Nojima PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nojima Bundle

Uncover the critical external factors shaping Nojima's trajectory with our expert-crafted PESTLE Analysis. Understand how political stability, economic shifts, and technological advancements are impacting their operations and market position. Our comprehensive report provides actionable intelligence, perfect for strategic planning and competitive analysis. Don't be left in the dark; gain a decisive advantage by downloading the full PESTLE Analysis for Nojima today and unlock deep-dive insights.

Political factors

Government policies, such as the Bank of Japan's monetary easing and fiscal stimulus packages, have a direct impact on consumer spending for electronics, a core area for Nojima. For instance, during the COVID-19 pandemic, stimulus checks in many countries, including Japan, temporarily boosted consumer spending on durable goods.

These policies can either lift or depress consumer confidence and available income, thereby influencing Nojima's sales. For example, a decrease in Japan's consumption tax, if implemented, would make electronics more affordable, potentially driving higher sales volumes for Nojima.

Subsidies for energy-efficient appliances, a policy trend in many developed nations, could also sway consumer choices toward specific product categories sold by Nojima.

In 2024, the Japanese government continued to explore measures to combat deflation and stimulate domestic demand, which could indirectly benefit retailers like Nojima by increasing overall purchasing power.

Japan's trade agreements and the geopolitical stability of its trading partners directly influence the availability and cost of electronic components and finished goods crucial for Nojima's inventory. For instance, continued strong trade relations with key Asian manufacturing hubs ensure a steadier flow of products, while shifts in these relationships could create vulnerabilities.

Disruptions stemming from international political tensions or trade disputes, such as those seen in recent years impacting semiconductor supply chains, can lead to significant product shortages and increased import costs for Nojima. This directly affects their ability to stock popular items and maintain competitive pricing in a market sensitive to value.

Retail sector regulations, including those concerning store opening hours and zoning laws, directly impact Nojima's operational agility and its capacity for strategic expansion. For instance, Japan's Act on Large-Scale Retail Stores, which has seen revisions over time, can influence where and how Nojima can establish new physical stores, potentially limiting prime locations or imposing restrictions on operating hours, especially for larger outlets.

Changes in promotional guidelines and consumer protection laws also play a crucial role. Stricter regulations on advertising or product safety can increase Nojima's compliance costs and necessitate adjustments to marketing strategies. Conversely, deregulation in certain areas could present opportunities for Nojima to innovate its retail formats or offer more flexible services, as seen in evolving e-commerce regulations that allow for varied delivery models.

Consumer Protection Laws

Stricter consumer protection laws are increasingly shaping how companies like Nojima operate, particularly concerning product warranties, return policies, and advertising practices. These regulations demand a high level of transparency and a commitment to excellent customer service, ensuring consumers are well-informed and fairly treated.

Compliance is not just a legal obligation; it's crucial for maintaining consumer trust and safeguarding Nojima's reputation. Failure to adhere to these evolving standards can lead to significant legal penalties and damage brand perception, directly impacting financial performance.

For instance, in 2024, the European Union continued to strengthen its consumer rights directives, with a particular focus on digital product sales and subscription services. Companies operating within the EU, including those with significant online presence like Nojima, must ensure their terms and conditions are clear and their marketing practices are free from deception. This includes providing robust warranty information and straightforward return processes. In Japan, the Consumer Contract Act also mandates clear disclosure of terms and prohibits unfair clauses, reinforcing the need for meticulous attention to detail in all customer interactions.

- Increased Scrutiny on Advertising: Authorities are cracking down on misleading claims, requiring verifiable evidence for product performance.

- Enhanced Warranty Requirements: Regulations often mandate longer warranty periods and clearer terms regarding repairs and replacements.

- Streamlined Return Processes: Consumers are being given more rights and easier avenues to return products that do not meet expectations.

- Data Privacy in Sales: Consumer protection now extends to how personal data is collected and used during sales transactions.

Political Stability and Business Confidence

Japan's generally stable political landscape offers Nojima a predictable operational framework, fostering confidence for sustained investment and strategic development. This stability is a key factor in attracting and retaining foreign direct investment, with Japan consistently ranking high in global political stability indices. For instance, the World Bank's 2023 Worldwide Governance Indicators showed Japan scoring in the 90th percentile for Political Stability and Absence of Violence/Terrorism.

However, shifts in government or policy, even if infrequent, can introduce volatility. Such changes might impact consumer spending patterns and business investment decisions. For example, a sudden revision in consumer electronics tax policies or import regulations could directly affect Nojima's pricing strategies and sales volumes in the short to medium term. This underscores the need for Nojima to maintain close monitoring of the political climate and adapt its strategies accordingly.

- Political Stability: Japan's consistent ranking in global stability metrics provides a reliable operating environment for Nojima.

- Investment Climate: A stable political climate supports long-term capital allocation and strategic business planning for Nojima.

- Policy Impact: Changes in government policies, such as taxation or trade regulations, can influence Nojima's profitability and market access.

