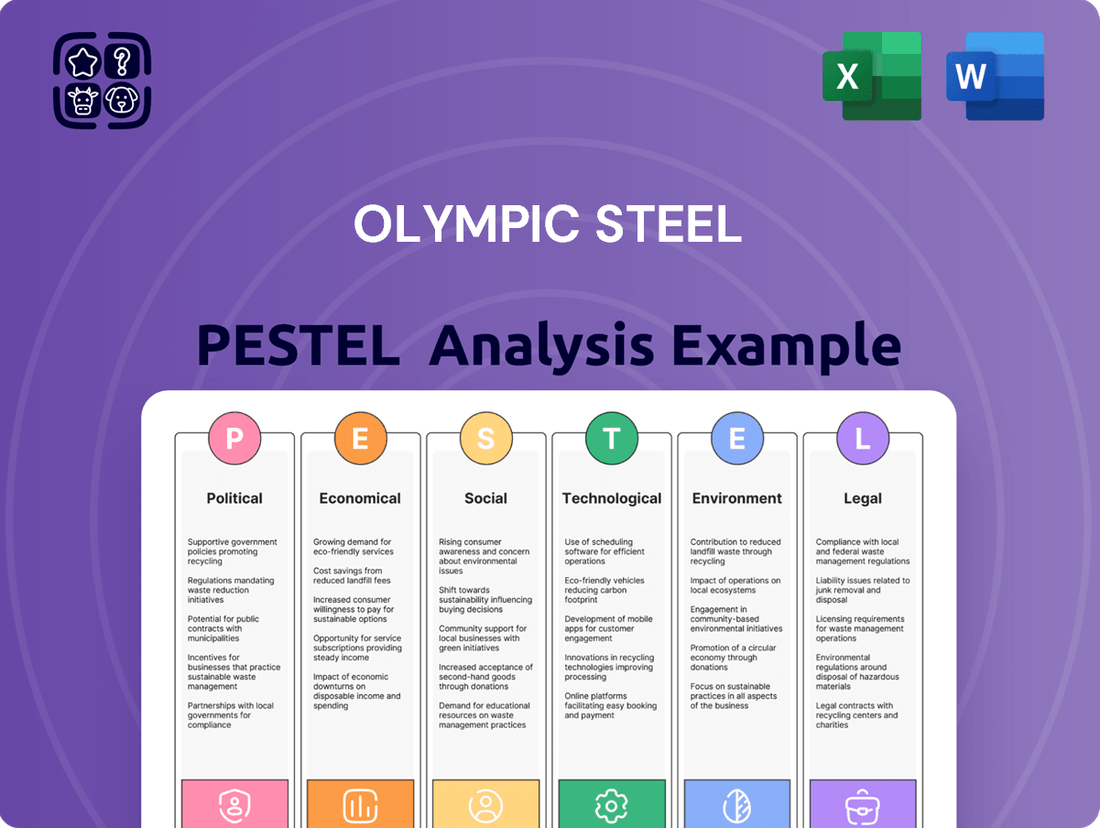

Olympic Steel PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Olympic Steel Bundle

Olympic Steel operates within a dynamic environment shaped by political stability, economic fluctuations, and evolving social attitudes. Understanding these external forces is crucial for strategic planning and identifying potential opportunities and threats. Our comprehensive PESTLE analysis delves into how these factors specifically impact Olympic Steel's operations, from regulatory compliance to market demand. Gain a competitive edge by leveraging these expert insights.

Unlock a deeper understanding of the technological advancements and environmental regulations affecting the steel industry and Olympic Steel directly. This in-depth PESTLE analysis provides actionable intelligence on how these external pressures can be navigated for sustained growth and profitability. Don't miss out on critical market foresight – download the full version now.

Political factors

Changes in trade policies, particularly tariffs on imported steel and aluminum, directly affect Olympic Steel's raw material costs and the competitiveness of its finished products. For instance, the Section 232 tariffs imposed in 2018 significantly increased costs for many steel consumers. Decisions regarding trade agreements and protectionist measures, like potential future adjustments to these tariffs in 2024 or 2025, will continue to shape Olympic Steel's sourcing and pricing strategies, impacting its ability to compete both domestically and internationally.

Increased government investment in infrastructure is a significant tailwind for Olympic Steel. For instance, the Infrastructure Investment and Jobs Act, enacted in late 2021, allocated over $1.2 trillion for infrastructure improvements. This funding directly translates into higher demand for steel and aluminum products used in constructing roads, bridges, public transit, and the electric grid, all key markets for Olympic Steel.

Geopolitical stability is a critical consideration for Olympic Steel. Global events like the ongoing conflict in Eastern Europe continue to impact energy prices and the availability of key raw materials essential for steel production. For instance, disruptions in the supply of critical minerals or energy shortages can directly translate into higher operating costs and price volatility for steel and aluminum, directly affecting Olympic Steel's profitability and supply chain reliability.

