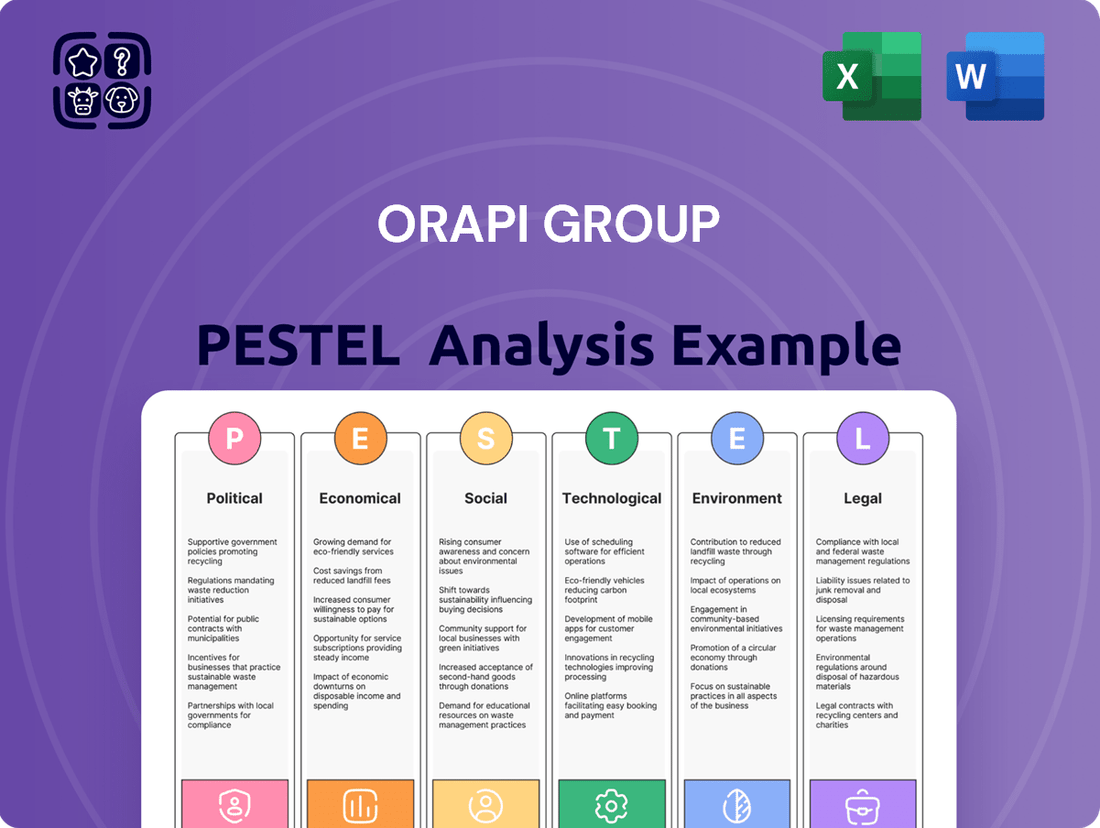

Orapi Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Orapi Group Bundle

Navigate the complex external forces shaping Orapi Group's trajectory with our meticulous PESTLE analysis. Understand the critical political, economic, social, technological, legal, and environmental factors influencing their operations and strategic decisions. This comprehensive report offers actionable intelligence to inform your investment or business planning. Don't be left in the dark; gain a competitive edge by downloading the full PESTLE analysis today and unlock the insights you need to thrive.

Political factors

Governments globally are increasingly scrutinizing chemical safety, with the EU's REACH regulation leading the charge. These evolving rules directly influence ORAPI's product development, production methods, and the expenses associated with meeting compliance. For example, the 2025 REACH updates focus on enhanced digitalization and more rigorous enforcement, which will likely increase operational demands for chemical producers.

Global trade policies, including tariffs and import/export regulations, directly impact ORAPI's operational costs and market reach. For instance, the ongoing trade friction between major economies can lead to unpredictable shifts in raw material pricing and availability, affecting chemical manufacturers like ORAPI. In 2024, the International Monetary Fund (IMF) projected global trade growth to be around 3.3%, a slight improvement but still subject to significant geopolitical headwinds.

Geopolitical tensions, such as regional conflicts or political instability, can disrupt critical shipping routes, as seen with the ongoing challenges in the Red Sea. These disruptions can significantly increase lead times and freight costs for chemical products, potentially impacting ORAPI's supply chain efficiency. The Suez Canal, a vital artery for global trade, experienced significant delays in early 2024 due to security concerns, affecting numerous industries reliant on maritime transport.

For ORAPI, a company with an international footprint, navigating these evolving trade policies and geopolitical dynamics is crucial for maintaining stable raw material sourcing and ensuring effective product distribution. The ability to adapt to sudden tariff changes or supply chain interruptions, such as those caused by geopolitical events, will be a key determinant of its competitive advantage.

Government initiatives to boost industrial output, particularly in sectors like healthcare and food processing, directly translate into increased demand for ORAPI's maintenance and hygiene solutions. For instance, the French government's commitment to revitalizing domestic manufacturing through programs like France 2030, which includes significant investment in health tech and sustainable industry, offers a fertile ground for ORAPI's product offerings.

