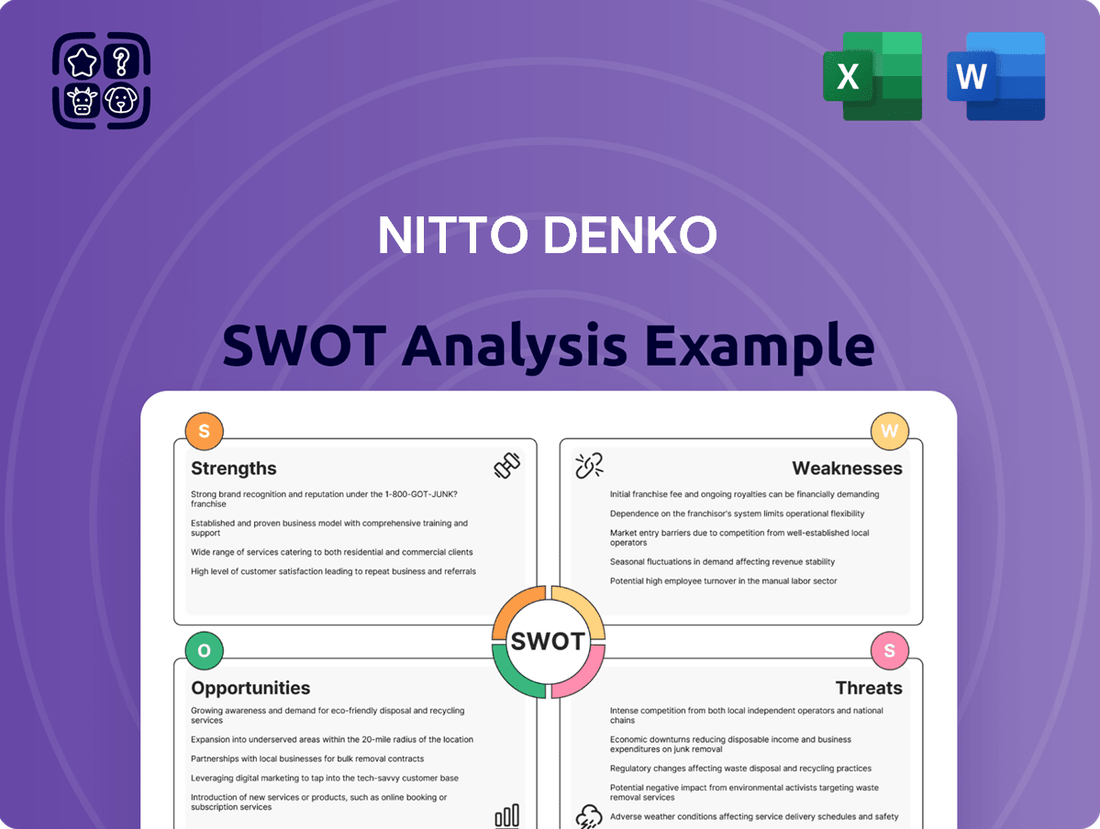

Nitto Denko SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nitto Denko Bundle

Nitto Denko's innovative materials and strong R&D capabilities position it well in the market. However, understanding the full scope of its competitive landscape and potential vulnerabilities is crucial for strategic planning. Our comprehensive SWOT analysis delves deep into these aspects, offering a clear roadmap for leveraging opportunities and mitigating risks.

Want the full story behind Nitto Denko's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Nitto Denko's strength lies in its incredibly diverse product lineup, featuring high-margin items like adhesive tapes, advanced optical films, critical medical supplies, and essential automotive parts. This wide range of offerings spans across key sectors such as electronics, automotive, healthcare, and environmental technologies.

This strategic diversification acts as a significant buffer against economic volatility. For instance, even with some headwinds faced in the automotive sector during fiscal year 2024, Nitto Denko experienced consistently strong demand from its electronics and industrial materials segments, highlighting the resilience built into its business model.

Nitto Denko's strength lies in its robust core technologies, particularly in adhesion, coating, and polymer synthesis. The company consistently channels substantial investment into research and development, demonstrating its commitment to innovation. For fiscal year 2024, Nitto Denko dedicated around ¥50 billion to R&D initiatives.

This dedication to R&D has positioned Nitto Denko as a recognized Top 100 Global Innovator. This recognition underscores its ability to develop pioneering products, such as novel sensor films tailored for the burgeoning IoT market and sophisticated adhesive films designed for the automotive industry.

