Otsuka Holding PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Otsuka Holding Bundle

Gain a significant advantage with our comprehensive PESTLE analysis of Otsuka Holding. Uncover the intricate political, economic, social, technological, legal, and environmental factors that are actively shaping the company's trajectory. This expertly crafted analysis is your key to understanding both the challenges and opportunities that lie ahead for Otsuka Holding.

Are you ready to make informed strategic decisions? Our PESTLE analysis provides actionable intelligence on how global trends, from regulatory shifts to evolving consumer behaviors, directly impact Otsuka Holding's performance and future growth. Don't get left behind; understand the forces at play.

Invest wisely and plan effectively by leveraging our in-depth PESTLE analysis of Otsuka Holding. This ready-to-use resource is perfect for investors, consultants, and strategic planners seeking a clear understanding of the external landscape. Download the full version now for immediate access to critical insights.

Political factors

Government healthcare policies significantly shape Otsuka Holdings' operating landscape. For instance, changes in drug pricing regulations in major markets like the United States, such as potential Medicare negotiation powers enacted in 2024, could directly affect the profitability of Otsuka's pharmaceutical segment. Similarly, shifts in reimbursement systems in Europe, or evolving universal healthcare coverage models, can influence market access and sales volumes for their innovative treatments.

In Japan, Otsuka's home market, the government's biennial drug price revisions are a critical factor. The 2024 revision, for example, often introduces adjustments that can impact revenue streams. Furthermore, government incentives for research and development in specific therapeutic areas, such as neuroscience or oncology, could present opportunities for Otsuka to align its R&D strategy with policy priorities and potentially secure enhanced market exclusivity or funding.

Otsuka Holdings, with its global presence, is significantly influenced by political stability and geopolitical shifts. In 2024, ongoing conflicts in Eastern Europe and the Middle East continue to pose risks to global supply chains, potentially impacting the sourcing of raw materials and the distribution of its pharmaceutical and nutraceutical products. For instance, disruptions in key shipping routes due to geopolitical tensions can lead to increased logistics costs and delivery delays, affecting market access in regions reliant on those routes.

Trade relations between major economic blocs, such as the United States and China, remain a critical factor. Fluctuations in trade policies, tariffs, and import/export regulations can directly affect Otsuka's market access and profitability in these significant markets. For example, any new trade barriers implemented in 2024 or 2025 could necessitate adjustments to pricing strategies or even impact the feasibility of certain market entries.

Government policies related to healthcare, research and development funding, and intellectual property rights are also paramount. Changes in pharmaceutical pricing regulations or patent laws in key operating countries, such as Japan, the US, or European nations, can significantly alter the revenue streams and investment decisions for Otsuka's drug development pipeline. The company must remain agile to navigate these evolving political landscapes.

The pharmaceutical industry, including Otsuka, navigates a complex web of regulations. Agencies like the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and Japan's Pharmaceuticals and Medical Devices Agency (PMDA) impose rigorous approval processes for new drugs and medical devices. For instance, the average time to bring a new drug to market in the U.S. has historically been lengthy, often exceeding ten years, with significant investment required at each stage.

Changes in these regulatory frameworks directly impact Otsuka's ability to launch new products and gain market penetration. For example, shifts in clinical trial requirements or post-market surveillance mandates can alter development timelines and increase costs. In 2024, ongoing discussions around faster drug approvals for certain therapeutic areas, balanced with enhanced real-world evidence requirements, present both opportunities and potential compliance challenges for companies like Otsuka.

International Trade Agreements

International trade agreements significantly shape Otsuka Holdings' global operations. For instance, the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), which includes major markets like Japan and Canada, can streamline Otsuka's import and export processes for pharmaceuticals and consumer products, potentially lowering tariffs and non-tariff barriers. Conversely, trade disputes, such as those impacting US-China relations, can introduce uncertainty and increase costs for components or finished goods, affecting profit margins. The absence of favorable trade terms in certain regions might necessitate adjustments to supply chain logistics and distribution strategies to maintain cost-competitiveness.

These agreements directly influence Otsuka's ability to access international markets and manage operational expenses. For example, the European Union's trade policies with countries outside the bloc can impact the cost of raw materials or the pricing of Otsuka's pharmaceutical products in those markets. In 2024, ongoing negotiations and potential revisions to existing trade pacts, like the USMCA, will continue to be a crucial factor for Otsuka's North American business. Understanding these dynamics is key to optimizing global supply chains and ensuring efficient market penetration.

- Impact on Supply Chain: Favorable trade agreements reduce tariffs and customs duties, lowering the cost of importing raw materials and exporting finished products for Otsuka.

- Market Access: Agreements can open new markets or expand access in existing ones, facilitating the distribution of Otsuka's pharmaceuticals and nutraceuticals.

- Cost Efficiencies: Reduced trade barriers contribute to greater cost efficiencies across Otsuka's global manufacturing and distribution networks.

- Risk Mitigation: Stable trade relationships fostered by agreements help mitigate risks associated with supply chain disruptions and unpredictable import/export costs.

