Onto Innovation Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Onto Innovation Bundle

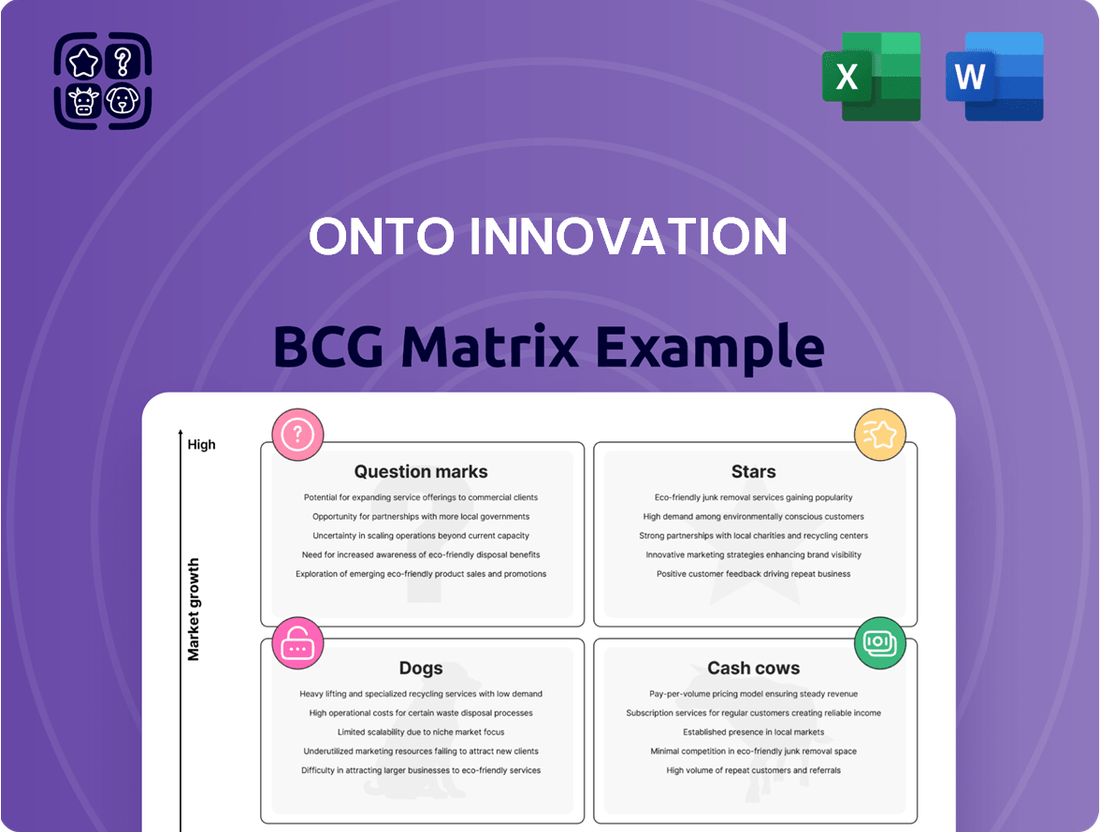

Curious about Onto Innovation's product portfolio performance? Our BCG Matrix analysis reveals the strategic positioning of their offerings, highlighting potential Stars, stable Cash Cows, underperforming Dogs, and promising Question Marks.

This glimpse into Onto Innovation's market standing is just the beginning. To truly unlock their growth potential, you need the full BCG Matrix report.

It provides detailed quadrant placements, data-backed recommendations, and a clear roadmap for smart investment and product decisions.

Don't miss out on the opportunity to gain a competitive edge with actionable insights.

Purchase the complete BCG Matrix today and equip yourself with the strategic clarity needed to navigate Onto Innovation's market landscape effectively.

Stars

AI Packaging Solutions shines as a Star for Onto Innovation. This segment experienced an impressive 180% revenue surge in 2024 compared to the previous year. Onto Innovation commands an estimated 60% market share within this burgeoning sector, underscoring its dominant position.

