Orapi Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Orapi Group Bundle

The Orapi Group exhibits robust strengths in its diversified product portfolio and established market presence, yet faces potential threats from evolving industry regulations. Understanding these dynamics is crucial for navigating the competitive landscape.

Dive deeper into Orapi's strategic advantages and potential vulnerabilities with our comprehensive SWOT analysis. This detailed report provides the critical context needed to anticipate market shifts and capitalize on opportunities.

Unlock the full potential of your strategic planning. Our complete Orapi Group SWOT analysis offers actionable insights and a clear roadmap for informed decision-making, empowering you to outmaneuver competitors.

Want to truly grasp Orapi's competitive edge and potential challenges? Purchase the full SWOT analysis today to gain access to an expertly crafted, editable report designed to enhance your strategic initiatives.

Don't miss out on the complete picture. Secure your copy of the Orapi Group SWOT analysis and equip yourself with the knowledge to drive growth and mitigate risks effectively.

Strengths

Orapi Group boasts an extensive product portfolio, encompassing lubricants, detergents, disinfectants, and maintenance solutions. This broad offering serves diverse sectors like food processing, healthcare, and industrial maintenance, showcasing significant technical depth. For example, their specialized lubricant additives are designed to prolong the life of machinery, a testament to their focus on product innovation. In 2023, Orapi Group reported a revenue of €520 million, underscoring the market's demand for their comprehensive solutions.

Orapi Group’s robust commitment to Research and Development is a significant strength. In 2024, the company dedicated 4.5% of its revenue to R&D, with substantial investments planned through 2025 and 2026. This focus fuels a pipeline of innovative products and enhancements.

With a global network of seven production centers and three dedicated research laboratories, Orapi ensures its R&D efforts translate effectively into market-ready solutions. This infrastructure underpins the company's ability to consistently deliver new and improved offerings, directly addressing evolving customer needs and maintaining a competitive advantage.

Orapi Group demonstrates a significant commitment to sustainability, highlighted by its 'Generation Orapi' ecological approach. This focus is validated by their Gold EcoVadis Business Sustainability Rating achieved in 2023, underscoring their dedication to environmentally responsible practices.

The financial impact of this commitment is clear, with 35% of Orapi's revenue in 2024 stemming from sustainable products. This figure directly translates the company's investment in eco-friendly solutions into tangible business success.

Furthermore, Orapi's product development prioritizes environmental safety and resourcefulness. Their offerings are engineered to be non-toxic to aquatic life and biodegradable, while also incorporating locally sourced or bio-sourced raw materials.

Global Presence and Distribution Network

Orapi Group's global presence is a significant strength, reaching over 2 million end-users worldwide. This expansive reach is supported by a robust distribution network spanning more than 100 countries.

The company effectively utilizes 32 subsidiaries and numerous local distributors to ensure broad market penetration. This established infrastructure allows Orapi Group to tap into diverse international markets, making its products and services widely accessible.

- Global Reach: Serves over 2 million end-users across more than 100 countries.

- Distribution Network: Leverages 32 subsidiaries and a network of distributors for market access.

- Market Penetration: Facilitates entry into diverse international markets through its extensive network.

- Product Accessibility: Ensures widespread availability of its offerings to a global customer base.

Strategic Acquisition and Vertical Integration

Orapi's strategic acquisition by Groupe Paredes, finalized in April 2024 with a 91% stake, is a powerful strength. This move, effective January 2025, united two entities to create a substantial combined turnover of €445 million. The resulting 'Industributeur®' model signifies a key advantage, allowing for the integration of manufacturing and distribution capabilities.

This vertical integration offers Orapi Group enhanced control over its entire value chain. Such consolidation is designed to streamline operations and potentially improve efficiency and profitability. The combined entity's scale positions it more competitively within its market.

- Strategic Consolidation: Acquisition of 91% stake by Groupe Paredes in April 2024.

- Operational Synergy: Merger effective January 2025 to streamline operations.

- Financial Scale: Combined entity boasts a turnover of €445 million.

- Value Chain Control: Establishment of an 'Industributeur®' model integrating manufacturing and distribution.