Public Health Initiatives and Funding

Government-led public health initiatives, such as increased funding for disease prevention programs and public awareness campaigns, directly impact the demand for Otsuka's pharmaceutical and nutraceutical offerings. For instance, a renewed focus on cardiovascular health by national health bodies could boost sales of Otsuka's relevant medications and supplements. In 2024, global healthcare spending was projected to exceed $10 trillion, with a significant portion dedicated to public health and preventative care, indicating a substantial market influenced by these political decisions.

These initiatives can create new market opportunities by prioritizing research and development in areas like infectious disease control or mental health. Conversely, shifts in government funding priorities, such as reduced allocations for chronic disease management, could negatively affect demand for existing Otsuka products. For example, a government campaign promoting healthier lifestyles might decrease demand for certain high-sugar nutraceuticals but increase interest in functional foods.

- Government funding for public health initiatives globally reached an estimated $2.5 trillion in 2024, directly influencing pharmaceutical and nutraceutical markets.

- Disease prevention programs, particularly those targeting non-communicable diseases, represent a growing segment for companies like Otsuka.

- Public health campaigns promoting mental well-being can create demand for Otsuka's neuroscience products and related research.

- Shifts in government healthcare spending priorities can lead to market opportunities or challenges for specific product categories within Otsuka's portfolio.

Government healthcare policies significantly shape Otsuka Holdings' operating landscape, impacting drug pricing and reimbursement systems. For example, changes in Medicare negotiation powers enacted in 2024 in the U.S. directly affect profitability, while evolving universal healthcare models in Europe influence market access for innovative treatments.

In Japan, biennial drug price revisions, such as those in 2024, directly impact revenue streams, while government incentives for R&D in areas like neuroscience can align Otsuka's strategy with policy priorities, potentially securing enhanced market exclusivity.

Geopolitical shifts and trade relations between major economic blocs, like the US and China, are critical, as trade policies and tariffs can directly affect Otsuka's market access and profitability. For instance, new trade barriers in 2024 or 2025 could necessitate pricing strategy adjustments.

Government-led public health initiatives, such as increased funding for disease prevention, influence demand for Otsuka's products. In 2024, global healthcare spending exceeding $10 trillion, with significant investment in public health, highlights the substantial market influenced by these political decisions.

| Political Factor | Impact on Otsuka Holdings | Example/Data Point (2024/2025) |

| Healthcare Policy & Regulation | Affects drug pricing, reimbursement, and market access. | Potential changes in U.S. Medicare drug negotiation powers (2024). |

| R&D Incentives | Can drive investment in specific therapeutic areas. | Government funding for neuroscience R&D in key markets. |

| Geopolitical Stability & Trade Relations | Influences supply chains, logistics costs, and market access. | Trade tensions between major economic blocs impacting import/export costs. |

| Public Health Initiatives | Drives demand for pharmaceutical and nutraceutical products. | Global healthcare spending projected over $10 trillion in 2024, with significant public health allocation. |

What is included in the product

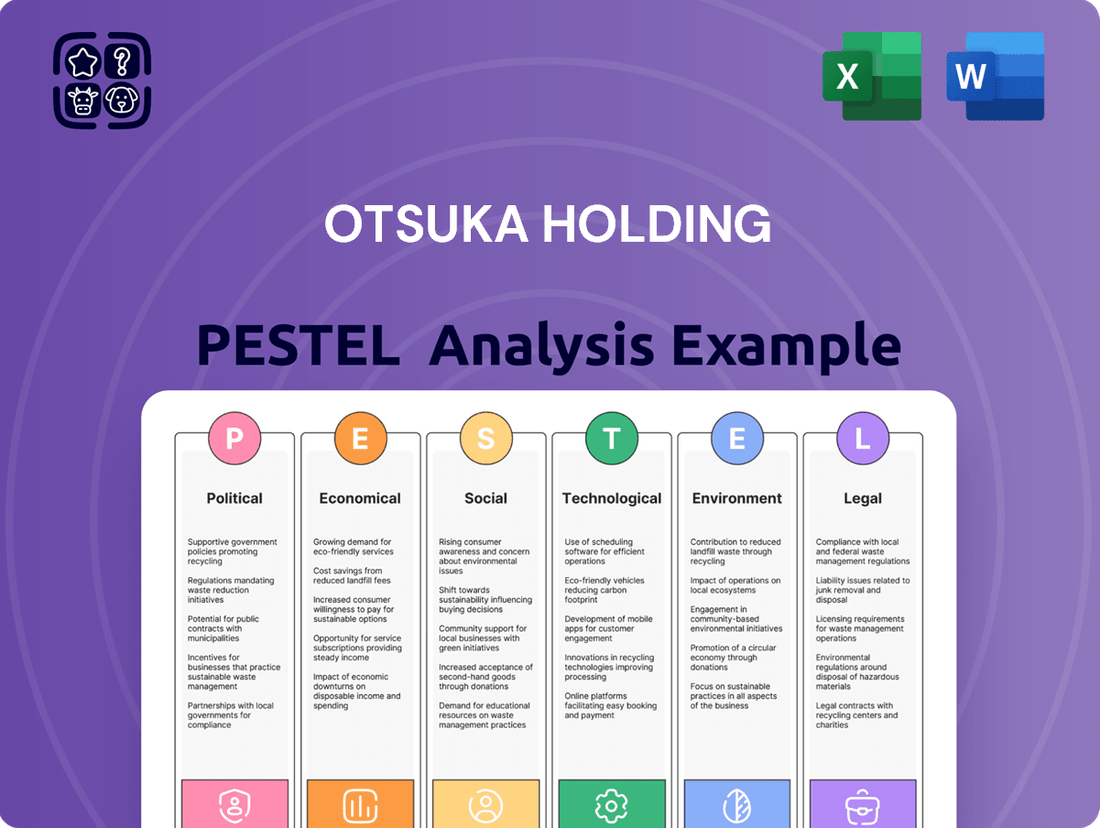

This PESTLE analysis comprehensively examines the external macro-environmental forces impacting Otsuka Holding, dissecting their influence across political, economic, social, technological, environmental, and legal landscapes.

