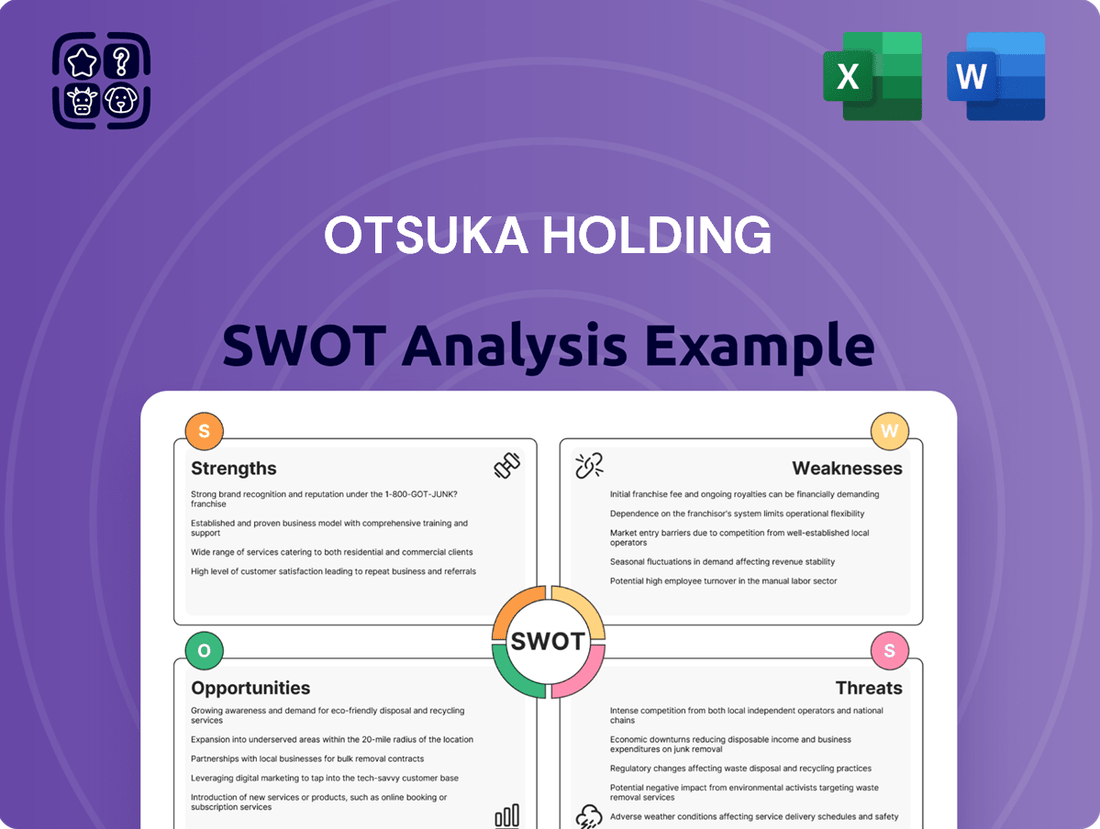

Otsuka Holding SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Otsuka Holding Bundle

Otsuka Holdings, a pharmaceutical giant, boasts significant strengths in its diverse product portfolio and robust R&D capabilities, particularly in neuroscience and oncology. However, it faces challenges from intense market competition and potential regulatory hurdles. Uncover the full strategic picture, including specific growth opportunities and critical risks, by diving into our comprehensive SWOT analysis.

Want to understand the complete story behind Otsuka's competitive edge and potential vulnerabilities? Purchase the full SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Otsuka Holdings benefits greatly from its diverse and balanced portfolio, which spans pharmaceuticals, nutraceuticals, and consumer products. This diversification creates a stable revenue stream, making the company less vulnerable to downturns in any single market. For instance, their key pharmaceutical products like ABILIFY MAINTENA and REXULTI, alongside popular consumer items such as POCARI SWEAT, collectively drove a notable revenue increase in fiscal 2024 and continued this positive trend into Q1 2025. This strategic blend of prescription medications and everyday health products not only broadens their market appeal but also effectively reduces the risk profile associated with pharmaceutical patent cliffs.