- Confidence: Political certainty bolsters both consumer and business confidence, directly affecting demand for Nojima's products.

Government policies in Japan, particularly monetary easing and fiscal stimulus, directly influence consumer spending on electronics, a key sector for Nojima. For instance, the Bank of Japan's continued accommodative stance in 2024 aimed to boost domestic demand, potentially increasing purchasing power for durable goods. Subsidies for energy-efficient appliances also encourage consumers to opt for specific product categories that Nojima offers.

Trade agreements and geopolitical stability are critical for Nojima's supply chain. Strong trade relations with Asian manufacturing hubs ensure a steady flow of components and finished goods, as seen in the consistent supply of semiconductors. Conversely, trade disputes can disrupt this flow, leading to shortages and price increases for electronics, impacting Nojima's inventory and pricing strategies.

Retail regulations, such as those governing store operations and consumer protection, shape Nojima's business. The Act on Large-Scale Retail Stores, for example, influences where Nojima can establish new physical locations. Stricter consumer protection laws, like Japan's Consumer Contract Act, mandate clear terms and fair practices, increasing compliance costs but also building consumer trust.

Japan's political stability provides a predictable environment for Nojima's long-term investments. The World Bank's Worldwide Governance Indicators consistently place Japan high in political stability. However, policy shifts, such as changes in taxation or import regulations, can introduce short-term volatility, requiring Nojima to remain adaptable.

What is included in the product

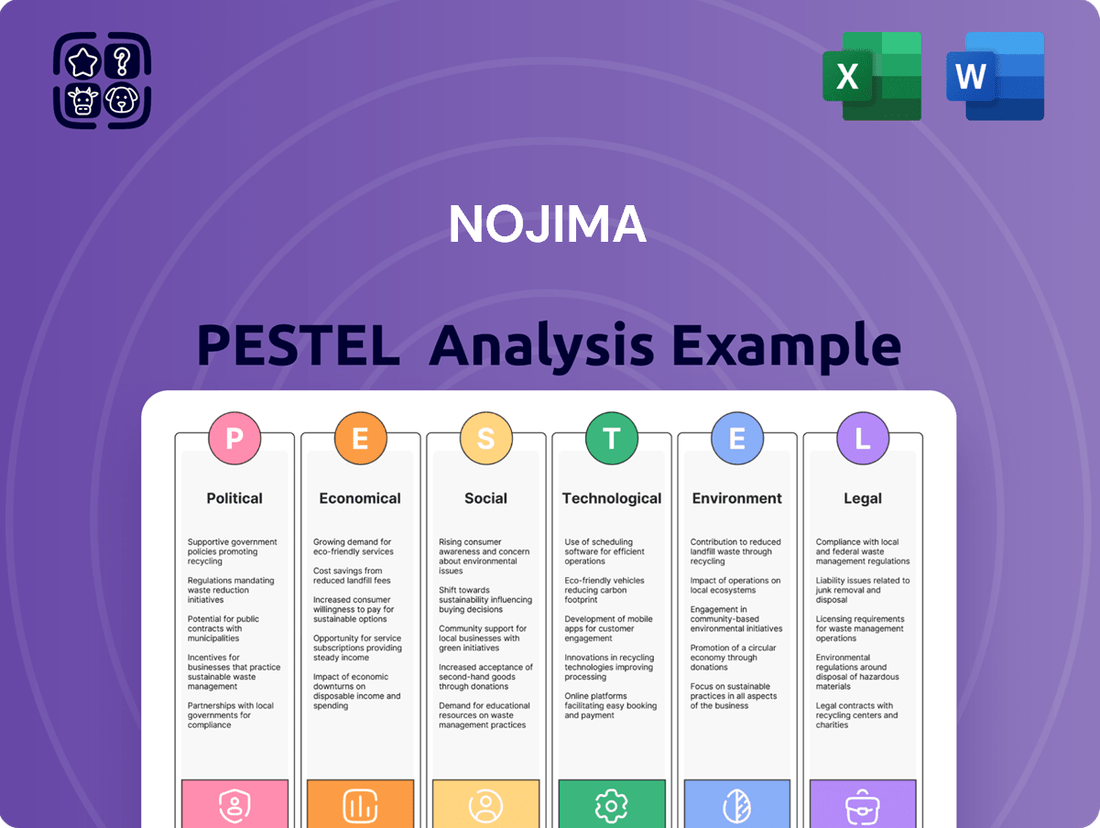

This Nojima PESTLE analysis provides a comprehensive overview of how external macro-environmental factors, including Political, Economic, Social, Technological, Environmental, and Legal influences, shape the company's strategic landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for actionable insights.

Economic factors

Consumer spending is a critical driver for Nojima, as its sales of electronics are directly tied to how much consumers have left to spend after essential expenses. When disposable income rises, people are more likely to purchase new gadgets and appliances. For instance, in early 2024, many economies saw continued wage growth, which, coupled with moderating inflation in some regions, offered consumers more purchasing power for discretionary goods.

