Party City Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Party City Bundle

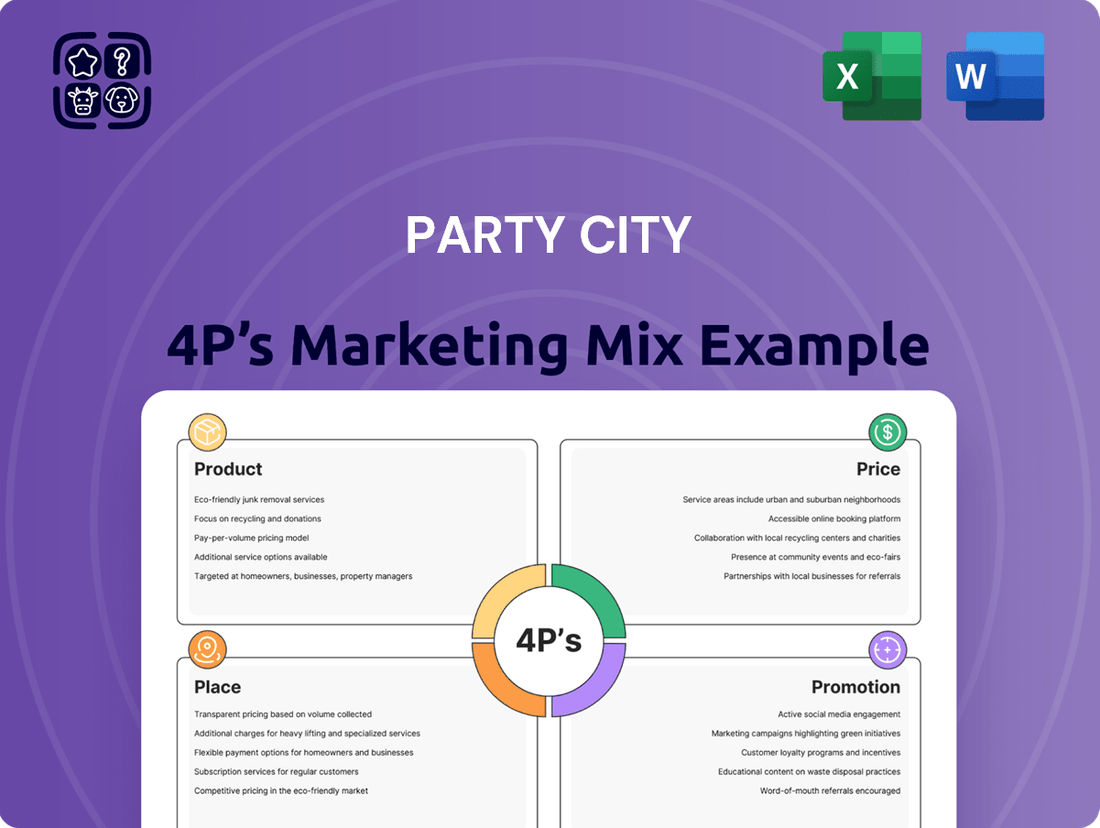

Party City's product strategy focuses on a vast, seasonal assortment of party supplies, from balloons to costumes, catering to diverse celebrations. Their pricing is generally competitive, often employing promotions and loyalty programs to attract value-conscious consumers. Place involves a strong brick-and-mortar presence alongside an e-commerce platform, ensuring broad accessibility for last-minute needs and planned events. Promotion utilizes a mix of advertising, social media engagement, and in-store events to build excitement and drive traffic.

Go beyond this overview and unlock a comprehensive, ready-to-use Marketing Mix Analysis for Party City. This in-depth report covers Product, Price, Place, and Promotion strategies in detail, offering actionable insights for business professionals, students, and consultants.

Product

Party City's product strategy historically revolved around offering a wide assortment of party supplies, aiming to be the definitive destination for all celebratory needs. This extensive range included everything from balloons and themed decorations to costumes and tableware, designed to cater to a multitude of events like birthdays, holidays, and specific themed parties.

The company's product breadth was a key differentiator, ensuring customers could find diverse items for various occasions. This comprehensive offering positioned Party City as a convenient one-stop shop, simplifying party planning for consumers across the spectrum of celebrations.