The escalating demand for sophisticated packaging, particularly for AI compute hardware, is a primary catalyst fueling this exceptional growth. Onto Innovation's strategic placement in this high-growth arena solidifies its market leadership. Continued dedication to advancing related technologies ensures sustained momentum.

The advanced nodes segment, which includes cutting-edge DRAM, NAND, and Gate-All-Around (GAA) technologies, experienced impressive growth, with its revenue doubling from the previous quarter in Q1 2025. This surge highlights the increasing demand for sophisticated semiconductor manufacturing capabilities.

Onto Innovation's advanced optical metrology solutions are indispensable for these demanding applications. Their technology plays a vital role in ensuring the precision and quality required for next-generation memory and logic devices, solidifying their leadership position in this rapidly expanding market.

With analysts projecting over 40% revenue growth for the advanced nodes segment in 2025, Onto Innovation is well-positioned to capitalize on this trend. This robust growth forecast underscores the segment's status as a Star within the BCG matrix, driven by technological innovation and market demand.

The Dragonfly inspection system, especially its G3 platform, is a shining example of a Star product for Onto Innovation. Its success is directly tied to the booming demand for sophisticated packaging solutions needed for AI hardware. This system’s advanced 2D and 3D defect detection and feature analysis capabilities are crucial for boosting manufacturing yields.

In 2024, Onto Innovation saw remarkable growth with its Dragonfly inspection tools, experiencing more than a doubling of revenue compared to the previous year. This impressive performance underscores the system's strong market position and its role in driving Onto Innovation’s overall expansion.

Gate-All-Around (GAA) Technology Solutions

Onto Innovation's expertise in Gate-All-Around (GAA) transistor technology places it in a prime position within the advanced semiconductor nodes market. This segment is experiencing robust expansion as manufacturers push the boundaries of chip complexity.

The company's metrology and inspection solutions are indispensable for the intricate 3D architectures characteristic of next-generation logic manufacturing. This critical role ensures the quality and performance of these advanced chips.

Market projections indicate continued growth for GAA technology through 2025, fueled by substantial customer investments in developing and producing these cutting-edge semiconductors. For instance, the global advanced packaging market, which often incorporates GAA, was valued at approximately $35 billion in 2023 and is projected to grow significantly.

- Onto Innovation's GAA solutions are vital for advanced semiconductor manufacturing.

- The company's metrology and inspection tools are critical for complex 3D transistor structures.

- The advanced nodes market, where GAA is key, is a high-growth segment for Onto Innovation.

- Customer investments in next-generation logic are driving the expansion of GAA technology adoption.

Power Semiconductor Metrology

Onto Innovation's metrology and inspection solutions are a significant draw in the burgeoning power semiconductor market, especially for Silicon Carbide (SiC) devices. These advanced materials are critical for the booming Electric Vehicle (EV) sector, driving substantial demand. The company’s offerings are tailored to meet the rigorous quality and performance requirements of SiC, making it a key player in this high-growth area.

The accelerating demand for SiC in EVs positions this segment as a strong Star for Onto Innovation. This market is not just growing; it's expanding at an impressive rate, fueled by the global shift towards electric mobility. Onto’s specialized technologies are crucial for ensuring the reliability and efficiency of these power components, which are at the heart of EV performance.

Financial projections indicate that revenue from the power semiconductor sector will surpass 2024 figures, underscoring the sustained momentum. This growth trajectory highlights Onto’s market relevance and its ability to capture share in a rapidly evolving industry. The company's investment in metrology for SiC directly addresses a critical bottleneck in the EV supply chain.

Key aspects of Onto Innovation’s strength in this Star segment include:

- Specialized Metrology for SiC Devices: Onto provides advanced inspection and measurement tools essential for the complex manufacturing of SiC power semiconductors.