Economic health significantly impacts Nojima's bottom line. Factors like high employment rates mean more people have income to spend, boosting demand. Conversely, economic downturns or rising inflation can lead consumers to cut back on non-essential purchases, directly affecting Nojima's sales volumes. The resilience of consumer confidence throughout 2024, despite some global economic uncertainties, has generally supported spending on durable goods.

Inflationary pressures directly affect Nojima by increasing the cost of sourcing electronic products from manufacturers. For instance, if producer price inflation in key electronics manufacturing regions like China continues its upward trend, as seen with producer price index (PPI) data hovering around 2-3% year-on-year in early 2024, Nojima faces higher input costs. This can squeeze profit margins, especially if the company struggles to pass these increased costs onto consumers accustomed to competitive pricing in the electronics sector.

Moreover, elevated inflation significantly erodes consumer purchasing power. With rising costs for essentials like food and energy, discretionary spending on items like new televisions or smartphones often declines. In 2024, countries like Japan experienced inflation rates that, while moderating from peaks, remained a concern for household budgets, impacting demand for Nojima's non-essential electronic goods.

Interest rate fluctuations directly impact consumer spending on big-ticket items that Nojima often sells, like appliances and electronics. For instance, a rise in the Bank of Japan's policy rate, which influences commercial lending, could increase the cost of financing for consumers taking out loans for these purchases. This increased borrowing cost can lead to reduced discretionary spending, affecting Nojima's sales volume.

Furthermore, Nojima itself relies on credit for managing inventory and funding expansion. If interest rates climb, the cost of borrowing for Nojima increases, potentially squeezing profit margins or slowing down strategic investments. For example, if Nojima's short-term debt facility has a variable rate tied to benchmark rates, higher rates translate directly to increased interest expenses.

Exchange Rate Fluctuations

Exchange rate fluctuations are a critical economic factor for Nojima, especially given its reliance on imported electronics. The strength of the Japanese Yen (JPY) directly influences the cost of goods. For instance, if the Yen weakens against currencies like the US Dollar or the Euro, Nojima's procurement costs for imported products will rise. This could force the company to absorb higher costs, impacting profitability, or pass them onto consumers through increased prices, potentially affecting sales volume.

Conversely, a stronger Yen would reduce import costs, providing Nojima with a competitive advantage or the opportunity to improve profit margins. Looking at recent trends, the Yen has experienced significant volatility. For example, in early 2024, the Yen traded around 150 JPY to the US Dollar, a level that makes imports considerably more expensive than when it was stronger, perhaps in the 130s. This persistent weakness presents a notable challenge for Nojima's cost management and pricing strategies.

- Impact on Procurement Costs: A weaker Yen (e.g., 150 JPY/USD in early 2024) increases the JPY cost of imported electronics.

- Margin Pressure: Higher import costs can squeeze Nojima's profit margins if price increases are not feasible.

- Consumer Pricing: Retail prices may rise to offset increased import expenses, potentially dampening consumer demand.

- Competitive Landscape: Competitors with lower import costs due to favorable exchange rates could gain an advantage.

Competitive Landscape and Pricing Pressure

Japan's consumer electronics retail sector is intensely competitive, with Nojima facing pressure from both traditional brick-and-mortar stores and burgeoning online marketplaces. This creates a challenging environment where price wars are common, impacting profit margins. For instance, during economic slowdowns, retailers often resort to aggressive discounting to capture market share, further intensifying this pricing pressure.

The landscape is further complicated by the presence of major players like Yamada Denki and Bic Camera, alongside e-commerce giants such as Amazon Japan and Rakuten Ichiba. This saturation means Nojima must constantly innovate and offer competitive pricing to retain its customer base. Economic headwinds, such as a potential dip in consumer confidence in late 2024 or early 2025, could exacerbate this by reducing overall spending power, forcing even more strategic price adjustments.

- Intense Competition: Nojima operates in a market with numerous strong domestic and international competitors.

- Online Shift: The growing dominance of e-commerce platforms necessitates competitive online pricing strategies.

- Economic Sensitivity: Downturns lead to increased price sensitivity among consumers, amplifying pricing pressure.

- Margin Squeeze: Aggressive pricing to maintain market share can significantly impact Nojima's profitability.

Economic factors significantly shape Nojima's performance, with consumer spending being paramount. Wage growth and moderating inflation in early 2024 generally supported disposable income. However, persistent inflation in 2024, as seen in Japan, continued to erode purchasing power for non-essential electronics, impacting Nojima's sales. Fluctuating interest rates also play a key role, affecting consumer financing for larger purchases and Nojima's own borrowing costs.

