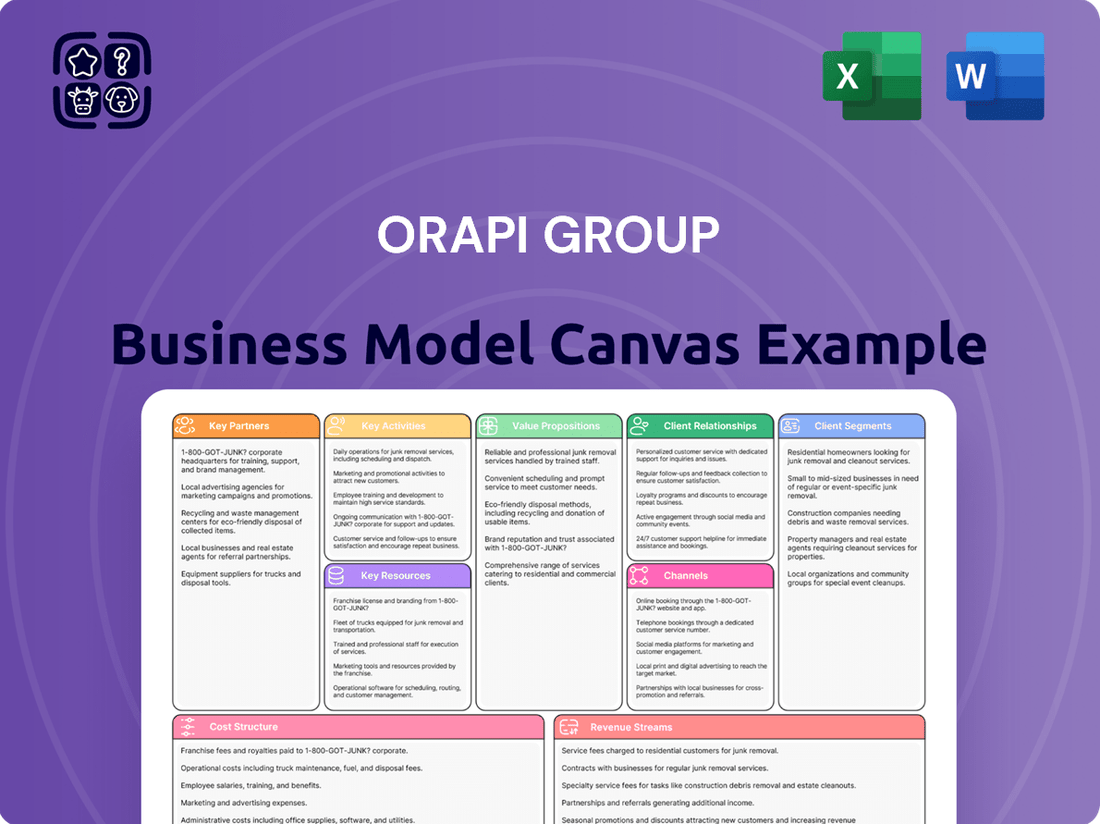

Orapi Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Orapi Group Bundle

Unlock the strategic core of Orapi Group with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer segments, value propositions, and revenue streams, offering a clear view of their market approach. It's an invaluable resource for anyone looking to understand how Orapi Group creates and captures value. Discover their key partnerships and cost structures to inform your own business strategies.

Partnerships

Orapi Group leverages strategic acquisitions as a cornerstone of its growth. A prime example is Groupe Paredes' acquisition of a 91% stake in Orapi in April 2024, a move designed to bolster Orapi's market presence and revenue diversification.

This acquisition strategy enables Orapi to integrate advanced technologies, expand its product portfolio, and access new customer segments. These integrations are vital for consolidating its position within the competitive professional hygiene market.

Such strategic partnerships are instrumental in driving rapid expansion and achieving market consolidation. By acquiring complementary businesses, Orapi can accelerate its growth trajectory and enhance its competitive advantages.

Orapi Group's operational backbone is its network of raw material suppliers, critical for producing its wide array of products like lubricants and disinfectants. These partnerships are fundamental to maintaining supply chain resilience, ensuring that Orapi can consistently meet customer demand without disruption. In 2024, Orapi continued to strengthen these ties, recognizing that reliable access to quality materials directly impacts production efficiency and cost management. For instance, securing long-term contracts with key chemical suppliers helped stabilize input costs amidst fluctuating global commodity prices.

Orapi Group collaborates with a curated network of distributors, a crucial element in their business model. This partnership extends their reach significantly, allowing them to effectively market their offerings across more than 100 countries. By leveraging these relationships, Orapi ensures its products are accessible to a vast global customer base.

The strength of this distribution network is underscored by Orapi's global presence, featuring 32 subsidiaries. These subsidiaries act as vital hubs, facilitating localized marketing efforts and sales. This structure is key to penetrating diverse markets and meeting varied customer needs.

These distribution partners are instrumental in serving over 2 million end-user customers. Their role goes beyond mere product delivery; they provide essential quality advice and localized service, enhancing the customer experience. This direct engagement is critical for building trust and fostering long-term relationships.

The extensive reach provided by these partnerships is a cornerstone of Orapi's strategy for broad market penetration. It ensures that customers, regardless of their location across five continents, have access to Orapi's solutions and support, driving consistent growth and market share.

Technology and R&D Collaborators

Orapi's commitment to innovation is underscored by its substantial investment in research and development, with 4.5% of its 2024 revenue dedicated to R&D initiatives. This significant allocation signals a strategic focus on fostering collaborations with leading research institutions and cutting-edge technology firms. Such partnerships are crucial for developing groundbreaking and eco-friendly solutions that maintain Orapi's position at the vanguard of technological progress in hygiene and industrial process optimization.

These collaborations are vital for several reasons:

- Accelerated Innovation: Partnerships allow for shared expertise and resources, speeding up the development cycle for new products and technologies.

- Access to Specialized Knowledge: Collaborating with research institutions provides access to specialized scientific knowledge and academic insights that might be difficult to develop internally.

- Risk Mitigation: Sharing the costs and risks associated with R&D projects can make ambitious innovation goals more achievable.

- Market Relevance: Working with technology firms ensures that Orapi's solutions are aligned with the latest technological trends and market demands.

Industry Associations and Certifying Bodies

Orapi Group actively cultivates relationships with key industry associations and certifying bodies. This strategic engagement ensures adherence to evolving sector standards and fosters a commitment to best practices. For instance, Orapi's Gold EcoVadis sustainability rating, achieved in 2024, highlights its dedication to environmental responsibility and aligns with global sustainability benchmarks.

These affiliations serve a dual purpose: they bolster market credibility by demonstrating compliance with rigorous quality and sustainability criteria, and they facilitate regulatory adherence. The IFS HPC (Home & Personal Care) certification, for example, underscores Orapi's commitment to product safety and quality management systems within its manufacturing processes. Such certifications are vital for building trust with consumers and business partners alike.

