Onto Innovation PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Onto Innovation Bundle

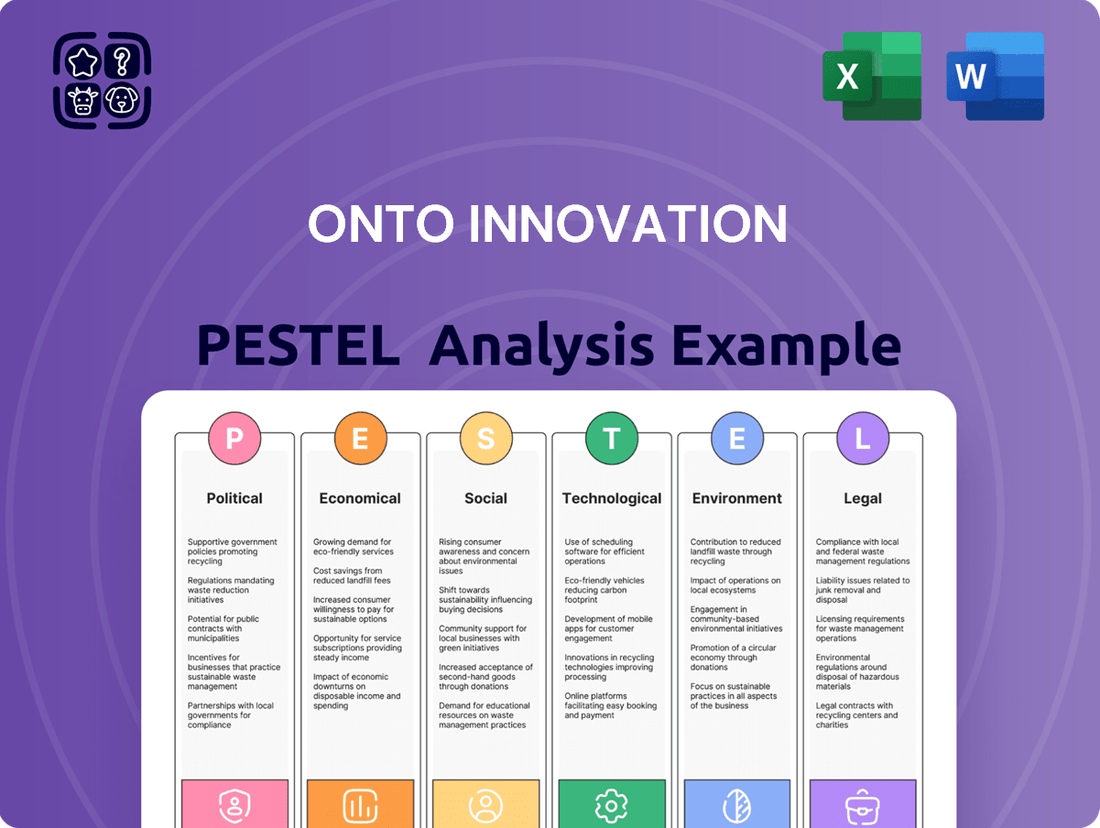

Navigate the complex external landscape impacting Onto Innovation with our detailed PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are shaping their market. This expert-crafted report provides actionable intelligence to inform your strategic decisions. Download the full version now and gain a critical competitive advantage.

Political factors

Geopolitical trade tensions, especially between the United States and China, continue to ripple through the global semiconductor industry. These ongoing disputes directly influence companies like Onto Innovation, which are integral to the semiconductor supply chain. For instance, in 2023, the US expanded export controls on advanced semiconductors and related manufacturing equipment to China, aiming to curb its technological advancements. This action, and similar measures, inject significant uncertainty into the market.

The increasing tariffs and restrictions on technology transfers raise production costs for manufacturers and can disrupt established supply routes. Companies must adapt by diversifying their sourcing and manufacturing locations, a strategic imperative for resilience. Onto Innovation's reported strategy of maintaining a relatively limited direct exposure to the Chinese market, as highlighted in their financial disclosures, positions them with a degree of insulation from the most severe direct impacts of these specific trade skirmishes.

Global governments are actively investing in semiconductor manufacturing through substantial subsidies and incentives. For instance, the US CHIPS and Science Act of 2022 allocated over $52 billion to boost domestic chip production and research. Similarly, the European Union's Chips Act aims to mobilize €43 billion in public and private investment by 2030, with a goal of doubling its market share in semiconductors by the same year.

These strategic moves by nations like Japan and South Korea also reflect a strong push to secure their semiconductor supply chains and drive domestic innovation. Japan, for example, has pledged billions in support for companies like TSMC to establish advanced foundries within its borders, aiming to bolster its technological independence and economic resilience.

