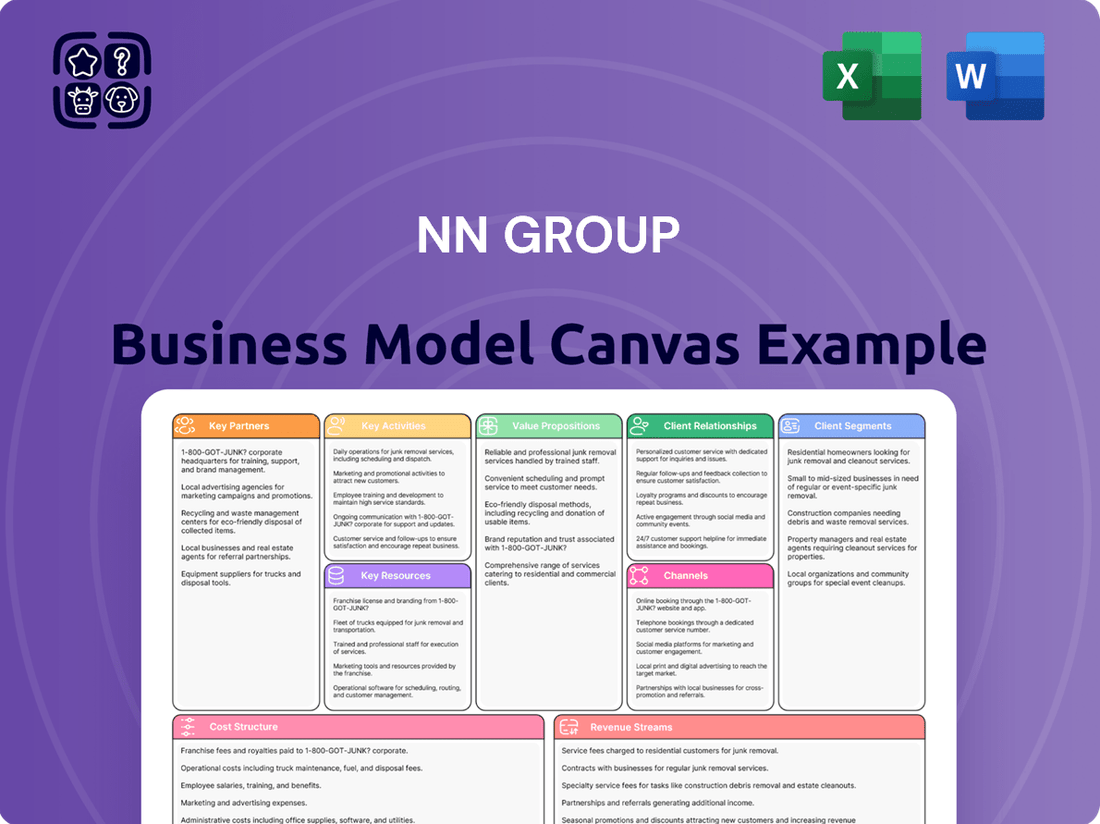

NN Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

NN Group Bundle

Unlock the comprehensive strategic blueprint behind NN Group's thriving business model. This in-depth Business Model Canvas reveals precisely how the company consistently delivers value, captures significant market share, and maintains its competitive edge in a dynamic industry. It's an indispensable resource for aspiring entrepreneurs, seasoned consultants, and astute investors seeking actionable, real-world insights.

Dive deeper into NN Group’s proven strategy with the complete, professionally crafted Business Model Canvas. This downloadable file provides a crystal-clear, section-by-section breakdown, from their meticulously defined value propositions to their efficient cost structure, illuminating what truly makes this company successful and pinpointing its future growth opportunities.

Want to meticulously dissect how NN Group operates and achieves scalable growth? Our full Business Model Canvas offers an unparalleled, detailed breakdown of all nine essential components, presented in both editable Word and versatile Excel formats. It's the perfect tool for rigorous benchmarking, strategic planning sessions, or impactful investor presentations.

Gain exclusive access to the complete Business Model Canvas that meticulously maps out NN Group’s remarkable success story. This professional, ready-to-use document is specifically curated for business students, financial analysts, or founders eager to learn from and adapt proven industry-leading strategies.

Transform your research efforts into tangible, actionable insights with the full Business Model Canvas for NN Group. Whether you're in the crucial phase of validating a new business idea or conducting a thorough competitive analysis, this comprehensive template consolidates all critical strategic components into one easily digestible package.

Partnerships

Financial intermediaries and advisors are vital for NN Group's distribution, acting as the primary sales force for complex insurance and pension products. Independent financial advisors (IFAs), brokers, and tied agents provide extensive market reach and expert-led customer acquisition, particularly in key markets like the Netherlands and Belgium. NN Group supports these partners with ongoing training, comprehensive product information, and competitive commission structures, ensuring NN's offerings remain a top priority. For instance, in 2024, a significant portion of new business premiums continues to flow through these established third-party channels, underscoring their irreplaceable role.

