Nojima SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nojima Bundle

Nojima's potential lies in its established brand presence and loyal customer base, offering a solid foundation for continued success. However, navigating the rapidly evolving electronics retail landscape presents significant challenges. Understanding these dynamics is crucial for anyone looking to invest or strategize within this sector.

Want the full story behind Nojima's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Nojima boasts an incredibly broad spectrum of consumer electronics, from essential home appliances and PCs to the latest mobile phones and audio-visual gear. This extensive product offering caters to a wide array of consumer needs and preferences.

Beyond just selling products, Nojima distinguishes itself by offering crucial services like professional installation, reliable repair, and dedicated after-sales support, building a true full-service experience for its customers. This commitment to the entire product lifecycle fosters customer loyalty.

Further strengthening its position, Nojima has strategically diversified into mobile communication services and comprehensive IT solutions. This expansion opens up new avenues for revenue and solidifies its presence in evolving tech markets, appealing to a broader customer base.

Nojima benefits from a robust retail network, operating 242 digital electronics stores as of September 2024, with a strong concentration in key areas like Tokyo and Kanagawa. This extensive physical presence allows for broad customer reach and accessibility.

The company's consulting sales model is a key differentiator. By focusing on personalized customer service and understanding individual needs, Nojima builds stronger relationships, fostering loyalty and potentially driving higher sales volumes through expert advice.

Nojima's strength lies in its diverse business portfolio, encompassing digital home appliance retail, carrier shop operations, internet services, and international ventures. This broad operational base provides resilience against downturns in any single sector.

The strategic acquisition of VAIO Corporation, finalized in late 2024 or early 2025, is a key development. This move bolsters Nojima's presence in the premium personal computer market, particularly targeting corporate clients.

This acquisition not only enhances their product offering but also opens new avenues for revenue streams and market penetration. It signals a proactive approach to expanding their high-margin business segments.

Commitment to Digital Transformation (DX) and Employee Development

Nojima's dedication to Digital Transformation (DX) is a significant strength. The company is pouring resources into IT services to enhance the in-store customer experience, aiming to create more engaging and efficient shopping environments. This forward-thinking approach is crucial in today's competitive retail landscape.

Furthermore, Nojima places a strong emphasis on its workforce. By increasing base salaries and cultivating an entrepreneurial spirit among employees, the company fosters a motivated and customer-focused team. This internal investment directly translates to better service delivery, a key differentiator.

- Digital Transformation Investment: Nojima is actively channeling funds into IT services for in-store improvements.

- Employee Well-being Focus: Initiatives like base salary increases support staff satisfaction and productivity.

- Entrepreneurial Culture: Encouraging an entrepreneurial mindset empowers employees to drive customer-centric solutions.

- Service Delivery Enhancement: The combination of DX and employee development directly strengthens their customer service capabilities.

Robust Financial Performance and Shareholder Returns

Nojima's financial performance has been exceptionally strong, with the fiscal year ending March 31, 2025, seeing record-high net sales and operating income. This robust financial health is a key strength, indicating effective operational management and market positioning. The company's commitment to shareholder value is evident through its consistent implementation of equity buyback programs and announcements of increased dividends. These actions not only reward investors but also signal strong confidence in Nojima's sustained profitability and future growth prospects.

Key financial highlights supporting this strength include:

- Record Operating Income: For the fiscal year ending March 31, 2025, Nojima achieved its highest ever operating income, underscoring its profitability.

- Consistent Dividend Growth: The company has demonstrated a pattern of increasing dividend payouts, reflecting a stable and growing earnings base.

- Share Buyback Initiatives: Active equity repurchase programs demonstrate management's belief that the company's stock is undervalued, returning capital directly to shareholders.

- Strong Net Sales: Record net sales for the same period highlight Nojima's ability to drive revenue growth in its core markets.

Nojima's extensive product range, covering everything from home appliances to mobile phones, ensures it appeals to a broad customer base. This wide selection, coupled with value-added services like installation and repair, builds strong customer loyalty and a comprehensive retail experience.

