NN Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NN Group Bundle

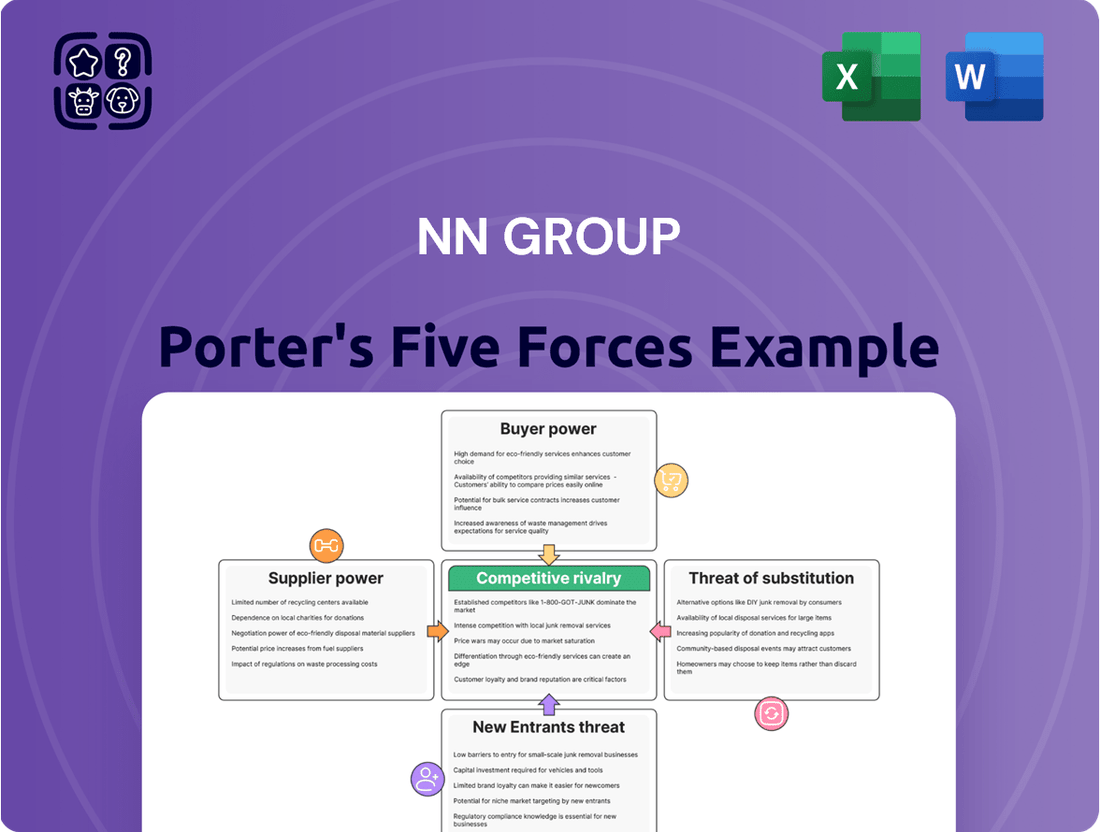

NN Group navigates a dynamic insurance landscape where the threat of new entrants is moderate, thanks to regulatory hurdles and capital requirements.

Buyer power is significant, with customers easily comparing policies and providers, driving a constant need for competitive pricing and superior service.

The bargaining power of suppliers, particularly for IT and specialized actuarial services, presents a notable challenge for NN Group.

Rivalry among existing competitors is intense, fueled by market saturation and a focus on customer retention through innovative products and digital solutions.

The threat of substitutes, such as alternative investment vehicles or self-insurance, requires NN Group to continuously demonstrate the value of its offerings.

The complete report reveals the real forces shaping NN Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Suppliers of specialized financial human capital, such as experienced actuaries, underwriters, and portfolio managers, command significant bargaining power. The highly specialized knowledge required in risk assessment, pricing, and investment management makes these professionals difficult to replace for NN Group. This scarcity gives them leverage in salary and compensation negotiations, directly impacting NN Group's operational costs. For instance, compensation for such roles in the financial sector continues to rise, with top-tier actuaries and portfolio managers seeing compensation packages exceeding 200,000 EUR annually in 2024, reflecting their leverage. This trend puts upward pressure on NN Group's talent acquisition and retention expenses.

Reinsurance companies wield considerable bargaining power over NN Group, providing crucial coverage for high-risk and catastrophic events. The global reinsurance market is highly concentrated, with the top ten reinsurers commanding a significant share, limiting NN Group's choices. This allows reinsurers to dictate terms and pricing, directly influencing NN Group's operational costs and product offerings. For instance, in 2024, property catastrophe reinsurance rates remained firm due to increased claims and capital costs, impacting insurers globally. NN Group's reliance on these few providers means higher reinsurance costs can compress its margins and affect the competitiveness of its insurance products.