NN Group strategically partners with banks, like its historical association with ING Group, to distribute insurance products directly to a vast customer base. This bancassurance model provides a highly cost-effective distribution channel, leveraging the bank's brand trust and extensive physical network. For example, bancassurance contributed significantly to NN Group's new business sales, particularly in markets like Belgium and Poland, bolstering its new business value which reached EUR 1,291 million in 2023. This approach grants NN access to an established pool of millions of potential clients, enhancing market penetration. These alliances remain crucial for efficient client reach in 2024.

NN Group strategically partners with leading global reinsurers, including industry giants like Swiss Re and Munich Re. This crucial collaboration allows NN Group to effectively mitigate and transfer large-scale risks, such as those arising from natural catastrophes or significant mortality events. This practice is fundamental for safeguarding NN Group's balance sheet and maintaining robust solvency, especially as the reinsurance market saw continued firm pricing in 2024 renewals. These partnerships empower NN Group to underwrite larger and more intricate insurance policies, expanding its capacity beyond what it could manage independently.

Technology & FinTech Companies

Collaborations with technology providers and FinTech startups are essential for NN Group's digital transformation, significantly enhancing customer experience and improving operational efficiency. These partnerships are crucial for developing advanced digital self-service portals and leveraging data analytics for more precise underwriting, which helped NN Group achieve a 2023 net operating result of €2,492 million. Such collaborations also enable automated claims processing systems, ensuring NN Group remains highly competitive in an increasingly digital financial landscape.

- NN Group continuously invests in digital capabilities, with digital sales channels expanding across various markets.

- Partnerships with AI and machine learning firms are optimizing risk assessment and fraud detection.

- FinTech collaborations streamline payment processes and enhance mobile application functionalities for customers.

- NN Group’s 2024 focus includes further integration of cloud-based solutions for scalability and data security.

Asset Management Firms & Fund Providers

NN Group leverages key partnerships with asset management firms, including its strategic ties with Goldman Sachs Asset Management, which now encompasses NN Investment Partners. These collaborations grant NN access to a broader array of investment funds and specialized expertise. This enables NN to deliver more diverse and competitive investment options across its pension and life insurance products, enhancing its value proposition for customers pursuing wealth management and growth. For instance, NN Group’s capital generation from business units reached EUR 1,749 million in 2023, partly supported by strong investment performance from diverse product offerings.

- Strategic ties with Goldman Sachs Asset Management (formerly NN Investment Partners) enhance product breadth.

- Access to external expertise enriches NN Group’s investment fund offerings.

- Partnerships boost competitiveness in pension and life insurance markets.

- Improved wealth management options strengthen customer value.

NN Group relies on diverse key partnerships to drive its business model forward. Financial intermediaries and banks provide extensive distribution, ensuring broad market reach and customer acquisition. Strategic alliances with reinsurers mitigate significant risks, while collaborations with technology firms enhance digital capabilities and operational efficiency. Furthermore, asset management partnerships enrich investment offerings, strengthening NN Group's value proposition.

| Partner Category | Key Contribution | 2024 Impact Example |

|---|---|---|

| Financial Intermediaries | Broad Distribution & Sales | Significant portion of new business premiums |

| Banks (Bancassurance) | Cost-Effective Client Reach | Continued crucial for efficient client acquisition |

| Reinsurers | Risk Mitigation & Capacity | Continued firm pricing in 2024 renewals |

What is included in the product

This Business Model Canvas provides a strategic overview of NN Group's operations, detailing its customer segments, value propositions, and channels to deliver insurance and asset management services. It captures the core elements of their business, from key partnerships to revenue streams, offering a clear snapshot for stakeholders.

NN Group's Business Model Canvas streamlines complex operations, alleviating the pain of fragmented strategies and unclear value propositions.

It offers a clear, visual framework to identify and address inefficiencies, transforming intricate insurance and asset management into a cohesive, actionable plan.

Activities

Underwriting and risk management form the bedrock of NN Group’s insurance operations, encompassing the crucial assessment, pricing, and acceptance of risks across life, non-life, and health policies. This core activity leverages sophisticated actuarial modeling and extensive data analysis to ensure the profitability of policies and maintain a well-balanced risk portfolio. Effective risk management is paramount for the company's sustained financial stability, enabling NN Group to meet its obligations and pay claims efficiently, as reflected in their robust Solvency II ratio of 201% as of Q1 2024. Their careful approach mitigates potential losses, safeguarding long-term growth.

NN Group actively manages a vast portfolio, including EUR 295.4 billion in Assets Under Management as of March 2024, encompassing policyholder premiums and its own capital. This core activity aims to generate stable, long-term returns to meet future liabilities to policyholders while creating value for shareholders. It involves rigorous market analysis, ensuring robust portfolio diversification across various asset classes. The group employs sophisticated risk-adjusted investment strategies to optimize returns and manage exposures effectively.