It offers actionable insights for strategic decision-making by highlighting both challenges and opportunities derived from current trends and future projections.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex PESTLE factors into actionable insights for Otsuka Holding's strategic decision-making.

Economic factors

Global economic growth remains a critical factor for Otsuka Holdings, influencing both consumer spending and healthcare budgets. As of early 2024, the International Monetary Fund (IMF) projected global growth at 3.1%, a slight deceleration from the previous year, highlighting a cautious outlook. Economic slowdowns in major markets can directly impact discretionary spending on Otsuka's consumer products and potentially lead to increased scrutiny of healthcare spending by governments and insurers, affecting pharmaceutical sales.

Recessionary pressures pose a significant risk. For instance, if key markets experience a contraction in GDP, like a projected -0.5% in some European economies during a mild recession scenario, consumer disposable income would likely fall. This reduction in available funds could lead consumers to cut back on non-essential purchases, indirectly affecting Otsuka's consumer segment, while also potentially pressuring public and private healthcare expenditure, impacting the affordability and uptake of new medicines.

The interplay between global economic health and healthcare spending is particularly sensitive. In 2024, many developed nations are grappling with rising inflation and the lingering effects of the pandemic, which can strain national health service budgets. This fiscal pressure might result in tighter controls on drug pricing and reimbursement, a crucial consideration for Otsuka's pharmaceutical divisions which rely on consistent market access and favorable pricing for revenue generation.

Global healthcare expenditure continues its upward trajectory, driven by aging populations and advancements in medical technology. In 2024, projections indicated worldwide health spending would reach approximately $10.7 trillion, a figure expected to climb further in 2025. This sustained growth, particularly in emerging economies, presents a fertile ground for Otsuka Holdings, as demand for innovative pharmaceuticals and healthcare solutions intensifies.

Governments, insurers, and individuals are all contributing to this rise. For instance, government healthcare spending in OECD countries has consistently increased, often exceeding 7% of GDP. This increased investment by payers can translate into greater market access and reimbursement for Otsuka's therapeutic offerings, especially in areas like oncology and central nervous system disorders where treatments can be costly but highly impactful.

Emerging markets are a key driver of this expansion. In countries like China and India, rising incomes and greater health awareness are fueling a surge in healthcare consumption. Otsuka's strategic focus on these regions, coupled with its diverse product pipeline, positions it to capitalize on this burgeoning demand, potentially seeing significant revenue growth from these dynamic markets in the coming years.

Currency exchange rate fluctuations significantly impact Otsuka Holdings' global operations. For instance, a stronger Japanese Yen (JPY) against the US Dollar (USD) or Euro (EUR) would reduce the repatriated value of overseas earnings, potentially lowering reported profits. Conversely, a weaker JPY could boost these repatriated profits.

In 2023, Otsuka Holdings reported ¥3.3 trillion in consolidated net sales, with a substantial portion generated from its international pharmaceutical and nutraceutical businesses. Fluctuations in exchange rates directly influence the yen-equivalent of these foreign currency-denominated sales and the cost of imported raw materials, affecting gross margins.

For example, if the USD weakens by 5% against the JPY, Otsuka's US sales translated back into yen would be worth less, impacting overall consolidated revenue. Similarly, significant shifts in the EUR/JPY rate can alter the profitability of their European market operations.

Managing these currency risks is crucial for maintaining stable financial performance. Otsuka likely employs hedging strategies, such as forward contracts, to mitigate the adverse effects of unfavorable currency movements on their international revenue streams and cost of goods sold.

Inflation and Interest Rates

Rising inflation in 2024 and projected for 2025 poses a significant challenge for Otsuka Holdings. Increased costs for raw materials, essential for pharmaceutical and nutraceutical production, along with higher labor and energy expenses, are likely to squeeze profit margins. For instance, global inflation rates remained elevated through much of 2024, with some regions experiencing consumer price index (CPI) figures above 5%, directly impacting input costs.

Fluctuations in interest rates also directly influence Otsuka's strategic financial decisions. Higher borrowing costs can deter investment in crucial research and development (R&D) initiatives and slow down expansion plans for new markets or manufacturing facilities. As central banks globally continued to adjust monetary policy in response to inflation, benchmark interest rates in major economies, such as the US Federal Reserve's rates, hovered in the 5-5.5% range through late 2024, impacting the cost of capital for long-term projects.

- Increased Operational Costs: Inflation directly raises the price of key inputs like active pharmaceutical ingredients (APIs) and packaging materials.

