NN Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NN Group Bundle

Unlock the secrets to NN Group's resilience and future growth with our comprehensive PESTLE analysis. Understand the intricate interplay of Political stability, Economic shifts, Sociocultural dynamics, Technological advancements, Environmental considerations, and Legal frameworks that are shaping its strategic landscape. This is your chance to gain a decisive advantage by anticipating market trends and mitigating potential risks. Don't just react to change; lead it.

For investors, strategists, and business leaders, this PESTLE analysis offers critical intelligence to inform your decisions and empower your market positioning. Discover the external forces that present both challenges and unparalleled opportunities for NN Group. Equip yourself with the foresight needed to navigate the complexities of the modern business environment.

Download the full PESTLE analysis now to access expert insights and actionable data, meticulously prepared to provide you with a clear, strategic roadmap. Make smarter, data-driven choices and secure your competitive edge. Get immediate access to the complete report and start building a more robust future today.

Political factors

Ongoing global geopolitical uncertainties, including the conflict in Ukraine and heightened trade tensions, create a volatile economic environment impacting NN Group's investment portfolio. These factors increase risks in international markets where NN Group operates, affecting asset valuations and client returns. For instance, the company must navigate potential disruptions to supply chains and capital flows, which could influence its 2024-2025 financial outlook. Proactive risk management and diversified investment strategies are crucial to protect assets and ensure stable returns amidst these global shifts.

As a major financial institution in core markets like Europe and Japan, NN Group faces continuous regulatory evolution. For instance, new EU consumer protection directives expected in 2025 could reshape product disclosures, impacting NN Group's sales processes and product design for life insurance and pensions. Compliance with evolving Solvency II capital requirements, which saw adjustments in 2024, directly influences the group's capital allocation and investment strategies. Navigating these stringent frameworks, including the Japanese Financial Services Agency's oversight, while maintaining competitive offerings and operational efficiency remains a significant political challenge for the company.

The ongoing EU integration and harmonization of financial regulations present both opportunities and challenges for NN Group. While a more unified European market simplifies cross-border operations, regulatory changes in one member state can have a broader impact across its diverse European portfolio. NN Group must adapt to evolving EU-wide rules, such as the continued implementation of Solvency II capital requirements and the expanding scope of sustainability disclosures under the Corporate Sustainability Reporting Directive (CSRD), which impacts reporting from financial year 2024 for many large entities.

Dutch Pension System Reforms

The Netherlands, a core market for NN Group, is undergoing significant pension reforms as of 2024, transitioning from defined benefit (DB) to defined contribution (DC) schemes. This political shift directly impacts NN's substantial pension business, requiring the company to adapt its product offerings. The new system, effective January 1, 2023, aims for more individual control and transparency. NN must align its services with these changes to maintain its market position.

- By 2025, over 300 billion euros in pension assets are expected to transition to the new DC framework.

- NN Group's Dutch pension assets under management (AUM) were approximately 177 billion euros at the end of 2023, significantly exposed to these reforms.

- The reforms necessitate new investment strategies and enhanced digital platforms for NN to serve participants.

- NN is actively developing new DC-compliant solutions, aiming to capture new mandates by mid-2025.

Political Polarization and Populism

The global rise of political polarization and populism introduces significant uncertainty for NN Group, leading to unpredictable policy changes and the potential for economic nationalism. This creates an unstable business environment, directly impacting investor confidence and the demand for long-term financial products like pensions and life insurance. For instance, recent European parliamentary elections in 2024 highlighted shifts that could influence future regulatory frameworks for financial services. NN Group must vigilantly monitor these trends and their potential effects across its key markets, including the Netherlands and Japan, where policy stability is vital for long-term planning.

- Economic policy shifts in major markets could alter investment landscapes.

- Increased regulatory divergence might complicate cross-border operations.

- Potential for capital controls or protectionist measures impacting free movement of funds.

- Consumer confidence, crucial for long-term savings, can be eroded by political instability.