This global trend creates significant opportunities for equipment providers such as Onto Innovation. As countries pour resources into building new fabrication plants and expanding existing ones, there will be increased demand for the advanced metrology and inspection solutions Onto provides to ensure chip quality and yield.

The increasing recognition of semiconductors as vital for national security is a significant political driver. This perspective fuels government policies aimed at achieving technological dominance, directly impacting companies like Onto Innovation that supply critical manufacturing equipment.

Consequently, nations are implementing stricter export controls, particularly on advanced semiconductor technologies. For instance, the US Department of Commerce's Bureau of Industry and Security (BIS) has been actively updating export regulations in 2024 and early 2025, targeting specific advanced chip manufacturing equipment and materials to countries deemed strategic risks, thereby shaping global supply chains and market access.

Governments are also channeling substantial strategic investments into domestic semiconductor manufacturing and research. The CHIPS and Science Act in the US, with over $52 billion allocated, is a prime example of this trend, aiming to onshore production and foster innovation, which could create new opportunities and competitive pressures for equipment providers.

These political maneuvers directly influence Onto Innovation's operational landscape, dictating market access for its metrology and inspection solutions. The company must navigate these evolving regulations and strategic investments to maintain its competitive edge and operational flexibility in a politically charged technological arena.

Impact of Regional Conflicts

Ongoing geopolitical tensions, including the conflict in Ukraine and instability in the Middle East, directly impact Onto Innovation by threatening the semiconductor supply chain. These conflicts can disrupt the availability of essential raw materials and hinder manufacturing processes critical for the company's operations. For instance, the ongoing conflict in Ukraine has continued to affect the global supply of neon gas, a crucial component for lithography, a process Onto Innovation’s equipment supports.

Companies like Onto Innovation must remain agile and adapt their supply chain strategies in response to these geopolitical risks. This includes diversifying sourcing contracts and building resilience to navigate potential disruptions. In 2024, many semiconductor firms were actively reassessing their reliance on single-source regions due to these persistent global uncertainties.

The need for companies to secure alternative suppliers and build buffer stock for key components becomes paramount. This strategic adjustment is a direct response to the volatile international landscape, ensuring operational continuity. This adaptability is crucial for maintaining market position and meeting customer demand amidst unpredictable events.

Specific impacts include:

- Disruption to critical raw material flows: Geopolitical events can limit access to vital materials used in semiconductor manufacturing.

- Manufacturing operational challenges: Conflicts can directly impede or halt production facilities, affecting output.

- Increased sourcing costs: Companies may face higher expenses as they secure materials from less traditional or more distant suppliers.

- Need for supply chain diversification: A strategic shift towards multiple sourcing locations is essential for mitigating risk.

Regulatory Streamlining for Manufacturing

The United States' 'Building Chips in America Act' is a significant political development aimed at boosting domestic semiconductor manufacturing. By allowing certain projects to bypass federal environmental reviews, the act seeks to expedite the construction of new fabrication plants, or fabs. This streamlined regulatory approach is designed to accelerate Onto Innovation's market opportunities in the US. For instance, the CHIPS and Science Act of 2022 allocated $52.7 billion to incentivize domestic semiconductor production and research, with a portion of this funding expected to fuel new fab construction where companies like Onto Innovation provide critical process control and metrology solutions.

This political push for faster development, however, presents a delicate balance between economic growth and environmental responsibility. While reducing regulatory hurdles can speed up project timelines, it also raises questions about the long-term environmental impact of increased manufacturing. Onto Innovation, as a supplier to the semiconductor industry, may see accelerated demand for its equipment as new fabs come online more quickly, but must also navigate evolving environmental compliance standards.

Key aspects of this regulatory shift include:

- Accelerated Permitting: Exemptions from certain federal environmental reviews aim to shorten the time it takes to get new semiconductor manufacturing facilities approved and built.

- Economic Stimulus: The legislation is tied to broader efforts to onshore critical industries, driven by national security and economic competitiveness concerns.

- Potential Trade-offs: The speed of development may be prioritized over thorough environmental impact assessments, creating a potential area of concern for future sustainability.

- Market Opportunity for Onto Innovation: Faster fab build-outs directly translate to increased demand for Onto's advanced metrology and inspection tools, crucial for qualifying and controlling new manufacturing processes.

