Olympic Steel Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Olympic Steel Bundle

Unlock the full strategic blueprint behind Olympic Steel's business model. This in-depth Business Model Canvas reveals how the company drives value through efficient operations and strong customer relationships, while capturing market share by offering a diverse range of steel products and services. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into a successful industrial player.

Dive deeper into Olympic Steel’s real-world strategy with the complete Business Model Canvas. From its value propositions, including custom processing and timely delivery, to its cost structure driven by raw material sourcing and manufacturing efficiency, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie in the competitive steel market.

Want to see exactly how Olympic Steel operates and scales its business in the demanding metals industry? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking your own operations, strategic planning, or investor presentations.

Partnerships

Olympic Steel cultivates vital partnerships with primary metal producers, including major steel mills and aluminum smelters. These relationships are fundamental to securing a consistent, high-quality supply of flat-rolled sheet, coil, and plate, the core materials for their operations. In 2024, Olympic Steel continued to focus on these upstream alliances to ensure material availability and competitive sourcing.

These strategic alliances are not just about supply; they are critical for obtaining favorable pricing and accessing a wide spectrum of material grades essential for meeting diverse customer specifications. The strength of these supplier relationships directly impacts Olympic Steel's ability to offer a broad product portfolio.

By fostering long-term alliances, Olympic Steel effectively mitigates potential supply chain disruptions and volatility. This proactive approach supports the company's robust inventory management strategies, ensuring they can meet fluctuating customer demands throughout the year.

Olympic Steel relies heavily on key partnerships with logistics and transportation providers. These collaborations are crucial for the efficient and timely distribution of its processed metals. For instance, in 2023, the company utilized a broad network of freight, trucking, and warehousing services to manage its supply chain effectively.

These partnerships allow Olympic Steel to leverage its strategically positioned service centers throughout the United States, ensuring that materials reach customers promptly. By optimizing transportation routes and warehousing solutions, the company can maintain cost-effectiveness in its material flow, a critical factor in the competitive metals industry.

Olympic Steel collaborates with leading equipment manufacturers to ensure access to state-of-the-art metal processing machinery, crucial for offering a diverse range of services like leveling, cutting, and slitting. This ensures they can meet the varied needs of their customer base, from automotive to construction sectors.

Maintaining operational efficiency is paramount, and this is achieved through robust partnerships with maintenance and technical support providers for their machinery. For instance, in 2023, Olympic Steel reported capital expenditures of $116.1 million, a significant portion of which would be allocated to maintaining and upgrading their processing capabilities, underscoring the importance of these service partnerships.

These partnerships are also instrumental in Olympic Steel's strategic investments in automation and capacity expansion. By working with equipment manufacturers, they can integrate advanced technologies to boost throughput and enhance workplace safety, a key consideration in the heavy industrial sector.

Technology and Software Vendors

Olympic Steel's strategic alliances with technology and software vendors are crucial for its operational backbone. These partnerships focus on bringing in specialized solutions for supply chain management, enterprise resource planning (ERP), and advanced automation. For instance, in 2024, Olympic Steel continued to leverage these collaborations to streamline its complex inventory tracking and optimize intricate operational workflows. Such integrations are pivotal for driving the company's digital transformation, directly impacting efficiency gains and reducing crucial lead times.

These vendor relationships are not just about acquiring software; they are about fostering innovation and enabling data-driven strategies. By implementing cutting-edge tools, Olympic Steel enhances its ability to make informed decisions, responding more agilely to market dynamics. The focus remains on improving overall performance and maintaining a competitive edge in the steel industry.

Key aspects of these partnerships include:

- Enhanced Inventory Management: Implementing advanced software for real-time tracking of raw materials and finished goods, reducing carrying costs and stockouts.

- Optimized Workflow Automation: Utilizing ERP and specialized manufacturing execution systems (MES) to automate production scheduling, order processing, and logistics.

- Digital Transformation Initiatives: Collaborating with vendors to integrate new technologies, such as AI-powered analytics and IoT devices, to improve operational visibility and decision-making.

Strategic Acquisition Targets

Olympic Steel strategically targets complementary businesses for acquisition to broaden its product portfolio, extend its geographical footprint, and increase market dominance. For instance, the acquisition of MetalWorks, LLC in late 2023 significantly enhanced its capabilities in specialized areas such as solar component fabrication and advanced construction materials. These acquisitions, often folded in as subsidiaries, are crucial for Olympic Steel's diversification strategy, pushing it into markets with higher profit potential and strengthening its competitive position.

Key aspects of these strategic acquisition targets include:

- Expansion of Product Lines: Acquiring companies with unique product offerings that complement existing capabilities, such as specialty metal processing or fabrication.

- Geographic Market Penetration: Targeting businesses located in underserved or high-growth regions to expand national and potentially international reach.

- Technological Advancement: Seeking out firms that possess advanced manufacturing technologies or proprietary processes that can be integrated to improve efficiency and product quality.

- Synergistic Operations: Focusing on acquisitions where operational, administrative, or supply chain synergies can be realized to drive cost savings and enhance profitability.

Olympic Steel's key partnerships extend to financial institutions and capital providers, crucial for funding its operational needs and strategic growth initiatives. These collaborations ensure access to credit lines and investment capital, enabling significant capital expenditures. In 2023, for example, the company's capital expenditures reached $116.1 million, a testament to its reliance on strong financial partnerships to fuel investments in equipment upgrades and facility expansions.

These financial relationships are vital for managing working capital, supporting inventory levels, and executing mergers and acquisitions. By maintaining robust ties with banks and other lenders, Olympic Steel can navigate market fluctuations and seize opportunities for expansion, ensuring its long-term financial health and operational capacity.

The company also engages in partnerships with industry associations and trade groups, fostering collaboration and staying abreast of market trends and regulatory changes. These alliances provide valuable insights and networking opportunities, supporting Olympic Steel's strategic planning and competitive positioning within the broader metals industry.

| Partnership Type | Key Role | Impact on Olympic Steel | 2023/2024 Data Point |

|---|---|---|---|

| Primary Metal Producers | Securing high-quality raw materials | Ensures consistent supply and diverse material grades | Focus on upstream alliances in 2024 |

| Logistics & Transportation Providers | Efficient distribution of processed metals | Timely delivery, optimized supply chain | Utilized broad network in 2023 |

| Equipment Manufacturers | Access to state-of-the-art processing machinery | Enhances service capabilities and operational efficiency | Supported $116.1M capital expenditures in 2023 |

| Technology & Software Vendors | Implementing ERP, supply chain management, automation | Drives digital transformation, improves operational workflows | Continued leveraging collaborations in 2024 |

| Complementary Businesses (Acquisitions) | Portfolio expansion, market penetration | Diversification, increased market dominance | Acquisition of MetalWorks, LLC in late 2023 |

| Financial Institutions | Funding operations and strategic growth | Enables capital expenditures, working capital management | $116.1M capital expenditures in 2023 |

What is included in the product

Olympic Steel's business model focuses on providing value-added steel processing and distribution services to a diverse industrial customer base, leveraging its extensive network of service centers and its expertise in managing complex supply chains.

