Orapi Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Orapi Group Bundle

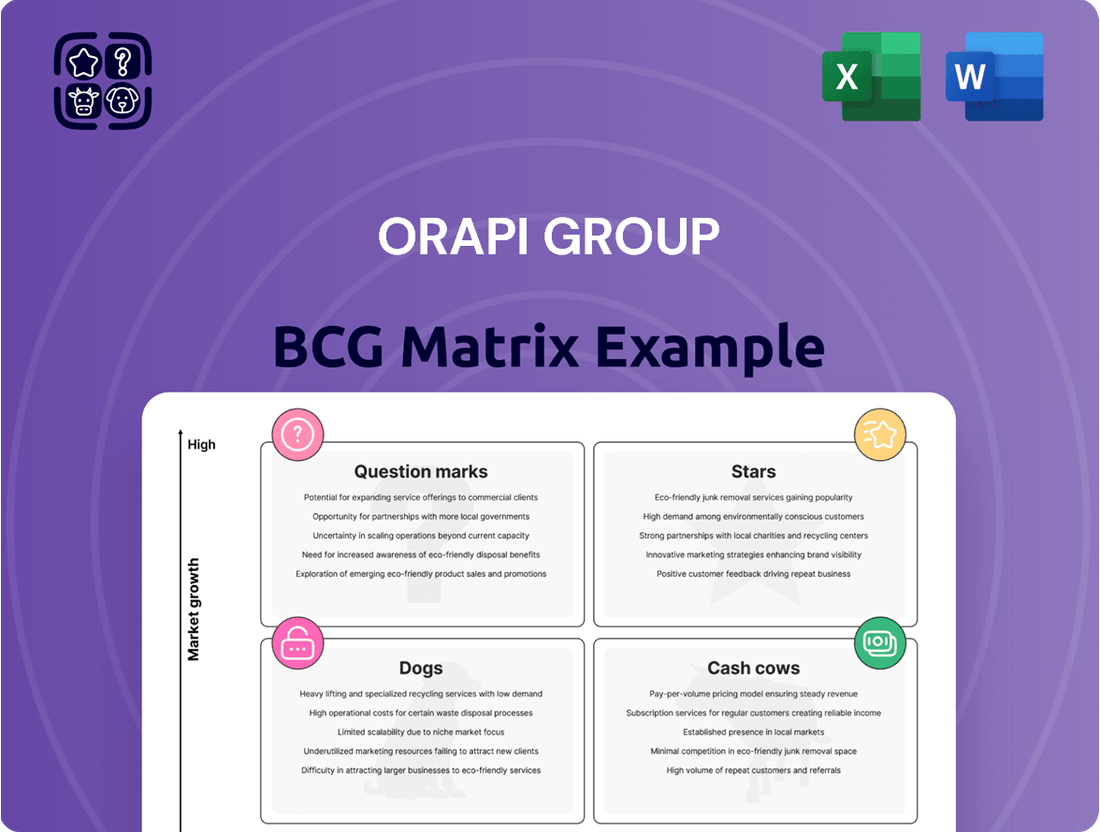

Curious about the Orapi Group's strategic positioning? This glimpse into their BCG Matrix reveals the fundamental framework for understanding their product portfolio's growth and market share. See which products are poised for future success and which might require a second look.

Don't let this initial overview be your only insight. The full Orapi Group BCG Matrix report provides a comprehensive quadrant-by-quadrant analysis, complete with actionable strategies for each product category. Understand where to invest, divest, and harvest to maximize your returns.

Gain the clarity needed to make informed decisions about Orapi Group's diverse offerings. Purchase the complete BCG Matrix to unlock a detailed breakdown, enabling you to optimize resource allocation and drive sustainable growth.

Stars

Orapi's advanced disinfection solutions, particularly their new soft formulations designed for sensitive medical and hospital settings, are positioned for significant success. This segment of the market is experiencing rapid expansion.

The global disinfectant market is a substantial and growing area, with projections indicating it will reach $15.6 billion by 2025. Healthcare environments are a key driver for this growth, demanding effective and safe disinfection products.

