Nojima Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nojima Bundle

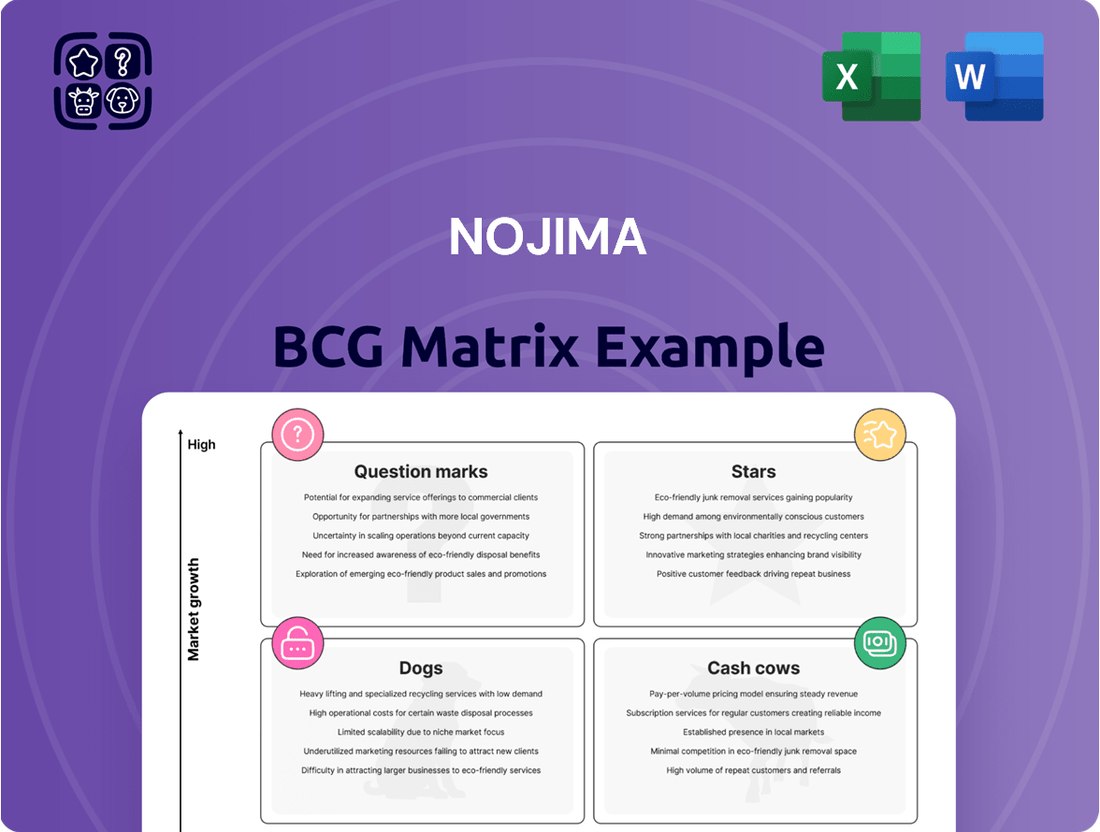

Curious about how this company's product portfolio stacks up? Our Nojima BCG Matrix preview offers a glimpse into its strategic positioning, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Understanding these dynamics is crucial for informed decision-making and maximizing growth. Don't miss out on the complete picture; unlock the full potential of your strategic planning by purchasing the complete BCG Matrix for actionable insights and a clear roadmap to success.

Stars

Nojima is heavily investing in its Digital Transformation (DX) Project, aiming to create a competitive edge through enhanced customer experiences and streamlined operations. This strategic push targets the integration of IT services directly into their retail business, with aspirations to offer these capabilities as standalone solutions.

A significant indicator of this commitment is their partnership with GlobalLogic Japan, a Hitachi Group company, initiated in June 2022. With ongoing discussions to further develop this collaboration, Nojima clearly signals its focus on this promising, high-growth sector.

Nojima's January 2025 acquisition of a significant stake in VAIO Corporation is a strategic move targeting the corporate PC segment. This aligns with VAIO's established reputation for quality and its focus on business clients.

The PC market is showing renewed vigor, largely due to the impending end of Windows 10 support in October 2025, which is expected to drive significant upgrade cycles. VAIO's corporate PC division is outperforming this trend, demonstrating robust growth that outpaces the broader market expansion.