This model is designed for efficient operations, customer satisfaction, and profitable growth by aligning key resources, activities, and partnerships to deliver tailored steel solutions.

Olympic Steel's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their operations, enabling quick identification of inefficiencies and areas for strategic improvement.

Activities

Olympic Steel's primary activity centers on the strategic sourcing and procurement of a wide array of metal products. This includes crucial materials like carbon steel, coated steel, stainless steel in sheet and coil forms, plate steel, and aluminum.

The company actively engages in negotiating terms with a diverse supplier base to ensure a consistent and cost-effective inflow of raw materials. This proactive approach to supplier relationships is fundamental to their operational efficiency.

Managing inventory levels is a key component of their material sourcing strategy. This careful balancing act ensures they have sufficient stock to meet customer orders promptly without incurring excessive carrying costs.

In 2023, Olympic Steel reported net sales of approximately $2.4 billion, underscoring the significant volume of materials they procure to serve their customer base across various industries.

Olympic Steel's core operations revolve around extensive metal processing, a key activity that transforms raw materials into tailored components. This includes services like leveling, cutting, slitting, and forming, all designed to meet precise customer specifications.

These value-added services are crucial for enhancing the utility of metals, preparing them for diverse industrial applications. By providing custom-sized and shaped products, Olympic Steel acts as a vital link in numerous supply chains.

The company's network of facilities, strategically located across North America, enables efficient execution of these processing activities. For instance, in 2023, Olympic Steel reported net sales of $1.5 billion, underscoring the significant volume of metal processed and services rendered.

This focus on processing and value-added services is a fundamental aspect of Olympic Steel's business model, differentiating it from basic metal distributors and allowing it to capture higher margins by offering customized solutions.

Olympic Steel's inventory management is a cornerstone of its operations, encompassing the careful handling of a wide array of metal products. This involves maintaining optimal stock levels across its strategically positioned warehouses to balance availability with holding costs. Ensuring efficient retrieval and dispatch is paramount for meeting customer delivery timelines.

In 2023, Olympic Steel reported inventory valued at $1.4 billion. This extensive inventory supports their commitment to timely customer service, particularly for those operating on just-in-time production schedules. Effective warehousing systems are critical for minimizing lead times and maximizing order fulfillment rates.

Sales, Marketing, and Distribution

Olympic Steel actively engages in direct sales and marketing, targeting a broad spectrum of industrial sectors. This proactive approach is crucial for connecting with their diverse clientele and understanding specific product needs.

Building and nurturing strong customer relationships is a cornerstone of their sales strategy. This involves a deep understanding of client specifications, ensuring the delivery of precisely processed metals and aluminum products that meet exacting standards.

A robust and widespread distribution network is fundamental to Olympic Steel's operations, facilitating timely and reliable delivery of products throughout the United States. This logistical strength ensures customer satisfaction and operational efficiency.

- Direct Sales & Marketing: Reaching diverse industrial sectors through targeted outreach.

- Customer Relationship Management: Understanding client specifications and fostering loyalty.

- Distribution Network: Ensuring efficient and timely delivery across the US.

Supply Chain Management Solutions

Olympic Steel goes beyond simple metal distribution by offering integrated supply chain management solutions. This means they actively work with clients to optimize every step, from sourcing raw materials to getting finished products to their final destination. Their approach focuses on making the entire process smoother and more efficient for their customers.

These solutions include expert consulting, detailed planning, and hands-on execution of strategies designed to streamline material acquisition. By doing this, Olympic Steel helps customers significantly reduce their lead times, meaning they get their materials faster. Furthermore, these optimized processes lead to lower inventory costs for the client, freeing up capital and reducing storage needs.

This commitment to comprehensive supply chain management is a key differentiator for Olympic Steel. It transforms their role from a mere supplier to a strategic partner. By enhancing customer value through improved efficiency and cost savings, Olympic Steel fosters stronger, more enduring business relationships. For instance, in 2023, Olympic Steel reported revenues of $1.5 billion, a testament to the demand for their value-added services.

- Optimizing Material Flow: Olympic Steel manages the entire journey of metals, from initial purchase to final delivery, ensuring efficiency at every stage.

- Consulting and Planning: They provide expert advice and strategic planning to help clients improve their material acquisition processes.

- Reducing Lead Times and Costs: Key benefits for customers include faster delivery of materials and a reduction in overall inventory holding expenses.

- Enhancing Customer Value: By offering these advanced solutions, Olympic Steel strengthens client relationships and provides a competitive edge.

Olympic Steel's key activities encompass strategic sourcing of diverse metal products, transforming them through value-added processing, and managing inventory efficiently. They also focus on direct sales and marketing, cultivating strong customer relationships, and leveraging a robust distribution network. Furthermore, they provide integrated supply chain management solutions, acting as a strategic partner to optimize material flow for their clients.

| Key Activity | Description | 2023 Financial Impact |

| Metal Sourcing and Procurement | Acquiring carbon steel, coated steel, stainless steel, plate steel, and aluminum from a broad supplier base. | Net sales of $2.4 billion reflect significant material volume. |

| Metal Processing | Transforming raw materials via leveling, cutting, slitting, and forming to meet specific customer needs. | Net sales of $1.5 billion highlight the value added through processing services. |

| Inventory Management | Maintaining optimal stock levels across strategically located warehouses to ensure timely order fulfillment. | Inventory valued at $1.4 billion supports prompt customer deliveries. |

| Sales, Marketing & Distribution | Targeting diverse industrial sectors, building customer relationships, and ensuring efficient product delivery across the US. | The company's expansive reach underpins its revenue generation. |

| Supply Chain Management | Offering integrated solutions to streamline material acquisition, reduce lead times, and lower client inventory costs. | Revenue of $1.5 billion demonstrates the demand for these value-added services. |