Continuous investment in research and development by Orapi ensures their disinfection products remain at the forefront of innovation and efficacy. This commitment to R&D helps them maintain a leading market position in this crucial sector.

Sustainable hygiene products are a burgeoning star within Orapi Group's portfolio, capturing 35% of its 2024 revenue. This category is a significant growth engine, fueled by heightened consumer awareness of environmental impact.

These offerings, characterized by their non-toxic, biodegradable, and eco-friendly formulations, directly address the demands of a rapidly expanding market segment. Orapi's distinguished Gold EcoVadis rating underscores their leadership and commitment in this vital and growing niche.

Orapi's specialized industrial lubricants and maintenance products cater to high-growth sectors such as aerospace and energy. These markets demand exceptional performance and specific industry approvals, making them prime candidates for Orapi's expertise. For instance, the global aerospace lubricants market was valued at approximately $1.2 billion in 2023 and is projected to grow at a CAGR of 5.5% through 2030, driven by increased aircraft production and maintenance needs.

The energy sector, particularly renewable energy, also presents significant opportunities. The demand for specialized lubricants in wind turbines, for example, is rising as the installed capacity of wind power continues to expand. By 2024, global wind power capacity is expected to exceed 1.5 terawatts, requiring robust lubrication solutions to ensure operational efficiency and longevity.

Orapi's focus on these niche markets, while potentially lower in volume compared to broader industrial applications, offers high growth potential. Technological advancements and stringent regulatory requirements create a competitive advantage for companies like Orapi that possess specialized knowledge and product certifications. This strategic positioning allows Orapi to capture value in segments where generic solutions are insufficient.

Integrated Hygiene Solutions for Healthcare

Orapi's integrated hygiene solutions for healthcare, covering cleaning, disinfection, and maintenance, position it strongly in a sector with consistent demand. The Laboratoire Garcin-Bactinyl® brand, tailored for medical settings, highlights Orapi's commitment to a market that prioritizes stringent hygiene and ongoing advancements. This focus allows them to capture a significant share of the healthcare hygiene market.

The healthcare hygiene market is substantial and growing. For example, the global hospital-acquired infection (HAI) prevention market was valued at approximately USD 15.5 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 7.2% through 2030. Orapi's offerings directly address this critical need.

- Market Growth: The increasing awareness of infection control and the rising number of healthcare facilities globally fuel demand for comprehensive hygiene solutions.

- Brand Strength: Laboratoire Garcin-Bactinyl® benefits from a reputation for quality and efficacy in a highly regulated environment.

- Product Breadth: Orapi's ability to offer a full suite of hygiene products simplifies procurement for healthcare providers.

- Innovation Focus: Continuous investment in R&D by Orapi ensures their solutions meet evolving healthcare standards and emerging pathogens.

New Market Entry Products via Strategic Acquisitions

Orapi's acquisition of Groupe Paredes in April 2024 introduces products that are poised to become Stars in the BCG matrix. These products, particularly those targeting new or fast-growing markets in professional hygiene, represent significant potential for rapid expansion and market share gains.

This strategic acquisition is designed to bolster Orapi's presence in the professional hygiene sector. By integrating Groupe Paredes' offerings, Orapi aims to access new customer segments and introduce high-growth potential products into its existing portfolio, thereby accelerating its market penetration and revenue generation.

- New Market Entry: Products gained from Groupe Paredes in April 2024 are expected to drive Orapi into new, high-growth market segments within professional hygiene.

- Star Potential: These acquired products are anticipated to exhibit rapid market growth and a strong competitive position, characteristic of Stars in the BCG matrix.

- Strategic Strengthening: The acquisition aims to enhance Orapi's overall market standing and broaden its customer reach through these new product lines.

- Portfolio Enhancement: Orapi anticipates that these new offerings will contribute significantly to a high-growth product mix, boosting overall company performance.

Orapi's sustainable hygiene products are a clear Star. Contributing 35% of 2024 revenue, these biodegradable and eco-friendly offerings tap into a market driven by environmental consciousness. Orapi's Gold EcoVadis rating further solidifies their leadership in this expanding niche.