- EV Market Demand: The increasing adoption of electric vehicles is a primary driver for the growth of SiC technology, creating a robust market for Onto's solutions.

- Projected Revenue Growth: The power semiconductor sector is expected to deliver revenue exceeding 2024 levels, signifying continued expansion and strong market penetration.

- Technological Leadership: Onto Innovation's commitment to developing cutting-edge metrology capabilities ensures it remains competitive in this fast-paced technological landscape.

Onto Innovation’s AI Packaging Solutions are a true Star. This segment saw a remarkable 180% revenue increase in 2024, capturing an estimated 60% market share. The surge is driven by the escalating need for advanced packaging in AI hardware.

The advanced nodes segment, encompassing technologies like DRAM, NAND, and Gate-All-Around (GAA), is another Star. Its revenue doubled quarter-over-quarter in Q1 2025, propelled by demand for sophisticated semiconductor manufacturing. Onto’s optical metrology is crucial for the precision required in these next-generation devices.

The power semiconductor market, particularly Silicon Carbide (SiC) for Electric Vehicles (EVs), is also a Star. Onto’s specialized metrology for SiC addresses critical needs in the booming EV sector, with revenue projected to exceed 2024 levels.

| Onto Innovation Star Segments | 2024 Revenue Growth (YoY) | Estimated Market Share | Key Driver | Outlook |

|---|---|---|---|---|

| AI Packaging Solutions | 180% | 60% | Demand for AI hardware packaging | Continued strong growth |

| Advanced Nodes (DRAM, NAND, GAA) | 100% (Q1 2025 QoQ) | N/A (Specific share for advanced nodes not publicly detailed) | Demand for advanced semiconductor manufacturing | Projected 40%+ revenue growth in 2025 |

| Power Semiconductors (SiC) | Exceeding 2024 levels projected | N/A (Specific share for SiC not publicly detailed) | EV market growth | Sustained momentum |

What is included in the product

This BCG Matrix analysis categorizes Onto Innovation's offerings into Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic guidance on investment, divestment, and resource allocation for each category.

Onto Innovation's BCG Matrix provides a clear, one-page overview of business unit performance, relieving the pain of strategic uncertainty.

Cash Cows

Onto Innovation's core process control solutions, encompassing their metrology and inspection systems, are firmly established as cash cows. These offerings are critical for semiconductor manufacturers aiming to boost device yield and overall production efficiency. Their broad adoption across the industry and Onto Innovation's competitive edge allow these products to deliver steady revenue streams and healthy profit margins.

Onto Innovation's established metrology portfolio, encompassing optical critical dimension (OCD) and films metrology, represents a significant cash cow. This segment serves a mature but indispensable market within the semiconductor industry, where Onto Innovation holds a commanding market share.

The proven utility and widespread adoption of these metrology solutions mean they demand minimal promotional expenditure. This allows them to generate substantial and consistent cash flow for the company.

For instance, in the fiscal year 2023, Onto Innovation reported total revenue of $784.2 million, with its metrology solutions forming a core part of this revenue stream, indicative of their stable market position and ongoing demand.

This reliable cash generation from its established metrology business is crucial, as it provides the financial resources needed to invest in and support other strategic growth areas within Onto Innovation.

Onto Innovation demonstrates exceptional free cash flow generation, a hallmark of a cash cow. In the first quarter of 2025, the company reported $92 million in operating cash flow. This impressive figure signifies a 100% conversion of its operating income into cash, highlighting the efficiency and profitability of its core operations.

This strong cash conversion indicates that Onto Innovation's established businesses are not only highly profitable but also require minimal reinvestment to maintain their current level of output. The excess capital generated can be strategically deployed, whether for further investments, managing debt obligations, or rewarding shareholders, all typical actions for a mature, cash-generating entity.

