, retraining, downtime |

| Dependency on Specialized Inputs | Growing reliance on advanced technology providers. | Automation software, AI logistics, green energy solutions | SIPG's focus on smart and green initiatives |

| SIPG's Customer Power | Reduced by SIPG's massive scale, but offset by supplier diversification. | Global port equipment manufacturers | SIPG handled over 47 million TEUs in 2023 |

What is included in the product

A Porter's Five Forces analysis for Shanghai International Port reveals the intense bargaining power of shipping lines and the threat of new port entrants, while also highlighting the port's strong competitive advantages.

Visualize competitive pressures at the Shanghai International Port with an intuitive spider chart, instantly revealing areas of greatest strategic concern.

Easily model the impact of new entrants or shifting buyer power by duplicating and customizing tabs for diverse market scenarios.

Customers Bargaining Power

Shanghai International Port Group's (SIPG) customers are heavily concentrated, primarily consisting of major global shipping lines. This consolidation trend is quite pronounced. By 2025, the top 20 global shipping carriers are projected to manage over 90% of the world's container vessel capacity. This significant concentration among a few large shipping alliances grants them considerable leverage when negotiating service agreements and pricing with port operators like SIPG.

The sheer volume of cargo these dominant shipping alliances can direct to or away from a port gives them substantial bargaining power. They can effectively demand more favorable terms and pricing due to their ability to shift considerable business. This dynamic means SIPG must carefully consider the demands of these key customers to maintain its competitive position and secure long-term contracts.

Switching costs for customers, particularly major shipping lines, are relatively low for Shanghai International Port. While rerouting vessels requires some logistical planning and schedule adjustments, the existence of numerous competitive ports in the region, such as Ningbo and Shenzhen, provides viable alternatives. This accessibility to other major hubs significantly reduces the friction for shipping lines to shift their port calls if Shanghai's terms become unfavorable, thereby bolstering their bargaining power.

Shipping lines are well-informed about port pricing and service quality worldwide, making them very sensitive to costs. For example, in 2024, the ongoing Red Sea disruptions forced many carriers to reroute vessels, significantly increasing fuel and operational expenses, thereby heightening their focus on port charges.

This increased sensitivity means customers actively scrutinize and negotiate a wide array of port fees. They are adept at comparing offers and leveraging their volume to secure better terms, directly impacting Shanghai International Port's ability to impose premium pricing.

Threat of Backward Integration

Major shipping lines are increasingly investing in their own port terminal operations. This backward integration strategy allows them to gain more control over their supply chains and lessen their dependence on external port providers like Shanghai International Port Group (SIPG).

This growing trend directly enhances the bargaining power of customers. By operating their own terminals, shipping companies can negotiate more favorable terms with port operators or even bypass them entirely for certain services, impacting SIPG's revenue streams.

For instance, in 2024, several global carriers announced significant investments in port infrastructure development or acquisitions, signaling a clear move towards greater self-sufficiency in terminal management. This strategic shift is a direct response to volatile market conditions and the desire for operational efficiency.

- Increased Shipping Line Control: Major carriers are acquiring or building their own terminals, reducing reliance on SIPG.

- Enhanced Bargaining Power: This vertical integration gives shipping lines more leverage in negotiations with port services.

- Strategic Market Response: The trend is driven by a need for supply chain control and efficiency in a dynamic market.

- 2024 Investment Trends: Global carriers made notable investments in port infrastructure, highlighting this growing backward integration.

Volume of Purchases

Shanghai International Port Group (SIPG) is the world's busiest container port, processing an enormous volume of cargo. For instance, in 2023, SIPG handled over 43 million TEUs (twenty-foot equivalent units). This sheer scale means that major shipping lines, which are SIPG's primary customers, often account for a substantial percentage of the port's total throughput.

The significant volume of business these large shipping lines bring directly translates into considerable bargaining power. They are in a strong position to negotiate favorable terms, including volume-based discounts on port services and preferential treatment regarding berth allocation and operational efficiency.