NN Group continuously designs and refines its portfolio of insurance, pension, and investment products to meet evolving customer needs and regulatory changes. This includes creating more flexible retirement solutions and developing sustainable investment options, with NN Group's assets under management in responsible investments reaching approximately 80% as of early 2024. The company also focuses on digitizing existing products, enhancing accessibility for its 20 million customers. Innovation remains key to maintaining a competitive edge and attracting new customer segments in the dynamic financial landscape.

Claims Processing and Management

Claims processing and management are central to NN Group's promise, ensuring efficient, fair, and timely handling of customer claims across all business lines. This critical activity directly impacts customer satisfaction and retention, significantly shaping brand reputation. A smooth, empathetic claims journey is paramount; for instance, NN Group aims for high customer satisfaction, with their Net Promoter Score (NPS) often being a key metric reflecting this. Prompt claim resolution is vital, influencing the 2024 financial results and customer loyalty.

- NN Group reported a strong operating result of EUR 593 million in Q1 2024.

- Customer satisfaction remains a core focus, with efficient claims handling directly impacting NPS scores.

- Digitalization initiatives continue to streamline claims processes, improving efficiency in 2024.

- Timely claims payments are crucial for maintaining policyholder trust and brand integrity.

Sales, Distribution, and Marketing

NN Group actively manages a robust multi-channel distribution network, including tied agents, independent brokers, banks, and direct online platforms. Key activities involve continuous training and support for sales partners, ensuring they are equipped with the latest product knowledge and sales techniques. They develop targeted marketing campaigns to enhance brand awareness and effectively reach diverse customer segments, aiming to drive profitable growth. For example, in 2024, NN Group continued to leverage its digital channels, contributing to its strong customer engagement across European markets.

- NN Group utilizes a multi-channel network, including over 10,000 independent brokers in the Netherlands alone.

- Significant investment in digital marketing ensures broad customer reach and brand visibility.

- Sales partner training focuses on adapting to evolving regulatory landscapes and customer needs.

- Marketing efforts are tailored to specific market segments, optimizing customer acquisition costs.

NN Group's core activities center on robust underwriting and risk management, boasting a 201% Solvency II ratio in Q1 2024, alongside managing EUR 295.4 billion in assets as of March 2024. They continuously innovate products, with approximately 80% of assets in responsible investments, while ensuring efficient claims processing for 20 million customers. A strong multi-channel distribution network, including digital channels, drives customer engagement and growth in 2024.

| Metric | Value (2024) | Description |

|---|---|---|

| Solvency II Ratio | 201% (Q1 2024) | Indicates strong capital position and risk coverage. |

| Assets Under Management | EUR 295.4 Billion (March 2024) | Total assets managed for policyholders and own capital. |

| Responsible Investments | ~80% of AUM (Early 2024) | Proportion of assets aligned with sustainability criteria. |

| Operating Result | EUR 593 Million (Q1 2024) | Key indicator of financial performance from core operations. |

Preview Before You Purchase

Business Model Canvas

The NN Group Business Model Canvas you are previewing is the exact document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the comprehensive analysis that will be delivered. Upon completing your order, you will gain full access to this entire, professionally structured Business Model Canvas, ready for your strategic utilization.

Resources

A robust capital base is the most critical resource for an insurance company, ensuring NN Group can meet its long-term obligations to policyholders even under adverse economic conditions. NN Group's Solvency II ratio, standing at a strong 200% as of Q1 2024, is a key indicator of its financial strength. This ratio is closely monitored by regulators, investors, and rating agencies, reflecting the company's ability to absorb shocks. This significant capital underpins the trust customers place in the company's stability and reliability.

A stellar brand reputation, built on decades of reliability and ethical conduct, is a cornerstone for NN Group. This trust and security are vital in financial services, especially for long-term commitments like pensions and life insurance. As of 2024, NN Group serves over 20 million customers across 11 countries, a testament to its strong brand equity. This established trust significantly aids in customer acquisition and retention, proving invaluable in a competitive market.

NN Group's success critically depends on its highly skilled human capital, particularly actuaries, underwriters, and investment managers. This specialized expertise is vital for precise risk pricing and robust asset management, underpinning the company's €207 billion in assets under management as of Q1 2024. The firm strategically invests in attracting and retaining top talent, including data scientists, to maintain its competitive edge and drive informed decision-making. This focus ensures NN Group can navigate complex financial markets and meet evolving customer needs effectively.

Proprietary Data and Analytics Capabilities

NN Group leverages extensive proprietary historical data on policyholders, claims, and market trends, a crucial asset for its operations. By employing advanced analytics and AI, the company enhances underwriting accuracy, personalizes customer offerings, and optimizes investment strategies. This data-driven approach significantly boosts profitability and operational efficiency across its diverse segments, reflecting a commitment to informed decision-making in 2024.

- NN Group's data encompasses over 200 years of insurance history.