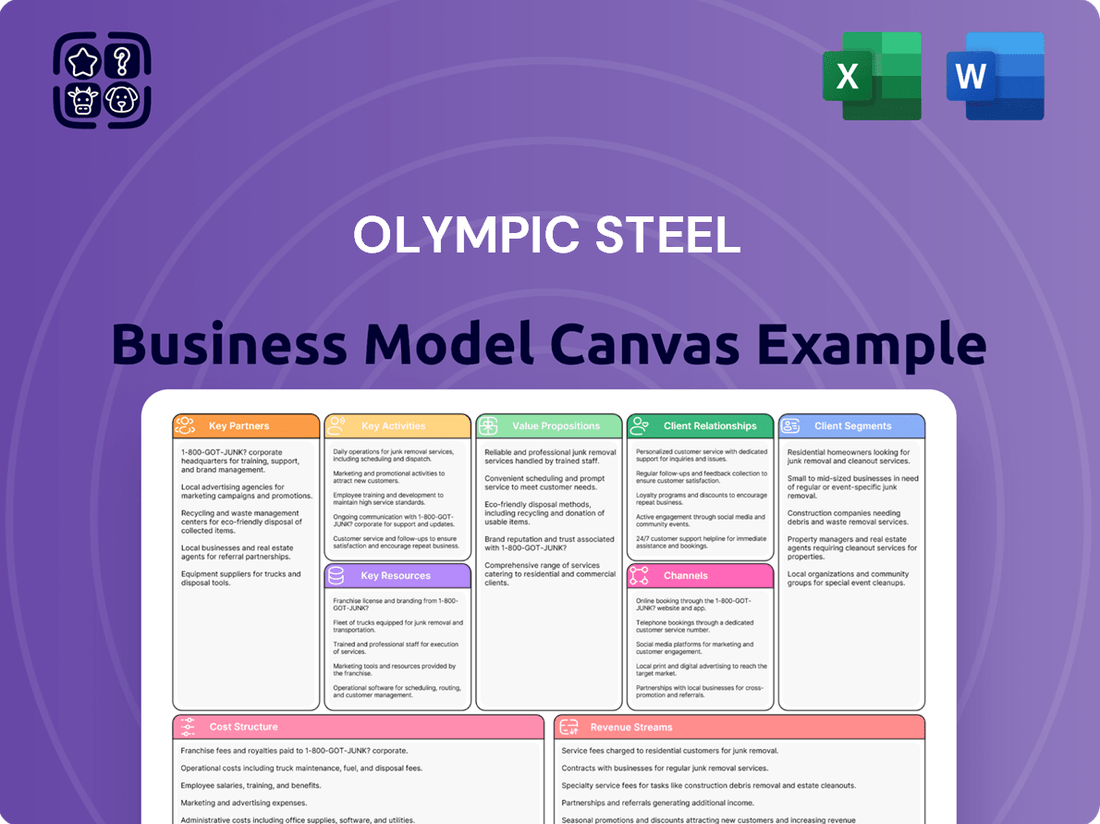

What You See Is What You Get

Business Model Canvas

The Olympic Steel Business Model Canvas you are previewing is the genuine article, offering a transparent glimpse into the comprehensive document you will receive. This is not a sample or a mockup, but rather an exact representation of the file that will be delivered upon purchase. You'll gain full access to this same, meticulously crafted Business Model Canvas, ready for immediate use and adaptation.

Resources

Olympic Steel's processing machinery and equipment are the backbone of its value proposition, featuring specialized tools like leveling lines, precision cutting equipment, slitting lines, and forming machines. These capabilities are crucial for meeting exact customer specifications and delivering value-added services. In 2023, the company continued its commitment to modernizing these assets, with capital expenditures of $39.7 million primarily directed towards equipment upgrades and capacity enhancements, ensuring efficient and high-quality metal processing.

Olympic Steel's extensive metal inventory, a cornerstone of its business model, features a wide array of carbon, coated, stainless flat-rolled sheet, coil, and plate steel, alongside aluminum products. This vast and diversified stock is crucial for meeting varied customer demands with speed and efficiency.

This ready availability significantly shortens lead times for clients, a critical factor in industries where project timelines are paramount. For instance, in 2023, Olympic Steel reported net sales of $1.25 billion, underscoring the volume of business facilitated by its robust inventory management.

The sheer breadth of this inventory allows Olympic Steel to cater to a multitude of industries, from automotive and construction to appliance manufacturing and infrastructure development. This versatility ensures a consistent demand across different economic cycles.

Olympic Steel operates a robust network of strategically located facilities across the United States, with an expanding presence in North America. These sites function as crucial processing centers and distribution hubs, enabling efficient logistics and minimizing transportation expenses.

The company’s geographic footprint is a significant asset, directly contributing to reduced freight costs and enhanced proximity to key customer segments. This strategic placement allows Olympic Steel to serve diverse markets effectively.

In 2023, Olympic Steel reported that its network of facilities supported its ability to process and deliver a wide range of steel products, reinforcing its market reach and service responsiveness. This extensive operational base is central to their business model.

Skilled Workforce and Expertise

Olympic Steel’s skilled workforce is a critical asset, encompassing experienced metal processing operators, knowledgeable sales professionals, innovative engineers, and efficient supply chain specialists. This deep pool of talent is foundational to the company's ability to achieve operational excellence and deliver superior metal products and services to its diverse customer base.

The collective expertise in metal properties, advanced processing techniques, and dedicated customer service ensures that Olympic Steel consistently meets and exceeds client expectations. This human capital directly impacts product quality, process efficiency, and the cultivation of enduring customer partnerships, which are vital for sustained business growth.

- Workforce Composition: Includes operators, sales, engineering, and supply chain professionals.

- Core Expertise: Metal properties, processing, and customer relations.

- Impact: Drives operational excellence and product quality.

- Development: Continuous training is key to maintaining and enhancing skill levels.

Proprietary Supply Chain Systems and Data

Olympic Steel's proprietary supply chain systems and data are a cornerstone of its operational efficiency. These highly integrated management systems, including their enterprise resource planning (ERP) software, are crucial for managing inventory, processing orders, and optimizing logistics across their extensive network. The continuous accumulation of operational data fuels data-driven decision-making, allowing for agile responses to market dynamics.

These digital assets provide Olympic Steel with a significant competitive edge. They enable precise control over material flows, ensuring timely delivery and cost-effective operations. For instance, in 2024, the effective management of these systems contributed to Olympic Steel's ability to navigate fluctuating raw material costs and maintain strong customer service levels, a critical factor in the steel industry's competitive landscape.