Orapi Group’s diverse product range, including lubricants, detergents, and disinfectants, caters to critical sectors like food processing and healthcare. Their revenue reached €520 million in 2023, demonstrating strong market demand for their comprehensive chemical solutions.

A significant strength lies in Orapi's substantial investment in Research and Development, allocating 4.5% of its 2024 revenue to R&D with continued investment planned for 2025-2026. This focus on innovation is supported by a global infrastructure of seven production centers and three research labs, ensuring new products are effectively brought to market.

Orapi's commitment to sustainability is underscored by its Gold EcoVadis rating in 2023 and the fact that 35% of its 2024 revenue came from sustainable products. Their products are designed with environmental responsibility in mind, being non-toxic to aquatic life and biodegradable, often utilizing locally sourced or bio-sourced materials.

The company's global footprint, serving over 2 million end-users across more than 100 countries via 32 subsidiaries and a wide distributor network, ensures broad market penetration and accessibility. This expansive reach is further solidified by the April 2024 acquisition by Groupe Paredes, creating a combined entity with a €445 million turnover, effective January 2025, and establishing an integrated 'Industributeur®' model.

| Strength Category | Key Aspects | Supporting Data/Facts |

| Product Portfolio & Market Reach | Extensive product range (lubricants, detergents, disinfectants) serving diverse sectors (food processing, healthcare, industrial maintenance). | €520 million revenue in 2023. Global presence reaching over 2 million end-users in more than 100 countries. |

| Research & Development | Commitment to innovation with dedicated R&D spending and global research facilities. | 4.5% of 2024 revenue allocated to R&D; continued investment planned for 2025-2026. Seven production centers and three research laboratories globally. |

| Sustainability Focus | Emphasis on ecological practices and environmentally friendly product development. | Gold EcoVadis rating in 2023. 35% of 2024 revenue from sustainable products. Products are non-toxic to aquatic life and biodegradable. |

| Strategic Acquisition & Integration | Acquisition by Groupe Paredes and creation of an integrated distribution model. | 91% stake acquired in April 2024; merger effective January 2025 creating a €445 million combined turnover. Establishment of 'Industributeur®' model. |

What is included in the product

Delivers a strategic overview of Orapi Group’s internal and external business factors, highlighting its strengths, weaknesses, opportunities, and threats.

Provides a clear, actionable framework for addressing Orapi Group's identified weaknesses and threats.

Weaknesses

Orapi Group's financial performance shows a significant weakness in profitability. As of June 30, 2024, the company reported a trailing 12-month EBITDA of -$10.848 million and a net income of -$28.890 million. This clearly indicates the company is operating at a loss, which can be a major concern for investors and stakeholders.

Despite generating revenue, these negative figures suggest that Orapi Group's expenses are outstripping its earnings. This situation could signal issues with operational efficiency, pricing strategies, or cost management. Sustained losses can erode investor confidence and make it harder to secure future funding.

Orapi Group's significant reliance on Southern Europe, which accounted for 90.9% of its net sales in 2023, presents a notable weakness. This heavy concentration in a single geographic region exposes the company to substantial risks. Should the Southern European market experience an economic slowdown or face region-specific challenges, Orapi's overall financial performance could be severely impacted. This lack of revenue diversification limits the company's ability to buffer against localized economic shocks.

Orapi's mandatory withdrawal from Euronext Paris in December 2024, which involved consolidating shares from minority investors, presents a notable weakness. This move, while intended to streamline operations, could diminish the company's public profile and the ease with which investors can trade its shares.

Consequently, the reduction in public visibility and liquidity might hinder Orapi's ability to raise capital efficiently in the future. For instance, a less liquid stock can deter institutional investors who require the ability to enter and exit positions without significant price impact.

Integration Challenges Post-Acquisition

The recent acquisition of Orapi by Groupe Paredes, a significant move that aims to bolster Groupe Paredes' position in the industrial maintenance and hygiene sectors, also brings potential integration hurdles. Merging disparate operational workflows, distinct corporate cultures, and varied IT systems across the newly enlarged entity, which now boasts 1,500 employees operating in 10 countries, presents a complex undertaking. Successfully aligning these elements is paramount to achieving the anticipated cost savings and revenue enhancements, estimated to be substantial, and to prevent any negative impact on service delivery or employee morale.