This acquisition allows Nojima to capitalize on this market resurgence and VAIO's strong performance, aiming to secure a more substantial market share. The synergy is expected to benefit from VAIO's high-quality offerings in a market increasingly driven by enterprise needs and upcoming operating system transitions.

CONEXIO Corporation, a key player in mobile phone distribution, became a subsidiary of Nojima in February 2023, significantly boosting Nojima's presence in mobile communication services. This strategic move allows Nojima to leverage CONEXIO's established network and expertise.

The mobile communication services segment is showing positive momentum, driven by successful initiatives like new member acquisition programs and focused efforts on inventory management. These actions are designed to enhance the segment's overall performance and market position.

Nojima is committed to strengthening the profitability of this core business. The company is investing in improving customer service capabilities and streamlining operational processes to achieve greater efficiency and customer satisfaction.

For the fiscal year ended March 2024, Nojima reported net sales of ¥567.8 billion, with its mobile communication services segment being a substantial contributor. The company's focus on these areas reflects a deliberate strategy to capitalize on market opportunities and drive sustained growth.

Overseas Business Expansion (Thunder Match Technology Sdn. Bhd.)

Nojima's strategic acquisition of Thunder Match Technology Sdn. Bhd. (TMT) in July 2023 has positioned its overseas business for significant expansion. TMT's net sales saw a notable increase, demonstrating early success in its integration and market penetration efforts.

The opening of TMT's largest store in December 2024 underscores Nojima's commitment to aggressively growing its international footprint. This move is particularly targeted at capturing market share in high-growth emerging markets, differentiating from the more mature Japanese electronics retail landscape.

- Overseas Growth Driver: Thunder Match Technology (TMT) acquisition in July 2023 is a key component of Nojima's international strategy.

- Sales Momentum: TMT's net sales have shown a substantial increase, indicating positive performance post-acquisition.

- Physical Expansion: The launch of TMT's largest store in December 2024 signals a robust investment in physical retail presence abroad.

- Market Strategy: This expansion targets high-growth potential in international markets, contrasting with Japan's established retail environment.

Digital Home Appliance Retail Stores (Strategic Openings & DX Integration)

Nojima's digital home appliance retail stores are a key component of its strategic growth, focusing on a 'scrap-and-build' approach to optimize its physical footprint. This strategy involves opening new, digitally integrated stores while closing underperforming ones, aiming to enhance customer experience and capture market share. By March 2025, Nojima plans to operate 231 stores, reflecting a net increase of 10 stores through 16 openings and 6 closures, underscoring its commitment to physical retail evolution.

- Strategic Store Optimization: Nojima is actively managing its store portfolio, opening 16 new digital home electronics retail locations and closing 6 by March 2025, leading to a net expansion to 231 stores.

- Digital Transformation Integration: Investment in digital transformation (DX) is central to the new store openings, aiming to create an enhanced and seamless customer experience.

- Consultative Sales Approach: Differentiating itself in a flat market, Nojima emphasizes a consulting-based sales model, providing expert advice and unique services to customers.

- Market Share Growth: The 'scrap-and-build' and DX integration strategies are designed to drive growth and increase Nojima's market share within the Japanese home electronics retail sector.

Nojima's digital transformation and VAIO Corporation acquisition position them strongly in the growing corporate PC market. This segment is experiencing a surge due to Windows 10 end-of-support in October 2025, driving upgrade cycles.

VAIO's business-focused PCs are outperforming the general market, with Nojima aiming to leverage this for increased market share.

CONEXIO Corporation's integration bolsters Nojima's mobile communication services, supported by successful member acquisition and inventory management for the fiscal year ended March 2024.

Overseas expansion through Thunder Match Technology, which saw substantial net sales growth, is further amplified by the December 2024 opening of TMT's largest store, targeting emerging markets.

| Business Segment | Key Developments | Market Context | Nojima's Strategy |

|---|---|---|---|

| Digital Transformation & IT Services | Partnership with GlobalLogic Japan (June 2022) | High-growth sector, potential for standalone solutions | Integrate IT services into retail, offer as services |

| Corporate PCs | Acquisition of stake in VAIO Corporation (Jan 2025) | Windows 10 EOL (Oct 2025) driving upgrades; VAIO outperforming market | Capitalize on VAIO's quality and market resurgence |

| Mobile Communication Services | CONEXIO Corporation subsidiary (Feb 2023) | Positive momentum from member acquisition and inventory management | Strengthen profitability, improve customer service |

| Overseas Business | Acquisition of Thunder Match Technology (July 2023) | TMT net sales increase; largest store opened Dec 2024 in emerging markets | Aggressive international footprint growth, capture market share |

What is included in the product

The Nojima BCG Matrix provides a strategic overview of a company's product portfolio by categorizing business units into Stars, Cash Cows, Question Marks, and Dogs based on market share and growth. It guides investment decisions by identifying units for growth, harvesting, or divestment.