Nitto Denko boasts a significant global manufacturing and sales network, allowing it to cater to a diverse international customer base and adapt swiftly to regional market demands. This widespread presence underpins its operational agility.

The company is actively bolstering its global supply chain, exemplified by its NT$4.483 billion investment in a new factory in Kaohsiung, Taiwan. This strategic expansion is designed to boost production capacity and streamline operations, especially for critical adhesive tapes vital to the semiconductor and electric vehicle industries.

This robust global footprint and ongoing investment in supply chain infrastructure are key strengths, enhancing Nitto Denko's ability to meet worldwide demand reliably and efficiently, even amidst market fluctuations.

Robust Financial Performance

Nitto Denko showcases exceptional financial strength, a key advantage in today's competitive landscape. The company achieved a remarkable ¥1.7 trillion in revenue for the fiscal year ending March 31, 2024, marking a substantial 12% increase from the previous year. This robust top-line growth was complemented by an operating income of ¥250 billion.

Further solidifying its financial standing, Nitto Denko demonstrated continued strong performance through December 2024. This period saw significant increases in both revenue and profits, underscoring the company's ability to consistently generate value and maintain a healthy financial position. This financial resilience allows for reinvestment in innovation and strategic expansion.

- Record Revenue: ¥1.7 trillion in FY ending March 31, 2024.

- Year-over-Year Growth: 12% revenue increase.

- Operating Income: ¥250 billion in FY ending March 31, 2024.

- Continued Strength: Significant revenue and profit increases reported through December 2024.

Commitment to Sustainability and ESG Initiatives

Nitto Denko demonstrates a strong commitment to sustainability with a clear Environmental, Social, and Governance (ESG) strategy. The company has set ambitious targets, including a 30% reduction in greenhouse gas emissions by 2030 and aims to power its operations with 100% renewable energy by 2025. This proactive approach not only addresses global environmental concerns but also positions Nitto Denko favorably among increasingly eco-conscious investors and consumers.

Their active involvement in corporate social responsibility (CSR) initiatives, exemplified by the Nitto ATP Finals Torino Green Project, further solidifies their dedication. Furthermore, Nitto Denko is developing innovative, eco-friendly products, such as biodegradable films, which directly align with prevailing global sustainability trends. This focus on green product development is crucial for maintaining a positive corporate image and capturing market share in a rapidly evolving landscape.

- ESG Strategy: Clear roadmap for environmental and social responsibility.

- Emission Reduction: Target of 30% GHG reduction by 2030.

- Renewable Energy: Goal of 100% renewable energy usage by 2025.

- Eco-Friendly Products: Development of biodegradable films and similar sustainable materials.

Nitto Denko's diverse product portfolio is a significant strength, encompassing high-margin items like adhesive tapes, optical films, medical supplies, and automotive components across electronics, healthcare, and environmental sectors. This diversification provides resilience against economic fluctuations; for example, strong electronics demand offset automotive sector challenges in fiscal year 2024.

The company's core technological expertise in adhesion, coating, and polymer synthesis, backed by substantial R&D investment (approximately ¥50 billion in FY2024), fuels innovation. This commitment has earned Nitto Denko recognition as a Top 100 Global Innovator, driving the development of new products for markets like IoT and automotive.

Nitto Denko benefits from a robust global manufacturing and sales network, enabling it to serve international customers and adapt to regional demands efficiently. Strategic investments, such as NT$4.483 billion in a Taiwan factory, further enhance its production capacity and supply chain for critical materials.

Financially, Nitto Denko is exceptionally strong, achieving ¥1.7 trillion in revenue for FY ending March 31, 2024, a 12% increase year-over-year, with ¥250 billion in operating income. Continued strong performance through December 2024 underscores its consistent value generation and financial stability, supporting future growth initiatives.

| Financial Highlight | FY Ending March 31, 2024 | Period Ending December 2024 |

|---|---|---|

| Revenue | ¥1.7 trillion | Significant Increase |

| Revenue Growth (YoY) | 12% | N/A |

| Operating Income | ¥250 billion | N/A |

| R&D Investment | ~¥50 billion | N/A |

What is included in the product

Delivers a strategic overview of Nitto Denko’s internal and external business factors, examining its core strengths, potential weaknesses, market opportunities, and competitive threats.

Offers a clear and actionable framework to identify and address strategic vulnerabilities, transforming potential weaknesses into growth opportunities.