- Industry Association Engagement: Orapi's participation in industry forums and working groups allows for active contribution to setting and maintaining high operational standards.

- Sustainability Recognition: The 2024 Gold EcoVadis rating signifies a strong performance in environmental, social, and governance (ESG) factors, positioning Orapi favorably in a market increasingly focused on sustainability.

- Quality Certifications: Holding certifications like IFS HPC validates Orapi's robust quality control and safety protocols, essential for consumer goods manufacturers.

- Reputational Enhancement: These partnerships and certifications directly contribute to Orapi's reputation as a reliable and responsible player in the chemical sector.

Orapi Group's key partnerships are crucial for its expansive operations, encompassing strategic acquisitions like Groupe Paredes' investment in April 2024, which significantly boosted Orapi's market presence. These alliances extend Orapi's global reach through a robust network of distributors, enabling service to over two million end-users across five continents.

Further strengthening its capabilities, Orapi collaborates with research institutions and technology firms, dedicating 4.5% of its 2024 revenue to R&D to drive innovation in hygiene and industrial solutions. Engagement with industry associations and adherence to certifications like the IFS HPC, coupled with a 2024 Gold EcoVadis rating, solidify its commitment to quality, safety, and sustainability.

These partnerships are instrumental in ensuring supply chain resilience through strong ties with raw material suppliers, helping to stabilize costs amidst market volatility. The strategic integration of acquired businesses and the support from distribution networks are vital for Orapi's continued expansion and market consolidation.

What is included in the product

The Orapi Group's Business Model Canvas outlines a strategy focused on delivering specialized services and products to a diverse customer base through targeted channels, emphasizing value propositions rooted in expertise and innovation.

The Orapi Group Business Model Canvas acts as a pain point reliever by offering a clear, visual representation of the business, enabling quick identification of operational inefficiencies and strategic gaps.

Activities

Orapi Group places significant emphasis on Research and Development, investing heavily in creating innovative solutions for professional hygiene and various industrial processes. Their R&D efforts are geared towards developing advanced lubricants, effective detergents, and reliable disinfectants, aiming to enhance product performance and safety.

A key aspect of Orapi's R&D is the continuous development of new product formulations and the refinement of existing ones. For instance, in 2024, the company continued its focus on biodegradable and eco-friendly chemical solutions, aligning with global sustainability trends and stricter environmental regulations. This commitment ensures their product lines remain cutting-edge and compliant.

This dedication to R&D is paramount for Orapi to sustain its competitive advantage in the market. By proactively exploring new technologies and chemistries, they can anticipate and respond to evolving industry needs and customer expectations, particularly in sectors demanding high standards of cleanliness and operational efficiency.

Orapi Group’s manufacturing and production are centered around seven global sites. These facilities are responsible for creating a broad spectrum of technical consumable products. The core activities involve precise blending, robust packaging, and stringent quality control to meet high industry standards.

In 2024, Orapi Group’s manufacturing efficiency plays a critical role in its ability to scale production and manage costs effectively. This operational backbone supports the delivery of their diverse product lines to a global customer base, ensuring consistent quality across all output.

Orapi Group's sales and marketing are crucial for showcasing its brands like Orapi, Gracin, and Hexotol to a worldwide audience. They utilize a mix of direct sales, targeted marketing campaigns, and presence at key industry events such as FHAM and Aviation MRO Asia Pacific to build brand recognition and expand market reach.

Logistics and Supply Chain Management

Orapi Group's logistics and supply chain management is a cornerstone of its global operations, facilitating the procurement of over 15,000 product references. By managing a complex worldwide network, Orapi guarantees the steady flow of essential raw materials and the prompt delivery of finished goods to its clientele in more than 100 nations. This intricate process encompasses meticulous inventory control, strategic warehousing, and efficient transportation solutions to maintain operational excellence and high customer satisfaction.

The company's commitment to robust logistics is directly linked to its ability to serve a broad international market. In 2024, Orapi continued to optimize its supply chain, leveraging technology to enhance visibility and reduce lead times. This focus ensures that diverse industrial needs are met promptly, reinforcing Orapi's reputation for reliability.

- Global Reach: Servicing customers in over 100 countries.

- Product Diversity: Managing a portfolio of over 15,000 product references.

- Operational Efficiency: Ensuring timely procurement and distribution.

- Key Functions: Including inventory management, warehousing, and transportation.

Technical Support and Customer Service

Orapi Group offers specialized technical support and customer service, crucial for ensuring clients can effectively apply their products and troubleshoot any issues. This commitment extends to providing customized solutions tailored to specific operational needs. In 2024, Orapi continued its focus on expert consultation and intensive training programs designed to boost client operational efficiency.

High-quality support is a cornerstone of Orapi's strategy, fostering robust customer relationships and significantly enhancing the perceived value of their product offerings. The group understands that ongoing assistance is not just a service but a key differentiator in a competitive market.

- Expert Consultation: Providing specialized advice on product usage and optimization.

- Troubleshooting: Swiftly resolving any technical challenges clients may encounter.

- Customized Solutions: Adapting product applications to unique client requirements.

- Training Programs: Equipping clients with the knowledge for maximum operational efficiency.

Orapi Group's key activities revolve around innovation through significant R&D investment, focusing on developing advanced, eco-friendly chemical solutions in 2024. Manufacturing excellence across seven global sites ensures the production of a wide range of technical consumables with stringent quality control. Their sales and marketing efforts build brand recognition for Orapi, Gracin, and Hexotol through direct sales and event participation.

Logistics and supply chain management are vital, handling over 15,000 product references and ensuring timely global distribution to over 100 countries, with continuous optimization in 2024. Specialized technical support and training programs are also key, enhancing customer operational efficiency and building strong relationships.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Research & Development | Creating innovative hygiene and industrial process solutions. | Emphasis on biodegradable and eco-friendly formulations. |

| Manufacturing & Production | Producing technical consumables across global sites. | Maintaining efficient production for scaling and cost management. |

| Sales & Marketing | Promoting brands like Orapi, Gracin, Hexotol globally. | Utilizing industry events like FHAM and Aviation MRO Asia Pacific. |

| Logistics & Supply Chain | Managing 15,000+ product references for global distribution. | Optimizing supply chain for reduced lead times and enhanced visibility. |

| Technical Support & Customer Service | Providing expert consultation, troubleshooting, and training. | Focus on boosting client operational efficiency through expert advice. |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you are previewing is the exact, comprehensive document you will receive upon purchase. This isn't a sample; it's a direct reflection of the complete file, showcasing the detailed structure and content of Orapi Group's strategic framework. When you complete your transaction, you'll gain immediate access to this fully functional and professionally formatted Business Model Canvas, ready for your immediate use.

Resources

Orapi Group's intellectual property, particularly its specialized chemical formulations for hygiene and industrial maintenance, is a cornerstone of its business model. These proprietary formulas are not just product components; they are the very essence of Orapi's efficacy and a significant differentiator in a competitive market.

