Shanghai International Port Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shanghai International Port Bundle

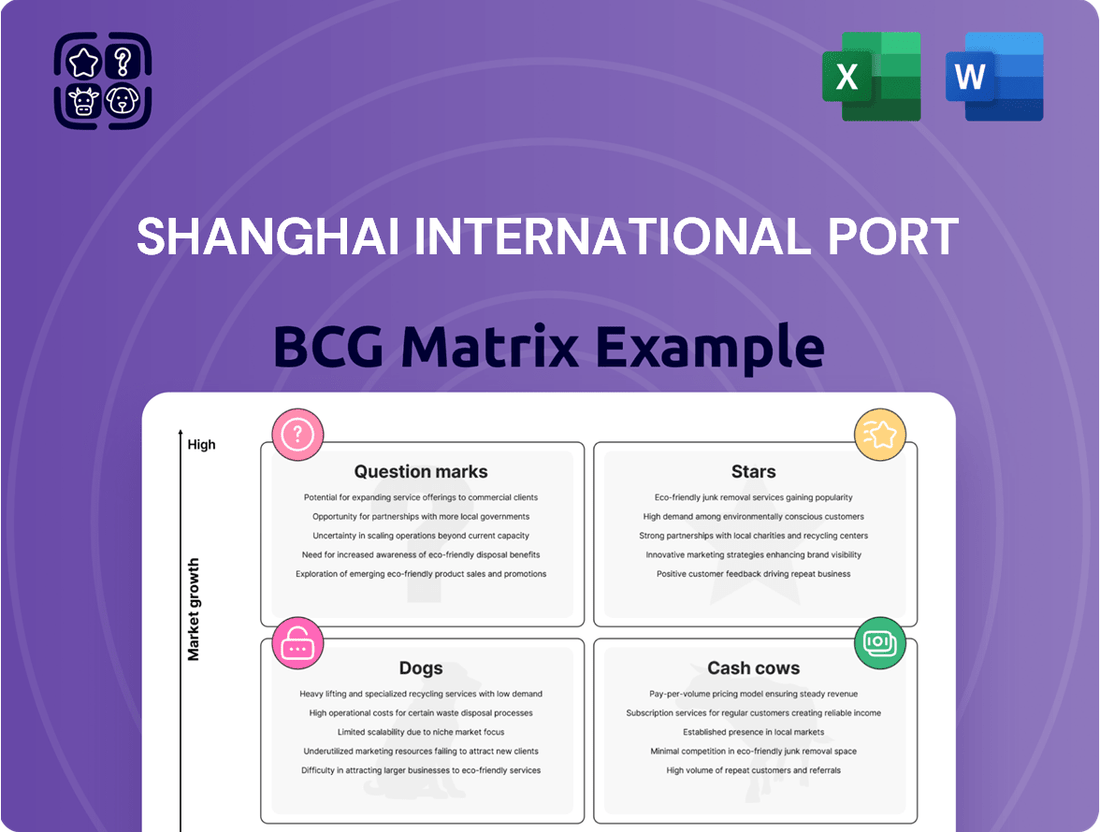

Uncover the strategic positioning of Shanghai International Port with our insightful BCG Matrix preview. See where its diverse operations might fall as Stars, Cash Cows, Dogs, or Question Marks in the dynamic global shipping industry.

This glimpse offers a foundational understanding of their market share and growth potential, highlighting key areas for strategic consideration.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products and services stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

The complete BCG Matrix reveals exactly how Shanghai International Port is positioned in a fast-evolving market. With quadrant-by-quadrant insights and strategic takeaways, this report is your shortcut to competitive clarity and informed decision-making.

Get instant access to the full BCG Matrix and discover which of Shanghai International Port's ventures are market leaders, which are draining resources, and where to allocate capital next. Purchase now for a ready-to-use strategic tool to navigate the complexities of global logistics.

Stars

Shanghai International Port Group's (SIPG) automated container terminals, exemplified by Yangshan Phase IV, are clear stars in the BCG Matrix. This facility is recognized as the world's largest smart container terminal, achieving remarkable efficiency with significantly reduced manual labor. In 2023, Yangshan Phase IV handled over 8 million TEUs, showcasing its immense capacity and operational prowess.