Weaknesses

Nitto Denko's significant exposure to cyclical industries, such as electronics and automotive, presents a notable weakness. Despite efforts at diversification, demand in these sectors can fluctuate considerably, impacting revenue streams. For instance, in fiscal year 2024, the automotive materials segment experienced sluggishness directly linked to reduced unit production, illustrating the company's vulnerability to industry-wide downturns and economic cycles.

Nitto Denko has faced challenges with certain product lines, as evidenced by an impairment loss of ¥2.69 billion in the third quarter of fiscal year 2025 specifically tied to plastic optical fiber cables. This situation highlights potential underperformance in particular segments, sometimes prompting the company to divest assets that are either commoditized or not meeting strategic objectives.

The company has also recorded goodwill impairment losses at various subsidiaries, suggesting that the acquired value of these businesses has not been realized as anticipated. These impairments can signal difficulties in integrating operations, achieving projected synergies, or adapting to market changes within those specific entities.

Nitto Denko operates in highly competitive advanced materials sectors, contending with global giants like 3M. This intense rivalry, especially in markets where Nitto holds a strong presence like Asia/Oceania, can lead to significant pricing pressures. For instance, 3M's diverse product portfolio and established market share present a constant challenge to Nitto's pricing power and profitability.

Reliance on Key Raw Materials

Nitto Denko, as a materials manufacturer, faces inherent vulnerabilities tied to its reliance on key raw materials. The availability and pricing stability of these essential inputs directly influence production costs and, consequently, profit margins. For instance, in fiscal year 2024, the company highlighted ongoing efforts to mitigate the impact of volatile raw material prices, a persistent challenge in the chemical and advanced materials sectors.

This dependency creates a continuous challenge for effective cost management. Supply chain disruptions, whether due to geopolitical events or natural disasters, can further exacerbate these issues, leading to potential production slowdowns or increased overhead. Nitto Denko's ability to navigate these fluctuations is crucial for maintaining its competitive edge.

- Dependency on specific chemical inputs

- Vulnerability to global commodity price swings

- Potential for supply chain bottlenecks affecting production

- Impact on cost competitiveness if raw material prices rise significantly

Capital Expenditure Requirements

Nitto Denko's commitment to innovation and growth, particularly in burgeoning sectors, necessitates substantial capital expenditures. For instance, the company's investment in advanced materials for semiconductor manufacturing and displays requires significant upfront funding to build and upgrade facilities. This heavy investment can become a vulnerability if unforeseen market downturns occur or if the projected returns from these large-scale projects don't materialize as anticipated, potentially straining financial flexibility.

The company's strategy involves continuous investment in research and development alongside production capacity expansion. In fiscal year 2023, Nitto Denko reported capital expenditures of approximately ¥96.1 billion (around $640 million USD), a considerable portion of which is directed towards enhancing its capabilities in high-growth areas. While this fuels future revenue streams, it also exposes the company to the risk of over-investment if demand forecasts prove overly optimistic or if competitive pressures erode pricing power.

- Significant Capital Outlay: Sustaining innovation and expanding production capacity in areas like advanced semiconductor materials and flexible display components demands considerable financial resources.

- Risk of Shifting Demand: Investments are vulnerable if market demand for these specialized products shifts unexpectedly, impacting the return on capital.

- Return on Investment Uncertainty: The success of large capital projects hinges on achieving projected returns, which can be affected by market dynamics and competitive landscapes.

- Fiscal Year 2023 Capex: Nitto Denko invested around ¥96.1 billion in capital expenditures, highlighting the scale of its commitment to growth-oriented assets.

Nitto Denko's reliance on specific chemical inputs makes it susceptible to price volatility and supply chain disruptions. For instance, fluctuations in the cost of key raw materials directly impact production expenses and profit margins, a challenge the company actively works to mitigate. This dependency can also lead to bottlenecks, potentially hindering production and affecting cost competitiveness if prices escalate significantly.

| Metric | FY2024 Impact | FY2025 Outlook |

|---|---|---|

| Raw Material Costs | Volatile, requiring mitigation efforts | Continued monitoring and management |

| Supply Chain Stability | Potential for disruptions | Ongoing focus on resilience |

| Profit Margins | Directly influenced by input costs | Impacted by raw material price trends |

Same Document Delivered

Nitto Denko SWOT Analysis

The file shown below is not a sample—it’s the real Nitto Denko SWOT analysis you'll download post-purchase, in full detail. You're getting a direct look at the professional, structured content you can expect. This preview accurately represents the comprehensive analysis that will be yours upon purchase. Rest assured, the quality and depth of information will be consistent with this glimpse.