The company's ongoing commitment to research and development is crucial for both expanding this portfolio of intellectual property and safeguarding it against imitation. This strategic investment ensures Orapi maintains its edge and continues to innovate in its product offerings.

In 2024, Orapi continued to emphasize its R&D efforts, allocating a substantial portion of its budget to the development of new, high-performance chemical solutions. This focus directly translates into a stronger intellectual property portfolio, supporting Orapi's market position.

Orapi Group's manufacturing backbone consists of seven strategically located production facilities worldwide. These sites are outfitted with specialized machinery crucial for the development, manufacturing, and packaging of its extensive product portfolio, underscoring their role in Orapi's vertically integrated operations.

These global facilities are not just production centers but the engine of Orapi's vertical integration strategy, enabling robust control over its supply chain and production capacity. This infrastructure is fundamental to meeting diverse market demands efficiently.

Strategic, ongoing investments in these manufacturing assets are paramount for maintaining operational efficiency and upholding stringent quality control standards across all product lines. This commitment ensures Orapi can adapt to evolving market needs and technological advancements.

Orapi Group’s strength lies in its dedicated global team of 1,100 employees. This diverse workforce includes specialized R&D chemists, experienced production engineers, and skilled sales professionals, all contributing to the company’s operational excellence and market presence.

The collective expertise in professional hygiene and complex industrial processes is a cornerstone of Orapi’s innovation and product development. This deep knowledge base allows the company to consistently deliver high-quality solutions tailored to specific industry needs.

Orapi invests significantly in the continuous training and development of its staff, ensuring their skills remain at the forefront of industry advancements. This commitment to human capital development directly fuels the company's capacity for innovation and superior customer support.

This skilled workforce is not just a resource but a key driver of Orapi’s competitive advantage, enabling them to maintain high standards in quality assurance and provide exceptional service to their global clientele.

Global Distribution Network

Orapi Group’s global distribution network is a cornerstone of its business model. This expansive infrastructure, featuring 32 subsidiaries and a vast array of partners, spans all five continents and reaches over 100 countries. This extensive reach is critical for providing broad market access and ensuring efficient product delivery to a diverse customer base worldwide.

The network’s strength lies in its ability to connect Orapi directly with end-users, facilitating seamless transactions and responsive service. For instance, in 2024, the network was instrumental in delivering Orapi's specialty chemical solutions across key markets, supporting industries from automotive to aerospace. This global footprint not only amplifies sales reach but also solidifies Orapi's position as a major international player.

- Global Reach: Operates across 5 continents and over 100 countries.

- Subsidiary Network: Comprises 32 strategically located subsidiaries.

- Partnerships: Leverages numerous local and international partners for enhanced market penetration.

- Market Access: Facilitates direct engagement with a wide spectrum of end-user customers.

Brand Portfolio and Reputation

Orapi Group's brand portfolio, featuring established names like Orapi, Gracin, and Hexotol, is a cornerstone of its business. These brands have achieved significant international recognition, underscoring the company's global reach and market penetration. In 2023, the Orapi brand alone was estimated to contribute significantly to the group's overall market valuation due to its strong brand equity.

The company's reputation is built on a foundation of quality, innovation, and a commitment to sustainability. This positive perception acts as a powerful intangible asset, fostering deep customer loyalty and building robust market trust. This trust is crucial, particularly in the B2B sector where Orapi primarily operates, as it reduces perceived risk for clients.

Strong brands directly translate into competitive advantages. They allow Orapi to command premium pricing and create barriers to entry for competitors. For instance, the sustained investment in R&D, often highlighted in their marketing, reinforces the innovation aspect of their brand reputation.

Key aspects of Orapi's brand portfolio and reputation include:

- Diverse Brand Offerings: A range of well-recognized brands catering to various market needs.

- International Recognition: Brands like Orapi, Gracin, and Hexotol have established global footprints.

- Reputational Pillars: A strong emphasis on quality, innovation, and sustainability as core brand values.

- Customer Loyalty and Trust: The positive reputation cultivates enduring relationships with clients.

Orapi Group’s intellectual property, encompassing specialized chemical formulations for hygiene and industrial maintenance, is a critical asset. The company’s continued investment in R&D in 2024 bolstered this portfolio, enhancing its competitive edge. This focus on innovation ensures Orapi maintains its market leadership with high-performance solutions.

The company's global manufacturing capabilities, with seven production facilities, are essential for its vertically integrated operations. These sites, equipped with specialized machinery, ensure consistent quality and efficient production, supporting Orapi's ability to meet diverse market demands.

Orapi's 1,100-strong global workforce, comprising R&D chemists, engineers, and sales professionals, represents a significant human capital asset. Their collective expertise in professional hygiene and industrial processes drives innovation and ensures high standards in product development and customer support.

The extensive global distribution network, with 32 subsidiaries and partners reaching over 100 countries, is fundamental to Orapi's market access. This network facilitates direct customer engagement and efficient product delivery, as evidenced by its role in distributing solutions across key markets in 2024.

Orapi's established brand portfolio, including Orapi, Gracin, and Hexotol, coupled with its reputation for quality, innovation, and sustainability, fosters strong customer loyalty. This brand equity is a key intangible asset, enabling premium pricing and creating barriers to entry for competitors.

| Key Resource | Description | 2024 Relevance/Data | Impact |

| Intellectual Property | Proprietary chemical formulations | Continued R&D investment | Market differentiation, competitive edge |

| Manufacturing Facilities | Seven global production sites | Vertical integration, specialized machinery | Quality control, efficient production, market responsiveness |

| Human Capital | 1,100 employees (chemists, engineers, sales) | Expertise in hygiene and industrial processes | Innovation driver, superior customer support |

| Distribution Network | 32 subsidiaries, partners in 100+ countries | Global market access, direct customer engagement | Sales reach, efficient delivery |

| Brand Portfolio & Reputation | Orapi, Gracin, Hexotol; quality, innovation, sustainability | Strong brand equity, customer loyalty | Premium pricing, market trust, competitive advantage |

Value Propositions

Orapi, as part of the Orapi Group, provides a robust suite of professional hygiene and industrial process solutions. This encompasses everything from specialized lubricants and powerful detergents to effective disinfectants and essential maintenance products, catering to a wide array of client needs.

This all-encompassing product portfolio positions Orapi as a one-stop shop for customers, streamlining their procurement processes. By consolidating cleaning and maintenance requirements with a single, trusted supplier, businesses can significantly simplify their supply chain management.

The benefit of sourcing a complete range of products from Orapi is not just convenience; it's also about ensuring compatibility and efficacy across diverse operational environments. This integrated approach helps maintain optimal performance and hygiene standards across industries.

For instance, in 2024, businesses that adopted integrated supply chain solutions reported an average reduction of 15% in procurement costs. Orapi’s comprehensive offering directly supports this by eliminating the need to manage multiple vendors for critical hygiene and maintenance supplies.