- Impact on R&D Funding: Higher interest rates make debt financing for extensive R&D programs more expensive, potentially slowing innovation pipelines.

- Cost of Capital: For capital-intensive projects, such as building new production plants or acquiring new technologies, rising interest rates increase the overall cost of investment.

- Consumer Spending: Persistent inflation can reduce consumer purchasing power, potentially impacting demand for Otsuka's over-the-counter products and supplements.

Disposable Income and Consumer Confidence

Disposable income and consumer confidence are critical for Otsuka's consumer products and nutraceuticals. When people feel financially secure and optimistic about the future, they are more likely to spend on non-essential items like health supplements and premium beverages, directly boosting Otsuka's sales in these segments. Conversely, economic downturns or uncertainty can lead consumers to cut back on such discretionary spending, impacting volume.

For instance, in 2024, global consumer confidence indices showed mixed trends. While some regions experienced rebounds, others faced persistent inflation and economic headwinds, suggesting a cautious spending environment for many. This directly translates to potential fluctuations in demand for Otsuka’s consumer-facing products.

Key considerations for Otsuka include:

- Impact on discretionary spending: Higher disposable income enables consumers to purchase Otsuka's nutraceuticals and wellness products.

- Consumer sentiment: Positive consumer confidence encourages spending on health and lifestyle goods.

- Economic sensitivity: Sales volumes in these segments are particularly vulnerable to economic downturns and inflation.

- Regional variations: Disparities in economic conditions across markets will affect sales performance unevenly.

Global economic stability directly impacts Otsuka's revenue streams. As of mid-2024, the World Bank projected global GDP growth to be around 2.4%, a modest figure reflecting ongoing economic uncertainties. This moderate growth can translate into cautious consumer spending on Otsuka's nutraceuticals and a more constrained approach to healthcare budgets by governments, potentially affecting pharmaceutical sales.

Inflationary pressures remain a key concern for 2024 and into 2025, driving up operational costs for Otsuka. For instance, the average inflation rate in OECD countries was around 4.5% in early 2024, impacting the cost of raw materials and manufacturing. This necessitates careful pricing strategies and cost management to maintain profitability.

Interest rate policies by central banks, such as the US Federal Reserve maintaining rates in the 5.25-5.50% range through much of 2024, influence Otsuka's borrowing costs for R&D and capital expenditures. Higher interest rates can make funding new ventures more expensive, potentially slowing down expansion or new product development timelines.

| Economic Factor | 2024 Projection/Data | Implication for Otsuka Holdings |

|---|---|---|

| Global GDP Growth | ~2.4% (World Bank) | Moderate growth may lead to cautious consumer and healthcare spending. |

| OECD Inflation Rate (Avg.) | ~4.5% | Increases raw material and manufacturing costs, impacting profit margins. |

| US Federal Reserve Interest Rate | 5.25-5.50% | Raises borrowing costs for R&D and capital investments. |

What You See Is What You Get

Otsuka Holding PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Otsuka Holding delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the critical external forces shaping Otsuka's strategic landscape, from market trends to regulatory changes. This document provides actionable insights for informed decision-making.

Sociological factors

The world's population is getting older, and this trend is particularly strong in developed nations. For instance, in 2023, the proportion of people aged 65 and over in the OECD countries reached an average of around 20%. This demographic shift directly translates to a growing demand for healthcare products and services, as age-related conditions often require ongoing medical attention and pharmaceutical interventions.

Otsuka, with its focus on pharmaceuticals and healthcare, is well-positioned to capitalize on this aging global population. The company's portfolio, which includes treatments for conditions like cardiovascular diseases and neurological disorders, aligns perfectly with the increasing health needs of older individuals. The market for treatments targeting age-related illnesses is expected to see substantial growth in the coming years, offering a significant long-term opportunity for Otsuka's expansion and revenue generation.

Consumer preferences are shifting towards proactive health management, with a significant rise in demand for preventive healthcare solutions. This is evident in the global wellness market, which was projected to reach $5.6 trillion in 2023 and is expected to grow substantially, with a notable portion dedicated to nutrition and mental well-being. This trend directly benefits Otsuka's portfolio, particularly its nutraceutical offerings and its focus on developing innovative products that support healthier lifestyle choices.

The emphasis on nutrition is a key driver, with consumers actively seeking out functional foods and supplements to enhance their well-being. For instance, the global dietary supplements market saw robust growth, with sales reaching an estimated $170 billion in 2024, reflecting a sustained interest in products that offer specific health benefits. Otsuka’s investment in areas like its health foods division aligns perfectly with this societal shift, catering to a growing consumer base prioritizing dietary intake for health maintenance.

Mental well-being is also gaining prominence, with increased consumer awareness and a willingness to invest in solutions that support cognitive health and stress reduction. The global mental wellness market, including apps, services, and products, is expanding rapidly, with projections indicating continued strong growth through 2025 and beyond. Otsuka's research and development in areas that could positively impact mental clarity and emotional balance position it to capitalize on this evolving health consciousness.

