Otsuka Holding Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Otsuka Holding Bundle

Otsuka Holding's marketing strategy masterfully blends innovative product development, strategic pricing, global distribution, and impactful promotion. Their success hinges on a deep understanding of diverse markets and consumer needs, evident in their varied portfolio.

Dive deeper into how Otsuka's unique product pipeline, from pharmaceuticals to nutraceuticals, is positioned for maximum market penetration. Understand the pricing strategies that support their premium brand image and accessibility.

Discover the intricate details of Otsuka's distribution networks, ensuring their life-changing products reach those who need them most worldwide. Uncover the promotional tactics that build brand loyalty and drive demand.

Unlock a comprehensive, ready-to-use 4Ps Marketing Mix Analysis for Otsuka Holding. This in-depth report is perfect for business professionals, students, and consultants seeking actionable strategic insights.

Save valuable time and gain a competitive edge. Our meticulously researched and editable analysis provides a clear roadmap to understanding Otsuka's marketing prowess, enabling you to apply similar strategies to your own ventures.

Product

Otsuka Holdings' diverse healthcare portfolio is a cornerstone of its marketing strategy, encompassing pharmaceuticals, nutraceuticals, and consumer goods. This broad product offering allows them to cater to a wide spectrum of health needs, from critical disease management to everyday wellness.

In pharmaceuticals, Otsuka is recognized for its innovation in areas like central nervous system disorders, oncology, and renal diseases, demonstrating a commitment to addressing significant medical challenges. For example, their drug Abilify (aripiprazole) has been a significant revenue driver in the psychiatric field.

Beyond prescription drugs, Otsuka’s nutraceutical and consumer goods segment features popular items like POCARI SWEAT, a well-known ion supply drink, and CalorieMate, a nutritional food block. This diversification helps capture a larger share of the health and wellness market, appealing to consumers seeking to maintain their health proactively.

This multi-faceted approach to product development and market presence allows Otsuka Holdings to mitigate risks associated with any single product category and capitalize on various growth opportunities within the global healthcare landscape. Their financial reports consistently show contributions from these diverse segments, reinforcing the strength of their product mix.

Otsuka's product strategy is deeply rooted in identifying and addressing unmet medical needs. This focus guides their research and development, aiming to create novel therapies for difficult-to-treat conditions. They particularly concentrate on areas like neuropsychiatry, nephrology, and oncology.

This dedication to unmet needs translates into significant R&D investment. For instance, Otsuka has been actively developing treatments for IgA nephropathy, a kidney disease with limited therapeutic options. Their commitment to mental health also continues with ongoing research into innovative solutions for various psychiatric conditions.

In 2024, Otsuka's pipeline reflects this strategy, with several promising candidates in late-stage development for conditions where patient outcomes can be significantly improved. The company's willingness to tackle complex diseases demonstrates a commitment to long-term value creation by serving patient populations with the greatest need.

Otsuka demonstrates a strong commitment to innovation by heavily investing in research and development. In 2024, the company allocated significant resources to R&D, aiming to cultivate internal breakthroughs and broaden its future product pipeline. This sustained investment is crucial for staying competitive in the pharmaceutical industry.

Complementing its internal R&D efforts, Otsuka strategically pursues acquisitions to bolster its innovation capabilities. A prime example is the 2024 acquisition of Jnana Therapeutics, a move designed to strengthen its drug discovery platforms and diversify its existing product portfolio, bringing in new therapeutic avenues.

This combined strategy of robust internal R&D investment and targeted acquisitions ensures Otsuka maintains a consistent flow of novel and effective products. By nurturing internal discoveries and integrating external advancements, the company is well-positioned to address unmet medical needs and drive future growth.

Global Development and Localization

Otsuka's global product development strategy includes significant localization efforts, ensuring products meet specific regional needs. This approach allows them to effectively introduce and expand the market presence of their diverse portfolio, from pharmaceuticals to nutraceuticals.

