Party City Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Party City Bundle

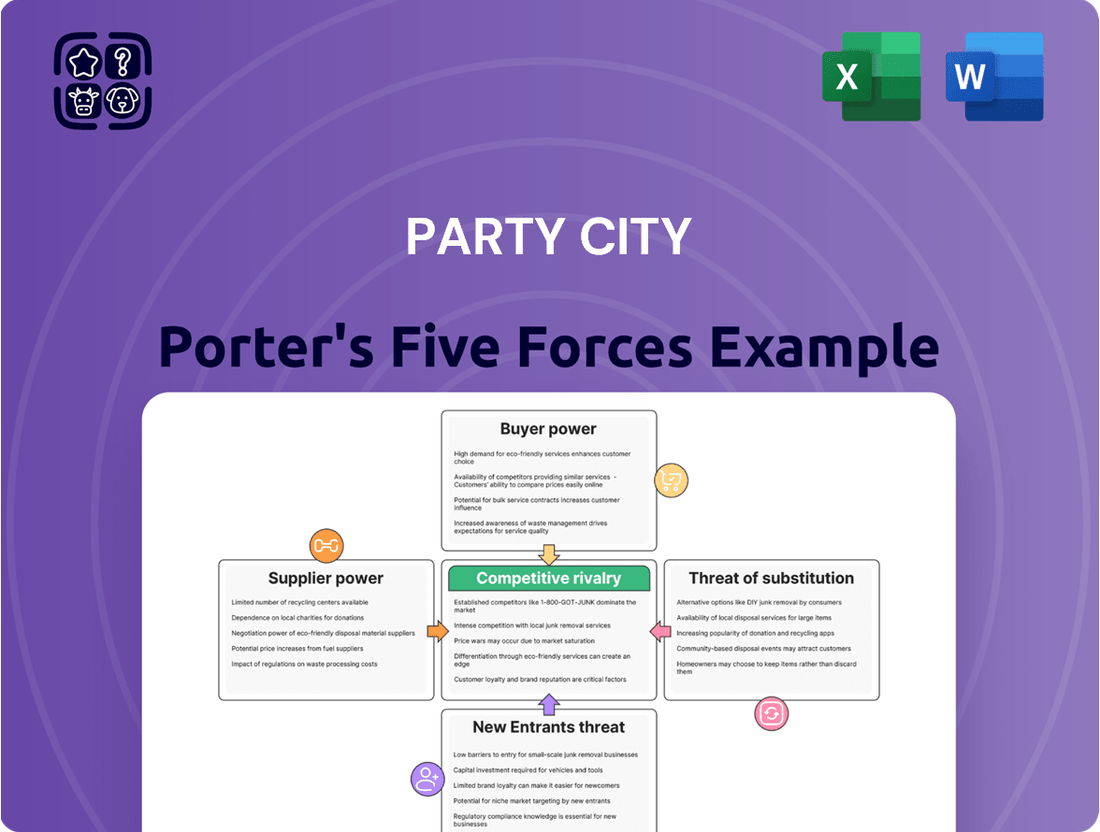

Party City navigates a landscape where the bargaining power of buyers, particularly event planners and individual consumers, can significantly impact pricing. The threat of new entrants, while potentially moderate due to capital requirements and brand loyalty, still presents a concern in the retail sector. Suppliers, especially for specialized party supplies, wield considerable influence over costs and availability.

The intensity of rivalry among existing competitors, including online retailers and other brick-and-mortar stores, is a constant pressure. Furthermore, the availability of substitutes, such as DIY party decorations or alternative entertainment options, necessitates continuous innovation. This snapshot only scratches the surface.

Unlock the full Porter's Five Forces Analysis to explore Party City’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Party City's internal manufacturing and distribution arm, Amscan, plays a crucial role in limiting the bargaining power of external suppliers for many standard party supplies. By producing a substantial portion of its inventory internally, Party City reduces its dependence on outside vendors for these core products. This vertical integration grants Party City greater command over product consistency and pricing, thereby weakening the leverage of external suppliers for items Amscan produces.