Geopolitical tensions, particularly US-China trade disputes, directly impact Onto Innovation's market access and create supply chain uncertainty. The US CHIPS and Science Act of 2022, allocating over $52 billion for domestic chip production, and similar EU initiatives, aim to bolster national semiconductor capabilities. Governments are increasingly viewing semiconductors as critical for national security, leading to stricter export controls on advanced technologies, with updated regulations in early 2025 shaping global supply chains.

| Political Factor | Description | Impact on Onto Innovation | Relevant Data/Events (2024-2025) |

| Trade Tensions | US-China trade disputes and export controls on advanced technology. | Creates market uncertainty and influences supply chain strategies. | US expanded export controls on advanced semiconductors in 2023; ongoing regulatory updates in 2024-2025. |

| Government Subsidies & Investment | National initiatives to boost domestic semiconductor manufacturing and R&D. | Increases demand for metrology and inspection solutions as new fabs are built. | US CHIPS Act ($52B+); EU Chips Act (€43B by 2030); Japan's significant investment in domestic chip production. |

| National Security Focus | Recognition of semiconductors as vital for national security. | Drives policies for technological dominance and stricter export controls. | Continued focus on securing supply chains and technological independence by major economies. |

| Regulatory Environment | Changes in regulations affecting manufacturing and trade. | Impacts market access, operational costs, and speed of new facility development. | US 'Building Chips in America Act' aims to expedite fab construction by streamlining environmental reviews. |

What is included in the product

This Onto Innovation PESTLE analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the company's operations and market position.

It provides actionable insights and forward-looking perspectives crucial for strategic decision-making and identifying opportunities.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining the understanding of external factors impacting Onto Innovation's strategic decisions.

Economic factors

The semiconductor industry is on a robust growth trajectory, with forecasts indicating double-digit expansion throughout 2024 and into 2025, aiming for record sales. This surge in chip manufacturing is a significant positive factor for Onto Innovation, as greater production volumes directly translate to increased demand for its advanced process control and inspection solutions.

The escalating demand for generative AI chips is a significant economic catalyst, driving immense investment into high-performance computing and sophisticated chip packaging. This surge is reshaping the semiconductor landscape, creating new market opportunities.

Onto Innovation is strategically positioned to capitalize on this trend. Its advanced metrology and inspection solutions are essential for the intricate manufacturing steps involved in producing these cutting-edge AI chips, ensuring quality and yield.

For instance, the global AI chip market was projected to reach over $40 billion in 2023 and is expected to grow at a CAGR of around 40% through 2030, highlighting the sheer scale of this economic driver. Onto's role in enabling this growth is therefore critical.

Semiconductor manufacturers are projecting substantial capital expenditures for 2025, with estimates suggesting industry-wide spending could surpass $200 billion. This surge is driven by the escalating demand for advanced chips across various sectors, from artificial intelligence to automotive. Onto Innovation, a key player in process control and metrology solutions, directly benefits from this trend.

The significant investments in new fabrication plants and upgrades to existing facilities translate into a heightened need for Onto Innovation's sophisticated equipment. These capital expenditures are essential for semiconductor companies to expand their production capacity and meet the projected growth in chip consumption, which analysts predict will see a compound annual growth rate of over 8% through 2026.

This increased demand for advanced manufacturing capabilities means that semiconductor companies are actively seeking to enhance their yield and efficiency. Onto Innovation's process control solutions are critical in achieving these goals, enabling manufacturers to ensure the quality and performance of their complex semiconductor devices.

Strong Financial Performance and Acquisitions

Onto Innovation is experiencing a period of significant financial strength. The company achieved record revenue in the first quarter of 2025, marking its seventh consecutive quarter of growth. This consistent upward trend underscores the company's effective operational strategies and market demand for its products and services.

Further bolstering its financial outlook, Onto Innovation recently acquired Semilab International's materials analysis business. This strategic move is expected to significantly enhance the company's revenue streams and solidify its competitive standing within the industry. The integration of Semilab's operations is anticipated to unlock new growth opportunities and expand Onto Innovation's technological capabilities.

- Record Q1 2025 Revenue: Onto Innovation reported its highest ever quarterly revenue in Q1 2025.

- Seventh Consecutive Quarter of Growth: This sustained growth highlights the company's stable performance.

- Acquisition of Semilab's Materials Analysis Business: This strategic acquisition is projected to boost revenue and market position.

- Strengthened Market Position: The integration of Semilab's assets will enhance Onto Innovation's competitive edge.

Cyclical Nature and Market Volatility

The semiconductor industry, despite its robust growth trajectory, is inherently cyclical. This means periods of rapid expansion can be followed by downturns, introducing market volatility. For Onto Innovation, this cyclical nature can impact revenue and profitability, even within its strong segments.

Onto Innovation is strategically positioned to benefit from high-growth areas such as advanced semiconductor nodes and AI-driven packaging solutions. However, broader macroeconomic shifts and the demand patterns within key end-markets, like automotive or consumer electronics, can still create headwinds and influence investor sentiment towards the company's stock.

For instance, while the global semiconductor market was projected to grow by over 10% in 2024 according to some industry forecasts, significant fluctuations in demand for consumer electronics, a major end-market, can quickly alter this outlook. This highlights the importance of understanding the cyclicality impacting even specialized players like Onto Innovation.

