Party City Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Party City Bundle

Unlock the full strategic blueprint behind Party City's business model. This in-depth Business Model Canvas reveals how the company drives value through its diverse product offerings and extensive retail footprint, captures market share by catering to various customer segments, and stays ahead in a competitive landscape with strategic partnerships. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into a successful retail operation.

Partnerships

Party City's wholesale operations depend heavily on raw material suppliers for essential components like paper, plastics, and fabrics used in party supplies and seasonal Halloween items. These partnerships are vital for maintaining a consistent and affordable supply chain, directly impacting production costs and product quality.

In 2024, the party supplies industry, which Party City operates within, continued to navigate fluctuating raw material costs. For instance, the price of paper pulp, a key component for many party decorations and tableware, saw volatility influenced by global demand and sustainability initiatives. Strong supplier relationships help mitigate these cost pressures.

Party City relies heavily on a robust network of logistics and shipping partners to ensure its vast array of party supplies reaches consumers and businesses efficiently. These collaborations are crucial for managing the inbound flow of raw materials for manufacturing and the outbound distribution of finished goods to over 700 stores in North America, as well as for e-commerce fulfillment and wholesale clients.

In 2024, optimizing transportation and warehousing remains a key focus. The company’s ability to handle seasonal surges, particularly for Halloween which accounts for a significant portion of its annual revenue, directly depends on the reliability and capacity of its shipping partners to manage increased volume and ensure timely deliveries across its diverse geographic footprint.

Party City actively partners with major entertainment franchises such as Marvel, Disney, and Nickelodeon through licensing agreements. These collaborations are crucial for offering a diverse and appealing selection of themed party supplies and costumes, tapping into the established popularity of these characters. For example, in 2023, the demand for licensed merchandise remained a significant driver of sales in the party goods sector, with character-themed items consistently performing well.

Wholesale Retail Partners

Party City's wholesale retail partners are crucial for extending its market presence beyond its own brand. This network includes a diverse range of businesses such as specialty party stores, large mass retailers, online shops, craft supply stores, grocery chains, and even dollar stores. These collaborations significantly broaden Party City's customer reach and create multiple avenues for revenue generation.

This wholesale strategy allows Party City to effectively utilize its manufacturing and sourcing capabilities, supplying products to a much larger and varied customer base globally. For instance, in 2023, the wholesale segment played a vital role in the company's overall sales strategy, contributing to its ability to compete in a dynamic retail environment by ensuring its products are available in numerous physical and digital locations.

- Diverse Retailer Network Party City partners with specialty retailers, mass merchants, e-commerce platforms, craft stores, grocery retailers, and dollar stores.

- Global Market Expansion These partnerships enable Party City to reach consumers across different geographic regions and market segments.

- Revenue Diversification The wholesale division provides a consistent revenue stream independent of Party City's direct-to-consumer sales.

- Leveraging Manufacturing Scale By supplying other retailers, Party City maximizes its production efficiency and economies of scale.

Technology and Service Providers

Party City collaborates with technology and service providers to enhance its operations. For instance, partnerships with companies offering price optimization software help manage competitive pricing strategies, a crucial aspect in the retail sector. In 2024, the retail industry continued to emphasize data-driven pricing to maximize revenue and maintain market share.

These alliances are vital for modernizing retail and wholesale functions, focusing on areas like inventory management and demand forecasting. Effective supply chain platforms, a key area for retail partnerships, enable better tracking and management of goods from supplier to consumer. This streamlines operations and reduces inefficiencies.

Key partnerships in this category also focus on merchandising and ensuring vendor compliance. By working with specialized service providers, Party City can ensure its product presentation is optimal and that its suppliers meet established standards. This contributes significantly to overall operational effectiveness and cost reduction.

- Price Optimization: Leveraging technology for dynamic pricing in a competitive market.

- Supply Chain Platforms: Enhancing inventory management and demand forecasting accuracy.

- Merchandising Solutions: Improving product presentation and customer engagement.

- Vendor Compliance: Ensuring adherence to quality and operational standards across the supply chain.

Party City's key partnerships extend to licensing agreements with major entertainment brands like Disney and Marvel. These collaborations were critical in 2023, driving sales through popular character-themed merchandise, a trend that continued into 2024. By securing these licenses, Party City offers a broad appeal, tapping into existing fan bases to boost demand for its themed party supplies and costumes.

What is included in the product

This Business Model Canvas provides a comprehensive overview of Party City's strategy, detailing its customer segments, value propositions, and channels.

It reflects Party City's real-world operations and plans, offering insights into its competitive advantages and supporting informed decision-making.

Party City's Business Model Canvas offers a clear, structured approach to identifying and addressing the challenges of the party planning industry, simplifying the complex process of sourcing and coordinating event supplies.

Activities

Party City's wholesale division actively engages in the design and development of a diverse array of party goods and seasonal merchandise, with a particular focus on Halloween. This critical activity involves conceptualizing and bringing to life new and innovative products that resonate with current industry trends and evolving customer desires. The aim is to consistently offer a fresh and attractive product selection that appeals to a broad market.

A key aspect of this process is the commitment to continuous product innovation. By staying ahead of the curve and introducing novel party supplies, Party City seeks to maintain strong customer engagement and secure a competitive edge. This forward-thinking approach ensures the product assortment remains dynamic and appealing throughout the year.

In 2024, the party supplies market continued to show resilience, with consumers increasingly seeking unique and themed items for celebrations. Party City's wholesale efforts in product design are directly tied to capitalizing on these trends, aiming to capture market share by offering distinctive and high-quality merchandise that stands out from competitors.

Party City’s manufacturing of party goods, largely managed by its subsidiary Amscan, is a cornerstone of its operations. This includes a wide array of items like balloons, costumes, and various party decorations, giving them substantial in-house production capabilities.

This vertical integration is a strategic advantage, offering Party City enhanced control over product quality, direct influence on manufacturing costs, and improved efficiency throughout its supply chain. By producing a significant portion of its inventory internally, the company can better respond to market demands and manage inventory levels effectively.

In 2024, Amscan, Party City’s manufacturing arm, continued to be a vital component, ensuring a steady supply of proprietary and licensed merchandise. While specific output numbers for 2024 are proprietary, the company's ability to offer a diverse and readily available selection of party supplies directly reflects the strength of its manufacturing base.