Regulatory Environment and Lobbying

The political landscape significantly shapes the operational environment for Olympic Steel. Shifts in governmental attitudes towards manufacturing, competition, and environmental stewardship directly influence costs and market entry. For instance, a stronger political will to enforce environmental regulations could necessitate increased capital expenditure on emissions control technology, impacting profitability. Conversely, deregulation might lower compliance costs but could also intensify competition.

Industry advocacy plays a crucial role in this dynamic. Lobbying by metals service centers, including potentially Olympic Steel, aims to shape legislation and policy in ways that benefit the sector. This could involve advocating for favorable trade policies, tax incentives for domestic manufacturing, or streamlined permitting processes. For example, during 2024, discussions around infrastructure spending proposals in the United States could lead to increased demand for steel products, with industry groups actively lobbying for policies that support domestic sourcing.

- Potential for increased infrastructure spending in 2024-2025 could drive demand for steel, influenced by political priorities.

- Lobbying efforts by industry associations aim to secure favorable trade agreements and domestic manufacturing incentives.

- Changes in environmental regulations, such as those concerning greenhouse gas emissions from steel production, can impact operational costs and investment decisions.

- Antitrust enforcement and competition policies can affect market dynamics and pricing power within the metals service center industry.

Industrial Policy and Subsidies

Government industrial policies, particularly those focused on domestic manufacturing, significantly shape the competitive landscape for companies like Olympic Steel. Subsidies aimed at bolstering the steel sector, for instance, can directly impact production costs and market pricing. As of early 2024, the US government has continued to explore and implement measures to strengthen domestic industrial capacity, with a notable focus on critical materials and manufacturing resilience, potentially benefiting domestic steel producers through favorable tax treatments or direct financial support.

These policy decisions can create both opportunities and challenges. A well-designed subsidy program can enhance a domestic manufacturer's ability to compete against imports, encouraging investment in new technologies and capacity expansion. Conversely, if subsidies are not carefully targeted or are perceived as distorting market competition, they could lead to inefficiencies or trade disputes, impacting the overall health and growth trajectory of the metals sector.

Recent legislative and executive actions in the United States underscore a commitment to revitalizing domestic manufacturing. For example, the Inflation Reduction Act of 2022, while broader in scope, includes provisions that incentivize domestic production of clean energy components, which in turn can drive demand for steel. Furthermore, ongoing discussions and potential actions related to trade policies and tariffs, often influenced by industrial policy considerations, can directly affect the cost of imported steel and the competitiveness of domestic producers.

- Government support for domestic steel production can lower input costs and improve Olympic Steel's price competitiveness against foreign rivals.

- Policies promoting advanced manufacturing techniques or emissions reduction in the steel industry could necessitate capital investment but offer long-term operational benefits.

- Trade policies, often intertwined with industrial strategy, can either protect the domestic market or increase the cost of raw materials and finished goods.

- The Biden administration's focus on supply chain resilience and domestic job creation signals a continued trend of government intervention to support key industries like steel manufacturing.

Governmental support for infrastructure projects remains a significant driver for Olympic Steel. The continued implementation of the Infrastructure Investment and Jobs Act, with substantial funding allocated through 2024 and beyond, is expected to boost demand for steel in construction and transportation. Furthermore, policies aimed at energy transition, such as investments in the electric grid and renewable energy infrastructure, also create new avenues for steel consumption.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external forces impacting Olympic Steel, detailing how Political, Economic, Social, Technological, Environmental, and Legal factors create both challenges and strategic advantages.

It offers actionable insights for Olympic Steel by highlighting how evolving market trends and regulatory landscapes across these six dimensions can inform future business strategies and investment decisions.

Olympic Steel's PESTLE analysis offers a pain point reliver by providing a clear, summarized version of the full analysis for easy referencing during meetings or presentations, ensuring stakeholders are aligned on external factors impacting the business.

Economic factors

Commodity price volatility, especially for key inputs like steel and aluminum coils and plates, significantly impacts Olympic Steel's operational costs and profit margins. For instance, in early 2024, hot-rolled coil (HRC) prices experienced considerable swings, trading in a range of approximately $750 to $850 per ton, directly affecting Olympic Steel's cost of goods sold.

Global supply and demand imbalances, coupled with geopolitical events and speculative trading in futures markets, are major drivers of this price instability. These fluctuations make it challenging for Olympic Steel to accurately forecast expenses and maintain consistent profitability. For example, a sudden surge in demand, as seen in some sectors during late 2023, can rapidly inflate raw material costs.