The company's strategic diversification into mobile services and IT solutions, alongside the acquisition of VAIO Corporation to bolster its premium PC offerings, demonstrates a forward-thinking approach to capturing growth in evolving tech markets.

Nojima's robust retail network, featuring 242 digital electronics stores as of September 2024, provides significant market reach. This strong physical presence is complemented by a consulting sales model that prioritizes personalized customer interaction, fostering deeper relationships.

The company's financial performance is a clear strength, with record net sales and operating income for the fiscal year ending March 31, 2025. This is further supported by consistent dividend increases and active share buyback programs, indicating financial stability and a commitment to shareholder returns.

What is included in the product

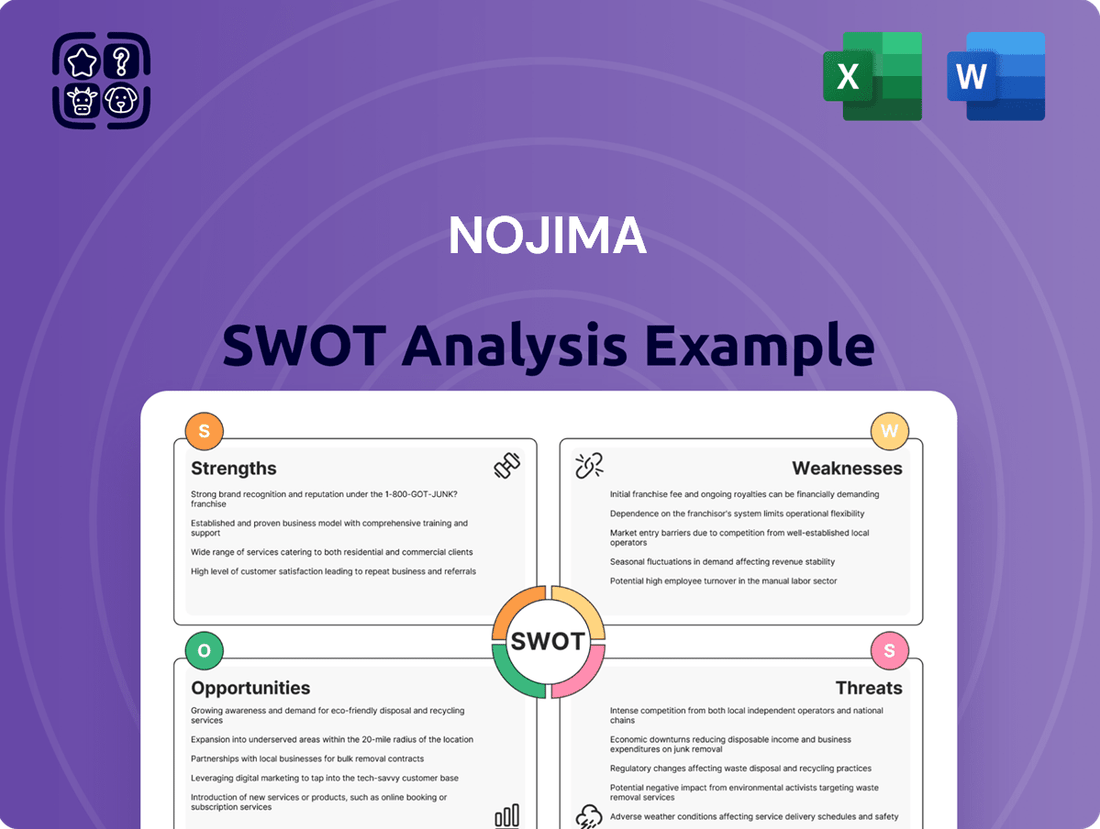

Analyzes Nojima’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable SWOT framework to identify and address strategic vulnerabilities.