Party City's retail store operations are the engine for direct sales and customer engagement. This includes managing the daily flow of over 750 Party City stores, plus the seasonal surge of Halloween City pop-ups, ensuring seamless inventory and delightful visual displays.

These operations are vital for generating revenue and reinforcing the brand's fun, celebratory image. In 2023, for example, the company reported net sales of $2.2 billion, with a significant portion directly attributable to its brick-and-mortar presence.

Effective management of these stores means more than just stocking shelves; it's about creating an immersive, enjoyable shopping experience that drives customer loyalty and repeat business, especially during peak seasons like Halloween.

Wholesale Distribution and Sales

Wholesale distribution and sales are central to Party City's operations, serving as a crucial channel beyond its direct-to-consumer retail presence. This segment manages the intricate logistics of getting party supplies not only into Party City's own stores but also to a broad network of other retailers across the globe. By handling this extensive distribution, the company aims to optimize its manufacturing output and reach a wider customer base.

The efficiency of this wholesale network is paramount. It ensures that products are available where and when consumers want them, whether through a physical Party City store or an independent retailer. This broad reach is key to leveraging manufacturing capacity fully, turning raw materials into finished goods that generate revenue across multiple sales channels.

In 2024, Party City continued to refine its wholesale strategy. The company's efforts in this area directly support its overall business model by creating demand and extending the brand's footprint. A robust wholesale operation can significantly contribute to revenue stability and market share expansion, especially in the competitive party supplies industry.

- Global Reach: Party City's wholesale division supplies party goods to retailers worldwide, extending its market presence beyond its own branded stores.

- Distribution Network: Managing a complex supply chain is a core activity, ensuring efficient product delivery to diverse sales channels.

- Capacity Utilization: Expanding wholesale operations helps Party City maximize the output from its manufacturing facilities, driving economies of scale.

- Revenue Diversification: This channel provides an additional revenue stream, supplementing sales from company-owned retail locations.

Marketing and Brand Promotion

Party City heavily invests in marketing and brand promotion to capture customer attention and boost sales. Their efforts span digital marketing, broad advertising campaigns, and targeted promotions that showcase their wide array of products and cater to seasonal events like Halloween and holidays.

In 2024, Party City continued its focus on digital channels, leveraging social media and online advertising to reach a broad audience. This strategy is crucial for maintaining brand awareness and connecting with a diverse customer base that actively seeks party supplies and decorations.

- Digital Marketing Focus: Party City dedicates significant resources to online advertising, including paid search, social media campaigns, and email marketing, aiming to drive traffic to both their e-commerce site and physical stores.

- Seasonal Campaigns: Key marketing pushes are tied to major holidays and events, such as Halloween, Christmas, and back-to-school, where they offer themed products and special promotions.

- Brand Visibility: Through consistent advertising and engaging content, Party City aims to remain top-of-mind for consumers planning any type of celebration, from small get-togethers to large events.

- Customer Engagement: Loyalty programs and personalized offers are utilized to foster repeat business and build stronger relationships with their customer base.

Party City's key activities revolve around designing and manufacturing a wide range of party supplies, primarily managed by its subsidiary Amscan. These activities are supported by extensive retail operations across over 750 stores and a robust wholesale distribution network serving global retailers. The company also prioritizes significant investment in marketing and brand promotion to maintain customer engagement and drive sales, especially during peak seasonal periods.

In 2024, Party City continued to leverage its integrated business model, with Amscan playing a crucial role in ensuring product availability and quality for both its own stores and wholesale clients. The company's marketing efforts increasingly focused on digital channels to connect with a broad consumer base.

The party supplies market remained dynamic in 2024, with consumers showing a strong preference for themed and unique products, a trend Party City's design and manufacturing divisions actively addressed.

| Key Activity | Description | 2024 Focus/Data |

| Product Design & Development | Conceptualizing and creating new party goods and seasonal merchandise. | Focus on innovative and trend-driven product lines, particularly for Halloween. |

| Manufacturing | Producing a wide array of party items, including balloons, costumes, and decorations. | Amscan, the manufacturing arm, ensures proprietary and licensed merchandise supply. |

| Retail Operations | Managing over 750 Party City stores and seasonal Halloween City pop-ups. | Focus on enhancing in-store customer experience and inventory management. |

| Wholesale Distribution | Supplying party goods to a global network of retailers beyond Party City stores. | Refining wholesale strategy to maximize manufacturing output and expand market reach. |

| Marketing & Brand Promotion | Advertising, digital marketing, and promotions to drive sales and brand awareness. | Increased emphasis on digital channels and seasonal campaigns. |