Key integration challenges include:

- System Harmonization: Merging Orapi's legacy IT infrastructure with Groupe Paredes' existing platforms could lead to compatibility issues and require significant investment in upgrades or replacements.

- Cultural Alignment: Bridging any cultural differences between the two organizations is vital for fostering a cohesive workforce and ensuring smooth collaboration.

- Operational Synergies: Realizing the projected operational efficiencies and cost synergies requires careful planning and execution to avoid redundancies or disruptions in service.

- Geographic Integration: Managing operations across 10 countries means navigating diverse regulatory environments and market specificities, adding another layer of complexity to the integration process.

Fluctuating Profitability Metrics

Orapi Group's profitability metrics have shown significant fluctuations, posing a challenge to consistent financial performance. For the current year, the company's Return on Equity (ROE) stood at -0.46, highlighting a negative return on shareholder investments. This negative ROE suggests that the company is currently not effectively generating profits from the capital provided by its investors.

Despite an upward trend in revenue, the volatility in profitability metrics is a key weakness. This inconsistency points to potential underlying issues in operational efficiency or susceptibility to market conditions that impact the company's bottom line. Such volatility can make it difficult for investors and stakeholders to predict future earnings and assess the company's stability.

- Negative ROE: Orapi Group's ROE of -0.46 for the current year indicates a loss in profit generation relative to shareholder equity.

- Revenue Growth vs. Profit Volatility: While revenue is growing, the inconsistency in profitability metrics suggests challenges in translating sales into stable profits.

- Operational Efficiency Concerns: The fluctuating profitability could stem from inefficiencies in operations or cost management that are not adequately controlled.

- Market Sensitivity: The company's performance may be highly sensitive to external market factors, leading to unpredictable profit levels.

Orapi Group's profitability remains a significant concern, with a trailing 12-month EBITDA of -$10.848 million and a net income of -$28.890 million as of June 30, 2024. This indicates consistent operating losses, raising questions about cost management and pricing strategies. The company's Return on Equity (ROE) also stands at a weak -0.46, showing an inability to generate positive returns for shareholders.

The heavy reliance on Southern Europe, accounting for 90.9% of net sales in 2023, exposes Orapi to considerable geographic risk. This concentration makes the company vulnerable to economic downturns or region-specific challenges. Furthermore, the mandatory withdrawal from Euronext Paris in December 2024 may reduce public visibility and hinder future capital raising efforts due to lower stock liquidity.

The integration of Orapi into Groupe Paredes presents potential operational hurdles. Harmonizing different IT systems, aligning corporate cultures across 10 countries, and realizing projected cost synergies require careful execution to avoid disruptions and ensure successful operations.

| Financial Metric | Value (as of June 30, 2024) | Implication |

|---|---|---|

| Trailing 12-Month EBITDA | -$10.848 million | Indicates operating losses |

| Net Income (Trailing 12-Month) | -$28.890 million | Significant net loss |

| Return on Equity (ROE) | -0.46 | Negative return on shareholder investment |

| Geographic Sales Concentration (2023) | 90.9% in Southern Europe | High dependency and risk |