A prime example of this localization is the expansion of POCARI SWEAT, Otsuka's popular ion supply drink. In 2023 and continuing into 2024, Otsuka has been actively developing its presence in markets like India, a region with a growing demand for health and wellness products. This expansion showcases their commitment to tailoring their offerings to local consumer preferences and environmental conditions.

Otsuka's focus on adapting products for specific health concerns is also evident. For instance, their pharmaceutical segment continuously researches and develops treatments for diseases prevalent in different geographical areas. This dual strategy of global reach and local adaptation is crucial for their sustained growth and market penetration.

- Global Reach with Local Flavor: Expanding POCARI SWEAT into India signifies a strategic move to tap into a large, emerging market by adapting to local tastes and health awareness.

- Targeted Health Solutions: Otsuka's pharmaceutical division prioritizes developing treatments for region-specific diseases, demonstrating a commitment to addressing diverse global health challenges.

- Nutraceutical Market Penetration: The company’s ongoing efforts to introduce and grow its nutraceutical products like POCARI SWEAT in new territories underscore a balanced approach between leveraging existing brand strength and localizing for new consumers.

- Market Adaptability: Otsuka's success hinges on its ability to balance standardized global product development with the flexibility to create niche products or variations that cater to distinct regional demands and consumer behaviors.

Commitment to Quality and Scientific Evidence

Otsuka Holding's commitment to quality and scientific evidence is a cornerstone of its marketing strategy, ensuring that all pharmaceuticals and nutraceuticals are developed and marketed with a strong foundation in rigorous scientific backing. This dedication to high quality standards is paramount in fostering trust among healthcare professionals and consumers, validating product efficacy and safety. For instance, Otsuka's investment in research and development reached approximately ¥196.9 billion (roughly $1.4 billion USD based on an exchange rate of ¥140/$) in the fiscal year ending March 2024, underscoring their commitment to science-driven innovation.

This science-first approach directly supports their core philosophy of developing products that contribute to better health globally. Their pipeline, which includes ongoing clinical trials for conditions like Alzheimer's disease and various cancers, exemplifies this commitment. The company's focus on evidence-based solutions differentiates them in a competitive market, reinforcing their brand as a reliable provider of health-enhancing products.

Key aspects of this commitment include:

- Rigorous clinical trials: Ensuring all pharmaceutical products meet stringent efficacy and safety benchmarks, with many products undergoing extensive Phase III trials before market release.

- Adherence to global quality standards: Maintaining compliance with international regulatory bodies such as the FDA, EMA, and PMDA, which often involves complex quality control processes.

- Investment in R&D: Consistently allocating significant financial resources to research and development, as seen in their substantial R&D expenditure for FY2024, to discover and validate novel therapeutic approaches.

- Transparency in data: Publishing research findings and clinical data to facilitate informed decision-making by medical professionals and regulatory agencies.

Otsuka's product strategy centers on addressing unmet medical needs, particularly in neuropsychiatry, oncology, and nephrology, exemplified by their continued development of treatments for conditions like IgA nephropathy. This focus extends to their nutraceuticals, with POCARI SWEAT and CalorieMate serving as key offerings in the broader health and wellness market. The company's investment in R&D, amounting to approximately ¥196.9 billion in FY2024, underpins this innovation-driven approach, further bolstered by strategic acquisitions like Jnana Therapeutics in 2024 to enhance their drug discovery capabilities.

| Product Category | Key Products/Therapeutic Areas | 2024/2025 Focus/Data |

|---|---|---|

| Pharmaceuticals | CNS disorders, Oncology, Renal Diseases (e.g., Abilify) | Continued development for IgA nephropathy, ongoing research in Alzheimer's, cancer; acquisition of Jnana Therapeutics (2024) to boost drug discovery. |

| Nutraceuticals & Consumer Goods | POCARI SWEAT, CalorieMate | Expansion into markets like India (2023-2024); emphasis on health and wellness for proactive health maintenance. |

| R&D Investment | Pipeline Development | ¥196.9 billion (approx. $1.4 billion USD) in FY2024; focus on novel therapies for complex diseases. |

What is included in the product

This analysis offers a comprehensive examination of Otsuka Holding's marketing mix, detailing their Product innovation, Pricing strategies, Place in the market, and Promotion efforts.

