Party City Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Party City Bundle

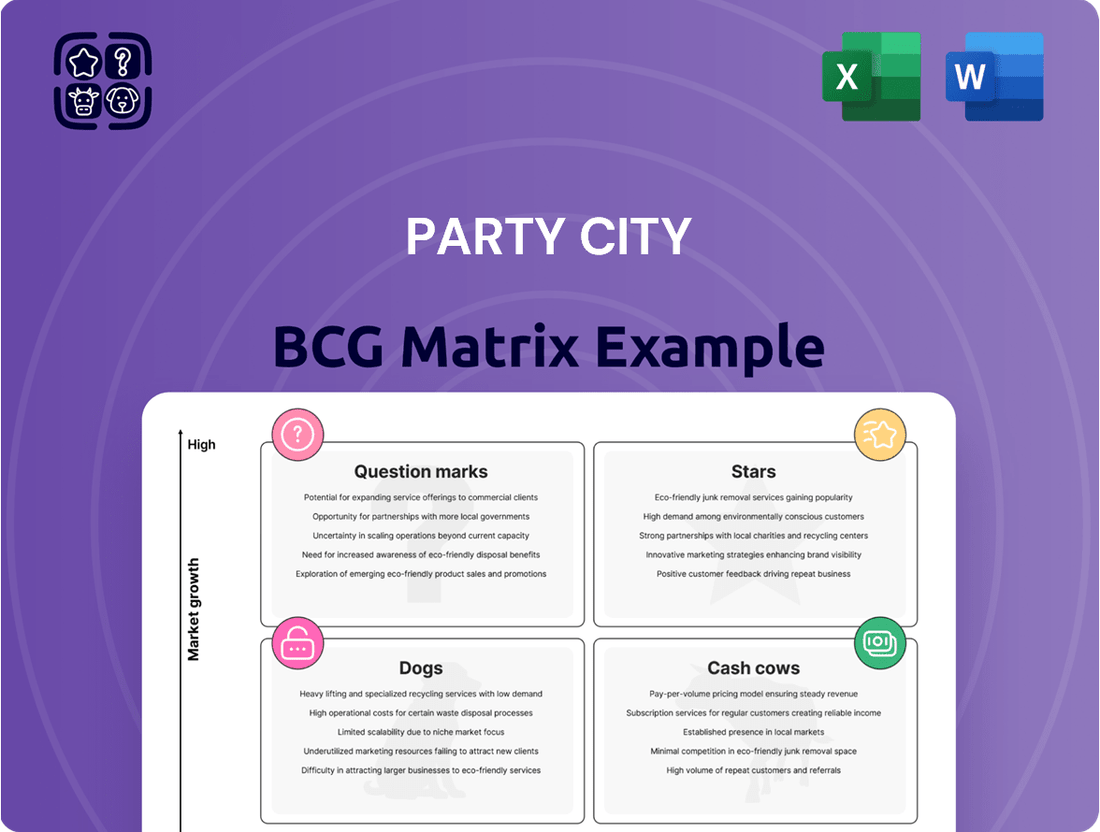

Party City's current market position can be visualized through its BCG Matrix, highlighting areas of strength and potential growth. Understanding which product categories are "Stars" with high growth and market share, and which are "Cash Cows" generating consistent revenue, is crucial for strategic planning.

This initial glimpse reveals the dynamics at play, but to truly navigate Party City's competitive landscape, a comprehensive analysis is essential. Uncover the "Dogs" that may be draining resources and the "Question Marks" with untapped potential.

Purchase the full BCG Matrix for a complete breakdown of Party City's product portfolio, offering data-backed insights and actionable recommendations to optimize investments and drive future success. This detailed report will equip you with the clarity needed to make informed strategic decisions.

Stars

Historically, Halloween City pop-up stores were a key component of Party City's strategy, fitting the 'Star' category in the BCG Matrix. These seasonal locations tapped into the significant retail surge around Halloween, a holiday that consistently drives consumer spending. In 2023, Halloween-related spending in the US was projected to reach $12.2 billion, underscoring the immense market opportunity these pop-ups addressed.

Party City's exclusive licensed character merchandise, featuring popular franchises like Disney's Descendants and Super Mario Bros., represented a strategic move to capture a high-growth segment in the party supplies market. These exclusive lines were designed to drive sales and solidify market share within themed party categories.

In 2024, the market for licensed character merchandise continued to be robust, with entertainment and gaming properties leading the charge. For Party City, these exclusive offerings were intended to differentiate them from competitors and command premium pricing, potentially boosting revenue in their Stars quadrant.