Rising interest rates, a key economic factor, directly impact Olympic Steel by increasing the cost of borrowing for capital expenditures and ongoing operations. For instance, the Federal Reserve's aggressive rate hikes throughout 2023 and into early 2024 have made financing new equipment or expanding facilities more expensive. This can slow down investment and potentially affect the company's long-term growth trajectory.

Inflation presents a dual challenge for Olympic Steel. It can diminish the purchasing power of their customers, potentially leading to reduced demand for steel products. Simultaneously, inflation drives up the cost of raw materials, energy, and labor, squeezing profit margins if these higher costs cannot be fully passed on to customers. As of late 2024, persistent inflation continues to be a concern for manufacturers across various sectors.

The overall health of the economy, reflected in Gross Domestic Product (GDP) growth, directly impacts demand for Olympic Steel's offerings. For instance, the U.S. GDP saw a significant annualized growth rate of 4.9% in the third quarter of 2023, indicating a strong economic environment that generally boosts industrial activity. This economic momentum suggests a favorable outlook for steel demand.

Industrial output, encompassing sectors like manufacturing and construction, serves as a crucial indicator for Olympic Steel. The U.S. industrial production index increased by 0.2% in November 2023, signaling continued expansion in these key areas. Higher industrial output typically means greater consumption of steel for machinery, infrastructure, and building projects.

Supply Chain Disruptions and Logistics Costs

Economic shocks, like the COVID-19 pandemic and ongoing geopolitical tensions, have significantly impacted global supply chains. These disruptions often result in material shortages and a surge in transportation expenses, directly affecting industries reliant on raw materials. For Olympic Steel, navigating these volatile conditions is paramount for operational continuity and client satisfaction.

In 2024, the aftermath of these disruptions continued to shape the logistics landscape. While some pressures eased, the cost of ocean freight, a key component for steel imports and exports, remained elevated compared to pre-pandemic levels. For instance, average container spot rates on major East-West trade lanes, while down from their 2021 peaks, were still notably higher than historical averages, impacting the landed cost of steel for manufacturers.

Olympic Steel's strategic approach to managing these economic factors includes:

- Diversifying Supplier Base: Reducing reliance on single-source suppliers to mitigate the impact of localized disruptions.

- Optimizing Inventory Management: Implementing just-in-case strategies for critical raw materials to buffer against short-term shortages.

- Leveraging Long-Term Logistics Contracts: Securing more predictable transportation rates and capacity through forward agreements.

- Investing in Domestic Sourcing: Exploring opportunities to increase the procurement of materials from North American suppliers to shorten supply lines.

The company's ability to adapt its supply chain and logistics strategies directly influences its cost competitiveness and its capacity to meet customer demand reliably in this dynamic economic environment. The continued volatility in energy prices, a significant input for steel production and transportation, also adds another layer of complexity to cost management in 2024 and into 2025.

Labor Market and Wage Inflation

Olympic Steel's operational costs, especially within its processing divisions, are significantly influenced by the economic factor of labor. A tight labor market, characterized by low unemployment rates and a shortage of available workers, often leads to increased wage demands from employees. This dynamic directly impacts the company's bottom line, as higher labor expenses can erode profit margins. For instance, the U.S. unemployment rate hovered around 3.9% in early 2024, indicating a persistently tight labor environment that pressures wages across various sectors, including manufacturing and processing.

The availability of skilled labor is another critical economic consideration for Olympic Steel. Specialized metal processing requires a workforce with specific technical expertise, and a scarcity of such talent can create bottlenecks in production and service delivery. This demand for specialized skills further fuels wage inflation in these niche areas. In 2024, reports indicated ongoing challenges in finding qualified welders and machine operators, essential roles within metal fabrication and processing industries.

- Labor Shortages: Persistent low unemployment rates in 2024 mean fewer available workers for Olympic Steel's processing facilities.

- Wage Pressures: A competitive labor market is driving up wages, increasing operating costs for the company.

- Skilled Worker Demand: The need for specialized metal processing skills creates a particular challenge in talent acquisition and retention.

- Impact on Costs: Rising labor expenses directly affect Olympic Steel's cost structure and potential profitability.

Economic factors significantly shape Olympic Steel's performance, with commodity price volatility, particularly for steel and aluminum, directly impacting its cost of goods sold and profit margins. For example, hot-rolled coil prices in early 2024 fluctuated between approximately $750 and $850 per ton, illustrating the challenges in cost forecasting due to supply and demand imbalances and geopolitical influences.

Rising interest rates, as demonstrated by Federal Reserve actions through 2023 and into early 2024, increase borrowing costs for capital expenditures, potentially slowing investment. Furthermore, inflation poses a dual threat by reducing customer purchasing power and increasing operational expenses for raw materials, energy, and labor, a concern for manufacturers as of late 2024.