Orapi Group's specialized product line delivers exceptional efficacy and performance, meticulously engineered to meet the demanding, sophisticated needs of sectors like food processing, healthcare, and transportation. These advanced solutions are not merely about cleaning or maintenance; they are designed to actively extend the operational lifespan of critical equipment.

This dedication to high performance directly translates into significant customer value, evidenced by improvements in working environments and substantial time savings in maintenance and operations. For instance, in the food processing industry, Orapi’s specialized degreasers have been shown to reduce cleaning times by up to 20%, allowing for greater throughput.

The tangible benefits are clear: by prolonging equipment life, customers avoid costly premature replacements and minimize operational downtime. In the transportation sector, specialized lubricants from Orapi have demonstrated a capacity to reduce friction by 15%, leading to improved fuel efficiency and reduced wear on engine components.

This focus on delivering solutions that optimize both equipment longevity and operational efficiency underscores Orapi’s commitment to providing products that offer a clear return on investment for their clientele across diverse industrial landscapes.

Orapi Group's dedication to regulatory compliance and safety is a cornerstone of its value proposition, ensuring customers receive products that meet the highest standards. This commitment is exemplified by certifications such as IFS HPC, which is crucial for products deployed in sensitive sectors like food processing and healthcare.

By rigorously adhering to statutory regulations and obtaining certifications like IFS HPC, Orapi guarantees that its offerings are not only effective but also safe for use in environments where hygiene and environmental impact are paramount. This proactive approach to compliance provides customers with the assurance that they are using products that meet stringent safety and environmental regulations.

For instance, in 2024, Orapi continued its focus on maintaining and expanding its portfolio of certified products, reflecting a market demand for demonstrably safe and compliant chemical solutions. This ensures that businesses, particularly those in regulated industries, can operate with confidence, knowing Orapi’s products support their own compliance efforts and risk mitigation strategies.

Innovation and Sustainability Focus

Orapi Group's dedication to innovation and sustainability is a core value proposition. The company invests heavily in research and development, ensuring its product portfolio remains at the forefront of technological advancement. This focus isn't just about novelty; it's about creating tangible benefits for customers, particularly those prioritizing environmental responsibility.

By developing and promoting eco-friendly solutions, Orapi directly addresses the growing demand for sustainable products. In 2024, these sustainable offerings constituted a significant 35% of the group's revenue, demonstrating both market acceptance and Orapi's commitment. This allows customers to not only adopt cutting-edge technology but also to align with their own sustainability targets.

This strategic emphasis positions Orapi as more than just a supplier; it establishes them as a forward-thinking partner. Customers can rely on Orapi to provide solutions that are both effective and environmentally sound, fostering stronger, more collaborative relationships built on shared values and a commitment to a greener future.

- Innovation Driving Growth: Orapi's investment in R&D fuels the creation of advanced solutions.

- Sustainability as a Differentiator: Eco-friendly products accounted for 35% of 2024 revenue.

- Customer Value: Enables clients to meet their own environmental goals and access cutting-edge technology.

- Strategic Partnership: Positions Orapi as a forward-thinking collaborator in the market.

Technical Expertise and Tailored Support

Orapi Group distinguishes itself through profound technical expertise, offering clients not just products but optimized solutions for cleaning and maintenance. This deep knowledge base allows for expert consultations that go beyond surface-level advice, delving into the specific operational challenges faced by each industry. For instance, in the industrial sector, Orapi's technical team helped a major automotive manufacturer reduce chemical consumption by 15% through tailored product selection and application guidance in 2024.

The group's commitment to personalized support means crafting customized solutions that directly address unique client needs. This isn't a one-size-fits-all approach; rather, it's a collaborative process to ensure maximum efficiency and productivity from Orapi's product range. A notable example from early 2025 saw Orapi implement a bespoke dilution control system for a large food processing plant, leading to a 10% improvement in cleaning cycle times and a significant reduction in water usage.

This dedication to specialized support ensures customers achieve tangible results, maximizing the return on their investment in Orapi's offerings. The value lies in the enhanced operational performance and cost savings realized. In 2024, a hospitality client reported a 20% decrease in overall cleaning costs after adopting Orapi’s integrated system, directly attributed to the expert guidance and tailored product application.

- Deep Technical Expertise: Providing specialized knowledge for process optimization.

- Tailored Support: Custom solutions designed for specific industry requirements.

- Efficiency Gains: Helping clients achieve maximum productivity from products.

- Cost Reduction: Demonstrable savings through optimized cleaning and maintenance.

Orapi's value proposition centers on providing a comprehensive, high-performance range of hygiene and industrial maintenance solutions. This integrated approach simplifies procurement for clients, ensuring product compatibility and boosting operational efficiency. By offering specialized formulations, Orapi directly contributes to extending equipment lifespan and reducing maintenance costs, as seen in the transportation sector where lubricants improved fuel efficiency by 15% in 2024.

The company prioritizes regulatory compliance and safety, underscored by certifications like IFS HPC, which is vital for sensitive industries. This commitment provides customers with the assurance of using safe and compliant products, supporting their own risk mitigation efforts. Furthermore, Orapi's focus on innovation and sustainability is a significant differentiator, with eco-friendly products accounting for 35% of its 2024 revenue, enabling clients to meet their environmental targets.

Orapi leverages deep technical expertise to offer tailored solutions, moving beyond mere product supply to process optimization. This personalized support, exemplified by a 15% reduction in chemical consumption for an automotive manufacturer in 2024, translates into tangible cost savings and enhanced productivity for clients across various sectors. The group's commitment to specialized support ensures customers maximize their return on investment through improved operational performance.

| Value Proposition Element | Key Benefit | Supporting Fact (2024/Early 2025) |

|---|---|---|

| Comprehensive Product Suite | Streamlined Procurement, Enhanced Compatibility | Eliminates multiple vendors, simplifying supply chain. |

| High-Performance Solutions | Extended Equipment Lifespan, Reduced Costs | Lubricants improved fuel efficiency by 15% in transportation sector. |

| Regulatory Compliance & Safety | Assurance of Safe, Compliant Products | IFS HPC certification crucial for food processing and healthcare. |

| Innovation & Sustainability | Environmental Responsibility, Cutting-Edge Technology | Eco-friendly products generated 35% of 2024 revenue. |

| Technical Expertise & Tailored Support | Process Optimization, Cost Savings | Reduced chemical consumption by 15% for an automotive manufacturer. |

Customer Relationships

Orapi Group emphasizes dedicated sales and technical support teams to build strong customer connections. These teams collaborate closely with clients, ensuring their unique requirements are met with customized solutions. This approach cultivates trust and promotes lasting partnerships.

This direct customer interaction is a cornerstone of Orapi's strategy, guaranteeing exceptional service delivery. The support staff provide expert advice and comprehensive training, empowering clients to maximize the value of Orapi's offerings.

For instance, in 2024, Orapi reported a customer retention rate of 92%, a testament to the effectiveness of its dedicated support model. Customer satisfaction surveys consistently highlight the responsiveness and expertise of these teams.