NN Group heavily depends on advanced software for policy administration, claims processing, and asset management, alongside crucial data for risk modeling. Key technology and data providers, especially those with proprietary systems or exclusive datasets, wield significant bargaining power. The financial sector's increasing reliance on such digital infrastructure, valued globally at over $300 billion in 2024 for financial software, underscores this. High switching costs associated with changing core IT infrastructure or data providers create long-term dependencies for NN Group, granting these suppliers leverage on pricing. This necessitates careful vendor management to mitigate potential cost escalations and operational disruptions.

Financial Intermediaries and Distribution Channels

NN Group relies on a diverse network of financial intermediaries, including agents, brokers, and banks, for product distribution. Independent financial advisors and large banking partners, with their extensive customer networks, wield significant bargaining power. These channels can influence customer choice and demand favorable commission structures, directly impacting NN Group's distribution costs and profit margins. For instance, in 2024, the landscape for insurance distribution continues to see intermediaries pushing for competitive terms, reflecting their crucial role in reaching diverse customer segments. Their ability to bundle products or offer exclusive access to client bases further strengthens their position.

- NN Group's reliance on third-party channels means these partners can dictate terms.

- Large banking partners, in particular, leverage their broad customer reach.

- Intermediaries influence customer preferences and product visibility.

- Demands for higher commissions directly affect NN Group's profitability and operational costs in 2024.

Asset Managers and Investment Partners

NN Group often engages external asset managers for niche asset classes or specialized strategies, influencing its product offerings. A key development was Goldman Sachs acquiring NN Group's investment management arm in 2021, establishing a significant partnership. The performance and fee structures of these partners directly impact the returns NN Group can deliver to its clients, granting these specialized managers considerable leverage. As of 2024, these relationships remain crucial for NN Group's comprehensive financial solutions.

- NN Group relies on external managers for specific asset classes.

- Goldman Sachs acquired NN Group's investment management arm in 2021, forming a strategic partnership.

- Partner performance and fees directly affect NN Group's client returns.

- Specialized managers hold leverage due to their critical role in NN Group's offerings.

NN Group's extensive regulatory landscape mandates reliance on specialized legal and compliance advisory firms. These firms possess unique expertise in financial regulations, data privacy, and corporate governance, essential for NN Group's operations. The global financial legal services market, valued at over $100 billion in 2024, reflects the high demand and specialized nature of these services. High switching costs and the critical nature of compliance give these providers significant bargaining power over NN Group's operational costs.

| Supplier Type | Bargaining Power Driver | 2024 Impact on NN Group |

|---|---|---|

| Legal & Compliance Firms | Specialized regulatory expertise, high switching costs | Increased operational costs, essential for market access |

| IT Hardware Vendors | Proprietary technology, supply chain reliance | Capital expenditure, infrastructure stability |

| Marketing Agencies | Brand reputation, customer acquisition effectiveness | Marketing spend, market share growth |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to NN Group's insurance and asset management operations.

Effortlessly pinpoint and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces for NN Group.

Customers Bargaining Power

For many standard insurance and investment products, individual customers face relatively low switching costs, especially with the proliferation of online comparison tools in 2024. This empowers customers to readily shop for the best prices and terms, increasing their price sensitivity towards providers like NN Group. To illustrate, a 2024 market analysis indicated that over 60% of individual insurance buyers in key European markets utilize digital platforms to compare offerings, driving intense competition. NN Group must maintain highly competitive pricing and innovative product features to effectively retain its individual client base and mitigate this bargaining power.

Large corporate clients and institutional investors, such as major pension funds, exert substantial bargaining power over NN Group. These entities purchase significant volumes of financial services and possess deep market knowledge, enabling them to negotiate highly favorable terms and fees. For instance, in 2024, the competitive landscape for institutional mandates continues to intensify, often leading to pressure on NN Group's margins within its corporate and institutional segments, as evidenced by ongoing fee compression trends in the European asset management and insurance sectors.

The digital age empowers NN Group's customers with greater price sensitivity due to reduced information asymmetry. Online platforms allow easy comparison of insurance and banking products, increasing customer bargaining power. For instance, in 2024, digital channels continue to be a primary touchpoint for product research, forcing NN Group to maintain competitive pricing and clearly articulate its value proposition against rivals. This transparency demands continuous innovation in product offerings and service delivery from NN Group.