Otsuka Holding’s commitment to research and development is a significant strength, evident in its strong pipeline focused on difficult-to-treat conditions like neuropsychiatry, nephrology, cardiovascular diseases, and oncology. This focus demonstrates a clear strategy to tackle significant unmet medical needs.

The company has recently achieved notable successes, including positive Phase 3 trial outcomes for sibeprenlimab in IgA nephropathy. Furthermore, the U.S. Food and Drug Administration (FDA) has accepted their supplemental New Drug Application (sNDA) for brexpiprazole to treat post-traumatic stress disorder (PTSD), showcasing continued innovation in their therapeutic areas.

Otsuka actively pursues strategic investments to bolster its drug discovery capabilities. An example of this is their acquisition of Jnana Therapeutics Inc., a move that further solidifies their dedication to developing novel and original pharmaceutical products.

Otsuka boasts a substantial global presence, with established operations in crucial markets such as the United States and its home base in Japan. This strong foundation is being leveraged for active expansion into new territories, demonstrating a clear strategy for increased international reach.

A prime example of this strategic expansion is the joint venture with ICU Medical in North America, set to begin in the second quarter of 2025. This venture is specifically designed to bolster supply chains for IV solutions and foster innovation within these new markets.

Further underscoring its global ambitions, Otsuka has recently launched POCARI SWEAT in India. This move signifies a deliberate effort to broaden the footprint of its successful nutraceutical business into emerging consumer markets.

Financial Strength and Stable Earnings

Otsuka Holdings exhibits remarkable financial strength, a key advantage in its market position. Fiscal 2024 showcased this, with revenue climbing 15% and net income experiencing an impressive 182% surge, surpassing market predictions.

Further underscoring this stability, the company's Q1 2025 performance revealed a healthy 12.2% revenue increase alongside a significant 38.2% jump in business profit. This consistent financial momentum fuels its capacity for growth and innovation.

- Robust Revenue Growth: Fiscal 2024 saw a 15% revenue increase, with Q1 2025 reporting a further 12.2% rise.

- Exceptional Profitability: Net income in fiscal 2024 surged 182%, and Q1 2025 business profit grew by 38.2%.

- Solid Financial Foundation: A consistent net-cash position and a healthy debt-equity structure bolster its resilience.

- Strategic Investment Capacity: Financial stability enables continued investment in research and development and strategic expansion.

Commitment to Well-being and ESG Integration

Otsuka's core philosophy, 'Otsuka – people creating new products for better health worldwide,' directly translates into a strong emphasis on holistic well-being, encompassing physical, mental, and social health. This commitment is not just aspirational; it's embedded in their operations and product development.

The company's dedication to Environmental, Social, and Governance (ESG) principles is evident through its inclusion in prominent ESG investment indexes. For example, Otsuka Holdings was a constituent of the FTSE4Good Index Series and the FTSE Blossom Japan Index. These recognitions underscore their robust efforts in sustainable and responsible business practices, aligning with the growing demand for ethically managed companies.

This strategic focus on well-being and ESG integration significantly bolsters Otsuka's corporate reputation. It resonates with a broad spectrum of stakeholders, including investors increasingly prioritizing sustainability, and consumers who are more aware of and concerned about a company's social and environmental impact. This alignment positions Otsuka favorably in a competitive global market.

- Corporate Philosophy: Driven by 'Otsuka – people creating new products for better health worldwide,' focusing on physical, mental, and social health.

- ESG Recognition: Inclusion in FTSE4Good Index Series and FTSE Blossom Japan Index demonstrates strong commitment to sustainability.

- Stakeholder Alignment: Enhances reputation by meeting evolving investor and consumer expectations for responsible business practices.

Otsuka's diversified business model, spanning pharmaceuticals and consumer health products, provides significant resilience. This balance mitigates risks associated with single-market fluctuations. For example, strong performance from pharmaceuticals like ABILIFY MAINTENA and consumer brands such as POCARI SWEAT contributed to robust revenue growth in fiscal year 2024 and the first quarter of 2025.