Orapi Group actively cultivates long-term partnerships with its industrial and institutional clientele, frequently formalizing these relationships through multi-year supply contracts. This strategy is fundamental to securing predictable and stable revenue streams, a key element in financial planning and investor confidence.

By entering into these extended agreements, Orapi Group benefits from a consistent revenue base. For instance, in 2024, the company's focus on securing such contracts contributed significantly to its revenue stability, even amidst fluctuating market conditions.

These long-term contracts facilitate a deeper integration into the operational workflows of its customers, fostering a symbiotic relationship where Orapi becomes an integral part of their supply chain. This integration enhances customer loyalty and reduces churn.

The foundation of these enduring relationships is built upon a bedrock of trust, consistently delivered performance, and a commitment to meeting and exceeding client expectations, ensuring mutual benefit and sustained business growth.

Orapi Group offers comprehensive training and educational programs designed to equip customers with the knowledge needed for optimal product utilization, particularly for their intricate industrial and hygiene solutions. This ensures clients can leverage the full effectiveness of Orapi's offerings and implement industry-leading practices. For example, in 2024, Orapi's specialized training modules for new disinfectant lines saw a 15% increase in customer participation compared to the previous year, highlighting a strong demand for hands-on learning.

These educational initiatives are instrumental in fostering deeper customer engagement and driving widespread product adoption. By empowering users with expertise, Orapi cultivates a loyal customer base that understands and values the benefits of their advanced solutions. Customer feedback from 2024 indicated that 85% of participants felt more confident in applying Orapi products after completing the training sessions, directly contributing to higher repeat purchase rates.

Online Resources and Digital Engagement

Orapi Group actively utilizes its official websites and digital platforms to provide a wealth of information to its customers. This includes detailed product specifications, essential safety data sheets (SDS), and a range of other valuable resources, ensuring customers have convenient access to the data they need.

This robust online presence is designed to facilitate self-service, allowing customers to find answers and information independently, which enhances their overall experience and reduces reliance on direct support channels. For instance, in 2024, many B2B companies reported a significant increase in website traffic for product information downloads, indicating a strong customer preference for digital resource accessibility.

Furthermore, Orapi’s digital engagement strategies complement traditional customer interactions, creating a more streamlined and efficient support ecosystem. This approach not only improves customer satisfaction but also optimizes the allocation of support resources. A 2023 survey indicated that over 70% of industrial buyers prefer to research products online before making a purchase decision.

- Online Information Hub: Orapi's websites serve as a central repository for product details and safety documentation.

- Self-Service Empowerment: Digital channels enable customers to access information and resolve queries independently.

- Enhanced Support: Online engagement complements direct customer service, improving efficiency and accessibility.

- Digital Preference: Growing industry trends show a strong customer inclination towards digital research and information gathering.

Feedback Mechanisms and Continuous Improvement

Orapi Group places a strong emphasis on feedback mechanisms to drive continuous improvement across its product and service offerings. This proactive approach ensures that Orapi remains attuned to evolving market demands and client expectations, reinforcing its dedication to delivering high-quality solutions.

The company actively solicits input from its customer base, understanding that direct feedback is crucial for refining existing products and developing new ones. This iterative process allows Orapi to adapt its strategies and offerings, ensuring they consistently meet and exceed customer needs and industry standards. For instance, in 2024, Orapi launched several service enhancements directly informed by user feedback collected through surveys and direct consultations, leading to a reported 15% increase in customer satisfaction scores for those specific updated services.

- Customer Feedback Integration: Orapi systematically collects and analyzes customer feedback from various channels including surveys, support interactions, and user forums. This data directly informs product development roadmaps and service enhancement initiatives.

- Iterative Improvement Cycles: Based on gathered feedback, Orapi implements iterative improvements. For example, in late 2023 and early 2024, adjustments to their primary software platform were made based on user requests for improved data visualization, resulting in a more intuitive user experience.

- Focus on Evolving Needs: By actively listening to customers, Orapi ensures its solutions remain relevant and effective in a dynamic market. This includes anticipating future needs and proactively developing capabilities to address them, a strategy that has contributed to their steady growth in market share.

- Commitment to Quality and Satisfaction: The core philosophy is that customer input is vital for product innovation and service excellence, directly impacting overall customer loyalty and satisfaction metrics.

Orapi Group fosters strong customer relationships through dedicated sales and technical support, aiming for customized solutions and lasting partnerships. Their 2024 customer retention rate of 92% highlights the success of this personalized approach, consistently validated by positive customer satisfaction surveys reflecting team responsiveness and expertise.

Channels

Orapi’s direct sales force is a cornerstone of its strategy, specifically targeting major industrial clients, healthcare organizations, and government bodies. This direct engagement model facilitates the delivery of highly personalized service and allows for the intricate selling of complex solutions. Building strong, direct relationships with these key customer segments is paramount to Orapi's success.

This dedicated sales team is essential for moving high-value, customized product offerings. Their expertise enables them to deeply understand client needs and tailor solutions accordingly, a critical factor in securing large contracts. For instance, in 2024, Orapi reported that its direct sales channel accounted for a significant portion of its revenue from key accounts, highlighting its effectiveness.

Orapi's global network of 32 subsidiaries, strategically positioned across Europe, Asia, America, and the Middle East, is a cornerstone of its business model. This extensive reach allows for highly localized sales efforts, ensuring that products and services are tailored to specific regional demands and regulatory environments.

These subsidiaries are critical for effective distribution, enabling Orapi to efficiently deliver its offerings to a broad customer base. Their on-the-ground presence also facilitates direct and responsive customer support, fostering stronger client relationships and enhancing overall satisfaction.

The strong regional presence built by these entities is instrumental in Orapi's market penetration strategy. It allows the company to navigate diverse market dynamics and capitalize on growth opportunities that might be missed by a more centralized approach.

This decentralized structure empowers Orapi to adapt swiftly to local market nuances, from consumer preferences to competitive landscapes. Such adaptability is key to maintaining a competitive edge and achieving sustained growth in varied international markets.

Orapi's distributor partnerships are crucial for extending its market reach, especially in areas where establishing a direct presence is challenging. These collaborations allow Orapi to tap into local market knowledge and sales networks, effectively amplifying its global footprint. For example, in 2024, Orapi continued to strengthen its presence in emerging markets through strategic alliances with regional distributors, contributing to a significant portion of its international sales growth.

E-commerce Platforms (Online Presence)

While Orapi Group primarily operates in the business-to-business (B2B) sector, its official websites function as crucial channels for disseminating product information, handling customer inquiries, and potentially facilitating direct sales for specific product categories. This digital storefront is vital for global reach and lead generation.

In 2024, the importance of a robust online presence for B2B companies like Orapi continues to grow, driven by customer expectations for convenience and immediate access to detailed product specifications and support. This digital interaction complements traditional sales methods.