Brand Loyalty and Trust

While price matters, brand reputation and trust are paramount in financial services, particularly for long-term products like life insurance and pensions. Customers exhibit strong loyalty to companies they trust, which significantly mitigates their bargaining power. NN Group’s extensive history and robust brand, consistently recognized among top insurers, helps retain its client base. In 2024, NN Group's strong solvency ratio and consistent dividend policy further reinforce customer confidence and brand stickiness.

- NN Group reported a strong Solvency II ratio of 196% in Q1 2024.

- The company aims for a stable to gradually increasing ordinary dividend per share.

- Customer loyalty in financial services can lead to lower churn rates, impacting profitability.

- Long-term relationships reduce the need for aggressive price competition for existing clients.

Rise of Customer-Centric Models

The financial services industry is rapidly shifting towards customer-centric models, empowering clients who now demand highly personalized advice and solutions. This trend significantly increases the bargaining power of customers, as they expect tailored products rather than generic offerings. For instance, digital channels reported an estimated 65% of financial services interactions in 2024, emphasizing the need for seamless, personalized online experiences. NN Group must continuously innovate its offerings and adapt to these evolving customer expectations to maintain its competitive edge and prevent client churn.

- Customer expectations for personalized services are rising, driving demand for tailored financial products.

- Digitalization in financial services increases customer access to information and switching options.

- NN Group must invest in data analytics to understand individual customer needs and preferences.

- The ability to offer unique, value-added propositions is crucial to retain customers in a competitive market.

Customer bargaining power against NN Group is elevated by accessible online comparison tools, utilized by over 60% of individual buyers in 2024, heightening price sensitivity. Large corporate clients also exert significant influence, negotiating terms that pressure NN Group's margins. While NN Group's strong brand and Q1 2024 Solvency II ratio of 196% foster loyalty, the rising demand for personalized digital services, representing 65% of interactions, further empowers customers.

| Customer Segment | Bargaining Power Driver | 2024 Impact on NN Group |

|---|---|---|

| Individual Customers | Online Comparison Tools | Over 60% use digital platforms, increasing price sensitivity. |

| Corporate/Institutional | Volume & Market Knowledge | Intensified competition, margin pressure in institutional segments. |

| All Customers | Digitalization & Personalization | 65% digital interactions, demanding tailored products and services. |

Preview the Actual Deliverable

NN Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. Our comprehensive Porter's Five Forces analysis of NN Group meticulously details the competitive landscape, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within the insurance sector. This in-depth report provides actionable insights for strategic decision-making.

Rivalry Among Competitors

The Dutch insurance market, a key segment for NN Group, is characterized by high concentration, particularly in life insurance. Major players like NN Group, Aegon, ASR, and Allianz command significant market share, intensifying competitive rivalry. This structure necessitates aggressive strategies to maintain or gain market position among these established entities. For instance, NN Group reported a strong capital position in early 2024, reflecting the robust financial standing required to compete effectively in this concentrated environment. The limited number of large insurers leads to fierce competition for customer acquisition and retention.

NN Group operates predominantly in mature European and Japanese markets, intensifying competitive rivalry. The Dutch life insurance sector, for instance, has seen continuous contraction, with new premium income for Dutch life insurers declining by approximately 4% in 2023, following a similar trend in previous years. This market saturation, coupled with a highly competitive non-life segment, forces insurers to aggressively vie for a finite customer base. Such conditions exert significant downward pressure on NN Group's growth prospects and overall profitability margins. Fierce competition necessitates innovation in product offerings and efficient cost management to maintain market share.

While some product differentiation exists through features and service quality, many core insurance and asset management offerings are inherently similar across the industry. This makes achieving a sustainable competitive edge solely based on product difficult for NN Group. Consequently, the company must intensely compete on its brand reputation, superior customer service, and operational efficiency. For example, NN Group's 2024 strategic focus on digital transformation aims to enhance customer experience, recognizing service as a key differentiator. Maintaining a strong solvency position, which was robust in Q1 2024, also underscores their efficiency and stability in a competitive landscape.

Regulatory Environment

The insurance sector, including NN Group, operates within a stringent regulatory landscape, notably the Solvency II framework, which mandates substantial capital reserves and compliance outlays. While this regulatory burden often deters new entrants, it simultaneously intensifies rivalry among established insurers. Companies like NN Group must continuously optimize their operations and capital deployment to maintain competitiveness. This focus on efficiency is crucial given the ongoing supervisory scrutiny and evolving regulatory demands in 2024.

- NN Group reported a strong Solvency II ratio of 197% as of Q1 2024, demonstrating robust capital management.

- The European Insurance and Occupational Pensions Authority (EIOPA) continues to refine Solvency II guidelines, impacting compliance strategies.