Weaknesses

Nojima's primary revenue stream is deeply rooted in Japan, with a significant portion of its business concentrated in the Tokyo and Kanagawa prefectures. This intense geographic focus, while beneficial for understanding a specific market, inherently limits its ability to diversify revenue on a global scale. As of late 2024, this concentration means the company is highly susceptible to Japan's unique economic headwinds and demographic trends, such as an aging population and slower consumer spending growth.

Nojima's extensive physical store network, a significant asset, also presents a considerable weakness due to high operating costs. Maintaining these locations across Japan involves substantial outlays for rent, utilities, and employee salaries. For instance, in fiscal year 2023, Nojima reported total operating expenses of ¥373.8 billion, a portion of which is directly attributable to store upkeep.

These considerable overheads can put pressure on profit margins, particularly when Nojima competes with online-only retailers. These digital competitors generally enjoy much lower infrastructure costs, allowing them to offer more competitive pricing. This disparity in operating expenses can impact Nojima's ability to attract price-sensitive customers.

Efficient management of these fixed and variable store-related costs is therefore paramount for Nojima's sustained profitability. The company must continuously seek ways to optimize these expenses without negatively impacting the customer experience or the effectiveness of its retail footprint.

Nojima's business model, which prioritizes in-store consulting, can be a disadvantage in the fiercely competitive consumer electronics market. This market frequently sees aggressive price wars, and Nojima might struggle to quickly match the price cuts initiated by larger online competitors. This could potentially impact sales volume and market share, especially if consumers prioritize price above all else.

Complexity of Inventory Management

Nojima's extensive product range, from large appliances to small electronics, creates significant inventory management challenges. This diversity makes it difficult to maintain optimal stock levels across all locations and distribution points. For instance, in fiscal year 2024, Nojima reported a significant increase in inventory value, highlighting the ongoing pressure to efficiently manage a wide array of goods.

The inherent complexity can result in costly issues like overstocking, leading to markdowns, or stockouts, causing lost sales opportunities. These inefficiencies directly erode profitability and operational efficiency. For example, a surge in demand for a particular mobile accessory followed by a sudden drop could leave Nojima with excess, potentially obsolete, inventory if not managed proactively.

- Diverse Product Portfolio: Managing a broad spectrum of electronics, from high-volume mobile phones to slow-moving niche accessories.

- Geographic Spread: Coordinating inventory across numerous retail stores and multiple distribution hubs in different regions.

- Risk of Obsolescence: Rapid technological advancements in electronics increase the risk of products becoming outdated quickly.

- Stockout/Overstock Balancing: The constant challenge of meeting customer demand without incurring excessive holding costs or lost sales.

Dependence on Consumer Spending Trends

Nojima's reliance on consumer spending makes it vulnerable to shifts in economic conditions. For instance, if inflation continues to rise, as seen in Japan with consumer prices increasing by 3.1% year-on-year in May 2024, consumers may cut back on discretionary purchases like electronics. This directly impacts Nojima's sales volumes and revenue streams.

Economic uncertainties, such as potential recessions or global supply chain disruptions, can further dampen consumer confidence. This sentiment can lead to a postponement of non-essential purchases, directly affecting Nojima's bottom line.

The company's financial performance is intrinsically linked to the overall health of the Japanese economy. A slowdown in economic growth, potentially impacting disposable incomes, would naturally translate to reduced demand for Nojima's product offerings.

Key factors influencing Nojima's weaknesses include:

- Sensitivity to discretionary spending: Nojima's product catalog, largely consisting of consumer electronics, is highly susceptible to changes in consumer purchasing power and confidence.

- Economic headwinds: Persistent inflation and potential economic downturns in Japan can significantly reduce demand for non-essential goods.

- Impact of consumer sentiment: A decline in consumer confidence, driven by economic uncertainty, directly translates to lower sales volumes for electronics retailers like Nojima.