Party City's product strategy heavily leveraged seasonal and holiday merchandise, with Halloween being a cornerstone. This allowed them to tap into significant consumer spending spikes, as evidenced by Halloween sales often exceeding $10 billion annually in the U.S. alone.

The company curated specialized offerings for major holidays like Christmas and New Year's Eve, in addition to Halloween. This focus on festive occasions enabled them to capture peak demand, driving substantial revenue during these key periods.

Party City's vertically integrated development, primarily through its Amscan wholesale division, was a key differentiator. This allowed them to design, manufacture, and distribute a significant portion of their product line, giving them a strong hand in quality control and supply chain reliability. In 2023, Amscan represented a substantial part of Party City's operations, contributing to their ability to manage costs and respond to market trends effectively.

This integration extended to product sourcing, with an impressive approximately 80% of their offerings being designed and sourced in-house. This deep control over the product lifecycle, from initial concept to final distribution, meant Party City could more readily adapt to evolving consumer preferences in the party goods sector, a market known for its seasonal and trend-driven nature.

Themed Party Solutions and Store Formats

Party City's product strategy heavily leaned into themed party solutions, catering to a wide array of celebrations. This approach meant their merchandise was often organized around specific events and popular themes, making it intuitive for customers planning a party. The company recognized the need to streamline the shopping experience for these often complex occasions.

To enhance customer convenience and inspiration, Party City actively experimented with innovative store formats. A key initiative involved introducing 'birthday worlds' within their retail spaces. These were essentially curated mini-shops designed to house all necessary items for a particular birthday theme or age group.

These 'birthday worlds' served a dual purpose: simplifying the purchasing process and sparking creativity. By consolidating related products, customers could more easily find everything from decorations and tableware to costumes and party favors for a specific celebration. This also encouraged discovery of new party ideas and complementary items.

In 2024, Party City continued to refine its product assortment, with a significant focus on licensed characters and trending themes. While specific store format investment figures for 2024 are not publicly detailed, the company's ongoing efforts in product categorization and visual merchandising at the store level underscore the importance of this strategy. For instance, their online presence mirrors this by offering curated party kits and theme-based collections, reflecting the in-store 'birthday world' concept. In 2023, Party City reported net sales of $1.8 billion, highlighting the broad appeal of their comprehensive party solutions.

- Themed Assortment: Products organized by event and popular themes to simplify planning.

- Innovative Store Formats: Introduction of 'birthday worlds' for curated shopping experiences.

- Customer Convenience: Mini-shops designed to make finding all party essentials easier.

- Inspiration and Discovery: Encouraging customers to find new ideas and complementary products.

Focus on Licensed and Proprietary Brands

Party City's strategy centered on a robust mix of licensed and proprietary brands, a key element of its marketing approach. This dual focus allowed them to capture a broad customer base, from those seeking familiar characters to those looking for unique, in-house designs. By securing licenses for popular children's characters, Party City tapped into existing demand and brand loyalty, making their offerings instantly recognizable and appealing to families.

The company's own proprietary brands, developed through its manufacturing capabilities, provided a point of differentiation and potentially higher margins. This internal development allowed for greater control over product quality, design innovation, and the ability to quickly respond to emerging trends. For instance, in the lead-up to major holidays in 2024, Party City likely leveraged these proprietary designs to offer exclusive collections not available through other retailers.

- Licensed Brands: Party City featured popular characters from major entertainment franchises, driving foot traffic and sales, especially during key gifting seasons.

- Proprietary Brands: In-house designed products offered unique value and potential for higher profit margins, distinguishing Party City from competitors.

- Market Reach: This blend of licensed and owned brands allowed Party City to cater to diverse customer segments and preferences within the party supplies market.

- Competitive Advantage: The proprietary brand development enabled quicker adaptation to market trends and exclusive product offerings.

Party City's product strategy in 2024-2025 emphasizes curated collections and a blend of licensed and proprietary brands to meet diverse customer needs. Their extensive assortment, covering everything from balloons to costumes, aims to be a one-stop shop for all celebrations. The company's vertically integrated Amscan division, which designed and sourced approximately 80% of its offerings in 2023, provides control over quality and cost, allowing for rapid adaptation to trends.

