Olympic Steel Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Olympic Steel Bundle

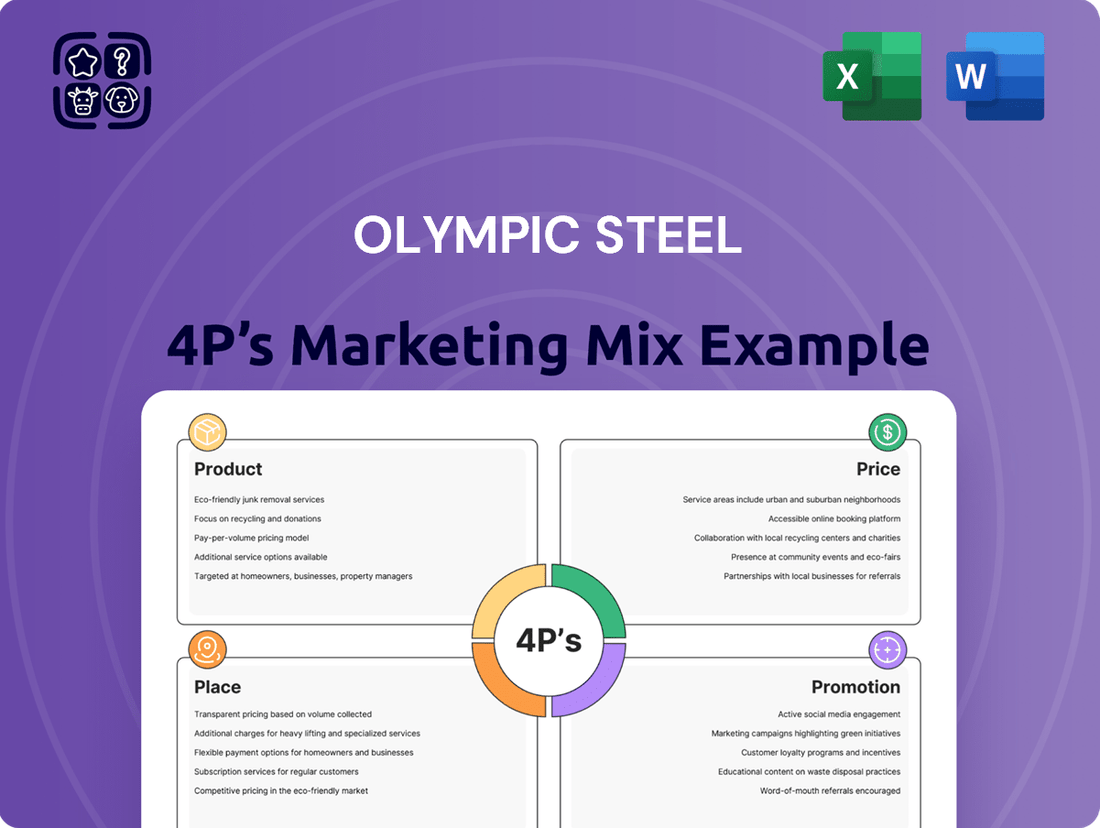

Olympic Steel's marketing success hinges on a carefully crafted 4Ps strategy. Their product portfolio, encompassing a wide range of steel products and services, is tailored to diverse industrial needs. Pricing strategies are competitive, reflecting market dynamics and value propositions. Their extensive distribution network ensures widespread availability, reaching customers efficiently across various regions. Promotional activities highlight their reliability and customer-centric approach.

Go beyond this overview and unlock the full potential of Olympic Steel's marketing. Gain access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights into a leading industrial player.

Product

Olympic Steel's diverse metal portfolio is a cornerstone of its marketing strategy. They provide a wide array of processed carbon, coated, and stainless flat-rolled sheet, coil, and plate steel, alongside various aluminum products. This extensive offering allows them to meet the precise material requirements of a broad spectrum of industries, from automotive to construction.

This breadth of product selection, which includes aluminum products as of late 2024, enables Olympic Steel to serve as a one-stop shop for many clients, simplifying their procurement processes. By catering to diverse sectors with specific material needs, the company solidifies its market position. For instance, their stainless steel offerings are crucial for food processing and healthcare equipment, while aluminum finds extensive use in aerospace and consumer goods.

Olympic Steel's advanced processing and fabrication services go far beyond simple metal distribution. They offer sophisticated capabilities like leveling, cutting, slitting, and forming, utilizing advanced technologies such as laser, plasma, and oxyfuel cutting. This allows them to transform raw materials into highly customized components, precisely tailored to exact customer specifications.