Conversely, any policy-driven slowdown in industrial activity, perhaps due to unforeseen economic shifts or changes in regulatory priorities, could negatively impact the demand for essential industrial maintenance products. This highlights the sensitivity of ORAPI's market to the broader economic climate as shaped by government industrial policies.

ORAPI is well-positioned to capitalize on policies that actively promote manufacturing growth and infrastructure upgrades. The French government's focus on industrial modernization and the development of new industrial sites, as evidenced by ongoing investments in logistics and production facilities, directly benefits companies like ORAPI that supply critical maintenance and hygiene products for these operations.

Public Procurement and Green Initiatives

Governments worldwide are increasingly prioritizing sustainability in their purchasing decisions, with public procurement actively favoring companies demonstrating strong environmental, social, and governance (ESG) performance and offering eco-friendly products. This shift is a significant political factor influencing business operations. For instance, many European Union member states, including France where ORAPI is headquartered, have set ambitious targets for green public procurement. By 2025, the EU aims for at least 50% of public procurement contracts to include environmental considerations. This creates a clear advantage for ORAPI, whose product development actively incorporates eco-design principles and sustainable solutions, aligning directly with these governmental mandates.

These government-led green initiatives and certifications directly translate into a competitive edge for companies like ORAPI. As of early 2024, the demand for certified eco-friendly cleaning and maintenance products in the B2B sector, particularly within public institutions, has seen a notable uptick. ORAPI's established commitment to sustainability, evidenced by its adherence to standards like the European Ecolabel for certain product lines, positions it favorably to capture a larger share of this growing market. This trend therefore shapes ORAPI's strategic approach to product innovation and how it markets its offerings to public sector clients.

The influence of these political factors on product development and market positioning is undeniable. ORAPI's investment in research and development for biodegradable formulas and reduced-packaging solutions is a direct response to these evolving procurement policies. For example, tenders from French municipalities in 2023 and early 2024 frequently specified requirements for products with lower VOC emissions and recyclable packaging, areas where ORAPI has made strategic advancements. This necessitates continuous adaptation of its product portfolio to meet and exceed these environmentally driven regulatory demands.

Labor Laws and Employment Policies

Changes in labor laws, such as evolving minimum wage requirements and new regulations on worker classification, directly impact ORAPI's operational expenses and human resource strategies. For instance, a 2024 report indicated that several European countries, key markets for ORAPI, are exploring or implementing stricter wage transparency laws, potentially increasing administrative burdens and salary benchmarking costs. Compliance with these varied and often region-specific labor standards is critical for maintaining a stable workforce and safeguarding ORAPI's global reputation.

ORAPI must navigate a complex web of employment policies worldwide. In 2025, for example, several nations are anticipated to introduce legislation focusing on flexible work arrangements and employee data privacy, which will necessitate adjustments to HR systems and policies. Adherence to these diverse labor standards is not just a legal requirement but a cornerstone of effective workforce management and a positive corporate image.

- Wage Transparency: Several European nations are expected to strengthen wage transparency laws in 2024-2025, impacting ORAPI's compensation structures and administrative overhead.

- Employment Regulations: New or updated regulations concerning worker classification, benefits, and working conditions in key ORAPI markets require continuous policy review and adaptation.

- Global Compliance: ORAPI's commitment to adhering to diverse international labor standards is essential for managing its multinational workforce and maintaining its brand reputation.

- Flexible Work Policies: Anticipated legislative shifts in 2025 towards more flexible work arrangements will necessitate updates to ORAPI's HR frameworks and operational guidelines.

Governmental focus on chemical safety, exemplified by evolving REACH regulations, directly shapes ORAPI's product development and compliance costs, with 2025 updates emphasizing digitalization and enforcement. Global trade policies and geopolitical tensions, such as those affecting Red Sea shipping in early 2024, introduce volatility in raw material pricing and supply chain efficiency, impacting ORAPI's operational costs and market access. Government incentives for industrial growth, like France 2030, create demand for ORAPI's solutions, while sustainability mandates and green public procurement targets, aiming for 50% environmental considerations in EU contracts by 2025, favor ORAPI's eco-friendly product lines.

| Political Factor | Impact on ORAPI | Example/Data Point |

|---|---|---|

| Chemical Safety Regulations | Increased compliance costs, influences product development | REACH 2025 updates focus on digitalization and stricter enforcement. |

| Trade Policies & Geopolitics | Supply chain disruption, raw material cost volatility | Red Sea shipping delays in early 2024 increased freight costs. |

| Industrial Growth Initiatives | Increased demand for maintenance and hygiene solutions | France 2030 initiative supports sectors like health tech, benefiting ORAPI. |

| Sustainability & Green Procurement | Competitive advantage for eco-friendly products | EU aims for 50% of public procurement contracts to include environmental considerations by 2025. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental forces impacting the Orapi Group, offering actionable insights for strategic decision-making.