The products acquired through the April 2024 acquisition of Groupe Paredes are positioned as Stars. These new offerings are targeting fast-growing segments within professional hygiene, indicating strong potential for rapid market share gains and accelerated revenue growth for Orapi.

Orapi's advanced disinfection solutions, especially those for sensitive medical settings, are also Stars. The global disinfectant market is robust, projected to reach $15.6 billion by 2025, with healthcare being a major growth driver demanding effective and safe products.

Specialized industrial lubricants for sectors like aerospace and energy also exhibit Star qualities. The aerospace lubricants market was valued at $1.2 billion in 2023, with a projected 5.5% CAGR through 2030, fueled by aircraft production and maintenance needs, while wind power expansion drives lubricant demand in the energy sector.

| Product Category | BCG Status | Key Growth Drivers | 2024 Revenue Contribution (Est.) | Market Growth Indicator |

|---|---|---|---|---|

| Sustainable Hygiene Products | Star | Consumer environmental awareness, Eco-friendly demand | 35% | Expanding niche |

| Groupe Paredes Acquired Products (Professional Hygiene) | Star | New market entry, High-growth segments | N/A (New Acquisition) | Rapid expansion anticipated |

| Advanced Disinfection Solutions (Medical) | Star | Healthcare infection control, Demand for safety | Significant | $15.6B global disinfectant market by 2025 |

| Specialized Industrial Lubricants (Aerospace/Energy) | Star | Aircraft production, Renewable energy expansion | Significant | Aerospace: $1.2B (2023) & 5.5% CAGR; Energy: Growing |

What is included in the product

Strategic evaluation of Orapi's portfolio, categorizing products into Stars, Cash Cows, Question Marks, and Dogs.

The Orapi Group BCG Matrix provides a clear, quadrant-based overview, instantly relieving the pain of strategic uncertainty.

Cash Cows

Orapi's established range of general-purpose industrial cleaners and degreasers likely represent cash cows within the Orapi Group's BCG Matrix. These products are staples in mature markets, serving diverse manufacturing and maintenance sectors with consistent demand. Orapi's long history has solidified its strong market presence and brand recognition in this segment, ensuring stable demand and a high market share.

The reliable cash flow generated by these products is a key characteristic of a cash cow. This stability often comes with lower promotional costs due to established brand loyalty and widespread adoption. In 2024, the industrial cleaning market continued to show resilience, with demand driven by ongoing industrial operations and stringent hygiene standards across various industries.

Traditional disinfectants and surface cleaners for commercial facilities represent Orapi's established cash cows. These are the everyday, high-volume essentials for offices, public spaces, and general hygiene needs, markets where Orapi has a strong and long-standing distribution network. Their consistent demand in mature hygiene sectors ensures stable, predictable revenue streams, requiring little in the way of new market penetration strategies.

In 2024, the global market for disinfectants and sanitizers was valued significantly, with traditional chemical disinfectants forming a substantial portion. Orapi's presence in this segment, particularly in commercial settings with established supply chains, allows for consistent sales. For example, the broader cleaning and hygiene products market consistently shows growth, with commercial facilities being a primary driver.

Orapi's foundational maintenance products for transportation, including standard vehicle cleaners and essential industrial oils, are firmly positioned as cash cows. These are the reliable workhorses of their product line, consistently generating revenue without requiring significant investment for growth.

The transportation sector, while mature, maintains a steady demand for upkeep, creating a stable, low-growth market. Orapi benefits from this by holding a substantial and consistent market share in these basic maintenance essentials, ensuring predictable income streams.

In 2024, the global automotive aftermarket, which includes these maintenance products, was valued at over $450 billion, a testament to the enduring need for vehicle care. Orapi's established presence in this segment allows them to capitalize on this consistent demand.

Hygiene Consumables for Food Processing

Hygiene consumables for food processing represent a classic Cash Cow for the Orapi Group. These products, including specialized detergents and sanitizers, cater to the food and beverage processing industry where maintaining impeccable hygiene is a constant, non-negotiable requirement. The demand for these items is inherently stable, driven by ongoing operational needs rather than cyclical trends.

