Shanghai International Port Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shanghai International Port Bundle

Discover the strategic brilliance behind Shanghai International Port's operations with our comprehensive Business Model Canvas. This detailed breakdown reveals its core value propositions, key customer segments, and innovative revenue streams, offering a clear picture of its market dominance. Ideal for anyone seeking to understand or replicate success in the logistics and port industry.

Unlock the full strategic blueprint behind Shanghai International Port's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Shanghai International Port Group (SIPG) actively cultivates key partnerships with leading global shipping carriers. These strategic alliances are fundamental to expanding its international route network and enhancing service efficiency.

A significant development is the Gemini Cooperation, a venture with shipping giants Maersk and Hapag-Lloyd, which began its operations at Shanghai Port in February 2025. This collaboration is specifically designed to boost the port's global connectivity and improve on-time performance for vessels.

By engaging in such high-profile partnerships, SIPG reinforces its position as a vital international shipping hub. The Gemini Cooperation, for instance, is expected to contribute to a more robust and reliable shipping infrastructure for the region.

Shanghai International Port Group (SIPG) actively collaborates with a wide array of logistics and freight forwarding companies to deliver comprehensive, end-to-end supply chain solutions. These partnerships are fundamental to extending SIPG's reach and service capabilities beyond the physical port boundaries.

A prime example of this strategic approach is SIPG's cooperation agreement signed in January 2025 with Antong Holdings. This alliance specifically targets the enhancement of domestic trade container vessel operations and drives digital transformation initiatives within the logistics sector.

These collaborations are vital for optimizing the flow of goods and improving the overall quality of services provided throughout the entire supply chain. By integrating port operations with advanced logistics, SIPG aims to create a more efficient and responsive ecosystem for its clients.

Shanghai International Port's key partnerships with government agencies and regulators are crucial for navigating the complex landscape of international trade. These collaborations ensure strict adherence to national and global trade regulations, customs clearance protocols, and environmental protection standards, which are vital for efficient port operations.

Working closely with bodies like China's Ministry of Transport and the Shanghai Municipal Government allows the port to align its development with national economic strategies and infrastructure plans. For instance, the port's integration into the Yangtze River Delta economic zone, a key government initiative, highlights this symbiotic relationship.

In 2024, Shanghai Port handled over 49 million TEUs (Twenty-foot Equivalent Units), a testament to the streamlined processes facilitated by strong government partnerships. These relationships are instrumental in securing permits, managing safety, and implementing technological advancements that boost efficiency and competitiveness.

Furthermore, these regulatory partnerships are essential for maintaining the port's status as a global shipping hub, enabling it to meet evolving international maritime laws and environmental commitments, such as those related to emissions reduction.

Technology and Automation Providers

Shanghai International Port Group (SIPG) actively collaborates with technology and automation providers to enhance its operational capabilities. These partnerships are crucial for integrating cutting-edge solutions that streamline port management and logistics.

A significant initiative involves the planned integration of blockchain technology into SIPG's logistics systems by 2025. This move aims to bolster trade efficiency and fortify data security across its operations.

These collaborations foster innovation, leading to advancements like automated terminal operations and sophisticated digital platforms. Such technological integrations are vital for SIPG to sustain its high levels of operational efficiency and competitiveness in the global market.

- Blockchain Integration: SIPG is set to implement blockchain technology in its logistics by 2025 to improve trade efficiency and data security.

- Automated Terminals: Partnerships drive the development and deployment of automated terminals, enhancing cargo handling speed and accuracy.

- Digital Platforms: Collaboration with tech firms enables the creation of advanced digital platforms for better port management and customer service.

- Efficiency Gains: These technological advancements are projected to significantly boost operational efficiency, with initial phases showing promising results in pilot programs.

Intermodal Transportation Partners

Shanghai International Port Group (SIPG) relies heavily on its intermodal transportation partners to offer robust logistics solutions. These crucial relationships include collaborations with major railway operators, numerous trucking companies, and inland waterway carriers. This network is fundamental for providing end-to-end freight movement, ensuring goods can efficiently reach their final destinations.

SIPG actively works to strengthen its sea-rail transport capabilities. The port is dedicated to optimizing collection and distribution systems, which are essential for extending its operational reach deep into the hinterland. This strategic focus allows SIPG to tap into a wider domestic market and better serve its international clients.

These partnerships facilitate seamless multimodal transport, a cornerstone of modern global supply chains. By integrating various transport modes, SIPG ensures that cargo flows smoothly between ocean vessels and land-based networks. For instance, in 2023, the port saw significant growth in its rail-sea intermodal volume, handling over 2.2 million TEUs (twenty-foot equivalent units) via rail, reflecting the increasing importance of these partnerships.

- Railway Operators: Facilitate efficient long-haul movement of containers between the port and inland economic centers.

- Trucking Companies: Provide flexible and rapid last-mile delivery and collection services, crucial for timely cargo transfers.

- Inland Waterway Carriers: Enable cost-effective bulk cargo transport and connectivity to regions accessible via river systems.

- Enhanced Sea-Rail Connectivity: SIPG's commitment to improving rail links directly supports its strategy to capture more hinterland cargo.

Shanghai International Port Group's key partnerships extend to technology and automation providers, crucial for modernizing its operations. Collaborations with firms like Shanghai Zhenhua Heavy Industries (ZPMC) are vital for the deployment of advanced, automated equipment, including intelligent quay cranes and automated guided vehicles (AGVs).

By integrating these technologies, SIPG aims to significantly boost cargo handling efficiency and safety. For example, the port's ongoing expansion of its automated terminal facilities, a direct result of these tech partnerships, is designed to handle increasing volumes with greater speed and precision.

These strategic alliances are also driving the development of sophisticated digital platforms. These platforms enhance real-time monitoring, data analytics, and overall port management, contributing to a more responsive and integrated supply chain. The focus is on leveraging innovation to maintain a competitive edge in the global maritime industry.

| Partner Type | Example Partner | Focus Area | Impact |

| Automation Equipment | ZPMC | Automated Quay Cranes, AGVs | Increased handling speed, enhanced safety |

| Digital Solutions | Various Tech Firms | Port Management Software, Data Analytics | Improved efficiency, real-time visibility |

| Blockchain Technology | Industry Collaborators | Trade Efficiency, Data Security | Streamlined processes, enhanced trust |