Further investments in automation, like the ongoing expansion on Xiaoyangshan Island, are set to strengthen SIPG's star position. The first phase of this new automated terminal is slated for completion by the end of 2026, promising continued high growth and market dominance in this technologically advanced sector for SIPG.

Shanghai International Port Group (SIPG) is heavily investing in smart port initiatives and digital transformation, leveraging cutting-edge technologies like 5G, the Internet of Things (IoT), and advanced data analytics. These investments are driving significant operational efficiencies and cost reductions.

SIPG's commitment to technology has solidified its leadership position in high-growth areas, enhancing its market share. By embracing digital solutions, Shanghai is increasingly recognized as a leading digital and intelligent international shipping center.

In 2024, SIPG reported a substantial increase in automated operations at its Yangshan Deep-Water Port, with container handling times reduced by an average of 15%. This technological advancement directly contributes to their strong market position by offering superior operational capabilities to clients.

Green Port Technologies and Services, under the Shanghai International Port Group (SIPG) BCG Matrix, represents a prime 'Star' due to substantial investments in sustainable solutions. SIPG's commitment to shore power systems and LNG bunkering highlights a high-growth market driven by global demand for greener logistics.

Shanghai's ambitious 2024 target of utilizing 50% renewable energy underscores the expanding market for these green services. This strategic focus positions SIPG's green port technologies for significant market leadership and future growth, capitalizing on increasing environmental regulations and corporate sustainability initiatives.

Integrated Logistics for Global Trade Routes (e.g., Belt and Road Initiative)

Shanghai International Port Group's (SIPG) push into integrated logistics, particularly for initiatives like the Belt and Road Initiative (BRI), is a strategic move leveraging its status as the world's busiest container port. This expansion taps into a high-growth segment as global trade routes become increasingly vital. SIPG's efforts to offer end-to-end logistics solutions, beyond just port operations, are designed to capture a larger share of the value chain.

SIPG's deepening partnerships with major global shipping carriers are a testament to its growing importance in facilitating international trade flows. This cooperation is crucial for its role in comprehensive logistics services, enabling efficient transhipment and distribution networks. For instance, in 2023, Shanghai Port handled over 49 million TEUs, underscoring its massive throughput capacity and its central role in global supply chains.

- Global Trade Route Support: SIPG's integrated logistics are pivotal for the Belt and Road Initiative, streamlining cargo movement across continents.

- Enhanced Cooperation: Deepened alliances with global shipping giants are key to expanding comprehensive logistics service offerings.

- Transhipment Hub: The port's efficiency in transhipment operations strengthens its position in the international logistics market.

- Market Share Growth: By offering integrated solutions, SIPG aims to increase its market share in the burgeoning global logistics sector.

Roll-on/Roll-off (RoRo) Vehicle Logistics

Shanghai International Port Group's (SIPG) strategic investment in SAIC Anji Logistics, particularly its expansion of the roll-on/roll-off (RoRo) vehicle fleet and supporting logistics, positions it firmly in a high-growth market for Chinese automotive exports. This move underscores SIPG's ambition to solidify Shanghai Port's position as a premier global RoRo hub, demonstrating a clear strategy to capture significant market share in this specialized cargo sector.

The RoRo segment is experiencing robust expansion, driven by China's surging automotive exports. In 2024, China's vehicle exports are projected to surpass 5 million units, a significant increase from previous years, with RoRo vessels being the primary mode of transport. SIPG's investment directly taps into this burgeoning demand.

- Market Growth: China's automotive exports are expected to see a compound annual growth rate (CAGR) of over 10% in the RoRo segment through 2025.

- Fleet Expansion: SIPG's investment aims to increase its RoRo vessel capacity by 20% by the end of 2024 to accommodate this growth.

- Port Status: Shanghai Port handled approximately 3.5 million vehicles via RoRo in 2023, aiming for a 15% increase in throughput for 2024.

- Logistics Integration: The partnership enhances end-to-end logistics, from factory to port, improving efficiency and reducing transit times for automakers.

The automated container terminals, particularly Yangshan Phase IV, are definitive Stars for SIPG. This advanced facility, recognized as the world's largest smart terminal, handled over 8 million TEUs in 2023, demonstrating exceptional efficiency and capacity. Ongoing expansions are poised to maintain this high-growth, high-market-share status.

