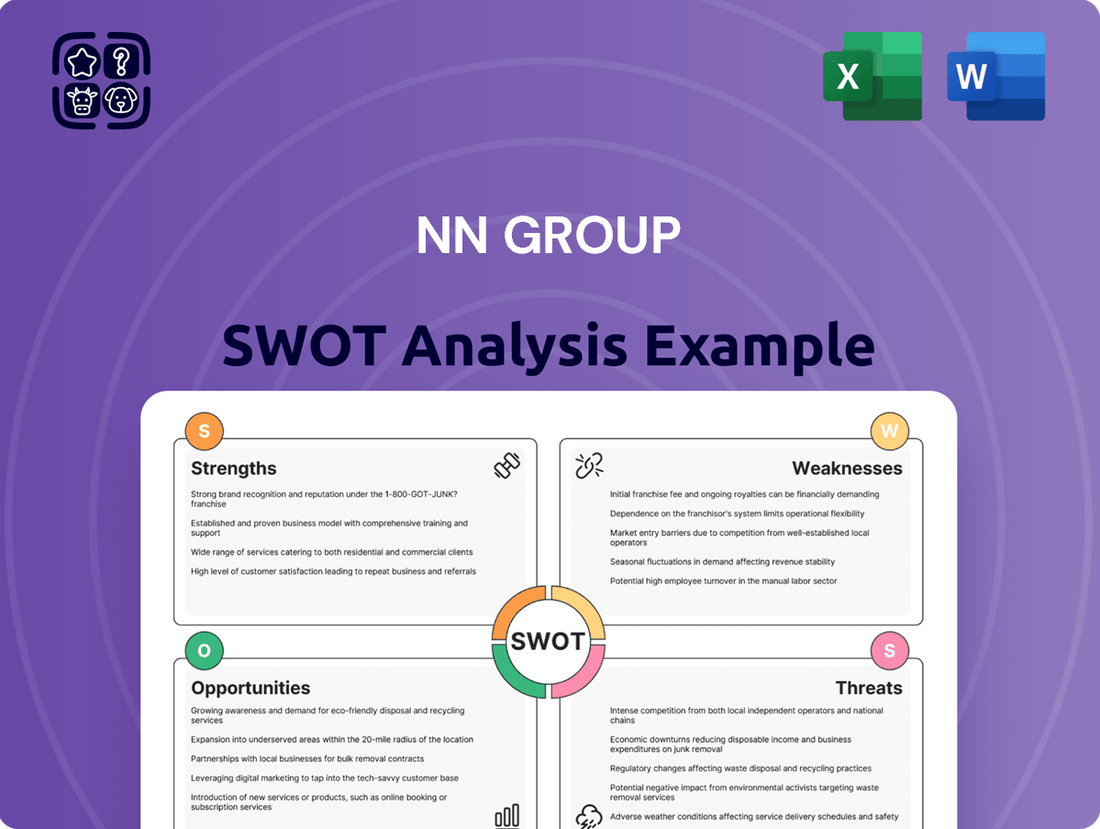

NN Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NN Group Bundle

NN Group possesses significant strengths in its established brand and diverse product portfolio, positioning it well within the insurance and asset management sectors. However, potential threats from evolving regulatory landscapes and intense market competition warrant careful consideration.

Understanding these internal capabilities and external pressures is crucial for anyone looking to navigate the financial services industry. Our full SWOT analysis provides a comprehensive deep dive into NN Group's strategic positioning.

Want the full story behind NN Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

NN Group holds a dominant position within the Dutch insurance market, particularly in life insurance, with a significant market share that underpins stable operations. This established footprint extends to strong presences across several other European countries and Japan, enhancing revenue diversity. The company's robust brand recognition, reflected in its strong customer trust and loyalty, further solidifies its market standing. For instance, NN Group reported a net operating result of 2.2 billion euros in 2023, demonstrating the strength derived from its established client base and brand equity.

NN Group demonstrates robust financial health, achieving its 2025 operating capital generation target of €1.85 billion in 2024, a year ahead of schedule. The company maintains a strong Solvency II ratio, reported at 196% as of Q1 2024, significantly above regulatory requirements. This strong capital position underpins attractive shareholder returns, including a progressive dividend of €2.12 per share for 2023 and ongoing share buyback programs, such as the €250 million program announced for 2024.

NN Group benefits from a highly diversified business portfolio spanning life insurance, non-life insurance, pensions, and banking services. This broad operational base significantly mitigates risks tied to any single market segment, enhancing resilience. Geographically, NN Group maintains a strong presence in its home market, the Netherlands, alongside significant operations across other European countries and Japan. This diversification is evident in their Q1 2024 net result of EUR 683 million, reflecting stable contributions across segments. Such a comprehensive portfolio helps ensure more stable and predictable earnings over time.