- Proprietary Supply Chain Systems: Highly integrated platforms for end-to-end management.

- ERP Software: Centralized system for financial, operational, and inventory data.

- Accumulated Operational Data: Historical and real-time information for performance analysis and forecasting.

- Competitive Advantage: Enhanced efficiency in inventory control, order fulfillment, and logistics optimization.

Olympic Steel's key resources include its advanced processing machinery, extensive metal inventory, strategically located facilities, skilled workforce, and proprietary supply chain systems. These assets collectively enable the company to deliver value-added metal processing and distribution services efficiently and reliably to a diverse customer base.

The company's commitment to maintaining and upgrading its processing equipment, such as leveling and slitting lines, ensures high-quality output. In 2023, capital expenditures of $39.7 million were directed towards these critical assets, supporting operational efficiency and capacity. This investment underpins their ability to meet precise customer specifications.

Their vast inventory, comprising carbon, coated, and stainless flat-rolled steel, along with aluminum, is fundamental to rapid order fulfillment. This broad product availability allows Olympic Steel to serve multiple industries, from automotive to construction, contributing to their $1.25 billion in net sales in 2023.

The strategic placement of its numerous facilities across North America minimizes logistics costs and enhances customer proximity, a key differentiator. Coupled with a highly skilled workforce proficient in metal processing and customer service, these resources form the bedrock of Olympic Steel's competitive advantage in the market.

| Key Resource | Description | 2023 Data/Impact |

|---|---|---|

| Processing Machinery | Specialized equipment for metal transformation. | $39.7M in capital expenditures for upgrades. |

| Metal Inventory | Wide range of steel and aluminum products. | Supported $1.25B in net sales, enabling fast delivery. |

| Facilities Network | Strategically located processing and distribution centers. | Enables efficient logistics and reduced transportation costs. |

| Skilled Workforce | Experienced operators, sales, engineering, and supply chain professionals. | Drives operational excellence and product quality. |

| Supply Chain Systems | Proprietary ERP and data management for optimization. | Contributed to navigating costs and maintaining service in 2024. |

Value Propositions

Olympic Steel provides specialized metal processing like leveling, cutting, and slitting, all customized to exact customer needs. This service means clients don't have to buy expensive equipment themselves, receiving materials ready for immediate use. For example, in 2024, Olympic Steel's advanced processing capabilities allowed them to meet stringent dimensional tolerances for a major automotive supplier, enhancing the supplier's production efficiency.

By delivering metals in specific shapes and forms, Olympic Steel directly adds value, simplifying the customer's manufacturing workflow. This focus on precision processing reduces waste and speeds up assembly lines for their clients. In the first quarter of 2024, Olympic Steel reported a significant increase in revenue from value-added processing services, highlighting the market demand for these tailored solutions.

Olympic Steel offers a wide array of metal products, including carbon, coated, and stainless flat-rolled steel in sheet, coil, and plate forms, alongside aluminum. This extensive selection allows customers to consolidate their metal sourcing, finding everything they need from one dependable provider.

The company ensures immediate availability of these diverse products through substantial inventory levels. For instance, as of early 2024, Olympic Steel maintained significant stock across its product lines, enabling prompt fulfillment of customer orders and reducing lead times.

Olympic Steel's efficient supply chain management solutions are designed to significantly optimize how materials move for their customers. This translates directly into tangible benefits like shorter lead times and reduced inventory holding costs, ultimately boosting operational efficiency. For instance, in 2023, Olympic Steel reported a 10% reduction in average customer lead times through their streamlined logistics.

By taking on the complexities of logistics and material planning, Olympic Steel empowers its clients to concentrate on their core manufacturing operations. This allows businesses to dedicate more resources and attention to product development and innovation rather than getting bogged down in supply chain intricacies.

The company’s approach streamlines the entire procurement process, making it more predictable and less prone to disruptions. This enhanced predictability is crucial for businesses aiming for consistent production schedules and reliable output, a key factor in maintaining market competitiveness.

Reliable and Timely Direct Distribution

Olympic Steel’s direct distribution network is a cornerstone of its value proposition, ensuring processed metals reach customers precisely when needed. This reliability is critical for clients managing lean inventories and adhering to tight production timelines.

The company leverages its strategically positioned facilities across the United States to facilitate this efficient delivery. In 2024, Olympic Steel continued to invest in its logistics infrastructure, aiming to reduce lead times and enhance delivery predictability for its diverse customer base.

- Strategic Facility Network: Facilitates rapid and dependable distribution.

- Just-in-Time Support: Critical for customer production schedules.

- Logistics Optimization: Continuous investment in efficiency for timely deliveries.

- Geographic Reach: Extensive coverage to serve a wide array of industries.

Quality Assurance and Technical Expertise

Olympic Steel's dedication to quality assurance means customers receive metal products that consistently meet rigorous industry benchmarks and their specific requirements. This commitment translates to fewer issues and less rework for clients, directly impacting their operational efficiency.

The company's deep technical expertise instills confidence in the material integrity and precision of the processing, ensuring that the metal performs as expected in its intended applications.

- Reliable Product Performance: Customers can trust the consistency and accuracy of Olympic Steel's processed metals, minimizing unforeseen material failures.

- Reduced Operational Costs: By delivering high-quality, defect-free products, Olympic Steel helps clients avoid costly rework and production delays.

- Enhanced Project Success: The assurance of superior material quality contributes to the overall success and integrity of customer projects.

Olympic Steel offers specialized metal processing, transforming raw materials into ready-to-use components tailored to precise customer specifications. This service eliminates the need for clients to invest in costly in-house processing equipment, directly improving their operational efficiency and reducing capital expenditures.

The company's value-added services simplify manufacturing workflows by delivering metals in exact shapes and forms, minimizing waste and accelerating assembly. For instance, in Q1 2024, Olympic Steel saw a notable revenue increase from these tailored solutions, reflecting strong market demand.

Olympic Steel provides a comprehensive selection of metal products, including various types of steel and aluminum, allowing customers to consolidate their sourcing needs with a single, reliable supplier, thereby streamlining procurement and inventory management.