Full Document Unlocks After Purchase

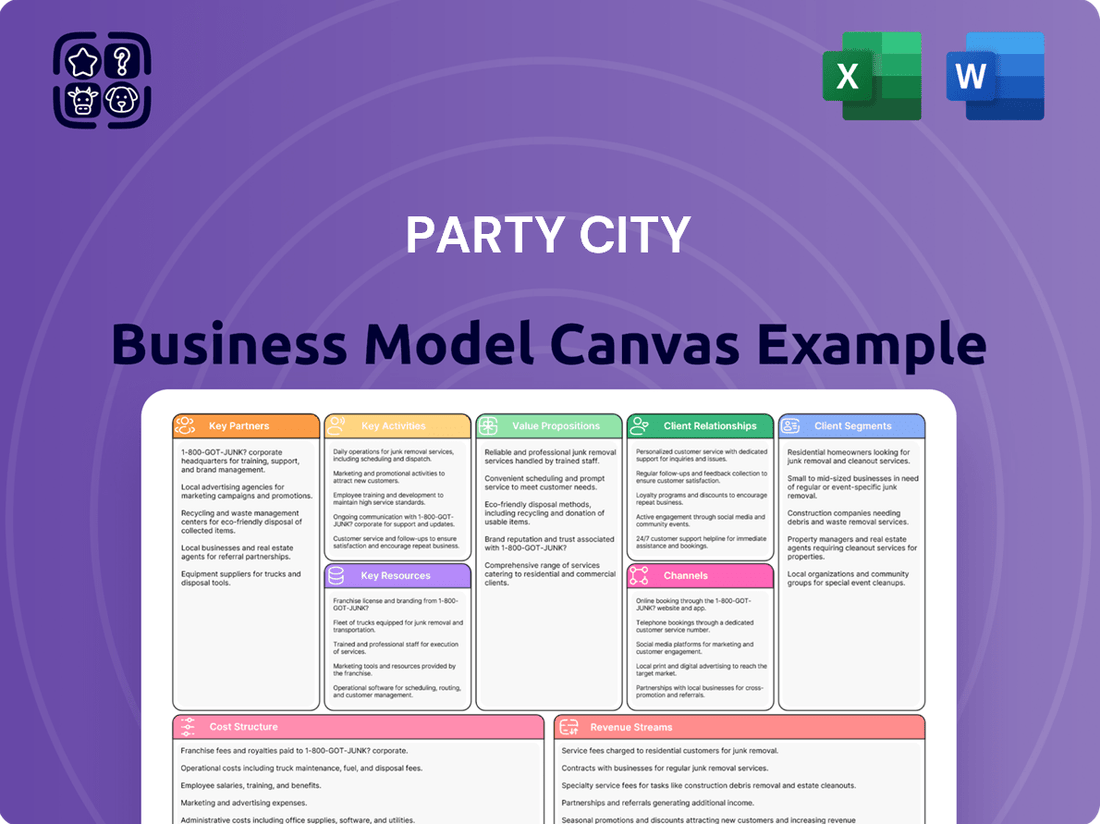

Business Model Canvas

The Business Model Canvas you are previewing is the actual document you will receive upon purchase, offering a comprehensive overview of Party City's strategic approach. This isn't a mockup; it's a direct representation of the detailed analysis contained within the final deliverable. Upon completing your order, you will gain full access to this identical, professionally structured document, ready for your review and application.

Resources

Party City operates manufacturing facilities, predominantly under its Amscan brand, focusing on items like balloons and costumes. These facilities and their equipment are vital for designing, producing, and distributing their extensive party supply inventory, serving both retail and wholesale channels.

This vertical integration, supported by their manufacturing capabilities, offers a significant competitive edge. For instance, Amscan, a key part of Party City's wholesale business, reported strong performance, contributing to the company's overall revenue streams, demonstrating the value of these owned production assets.

Party City's retail store network is a foundational element, encompassing numerous permanent Party City locations and a significant number of seasonal Halloween City pop-up stores throughout North America.

These physical stores are critical sales channels, offering customers a direct and tangible way to experience and purchase Party City's extensive product assortment.

The company's broad geographical presence through these stores facilitates direct consumer interaction, driving brand awareness and immediate sales opportunities.

As of late 2023, Party City operated approximately 750 stores, highlighting the substantial scale of this key resource for reaching a wide customer base.

Party City's extensive inventory of party goods and Halloween merchandise is a cornerstone of its business. This includes a wide array of decorations, costumes, tableware, and accessories designed to serve diverse celebrations and customer tastes. For instance, during the peak Halloween season in 2023, the company heavily relied on its vast selection of costumes and themed decorations to drive sales, aiming to capitalize on consumer spending which often surges during this period.

The breadth of this product assortment is critical for meeting varied consumer demand across different holidays and events throughout the year. Managing this large inventory effectively, especially with its significant seasonal fluctuations, directly impacts Party City's profitability. In 2024, the company is expected to continue optimizing its stock levels to minimize carrying costs while ensuring popular items, particularly for major events like Halloween, are readily available to capture maximum revenue.

Brand Reputation and Intellectual Property

Party City's brand reputation is a cornerstone of its business model, acting as a significant draw for customers seeking party supplies. This established name recognition fosters trust and simplifies purchasing decisions in a crowded retail landscape. In 2024, the company continued to leverage its brand equity to maintain market presence.

Intellectual property, including proprietary designs for party goods and exclusive rights to licensed characters, provides a crucial competitive advantage. These unique offerings differentiate Party City from general retailers and online marketplaces. The company's portfolio of unique designs contributes directly to its value proposition, particularly for themed celebrations.

- Brand Recognition: Party City's well-known brand name facilitates customer acquisition and loyalty.

- Proprietary Designs: Unique product designs offer a distinct market advantage, increasing perceived value.

- Licensed Product Rights: Exclusive rights to popular characters and themes drive traffic and sales, especially for children's parties.

- Competitive Differentiation: The combination of brand strength and unique IP sets Party City apart from competitors.

Skilled Workforce

Party City’s skilled workforce is a critical asset, encompassing a wide range of expertise. This includes creative designers who conceptualize new party products, supply chain specialists who manage complex logistics, knowledgeable retail staff who engage customers, and dedicated corporate employees overseeing operations. In 2024, maintaining and enhancing these skill sets is paramount for staying competitive.

The collective expertise of this workforce is fundamental to the company's success. Designers drive product innovation, supply chain experts ensure efficient sourcing and distribution, retail teams provide essential customer service, and corporate staff manage strategic planning and execution. This human capital underpins both the retail store experience and the wholesale distribution network.

Focusing on employee retention and continuous training is vital for Party City's sustained performance. Investing in their development ensures they remain adept at managing inventory, understanding customer needs, and adapting to evolving market trends. For instance, a well-trained associate can significantly impact sales and customer loyalty.

- Product Innovation: Designers are key to developing new, on-trend party supplies.

- Operational Efficiency: Supply chain and logistics experts ensure timely product availability.

- Customer Experience: Retail staff are the frontline for customer engagement and sales.

- Strategic Management: Corporate teams guide overall business direction and growth.

Party City's manufacturing facilities, primarily under the Amscan brand, are essential for producing a vast array of party supplies, including balloons and costumes. These facilities represent significant capital investment and are crucial for maintaining quality control and supply chain efficiency. In 2024, the company continued to leverage these assets for both its retail and wholesale operations, ensuring a consistent flow of goods.

The Amscan wholesale division, a key component of Party City's manufacturing and distribution network, reported robust performance, underscoring the strategic importance of these owned production capabilities. This vertical integration allows for greater control over product development and cost management.