Exchange rate volatility, particularly the Yen's weakness against the USD around 150 JPY/USD in early 2024, directly impacts Nojima's procurement costs for imported electronics, potentially squeezing margins or leading to price increases that deter consumers. The highly competitive retail landscape, intensified by e-commerce, means Nojima must navigate these economic pressures carefully with its pricing strategies.

| Economic Factor | Impact on Nojima | 2024/2025 Data Point |

|---|---|---|

| Consumer Spending | Directly drives electronics sales; higher disposable income leads to more purchases. | Wage growth observed early 2024, but inflation impacted discretionary spending. |

| Inflation | Increases input costs for imported goods; reduces consumer purchasing power for non-essentials. | Japan's inflation rates remained a concern for household budgets in 2024. |

| Interest Rates | Affects consumer financing for big-ticket items and Nojima's borrowing costs. | Potential Bank of Japan policy rate adjustments influence lending costs. |

| Exchange Rates (JPY/USD) | Weak Yen increases import costs for electronics, impacting margins and pricing. | Yen traded around 150 JPY/USD in early 2024, making imports expensive. |

Preview Before You Purchase

Nojima PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Nojima PESTLE analysis provides a comprehensive overview of the external factors influencing the company's operations. You'll gain insights into Political, Economic, Social, Technological, Legal, and Environmental considerations. The detailed breakdown ensures you have a complete understanding of the landscape Nojima navigates.

Sociological factors

Japan's demographic landscape is significantly shaped by its rapidly aging population and a declining birth rate. As of 2023, approximately 29.9% of Japan's population was aged 65 or older, a figure projected to rise. This trend directly impacts Nojima by altering the consumer base for electronics.

The increasing proportion of older adults suggests a potential shift in demand towards products that are user-friendly and cater to specific needs of this demographic. For instance, there may be growing interest in health monitoring devices, simplified home appliances, or electronics with enhanced accessibility features, requiring Nojima to innovate its product portfolio and marketing approaches to align with these evolving consumer preferences.

Shifting consumer lifestyles are significantly impacting electronics demand. The rise of remote work, with an estimated 30% of the US workforce working remotely at least part-time in 2024, fuels demand for laptops, monitors, and reliable home networking equipment. Similarly, the growing adoption of smart home technology, projected to reach over 50% of US households by 2025, creates opportunities for connected devices like smart speakers and security systems.

Nojima needs to stay attuned to these evolving preferences. A heightened focus on health and wellness, for instance, translates into increased interest in wearable fitness trackers and health monitoring devices. By aligning its product offerings with these contemporary consumer needs, Nojima can better capture market share.

Japan boasts a high internet penetration rate, with approximately 92% of the population online as of early 2024, indicating a generally tech-savvy consumer base. This widespread digital adoption fuels demand for Nojima's advanced electronic products and services.

However, a significant portion of the elderly population, around 30% in 2023, still exhibits lower digital literacy, presenting a challenge for Nojima. The company must balance offering cutting-edge technology with accessible support and simpler product interfaces to cater to this segment.

Nojima's success hinges on its ability to adapt to evolving technological trends, such as the growing interest in AI-powered home appliances and smart living solutions. Consumer willingness to embrace these innovations will directly influence sales performance in the 2024-2025 period.

Urbanization and Retail Shopping Habits

Japan continues to experience a high degree of urbanization, with approximately 92% of its population residing in urban areas as of 2023. This concentration of people in cities directly impacts retail strategies. For Nojima, a leading electronics retailer, understanding these urbanized shopping habits is crucial. The shift towards convenience and digital solutions, driven by urban lifestyles, means a strong online presence is no longer optional but a necessity.

The evolving retail landscape in urban Japan presents a dual challenge and opportunity for Nojima. While traditional large-format stores can thrive in densely populated areas, the pervasive influence of e-commerce and a growing consumer preference for at-home or on-the-go shopping cannot be ignored. Nojima must strategically balance its physical footprint with investments in its digital capabilities to effectively reach and serve its diverse customer base.

- Urban Population: Japan's urbanization rate stood at around 92% in 2023, a testament to the concentration of consumers in cities.

- E-commerce Growth: The Japanese e-commerce market is projected to reach ¥30.4 trillion (approximately $200 billion USD) by 2027, highlighting a significant shift in consumer behavior.

- Convenience Factor: Urban dwellers often prioritize convenience, leading to increased demand for online shopping, same-day delivery, and click-and-collect services.

- Retail Mix: Nojima's success hinges on optimizing its mix of physical stores and online platforms to cater to these varied urban shopping preferences.

Sustainability Consciousness and Ethical Consumption

Consumers are increasingly prioritizing sustainability and ethical practices, impacting their purchasing choices. Nojima is feeling this pressure, needing to offer greener products and demonstrate responsible sourcing to resonate with this growing segment. For instance, a 2024 survey indicated that over 70% of consumers are willing to pay more for products from brands committed to sustainability.

This shift means Nojima must actively promote recycling programs and ensure its supply chain adheres to ethical labor and environmental standards. Failing to do so could alienate a significant portion of its customer base. In 2025, reports suggest that the global market for sustainable goods is projected to reach over $150 billion, highlighting the economic imperative for companies like Nojima to adapt.

- Consumer Demand for Eco-Friendly Products: A significant and growing segment of the market actively seeks out products with a lower environmental impact.