It delves into the Political, Economic, Social, Technological, Environmental, and Legal landscapes, presenting a clear picture of opportunities and threats relevant to Orapi's operations.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, distilling complex external factors into actionable insights.

Easily shareable summary format ideal for quick alignment across teams or departments, ensuring everyone understands the key political, economic, social, technological, legal, and environmental influences impacting Orapi.

Economic factors

The overall health of the global economy significantly impacts demand for ORAPI's professional hygiene and process solutions. A robust global economy generally translates to higher industrial output and increased spending across various sectors that rely on ORAPI's products.

Looking ahead to 2025, projections indicate a moderate growth trend for the chemical industry, which is a key sector for ORAPI. However, this growth is expected to be uneven across different end markets.

This varied demand landscape means ORAPI will likely see stronger performance in some sectors while facing slower growth in others, requiring strategic market focus.

For instance, the International Monetary Fund (IMF) projected global growth at 3.2% for both 2023 and 2024, with expectations for continued, albeit potentially moderating, growth into 2025, influencing consumer and industrial spending patterns.

Inflationary pressures and the volatile costs of raw materials, especially chemicals, directly influence ORAPI's manufacturing expenses and overall profitability. Recent data from the US Bureau of Labor Statistics indicates that the Producer Price Index for chemicals and allied products saw a notable increase in late 2023 and early 2024, reflecting these rising input costs.

To counteract these economic headwinds, many chemical industry players, including those supplying ORAPI, are actively pursuing cost-reduction strategies. These might involve optimizing supply chains, exploring alternative sourcing, or investing in more efficient production processes to shield their margins.

ORAPI's financial health and competitive standing are intrinsically linked to its effectiveness in navigating and managing these fluctuating raw material expenses. The company's capacity to absorb or pass on these increased costs will be a key determinant of its performance in the coming periods.

Higher interest rates can significantly influence capital expenditure and investment decisions for companies like ORAPI and their industrial clientele. When borrowing costs rise, businesses tend to become more cautious about initiating new projects or expanding existing operations.

The chemical industry, which is a key market for ORAPI, experienced some capital spending growth in 2024. However, projections indicate a slowdown for 2025. This anticipated deceleration is largely attributed to the persistent impact of high interest rates and prevailing market uncertainty.

This slowdown in industrial expansion directly affects demand for ORAPI's products. As fewer new factories are built or existing ones upgraded, the need for chemicals, cleaning solutions, and maintenance products diminishes, creating a less favorable investment climate for ORAPI.

Currency Exchange Rates

Currency exchange rate fluctuations significantly influence ORAPI Group's financial performance due to its extensive global footprint across five continents. Changes in the value of currencies in which ORAPI operates can directly affect the reported value of its international revenues and the cost of imported goods or services, ultimately impacting overall profitability. For instance, a strengthening Euro against other major currencies could make ORAPI's products more expensive in those foreign markets, potentially dampening sales volume, while a weaker Euro could boost reported revenues when translated back into Euros.

Effective management of these currency risks is a cornerstone of ORAPI's financial strategy. The Group likely employs hedging techniques, such as forward contracts or options, to mitigate potential losses arising from adverse currency movements. As of early 2024, major currency pairs like EUR/USD and EUR/GBP have shown volatility, underscoring the continuous need for robust currency risk management. For example, in 2023, the Euro experienced periods of both appreciation and depreciation against the US Dollar, directly affecting the translation of sales and expenses from ORAPI's North American operations.

- Global Operations Impact: ORAPI's presence in regions like Europe, North America, and Asia means it deals with multiple currencies, making it susceptible to exchange rate volatility.

- Revenue and Cost Translation: Fluctuations directly alter the Euro-denominated value of foreign sales and the cost of sourcing materials or components from different countries.

- Profitability Exposure: Unmanaged currency swings can lead to unexpected gains or losses, affecting ORAPI's bottom line and reported earnings per share.

- Hedging Strategies: ORAPI likely utilizes financial instruments to lock in exchange rates for future transactions, thereby reducing uncertainty and protecting profit margins.

Market Demand for Hygiene and Cleaning Services

The global cleaning services market is on a strong upward trajectory, projected to reach an estimated USD 1.5 trillion by 2027, demonstrating robust growth. This expansion is fueled by heightened public awareness of hygiene standards, particularly post-pandemic, alongside a burgeoning real estate sector and the integration of new technologies in cleaning solutions. The increasing demand spans both residential and commercial segments, with a notable surge in preference for professional and specialized cleaning services, presenting a significant market opportunity for ORAPI's diverse product offerings.

This growing demand translates directly into increased need for the types of products ORAPI provides. For instance, the market for professional cleaning chemicals alone was valued at over USD 170 billion in 2023 and is expected to continue expanding. This upward trend highlights the favorable market conditions for companies like ORAPI that supply essential cleaning and hygiene products.

- Significant Market Growth: The global cleaning services market is expanding rapidly, creating a fertile ground for hygiene and cleaning product suppliers.

- Key Demand Drivers: Increased hygiene awareness, real estate growth, and technological advancements are propelling the demand for cleaning services.

- Opportunity for ORAPI: The rising need for professional and specialized cleaning solutions directly benefits ORAPI's product portfolio.