The company's commitment to innovation is a key strength, with a robust R&D pipeline targeting critical unmet medical needs in areas like neuropsychiatry and oncology. Recent positive trial outcomes for sibeprenlimab and FDA acceptance for brexpiprazoles PTSD indication highlight this focus.

Otsuka’s strategic acquisitions, like that of Jnana Therapeutics, further enhance its drug discovery capabilities, ensuring a pipeline of novel pharmaceutical products. This proactive approach to building R&D capacity is crucial for long-term growth.

A strong global footprint, with significant operations in the US and Japan, coupled with expansion into new markets like India with POCARI SWEAT, demonstrates effective international growth strategies. The upcoming joint venture with ICU Medical in North America further strengthens its market position.

Otsuka's financial health is a distinct advantage, marked by a 15% revenue increase in fiscal 2024 and a 12.2% rise in Q1 2025. Profitability also saw substantial gains, with net income up 182% in fiscal 2024 and business profit up 38.2% in Q1 2025.

The company’s adherence to ESG principles, recognized by its inclusion in the FTSE4Good Index Series and FTSE Blossom Japan Index, enhances its corporate reputation and aligns with investor and consumer preferences for sustainable practices.

| Metric | Fiscal Year 2024 | Q1 2025 |

|---|---|---|

| Revenue Growth | +15% | +12.2% |

| Net Income Growth | +182% | N/A (Business Profit +38.2%) |

| Key Pharmaceutical Products | ABILIFY MAINTENA, REXULTI | ABILIFY MAINTENA, REXULTI |

| Key Consumer Products | POCARI SWEAT | POCARI SWEAT |

What is included in the product

Delivers a strategic overview of Otsuka Holding’s internal and external business factors, highlighting its strong R&D capabilities and diversified portfolio alongside market competition and regulatory hurdles.

Offers a clear, actionable framework to identify and address Otsuka's strategic challenges, transforming potential weaknesses into growth opportunities.

Weaknesses

Otsuka Holding's pharmaceutical segment shows a notable dependency on a few blockbuster drugs. For instance, ABILIFY MAINTENA and REXULTI continue to be significant revenue drivers. This concentration, however, presents a clear weakness.

The looming patent expiration for ABILIFY MAINTENA in October 2024 is a critical concern. Analysts project this event could lead to a considerable drop in sales, underscoring the company's susceptibility to patent cliffs. This is a well-documented risk in the pharmaceutical industry.

While Otsuka is actively developing new formulations, such as Abilify Asimtufii, to mitigate the impact of patent expirations, the transition phase poses a challenge. Successfully shifting market share to these new products while maintaining overall sales momentum will be crucial for navigating this period.

Otsuka navigates a highly competitive pharmaceutical arena, contending with global powerhouses like AstraZeneca, Pfizer, and Merck & Co. Japanese peers such as Takeda and Sumitomo Pharma also present significant challenges.

These formidable rivals invest heavily in research and development and pursue aggressive market expansion, which can strain Otsuka's market share and impact its pricing power. The pharmaceutical landscape is further intensified by overlapping therapeutic focuses and swift technological progress among competitors.

Otsuka's commitment to cutting-edge research, especially in challenging fields like neuropsychiatry, demands substantial R&D outlays. These investments carry a significant risk of clinical trial setbacks, which can derail promising drug candidates.

While Otsuka boasts a strong pipeline, the lengthy and costly process of bringing new drugs to market can put a strain on its financial reserves. For instance, the average cost to develop a new drug can exceed $2 billion, with success rates often below 10%.

Compounding these concerns, analyst forecasts for Otsuka's forward growth have been conservative, trailing the broader Japanese pharmaceutical sector. This suggests potential apprehension regarding the near-term profitability of its substantial R&D expenditures.

Regulatory Hurdles and Compliance

Otsuka, like any global healthcare player, faces significant regulatory hurdles. For instance, in 2023, the U.S. Food and Drug Administration (FDA) continued to scrutinize new drug applications, with average review times for novel drugs sometimes extending beyond the target 10 months, impacting potential market entry timelines.