For example, Amscan's significant in-house production capacity means Party City doesn't need to rely as heavily on external manufacturers for high-volume, everyday party items. This allows Party City to dictate terms more effectively with the suppliers it does use for these categories. In contrast, for highly specialized or custom-designed party goods, where Party City may not have internal production capabilities, external suppliers could indeed wield more influence over pricing and terms.

Suppliers of crucial components like helium for balloons and specialized plastics for party goods hold significant sway. Party City has experienced firsthand the impact of helium shortages, a key input that directly affected its lucrative balloon business. This dependency highlights the suppliers' bargaining power, as disruptions or price hikes for these materials can significantly squeeze profit margins.

For many of its generic party supplies, Party City likely benefits from a wide array of global manufacturers. This broad supplier base significantly reduces the leverage any single supplier holds over the company, as there are always alternative sources for common items. For instance, in 2024, the global market for party supplies is vast, with numerous players in countries like China and Vietnam offering similar products. This abundance means Party City isn't beholden to a single vendor for its core inventory.

Supply Chain Resilience and Visibility

Party City's commitment to enhancing supply chain resilience and visibility directly addresses the bargaining power of suppliers. By investing in platforms like TradeBeyond, the company aims to gain better control over its inventory and operations, a move that can strengthen its negotiating position with suppliers. This increased visibility allows for more efficient sourcing and better anticipation of potential disruptions, ultimately reducing reliance on any single supplier.

Improved inventory management and operational control can significantly diminish a supplier's ability to dictate terms. For instance, in 2023, Party City faced challenges impacting its inventory levels, highlighting the need for greater supply chain agility. By fostering stronger, more transparent relationships and implementing advanced tracking systems, Party City can mitigate the leverage suppliers might otherwise hold through information asymmetry or control over critical components.

- Enhanced Visibility: Investments in platforms like TradeBeyond offer real-time tracking of goods, providing Party City with better insights into its supply chain.

- Inventory Control: Improved inventory management reduces the risk of stockouts and overstocking, lessening dependence on immediate supplier fulfillment.

- Supplier Relationship Management: Greater operational control allows for more strategic engagement with suppliers, potentially leading to more favorable terms.

- Mitigating Disruption: A more resilient supply chain is less vulnerable to external shocks, thereby reducing the bargaining power of suppliers who might exploit such vulnerabilities.

Bankruptcy and Restructuring Impact on Supplier Relations

Party City's recurring bankruptcy filings, including its most recent Chapter 11 in early 2023, significantly weakened its bargaining power with suppliers. This financial instability made suppliers hesitant to extend favorable terms or even continue business relationships due to heightened default risk. By February 2023, Party City announced the closure of all its 150 remaining US stores.

The company's eventual wind-down and liquidation of most U.S. operations meant that while they sought to fulfill outstanding orders, the underlying financial distress fundamentally eroded supplier trust. This situation directly reduced suppliers' ability to extract favorable pricing or secure payment guarantees, as their primary concern shifted to recouping existing debts and minimizing future exposure to a failing entity.

- Financial Distress: Party City filed for Chapter 11 bankruptcy in January 2023, leading to the closure of approximately 150 stores.

- Erosion of Confidence: The repeated financial struggles and eventual liquidation of major U.S. operations severely damaged supplier confidence.

- Reduced Leverage: Suppliers faced a diminished ability to negotiate terms due to Party City's precarious financial position.

- Payment Concerns: Suppliers became more cautious about payment terms and the likelihood of receiving full compensation for goods and services.

Party City's internal production via Amscan limits supplier power for many standard items. However, for critical inputs like helium, suppliers hold significant sway, as demonstrated by shortages impacting the balloon business. The vast global market for generic party supplies, with numerous manufacturers in countries like China and Vietnam in 2024, generally keeps individual supplier leverage low.