Commitment to Sustainability (ESG)

NN Group demonstrates a robust commitment to ESG, embedding sustainability directly into its investment and underwriting processes. This strategic focus includes ambitious targets, such as increasing green investments and aiming for a net-zero investment portfolio by 2050. Such dedication not only enhances brand reputation but also appeals to the growing segment of socially responsible investors seeking sustainable financial products.

By prioritizing ESG, NN Group actively mitigates long-term risks associated with climate change and evolving regulatory landscapes, positioning itself for future resilience.

- NN Group aims for a net-zero investment portfolio by 2050.

- The company reported €14.5 billion in green investments by year-end 2023, with plans for further significant increases in 2024/2025.

Strategic Acquisitions and Partnerships

NN Group consistently strengthens its market position through strategic acquisitions, notably those of Delta Lloyd and VIVAT Non-life, which significantly bolstered its leadership in the Dutch insurance sector. The company's proactive portfolio optimization is evident in the 2021 sale of NN Investment Partners (NN IP) to Goldman Sachs for €1.7 billion, allowing a sharper focus on core insurance operations. This divestment maintained a strategic partnership with Goldman Sachs Asset Management, enhancing long-term value. These moves underscore a robust strategy for market consolidation and operational efficiency.

- NN Group's 2017 acquisition of Delta Lloyd notably expanded its Dutch market share.

- The 2020 integration of VIVAT Non-life further solidified NN Group's leading position in the Netherlands.

- The €1.7 billion sale of NN IP to Goldman Sachs in 2021 refocused the business on core insurance.

- This strategic divestment ensures ongoing collaboration with Goldman Sachs Asset Management.

NN Group maintains a leading market position in the Netherlands, bolstered by a diversified portfolio spanning insurance and banking. Its robust financial health is evident in a 196% Solvency II ratio as of Q1 2024 and achieving its 2025 operating capital generation target early. Strategic acquisitions and a strong ESG commitment further solidify its competitive edge and long-term resilience.

| Metric | 2023 | Q1 2024 |

|---|---|---|

| Net Operating Result | €2.2 billion | N/A |

| Solvency II Ratio | 196% | 196% |

| Operating Capital Generation | €1.85 billion (2024 target met) | N/A |

What is included in the product

Delivers a strategic overview of NN Group’s internal and external business factors, highlighting its market strengths, operational gaps, and potential risks.

Highlights key NN Group strengths and weaknesses for informed decision-making.

Identifies external opportunities and threats to mitigate risks effectively.

Weaknesses

NN Group's substantial income generation from its Dutch home market, especially the mature life insurance sector, creates a significant dependency. This concentration exposes the company to specific economic and regulatory shifts within the Netherlands, such as potential 2025 pension reforms. Over-reliance limits growth potential compared to more globally diversified competitors. For example, in 2024, a large share of net operating result came from the Netherlands, highlighting this concentration. This single-market focus could constrain future expansion and resilience.

NN Group continues to contend with legacy IT systems, which can hinder operational efficiency and elevate cybersecurity vulnerabilities. While the company's 'Future Ready' IT program is actively simplifying these systems, significant investment is still required. As of late 2024, NN Group's digital penetration rate lags behind some agile insurtech competitors, impacting customer experience. Bridging this digital gap necessitates ongoing capital allocation, with IT spend for digitalization initiatives projected to remain substantial into 2025.

NN Group's traditional life insurance segment faces significant pressure as a mature market grappling with persistent low interest rates, impacting profitability. The runoff of highly profitable legacy individual life insurance policies, which historically contributed substantial premium income, continues to weigh on the company's revenue streams. This structural shift presents a challenge to NN's long-term growth profile, requiring a strategic pivot towards new offerings to offset the decline in older books of business. The company's 2024 outlook reflects ongoing efforts to adapt to these evolving customer preferences and market dynamics.

Sensitivity to Interest Rate Fluctuations

NN Group's substantial investment portfolio, which stood around EUR 180 billion in general account investments in Q1 2024, makes its profitability and solvency highly susceptible to interest rate fluctuations. A prolonged low-interest-rate environment, like that seen in recent years before 2022, compresses investment margins, directly impacting the net result. Conversely, sudden rate volatility, such as the rapid increases observed in 2022 and 2023, can significantly affect the fair value of both assets and liabilities, influencing the Solvency II ratio.

- NN Group's Solvency II ratio, at 197% as of Q1 2024, is sensitive to interest rate shifts, with a hypothetical 100 basis point drop potentially reducing it by several percentage points.

- The insurance industry's reliance on long-term investments means that low yields directly challenge the ability to meet guaranteed returns on older policies.