- Ethical Sourcing Expectations: Consumers are scrutinizing supply chains for fair labor practices and responsible resource management.

- Brand Reputation and Sustainability: Companies demonstrating strong sustainability commitments often enjoy enhanced brand loyalty and positive public perception.

- Regulatory and Investor Pressure: Beyond consumer demand, governments and investors are increasingly pushing for sustainable business operations.

Japan's societal fabric is deeply influenced by its aging population and low birth rates. This demographic shift, with nearly 30% of the population over 65 in 2023, reshapes the consumer market for electronics, requiring Nojima to focus on user-friendly devices and accessibility features for older adults.

Lifestyle changes, such as the rise of remote work, estimated to involve 30% of the US workforce part-time in 2024, and the projected 50% smart home adoption in US households by 2025, are driving demand for specific electronics like laptops and smart home devices. Nojima must adapt by offering products that align with these evolving consumer needs, including health monitoring wearables.

Urbanization in Japan, with 92% of the population living in cities as of 2023, necessitates a strong online presence and strategic retail mix for Nojima, balancing physical stores with digital capabilities to cater to convenience-driven urban shoppers. The Japanese e-commerce market's projected growth to $200 billion by 2027 underscores this trend.

Growing consumer emphasis on sustainability, with over 70% of consumers willing to pay more for eco-friendly products in 2024, pushes Nojima to promote recycling and ethical sourcing. The global sustainable goods market, projected to exceed $150 billion in 2025, highlights the financial imperative for Nojima to embrace these values.

Technological factors

The consumer electronics sector is in a constant state of flux, with new gadgets and upgrades hitting the market at breakneck speed. This rapid innovation means that products can become outdated almost as soon as they are released, a challenge Nojima must navigate. For instance, smartphone upgrade cycles have shortened considerably, with many consumers now replacing their devices every two to three years, driven by technological leaps rather than necessity.

Nojima’s ability to effectively manage its inventory and supply chain is paramount. They need to ensure they have the latest models readily available for consumers eager for cutting-edge technology, while simultaneously minimizing the financial hit from unsold, older inventory. In 2024, companies in this space are increasingly investing in agile supply chain solutions and data analytics to predict demand more accurately and reduce the risk of holding obsolete stock.

The relentless growth of e-commerce, with global online retail sales projected to reach $8.1 trillion by 2024 according to Statista, presents a significant technological factor for Nojima. Consumers increasingly expect a fluid experience across online and physical stores, demanding seamless integration for browsing, purchasing, and collecting goods. This omnichannel shift means Nojima must continue investing in robust digital infrastructure and user-friendly interfaces to remain competitive.

Nojima can significantly boost its operational efficiency by integrating Artificial Intelligence (AI) and the Internet of Things (IoT) into its retail processes. AI can power personalized customer recommendations, leading to increased sales, while IoT devices can optimize inventory management through real-time tracking, reducing stockouts and overstock situations. For example, in 2024, retailers adopting AI for personalization saw an average increase in customer engagement of 15%.

These advanced technologies also contribute to a superior customer experience. Smart store layouts, guided by IoT sensors and AI analytics, can improve traffic flow and product placement. This enhances customer satisfaction and encourages longer shopping times. By 2025, it's projected that 60% of retail customer interactions will be AI-driven, further highlighting the importance of this integration.

Furthermore, the implementation of AI and IoT can lead to substantial reductions in operational costs. Predictive maintenance for store equipment, optimized energy consumption through smart building management, and streamlined supply chain logistics are just a few examples. These efficiencies free up capital for reinvestment and improve Nojima's overall profitability.

Cybersecurity and Data Privacy Technologies

Nojima, like all businesses heavily reliant on online operations and customer data, faces critical technological factors concerning cybersecurity and data privacy. As digital transactions and data collection surge, the implementation of advanced cybersecurity measures and robust data privacy technologies becomes absolutely essential. Protecting sensitive customer information from breaches is not just a legal requirement but a fundamental aspect of building and maintaining customer trust, which directly impacts Nojima's reputation and financial stability.

The increasing sophistication of cyber threats means Nojima must continuously invest in and update its security infrastructure. For instance, in 2023, global data breach costs averaged $4.45 million, a significant increase from previous years, highlighting the financial ramifications of inadequate protection. Nojima's commitment to data privacy, including adherence to regulations like Japan's Act on the Protection of Personal Information (APPI), is crucial for preventing hefty fines and legal liabilities, which could otherwise disrupt operations and impact profitability.

Key technological considerations for Nojima include:

- Advanced Encryption and Secure Storage: Implementing state-of-the-art encryption for data both in transit and at rest to prevent unauthorized access.

- Regular Security Audits and Vulnerability Testing: Proactively identifying and rectifying weaknesses in IT systems to stay ahead of potential cyberattacks.

- Compliance with Data Privacy Frameworks: Ensuring all data handling practices align with evolving international and domestic privacy regulations, such as GDPR and APPI.