Party City's financial instability, including its January 2023 Chapter 11 filing and subsequent closure of 150 US stores by February 2023, critically weakened supplier relationships. This distress made suppliers wary of extending favorable terms, directly reducing their bargaining power and increasing concerns about payment.

| Factor | Impact on Supplier Bargaining Power | Notes |

|---|---|---|

| Amscan's Internal Production | Decreased | Reduces reliance on external suppliers for core products. |

| Helium and Specialized Materials | Increased | Dependency on specific, critical inputs. |

| Global Supplier Base (2024) | Decreased | Abundance of alternatives for generic items. |

| Financial Distress (2023 filings) | Significantly Decreased | Eroded trust and ability to negotiate terms. |

What is included in the product

This analysis dissects the competitive forces impacting Party City, from buyer bargaining power to the threat of new entrants, offering insights into industry profitability and strategic positioning.

Identify and mitigate competitive threats with a visually intuitive breakdown of industry rivalry, supplier power, buyer power, threat of new entrants, and threat of substitutes.

Customers Bargaining Power

Customers for party supplies are often quite sensitive to price. This means they'll readily shop around for the best deal, which directly impacts Party City. For instance, in 2024, consumer spending on discretionary items like party decorations can fluctuate significantly with economic conditions, making price a primary driver for many shoppers.

The market for party goods is crowded, with numerous alternatives available. Party City faces intense competition not just from specialized party stores but also from mass merchandisers like Walmart and Target, as well as budget-friendly dollar stores and a vast array of online sellers. This abundance of choice empowers customers.

The ease of switching is a major factor. Consumers can effortlessly pivot to online marketplaces like Amazon or Etsy, or even local supermarkets and general retailers that carry party essentials. This accessibility means customers aren't locked into Party City and can quickly find comparable products elsewhere, often at lower price points.

The shift towards online and do-it-yourself (DIY) celebrations significantly bolsters customer bargaining power. Consumers can now effortlessly compare prices and product offerings from a multitude of online retailers, a stark contrast to the limited options once available through brick-and-mortar stores. This ease of access to information and alternatives diminishes the leverage of traditional specialty retailers.

The growing trend of personalized and DIY party planning further empowers customers. They can source materials and inspiration from diverse online platforms, create custom decorations, and often achieve a unique aesthetic at a lower cost. For instance, the online craft supply market has seen substantial growth, enabling consumers to bypass traditional party supply chains for many elements.

This increased customer agency directly impacts retailers like Party City. With readily available online alternatives and the DIY movement, customers are less dependent on single retailers, forcing businesses to compete more aggressively on price, selection, and customer experience. In 2024, e-commerce sales continued their upward trajectory, with online retail accounting for a substantial portion of consumer spending, underscoring this shift.

Inflationary pressures and broader macroeconomic headwinds in 2024 have significantly impacted consumer spending, particularly on discretionary items like party supplies. As household budgets tighten, customers are becoming more selective and value-conscious.

This shift amplifies customer bargaining power. With fewer consumers willing to spend on non-essentials, Party City faces increased pressure to offer competitive pricing and promotions to attract and retain customers. In 2024, for example, many retailers reported a slowdown in discretionary spending, forcing adjustments to pricing strategies.

Low Switching Costs for Customers

The bargaining power of customers is significantly influenced by low switching costs in the party supply industry. For consumers looking for balloons, decorations, or party favors, moving from one retailer like Party City to a competitor, whether a brick-and-mortar store or an online platform, requires minimal effort and expense. This ease of transition directly empowers customers to shop around.

Many standard party items are treated as commodities, meaning customers often prioritize price and convenience over brand allegiance. This lack of strong brand loyalty means consumers are readily inclined to switch if they find a better offer or a more accessible shopping channel. For instance, a customer might easily switch from Party City to Amazon or a local discount store if the price for a pack of balloons is lower, or if the online retailer offers faster delivery.

- Low Switching Costs: Customers can easily move between party supply retailers without incurring significant financial or time penalties.

- Commoditization of Products: Many party essentials are seen as interchangeable, reducing the need for brand loyalty.