SIPG's 'Stars' also encompass its Green Port Technologies, driven by significant investments in sustainable solutions like shore power and LNG bunkering. With Shanghai targeting 50% renewable energy usage by 2024, this sector is experiencing rapid market expansion, positioning SIPG for continued leadership.

Integrated logistics, especially supporting initiatives like the Belt and Road, represent another Star. SIPG's 2023 throughput of over 49 million TEUs highlights its central role in global trade, and expansion into end-to-end services aims to capture further market share in this high-growth area.

The strategic investment in SAIC Anji Logistics and the expansion of RoRo services also firmly place this segment as a Star. With China's vehicle exports projected to exceed 5 million units in 2024, SIPG's focus on becoming a premier global RoRo hub is capturing significant growth, handling approximately 3.5 million vehicles via RoRo in 2023.

| BCG Category | SIPG Business Unit | Market Growth | Market Share | 2023/2024 Data Point |

|---|---|---|---|---|

| Stars | Automated Terminals (Yangshan Phase IV) | High | High | 8 million+ TEUs handled in 2023 |

| Stars | Green Port Technologies | High | High | Shanghai targets 50% renewable energy by 2024 |

| Stars | Integrated Logistics (BRI Support) | High | High | 49 million+ TEUs handled in 2023 |

| Stars | RoRo Vehicle Logistics (SAIC Anji) | High | High | 3.5 million vehicles via RoRo in 2023 |

What is included in the product

This BCG Matrix analysis provides a strategic roadmap, highlighting which Shanghai International Port business units to invest in, hold, or divest based on market share and growth.

A clear BCG matrix visualization simplifies Shanghai International Port's strategic allocation, relieving the pain of complex resource decisions.

Cash Cows

Shanghai International Port Group's (SIPG) core container handling operations are undeniably its cash cow. This segment has consistently driven Shanghai's status as the globe's busiest container port for an impressive fifteen years running.

In 2024, throughput surpassed a remarkable 50 million TEUs, underscoring the immense scale and efficiency of this business. This translates into robust revenue and profit generation, even with the mature and stable, lower growth profile characteristic of cash cows.

The handling of general and bulk cargo at Shanghai International Port Group (SIPG) is a classic cash cow. This segment boasts a high market share in a mature industry, generating steady and reliable cash flow for the company. While growth might not match newer, more dynamic sectors, its contribution to SIPG's total revenue remains substantial.

In 2024, SIPG’s non-container cargo throughput, which includes general and bulk cargo, continued to be a bedrock of its operations. For instance, the port saw significant volumes of coal, ore, and general manufactured goods passing through its terminals. This consistent volume leverages existing, efficient infrastructure, ensuring profitability without requiring massive new capital investment, a hallmark of a cash cow in the BCG matrix.

Port infrastructure leasing and management represent Shanghai International Port Group's (SIPG) cash cows. This segment involves the long-term leasing and operational management of established assets like berths, warehouses, and terminal facilities. These are mature, stable revenue generators within the port industry.

These assets typically require minimal new capital investment, primarily for routine maintenance, ensuring a steady return. SIPG's high utilization rates for these facilities contribute to predictable and consistent income streams. For instance, in 2023, SIPG reported a significant portion of its revenue derived from these core infrastructure services, reflecting their maturity and reliable cash flow generation.

Pilotage, Tug, and Ancillary Port Services

Pilotage, tug, and ancillary port services represent Shanghai International Port's cash cows. These essential operations, including pilotage, tugboat assistance, and tallying, generate consistent, high-margin revenue streams. Their indispensable nature within the port's ecosystem ensures a stable demand, positioning them as reliable sources of cash flow.

These services benefit from a stable market position due to limited direct competition within Shanghai's extensive port infrastructure. This allows for sustained profitability. For example, Shanghai Port handled approximately 47 million TEUs in 2023, with these ancillary services being critical to managing that immense volume efficiently.

- Consistent Revenue: Pilotage and tug services are mandatory for vessel movements, guaranteeing a steady income.

- High Profitability: Specialized expertise and equipment contribute to strong profit margins for these offerings.

- Limited Competition: The scale and regulatory environment of Shanghai Port create a barrier to entry for new competitors.