- High Throughput: SIPG processed over 43 million TEUs in 2023, underscoring its immense scale.

- Customer Concentration: Large shipping lines represent a significant portion of SIPG's cargo volume.

- Negotiating Leverage: This concentration empowers customers to demand volume discounts and priority services.

- Competitive Environment: The ability to shift cargo to other ports, if feasible, further strengthens customer bargaining power.

The bargaining power of customers for Shanghai International Port Group (SIPG) is significant, primarily due to the concentration of its client base among major global shipping lines. These carriers, representing a substantial portion of SIPG's throughput, wield considerable influence in negotiations. For example, in 2023, SIPG handled over 43 million TEUs, with a large share originating from a few key shipping alliances.

The ability of these shipping lines to shift considerable cargo volumes to alternative ports, such as Ningbo or Shenzhen, further amplifies their negotiating leverage. This is compounded by the fact that switching costs are relatively low for these entities. In 2024, heightened operational costs due to global disruptions also made these carriers acutely cost-sensitive, driving more aggressive price negotiations.

Furthermore, the trend of major shipping lines investing in their own port terminal operations in 2024, aiming for greater supply chain control and efficiency, directly diminishes their reliance on third-party providers like SIPG, thereby strengthening their bargaining position.

| Customer Characteristic | Impact on Bargaining Power | Supporting Data/Trend |

|---|---|---|

| Customer Concentration | High | Top 20 carriers expected to manage >90% of global container capacity by 2025. SIPG's 2023 throughput: >43 million TEUs. |

| Switching Costs | Low | Availability of numerous regional competing ports (e.g., Ningbo, Shenzhen). |

| Cost Sensitivity | High | Increased focus on port charges due to rising operational expenses in 2024 (e.g., Red Sea rerouting). |

| Backward Integration | Increasing | Global carriers invested in port infrastructure/acquisitions in 2024 for greater self-sufficiency. |

Full Version Awaits

Shanghai International Port Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Shanghai International Port Porter's Five Forces Analysis delves into the competitive landscape, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. Understanding these forces is crucial for strategizing within the global port industry.

Rivalry Among Competitors

While Shanghai International Port Group (SIPG) holds a unique position as the sole operator of public terminals in Shanghai, the world's busiest port, it navigates a landscape of fierce competition. Rivalry stems from major global and regional ports, especially within Asia, which are constantly vying for shipping line business through significant investments in capacity and cutting-edge technology.

Key competitors include other prominent Chinese ports such as Ningbo-Zhoushan and Shenzhen, both of which are expanding their infrastructure and operational capabilities. Internationally, hubs like Singapore and Busan pose a substantial competitive threat, continually upgrading their facilities and services to attract global shipping traffic. For instance, Singapore Port handled over 37.2 million TEUs (twenty-foot equivalent units) in 2023, showcasing its continued strength as a major maritime hub.

The global maritime trade is expected to grow by a steady 2.4% in 2024, with projections indicating a further 2% increase in 2025. This expansion generally tempers intense rivalry by ensuring ample business opportunities for all players.

Despite this growth, competition within the port industry remains robust. Significant global investments in port infrastructure and capacity expansion, particularly in China, mean that ports are actively competing to capture a larger share of the increasing trade volumes. The ongoing growth in containerization further intensifies this competitive landscape as ports strive to handle more of this efficient shipping method.

Shanghai International Port Group (SIPG) achieves product differentiation through superior operational efficiency, cutting-edge automation, and a suite of advanced digital solutions. Their commitment to specialized cargo handling, including emerging areas like LNG bunkering, further sets them apart. The strategic advantage of SIPG’s deep-water facilities and extensive network, exemplified by the Yangshan Deep Water Port, is a significant differentiator.

While SIPG has historically led in automation, other global ports are rapidly catching up, adopting similar technologies. This means the competitive landscape is dynamic, requiring continuous innovation. SIPG’s ability to offer integrated logistics services, encompassing more than just traditional port operations, provides a crucial competitive edge by streamlining supply chains for their clients.