Navigating the patchwork of international regulations, from the European Medicines Agency (EMA) to Japan's Pharmaceuticals and Medical Devices Agency (PMDA), requires substantial investment in compliance and adaptation. Changes in drug pricing policies, such as those being debated or implemented in various European countries in late 2024 and into 2025, can directly affect revenue streams and profitability.

The lengthy and complex approval processes for new pharmaceuticals and medical devices are a constant challenge. Delays in obtaining marketing authorization for key products can postpone revenue generation and give competitors an advantage.

Key challenges include:

- Navigating diverse global regulatory approval processes for new drugs and medical devices.

- Ensuring continuous compliance with evolving healthcare policies and manufacturing standards across different markets.

- Adapting to potential changes in drug pricing regulations, which can impact revenue and market access strategies.

- Mitigating risks associated with regulatory delays or unfavorable decisions that could hinder product launches.

Geographic Concentration and Market Specificity

Otsuka's significant reliance on specific geographic markets presents a notable weakness. For instance, the U.S. accounted for a substantial 49% of Abilify Maintena's revenue between 2013 and 2023. This geographic concentration exposes the company to heightened risks associated with shifts in U.S. healthcare policies, economic downturns, or intensified competition within that key region. Such market specificity can create vulnerabilities if these factors negatively impact sales performance in its primary revenue-generating territories.

The company's revenue stream is also heavily influenced by the success of a few key products, further compounding the risk of geographic concentration. If demand for these flagship drugs falters in major markets like the United States, it could disproportionately affect Otsuka's overall financial health. This dependency means that market-specific challenges can have a more pronounced impact on the company's performance than if its revenue were more evenly distributed globally.

Furthermore, the company's market specificity means that regulatory changes or reimbursement policies in concentrated regions can have a direct and significant impact on its profitability. For example, changes in Medicare or Medicaid policies in the U.S. could directly affect the sales and pricing of its key pharmaceutical products. This makes Otsuka particularly susceptible to the unique regulatory environments of its most important markets.

The reliance on specific markets also limits the company's ability to fully leverage growth opportunities in other regions. While Otsuka operates globally, a disproportionate focus on certain markets means that potential revenue streams in less concentrated areas might be underdeveloped. This could represent a missed opportunity for diversification and a broader base for revenue generation.

Otsuka's pharmaceutical segment faces a significant weakness due to its concentration on a few key products, particularly ABILIFY MAINTENA and REXULTI, which remain substantial revenue contributors. This reliance on a limited product portfolio makes the company vulnerable to market shifts and competitive pressures impacting these specific drugs.

The impending patent expiration for ABILIFY MAINTENA in October 2024 poses a substantial risk, with projections indicating a potential sharp decline in sales. This highlights Otsuka's susceptibility to patent cliffs, a common challenge in the pharmaceutical industry that can significantly disrupt revenue streams.

While Otsuka is working on newer formulations like Abilify Asimtufii to offset patent expirations, the transition period presents a considerable hurdle. Successfully shifting patient and market share to these new products while maintaining overall sales momentum will be crucial for navigating this challenging phase.

Same Document Delivered

Otsuka Holding SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It delves into Otsuka Holding's Strengths, Weaknesses, Opportunities, and Threats, providing a comprehensive overview.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing Otsuka Holding's strategic positioning and market dynamics.

Opportunities

Emerging economies, with their rapidly growing populations and increasing healthcare demands, represent a significant growth avenue for Otsuka. The company's strategic entry into markets like India with products such as POCARI SWEAT highlights its intent to capture new consumer segments and address prevalent health and wellness needs in developing regions. This expansion is crucial for diversifying revenue streams beyond established markets.

Otsuka's approach in these new territories often involves tailoring product offerings and distribution strategies to local conditions, a critical factor for success. For instance, building local manufacturing capabilities can reduce costs and improve market responsiveness, as seen with other global pharmaceutical players. This localized strategy is key to overcoming logistical and regulatory hurdles inherent in emerging markets.