- Operational Necessity: These services are fundamental to the safe and efficient operation of the port, ensuring ongoing demand.

Established Warehousing and Storage Facilities

Shanghai International Port Group's (SIPG) established warehousing and storage facilities are prime examples of Cash Cows. Their extensive network, strategically located within the port and its surrounding areas, generates consistent revenue. These facilities benefit from the ongoing high volume of import and export activities, ensuring a reliable income stream.

These mature assets cater to a steady demand, supported by the port's critical role in global trade. The market for these services, while not experiencing rapid growth, remains robust due to the consistent need for cargo handling and storage. This stability translates into predictable and substantial cash generation for SIPG.

In 2023, SIPG reported total operating income of approximately RMB 46.0 billion. A significant portion of this revenue is directly attributable to the stable operations of its warehousing and storage services, which are crucial for maintaining the port's efficiency and profitability.

- High Utilization Rates: The established facilities consistently see high utilization, reflecting the ongoing demand for storage and logistics solutions.

- Stable Revenue Streams: These operations provide a predictable and substantial cash flow, vital for funding other business ventures.

- Low Market Growth, High Market Share: While the logistics market may not be expanding rapidly, SIPG's dominant position ensures they capture a significant share of existing demand.

- Contribution to Overall Profitability: The consistent earnings from warehousing and storage are a key driver of SIPG's overall financial performance.

Shanghai International Port Group's (SIPG) core container handling operations, which have maintained Shanghai’s position as the world’s busiest container port for fifteen consecutive years, are its primary cash cows. In 2024, this segment handled over 50 million TEUs, demonstrating consistent efficiency and generating substantial, stable profits despite its mature, lower-growth profile.

The handling of general and bulk cargo also functions as a cash cow, holding a significant market share in a mature sector and delivering reliable cash flow. This segment leverages existing infrastructure, ensuring profitability without extensive new capital expenditure, a hallmark of a cash cow.

SIPG's port infrastructure leasing and management, including berths and warehouses, are also cash cows. These mature, stable revenue generators require minimal new investment beyond maintenance, providing consistent income streams. In 2023, these services contributed a significant portion to SIPG's revenue, highlighting their reliable cash generation.

Pilotage, tug, and ancillary port services are indispensable cash cows, offering consistent, high-margin revenue due to their essential nature and limited competition within Shanghai's port ecosystem. These services are vital for the port's efficient operation, ensuring ongoing demand.

Established warehousing and storage facilities represent further cash cows for SIPG, generating consistent revenue from high import/export volumes. These mature assets cater to steady demand, providing predictable cash flow crucial for funding other ventures.

| Business Segment | BCG Category | Key Characteristics | 2024 Data Point (Illustrative) |

| Container Handling | Cash Cow | High Market Share, Mature Market, Stable Cash Flow | 50+ million TEUs handled |

| General & Bulk Cargo Handling | Cash Cow | High Market Share, Mature Market, Reliable Revenue | Consistent substantial volumes of coal, ore, etc. |

| Infrastructure Leasing & Management | Cash Cow | Established Assets, Low Investment Needs, Predictable Income | Significant revenue contribution in 2023 |

| Pilotage, Tug & Ancillary Services | Cash Cow | Essential Operations, High Margins, Limited Competition | Critical for managing ~47 million TEUs in 2023 |

| Warehousing & Storage | Cash Cow | High Utilization, Stable Demand, Predictable Earnings | Key driver of ~RMB 46.0 billion total operating income in 2023 |

What You See Is What You Get

Shanghai International Port BCG Matrix

The Shanghai International Port BCG Matrix preview you're seeing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks or sample data—just the complete, analysis-ready BCG Matrix ready for your strategic decision-making. You can confidently use this preview as an accurate representation of the professional report you'll gain access to, ensuring immediate applicability for your business planning and competitive insights.

Dogs

Terminals and berths within Shanghai International Port that still heavily rely on manual operations and have not adopted significant automation technologies are likely positioned in the Dogs quadrant of the BCG Matrix. These facilities are characterized by low market share and operate within a low-growth segment of the port's overall business.

These manual terminals often struggle to compete with more advanced, automated counterparts due to inherent inefficiencies and higher per-unit operating costs. For example, a manual loading/unloading process might take 30% longer than an automated system, directly impacting throughput and revenue generation per berth.