Party City's extensive inventory of party goods, encompassing decorations, costumes, and tableware, is a primary resource. This vast selection caters to a wide range of customer needs and seasonal demands. For example, during the 2023 Halloween season, the company relied heavily on its diverse costume and decoration stock to drive sales, demonstrating the critical role of inventory breadth. The company aims to optimize stock levels in 2024 to balance availability with holding costs, ensuring popular items are accessible for peak events.

Party City's brand recognition is a vital intangible asset, fostering customer trust and driving repeat business. This established reputation simplifies purchasing decisions for consumers amidst a competitive market. The company continues to build on this equity in 2024 to maintain its market position.

Intellectual property, including proprietary product designs and exclusive licensing for popular characters, provides a distinct competitive edge. These unique offerings differentiate Party City from general retailers, enhancing its value proposition, particularly for themed events and children's parties.

Party City's workforce, comprising designers, supply chain specialists, retail associates, and corporate staff, represents a key human resource. In 2024, retaining and developing these skilled employees is crucial for innovation and customer service. The expertise of this team underpins the company's retail and wholesale operations, from product creation to customer engagement.

Value Propositions

Party City truly aims to be the ultimate destination for any celebration, offering a vast array of party supplies, decorations, and costumes. This makes it incredibly convenient for shoppers, turning potentially stressful party planning into a much simpler experience. Imagine needing balloons, themed tableware, and a costume – all under one roof.

This one-stop-shop approach significantly cuts down on the time and effort consumers spend searching across multiple stores or websites. By consolidating diverse party needs, Party City streamlines the entire planning process, allowing customers to focus on the fun aspects of their event.

The sheer variety of products available ensures that whether it's a child's birthday, a Halloween bash, or a major holiday gathering, customers can find everything they require. This broad appeal across different occasions is a key part of their value.

In 2023, the U.S. party supplies market was valued at approximately $10.7 billion, highlighting the significant demand for convenient and comprehensive party solutions like those offered by Party City. This market segment continues to show steady growth, underscoring the effectiveness of their one-stop-shop strategy.

Party City's business model thrives on its wide assortment of products, offering an extensive and innovative selection of party goods. This includes everything from balloons and tableware to banners and licensed merchandise, ensuring customers can find precisely what they need for any celebration.

This vast variety is a key value proposition, allowing Party City to cater to diverse tastes, specific themes, and ever-changing trends. For instance, in the lead-up to major holidays like Halloween and Christmas, their inventory expands significantly, often seeing double-digit percentage increases in specific product categories to meet seasonal demand.

The breadth of their product offering directly addresses specific customer demands, making Party City a go-to destination for comprehensive party planning. This extensive selection enhances the overall shopping experience, encouraging customers to consolidate their purchases rather than visiting multiple retailers.

Party City ensures customers can easily find what they need, whether they prefer browsing in a physical store or shopping online. Their extensive network of over 800 stores across North America, as of early 2024, provides readily accessible locations for last-minute party needs. This dual approach, combining brick-and-mortar presence with a robust e-commerce platform, caters to diverse shopping habits and guarantees product availability.

Value for Money

Party City's value proposition centers on offering a broad selection of party supplies at competitive price points, making celebrations accessible. Recent efforts in 2024 have included strategic price reductions across various categories to appeal to consumers managing tighter budgets in an inflationary period. This focus on affordability is key to attracting and retaining a wide customer base.

The company understands that many consumers are budget-conscious, actively seeking quality products without breaking the bank. By providing good value, Party City aims to be the go-to destination for everyday celebrations, from birthdays to holidays.

- Competitive Pricing: Party City strives to offer its extensive range of party essentials at prices that are attractive to a broad demographic.

- Affordability Focus: Strategies in 2024 have specifically targeted price reductions to enhance the affordability of party planning for consumers.

- Value for Budget-Conscious Shoppers: The proposition resonates with individuals looking for quality party supplies without incurring excessive costs.

- Customer Retention: Offering strong value is crucial for maintaining customer loyalty, especially in challenging economic climates.

Seasonal and Trendy Merchandise

Party City's strength lies in its curated selection of seasonal and on-trend merchandise, a key value proposition for its customers. This is particularly evident in their robust Halloween offerings, a significant sales driver. For instance, in the fiscal year 2023, Halloween-related sales represented a substantial portion of their annual revenue, demonstrating the importance of this seasonal focus.

The company actively monitors and incorporates current pop culture trends and popular characters into their party supply inventory. This commitment to relevance ensures they capture demand for new and trending themes, keeping the brand fresh and appealing. Their ability to quickly source and stock items related to popular movies, TV shows, or characters directly impacts customer engagement and purchase decisions.

- Seasonal Dominance: Party City's Halloween business is a prime example, consistently driving significant sales spikes.

- Trend Responsiveness: The company's agility in stocking merchandise tied to current pop culture trends is a major draw for consumers seeking timely party supplies.

- Customer Relevance: By staying on top of what's popular, Party City maintains its position as a go-to destination for contemporary party needs.

Party City offers a comprehensive, one-stop-shop experience for all celebration needs, simplifying party planning. This convenience is backed by a vast assortment of party supplies, decorations, and costumes, catering to diverse themes and occasions.

The brand's commitment to staying current with trends, particularly evident in its strong seasonal offerings like Halloween, ensures relevance and appeal. This focus on popular culture and timely merchandise is a key driver of customer engagement and sales.

Party City provides competitive pricing and affordability, making celebrations accessible to a wide range of consumers, especially those who are budget-conscious. Their strategies in 2024 have included targeted price reductions to enhance value.

The company balances a strong physical store presence, with over 800 locations as of early 2024, with a robust e-commerce platform to meet varied customer shopping preferences.

| Value Proposition | Description | Supporting Data/Facts |

|---|---|---|

| One-Stop Shop Convenience | Consolidates diverse party needs, saving customers time and effort. | U.S. party supplies market valued at ~$10.7 billion in 2023, indicating demand for comprehensive solutions. |

| Extensive Product Assortment | Offers a wide variety of themed goods, balloons, tableware, and licensed merchandise. | Inventory expands significantly for major holidays, with double-digit percentage increases in key categories. |

| Seasonal & Trend Responsiveness | Curates merchandise aligned with current pop culture and seasonal events. | Halloween sales are a significant annual revenue driver; company monitors and stocks trending items. |

| Competitive Pricing & Affordability | Provides value-oriented pricing, with strategic reductions in 2024. | Focus on affordability appeals to budget-conscious shoppers, enhancing customer retention. |

| Omnichannel Accessibility | Combines extensive physical store network with a robust online presence. | Over 800 North American stores as of early 2024 ensure easy access to products. |

Customer Relationships

Party City's core customer relationship is transactional, emphasizing ease and speed for party supply purchases. This means a focus on quick checkouts, whether in a physical store or online, ensuring customers can get what they need for immediate celebrations without fuss. For instance, during peak holiday seasons, the company aims to optimize inventory and staffing to handle high volumes efficiently.