Exit Barriers

Exit barriers for Shanghai International Port Porter (SIPG) are exceptionally high, primarily due to the immense capital sunk into its extensive infrastructure. We are talking about billions invested in specialized cranes, deep-water berths, and vast container yards. For instance, SIPG's ongoing expansion projects, like the development of the Yangshan Deep-Water Port, represent significant, long-term capital commitments. These aren't assets that can be easily repurposed or sold off if the business falters.

Furthermore, the strategic national importance of a major hub like Shanghai Port means that government entities are highly unlikely to permit a complete exit. This strategic value acts as a substantial, albeit intangible, barrier. The sheer scale of operations and the critical role SIPG plays in global trade mean that any potential closure would have significant economic repercussions, making a smooth exit improbable.

These formidable exit barriers mean that existing players, including SIPG and its domestic and international competitors, are effectively locked into the market. This immobility intensifies competitive rivalry, as companies must continue to operate and compete fiercely rather than seek an easy exit. The high sunk costs compel companies to fight for market share to justify their continued investment, leading to sustained competitive pressure within the industry.

- Massive Fixed Asset Investments: SIPG's infrastructure, including specialized port equipment and extensive terminal facilities, represents billions in capital expenditure, making divestment difficult.

- Strategic National Importance: As a key node in global supply chains, Shanghai Port's role in national economic strategy deters outright closure or easy exit by regulatory bodies.

- Long-Term Lease Commitments: Operating agreements and land concessions for port facilities often involve long-term contracts, further increasing the cost and complexity of exiting the market.

- Intensified Rivalry: High exit barriers force existing competitors to remain engaged, leading to sustained and often fierce competition for market share and operational efficiency.

Intensity of Competition

Competitive rivalry within the port industry, including Shanghai International Port, is exceptionally intense. This is fueled by ongoing, substantial investments in upgrading facilities, increasing cargo handling capacity, and striving for greater operational efficiency. Ports are locked in a constant battle to offer the most attractive transit times, competitive handling costs, robust hinterland connectivity, and superior value-added logistics services to attract global shipping lines and cargo owners.

The drive for market share necessitates continuous innovation and investment. For instance, many major ports globally, including those in direct competition with Shanghai, have been investing billions in automated terminals and advanced digital solutions. In 2023, the Port of Rotterdam, a key European competitor, continued its expansion projects focused on efficiency and sustainability, aiming to handle increased volumes and offer integrated logistics solutions. This global trend forces Shanghai International Port to remain at the forefront of technological adoption and service excellence.

- Transit Times: Shaving hours off vessel turnaround directly impacts shipping line costs and schedules.

- Handling Costs: Efficiency in loading/unloading translates to direct savings for cargo owners.

- Hinterland Connectivity: Seamless integration with rail and road networks is crucial for efficient cargo movement inland.

- Value-Added Services: Offering services like warehousing, customs brokerage, and consolidation differentiates ports.

Furthermore, geopolitical realignments and the persistent disruptions in global supply chains, a reality in 2024, significantly heighten competitive pressures. Ports must remain agile, adapting to shifting trade patterns and the evolving demands of international commerce. This includes developing contingency plans and investing in infrastructure that can accommodate new trade routes or accommodate the rerouting of cargo, making resilience a key competitive factor.

Competitive rivalry is a dominant force for Shanghai International Port Group (SIPG). Ports worldwide, particularly in Asia, are aggressively investing in capacity and technology to win business from shipping lines. This means SIPG constantly faces pressure to improve efficiency and service offerings.