As of 2024, while Shanghai Port's overall container throughput reached over 49 million TEUs (Twenty-foot Equivalent Units), a significant portion of this growth is attributed to automated terminals. The less efficient manual berths contribute a diminishing percentage to this total, reflecting their declining competitiveness in the global shipping landscape.

The investment required to upgrade these manual facilities to modern automated standards can be substantial, often outweighing the potential returns in a mature and highly competitive port environment. This makes them a strategic challenge for the port's future development, often requiring careful consideration for modernization or potential divestment.

Certain specialized cargo handling services at Shanghai International Port might be categorized as 'Dogs' in the BCG Matrix. These are segments where demand is steadily decreasing, perhaps due to technological shifts or changes in global trade patterns, leading to low market share and minimal growth prospects.

For instance, handling of certain traditional manufactured goods that are now more efficiently transported via other methods or have seen their production decline could fall into this category. These operations would represent low revenue generators for the port, potentially consuming valuable resources without yielding significant returns.

As of 2024, while specific figures for declining niche services are proprietary, broader trends in global shipping indicate a move towards consolidation and efficiency. Ports globally are adapting their infrastructure and services to focus on high-demand, high-volume cargo, making less utilized or declining segments less strategic.

Shanghai International Port's older, underutilized equipment and facilities act as a significant drain on resources. These assets, often lacking modernization, suffer from low operational efficiency and incur disproportionately high maintenance expenses. In the hyper-competitive global port landscape, this translates directly into a weak market position.

Consequently, these underperforming assets fall squarely into the Dogs quadrant of the BCG Matrix for Shanghai International Port. For example, reports from 2024 indicated that certain older quay cranes, while still functional, operated at significantly lower throughput rates compared to newer models, contributing to increased turnaround times and reduced overall port capacity utilization for those specific berths.

The financial implications are stark. The high maintenance costs associated with keeping these older assets operational, coupled with their limited revenue-generating capacity due to inefficiency, create a negative return on investment. This situation necessitates a strategic decision: either a substantial capital investment for modernization to boost efficiency and competitiveness, or a complete divestiture to free up capital and operational focus.

Legacy Administrative and Operational Processes

Legacy administrative and operational processes at Shanghai International Port, particularly those not directly tied to cargo movement, can be classified as Dogs in the BCG Matrix. These traditional, often manual, systems are a drag on efficiency and profitability. For instance, paper-based customs clearance or manual inventory tracking, while once standard, now create bottlenecks and increase operational costs.

These legacy systems are characterized by:

- Low market growth: They do not drive expansion in a sector increasingly defined by digital solutions.

- Low relative market share: They fall behind competitors who have adopted advanced, integrated digital platforms.

- High operational costs: Manual processes require more labor and are prone to errors, leading to higher overheads.

- Limited contribution to innovation: They divert resources from investments in cutting-edge technology that could enhance competitiveness.

Non-strategic or Underperforming Minority Investments

Non-strategic or underperforming minority investments within Shanghai International Port Group's (SIPG) portfolio would represent ventures that don't align with their core port operations or logistics strengths. These might include smaller stakes in unrelated businesses or ports with minimal growth potential.

For instance, if SIPG held a minority stake in a regional logistics firm that consistently reported single-digit revenue growth and had a net profit margin below 2% in 2024, it would likely be categorized here. Such an investment might tie up capital without generating substantial returns or offering synergistic benefits to SIPG's primary business of operating major port facilities.

- Low Return on Investment: These investments typically yield returns significantly below SIPG's cost of capital, potentially dragging down overall portfolio performance.

- Limited Strategic Fit: They often lack clear connections to SIPG's core competencies in port management, shipping, and related logistics services.

- Suboptimal Capital Allocation: Capital deployed in these ventures could be better utilized in higher-growth, strategic areas of the business.

- Potential for Divestment: Companies often consider divesting such assets to streamline operations and improve financial efficiency.

Certain older, less efficient cargo handling equipment and manual berths at Shanghai International Port can be classified as Dogs. These segments exhibit low market share due to their declining operational efficiency and are situated within a mature, low-growth segment of the port's service offerings.

As of 2024, while Shanghai Port's overall throughput remained robust, a substantial portion of its growth was driven by modern, automated terminals. The contribution of these older, manual facilities to overall throughput was minimal and declining, highlighting their diminished competitiveness.