The Nojima BCG Matrix provides a clear, visual roadmap to reallocate resources from underperforming "Dogs" to promising "Stars," easing the pain of inefficient capital deployment.

Cash Cows

Traditional home appliance sales, encompassing items like refrigerators and washing machines, represent a classic Cash Cow for Nojima. This sector is a mature market, meaning growth is slow, but Nojima's established brand and extensive distribution network likely give it a substantial market share. In 2024, the global home appliance market was projected to reach over $250 billion, indicating a stable, albeit not rapidly expanding, demand base.

These essential household goods generate consistent revenue streams. Despite market maturity, the constant need for replacements and new installations ensures a steady cash flow. Nojima's long history in this segment, coupled with a loyal customer base, allows it to reliably convert sales into predictable cash generation, funding other ventures.

Nojima's after-sales support and installation services represent a classic Cash Cow within its business portfolio. While the market for these services might not be experiencing explosive growth, they are indispensable for electronics consumers, ensuring continued product functionality and customer satisfaction.

These essential services, including repairs and technical assistance, are vital for customer loyalty and generate consistent, high-margin revenue streams for Nojima. In 2024, the demand for reliable electronics maintenance and setup remained robust, underscoring the enduring value of these offerings.

By leveraging its established infrastructure and knowledgeable staff, Nojima effectively monetizes these support functions. The company's ability to provide seamless installation and dependable after-sales care not only secures repeat business but also enhances its overall brand reputation in a competitive electronics retail landscape.

Nojima's internet broadband services, primarily through NIFTY Corporation, are firmly positioned as a Cash Cow in its business portfolio. This sector is characterized by a mature market where ultra-high-speed connectivity is now considered essential, similar to other utilities.

The subscription-based model for these broadband services generates predictable and stable recurring revenue. While growth in this segment may be modest due to high market penetration and saturation, the consistent cash flow it provides is invaluable for funding other business ventures.

As of early 2024, the demand for reliable, high-speed internet continues to be robust, underpinning the stable revenue streams for Nojima's broadband operations. This stability allows for consistent operational performance and reliable cash generation.

Financial Business (FX Trading & Margin Trading)

Nojima's financial business, encompassing foreign exchange (FX) trading and margin trading on exchange stock indexes, functions as a significant cash cow for the company.

Despite potential market volatility, this segment consistently generates substantial cash flow due to its well-defined investment strategies and established operational framework.

This financial services arm, by facilitating over-the-counter FX and margin trading, contributes directly to Nojima's overall profitability and cash generation capabilities.

For instance, in the fiscal year ending March 2024, Nojima's financial services segment reported robust revenue, underscoring its role as a reliable cash generator.

- FX Trading: Facilitates currency exchange transactions, generating revenue through spreads and commissions.

- Margin Trading: Allows clients to trade stock indexes with leverage, creating income from interest and fees.

- Cash Generation: The consistent demand for these financial services, even amidst market fluctuations, ensures a steady inflow of cash.

- Profitability Contribution: This segment directly bolsters Nojima's bottom line, supporting investments in other business areas.

Carrier Shop Operations (Existing Mobile Phone Sales)

Nojima's carrier shop operations, primarily focused on existing mobile phone sales, function as a classic Cash Cow within its business portfolio. This segment, separate from strategic growth plays like the CONEXIO acquisition, consistently generates substantial revenue and profit.

Despite market headwinds, such as extended device replacement cycles driven by increasing smartphone prices, these established shops remain vital for consumers. Their steady demand and essential service provision ensure a reliable cash flow stream for Nojima.

- Revenue Contribution: In fiscal year 2023, Nojima's mobile retail segment, encompassing these carrier shops, reported a significant portion of the company's overall revenue, demonstrating its ongoing financial strength.

- Profitability: While specific profit margins for carrier shops alone are not always itemized, the segment's consistent performance indicates healthy profitability, contributing directly to Nojima's cash reserves.