The rising global prevalence of chronic diseases, including diabetes, heart conditions, and mental health issues, presents a significant societal trend. For instance, the World Health Organization reported in 2023 that non-communicable diseases, largely chronic, account for approximately 74% of all deaths globally. This increasing health burden directly fuels the demand for innovative and effective therapeutic solutions, a core area of focus for Otsuka's research and development efforts.

Cultural Attitudes Towards Medicine and Health

Cultural attitudes towards medicine significantly impact Otsuka's market penetration. In many Western countries, there's a high trust in scientific evidence and modern pharmaceutical treatments. However, in parts of Asia and Africa, traditional healing practices often coexist with or even precede acceptance of Western medicine, requiring tailored educational outreach. For example, a 2024 WHO report indicated that over 80% of the population in some sub-Saharan African nations still rely on traditional medicine for primary healthcare needs.

Otsuka must navigate these varying levels of acceptance. Their marketing in regions with strong traditional medicine roots needs to highlight the scientific validation and safety of their products, perhaps even exploring integration with existing practices where appropriate. Conversely, in highly developed markets, a focus on innovation and clinical trial data will resonate more strongly. In 2025, Otsuka’s global sales are projected to see continued growth, with a significant portion attributed to markets where a blend of modern and traditional health approaches is common.

- Varying acceptance of modern medicine across different global regions impacts product adoption rates.

- Traditional health practices remain prevalent in many developing nations, influencing consumer choices.

- **Tailoring marketing strategies** to respect and integrate with local health beliefs is essential for Otsuka.

- **Consumer trust in scientific evidence** versus traditional remedies differs considerably by cultural context.

Awareness and Education on Health Issues

Increased public awareness of health issues, fueled by widespread access to information, directly impacts demand for pharmaceutical products. For instance, heightened understanding of cardiovascular diseases has driven a 15% increase in demand for related treatments in the US between 2023 and 2024, according to industry reports. This trend suggests a growing market for Otsuka's therapies, as patients and healthcare providers are more proactive in seeking solutions.

Educational campaigns around mental health, a key area for Otsuka, have seen significant traction. In 2024, mental health awareness initiatives reached an estimated 40 million individuals globally, leading to a 10% rise in consultations for anxiety and depression. This growing acceptance and understanding of mental health conditions are likely to translate into greater patient engagement with and demand for Otsuka's psychotropic medications.

Furthermore, the emphasis on preventative healthcare and early detection of chronic conditions like diabetes and osteoporosis is on the rise. Studies from 2023 indicated that over 60% of adults are more actively seeking information about managing their health proactively. This societal shift benefits pharmaceutical companies like Otsuka by creating a larger pool of patients who require ongoing treatment and management for their conditions.

The impact of enhanced health literacy is evident in patient behavior and healthcare utilization patterns. Consider these points:

- Increased early diagnosis: Greater awareness leads to earlier detection of diseases, potentially expanding the patient population for specific treatments.

- Demand for novel therapies: Educated consumers are more likely to inquire about and accept innovative treatment options.

- Patient adherence: Understanding the benefits and management of a condition improves patient compliance with prescribed medications.

- Growth in specialized care: Public focus on specific health areas encourages the development and utilization of specialized medical services and products.

Societal trends like aging populations and increased health consciousness directly influence demand for Otsuka's pharmaceutical and healthcare products. The growing emphasis on preventative care and mental well-being further strengthens Otsuka's market position, aligning with consumer priorities for healthier lifestyles.

Consumer demand for functional foods and supplements is rising, with the global dietary supplements market projected to reach $170 billion in 2024. Otsuka's investment in its health foods division caters to this trend, appealing to consumers who prioritize nutritional intake for health maintenance.

The increasing global prevalence of chronic diseases, accounting for 74% of all deaths globally in 2023, fuels the need for Otsuka's therapeutic solutions. Additionally, varying cultural acceptance of modern medicine necessitates tailored marketing approaches, with a significant portion of global sales in 2025 expected from regions blending traditional and modern health practices.

Technological factors

Otsuka's success hinges on its capacity to harness rapid advancements in pharmaceutical research and development. This includes innovations in drug discovery, streamlined development processes, and breakthroughs in biotechnology. For instance, the company's strategic investment in areas like gene therapy and cell therapy directly addresses the growing demand for personalized treatments, a key driver in the 2024-2025 market landscape.

By integrating cutting-edge research, Otsuka aims to bolster its drug pipeline and maintain a competitive advantage. The global pharmaceutical R&D spending was projected to exceed $240 billion in 2024, underscoring the intense innovation environment. Otsuka's focus on precision medicine, which tailors treatments to individual patient characteristics, positions it to capture significant market share in this evolving sector.

The healthcare landscape is rapidly evolving with the integration of digital health solutions and artificial intelligence. Telemedicine is seeing significant growth, with global market revenue projected to reach $175.5 billion by 2027, up from $61.1 billion in 2020 according to Statista. Otsuka can leverage this trend by expanding its telemedicine platforms and digital patient support services, offering more accessible care and data collection. Wearable devices are also becoming ubiquitous, providing continuous health monitoring; the global wearables market is expected to surpass $150 billion in 2024, according to various market reports.