NN Group faces political headwinds from Dutch pension reforms, transitioning over 300 billion euros to new DC schemes by 2025, directly impacting its 177 billion euro AUM. Evolving EU regulations, like 2025 consumer protection directives and 2024 Solvency II adjustments, reshape product design and capital allocation. Global geopolitical uncertainties and rising populism also create an unpredictable environment for financial services.

| Political Factor | Key Impact | 2024/2025 Data |

|---|---|---|

| Dutch Pension Reform | Product adaptation, market share | €300bn assets transitioning by 2025 |

| EU Regulatory Evolution | Compliance, capital allocation | New EU consumer directives by 2025 |

| Geopolitical Uncertainty | Investment portfolio volatility | Ongoing Ukraine conflict, trade tensions |

What is included in the product

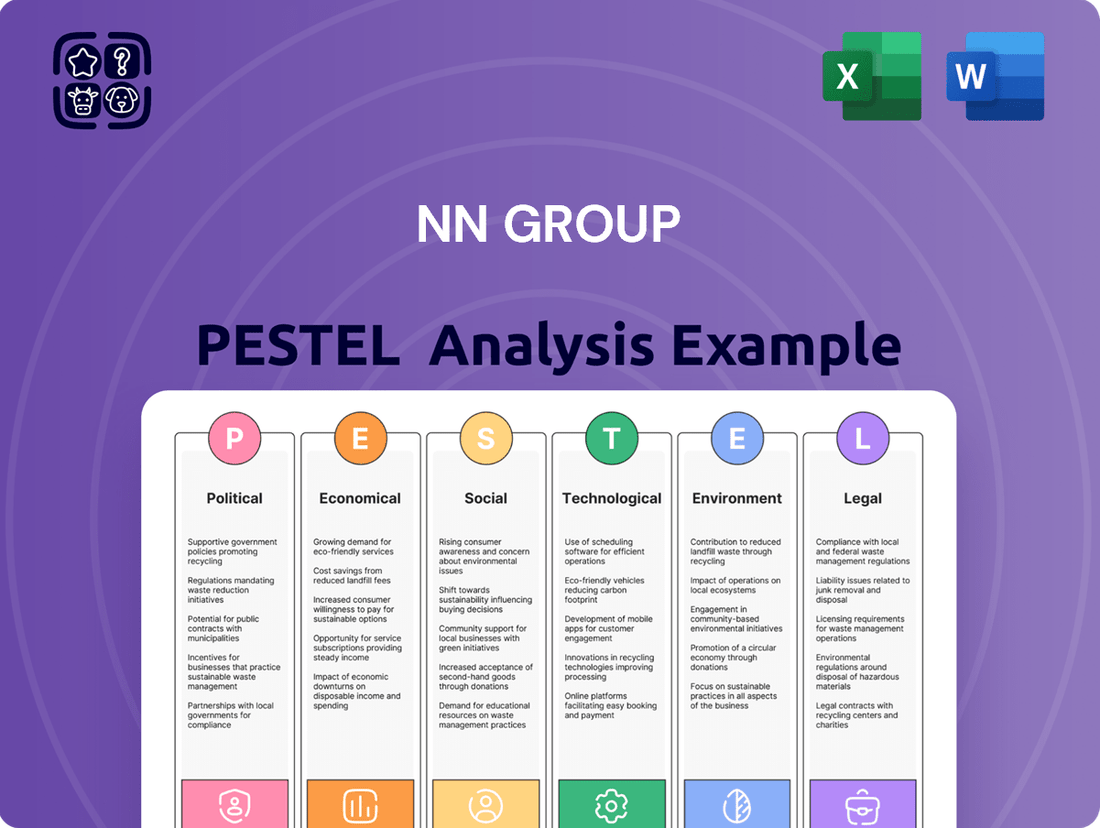

NN Group's PESTLE analysis examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations, providing a comprehensive understanding of the external landscape.

This analysis equips stakeholders with the insights needed to navigate market complexities and formulate effective strategies for NN Group.

A comprehensive PESTLE analysis of NN Group that identifies key external factors impacting the insurance and asset management sectors, providing actionable insights for strategic decision-making.