Key rivals like Ningbo-Zhoushan and Shenzhen in China, alongside international hubs such as Singapore and Busan, are expanding their infrastructure. For example, Singapore Port handled over 37.2 million TEUs in 2023, highlighting the scale of competition. Global maritime trade is projected to grow, but this growth is met with significant port development, intensifying the fight for market share.

| Port | 2023 TEUs (Approx.) | Key Competitive Factor |

|---|---|---|

| Shanghai (SIPG) | 43.7 million | Automation, Digital Solutions |

| Singapore | 37.2 million | Connectivity, Value-Added Services |

| Ningbo-Zhoushan | 35.4 million | Capacity Expansion, Hinterland Integration |

| Shenzhen | 30.1 million | Efficiency, Specialized Cargo Handling |

SSubstitutes Threaten

The threat of substitutes for Shanghai International Port is significant due to the availability of alternative ports. Customers, specifically shipping lines, have viable options within China and across the wider Asia-Pacific region. For instance, ports such as Ningbo-Zhoushan, Shenzhen, and Qingdao offer competitive services and possess the capacity to manage substantial container volumes. These ports directly substitute for Shanghai for numerous shipping routes, providing shippers with alternatives.

Shipping lines possess considerable operational flexibility, allowing them to select ports based on a variety of factors. Cost-effectiveness, operational efficiency, and geopolitical considerations all play a role in these decisions. In 2024, the ongoing development and capacity expansion at competing Asian ports, including those in Vietnam and Malaysia, further intensify this competitive pressure, presenting readily available alternatives for cargo diversion.

While Shanghai International Port Porter primarily deals with maritime shipping, other transportation modes act as substitutes, especially for specific cargo types. Air freight offers a faster alternative for high-value, time-sensitive, or perishable goods, though at a significantly higher cost. For instance, the global air cargo market handled approximately 130 million tons in 2023, a fraction of sea freight but crucial for certain industries.

Land-based transportation, particularly rail, presents another substitute, particularly for inland distribution or for routes where sea freight is less efficient or direct. China-Europe Railway Express, for example, provides a rail link that bypasses traditional sea routes for certain goods. While rail freight capacity and speed differ from sea freight, it can be a viable option for specific trade lanes and cargo, impacting the demand for port services for those specific shipments.

Alternative sea routes present a significant threat to Shanghai International Port. For instance, bypassing the Suez Canal via the Cape of Good Hope can add considerable time and cost to shipments, making it a less attractive substitute for many. However, the emergence of new direct routes, such as the Chancay Mega Port in Peru, offers a potential alternative for certain trade flows, especially those connecting Asia to South America.

The decision between using established routes through Shanghai or considering these substitutes hinges on a careful price-performance trade-off. Factors like cargo urgency, the inherent value of the goods, and prevailing geopolitical risks all play a role. For example, canal tolls at Suez can fluctuate, impacting the overall cost-competitiveness of traditional routes. Customers meticulously evaluate these variables when choosing their shipping pathways.

In 2024, the global shipping industry continued to grapple with capacity constraints and evolving trade patterns. While specific data on the diversion of cargo from Shanghai to alternative routes due to cost-performance trade-offs is complex to isolate, general trends in shipping costs offer insight. For example, the cost of shipping a 40-foot equivalent unit (FEU) container from Asia to Europe, a key trade lane for Shanghai, saw significant volatility throughout 2023 and into 2024, influenced by fuel prices and demand, directly impacting the attractiveness of substitute routes.

Customer Willingness to Switch

Customer willingness to switch away from Shanghai International Port Group (SIPG) is a critical factor. This willingness is shaped by the perceived value offered by alternative ports and transportation methods, considering aspects like how dependable they are, their overall expense, how long it takes for goods to arrive, and how robust their operations are in the face of disruptions.

Recent global events have significantly amplified this willingness. For instance, the Red Sea crisis and various port strikes throughout 2023 and into early 2024 have underscored the importance of supply chain resilience for businesses. This heightened awareness is driving companies to actively seek and evaluate alternative shipping routes and ports, making them more open to considering options beyond SIPG. In 2023, global shipping costs saw considerable volatility, with the Shanghai Containerized Freight Index (SCFI) fluctuating significantly, impacting the cost-competitiveness of different routes and ports.

This increased receptiveness to substitutes puts pressure on SIPG to continually enhance its competitive edge. To retain market share, SIPG must focus on:

- Maintaining highly competitive pricing structures in comparison to other major Asian and global ports.