It's designed for professionals seeking to understand Otsuka Holding's strategic positioning through a deep dive into their actual marketing practices and competitive landscape.

Simplifies Otsuka's complex 4Ps strategy into actionable insights, relieving the pain of information overload for strategic decision-making.

Provides a clear, concise overview of Otsuka's marketing pillars, easing the burden of understanding and communicating their market approach.

Place

Otsuka leverages an extensive global distribution network, ensuring its pharmaceutical and nutraceutical products are accessible in key markets like North America, Europe, and Asia. This reach is built on a hybrid model, employing direct sales teams alongside strategic alliances and wholly-owned subsidiaries across numerous international locations.

The company's commitment to bolstering its worldwide supply chain is evident in strategic moves, such as its significant joint venture within the North American intravenous solutions sector. This expansion directly enhances their capacity to deliver critical medical supplies efficiently. As of early 2024, Otsuka's global presence included operations in over 20 countries, supporting diverse product portfolios.

Otsuka actively pursues strategic partnerships and joint ventures to bolster market access and supply chain resilience. A key initiative is the formation of a new North American company with ICU Medical, focused on IV solutions, which commenced operations in early Q2 2025. This collaboration is designed to expand Otsuka's reach into new territories and enhance the consistent availability of its products.

Otsuka leverages specialized sales teams to directly engage healthcare professionals, hospitals, and clinics for its pharmaceutical products. This direct engagement is crucial for conveying intricate medical information accurately and ensuring products reach the correct patient demographic via prescription pathways.

Their strategic focus on specific therapeutic areas, such as neuropsychiatry and nephrology, demands highly targeted distribution and sales efforts. For instance, Otsuka's commitment to CNS disorders, a significant market, requires a sales force deeply knowledgeable about these complex conditions.

This specialized approach aligns with the 4Ps marketing mix, specifically 'Promotion' and 'Place'. By building strong relationships with prescribers through dedicated teams, Otsuka effectively drives product adoption and maintains market presence in its key focus areas.

Retail and Consumer Channels for Nutraceuticals

Otsuka's nutraceutical and consumer goods, exemplified by POCARI SWEAT, benefit from extensive reach through diverse retail channels. These include major supermarkets, ubiquitous convenience stores, and increasingly, robust online marketplaces. This widespread distribution ensures that their products are readily available to a vast consumer base, capitalizing on existing retail networks for maximum penetration.

Otsuka is actively integrating sustainability into its consumer product distribution. A key initiative involves promoting bottle-to-bottle recycling, aiming to reduce environmental impact and foster a circular economy for their packaging. This aligns with growing consumer demand for eco-conscious brands and practices.

The company's strategy focuses on accessibility, making products like POCARI SWEAT a convenient choice for daily hydration and wellness needs. This broad market approach is a cornerstone of their retail strategy.

- Broad Retail Penetration: Otsuka leverages supermarkets, convenience stores, and online platforms for wide product availability.

- Consumer Accessibility: The strategy prioritizes making nutraceuticals and consumer products easily obtainable for everyday shoppers.

- Environmental Initiatives: Focus on sustainable distribution practices, including bottle-to-bottle recycling programs.

- Brand Presence: Ensuring key products like POCARI SWEAT are staples in the consumer's purchasing journey.

Digital Health and E-commerce Integration

Otsuka is actively enhancing its market 'place' by weaving digital health solutions and e-commerce into its strategy. This focus aims to boost patient adherence and improve health outcomes, particularly for chronic conditions. For instance, Otsuka's development of digital tools and apps, like those assisting caregivers of Alzheimer's patients, offers vital information and support, effectively extending its reach into the digital patient journey.

These digital initiatives represent a significant evolution in how Otsuka connects with its customers. By embracing e-commerce and digital platforms, the company can offer more accessible and personalized support, moving beyond traditional distribution channels. This strategic integration is crucial for staying competitive in the evolving healthcare landscape, where patient engagement and remote support are paramount. Otsuka's investment in these areas underscores a commitment to innovative patient care models.