- Cyclical Downturns: The semiconductor industry has historically experienced cycles of boom and bust, with demand heavily influenced by global economic conditions.

- End-Market Sensitivity: Onto Innovation's performance is tied to the health of various end-markets, such as smartphones, data centers, and automotive, which themselves are subject to economic cycles.

- Inventory Adjustments: During downturns, customers may reduce their inventory levels, leading to decreased orders for equipment and materials providers like Onto Innovation.

- Investor Sentiment: Market volatility can lead to significant swings in investor confidence, impacting Onto Innovation's stock price regardless of its operational performance.

The semiconductor industry's robust growth, projected for double-digit expansion through 2025, directly fuels demand for Onto Innovation's advanced process control and inspection solutions. This expansion is driven by the escalating demand for AI chips, a market expected to exceed $40 billion in 2023 and grow at a ~40% CAGR. Furthermore, substantial capital expenditures, anticipated to surpass $200 billion industry-wide in 2025, signal increased investment in fabrication facilities, creating a direct need for Onto's sophisticated equipment to enhance yield and efficiency.

| Key Economic Drivers | 2023/2024 Projections | 2025 Outlook | Impact on Onto Innovation |

| Semiconductor Industry Growth | 10%+ growth in 2024 | Continued double-digit growth | Increased demand for process control and inspection solutions |

| AI Chip Market | >$40 billion (2023) | ~40% CAGR | High demand for advanced metrology for AI chip manufacturing |

| Semiconductor CapEx | ~$150 billion (2024) | >$200 billion | Higher demand for advanced manufacturing equipment |

What You See Is What You Get

Onto Innovation PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Onto Innovation PESTLE analysis covers political, economic, social, technological, legal, and environmental factors impacting the company. It provides a detailed overview, enabling informed strategic decision-making. You'll gain valuable insights into the external forces shaping Onto Innovation's market landscape.

Sociological factors

The semiconductor sector, including companies like Onto Innovation, is grappling with a critical and worsening shortage of skilled talent. This deficit is especially pronounced for engineers and technicians essential for the complex, advanced manufacturing processes that underpin the industry.

Addressing this talent gap requires substantial investment in training and development initiatives. Companies must prioritize upskilling their existing workforce and reskilling individuals to meet the evolving demands of semiconductor production, ensuring Onto Innovation can maintain its operational capabilities.

For instance, a 2024 report highlighted that the global semiconductor industry needs to fill approximately 200,000 new roles by 2030, with a significant portion requiring specialized engineering expertise, directly impacting companies like Onto Innovation's ability to scale and innovate.

The semiconductor industry, including companies like Onto Innovation, faces a significant demographic challenge with a large segment of its U.S. workforce being 45 years or older. This trend, projected to continue into 2024 and 2025, means many highly experienced professionals are nearing retirement age, intensifying the existing talent gap.

As these seasoned experts retire, they take with them invaluable institutional knowledge and technical expertise. Onto Innovation, therefore, must proactively develop strategies for effective knowledge transfer, perhaps through mentorship programs or robust training initiatives, to bridge this impending experience deficit.

To counteract future workforce deficiencies, Onto Innovation needs to focus on attracting and retaining younger talent. This involves creating appealing career paths and work environments that resonate with emerging professionals, ensuring a pipeline of skilled individuals for the coming years.

Societies are increasingly recognizing that a diverse workforce isn't just a matter of fairness, but a significant business advantage. Companies with diverse teams often see enhanced innovation and greater resilience in the face of challenges.

Onto Innovation's active commitment to fostering diversity and inclusion directly addresses these evolving societal expectations. This focus not only strengthens their internal teams by bringing together varied perspectives but also positions them favorably in the competition for top talent, as a broader range of candidates are attracted to inclusive environments.

Evolving Expectations for Ethical Operations

Consumers, customers, and non-governmental organizations are increasingly demanding that companies operate with higher ethical and social standards. This pressure is a significant sociological factor shaping business practices across industries. For Onto Innovation, this translates into a need to demonstrate responsible sourcing, fair labor practices, and environmental stewardship throughout its supply chain.

Onto Innovation's commitment to ethical operations is evident in its membership with the Responsible Business Alliance (RBA). This membership signifies adherence to a code of conduct focused on worker rights, health and safety, and environmental protection. Their efforts to improve worker well-being, as highlighted in their sustainability reports, directly address these evolving societal expectations. For instance, in 2023, Onto Innovation continued to invest in programs aimed at enhancing employee safety and professional development, reflecting a proactive approach to corporate social responsibility.

- Responsible Business Alliance (RBA) Membership: Onto Innovation actively participates in the RBA, aligning its practices with global standards for ethical supply chains.

- Worker Well-being Initiatives: The company focuses on improving worker health, safety, and overall well-being as a direct response to societal pressures.