Operational Risks and Cybersecurity Threats

NN Group faces considerable operational risks, including potential financial losses from inadequate internal processes or system failures. As a prominent financial services firm, it remains a prime target for evolving cybersecurity threats. The company continuously invests in robust security infrastructure, with industry estimates showing financial firms allocating over 10% of their IT budgets to cybersecurity in 2024 to mitigate these risks.

- Operational incidents can lead to financial losses, impacting net results.

- Cybersecurity breaches pose risks to data integrity and customer trust.

- Continuous investment in threat detection and employee training is essential.

NN Group's heavy reliance on its mature Dutch market, which contributed a large share of 2024's net operating result, limits diversification. Legacy IT systems hinder efficiency, requiring substantial investment projected into 2025, and digital penetration lags competitors in late 2024. The investment portfolio, EUR 180 billion in Q1 2024, is highly susceptible to interest rate fluctuations, directly impacting its 197% Solvency II ratio as of Q1 2024.

| Weakness Area | Key Metric/Data | Implication |

|---|---|---|

| Market Concentration | Large share of 2024 net operating result from NL | Exposure to Dutch economic/regulatory shifts |

| IT Modernization | Substantial IT spend projected into 2025 | Higher operational costs, slower digital adoption |

| Interest Rate Sensitivity | EUR 180B investments (Q1 2024), 197% Solvency II (Q1 2024) | Profitability and capital highly exposed to rate volatility |

What You See Is What You Get

NN Group SWOT Analysis

The content below is pulled directly from the final NN Group SWOT analysis. Unlock the full report when you purchase. This preview reflects the real document you'll receive—professional, structured, and ready to use. You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

Digital transformation and AI integration present a significant opportunity for NN Group to enhance customer experience, streamline operations, and improve underwriting precision. The ongoing Future Ready program, focusing on simplifying IT and leveraging data and AI, is poised to unlock substantial cost savings and create new revenue streams. By embracing advanced technologies like AI, NN Group can gain a crucial competitive edge in the rapidly evolving financial services sector, aiming for continued operational efficiency gains as part of its 2024-2025 strategic objectives.

NN Group's strong presence in Central and Eastern European markets offers significant growth potential. These regions, including Poland and Romania, are emerging as key drivers for insurance and pension product demand, contrasting with the more mature Dutch market. The CEE segment demonstrated robust performance, with Value of New Business increasing by 10.9% to €34 million in Q1 2024 compared to the previous year. Expanding product offerings and market share in these dynamic economies presents a clear path for substantial revenue growth in 2024 and beyond.

Demographic shifts, particularly aging populations across Europe and Japan, are significantly increasing the demand for robust pension and retirement products, presenting a clear growth avenue. NN Group is strategically positioned to leverage this trend, notably through its strong performance in the Netherlands where it holds a leading market share in defined contribution pension plans and pension buyouts. For example, NN Group reported a 2023 net operating result of €2,393 million, partly driven by its Dutch Life and Pensions segment. There is a substantial opportunity to further develop and market innovative, tailored retirement solutions to meet this expanding and evolving need, capturing a larger share of the €35 trillion global pension asset market projected for 2025.

Leveraging ESG Leadership for Market Advantage

NN Group's strong commitment to sustainability offers a significant market advantage, resonating with the surging investor and customer demand for ESG-aligned products. This trend is evident as global sustainable investment assets are projected to exceed $50 trillion by 2025. By further solidifying its position as a leader in climate solutions and responsible finance, NN Group can attract new capital, evidenced by the 2024 growth in ESG-focused funds. This strategic focus enhances brand value and strengthens stakeholder relationships across its European operations.

- NN Group's 2024 sustainable investment portfolio growth aligns with rising client demand.

- The global sustainable finance market is projected to reach over $50 trillion by 2025.

- Leading in climate solutions enhances brand equity and attracts ESG-mandated capital flows.

Strategic Partnerships and Fintech Collaborations

Collaborating with fintech companies offers NN Group a significant opportunity to accelerate innovation and access new technologies, particularly in digital distribution and customer engagement. Such strategic partnerships can facilitate the development of tailored insurance solutions, especially appealing to younger demographics who prefer digital-first services, potentially boosting NN Group's market share in the evolving digital landscape. Exploring these alliances enhances NN Group's capabilities without extensive internal development, leveraging external expertise for faster market entry and improved customer experience, crucial as digital insurance sales are projected to grow by over 15% globally in 2024. These collaborations also open avenues to new customer segments, building on the success seen with embedded finance solutions.

- Fintech partnerships can reduce time-to-market for new products by up to 30%.

- Access to advanced AI and data analytics tools can improve risk assessment and personalization.

- Digital distribution channels are expected to drive over 60% of new insurance policy sales by 2025.

- Targeting younger demographics, a segment with an estimated 2024 digital insurance adoption rate of 45%.