- Market Position: With a strong network of physical stores, Nojima's carrier shops benefit from brand recognition and customer loyalty, allowing them to maintain sales volume even in a competitive landscape.

Nojima's traditional home appliance sales are a prime example of a Cash Cow. This mature market, though slow-growing, benefits from Nojima's strong brand and distribution, ensuring steady revenue. The global home appliance market exceeding $250 billion in 2024 highlights the consistent demand for these essential items, which require regular replacement and new installations.

These durable goods provide a reliable stream of income for Nojima. The constant need for new appliances and replacements, even in a saturated market, translates into predictable cash generation. Nojima's established presence and customer loyalty in this sector allow it to effectively convert sales into consistent cash flow, which can then be reinvested in other business areas.

Nojima's financial services, including FX and margin trading, are a significant Cash Cow. This segment consistently generates substantial cash flow through its established strategies, contributing directly to Nojima's profitability. For instance, Nojima's financial services segment reported robust revenue in the fiscal year ending March 2024, underscoring its role as a reliable cash generator.

| Business Segment | BCG Matrix Category | Key Characteristics | 2024 Market Insight |

|---|---|---|---|

| Home Appliances | Cash Cow | Mature market, high brand recognition, extensive distribution. Generates consistent revenue from replacements and new purchases. | Global market projected over $250 billion, indicating stable demand. |

| After-Sales Support & Installation | Cash Cow | Indispensable services for electronics consumers, ensuring product functionality and customer satisfaction. High-margin revenue streams. | Demand for reliable electronics maintenance remained robust in 2024. |

| Internet Broadband (NIFTY) | Cash Cow | Subscription-based model provides predictable recurring revenue in a saturated market. Essential service for consumers. | Robust demand for high-speed internet continues to underpin stable revenue streams. |

| Financial Services (FX, Margin Trading) | Cash Cow | Well-defined strategies and operational framework generate substantial cash flow, despite market volatility. | Fiscal year ending March 2024 saw robust revenue from this segment. |

| Carrier Shops (Mobile Sales) | Cash Cow | Consistent revenue and profit generation despite longer device replacement cycles. Vital for consumers needing essential services. | Mobile retail segment contributed significantly to Nojima's overall revenue in FY2023. |

What You’re Viewing Is Included

Nojima BCG Matrix

The Nojima BCG Matrix preview you are currently viewing is the exact, fully polished document you will receive after your purchase. This means you can confidently assess its strategic value and professional presentation, knowing that no watermarks or demo elements will be present in the final, downloadable file.

Dogs

Older or niche audio-visual equipment, like legacy DVD players or specialized audio interfaces, often find themselves in the Dogs quadrant of the BCG Matrix. These items typically experience declining consumer interest and face intense competition from newer technologies, leading to low sales volumes. For instance, the market for portable CD players, a once-dominant category, has shrunk dramatically, with sales in 2023 representing a fraction of their peak.

These products tie up valuable capital in inventory and occupy shelf space that could be allocated to more profitable, high-growth items. Their contribution to overall revenue is minimal, making them a drain on resources without offering significant future potential. Retailers carrying such items must carefully manage their stock to avoid obsolescence and associated write-downs, a common challenge in the fast-evolving consumer electronics sector.

Before Nojima's acquisition of VAIO, its general personal computer sales, especially older or less sought-after models, likely fell into the 'Dogs' category of the BCG matrix. These products would have struggled with a low market share in a highly competitive and consolidating PC market. For instance, in 2023, the global PC market saw shipments decline by 14.8% year-over-year, highlighting the intense pressure on older inventory.

These 'Dog' products typically required significant price reductions to clear stock, impacting profitability. The need for heavy discounting to move inventory meant that these PC lines were likely contributing little to Nojima's overall revenue growth. Such products often represent a drain on resources without offering substantial returns, a hallmark of the 'Dog' quadrant.

Underperforming physical store locations within Nojima's retail network would be classified as Dogs in the BCG Matrix. These are stores that are not only growing slowly but also hold a small market share in their respective segments. For instance, a store in a declining suburban mall with low customer visits and facing stiff competition from nearby electronics giants would fit this description.

These locations represent a drain on resources, consuming operational costs such as rent, utilities, and staffing without yielding proportionate returns. In 2024, Nojima, like many retailers, faces the challenge of optimizing its physical footprint. Identifying and addressing these underperforming assets is crucial for improving overall profitability and resource allocation.