- Stakeholder Expectations: Growing demand from consumers, customers, and NGOs for transparency and ethical conduct influences Onto Innovation's operational strategies.

Community Engagement and Local Impact

As the semiconductor industry grows, companies like Onto Innovation are increasingly examined for their effects on local areas. This includes how they influence infrastructure, housing availability, and the strain on public services. The demand for skilled labor and the physical footprint of manufacturing facilities can significantly alter the social fabric of a community.

Maintaining a positive relationship with these communities is paramount for Onto Innovation's ongoing operations. This social license to operate hinges on demonstrating a commitment to being a responsible corporate citizen. In 2023, for instance, the semiconductor industry’s expansion projects, such as those in Arizona and Ohio, have brought both economic opportunities and challenges related to local resource management and community integration.

Onto Innovation’s proactive approach to community engagement, including local investment and support programs, directly addresses these concerns. By actively participating in and contributing to the well-being of the areas where it operates, the company builds trust and goodwill, which are essential for long-term success.

- Infrastructure Strain: Rapid industry growth can strain local roads, utilities, and public transportation, requiring careful planning and investment to mitigate negative impacts.

- Housing Affordability: Increased demand for housing due to new jobs can lead to rising costs, affecting local residents and potentially creating workforce challenges.

- Public Service Capacity: Schools, healthcare facilities, and emergency services may need to expand their capacity to serve a growing population, necessitating collaboration between companies and local governments.

- Workforce Development: Investing in local training and educational programs helps ensure that community members can benefit from new job opportunities created by the expanding industry.

The semiconductor industry, including Onto Innovation, faces a critical shortage of skilled labor, particularly engineers and technicians, a challenge projected to worsen through 2025. This deficit is compounded by an aging workforce, with a significant portion of U.S. employees aged 45 and over, nearing retirement and taking valuable expertise with them.

Societal expectations are shifting towards greater corporate responsibility, emphasizing diversity, ethical practices, and community engagement. Onto Innovation's commitment to these areas, demonstrated through RBA membership and worker well-being initiatives, directly addresses these evolving demands, fostering a positive brand image and attracting talent.

The expansion of the semiconductor sector, driven by global demand, places pressure on local communities regarding infrastructure and public services. Onto Innovation's proactive community engagement strategies aim to mitigate these impacts and ensure a sustainable social license to operate, aligning with societal expectations for corporate citizenship.

Technological factors

The rapid advancement and widespread integration of artificial intelligence (AI) are creating a significant surge in demand for sophisticated, high-performance chips. This trend is pushing the limits of conventional silicon manufacturing processes.

Onto Innovation's specialized solutions play a crucial role in enabling the advanced process control necessary for producing these complex, AI-specific semiconductors. This directly broadens the company's total addressable market.

For instance, the AI chip market alone was projected to reach over $100 billion by 2027, indicating substantial growth opportunities. Onto Innovation's metrology and inspection tools are essential for achieving the sub-nanometer precision required for these cutting-edge chips.

Technological advancements in semiconductor packaging, such as 2.5D, 3D stacking, hybrid bonding, and chiplets, are fundamentally reshaping how chips are designed, leading to significant improvements in power efficiency, performance, and overall device size. These innovations are critical for next-generation computing and artificial intelligence applications. For instance, the chiplet market is projected to grow substantially, with some estimates placing its value at over $100 billion by 2030, underscoring the demand for these advanced integration methods.

Onto Innovation's specialized metrology and inspection solutions are pivotal in this evolving landscape, particularly their offerings for 3D bump inspection. These technologies are essential for guaranteeing the high yield and unwavering reliability demanded by advanced packaging processes. With complex interconnects and tighter tolerances in 3D-stacked architectures, precise measurement and defect detection are paramount for manufacturing success, directly impacting the cost-effectiveness and performance of these advanced semiconductor products.

The semiconductor industry is pushing the boundaries with increasingly complex transistor designs, such as Gate-All-Around (GAA) FETs, and the integration of diverse chip components through heterogeneous integration. These advancements create significant hurdles for precision manufacturing and demand sophisticated process control. Onto Innovation's advanced metrology and inspection systems are critical for navigating these intricate manufacturing stages, ensuring high yields for these cutting-edge technologies.

For instance, the transition to GAA architectures, which began gaining traction in advanced nodes around 2022-2023 with initial production from companies like Samsung, requires metrology capable of inspecting features measured in single-digit nanometers. Onto Innovation’s offerings are designed to detect subtle defects that could compromise the performance and reliability of these densely packed, multi-layered structures. The company reported strong demand for its inspection and metrology solutions in its Q4 2023 earnings, indicating the market's need for these capabilities.