Orapi's established reputation and deep commitment to stringent industry standards, such as HACCP and Halal certifications, have solidified its position. This allows the company to command a significant market share within this mature, yet perpetually essential, market segment. The consistent revenue generated from these products provides a reliable financial foundation for the Orapi Group.

- Market Share: Orapi holds a substantial share in the hygiene consumables market for food processing.

- Demand Stability: Demand is consistently strong due to the non-negotiable hygiene requirements in the food and beverage sector.

- Industry Standards: Adherence to HACCP and Halal certifications reinforces Orapi's credibility and market position.

- Financial Contribution: These products are key revenue generators, contributing significantly to the Orapi Group's overall financial health.

Legacy Product Lines with Established Customer Bases

Orapi's legacy product lines, particularly those with decades of history and a strong following, are indeed its cash cows. These established offerings tap into a loyal customer base, especially within Southern Europe, which accounted for a significant 90.9% of Orapi's net sales in 2023. Their enduring market presence is bolstered by customer inertia and well-developed supply chains, meaning they generate substantial profits with minimal need for fresh capital infusion to sustain their positions.

These products represent a stable revenue stream for Orapi Group.

- High Profitability: These mature products often have lower production costs due to economies of scale and established processes, leading to strong profit margins.

- Low Investment Needs: Unlike growth-stage products, cash cows require minimal R&D or marketing spend to maintain their market share, allowing Orapi to reallocate resources elsewhere.

- Customer Loyalty: Decades of operation have fostered deep customer relationships and brand recognition, creating a predictable demand.

- Geographic Concentration: The significant reliance on Southern Europe for 90.9% of net sales highlights a key market where these legacy products perform exceptionally well.

Orapi's general-purpose industrial cleaners and degreasers are classic cash cows, benefiting from steady demand in mature markets. These products have a strong market share due to Orapi's established brand and distribution, generating stable, predictable revenue with minimal reinvestment. The industrial cleaning market's resilience in 2024, driven by ongoing operations and hygiene standards, underscores the consistent sales Orapi experiences with these essential items.

Traditional disinfectants and surface cleaners for commercial use also fall into the cash cow category. Their high-volume, everyday demand in mature hygiene sectors, supported by Orapi's extensive distribution, ensures consistent earnings. The global disinfectants and sanitizers market, where traditional chemical disinfectants remain a significant component, highlights the stable revenue these products provide.

Orapi's foundational transportation maintenance products, like standard vehicle cleaners and industrial oils, are also cash cows. These reliable items serve a mature but consistent demand in the transportation sector, where Orapi holds a substantial market share. The global automotive aftermarket’s robust valuation in 2024, exceeding $450 billion, confirms the enduring market for these essential upkeep products.

Delivered as Shown

Orapi Group BCG Matrix

The Orapi Group BCG Matrix preview you're seeing is the identical, fully formatted document you'll receive upon purchase, offering a clear and actionable strategic overview.

This isn't a sample; it's the complete Orapi Group BCG Matrix, ready for immediate integration into your business planning and decision-making processes.

Expect to download the exact same comprehensive Orapi Group BCG Matrix report that's displayed here, ensuring no surprises and immediate utility for your strategic analysis.

The Orapi Group BCG Matrix you preview is the final, professionally compiled analysis you'll acquire, empowering you with essential market insights for growth.

Dogs

Obsolete or low-demand niche adhesives and sealants within the Orapi Group's portfolio would likely be categorized as Dogs in a BCG matrix. These are products with outdated formulations or those serving highly specific, shrinking industrial niches that haven't seen innovation. For instance, a sealant designed for a now-discontinued manufacturing process would fall into this category.

Such products typically exhibit low market share and operate in markets experiencing little to no growth. This translates to minimal revenue generation for Orapi. A 2024 analysis might reveal that these legacy products contribute less than 1% of the group's total revenue, despite occupying shelf space or requiring some level of inventory management.