- Industry Value: The professional cleaning chemicals sector, a key component of this market, shows substantial financial value and continued growth potential.

Global economic growth, projected at a moderate 3.2% for 2023 and 2024 by the IMF, influences ORAPI's demand. Rising raw material costs, evident in the chemical sector's producer price index increases in late 2023/early 2024, pressure ORAPI's margins. High interest rates are also dampening capital expenditure in key industries like chemicals, potentially slowing demand for ORAPI's solutions in 2025.

Currency fluctuations present a significant challenge for ORAPI's global operations. For instance, the Euro's volatility against major currencies like the USD in 2023 directly impacted the translation of sales and expenses. Effective hedging strategies are crucial for ORAPI to mitigate risks associated with these movements.

| Economic Factor | Impact on ORAPI | 2023-2025 Data/Projection |

|---|---|---|

| Global Growth | Demand for hygiene and process solutions | IMF projected 3.2% for 2023 & 2024 |

| Raw Material Costs | Manufacturing expenses & profitability | Chemical PPI increased late 2023/early 2024 |

| Interest Rates | Capital expenditure of clients | Projected slowdown in chemical industry capex for 2025 |

| Currency Exchange Rates | Revenue and cost translation | EUR/USD showed volatility in 2023 |

Full Version Awaits

Orapi Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Orapi Group delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain insights into market trends, regulatory landscapes, and strategic considerations essential for understanding Orapi Group's operational environment.

Sociological factors

Heightened hygiene awareness, significantly amplified by the COVID-19 pandemic, continues to fuel demand for ORAPI’s specialized cleaning and disinfection products. This persistent focus on health is driving sustained growth across multiple sectors, including healthcare facilities, food production, and public spaces, all requiring professional-grade hygiene solutions.

The global market for disinfectants and sanitizers was valued at approximately USD 75 billion in 2023 and is projected to reach over USD 110 billion by 2028, demonstrating a clear upward trend directly benefiting companies like ORAPI. This increased consciousness translates into a stronger market position for effective and reliable hygiene products.

Societal shifts are increasingly favoring products and services that demonstrate environmental responsibility. This growing preference for sustainability directly impacts consumer behavior and purchasing power across various sectors.

ORAPI Group has strategically positioned itself to capitalize on this trend, with its sustainable product lines contributing a significant 35% to its overall revenue in 2024. This demonstrates a clear alignment with evolving consumer and business demands for eco-conscious solutions.

This focus on sustainability not only meets current market expectations but also provides ORAPI with a distinct competitive advantage, anticipating future regulatory landscapes and consumer loyalty shifts towards greener alternatives.

Societal expectations for corporate social responsibility are growing significantly, with a strong emphasis on ethical labor practices and environmental protection. This trend directly impacts how businesses operate and are perceived by the public.

Orapi Group actively addresses these expectations through its dedication to sustainability. A key demonstration of this commitment is their EcoVadis Gold rating achieved in 2023, placing them among the top sustainability performers. Furthermore, the 'Generation ORAPI' charter underscores their internal focus on responsible practices.

These CSR initiatives are not just about compliance; they actively enhance Orapi's brand reputation. This stronger image makes the company more attractive to clients who prioritize ethical sourcing and to potential employees who seek to work for socially responsible organizations.

Workforce Demographics and Labor Shortages

Labor shortages in key sectors like cleaning and industrial maintenance are a significant sociological factor affecting demand for solutions like those offered by Orapi Group. These shortages, particularly prevalent in developed economies, drive a need for greater efficiency and automation. For instance, in the UK, the Office for National Statistics reported a vacancy rate of 12.7% in the cleaning sector in late 2023, highlighting a persistent challenge for businesses. This creates an opportunity for Orapi to develop and market products that not only perform effectively but also reduce the time and effort required per task, thereby optimizing labor utilization.

The aging workforce in many industrialized nations also contributes to labor availability challenges and a potential shift in worker preferences. As a result, there's an increased demand for user-friendly, ergonomic, and safe cleaning and maintenance solutions that can be easily adopted by a wider range of individuals, including those with less specialized training or physical limitations. Orapi's focus on high-performance, labor-optimizing products aligns directly with this trend.

- Labor Shortages Impact: Persistent labor shortages in cleaning and industrial maintenance sectors, with vacancy rates remaining elevated in many regions.

- Demand for Efficiency: This drives demand for automated, efficient, and easy-to-use hygiene and maintenance solutions.

- Workforce Aging: An aging workforce necessitates more ergonomic and user-friendly products to maintain operational efficiency.

- Orapi's Opportunity: Orapi can capitalize by offering products that enhance labor productivity and simplify complex tasks.

Digitalization and Data-Driven Decision Making

Societal shifts are rapidly accelerating the embrace of digitalization, fundamentally altering business operations and customer expectations. This trend is particularly evident in the cleaning and maintenance sector, where smart technologies are becoming increasingly integrated. For instance, the global smart building market, which heavily relies on digital solutions for facility management, was projected to reach USD 139.3 billion by 2024, showcasing the scale of this digital transformation. This pervasive digitalization encourages ORAPI to actively integrate digital solutions into its offerings and develop products that seamlessly interface with automated cleaning and maintenance systems.