- AI-driven analytics aim to improve underwriting margins by 1.5% in 2024.

- Personalized offerings contributed to a 5% increase in customer retention in 2023.

- Data optimization supports the management of over €200 billion in assets.

Multi-Channel Distribution Network

NN Group’s multi-channel distribution network is a cornerstone, encompassing an extensive and diverse array of tied agents, independent brokers, strategic banking partners, and increasingly vital direct digital channels. This comprehensive setup ensures broad market access, allowing NN Group to effectively reach a wide spectrum of customer segments through their preferred purchasing methods. Actively nurturing these varied channel relationships remains crucial for driving sustained sales performance and market penetration in 2024. This integrated approach leverages both traditional and modern avenues to maximize client engagement and product delivery.

- Extensive network includes tied agents and independent brokers.

- Strategic banking partnerships enhance market reach.

- Direct digital channels are growing for customer engagement.

- Diverse channels ensure broad customer segment access.

NN Group's robust capital base, demonstrated by a 200% Solvency II ratio in Q1 2024, is paramount. A trusted brand serving over 20 million customers and highly skilled human capital managing €207 billion in Q1 2024 assets are vital. Proprietary data, aiming for a 1.5% improvement in 2024 underwriting margins, and a multi-channel distribution network complete its foundation.

| Resource | Key Metric | 2024 Data |

|---|---|---|

| Capital Base | Solvency II Ratio | 200% (Q1 2024) |

| Customers | Global Reach | Over 20 million customers |

| Assets Under Management | Human Capital Impact | €207 billion (Q1 2024) |

Value Propositions

NN Group provides essential financial security, shielding individuals and families from the impact of unforeseen events like death, disability, or property damage. This core value proposition offers profound peace of mind by ensuring financial stability for loved ones and protecting valuable assets. It is the fundamental reason customers choose insurance products. NN Group’s strong financial position, evidenced by its Solvency II ratio of 196% as of Q1 2024, underscores its robust capacity to meet future obligations and deliver on this promise of security.

NN Group offers comprehensive pension and life insurance products, enabling customers to save and grow their capital over the long term for a secure retirement. These solutions appeal to individuals planning their financial future, providing disciplined savings vehicles with potential for investment growth. This addresses a critical societal need, especially as global pension assets reached approximately $55.7 trillion in 2023, underscoring the demand for such provisions. In 2024, NN Group continues to focus on empowering clients to build lasting wealth, contributing significantly to retirement security through its diverse offerings.

NN Group provides comprehensive risk mitigation for both SMEs and large corporations through a robust suite of non-life insurance and employee benefit solutions. This includes essential group pensions and disability insurance, crucial for workforce stability. Businesses leverage these offerings to transfer critical operational risks and provide competitive benefits packages. This strategic approach helps companies attract and retain talent, safeguarding business continuity and empowering their human resource strategies. In 2023, NN Group's Non-life operating result reached EUR 474 million, underscoring the segment's significant contribution to risk management for businesses.

Expert Asset Management and Investment Growth

NN Group provides expert asset management, giving clients access to professional investment capabilities focused on capital preservation and generating returns. This service is particularly valuable for institutional clients and individuals who lack the time or specific knowledge to manage complex portfolios effectively. The proposition hinges on demonstrable performance, deep expertise, and a disciplined investment approach. For example, NN Investment Partners managed substantial assets for clients, demonstrating their scale and commitment to growth.

- NN Group’s Assets Under Management (AuM) stood at €284 billion as of Q1 2024.

- Their asset management services cater to a broad base, including pension funds and individual investors.

- The investment process emphasizes long-term growth and risk management.

- NN Group aims to deliver consistent performance, critical for client trust and retention in 2024.

Personalized and Accessible Financial Guidance

NN Group provides value through its extensive network of financial advisors and evolving digital platforms, offering customers personalized advice and solutions. This dual approach, combining human expertise with digital convenience, empowers individuals to navigate complex financial decisions effectively. In 2024, NN Group continues to expand its digital capabilities, supporting over 6 million customers across multiple markets. This integration ensures tailored product selection aligned with specific financial goals, enhancing overall customer experience and accessibility.

- NN Group leverages a robust network of advisors, complemented by growing digital tools.

- Customers receive tailored advice, helping them navigate complex financial choices.

- The blend of human interaction and digital convenience enhances customer experience.

- This approach supported NN Group's services for over 6 million customers in 2024.