The overall economic health, measured by GDP growth, directly correlates with demand for Olympic Steel's products; for instance, the 4.9% annualized GDP growth in Q3 2023 signaled a robust environment for industrial activity. Similarly, industrial output, with the U.S. industrial production index rising 0.2% in November 2023, indicates continued expansion in manufacturing and construction, sectors that heavily consume steel.

Labor market dynamics also play a crucial role, with persistent low unemployment rates around 3.9% in early 2024 driving wage pressures and increasing operational costs for Olympic Steel. The demand for skilled labor, such as welders and machine operators, further exacerbates wage inflation and presents talent acquisition challenges.

| Economic Factor | Impact on Olympic Steel | Data Point (2023-2024) |

|---|---|---|

| Commodity Prices | Affects cost of goods sold and profit margins | HRC prices: ~$750-$850/ton (early 2024) |

| Interest Rates | Increases borrowing costs for capital expenditures | Fed rate hikes continued through early 2024 |

| Inflation | Reduces purchasing power, increases operational costs | Persistent concern for manufacturers (late 2024) |

| GDP Growth | Drives demand for steel products | U.S. GDP: 4.9% annualized growth (Q3 2023) |

| Labor Market | Impacts wage costs and availability of skilled workers | U.S. Unemployment Rate: ~3.9% (early 2024) |

What You See Is What You Get

Olympic Steel PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This detailed PESTLE analysis of Olympic Steel covers all crucial external factors impacting the company's operations and strategy. You'll gain insights into Political, Economic, Social, Technological, Legal, and Environmental influences, providing a comprehensive understanding of the competitive landscape.

Sociological factors

Olympic Steel faces the challenge of an aging workforce, a trend mirrored across the manufacturing sector, with a significant portion of skilled trades nearing retirement age. This demographic shift, coupled with a broader shortage of skilled labor, directly impacts the company's ability to recruit and retain qualified personnel for critical roles in steel production and processing. For instance, the U.S. Bureau of Labor Statistics projected a need for over 300,000 new welders by 2026, highlighting the competitive landscape for essential manufacturing skills.

To counteract these demographic pressures, Olympic Steel must prioritize investment in robust training and development programs. Such initiatives are vital not only for upskilling the existing workforce but also for attracting new talent by offering clear career progression paths and specialized training. In 2024, many manufacturing firms are dedicating substantial portions of their operational budgets to apprenticeship programs and internal academies to bridge these skill gaps and ensure a pipeline of competent employees.

Societal expectations and increasing regulatory pressures are pushing companies like Olympic Steel to prioritize workplace health and safety. This means investing more in advanced safety equipment and training, which can impact operational costs but also boosts employee morale. For instance, in 2023, the U.S. Bureau of Labor Statistics reported a total recordable case rate of 2.7 per 100 full-time workers in the manufacturing sector, a figure that companies strive to beat.

A robust safety record isn't just about compliance; it's a significant factor in building a positive public image and attracting top talent. Olympic Steel’s commitment to safety, reflected in its operational procedures and employee well-being programs, directly contributes to its reputation. Companies with strong safety cultures often see lower turnover rates and improved productivity, as employees feel more secure and valued in their work environment.

Olympic Steel's commitment to community engagement directly influences its social license to operate, a critical factor in its ongoing success. In 2024, the company highlighted its support for local initiatives, including contributions to youth sports programs and educational partnerships in the regions where it has facilities. These efforts are not just philanthropic; they build goodwill and can mitigate potential operational disruptions. A strong reputation fostered through these interactions is vital for attracting skilled labor, a challenge across the manufacturing sector.

Consumer Preferences for Sustainable Products

Consumer preferences are shifting significantly towards sustainability, impacting industries like steel. In 2024, a significant portion of consumers, particularly younger demographics, indicated a willingness to pay a premium for eco-friendly products. This trend extends to industrial buyers who are increasingly scrutinizing the environmental footprint of their suppliers.

Olympic Steel, like many in the metals sector, faces pressure to adapt its product lines and sourcing strategies. The demand for recycled steel content is growing, with many infrastructure projects and manufacturing sectors prioritizing materials with a lower embodied carbon. For instance, by 2025, several key European Union directives are expected to further mandate the use of recycled content in construction and manufacturing.

- Growing Demand for Recycled Content: In 2024, global demand for steel made with significant recycled content reached new highs, driven by ESG (Environmental, Social, and Governance) mandates.

- Supplier Scrutiny: Industrial clients are actively auditing their supply chains, favoring steel providers with demonstrable commitments to reduced emissions and sustainable practices.

- Product Innovation: Companies like Olympic Steel are exploring innovations in steel production that incorporate higher percentages of recycled materials or utilize cleaner energy sources.