Nojima's heavy reliance on the Japanese market, particularly the Tokyo and Kanagawa prefectures, poses a significant weakness due to limited revenue diversification. This geographic concentration makes the company highly vulnerable to Japan's specific economic challenges, such as an aging population and subdued consumer spending growth, as observed in late 2024.

The extensive physical store network, while an asset, also represents a considerable weakness due to high operating costs. Maintaining these numerous locations incurs substantial expenses for rent, utilities, and staffing. In fiscal year 2023, Nojima reported operating expenses of ¥373.8 billion, a portion of which is directly tied to store upkeep, impacting profit margins against lower-cost online competitors.

Nojima's strategy of prioritizing in-store consulting can be a disadvantage in the highly competitive consumer electronics sector, where aggressive price wars are common. This approach may hinder its ability to quickly match price reductions offered by larger online retailers, potentially affecting sales volume and market share, especially for price-sensitive consumers.

Preview Before You Purchase

Nojima SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This comprehensive document provides a strategic overview of Nojima's internal strengths and weaknesses, as well as external opportunities and threats. You'll gain actionable insights to inform your business decisions. Our commitment is to transparency, ensuring you receive exactly what you see.

Opportunities

Nojima's e-commerce expansion and omnichannel strategy represent a significant growth opportunity. By further developing and integrating its online platforms with physical stores, Nojima can offer a seamless customer journey. This approach caters to modern shopping behaviors, allowing customers to browse online and pick up in-store, or vice-versa.

The global e-commerce market is projected to reach $8.1 trillion by 2024, a testament to its continued expansion. Nojima can tap into this by enhancing its digital presence, offering personalized recommendations, and streamlining the online purchasing process. This integration can significantly broaden its customer reach beyond geographical limitations of physical stores.

An effective omnichannel strategy can boost customer loyalty and increase sales. For instance, by offering services like buy online, pick up in-store (BOPIS), Nojima can capture impulse purchases and reduce delivery wait times. This convenience factor is crucial in retaining customers in a competitive retail landscape.

In 2023, Nojima reported a substantial increase in online sales, indicating a positive consumer response to its digital initiatives. Further investment in user experience, mobile optimization, and digital marketing will be key to capitalizing on this trend and driving substantial revenue growth in the coming years.

The smart home market is expanding rapidly, driven by consumer demand for convenience and automation. By 2024, global smart home spending was projected to reach $157 billion, with further growth expected. Nojima's established presence in consumer electronics, coupled with its installation capabilities, positions it well to capitalize on this trend by offering comprehensive smart home solutions.

Nojima's strategy of pursuing strategic acquisitions, exemplified by the 2023 integration of VAIO, offers significant growth avenues. This move allows Nojima to broaden its product portfolio and bolster its technological expertise, potentially tapping into lucrative corporate client segments. By acquiring companies with complementary strengths, Nojima can accelerate its market penetration and innovation cycles.

Further opportunities lie in forming alliances with forward-thinking technology firms. These collaborations can yield exclusive product launches and bundled service packages, thereby solidifying Nojima's competitive standing. Such partnerships are crucial for staying ahead in a rapidly evolving consumer electronics landscape, ensuring continued relevance and customer appeal.

Leveraging Data for Personalized Services

Nojima can unlock significant opportunities by leveraging customer data. By analyzing insights from both digital platforms and physical stores, the company can craft highly personalized marketing campaigns. For instance, in 2024, retailers saw a 30% increase in customer engagement when using personalized recommendations, a trend Nojima can capitalize on.

This data-driven approach allows for tailored product suggestions and customized after-sales support, directly addressing individual customer needs. Such personalization is crucial, as studies from early 2025 indicate that 65% of consumers are more likely to purchase from brands that offer personalized experiences.

The benefits extend to enhanced customer loyalty and improved conversion rates. By making customers feel understood and valued, Nojima can foster stronger relationships, leading to increased repeat business. In the competitive retail landscape of 2024-2025, customer retention driven by personalization is a key differentiator.

- Personalized Marketing: Tailoring promotions and communications based on purchase history and browsing behavior.