The company's efforts in digital health are directly impacting patient support. For example, in 2024, digital health initiatives are expected to play a larger role in patient engagement strategies, with a projected growth in the global digital health market reaching over $600 billion by 2026, according to some market analyses. Otsuka is positioning itself to capture a share of this expanding market by offering tangible digital solutions.

Key aspects of Otsuka's digital health and e-commerce integration include:

- Development of patient support applications: Tools designed to monitor progress, provide educational content, and facilitate communication between patients, caregivers, and healthcare providers.

- Expansion into digital therapeutics: Exploring the use of software-based interventions to treat or manage medical conditions.

- Partnerships with digital health platforms: Collaborating with existing technology providers to enhance service delivery and reach.

- E-commerce pilot programs: Testing online sales channels for select products to improve accessibility and convenience for consumers.

Otsuka's distribution strategy for its pharmaceutical offerings relies on specialized sales teams and strategic alliances, ensuring precise delivery to healthcare professionals and institutions. This focus on targeted reach within specific therapeutic areas, such as neuropsychiatry, underscores their commitment to specialized market penetration. As of early 2024, Otsuka operated in over 20 countries, demonstrating a robust global supply chain.

For its consumer products like POCARI SWEAT, Otsuka utilizes broad retail penetration, encompassing supermarkets, convenience stores, and online platforms for maximum accessibility. This widespread availability is complemented by a growing emphasis on sustainable distribution practices, including bottle-to-bottle recycling initiatives, aligning with consumer demand for eco-friendly options.

The company is also expanding its 'place' through digital health solutions and e-commerce, aiming to enhance patient adherence and support. By developing patient support applications and exploring digital therapeutics, Otsuka is evolving its customer connection beyond traditional channels, positioning itself within the rapidly growing global digital health market, projected to exceed $600 billion by 2026.

| Product Category | Distribution Channels | Key Markets | Recent Developments (2024-2025) |

|---|---|---|---|

| Pharmaceuticals | Direct Sales Teams, Strategic Alliances, Subsidiaries | North America, Europe, Asia | Joint venture with ICU Medical for IV solutions (operational Q2 2025) |

| Nutraceuticals/Consumer Goods (e.g., POCARI SWEAT) | Supermarkets, Convenience Stores, Online Marketplaces | Global | Increased focus on bottle-to-bottle recycling programs |

| Digital Health Solutions | E-commerce Platforms, Patient Support Apps | Global (expanding) | Growth in digital health market projected over $600 billion by 2026 |