- Regulatory compliance costs for large European insurers are estimated to be significant, influencing operational efficiency.

- Increased transparency requirements under Solvency II drive greater competition on pricing and product offerings among incumbents.

Price Competition

Given the similarities across insurance products, customers are highly price-sensitive, making price competition a significant factor for NN Group. The rise of online aggregators, like Independer in the Netherlands, has further intensified this price-based rivalry by enabling easy comparison. In 2024, NN Group must meticulously manage its cost structure to remain competitive on price while sustaining profitability amidst tight margins. This focus is crucial as the market demands value, reflected in their 2024 cost-income ratio targets.

- NN Group’s 2024 cost-income ratio is targeted for efficiency.

- Online aggregators drive transparent pricing comparisons.

- Customer acquisition costs remain a key competitive metric.

- Product standardization increases price elasticity of demand.

NN Group faces intense rivalry in concentrated, mature European and Japanese markets, where major players aggressively compete for a finite customer base. Limited product differentiation forces competition on brand reputation, customer service, and operational efficiency, highlighted by NN Group's 2024 digital transformation efforts. Stringent regulations like Solvency II, alongside high price sensitivity driven by online aggregators, compel a focus on cost management and robust capital.

| Metric | 2023 Data | 2024 Data (Q1) |

|---|---|---|

| NN Group Solvency II Ratio | 196% | 197% |

| Dutch Life Insurance New Premium Income Change | -4% | N/A |

| NN Group Cost-Income Ratio Target | N/A | Efficiency focus |

SSubstitutes Threaten

The growth of robo-advisors presents a significant substitute for NN Group's traditional asset management services. These digital platforms offer automated, low-cost investment solutions, appealing to a broad and expanding segment of the market. Globally, the AUM in the robo-advisor segment is projected to reach US$2.28 trillion in 2024, indicating a substantial shift in client preferences. This trend, particularly among younger investors, could erode NN Group's customer base for conventional advisory offerings. The projected 13.91% CAGR for robo-advisors through 2028 further highlights this evolving competitive landscape.

Peer-to-peer (P2P) insurance models are emerging as a substitute for traditional offerings like those from NN Group. These innovative models, where groups pool premiums, promise lower costs and enhanced transparency, directly challenging conventional insurers. While still a niche market, with global P2P insurance gross written premiums estimated at a small fraction of the total market in 2024, their potential for long-term disruption is notable. Their appeal lies in direct community engagement and a perceived fairness, posing a gradual, yet significant, competitive pressure.

Bank savings products pose a significant threat to NN Group's savings-oriented life insurance and pension offerings. Changes in tax regulations, like the Dutch Bank Savings Act of 2008, historically made bank savings more attractive, directly impacting demand for some insurance products. This competition remains relevant, with Dutch households holding over €450 billion in savings accounts as of early 2024, reflecting a strong preference for liquidity. NN Group must continuously innovate to differentiate its long-term savings solutions against these accessible banking alternatives.

Self-Insurance and Alternative Risk Transfer

Large corporations increasingly opt for self-insurance or alternative risk transfer mechanisms over traditional policies, especially for predictable, high-frequency, low-severity risks. This trend significantly reduces the addressable market for NN Group's corporate insurance products. As of 2024, the global captive insurance market, a key ART mechanism, continued to expand, reflecting this shift. This directly impacts NN Group's potential premium income from large enterprise clients.

- Captive insurance growth reduces demand for commercial policies.

- Corporate clients seek more cost-efficient risk retention strategies.

- Predictable risks are increasingly managed internally.

- NN Group faces pressure on corporate insurance market share.

Direct Investment by Individuals

The increasing accessibility of online trading platforms allows individuals to bypass traditional asset managers and invest directly in stocks, bonds, and other securities. This trend towards do-it-yourself investing directly substitutes NN Group's asset management services. The availability of financial information and research online further facilitates this shift, with platforms like DeGiro seeing continued growth in retail accounts.

- By Q1 2024, online brokerage platforms continued to attract new retail investors, with many offering commission-free trading.

- Globally, the DIY investment trend saw a significant boost, with millions of new individual brokerage accounts opened in 2023.

- The market for robo-advisory services, a low-cost alternative, is projected to reach substantial assets under management in 2024.

- NN Group faces pressure as individual investors increasingly manage their own portfolios, impacting potential asset inflows.