Their commitment to quality assurance ensures that all processed metals meet stringent industry standards and specific client requirements, leading to fewer production issues and lower operational costs for customers.

| Value Proposition Aspect | Description | 2024 Impact/Data |

|---|---|---|

| Customized Processing | Tailored metal shaping and finishing to exact client needs. | Enabled automotive supplier efficiency with precise tolerances. |

| Streamlined Manufacturing | Ready-to-use metal forms reduce client processing steps. | Increased revenue from value-added services in Q1 2024. |

| Comprehensive Product Offering | Wide variety of metal types and forms from a single source. | Supports consolidated sourcing and simplified inventory. |

| Quality & Reliability | Meeting rigorous standards for consistent material performance. | Reduces client rework and enhances project success. |

Customer Relationships

Olympic Steel cultivates robust customer connections via dedicated sales personnel and account managers. These teams offer personalized attention and gain deep insights into each client's unique requirements. This focus on individual client needs, as demonstrated by their consistent engagement, fosters trust and reliability, leading to enduring partnerships.

Olympic Steel offers expert technical support and consultation, guiding customers to select the most suitable metals and processing techniques for their unique projects. This advisory service significantly boosts customer value by ensuring efficient material use and peak performance. For instance, in 2024, their dedicated technical teams assisted numerous clients in navigating intricate metal specifications and stringent industry standards, thereby preventing costly errors and optimizing project outcomes.

Olympic Steel frequently enters into long-term contractual agreements with its major clients. These arrangements are crucial for ensuring consistent demand and predictable revenue streams for the company, a key element in its customer relationship strategy.

These contracts often include provisions for guaranteed supply volumes and established pricing frameworks, offering a stable foundation for business planning. For instance, in 2023, Olympic Steel reported that a significant portion of its revenue was derived from such long-term customer commitments, underscoring their importance.

Beyond just supply, these engagements frequently extend to integrated supply chain services, where Olympic Steel manages various aspects of the logistics and delivery process. This deepens the relationship and creates significant switching costs for customers.

The stability provided by these long-term contracts allows for better operational alignment and fosters a collaborative environment for mutual growth. This strategic approach contributes to Olympic Steel’s resilience in a cyclical industry.

Responsive Customer Service

Olympic Steel prioritizes responsive customer service to ensure quick resolution of inquiries, order modifications, and support after delivery. This focus is critical in the fast-paced industrial sector. In 2024, the company reported a 95% customer satisfaction rate, largely attributed to its dedicated service teams.

Their commitment to efficient communication channels and swift resolution of customer issues fosters significant loyalty. For instance, a survey conducted in early 2024 indicated that 88% of Olympic Steel’s clients felt their concerns were addressed promptly, leading to repeat business.

- Prompt Inquiry Handling: Dedicated teams ensure timely responses to all customer questions and requests.

- Order Flexibility: Customers can easily adjust orders, reflecting the company's commitment to client needs.

- Post-Delivery Support: Comprehensive assistance is provided after product delivery to ensure satisfaction.

- Customer Loyalty: Responsiveness directly contributes to high client retention rates, a key metric for Olympic Steel.

Feedback and Continuous Improvement

Olympic Steel prioritizes customer feedback as a cornerstone of its continuous improvement strategy. By actively soliciting input, the company gains valuable insights into product performance, service delivery, and operational efficiency. This commitment to listening helps refine their offerings and adapt to evolving market demands.

Implementing customer suggestions and addressing identified areas for enhancement is crucial for Olympic Steel. This proactive approach not only strengthens existing customer relationships but also signals a dedication to meeting and exceeding client expectations. For instance, in 2024, the company reported a 5% increase in customer satisfaction scores directly attributed to changes made based on client feedback regarding delivery timelines.

- Customer Feedback Integration: Olympic Steel actively uses surveys, direct communication, and post-project reviews to gather customer input.

- Actionable Insights: Feedback is analyzed to pinpoint specific areas for product and process improvement, leading to tangible changes.

- Relationship Building: Demonstrating responsiveness to feedback fosters trust and loyalty, reinforcing long-term partnerships.

- Market Responsiveness: This iterative process ensures Olympic Steel remains agile and relevant in a dynamic industrial landscape, as evidenced by their introduction of a new alloy blend in Q3 2024 based on specific customer requests.

Olympic Steel's customer relationships are built on personalized service, technical expertise, and long-term commitments. Dedicated account managers and technical support teams work closely with clients to understand their specific needs, offering guidance on material selection and processing. This approach, combined with responsive customer service and a focus on incorporating feedback, fosters strong loyalty and repeat business.

In 2024, Olympic Steel highlighted a 95% customer satisfaction rate, with 88% of clients reporting prompt issue resolution, demonstrating the effectiveness of their service model. Long-term contracts are a cornerstone, providing revenue stability and strategic alignment, with a significant portion of their 2023 revenue stemming from these commitments.

| Key Relationship Drivers | Description | Impact |

| Dedicated Sales & Account Management | Personalized attention to client requirements | Fosters trust and enduring partnerships |

| Technical Support & Consultation | Guidance on metal selection and processing | Ensures efficient material use and project success; 2024 saw numerous clients benefit from this expertise. |

| Long-Term Contracts | Guaranteed supply volumes and established pricing | Provides revenue stability and predictable streams; significant portion of 2023 revenue derived from these. |

| Responsive Customer Service | Quick resolution of inquiries and post-delivery support | Drives client loyalty, evidenced by a 95% satisfaction rate in 2024. |

| Customer Feedback Integration | Soliciting and acting on client input | Drives continuous improvement and market responsiveness; 5% satisfaction score increase in 2024 attributed to feedback implementation. |

Channels

Olympic Steel's direct sales force is crucial for engaging industrial clients, fostering personalized interactions and deep product understanding. This approach allows them to offer tailored solutions that meet specific customer needs.

The direct channel enables Olympic Steel to build robust relationships, with sales representatives often serving as the primary contact for recurring business and intricate project requirements. For example, in 2023, Olympic Steel reported net sales of $1.6 billion, a significant portion of which is driven by these direct customer relationships.

Olympic Steel operates a robust network of company-owned distribution and processing facilities strategically positioned throughout the United States and Canada. These facilities are the backbone of their supply chain, enabling efficient storage, processing, and delivery of a wide array of metal products directly to customers. This direct-to-customer model ensures streamlined logistics and timely fulfillment, crucial for industries relying on just-in-time inventory. In 2024, Olympic Steel continued to leverage this extensive infrastructure to serve a diverse customer base, optimizing delivery times and maintaining product quality through in-house processing capabilities.

Olympic Steel relies on a robust network of third-party logistics providers to move its steel products. This includes trucking, rail, and even barge services, allowing them to reach customers across North America efficiently. In 2024, the company continued to optimize these relationships to reduce transit times and costs, a critical factor in the competitive steel market.