Opportunities

The burgeoning Internet of Things (IoT) sector offers a substantial avenue for growth, with the market anticipated to reach ¥3 trillion by 2025. Nitto Denko's innovative sensor films are well-positioned to capitalize on this expansion, providing essential components for smart devices and connected systems.

The electric vehicle (EV) market is another key area of opportunity. As demand for EVs escalates, so does the need for advanced materials like those Nitto Denko develops for larger displays and enhanced performance, aligning with the industry's rapid evolution.

Furthermore, the burgeoning field of augmented reality (AR) presents a promising frontier. Nitto Denko's material science expertise can contribute significantly to the development of next-generation AR devices, creating new revenue streams.

The medical and healthcare sector presents a significant avenue for growth, with Nitto Denko experiencing a robust 20% revenue increase in this segment during fiscal year 2024. This strong performance underscores the market's demand for innovative healthcare solutions.

Nitto Denko is strategically leveraging its expertise in advanced materials to develop critical components for drug delivery patches and other medical devices. This focus on high-value products aligns with the increasing needs of the global healthcare industry.

Furthermore, the company's commitment to expansion is evident through its strategic acquisitions within the healthcare space. These moves are designed to broaden its product portfolio and enhance its market presence in this lucrative and rapidly evolving sector.

The increasing global push for sustainability presents a significant opportunity for Nitto Denko. Growing consumer and regulatory demand for eco-friendly products means Nitto Denko can capitalize on developing and marketing items like biodegradable films and compostable non-woven fabrics. This market trend is further supported by Nitto Denko's own stated goal of achieving carbon neutrality by 2050, demonstrating a strategic alignment with this burgeoning sector.

Strategic Collaborations and Acquisitions

Strategic collaborations, like Nitto Denko's partnership with T-Hub, are crucial for fostering innovation and accessing new markets, particularly in areas like waste management and semiconductors. These alliances can accelerate the development and adoption of cutting-edge technologies.

Acquisitions represent another significant opportunity. The company's partial stake in an augmented reality optical firm in 2024 exemplifies this strategy, enabling Nitto Denko to integrate novel technologies and penetrate nascent product segments. This proactive approach to M&A is vital for staying ahead in rapidly evolving industries.

- Partnerships: Collaborations with entities like T-Hub can unlock synergistic growth in areas such as semiconductors, digital health, and waste management, driving innovation and market reach.

- Acquisitions: Strategic investments, such as the 2024 stake in an AR optical firm, provide access to emerging technologies and allow for expansion into high-growth product categories.

- Technology Integration: These moves facilitate the seamless integration of acquired or partnered technologies into Nitto Denko's existing product portfolio, enhancing competitive offerings.

Digital Transformation and Operational Efficiency

Nitto Denko's embrace of digital transformation presents a significant opportunity to streamline its manufacturing and operational processes. By integrating advanced digital technologies, the company can achieve greater precision and speed in production, leading to enhanced efficiency. For instance, in 2023, many leading manufacturing firms reported productivity gains of 10-20% through targeted automation initiatives, a benchmark Nitto Denko can aim for.

Investments in smart factory solutions, including AI-driven analytics and the Internet of Things (IoT) for real-time monitoring, offer a pathway to optimize resource allocation. This can translate into tangible cost reductions and improved output quality. The global smart factory market, valued at approximately $25 billion in 2023, is projected to grow substantially, indicating strong industry momentum and available technological advancements.

- Enhanced Production Efficiency: Digitalization can boost output by 10-20% through automation.

- Cost Reduction: Smart factory solutions optimize resource use, lowering operational expenses.

- Improved Productivity: Real-time data and AI analytics refine processes across global sites.

- Market Alignment: Leveraging the growing smart factory market trends to modernize operations.

Nitto Denko is well-positioned to capitalize on the expanding Internet of Things (IoT) market, which is projected to reach ¥3 trillion by 2025, by supplying essential sensor films for smart devices. The company is also benefiting from the robust growth in the electric vehicle (EV) sector, developing advanced materials for larger displays and improved performance. Furthermore, Nitto Denko's expertise in material science offers significant opportunities in the burgeoning augmented reality (AR) field, enabling the creation of next-generation AR devices.

The medical and healthcare segment is a key growth driver, with Nitto Denko experiencing a substantial 20% revenue increase in fiscal year 2024 for its medical products. Strategic acquisitions and product development in areas like drug delivery patches are further strengthening its position in this high-demand sector. The company's focus on sustainability also presents an opportunity, as it can leverage the increasing demand for eco-friendly materials, aligning with its carbon neutrality goal for 2050.