Party City significantly boosted its digital fulfillment capabilities throughout 2024, a strategic move to capture a larger share of the expanding online party supply market. This investment was designed to enhance customer experience and streamline the online purchasing process.

Despite facing intense competition from major e-commerce players, Party City's commitment to improving its digital infrastructure reflects a clear strategy to drive higher growth and gain market traction in online sales.

New Store Format with 'Birthday Worlds' (Pilot Program)

Party City launched an accelerated rollout of its new store format in early 2024, heavily featuring dedicated 'birthday worlds' and an enhanced balloon experience. This strategic move, building on successful pilot programs, aims to revitalize the in-store customer journey and boost sales within its core party planning segment.

The initiative is designed to foster cross-selling opportunities by consolidating popular birthday-related merchandise, making it easier for customers to find everything they need for celebrations. This focus on improving the physical retail space is a key part of Party City's strategy to solidify its market position.

- 'Birthday Worlds' Format: The new format centralizes birthday-themed products, creating a more immersive and convenient shopping experience for customers planning parties.

- Balloon Experience Redesign: Significant investment has been made in redesigning the balloon presentation and service area to enhance customer satisfaction and potentially increase balloon sales, a key revenue driver.

- Pilot Program Success: The accelerated rollout is a direct result of positive outcomes observed during initial pilot programs, indicating strong customer reception and potential for increased sales.

- Market Share Focus: This initiative directly targets an increase in market share within the crucial birthday segment, aiming to capture a larger portion of consumer spending on party essentials.

Vertically Integrated Manufacturing (Amscan - Historical)

Vertically integrated manufacturing, historically embodied by Amscan, was a key pillar for Party City. This division produced a substantial amount of the company's merchandise, likely fostering significant cost efficiencies and a strong position within its supply chain. While Party City has reportedly divested its manufacturing operations to concentrate on retail and wholesale, the intellectual property associated with Amscan has been retained following the company's acquisition.

The strategic move away from in-house manufacturing suggests a pivot towards optimizing core retail and wholesale competencies. This shift could allow for greater flexibility in sourcing and product development. The acquisition of Party City, including the Amscan IP, signifies a potential future avenue for leveraging these manufacturing capabilities or brand recognition.

- Historical Cost Advantage: Amscan's vertical integration likely provided a competitive edge through controlled production costs.

- Supply Chain Control: Direct manufacturing offered greater oversight and reliability in product availability.

- Strategic Divestment: Party City's exit from manufacturing indicates a focus on core retail and wholesale strengths.

- IP Acquisition: The Amscan intellectual property is now part of the assets acquired alongside Party City.

Party City's exclusive licensed character merchandise, particularly in high-demand categories like Disney and Super Mario, represented its 'Star' performers. These items capitalized on the strong consumer interest in popular franchises, driving significant sales. In 2024, the market for licensed entertainment merchandise remained a robust sector, with continued strong performance from established and emerging IPs.

The accelerated rollout of Party City's new store format, emphasizing 'birthday worlds' and an enhanced balloon experience, also positioned these initiatives as potential Stars. This strategic investment aimed to revitalize the in-store customer journey and capture a larger share of the lucrative birthday party market. The focus on experiential retail and curated product displays sought to differentiate Party City from online competitors and drive increased foot traffic and basket size.

Party City's significant investments in digital fulfillment capabilities throughout 2024 aimed to capture a larger portion of the growing online party supply market. This focus on enhancing the online customer experience and streamlining purchasing processes positioned these digital efforts as key growth drivers, aligning with the characteristics of a 'Star' in the BCG matrix.

| Initiative | BCG Category | Rationale | 2024 Relevance |

| Licensed Character Merchandise | Star | Capitalizes on high consumer demand for popular IPs, driving sales in themed party categories. | Continued strong market for licensed entertainment goods. |

| New Store Format ('Birthday Worlds', Balloon Experience) | Star | Revitalizes in-store experience, targets lucrative birthday market, and aims to increase market share. | Accelerated rollout based on successful pilot programs. |

| Digital Fulfillment Capabilities | Star | Enhances online customer experience and streamlines purchasing to capture growing e-commerce market share. | Significant investment to compete with major online retailers. |

What is included in the product

This BCG Matrix overview analyzes Party City's product lines as Stars, Cash Cows, Question Marks, and Dogs, guiding strategic decisions.

The Party City BCG Matrix offers a clear visual of business unit performance, relieving the pain of uncertain strategic direction.