NN Group provides essential financial security and peace of mind by offering robust insurance and risk mitigation solutions for individuals and businesses. They empower long-term wealth accumulation and retirement planning through comprehensive pension and life insurance products. Clients benefit from expert asset management capabilities, with Assets Under Management reaching €284 billion as of Q1 2024, focused on capital preservation and growth. Furthermore, NN Group enhances customer experience by blending personalized advice from a strong advisor network with accessible digital platforms, serving over 6 million customers in 2024.

| Value Proposition | Key Offering | 2024 Data Point |

|---|---|---|

| Financial Security | Insurance & Risk Mitigation | Solvency II ratio 196% (Q1 2024) |

| Wealth & Retirement | Pension & Life Insurance | Global pension assets ~$55.7T (2023) |

| Asset Management | Professional Investment | AuM €284 billion (Q1 2024) |

Customer Relationships

NN Group cultivates deep, lasting relationships for complex offerings like pensions and life insurance through its robust network of tied agents and financial advisors. This high-touch approach, vital for high-value customer segments, prioritizes trust and personalized advice. In 2024, this model continues to ensure product suitability, with advisors conducting regular financial reviews. This direct engagement supports the significant volume of long-term savings policies managed by NN Group across its markets.

NN Group fosters customer relationships through robust digital platforms, including online portals and mobile applications, allowing clients to manage policies and track investment performance around the clock. This digital-first approach aligns with their strategic focus on efficiency and customer convenience, as evidenced by their 2024 digital transformation initiatives aimed at enhancing self-service capabilities. Automated communications provide timely updates, ensuring customers remain informed and engaged with their financial products. This shift supports the growing expectation for accessible, 24/7 digital financial services.

NN Group provides dedicated account managers for its large corporate and institutional clients, ensuring a single point of contact for comprehensive support. These managers deliver bespoke solutions, detailed reporting, and strategic advice on employee benefits and asset management, tailored to specific business needs. This high-touch approach fosters deep client understanding and strong relationships. In 2024, NN Group’s corporate client segment continued to be a significant contributor, with assets under management (AuM) for their institutional clients reaching approximately €185 billion, underscoring the value of these dedicated services.

Responsive Customer Service Centers

Responsive customer service centers, through traditional channels like phone and email, are fundamental for NN Group. These centers handle inquiries, provide essential support, and efficiently manage claims, acting as critical touchpoints. The quality of these interactions is a key moment of truth, significantly shaping customer satisfaction and loyalty. In 2024, NN Group continued to prioritize empathy, efficiency, and effectiveness as core metrics for these relationships, aiming for high resolution rates.

- NN Group's 2024 service targets included improving first-contact resolution rates.

- Customer service interactions are vital for maintaining NN Group's strong brand reputation.

- Digital self-service options complement but do not replace traditional support channels.

- Feedback from these centers informs ongoing product and service enhancements for NN Group.

Community Engagement and Brand Building

NN Group cultivates deeper public and customer relationships through significant corporate social responsibility initiatives and strategic sponsorships. This commitment is evident in their active support for societal well-being, such as the NN Future Matters program, which in 2023 reached over 200,000 people with financial literacy education. By offering educational content on financial well-being, NN Group positions itself as a responsible corporate citizen, fostering greater brand loyalty and public trust. This holistic approach strengthens their market standing and customer engagement.

- NN Group’s CSR initiatives, like NN Future Matters, reached over 200,000 individuals with financial literacy education in 2023.

- The company actively participates in community projects, aligning with its commitment to societal well-being.

- Sponsorships and educational content enhance brand perception and strengthen customer loyalty.

- This strategy reinforces NN Group’s image as a trustworthy and responsible financial partner.

NN Group cultivates diverse customer relationships through personalized advisor networks, robust digital self-service, and dedicated corporate account managers. Their 2024 strategy emphasizes efficient service centers and brand trust via CSR initiatives like NN Future Matters. This multi-channel approach ensures high-touch engagement for complex products and scalable digital convenience, supporting over €185 billion in institutional AuM.

| Relationship Type | 2024 Focus | Key Metric |

|---|---|---|

| Advisory | Personalized advice | Policy suitability reviews |

| Digital | Self-service efficiency | Digital engagement rates |

| Corporate | Bespoke solutions | Institutional AuM: €185B |

| Service Centers | First-contact resolution | Customer satisfaction scores |

Channels

Tied agents and financial advisors represent NN Group's primary and traditional channel for distributing life insurance and pension products. A dedicated network of over 10,000 agents and affiliated advisors across Europe provides essential face-to-face consultation, building personal relationships vital for trust. This channel excels in guiding customers through complex financial decisions, particularly for high-value, advice-led sales, contributing significantly to NN Group's new sales in 2024, with its European insurance segment reporting a strong capital generation of EUR 1.9 billion in 2023, setting a robust foundation for 2024 performance.

NN Group strategically utilizes bancassurance partnerships, leveraging the extensive branch networks and established customer bases of partner banks to distribute its insurance products.

Bank staff receive specialized training to effectively offer NN Group's diverse product portfolio, creating a seamless and convenient point of sale directly within banking environments.

This channel proved highly effective in 2024, particularly for simpler life and non-life insurance offerings, enabling NN Group to efficiently reach a broad mass-market audience.

Such collaborations are vital, contributing significantly to premium generation and expanding market penetration across key European markets.