What You See Is What You Get

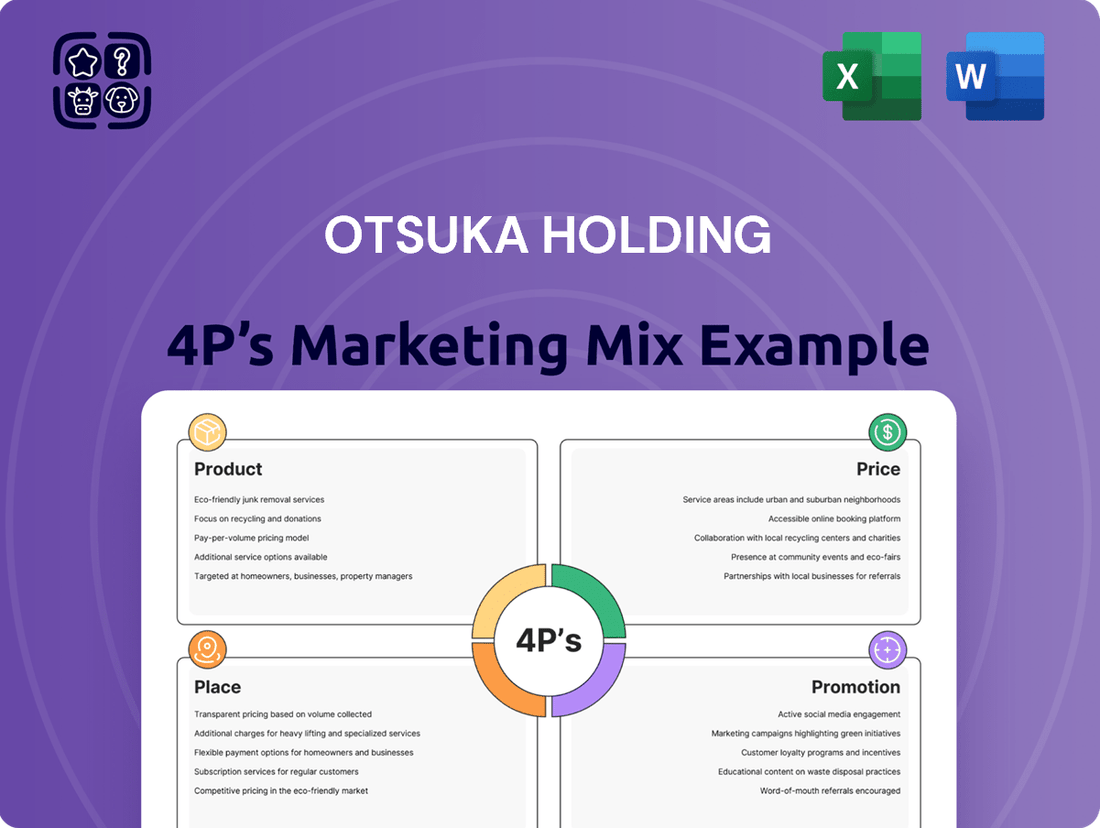

Otsuka Holding 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis delves into Otsuka Holding's Product, Price, Place, and Promotion strategies. You'll gain a clear understanding of their offerings, pricing models, distribution channels, and promotional activities. This is the same ready-made Marketing Mix document you'll download immediately after checkout, providing you with valuable insights.

Promotion

Otsuka actively fosters patient-centric awareness campaigns, focusing on diseases and treatment options for its pharmaceutical offerings. These initiatives often partner with patient advocacy groups to amplify their reach and impact.

By leveraging storytelling, such as sponsoring documentaries that explore the experiences of caregivers, Otsuka aims to humanize the challenges associated with conditions like Alzheimer's and mental health disorders.

For example, in 2024, Otsuka Pharmaceutical's continued investment in patient advocacy and disease awareness reflects a growing trend in the healthcare sector, where companies are dedicating significant resources to educational outreach programs.

This approach not only educates the public but also builds trust and empathy, crucial elements in promoting adherence to treatment plans and improving patient outcomes.

Otsuka's pharmaceutical promotion hinges on robust scientific and medical communications targeting healthcare professionals. This involves sharing pivotal clinical trial data, such as the promising Phase 3 results for their investigational drug candidate targeting Alzheimer's disease, which demonstrated significant cognitive benefits in late 2024. Engaging in comprehensive medical education programs and actively participating in major scientific congresses, like the American Academy of Neurology annual meeting, are key to highlighting the efficacy and safety profiles of their innovative treatments, fostering prescriber confidence.

Otsuka actively cultivates brand recognition and loyalty for its consumer goods, particularly in the nutraceutical sector. This strategic focus on brand building is crucial for differentiating its products in a competitive market.

The company employs a multi-faceted approach, utilizing traditional advertising alongside modern digital campaigns. Sponsorships and public relations also play a significant role in shaping consumer perception and fostering positive associations with their brands.

A prime illustration of this strategy is Otsuka's global partnership with World Athletics, prominently featuring POCARI SWEAT. This association positions the beverage as an ideal hydration choice for athletes and event attendees, reaching a wide, health-conscious audience.

In 2023, Otsuka's pharmaceutical segment saw significant growth, with consumer products contributing to overall brand strength. While specific brand-building expenditure figures are not publicly itemized, the consistent investment in such initiatives underscores their importance to the company's long-term success and market penetration.

Digital Marketing and Content Creation

Otsuka Holdings leverages digital marketing extensively to connect with its diverse audiences. This strategy involves actively using social media platforms, targeted online advertising, and robust digital content creation to disseminate information and engage consumers. For instance, in 2024, digital ad spend across various platforms supported campaigns promoting their pharmaceutical and nutraceutical offerings, aiming for a wide digital footprint.