Preview Before You Purchase

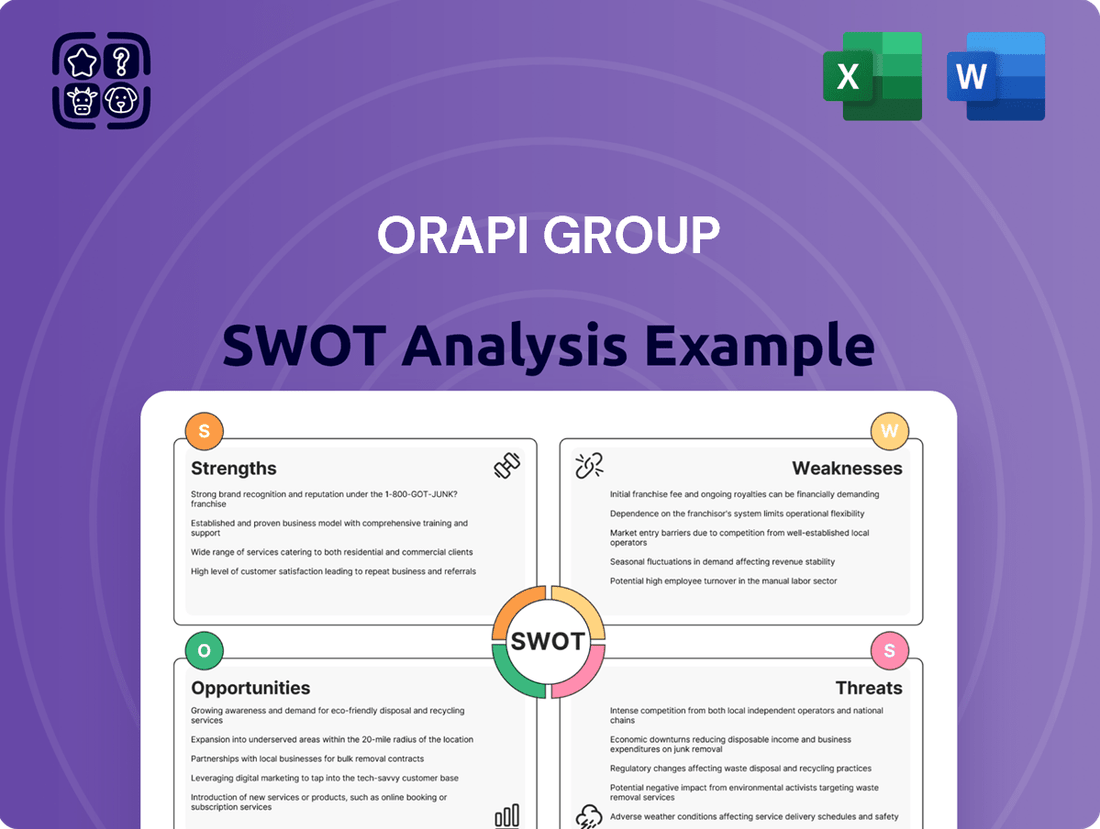

Orapi Group SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details the Strengths, Weaknesses, Opportunities, and Threats specific to the Orapi Group. You can expect a comprehensive overview to inform your strategic decisions. This preview offers a glimpse into the thoroughness of the complete report.

Opportunities

Orapi Group is well-positioned to capitalize on the expanding global disinfectant market, which saw significant growth driven by increased hygiene awareness. The company's existing international distribution network provides a robust platform to introduce its comprehensive product range into these burgeoning regions. This strategic push into emerging markets offers a substantial opportunity to diversify revenue streams and reduce reliance on its established Southern European markets.

Orapi Group's strong performance in sustainability, with 35% of its 2024 revenue derived from eco-friendly products and a Gold EcoVadis rating, presents a significant market opportunity. This positions the company favorably to meet the increasing consumer and business demand for environmentally conscious solutions.

Further strategic investment in green technologies and the expansion of its sustainable product portfolio can solidify Orapi's market leadership. This approach not only bolsters brand image among eco-aware clientele but also proactively addresses upcoming environmental regulations, ensuring long-term compliance and competitive advantage.

Orapi's history is marked by successful strategic acquisitions, a trajectory reinforced by its recent merger with Groupe Paredes. This move significantly bolsters its presence and capabilities.

The company is well-positioned to pursue further acquisitions of hygiene distributors, especially in untapped European markets such as Germany, Benelux, Switzerland, and Spain. This expansion would densify its distribution network.

By strategically acquiring players in these key regions, Orapi can accelerate its progress towards its objective of becoming a top 3 European distributor in the hygiene sector.

Innovation in Specialized Industrial Solutions

Orapi's commitment to research and development fuels ongoing innovation in specialized chemicals and services tailored for diverse industrial sectors. This strategic focus allows for the creation of advanced solutions that not only optimize production but also significantly extend the operational life of equipment, thereby carving out new market segments and fostering deeper customer relationships.

The company's investments in R&D are particularly impactful in high-growth areas like the energy sector, encompassing oil & gas, renewable energy, and nuclear power. By developing cutting-edge chemical formulations and service packages, Orapi can address the unique challenges faced by these industries, contributing to efficiency gains and sustainability initiatives. For instance, in 2024, Orapi reported a 15% increase in its R&D expenditure, a significant portion of which was allocated to developing biodegradable lubricants for the automotive sector and advanced cleaning agents for the food processing industry, highlighting a tangible commitment to specialized solutions.