The company's strategy revolves around making the buying experience as smooth as possible. This includes well-organized store layouts and intuitive website navigation. In 2023, Party City reported that over 70% of its sales were completed through its e-commerce channels, highlighting the importance of this digital transactional efficiency.

While transactional, this model is supported by efforts to drive repeat business through promotions and loyalty programs. Although the primary interaction is a one-time purchase, Party City seeks to encourage customers to return for future events by offering value and convenience. This transactional foundation is crucial for managing the high volume of diverse customer needs.

Party City offers customer service support to help with questions, product details, and resolving any problems customers might encounter. This support is available through multiple channels, including in-store assistance, phone, and online chat, ensuring customers can get help when they need it. For example, in 2024, Party City continued to emphasize its omni-channel customer service approach, aiming to provide seamless support across all touchpoints.

Effective customer service is crucial for Party City to address customer concerns promptly and maintain a high level of satisfaction. Positive interactions build trust and encourage repeat business, which is vital for a retail environment focused on celebrations and events. In recent years, customer feedback data indicates that quick resolution times and knowledgeable staff significantly impact customer loyalty.

Party City likely utilizes loyalty programs to encourage repeat purchases and cultivate lasting customer connections. These programs could offer points for purchases, exclusive discounts, or early access to new seasonal merchandise, directly incentivizing customers to choose Party City for their celebratory needs.

By tracking loyalty program participation, Party City can gather valuable data on customer preferences and buying habits. This information is crucial for tailoring marketing efforts, such as sending personalized promotions for upcoming holidays or relevant party themes, thereby increasing engagement and sales.

In 2024, the retail sector saw a significant rise in customer loyalty program adoption, with many businesses reporting increased customer retention rates. For instance, a study by LoyaltyLion indicated that companies with robust loyalty programs can see a 10-15% increase in customer lifetime value.

Community Engagement and Party Ideas

Party City actively cultivates its customer community through various channels, offering a wealth of party ideas and inspiration. This engagement extends beyond simple sales, positioning the brand as a go-to resource for celebration planning.

By fostering a sense of community and providing creative content, Party City aims to build stronger brand affinity. This strategy is vital in a market where emotional connection drives purchasing decisions.

- Social Media Presence: Party City leverages platforms like Instagram and Pinterest to showcase trending party themes and DIY ideas, encouraging user-generated content and interaction.

- In-Store Workshops: Select locations host in-store workshops focused on balloon arrangements or craft projects, offering hands-on engagement and expert advice.

- Online Content Hub: The Party City website features a comprehensive blog and idea gallery, providing seasonal party inspiration and planning guides.

- Loyalty Programs: Rewards programs incentivize repeat business and foster a sense of belonging among dedicated customers.

Personalized Recommendations

Party City leverages its digital platforms to provide highly personalized product recommendations. By analyzing past purchases and browsing history, the company can suggest items that align with individual customer preferences and upcoming event needs. This tailored approach significantly improves the online shopping experience, making it easier for customers to find exactly what they're looking for, from balloons to themed decorations.

This focus on personalization aims to drive increased sales and foster greater customer loyalty. For instance, a customer who frequently buys dinosaur-themed items might receive recommendations for new dinosaur party supplies or related accessories. In 2024, e-commerce sales for the party supply industry continued their upward trend, with personalized digital experiences being a key differentiator. Party City's strategy in this area is designed to capitalize on this consumer behavior.

- Enhanced Customer Experience: Tailored suggestions make shopping more efficient and enjoyable.

- Increased Sales Conversion: Relevant recommendations lead to higher purchase rates.

- Improved Customer Retention: Personalization builds stronger relationships and encourages repeat business.

- Data-Driven Insights: Understanding customer behavior allows for more effective inventory and marketing strategies.

Party City's customer relationships are primarily transactional, focusing on making purchases quick and convenient for immediate event needs. This is supported by a robust digital presence and efficient in-store operations, aiming to provide a seamless buying journey.

The company enhances these transactional ties through loyalty programs and personalized recommendations, leveraging customer data to drive repeat business and increase sales. In 2024, efforts continued to integrate these strategies across all touchpoints.

Community building through inspirational content and social media engagement further strengthens brand affinity, positioning Party City as a planning resource. This multifaceted approach aims to foster deeper connections beyond the point of sale.

| Customer Relationship Aspect | Description | 2024 Focus/Data Point |

|---|---|---|

| Transactional Ease | Streamlined checkout, efficient inventory management for quick purchases. | Over 70% of sales in 2023 occurred via e-commerce, indicating a strong digital transactional focus. |

| Loyalty Programs | Incentivizing repeat business through rewards, exclusive offers, and early access. | Industry data shows loyalty programs can boost customer lifetime value by 10-15%. |

| Personalization | Tailored product recommendations based on past behavior and preferences. | Continued emphasis on personalized digital experiences to capitalize on e-commerce growth. |

| Community Engagement | Providing party ideas, inspiration, and fostering interaction via social media and content hubs. | Leveraging platforms like Instagram and Pinterest to showcase trends and encourage user content. |

Channels

Party City's extensive network of physical retail stores functions as a core channel for direct consumer engagement and sales. These locations offer a tangible shopping experience, allowing customers to physically interact with a vast selection of party supplies, decorations, and costumes. As of early 2024, Party City operated over 700 stores across North America, providing convenient access to a broad customer base seeking immediate party solutions.

Halloween City pop-up stores represent a highly specialized sales channel for Party City, designed to meet the concentrated demand during the Halloween season. These temporary retail spaces are strategically placed to capture customers actively seeking costumes, decorations, and party supplies.