Cash Cows

Party City's core party supplies, like balloons and tableware, represent their established Cash Cows. These are the bedrock items that consistently drive sales, requiring minimal new investment due to their mature market status and predictable demand. They reliably generate substantial cash flow, a vital component for funding other areas of the business.

Despite occasional challenges, such as the 2021-2022 helium shortages impacting balloon availability, these basic essentials maintain a strong, steady sales volume. For instance, in the fiscal year ending February 3, 2024, Party City's total revenue was $1.9 billion, with a significant portion attributed to these fundamental categories. The consistent demand for these items across numerous celebrations ensures a stable income stream for Party City.

General birthday celebration merchandise, encompassing items for all ages, has historically been a robust revenue stream for Party City. This category likely holds a significant market share within a mature and stable segment of the party supplies industry. For instance, in 2024, sales of general birthday decor and accessories continued to represent a substantial portion of overall revenue, demonstrating consistent consumer demand that doesn't fluctuate wildly with fleeting trends.

Given its high market share and stable market conditions, this merchandise is a classic Cash Cow for Party City. This means it generates more cash than it consumes, allowing for investment in other areas of the business or distribution to shareholders. The focus here is on maintaining this strong position through efficient operations and targeted marketing, rather than aggressive expansion, as the market itself is not experiencing rapid growth.

Before its wind-down, Party City's wholesale distribution to other retailers operated as a significant cash cow. This segment held a strong market share within the mature business-to-business party goods sector, supplying products to a global network of other retail businesses.

The established supply chains and long-standing client relationships within this division were instrumental in generating substantial cash flow. These consistent sales, even in a mature market, provided the financial backbone for the company.

Seasonal Holiday Decorations (Non-Halloween)

Beyond Halloween, Party City's general holiday decorations for events like Christmas, New Year's, and other major celebrations likely functioned as consistent cash cows in 2024. These items experience predictable demand surges tied to specific times of the year, allowing for efficient inventory management and marketing. Party City's established retail footprint and brand recognition provide a strong platform to capture a significant share of this market. For instance, the holiday season is a critical revenue period for many retailers, and Party City's focus on celebratory goods positions it well to capitalize on this. In 2023, the U.S. seasonal holiday decor market was estimated to be worth billions, with Christmas and New Year's decorations forming a substantial portion of this. Party City's ability to leverage this consistent demand for non-Halloween holidays solidifies its cash cow status in these product categories.

- Consistent Demand Cycles: Non-Halloween holiday decorations experience predictable peaks, supporting steady revenue.

- Established Retail Presence: Party City's existing stores and online channels efficiently reach consumers for these products.

- Market Share Capture: The brand's recognition allows it to secure a significant portion of the general holiday decoration market.

- Revenue Contribution: These categories likely provide a stable and substantial income stream, funding other business initiatives.

Franchised Store Operations (Remaining Entities)

Even as Party City's corporate-owned stores face closures, its franchised locations, particularly those in Canada, continue to be a source of revenue. These remaining franchises act as cash cows for the parent company, leveraging established brand recognition with significantly lower overhead for the intellectual property holder.

In 2024, the resilience of these franchised operations became even more apparent. While the overall market for party supplies has seen shifts, the established presence and localized marketing efforts of these franchisees have allowed them to maintain a steady income stream. This stability is crucial for the brand's ongoing financial health.

- Franchised Store Performance: Franchised locations, especially in Canada, represent a stable revenue stream.

- Brand Equity: These stores benefit from existing brand recognition, reducing marketing costs for the parent company.

- Lower Operational Costs: The franchise model shifts significant operational burdens away from the parent company, enhancing profitability.

- Cash Generation: The consistent income from these operations acts as a vital cash cow, supporting other business initiatives.

Party City's core party supplies, like balloons and tableware, represent their established Cash Cows. These are the bedrock items that consistently drive sales, requiring minimal new investment due to their mature market status and predictable demand. They reliably generate substantial cash flow, a vital component for funding other areas of the business.

Despite occasional challenges, such as the 2021-2022 helium shortages impacting balloon availability, these basic essentials maintain a strong, steady sales volume. For instance, in the fiscal year ending February 3, 2024, Party City's total revenue was $1.9 billion, with a significant portion attributed to these fundamental categories. The consistent demand for these items across numerous celebrations ensures a stable income stream for Party City.