- Ensuring exceptional service reliability and efficiency to minimize transit times and avoid delays.

- Investing in advanced technology and infrastructure to bolster supply chain resilience and offer seamless connectivity.

- Proactively addressing and mitigating operational risks that could lead to service disruptions.

Technological Advancements in Logistics

Technological advancements are significantly increasing the threat of substitutes for Shanghai International Port. Integrated logistics and supply chain management platforms, often powered by digital technologies, now offer customers end-to-end visibility. This makes it much simpler for businesses to compare and utilize various transportation modes and providers. For instance, by mid-2024, global supply chain visibility software adoption was projected to reach over 70% among large enterprises, a substantial increase from previous years, enabling easier exploration of alternative logistics hubs.

These sophisticated digital solutions reduce a customer's dependence on a single port for their entire logistics operation. They streamline the process of managing multi-modal transport, meaning goods can be efficiently routed through different ports or inland terminals. This increased flexibility and ease of management directly empower customers to consider and implement substitute solutions, thereby diminishing the port's traditional bargaining power.

The growing sophistication of these technologies makes alternative logistics strategies more viable and cost-effective. With real-time tracking and optimized routing, businesses can now more readily shift volumes to other ports or hinterland connections if Shanghai's services become less competitive. This trend is supported by the continued investment in digital infrastructure across the global logistics sector, with companies like Maersk and CMA CGM heavily investing in digital platforms throughout 2024 to enhance customer experience and service integration.

- Increased Visibility: Digital platforms offer end-to-end tracking, making it easier to manage multi-modal transport.

- Reduced Port Reliance: Technology facilitates the use of various substitute ports and inland logistics solutions.

- Enhanced Viability: Advancements make alternative logistics strategies more practical and cost-effective for businesses.

- Customer Empowerment: Sophisticated tools allow customers greater flexibility in choosing their logistics providers and routes.

The threat of substitutes for Shanghai International Port (SIPG) is influenced by the availability and attractiveness of alternative ports and transportation methods. Competitors like Ningbo-Zhoushan, Shenzhen, and Qingdao offer comparable services within China, while other Asian ports are expanding their capacity, presenting viable alternatives for shipping lines in 2024.

Shipping lines can easily divert cargo due to operational flexibility, considering factors like cost, efficiency, and geopolitical risks. For instance, the ongoing development of ports in Vietnam and Malaysia provides shippers with readily available alternatives, intensifying competitive pressure on SIPG.

While maritime shipping is dominant, air freight and rail transport act as substitutes for specific cargo types. Air cargo is crucial for high-value, time-sensitive goods, and rail, like the China-Europe Railway Express, offers an alternative for inland distribution, impacting port demand for certain trade lanes.

| Alternative Port | Key Services | 2024 Capacity/Development Focus |

|---|---|---|

| Ningbo-Zhoushan Port | Container, bulk cargo, oil | Continued expansion of automated terminals, increased capacity |

| Port of Shenzhen | Container, logistics services | Smart port initiatives, enhanced intermodal connectivity |

| Port of Qingdao | Container, bulk, oil | Digitalization of operations, focus on green port development |

| Ho Chi Minh City (Vietnam) | Container, logistics | Infrastructure upgrades, increased draft capabilities |

| Port Klang (Malaysia) | Container, logistics | Expansion of container terminals, focus on regional trade hub |

Entrants Threaten

Entering the port operating industry, particularly at the scale of an international hub like Shanghai, demands an enormous amount of capital. This includes hefty costs for acquiring land, deepening waterways, building terminals, and purchasing state-of-the-art machinery. Global port infrastructure investments were significant in 2024, reaching an estimated $73 billion, underscoring the substantial financial hurdle for new companies aiming to compete.

The port industry, especially in China, faces significant regulatory barriers. State-owned enterprises, like Shanghai International Port Group (SIPG), frequently possess exclusive operational rights for public terminals. This creates a steep climb for any potential new player looking to enter the market.