High Gross Margin Products

Onto Innovation's established product lines are demonstrating robust financial health, consistently achieving high gross margins. These margins, hovering around 55% in both Q4 2024 and Q1 2025, are characteristic of mature products that have secured a strong competitive position. This sustained profitability points to the efficiency of their operations and their ability to command premium pricing in established markets.

These strong gross margins are a key indicator of cash cow status within the BCG matrix framework. Such products typically generate more cash than they consume, providing a stable source of funding for other business initiatives. The consistent performance suggests a well-defended market share and efficient cost management.

- Consistent Gross Margins: Achieved approximately 55% in Q4 2024 and Q1 2025.

- Profitability Indicator: High margins signify strong earnings power from established products.

- Competitive Advantage: Reflects market leadership and pricing power in mature segments.

- Cash Generation: Supports the classification as cash cows, funding other business areas.

Financial Stability from Core Operations

Onto Innovation's cash cow segment demonstrates robust financial stability, primarily due to its substantial cash reserves. As of December 2024, the company reported $852 million in cash and cash equivalents. This strong liquidity position, coupled with a low debt-to-equity ratio, highlights the dependable cash flow generated by its core operations.

The inherent strength of these stable businesses allows Onto Innovation to weather market volatility and pursue strategic investments. This financial bedrock ensures the company can fund expansion or research and development without relying heavily on external borrowing, a classic indicator of a healthy cash cow.

- High Cash Reserves: $852 million as of December 2024.

- Minimal Debt: Indicates reliance on internally generated funds.

- Stable Operations: Core businesses consistently generate predictable cash flow.

- Financial Foundation: Enables resilience against market downturns and funding for growth initiatives.

Onto Innovation's metrology and inspection solutions are classic cash cows, generating substantial and consistent cash flow. Their established market position and high demand mean they require minimal investment to maintain, allowing them to fund other growth initiatives. This stability is further underscored by strong financial performance metrics.

| Metric | Q1 2025 | Q4 2024 | FY 2023 |

|---|---|---|---|

| Operating Cash Flow | $92 million | - | - |

| Gross Margin | ~55% | ~55% | - |

| Cash & Cash Equivalents (as of Dec 2024) | $852 million | - | - |

Full Transparency, Always

Onto Innovation BCG Matrix

The Onto Innovation BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no hidden watermarks or trial limitations; you get the complete strategic analysis ready for your business planning. It's a direct reflection of the professional-grade report you'll download, ensuring you know exactly what you're acquiring for your decision-making processes.

Dogs

The Software and Services segment at Onto Innovation has experienced a notable slowdown, with revenue declining sequentially by 4% in the fourth quarter of 2024 and a further 5% in the first quarter of 2025. This trend points towards a low-growth trajectory for this particular area of the business.

While this segment continues to contribute to Onto Innovation's overall revenue, its shrinking share suggests it might not be a primary focus for strategic expansion or future growth. The diminishing contribution could signal a potential shift in market demand or competitive pressures affecting this segment.

Considering these performance indicators, the Software and Services segment could be categorized as a 'Dog' within the BCG matrix if it consistently struggles to gain market share or achieve profitability levels comparable to other, more robust segments of the company.

Legacy inspection tools, representing the older generation in this context, would likely fall into the Dogs quadrant of the BCG Matrix. These are systems that haven't kept pace with technological advancements in semiconductor manufacturing. For instance, older optical inspection systems might struggle to detect defects at advanced nodes, where feature sizes are measured in nanometers.

The semiconductor industry's relentless push towards smaller process nodes, like those below 7nm, demands inspection equipment with significantly higher resolution and sensitivity. Tools lacking these capabilities, such as older metrology or defect review stations, would experience a shrinking addressable market. This decline in demand, coupled with competition from newer, more capable technologies, would naturally lead to a low market share for these legacy systems.