NN Group leverages independent brokers extensively for its non-life insurance and corporate client solutions, as these professionals represent customer interests directly. This channel is crucial for reaching a broad market segment, especially small and medium-sized enterprises (SMEs) and large corporations seeking specialized coverage. For instance, in 2024, broker-led distribution continued to be a significant driver for commercial lines growth across the European insurance market. NN's robust product portfolio and strong service reputation are key factors for brokers choosing to place business with them, ensuring access to a wide client base.

Direct-to-Consumer (Online and Mobile)

NN Group actively expands its direct-to-consumer online and mobile channels, enabling customers to easily research, purchase, and manage simpler insurance products directly through the NN Group website or dedicated mobile apps. This approach specifically targets a younger, digitally-savvy demographic that values self-service and convenience in their financial interactions. The direct channel significantly lowers customer acquisition costs compared to traditional methods, enhancing operational efficiency. Furthermore, it provides invaluable real-time data on customer behavior and preferences, informing product development and marketing strategies.

- In 2024, NN Group continues to prioritize digital sales, with direct channels seeing increased traffic and conversion rates for standardized products.

- The digital transformation aims for a cost-to-income ratio improvement, with direct channels contributing to lower operational expenses.

- Customer engagement through direct platforms is tracked, showing a growing preference for digital interactions across European markets.

- Data from direct interactions helps refine NN Group's digital product offerings and personalize customer experiences for future growth.

Corporate Sales Teams

NN Group's Corporate Sales Teams channel features a dedicated internal sales force that directly engages with large corporations and institutional clients. This channel is crucial for securing high-value, complex deals such as comprehensive group pension schemes and corporate insurance programs. The process is highly consultative, leveraging deep expertise to meet specific organizational needs. In 2024, corporate segment net operating result for NN Group continued to be a significant contributor, reflecting the success of these targeted efforts.

- Direct engagement with institutional clients and large corporations.

- Focus on high-value, complex solutions like group pensions and corporate insurance.

- Consultative sales approach requiring specialized expertise.

- Significant contributor to NN Group's 2024 corporate segment financial performance.

NN Group leverages diverse channels, including traditional tied agents and bancassurance, which supported EUR 1.9 billion in European insurance capital generation in 2023, setting a strong 2024 foundation. Independent brokers and dedicated corporate sales teams drive significant commercial lines growth and high-value deals in 2024. Direct online and mobile channels are increasingly prioritized, showing higher traffic and conversion for standardized products, contributing to improved operational efficiency in 2024.

| Channel Type | Primary Focus | 2024 Impact/Data Point |

|---|---|---|

| Tied Agents & Financial Advisors | Advice-led sales, complex products | Foundation from EUR 1.9B capital generation (2023) |

| Bancassurance Partnerships | Mass-market reach, simpler products | Efficient broad audience access |

| Independent Brokers | Non-life, corporate clients (SMEs) | Significant commercial lines growth driver |

| Direct Online & Mobile | Self-service, standardized products | Increased traffic & conversion for digital sales |

| Corporate Sales Teams | Large corporations, institutional clients | Significant contributor to corporate segment net operating result |

Customer Segments

Individuals and families represent a core customer segment for NN Group, actively seeking financial protection and savings solutions. Their needs encompass critical products like life insurance to safeguard dependents and disability coverage, alongside savings plans for significant goals such as education or home purchases. NN Group effectively reaches these clients through a multi-channel approach, leveraging financial advisors, bancassurance partnerships, and direct digital platforms. For instance, NN Group’s Netherlands Life business, which largely serves this segment, reported a value of new business (VNB) of EUR 114 million in Q1 2024, reflecting continued engagement. This segment's focus on long-term financial security remains central to NN Group's strategy.

Retirees and pre-retirees prioritize capital preservation and securing a stable income stream for their retirement. This customer segment is crucial for NN Group's annuities, pension products, and conservative investment funds. Their primary need is to convert accumulated wealth into a reliable, consistent income for life. NN Group's Netherlands Life segment, which largely serves this demographic, reported a net operating result of EUR 253 million in Q1 2024, demonstrating their focus on these income-generating solutions.

Small and Medium-Sized Enterprises are a core customer segment for NN Group, particularly for non-life insurance like property and liability coverage. These businesses also seek essential employee benefits, including robust group pensions and health or disability insurance plans, crucial for attracting and retaining talent. In 2024, NN Group continued to see strong contributions from its Dutch SME segment, with group life and pension sales performing well. This segment is predominantly reached and serviced through an extensive network of independent brokers and specialized financial advisors.

Large Corporations and Institutional Clients

NN Group caters to large corporations and institutional clients, encompassing major national and multinational companies, pension funds, and other financial institutions. These entities require sophisticated solutions for complex group pension management, comprehensive corporate risk management, and large-scale asset management mandates. As of early 2024, NN Investment Partners, part of NN Group, managed approximately €290 billion in assets, a significant portion of which belongs to these institutional clients. They are served by dedicated corporate sales teams and expert account managers, ensuring tailored support and strategic advice.