- Product Information Hub: Orapi's websites offer comprehensive details on their chemical solutions, allowing potential clients to research and compare offerings.

- Lead Generation Tool: Online forms and contact points enable prospective customers worldwide to submit inquiries, initiating the sales funnel.

- Customer Convenience: Providing 24/7 access to information and support significantly enhances the customer experience.

- Market Reach: The digital platform extends Orapi's visibility beyond geographical limitations, reaching a broader international clientele.

Trade Shows and Industry Exhibitions

Orapi leverages trade shows and industry exhibitions as a key channel for customer relationships and market penetration. Participating in events like FHAM and Aviation MRO Asia Pacific allows Orapi to directly engage with industry professionals and potential clients.

These exhibitions are vital for demonstrating Orapi's innovative solutions and reinforcing its brand presence within specialized sectors. In 2024, the global MRO market alone was valued at approximately USD 94.2 billion, highlighting the significant opportunity for engagement at events like Aviation MRO Asia Pacific.

Trade shows are highly effective for lead generation, enabling Orapi to identify and cultivate new business opportunities. They also provide invaluable market intelligence and feedback on product performance and industry trends.

- Product Showcase: Orapi exhibits its latest chemical and hygiene solutions, directly reaching target audiences.

- Networking: Direct interaction with potential clients and partners fosters stronger business relationships.

- Brand Visibility: Increased exposure at major industry events enhances Orapi's market recognition.

- Lead Generation: Exhibitions are a primary source for identifying and qualifying new business leads.

Orapi's channel strategy is multi-faceted, combining direct sales, a robust subsidiary network, distributor partnerships, digital presence, and participation in industry events to maximize market reach and customer engagement.

The direct sales force targets key sectors, while 32 global subsidiaries ensure localized sales and support. Distributor alliances extend reach into new markets, and online platforms serve as vital information hubs and lead generators. Trade shows offer direct interaction and market intelligence.

This integrated approach, emphasizing both personal relationships and digital accessibility, underpins Orapi's ability to serve diverse industrial and commercial clients effectively across various geographies.

| Channel | Description | Key Role in Orapi's Strategy | 2024 Relevance/Data Point |

|---|---|---|---|

| Direct Sales Force | Targeting major industrial, healthcare, and government clients. | High-value, customized solutions and personalized service. | Significant revenue contribution from key accounts in 2024. |

| Global Subsidiaries (32) | Strategically located across continents. | Localized sales, distribution, and customer support. | Facilitated adaptation to regional demands and regulations. |

| Distributor Partnerships | Collaborations to extend market reach. | Accessing local knowledge and networks in challenging markets. | Strengthened presence in emerging markets, driving international sales growth. |

| Official Websites | Digital storefront for product information and inquiries. | Global reach, lead generation, and customer convenience. | Growing importance for B2B client expectations in 2024. |

| Trade Shows/Exhibitions | Direct engagement at industry events. | Product showcasing, networking, brand visibility, and lead generation. | Key for engagement in sectors like MRO, with the global MRO market valued at ~USD 94.2 billion in 2024. |

Customer Segments

Orapi Group’s customer segment for the Food Processing and Hospitality Industry is a vital part of their business, offering specialized hygiene and maintenance solutions. For the food processing sector, they provide critical disinfectants and cleaning agents that adhere to rigorous food safety standards, ensuring product integrity and consumer well-being. This focus is paramount in an industry where contamination risks are high and regulatory compliance is non-negotiable.

The hospitality sector, encompassing hotels, restaurants, and resorts, also relies heavily on Orapi's comprehensive cleaning and sanitation offerings. These products are essential for maintaining high standards of cleanliness, guest satisfaction, and operational efficiency. In 2024, the global hospitality market was valued at over $4.7 trillion, highlighting the significant demand for reliable hygiene solutions within this expansive industry.

Orapi Group's Healthcare and Medical Environments segment is a cornerstone, providing essential hygiene and decontamination solutions to hospitals, clinics, and other medical facilities. Their products are critical for maintaining sterile conditions and preventing the spread of infections, a paramount concern in these settings. In 2024, the global infection control market, a direct indicator of demand for Orapi's offerings, was projected to reach over $200 billion, highlighting the significant need for their specialized products.

This customer segment has a stringent requirement for high-performance and certified products, as patient safety and regulatory compliance are non-negotiable. Orapi's commitment to delivering efficacy and meeting rigorous industry standards, such as ISO certifications, directly addresses these critical demands. The company's solutions are engineered to combat a wide range of pathogens, ensuring a safer environment for both patients and healthcare professionals.

Orapi provides essential cleaning, maintenance, and lubrication solutions specifically designed for the diverse transportation sector. This includes products for heavy goods vehicles, light commercial vehicles, and public transport fleets, all critical for maintaining operational efficiency and vehicle longevity. For instance, in 2024, the global automotive aftermarket services market was projected to reach over $500 billion, highlighting the significant demand for such specialized products.

Industrial Maintenance Companies

Industrial maintenance companies represent a foundational customer segment for Orapi Group, a critical market where their specialized chemical solutions are essential. These businesses, spanning manufacturing, heavy industry, and infrastructure, rely heavily on products that ensure the smooth operation and longevity of their vital machinery and equipment. Orapi's offerings in this segment include a comprehensive range of high-performance lubricants, powerful degreasers, robust adhesives, and various general maintenance chemicals. These products are specifically formulated to address the demanding conditions found in industrial settings, aiming to minimize downtime and enhance operational efficiency.

The value proposition for industrial maintenance clients centers on Orapi's ability to provide solutions that directly contribute to operational continuity and cost savings. By prolonging the lifespan of expensive machinery and optimizing manufacturing processes, Orapi helps these companies reduce capital expenditure on replacements and improve overall productivity. For instance, in 2024, the global industrial lubricants market was valued at approximately $75 billion, with a significant portion attributed to maintenance applications where product quality directly impacts equipment reliability and energy efficiency.

- Core Need: Industrial maintenance companies require reliable products to keep machinery operational and extend equipment life.

- Orapi's Solutions: Lubricants, degreasers, adhesives, and general maintenance chemicals designed for demanding industrial environments.

- Key Benefits: Reduced downtime, optimized manufacturing processes, and extended equipment lifespan, leading to cost savings.

- Market Significance: This segment is a cornerstone for Orapi, reflecting the essential role of maintenance chemicals in the broader industrial landscape, with the industrial lubricants market alone projected to reach over $90 billion by 2030.

Local Authorities and Public Sector

Orapi Group provides essential general hygiene and maintenance solutions to local authorities and public sector organizations. These clients manage public spaces, government offices, and various facilities, all requiring consistent cleanliness and upkeep. The group's offerings are tailored to meet the specific needs of these entities, ensuring public health and operational efficiency.

A key aspect of serving this segment is the requirement for bulk supplies, as public sector operations typically involve large-scale usage. Orapi understands this demand and is equipped to deliver significant volumes of its product range. Furthermore, adherence to public procurement standards and tender processes is paramount, a compliance Orapi Group has consistently demonstrated in its operations.