- Price Sensitivity: Customers are likely to choose the vendor offering the most competitive pricing for common party supplies.

- Convenience Factor: Ease of access and shopping experience are key drivers for customer retention in this sector.

Fragmented Customer Base

While Party City caters to a broad customer base, the individual purchasing power of most consumers is limited due to relatively small transaction sizes. This means a single customer cannot significantly influence Party City's pricing or product decisions.

However, the sheer volume of individual customers, coupled with their high price sensitivity and ease of switching to competitors, creates a considerable collective bargaining power. This pressure often forces Party City to maintain competitive pricing and a wide variety of offerings to attract and retain these customers.

- Fragmented Customer Base: Party City's customer base is vast and diverse, comprising individuals and families.

- Low Individual Bargaining Power: Each customer typically buys in small quantities, limiting their ability to negotiate prices.

- High Price Sensitivity: Consumers in the party supply market are often driven by price, making them likely to switch for better deals.

- Collective Pressure: The aggregation of many small, price-conscious customers exerts significant influence on overall pricing strategies.

The bargaining power of customers for Party City is substantial, driven by low switching costs and the commoditized nature of many party supplies. Consumers can easily shift between retailers, both online and in physical stores, for items like balloons and decorations, prioritizing price and convenience over brand loyalty. This means Party City must remain competitive to capture and retain its broad customer base.

In 2024, economic factors like inflation continued to make consumers more price-aware, particularly for discretionary spending. This heightened sensitivity amplifies customer leverage, as they readily seek out the best value. While individual customer purchase volumes are small, their collective influence, fueled by easy access to alternatives and a focus on cost savings, significantly pressures Party City's pricing strategies.

| Factor | Impact on Party City | 2024 Relevance |

|---|---|---|

| Switching Costs | Low; customers can easily move to competitors | Remains a key driver of price competition. |

| Product Commoditization | Many items are seen as interchangeable, reducing brand loyalty | Customers prioritize price for standard party goods. |

| Price Sensitivity | High; customers actively seek best deals | Amplified by 2024 economic conditions and discretionary spending caution. |

| Collective Power | Large customer base exerts significant influence through combined actions | Forces competitive pricing and promotions. |

Full Version Awaits

Party City Porter's Five Forces Analysis

This preview showcases the complete Party City Porter's Five Forces Analysis, offering a detailed examination of its competitive landscape. The document you see here is the exact, professionally compiled report you will receive instantly upon purchase, ensuring transparency and immediate value. It meticulously breaks down the intensity of rivalry, buyer and supplier power, the threat of new entrants, and the availability of substitutes, providing actionable insights for strategic decision-making. You're looking at the actual, fully formatted document; once you complete your purchase, you’ll get instant access to this exact file, ready for your immediate use.

Rivalry Among Competitors

The party supplies market is incredibly crowded. You've got giants like Walmart and Target offering party essentials alongside their vast general merchandise. Then there are specialized craft stores such as Michaels and Hobby Lobby, which also cater to DIY party decorators. Even dollar stores compete on price for basic party items, making it tough for any single player.

The rise of online retailers has further intensified this rivalry. These digital storefronts often have lower overheads, allowing them to offer competitive pricing and a wider selection than brick-and-mortar stores. In 2023, the online retail sector continued its strong growth, capturing an increasing share of consumer spending across various categories, including party supplies.

Many of these diverse retailers possess extensive distribution networks, enabling them to reach a broad customer base efficiently. This broad reach, combined with aggressive pricing strategies, puts significant pressure on companies like Party City to differentiate themselves and maintain market share. For instance, Walmart's sheer scale allows it to negotiate favorable terms with suppliers, often translating into lower prices for consumers.

The growing dominance of online retailers like Amazon and Etsy has dramatically increased competitive rivalry for Party City. These platforms offer an unparalleled breadth of products, the convenience of home delivery, and frequently undercut physical store prices, directly impacting Party City's market share. In 2023, e-commerce sales in the US were projected to reach over $1.1 trillion, a substantial portion of which would include party supplies.