Without substantial upgrades or a pivot to niche applications, these older generation inspection tools are positioned for minimal growth. The capital expenditure required for such upgrades might not be justified by the potential returns, especially when new equipment offers superior performance. Consequently, their contribution to overall revenue and profitability is likely to be limited, with a high probability of becoming obsolete.

Products with limited R&D investment at Onto Innovation, if any exist, would be categorized as Dogs in the BCG matrix. These are offerings that operate in slow-growing markets and have a low market share, meaning they don't generate significant revenue and require substantial investment to improve their position. In the semiconductor sector, where technological advancements are rapid, products that aren't continually updated to meet evolving demands can quickly become obsolete.

For instance, if Onto Innovation had a legacy inspection system targeting a niche, mature segment of the semiconductor manufacturing process that has seen minimal technological shifts, it might fall into this category. Such products would likely have low sales growth and require ongoing, albeit perhaps modest, R&D to maintain their existing functionality. Without significant innovation, their market share would likely stagnate or decline, making them less attractive from a strategic investment perspective.

Segments Facing Intense Commoditization

Onto Innovation's product lines operating in highly commoditized segments of the semiconductor equipment market would be categorized as Dogs in the BCG Matrix. These segments are characterized by fierce price competition and limited product differentiation, which naturally leads to reduced profit margins and restricted growth potential. For instance, older generations of metrology or inspection equipment, where the technology is mature and widely available from multiple vendors, often fall into this category. In 2023, the overall semiconductor equipment market saw fluctuations, but segments with established, less innovative products are particularly vulnerable to commoditization pressures.

Companies with Dog products must focus on cost optimization to maintain any profitability. Alternatively, they might consider divesting these product lines to reallocate resources to more promising areas of their business. The challenge lies in the fact that these mature markets, while less profitable, can still represent a stable, albeit small, revenue stream. Managing this transition requires careful strategic planning to avoid disrupting core business operations or alienating existing customers.

Key characteristics of these commoditized segments include:

- Low Differentiation: Products offer minimal unique features or technological advantages compared to competitors.

- Price Sensitivity: Customers primarily base purchasing decisions on cost rather than performance or innovation.

- Mature Technology: The underlying technology is well-established, with incremental improvements rather than breakthroughs.

- Intense Competition: A large number of suppliers vie for market share, driving down prices.

Non-Strategic or Divested Offerings

Onto Innovation would place products or business units considered non-strategic or slated for divestiture within the Dogs quadrant of the BCG Matrix. These segments might not fit with the company's primary focus or future plans, potentially yielding low profits or consuming valuable capital. For instance, if Onto Innovation decided to exit a legacy product line that represented less than 5% of its total revenue in 2024, that product line would likely be categorized as a Dog. Companies frequently sell off these types of assets to free up resources for more promising investments.

The rationale for such a placement is straightforward: these offerings typically exhibit low market share and low growth potential. Onto Innovation, like many tech companies, constantly evaluates its portfolio to ensure resources are directed toward areas with the highest strategic value and return on investment.

- Low Market Share: Offerings in this quadrant typically hold a small portion of their respective markets.

- Low Growth Potential: The markets for these products or services are not expected to expand significantly.

- Resource Drain: They may consume management attention and capital without generating substantial returns.

- Divestiture Candidates: These are often prime candidates for sale or discontinuation to improve overall company efficiency.

Products or business units deemed non-strategic or facing divestiture at Onto Innovation would be classified as Dogs. These segments typically possess low market share and limited growth prospects, potentially draining resources without significant returns. For example, a legacy product line contributing less than 5% of total revenue in 2024 would likely be considered a Dog, a common candidate for sale to reallocate capital to more promising ventures.

These offerings are characterized by minimal market share and low growth potential, often consuming valuable management attention and capital without substantial returns. Consequently, they are frequently prime candidates for divestiture or discontinuation to enhance overall company efficiency and focus on higher-value areas.

The Software and Services segment, experiencing sequential revenue declines in late 2024 and early 2025, could also be categorized as a Dog if its market share and growth remain persistently low. This indicates a potential shift in market demand or competitive pressures impacting this area.