This channel effectively targets a distinct customer segment, those with immediate and seasonal needs, by offering a curated selection of Halloween-specific products. In 2024, Party City continued to leverage this model, recognizing that these pop-ups can drive significant seasonal revenue and brand visibility.

The pop-up strategy allows Party City to test new markets and reach consumers who might not visit their permanent stores, especially in areas with less established retail presence for the brand. This approach allows for flexibility in real estate and marketing spend, focusing resources precisely when and where they are most impactful for Halloween.

PartyCity.com serves as a vital e-commerce channel, providing customers with a vast array of party supplies for direct purchase and delivery. This digital storefront significantly enhances customer convenience, catering to those who prefer shopping from home.

The website expands Party City's market reach considerably, allowing it to connect with customers far beyond the limitations of its physical store locations. In 2024, e-commerce sales continued to be a significant driver for many retail businesses, with online channels often showing robust growth.

Key functionalities of PartyCity.com include seamless order tracking, keeping customers informed about their purchases. Additionally, the platform regularly features online coupons and promotions, incentivizing purchases and fostering customer loyalty.

Wholesale Distribution Network

Party City's wholesale distribution network is a crucial element, allowing them to extend their reach far beyond their own brick-and-mortar stores and e-commerce platforms. This network acts as a vital conduit for their manufactured party supplies, ensuring these products land in the hands of consumers through various retail touchpoints globally. It’s about leveraging their production prowess and getting their goods into as many shopping carts as possible, even those not directly associated with the Party City brand.

This expansive channel partners with a diverse array of retailers. Think of major mass merchants, where families do their regular shopping, and specialized party supply stores that cater to specific event needs. Even grocery stores often carry seasonal or popular party items, demonstrating the breadth of this wholesale reach. This strategy is key to diversifying sales and not solely relying on direct customer engagement.

The wholesale division plays a significant role in Party City's overall revenue stream. For instance, in the fiscal year 2023, the company reported total net sales of $2.2 billion. While specific figures for the wholesale segment aren't always broken out separately in public reports, it's understood to be a substantial contributor, allowing Party City to capitalize on economies of scale in manufacturing and logistics.

- Global Reach: Distributes manufactured party goods to retailers worldwide, expanding market penetration.

- Diverse Retail Partnerships: Includes mass merchants, specialty stores, and grocery chains, broadening consumer access.

- Sales Diversification: Reduces reliance on direct-to-consumer channels, creating a more resilient business model.

- Leveraging Manufacturing: Maximizes the benefit of their production capabilities by supplying other businesses.

Social Media and Digital Marketing Platforms

Social media and digital marketing platforms are critical channels for Party City to connect with its audience. These platforms are used for everything from running targeted ad campaigns to sharing inspiring party ideas, ultimately driving customers to both their e-commerce site and brick-and-mortar locations. For instance, in 2024, many retailers saw significant ROI from social media advertising, with platforms like Meta (Facebook/Instagram) and TikTok being key drivers of discovery and purchase intent.

These digital touchpoints are essential for building brand awareness and fostering a community around celebrations. Party City leverages these channels not just for promotion but also for direct customer engagement, responding to queries and gathering feedback. This interactive approach is crucial for an effective omnichannel strategy.

- Brand Visibility: Platforms like Instagram and Pinterest are utilized to showcase party supplies and thematic inspiration, increasing brand reach.

- Customer Engagement: Interactive content, contests, and direct messaging foster a sense of community and loyalty.

- Sales Generation: Targeted advertising campaigns and shoppable posts directly drive traffic and conversions, both online and in-store.

- Omnichannel Integration: Digital efforts are coordinated with in-store experiences, ensuring a seamless customer journey across all touchpoints.

Party City's channels are multifaceted, encompassing physical retail, seasonal pop-ups, a robust e-commerce platform, and a significant wholesale distribution network. These channels work in concert to maximize market reach and cater to diverse customer needs, from immediate in-store purchases to online convenience and broader retail availability through wholesale partnerships. Digital marketing and social media also play a crucial role in driving engagement and sales across all these touchpoints.

Customer Segments

Individual consumers and party hosts represent Party City's largest customer base. This segment includes parents organizing children's birthday parties, individuals planning baby showers, graduations, and a multitude of other personal events. They are looking for a broad spectrum of party supplies, from balloons and tableware to elaborate decorations and themed costumes.

These customers prioritize convenience and a wide, accessible selection to streamline their event planning. In 2024, the demand for in-person celebrations remained strong, with many families eager to create memorable experiences. Party City's extensive product catalog caters to this need, offering everything required for diverse personal gatherings throughout the year.

Seasonal shoppers, particularly those focused on Halloween, represent a crucial customer segment for Party City. This group actively seeks out costumes, decorations, and party essentials, making the Halloween period a significant revenue driver for the company. In 2023, Halloween spending in the U.S. was projected to reach $12.2 billion, with a substantial portion attributed to costumes and decorations.

These shoppers often prioritize unique and trending items to create memorable experiences for themed parties and trick-or-treating. They are motivated by the desire for variety and novelty, looking for specific items that align with current pop culture trends or popular costume themes. This segment's purchasing behavior is highly concentrated around the autumn months, making it a key focus for inventory and marketing efforts.

Event planners and businesses represent a crucial customer segment for Party City. This group encompasses professional event organizers, corporate entities, and various organizations that require party supplies for larger-scale events, from company galas to themed celebrations. They often seek specialized products and benefit from bulk purchasing options, a need that Party City's wholesale capabilities are designed to meet.

In 2024, the events industry continued its robust recovery. For instance, the global events market was projected to reach over $1.5 trillion by the end of the year, highlighting the significant demand for event-related supplies. Businesses planning corporate functions in particular are a key demographic, often requiring customized solutions and consistent product availability to ensure brand alignment and successful execution of their events.

Wholesale Clients (Other Retailers)

Party City's wholesale segment serves a diverse range of other retailers. This includes specialty party stores, general mass merchants, and even dollar stores that look to stock their shelves with party supplies. These businesses procure Party City's products in significant quantities to offer to their own customer bases.

These wholesale clients rely on Party City's established manufacturing prowess and extensive product catalog. They seek a reliable supplier that can provide a wide variety of party essentials, from balloons and decorations to costumes and tableware, enabling them to cater to different consumer preferences.