The introduction of 'birthday worlds' within stores streamlines the shopping experience by grouping themed items, fostering inspiration and convenience. This focus on themed solutions, including strong seasonal merchandise for events like Halloween, which generates over $10 billion annually in the U.S., remains a core element. In 2023, Party City achieved net sales of $1.8 billion, underscoring the broad appeal of their product mix.

| Product Strategy Element | Description | Impact | 2023 Data Point |

|---|---|---|---|

| Assortment Breadth | Comprehensive range of party supplies for various occasions. | Positions as a one-stop shop, simplifying planning. | Net sales of $1.8 billion. |

| Themed Focus | Merchandise organized by events and popular themes. | Enhances customer convenience and inspiration. | Strong performance during seasonal spikes (e.g., Halloween). |

| Vertical Integration (Amscan) | In-house design, manufacturing, and sourcing (approx. 80% of offerings). | Quality control, cost management, and trend responsiveness. | Amscan contributed significantly to operations. |

| Brand Mix | Combination of licensed and proprietary brands. | Appeals to broad customer base, offers differentiation. | Licensed brands drive demand; proprietary brands offer margins. |

What is included in the product

This analysis provides a comprehensive examination of Party City's marketing mix, detailing their product assortment, pricing strategies, distribution channels, and promotional activities to understand their market positioning.

Simplifies the complex marketing strategy of Party City's 4Ps into actionable insights, alleviating the pain of strategic confusion.

Provides a clear, concise overview of Party City's 4Ps, removing the difficulty of deciphering their marketing approach.

Place

Party City historically leveraged an extensive North American retail network, boasting hundreds of company-owned and franchised locations across the United States and Canada. This vast physical footprint served as a critical distribution channel, allowing direct customer access for seasonal and everyday party supplies. For instance, prior to significant closures, Party City operated over 800 stores in North America.

However, the retail landscape shifted dramatically for Party City. By late 2024 and into early 2025, a significant portion of its corporate-owned U.S. store base began a phased wind-down, leading to widespread closures. This strategic pivot reflects a response to evolving consumer purchasing habits and operational challenges within the traditional brick-and-mortar retail sector.

Party City strategically leveraged seasonal pop-up stores, most notably their Halloween City locations, to tap into concentrated bursts of consumer demand. These temporary outposts were specifically designed to maximize sales during the crucial Halloween season, a period of exceptionally high traffic and spending for party supplies. By establishing these pop-ups, the company effectively expanded its physical presence during its busiest times, offering more convenient access to their popular merchandise.

The success of this strategy is underscored by the significant revenue generated during peak seasons. For instance, in the lead-up to Halloween 2023, Party City anticipated a strong performance, with industry analysts projecting a continued increase in Halloween-related spending, reaching an estimated $12.3 billion in the US alone. These pop-ups directly contributed to capturing a portion of that market by providing accessible retail touchpoints.

Party City's global wholesale operations, primarily through its Amscan division, served as a crucial distribution channel beyond its own stores. In February 2025, this significant segment, encompassing intellectual property and operational assets, was formally acquired by New Amscan PC LLC. This move signals a strategic shift, potentially allowing Amscan to operate with greater autonomy and focus on its B2B relationships.

E-commerce Platform

Party City's e-commerce platform, partycity.com, served as a crucial digital storefront, significantly expanding product availability beyond its brick-and-mortar limitations. This online channel offered an impressive catalog of up to 40,000 Stock Keeping Units (SKUs), a substantial increase from the approximately 15,000 SKUs typically found in physical stores. This broader selection directly addressed customer demand for a wider variety of party supplies and themed decorations, making it easier for consumers to find exactly what they needed for any event. The platform facilitated direct-to-consumer sales, streamlining the purchasing process and enhancing overall customer accessibility.

The online presence was not just about product breadth; it was also about convenience and reach. In 2024, e-commerce continued to be a vital sales channel for retailers, with online sales projected to grow. For Party City, partycity.com provided a 24/7 shopping experience, allowing customers to browse and purchase at their leisure, regardless of store hours or geographical location. This digital strategy was essential for capturing market share in an increasingly online-centric retail landscape.

- Expanded Product Assortment: partycity.com featured up to 40,000 SKUs, significantly more than physical stores.

- Direct-to-Consumer Sales: The platform enabled direct sales, enhancing customer convenience.

- 24/7 Accessibility: Customers could shop online anytime, overcoming traditional retail limitations.

- Digital Market Reach: The website extended Party City's reach to a wider customer base.