Economic factors

NN Group's profitability is directly impacted by interest rate fluctuations, particularly for its life insurance and pension products which manage substantial long-term liabilities. As of early 2025, the European Central Bank's (ECB) interest rate decisions, with the deposit facility rate around 4.00%, significantly influence NN Group's investment returns. Persistently low or volatile interest rates can compress investment income and complicate the accurate valuation of long-term liabilities. This sensitivity means NN Group's financial performance is closely tied to the monetary policies enacted by central banks across its primary markets.

Rising inflation significantly erodes the real value of NN Group's customer savings and investments, impacting purchasing power and financial planning for 2024 and 2025. This economic pressure influences customer behavior, potentially shifting demand for certain insurance products and increasing the cost of claims paid out, especially in long-term contracts. For NN Group, managing these effects is crucial, requiring nimble adjustments to investment strategies, such as favoring inflation-linked bonds, and dynamic product pricing. The European Central Bank's 2025 inflation target of 2.0% remains a key benchmark, influencing NN Group's operational adjustments to mitigate financial risk and maintain profitability.

The economic performance of key markets like the Eurozone and Japan directly impacts NN Group’s growth. Strong economic expansion, such as the Eurozone's projected 1.4% GDP growth for 2025, typically boosts demand for insurance, pensions, and investment products. Conversely, economic slowdowns, like Japan's anticipated 0.9% GDP growth in 2024, can reduce disposable income, affecting new sales and assets under management. Sustained growth across these regions is vital for NN Group's revenue stability and expansion plans.

Market Volatility

Global financial markets frequently experience volatility, driven by economic shifts or geopolitical events. This directly influences the value of NN Group's significant investment portfolio, which stood at approximately €280 billion as of Q1 2024. Such fluctuations impact its capital generation and can affect its robust Solvency II ratio, which was reported at 200% in early 2024. Effective risk management, including hedging strategies, is paramount for NN Group to navigate these market swings and maintain financial stability.

- Global equity and bond market fluctuations directly impact NN Group's €280 billion investment portfolio.

- NN Group's Solvency II ratio, reported at 200% in Q1 2024, is sensitive to market volatility.

- Interest rate changes and geopolitical tensions continue to drive market uncertainty in 2024-2025.

- Robust risk management and hedging strategies are crucial for mitigating volatility's effects on capital.

Currency Exchange Rate Fluctuations

NN Group, as a major international insurer, faces significant exposure to currency exchange rate movements, which directly influence its financial results. Fluctuations between the Euro and other key currencies, notably the Japanese Yen, can materially impact the reported value of its extensive international operations and solvency position. For instance, a stronger Euro against the Yen reduces the Euro-equivalent value of NN Life Japan's assets and earnings. To mitigate these inherent risks, NN Group actively employs hedging strategies, aiming to stabilize its capital position and earnings against adverse currency shifts, especially concerning its substantial Japanese portfolio.

- NN Group's Q1 2024 results highlighted currency translation effects impacting net operating result.

- The Euro/Yen exchange rate volatility remains a key factor for NN Life Japan's contribution.

- NN Group's Solvency II ratio in 2024 benefits from disciplined hedging against currency exposures.

NN Group's financial health is acutely sensitive to economic shifts, particularly interest rates and inflation, which directly influence investment returns and operational costs. The European Central Bank's 4.00% deposit rate in early 2025 and its 2.0% inflation target for 2025 are critical benchmarks. Furthermore, global market volatility impacts NN Group's €280 billion investment portfolio, requiring robust risk management for its 200% Solvency II ratio. Sustained economic growth, like the Eurozone's projected 1.4% GDP for 2025, remains vital for product demand and revenue stability.

| Economic Factor | 2024/2025 Data Point | Impact on NN Group |

|---|---|---|

| ECB Deposit Facility Rate | ~4.00% (early 2025) | Influences investment income and liability valuation. |

| ECB Inflation Target | 2.0% (2025) | Affects customer purchasing power and claims costs. |

| Eurozone GDP Growth | 1.4% (projected 2025) | Drives demand for insurance and pension products. |

| Investment Portfolio | €280 billion (Q1 2024) | Exposed to market volatility, impacting capital. |

What You See Is What You Get

NN Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of NN Group delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain valuable insights into market dynamics and strategic opportunities. Understand the external forces shaping NN Group's operations and future growth. This detailed report equips you with the knowledge to navigate the complex business landscape.