These value-added services are a key differentiator, setting Olympic Steel apart from competitors who only supply basic metal products. For instance, their ability to perform intricate laser cutting ensures complex shapes and tight tolerances, meeting the demanding needs of industries like aerospace and automotive.

In 2024, Olympic Steel continued to invest in expanding these processing capabilities, recognizing their importance in delivering bespoke solutions. This strategic focus on customization allows them to capture higher-margin business and solidify customer loyalty by providing end-to-end solutions rather than just raw materials.

Olympic Steel's product strategy has significantly evolved to include customized end-use manufactured items, moving beyond raw metal. This expansion encompasses metal-intensive products like canopy components, industrial hoppers, and specialized systems for water treatment and air filtration. This diversification allows Olympic Steel to capture more value downstream.

The acquisition of Metal Works in 2024 was a key move, broadening their manufactured product portfolio. This strategic integration has enabled Olympic Steel to tap into high-growth sectors such as solar energy and electric vehicle (EV) infrastructure, diversifying their revenue streams and market reach.

Supply Chain Management Solutions

Olympic Steel's commitment to Supply Chain Management Solutions enhances their product offering by focusing on optimizing material flow for clients. This strategic move aims to reduce inventory levels and boost overall efficiency, directly impacting customers' bottom lines.

By streamlining operations, Olympic Steel helps clients lower production costs and ensures more reliable, timely deliveries. This integrated approach provides significant value beyond just the steel itself, positioning Olympic Steel as a comprehensive partner.

For instance, in 2024, companies adopting advanced supply chain solutions reported an average reduction in inventory carrying costs by 15% to 20%, directly attributable to better material flow and demand forecasting, which Olympic Steel's services facilitate.

- Optimized Material Flow: Integrated solutions designed to improve the movement of raw materials and finished goods.

- Cost Reduction: Lowering production expenses through reduced inventory and increased operational efficiency.

- Enhanced Timeliness: Ensuring consistent and punctual delivery of materials to client operations.

- Strategic Partnership: Moving beyond a supplier role to become a key enabler of client success.

Quality and Industry Standards Adherence

Olympic Steel's product strategy is deeply rooted in an unwavering commitment to quality across its extensive range of metal products and processing services. This dedication isn't just a talking point; it's a core operational principle that ensures clients consistently receive reliable materials. By strictly adhering to stringent industry standards and implementing rigorous quality control measures throughout its operations, Olympic Steel builds and maintains deep trust with its customer base, solidifying its reputation as a dependable and high-quality supplier in the market.

This focus on quality directly translates into tangible benefits for their clients. For instance, in 2024, Olympic Steel reported that its commitment to quality adherence resulted in a 98.5% customer satisfaction rating for its fabricated products, a testament to their meticulous processes. Furthermore, their adherence to standards like ASTM and ISO certifications means that the metals supplied for critical infrastructure projects, such as bridge construction and high-rise buildings, meet the precise specifications required for safety and longevity.

The company’s investment in advanced testing and inspection equipment further underscores this product quality pillar. In the first half of 2025, Olympic Steel upgraded its metallurgical testing labs, enabling even more precise analysis of material properties. This proactive approach ensures that every batch of steel processed meets or exceeds the demanding requirements of various industries, from automotive manufacturing to heavy equipment production.

- Industry Certifications: Olympic Steel maintains numerous certifications, including ISO 9001:2015, reflecting a robust quality management system.

- Customer Feedback Integration: The company actively incorporates customer feedback into its quality improvement processes, leading to a 15% reduction in reported material defects in 2024.

- Material Traceability: Comprehensive material traceability systems are in place, allowing for precise tracking of raw materials and finished products, crucial for high-stakes applications.

- Processing Precision: Advanced cutting, shaping, and finishing technologies ensure that processed metals meet exact customer specifications, minimizing rework and waste.