Non-core, Low-Contribution Diversified Investments

Nojima's financial reports have detailed its involvement in diversified investments, including currency pair trading as part of its international strategy. While these ventures aim for broader market participation, some periods have shown a slight downturn in net sales and ordinary income from these specific segments. For instance, in the fiscal year ending February 2024, while overall company performance was strong, these smaller, less central investment activities may not have met expected benchmarks.

If these non-core, diversified investments consistently contribute minimally to overall profits or even incur losses relative to the capital invested, they can be categorized as Dogs within the BCG Matrix framework.

- Low Market Share: These investments likely operate in niche areas or face intense competition, limiting their ability to capture significant market share.

- Low Growth Potential: The inherent nature of some diversified investments, especially those with limited strategic focus, might mean they have limited prospects for substantial future growth.

- Capital Drain: If the returns are consistently poor, these assets can tie up valuable capital that could be better deployed in more promising core business areas or high-growth investments.

- Strategic Review: Such investments often warrant a strategic review to determine if divesting or restructuring them would improve overall financial health and resource allocation.

Specific Slow-Moving Inventory Categories

Within its broad product range, specific categories of slow-moving inventory that do not align with current consumer trends or are heavily commoditized with slim margins would be older generation smartphones and tablet models, as well as certain accessories like wired headphones and generic charging cables. This includes items that require frequent markdowns, tying up capital and warehouse space without generating sufficient profit. For instance, in early 2024, electronics retailers often found themselves with excess stock of models launched in 2022 or earlier, which had seen significant price drops due to newer releases and the rapid pace of technological advancement.

These categories typically exhibit lower inventory turnover ratios compared to fast-moving products. For example, a category like legacy gaming consoles, which were once popular but have been superseded by newer hardware, often sits in warehouses for extended periods. By April 2024, retailers were still working through remaining stock of consoles from the previous generation, impacting their ability to invest in more current, profitable inventory.

- Older Generation Smartphones: Inventory turnover for these items can be as low as 2-3 times per year, compared to 8-10 times for current models.

- Commoditized Accessories: Generic charging cables and basic screen protectors often have profit margins below 15%, making them unattractive unless sold in high volume.

- Legacy Gaming Consoles: These can remain in inventory for over a year, depreciating in value and requiring significant storage space.

- Out-of-Season Apparel: While not strictly electronics, this applies to any retail sector where seasonal items that didn't sell in their prime season become slow-moving.

Nojima's 'Dogs' encompass products with a low market share in low-growth markets, such as older smartphone models and certain accessories. These items, like legacy wired headphones, see declining demand and intense price competition. For instance, by mid-2024, sales of wired headphones continued to shrink as wireless alternatives dominated the market, with a projected 10% year-over-year decline in that segment.

These 'Dog' products represent a financial drain, tying up capital in slow-moving inventory and requiring significant markdowns to clear. Their low turnover rates, often below 3 times annually, necessitate careful inventory management. By the end of fiscal year 2024, Nojima, like other electronics retailers, faced the challenge of clearing out older generation devices that contributed minimally to overall profitability.

Underperforming physical store locations, particularly those in declining retail environments with low foot traffic and facing strong competition, also fall into the 'Dogs' category. These stores consume operational costs without generating substantial revenue. In 2024, optimizing the retail footprint by identifying and addressing these underperforming assets became a key strategy for many retailers to improve resource allocation and overall financial health.

| Product Category | Market Share | Market Growth | Inventory Turnover (Annual) | Typical Profit Margin |

|---|---|---|---|---|

| Legacy Smartphones (e.g., pre-2022 models) | Low | Declining | 2-3x | 5-10% |

| Wired Headphones | Low | Declining | 3-4x | 8-12% |

| Generic Charging Cables | Low | Stable but Low Growth | 4-5x | 5-8% |

| Underperforming Retail Stores | Low (in segment) | Low (in segment) | N/A (focus on sales per sq ft) | Negative to Low |

Question Marks

Nojima's 'DX Project,' in partnership with GlobalLogic, is a prime example of a question mark in the BCG matrix. These initiatives are focused on developing innovative customer experiences and digital platforms, representing areas with considerable growth potential. However, their market share is currently undefined, reflecting the nascent stage of these ventures.