By focusing on unmet medical needs and consumer wellness in these burgeoning economies, Otsuka can establish a strong foothold. Partnerships with local entities can accelerate market penetration, leveraging existing networks and regulatory knowledge. As of 2024, many emerging markets are projected to see healthcare spending growth exceeding 7% annually, presenting a substantial opportunity for companies like Otsuka to capitalize on this trend.

The increasing integration of digital health and AI presents a significant opportunity for Otsuka. For instance, AI's role in drug discovery is rapidly expanding, with some studies suggesting it can reduce discovery timelines by up to 40%. Otsuka's existing initiatives, such as its smartphone app for depression treatment and its joint research in epilepsy smart medical technology, position it well to capitalize on this trend.

By further leveraging AI in R&D, Otsuka can streamline the drug development process, potentially leading to faster market entry for new therapies. This also opens doors for personalized medicine, where patient data can be analyzed to tailor treatments, improving efficacy and patient outcomes. The global digital health market was valued at approximately $200 billion in 2023 and is projected to grow significantly, offering substantial new revenue potential for companies embracing these innovations.

Otsuka's strategic partnerships and acquisitions are key to its expansion. For example, in early 2024, Otsuka Pharmaceutical acquired worldwide rights to Cantargia's CAN10, a promising drug candidate for autoimmune diseases, demonstrating a clear intent to bolster its therapeutic pipeline. This inorganic growth strategy not only broadens its product offerings but also integrates cutting-edge technologies. The company also formed a joint venture with ICU Medical, further highlighting its proactive approach to inorganic growth and market penetration. These ventures are crucial for accelerating drug development and entering new therapeutic areas efficiently.

Growing Demand for Mental Health and Kidney Disease Therapies

Otsuka's established expertise in neuropsychiatry and nephrology taps into significant global unmet medical needs, with growing patient populations driving demand. For example, chronic kidney disease (CKD) affects an estimated 10% of the global population, a figure projected to rise.

The company's pipeline advancements, particularly in IgA nephropathy and PTSD, are strategically aligned with increasing healthcare focus on these conditions. IgA nephropathy, a common cause of kidney failure, presents a clear opportunity for innovative therapies.

Otsuka's sustained investment in these therapeutic areas reflects a commitment to addressing major social issues and positions them for substantial long-term growth. The global mental health market alone was valued at over $380 billion in 2023 and is expected to expand further.

This strategic focus on high-need areas offers a clear path to capitalize on the expanding market for specialized treatments, reinforcing their market position.

- Neuropsychiatry: Otsuka has a strong portfolio, including treatments for schizophrenia and depression, areas with persistent patient needs.

- Nephrology: The company is investing in novel therapies for kidney diseases like IgA nephropathy, a condition with limited treatment options.

- Market Growth: The global mental health market is projected to grow significantly, and the prevalence of kidney diseases continues to increase worldwide.

- Pipeline Strength: Positive developments in clinical trials for their kidney disease and mental health drug candidates enhance future revenue potential.

Advancements in Preventative Health and Personalized Nutrition

The growing global focus on preventative health and personalized nutrition presents a significant opportunity for Otsuka. This trend directly benefits their nutraceutical and consumer products divisions, as consumers increasingly seek out health-oriented solutions. For instance, brands like POCARI SWEAT and Nature Made supplements are already capitalizing on this demand. Otsuka's continued investment in innovation, such as developing new gummy supplement formats and expanding corporate wellness services, is poised to drive further growth. The global dietary supplements market, for example, was projected to reach over $230 billion by 2025, indicating a substantial and expanding customer base for Otsuka's offerings.

- Growing Consumer Demand: Increased awareness of wellness fuels demand for preventative health products.

- Strong Brand Portfolio: POCARI SWEAT and Nature Made are well-positioned to capture this market.

- Innovation Potential: Gummy supplements and corporate health services offer avenues for sustained growth.

- Market Size: The global dietary supplements market is a significant and expanding opportunity.

Otsuka's strategic expansion into emerging economies, particularly in Asia, offers substantial growth potential, driven by rising healthcare needs and increasing disposable incomes. The company’s focus on popular brands like POCARI SWEAT in markets such as India, which saw its healthcare spending grow by an estimated 7.5% in 2023, allows it to tap into new consumer bases. This geographic diversification is vital for long-term stability and revenue growth beyond its traditional markets.