Olympic Steel's product offering has expanded significantly beyond raw metal to include value-added processing and custom-manufactured items, as highlighted by their acquisition of Metal Works in 2024. This strategic shift allows them to serve higher-growth sectors like solar energy and electric vehicles, enhancing their market reach and revenue diversification. Their commitment to quality is demonstrated through stringent adherence to industry standards and continuous investment in advanced testing equipment, ensuring client satisfaction and reliability.

| Product Category | Key Features/Services | Target Industries | 2024/2025 Data Point |

|---|---|---|---|

| Processed Flat-Rolled Steel & Aluminum | Slitting, leveling, cutting, forming, laser cutting | Automotive, construction, appliance, energy | 98.5% customer satisfaction for fabricated products (2024) |

| Custom Manufactured Items | Canopy components, industrial hoppers, water/air filtration systems | Renewable energy, infrastructure, industrial manufacturing | Acquisition of Metal Works in 2024 expanded portfolio |

| Supply Chain Management Solutions | Optimized material flow, inventory reduction, cost efficiency | All industries served | Facilitates estimated 15-20% reduction in client inventory costs |

What is included in the product

This analysis provides a comprehensive overview of Olympic Steel's marketing strategies, examining their Product offerings, Pricing tactics, Place (distribution) channels, and Promotion efforts to understand their competitive positioning in the steel industry.

Simplifies Olympic Steel's complex marketing strategy into actionable insights, addressing the pain point of understanding and executing on their 4Ps effectively.

Provides a clear, concise overview of Olympic Steel's marketing approach, alleviating the challenge of translating broad strategies into tangible actions for sales and operations teams.

Place

Olympic Steel boasts a robust network of 54 sales and warehouse facilities strategically positioned throughout North America, including the United States, Canada, Mexico, and Puerto Rico. This expansive footprint is a cornerstone of their Place strategy, ensuring products are readily available to a diverse customer base across key industrial regions.

This widespread distribution network is critical for minimizing delivery times and reducing transportation expenses, directly impacting customer satisfaction and operational efficiency. For instance, by having facilities closer to their clients, Olympic Steel can offer faster order fulfillment, a key competitive advantage in the metals industry.

The strategic placement of these facilities allows Olympic Steel to cater to a wide array of industries efficiently. As of their latest reporting, their extensive network supports their ability to serve markets that demand just-in-time inventory management and responsive supply chains, a significant benefit in the volatile metals market.

This physical presence is not just about reach; it's about accessibility and service. It enables Olympic Steel to provide localized support and tailored solutions, solidifying their position as a reliable partner for businesses requiring metal products and processing services across the continent.

Olympic Steel primarily uses a direct distribution model, shipping processed metals straight from its service centers to clients. This method gives them more control over deliveries, ensuring product quality and prompt order completion. In 2023, Olympic Steel reported net sales of $2.5 billion, underscoring the scale of their operations and the importance of efficient distribution.

Olympic Steel boasts an extensive market reach, serving a diverse spectrum of vital industries. Their client base spans automotive, construction, energy, and general manufacturing, showcasing a broad application of their steel products and services.

This wide industry penetration is a significant strength, as evidenced by their diversified revenue streams. For instance, in the first quarter of 2024, Olympic Steel reported net sales of $650.6 million, with contributions from these varied sectors cushioning against downturns in any single market.

This broad market engagement not only solidifies their industry position but also significantly mitigates risk. By not being overly reliant on one sector, Olympic Steel demonstrates resilience and adaptability to fluctuating economic conditions across different industries.

Efficient Inventory and Logistics Management

Olympic Steel's place strategy hinges on efficient inventory and logistics management. This ensures metal products are readily available to customers across its network of facilities, optimizing stock levels for diverse metal types and forms.

The company utilizes advanced inventory management systems to shorten lead times, a critical factor in the metals industry. This focus on availability and speed directly enhances customer satisfaction and strengthens their market position.

- Optimized Stock Levels: Maintaining appropriate inventory of various steel products, from carbon flat-rolled to stainless steel, across multiple service centers.

- Reduced Lead Times: Implementing streamlined logistics and warehousing to ensure quicker delivery to manufacturing clients.

- Geographic Reach: Strategically located facilities to serve key industrial hubs, minimizing transportation costs and transit times.

- Supply Chain Integration: Working closely with suppliers and customers to create a more responsive and efficient flow of materials.

Ongoing Expansion and Capacity Investments

Olympic Steel is actively expanding its operational capacity and processing capabilities. Recent investments include new cut-to-length lines and advanced high-speed specialty metal slitters. These additions are slated for completion and operational readiness in late 2025 and early 2026.

These strategic investments are designed to significantly boost throughput and enhance operational safety. By optimizing their distribution network, Olympic Steel aims to improve efficiency and service delivery to its customers. This proactive approach positions the company for sustained growth and market competitiveness.

- Capacity Expansion: New cut-to-length lines and high-speed specialty metal slitters are being implemented.

- Timeline: Expected operational readiness by late 2025 and early 2026.

- Benefits: Increased throughput and improved safety standards.