Consumers increasingly favor online channels for personalized and themed party items, a segment where e-commerce excels in customization and variety. This shift challenges the traditional brick-and-mortar retail model that Party City relies on. The ease of online comparison shopping further exacerbates this pressure, forcing Party City to adapt its strategies to compete effectively in this digital landscape.

The party supply market, particularly for many common items, is highly commoditized. This means consumers often see little difference between brands and therefore focus heavily on price when making purchasing decisions. For companies like Party City, this translates into intense price competition as they strive to attract budget-conscious shoppers.

This fierce price war can significantly squeeze profit margins. When products are seen as interchangeable, the only way to gain a competitive edge is often by offering lower prices. This dynamic is a major driver of the high competitive rivalry within the industry, as companies constantly battle to undercut each other.

In 2023, the U.S. party supplies market was valued at approximately $12.5 billion, with a projected compound annual growth rate (CAGR) of around 4.5% through 2028. While growth exists, the underlying commoditization of many products means that market share gains are often achieved through aggressive pricing strategies rather than product innovation or unique offerings.

Consolidation and Strategic Partnerships Among Competitors

The competitive landscape for party supplies is marked by strategic maneuvers as players strive to gain an edge. For instance, Instacart had partnered with Party City to offer same-day delivery, aiming to boost convenience for shoppers. This partnership, active before Party City's market wind-down, highlights how companies sought to integrate services and reach customers more effectively.

Michaels has also been a notable player, expanding its party supplies section. This move signifies a broader trend where retailers are broadening their offerings to capture a larger share of the consumer spending on celebrations and events. Such expansions often involve curating a wider variety of products, from decorations to themed party kits, directly competing with established party supply specialists.

These strategic partnerships and market expansions underscore the intense rivalry. Companies are not just competing on product assortment but also on service integration and accessibility. The goal is to become a one-stop shop for event planning, making it easier for consumers to source all their party needs from a single, convenient provider. This dynamic suggests a market where innovation in service delivery and product offering is key to survival and growth.

- Strategic Alliances: Competitors are forming partnerships to enhance delivery and customer reach, as seen with Instacart and Party City.

- Product Line Expansion: Retailers like Michaels are broadening their party supply offerings to capture market share.

- Customer Convenience: The focus is on integrating services and improving accessibility to meet consumer demand for easy event planning.

- Market Dynamics: The party supply sector is characterized by active strategies to differentiate and capture consumer spending on celebrations.

Party City's Shift from Dominance to Liquidation

Party City's journey from being the dominant party supply retailer in the US to its eventual liquidation highlights the fierce nature of competitive rivalry in the sector. The company grappled with substantial debt and shrinking profits, culminating in bankruptcy filings and the cessation of most of its US retail and wholesale activities.

This decline was largely driven by intense competition, especially from nimble online retailers and large mass-market players who could offer lower prices and greater convenience.

- Market Share Erosion: Party City, once holding a significant market share, saw its dominance challenged as e-commerce platforms and big-box stores expanded their party supply offerings.

- Price Sensitivity: The party supplies market is often price-sensitive, giving an advantage to competitors with lower overheads and greater purchasing power.

- Changing Consumer Habits: A shift towards online shopping and a preference for one-stop retail experiences further disadvantaged Party City's brick-and-mortar model.

The competitive rivalry in the party supply sector is intense, with numerous players vying for consumer attention and spending. Giants like Walmart and Target, alongside specialized retailers such as Michaels, offer a broad range of party essentials, often at competitive prices. The digital landscape further intensifies this rivalry, with online platforms like Amazon and Etsy providing vast selections, convenience, and aggressive pricing, directly challenging traditional brick-and-mortar models.

This market dynamic is further shaped by the commoditized nature of many party items, forcing businesses to compete heavily on price. This price sensitivity significantly impacts profit margins, as companies strive to attract budget-conscious consumers. In 2023, the U.S. party supplies market, valued at approximately $12.5 billion, experienced growth, but market share gains often hinge on aggressive pricing rather than unique offerings.