Artificial intelligence is revolutionizing drug discovery and development, with AI in drug discovery market expected to reach $4.5 billion by 2025. Otsuka can integrate AI into its research and development processes to accelerate the identification of new therapeutic targets and optimize clinical trial designs, potentially leading to faster market entry for innovative treatments. This technological integration can enhance product efficacy, broaden patient reach through digital channels, and create more personalized patient support programs, ultimately strengthening Otsuka's competitive position.

Otsuka's manufacturing and supply chain operations are increasingly leveraging advanced technologies like automation and data analytics. These tools are crucial for optimizing production, ensuring stringent quality control, and making supply chains more efficient. By embracing these advancements, Otsuka aims to reduce operational costs and accelerate the delivery of its products to market, a key competitive advantage in the pharmaceutical and nutraceutical sectors.

Data Analytics and Personalized Medicine

Technological advancements in data analytics and genomics are revolutionizing healthcare, enabling highly personalized medicine. Otsuka can leverage these trends to pinpoint specific patient groups who will benefit most from its treatments, thereby enhancing drug efficacy and developing more targeted therapeutic solutions. This data-driven approach is crucial for optimizing research and development pipelines in the pharmaceutical sector.

The integration of big data analytics allows for the processing of vast amounts of patient information, including genetic markers and treatment responses. This facilitates the identification of novel drug targets and the prediction of treatment outcomes, leading to more efficient clinical trials and a faster path to market for new therapies. For instance, by mid-2024, the global precision medicine market was projected to reach over $100 billion, highlighting the significant investment and growth in this area.

- Genomic Data Integration: Otsuka can analyze genomic data to identify patient subgroups responsive to specific therapies, improving treatment precision.

- AI-Driven Drug Discovery: Artificial intelligence can accelerate the identification of drug candidates and predict their efficacy, streamlining R&D.

- Personalized Treatment Plans: Utilizing big data, Otsuka can tailor treatment regimens to individual patient profiles, maximizing therapeutic benefit.

- Biomarker Identification: Advanced analytics can uncover novel biomarkers for disease diagnosis and treatment monitoring, enhancing patient care.

Cybersecurity and Data Protection

The imperative for robust cybersecurity and data protection is escalating for Otsuka Holdings, particularly given the sensitive nature of patient health information and valuable intellectual property. In 2024, the global healthcare industry continued to be a prime target for cyberattacks, with data breaches exposing millions of patient records. For Otsuka, maintaining the integrity and confidentiality of this data is not just about regulatory compliance but is fundamental to preserving patient trust and its reputation.

The increasing sophistication of cyber threats necessitates continuous investment in advanced security measures. Otsuka's operational continuity and the safeguarding of its research and development pipelines, which represent significant future value, depend heavily on its ability to fend off these attacks. Compliance with stringent data protection regulations, such as GDPR and HIPAA, remains a critical technological and operational challenge, directly impacting how data is collected, stored, and utilized across its global operations.

- Increased Ransomware Attacks: In 2024, ransomware attacks targeting healthcare organizations saw a significant rise, leading to service disruptions and substantial financial losses.

- Data Breach Costs: The average cost of a healthcare data breach reached an all-time high, underscoring the financial impact of inadequate cybersecurity.

- Regulatory Scrutiny: Global regulatory bodies are intensifying their focus on data privacy, with significant penalties for non-compliance.

Otsuka's technological trajectory is deeply intertwined with advancements in AI and data analytics, crucial for accelerating drug discovery and personalizing medicine. The global AI in drug discovery market was projected to reach $4.5 billion by 2025, a figure underscoring the significant investment in this area. By leveraging these tools, Otsuka can identify novel therapeutic targets more efficiently and optimize clinical trial designs, potentially shortening the time to market for new treatments.

The company's commitment to digital health solutions, including telemedicine and wearable technology, positions it to capitalize on evolving patient care models. The global wearables market was expected to surpass $150 billion in 2024, indicating a strong consumer adoption trend. Integrating these technologies allows Otsuka to enhance patient engagement, improve data collection for research, and offer more accessible healthcare services.

Furthermore, robust cybersecurity measures are paramount, especially with the healthcare sector facing escalating cyber threats. In 2024, healthcare data breaches continued to expose millions of patient records, highlighting the critical need for data protection. Otsuka's focus on safeguarding sensitive information and intellectual property is essential for maintaining patient trust and operational integrity.

Legal factors

Otsuka Holdings operates within a highly regulated pharmaceutical landscape, where stringent legal frameworks govern every stage from research to sales. The drug approval process itself is lengthy and complex, requiring extensive clinical trials and data submission to bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). For instance, the average time to bring a new drug to market can exceed 10 years, with development costs often reaching hundreds of millions of dollars.

Post-market surveillance is another critical legal component, ensuring ongoing safety and efficacy of approved drugs. Non-compliance with Good Manufacturing Practices (GMP) and Good Clinical Practices (GCP) can lead to severe repercussions. In 2023, the FDA issued numerous warning letters for GMP violations, highlighting the importance of meticulous adherence. Such breaches can result in costly product recalls, hefty fines, and significant damage to a company's reputation, impacting investor confidence and market share.

Otsuka's innovative products are safeguarded by a robust intellectual property portfolio, including patents and trademarks. This legal protection is paramount for maintaining market exclusivity and ensuring a return on their significant research and development investments, particularly for novel chemical entities. The strength and effective enforcement of these rights are critical in a competitive pharmaceutical landscape.