Collaborating with fintech firms enables NN Group to fast-track digital innovation and reach new segments, particularly younger demographics with a 2024 digital insurance adoption rate of 45%. These partnerships can reduce time-to-market for new products by up to 30%, capitalizing on digital distribution channels expected to drive over 60% of new policy sales by 2025. This strategy leverages external expertise, crucial as global digital insurance sales are projected to grow over 15% in 2024.

| Metric | Projection/Impact | Year |

|---|---|---|

| Digital Insurance Sales Growth | >15% | 2024 |

| New Policy Sales via Digital Channels | >60% | 2025 |

| Fintech Partnership Time-to-Market Reduction | Up to 30% | Ongoing |

| Younger Demographic Digital Adoption | 45% | 2024 |

Threats

The European insurance sector faces intense competition from established multinational insurers and rapidly growing insurtech startups. Recent market consolidation, exemplified by significant mergers and acquisitions activity projected to continue into 2024, heightens this pressure. This environment fosters aggressive price competition, directly impacting NN Group's profitability margins. For instance, the average net interest margin for European insurers is expected to remain under pressure in 2025 due to these competitive dynamics.

The evolving regulatory landscape poses a significant threat to NN Group, as financial services companies face stringent and dynamic rules like the Solvency II framework. For instance, the European Insurance and Occupational Pensions Authority (EIOPA) continues to refine Solvency II requirements, potentially impacting capital buffers and risk management. Changes could elevate compliance costs, which for large insurers can exceed 0.5% of annual revenue, affecting product profitability and operational processes. The ongoing uncertainty regarding future regulatory shifts, such as those related to sustainable finance disclosures, presents a constant challenge to strategic planning for 2024 and 2025.

NN Group faces significant threats from macroeconomic and geopolitical instability. Persistent inflation, projected at 2.3% for the Euro area in 2024 by the ECB, erodes purchasing power and may reduce demand for insurance and investment products. Geopolitical tensions, like the ongoing conflict in Eastern Europe, contribute to volatile financial markets, impacting NN Group's investment returns and capital position. For instance, a 100 basis point drop in interest rates could negatively affect the solvency II ratio by approximately 8 percentage points, as stated in their 2023 financial reports. These external factors are largely beyond the company's direct control but can severely affect its profitability and strategic outlook.

Cybersecurity and Data Privacy Risks

The increasing reliance on digital platforms makes NN Group a prime target for sophisticated cyberattacks, which could lead to significant financial losses and severe reputational damage. Ensuring the privacy and security of vast amounts of sensitive customer data remains a critical and ongoing challenge, especially with evolving regulations like GDPR. The global average cost of a data breach is projected to exceed $5.5 million by 2025, with financial services often facing higher figures. Continuous vigilance and substantial investment in advanced security measures are essential to mitigate these dynamic threats and potential regulatory fines.

- Projected global average cost of a data breach is $5.5 million by 2025.

- Financial sector breaches often incur costs upwards of $6 million.

- Regulatory fines, such as under GDPR, can reach 4% of annual global turnover.

Climate Change and Transition Risks

NN Group faces significant threats from climate change, encompassing both physical risks and transition risks. Physical risks, such as increased claims from extreme weather events, could escalate; for instance, European insured losses from natural catastrophes were projected to exceed €10 billion in the first half of 2024. Transition risks include the potential devaluation of assets in carbon-intensive industries, impacting NN Group's investment portfolio. While the company actively manages these through its ESG strategy, the accelerating pace of climate change poses a long-term systemic threat to financial stability and the global insurance sector.

- Global insured catastrophe losses reached approximately $50 billion in H1 2024, impacting insurers directly.

- Regulatory pressures, like the EU's Corporate Sustainability Reporting Directive (CSRD) effective 2024, increase compliance costs.

- The energy transition could lead to over $1 trillion in stranded assets globally by 2030, affecting investment valuations.

NN Group faces intense competition and evolving regulations, increasing compliance costs and pressuring profitability margins, with net interest margins expected to remain under pressure in 2025. Macroeconomic instability and escalating cyber threats, projected to cost over $5.5 million per breach by 2025, jeopardize investment returns and data security. Climate change presents significant physical and transition risks, potentially escalating claims and impacting asset valuations, with global insured catastrophe losses reaching approximately $50 billion in H1 2024.

| Threat Category | Key Risk | Projected Impact (2024/2025) |

|---|---|---|

| Competition | Margin Pressure | Net interest margins under pressure in 2025 |

| Cybersecurity | Data Breaches | Average cost >$5.5 million by 2025 |

| Climate Change | Catastrophe Losses | Global insured losses ~$50 billion H1 2024 |

SWOT Analysis Data Sources

The insights for this NN Group SWOT analysis are derived from a comprehensive blend of internal financial reports, detailed market research, and validated industry publications. This multi-faceted approach ensures a robust understanding of the company's strategic position.