Sociological factors

Europe's aging population, with those aged 65+ projected to exceed 21% by 2025, significantly boosts demand for retirement and pension products, a core business for NN Group. Japan also presents a strong market, with over 29% of its population already aged 65 or older. However, increased longevity extends the duration of benefit payouts, creating a substantial risk for life insurance and pension providers. NN Group must accurately price this longevity risk to maintain financial stability and profitability in 2024 and 2025.

Modern consumers increasingly expect personalized, convenient, and digitally-enabled financial services. NN Group must significantly invest in technology and innovate its customer service to meet these evolving demands. This includes providing seamless digital experiences for purchasing products, managing policies, and filing claims, a critical factor given that digital channels contributed over 60% of new business in some segments by early 2025. Adapting to these shifts ensures NN Group remains competitive and captures growth in a rapidly digitizing market.

There is a growing societal focus on financial literacy and planning for the future, with over 70% of European adults prioritizing long-term financial security by early 2025. This trend creates significant opportunities for NN Group to educate consumers and offer tailored products that help them achieve their financial goals. For instance, NN Group's 2024 initiatives in digital financial planning tools aim to reach 1.5 million new users. The company's proactive efforts to support the financial well-being of its customers, especially through accessible retirement solutions, can significantly enhance its brand reputation and market share.

Increasing Demand for Sustainable and Responsible Investing

Customers and investors are increasingly demanding that financial institutions operate sustainably and offer responsible investment products, reflecting a significant societal shift. NN Group has actively responded by integrating sustainability into its core strategy and expanding its offering of investment solutions that rigorously consider environmental, social, and governance (ESG) factors. This commitment is crucial for attracting and retaining clients, with sustainable funds globally witnessing net inflows reaching over $80 billion in Q1 2024. For NN Group, aligning with these preferences enhances brand reputation and secures long-term client relationships.

- Sustainable investment assets are projected to exceed $50 trillion by 2025 globally.

- NN Group's assets under management (AuM) in responsible investments grew to over €200 billion in 2023.

- Client surveys indicate over 70% of investors prioritize ESG considerations in their financial decisions as of 2024.

Shifting Work and Employment Patterns

The rise of the gig economy and flexible work arrangements significantly reshapes traditional employment, impacting pension accrual and insurance needs. This shift means a growing segment of the workforce, projected to include over 80 million gig workers in Europe by 2025, requires tailored financial solutions. NN Group must innovate its product offerings to address these evolving demands effectively.

- By 2025, the European gig economy workforce is estimated to exceed 80 million individuals, a substantial increase from previous years.

- Flexible workers often face gaps in traditional pension schemes, necessitating new accrual models.

- NN Group can develop micro-insurance products and customizable savings plans for this segment.

- Data from 2024 indicates a 15% year-over-year increase in demand for portable benefits from self-employed individuals.

Europe's aging population and the rise of the gig economy are reshaping demand for tailored pension and insurance products, with over 21% of Europeans projected to be 65+ by 2025 and 80 million gig workers expected in Europe by the same year. Consumers increasingly expect digitally-enabled financial services and prioritize financial literacy, alongside a strong demand for sustainable investment products. NN Group must adapt its offerings and digital strategy to meet these evolving societal expectations. This includes addressing the 70% of European adults prioritizing long-term financial security by early 2025.

| Sociological Factor | Key Trend | 2024/2025 Data Point |

|---|---|---|

| Aging Population | Increased demand for retirement products | Europeans 65+ to exceed 21% by 2025 |

| Digitalization | Demand for seamless digital services | Digital channels >60% new business by early 2025 |

| Sustainability | Preference for ESG-integrated products | Sustainable assets >$50 trillion globally by 2025 |

| Gig Economy | Need for flexible financial solutions | European gig workers >80 million by 2025 |