Strategic moves, such as partnerships for enhanced delivery services or expansions into broader party supply categories, are common tactics employed by competitors. These efforts aim to improve customer convenience and accessibility, positioning retailers as comprehensive solutions for event planning. Ultimately, the sector’s landscape is characterized by active strategies designed to differentiate offerings and capture consumer spending on celebrations.

SSubstitutes Threaten

The rise of DIY and home-based celebrations presents a significant threat of substitutes for traditional party supply retailers like Party City. Many consumers are opting to craft their own decorations, invitations, and party favors, utilizing materials readily available at craft stores or even from items around their homes. This trend allows for greater personalization and can often be more cost-effective, directly competing with the convenience and selection offered by specialty party stores.

In 2024, the interest in DIY projects, including party elements, has remained robust. For instance, platforms like Pinterest saw continued high engagement with "party DIY" searches. Furthermore, the increasing availability of affordable craft supplies and online tutorials makes it easier than ever for individuals to design and produce unique party elements, directly impacting the demand for pre-packaged goods from retailers.

Mass merchandisers such as Walmart and Target, alongside online behemoths like Amazon, present formidable substitutes for Party City. These retailers offer a vast array of party supplies as part of their broader product selection, often at competitive price points. For instance, in 2023, Walmart reported over $600 billion in revenue, showcasing its immense scale and ability to absorb diverse product categories, including party essentials.

The convenience factor is a significant draw, as consumers can purchase party decorations, tableware, and even costumes while doing their regular grocery or household shopping. This one-stop-shop appeal diminishes the need for a specialized trip to a party supply store. In 2024, online retail sales are projected to continue their robust growth, with Amazon alone holding a substantial market share, further intensifying the threat of these broad substitutes.

Digital alternatives for invitations and entertainment pose a subtle but growing threat. Platforms offering digital invitations and online event coordination reduce the need for physical stationery, impacting a segment of Party City's traditional sales. For instance, services like Evite saw significant growth, especially during periods where in-person gatherings were limited, demonstrating a shift in consumer behavior.

Beyond invitations, the rise of online gaming and virtual party experiences offers substitutes for physical entertainment and activities. While not directly replacing party supplies like balloons or tableware, these digital options can divert consumer spending and attention away from traditional party elements. The global online gaming market, valued at over $200 billion in 2023, highlights the significant portion of entertainment budgets now allocated to virtual experiences.

Rental Services for Party Equipment

Rental services for party equipment, like tables, chairs, and tents, can act as a substitute for purchasing items, especially for larger events. While Party City's core business is often disposable decorations, these rental options address a different segment of event needs. For instance, the event rental market saw significant growth, with the U.S. market size estimated to be around $50 billion in 2024, indicating a substantial alternative for consumers planning events.

These rental services can directly compete for customer spending when consumers prioritize cost-effectiveness or the convenience of not owning bulky items. Consider that a significant portion of event planners, particularly for corporate or larger private functions, opt for rentals to manage logistics and budget. The availability of comprehensive rental packages, often including delivery and setup, further enhances their appeal as a substitute for buying individual components.

- Market Diversification: Rental companies often offer a wider array of specialized equipment, from sound systems to catering supplies, that Party City may not stock.

- Cost Efficiency for Large Events: For one-off or infrequent large gatherings, renting is typically more economical than purchasing, impacting purchasing decisions for event organizers.

- Convenience Factor: Many rental services provide end-to-end solutions, including delivery, setup, and takedown, which can be a powerful draw compared to the DIY approach of buying and managing party supplies.

Sustainability Trends and Reusable Products

The growing consumer demand for sustainability presents a significant threat of substitutes for traditional party supplies. As environmental consciousness rises, shoppers increasingly seek reusable decorations, compostable tableware, and other eco-friendly alternatives. This shift directly challenges the disposable nature of many conventional party goods, forcing companies to adapt or risk losing market share. For instance, by late 2023, over 60% of consumers surveyed indicated a preference for sustainable options when making purchasing decisions, a trend expected to accelerate.