- Employee Training on Cybersecurity Best Practices: Educating staff on phishing, malware, and secure data handling to mitigate human-error-related breaches.

Advancements in Mobile Communication and IT Solutions

Nojima's strong presence in mobile communication and IT solutions necessitates constant adaptation to evolving network technologies, such as the ongoing rollout of 5G and early research into 6G. For instance, by late 2024, 5G coverage in Japan, a key market for Nojima, was projected to exceed 90% of populated areas, driving demand for compatible devices and services. Keeping pace with these advancements is crucial for Nojima to offer innovative products and maintain its market leadership.

The company must also stay abreast of enterprise IT trends, including cloud computing adoption, cybersecurity advancements, and the increasing integration of artificial intelligence in business operations. In 2024, global enterprise IT spending was forecast to reach over $1.5 trillion, highlighting the significant opportunities and the need for Nojima to provide relevant solutions. This continuous technological engagement ensures Nojima remains competitive and can meet the dynamic needs of its customer base.

- 5G Deployment: Continued expansion of 5G networks in key markets provides opportunities for Nojima to offer new devices and services.

- IT Solutions Demand: Growing enterprise investment in cloud, AI, and cybersecurity creates a market for Nojima's IT-related offerings.

- Technological Obsolescence: Failure to adapt to rapid technological shifts can render Nojima's existing product lines and services outdated.

- Innovation as a Differentiator: Early adoption and integration of emerging technologies like 6G will be key to Nojima's future competitive advantage.

Technological advancements are a primary driver of change in Nojima's operating environment, necessitating continuous adaptation. The rapid pace of innovation in consumer electronics, exemplified by shorter smartphone upgrade cycles, means Nojima must maintain agile inventory and supply chain management to avoid obsolescence. The projected $8.1 trillion global online retail sales by 2024 underscore the importance of robust digital infrastructure and seamless omnichannel experiences.

Integrating AI and IoT offers significant opportunities for Nojima to enhance customer experience and operational efficiency. AI-driven personalization, which saw an average 15% increase in customer engagement for retailers in 2024, can boost sales, while IoT can optimize inventory management. Furthermore, by 2025, an estimated 60% of retail customer interactions are expected to be AI-driven, highlighting the critical need for Nojima to embrace these technologies to remain competitive and improve profitability through cost reductions in areas like predictive maintenance and energy consumption.

Cybersecurity and data privacy are paramount technological concerns for Nojima, given its reliance on digital operations and customer data. The average cost of a data breach in 2023 reached $4.45 million, emphasizing the financial and reputational risks of inadequate security. Adherence to data privacy regulations, such as Japan's APPI, is crucial for preventing substantial fines and maintaining customer trust.

Nojima's position in mobile and IT solutions requires it to stay current with network technologies like 5G, with coverage in Japan projected to exceed 90% of populated areas by late 2024. This trend fuels demand for compatible devices. Additionally, the over $1.5 trillion forecast for global enterprise IT spending in 2024 highlights the market for Nojima's IT offerings, provided it can adapt to trends like cloud computing, AI integration, and cybersecurity advancements.

| Technological Factor | Impact on Nojima | Key Data/Trend (2024-2025) |

| Rapid Product Innovation & Obsolescence | Need for agile inventory and supply chain management. | Shortened smartphone upgrade cycles (2-3 years). |

| E-commerce Growth & Omnichannel Expectations | Requirement for robust digital infrastructure and seamless user experience. | Global online retail sales projected to reach $8.1 trillion by 2024. |

| AI & IoT Integration | Opportunities for enhanced customer engagement and operational efficiency. | AI personalization boosted engagement by 15% (2024); 60% of retail interactions to be AI-driven by 2025. |

| Cybersecurity & Data Privacy | Critical for protecting customer data, maintaining trust, and avoiding financial penalties. | Global data breach costs averaged $4.45 million (2023). |

| Network Technology Evolution (5G/6G) | Drives demand for new devices and services; requires continuous adaptation. | 5G coverage in Japan projected over 90% of populated areas (late 2024). |

| Enterprise IT Spending | Market opportunities for IT solutions, dependent on keeping pace with trends. | Global enterprise IT spending forecast over $1.5 trillion (2024). |

Legal factors

Nojima, a major electronics retailer, navigates a complex landscape shaped by Japan's Personal Information Protection Act (PIPA). As they collect vast amounts of customer data from sales, repairs, and loyalty programs, adherence to PIPA and similar global data protection mandates is paramount. Failure to comply can result in severe penalties; for instance, under PIPA, companies can face fines up to ¥100 million (approximately $670,000 USD as of mid-2024) for serious violations.

Nojima must strictly comply with Japan’s rigorous product safety and quality standards for all electronics. This involves adhering to regulations for electrical safety and electromagnetic compatibility to safeguard consumers and prevent costly product recalls. For instance, in 2023, the Japanese government continued to enforce the Consumer Product Safety Act, with ongoing updates to specific technical requirements for electronic goods, impacting product design and manufacturing processes.