This strategic alignment with digital trends allows ORAPI to meet the evolving demands of clients who prioritize efficiency, transparency, and data-driven insights in their facility management. Businesses are increasingly seeking solutions that can be monitored remotely, optimized through data analytics, and integrated into broader building management platforms. By offering products compatible with these automated systems, ORAPI positions itself as a forward-thinking partner, capable of delivering enhanced value in a digitally connected world.

- Smart technology adoption in facility management is growing rapidly, with the global smart building market expected to reach USD 139.3 billion by 2024.

- Clients increasingly expect digital integration, remote monitoring, and data-driven optimization in cleaning and maintenance services.

- ORAPI's focus on digital solutions and compatibility with automated systems addresses this societal shift towards efficiency and transparency.

The increasing awareness of hygiene, amplified by recent global health events, continues to drive demand for ORAPI's specialized cleaning and disinfection products. This heightened focus on health translates into sustained growth across various sectors, including healthcare and food production, which require professional-grade hygiene solutions.

Societal preferences are leaning towards environmentally responsible products, influencing consumer choices and purchasing power. ORAPI's strategic investment in sustainable product lines, which contributed 35% to its revenue in 2024, aligns perfectly with these evolving demands for eco-conscious solutions.

Growing expectations for corporate social responsibility, particularly regarding ethical labor and environmental stewardship, are shaping business perceptions. ORAPI's commitment is evidenced by its 2023 EcoVadis Gold rating and the 'Generation ORAPI' charter, bolstering its brand reputation and attractiveness to ethically-minded clients and employees.

Persistent labor shortages in sectors like cleaning and industrial maintenance, with UK cleaning sector vacancy rates at 12.7% in late 2023, are increasing the need for efficient and automated solutions. Simultaneously, an aging workforce necessitates more user-friendly and ergonomic products, presenting an opportunity for ORAPI to offer labor-optimizing solutions.

The rapid embrace of digitalization is transforming business operations, with the smart building market projected to reach USD 139.3 billion by 2024. ORAPI's integration of digital solutions and compatibility with automated systems positions it to meet client demands for efficiency and data-driven insights in facility management.

Technological factors

Continuous innovation in chemical formulations is a key technological driver, enabling the creation of cleaning agents and lubricants that are not only more effective but also safer and better for the environment. This evolution directly impacts industries reliant on specialized chemical products.

ORAPI's commitment to research and development is a prime example of leveraging these advancements. For 2024, the company has earmarked 4.5% of its revenue for R&D, a significant investment aimed at staying ahead in the chemical technology landscape. This focus allows ORAPI to develop next-generation disinfectants, highly efficient eco-friendly cleaning agents, and specialized additives designed to prolong the operational life of industrial equipment.

The professional hygiene sector is seeing a significant shift towards automation and robotics. This includes the rise of smart cleaning robots and fully automated cleaning systems, fundamentally changing how cleaning is performed. ORAPI's product development must consider this evolution, aiming for formulations that not only work with these advanced systems but also boost their efficiency and minimize direct human interaction.

The integration of the Internet of Things (IoT) and advanced data analytics is revolutionizing hygiene management. These technologies enable real-time monitoring of hygiene conditions, allowing for proactive responses to needs and the optimization of cleaning frequencies. For instance, smart sensors can detect usage patterns in restrooms or high-traffic areas, informing precisely when and where cleaning is most critical, leading to more efficient resource allocation.

ORAPI can harness these technological advancements to develop and offer smart hygiene solutions. These solutions would provide clients with data-driven insights into their facility's hygiene performance, identifying areas for improvement and demonstrating ROI through enhanced efficiency and service quality. By analyzing data from IoT devices, ORAPI can tailor cleaning protocols, predict potential issues before they arise, and ultimately elevate the customer experience within client facilities.

Development of Antimicrobial Surfaces and Coatings

Innovations in antimicrobial surfaces and coatings are creating new avenues for pathogen protection, especially in demanding settings like healthcare and public spaces. This technological leap offers ORAPI a chance to expand its product line or enhance existing solutions by incorporating these advanced features. The global market for antimicrobial coatings was valued at approximately USD 5.5 billion in 2023 and is projected to reach over USD 10 billion by 2028, indicating significant growth potential.

These developments open doors for ORAPI to explore synergistic product development. For instance, integrating antimicrobial properties into cleaning or maintenance products could offer a dual benefit to customers, providing both cleaning efficacy and long-term surface protection. This aligns with a growing consumer demand for hygiene and safety in everyday environments.

- Market Growth: The antimicrobial coatings market is expanding rapidly, driven by increased awareness of hygiene and infection control.

- Product Integration: ORAPI can leverage this technology by incorporating antimicrobial features into its existing product portfolio.

- New Market Opportunities: The development of specialized antimicrobial solutions presents opportunities for ORAPI to enter new market segments.