The company's commitment to digital health and AI integration positions it to capitalize on the rapidly evolving healthcare landscape. For instance, advancements in AI can accelerate drug discovery, potentially reducing development timelines by up to 40% as seen in industry trends, while Otsuka’s existing digital health initiatives are already paving the way. The global digital health market, valued at approximately $200 billion in 2023, is a significant area for future revenue generation.

Otsuka's targeted investments in therapeutic areas with high unmet needs, such as neuropsychiatry and nephrology, align with significant global health trends. The growing prevalence of conditions like chronic kidney disease, affecting an estimated 10% of the global population, and the expanding mental health market, valued at over $380 billion in 2023, present clear opportunities for Otsuka's specialized treatments.

The increasing consumer demand for preventative health and wellness products, exemplified by Otsuka's nutraceutical brands like Nature Made, provides another avenue for growth. The global dietary supplements market, projected to exceed $230 billion by 2025, underscores the significant market potential for these offerings. Otsuka's innovation in formats like gummy supplements and its expansion into corporate wellness services further enhance its ability to capture this growing market segment.

Threats

A major concern for Otsuka is the upcoming patent expiration of flagship products. For instance, ABILIFY MAINTENA's patent is set to expire in October 2024, a development anticipated to significantly reduce its sales contribution. This patent cliff presents a substantial immediate threat.

The introduction of generic versions of these key drugs will inevitably lead to increased competition and price erosion. While Otsuka is working on new formulations and delivery methods, the market impact of lower-cost generics is unavoidable and will likely affect both revenue streams and market dominance.

Successfully navigating this patent expiration period and building a strong pipeline of innovative new treatments is paramount. Otsuka's ability to offset the revenue loss from expiring patents with new product launches will be crucial for maintaining its financial health and market position in the coming years.

The global pharmaceutical arena is fiercely competitive, with established giants and emerging biotechs constantly striving for dominance. This dynamic means companies like Otsuka face a continuous challenge from numerous players across virtually every therapeutic category, making it harder to stand out.

Competitors are not just present; they are actively investing billions in research and development to bring innovative therapies to market. In 2023, global pharmaceutical R&D spending was estimated to be over $240 billion, a figure expected to grow. This heavy investment fuels aggressive market strategies, including robust marketing campaigns and strategic pricing, which can directly impact Otsuka's market access and profitability.

The pressure to innovate and compete on price can lead to significant pricing pressures. For instance, in oncology, a key area for many pharma companies, the introduction of even a slightly superior treatment can dramatically shift market share and force price adjustments. This environment makes it challenging for Otsuka to maintain margins and secure favorable reimbursement for its pipeline and existing products.

Ultimately, this intensified global rivalry poses a significant threat to Otsuka's growth prospects and profitability. The constant need to out-innovate and out-market competitors, coupled with potential pricing erosion, could dampen the company's financial performance and hinder its ability to capture new market opportunities.

Healthcare reforms and increasingly stringent regulations worldwide present a significant hurdle for pharmaceutical companies like Otsuka. These changes, including government-imposed pricing controls in key markets, directly threaten profitability, especially for patented products. For instance, the U.S. Medicare Drug Price Negotiation Program, initiated in 2023, directly targets high-cost prescription drugs, potentially impacting revenues from Otsuka's key therapies.

Navigating the complex and ever-shifting regulatory environments for drug approval and reimbursement is a constant challenge. Companies must invest heavily in compliance and adapt strategies rapidly to meet diverse international standards, adding to operational costs and potentially delaying market access for new treatments.

Economic Downturns and Shifting Consumer Spending

Global economic instability, including potential recessions, poses a significant threat to Otsuka Holdings. Such conditions could directly impact consumer spending, particularly on non-essential products within their healthcare and nutraceutical segments. For instance, a downturn might see consumers cutting back on dietary supplements or functional foods, items often considered discretionary when budgets tighten. Indeed, in 2024, forecasts from organizations like the IMF indicated slower global growth, with increased downside risks, potentially dampening consumer confidence and discretionary spending across various markets where Otsuka operates.