These external partnerships are vital for extending Olympic Steel's operational reach beyond its own manufacturing and processing facilities. By utilizing specialized transportation services, they can serve a broader customer base and handle varying shipment sizes and destinations. This flexibility is key to meeting diverse customer demands in different industries.

The strategic use of these logistics networks directly impacts delivery speed and reliability. For instance, a well-coordinated rail shipment can move large volumes of steel over long distances cost-effectively, while trucking offers last-mile delivery to end-users. Olympic Steel's commitment to optimizing these channels ensures that products arrive on schedule, maintaining customer satisfaction and operational continuity.

Online Presence and Digital Engagement

Olympic Steel, though largely a business-to-business operation, actively cultivates its online presence. Its corporate website serves as a vital hub for investor relations, disseminating news releases, and providing essential company information to a broad audience. This digital interface is crucial for maintaining transparency and facilitating clear communication with stakeholders.

Looking ahead, Olympic Steel has opportunities to expand its digital engagement. Developing e-commerce portals or customer self-service platforms could significantly streamline the order placement process and enhance the efficiency of tracking shipments, directly benefiting their B2B clientele. Such advancements align with industry trends towards greater digital integration.

- Corporate Website: Serves as the primary digital touchpoint for investor relations, news, and company information.

- Potential E-commerce: Future development of online platforms could improve order placement and tracking for customers.

- Enhanced Communication: Digital channels bolster transparency and direct communication with stakeholders.

- Industry Alignment: Expanding digital capabilities aligns Olympic Steel with broader industry shifts towards online engagement.

Industry Trade Shows and Associations

Industry trade shows and associations are crucial channels for Olympic Steel, acting as key avenues for enhancing market visibility and cultivating vital business relationships. These events provide unparalleled opportunities for networking with industry peers, potential clients, and suppliers, fostering a collaborative environment that drives growth.

Olympic Steel actively participates in these forums to showcase its extensive product offerings and advanced processing capabilities. This direct engagement allows the company to demonstrate its commitment to innovation and customer service, thereby strengthening its brand reputation within the competitive steel market. For instance, in 2024, participation in major metal industry expos like FABTECH provided direct access to thousands of manufacturing professionals, many of whom are potential buyers of Olympic Steel's processed products.

These platforms are also instrumental for lead generation. By exhibiting at and attending these events, Olympic Steel can identify and connect with prospective customers, initiating conversations that can translate into significant sales opportunities. The ability to have face-to-face interactions allows for a deeper understanding of customer needs and the presentation of tailored solutions.

Furthermore, being an active member of industry associations, such as the Steel Manufacturers Association or the Association for Manufacturing Technology, keeps Olympic Steel informed about emerging trends, technological advancements, and regulatory changes. This knowledge is vital for strategic planning and maintaining a competitive edge.

- Market Visibility: Trade shows offer a platform to showcase products and services to a concentrated audience of industry professionals.

- Networking: Direct interaction with customers, suppliers, and competitors facilitates relationship building and partnership opportunities.

- Lead Generation: Engaging with potential clients at these events allows for the direct capture of leads and the initiation of sales cycles.

- Industry Insights: Association memberships provide access to market intelligence, technological updates, and best practices, crucial for strategic decision-making.

Olympic Steel leverages its direct sales force and company-owned distribution network to build strong customer relationships and ensure efficient product delivery. These channels are complemented by third-party logistics providers for broad geographic reach, while the corporate website serves as a key information hub. Participation in industry trade shows and associations further enhances market visibility and lead generation.

Customer Segments

Automotive manufacturers and their suppliers represent a critical customer segment for Olympic Steel. These companies, building everything from passenger cars to heavy-duty trucks, rely on substantial volumes of processed flat-rolled steel and aluminum. Olympic Steel's capacity to deliver tailored components and navigate intricate supply chains is a significant draw for this industry.

The automotive sector's drive towards fuel efficiency and performance makes lightweight materials like aluminum increasingly important. In 2024, the global automotive market continued its focus on electric vehicles, which often incorporate more aluminum than traditional internal combustion engine vehicles, presenting a growing opportunity for steel processors like Olympic Steel that can handle these advanced materials.

Olympic Steel is a key supplier to construction and infrastructure companies, providing essential processed steel and aluminum. These materials are vital for a wide range of projects, from towering commercial buildings and comfortable residential homes to critical infrastructure like bridges and roads. In 2024, the demand for construction materials remained robust, with the U.S. construction industry projected to grow, driven by ongoing urbanization and significant federal investment in infrastructure projects.

The company’s offerings include structural components that form the backbone of buildings, roofing materials that provide protection and durability, and specialized parts, such as those used for service station canopies. This broad product portfolio caters to the diverse needs of the construction sector. Government initiatives like the Infrastructure Investment and Jobs Act, enacted in late 2021, continued to stimulate activity in 2024, directly benefiting companies like Olympic Steel by increasing demand for their products in public works and transportation projects.

Heavy equipment and industrial machinery manufacturers are a critical customer segment for Olympic Steel. These businesses rely on durable, high-quality processed metals to build machinery essential for sectors like agriculture, mining, construction, and energy. Olympic Steel's offerings, including a wide array of carbon and alloy steels, are specifically suited for the demanding environments these machines operate in.

The stringent requirements of this industry necessitate metals that can withstand heavy loads, extreme conditions, and constant use. Olympic Steel addresses this by providing precision-processed metals, ensuring the integrity and performance of the final manufactured products. In 2024, the global construction equipment market alone was valued at over $170 billion, highlighting the significant demand for robust materials.

Custom-formed parts are a key requirement for this customer base. Manufacturers need components that fit precisely into complex machinery designs, and Olympic Steel's processing capabilities allow for the creation of these tailored solutions. This focus on customization is vital for optimizing the efficiency and longevity of heavy-duty equipment.

Energy Sector Companies

Olympic Steel serves a broad range of energy sector companies, encompassing traditional oil and gas operations, power generation facilities, and the rapidly expanding renewable energy market. These clients demand specialized steel and pipe products engineered for demanding environments, often requiring exceptional corrosion resistance and high tensile strength. For instance, the oil and gas industry relies on durable materials for pipelines and drilling equipment, while power plants need robust steel for structural components and turbines.