Demand for Enhanced Metrology and Inspection

The relentless drive for smaller, more powerful semiconductor devices directly fuels the demand for advanced metrology and inspection solutions. As chip feature sizes continue to shrink, pushing into the nanometer scale, and as semiconductor packaging becomes increasingly complex with denser interconnects, the precision and accuracy of measurement and inspection tools become paramount. This trend creates a significant technological imperative for companies like Onto Innovation.

Onto Innovation's strategic product development is closely aligned with these evolving technological demands. Their roadmap features new systems specifically designed to tackle these challenges. For example, the Iris G2 system addresses critical film metrology needs, essential for ensuring the precise deposition and etching of ultra-thin layers that define advanced semiconductor architectures. Simultaneously, solutions like EchoScan are being developed to improve interconnect yields in cutting-edge packaging technologies such as hybrid bonding, where direct wafer-to-wafer or die-to-wafer connections require exceptionally high precision.

- Shrinking Feature Sizes: Continued advancements in lithography, such as those enabling 2nm and sub-2nm process nodes, necessitate metrology capable of measuring features at the atomic level.

- Denser Packaging: Technologies like 2.5D and 3D packaging, including advanced fan-out wafer-level packaging and chiplets, require inspection systems to verify the integrity of thousands of microscopic interconnects.

- Hybrid Bonding Advancements: The adoption of hybrid bonding for next-generation memory and logic devices demands metrology that can ensure sub-micron alignment and defect detection for robust wafer-to-wafer integration.

- Onto Innovation's Response: The company's investments in systems like Iris G2 for film metrology and EchoScan for interconnect inspection directly address these critical needs within the semiconductor manufacturing ecosystem.

Role of Digitalization and Automation

The semiconductor industry is rapidly embracing digitalization and automation, with AI and digital twin technologies at the forefront. These advancements are revolutionizing research and development, leading to more sophisticated chip designs and significantly improving yield management throughout the manufacturing process. Onto Innovation's strategic emphasis on optimizing customers' critical path of progress by enhancing efficiency and intelligence directly taps into this powerful technological wave. For instance, their solutions are designed to accelerate time-to-market for advanced semiconductor technologies, a crucial factor in the competitive landscape.

This digital transformation is not just about speed; it’s about precision and predictive capabilities. AI algorithms can analyze vast datasets from manufacturing floors to identify potential issues before they impact production, minimizing costly downtime and material waste. Digital twins, virtual replicas of physical assets and processes, allow for extensive simulation and testing of new designs and manufacturing parameters without disrupting actual operations. This synergy between AI and digital twins is a cornerstone for achieving the next generation of semiconductor manufacturing excellence.

Onto Innovation's commitment to this trend is evident in their product development and customer engagements. They are instrumental in enabling manufacturers to leverage data-driven insights for continuous improvement. The company's focus on delivering smarter, more efficient solutions aligns perfectly with the industry's drive to reduce costs and increase throughput in an era of increasing chip complexity and demand. This digital integration is expected to further solidify Onto Innovation's position as a key enabler in the semiconductor ecosystem through 2025 and beyond.

- AI-driven process optimization: Enhancing predictive maintenance and quality control in semiconductor fabrication.

- Digital twin integration: Enabling virtual testing and validation of new chip designs and manufacturing workflows.

- Accelerated R&D cycles: Streamlining the design and development of next-generation semiconductor devices.

- Yield management improvements: Reducing waste and increasing the output of high-quality chips through advanced analytics.

The semiconductor industry's relentless pursuit of smaller, more powerful chips, exemplified by the push towards 2nm and sub-2nm process nodes, demands metrology capable of atomic-level precision. This technological imperative is directly addressed by Onto Innovation's advanced inspection and metrology solutions, such as their Iris G2 system for critical film metrology and EchoScan for interconnect inspection, crucial for next-generation packaging like hybrid bonding.

The increasing complexity of chip architectures, including Gate-All-Around (GAA) FETs and heterogeneous integration, necessitates sophisticated process control. Onto Innovation's systems are vital for ensuring high yields during these intricate manufacturing stages, with demand for such capabilities highlighted by the company's strong Q4 2023 performance.

Digitalization, powered by AI and digital twins, is transforming semiconductor R&D and manufacturing. Onto Innovation's focus on enhancing efficiency and intelligence aligns with this trend, aiming to accelerate time-to-market for advanced technologies and improve yield management through data-driven insights.

The company's strategic product development, including new systems for film metrology and interconnect inspection, directly targets the evolving technological demands of shrinking feature sizes, denser packaging, and advancements in hybrid bonding.

Legal factors

Export controls, particularly those originating from the United States concerning advanced semiconductor technology, directly limit Onto Innovation's market access. These regulations, such as those impacting sales to China, dictate where the company's sophisticated metrology and inspection equipment can be legally deployed. Failure to comply can result in significant penalties, impacting revenue streams.