Legacy inspection tools, failing to keep pace with advancements like sub-7nm process nodes, represent another example of Dogs. Their shrinking addressable market and competition from newer technologies lead to low market share and minimal growth potential without significant upgrades.

| Segment/Product Type | BCG Quadrant | Rationale | Example Characteristics |

|---|---|---|---|

| Legacy Inspection Tools | Dog | Low market share, low growth, obsolete technology | Struggle to detect sub-7nm defects, shrinking market |

| Non-Strategic Product Lines | Dog | Low market share, low growth, candidate for divestiture | Revenue < 5% of total in 2024, not aligned with future focus |

| Commoditized Product Offerings | Dog | Low differentiation, price sensitivity, mature technology | High competition, low profit margins in mature segments |

| Software and Services (Declining) | Potential Dog | Low growth trajectory, shrinking revenue contribution | Sequential revenue decline in Q4 2024 and Q1 2025 |

Question Marks

The EchoScan™ Hybrid Bonding System from Onto Innovation is positioned as a Question Mark in the BCG Matrix. This innovative system is designed to detect voids in hybrid bonding, a crucial process for advanced semiconductor manufacturing, targeting a segment with significant growth potential.

As a newly launched product, EchoScan™ likely holds a minimal market share currently. However, its ability to improve yields in high-demand, cutting-edge chip production gives it substantial future promise.

For instance, the hybrid bonding market itself is projected to grow significantly, with some analysts forecasting a compound annual growth rate of over 20% through 2027. This expansion underscores the strategic importance of technologies like EchoScan™.

Significant investment will be necessary for market penetration and customer integration. This investment is key to elevating EchoScan™ from its current Question Mark status to a potential market leader or Star in the future.

Onto Innovation's JetStep® lithography system, designed for one-micron glass applications in advanced panel-level packaging, currently falls into the Question Mark category of the BCG matrix. This positioning highlights its presence in an emerging, high-growth market driven by the increasing demand for sophisticated packaging solutions in the semiconductor industry. The system's capability for wide-field optics and high-resolution imaging is a key technological advantage.

The success of JetStep® lithography is intrinsically tied to its ability to quickly penetrate and gain widespread adoption within the panel manufacturing sector. Achieving significant market share in this nascent but rapidly expanding segment is crucial for its future growth trajectory. For example, the advanced packaging market, which JetStep® targets, was projected to reach approximately $30 billion in 2024, with significant growth expected from technologies like fan-out wafer-level packaging (FOWLP) and panel-level packaging (PLP).

The Iris G2 Critical Films Metrology system is positioned as a question mark within Onto Innovation's BCG Matrix. This is due to its status as a newer product targeting a significant market opportunity, projected at $400 million by 2025, especially within the high-growth advanced nodes segment.

Despite the promising market size and its operation in a high-growth area for advanced, mature, and specialty devices, substantial investment in marketing and sales is necessary. This is crucial for the Iris G2 to gain traction and transition from its current question mark status toward becoming a star performer.

3Di™ Bump Metrology

Onto Innovation's 3Di™ Bump Metrology, integrated into the Dragonfly® G3 system, is a strategic play within the semiconductor industry, specifically targeting the high-growth market for High-Bandwidth Memory (HBM) and advanced logic. This technology directly addresses the increasing demand for sophisticated 3D interconnects, a critical component fueled by the booming AI sector. The semiconductor industry saw significant investment in advanced packaging in 2024, with projections indicating continued growth as AI workloads demand more efficient data transfer.

While the Dragonfly® platform is established, 3Di™ Bump Metrology's specific focus on complex 3D interconnects positions it as a Question Mark within Onto Innovation's portfolio. This means it operates in a high-growth market but has a relatively low market share or is a newer product needing further development and market penetration. The success of 3Di™ hinges on continued R&D and aggressive market adoption strategies to solidify its position.