Reduced disposable income is a primary concern, forcing consumers to prioritize essential goods over health supplements or specialized functional foods. This shift in spending habits could notably affect Otsuka's nutraceutical business, a segment that relies on consumers having surplus income to invest in their well-being beyond basic nutritional needs. For example, if inflation continues to erode purchasing power, as seen in various economies through 2024, consumers may opt for cheaper, less specialized alternatives or forgo such purchases altogether.

Furthermore, economic pressures on healthcare systems worldwide present another challenge. Governments and insurers facing budgetary constraints might implement measures to control drug spending, which could indirectly affect pharmaceutical companies like Otsuka. This could manifest as tighter reimbursement policies or increased pressure on pricing, impacting the profitability of their core pharmaceutical offerings. The ongoing discussions around healthcare cost containment in major markets throughout 2024 and projected into 2025 underscore this persistent threat.

- Economic Slowdown Impact: Global economic instability could reduce consumer spending on Otsuka's nutraceutical and non-essential healthcare products.

- Disposable Income Reduction: Lower disposable income may lead consumers to prioritize necessities over health supplements, affecting the nutraceutical segment.

- Healthcare System Strain: Economic pressures could result in reduced drug spending by healthcare systems, impacting pharmaceutical revenue.

- 2024/2025 Economic Outlook: Projections for 2024 and 2025 indicated continued global economic uncertainty, with potential for reduced consumer and governmental spending in key markets.

Supply Chain Disruptions and Geopolitical Risks

Otsuka's global reach means its supply chain is vulnerable. Geopolitical events, like the ongoing conflicts and trade tensions impacting global shipping in 2024-2025, can significantly disrupt the flow of raw materials and finished goods. These disruptions can cause manufacturing delays, driving up production costs and potentially leading to shortages of essential products like their IV solutions or pharmaceuticals. For instance, the semiconductor shortage, which continued to affect various industries into early 2025, highlights how interconnected supply chains can be impacted.

The company's efforts to mitigate these risks, such as its IV solution joint venture, are crucial. However, the inherent complexity of global logistics means that unforeseen events, such as extreme weather events impacting key production regions in late 2024, can still create bottlenecks. These issues directly affect Otsuka's ability to meet demand, potentially impacting revenue streams and, more critically, patient access to necessary treatments.

- Global Operations Vulnerability: Otsuka's extensive international presence exposes it to a wide array of potential supply chain disruptions.

- Geopolitical Impact: Ongoing geopolitical tensions and trade disputes in 2024-2025 continue to create uncertainty and logistical challenges for global manufacturers.

- Cost and Availability Concerns: Disruptions lead to increased manufacturing costs and can result in product shortages, affecting both financial performance and patient care.

- Mitigation Efforts: While joint ventures and strategic partnerships aim to bolster supply chain resilience, the dynamic nature of global risks requires continuous adaptation.

The intensifying competition within the pharmaceutical industry poses a significant threat, with rivals actively investing in R&D. Global pharmaceutical R&D spending exceeded $240 billion in 2023 and is projected to grow, fueling aggressive market strategies that could impact Otsuka's market access and pricing power.

Healthcare reforms and stringent regulations worldwide, including government-imposed pricing controls like the U.S. Medicare Drug Price Negotiation Program initiated in 2023, directly threaten Otsuka's profitability, especially for its patented products.

Economic instability and potential recessions, as indicated by slower global growth forecasts for 2024, could reduce consumer spending on Otsuka's nutraceuticals and non-essential healthcare products, impacting revenue streams.

Global supply chains are vulnerable to geopolitical events and trade tensions, which can disrupt the flow of raw materials and finished goods, leading to increased costs and potential product shortages through 2025.

SWOT Analysis Data Sources

This Otsuka Holding SWOT analysis is built upon a robust foundation of data, drawing from publicly available financial statements, comprehensive market research reports, and expert industry analysis to ensure a thorough and insightful assessment.