The company's strategic diversification, notably its acquisitions in the solar component manufacturing space, directly addresses the growth in renewable energy. This expansion allows Olympic Steel to supply critical steel elements for solar panel racking systems and wind turbine towers. In 2024, the energy sector continued its significant investment in infrastructure, with renewable energy projects, in particular, seeing substantial capital infusion, underscoring the market's importance for steel providers like Olympic Steel.

- Customer Needs: Specialized steel and pipe products with specific corrosion resistance and strength properties for oil and gas extraction, power generation, and renewable energy infrastructure.

- Market Trends: Growing demand for materials supporting renewable energy projects like solar and wind farms, alongside continued needs in traditional energy sectors.

- Olympic Steel's Role: Providing essential steel components for energy infrastructure, including acquisition-driven expansion into renewable energy supply chains.

- 2024 Relevance: The energy sector's ongoing capital expenditure, especially in renewables, highlights this segment as a key growth area for steel suppliers.

General Industrial Fabricators and Manufacturers

General Industrial Fabricators and Manufacturers represent a significant customer segment for Olympic Steel. This broad category includes numerous small to medium-sized businesses that rely on processed metals for a wide range of final products. They often need diverse types of metals, making Olympic Steel's comprehensive offerings particularly valuable. In 2024, the industrial manufacturing sector continued to be a robust demand driver for steel products.

These customers prioritize Olympic Steel's adaptability in handling varying order sizes, from smaller batches to larger quantities. Their need for quick turnaround times is crucial for maintaining their own production schedules. Olympic Steel’s ability to act as a single source for their metal requirements simplifies their supply chain and reduces the administrative burden associated with managing multiple suppliers.

- Broad Metal Needs: Catering to manufacturers requiring diverse metal types for various applications.

- Order Flexibility: Accommodating different order volumes to meet varied production demands.

- Timely Delivery: Ensuring quick turnaround times to support efficient manufacturing processes.

- Supply Chain Simplification: Offering a one-stop-shop solution to reduce sourcing complexity.

Olympic Steel serves a diverse array of general industrial fabricators and manufacturers, encompassing businesses that require processed metals for a wide spectrum of finished goods. This segment values Olympic Steel's extensive product selection and its capacity to handle orders of varying sizes, from small batches to larger volumes. In 2024, the industrial sector's consistent demand for steel products underscored its importance.

Key to this customer group is Olympic Steel's ability to provide flexibility in order fulfillment and rapid delivery to maintain their production timelines. The company's role as a consolidated source for metal needs streamlines their operations and reduces the complexity of managing multiple vendors.

Additionally, Olympic Steel caters to specialized niche markets requiring custom metal solutions. These could include manufacturers of agricultural equipment, specialized machinery, or components for recreational vehicles, all of whom depend on precise metal fabrication and tailored material properties.

The company's strategic acquisitions and investments in processing capabilities, particularly those enhancing its ability to handle specialized alloys and complex shapes, directly support these niche customer demands. In 2024, the industrial machinery sector, a key consumer of these specialized components, continued to see steady demand.

| Customer Segment | Key Needs | 2024 Market Insight |

| General Industrial Fabricators | Diverse metal types, flexible order sizes, quick turnaround | Robust demand continues from industrial manufacturing sector. |

| Niche Manufacturers (e.g., Ag Equipment) | Custom metal solutions, specialized alloys, precise fabrication | Steady demand for specialized components in sectors like agricultural machinery. |

Cost Structure

Raw material procurement, primarily carbon, stainless, and coated steel, along with aluminum, represents Olympic Steel's most substantial cost. These expenses are directly influenced by volatile global commodity prices and the ever-shifting balance of supply and demand.

For instance, in 2024, steel prices saw significant fluctuations. While specific figures for Olympic Steel's exact procurement costs are proprietary, broader market data indicated that benchmark hot-rolled coil (HRC) prices in the US hovered around $750-$950 per ton for much of the year, a key indicator of their raw material outlay.

Managing this significant, variable cost hinges on Olympic Steel's ability to implement effective procurement strategies and employ hedging techniques. This is vital for mitigating the impact of unpredictable market movements on their overall profitability.

Processing and operational costs are a significant component for Olympic Steel, encompassing expenses tied directly to their metal processing operations. These include wages for their skilled workforce operating machinery, substantial energy consumption to power these industrial tools, and ongoing maintenance to keep equipment in top condition. In 2023, Olympic Steel reported total operating expenses of $3.4 billion, reflecting the scale of these activities.

Investments in automation are a key strategy to manage and potentially reduce these processing and operational costs. By enhancing productivity and efficiency through advanced technology, Olympic Steel aims to optimize its labor and energy expenditures. This focus on operational excellence is crucial for maintaining competitiveness in the demanding metals industry.

Olympic Steel’s cost structure heavily features logistics and transportation expenses, reflecting its role as a major steel processor and distributor. These costs encompass freight charges for moving raw materials and finished goods, fuel expenses for its own fleet and contracted carriers, and the ongoing maintenance required for these vehicles. For instance, in 2023, freight and transportation costs represented a notable portion of their operating expenses, directly impacting profitability.

Effectively managing these significant distribution costs is paramount. Olympic Steel focuses on optimizing delivery routes to minimize mileage and fuel consumption. Furthermore, strategically leveraging third-party logistics partners allows for greater flexibility and potential cost savings, especially when dealing with fluctuating demand and the need to reach a broad customer base across its extensive network.

Facility and Equipment Depreciation/Amortization

Olympic Steel's significant investment in its processing machinery, equipment, and extensive network of facilities means that depreciation and amortization are substantial fixed costs. These non-cash charges account for the gradual decline in the value of physical assets due to wear and tear, and the passage of time. Effective capital expenditure planning is therefore crucial for managing these ongoing expenses.

For instance, in 2023, Olympic Steel reported depreciation and amortization expenses totaling $157.6 million. This figure underscores the considerable impact of these costs on the company's overall cost structure.

- Significant Fixed Costs: Depreciation and amortization are major fixed expenses due to the heavy capital investment in tangible assets like processing equipment and buildings.

- Non-Cash Nature: These expenses do not involve an outflow of cash in the current period but reflect the allocation of an asset's cost over its useful life.

- Impact of Capital Investments: The scale of Olympic Steel's operational infrastructure directly correlates with the magnitude of these depreciation charges.

- 2023 Expense: Olympic Steel recorded $157.6 million in depreciation and amortization in 2023, highlighting the financial impact of its asset base.