- Market Differentiation: A strong sustainability profile can serve as a key differentiator, attracting environmentally conscious customers and potentially commanding higher margins.

Corporate Social Responsibility (CSR)

Societal expectations for corporate social responsibility (CSR) are increasingly influencing companies like Olympic Steel. There's a growing demand for businesses to operate ethically, contribute positively to communities, and maintain transparent practices. This shift directly impacts how stakeholders perceive a company and, consequently, its brand image and long-term viability.

For Olympic Steel, this means a heightened focus on environmental stewardship, employee well-being, and community engagement. For instance, in 2023, the metals industry, which Olympic Steel operates within, saw continued pressure to reduce its carbon footprint. Companies are investing in cleaner production methods and sustainable sourcing, with many aiming for significant emissions reductions by 2030.

- Ethical Operations: Stakeholders, including investors and customers, expect fair labor practices and responsible supply chains.

- Community Impact: Companies are increasingly judged on their contributions to local economies and social welfare programs.

- Transparency: Open communication about business practices and performance is crucial for building trust and enhancing brand reputation.

- Environmental Stewardship: A commitment to reducing environmental impact, such as carbon emissions and waste, is a key CSR expectation.

Societal expectations regarding workplace safety and employee well-being are paramount for Olympic Steel. In 2024, the U.S. manufacturing sector continued to see a focus on reducing workplace incidents, with companies like Olympic Steel investing in advanced safety protocols and training to foster a secure environment. This commitment not only aids in regulatory compliance but also significantly boosts employee morale and retention.

Furthermore, the growing demand for corporate social responsibility (CSR) means Olympic Steel must demonstrate ethical operations and positive community engagement. By supporting local initiatives and maintaining transparent practices, the company builds trust and enhances its brand image. This is particularly relevant as stakeholders, including customers and investors, increasingly prioritize suppliers with strong ethical and environmental track records.

The demographic shift towards an aging workforce presents a challenge, with many skilled trades nearing retirement. To address this, Olympic Steel is prioritizing investment in training and development programs, as highlighted by the U.S. Bureau of Labor Statistics' projection of a significant need for skilled manufacturing labor through 2026. These initiatives are crucial for bridging skill gaps and ensuring a pipeline of qualified employees.

Consumer and industrial buyer preferences are increasingly leaning towards sustainability, impacting Olympic Steel's operations. The demand for steel with a high recycled content is rising, driven by environmental mandates and a desire for products with a lower carbon footprint. By 2025, several key regulations are expected to further boost the use of recycled materials in construction and manufacturing.

Technological factors

Olympic Steel's investment in advanced automation and robotics significantly bolsters its processing capabilities. By integrating automated cutting, slitting, and material handling, the company can achieve greater operational efficiency and precision in its service centers. This technological advancement also contributes to a safer working environment by minimizing manual labor in hazardous tasks.

The strategic adoption of robotics directly impacts Olympic Steel's cost structure, primarily through reduced labor expenses and increased throughput. For instance, the manufacturing sector, as a whole, saw productivity gains of 2.7% in 2024, a trend Olympic Steel aims to leverage through its automation initiatives. These systems are designed to handle materials with higher accuracy, leading to less waste and improved product quality, which is crucial in a competitive market.

Olympic Steel is leveraging digital transformation to gain a competitive edge. By implementing advanced Enterprise Resource Planning (ERP) systems, the company can achieve better oversight of its operations, from raw material procurement to finished product delivery. This digital integration is crucial for optimizing inventory levels and reducing holding costs, a key factor in the volatile metals market.

The company's focus on data analytics is transforming how it makes decisions. Sophisticated analytical tools allow Olympic Steel to refine demand forecasting, which is vital for managing fluctuating steel prices and customer needs. For instance, improved forecasting accuracy directly impacts purchasing decisions, ensuring they acquire materials at opportune times, thereby boosting cost efficiency.

Supply chain management software plays a significant role in streamlining operations. This technology provides real-time visibility into logistics, enabling quicker responses to disruptions and optimizing transportation routes. In 2024, companies across the manufacturing sector reported an average of 15% improvement in on-time delivery rates after adopting advanced supply chain solutions.

These technological investments enhance operational agility and decision-making. By having readily available, analyzed data, Olympic Steel can adapt more swiftly to market shifts, customer demands, and potential supply chain bottlenecks, ultimately improving overall business performance and profitability.

Technological advancements in metallurgy are continuously yielding novel steel and aluminum alloys with enhanced strength, durability, and corrosion resistance. For Olympic Steel, this translates into significant opportunities to diversify its product portfolio, catering to sectors demanding higher performance materials.

For instance, the development of advanced high-strength steels (AHSS) is revolutionizing the automotive industry, offering lighter yet stronger components that improve fuel efficiency and safety. Olympic Steel's ability to adapt and incorporate these materials is crucial for maintaining its competitive edge.