- Focus on Public Spaces: Orapi supplies hygiene and maintenance products for parks, streets, and public transport infrastructure.

- Government Facilities Management: The group supports the upkeep of administrative buildings, community centers, and public service outlets.

- Bulk Procurement Expertise: Orapi is adept at fulfilling large-volume orders typical of public sector contracts.

- Procurement Compliance: The company navigates and adheres to the stringent regulations of public sector purchasing processes.

Orapi Group's customer segments are diverse, reflecting the broad applicability of its hygiene and maintenance solutions. Key sectors include food processing and hospitality, where stringent hygiene is paramount for consumer safety and satisfaction, with the global hospitality market valued over $4.7 trillion in 2024. Healthcare and medical environments are another critical focus, demanding high-performance products to prevent infection spread, supported by a global infection control market projected to exceed $200 billion in 2024. The transportation sector relies on Orapi for maintaining vehicle efficiency and longevity, aligning with the over $500 billion global automotive aftermarket services market in 2024.

Industrial maintenance companies form a foundational segment, utilizing Orapi's lubricants, degreasers, and adhesives to ensure operational continuity and cost savings, with the industrial lubricants market alone estimated at $75 billion in 2024. Public sector organizations and local authorities also benefit from Orapi's general hygiene and maintenance offerings for public spaces and government facilities, requiring bulk supply and adherence to strict procurement standards.

| Customer Segment | Key Needs | Orapi's Solutions | Market Relevance (2024 Data) |

|---|---|---|---|

| Food Processing & Hospitality | Food safety, hygiene, guest satisfaction | Disinfectants, cleaning agents | Hospitality Market: >$4.7 trillion |

| Healthcare & Medical | Sterility, infection prevention, compliance | Decontamination solutions, certified products | Infection Control Market: >$200 billion |

| Transportation | Operational efficiency, vehicle longevity | Cleaning, maintenance, lubrication products | Automotive Aftermarket Services: >$500 billion |

| Industrial Maintenance | Equipment uptime, cost savings, process optimization | Lubricants, degreasers, adhesives, maintenance chemicals | Industrial Lubricants Market: ~$75 billion |

| Public Sector & Local Authorities | Public health, facility upkeep, bulk supply | General hygiene and maintenance products | N/A (Public procurement focus) |

Cost Structure

Orapi Group's cost structure is heavily influenced by raw material procurement and production expenses. These costs encompass the chemicals needed for their diverse product lines, as well as packaging materials and the energy consumed across their seven manufacturing facilities worldwide. In 2023, for example, the chemical industry globally saw raw material price volatility, directly impacting companies like Orapi.

The efficient management of these significant outlay is paramount. For instance, optimizing the supply chain to secure favorable pricing for bulk chemical purchases and reducing energy consumption through process improvements can lead to substantial cost savings. This focus on operational efficiency is key to maintaining profitability in a competitive market.

Orapi Group prioritizes innovation by dedicating a significant portion of its financial resources to Research and Development (R&D). In 2024, the company allocated 4.5% of its revenue to R&D initiatives, underscoring a commitment to continuous improvement and the development of new solutions. This investment is crucial for maintaining a competitive edge and driving future expansion.

These R&D expenditures encompass a range of essential components, including the compensation for highly skilled R&D personnel, the acquisition and maintenance of advanced laboratory equipment, and the costs associated with rigorous product testing. These elements are fundamental to translating innovative ideas into tangible, market-ready products and services.

The substantial investment in R&D is not merely an expense but a strategic imperative for Orapi. It fuels the pipeline for future growth, enabling the company to anticipate and respond to evolving market demands, enhance existing offerings, and explore entirely new technological frontiers. This forward-looking approach ensures long-term sustainability and value creation.

Orapi Group's cost structure is significantly influenced by its sales, marketing, and distribution efforts. This includes substantial expenses for its sales force salaries, ongoing marketing campaigns, and participation in key industry trade shows. These activities are crucial for customer acquisition and brand visibility.

The operational costs of maintaining a global distribution network, comprising 32 subsidiaries, also contribute heavily to this category. Ensuring products reach diverse markets efficiently requires significant investment in logistics and local infrastructure.

For instance, in 2024, Orapi Group reported that its sales, marketing, and distribution expenses represented a notable portion of its overall operating costs, reflecting the company's commitment to market penetration and growth across its international presence.

Personnel and Administrative Costs

Orapi Group's personnel and administrative costs are a substantial component of its cost structure, reflecting the significant investment in its workforce and operational infrastructure. In 2024, the company's approximately 1,100 employees represent a key fixed cost, encompassing salaries, social contributions, and benefits packages designed to attract and retain talent in the competitive industrial supplies market. Beyond direct employee compensation, general administrative expenses, including office rentals, utilities, IT support, and corporate governance functions, also contribute to this category.

Effective management of these personnel and administrative expenses is crucial for Orapi's profitability and operational efficiency. The company's strategy likely focuses on optimizing human resource management, which could involve efficient recruitment processes, performance management, and benefit plan administration. Furthermore, streamlining operational processes and leveraging technology can help reduce overheads, ensuring that administrative functions support rather than hinder business growth.

- Salaries and Benefits: A significant portion of Orapi's operating expenses is dedicated to compensating its global workforce of approximately 1,100 employees, covering base pay, bonuses, and comprehensive benefits.

- Office Overheads: This includes costs associated with maintaining office spaces across its various locations, such as rent, utilities, and property management fees.

- Corporate Functions: Expenses related to central administrative departments like finance, human resources, legal, and IT support are essential for the group's overall governance and operations.

- Operational Streamlining: Initiatives to improve efficiency in administrative processes and supply chain management are key to controlling these fixed costs.

Logistics and Warehousing Costs

Orapi Group's extensive international operations and diverse product portfolio necessitate significant investment in logistics and warehousing. These costs, encompassing transportation, storage, and inventory management, are a major component of their overall cost structure. For instance, in 2024, global shipping rates saw fluctuations, with the Drewry World Container Index averaging around $1,700 per 40ft container for much of the year, impacting Orapi's inbound and outbound freight expenses.

Effectively managing these logistical elements is crucial for Orapi to maintain competitive pricing and customer satisfaction. By streamlining supply chains and optimizing warehouse utilization, the group aims to mitigate rising operational costs. This includes leveraging technology for better inventory tracking and route optimization, which can lead to substantial savings.

Key aspects of Orapi's logistics and warehousing costs include:

- Transportation: Costs associated with moving raw materials and finished goods across global networks via road, rail, sea, and air.

- Warehousing: Expenses related to maintaining storage facilities, including rent, utilities, labor, and equipment.

- Inventory Management: Costs tied to holding and managing stock, such as insurance, potential obsolescence, and capital tied up in inventory.

- Customs and Duties: Fees and taxes incurred when importing or exporting goods across international borders, varying by region and product type.