Technological factors

The insurance and asset management industries are undergoing a significant digital transformation, heavily focusing on data and Artificial Intelligence. NN Group is actively investing in its Future Ready IT initiative, a multi-year program aiming to simplify legacy systems and leverage AI to improve underwriting accuracy, enhance customer service, and strengthen risk management capabilities. This commitment reflects a broader industry trend where digital solutions are key to operational efficiency. For instance, advanced AI models are projected to optimize claims processing by up to 30% by mid-2025 across the sector. Successful implementation of these technologies is crucial for NN Group to boost its competitiveness and operational resilience.

The increasing reliance on digital platforms makes financial services companies like NN Group prime targets for cyberattacks. Protecting sensitive customer data and critical infrastructure presents a significant technological hurdle. NN Group must continuously invest in robust cybersecurity measures; for instance, global financial institutions are projected to spend over $65 billion on cybersecurity in 2024, highlighting the scale of necessary defense. This ongoing expenditure is crucial to mitigate evolving threats, such as sophisticated ransomware and phishing campaigns, which continue to rise in frequency and complexity, safeguarding the company's operational integrity and customer trust.

The financial services landscape faces significant disruption from agile FinTech and InsurTech companies. These new entrants often leverage advanced technology, such as AI-driven analytics, to deliver highly specialized and user-friendly products, frequently at lower costs. This intensifies competition for NN Group, which reported a net operating result of EUR 2.5 billion in 2023, yet must continue innovating to maintain market share against these nimble players. Remaining competitive requires NN Group to accelerate its digital transformation efforts and explore strategic partnerships or acquisitions in the tech space by 2025.

Data Analytics and Big Data

The ability to collect, analyze, and utilize large volumes of data is a crucial competitive advantage for NN Group. Leveraging advanced data analytics allows the company to gain deeper insights into customer behavior, improve risk assessment accuracy, and develop more personalized insurance and pension products. A data-driven approach is central to NN Group's 2024-2025 strategy, aiming to enhance client engagement and operational efficiency. This focus helps them better understand market trends and client needs, driving product innovation.

- NN Group's 2024 strategic priorities emphasize data-driven customer journeys and operational improvements.

- The company continuously invests in AI and machine learning tools to refine risk models and personalize offerings.

- Data insights contribute to a more tailored approach, increasing client satisfaction and retention rates.

- By Q1 2025, NN Group aims to further integrate data analytics across all business segments for enhanced decision-making.

Blockchain and Distributed Ledger Technology

Blockchain technology, while still emerging in insurance, offers significant potential for NN Group to streamline operations, enhance transparency, and combat fraud. The global blockchain in insurance market is projected to reach approximately $1.3 billion by 2025, indicating growing industry adoption. NN Group is actively exploring applications in areas like claims processing and policy administration, aiming to leverage this innovation for efficiency gains.

Staying informed about these developments is crucial for maintaining a competitive edge and fostering future innovation within the financial and insurance sectors.

- By 2025, the global blockchain in insurance market is anticipated to approach $1.3 billion.

- NN Group is exploring blockchain for improved claims processing efficiency.

- Distributed ledger technology can enhance policy administration transparency.

- Blockchain adoption could significantly reduce fraud within the insurance sector.

NN Group is actively investing in digital transformation and AI, aiming to optimize operations and customer engagement, with AI models projected to optimize claims processing by up to 30% by mid-2025. This digital reliance demands continuous cybersecurity investment, as global financial institutions are projected to spend over $65 billion on cybersecurity in 2024. The company also faces disruption from agile FinTech and InsurTech players, requiring accelerated innovation and potential strategic partnerships by 2025 to maintain its market position.

| Technological Area | Key Focus | Projected Impact/Investment (2024/2025) |

|---|---|---|

| Digital Transformation & AI | Operational efficiency, customer service | Up to 30% claims processing optimization by mid-2025 |

| Cybersecurity | Data protection, infrastructure defense | Over $65 billion global financial institution spending in 2024 |

| Blockchain | Streamlined operations, fraud combat | Global market projected $1.3 billion by 2025 |

Legal factors

NN Group operates under stringent Solvency II regulations across Europe, which dictate robust capital requirements and risk management protocols for insurers. As of March 31, 2024, NN Group maintained a strong Solvency II ratio of 195%, underscoring its capital resilience. Changes to these complex rules, such as potential adjustments in 2025, directly influence the company's capital allocation and strategic growth initiatives. Continuous compliance with these evolving standards is paramount for NN Group to manage its financial stability and operational scope effectively.