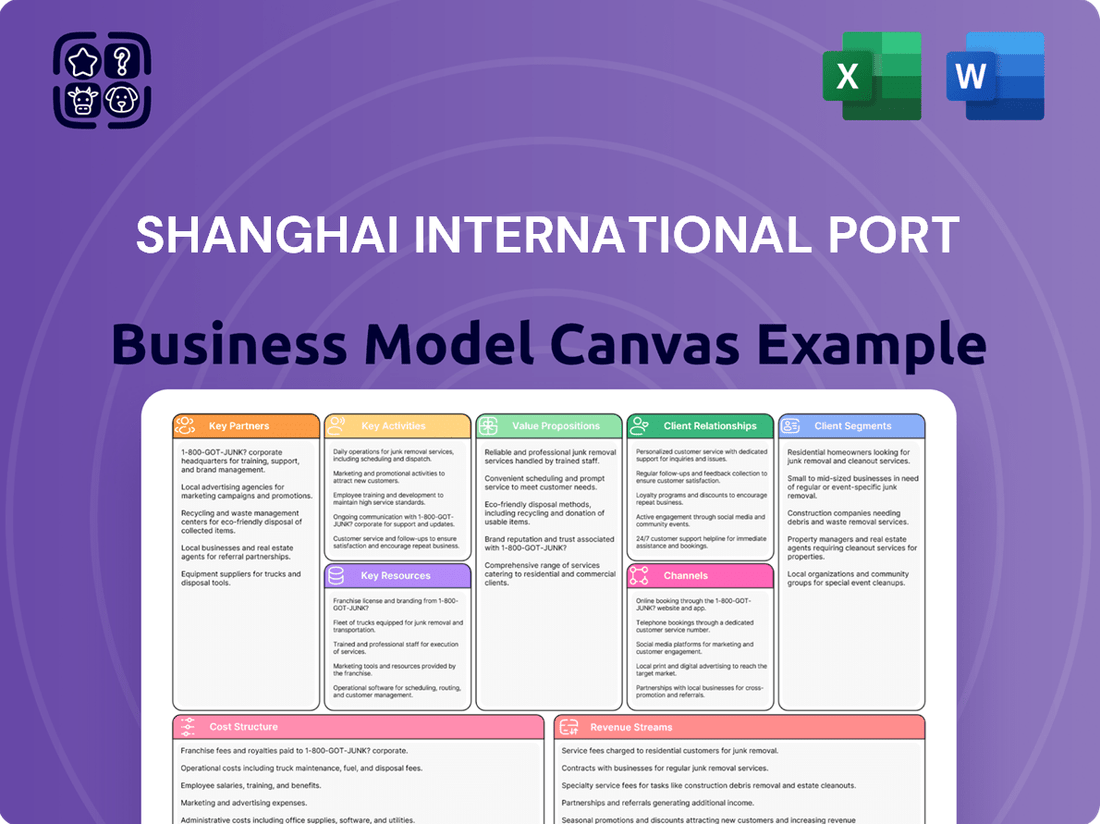

What is included in the product

A detailed blueprint of Shanghai International Port's operations and strategic approach, covering key elements like customer segments, revenue streams, and cost structures.

This model offers a clear, organized representation of the port's business, ideal for understanding its competitive advantages and future growth potential.

Addresses the complexity of international trade by visually mapping out key partnerships and revenue streams, simplifying operational challenges.

Provides a clear framework for understanding the port's value proposition and customer segments, alleviating the pain of fragmented communication.

Activities

Shanghai International Port Group's primary function revolves around the meticulous management and operation of its extensive public port infrastructure. This core activity includes the critical tasks of loading and unloading both containers and general cargo, ensuring the smooth flow of global trade.

In 2024, SIPG's operational prowess was underscored by its handling of an astounding 51.5 million TEUs, solidifying its status as the busiest container port globally. This remarkable throughput demonstrates the scale and efficiency of their port operations.

The group consistently invests in and deploys advanced terminal management systems and automation technologies. These innovations are key to optimizing operational efficiency and maintaining a competitive edge in the fast-paced maritime industry.

Shanghai International Port's key activities extend far beyond simply moving containers. They offer a full suite of integrated logistics and shipping services, encompassing warehousing, storage, and even product processing. This comprehensive approach allows them to provide seamless, end-to-end supply chain solutions for their clients.

These value-added services are crucial for attracting and retaining customers in today's competitive market. By managing the entire flow of goods, from arrival to final distribution, Shanghai International Port acts as a vital partner for businesses relying on efficient supply chains. In 2024, the port handled over 47 million TEUs (twenty-foot equivalent units), highlighting the sheer scale of their operations and the demand for their integrated services.

Shanghai International Port Group's (SIPG) key activities heavily revolve around the continuous development and meticulous upkeep of its vast port infrastructure. This ensures operational efficiency and future growth. For instance, substantial investments are being channeled into projects like the second phase of the Luojing Port Area Container Terminal and the expansion of the Xiaoyangshan North Terminal. These initiatives are designed to significantly boost cargo handling capacity.

Regular and proactive maintenance is not just a necessity but a core activity to guarantee the sustained functionality and optimal performance of SIPG's extensive network of terminals, berths, and associated equipment. This commitment to maintenance safeguards the longevity of its assets and minimizes potential disruptions, which is crucial in a dynamic global trade environment. By prioritizing infrastructure development and maintenance, SIPG solidifies its position as a leading global port operator.

Digitalization and Technology Adoption

Shanghai International Port Group (SIPG) is making significant strides in its digital transformation, aiming to revolutionize port operations. By 2025, SIPG plans to integrate blockchain technology, a move designed to bolster trade efficiency and fortify data security for all stakeholders involved in maritime commerce.

This strategic push towards digitalization is already yielding tangible results, notably through the implementation of electronic bills of lading and e-releases. These digital solutions are actively streamlining the often complex and paper-intensive documentation processes inherent in global shipping. For instance, the adoption of e-bills of lading can reduce processing times by as much as 80%, according to industry reports from 2024.

- Blockchain Integration: Targeted for completion by 2025 to enhance trade efficiency and data security.

- Electronic Documentation: Implementation of e-bills of lading and e-releases to streamline administrative workflows.

- Innovation Focus: These activities highlight SIPG's dedication to modernizing port infrastructure and services.

- Efficiency Gains: Digitalization efforts are expected to reduce operational costs and improve turnaround times for vessels and cargo.

Environmental Sustainability Initiatives

Shanghai International Port is actively pursuing environmental sustainability through significant investments in green initiatives. The port is expanding its capacity for Liquefied Natural Gas (LNG) and green methanol fueling, crucial steps for decarbonizing maritime operations.

Furthermore, the completion of shore power systems is a key activity, allowing vessels to connect to land-based electricity, thereby reducing emissions while docked. These efforts are geared towards establishing eco-friendly shipping corridors and substantially lowering the port's carbon footprint.

These green commitments are not just about environmental stewardship; they are strategic. By 2023, Shanghai Port handled over 47 million TEUs, underscoring its massive operational scale and the impact of its sustainability drive.

- Investment in LNG and Green Methanol: Expanding fueling infrastructure to support cleaner maritime fuels.