- Key Wholesale Customer Types: Specialty stores, mass merchants, dollar stores.

- Value Proposition: Bulk purchasing for resale, access to diverse product range and manufacturing capabilities.

- Purchasing Motivation: Stocking shelves with popular and varied party goods to meet consumer demand.

Budget-Conscious Shoppers

Budget-Conscious Shoppers are a key customer segment for Party City, characterized by their keen eye for value and a strong inclination towards deals. These individuals actively search for discounts and promotions to make their celebrations more affordable. Party City's approach to offering price reductions directly appeals to this group, ensuring that party essentials are accessible without breaking the bank. For them, getting the most for their money is paramount when planning any event.

This segment prioritizes cost-effectiveness in their purchasing decisions for party supplies. They are likely to compare prices across different retailers and are motivated by sales events or loyalty programs that offer savings. In 2024, understanding this price sensitivity is crucial for Party City's marketing efforts.

- Price Sensitivity: This group actively seeks out sales, coupons, and clearance items.

- Value Proposition: They are drawn to promotions that offer a clear benefit for their spending.

- Deal Hunting: Customers in this segment will invest time in finding the best possible prices.

- Affordability Focus: The primary driver is making celebrations cost-effective.

Party City serves individual consumers and party hosts who are looking for a wide variety of party supplies for personal events. These customers, including parents and event organizers, prioritize convenience and a broad selection to simplify their planning. In 2024, demand for in-person celebrations remained robust, underscoring the need for accessible, comprehensive party solutions.

Seasonal shoppers, particularly for Halloween, form a crucial segment. In 2023, U.S. Halloween spending hit $12.2 billion, with costumes and decorations being major contributors. These shoppers seek unique and trending items to enhance their themed parties and trick-or-treating experiences.

Event planners and businesses, including corporate entities, rely on Party City for larger-scale events. The global events market was projected to exceed $1.5 trillion in 2024, highlighting the demand for event-related supplies, with businesses often requiring customized solutions and consistent availability.

Wholesale customers, such as specialty stores and mass merchants, purchase Party City products in bulk for resale. They value the company's manufacturing capabilities and extensive catalog to meet diverse consumer demands for party essentials.

Budget-conscious shoppers are also a significant segment, actively seeking deals and discounts to make celebrations more affordable. Party City's promotional offers directly appeal to this group, prioritizing value for money.

| Customer Segment | Key Characteristics | Purchasing Motivation | 2024 Relevance |

| Individual Consumers/Party Hosts | Seek convenience, wide selection for personal events. | Streamline party planning, create memorable experiences. | Continued strong demand for in-person celebrations. |

| Seasonal Shoppers (e.g., Halloween) | Focus on costumes, decorations, trending items. | Desire for unique, pop-culture aligned items. | Significant revenue driver, especially in autumn. (2023 U.S. Halloween spend: $12.2B) |

| Event Planners/Businesses | Require supplies for large-scale or corporate events. | Need for bulk options, customization, brand alignment. | Robust events industry recovery. (Global events market projected >$1.5T in 2024) |

| Wholesale Customers | Retailers stocking shelves for their own customers. | Access to diverse product range, reliable supply. | Dependence on established manufacturing and catalog. |

| Budget-Conscious Shoppers | Prioritize value, actively seek discounts and promotions. | Make celebrations cost-effective. | Price sensitivity drives purchasing decisions. |

Cost Structure

The cost of goods sold (COGS) is a major component of Party City's expenses, covering the direct costs of creating and acquiring party supplies. This includes everything from the raw materials used in manufacturing to the labor involved in production and the transportation costs to get products to their stores and distribution centers. For instance, in fiscal year 2023, Party City reported a COGS of $1.6 billion, highlighting the significant investment in their product inventory.

Inflationary pressures have notably impacted these costs, particularly for raw materials and freight. These rising expenses directly affect the profitability of each item sold. Effectively managing and controlling COGS is therefore paramount for Party City to maintain healthy profit margins and remain competitive in the market.

Operating a vast network of retail stores is a significant cost driver for Party City, encompassing expenses like rent for prime locations, utilities to power the stores, regular maintenance to keep them presentable, and wages for store associates. These costs, both fixed and variable, form a core part of their overall expense structure.

For instance, in 2024, retail rent alone represented a substantial portion of operating expenses for many brick-and-mortar retailers, with average commercial rents varying significantly by region but consistently being a major fixed cost. Party City's strategy to optimize store formats and carefully manage lease agreements directly influences the manageability of these substantial operating expenditures.

Party City dedicates significant resources to marketing and advertising to boost product visibility and customer engagement. These costs encompass a broad range of activities, from targeted digital campaigns and social media promotions to traditional print and television advertisements, as well as in-store promotions.

In 2024, the company continued its focus on reaching a wide audience through a mix of online and offline channels. For instance, their digital marketing efforts likely included search engine marketing, display advertising, and influencer collaborations. These initiatives are crucial for driving foot traffic and online sales.

While essential for growth, these marketing and advertising outlays represent a substantial portion of Party City's operational expenses. The effectiveness of these campaigns directly impacts revenue generation, making it a critical area for investment and careful management. For example, in recent years, companies in the retail sector have seen marketing costs fluctuate, with a notable increase in digital ad spend.

Logistics and Distribution Costs

The costs associated with getting Party City products from manufacturers to customers are quite substantial. This includes everything from storing goods in warehouses to moving them via trucks, ships, or planes, and generally managing the whole flow of goods. For example, in 2023, transportation costs alone represented a significant portion of operating expenses for many retail companies due to ongoing supply chain pressures and volatile fuel prices.

Efficiently getting party supplies to both brick-and-mortar stores and wholesale partners is essential for sales. However, these logistical operations can be expensive, especially when dealing with the complexities of a global supply chain and unpredictable fuel costs. In 2024, many retailers are still navigating increased freight rates compared to pre-pandemic levels.

- Warehousing: Costs related to storing inventory in distribution centers, including rent, utilities, and staff.

- Transportation: Expenses for moving goods, such as trucking, shipping, and air freight, heavily influenced by fuel prices.

- Supply Chain Management: Costs for managing relationships with suppliers, inventory tracking, and optimizing the flow of goods.