In 2024, the global market for advanced steel is projected to reach substantial figures, indicating a strong demand for innovative material solutions. Staying ahead of these material science breakthroughs ensures Olympic Steel remains relevant and can capitalize on emerging market needs.

E-commerce and Digital Customer Platforms

The ongoing shift towards online purchasing and digital customer engagement means companies like Olympic Steel must build strong e-commerce capabilities. This is crucial for streamlining the buying process and enhancing how customers interact with the business. For instance, in 2023, B2B e-commerce sales in the U.S. were estimated to reach over $1.7 trillion, highlighting the significant market potential for digital platforms in industrial sectors.

Olympic Steel can harness these digital advancements to refine its customer experience, making it easier for clients to browse products, place orders, and manage their accounts. Investing in user-friendly online portals and self-service options can lead to greater customer satisfaction and loyalty. The company's own digital initiatives, such as enhancing its website for quote requests and order tracking, directly address this trend, aiming to improve operational efficiency and expand its market footprint.

- Enhanced Customer Experience: Online platforms allow for 24/7 access to product information, pricing, and order status, improving convenience for clients.

- Streamlined Order Processing: Digital ordering systems can reduce manual input, minimize errors, and speed up fulfillment times.

- Expanded Market Reach: E-commerce enables Olympic Steel to connect with a broader customer base beyond traditional geographical limitations.

- Data-Driven Insights: Digital interactions provide valuable data on customer behavior and preferences, informing sales and marketing strategies.

Cybersecurity and Data Protection

As Olympic Steel's operations increasingly rely on digital platforms, the threat landscape for cyberattacks expands significantly. A breach could compromise sensitive company financial data and customer information, leading to substantial financial losses and reputational damage. For instance, the average cost of a data breach in the manufacturing sector reached $4.73 million in 2024, according to IBM's Cost of a Data Breach Report. This underscores the critical need for robust cybersecurity investments to safeguard operations and maintain stakeholder confidence.

Investing in advanced cybersecurity measures is paramount for Olympic Steel. These investments are essential not only for protecting proprietary information and client data but also for ensuring the uninterrupted flow of business operations. Downtime caused by cyber incidents can lead to lost revenue and decreased productivity. A 2024 survey by Deloitte indicated that 68% of manufacturers consider cybersecurity a top priority, reflecting a widespread understanding of its importance in maintaining operational resilience.

Key technological considerations for Olympic Steel regarding cybersecurity and data protection include:

- Implementation of multi-factor authentication across all critical systems.

- Regular vulnerability assessments and penetration testing to identify and address weaknesses.

- Employee training programs focused on phishing awareness and secure data handling practices.

- Development and regular testing of a comprehensive incident response plan.

Olympic Steel's adoption of advanced automation and digital platforms is a key technological factor impacting its operations. The company is leveraging robotics and AI to enhance processing efficiency, reduce costs, and improve product quality. For example, advancements in metallurgy are enabling the development of new, high-strength steel alloys, which Olympic Steel can incorporate into its product offerings to meet evolving industry demands.

Digital transformation is central to Olympic Steel's strategy, with investments in ERP systems and data analytics aimed at optimizing inventory, forecasting demand, and streamlining supply chains. This digital focus is crucial for navigating volatile market conditions. In 2024, manufacturing sector productivity saw a 2.7% increase, a trend that Olympic Steel's technological investments are designed to mirror and surpass.

The company's commitment to e-commerce capabilities is another significant technological trend. By enhancing online platforms for customer interaction and order processing, Olympic Steel aims to expand its market reach and improve customer experience. This aligns with the broader B2B e-commerce growth, which reached over $1.7 trillion in the U.S. in 2023.

Cybersecurity is a critical technological consideration, given the increasing reliance on digital systems. The average cost of a data breach in manufacturing reached $4.73 million in 2024, highlighting the need for robust protection of sensitive data and operational continuity.

Legal factors

Olympic Steel faces significant legal hurdles related to environmental regulations. Compliance with laws governing emissions, waste disposal, and pollution control is paramount. Failure to adhere to federal, state, and local environmental mandates can result in substantial fines and the revocation of crucial operational permits.

For instance, the Environmental Protection Agency (EPA) continuously updates standards for industrial emissions. In 2024, the EPA continued its focus on reducing greenhouse gases, impacting heavy industries like steel manufacturing. Olympic Steel’s adherence to these evolving standards is critical for its continued operation and reputation.

Olympic Steel's operations are significantly shaped by labor laws. In 2024, compliance with regulations regarding minimum wage, overtime, and workplace safety is paramount. For instance, the Fair Labor Standards Act (FLSA) in the US dictates pay structures, directly affecting operational costs and profitability.