General birthday celebration merchandise, encompassing items for all ages, has historically been a robust revenue stream for Party City. This category likely holds a significant market share within a mature and stable segment of the party supplies industry. For instance, in 2024, sales of general birthday decor and accessories continued to represent a substantial portion of overall revenue, demonstrating consistent consumer demand that doesn't fluctuate wildly with fleeting trends.

Given its high market share and stable market conditions, this merchandise is a classic Cash Cow for Party City. This means it generates more cash than it consumes, allowing for investment in other areas of the business or distribution to shareholders. The focus here is on maintaining this strong position through efficient operations and targeted marketing, rather than aggressive expansion, as the market itself is not experiencing rapid growth.

Beyond Halloween, Party City's general holiday decorations for events like Christmas, New Year's, and other major celebrations likely functioned as consistent cash cows in 2024. These items experience predictable demand surges tied to specific times of the year, allowing for efficient inventory management and marketing. Party City's established retail footprint and brand recognition provide a strong platform to capture a significant share of this market. For instance, the holiday season is a critical revenue period for many retailers, and Party City's focus on celebratory goods positions it well to capitalize on this. In 2023, the U.S. seasonal holiday decor market was estimated to be worth billions, with Christmas and New Year's decorations forming a substantial portion of this. Party City's ability to leverage this consistent demand for non-Halloween holidays solidifies its cash cow status in these product categories.

Even as Party City's corporate-owned stores face closures, its franchised locations, particularly those in Canada, continue to be a source of revenue. These remaining franchises act as cash cows for the parent company, leveraging established brand recognition with significantly lower overhead for the intellectual property holder. In 2024, the resilience of these franchised operations became even more apparent. While the overall market for party supplies has seen shifts, the established presence and localized marketing efforts of these franchisees have allowed them to maintain a steady income stream. This stability is crucial for the brand's ongoing financial health.

| Category | BCG Matrix Status | Key Characteristics | 2024 Relevance | Financial Implication |

| Core Party Supplies (Balloons, Tableware) | Cash Cow | High market share, low growth market, stable demand. | Continued reliable sales driver. | Generates significant, consistent cash flow. |

| General Birthday Merchandise | Cash Cow | Mature market segment, consistent consumer spending. | Substantial portion of overall revenue. | Provides predictable income, funding other initiatives. |

| Non-Halloween Holiday Decorations | Cash Cow | Predictable seasonal demand, established market. | Capitalizes on major holiday spending periods. | Stable revenue streams, efficient operations. |

| Franchised Locations (e.g., Canada) | Cash Cow | Leverages brand equity with reduced overhead. | Resilient revenue despite broader store closures. | Stable income for parent company, lower operational risk. |

What You See Is What You Get

Party City BCG Matrix

The Party City BCG Matrix preview you are examining is the complete, unwatermarked document you will receive instantly upon purchase. This meticulously crafted analysis, designed for strategic insight, will be delivered in its final, ready-to-use format, allowing for immediate application in your business planning and decision-making processes.

Dogs

Many Party City physical stores, particularly those in less desirable locations or with significant operational costs, became dogs. This underperformance was driven by dwindling foot traffic and sales, a direct consequence of intense competition within the retail sector.

The company’s strategic response included closing more than 80 underperforming locations. This significant number of closures, spanning from late 2022 through mid-2024, underscored the low market share and dim growth prospects of these specific outlets.

Party City’s outdated product lines, those failing to adapt to shifting consumer tastes or viral social media trends, would undoubtedly be classified as Dogs in their BCG Matrix. These are the items that just aren't resonating anymore, leading to sluggish sales and tying up valuable resources.

For instance, consider the decline in demand for certain traditional costume categories that haven't been refreshed with modern interpretations or pop culture references. These products likely experienced a significant drop in sales volume, potentially contributing to a negative growth rate and a low market share.

In 2024, retailers across the party supply sector have seen a marked preference for interactive and customizable party elements. Products that remain static or lack an engaging aspect, such as generic party favors without personalization options, would fit the Dog profile, generating minimal revenue and occupying prime retail real estate without driving profit.

The cost of maintaining inventory for these underperforming items, coupled with their low sales velocity, would represent a drain on Party City’s resources. These products are essentially burdens, requiring storage, marketing attention, and shelf space that could be better allocated to more popular or emerging product categories.

Before significant 2024 investments, Party City's e-commerce strategy was a clear 'Dog'. Their digital presence struggled against established online retailers, resulting in a diminished market share in a booming sector.

This underperformance meant Party City missed out on substantial online sales growth. For instance, the global e-commerce market was projected to reach over $6.3 trillion in 2023, a figure Party City's prior digital strategy failed to tap into effectively.