- Strategic Goal: Optimization of the company's distribution network.

Olympic Steel's Place strategy emphasizes a vast network of 54 sales and warehouse facilities across North America, ensuring product accessibility and minimizing delivery times. This extensive geographic reach, serving key industrial regions, is crucial for their direct distribution model, which prioritizes efficient order fulfillment and customer satisfaction.

The company's commitment to optimizing inventory and logistics management is a cornerstone of their Place strategy. By maintaining optimized stock levels across their facilities, they aim to reduce lead times for critical metal products and forms, enhancing responsiveness to customer needs.

Olympic Steel's strategic investments in capacity expansion, including new cut-to-length lines and specialty metal slitters expected by late 2025 and early 2026, will further strengthen their distribution network. These enhancements are designed to boost throughput and operational efficiency, reinforcing their ability to serve diverse industrial markets effectively.

| Facility Count | Geographic Focus | Distribution Model | Key Investment (2025/2026) | Recent Net Sales (Q1 2024) |

|---|---|---|---|---|

| 54 | North America | Direct Distribution | New Cut-to-Length Lines & Slitters | $650.6 million |

What You Preview Is What You Download

Olympic Steel 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Olympic Steel's 4P's Marketing Mix covers Product, Price, Place, and Promotion in detail. Understand their strategies for each element, from their diverse steel product offerings to their distribution channels and promotional activities. This is not a sample; it's the final version you’ll get right after purchase, providing you with the complete picture of their marketing approach.

Promotion

Olympic Steel focuses its promotion on direct sales and cultivating deep relationships within targeted industries like manufacturing and construction. This approach allows their sales teams to directly communicate the unique benefits of their steel products and services to key decision-makers.

By fostering these long-term connections, Olympic Steel ensures their promotional efforts are highly relevant and effective. For instance, their emphasis on building client trust is crucial in a sector where reliability and consistent supply are paramount. In 2024, the industrial sector represented a significant portion of their revenue, underscoring the success of this targeted strategy.

Olympic Steel actively manages its digital presence to communicate its value proposition and product offerings. Their corporate website serves as a central hub for information, detailing their extensive steel product catalog and manufacturing capabilities.

Investor relations are a key focus of their online communication strategy. The company consistently publishes regular news releases, webcast alerts for financial results, and annual reports on their website to ensure stakeholders are kept well-informed and to foster transparency.

For instance, in their Q1 2024 earnings release, the company highlighted their strategy of leveraging digital platforms to disseminate crucial financial updates. This commitment to online accessibility aims to provide a clear and timely view of their performance and strategic direction to investors and the broader market.

Olympic Steel's strategic acquisitions, such as the 2024 purchase of Metal Works, act as a powerful promotional lever. This move expanded their product portfolio into burgeoning sectors like solar components and advanced construction materials, effectively broadening their market appeal and showcasing innovation.

These carefully chosen acquisitions are more than just expansion; they are a clear signal to the market about Olympic Steel's commitment to strategic growth and its ability to adapt to evolving industry demands. This diversification inherently promotes the company by highlighting its forward-thinking approach and expanded capabilities.

Recognition and Industry Partnerships

Olympic Steel actively cultivates brand recognition and strengthens its market position through strategic industry partnerships and supplier recognition programs. Their designation as a Partner-level Supplier for 2024 within the John Deere Achieving Excellence Program is a significant testament to their consistent quality and service delivery. This type of acknowledgment directly impacts their public perception, making them a more attractive partner for other leading companies.

These industry accolades serve as powerful endorsements, reinforcing Olympic Steel's commitment to excellence and reliability. Such recognition not only bolsters their existing relationships but also acts as a significant draw for potential new business opportunities and collaborations. For instance, being recognized by a major player like John Deere signals a high standard of operational performance, which is crucial in the competitive steel industry.

- John Deere Achieving Excellence Program: Awarded Partner-level Supplier status for 2024.

- Brand Enhancement: Recognition boosts Olympic Steel's reputation for quality and service.

- Partnership Attraction: Accolades draw new business and collaboration opportunities.

Emphasis on Value-Added Services and Solutions

Olympic Steel's marketing clearly highlights their role beyond simply supplying raw steel. They focus on providing value-added processing and robust supply chain management. This approach directly addresses customer needs for streamlined operations and cost reduction, positioning them as a solutions provider rather than just a material vendor.