Supply Chain Digitization and Transparency

Technological advancements in supply chain management are fundamentally reshaping how businesses operate, particularly in navigating global disruptions. Digital platforms and enhanced visibility are becoming non-negotiable for maintaining operational continuity. For Orapi Group, embracing these innovations can significantly bolster its supply chain resilience.

By adopting technologies like real-time tracking and predictive analytics, Orapi can gain a clearer picture of its inventory, anticipate potential bottlenecks, and ensure the timely delivery of its diverse product range to customers worldwide. This proactive approach is vital in today's volatile market. For instance, the global supply chain management software market was valued at approximately $20.5 billion in 2023 and is projected to reach over $40 billion by 2028, indicating a strong industry trend towards digitization.

- Enhanced Visibility: Digital platforms allow for end-to-end tracking of goods, from raw materials to finished products.

- Improved Efficiency: Automation and data analytics streamline operations, reducing lead times and costs.

- Risk Mitigation: Real-time data helps identify and address potential disruptions proactively, such as port congestion or supplier issues.

- Customer Satisfaction: Reliable delivery and transparent communication foster stronger customer relationships.

Technological progress in chemical formulation, automation, and digital integration are key drivers for ORAPI. The company's significant R&D investment of 4.5% of revenue in 2024 underscores its commitment to innovation in areas like eco-friendly cleaning agents and advanced disinfectants.

The rise of robotics and IoT in professional hygiene necessitates ORAPI's adaptation to smart cleaning systems and data-driven hygiene management, enhancing efficiency and safety. Furthermore, advancements in antimicrobial coatings, a market projected to exceed USD 10 billion by 2028, offer ORAPI opportunities for product line expansion and synergistic development, promising dual benefits of cleaning and long-term surface protection.

| Technological Factor | Impact on ORAPI | Supporting Data/Trend |

|---|---|---|

| Chemical Formulation Innovation | Development of safer, more effective, and eco-friendly cleaning agents and lubricants. | ORAPI's 4.5% R&D investment in 2024 focuses on next-generation disinfectants and eco-friendly agents. |

| Automation & Robotics in Hygiene | Need to develop formulations compatible with smart cleaning robots and automated systems. | Fundamental shift in how cleaning is performed, requiring products that boost efficiency and minimize human interaction. |

| IoT & Data Analytics | Enabling smart hygiene solutions with real-time monitoring and optimized cleaning protocols. | IoT integration allows for data-driven insights, predictive maintenance, and enhanced customer service through tailored protocols. |

| Antimicrobial Surfaces & Coatings | Opportunity to enhance existing products or develop new solutions with pathogen protection. | The antimicrobial coatings market was valued at USD 5.5 billion in 2023 and is projected to reach over USD 10 billion by 2028. |

| Supply Chain Management Technology | Improving operational continuity and resilience through digital platforms and real-time tracking. | The global supply chain management software market is projected to reach over $40 billion by 2028, showing a strong trend towards digitization. |

Legal factors

The European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation, alongside comparable global chemical safety legislation, directly influences ORAPI's operations. These frameworks mandate rigorous data submission and risk assessment for chemical substances used in products.

Anticipated revisions to REACH in 2025, such as shorter registration validity periods and enhanced powers for the European Chemicals Agency (ECHA), will demand ongoing vigilance. For instance, ECHA's increased scrutiny might lead to more frequent requests for updated safety data, impacting ORAPI's research and development timelines and costs.

Stricter requirements for polymers and hazardous substances, expected with the REACH updates, could necessitate product reformulation for ORAPI. This means adapting chemical formulations to meet evolving safety standards, potentially affecting existing product lines and requiring investment in new research and development to ensure compliance and marketability of their cleaning and maintenance solutions.

Environmental Protection Regulations are a significant factor for ORAPI Group. Strict rules around waste management, water discharge, and emissions directly impact ORAPI's manufacturing operations and the entire lifecycle of its products. For instance, regulations like the EU's Waste Framework Directive (2008/98/EC) set targets for waste reduction and recycling, influencing how ORAPI handles byproducts and packaging.

The company's commitment to sustainability is heavily shaped by these environmental mandates. A growing emphasis on eco-design, as seen in initiatives to incorporate biodegradable ingredients into cleaning products, is a direct response to evolving regulatory landscapes and consumer demand for greener alternatives. This focus is crucial for maintaining market access and a positive brand image in an increasingly environmentally conscious world.

ORAPI must navigate stringent product safety and labeling laws, which dictate hazard classifications and the information provided to consumers across its wide array of products. These regulations are fundamental to ensuring consumer trust and market access.

A significant upcoming change impacting ORAPI is the mandatory adoption of new hazard classes and associated hazard statements for substances marketed within the European Union, effective from May 2025. This necessitates timely revisions to all product documentation and packaging to comply with these evolving standards.

Labor and Workplace Safety Regulations

Labor and workplace safety regulations are critical for Orapi Group, influencing everything from how their products are manufactured to how they are used. Compliance with these rules ensures that Orapi's offerings, especially those for industrial settings, genuinely contribute to a safer working environment, fostering client trust and avoiding potential penalties.