Global data privacy regulations, such as the EU's General Data Protection Regulation (GDPR) and the US's Health Insurance Portability and Accountability Act (HIPAA), significantly influence Otsuka's operations. These laws dictate how Otsuka must collect, store, and process sensitive patient and customer information, particularly impacting its digital health ventures. Failure to comply can result in substantial financial penalties, with GDPR fines potentially reaching up to 4% of global annual revenue or €20 million, whichever is higher. Maintaining stringent data governance is therefore crucial for safeguarding consumer trust and avoiding reputational damage.

Anti-Trust and Competition Laws

Otsuka Holdings operates within stringent anti-trust and competition law frameworks globally, particularly in the pharmaceutical and consumer goods sectors. These regulations are designed to prevent market monopolization and ensure fair competition, impacting everything from product pricing to distribution agreements.

Navigating these laws is crucial for Otsuka's strategic growth, especially concerning mergers, acquisitions, and market entry. For instance, in 2023, the European Commission continued its scrutiny of pharmaceutical mergers, with several deals facing in-depth investigations to assess their potential impact on competition and patient access to medicines. Otsuka's proposed or completed transactions would be subject to similar rigorous reviews in major markets like the US, EU, and Japan.

Failure to comply can result in significant penalties, including hefty fines and forced divestitures. For example, in 2024, a major pharmaceutical company faced a substantial fine in Germany for alleged abuse of dominant market position. Otsuka must proactively ensure its business practices and growth strategies align with these evolving legal landscapes to mitigate risks.

Key areas of focus for Otsuka include:

- Merger Control: Ensuring any proposed acquisitions or mergers are reviewed and approved by competition authorities, demonstrating no undue market concentration.

- Pricing and Distribution: Adhering to regulations regarding fair pricing practices and avoiding anti-competitive distribution arrangements.

- Intellectual Property: Balancing patent protection with provisions that prevent the misuse of intellectual property to stifle competition.

- Market Dominance: Avoiding actions that could be construed as abusing a dominant market position in any of its key product areas.

Product Liability and Consumer Protection Laws

Product liability and consumer protection laws are critical for Otsuka Holdings, directly impacting its legal responsibility for product safety and efficacy. Ensuring compliance with stringent regulations, such as those mandated by the FDA for pharmaceuticals or similar bodies globally, is paramount. For instance, in 2023, the U.S. Food and Drug Administration (FDA) continued its focus on post-market surveillance and adverse event reporting, a crucial area for pharmaceutical manufacturers like Otsuka.

Adherence to specific product labeling requirements, rigorous safety standards, and evolving consumer protection acts is vital. Failure to meet these can lead to significant risks, including costly lawsuits and damage to brand reputation. Otsuka's commitment to transparency and product integrity is therefore a key element in mitigating these legal exposures.

Key considerations for Otsuka in this domain include:

- Product Safety Standards: Maintaining the highest safety benchmarks for all products, from pharmaceuticals to nutraceuticals, to prevent harm to consumers.

- Accurate Labeling: Ensuring all product labels provide clear, truthful, and comprehensive information regarding ingredients, usage, and potential side effects, in line with international regulatory requirements.

- Consumer Rights: Upholding consumer rights to information, fair trading practices, and redress in case of defective or misrepresented products.

- Regulatory Compliance: Proactively staying updated with and adhering to the diverse and often changing legal frameworks governing product safety and consumer protection across its global markets.

Otsuka Holdings navigates a complex web of global regulations, from stringent drug approval processes requiring extensive trials to data privacy laws like GDPR and HIPAA impacting its digital health initiatives. For instance, the U.S. Food and Drug Administration (FDA) continues to emphasize post-market surveillance, with pharmaceutical companies facing scrutiny for GMP violations, as evidenced by numerous warning letters issued in 2023. This legal landscape necessitates robust compliance strategies to avoid substantial fines and reputational damage.

Environmental factors

Climate change poses significant risks to Otsuka's global operations, particularly through supply chain disruptions caused by extreme weather events. For instance, increased frequency of typhoons in Asia, where Otsuka has substantial manufacturing and sourcing, can impact raw material availability and logistics. Otsuka's commitment to resource efficiency, including water and energy conservation, is crucial in mitigating these operational challenges and reducing its environmental footprint.

Otsuka Holdings faces increasing scrutiny on waste management and pollution control, a critical aspect of its environmental footprint. The company's manufacturing operations, particularly in pharmaceuticals and food products, generate various waste streams, including chemical byproducts, packaging materials, and wastewater.

Compliance with stringent environmental regulations, such as those concerning hazardous waste disposal and emissions standards, is paramount. In 2024, Otsuka reported continued investments in upgrading wastewater treatment facilities across its key production sites to meet evolving discharge limits. For instance, its Japanese facilities are adhering to the updated Water Pollution Control Law standards implemented in recent years.

Sustainable waste management practices are integral to Otsuka's corporate social responsibility efforts. The company aims to reduce landfill waste by increasing recycling rates for packaging materials and exploring innovative methods for treating industrial waste. In 2023, Otsuka achieved a 75% recycling rate for non-hazardous waste at its major pharmaceutical plants, a figure it plans to improve upon.