A key component of their digital promotion is the development and launch of new digital resources and applications. These tools are designed to offer valuable information and support, particularly for caregivers, enhancing user experience and brand loyalty. This focus on digital utility underscores their commitment to innovation beyond traditional product offerings.

Their digital marketing efforts in 2024 and projected into 2025 are multifaceted, aiming to build brand awareness and provide accessible health solutions. Key digital initiatives include:

- Social Media Engagement: Active presence on platforms like X (formerly Twitter) and Facebook, sharing health tips and company updates.

- Online Advertising: Campaigns on Google Ads and healthcare-specific websites to reach relevant demographics.

- Digital Content Hubs: Development of informational websites and mobile applications offering disease management resources and caregiver support tools.

- Data-Driven Optimization: Continuous analysis of digital campaign performance to refine ad spend and content strategy for maximum impact.

Corporate Social Responsibility and Public Relations

Otsuka Holdings actively weaves its Corporate Social Responsibility (CSR) efforts into its public relations and promotional activities, emphasizing its dedication to global health and wellness. This commitment is evident in their sustainability initiatives, environmental conservation projects, and focused efforts on addressing critical social issues such as tuberculosis and dementia care.

These CSR actions significantly boost Otsuka's public image, reinforcing its core corporate philosophy and building trust with stakeholders. For instance, Otsuka's commitment to environmental sustainability is a key differentiator, aligning with growing consumer and investor demand for eco-conscious business practices.

In 2023, Otsuka Pharmaceutical, a key subsidiary, continued its long-standing engagement in combating infectious diseases, including its active role in tuberculosis control programs. Furthermore, the company's focus on mental health and neurological disorders, such as dementia, through research and patient support programs, demonstrates a tangible commitment to improving quality of life.

Key CSR highlights for Otsuka include:

- Sustainability Initiatives: Reducing environmental impact across operations, with specific targets for carbon emission reduction by 2030.

- Global Health Focus: Continued investment in research and development for neglected diseases and mental health conditions.

- Community Engagement: Support for local communities and health education programs worldwide.

- Ethical Practices: Upholding high standards in business conduct and transparent reporting of CSR performance.

Otsuka's promotional strategy for its pharmaceuticals emphasizes scientific communication and patient-centric awareness. By sharing clinical trial data, such as the promising Phase 3 results for their Alzheimer's candidate in late 2024, they build prescriber confidence. Concurrently, patient advocacy partnerships and storytelling humanize challenging diseases, fostering trust and treatment adherence.

Price

Otsuka's pharmaceutical segment, a key component of its overall strategy, frequently employs value-based pricing for its innovative drugs. This approach is particularly relevant for treatments addressing significant unmet medical needs, where the clinical benefits and improved patient outcomes justify higher price points. For instance, drugs like Rexulti (brexpiprazole), used for schizophrenia and depression, reflect substantial research and development expenditures, alongside the profound impact on a patient's quality of life.

The pricing of these pharmaceuticals is meticulously calculated by considering the extensive R&D investment, which can run into hundreds of millions of dollars per drug. Furthermore, the severity of the diseases treated and the demonstrable improvement in patient health and longevity are critical factors. This aligns with industry trends where efficacy and patient well-being are paramount in determining a drug's market value.

In 2023, Otsuka Pharmaceutical reported net sales of approximately ¥362.5 billion (around $2.4 billion USD at an approximate ¥150/USD exchange rate) for its pharmaceutical business. This figure underscores the significant revenue generated by its portfolio, which is heavily influenced by the value-based pricing of its specialized medications.

Otsuka likely utilizes competitive pricing for its nutraceuticals and consumer products, aiming to secure market share and attract a wide range of consumers. This strategy involves closely monitoring competitor pricing, understanding market demand fluctuations, and assessing consumer purchasing power. For instance, POCARI SWEAT's pricing would be carefully calibrated to remain appealing and accessible in a crowded beverage market.