Navigating this complex web of international trade laws is crucial for Onto Innovation's global operations. The company must meticulously adhere to regulations like the Export Administration Regulations (EAR) to ensure its products reach permissible markets, a challenge amplified by geopolitical shifts. For instance, evolving trade policies in 2024 and 2025 continue to shape these restrictions.

Onto Innovation operates within a stringent legal landscape, particularly concerning environmental compliance. Regulations like the Restriction of Hazardous Substances (RoHS), Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH), and Waste Electrical and Electronic Equipment (WEEE) directives directly impact semiconductor manufacturing. These frameworks impose strict limitations on the use of certain materials, require rigorous testing, and dictate responsible end-of-life management for electronic products. For instance, REACH, a cornerstone of EU chemical regulation, continuously updates its list of Substances of Very High Concern (SVHCs), requiring ongoing diligence from manufacturers like Onto Innovation to ensure their supply chains and product compositions remain compliant. Failure to adhere can result in significant penalties and market access restrictions.

Intellectual property protection is a cornerstone for Onto Innovation, a tech firm deeply embedded in a rapidly evolving and competitive landscape. Safeguarding its patents, trade secrets, and unique technologies through robust legal strategies is critical to maintaining its market edge. In 2023, the semiconductor industry, where Onto Innovation operates, saw significant patent filings, underscoring the intense focus on innovation and the need for strong IP enforcement.

Navigating potential intellectual property disputes with rivals is an ongoing challenge. Such litigation can be costly and time-consuming, potentially impacting research and development timelines and financial performance. For instance, in late 2024, several key players in the advanced materials sector engaged in high-profile patent disputes, highlighting the financial and strategic risks involved.

Labor and Employment Laws

Onto Innovation navigates a complex web of labor and employment laws as a global operator. These regulations, varying by country, dictate everything from fair wages and safe working conditions to non-discrimination policies and fundamental employee rights. For instance, in 2024, many European nations continued to strengthen worker protections, impacting hiring practices and compensation structures for companies like Onto Innovation.

Ensuring compliance is not just a legal necessity but a critical component of risk management. Failure to adhere to these diverse legal frameworks can lead to costly litigation, reputational damage, and operational disruptions. Onto Innovation's commitment to understanding and implementing these laws across its international workforce is paramount for maintaining smooth operations and fostering positive employee relations.

- Global Compliance: Onto Innovation must adhere to labor laws in all operating regions, ensuring fair treatment and legal adherence for its diverse workforce.

- Wage and Hour Regulations: Compliance with minimum wage laws, overtime rules, and payment frequency is a constant requirement across different jurisdictions.

- Anti-Discrimination and Equal Opportunity: Onto Innovation is bound by laws prohibiting discrimination based on age, gender, race, religion, and other protected characteristics.

- Workplace Safety and Health: Adherence to occupational health and safety standards is mandatory to protect employees and prevent workplace accidents.

Product Safety and Liability Regulations

Onto Innovation's sophisticated equipment, crucial for semiconductor manufacturing, must adhere to rigorous product safety and liability regulations. This ensures the safety of its customers' advanced facilities and skilled personnel. For instance, in 2023, the semiconductor industry continued to see increased scrutiny on equipment safety protocols, with regulatory bodies like OSHA in the US and similar agencies globally issuing updated guidelines for high-tech manufacturing environments.

Navigating these complex product safety laws and proactively managing potential product liability risks are persistent legal challenges for Onto Innovation. The company’s commitment to rigorous testing and quality control directly impacts its ability to mitigate these risks, especially as new generations of semiconductor technology emerge, potentially introducing novel safety considerations.

- Product Safety Compliance: Onto Innovation must ensure its metrology and inspection equipment meets international safety standards, such as those set by the International Electrotechnical Commission (IEC) for electrical safety and machinery.

- Liability Management: The company actively manages product liability by investing in robust design, comprehensive testing, and clear operating instructions to minimize the risk of equipment-related incidents.

- Regulatory Landscape: Staying abreast of evolving safety regulations in key markets like the United States, Europe, and Asia is critical for uninterrupted market access and customer trust.

Onto Innovation faces significant legal hurdles related to export controls, especially from the United States, impacting its ability to sell advanced semiconductor technology globally. For example, ongoing trade policy shifts in 2024 and 2025 continue to influence market access, particularly concerning sales to China, and non-compliance carries substantial financial penalties.

Environmental factors

Semiconductor manufacturing is a thirsty business, guzzling energy and water while producing considerable waste. Onto Innovation, deeply embedded in this sector, feels the ripple effect of this high resource demand. This means there's an increasing expectation for Onto to help its clients adopt more efficient manufacturing methods. For instance, the Semiconductor Industry Association reported that advanced chip fabrication plants can consume millions of gallons of water daily in 2024. Onto Innovation’s role in developing advanced process control and metrology solutions can directly contribute to reducing this consumption by optimizing yields and minimizing material waste.