- Enhanced Customer Experience: Offering product recommendations and support that align with individual preferences.

- Increased Loyalty: Building stronger customer relationships through customized engagement, boosting retention.

- Improved Sales: Driving higher conversion rates and repeat purchases by meeting specific customer needs.

Subscription-based Service Models

Nojima can significantly enhance revenue predictability by adopting subscription-based models for services such as extended warranties, premium technical support, and even equipment leasing. This strategic shift moves away from solely transactional sales, cultivating more stable, recurring income. For example, a well-executed subscription service could bolster Nojima's customer lifetime value, as seen in the broader electronics retail sector where similar models have proven effective in fostering loyalty and consistent revenue generation.

Implementing these subscription services allows Nojima to build deeper, more enduring relationships with its customer base. Beyond the initial purchase, these ongoing service agreements create touchpoints that nurture loyalty and encourage repeat business. This approach aligns with industry trends where consumers increasingly value ongoing support and access over outright ownership, potentially leading to a more resilient financial profile for the company.

Opportunities within subscription models for Nojima include:

- Extended Warranty Programs: Offering multi-year protection plans for electronics and appliances, generating predictable service revenue.

- Premium Technical Support: Providing tiered support packages with faster response times, remote troubleshooting, and personalized assistance.

- Software and Digital Services: Licensing proprietary or third-party software for smart home devices or offering cloud storage solutions.

- Equipment Rental/Leasing: Exploring options for high-value items or specialized equipment, providing access without the upfront cost for consumers.

Nojima's strategic acquisitions and partnerships present a clear path for expansion and technological advancement. The company's 2023 acquisition of VAIO, for instance, bolstered its product portfolio and technological capabilities, opening doors to new customer segments. Furthermore, forging alliances with innovative tech firms can lead to exclusive product offerings and bundled services, solidifying Nojima's market position.

By capitalizing on the burgeoning smart home market, Nojima can leverage its consumer electronics expertise to provide integrated automation solutions. With global smart home spending projected to reach $157 billion by 2024, this sector offers substantial revenue potential.

Nojima's continued investment in its e-commerce and omnichannel strategies is a key opportunity, aligning with the projected $8.1 trillion global e-commerce market by 2024. Enhancing digital platforms and integrating them with physical stores creates a seamless customer experience, driving loyalty and sales.

The company can also unlock significant revenue streams through subscription-based services, such as extended warranties and premium technical support. This model fosters recurring income and strengthens customer lifetime value, a strategy proven effective in the electronics retail sector.

| Opportunity Area | 2024/2025 Growth Drivers | Key Initiatives | Market Impact |

|---|---|---|---|

| E-commerce & Omnichannel | Projected $8.1T Global E-commerce Market (2024) | Platform enhancement, BOPIS, personalized recommendations | Increased customer reach, loyalty, and sales |

| Smart Home Market | Projected $157B Global Smart Home Spending (2024) | Integrated solutions, installation services | Capture growing demand for automation and convenience |

| Strategic Acquisitions & Alliances | VAIO acquisition (2023), tech partnerships | Portfolio expansion, technological integration, exclusive offerings | Accelerated innovation, market penetration |

| Subscription Services | Growing consumer preference for ongoing support | Extended warranties, premium tech support, digital services | Predictable revenue, enhanced customer lifetime value |

Threats

The consumer electronics landscape is fiercely competitive online, with giants like Amazon and specialized retailers often undercutting prices and providing faster delivery. This means Nojima faces constant pressure to match aggressive pricing, which can significantly squeeze its profit margins. For instance, in the first half of fiscal year 2024, global e-commerce sales growth continued to outpace brick-and-mortar, highlighting the increasing importance of online channels where Nojima must compete aggressively.

The electronics retail sector faces a significant threat from rapid technological obsolescence. As new models and innovations emerge, older products can quickly lose their appeal and value. This was evident in 2024, where the average product lifecycle in consumer electronics continued to shrink, impacting resale values and potentially leading to substantial inventory write-downs for retailers like Nojima if not managed proactively.