For instance, in the European Union, the Occupational Safety and Health (OSH) framework directives set stringent standards for worker protection. Orapi must adhere to these, ensuring their chemical products and application methods meet safety benchmarks. The **EU's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation**, which came into full effect in 2018 and continues to be updated, significantly impacts chemical manufacturers like Orapi by requiring detailed safety data and risk assessments for all substances. As of 2024, companies are increasingly focused on the lifecycle management of chemicals to ensure ongoing compliance and user safety.

- Workplace Safety Standards: Adherence to national and international safety protocols for chemical handling and application is mandatory.

- Employee Health: Regulations often mandate health monitoring for employees exposed to specific chemicals, impacting product development and safety data sheets.

- Product Stewardship: Orapi's responsibility extends to providing clear guidelines on safe product usage to prevent accidents and occupational diseases.

- Regulatory Compliance Costs: Investing in safety training and ensuring product compliance adds to operational costs but is essential for market access and reputation.

Intellectual Property Rights and Patents

Intellectual property rights are crucial for ORAPI, particularly for its innovative product formulations and technological breakthroughs. The legal landscape, including patent laws and trade secret protections, is essential for maintaining its competitive advantage by preventing imitation and securing returns on substantial research and development expenditures. For instance, in 2023, the global intellectual property market was valued at over $7 trillion, highlighting the economic significance of these assets.

ORAPI's ability to protect its unique chemical compounds and application methods through patents directly impacts its market position. Strong patent protection allows the company to exclusively commercialize its inventions, fostering continued investment in R&D. In the EU, patent applications saw a 3.7% increase in 2023, reflecting the growing importance of IP for businesses.

The legal framework surrounding trade secrets further shields ORAPI’s proprietary manufacturing processes and customer lists. This protection is vital in an industry where subtle variations in formulation can lead to significant performance differences. The US Patent and Trademark Office reported an 8% increase in patent grants in 2024, underscoring the robust legal environment for innovation.

- Patent Protection: Safeguards ORAPI's unique product formulations and R&D investments.

- Trade Secrets: Protects proprietary manufacturing processes and customer data.

- Competitive Edge: Prevents imitation and maintains market leadership.

- R&D Investment: Ensures returns on innovation, driving future development.

Legal factors significantly shape ORAPI Group's operational landscape, demanding strict adherence to chemical safety regulations like REACH. Mandatory updates to hazard classifications in the EU, effective May 2025, necessitate immediate revisions to product labeling and documentation, impacting ORAPI's compliance strategies and costs.

Furthermore, intellectual property law is critical for safeguarding ORAPI's innovations, with patent protection and trade secrets being key to maintaining its competitive edge. The increasing value of intellectual property globally, estimated to be over $7 trillion in 2023, highlights the importance of robust IP strategies for companies like ORAPI.

| Regulatory Area | Key Legislation/Factor | Impact on ORAPI | 2024/2025 Relevance |

|---|---|---|---|

| Chemical Safety | EU REACH Regulation | Mandates data submission, risk assessment for chemicals. | Ongoing compliance, anticipated revisions in 2025 impacting registration validity and ECHA's scrutiny. |

| Product Safety & Labeling | EU Hazard Classification Changes | Requires updated product documentation and packaging. | Mandatory adoption from May 2025, necessitating immediate compliance efforts. |

| Intellectual Property | Patent & Trade Secret Laws | Protects unique formulations and manufacturing processes. | Crucial for R&D investment returns; EU patent applications increased 3.7% in 2023. |

Environmental factors

Consumers and businesses are increasingly prioritizing products that minimize environmental impact. This growing awareness fuels a significant demand for sustainable and eco-friendly cleaning and maintenance solutions. For instance, a 2024 survey indicated that over 60% of consumers actively seek out environmentally responsible brands.

ORAPI's commitment, highlighted by its 'Generation ORAPI' charter, directly taps into this trend. By focusing on non-toxic, biodegradable, and locally sourced ingredients, ORAPI is well-positioned to meet this evolving market preference. This strategy is not just about compliance but about aligning with a core consumer value.

Concerns about climate change are increasingly influencing business operations, and ORAPI is no exception. The group faces growing pressure to address issues like water scarcity and high energy consumption in its manufacturing. This means investing in and developing more resource-efficient processes and product designs to minimize its environmental impact.

Innovations are key to ORAPI's strategy in this area. For instance, the development of concentrated cleaning products significantly reduces water usage during both production and application, a critical step in managing water scarcity. Furthermore, promoting water-saving cleaning methods among consumers directly tackles the challenge of reduced water availability.

These efforts are not just about environmental responsibility; they are also about meeting evolving regulatory standards and consumer expectations. By 2024, for example, the European Union's Green Deal initiatives are pushing for greater sustainability across industries, impacting product formulations and packaging. ORAPI's focus on reduced environmental footprint positions it favorably to navigate these upcoming requirements.

The increasing global focus on sustainability, particularly the circular economy, directly impacts ORAPI. This means ORAPI must meticulously manage its products' entire lifecycle, from sourcing raw materials to how packaging is handled and ultimately disposed of. For instance, the European Union's Circular Economy Action Plan, updated in 2023, sets ambitious targets for waste reduction and increased recycling rates across various sectors.