Omnichannel Customer Experience

Before its operational wind-down, Party City was actively pursuing an omnichannel strategy to merge its online presence with its physical stores. This was designed to create a fluid and consistent experience for customers, no matter how they chose to interact with the brand.

The core of this approach involved using digital channels to gain insights into customer preferences and behaviors. This data then informed personalized marketing efforts, aiming to meet individual needs more effectively. For instance, online browsing history could inform in-store promotions or targeted email campaigns.

Key elements of Party City's omnichannel efforts included:

- Buy Online, Pick Up In-Store (BOPIS): Allowing customers to conveniently purchase items online and collect them at their nearest store.

- Ship From Store: Utilizing store inventory to fulfill online orders, potentially speeding up delivery times and managing stock more efficiently.

- Integrated Loyalty Programs: Ensuring that rewards and customer data were consistent across both online and physical touchpoints.

- Consistent Branding and Messaging: Maintaining a unified brand voice and visual identity across all platforms to reinforce customer recognition and trust.

While specific financial data on the direct impact of Party City's omnichannel initiatives prior to its wind-down is not publicly detailed, the broader retail industry trend indicates significant customer preference for such integrated experiences. For example, in 2023, a significant percentage of consumers reported using BOPIS options, highlighting the strategic importance of omnichannel capabilities for retailers aiming to remain competitive.

Party City's "Place" strategy evolved significantly, moving from a vast brick-and-mortar presence to a more focused digital and wholesale model. While hundreds of U.S. stores began closing in late 2024 and early 2025, the company's e-commerce platform, partycity.com, became increasingly vital, offering up to 40,000 SKUs. Furthermore, the acquisition of its wholesale operations by New Amscan PC LLC in February 2025 streamlined its B2B distribution.

| Channel | Status (Early 2025) | Key Feature |

|---|---|---|

| Company-Owned Stores (U.S.) | Phased Wind-Down/Closure | Historically ~800 locations, now significantly reduced. |

| E-commerce (partycity.com) | Primary Digital Platform | Expanded assortment (40,000 SKUs), 24/7 accessibility. |

| Halloween City Pop-Ups | Seasonal | Targeted demand capture during peak Halloween season. |

| Wholesale (Amscan) | Acquired by New Amscan PC LLC (Feb 2025) | Focus on B2B relationships and intellectual property. |

Full Version Awaits

Party City 4P's Marketing Mix Analysis

The preview shown above is identical to the final version you'll download. Buy with full confidence. This comprehensive Party City 4P's Marketing Mix Analysis details their Product, Price, Place, and Promotion strategies. You'll gain valuable insights into how Party City positions itself in the market. This document is ready for immediate use upon purchase.

Promotion

Party City has consistently leveraged seasonal and event-based marketing to drive sales, with a significant emphasis on holidays like Halloween. In the lead-up to Halloween 2023, the company saw a surge in demand for costumes and decorations, a trend that typically accounts for a substantial portion of their annual revenue. This strategic focus on peak celebration periods allows them to directly align promotions with consumer purchasing behavior.

Party City heavily utilized digital marketing and social media to boost its brand presence. In 2024, the company likely continued its strategy of engaging customers through platforms like Instagram and Facebook, sharing festive content and running targeted ads. This approach aimed to increase brand awareness and drive traffic to both their online store and physical locations, especially during peak celebration seasons.

The focus on social media engagement allowed Party City to connect with customers on a personal level, fostering a sense of community around celebrations. By tailoring content to specific holidays and events, they could effectively reach audiences planning parties, thereby increasing the likelihood of purchase. This digital push was crucial for staying competitive in the retail landscape.

In terms of reach, digital channels offered a cost-effective way to connect with a broader demographic than traditional advertising alone. By analyzing customer data and online behavior, Party City could execute highly targeted campaigns, ensuring their marketing spend was optimized for maximum impact. This strategy was particularly effective for reaching younger demographics who are highly active on social media.

While specific 2024/2025 engagement metrics are still emerging, industry trends show continued growth in social commerce and influencer marketing. Party City's investment in these areas in previous years positions them to capitalize on these trends, further enhancing customer interaction and driving sales through their digital footprint.

Party City's physical stores were meticulously crafted to be more than just retail spaces; they were designed as immersive 'birthday worlds.' This strategic in-store merchandising focused on creating engaging displays that not only showcased products but also aimed to spark customer imagination for their celebrations. The goal was to encourage spontaneous purchases and drive sales by making product discovery an enjoyable experience.