The strategic challenge lies in the high cost of modernizing these legacy operations versus their low potential return. For instance, older quay cranes might have a throughput capacity 30% lower than newer models, leading to increased vessel turnaround times and higher operational costs per TEU handled.

Managing these Dog segments requires a strategic decision: either significant capital investment for upgrades to improve efficiency and competitiveness, or divestment to reallocate resources to more promising areas of the port's operations.

| BCG Category | Shanghai Port Segment | Characteristics | 2024 Data Point | Strategic Implication |

|---|---|---|---|---|

| Dogs | Manual Cargo Handling Berths | Low throughput, high labor costs, inefficient operations | Contribution to overall TEU throughput < 5% | Modernization or divestment required |

| Dogs | Legacy Administrative Systems | Paper-based processes, manual data entry, slow processing times | Increased processing time for customs clearance by up to 20% compared to digital platforms | Digitization and integration for efficiency gains |

| Dogs | Underutilized Older Equipment | Low operational efficiency, high maintenance costs, outdated technology | Maintenance costs for older cranes 15% higher than newer models | Replacement or decommissioning |

Question Marks

Emerging cross-border e-commerce logistics hubs within the Shanghai International Port Group (SIPG) ecosystem are a prime example of a high-growth area. While the overall market is expanding rapidly, SIPG's current market share in this specialized niche may still be establishing itself. For instance, global cross-border e-commerce sales were projected to reach $2.1 trillion in 2024, indicating substantial potential for logistics providers.

Capturing a more significant portion of this burgeoning market will necessitate considerable investment. SIPG needs to strategically develop and enhance its infrastructure to cater to the unique demands of e-commerce, such as faster processing times and specialized warehousing. This focus on specialized hubs positions SIPG to leverage the ongoing digital transformation in global trade and capitalize on the increasing consumer appetite for international goods.

Shanghai International Port Group (SIPG) is exploring advanced supply chain financing services, a move that aligns with the digital transformation trend in logistics. This venture into fintech solutions for the sector represents a high-growth potential market. For instance, the global supply chain finance market was valued at approximately $8.2 trillion in 2023 and is projected to reach over $14 trillion by 2030, highlighting the significant opportunity.

As a relatively new participant in this specific area, SIPG would likely begin with a low market share. This necessitates considerable investment to build scale, develop robust platforms, and establish trust within the logistics ecosystem. The initial investment requirements are substantial, aiming to overcome established players and capture market demand.

The strategic rationale for SIPG entering this space is to leverage its existing port infrastructure and relationships to offer integrated financial solutions. This could include digital platforms for invoice financing, inventory financing, and payment solutions, creating a more efficient and transparent supply chain for its clients. The goal is to move beyond traditional port services into value-added financial offerings.

New international port investments and partnerships represent Shanghai International Port Group's (SIPG) strategic move into the "Question Marks" category of the BCG Matrix. These ventures, particularly in burgeoning emerging markets, are characterized by their substantial growth prospects but also by the significant capital outlay required and their initial, often modest, market share.

For instance, SIPG's reported investments in overseas port infrastructure in the years leading up to 2025, such as its stake in the Port of Piraeus in Greece, illustrate this dynamic. While Piraeus has shown strong growth, exceeding 5.6 million TEUs handled in 2023, it initially represented a new market for SIPG, demanding considerable resources and facing competition.

The success of these international endeavors is intrinsically tied to a complex web of geopolitical stability, evolving trade routes, and regional economic performance, factors that introduce a layer of inherent risk. SIPG's strategy here is to nurture these investments, aiming to convert them into Stars through sustained capital allocation and operational expertise.

In 2024, SIPG continued to explore such opportunities, with ongoing assessments for potential partnerships in Southeast Asia and Africa, regions identified for their high potential but also for their nascent logistical frameworks and regulatory landscapes.

Niche Specialized Cold Chain Logistics

Shanghai International Port Group's (SIPG) venture into niche specialized cold chain logistics, particularly for pharmaceuticals and high-value perishables, represents a significant growth opportunity. This segment is experiencing robust demand, driven by global trade in temperature-sensitive goods. For instance, the global cold chain market was valued at approximately USD 180 billion in 2023 and is projected to reach over USD 300 billion by 2028, indicating a strong compound annual growth rate.