Nojima's advertising and marketing efforts must strictly adhere to consumer protection laws, ensuring all claims are truthful and fair trade practices are upheld. This includes avoiding any misleading statements about product performance or pricing to prevent hefty fines and safeguard its reputation.

In 2024, regulatory bodies like the FTC continued to emphasize transparency in advertising. For instance, digital advertising spending in Japan was projected to reach approximately ¥2.3 trillion in 2024, highlighting the increased scrutiny on online marketing practices to prevent deceptive content.

Failure to comply with these regulations can result in significant penalties, impacting Nojima's financial performance and brand trust. For example, in 2023, several major e-commerce platforms faced investigations and fines for unsubstantiated discount claims, underscoring the importance of meticulous compliance.

Labor Laws and Employment Regulations

As a significant employer in Japan, Nojima is bound by stringent labor laws. These regulations dictate everything from standard working hours, which generally adhere to a 40-hour week, to minimum wage requirements. For 2024, Japan's average minimum wage across prefectures is around ¥1,100 per hour, with variations by region. Nojima must also ensure compliance with laws concerning overtime pay, paid leave entitlements, and robust workplace safety standards to prevent accidents and ensure employee well-being.

Navigating these labor laws is not just a matter of legal obligation but a strategic imperative for Nojima. Consistent adherence helps foster a stable and motivated workforce, minimizing the risk of costly labor disputes and costly legal penalties. For instance, in 2023, Japan saw a decrease in labor disputes compared to previous years, underscoring the importance of proactive compliance. Companies that prioritize fair treatment and safe working conditions, as mandated by laws like the Industrial Safety and Health Act, often experience lower employee turnover and higher productivity.

- Working Hours: Adherence to the standard 40-hour workweek and regulations on overtime.

- Wages: Compliance with national and prefectural minimum wage laws, with average rates around ¥1,100 per hour in 2024.

- Employee Benefits: Provision of legally mandated benefits such as health insurance and pension contributions.

- Workplace Safety: Implementation of safety protocols to comply with the Industrial Safety and Health Act, aiming to reduce workplace accidents.

E-Waste and Recycling Legislation

Japan's commitment to environmental responsibility is clearly demonstrated through its stringent e-waste legislation. The Home Appliance Recycling Law, for instance, mandates that manufacturers, importers, and retailers like Nojima play a crucial role in the collection and recycling of specific end-of-life products. This legal framework ensures that electronic waste is managed responsibly, preventing it from contributing to environmental pollution.

Nojima, as a major electronics retailer, is legally bound to comply with these regulations. This involves establishing and maintaining efficient collection systems for used appliances and partnering with certified recycling facilities. For example, under the law, consumers typically pay a recycling fee when purchasing new appliances, which helps fund the recycling process. Nojima's compliance efforts require significant investment in logistics, consumer education, and the infrastructure necessary to handle these returned products, directly impacting operational costs and business strategy.

The legal factors surrounding e-waste management present both challenges and opportunities for Nojima.

- Legal Obligation: Nojima must adhere to the Home Appliance Recycling Law, ensuring proper collection and recycling of end-of-life products.

- Compliance Costs: Meeting these regulations necessitates investment in collection infrastructure, transportation, and partnerships with recycling facilities.

- Reputational Impact: Effective compliance can enhance Nojima's brand image as an environmentally conscious company, appealing to increasingly eco-aware consumers.

- Market Trends: Growing consumer demand for sustainable practices means that robust e-waste management can be a competitive differentiator.

Nojima's operations are heavily influenced by Japanese consumer protection laws, particularly concerning product safety, advertising, and data privacy. In 2024, the Personal Information Protection Act (PIPA) continued to mandate stringent data handling practices, with potential fines reaching ¥100 million for violations. Furthermore, adherence to product safety standards under the Consumer Product Safety Act is crucial, preventing recalls and ensuring consumer trust. Marketing claims must be truthful, a focus for regulators given the projected ¥2.3 trillion in digital advertising spending in Japan for 2024.

| Regulation Area | Key Compliance Points | Potential Consequences of Non-Compliance | Relevant 2024/2025 Data/Trends |

| Data Privacy (PIPA) | Secure customer data collection, storage, and usage. | Fines up to ¥100 million (approx. $670,000 USD). Reputational damage. | Increased digital transactions heighten data security risks. |

| Product Safety | Adherence to electrical safety, EMC standards. | Product recalls, fines, lawsuits, loss of consumer confidence. | Ongoing updates to technical requirements for electronics. |

| Advertising & Fair Trade | Truthful advertising, avoidance of misleading claims. | FTC investigations, fines, damage to brand reputation. | Heightened scrutiny on digital advertising practices. |

Environmental factors

The escalating global generation of electronic waste (e-waste) presents a substantial environmental hurdle, with projections indicating a continued upward trend. In 2023, the world produced an estimated 62 million metric tons of e-waste, a figure expected to reach 82 million metric tons by 2030, according to the Global E-waste Monitor 2024.