- NN Group’s Institutional Mandates: Includes pension funds and large corporate clients.

- Asset Management Focus: Provides large-scale asset management, with NN Investment Partners managing around €290 billion as of 2024.

- Specialized Services: Offers corporate risk management and group pension solutions.

- Dedicated Support: Served by specialized sales and account management teams.

High-Net-Worth Individuals (HNWIs)

High-Net-Worth Individuals (HNWIs) represent a crucial segment for NN Group, seeking advanced wealth management and bespoke investment solutions. Their needs extend beyond standard offerings to include sophisticated life insurance structures for wealth transfer and tax optimization. These clients, with investable assets typically exceeding €1 million, are served by dedicated private bankers and specialized financial advisors. The global HNWI population is projected to continue growing in 2024, emphasizing the demand for tailored financial services.

- HNWIs seek advanced wealth management and bespoke investment solutions.

- Sophisticated life insurance structures are key for wealth transfer and tax optimization.

- They are served by private bankers and specialized financial advisors.

- Global HNWI wealth is expected to reach new highs in 2024.

NN Group serves a broad spectrum of clients, including individuals and families focused on financial protection and savings, as well as retirees seeking stable income. For instance, NN Group's Netherlands Life business reported a value of new business of EUR 114 million and a net operating result of EUR 253 million in Q1 2024, largely serving these segments.

The company also caters to businesses, from Small and Medium-Sized Enterprises requiring non-life insurance and employee benefits, to large corporations and institutional clients needing complex group pensions and asset management solutions. NN Investment Partners managed approximately €290 billion in assets as of early 2024 for these institutional clients.

High-Net-Worth Individuals constitute a key segment, seeking advanced wealth management and bespoke investment solutions, including sophisticated life insurance structures for wealth transfer. The global HNWI population is projected to continue growing in 2024, emphasizing demand for tailored services.

| Customer Segment | Key Need | 2024 Data Point |

|---|---|---|

| Individuals/Families | Financial Protection | NL Life VNB: €114M (Q1 2024) |

| Retirees/Pre-Retirees | Stable Income | NL Life Net Op. Result: €253M (Q1 2024) |

| Institutional Clients | Asset Management | NN IP AUM: ~€290B (Early 2024) |

Cost Structure

Policyholder Benefits and Claims Paid represents NN Group's most substantial cost, fulfilling its direct contractual promises to customers. This crucial expense encompasses a wide array of payments, including life insurance payouts, essential pension benefits, various annuity payments, and claims settled on non-life policies. For instance, in 2023, NN Group reported claims and benefits paid totaling EUR 27.2 billion, highlighting the magnitude of this obligation. This cost is intrinsically linked to the overall volume of policies underwritten and the inherent risk profile of the business portfolio.

Employee compensation and sales commissions form a significant cost for NN Group, encompassing salaries and benefits for its global workforce. This category also includes vital commissions and fees paid to the extensive distribution network, such as agents, brokers, and banking partners. As a prominent service-based financial institution, human capital represents a primary expense. Effectively managing these sales commissions is crucial for NN Group to drive profitable growth and maintain its market position, especially considering its continued focus on customer-centric strategies and digital transformation in 2024.

NN Group's cost structure involves substantial technology and operational expenses, critical for its strategic objectives. This includes significant investments in IT infrastructure, software development, and cybersecurity, with a continued focus on digital transformation projects in 2024. Day-to-day operating costs, such as real estate, utilities, and administration, also form a core part of these expenditures. For Q1 2024, NN Group reported total operating expenses of EUR 984 million, reflecting these ongoing costs. These investments are vital for maintaining efficiency, ensuring robust security, and sustaining competitiveness in the evolving financial landscape.

Marketing and Customer Acquisition Costs

Marketing and customer acquisition costs for NN Group encompass all expenditures aimed at brand building and attracting new clients. These expenses vary significantly by channel, ranging from direct-to-consumer digital marketing initiatives to commissions paid to financial advisors for new policies. This is a crucial investment for NN Group, underpinning its future growth and market share expansion. In 2024, digital channels continue to gain prominence, influencing the cost structure.

- NN Group’s marketing spend supports brand visibility across diverse markets.

- Costs include digital advertising, traditional media, and advisor commissions.

- Digital acquisition channels are increasingly optimized for cost-efficiency.

- NN Group targets sustainable growth through strategic customer outreach.

Regulatory Compliance and Risk Management

Operating in the highly regulated financial sector incurs substantial costs for NN Group, driven by compliance with frameworks like Solvency II and IFRS 17, alongside anti-money laundering (AML) rules. These mandatory expenses cover legal teams, dedicated compliance officers, and sophisticated systems for monitoring and reporting, essential for maintaining their operating license. In 2024, the industry continues to see significant investment in these areas, with global regulatory compliance costs for financial institutions often reaching over 10% of their operational expenditure.