- Last-Mile Delivery: The final leg of delivery to stores or direct to consumers, often a major cost driver.

General and Administrative Expenses

General and administrative (G&A) expenses are the bedrock of Party City's operational support, encompassing everything from executive salaries and corporate office rent to essential legal and accounting services. These costs, while not directly tied to selling a single balloon or costume, are crucial for maintaining the company's overall structure and compliance. For instance, in 2023, Party City’s selling, general, and administrative expenses were reported at $790.7 million. This figure highlights the significant investment required to manage the business effectively.

Effective management of these G&A costs is paramount for Party City's profitability and efficiency. Keeping these expenses lean allows for greater resources to be allocated to customer-facing activities, product development, and marketing. A streamlined G&A structure directly impacts the bottom line, ensuring that the company can remain competitive in the dynamic party supply market. This focus on operational efficiency is a key component of their business model.

- Corporate Overhead: Includes costs associated with maintaining headquarters and administrative offices.

- Administrative Salaries: Compensation for non-sales and non-production staff, such as HR, finance, and legal teams.

- Professional Fees: Expenses for legal counsel, auditors, and other external consultants.

- Other Operational Costs: Miscellaneous expenses necessary for the smooth functioning of the business, like insurance and IT support.

Party City's cost structure is heavily influenced by the cost of goods sold (COGS), which in fiscal year 2023 stood at $1.6 billion. This figure encompasses raw materials, labor, and transportation for their extensive party supplies. Operating a wide network of retail stores also represents a significant expenditure, covering rent, utilities, and staff wages, with retail rent remaining a substantial fixed cost in 2024.

Marketing and advertising expenses are crucial for visibility, with digital ad spend seeing notable increases in the retail sector. Logistics costs, including warehousing and transportation, are substantial, with freight rates in 2024 still elevated compared to pre-pandemic levels. General and administrative (G&A) expenses, totaling $790.7 million in 2023, cover corporate overhead, salaries, and professional fees, all vital for business operations.

| Cost Component | 2023 Data | 2024 Trends |

| Cost of Goods Sold (COGS) | $1.6 billion | Continued impact from raw material and freight inflation. |

| Operating Expenses (Stores) | Significant portion of overall costs | Retail rents remain a major fixed cost; optimization of store formats is key. |

| Marketing & Advertising | Substantial portion of operational expenses | Increased focus on digital channels; digital ad spend continues to rise. |

| Logistics & Supply Chain | Significant portion of operating expenses | Elevated freight rates persist; efficiency in supply chain management is critical. |

| General & Administrative (G&A) | $790.7 million | Focus on lean operations to improve profitability; essential for business functioning. |

Revenue Streams

Party City's primary revenue source is direct retail sales of party supplies, decorations, and costumes through its extensive network of Party City branded stores. This core business model relies on consistent demand for everyday celebrations alongside significant spikes during major holidays and seasonal events. For instance, in the first quarter of 2024, Party City reported net sales of $450 million, with a substantial portion attributed to these in-store transactions.

Revenue from Party City's Halloween City pop-up stores is a crucial, though seasonal, income source, peaking significantly during the Halloween period. These temporary locations expertly tap into the heightened consumer demand for costumes, decorations, and party supplies, making a substantial impact on the company's yearly sales figures.

Revenue generated through PartyCity.com is a significant component of Party City's financial performance. This digital storefront offers customers a convenient way to browse and purchase party supplies, expanding the company's reach beyond its brick-and-mortar presence. In 2024, e-commerce sales continued to be a vital driver of growth in the competitive party goods market.

Wholesale Sales to Other Retailers

Party City's wholesale division is a significant revenue generator, allowing the company to extend its reach beyond its own stores. They design, produce, and supply a wide array of party supplies to other retailers worldwide, effectively tapping into the business-to-business market.

This approach diversifies their income streams and capitalizes on their manufacturing expertise. For instance, in 2023, Party City's wholesale segment contributed to their overall sales, allowing them to leverage their product development and supply chain capabilities to serve a wider customer base.

- Global Distribution Network: Party City partners with numerous independent retailers across various countries, expanding its market penetration.

- Product Portfolio: The wholesale offering encompasses a broad range of party essentials, from balloons and decorations to costumes and tableware.

- Brand Leverage: Retailers benefit from Party City's established brand recognition and reputation for quality party products.

- B2B Sales Growth: This channel represents a strategic move to increase sales volume and profitability by serving a broader market.

Franchise Royalties and Fees

Party City's franchise model provides a consistent revenue stream through initial fees and ongoing royalty payments. These royalties are calculated as a percentage of net sales from each franchised store, offering a variable but predictable income based on the performance of these independent locations.

Even as Party City has been transitioning its corporate retail presence in the US, its franchised stores, particularly in international markets, continue to contribute significantly to this revenue. This demonstrates the resilience of the brand through its franchised partnerships.

- Franchise Fees: One-time payments received from new franchisees for the right to operate a Party City store under the brand's established system.

- Royalty Payments: Ongoing fees, typically a percentage of gross sales, paid by franchisees to Party City for continued use of the brand, operational support, and marketing.

- Continued Operations: Franchised locations in regions outside the US remain active, ensuring the continuation of this revenue stream for the company.

Party City's revenue streams are multifaceted, encompassing direct retail sales, e-commerce, wholesale operations, and franchise agreements. The company's strategic focus on both physical and digital channels, alongside its B2B and licensing models, aims to capture a broad market share. This diversified approach is crucial for sustained financial performance in the dynamic party supplies industry.

| Revenue Stream | Description | 2023/2024 Data Points |

|---|---|---|

| Retail Sales | In-store sales of party supplies, decorations, and costumes. | Net sales of $450 million reported in Q1 2024. |

| E-commerce | Online sales through PartyCity.com. | Continues to be a vital driver of growth. |

| Wholesale | Supplying party supplies to other retailers globally. | Contributed to overall sales in 2023, leveraging product development. |

| Franchising | Revenue from initial fees and royalties from franchised stores. | International franchised locations remain active contributors. |

Business Model Canvas Data Sources

The Party City Business Model Canvas is informed by extensive market research, including consumer behavior analysis and competitive landscape studies. This data is supplemented by internal sales figures and operational efficiency reports to ensure a comprehensive view of the business.