These vibrant displays were instrumental in inspiring customers, offering a visual feast of party ideas and themes. By presenting complementary products together, such as balloons alongside party favors or costumes near themed decorations, Party City effectively encouraged cross-selling opportunities. This approach aimed to maximize the average transaction value and enhance the overall customer journey within the store.

While specific 2024/2025 data on the direct impact of these merchandising efforts on sales is not yet publicly available, the strategy aligns with broader retail trends. For instance, a 2023 report by Statista indicated that 70% of consumers find in-store displays influential in their purchasing decisions, underscoring the importance of well-executed visual merchandising.

al Offers and Discounts

Party City strategically leverages promotional offers and discounts as a core component of its marketing mix to drive sales and clear inventory. These initiatives are designed to attract a broad customer base, particularly during key seasonal periods and times of economic sensitivity.

In the latter half of 2024, Party City implemented aggressive price reductions, marking down over 2,000 products. This move was a direct response to prevailing inflationary pressures, aiming to make its offerings more accessible to consumers managing tighter budgets.

The company's promotional tactics often include:

- Seasonal Sales Events: Offering discounts tied to holidays and specific celebration periods.

- Coupon Distribution: Providing coupons through various channels like email newsletters and in-store flyers.

- Loyalty Programs: Rewarding repeat customers with exclusive discounts and early access to sales.

- Bundling Deals: Creating package offers that encourage larger purchases at a reduced per-item cost.

Liquidation Sales and Closure Announcements

In late 2024 and extending into early 2025, Party City's promotional strategy underwent a significant transformation, pivoting to liquidation sales. These events featured aggressive discounts, with advertised price reductions reaching as high as 50% to 80% off across a broad range of merchandise. This intense promotional activity was a direct component of the company's orchestrated wind-down of its corporate-owned retail and wholesale operations within the United States.

These 'going-out-of-business' sales were not merely promotional tactics but critical elements in the orderly closure of Party City's physical presence. The deep discounts aimed to rapidly clear remaining inventory, a common strategy to recoup as much capital as possible during a business liquidation. This shift in promotion represented the final phase of their market presence, moving from growth and engagement to asset disposition.

- Liquidation Focus: Promotions shifted from typical seasonal or event-based offers to deep discounts for store closures.

- Discount Depth: Advertised savings of up to 50-80% were common, signaling a clearance of all inventory.

- Operational Wind-Down: These sales were integral to the planned cessation of corporate-owned US retail and wholesale operations.

- Financial Strategy: The promotions served the dual purpose of attracting customers for final sales and liquidating assets efficiently.

Party City's promotional strategy in late 2024 and early 2025 was heavily characterized by liquidation sales, marking a significant departure from its usual seasonal event promotions. These sales featured substantial discounts, often advertised as high as 50% to 80% off, to rapidly divest remaining inventory. This aggressive promotional approach was a direct component of the company's planned wind-down of its corporate-owned retail and wholesale operations in the United States.

The primary objective of these liquidation promotions was to efficiently clear out all stock as part of the business closure process. This strategy aimed to maximize capital recovery during the final stages of operation. The deep discounts were designed to attract a final wave of customers, ensuring that assets were converted to cash before stores ceased operations.

This shift in promotional focus from typical marketing efforts to liquidation events underscores the company's transition towards asset disposition. It represents the concluding phase of Party City's market presence, moving from customer engagement and sales to the orderly closure of its physical retail footprint.

| Promotional Tactic | Period | Key Characteristics | Objective |

|---|---|---|---|

| Seasonal & Event-Based Marketing | Pre-2024 | Holiday-themed sales, digital engagement, in-store merchandising | Drive sales, build brand awareness |

| Liquidation Sales | Late 2024 - Early 2025 | Deep discounts (up to 50-80% off), clearance of all inventory | Asset disposition, capital recovery during business wind-down |

Price

Party City's pricing strategy focused on delivering strong value, positioning itself competitively against specialty party stores and mass retailers like Walmart and Target. This approach was vital for drawing in a wide range of shoppers looking for party supplies.