- Solvency II and IFRS 17 compliance drives significant IT and personnel costs.

- Anti-money laundering (AML) efforts require continuous investment in technology and expertise.

- Regulatory reporting demands substantial resources for data collection and analysis.

- NN Group’s 2024 operational costs reflect ongoing investments in these critical areas.

NN Group's cost structure is primarily driven by policyholder benefits and claims, which are its largest expenditure, fulfilling direct customer promises. Significant costs also stem from employee compensation and sales commissions, essential for its service-based model and extensive distribution network. Additionally, substantial technology and operational expenses, like the EUR 984 million in Q1 2024 operating expenses, are crucial for digital transformation and efficiency. Regulatory compliance costs, including Solvency II and AML efforts, represent another mandatory and substantial financial outlay.

| Cost Category | Key Driver | 2024 Relevance |

|---|---|---|

| Policyholder Benefits | Contractual obligations | Largest outflow, ongoing |

| Operating Expenses | IT, Admin, Salaries | EUR 984M (Q1 2024) |

| Regulatory Compliance | Solvency II, AML | Significant, continuous investment |

Revenue Streams

Insurance premiums represent NN Group's primary revenue stream, stemming from regular payments by individuals and companies for various life and non-life insurance policies.

This consistent inflow of funds provides a stable and predictable cash flow, essential for the group's operations and financial health.

Gross Written Premiums (GWP) serves as a key performance indicator, highlighting the volume of business generated.

For instance, NN Group's Non-life GWP increased by 10.1% to EUR 1,228 million in the first quarter of 2024, demonstrating robust growth in this vital segment.

NN Group generates substantial revenue from its vast investment portfolio, funded by shareholder equity and the insurance float from premiums. This diversified portfolio includes bonds, equities, and real estate, yielding interest income, dividends, and capital gains. For instance, in Q1 2024, NN Group reported an operating result of EUR 547 million, significantly influenced by these investment returns. This income stream remains sensitive to the volatility and performance of global financial markets.

NN Group generates revenue through asset management and administration fees, primarily by managing assets for both institutional and individual clients. These fees are typically calculated as a percentage of the Assets Under Management (AUM) held by the company. For example, as of March 31, 2024, NN Group's general account assets supporting their insurance businesses, which they manage, stood at EUR 177.3 billion. Furthermore, the company earns additional fees by providing crucial administrative services for pension funds and other large-scale investment schemes, contributing to their diverse revenue streams.

Bancassurance and Distribution Fees

NN Group generates significant revenue through bancassurance and distribution fees by partnering with banks and other financial institutions. These arrangements involve the sale of NN Group’s insurance and investment products through the partner's channels, leading to fee-sharing. This includes upfront commissions on new policies and ongoing fees based on the volume or value of policies managed, diversifying NN Group's income streams beyond direct sales. For instance, in 2024, NN Group continued to leverage its strong bancassurance partnerships, contributing to its fee income growth.

- Upfront commissions for new policies sold through partners.

- Ongoing service fees for managed policies.

- Diversifies revenue, reducing reliance on direct sales channels.

- Supports NN Group's 2024 strategic focus on multi-channel distribution.

Annuity and Pension Payout Products

NN Group generates revenue through its annuity and pension payout products by providing retirees with a guaranteed income stream. The company earns a margin based on the difference between the lump sum received from customers and the expected future payouts, accounting for investment returns and longevity assumptions. This is a crucial revenue stream within the retirement solutions market.

- NN Group's net operating result for Insurance Europe, a key segment for these products, was EUR 191 million in Q1 2024.

- These products are fundamental to NN Group's life insurance business, contributing significantly to its overall financial performance.

NN Group’s revenue streams are diverse, primarily driven by insurance premiums, a stable and predictable cash flow source, with Non-life Gross Written Premiums increasing by 10.1% to EUR 1,228 million in Q1 2024.

Significant income also stems from its extensive investment portfolio, contributing to an operating result of EUR 547 million in Q1 2024 through interest, dividends, and capital gains.

Fee-based services, including asset management with EUR 177.3 billion in general account assets as of March 31, 2024, and bancassurance commissions, further diversify income.

Annuity and pension payouts, which generated a net operating result of EUR 191 million for Insurance Europe in Q1 2024, complete this robust revenue model.

| Revenue Source | Key Metric (Q1 2024) | Value |

|---|---|---|

| Insurance Premiums | Non-life GWP increase | 10.1% |

| Investment Portfolio | Operating Result | EUR 547 million |

| Asset Management Fees | General Account Assets | EUR 177.3 billion |

| Annuity/Pension Payouts | Insurance Europe Net Operating Result | EUR 191 million |

Business Model Canvas Data Sources

The NN Group Business Model Canvas is informed by a blend of internal financial reports, extensive market research, and strategic analysis of industry trends. This multi-faceted approach ensures a comprehensive and accurate representation of the business.