Significant investments are being channeled into these digital transformation efforts, spanning both technology and human capital. The goal is to fundamentally reshape Nojima's retail and service delivery models. Despite these substantial outlays, the ultimate market adoption and long-term profitability of these new platforms remain uncertain, a hallmark of question mark businesses.

Nojima's acquisition of Animax Broadcast Japan Inc. and Kids Station Inc. in April 2024 marks a strategic move into the burgeoning anime and children's entertainment sectors. While these markets show significant growth potential, Nojima is still in the early stages of establishing its presence and realizing synergistic benefits.

This strategic positioning places these new ventures in the Question Mark quadrant of the BCG Matrix. The high-growth nature of the content business is evident, with the global anime market projected to reach over $40 billion by 2027, according to some industry forecasts. However, Nojima's current market share and its capacity to effectively integrate and differentiate these channels remain key considerations for future success.

Nojima's strategic partnerships, such as those with VAIO and Connexio Corporation, highlight a calculated move into new market segments for product development and sales expansion. These collaborations are designed to bolster VAIO's presence within Nojima's retail network and to cultivate corporate clients, signaling a proactive approach to diversification.

While VAIO as a brand might be considered a Star within Nojima's portfolio, these specific new ventures in product development and market penetration are essentially Question Marks. They represent potential growth areas but require substantial investment and strategic nurturing to achieve significant market share and profitability.

For instance, the expansion into corporate clients through partnerships like the one with Connexio Corporation is a nascent effort. The success of these new avenues hinges on Nojima's ability to effectively leverage these collaborations to create demand and establish a strong foothold in previously untapped markets.

The financial commitment for these new product development initiatives and market explorations is critical. By 2024, Nojima's investment in such strategic alliances is geared towards laying the groundwork for future revenue streams, even as the immediate returns remain uncertain.

Targeted Smaller Store Formats in New Areas

Nojima is strategically deploying smaller store formats to penetrate new areas, aiming to be closer to their customer base. This approach targets nascent micro-markets and customer segments, representing potential high-growth avenues.

While this expansion into new territories offers significant upside, the market share and profitability of these smaller, targeted formats remain largely unproven. Careful observation and data analysis will be crucial to assess their success.

- Expansion into new micro-markets

- Focus on customer proximity

- Unproven market share and profitability

- Requires careful monitoring and data analysis

Mobile Communication Services - New Customer Base Recruitment (CONEXIO synergy)

Nojima's mobile communication services are exploring new customer acquisition strategies, specifically through initiatives like CONEXIO synergy, which fall into the Question Mark quadrant of the BCG Matrix. These efforts aim to capture growth from untapped market segments by offering tailored products and services. The success hinges on the effectiveness and scalability of these novel recruitment methods.

The company is investing in measures to attract a new customer base, recognizing the potential for high growth in these less-penetrated markets. This strategic focus on expanding the customer pool is crucial for future revenue streams.

- New Member Recruitment: Initiatives are underway to attract and onboard new subscribers to mobile communication services.

- CONEXIO Synergy: Integration with CONEXIO is a key component of reaching and serving these new customer segments.

- High Growth Potential: The strategy targets previously unreached customer bases, indicating an expectation of significant market expansion.

- Uncertainty: The long-term viability and success of these new recruitment strategies are still being evaluated, characteristic of a Question Mark.

Nojima's ventures into new digital platforms and the anime/children's entertainment sectors, alongside strategic partnerships like those with VAIO and Connexio, exemplify Question Marks. These areas exhibit high growth potential but currently hold uncertain market share and profitability for Nojima.

The company's investment in these nascent initiatives, such as its DX Project and the acquisition of content providers in April 2024, signifies a commitment to future revenue streams, even as their long-term success is yet to be determined.

Nojima's expansion into smaller store formats and new customer acquisition strategies for mobile services also fit the Question Mark profile. These efforts aim to tap into high-growth micro-markets and unreached customer bases, requiring careful monitoring to assess market penetration and profitability.

The global anime market, for instance, is projected for substantial growth, with some forecasts placing it over $40 billion by 2027. Nojima's move into this sector, alongside its other emerging ventures, reflects a strategy of pursuing high-potential but currently unproven market segments.

BCG Matrix Data Sources

Our Nojima BCG Matrix leverages a robust blend of internal sales figures, customer feedback, and market research reports to accurately assess product portfolio performance and strategic positioning.