The semiconductor sector, a vital engine of modern technology, faces growing scrutiny over its environmental impact, particularly concerning greenhouse gas emissions. Onto Innovation, recognizing this challenge, has demonstrated a commitment to sustainability by not only meeting but exceeding its 2025 environmental targets. This includes significant reductions in its carbon footprint and a notable increase in the adoption of renewable energy sources, reflecting a proactive approach to aligning with global sustainability initiatives.

Semiconductor manufacturing, a core area for Onto Innovation, inherently involves the use of hazardous materials, including per- and polyfluoroalkyl substances (PFAS). These chemicals, critical for certain fabrication processes, present significant environmental risks if mishandled, leading to potential soil and water contamination. As of early 2024, regulatory bodies worldwide, including the EPA in the United States, are intensifying their focus on PFAS, proposing stricter controls and potential bans on their use, which could impact supply chains and manufacturing processes.

Onto Innovation's commitment to robust management of these hazardous materials is paramount. The company's equipment and process solutions must facilitate not only the safe handling of such chemicals but also actively promote waste minimization strategies. This proactive approach is crucial as environmental compliance costs can rise significantly with increased regulatory oversight and potential remediation efforts, a factor that could influence operational expenses and investment decisions throughout 2024 and 2025.

Supply Chain Environmental Responsibility

There's a significant push for companies to demonstrate environmental stewardship across their entire supply chain, starting with how raw materials are sourced and extending to what happens when a product reaches its end-of-life. This expectation is becoming a standard for responsible corporate behavior.

Onto Innovation actively participates in organizations like the Responsible Business Alliance (RBA). This engagement underscores the company's dedication to embedding sustainable and ethical practices throughout its value chain. In 2023, the RBA reported that its member companies collectively conducted over 14,000 audits, with a growing emphasis on environmental performance indicators.

This commitment translates into tangible actions:

- Focus on sustainable sourcing: Prioritizing suppliers who adhere to environmental regulations and demonstrate reduced carbon footprints.

- Waste reduction initiatives: Implementing programs to minimize waste generation and promote recycling and reuse within manufacturing processes.

- Energy efficiency improvements: Investing in technologies and operational changes to lower energy consumption across facilities and supplier operations.

- Compliance and transparency: Ensuring adherence to global environmental standards and providing clear reporting on environmental impact.

Climate Change and Extreme Weather Impacts

The increasing frequency of extreme weather events, a direct consequence of climate change, poses a significant threat to global supply chains. For companies like Onto Innovation, which rely on a complex network of suppliers for raw materials and manufacturing, these events can cause considerable disruption. For instance, severe flooding or prolonged droughts can impact the extraction of essential minerals used in semiconductor manufacturing, or damage crucial transportation infrastructure, hindering logistics. In 2024, the World Meteorological Organization reported a notable uptick in weather-related disasters compared to previous decades, highlighting the growing vulnerability of global trade routes.

Onto Innovation's global footprint necessitates a proactive approach to climate resilience. This means meticulously assessing the potential impact of climate-related risks on its supply chain and implementing mitigation strategies. This could involve diversifying supplier locations to reduce dependence on single geographic regions prone to specific weather extremes, or investing in more robust logistics and warehousing solutions that can withstand adverse conditions. The company's 2024 sustainability report indicated ongoing efforts to map supply chain vulnerabilities to climate risks, aiming to build greater operational robustness.

- Supply Chain Disruption: Extreme weather events like hurricanes, floods, and wildfires can halt production and transportation, impacting Onto Innovation's ability to source materials and deliver finished products.

- Increased Operational Costs: Recovering from weather-related damage or rerouting shipments due to disrupted infrastructure can lead to higher operating expenses.

- Raw Material Scarcity: Climate change can affect the availability and cost of critical raw materials essential for semiconductor manufacturing processes.

- Regulatory and Compliance Risks: Growing global focus on climate change may lead to new regulations impacting supply chain operations and material sourcing.

Environmental regulations are tightening globally, impacting resource-intensive industries like semiconductor manufacturing where Onto Innovation operates. The focus on reducing water usage, energy consumption, and waste is intensifying, with bodies like the EPA in the US increasing scrutiny on chemicals like PFAS. Onto Innovation's efforts in waste minimization and sustainable sourcing, evidenced by its participation in the Responsible Business Alliance, directly address these growing environmental expectations and compliance demands through 2024 and 2025.

PESTLE Analysis Data Sources

Our Onto Innovation PESTLE Analysis is built on a robust foundation of data sourced from leading market research firms, official government publications, and reputable industry associations. This ensures our insights into political, economic, social, technological, legal, and environmental factors are accurate and relevant to Onto Innovation's operational landscape.