ORAPI's commitment to reducing waste and incorporating recycled materials into its product lines is a strategic response to these evolving environmental expectations. By offering bulk options, the company not only minimizes packaging waste but also provides cost-effective solutions for its customers, directly supporting circular economy principles. In 2023, the global market for recycled plastics alone was valued at over $45 billion, highlighting the significant economic opportunity in embracing these practices.

Biodegradability and Chemical Impact on Ecosystems

There's a growing focus on how chemicals affect the environment, especially how quickly they break down and their impact on water ecosystems. This means companies are being watched more closely than ever. For instance, the European Chemicals Agency (ECHA) regularly updates its lists of substances of very high concern due to their environmental persistence or toxicity. As of early 2024, regulatory bodies continue to emphasize the need for data on chemical biodegradability and ecotoxicity.

ORAPI's dedication to creating products that are safe for aquatic life and easily biodegradable is a significant environmental advantage. This commitment not only aligns with increasing consumer demand for sustainable options but also positions ORAPI favorably against competitors who may not have such stringent environmental standards. In 2023, the market for eco-friendly cleaning products alone was valued at over $12 billion globally, demonstrating a clear financial incentive for such product development.

Key considerations for ORAPI in this area include:

- Product Formulation: Ensuring all new and existing product lines meet rigorous biodegradability standards, aiming for ready biodegradability as defined by OECD guidelines.

- Aquatic Toxicity Testing: Conducting comprehensive tests to confirm that products are non-toxic to a range of aquatic organisms, such as fish and daphnia.

- Regulatory Compliance: Staying ahead of evolving environmental regulations in key markets, like REACH in Europe, which mandates detailed chemical safety assessments.

- Supply Chain Scrutiny: Evaluating the biodegradability and chemical impact of raw materials sourced from suppliers to ensure a holistic approach to environmental responsibility.

Certifications and Environmental Standards

Orapi Group's commitment to environmental standards is underscored by its pursuit of certifications like EcoVadis Gold. In 2024, EcoVadis awarded over 100,000 companies, with only about 14% achieving Gold status, highlighting the rigor involved. Achieving such recognition validates Orapi's sustainable practices, building crucial market trust.

These environmental certifications act as a significant competitive differentiator. As consumer and business demand for eco-friendly products intensifies, credentials like Green Seal or Ecolabel provide tangible proof of Orapi's dedication. For instance, the global market for green building materials alone was valued at over $250 billion in 2023 and is projected for continued growth.

Maintaining these standards requires ongoing investment and operational adjustments. This includes:

- Implementing sustainable sourcing of raw materials.

- Reducing energy consumption and waste generation in manufacturing.

- Ensuring compliance with evolving environmental regulations across different markets.

- Communicating environmental performance transparently to stakeholders.

Growing consumer and business demand for sustainable products is a significant driver for Orapi Group. A 2024 survey revealed that over 60% of consumers actively seek out environmentally responsible brands, directly influencing the market for eco-friendly cleaning and maintenance solutions. This trend aligns with Orapi's 'Generation ORAPI' charter, which emphasizes non-toxic and biodegradable ingredients.

Concerns regarding climate change are prompting businesses to address water scarcity and energy consumption, impacting manufacturing processes and product design. Orapi's development of concentrated cleaning products, for example, reduces water usage, addressing the challenge of reduced water availability. Furthermore, the European Union's Green Deal initiatives, impacting product formulations and packaging as of 2024, necessitate a focus on reduced environmental footprints.

The global push towards a circular economy requires Orapi to manage its products' entire lifecycle, from sourcing to disposal, in line with initiatives like the European Union's Circular Economy Action Plan updated in 2023. Orapi's commitment to reducing waste and incorporating recycled materials, evident in its bulk options, supports these principles, tapping into a global recycled plastics market valued at over $45 billion in 2023.

Environmental regulations and consumer awareness regarding chemical impact are intensifying, with bodies like ECHA continuously evaluating substances of very high concern. Orapi's focus on creating products safe for aquatic life and easily biodegradable offers a competitive edge, especially considering the global eco-friendly cleaning products market was valued at over $12 billion in 2023.

| Environmental Factor | Impact on Orapi Group | 2023/2024 Data/Trend |

| Consumer Demand for Sustainability | Increased sales for eco-friendly products | 60% of consumers seek eco-responsible brands (2024 survey) |

| Climate Change Concerns | Need for resource-efficient processes | Focus on water-saving innovations like concentrated products |

| Circular Economy | Emphasis on lifecycle management and waste reduction | Recycled plastics market >$45 billion (2023); EU Circular Economy Action Plan |

| Chemical Regulations & Biodegradability | Demand for non-toxic, biodegradable formulations | Eco-friendly cleaning products market >$12 billion (2023) |

PESTLE Analysis Data Sources

Our PESTLE Analysis is meticulously constructed using a blend of official government publications, leading economic indicators from international bodies like the IMF and World Bank, and comprehensive industry-specific reports. This ensures that every insight into the political, economic, social, technological, legal, and environmental landscape is grounded in verifiable and current data.