The threat of substitutes for NN Group stems from diverse alternatives, including the rapid growth of digital investment platforms like robo-advisors and online trading, which enable direct or low-cost automated investing. Corporations increasingly adopt self-insurance and alternative risk transfer mechanisms, impacting demand for traditional corporate policies. Bank savings products remain a significant substitute for long-term savings, reflecting a preference for liquidity. Emerging peer-to-peer insurance models also present a novel, cost-effective alternative.

| Substitute Category | 2024 Market Impact | NN Group Impact |

|---|---|---|

| Digital Investment Platforms | Robo-advisor AUM projected US$2.28 trillion | Pressure on asset management inflows |

| Corporate Self-Insurance | Captive insurance market expansion | Reduced demand for corporate policies |

| Bank Savings | Dutch households €450+ billion in savings | Competition for long-term savings products |

Entrants Threaten

The insurance industry requires significant capital, mandated by regulations such as Solvency II, ensuring firms can meet policyholder obligations. These substantial capital needs, exemplified by NN Group's robust Solvency II ratio of 204% as of December 31, 2023, create a formidable barrier. This high entry cost deters new companies, safeguarding established players like NN Group from a rapid influx of competitors. New entrants in 2024 still face these stringent financial hurdles, limiting market disruption.

New entrants into the European insurance and financial services sector, where NN Group operates, face incredibly complex and stringent regulatory and licensing hurdles. Obtaining necessary approvals from authorities like the European Central Bank (ECB) or national supervisors such as DNB (De Nederlandsche Bank) is a time-consuming process, often taking multiple years for full authorization. These extensive regulatory barriers, including strict Solvency II capital requirements, effectively protect incumbent firms and maintain stability within the established market. For instance, achieving compliance with the comprehensive 2024 regulatory frameworks demands significant upfront investment and specialized expertise, deterring many potential new players.

Insurance thrives on trust, and NN Group, with its extensive history, boasts robust brand recognition and a solid reputation across its markets. New entrants face substantial hurdles and high costs in cultivating comparable levels of customer trust and loyalty, a process that can take decades. This established credibility, evident in NN Group serving approximately 18 million clients as of early 2024, provides a significant barrier, making it challenging for newcomers to attract and retain a substantial customer base. Consequently, NN Group maintains a competitive edge in customer acquisition and retention.

Economies of Scale

Economies of scale present a formidable barrier for new entrants in the insurance and asset management sectors. Larger players like NN Group benefit significantly by spreading their substantial fixed costs, such as technology, regulatory compliance, and marketing, across a vast customer base. This enables NN Group to achieve lower average costs per policy or asset under management, making it exceptionally difficult for smaller, newer companies to compete on price or operational efficiency. For instance, NN Group reported a net result of EUR 584 million in Q1 2024, demonstrating its scale.

- NN Group's assets under management (AuM) stood at EUR 301 billion as of Q1 2024.

- Large-scale IT infrastructure and robust compliance frameworks are costly for new entrants.

- Customer acquisition costs are lower for established firms due to brand recognition and cross-selling.

- Regulatory capital requirements disproportionately impact smaller, less diversified firms.

Access to Distribution Channels

New entrants into the insurance market, like those potentially challenging NN Group, face significant barriers regarding access to distribution channels. Established insurers possess extensive networks of agents, brokers, and banking partners, which are crucial for reaching customers and generating premiums.

Gaining access to these well-entrenched channels is a major hurdle, as building a comparable distribution network from scratch requires substantial investment and time. For instance, NN Group benefits from its long-standing relationships and broad reach across its markets, including the Netherlands and Belgium, making it difficult for newcomers to compete effectively on distribution alone. This lack of access severely impedes market entry for potential challengers.

- NN Group’s distribution includes over 1,700 tied agents and more than 10,000 independent brokers as of early 2024.

- Digital channels, while growing, still represent a smaller share of new policy sales compared to traditional networks for many established insurers.

- The cost of acquiring a new customer through proprietary digital channels can exceed that of leveraging existing broker networks in certain segments.

- Regulatory requirements often necessitate extensive licensing and compliance for distribution, further complicating entry for new players.

New entrants face high barriers in the insurance sector due to substantial capital demands and stringent 2024 regulations, protecting incumbents like NN Group. The company's established brand, serving 18 million clients, coupled with vast distribution networks and significant economies of scale, further deters competition. These factors collectively ensure a low threat from new players.

| Barrier | NN Group Metric (2024) | Impact |

|---|---|---|

| Capital | Solvency II ratio 204% (Dec 2023) | High entry cost |

| Customers | 18 million clients | Trust, loyalty |

| Distribution | 1,700+ tied agents | Extensive reach |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages a comprehensive suite of data, including company financial statements, market research reports from firms like Gartner and Forrester, and competitor public disclosures to provide a robust assessment of industry competitive intensity.