The primary concern with these Dog products is their potential to tie up valuable resources, including capital for inventory, manufacturing capacity, and even marketing efforts that yield negligible returns. Identifying and strategically managing these items is crucial for optimizing the group's overall product portfolio performance.

Orapi's regional product lines in areas like North America represent a classic example of "Dogs" in the BCG matrix. These offerings struggle with very low market penetration, with North America accounting for a mere 0.8% of net sales in 2024. This indicates a lack of significant scale or a strong competitive edge in these markets.

Such underperforming segments often consume valuable resources, including R&D and marketing investment, without delivering substantial returns. This situation is typical when a company has a low market share within a local market that is either experiencing slow growth or is intensely competitive, making it difficult to gain traction.

Orapi Group's Dogs category encompasses commoditized cleaning or maintenance products facing fierce price competition. In 2024, the industrial cleaning market, a key segment for Orapi, saw global revenues estimated at over $75 billion, yet growth remained sluggish, projected at a CAGR of around 2-3% through 2030. This environment makes it challenging for Orapi to carve out market share when differentiation is minimal, forcing a reliance on price alone.

Products in this segment often struggle to achieve profitability due to high input costs and intense pressure from numerous competitors, including large multinational corporations and smaller, agile regional players. For instance, basic industrial degreasers or general-purpose disinfectants, while essential, offer little room for premium pricing or unique selling propositions, often resulting in thin margins that barely cover operational expenses.

These offerings typically reside in stagnant or even declining market segments, where innovation is slow and customer loyalty is primarily driven by cost. The risk of incurring losses is significant, especially if production costs rise or if a competitor initiates a price war. Consequently, these products represent a drain on resources that could be better allocated to more promising areas of the business.

Divestiture becomes a logical consideration for these Dog products. By selling off these low-performing assets, Orapi Group can free up capital, management attention, and production capacity. This strategic move allows the company to reinvest in its Stars or Question Marks, fostering growth and improving the overall health of its product portfolio.

Older Generations of Personal Protective Equipment (PPE)

Older generations of Personal Protective Equipment (PPE) from Orapi Group, such as basic gloves or masks, often fall into the Dogs category of the BCG Matrix. This is because these products typically face intense competition from numerous suppliers offering similar, widely available alternatives. The market for these foundational PPE items is often saturated and highly price-sensitive, making it a challenge for them to stand out or achieve substantial market growth. For instance, the global industrial gloves market, a segment where older PPE might reside, was valued at approximately USD 12.5 billion in 2023 and is projected to grow at a modest CAGR of around 4% through 2030, indicating a mature and competitive landscape. Without significant differentiation or cost advantages, these products struggle to generate high returns.

- Market Saturation: Basic PPE products are offered by a vast number of competitors, leading to a crowded marketplace.

- Price Sensitivity: Consumers in this segment are highly focused on cost, making it difficult to command premium pricing.

- Limited Differentiation: Older PPE often lacks the advanced features or specialized materials found in newer, more innovative products.

- Low Growth Potential: The demand for basic PPE is relatively stable but not experiencing rapid expansion, limiting profitability prospects.

Products Affected by Rapid Technological Obsolescence

Products susceptible to rapid technological obsolescence, such as legacy chemical formulations for industrial cleaning that have been replaced by bio-based or nanotechnology alternatives, would likely be categorized as Dogs in the Orapi Group BCG Matrix. These items face dwindling demand as customers actively seek out more efficient, sustainable, or cost-effective solutions. For instance, if Orapi maintained a product line of traditional solvent-based degreasers while the market shifted towards water-based or enzymatic cleaners, these older products would experience a sharp decline.

Such products are characterized by low market share and low growth potential. In 2024, the global industrial cleaning market saw a significant push towards green chemistry, with market research indicating a compound annual growth rate of over 6% for eco-friendly cleaning agents. Products that haven't adapted to this trend would struggle to compete.

- Declining Demand: Customer preference shifts towards newer, superior technologies.

- Low Market Share: Unable to compete effectively with innovative alternatives.

- Limited Growth Potential: Future market expansion is unlikely without significant product overhaul.

- Investment Avoidance: Companies often cease investing in products with obsolete core technology.