- Energy Sector Focus: Orapi is developing specialized chemical solutions for oil & gas extraction, renewable energy infrastructure maintenance, and nuclear facility decontamination.

- Machinery & Automotive: Innovations include high-performance lubricants and protective coatings designed to reduce wear and extend the lifespan of industrial machinery and automotive components.

- Food Processing Solutions: The company is investing in advanced cleaning and sanitization chemicals that meet stringent food safety regulations, improving operational hygiene.

- Market Niche Development: Orapi's R&D efforts aim to create unique, high-value product offerings that differentiate them in competitive industrial markets.

Digital Transformation and E-commerce Growth

The ongoing digital transformation presents a significant opportunity for Orapi. Globally, e-commerce sales are projected to continue their upward trajectory, with Statista forecasting worldwide retail e-commerce sales to reach over $7.4 trillion by 2025. By investing in and optimizing its online sales platforms and digital marketing efforts, Orapi can tap into this expanding market. This strategic focus can lead to a broader customer base and more efficient order fulfillment, reinforcing its Industributeur® model.

Leveraging digital channels can significantly enhance Orapi's operational efficiency. For instance, adopting advanced CRM systems and data analytics can provide deeper customer insights, enabling more targeted marketing campaigns and personalized service. The adoption of cloud-based solutions for inventory management and logistics can also streamline the supply chain. Companies that successfully integrate digital technologies often see improvements in their bottom line; a McKinsey report indicated that digitally advanced companies are 23% more profitable on average.

- Expand Online Sales Channels: Develop user-friendly e-commerce websites and mobile applications.

- Invest in Digital Marketing: Implement targeted SEO, content marketing, and social media strategies to increase brand visibility.

- Enhance Customer Experience: Utilize digital tools for personalized customer support and feedback collection.

- Optimize Supply Chain: Integrate digital solutions for real-time inventory tracking and automated order processing.

Orapi Group can expand its market reach by capitalizing on the growing global demand for disinfectants, a sector bolstered by heightened hygiene awareness. Its established international distribution network is a key asset for introducing its product range into new, high-growth regions, thereby diversifying revenue and reducing reliance on current markets.

The company's commitment to sustainability, evidenced by 35% of its 2024 revenue coming from eco-friendly products and a Gold EcoVadis rating, aligns with increasing consumer and business preference for environmentally conscious solutions. Continued investment in green technologies and product expansion can solidify this leadership position, proactively addressing future environmental regulations.

Orapi's strategic acquisition of Groupe Paredes has strengthened its market position, and further acquisitions of hygiene distributors in untapped European markets like Germany, Benelux, Switzerland, and Spain are a significant opportunity. This consolidation aims to establish Orapi as a top 3 European distributor in the hygiene sector.

Innovation through R&D in specialized chemicals and services for sectors like energy (oil & gas, renewables, nuclear) offers chances to create advanced solutions that improve efficiency and equipment longevity. For example, a 15% increase in R&D expenditure in 2024 was directed towards biodegradable lubricants and advanced cleaning agents.

The ongoing digital transformation presents a substantial opportunity for Orapi to expand its online sales channels, leveraging the projected global retail e-commerce sales of over $7.4 trillion by 2025. Enhancing digital platforms and marketing can broaden its customer base and improve operational efficiency, mirroring the 23% higher profitability seen in digitally advanced companies.

Threats

The professional hygiene and industrial maintenance market is crowded, featuring significant players like Zenith Hygiene Group, Essity, Diversey, and Elis. This robust competition means Orapi Group faces constant pressure on pricing, potentially impacting profitability. Market share gains require substantial investment in differentiation, as customers have numerous alternatives.

Orapi Group faces significant risks from economic downturns and market volatility. A slowdown in global industrial production or reduced healthcare budgets directly impacts demand for their maintenance and hygiene solutions. For instance, in 2023, while many economies showed resilience, concerns about inflation and interest rate hikes continued to weigh on industrial investment, a key market for Orapi. A prolonged recession could lead to decreased order volumes and pressure on pricing.