Strict consumer protection and data privacy laws, such as Europe's General Data Protection Regulation (GDPR), significantly impact NN Group's operations. The company must rigorously adhere to these regulations in all customer interactions and data handling processes. Non-compliance risks substantial penalties, potentially reaching up to 4% of annual global turnover or €20 million, whichever is higher, alongside severe reputational damage. Ensuring robust data security and transparent data usage remains a critical compliance focus for NN Group in 2024 and 2025.

NN Group, as a financial institution, must adhere to stringent Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations to prevent illicit activities. This necessitates robust systems for detecting and reporting suspicious transactions, requiring continuous vigilance. Compliance costs remain significant, with financial institutions globally dedicating substantial resources, often exceeding 1% of revenue, to AML efforts in 2024. Ongoing investment in advanced analytics and staff training is crucial to meet evolving regulatory demands and avoid potential fines.

Mandatory Auditor Rotation

Mandatory auditor rotation, driven by legislation in various jurisdictions, significantly impacts NN Group's compliance framework. This legal requirement, aimed at enhancing auditor independence and audit quality, necessitated NN Group to transition its external auditor from PwC to KPMG for the 2020 financial year following a competitive tender process. This change, completed in early 2020, involved substantial internal resources for selection, onboarding, and ensuring a seamless handover of complex financial data for ongoing scrutiny in 2024 and 2025. The shift ensures continued adherence to regulatory standards, impacting audit fees and the internal control environment.

- The transition to KPMG as NN Group's external auditor for the 2020 financial year continues to influence audit practices and costs through 2024.

- Compliance with EU Audit Reform (EU Regulation No 537/2014) mandates audit firm rotation generally after a maximum of 10 years.

- NN Group’s 2023 Annual Report notes audit fees paid to KPMG were EUR 11 million.

Changes in Contract and Labor Law

Evolving labor laws and regulations significantly impact NN Group, which employs over 14,000 individuals globally as of early 2025. The company must diligently monitor changes in employment contracts, working conditions, and employee rights across its diverse operational footprint, including key markets like the Netherlands, Belgium, and Japan.

Staying informed ensures fair workforce treatment and full compliance with local legal requirements, mitigating potential fines or reputational damage. For instance, recent EU directives on pay transparency and platform work require careful adaptation across NN Group's European entities.

- NN Group's 2024 compliance efforts focus on EU Pay Transparency Directive implementation.

- Adaptation to evolving national collective bargaining agreements remains crucial for 2025.

- Monitoring stricter data privacy laws concerning employee information is a continuous priority.

NN Group navigates a complex legal landscape, with stringent Solvency II regulations dictating capital and risk management, alongside evolving data privacy laws like GDPR. Compliance with Anti-Money Laundering (AML) rules and mandatory auditor rotation, such as the 2020 shift to KPMG, significantly impact operations and costs. Evolving labor laws, including 2024 EU Pay Transparency directives, further shape NN Group's 2024-2025 operational framework.

| Legal Area | Impact on NN Group | 2024/2025 Data Point |

|---|---|---|

| Solvency II | Capital resilience, risk management | 195% Solvency II ratio (Mar 2024) |

| GDPR | Data handling, consumer protection | Up to 4% global turnover fine risk |

| AML/CTF | Financial crime prevention | >1% revenue compliance cost (2024) |

| Auditor Rotation | Audit independence, costs | EUR 11M audit fees to KPMG (2023) |

| Labor Laws | Workforce management, rights | EU Pay Transparency Directive (2024) |

Environmental factors

Climate change presents significant challenges for NN Group's insurance and investment activities, encompassing both physical and transition risks. Physical risks involve the rising frequency and intensity of extreme weather events, which directly impact claims across their insurance portfolios. Concurrently, transition risks stem from the global shift towards a low-carbon economy, affecting asset valuations and investment strategies. NN Group actively manages these risks, with a commitment to reducing the carbon footprint of its proprietary investments by 50% by 2030 compared to 2019, reflecting a strategic adaptation to evolving environmental standards.