Orapi Group's "Dogs" represent products in mature or declining markets with low market share, such as certain legacy cleaning chemicals or basic PPE lines. These offerings contribute minimally to revenue, with 2024 data potentially showing them accounting for less than 1% of total sales. For example, older generation gloves in a saturated market might struggle to achieve significant sales volume.

These low-performing products consume resources like inventory management and marketing without generating proportional returns. The industrial cleaning market, while vast at over $75 billion globally in 2024, shows sluggish growth for commoditized items, making it hard for Orapi to gain traction. Divesting these "Dogs" can free up capital and focus resources on more promising segments.

Consider Orapi's presence in North America, where market penetration was only 0.8% of net sales in 2024. This low share in a competitive region highlights how certain product lines can become "Dogs." Similarly, commoditized industrial cleaners facing intense price competition in 2024 exemplify this category, where thin margins barely cover costs.

The company's older PPE, like basic masks, also fit the "Dog" profile. The global industrial gloves market, valued at $12.5 billion in 2023, shows modest growth, making it hard for undifferentiated products to stand out. These products face market saturation and price sensitivity, limiting their profitability.

| Product Category Example | Market Share (Estimated 2024) | Market Growth (CAGR) | Key Challenges |

| Legacy Industrial Cleaners | Low (<1%) | Low (2-3%) | Price competition, commoditization |

| Basic Personal Protective Equipment (PPE) | Low (<1%) | Modest (4%) | Market saturation, lack of differentiation |

| Regional Product Lines (e.g., North America) | Very Low (0.8% of net sales) | Niche-dependent | Low penetration, intense competition |

Question Marks

Orapi Group's emerging eco-friendly industrial solutions represent a significant growth opportunity within the Question Marks category of the BCG Matrix. These novel, environmentally conscious products for industrial processes and maintenance are still finding their footing in the market. The broader sustainable product market is certainly expanding, with global green technology and sustainability market size projected to reach $50.97 billion in 2024, but Orapi's specific early-stage offerings may not yet command a substantial market share.

These innovative solutions necessitate considerable investment in both marketing and distribution channels to effectively capture market share. The high-growth environment for sustainable industrial practices presents a compelling case for Orapi to strategically allocate resources. For instance, the demand for industrial biotechnology, a key component of many eco-friendly solutions, saw a CAGR of 8.5% from 2023 to 2030, reaching an estimated $10.3 billion by 2023.

Orapi Group's potential ventures into advanced digital or IoT-integrated hygiene systems likely represent a significant investment in a high-growth, yet nascent, market segment. While the overall hygiene sector is mature, the integration of IoT for real-time monitoring, predictive maintenance, and data-driven optimization of hygiene processes offers substantial future potential. For instance, the global smart hygiene market was valued at an estimated $2.5 billion in 2023 and is projected to reach over $10 billion by 2030, indicating a compound annual growth rate (CAGR) exceeding 20%.

Given this rapid technological evolution, Orapi's current market share in these sophisticated solutions is probably modest as they establish their presence and develop specialized expertise. These initiatives are cash-intensive, requiring substantial outlays for research and development (R&D) to create innovative products and for market development to educate customers and build adoption. The financial commitment is necessary to gain a foothold in a segment where early-mover advantages can be substantial.

Orapi's venture into North America, a region where its market share currently stands at a mere 0.8% of net sales, positions it as a classic question mark in the BCG matrix. This limited presence signifies a substantial opportunity for growth, given the vast potential of these markets.

However, achieving significant penetration will undoubtedly demand considerable financial investment and strategic focus. The challenge lies in transforming this nascent presence into a dominant force.

By 2024, Orapi's commitment to North America will be a critical determinant of its future trajectory. The company needs to analyze market dynamics, competitive landscapes, and potential acquisition targets to formulate an effective entry strategy.

The success of these expansion efforts will hinge on Orapi's ability to allocate resources wisely and adapt its product offerings to meet the specific demands of North American consumers.