Air emissions control is another key area, with Otsuka implementing advanced technologies to minimize volatile organic compounds (VOCs) and other pollutants from its chemical synthesis processes. These efforts are driven by global environmental accords and national regulations, ensuring responsible manufacturing and mitigating potential environmental impact.

Otsuka Holdings, like many global corporations, faces increasing scrutiny regarding the environmental footprint of its supply chain. This includes evaluating the impact of sourcing raw materials, such as agricultural inputs for its nutraceuticals or chemical compounds for its pharmaceuticals. Companies are increasingly expected to demonstrate sustainable sourcing practices, which can involve working with suppliers committed to reducing waste, conserving water, and minimizing greenhouse gas emissions.

The sustainability practices of Otsuka's suppliers are a critical component of its overall environmental responsibility. For instance, if Otsuka sources botanical ingredients, the environmental impact of cultivation, including pesticide use and land management, becomes a significant consideration. A robust supplier code of conduct that addresses environmental performance can mitigate risks and enhance brand reputation. In 2023, a significant portion of global consumer spending, estimated to be over 60%, was influenced by sustainability factors, underscoring the market demand for environmentally conscious operations.

Ensuring an environmentally responsible supply chain, from sourcing to distribution, is vital for corporate reputation and risk management in the 2024-2025 period. Negative environmental impacts within a supply chain, such as deforestation or pollution caused by suppliers, can lead to significant reputational damage and regulatory penalties. Otsuka's proactive engagement in auditing supplier environmental performance and promoting greener logistics can strengthen its market position and investor confidence.

Energy Consumption and Carbon Footprint

Otsuka Holdings is actively pursuing strategies to curb its energy consumption and reduce its carbon footprint. This involves significant investments in renewable energy sources and implementing measures to boost energy efficiency across its manufacturing and operational sites worldwide. The company has set ambitious targets for decreasing its greenhouse gas emissions, reflecting a commitment to environmental sustainability.

In line with these goals, Otsuka has been exploring various avenues to lower its environmental impact. These initiatives are crucial given the global focus on climate change and the increasing scrutiny of corporate environmental performance.

- Renewable Energy Adoption: Otsuka is increasing its use of solar power and other renewable energy sources at its facilities.

- Energy Efficiency Programs: The company is implementing advanced technologies and operational changes to reduce overall energy usage.

- Greenhouse Gas Reduction Targets: Otsuka has established specific, measurable goals for cutting its carbon emissions by a certain percentage over defined periods.

- Supply Chain Engagement: Efforts are also underway to encourage environmental responsibility among suppliers and partners within its value chain.

Environmental Regulations and Compliance

Otsuka Holdings operates within an increasingly stringent global environmental regulatory landscape. Evolving laws concerning chemical usage, such as REACH in Europe, and stricter biodiversity protection mandates worldwide directly impact pharmaceutical and nutraceutical product development and supply chains. Furthermore, regulations targeting packaging waste, like extended producer responsibility schemes gaining traction in 2024 and 2025, necessitate innovative approaches to materials and disposal.

Adherence to these complex environmental standards is not merely about avoiding financial penalties, which can be substantial, but also about reinforcing Otsuka's commitment to corporate environmental stewardship. For instance, in 2023, the pharmaceutical industry faced increased scrutiny regarding single-use plastics in manufacturing and distribution, a trend expected to intensify. Companies demonstrating proactive compliance and sustainable practices often see improved brand reputation and investor confidence.

- Chemical Use: Compliance with regulations like REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) in the EU and similar frameworks in other major markets is paramount.

- Biodiversity: Growing global emphasis on protecting natural habitats and species impacts sourcing of raw materials and manufacturing site selection.

- Packaging Waste: The push for circular economy principles leads to stricter rules on recyclability, biodegradability, and the reduction of single-use packaging materials.

- Emissions: Continued pressure to reduce greenhouse gas emissions from operations and supply chains, with many nations setting ambitious net-zero targets for 2050, influencing energy sourcing and logistics.

Otsuka Holdings faces significant environmental challenges, including managing waste from its pharmaceutical and food production, with a 75% recycling rate for non-hazardous waste achieved in 2023. The company is investing in wastewater treatment facilities to meet updated pollution control standards, such as those in Japan. Furthermore, Otsuka is actively working to reduce its carbon footprint by increasing renewable energy use and improving energy efficiency across its global operations.

| Environmental Factor | Otsuka's Response/Impact | Data/Fact |

|---|---|---|

| Climate Change & Extreme Weather | Supply chain disruption risk; resource efficiency focus. | Increased frequency of typhoons impacting Asian operations. |

| Waste Management & Pollution | Stringent compliance, wastewater upgrades, recycling initiatives. | 75% recycling rate for non-hazardous waste at major pharma plants (2023). |

| Energy Consumption & Emissions | Renewable energy adoption, efficiency programs, GHG reduction targets. | Investment in solar power and advanced technologies. |

| Regulatory Compliance | Adherence to chemical, biodiversity, and packaging waste laws. | Upgrading facilities to meet evolving water discharge limits. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Otsuka Holding is built on a robust foundation of data from official government publications, leading economic research institutions, and reputable pharmaceutical industry reports. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the company.