Non-core, Low-Margin Merchandise

Non-core, low-margin merchandise at Party City would fall into the 'Dog' category of the BCG Matrix. These are items that don't generate significant sales or profit and are easily found at lower prices elsewhere. Think of generic party favors, basic balloons, or simple disposable tableware where Party City faced stiff competition from discount retailers and mass merchants.

These products typically offered very thin profit margins, meaning even with high volume, their contribution to overall profitability was minimal. In 2024, the continued pressure from online marketplaces and dollar stores for these types of items would only exacerbate their 'Dog' status.

- Low Sales Growth: These items likely saw stagnant or declining sales as consumers opted for more specialized or value-oriented alternatives.

- Low Market Share: Due to intense competition, Party City would have struggled to maintain a dominant market share for these generic products.

- Thin Margins: The profit on each unit sold was minimal, making it difficult to offset operational costs.

- Competition: Direct competition from mass retailers and online platforms offering similar goods at lower price points was a significant factor.

The Helium Business Segment (Impacted by Shortages)

The helium shortage, a significant external shock, profoundly impacted Party City's balloon business, a cornerstone of its revenue. This scarcity directly affected sales, leading to noticeable financial strain for a segment that was previously a strong performer.

This inability to reliably source and price helium, a critical component for their core offerings, effectively transformed a once-promising business area into a 'Dog' within the BCG Matrix framework. The consistent supply of balloons, a key product for Party City, was jeopardized.

- Helium Shortage Impact: The global helium shortage, exacerbated by geopolitical events and increased industrial demand, significantly disrupted the supply chain for Party City's balloon products.

- Sales Decline: Reports indicated a substantial drop in balloon sales for Party City during periods of acute shortage, directly impacting revenue streams. For instance, in early 2023, some analysts noted a double-digit percentage decline in sales for seasonal celebration items heavily reliant on helium.

- Pricing Challenges: The increased cost of helium made it difficult for Party City to maintain competitive pricing for its balloon assortments, further dampening consumer demand and profitability.

- Strategic Re-evaluation: The segment's performance under these conditions necessitated a re-evaluation of its future, pushing it into the 'Dog' category due to its low market share and low growth prospects in the face of persistent supply chain issues.

Party City's underperforming physical stores, struggling with declining foot traffic and high operational costs, became clear 'Dogs' in their BCG Matrix. This was further evidenced by the company closing over 80 such locations between late 2022 and mid-2024, highlighting their low market share and poor growth outlook.

Outdated product lines, failing to keep pace with evolving consumer tastes and viral trends, also fell into the 'Dog' category. For example, generic party favors without personalization options, facing stiff competition from discount retailers and online marketplaces in 2024, generated minimal revenue and profit.

The company's prior e-commerce strategy was also a 'Dog', with a diminished market share in a rapidly growing sector. This missed opportunity was significant, given the global e-commerce market was projected to exceed $6.3 trillion in 2023.

The helium shortage significantly impacted Party City's balloon business, a key revenue driver, transforming it into a 'Dog'. This disruption, coupled with increased helium costs, made it challenging to maintain competitive pricing and consistent supply, leading to sales declines.

Question Marks

The acquisition of Party City's intellectual property by Amscan in February 2025 creates a distinct 'Question Mark' within the BCG matrix for the newly formed New Amscan PC LLC. This entity is positioned to potentially capture significant market share, but its path to achieving this is still being defined. For instance, Amscan, prior to this acquisition, was already a leading global party goods manufacturer and distributor, reporting robust sales figures that indicate a strong operational foundation.

The strategic pivot with Party City's IP aims to leverage Amscan's established sourcing and distribution networks, which are known for efficiency and global reach, to potentially reignite the Party City brand. However, the success of these new strategies in a competitive retail landscape, particularly in the post-pandemic environment of 2024-2025, remains a key variable. Analysts in early 2025 noted a continued consumer demand for celebratory goods, but also an increasing price sensitivity, which will test New Amscan PC LLC's ability to innovate and compete effectively.

The party supplies market is experiencing significant shifts, with personalized and eco-friendly options becoming increasingly popular. For instance, the global personalized gifts market was projected to reach $31.2 billion by 2024, indicating strong consumer demand for custom items. Similarly, the sustainable packaging market, which often overlaps with eco-friendly party supplies, saw substantial growth, with some reports suggesting it could reach over $400 billion by 2027.