While the market is expanding, SIPG's current penetration in this highly specialized, capital-intensive area might be limited. The development of advanced infrastructure, such as specialized reefer terminals and temperature-controlled warehousing, requires substantial investment. This makes it a potential question mark in the BCG matrix, where significant investment is needed to capture market share and build necessary expertise.

- Market Growth: The global pharmaceutical logistics market alone, a key component of specialized cold chain, is expected to grow significantly, with projections suggesting a value exceeding USD 200 billion by 2027.

- Capital Intensity: Establishing state-of-the-art cold chain facilities involves high upfront costs for technology, specialized equipment, and adherence to stringent regulatory standards.

- SIPG's Position: SIPG's current market share in this specific niche is likely lower compared to established global players, necessitating strategic investments to enhance capabilities.

- Investment Rationale: Targeted capital allocation is crucial for SIPG to develop specialized expertise, build advanced infrastructure, and secure a competitive position in this high-potential segment.

Alternative Fuel Bunkering Infrastructure (e.g., Green Methanol, Hydrogen)

While Liquefied Natural Gas (LNG) bunkering is a mature and profitable segment for Shanghai International Port (SIPG), acting as a Cash Cow, the infrastructure for emerging green fuels like green methanol and hydrogen is still in its infancy.

This nascent market presents significant growth potential, but SIPG's current market share in these areas remains low.

- Green Methanol & Hydrogen Infrastructure: SIPG's investment in green methanol and hydrogen bunkering infrastructure places it in a high-growth, emerging market.

- R&D and Investment Needs: Significant research, development, and capital expenditure are necessary to establish a leading position in these future fuel markets.

- Strategic Forward Look: These initiatives demonstrate SIPG's commitment to future maritime fuel trends, positioning them for long-term industry shifts.

- Market Share: While investment is substantial, the current market share for these alternative fuels is minimal compared to established options.

The global maritime industry's push towards decarbonization, with regulations increasingly favoring greener fuels, underscores the strategic importance of developing this alternative fuel bunkering infrastructure.

SIPG's expansion into new international port investments and partnerships exemplifies a "Question Mark" in the BCG matrix. These ventures, often in high-growth emerging markets, demand substantial capital and currently hold a modest market share. For example, SIPG's involvement in the Port of Piraeus, which handled over 5.6 million TEUs in 2023, represents a significant, resource-intensive undertaking in a new market.

The success of these international initiatives hinges on geopolitical stability and regional economic performance, introducing inherent risks. SIPG's strategy focuses on nurturing these investments through sustained capital allocation and operational expertise, aiming to elevate them into "Stars." In 2024, SIPG continued to evaluate potential partnerships in promising regions like Southeast Asia and Africa, which have high growth potential but also nascent logistical frameworks.

SIPG's strategic entry into niche markets like specialized cold chain logistics, particularly for pharmaceuticals, also falls into the "Question Mark" category. This segment exhibits robust demand, with the global cold chain market projected to exceed $300 billion by 2028, but requires substantial investment in advanced infrastructure and specialized expertise. SIPG's current penetration in this capital-intensive area is likely limited, necessitating targeted capital for growth.

The development of green fuel bunkering infrastructure, such as for green methanol and hydrogen, represents another "Question Mark" for SIPG. While the global maritime industry is shifting towards decarbonization, the market share for these alternative fuels is minimal, requiring significant research and capital expenditure to establish a leading position. This strategic focus positions SIPG for long-term industry shifts in maritime fuels.

| BCG Category | SIPG Initiative | Market Growth Potential | Current Market Share | Investment Requirement |

| Question Mark | New International Port Investments/Partnerships | High (Emerging Markets) | Low | High |

| Question Mark | Specialized Cold Chain Logistics (Pharma) | High (Global Cold Chain Market ~$300B by 2028) | Low | High |

| Question Mark | Green Fuel Bunkering (Methanol/Hydrogen) | High (Decarbonization Trend) | Minimal | High |

BCG Matrix Data Sources

Our Shanghai International Port BCG Matrix leverages comprehensive data from the port's annual financial reports, official government statistics on cargo throughput, and leading maritime industry research publications.