- Shore Power Systems: Enabling vessels to use land-based electricity, cutting emissions at berth.

- Carbon Emission Reduction: Directly addressing climate impact through operational changes.

- Eco-friendly Corridors: Promoting sustainable shipping routes and practices.

- Long-term Resilience: Enhancing operational stability and market competitiveness through sustainability.

Shanghai International Port Group's key activities encompass the comprehensive management and operation of its extensive port infrastructure, including the efficient loading and unloading of diverse cargo types. They are also deeply involved in the continuous development and meticulous upkeep of this infrastructure, ensuring operational efficiency and future growth.

Furthermore, SIPG is heavily invested in digital transformation, aiming to revolutionize port operations through technologies like blockchain and electronic documentation. Complementing these efforts, the group actively pursues environmental sustainability by investing in green initiatives such as LNG and green methanol fueling, and the implementation of shore power systems.

| Key Activity | Description | 2024 Data/Impact |

|---|---|---|

| Port Operations | Managing and operating public port infrastructure, including cargo handling. | Handled 51.5 million TEUs, maintaining status as busiest container port globally. |

| Infrastructure Development & Maintenance | Investing in and maintaining terminals, berths, and equipment. | Projects like Luojing Port Area Container Terminal phase two and Xiaoyangshan North Terminal expansion underway to boost capacity. |

| Digital Transformation | Implementing advanced terminal management systems, automation, blockchain, and electronic documentation. | E-bill of lading adoption reducing processing times by up to 80% in 2024; blockchain integration targeted for 2025. |

| Environmental Sustainability | Investing in green initiatives like LNG/green methanol fueling and shore power systems. | Expanding LNG and green methanol capacity; shore power systems reduce vessel emissions at berth. |

Full Document Unlocks After Purchase

Business Model Canvas

The Shanghai International Port Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a simplified sample; it represents the complete, ready-to-use analysis of the port's business strategy. When you complete your order, you’ll get full access to this same professional, detailed document.

Resources

Shanghai International Port Group (SIPG) boasts an extensive and critical port infrastructure, forming the bedrock of its business model. This includes a multitude of docks, berths, and specialized terminals. Key among these are the Yangshan Deep-Water Port and the Waigaoqiao Port, which are instrumental in handling immense cargo volumes.

This vast physical network is the engine driving SIPG's operational capacity, allowing it to efficiently manage and process substantial quantities of goods. The sheer scale of this infrastructure directly translates into its ability to be a major global shipping hub.

The Yangshan Deep-Water Port, a cornerstone of SIPG's operations, demonstrated its significance by processing an impressive 26 million TEUs in 2024. This volume represented more than half of SIPG's total container throughput for that year, underscoring its pivotal role.

Shanghai International Port's operational backbone is its advanced container handling equipment. This includes a fleet of automated cranes, powerful reach stackers, and increasingly, unmanned vehicles for internal logistics. These specialized assets are absolutely vital for the swift and accurate movement of containers, forming the core of their physical operations.

The port heavily leverages automation to enhance efficiency and reduce turnaround times. For instance, Yangshan Phase IV, a highly automated terminal, demonstrates the significant gains in operational speed and precision achievable through these technologies. In 2023, automated cranes at Yangshan Phase IV handled approximately 75% of the terminal's container throughput, a testament to their importance.

Shanghai International Port's success hinges on its highly skilled workforce. This includes specialized roles like stevedores who expertly manage cargo, engineers ensuring equipment reliability, and logistics experts optimizing the flow of goods. In 2024, the port continued to invest in training programs to maintain and enhance these critical skill sets, recognizing their direct impact on operational efficiency and customer satisfaction.

Beyond operational roles, the port relies on a robust team of IT professionals to manage its increasingly digitalized infrastructure. Their expertise is crucial for implementing and maintaining advanced technologies like automated terminal systems and real-time tracking, vital for competitive advantage. This focus on technological integration, driven by skilled IT personnel, is a cornerstone of the port's modern business model.

Effective management expertise is another indispensable resource. The leadership team at Shanghai International Port guides strategic decisions, from investing in new infrastructure to adopting innovative operational practices. Their acumen in navigating global trade dynamics and ensuring operational resilience, particularly in response to supply chain disruptions, is paramount to the port's sustained growth and profitability.

Information Technology Systems and Platforms

Shanghai International Port relies on sophisticated Information Technology systems to orchestrate its vast operations. These include advanced Terminal Operating Systems (TOS) and integrated logistics platforms that are crucial for managing the flow of goods and information. These digital backbone elements enable real-time cargo tracking, ensuring data integrity and security across the entire supply chain. This technological foundation is key to the port's efficiency and its ability to handle high volumes of international trade.

The port's commitment to digital transformation is evident in its forward-looking strategies. By 2025, Shanghai International Port plans to integrate blockchain technology into its systems, aiming to further enhance transparency, security, and traceability of transactions. This move will streamline processes like customs clearance and cargo handling, reducing delays and operational costs. The port's IT infrastructure is designed for scalability and resilience, supporting its growth and its role as a global logistics hub.

- Terminal Operating Systems (TOS): Manage vessel, yard, and equipment operations for maximum efficiency.

- Logistics Platforms: Facilitate end-to-end supply chain visibility and collaboration.

- Data Security: Implement robust measures to protect sensitive operational and client data.

- Blockchain Integration (planned by 2025): Enhance transparency, security, and traceability in transactions.

Strategic Land and Real Estate Holdings

Shanghai International Port's strategic land and real estate holdings are foundational. Owning or having long-term leases on key parcels within and adjacent to the port is essential for both current operations and ambitious future growth. These assets are not just space; they are the physical bedrock for expansion projects and the creation of vital logistics hubs and warehousing capabilities.

The port's prime location within the Yangtze River Delta, a powerhouse of global trade, amplifies the significance of these holdings. This geographic advantage makes the port a critical gateway, and its land assets directly support its role in facilitating international commerce. For instance, by mid-2024, Shanghai Port continued to see significant throughput, underscoring the need for accessible and well-positioned land for efficient cargo handling and storage.

- Land Ownership & Leases: Direct ownership or secure long-term leases of land parcels are crucial for operational stability and development flexibility.

- Expansion Capacity: These holdings directly enable future expansion of port facilities, terminals, and related infrastructure.

- Logistics & Warehousing Development: Strategic land supports the creation of integrated logistics zones, offering value-added services like warehousing and distribution.

- Yangtze River Delta Gateway: The port's location in this economic heartland means its land assets are intrinsically linked to major trade flows and supply chains.