Investing heavily in these niche areas, where Party City currently has a low market share, would classify these ventures as Stars within the BCG matrix, requiring substantial investment to capture growing market share in a high-growth segment.

Party City's foray into online marketplaces like Amazon, while historically challenging, could be repositioned as a Question Mark within the BCG matrix if a revitalized strategy is implemented. This signifies a low current market share in a rapidly expanding digital sales channel, necessitating substantial investment to compete effectively.

In 2024, the e-commerce sector continued its robust growth, with online retail sales projected to reach trillions globally. For Party City, this presents a high-growth opportunity, but their existing presence on such platforms may still represent a modest market share compared to dominant players, fitting the Question Mark profile.

The key challenge for Party City on marketplaces like Amazon is the intense competition and the need for significant marketing spend and operational adjustments to gain visibility and sales volume. This investment is crucial to move beyond a niche presence and capture a more meaningful share of the online party supplies market.

Success in this area would require a data-driven approach to product selection, pricing, and customer engagement, aligning with the evolving consumer behavior favoring online purchasing. Without a strong strategic shift, this venture risks remaining a low-share, high-cost initiative.

International Expansion (Beyond Core North America)

Party City's international expansion beyond North America currently represents a challenging Dogs category in a BCG Matrix analysis. While the company has had a past global presence, venturing into new international markets with low brand recognition and market share demands significant capital outlay. These efforts are characterized by high investment requirements for potentially substantial, yet highly uncertain, returns.

- Low Brand Recognition: In many new international markets, Party City is not a household name, requiring extensive marketing to build awareness and trust.

- Market Share Challenges: Established local competitors often hold dominant positions, making it difficult for Party City to gain significant market share quickly.

- High Investment Costs: Establishing distribution networks, adapting products to local tastes, and complying with regulations in diverse countries are all costly endeavors.

- Uncertain Returns: The success of these ventures is highly dependent on consumer adoption and competitive responses, leading to unpredictable financial outcomes.

Revitalization of the Wholesale Segment under New Ownership

The wholesale division, now operating under New Amscan PC LLC, presents a potential 'Question Mark' in the BCG matrix. The new ownership is focused on capitalizing on existing strengths in sourcing and distribution to revitalize this segment.

This strategic shift towards wholesale, particularly if it involves introducing new product lines or broadening its customer reach, positions it as a high-growth potential area. However, its future market penetration remains uncertain.

- New Ownership Focus: New Amscan PC LLC is actively working to re-establish and grow the wholesale business.

- Leveraging Strengths: The strategy hinges on optimizing sourcing and distribution capabilities.

- Growth Potential: Expansion into new products or markets could drive significant revenue growth.

- Market Uncertainty: The success of these initiatives and the division's future market share are not yet guaranteed.

The revitalized Party City brand under New Amscan PC LLC, particularly its online presence and expansion into new product categories like personalized or eco-friendly items, currently fits the 'Question Mark' profile. This classification stems from its position in high-growth market segments where its current market share is relatively low, demanding significant investment to capture a larger piece of the pie.

For example, the projected growth of the personalized gifts market, expected to reach $31.2 billion by 2024, highlights a lucrative, expanding sector where Party City's current penetration is likely modest but holds considerable future potential if strategic investments are made. Similarly, the increasing consumer demand for sustainable party supplies, a segment experiencing rapid adoption, presents another avenue where Party City could establish a stronger foothold.

The key challenge and opportunity lie in Amscan's ability to strategically invest in marketing, product development, and distribution for these nascent or under-penetrated areas. Success here would see these ventures mature into 'Stars,' while failure could relegate them to 'Dogs' if market share doesn't materialize despite the investment.

| BCG Category | Party City Segment | Market Growth | Market Share | Strategic Implication |

|---|---|---|---|---|

| Question Mark | Online Marketplaces (e.g., Amazon) | High (E-commerce sector growth) | Low to Moderate | Requires significant investment for market share gain; potential to become a Star or Dog. |

| Question Mark | Personalized & Eco-friendly Party Supplies | High (Driven by consumer trends) | Low | High growth potential; needs strategic focus and investment to capture market share. |

| Question Mark | Wholesale Division (New Focus) | Moderate to High (Depending on new product lines) | Low to Moderate (New ownership focus) | Leveraging Amscan's strengths; success depends on market penetration and product strategy. |

BCG Matrix Data Sources

Our Party City BCG Matrix is constructed using a blend of financial disclosures, proprietary market research, and industry growth forecasts to accurately position each business segment.