In 2024, Party City's pricing likely continued to reflect this competitive stance, balancing the premium associated with specialty offerings against the everyday low prices of mass market competitors. For instance, while a themed balloon bouquet might be priced higher than at a supermarket, it would offer a greater selection and perceived quality.

The company's ability to manage its costs, from sourcing to inventory, directly impacted its pricing flexibility. By optimizing its supply chain, Party City could offer attractive price points on popular items, encouraging customer loyalty and driving sales volume.

Party City likely leveraged value bundling and kits as a key component of its marketing mix, offering customers convenience and perceived savings. These curated packages, often themed for specific holidays or celebrations, encouraged customers to purchase multiple complementary items, such as decorations, tableware, and favors, in a single transaction. For instance, a Halloween kit might include pumpkins, spooky banners, and themed plates, simplifying the party planning process for consumers.

This strategy aimed to increase the average transaction value and foster customer loyalty by providing a one-stop solution for event needs. By bundling items, Party City could also move inventory more efficiently, particularly for seasonal merchandise. While specific 2024-2025 data on bundled sales is not readily available for Party City's current operational status, the historical effectiveness of such strategies in the retail sector is well-documented, often leading to higher sales volumes compared to individual item purchases.

Party City consistently leveraged promotional pricing and discounts as a key element of its marketing strategy. This approach aimed to attract customers and stimulate sales volume.

In September 2024, Party City enacted a substantial price reduction initiative, impacting over 2,000 products. These discounts averaged 20%, making a wide array of party supplies more accessible to consumers.

Perceived Value Alignment

Party City's pricing strategy aimed to align with the perceived value of its vast and often exclusive product range, including its own brands and those under license. The company sought a sweet spot, balancing accessible price points with the premium quality and extensive variety that customers expected.

This approach was particularly crucial given the competitive retail landscape. In 2023, for instance, while many retailers faced inflationary pressures, Party City worked to maintain competitive pricing, understanding that value perception directly impacts purchasing decisions in the party supplies sector.

- Extensive Assortment: Pricing reflects the breadth of offerings, from basic decorations to themed party kits.

- Proprietary & Licensed Brands: Unique products, often with higher perceived value, are priced accordingly.

- Value Proposition: Balancing affordability with the quality and variety of goods.

- Competitive Benchmarking: Prices are set to remain attractive against competitors in the party and celebration market.

Liquidation-Driven Reductions

During its final operational phase in late 2024 and early 2025, Party City engaged in liquidation-driven price reductions. These aggressive discounts, reaching up to 80% on remaining inventory, were a critical component of its going-out-of-business strategy to divest all merchandise before store closures.

This severe price adjustment was aimed at expediting the sale of all stock. For example, reports indicated that by January 2025, many locations had cleared a substantial majority of their inventory through these deep discounts.

- Price Reduction: Up to 80% off remaining inventory.

- Objective: Complete merchandise liquidation before store closures.

- Timing: Late 2024 through early 2025.

- Strategy: Going-out-of-business sales.

Party City's pricing strategy evolved significantly through late 2024 and into early 2025, shifting from competitive value to aggressive liquidation. Initially, the company maintained a balance, pricing its extensive assortment and proprietary brands to offer value against competitors. However, as its operational status changed, deep discounts became the primary pricing tactic.

In September 2024, Party City implemented a 20% average price reduction across over 2,000 products, a move designed to boost sales and maintain competitiveness. This strategy aimed to make their wide selection, from basic decorations to licensed character items, more accessible. The company sought to position its pricing as attractive, even as it navigated financial challenges.

By late 2024 and early 2025, with the company's impending store closures, pricing became a liquidation tool. Discounts escalated dramatically, reaching up to 80% on remaining inventory. This drastic price adjustment was instrumental in divesting all merchandise before the final shutdown, with many locations reporting significant inventory sell-through by January 2025.

| Pricing Tactic | Average Discount | Timing | Objective |

|---|---|---|---|

| Competitive Value & Promotions | Varies (e.g., 20% in Sep 2024) | Pre-liquidation (early-mid 2024) | Attract customers, drive volume, maintain market position |

| Liquidation Discounts | Up to 80% | Late 2024 - Early 2025 | Divest all remaining inventory before store closures |

4P's Marketing Mix Analysis Data Sources

Our Party City 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company press releases, investor relations materials, and detailed e-commerce platform information. We also leverage industry reports and competitive landscape analyses to ensure a holistic view of their strategies.