Securing the necessary permits, navigating complex environmental approval processes, and obtaining crucial land or water rights are substantial challenges. These bureaucratic requirements can significantly delay or even prevent new entrants from establishing a foothold.

Further reinforcing these barriers, China's 14th Five-Year Plan (2021-2025) prioritizes the state-backed development of existing ports. This strategic focus inherently limits opportunities for independent, new market participants, solidifying the position of established entities.

Established port operators like Shanghai International Port Group (SIPG) leverage substantial economies of scale, meaning they can process enormous volumes of cargo more cost-effectively. In 2023, SIPG handled over 43 million TEUs (twenty-foot equivalent units), a testament to their operational efficiency. This massive throughput allows them to spread fixed costs over a larger base, resulting in a lower per-unit cost for services.

For potential new entrants, achieving similar cost advantages is a significant hurdle. They would need to invest heavily in infrastructure and operations to even approach SIPG's scale, making it challenging to compete on price. This inherent cost advantage acts as a powerful barrier, protecting SIPG from new competition.

Access to Distribution Channels and Networks

New entrants into the port services industry, specifically those looking to compete with Shanghai International Port Porter (SIPG), would encounter significant hurdles in accessing established distribution channels and networks. Building the necessary relationships with major global shipping lines and seamlessly integrating into existing international logistics frameworks is a formidable challenge. SIPG's advantage lies in its deep-rooted, long-standing relationships with key players and its crucial position along vital global trade routes, particularly within the economically significant Yangtze River Delta region.

Developing this level of extensive connectivity and fostering the trust required to operate within these complex supply chains demands substantial investment in both time and financial resources. For instance, in 2023, SIPG handled over 43 million TEUs (Twenty-foot Equivalent Units) of container throughput, underscoring its massive operational scale and the established network it commands. Newcomers would need to replicate this immense logistical infrastructure and secure similar partnerships to gain meaningful market access.

- Limited access to established global shipping line partnerships

- Difficulty in integrating into existing international logistics networks

- SIPG's strategic advantage through long-standing relationships

- The high cost and time required to build comparable connectivity and trust

Incumbent Advantages and Brand Loyalty

Shanghai International Port Group (SIPG) benefits from a substantial incumbent advantage, having been the world's busiest container port for 15 consecutive years. This sustained leadership is built on a foundation of advanced infrastructure and a proven track record of operational efficiency. For instance, in 2023, SIPG handled over 43 million TEUs (Twenty-foot Equivalent Units), reinforcing its dominant position.

This established efficiency cultivates a significant degree of brand loyalty among key stakeholders, including major shipping lines and cargo owners. These entities prioritize reliability and the assurance of service continuity, factors that SIPG has consistently delivered. Consequently, any new entrant would face the formidable challenge of matching SIPG's operational excellence and its deeply ingrained reputation.

- Established Infrastructure: SIPG's extensive network of terminals and cutting-edge technology represent massive capital investments that are difficult for new players to replicate.

- Operational Efficiency: Consistent high throughput and rapid turnaround times at SIPG create a strong preference among users who value speed and predictability.

- Brand Recognition: Fifteen years as the world's busiest port has cemented SIPG's brand as synonymous with large-scale, reliable port operations.

- Economies of Scale: SIPG's sheer volume allows for cost efficiencies that are challenging for smaller, newer entrants to achieve, further solidifying its competitive edge.

The threat of new entrants for Shanghai International Port Group (SIPG) is notably low due to several formidable barriers. The sheer capital required for port infrastructure, estimated at $73 billion globally in 2024, makes entry exceptionally difficult. Regulatory hurdles, including exclusive rights for state-owned enterprises and complex approval processes, further deter new players. Moreover, SIPG's established economies of scale, handling over 43 million TEUs in 2023, and its deeply entrenched relationships with shipping lines create significant disadvantages for any newcomer attempting to gain market access and compete on cost or network reach.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Shanghai International Port leverages data from the port's annual reports, official government publications, and maritime industry trade journals to assess competitive dynamics.