Otsuka's reimbursement and access strategies are crucial for drug adoption. In 2024, the company continues to engage with payers and regulatory bodies globally to secure favorable formulary placement and reimbursement terms for its innovative treatments, especially for psychiatric and neurological conditions.

Navigating the varied healthcare landscapes of key markets like the US, Europe, and Japan requires tailored approaches. Otsuka's 2024 efforts focus on demonstrating the long-term value and cost-effectiveness of its therapies to ensure broad patient access, a critical component of their market penetration.

The company actively participates in health technology assessments and evidence-based discussions to support reimbursement negotiations. For instance, securing reimbursement for new oncology drugs in 2025 will likely involve robust real-world evidence showcasing improved patient outcomes and reduced overall healthcare burden.

Global and Regional Pricing Variations

Otsuka's pricing strategies are highly localized, reflecting significant variations in economic conditions, healthcare reimbursement policies, and regulatory frameworks across different global markets. For instance, drug pricing in developed markets like the United States often differs substantially from pricing in emerging economies or European countries with national health services.

The company navigates a complex web of international trade policies, including tariffs and price controls, which directly influence its pricing decisions. This necessitates a dynamic approach to pricing to remain competitive and accessible.

- Regional Price Disparities: Otsuka's flagship products, such as Abilify (aripiprazole), have historically shown significant price differences. For example, in 2024, the average wholesale price for a 30-day supply of Abilify in the US could range from $300 to over $1,500 depending on the formulation and dosage, while in many European countries, similar treatments, often covered by national health insurance, might have a significantly lower out-of-pocket cost or a negotiated reimbursement price.

- Economic Factor Impact: Gross Domestic Product (GDP) per capita is a key indicator. In 2023, Japan's GDP per capita was approximately $34,000, while countries like India had a GDP per capita around $2,600. This economic disparity directly impacts the affordability and thus the pricing strategy for Otsuka's pharmaceuticals in these respective markets.

- Competitive Landscape: The presence and pricing of generic alternatives or competitor drugs heavily influence Otsuka's pricing. In markets where generic competition is robust, pricing strategies must be more aggressive to maintain market share.

- Regulatory Influence: Pharmaceutical pricing is often subject to governmental review and negotiation. For example, the Inflation Reduction Act in the US, implemented in stages from 2022, allows Medicare to negotiate prices for certain high-cost drugs, which will likely impact Otsuka's US pricing strategies for eligible products in the coming years.

Investment in R&D Impact on Pricing

Otsuka's significant commitment to research and development, including strategic acquisitions of biotech companies, fundamentally shapes its product pricing. For instance, the company's robust pipeline development, often requiring billions in investment for novel drug discovery and clinical trials, means that successful therapies must be priced to ensure a return on this substantial outlay and to finance ongoing innovation.

This approach aligns with the pharmaceutical industry's pricing structure, where the high cost of bringing a new drug to market, from initial research to regulatory approval, is a primary driver of its final price. Otsuka's ongoing R&D expenditure, a critical component of its long-term strategy, directly translates into the value proposition and pricing of its innovative treatments.

- R&D Investment: Otsuka’s R&D spending is a major factor in its pricing strategy.

- Biotech Acquisitions: Acquiring biotech firms adds to R&D costs, influencing pricing.

- Recouping Investment: Breakthrough therapies are priced to recover high development expenses.

- Funding Future Innovation: Pricing models aim to provide capital for subsequent research and development.

Otsuka's pricing for pharmaceuticals, especially innovative treatments, is predominantly value-based, reflecting extensive R&D investment and significant patient benefit. For instance, drugs like Rexulti exemplify this, with pricing justified by clinical impact and quality-of-life improvements. In 2023, Otsuka Pharmaceutical's pharma segment generated ¥362.5 billion in net sales, highlighting the revenue power of these specialized, value-driven medications.

4P's Marketing Mix Analysis Data Sources

Our Otsuka Holding 4P's Marketing Mix Analysis is built on a foundation of publicly available data, including financial reports, investor relations materials, and official company announcements. We also incorporate insights from reputable industry publications and market research reports to provide a comprehensive view.