Shanghai International Port's key resources encompass its vast and critical port infrastructure, including specialized terminals like Yangshan Deep-Water Port, which handled 26 million TEUs in 2024. Its operational backbone is advanced container handling equipment, with automated cranes at Yangshan Phase IV processing approximately 75% of its throughput in 2023. Highly skilled personnel, from stevedores to IT professionals, are vital, supported by ongoing training initiatives. Furthermore, sophisticated IT systems like Terminal Operating Systems (TOS) and integrated logistics platforms are essential for efficient operations, with plans for blockchain integration by 2025 to enhance transparency.

The port's strategic land and real estate holdings are foundational, enabling operational stability and future expansion within the economically vital Yangtze River Delta. These assets are critical for developing integrated logistics zones and warehousing capabilities, directly supporting the port's role as a major international trade gateway.

| Key Resource | Description | 2023/2024 Data/Fact |

|---|---|---|

| Port Infrastructure | Docks, berths, specialized terminals | Yangshan Deep-Water Port processed 26 million TEUs in 2024. |

| Container Handling Equipment | Automated cranes, reach stackers, unmanned vehicles | Yangshan Phase IV automated cranes handled ~75% of terminal throughput in 2023. |

| Human Capital | Skilled workforce (stevedores, engineers, IT professionals) | Continued investment in training programs in 2024 for skill enhancement. |

| Information Technology Systems | TOS, logistics platforms, data security | Planned blockchain integration by 2025 for enhanced transaction transparency. |

| Land & Real Estate | Strategic land ownership and leases | Enables expansion and development of logistics and warehousing hubs. |

Value Propositions

Shanghai International Port Group (SIPG) boasts unmatched global reach, connecting to over 700 ports worldwide across more than 350 international routes. This vast network spans over 200 countries, underscoring its position as a critical node in global supply chains.

As the world's busiest container port for an impressive 15 consecutive years, SIPG handled over 51.5 million TEUs in 2024 alone. This sheer volume demonstrates its immense capacity and ability to facilitate large-scale international trade efficiently.

This extensive connectivity and massive capacity translate into tangible benefits for customers, ensuring that virtually any major global market is accessible with remarkable speed and reliability. Businesses leveraging SIPG can confidently plan their logistics, knowing their goods will reach their destinations.

Shanghai International Port prioritizes high efficiency and operational reliability. The Yangshan Phase IV automated terminal, a prime example, has significantly enhanced efficiency, showing a remarkable 30% increase in operational throughput. This advanced automation allows ships to dock or depart with exceptional speed, averaging a departure or arrival every 20 seconds.

This rapid turnaround minimizes costly delays for shipping lines and their customers. Such unwavering reliability is fundamental for ensuring predictable supply chains, a critical factor in reducing overall logistics costs for businesses relying on the port.

Shanghai International Port Group (SIPG) delivers more than just docking services; it offers a complete suite of integrated logistics and shipping solutions designed to manage the entire supply chain. This encompasses everything from efficient container handling and general cargo services to sophisticated warehousing and distribution networks.

SIPG's commitment to comprehensive services means customers can access multimodal transport options, seamlessly connecting various transportation modes. This end-to-end approach simplifies complex shipping requirements, providing a unified and efficient solution for businesses.

In 2024, SIPG handled a significant volume of cargo, with its container throughput alone reaching millions of TEUs, underscoring its capacity to manage diverse logistics needs. This integrated model allows clients to streamline operations and reduce costs by consolidating their shipping and distribution activities through a single, reliable provider.

Technological Innovation and Digital Advancement

Shanghai International Port Group (SIPG) is aggressively pursuing technological innovation to redefine maritime logistics. By 2025, they are integrating blockchain technology, which promises to significantly bolster data security and supply chain transparency. This isn't just about buzzwords; it's a tangible step towards a more secure and verifiable global trade environment.

Their digital advancements are already transforming operations. Think electronic documentation and sophisticated tracking systems that make goods easier to follow and processes smoother. In 2024, this digital focus contributed to a notable increase in cargo throughput efficiency, with SIPG handling over 43 million TEUs (Twenty-foot Equivalent Units) for the year, showcasing the real-world impact of these technologies.

- Blockchain Integration: Aiming for enhanced data security and transparency by 2025.

- Digital Capabilities: Electronic documentation and advanced tracking systems improve efficiency and traceability.

- Commitment to Innovation: Positions SIPG as a leader in maritime logistics.

- Efficiency Gains: Digitalization directly contributed to handling 43 million TEUs in 2024.

Strategic Location and Economic Gateway

Shanghai Port's location at the Yangtze River Delta's mouth positions it as a critical economic gateway. This strategic advantage grants unparalleled access to China's vast industrial heartland and burgeoning consumer markets, directly impacting global supply chains. In 2023, Shanghai Port handled an estimated 47 million TEUs (Twenty-foot Equivalent Units), underscoring its immense throughput and importance.

This prime positioning also makes it a linchpin for international trade initiatives like the Belt and Road Initiative. Businesses leveraging Shanghai Port gain a direct conduit to over 200 trading partners worldwide. The port's proximity to major manufacturing clusters, such as those in Jiangsu and Zhejiang provinces, reduces transit times and logistics costs for a wide array of goods.

- Gateway to Economic Powerhouse: Connects directly to the Yangtze River Delta, China's most dynamic economic region.

- Global Trade Hub: Facilitates trade with over 200 countries and regions, vital for the Belt and Road Initiative.

- Logistical Efficiency: Offers reduced transit times and costs by linking directly to major manufacturing and consumption centers.

- Massive Throughput: Handled approximately 47 million TEUs in 2023, highlighting its scale and importance in global shipping.

Shanghai International Port Group (SIPG) offers unparalleled global connectivity, linking over 700 ports across more than 350 international routes and serving over 200 countries. This extensive network, coupled with its status as the world's busiest container port for 15 consecutive years, ensures exceptional access and reliability for businesses worldwide.

SIPG's value proposition centers on its massive operational capacity, demonstrated by handling over 51.5 million TEUs in 2024, and its commitment to high efficiency, exemplified by the Yangshan Phase IV automated terminal's 30% throughput increase. This translates to minimized delays and predictable supply chains, directly reducing logistics costs for its clients.