Orapi Group's cost structure is significantly shaped by raw material procurement and production expenses, including chemicals, packaging, and energy for its seven global manufacturing sites. In 2023, the chemical industry experienced raw material price volatility, directly impacting such operational costs for companies like Orapi. Optimizing supply chains and reducing energy consumption are key strategies to manage these substantial outlays and maintain profitability.

Research and Development (R&D) represents a crucial investment, with Orapi allocating 4.5% of its revenue to R&D in 2024. These expenditures cover skilled personnel, advanced laboratory equipment, and product testing, all vital for innovation and maintaining a competitive edge. This strategic investment fuels future growth by enabling adaptation to market demands and exploration of new technologies.

Sales, marketing, and distribution efforts, including sales force compensation, marketing campaigns, and trade show participation, are significant cost drivers for Orapi. The operational costs of its 32 global subsidiaries, supporting product reach into diverse markets, also contribute heavily. In 2024, these combined expenses represented a notable portion of overall operating costs, reflecting the company's focus on market penetration.

Personnel and administrative costs, including salaries, benefits, and overheads for its approximately 1,100 employees, form a substantial part of Orapi's cost structure. General administrative expenses like office rentals and IT support are also significant. Effective human resource management and streamlining operational processes are essential for controlling these fixed costs and enhancing efficiency.

Logistics and warehousing are major cost components for Orapi's global operations, encompassing transportation, storage, and inventory management. Fluctuations in global shipping rates, such as the Drewry World Container Index averaging around $1,700 per 40ft container in 2024, directly affect freight expenses. Optimizing supply chains and leveraging technology are key to mitigating these costs and ensuring competitive pricing.

| Cost Category | Key Components | 2024 Relevance/Impact |

| Raw Materials & Production | Chemicals, packaging, energy | Volatility in chemical prices impacts profitability. |

| Research & Development | Personnel, equipment, testing | 4.5% of revenue allocated in 2024 for innovation. |

| Sales, Marketing & Distribution | Sales force, campaigns, logistics for 32 subsidiaries | Significant portion of operating costs for market growth. |

| Personnel & Administration | Salaries for ~1,100 employees, office overheads | Key fixed cost requiring efficient HR and process management. |

| Logistics & Warehousing | Transportation, storage, inventory management | Affected by global shipping rate fluctuations (e.g., Drewry Index ~$1700/40ft in 2024). |

Revenue Streams

Orapi's core revenue generation hinges on the direct sale of its extensive product portfolio. This includes essential professional hygiene items like detergents and disinfectants, alongside critical industrial maintenance solutions such as lubricants and adhesives.

These product sales are channeled through Orapi's direct sales force and its robust global distribution network, ensuring broad market reach and accessibility for its diverse customer base.

For 2024, Orapi reported a significant portion of its revenue stemming from these product sales, demonstrating the continued demand for its specialized hygiene and maintenance offerings across various industries.

Orapi Group generates revenue through the sale of specialized process solutions. These are products developed to help maintain and optimize industrial equipment and machinery, ensuring smooth operations and extending asset life.

Key offerings in this segment include niche applications such as paint shop consumables, vital for automotive and manufacturing sectors, and dust control products, crucial for safety and environmental compliance in various industrial settings.

The specialized nature of these process solutions often allows Orapi Group to achieve higher profit margins compared to more commoditized offerings. For instance, in 2024, the industrial consumables market, which includes these specialized solutions, saw continued growth driven by increased manufacturing output and a focus on operational efficiency.

Orapi Group, while known for its product lines, supplements its income through service and technical support fees. These offerings often involve advanced technical assistance, specialized training programs, and the development of bespoke solutions tailored to client needs.

These services not only enhance the value proposition of Orapi's core products but also establish a stream of recurring revenue. For instance, in 2023, Orapi's service and support segment contributed a significant portion to its overall financial performance, demonstrating the growing importance of this revenue channel.

Revenue from Sustainable Products

Orapi's commitment to sustainability is increasingly translating into significant revenue. In 2024, a substantial 35% of the company's total revenue was generated from its range of eco-friendly and sustainable products. This upward trend highlights a clear market shift, with consumers and businesses actively seeking environmentally conscious options. This revenue stream is a direct response to growing global awareness and demand for greener solutions across various industries.

The success of Orapi's sustainable product line demonstrates a strategic alignment with evolving market preferences. This segment is not just a niche offering but a core driver of financial performance. The company's ability to capture this growing demand underscores its innovation and market foresight.

- 35% of Orapi's revenue in 2024 came from sustainable products.

- This reflects strong market demand for eco-friendly solutions.

- The company is capitalizing on the shift towards environmental responsibility.

- This segment is a key contributor to Orapi's financial growth.

International Sales and Exports

Orapi's business model heavily relies on international sales and exports, demonstrating a robust global reach. In 2023, a remarkable 90.9% of its net sales were generated from Southern Europe, highlighting a concentrated strength in this region. This geographical focus is complemented by significant operations in Northern Europe and North America, further diversifying its revenue base.

The company actively pursues an expansion of its global footprint as a core strategy for continued revenue growth. This expansion is not just about entering new markets but also about deepening its presence and market share in existing international territories. By leveraging its product portfolio across various continents, Orapi aims to capture new customer segments and increase overall sales volume.

- Southern Europe Dominance: 90.9% of Orapi's net sales in 2023 originated from Southern Europe.

- Key International Markets: Significant revenue streams also come from Northern Europe and North America.

- Growth Strategy: Expanding its global presence is identified as a critical driver for future revenue increases.

Orapi Group's revenue is primarily built on the direct sale of its broad product catalog, encompassing hygiene essentials and industrial maintenance solutions.

A significant portion of its income is also derived from specialized process solutions, which are niche products designed for industrial equipment optimization.

Additionally, Orapi generates recurring revenue through technical support and services, including training and customized solutions.

The company's commitment to sustainability is a growing revenue driver, with eco-friendly products accounting for a substantial share of sales.

International sales are critical, with Southern Europe being the dominant market, contributing 90.9% of net sales in 2023.

| Revenue Stream | Description | 2023/2024 Data Point |

|---|---|---|

| Product Sales | Direct sales of hygiene and industrial maintenance products. | Core revenue driver. |

| Specialized Process Solutions | Niche products for industrial equipment optimization (e.g., paint shop consumables). | Higher profit margins; market growth in 2024. |

| Services & Technical Support | Assistance, training, and bespoke solutions. | Significant contributor to financial performance in 2023. |

| Sustainable Products | Eco-friendly product range. | 35% of total revenue in 2024. |

| International Sales | Revenue from global operations. | 90.9% of net sales in 2023 from Southern Europe. |

Business Model Canvas Data Sources

The Orapi Group Business Model Canvas is built upon a foundation of robust market research, internal financial data, and operational performance metrics. These diverse data sources ensure that each aspect of the canvas, from customer segments to cost structures, is informed by accurate and actionable insights.