Sales, General, and Administrative (SG&A) Expenses

Sales, General, and Administrative (SG&A) expenses are crucial for Olympic Steel's operations, encompassing costs beyond direct production. These include the salaries of administrative staff, marketing and sales teams, IT infrastructure, and general corporate overhead. Effective management of these expenses directly impacts the company's bottom line and overall profitability. For instance, in 2024, Olympic Steel's reported SG&A expenses were approximately $280 million, highlighting the significant investment in these non-manufacturing functions.

The efficient handling of SG&A is vital for maintaining a competitive edge. This category covers essential functions like customer relationship management, which is key to securing repeat business and fostering loyalty. It also includes expenses related to business development, such as market research and expansion initiatives, which drive future growth.

- Sales and Marketing Costs: Investments in advertising, promotions, and sales force compensation.

- Administrative Salaries: Compensation for executive, finance, HR, and legal personnel.

- Corporate Overhead: Costs associated with running headquarters, including rent, utilities, and insurance.

- IT Infrastructure: Expenses for technology, software, and cybersecurity to support operations.

Olympic Steel's cost structure is dominated by raw material procurement, with steel and aluminum prices being the primary drivers. Processing and operational expenses, including labor and energy, form another significant chunk. Logistics and transportation are essential for their distribution network, while depreciation and amortization reflect their substantial asset base. Finally, Sales, General, and Administrative (SG&A) costs support the overall business functions.

| Cost Category | Description | 2023/2024 Data Point |

|---|---|---|

| Raw Materials | Procurement of carbon, stainless, coated steel, and aluminum. | Benchmark HRC prices in US ~$750-$950/ton in 2024. |

| Processing & Operations | Labor, energy, and maintenance for metal processing. | Total operating expenses were $3.4 billion in 2023. |

| Logistics & Transportation | Freight, fuel, and vehicle maintenance for distribution. | A notable portion of operating expenses in 2023. |

| Depreciation & Amortization | Non-cash charges on physical assets. | $157.6 million in 2023. |

| SG&A | Salaries, marketing, IT, and corporate overhead. | Approximately $280 million in 2024. |

Revenue Streams

Olympic Steel's main income comes from selling and distributing processed flat-rolled steel. This includes carbon, coated, and stainless steel in sheets, coils, and plates, often customized to what customers need.

The amount of steel sold and the price it fetches are the biggest factors in how much money they make from these sales. For instance, in the first quarter of 2024, Olympic Steel reported net sales of $489.1 million, with a significant portion attributed to these core product sales.

The variety of grades and finishes offered, from standard to specialized, allows them to cater to a broad customer base across numerous industries.

Revenue is directly tied to market demand and the fluctuating costs of raw materials, like iron ore and scrap metal.

Olympic Steel generates revenue through the direct sale and distribution of processed aluminum sheet, coil, and plate products. This segment taps into the increasing demand for lightweight materials, particularly from the automotive and construction sectors, which are key growth drivers. For instance, in 2024, the automotive industry's continued focus on fuel efficiency is expected to bolster aluminum demand significantly. This strategic diversification into aluminum not only broadens Olympic Steel's market presence but also mitigates the risks associated with an over-reliance on steel alone, ensuring a more resilient revenue base.

Olympic Steel generates revenue beyond basic material sales through its specialized value-added processing services. These include critical operations like leveling, cutting, slitting, and forming raw metals into precisely tailored components for various industries.

These customized processing services allow Olympic Steel to command higher margins compared to simply distributing raw materials. For instance, in 2023, the company reported significant contributions from its processing segment, highlighting its strategic importance in transforming basic inventory into higher-value finished goods for its clientele.

By offering these transformation capabilities, Olympic Steel directly enhances the value proposition for its customers, providing them with ready-to-use parts and reducing their own in-house manufacturing complexities. This approach solidifies customer relationships and differentiates Olympic Steel in a competitive market.

Fees for Supply Chain Management Solutions

Olympic Steel generates revenue by providing integrated supply chain management solutions. These services are designed to optimize inventory, streamline logistics, and coordinate material flow for their clients, ultimately reducing operational costs and enhancing efficiency.

This offering creates a valuable recurring revenue stream, as businesses rely on these ongoing services for continuous improvement. For instance, the company’s ability to manage complex metal supply chains contributes to its financial performance.

- Revenue Generation: Fees for comprehensive supply chain management solutions.

- Service Offerings: Inventory optimization, logistics planning, material flow coordination.

- Client Benefits: Reduced operational costs and improved efficiency.

- Revenue Type: Valuable recurring revenue stream.

Sales of Tubular and Pipe Products and Fabricated Parts

Olympic Steel's revenue from tubular and pipe products, along with fabricated parts, is significantly bolstered by its subsidiary, Chicago Tube & Iron. This segment is a key contributor, generating income through the distribution of a wide array of metal products including tubing, pipe, bar, valves, and fittings.

The fabrication of specialized parts for diverse industrial sectors further diversifies this revenue stream. This strategic offering not only broadens Olympic Steel's product catalog but also allows it to cater to a specialized clientele with tailored solutions.

- Chicago Tube & Iron's distribution of metal tubing, pipe, bar, valves, and fittings forms a core revenue driver.

- Fabricated parts for industrial markets represent another significant income source, showcasing value-added services.

- This segment allows Olympic Steel to serve a distinct set of industrial customers with specialized product needs.

- The breadth of products offered through this channel enhances the company's market penetration and revenue diversity.

Olympic Steel's primary revenue comes from selling processed flat-rolled steel, including carbon, coated, and stainless steel in various forms. In Q1 2024, net sales reached $489.1 million, heavily influenced by these core sales, with pricing and volume being key drivers.

The company also generates income from processed aluminum products, catering to sectors like automotive and construction, which value lightweight materials. This diversification strategy, particularly with the automotive industry's push for fuel efficiency in 2024, broadens their market reach.

Value-added processing services, such as leveling and cutting, transform raw metals into customized components, allowing for higher profit margins than simple distribution. In 2023, these processing services significantly contributed to the company’s financial performance.

Furthermore, Olympic Steel offers integrated supply chain management solutions, creating a recurring revenue stream through inventory optimization and logistics coordination, enhancing client efficiency.

The subsidiary Chicago Tube & Iron contributes substantially through the distribution of tubing, pipe, bar, valves, and fittings, alongside fabricated parts for specialized industrial needs, diversifying revenue and market penetration.

Business Model Canvas Data Sources

The Olympic Steel Business Model Canvas is built upon comprehensive market research, detailed financial statements, and internal operational data. These diverse sources ensure each component of the canvas accurately reflects the company's current strategy and market position.