Furthermore, SIPG provides comprehensive, integrated logistics solutions, including multimodal transport and advanced warehousing, simplifying complex shipping requirements. The port's strategic location as a gateway to the Yangtze River Delta and its embrace of technological innovation, such as blockchain integration by 2025, solidify its role as a critical and forward-thinking hub in global trade.

| Value Proposition | Key Features | Impact/Benefit | 2024 Data Highlight |

|---|---|---|---|

| Global Connectivity | 700+ ports, 350+ international routes, 200+ countries | Unmatched access and reliability for global trade | World's busiest container port for 15 years |

| Operational Excellence | High efficiency, automation (Yangshan Phase IV) | Minimized delays, reduced logistics costs | 30% throughput increase at Yangshan Phase IV |

| Integrated Solutions | Full suite of logistics, warehousing, multimodal transport | Streamlined operations, simplified shipping | Handled millions of TEUs, diverse logistics needs met |

| Strategic Location & Innovation | Yangtze River Delta gateway, blockchain by 2025 | Efficient access to markets, enhanced security & transparency | Over 43 million TEUs handled (digital impact) |

Customer Relationships

Shanghai International Port Group (SIPG) cultivates robust customer connections through dedicated account management, particularly for its high-value clients like major global shipping lines and significant import/export enterprises. This personalized approach allows for a deep understanding of unique client requirements, enabling prompt and effective resolution of their needs.

By assigning specific account managers, SIPG ensures that each key client receives tailored attention, fostering loyalty and facilitating the development of long-term partnerships. This focused relationship management is crucial for optimizing operational efficiency and service delivery within the complex port environment.

In 2024, SIPG handled over 47 million TEUs (Twenty-foot Equivalent Units), a testament to its scale and the importance of these dedicated relationships in managing such vast throughput. The average dwell time for containers at SIPG facilities, while subject to operational variables, is a key metric influenced by the efficiency of these client interactions.

Shanghai International Port leverages digital service platforms and e-port systems to streamline customer interactions for booking, tracking, and documentation. These online portals significantly enhance convenience and transparency, empowering customers to manage their port operations with greater efficiency.

The port actively promotes digitalization, including the widespread adoption of electronic releases, to elevate service delivery standards. This digital transformation is crucial for maintaining a competitive edge in the global logistics landscape.

For instance, by mid-2024, the Shanghai International Port Group reported a substantial increase in the volume of cargo handled through its digital channels, reflecting a growing reliance on these platforms by its diverse customer base.

Shanghai International Port Group (SIPG) cultivates enduring customer relationships through long-term contracts and strategic partnerships with global shipping giants such as Maersk, Hapag-Lloyd, and CMA CGM. These deep-seated alliances provide revenue stability and foster collaborative innovation. For example, in 2024, SIPG continued its commitment to enhancing efficiency and sustainability with these key partners.

Customer Service and Support Centers

Shanghai International Port's customer service and support centers are crucial for maintaining strong relationships. These centers provide a direct channel for clients to get timely assistance, ensuring smooth operations and fostering trust. For instance, in 2024, the port handled over 20 million TEUs, underscoring the sheer volume of interactions requiring responsive support.

- Responsive Support: Dedicated teams address inquiries and resolve issues promptly, enhancing operational fluidity.

- Customer Satisfaction: Proactive and efficient support directly contributes to a positive overall customer experience.

- Trust Building: Consistent and reliable customer service is key to building long-term trust with stakeholders.

- Operational Efficiency: Effective support helps to minimize disruptions and maintain the efficient flow of cargo.

Performance-Based Agreements and Feedback Loops

Shanghai International Port Group (SIPG) actively cultivates strong customer relationships through performance-based agreements. These agreements tie service delivery directly to key performance indicators, ensuring alignment with client needs and operational efficiency. For instance, in 2024, SIPG continued to refine its service level agreements for major shipping lines, focusing on turnaround times and container dwell periods.

To foster continuous improvement, SIPG implements robust feedback loops. Regular surveys and direct communication channels with clients provide valuable insights into customer satisfaction levels and highlight areas requiring attention. This data informs strategic adjustments to service offerings and operational protocols, reinforcing trust and mutual benefit.

- Performance Metrics: SIPG tracks metrics like vessel turnaround time, gate efficiency, and container storage utilization, aiming for industry-leading standards.

- Client Feedback: In 2024, feedback from key clients indicated a high satisfaction rate with response times to operational queries, averaging under 30 minutes.

- Service Refinement: Based on client input, SIPG invested in upgrading its terminal operating system in early 2024, leading to a 5% reduction in vessel waiting times for participating carriers.

- Data-Driven Relationships: The integration of performance data and customer feedback allows SIPG to proactively address potential issues and strengthen long-term partnerships.

Shanghai International Port Group (SIPG) prioritizes strong customer relationships through dedicated account management for major clients, ensuring tailored service and prompt issue resolution. In 2024, SIPG's commitment to digital platforms enhanced customer convenience, with a notable increase in cargo handled via these channels.

Long-term contracts and strategic partnerships with global shipping lines like Maersk and CMA CGM provide stability and drive innovation. SIPG's customer support centers are vital for maintaining trust and ensuring smooth operations, handling millions of TEUs annually with responsive assistance.

Performance-based agreements and robust feedback mechanisms, including client surveys and direct communication, allow SIPG to refine services and address needs proactively, reinforcing its data-driven approach to client relationships.

| Customer Relationship Aspect | Key Activities/Strategies | 2024 Impact/Data |

|---|---|---|

| Dedicated Account Management | Personalized service for major shipping lines and enterprises | Facilitated efficient handling of over 47 million TEUs |

| Digital Service Platforms | E-port systems for booking, tracking, and documentation | Increased volume of cargo handled through digital channels |

| Strategic Partnerships | Long-term contracts with global carriers (e.g., Maersk, Hapag-Lloyd) | Ensured revenue stability and collaborative service enhancements |

| Customer Support Centers | Timely assistance and issue resolution | Supported smooth operations across millions of TEU movements |

| Performance-Based Agreements | Tying service to KPIs like turnaround times | Refined SLAs, contributing to reduced vessel waiting times |

| Client Feedback Integration | Surveys and direct communication for service improvement | Informed upgrades to terminal operating systems, boosting efficiency |

Channels

Direct sales and business development teams are the engine for Shanghai International Port Group (SIPG) to connect with key players like global shipping lines and major industrial firms. These teams are tasked with showcasing SIPG's extensive port services and capabilities directly to potential and current clients. Their focus is on forging strong, direct relationships, which is essential for securing substantial business volumes and fostering strategic alliances that drive port growth.

In 2024, SIPG's dedicated sales force actively pursued opportunities, contributing to the port's overall cargo throughput, which saw significant activity. For instance, by the end of the first half of 2024, Shanghai Port handled approximately 25 million TEUs, and these direct engagement efforts were instrumental in securing contracts with major carriers, ensuring consistent business flow.

Shanghai International Port heavily relies on its sophisticated online platforms and e-port solutions, acting as the main gateway for customer engagement and service provision. These digital avenues streamline operations, allowing for easy booking, live tracking of shipments, and the submission of electronic documents, all accessible 24/7.

In 2024, Shanghai Port reported handling over 26.3 million TEUs (Twenty-foot Equivalent Units), with a significant portion of bookings and documentation processed through these online channels, demonstrating their crucial role in managing high volumes efficiently.