Changes in employment regulations, such as those concerning paid sick leave or benefits mandates, can necessitate adjustments to HR policies and increase expenses. For example, the potential for expanded federal or state-level mandates on employee benefits in 2025 could impact Olympic Steel's overall labor budget and talent acquisition strategies.

Union relations also play a crucial role, with collective bargaining agreements influencing wage scales and work rules. The percentage of unionized workers within the steel industry, which can fluctuate, directly impacts negotiation dynamics and the company's ability to manage labor costs efficiently.

Trade and anti-dumping laws significantly influence Olympic Steel's operational costs and market access. For instance, Section 232 tariffs imposed by the United States on steel imports in 2018, initially set at 25%, impacted the cost of raw materials for many domestic manufacturers, including those that might source semi-finished goods internationally. While these tariffs have seen adjustments and exemptions for various countries, their existence and potential reimposition create ongoing uncertainty for global sourcing strategies and competitive pricing.

Anti-dumping duties, levied when foreign producers sell goods below fair market value, can also reshape the competitive arena. In 2024, the U.S. Department of Commerce actively investigates and enforces these duties across various steel product categories. For Olympic Steel, understanding and adhering to these regulations is critical to avoid penalties and ensure fair competition against subsidized imports, directly affecting their ability to secure cost-effective inputs and maintain market share.

Product Liability and Safety Standards

Olympic Steel must adhere to stringent legal requirements regarding product quality and safety. Failure to meet these standards for processed steel materials can result in significant litigation due to product defects, potentially impacting the company's financial stability and reputation. For instance, in 2024, the U.S. Consumer Product Safety Commission (CPSC) continued to enforce regulations across various industries, underscoring the importance of robust safety protocols for all manufactured goods that incorporate steel components.

Maintaining strict quality control measures is therefore paramount for Olympic Steel. This includes rigorous testing and compliance checks throughout the processing lifecycle to ensure that its products meet or exceed industry-specific safety standards. Such diligence helps mitigate the risk of liability claims and reinforces customer trust.

- Product Liability: Legal frameworks often hold manufacturers responsible for damages caused by defective products.

- Safety Standards: Compliance with national and international safety regulations is non-negotiable.

- Litigation Risk: Non-compliance can lead to costly lawsuits, fines, and reputational damage.

- Quality Assurance: Investment in advanced quality control systems is essential to prevent defects and ensure safety.

Corporate Governance and Reporting Standards

Olympic Steel, as a publicly traded entity, must adhere strictly to securities laws and corporate governance mandates. This includes compliance with regulations such as the Sarbanes-Oxley Act of 2002, which governs financial reporting and corporate accountability. These legal frameworks are crucial for maintaining transparency and safeguarding the interests of all stakeholders, particularly investors. For instance, in 2023, the SEC continued its focus on robust internal controls and accurate financial disclosures, a trend expected to persist through 2024 and into 2025.

The company's commitment to these standards directly impacts investor confidence and its ability to access capital markets. Adherence ensures that financial statements accurately reflect the company's performance, preventing fraudulent practices and promoting ethical business conduct. Olympic Steel's annual reports, such as the one filed for the fiscal year ending December 31, 2023, demonstrate its ongoing efforts to meet these stringent reporting requirements, providing key financial metrics that guide investment decisions.

- SEC Enforcement: Continued scrutiny of financial reporting and internal controls by the Securities and Exchange Commission (SEC) remains a key legal factor.

- Sarbanes-Oxley Act (SOX): Ongoing compliance with SOX provisions, including Section 404 on internal control over financial reporting, is essential.

- Corporate Governance Best Practices: Adherence to evolving corporate governance guidelines, often influenced by shareholder activism and market trends, is critical for maintaining board oversight and stakeholder trust.

- Environmental, Social, and Governance (ESG) Reporting: Increasing regulatory and investor demand for transparent ESG disclosures adds another layer of legal and compliance considerations.

Olympic Steel navigates a complex legal landscape, with environmental regulations like the EPA's focus on greenhouse gas emissions in 2024 significantly impacting operations. Labor laws, including the FLSA, dictate wage structures and workplace safety, with potential 2025 benefit mandates adding to cost considerations. Trade and anti-dumping laws, exemplified by Section 232 tariffs and Commerce Department investigations in 2024, directly affect raw material costs and market competitiveness.

Environmental factors

The steel industry, including service centers like Olympic Steel, is under increasing scrutiny to curb carbon emissions. As of early 2024, global efforts to limit warming to 1.5°C are intensifying, putting pressure on energy-intensive sectors. This translates to potential mandates or strong market expectations for Olympic Steel to improve energy efficiency and integrate renewable energy sources into its operations.