By emphasizing these integrated services, Olympic Steel appeals to businesses looking to optimize their production processes and minimize expenses. For instance, their ability to offer custom processing, like cutting, slitting, and coating, means customers receive materials ready for immediate use, cutting down on internal labor and equipment costs.

- Value-Added Processing: Olympic Steel offers services such as cutting, slitting, and coating, reducing customer operational burdens.

- Supply Chain Management: The company provides integrated logistics and inventory solutions, enhancing customer efficiency.

- Cost Reduction: By handling complex processing, Olympic Steel helps clients lower their overall production costs.

- Efficiency Improvement: Customers benefit from receiving ready-to-use materials, accelerating their manufacturing timelines.

This strategic emphasis is crucial in a competitive market where customers seek partners who can contribute to their bottom line. Olympic Steel's commitment to these services underpins their market strategy, aiming to build long-term relationships based on tangible benefits and operational improvements for their clients.

Olympic Steel's promotional strategy heavily relies on direct sales engagement, fostering strong industry relationships, and leveraging digital platforms for communication. Their emphasis on value-added services and strategic acquisitions, like the 2024 Metal Works purchase, further enhances their market appeal and communicates growth. Industry recognition, such as their 2024 Partner-level Supplier status with John Deere, reinforces their commitment to quality and attracts new business.

| Promotional Element | Description | Key Metric/Example (2024/2025) |

|---|---|---|

| Direct Sales & Relationship Building | Focus on deep connections within manufacturing and construction. | Industrial sector represented a significant portion of 2024 revenue, demonstrating effectiveness. |

| Digital Presence | Corporate website for product information, investor relations news releases, and financial reports. | Q1 2024 earnings release highlighted digital platform use for financial updates. |

| Strategic Acquisitions | Expanding product portfolio and market reach through purchases. | 2024 acquisition of Metal Works broadened offerings into solar components and advanced construction materials. |

| Industry Partnerships & Recognition | Cultivating brand recognition through accolades. | Awarded Partner-level Supplier status by John Deere in 2024 for the Achieving Excellence Program. |

| Value-Added Services Promotion | Highlighting custom processing and supply chain management. | Services like cutting, slitting, and coating reduce customer operational burdens and costs. |

Price

Olympic Steel's pricing strategy for its core carbon, coated, and stainless flat-rolled steel and aluminum products is fundamentally driven by fluctuating market rates. This means prices can shift considerably based on global commodity prices and the ongoing balance between supply and demand within the metals sector. For instance, in early 2024, the average selling price for hot-rolled steel coiled products saw fluctuations influenced by raw material costs and construction demand.

The company actively monitors these external market dynamics to ensure its pricing remains competitive. This includes tracking benchmark prices for key commodities like iron ore and coking coal, which directly impact production costs. In Q1 2024, iron ore prices averaged around $130 per metric ton, a key input for steel production.

Supply-demand imbalances are a critical pricing determinant. During periods of high demand, such as increased infrastructure spending or automotive production, prices tend to rise. Conversely, oversupply can lead to price erosion. For example, a surge in construction projects in late 2023 and early 2024 supported stronger pricing for coated steel products.

Olympic Steel’s ability to adapt its pricing in response to these market conditions is crucial for maintaining profitability. This adaptive pricing allows the company to navigate the inherent volatility of the metals market while aiming to secure favorable margins on its extensive product portfolio.

Olympic Steel's advanced processing and fabrication services are priced using a value-based approach. This strategy aligns pricing with the tangible benefits customers receive, such as reduced lead times and lower manufacturing costs through customized, ready-to-install components. For example, their precision cutting and forming operations can significantly minimize scrap and labor for clients, justifying a premium over raw material costs.

This value-based pricing allows Olympic Steel to capture higher profit margins on these specialized services. In 2024, the demand for custom metal fabrication, particularly for sectors like automotive and construction, remained robust, supporting this pricing model. The company's ability to deliver complex fabrications directly to assembly lines or project sites translates into significant operational efficiencies for their customers, a key driver of perceived value.

Olympic Steel's pricing strategy is deeply intertwined with the ebb and flow of the broader economy and specific government actions. Fluctuations in industrial demand, a key driver for steel consumption, directly impact the company's ability to set and maintain prices. For instance, in early 2024, industrial production in the US saw modest growth, but concerns about global economic slowdowns created price pressures.

Government policies, particularly tariffs on steel and aluminum imports, play a crucial role in shaping Olympic Steel's transactional pricing. These tariffs, implemented to protect domestic industries, can lead to increased raw material costs for some customers, potentially boosting demand for domestically sourced steel like that from Olympic Steel, but also risking retaliatory measures that could disrupt supply chains and international sales.