Nojima must therefore maintain agile inventory management practices, ensuring it can adapt swiftly to these accelerated product cycles. Failure to do so could result in financial strain from holding unsellable older stock. For instance, a sharp decline in demand for a particular smartphone model, announced in late 2024, could have left retailers with significant unsold inventory if they hadn't already adjusted their purchasing.

A significant economic downturn in Japan, marked by rising inflation or a general decline in disposable income, presents a substantial threat to Nojima's sales volumes. Consumer electronics, often considered non-essential items, make the company particularly susceptible to fluctuations in consumer confidence and household spending habits.

For instance, Japan experienced a CPI inflation rate of 3.2% in 2023, a notable increase from previous years, which directly impacts the purchasing power of consumers. This economic pressure could lead to delayed or canceled purchases of higher-ticket electronic goods, directly affecting Nojima's revenue streams for 2024 and 2025.

Supply Chain Disruptions

Global supply chain vulnerabilities pose a significant threat to Nojima. Shortages of critical components, such as semiconductors, are a persistent issue. For instance, the automotive industry, a key sector for electronics, faced widespread production cuts in 2021 and 2022 due to chip scarcity, impacting vehicle availability and sales.

Geopolitical tensions and logistical challenges further exacerbate these supply chain risks. Port congestion and rising shipping costs, which spiked significantly in 2021 and remained elevated through 2022, can delay shipments and increase operational expenses for retailers like Nojima. These disruptions can lead to stockouts, higher procurement costs, and an inability to meet customer demand, directly impacting sales and Nojima's reputation.

- Semiconductor Shortages: Continued global semiconductor shortages, ongoing since 2020, directly affect the availability of a wide range of electronic products Nojima sells.

- Logistical Bottlenecks: Persistent port congestion and elevated shipping rates, which saw container shipping costs increase by over 80% in 2021 compared to pre-pandemic levels, impact delivery times and costs.

- Geopolitical Instability: Trade disputes and regional conflicts can disrupt the flow of goods and components, creating uncertainty in inventory management.

- Increased Procurement Costs: Supply chain disruptions often translate into higher raw material and component prices, squeezing Nojima's profit margins.

New Entrants and Direct-to-Consumer Models

New market entrants, especially manufacturers increasingly adopting direct-to-consumer (DTC) sales, pose a significant threat by bypassing established retail channels. This shift directly challenges the role of intermediaries like Nojima, potentially eroding their necessity. For instance, in 2024, the global DTC e-commerce market saw continued robust growth, with many electronics manufacturers investing heavily in their own online platforms to control the customer experience and capture higher margins.

This trend intensifies competition for customer attention and loyalty, as brands can now engage directly with consumers, offering personalized experiences and potentially more competitive pricing. The increasing relevance of these DTC models could diminish the perceived value of large physical retail chains, impacting foot traffic and sales volumes for companies like Nojima.

- Increased Competition: Manufacturers launching DTC platforms directly compete with Nojima's core business.

- Disintermediation Risk: The need for traditional retailers as intermediaries is reduced.

- Margin Pressure: DTC models can offer better pricing, putting pressure on Nojima's margins.

- Customer Loyalty Shift: Brands can build direct relationships, potentially diverting customer loyalty away from retailers.

The intense competition from online retailers and manufacturers' direct-to-consumer (DTC) sales models presents a significant threat. Nojima faces pressure to match aggressive online pricing, which can impact its profitability, as seen with continued global e-commerce growth outpacing brick-and-mortar in early fiscal year 2024. This disintermediation risk means brands can bypass retailers like Nojima, potentially eroding their necessity and customer loyalty.

SWOT Analysis Data Sources

This Nojima SWOT analysis is built upon a foundation of verified financial reports, comprehensive market intelligence, and expert industry evaluations. These sources provide the robust data necessary for a precise and actionable strategic assessment.