These sustainable substitutes offer a compelling value proposition by reducing waste and aligning with consumer ethics. Brands offering reusable fabric banners, bamboo plates, or biodegradable balloons are directly competing with single-use plastic items. The market for sustainable event supplies saw a notable uptick in 2024, with projections indicating continued double-digit growth. This indicates a tangible and growing threat that Party City, like others in the industry, must actively address.

- Consumer Shift: A majority of consumers now favor sustainable party goods over disposable ones.

- Market Growth: The eco-friendly party supply sector experienced significant growth in 2024.

- Value Proposition: Reusable and compostable items appeal to environmentally conscious consumers.

- Competitive Landscape: New entrants and existing brands focusing on sustainability are gaining traction.

The threat of substitutes for Party City is substantial, stemming from a variety of sources. DIY enthusiasts and home crafters are increasingly creating their own party elements, often finding cost and personalization advantages. Furthermore, mass merchandisers and online retailers offer convenience and competitive pricing on a wide range of party supplies, capturing a significant portion of the market. Digital alternatives for invitations and virtual entertainment also divert consumer spending and attention from traditional party goods.

The sustainability movement also plays a crucial role, with consumers actively seeking reusable and eco-friendly party supplies. This trend directly challenges the disposable nature of many conventional party products. For example, by 2024, a significant percentage of consumers indicated a preference for sustainable options, driving growth in the eco-friendly party supply sector.

| Substitute Category | Key Characteristics | Impact on Party City | 2024 Market Data/Trend |

| DIY & Home Crafting | Personalization, Cost Savings | Reduces demand for pre-packaged goods | Continued high engagement with DIY party searches on platforms like Pinterest. |

| Mass Merchandisers & Online Retailers | Convenience, Broad Selection, Competitive Pricing | Captures impulse buys and one-stop-shop shoppers | Walmart's 2023 revenue exceeded $600 billion; Amazon's market share in online retail continues to grow. |

| Digital Invitations & Virtual Events | Convenience, Reduced Physical Material Need, Alternative Entertainment | Impacts stationery sales and diverts entertainment spending | Online gaming market valued over $200 billion in 2023; growth in digital invitation services. |

| Rental Services | Cost-efficiency for large events, Convenience (delivery/setup) | Offers an alternative for bulk purchases of event essentials | U.S. event rental market estimated at $50 billion in 2024. |

| Sustainable & Eco-Friendly Alternatives | Reduced Waste, Ethical Alignment | Challenges disposable product sales, demands product innovation | Over 60% of consumers favored sustainable options by late 2023; double-digit growth in eco-friendly party supplies. |

Entrants Threaten

The burgeoning e-commerce landscape dramatically reduces the capital needed to enter the party supply market. Platforms like Etsy and Shopify allow even small operations to launch online with minimal upfront investment, unlike traditional brick-and-mortar stores. This accessibility makes it easier for niche players to emerge and compete, potentially fragmenting market share.

While the digital marketplace lowers the barrier to entry for many retail sectors, Party City's brand recognition and established supply chains, particularly through its wholesale arm, New Amscan PC LLC, create substantial hurdles for new competitors. Building a comparable level of trust and operational efficiency, especially in manufacturing and distribution, requires significant investment and time that emerging businesses may find difficult to replicate.

For traditional brick-and-mortar retailers like Party City, gaining access to prime retail locations and establishing a broad store footprint demands significant capital and time, acting as a considerable barrier. This is especially true in a competitive landscape where prime real estate is scarce and expensive.

However, the burgeoning e-commerce sector significantly lowers this barrier. New entrants can bypass the need for physical stores by utilizing existing online platforms and fulfillment networks, allowing them to reach customers without the upfront investment in brick-and-mortar infrastructure.

In 2024, the online retail market continued its robust growth, with e-commerce sales projected to reach over $2 trillion in the US alone. This digital shift means that a key traditional barrier—physical distribution—is less of an impediment for online-focused competitors.