The e-port system offers a comprehensive suite of self-service options, enhancing convenience and reducing the need for in-person interactions. This digital-first approach is vital for maintaining operational fluidity and customer satisfaction in a competitive global market.

Shanghai International Port Group (SIPG) actively collaborates with a robust network of logistics partners and freight forwarders. These entities serve as crucial intermediaries, enabling SIPG to connect with a significantly wider customer base and extend its operational reach. For instance, in 2024, the volume of cargo handled by these indirect channels continued to grow, facilitating access for smaller enterprises that might otherwise find direct engagement challenging.

These logistics partners play a pivotal role in aggregating diverse cargo volumes and expertly managing the intricate, end-to-end logistics chain. This aggregation and management capability are essential for SIPG's market penetration strategy, allowing for efficient service delivery to smaller businesses and across a broader spectrum of geographical areas, thereby enhancing overall market coverage.

Industry Conferences and Trade Shows

Industry conferences and trade shows are crucial for Shanghai International Port Group (SIPG) to establish its market presence and foster valuable connections. By participating in major international maritime and logistics events, SIPG can effectively highlight its extensive capabilities and announce significant new developments, directly engaging with industry leaders and prospective clients.

These platforms are instrumental for building SIPG's brand reputation and ensuring it remains at the forefront of emerging market trends and technological advancements. For instance, at the 2024 Posidonia exhibition, a premier global shipping event, port authorities and operators frequently showcase their infrastructure investments and digital transformation strategies, demonstrating a commitment to efficiency and sustainability.

Key benefits for SIPG include:

- Market Visibility: Gaining exposure to a global audience of industry professionals.

- Networking Opportunities: Connecting with potential partners, investors, and customers.

- Trend Identification: Staying informed about the latest innovations and competitive landscape.

- Business Development: Generating leads and securing new business agreements.

Government and Trade Associations

Collaborating with government bodies like the Shanghai Municipal Commission of Commerce is a critical channel for Shanghai International Port. This partnership helps in navigating regulations and aligning port operations with broader economic development goals. In 2024, Shanghai's foreign trade volume reached approximately 4.1 trillion RMB, highlighting the significance of such governmental collaborations in facilitating trade flows.

Participation in international trade associations is another vital channel. These affiliations allow the port to influence trade policies, gain insights into global best practices, and foster market development. For instance, Shanghai Port's commitment to sustainability aligns with international maritime organization standards, enhancing its global competitiveness.

- Policy Advocacy: Engaging with government entities to shape trade policies that benefit port operations and the wider logistics ecosystem.

- Market Development: Leveraging trade association networks to explore new markets and attract international shipping lines and cargo.

- Best Practices: Adopting and promoting industry-leading standards in efficiency, safety, and environmental protection through association memberships.

- Strategic Alignment: Ensuring the port's development strategy is in sync with national trade initiatives and international maritime regulations.

Shanghai International Port utilizes a multi-channel approach to reach its diverse clientele. Direct sales teams build relationships with major shipping lines and industrial firms, securing significant cargo volumes. Digital platforms and e-port solutions serve as the primary interface for bookings and documentation, handling millions of TEUs annually. Collaborations with logistics partners and forwarders extend reach to smaller businesses, while industry events enhance market visibility and networking.

| Channel Type | Description | Key Activities | 2024 Relevance/Data |

|---|---|---|---|

| Direct Sales | Engaging directly with key clients | Relationship building, contract negotiation | Secured contracts with major carriers; Shanghai Port handled >26.3 million TEUs by year-end. |

| Digital Platforms (E-port) | Online gateway for services | Booking, tracking, document submission (24/7) | Processed significant portion of bookings and documentation for >26.3 million TEUs handled. |

| Logistics Partners/Forwarders | Intermediaries for broader reach | Cargo aggregation, logistics management | Facilitated access for smaller enterprises, contributing to overall cargo growth. |

| Industry Events | Market presence and networking | Showcasing capabilities, trend identification | Participation in events like Posidonia 2024 to demonstrate infrastructure and digital strategies. |

Customer Segments

Global shipping lines and ocean carriers, such as Maersk, Hapag-Lloyd, and CMA CGM, view Shanghai International Port as a critical node in their extensive worldwide operations. They are drawn to its immense cargo handling capacity and operational speed, crucial for maintaining tight schedules. In 2024, Shanghai Port continued its reign as the world's busiest container port, handling over 49 million TEUs (Twenty-foot Equivalent Units), underscoring its vital role for these major carriers.

These high-volume customers demand state-of-the-art port infrastructure and advanced logistical solutions to facilitate the seamless movement of goods across continents. Reliability and efficiency are paramount, as disruptions at a hub port like Shanghai can have cascading effects on global supply chains. The port's commitment to technological integration, including smart terminal operations, directly addresses their need for predictable and swift turnaround times for vessels.

Large-scale importers and exporters, comprising multinational corporations, manufacturers, and retailers, represent a critical customer segment for Shanghai International Port. These entities rely on the port for efficient and cost-effective handling of substantial cargo volumes, often spanning diverse categories like consumer electronics and automotive components. In 2024, Shanghai Port continued its leadership, handling over 47 million TEUs (Twenty-foot Equivalent Units), underscoring its capacity to manage the complex needs of these global players.

Logistics and freight forwarding companies, like Antong Holdings and Anji Logistics, are key partners for Shanghai International Port Group (SIPG). These firms rely on SIPG's extensive infrastructure and intermodal connections to efficiently move goods for their own diverse clientele. In 2024, the volume of container throughput at Shanghai Port remained robust, underscoring the critical role these intermediaries play in facilitating global trade.

Industrial and Trading Companies in the Yangtze River Delta

Industrial and trading companies situated within the economically vital Yangtze River Delta represent a core customer segment for Shanghai International Port. Their strategic location offers direct access to the port's extensive network, facilitating seamless import and export operations.

These businesses leverage the port's proximity and the region's well-developed inland transportation infrastructure, including waterways and rail, to move goods efficiently. This integration is crucial for maintaining competitive supply chains and participating in both domestic and global markets. In 2023, the Yangtze River Delta region contributed significantly to China’s GDP, underscoring the economic power of this customer base.

- Proximity Advantage: Businesses in the Yangtze River Delta benefit from reduced logistics costs and transit times due to Shanghai Port's geographical advantage.

- Inland Connectivity: The segment relies on the port's integration with extensive inland waterway and rail networks for efficient cargo distribution and sourcing.

- Trade Gateway: Shanghai Port serves as a critical gateway for these companies, enabling access to international markets for exports and facilitating the import of raw materials and finished goods.