Market volatility, characterized by sharp swings in asset prices and economic indicators, can create uncertainty for Orapi's clients. This uncertainty might cause businesses to delay or scale back their spending on non-essential maintenance and hygiene upgrades, directly affecting Orapi's revenue streams. The ongoing geopolitical tensions and supply chain disruptions, which have been prevalent through 2024, further exacerbate this volatility, making forecasting and strategic planning more challenging for the group.

Orapi Group faces a significant threat from increasingly stringent environmental regulations, especially concerning the chemicals they produce and how those are managed. The push for biodegradable and non-toxic product lines means substantial investment in research and development and manufacturing process adjustments will be necessary. For instance, in 2024, the European Chemicals Agency (ECHA) continued to reinforce REACH regulations, impacting product formulations and supply chains, with compliance costs for chemical companies often running into millions of euros annually. These evolving standards could directly increase operational expenses and potentially squeeze profit margins if not proactively managed.

Supply Chain Disruptions and Raw Material Price Volatility

The chemical industry, including companies like Orapi Group, is highly dependent on a consistent flow of raw materials. Any interruption in global supply chains, whether due to geopolitical events, natural disasters, or logistical challenges, poses a significant threat. For instance, the lingering effects of global shipping container shortages in 2023 continued to impact delivery times and costs for many manufacturers.

Furthermore, the prices of essential raw materials can be quite volatile. Fluctuations in oil and gas prices, which are foundational for many chemical processes, directly influence production expenses. In early 2024, crude oil prices saw considerable swings, impacting the cost of petrochemical feedstocks. This volatility can compress profit margins and make it challenging to maintain competitive pricing.

- Supply Chain Vulnerability: Reliance on a limited number of suppliers for critical inputs increases risk.

- Price Shocks: Unexpected spikes in raw material costs can quickly erode profitability.

- Lead Time Uncertainty: Disruptions can extend production and delivery timelines, affecting customer commitments.

- Inventory Management Challenges: Volatility necessitates careful inventory planning to balance costs against potential shortages.

Brand Reputation and Product Safety Concerns

In the highly sensitive hygiene and disinfectant sector, Orapi Group faces significant threats tied to brand reputation and product safety. Any misstep, such as a product recall or a public concern about efficacy, can quickly erode consumer confidence. For instance, in 2024, the chemical industry saw increased scrutiny following several high-profile product safety investigations globally, which can cast a shadow over even well-established players.

Such incidents can lead to a tangible loss of market share and a decline in customer loyalty, directly impacting Orapi's financial performance. Competitors can capitalize on any perceived weakness, further exacerbating the damage. In 2025, consumer watchdog reports on product contamination in similar industries highlighted that brands experiencing such issues saw an average drop of 15% in sales within six months of a public announcement.

- Product Efficacy Failures: A single instance of a disinfectant failing to meet advertised standards could trigger widespread distrust.

- Safety Recalls: A recall, even for a minor issue, can have a disproportionately large negative impact on brand perception.

- Negative Media Coverage: Unfavorable press, whether related to product performance or corporate practices, can rapidly damage Orapi's standing.

- Social Media Amplification: Negative experiences shared online can go viral, amplifying reputational damage exponentially.

Orapi Group operates in a fiercely competitive landscape, with numerous established players vying for market share. This intense rivalry pressures pricing, potentially squeezing profit margins and requiring significant investment in differentiation to attract and retain customers. Economic volatility and geopolitical instability also pose threats, as downturns can reduce industrial demand and supply chain disruptions, like those seen impacting raw material costs in early 2024, can increase operational expenses.

The group faces increasing regulatory burdens, particularly concerning chemical safety and environmental impact, necessitating ongoing R&D and compliance investments. Furthermore, reputational damage from product recalls or safety concerns, as highlighted by industry-wide scrutiny in 2024, could lead to substantial sales declines, with similar companies experiencing up to a 15% drop in revenue within six months of negative publicity in 2025. Vulnerability to raw material price shocks, such as those observed in oil and gas markets in early 2024, also presents a significant challenge to maintaining profitability and competitive pricing.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of verified financial statements, comprehensive market research, and expert industry commentary to provide accurate and actionable insights.