Furthermore, Olympic Steel might face growing demands regarding its Scope 3 emissions, which encompass emissions from its vast supply chain, including the raw materials it sources and the transportation of finished goods. By 2025, many customers, particularly those in Europe and North America, are expected to have more rigorous sustainability reporting requirements. This could influence supplier selection and necessitate greater transparency in Olympic Steel's environmental performance metrics.

Olympic Steel faces significant environmental responsibilities concerning the substantial volume of scrap metal generated from its processing activities. Effective waste management and robust recycling programs are therefore critical operational necessities. The company's commitment to sustainability is directly tied to its ability to manage these byproducts responsibly.

Prioritizing the use of recycled content in its manufacturing processes is a key environmental consideration for Olympic Steel. This not only reduces the demand for virgin materials but also aligns with circular economy principles. Minimizing the amount of waste sent to landfills is a crucial aspect of their environmental stewardship, impacting both regulatory compliance and public perception.

In 2023, the metals recycling industry in the United States processed approximately 67 million tons of scrap metal, a figure that underscores the scale of material flow within the sector. Olympic Steel's operations contribute to this ecosystem, and their internal waste management practices directly influence their environmental footprint and resource efficiency.

Growing concerns about the depletion of vital natural resources, like iron ore and coking coal, directly influence the steel industry's operational costs and material availability. This trend is intensifying the demand for sustainable sourcing practices across the sector. For Olympic Steel, demonstrating responsible material procurement and maintaining robust supply chain transparency are becoming critical differentiators, potentially impacting investor confidence and customer loyalty as environmental, social, and governance (ESG) considerations gain prominence in investment decisions.

Water Usage and Pollution Control

Olympic Steel, like many in the metals processing industry, relies on water for cooling, cleaning, and other essential operations. In 2024 and looking ahead to 2025, the company faces increasingly stringent regulations governing both water usage and the quality of discharged wastewater. Efficient water management is therefore critical, not just for environmental compliance but also for operational cost control. Failing to meet these standards can result in significant fines and reputational damage.

To address these challenges, Olympic Steel must prioritize robust wastewater treatment systems. These systems are designed to remove contaminants before water is released back into the environment, ensuring compliance with national and local environmental protection agency (EPA) guidelines. Investing in advanced filtration and treatment technologies will be key to minimizing their environmental footprint and maintaining their social license to operate. For instance, the U.S. EPA's Clean Water Act sets discharge limits for various pollutants, and companies like Olympic Steel must adhere to these to avoid penalties.

Key considerations for Olympic Steel in managing water usage and pollution control include:

- Water Consumption Reduction: Implementing water recycling and reuse programs within processing facilities to lower overall intake.

- Wastewater Treatment Technologies: Investing in and maintaining state-of-the-art treatment systems to meet or exceed discharge permit requirements.

- Regulatory Compliance Monitoring: Continuously monitoring water discharge quality and usage to ensure adherence to evolving environmental laws and standards.

- Pollution Prevention Strategies: Proactively identifying and mitigating potential sources of water pollution within their operational processes.

Energy Consumption and Efficiency

The metal processing industry, including operations like those at Olympic Steel, is inherently energy-intensive. This means that fluctuations in energy prices and the environmental impact of energy use are major considerations for the company's operational costs and its sustainability efforts. For instance, in 2023, the industrial sector accounted for approximately 31% of total U.S. electricity consumption, highlighting the significant energy demands of manufacturing.

Olympic Steel's commitment to improving energy efficiency directly impacts its bottom line and its environmental footprint. By investing in more efficient machinery and optimizing production processes, the company can reduce its reliance on fossil fuels and lower its operational expenses. For example, upgrades to electric arc furnaces or annealing furnaces can yield substantial energy savings over time.

Exploring alternative energy sources is also becoming increasingly important. This could involve sourcing electricity from renewable providers or investigating on-site renewable energy generation.

- Energy Costs: Fluctuations in natural gas and electricity prices directly affect Olympic Steel's profitability.

- Efficiency Initiatives: Investments in energy-saving technologies, such as variable speed drives and LED lighting, are critical for cost reduction.

- Renewable Energy: The company may explore power purchase agreements for renewable energy to mitigate its carbon footprint and potentially stabilize energy costs.

- Regulatory Landscape: Evolving environmental regulations related to emissions and energy usage can influence operational strategies and investment decisions.

Olympic Steel faces increasing pressure regarding its carbon footprint and energy consumption. As of early 2024, global climate initiatives are intensifying, demanding greater energy efficiency and the integration of renewables in energy-intensive sectors like steel processing. This trend is expected to continue, influencing operational strategies and investment in cleaner technologies through 2025.

PESTLE Analysis Data Sources

Our PESTLE analysis for Olympic Steel integrates data from official government publications, reputable financial news outlets, and leading industry analysis firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the steel industry.