Highly Specialized, Recently Developed Lubricants for Niche Applications

Orapi Group's highly specialized, recently developed lubricants for niche applications represent a classic "Question Mark" in the BCG Matrix. These innovative products are designed for emerging industrial sectors, such as advanced robotics or specialized semiconductor manufacturing, which are experiencing rapid growth but are not yet widely established.

Currently, these lubricants hold a low market share as they are in the early stages of market penetration and require significant investment in research and development alongside dedicated market education efforts to demonstrate their unique value proposition. For instance, the advanced synthetic ester lubricants for extreme temperature aerospace applications, while promising, still need to build brand recognition and customer trust against established alternatives.

- Targeting High-Growth Niches: These lubricants are aimed at sectors with projected compound annual growth rates (CAGR) exceeding 15%, such as the advanced materials processing industry.

- Low Market Share: Despite high potential, current market share for these specialized products is typically below 5%, reflecting their nascent stage.

- R&D and Market Education Focus: Significant resources are allocated to further product refinement and educating potential customers on the benefits of these cutting-edge formulations.

- Investment Required: Continued investment is crucial to scale production and capture market share as these niche applications mature.

New Disinfection Technologies (e.g., advanced virucidal formulations)

Orapi Group's new soft formulation for its Bactinyl® range, potentially featuring advanced virucidal technologies against emerging pathogens, could represent a Question Mark in their BCG matrix. This is due to the significant investment needed for market penetration despite the disinfectant market's overall growth. For instance, the global disinfectants market was valued at approximately USD 35.5 billion in 2023 and is projected to reach USD 55.3 billion by 2030, indicating a robust growth trajectory. However, successfully capturing market share with a novel formulation necessitates extensive marketing campaigns and a concerted effort to drive adoption within specific high-growth healthcare segments.

- Market Potential: The global disinfectants market is expanding, with projections indicating continued strong growth.

- Investment Required: Significant marketing and sales resources are essential to establish a new formulation.

- Adoption Challenges: Healthcare providers may require substantial evidence and time to switch to new disinfection protocols.

- Competitive Landscape: The market likely has established players, making it challenging for new entrants to gain traction quickly.

Question Marks within Orapi Group's portfolio represent nascent products or market entries with high growth potential but currently low market share. These ventures, such as their eco-friendly industrial solutions or specialized lubricants, require substantial investment in research, development, and market education to gain traction. The company is strategically allocating resources to these areas, aiming to convert them into future Stars.

The success of these Question Marks hinges on Orapi's ability to navigate competitive landscapes and drive customer adoption in high-growth sectors. For instance, the global smart hygiene market, where Orapi has new offerings, is projected for significant expansion, with an estimated CAGR exceeding 20% between 2023 and 2030.

Orapi's limited presence in North America, currently at 0.8% of net sales, exemplifies a classic Question Mark. This segment demands strategic focus and investment to capitalize on market opportunities and build a stronger foothold.

The company's new soft formulation for Bactinyl®, potentially featuring advanced virucidal technologies, also falls into this category. Despite the disinfectants market's overall growth, estimated at USD 35.5 billion in 2023, significant marketing efforts are needed to establish this new product.

| Product/Segment | Market Growth | Current Market Share | Investment Needs | BCG Category |

|---|---|---|---|---|

| Eco-friendly Industrial Solutions | High (e.g., Green Tech Market $50.97B in 2024) | Low | High (R&D, Marketing) | Question Mark |

| IoT-Integrated Hygiene Systems | Very High (e.g., Smart Hygiene Market >20% CAGR) | Low | High (R&D, Market Dev.) | Question Mark |

| Specialized Lubricants | High (Niche sectors >15% CAGR) | Low (<5%) | High (R&D, Education) | Question Mark |

| Bactinyl® Soft Formulation | High (Disinfectants Market $35.5B in 2023) | Low | High (Marketing, Adoption) | Question Mark |

| North America Presence | High (Vast Market Potential) | Very Low (0.8% Net Sales) | High (Strategy, Investment) | Question Mark |

BCG Matrix Data Sources

Our Orapi Group BCG Matrix leverages comprehensive market data, including financial reports, industry growth rates, and competitive landscape analysis, to provide a clear strategic overview.