There is a growing expectation for financial institutions to embed Environmental, Social, and Governance (ESG) factors into their core operations. NN Group is actively integrating sustainability considerations into its investment decisions and insurance underwriting policies, driven by both regulatory pressure and stakeholder demand. For instance, NN Group aims for 65% of its proprietary investment portfolio to be Paris-aligned by 2030, building on its 2024 progress. This strategic shift reflects increasing scrutiny from regulators like the European Banking Authority and the evolving preferences of clients seeking responsible financial products. Such integration enhances long-term resilience and aligns with global sustainability goals.

NN Group is deeply committed to achieving net-zero greenhouse gas emissions across its own operations and its extensive investment and insurance portfolios by 2050, aligning with the Paris Agreement. This ambitious goal necessitates a robust strategy and concrete actions, such as targeting a 50% reduction in financed emissions from listed equity and corporate bonds by 2030, based on 2019 levels. Their progress, including annual reporting on portfolio decarbonization, is under constant scrutiny from stakeholders, including institutional investors managing over €1.5 trillion in assets, and the wider public. Demonstrating tangible reductions, like an observed 30% cut in operational emissions by early 2024 compared to 2019, is crucial for maintaining investor confidence and regulatory compliance.

Investments in Climate Solutions

NN Group actively increases its investments in climate solutions, aligning its financial goals with environmental commitments. As of early 2025, the company targets over €6 billion in green investments by 2030, including renewable energy and green buildings. These initiatives not only support the transition to a low-carbon economy but also aim to deliver attractive long-term returns for the portfolio. NN Group's sustainable investments reflect a strategic pivot towards resilient, environmentally conscious assets.

- NN Group aims for over €6 billion in green investments by 2030.

- Current sustainable investments represent a significant portion of its total portfolio.

- Renewable energy and green real estate are key focus areas.

- These investments contributed to a 2024 portfolio carbon footprint reduction.

Reporting and Disclosure on Environmental Impact

Increasing regulatory and stakeholder demand drives transparent reporting on environmental performance. NN Group addresses this by publishing detailed information on its climate-related risks and opportunities, alongside progress on sustainability targets, within its 2024 Annual Report and other disclosures. This commitment to transparency is crucial for building trust and accountability among investors and the broader public.

- NN Group's 2024 Annual Report, released in March 2024, details climate-related financial disclosures.

- The group's sustainability targets and progress are clearly outlined in investor presentations and annual filings.

NN Group actively addresses climate change risks, targeting net-zero emissions by 2050 and a 50% reduction in financed emissions by 2030 compared to 2019 levels. They aim for over €6 billion in green investments by 2030, enhancing portfolio resilience and aligning with global sustainability goals. Transparency in reporting climate-related progress, including a 30% cut in operational emissions by early 2024, is crucial for stakeholders.

| Environmental Focus Area | 2024/2025 Current Status / Target | Timeline |

|---|---|---|

| Net-Zero Emissions | Achieve across operations and portfolios | 2050 |

| Financed Emissions Reduction | 50% reduction from 2019 levels | By 2030 |

| Green Investments Target | Over €6 billion | By 2030 |

| Proprietary Investments Paris-Aligned | 65% of portfolio | By 2030 |

| Operational Emissions Reduction | 30% cut from 2019 levels (observed) | Early 2024 |

PESTLE Analysis Data Sources

Our PESTLE Analysis is meticulously crafted using data from reputable sources including government reports, international economic organizations, and leading market research firms. Each factor, from emerging technological trends to shifting socio-cultural landscapes, is supported by current and verifiable information.