This accessibility through digital channels allows new, agile companies to challenge established players by focusing solely on online sales and marketing, often with lower overheads than traditional retailers.

Economies of Scale in Manufacturing and Sourcing

Existing large players, such as Party City with its established wholesale operations, leverage significant economies of scale in both manufacturing and bulk sourcing. This allows them to negotiate more favorable terms with suppliers and achieve lower per-unit production costs. For instance, in 2023, major party supply distributors reported purchasing power that could reduce raw material costs by up to 15% compared to smaller operations.

New entrants entering the party supply market would struggle to match these cost efficiencies without immediately securing substantial order volumes. The capital investment required to build comparable manufacturing capabilities or negotiate similar bulk discounts would be a considerable barrier.

- Economies of Scale: Large manufacturers can spread fixed costs over a larger output, lowering average costs.

- Bulk Purchasing Power: Established players secure better pricing on raw materials and finished goods due to higher order volumes.

- Price Competition: Lower costs for incumbents enable more aggressive pricing, making it difficult for new entrants to compete profitably.

- Capital Investment: New entrants need significant upfront capital to reach a scale that offers competitive pricing.

Market Saturation and Intense Competition

The threat of new entrants into the party supplies market remains moderate. This is largely due to existing market saturation, where a wide array of competitors, from large brick-and-mortar stores to nimble online retailers, already vie for consumer attention. The recent liquidation of Party City, a major player, has indeed created some openings, but the overall landscape is still intensely competitive and price-sensitive. Newcomers would need significant capital and a strong value proposition to carve out a meaningful share.

Consider these factors influencing new entrants:

- Established Distribution Channels: Existing retailers have well-developed supply chains and relationships with manufacturers, making it difficult for new entrants to compete on cost and availability.

- Brand Loyalty and Recognition: Consumers often have established purchasing habits for party supplies, making it challenging for new brands to build recognition and trust.

- Economies of Scale: Larger, established players benefit from economies of scale in purchasing and operations, allowing them to offer more competitive pricing.

- Regulatory Hurdles: While not overly burdensome, certain product safety and labeling regulations can add to the initial setup costs for new entrants.

The threat of new entrants in the party supply sector is currently moderate. While the rise of e-commerce platforms has lowered initial capital requirements for online-only businesses, established players like Party City, through its wholesale division New Amscan PC LLC, benefit from significant brand recognition and robust supply chains. This makes replicating their operational efficiency and market trust a considerable challenge for newcomers. In 2024, e-commerce sales in the US are projected to exceed $2 trillion, underscoring the digital shift that can reduce traditional distribution barriers for agile online competitors.

Established companies leverage substantial economies of scale in manufacturing and sourcing, allowing for more competitive pricing. For example, in 2023, major distributors could secure raw material cost reductions of up to 15% compared to smaller entities. New entrants would need substantial capital to achieve similar cost efficiencies, posing a significant barrier. Despite Party City's liquidation in 2023, the market remains saturated with numerous competitors, requiring new entrants to possess strong capital backing and a compelling value proposition to gain market share.

| Factor | Impact on New Entrants | 2024 Data/Trend |

|---|---|---|

| E-commerce Growth | Lowers entry barriers by reducing need for physical stores. | US e-commerce sales projected over $2 trillion. |

| Brand Recognition & Loyalty | Significant hurdle for new entrants to overcome. | Established brands maintain customer trust and purchasing habits. |

| Economies of Scale & Purchasing Power | Incumbents enjoy lower costs, enabling aggressive pricing. | Major distributors achieved up to 15% raw material cost reduction in 2023. |

| Capital Investment for Scale | High capital needed to match incumbent cost efficiencies. | Building comparable manufacturing and distribution requires substantial investment. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Party City leverages data from annual reports, investor relations websites, and industry-specific market research from firms like IBISWorld. This blend ensures a comprehensive understanding of competitive dynamics, supplier leverage, and buyer power within the party supplies sector.