Nojima's proactive engagement in sustainable e-waste management, including robust take-back programs and the promotion of recycling, is not merely about environmental stewardship but also a strategic imperative. These initiatives help Nojima navigate increasingly stringent environmental regulations and bolster its reputation for corporate social responsibility, resonating positively with environmentally conscious consumers in the 2024-2025 period.

Nojima's extensive network of large retail stores requires significant energy for operations, impacting its environmental footprint. The company is actively working to mitigate this through investments in energy-efficient lighting and HVAC systems across its stores. These initiatives not only support environmental sustainability but also offer tangible operational cost reductions.

A key strategy for Nojima involves promoting energy-efficient products to its customer base. This aligns with growing consumer demand for appliances that minimize electricity usage, a trend that has seen considerable acceleration in recent years. For example, sales of ENERGY STAR certified products in Japan, a benchmark for energy efficiency, have shown consistent year-over-year growth, with many categories seeing double-digit percentage increases leading up to 2025.

Nojima is increasingly focused on reducing its carbon footprint throughout its entire supply chain. This includes scrutinizing emissions from manufacturing processes, optimizing delivery routes to cut down on transportation fuel, and selecting suppliers who also prioritize environmental responsibility. By 2024, many electronics retailers like Nojima are seeing pressure to report Scope 3 emissions, which encompass supply chain impacts, making this a critical area.

Within its own retail and operational facilities, Nojima is implementing sustainable practices. This could involve energy-efficient lighting and HVAC systems, waste reduction programs, and exploring renewable energy sources for its stores and offices. For instance, major retailers in 2024 are investing heavily in solar panel installations on their distribution centers to lower their operational emissions.

Consumer Demand for Eco-friendly Products

Consumers are increasingly prioritizing electronics that are kind to the planet. This shift means a growing demand for products manufactured with sustainability in mind. Nojima can tap into this by featuring items made from recycled plastics, boasting impressive energy efficiency ratings, or designed for a longer lifespan and easier repairs.

This trend is backed by significant market shifts. For instance, a 2024 report indicated that over 60% of consumers consider sustainability a key factor when purchasing electronics. Nojima's strategic stocking of eco-conscious options directly addresses this growing consumer consciousness, potentially boosting sales and brand loyalty.

- Growing Eco-Consciousness: A significant portion of consumers actively seek out environmentally responsible brands.

- Market Opportunity: Nojima can gain a competitive edge by offering a curated selection of sustainable electronics.

- Product Differentiation: Stocking energy-efficient and repairable items sets Nojima apart from competitors.

- Brand Reputation: Aligning with eco-friendly values enhances Nojima's public image and appeal.

Sustainable Sourcing and Material Use

Nojima's dedication to sourcing materials sustainably is crucial, especially with growing consumer demand for ethical products. This includes actively avoiding conflict minerals and ensuring fair labor practices throughout its supply chain. For instance, in 2024, a significant portion of electronics manufacturers reported increased scrutiny from consumers regarding the origin of raw materials, with over 60% indicating a shift in purchasing decisions based on sustainability credentials.

This commitment not only mitigates environmental risks but also bolsters Nojima's brand reputation. By prioritizing ethical sourcing, the company can differentiate itself in a competitive market. A 2025 report by a leading retail analytics firm highlighted that brands with transparent and sustainable supply chains saw an average 8% higher customer loyalty compared to their less transparent counterparts.

- Focus on Conflict-Free Minerals: Nojima aims to ensure all minerals like tin, tantalum, tungsten, and gold used in its products are sourced responsibly, avoiding regions known for funding conflict.

- Ethical Labor Audits: Regular audits of suppliers are conducted to guarantee safe working conditions and fair wages, aligning with international labor standards.

- Supply Chain Transparency: The company is working towards greater transparency, allowing consumers to trace the origin of key components in the products they purchase.

- Recycled Material Integration: Nojima is exploring increased use of recycled materials in its product packaging and components to reduce its environmental footprint.

Nojima faces the environmental challenge of massive e-waste generation, projected to hit 82 million metric tons globally by 2030. The company's commitment to robust take-back and recycling programs addresses this, aligning with its strategy to meet stricter environmental regulations and appeal to eco-conscious consumers in 2024-2025.

Nojima is actively reducing its operational footprint by investing in energy-efficient technologies for its retail stores, directly addressing energy consumption. Furthermore, the company is promoting energy-efficient products, tapping into a growing consumer demand that saw significant increases in sales of certified products in Japan leading up to 2025.

The company is also focused on minimizing its supply chain emissions, a critical area as retailers like Nojima face pressure to report Scope 3 emissions by 2024. This includes optimizing logistics and selecting environmentally responsible suppliers, demonstrating a holistic approach to sustainability.

PESTLE Analysis Data Sources

Our Nojima PESTLE Analysis is built on a robust foundation of data, drawing from reputable industry publications, government reports, and international economic databases. We meticulously gather information on political stability, economic indicators, social trends, technological advancements, environmental regulations, and legal frameworks.