The company must therefore adopt a dynamic pricing approach to navigate this volatility. In 2024, with ongoing geopolitical tensions and supply chain adjustments, Olympic Steel likely adjusted its pricing models frequently to account for shifts in raw material costs, energy prices, and competitive pressures influenced by these tariffs. This requires constant market monitoring and agile decision-making.

Volume-Based and Contractual Pricing

Olympic Steel likely employs volume-based pricing, offering discounts to customers who commit to larger orders. This strategy encourages higher purchase volumes, driving revenue growth and improving inventory turnover. For instance, a customer purchasing 1,000 tons may receive a better per-ton price than one buying 100 tons.

Furthermore, the company probably utilizes contractual pricing for its key industrial clients, establishing multi-year agreements. These contracts provide a predictable revenue stream for Olympic Steel and price stability for its customers, mitigating the impact of market volatility. Such long-term relationships are crucial in the cyclical steel industry, fostering loyalty and operational efficiency.

Olympic Steel's approach to pricing, incorporating both volume discounts and long-term contracts, aims to secure consistent demand and build robust client relationships. This strategy is evident in the steel industry's typical practices, where large-scale consumers benefit from preferential pricing. In 2024, the company's focus on these pricing structures likely contributed to its financial stability amidst fluctuating raw material costs.

Key aspects of Olympic Steel's pricing strategy include:

- Volume Discounts: Incentivizing larger purchase commitments to boost sales volume.

- Contractual Agreements: Establishing long-term relationships with industrial clients for predictable revenue.

- Customer Retention: Fostering loyalty through stable pricing and mutually beneficial terms.

- Revenue Predictability: Mitigating market fluctuations and ensuring consistent income streams.

Operational Efficiency and Cost Optimization Influence

Olympic Steel’s pricing is heavily influenced by its commitment to operational efficiency. The company actively pursues cost optimization across its value chain, from inventory management to logistics. For instance, in Q1 2024, Olympic Steel reported improved operating income, partly due to streamlined operations.

Strategic investments in automation and advanced manufacturing processes further bolster these efficiencies. This focus allows Olympic Steel to maintain competitive pricing in a challenging market. The company’s dedication to controlling internal costs is a key factor in its ability to offer attractive prices while safeguarding profitability.

- Optimized Inventory: Reduces holding costs and improves cash flow.

- Logistics Efficiency: Minimizes transportation expenses and delivery times.

- Capital Investments: Funding for automation enhances productivity and reduces labor costs.

- Cost Control: Direct impact on the company's ability to price competitively.

Olympic Steel's pricing strategy is a dynamic blend of market-driven rates for commodities and value-based pricing for specialized services. This approach ensures competitiveness while capturing the unique benefits offered to customers, as seen in their strong performance in 2024. The company leverages market intelligence and cost efficiencies to maintain profitability.

Key pricing drivers include fluctuating global commodity prices, supply-demand dynamics, and the value derived from their advanced processing capabilities. For example, the average selling price for hot-rolled steel coiled products in early 2024 was influenced by raw material costs and construction demand, while fabricated products were priced based on the significant operational efficiencies they provide clients.

The company also employs volume discounts and contractual agreements to foster customer loyalty and ensure revenue predictability. These strategies, coupled with a relentless focus on operational efficiency, allow Olympic Steel to navigate market volatility effectively. In 2024, streamlined operations contributed to improved operating income, supporting their competitive pricing.

| Pricing Factor | Impact on Olympic Steel | Example (2024 Data Context) |

|---|---|---|

| Market Rates (Commodities) | Directly influences raw material costs and selling prices for core products. | Iron ore prices around $130/metric ton in Q1 2024 impacted steel production costs. |

| Supply & Demand | Creates price volatility; high demand supports higher prices, oversupply erodes them. | Strong construction demand in late 2023/early 2024 supported pricing for coated steel. |

| Value-Added Services | Allows for premium pricing based on customer benefits like reduced lead times. | Custom fabrication pricing reflects reduced scrap and labor costs for clients. |

| Operational Efficiency | Enables competitive pricing by lowering internal costs. | Streamlined operations in Q1 2024 contributed to improved operating income. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Olympic Steel is built upon a foundation of verified, up-to-date information derived from company filings, investor relations materials, official press releases, and industry-specific market research. We leverage these credible sources to accurately assess their product offerings, pricing strategies, distribution channels, and promotional activities.