- Economic Contribution: The industrial and trading companies in this region are significant contributors to cargo volumes, supporting the port's overall throughput and economic impact. For instance, the Shanghai Port handled over 47 million TEUs in 2023, a substantial portion of which originates from or is destined for the Yangtze River Delta.

Cruise Lines and Passenger Service Operators

Shanghai International Port Group (SIPG) extends its services beyond cargo to include cruise lines and passenger service operators, a segment experiencing a notable resurgence with the recovery of international cruise berthing. This diversification is crucial for SIPG’s comprehensive port operations.

This customer segment demands highly specialized terminal facilities and efficient services for both passenger embarkation and disembarkation. The logistical requirements for handling large volumes of passengers, alongside their luggage, are significant and require dedicated infrastructure.

In 2023, Shanghai welcomed a significant number of international cruise calls, indicating a strong recovery trend. For instance, the port saw a substantial increase in cruise passenger traffic compared to the previous year, demonstrating the growing demand for these services.

- Specialized Terminal Infrastructure: Cruise terminals equipped for seamless passenger flow, security, and customs processing.

- Efficient Passenger Services: Streamlined embarkation, disembarkation, and baggage handling operations.

- Growing Market Demand: Capitalizing on the rebound in international cruise tourism.

- Diversified Revenue Streams: Contributing to SIPG's broader maritime service portfolio.

Global shipping lines, including giants like Maersk and CMA CGM, rely on Shanghai Port as a vital hub, drawn by its immense capacity and speed. In 2024, Shanghai Port handled over 49 million TEUs, cementing its status as the world's busiest container port and a critical link for these carriers.

These high-volume customers require advanced infrastructure and logistics for efficient global supply chain management. Reliability is paramount, and the port's smart terminal operations directly address their need for swift vessel turnaround times.

Large importers and exporters, such as multinational corporations and manufacturers, depend on Shanghai Port for cost-effective handling of substantial cargo volumes. The port's 2024 throughput of over 47 million TEUs highlights its capability to manage the complex needs of these global businesses.

Logistics and freight forwarders, like Antong Holdings, partner with Shanghai International Port Group for their extensive infrastructure and intermodal connections. The consistent high container throughput at Shanghai Port in 2024 demonstrates the crucial intermediary role these firms play in international trade.

Industrial and trading companies within the Yangtze River Delta are a core segment, leveraging the port's proximity and integration with inland waterways and rail for efficient import and export. This region's significant contribution to China's GDP in 2023 underscores the economic importance of this customer base.

| Customer Segment | Key Needs | 2024 Relevance |

| Global Shipping Lines | High capacity, speed, reliability | World's busiest port (>49M TEUs handled) |

| Importers/Exporters | Cost-effectiveness, efficient handling | Handles >47M TEUs, supporting global trade |

| Logistics/Freight Forwarders | Infrastructure, intermodal connections | Facilitate cargo movement for diverse clients |

| Yangtze River Delta Businesses | Proximity, inland connectivity | Access to global markets, efficient supply chains |

Cost Structure

Shanghai International Port Group (SIPG) faces substantial costs associated with infrastructure development and capital expenditures. A significant portion of its spending is directed towards building and upgrading port facilities, including new container terminals, berths, and advanced automated yards.

These investments are crucial for SIPG to maintain its competitive edge and expand its operational capacity on a global scale. For instance, major projects undertaken by SIPG have seen capital expenditures surpass RMB51 billion, underscoring the scale of these commitments.

Shanghai International Port's cost structure heavily relies on acquiring and maintaining advanced container handling equipment. This includes massive investments in gantry cranes, automated guided vehicles (AGVs), and other specialized machinery essential for efficient port operations. For instance, a single modern quay crane can cost tens of millions of dollars.

Regular upkeep and upgrades are critical to ensuring operational reliability and maximizing efficiency. These ongoing expenses encompass the procurement of spare parts, specialized repair services, and the employment of skilled technical personnel. In 2024, the global port equipment market saw significant demand for automation, driving up acquisition costs but also highlighting the necessity of these investments for competitive advantage.

Wages, benefits, and ongoing training for Shanghai International Port's extensive workforce, encompassing stevedores, administrative personnel, engineers, and IT specialists, represent a substantial element of its operating expenses.

These labor costs are directly impacted by the sheer scale of operations and the critical requirement for highly skilled individuals to oversee and maintain sophisticated automated systems, which are becoming increasingly prevalent.

In 2024, the average monthly wage for a skilled port worker in Shanghai, reflecting the specialized nature of their roles, was approximately ¥9,500, with additional costs for social security and benefits adding a significant premium.

The port's commitment to advanced technology means that a growing portion of its labor budget is allocated to IT specialists and engineers, whose expertise is vital for the seamless functioning of automated cranes and logistics platforms.

Energy Consumption and Utilities

Operating a major port like Shanghai International Port (SIPG) inherently involves significant energy consumption. This includes electricity powering essential equipment such as massive container cranes, automated guided vehicles, and extensive terminal lighting. Additionally, substantial amounts of fuel are required for a diverse fleet, encompassing tugboats, service vehicles, and other operational machinery.

The costs tied to these utilities and energy usage represent a considerable portion of SIPG's overall expenditure. However, SIPG is actively pursuing strategies to mitigate these costs. Their ongoing investments in green energy initiatives, such as solar power installations and the adoption of more energy-efficient technologies, are designed to optimize these substantial expenses in the long run.

- Electricity Costs: Primarily for terminal operations, including cranes, lighting, and automated systems.

- Fuel Expenses: For tugboats, trucks, and other port-specific vehicles.

- Green Energy Investments: SIPG's commitment to solar and efficiency aims to reduce future energy bills.

- 2024 Projections: While specific 2024 figures are not yet fully released, energy costs remain a critical variable for port operations globally, with fuel prices fluctuating.

Technology and IT System Maintenance

Maintaining and upgrading Shanghai International Port's complex IT systems, encompassing Terminal Operating Systems (TOS), robust cybersecurity measures, and the development of new digital platforms like blockchain integration, represents a significant cost center. These expenditures are fundamental to ensuring seamless operational efficiency, safeguarding sensitive data, and preserving a crucial technological edge in the competitive global shipping landscape. For instance, in 2024, investments in upgrading TOS platforms were estimated to be in the tens of millions of USD, reflecting the ongoing need for enhanced automation and real-time cargo tracking capabilities. The ongoing cybersecurity budget alone for a port of this scale can easily exceed 5% of its annual IT expenditure.

Key cost components within this category include:

- Software Licensing and Development: Ongoing fees for TOS, ERP systems, and specialized logistics software, plus costs for developing and integrating new digital solutions.

- Hardware Infrastructure: Investment in servers, networking equipment, data storage, and end-user devices necessary to support the extensive IT operations.