- High-Growth Market: The AI revolution is driving unprecedented demand for HBM and advanced logic, creating a fertile ground for 3Di™ Bump Metrology.

- New Application Focus: While leveraging existing technology, 3Di™'s specialization in complex 3D interconnects is a relatively nascent but crucial area.

- Question Mark Status: This implies a need for strategic investment to capture market share and capitalize on the burgeoning demand for advanced semiconductor packaging solutions.

- Investment Rationale: Focused investment is required to enhance its capabilities, expand its market reach, and transform it from a promising technology into a market leader.

New Geographic Market Expansions

Onto Innovation's strategic expansion into new geographic markets, particularly in Asia, is driven by a need to accelerate manufacturing capabilities and respond to tariff impacts. Shipments from new facilities are expected to commence in the latter half of 2025, marking a significant step in their global footprint. This move is designed to better serve market demands and mitigate potential risks associated with trade policies.

While this expansion is a proactive measure, gaining substantial market share in these new regions for specific product lines will likely present initial challenges. These emerging regional presences represent nascent market opportunities that will require dedicated strategic investment and tailored localized market penetration efforts to yield significant returns and solidify their competitive position.

- Asian Expansion: Onto Innovation is accelerating manufacturing in Asia, with shipments from new facilities slated for the second half of 2025.

- Strategic Rationale: This expansion aims to address market demands and mitigate risks stemming from tariff impacts.

- Market Share Challenges: Initial gains in significant market share within these new regions for specific product lines are anticipated to be challenging.

- Investment Focus: These nascent regional presences require strategic investment and localized market penetration to establish a strong foothold.

Onto Innovation’s new product lines, like those focused on advanced semiconductor packaging and metrology for next-generation chips, are prime examples of Question Marks. These products operate in rapidly expanding markets, such as High-Bandwidth Memory (HBM), which saw significant investment in 2024 due to AI demand, but currently hold a modest market share.

The success of these Question Marks hinges on substantial investment in research, development, and market penetration. For instance, the hybrid bonding market, a key area for Onto Innovation, is expected to grow at over 20% annually through 2027, highlighting the potential for these new offerings.

Strategic allocation of capital is critical to transform these promising but unproven products into market leaders. Without significant marketing and sales efforts, these products risk remaining in the Question Mark quadrant, unable to capitalize on their high-growth market potential.

The company's expansion into new geographic markets, expected to see shipments from new facilities in the latter half of 2025, also represents a Question Mark strategy. While this move addresses market demands and tariff impacts, achieving significant market share in these nascent regions will require dedicated investment and localized strategies.

| Onto Innovation Product Category | BCG Matrix Position | Market Growth | Market Share | Strategic Implication |

| EchoScan™ Hybrid Bonding System | Question Mark | High (e.g., Hybrid bonding market >20% CAGR through 2027) | Low (Newly launched) | Requires significant investment for market penetration and growth. |

| JetStep® Lithography | Question Mark | High (Advanced packaging market projected for significant growth, ~$30B in 2024) | Low/Developing | Needs to gain widespread adoption in panel manufacturing to become a Star. |

| Iris G2 Critical Films Metrology | Question Mark | High (Advanced nodes segment, market size ~$400M by 2025) | Low/Developing | Investment in marketing and sales crucial for market traction. |

| 3Di™ Bump Metrology (Dragonfly® G3) | Question Mark | High (Driven by AI, HBM demand) | Low/Niche | Focus on R&D and aggressive adoption strategies needed to become a leader. |

| Asian Market Expansion | Question Mark | High (Addressing market demands) | Low (Nascent regional presence) | Requires strategic investment and localized penetration to gain market share. |

BCG Matrix Data Sources

Our BCG Matrix leverages robust data from financial reports, industry trend analyses, and competitor market share data to provide accurate strategic insights.