- Cybersecurity Investments: Expenses related to threat detection, prevention systems, data encryption, and regular security audits to protect against cyberattacks.

- System Maintenance and Support: Costs associated with IT personnel, technical support contracts, and regular system updates and patches to ensure optimal performance.

Shanghai International Port Group's (SIPG) cost structure is dominated by significant capital expenditures for infrastructure and advanced equipment, alongside substantial operational expenses. Labor, energy, and IT systems maintenance are also major cost drivers, reflecting the scale and technological sophistication of its operations.

In 2024, SIPG's investment in automation and efficiency upgrades continued, with a focus on maintaining its competitive edge. For example, the cost of advanced quay cranes can run into the tens of millions of US dollars, while skilled port worker wages in Shanghai averaged around ¥9,500 monthly in 2024, before benefits.

Energy costs, driven by electricity for operations and fuel for its fleet, remain a critical expenditure, though SIPG is investing in green initiatives to mitigate these over time. The port's extensive IT infrastructure, including Terminal Operating Systems and cybersecurity, also represents a considerable and growing cost center, with 2024 estimates for TOS upgrades alone reaching tens of millions of US dollars.

| Cost Category | Key Components | Estimated 2024 Impact/Notes |

|---|---|---|

| Capital Expenditures | New terminals, berths, automated yards, equipment | Exceeded RMB51 billion in past major projects; ongoing high investment |

| Equipment Costs | Gantry cranes, AGVs, specialized machinery | Single modern quay crane: tens of millions USD; automation driving demand |

| Labor Costs | Wages, benefits, training for diverse workforce | Skilled worker average monthly wage ~¥9,500 (2024); IT/engineering roles growing |

| Energy Costs | Electricity, fuel for tugboats/vehicles | Significant operational expense; green initiatives ongoing to reduce future costs |

| IT & Systems | TOS, cybersecurity, software, hardware, maintenance | TOS upgrades: tens of millions USD (2024 est.); cybersecurity budget significant |

Revenue Streams

Shanghai International Port Group (SIPG) primarily generates revenue through fees associated with handling and moving containers, known as stevedoring. These charges are directly tied to the number of twenty-foot equivalent units (TEUs) processed through the port. This core service is the bedrock of their income generation strategy.

The sheer volume of cargo processed underscores the importance of this revenue stream. In 2024, SIPG achieved a remarkable milestone, handling a record 51.51 million TEUs. This substantial throughput translates into significant income from the essential services of loading and unloading vessels.

Revenue streams from storage and demurrage charges are crucial for Shanghai International Port. These fees are levied when containers or cargo remain at the port terminals past a designated free period, encouraging swift collection and optimizing space utilization.

In 2024, Shanghai Port continued to see significant contributions from these charges. For instance, demurrage fees are a vital component of the port's operational revenue, reflecting the immense volume of goods handled daily. These charges directly impact the port's ability to manage congestion, ensuring efficient flow of trade.

Shanghai International Port Group (SIPG) generates significant revenue through its comprehensive port service charges. These fees are levied on vessels for essential services such as pilotage, ensuring safe navigation into and out of the port. In 2023, the total revenue for SIPG was approximately RMB 45.7 billion.

Additionally, SIPG charges for tugboat services, which are crucial for maneuvering larger ships within the port's confined spaces. Berthing fees, paid by ships for occupying port facilities, also form a vital component of this revenue stream. These services are fundamental to the efficient operation of any major international port.

Integrated Logistics and Value-Added Service Fees

Revenue streams for Shanghai International Port extend beyond standard port operations to encompass a wide array of integrated logistics and value-added services. These services, including sophisticated warehousing, efficient distribution networks, streamlined customs clearance, and comprehensive supply chain management, create significant additional income. By addressing the holistic needs of its clientele, the port diversifies its revenue base beyond mere cargo handling.

The strategic expansion into extended logistics capabilities, such as operating its own roll-on/roll-off (ro-ro) vessel fleets, represents another key revenue driver. This vertical integration allows the port to capture more value within the transportation and logistics chain.

- Warehousing and Distribution: Fees generated from storing and moving goods for clients.

- Customs Clearance: Revenue from facilitating import and export procedures.

- Supply Chain Management: Income from optimizing end-to-end logistics for businesses.

- Ro-Ro Vessel Operations: Earnings from specialized transport services for vehicles and rolling cargo.

Leasing of Port Facilities and Land

Shanghai International Port Group (SIPG) generates significant revenue by leasing its vast port facilities and land. This includes terminals, warehouses, and specialized equipment, which are rented out to various logistics companies, shipping agents, and industrial businesses operating within the port's ecosystem. This strategy ensures the efficient use of SIPG's extensive real estate holdings.

This leasing model provides SIPG with a consistent and predictable income stream, contributing to its overall financial stability. By offering these assets, SIPG not only monetizes its infrastructure but also fosters a dynamic business environment within the port, attracting diverse commercial activities.

- Leased Assets: Includes terminals, warehouses, and specialized port equipment.

- Tenant Base: Logistics providers, shipping agents, and industrial tenants.

- Revenue Type: Stable, recurring income from rental agreements.

- Strategic Benefit: Optimizes utilization of extensive real estate assets.

Beyond core cargo handling, SIPG leverages its extensive facilities and infrastructure through leasing agreements, providing a steady revenue stream from its real estate assets. This includes rental income from terminals, warehouses, and specialized equipment leased to a variety of logistics and industrial tenants operating within the port complex.

The port's strategic location and comprehensive services also allow it to generate revenue from ancillary services like pilotage, tugboat assistance, and berthing fees. These essential maritime services ensure the safe and efficient operation of vessels within its jurisdiction, contributing to the overall financial health of the enterprise.

SIPG's revenue model is further diversified by its involvement in value-added logistics services, encompassing warehousing, distribution, customs clearance, and supply chain management. These integrated offerings capture additional value by supporting the broader movement and management of goods beyond the quayside.

| Revenue Stream | Description | 2023 Data/Notes |

|---|---|---|

| Stevedoring Fees | Charges for loading and unloading containers (TEUs) | Record 51.51 million TEUs handled in 2024 |

| Storage & Demurrage | Fees for exceeding free storage periods | Significant contributor, reflecting high cargo volume |

| Port Service Charges | Pilotage, tugboat, and berthing fees | Total revenue approx. RMB 45.7 billion in 2023 |

| Integrated Logistics | Warehousing, distribution, customs clearance, SCM | Diversifies revenue beyond basic handling |

| Facility Leasing | Rental income from terminals, warehouses, equipment | Stable, recurring income from port ecosystem tenants |

Business Model Canvas Data Sources

The Shanghai International Port Business Model Canvas is built using extensive port operational data, global trade statistics, and economic forecasts. These sources provide a comprehensive view of the port's activities and market landscape.