Strategic collaborations, such as the one with T-Hub, are fostering innovation and market access in areas like semiconductors and waste management. Acquisitions, including a stake in an AR optical firm in 2024, are enabling Nitto Denko to integrate new technologies and enter emerging product categories. Digital transformation initiatives, including smart factory solutions and AI-driven analytics, are enhancing production efficiency and reducing costs, mirroring industry trends that show productivity gains of 10-20% through automation.

| Opportunity Area | Market Projection/Growth | Nitto Denko's Role/Benefit |

|---|---|---|

| Internet of Things (IoT) | ¥3 trillion by 2025 | Supplying essential sensor films for smart devices |

| Electric Vehicles (EVs) | Escalating demand | Developing advanced materials for displays and performance |

| Augmented Reality (AR) | Burgeoning field | Contributing material science expertise to next-gen devices |

| Medical & Healthcare | 20% revenue increase (FY2024) | Providing drug delivery patches, expanding via acquisitions |

| Sustainability | Growing consumer/regulatory demand | Developing eco-friendly films and fabrics; targeting carbon neutrality by 2050 |

Threats

Global economic slowdowns pose a significant threat to Nitto Denko, potentially dampening demand across its key sectors like electronics and automotive. For instance, a projected global GDP growth rate of 2.6% for 2024, down from previous years, suggests a more challenging operating environment. This economic deceleration can translate into reduced industrial output and consumer spending, directly impacting Nitto Denko's sales volumes and overall profitability.

Market volatility, often exacerbated by geopolitical instability, further complicates the landscape for Nitto Denko. Fluctuations in currency exchange rates and supply chain disruptions, which have been prevalent in recent years, can erode margins and create forecasting difficulties. The company's reliance on international markets means it is particularly susceptible to these external shocks, making consistent revenue generation a challenge.

Nitto Denko's extensive reliance on a global supply chain exposes it to significant risks. Geopolitical instability, natural calamities, and trade disputes can all interrupt operations. For instance, the ongoing restructuring of the global semiconductor supply chain presents a complex challenge, even with strategic investments in production sites like Taiwan.

The electronics and optronics sectors are characterized by an incredibly rapid pace of technological evolution. This means that products Nitto Denko currently offers could become outdated much faster than in the past. For instance, advancements in display technology, like the increasing adoption of microLEDs over OLEDs, could quickly diminish demand for components designed for older standards. This constant churn necessitates continuous innovation to maintain market relevance.

While Nitto Denko commits significant resources to research and development, a substantial threat lies in failing to accurately predict or effectively respond to emerging industry standards and disruptive technologies. If the company misjudges the trajectory of innovation, such as a shift towards new semiconductor manufacturing processes or novel material science breakthroughs, its competitive edge could be significantly weakened. For example, a failure to invest in next-generation flexible display substrates could leave them behind as the market shifts.

Intensifying Regulatory Scrutiny and Environmental Compliance

Nitto Denko faces increasing global regulatory scrutiny, particularly concerning environmental impact and chemical usage. For instance, by the end of 2023, the EU's REACH regulation continued to evolve, potentially impacting materials used in Nitto Denko's products, requiring costly reformulation or compliance measures. Stricter mandates on sustainability could necessitate substantial investments in advanced manufacturing processes and eco-friendly materials, impacting profitability.

The company's proactive stance on Environmental, Social, and Governance (ESG) initiatives, including its 2023 sustainability report detailing progress in reducing greenhouse gas emissions, is a strength. However, intensified environmental compliance, such as the growing focus on circular economy principles and extended producer responsibility, could still pose a threat. For example, if new regulations emerge requiring specific recycled content percentages in electronic components, Nitto Denko might need to re-engineer its supply chain and product design, incurring significant capital expenditures to maintain market access and competitive positioning.

- Increased Compliance Costs: Evolving environmental regulations globally, such as those impacting chemical safety and waste management, can lead to higher operational expenses for Nitto Denko.

- Operational Restrictions: Stricter rules on emissions or the use of certain materials might necessitate changes in manufacturing processes, potentially limiting production or requiring new technology investments.

- Market Access Challenges: Failure to comply with stringent environmental standards in key markets could jeopardize Nitto Denko's ability to sell its products, impacting revenue streams.

- R&D Investment Pressure: The need to develop and implement sustainable alternatives for materials and processes will likely require increased allocation of resources towards research and development.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations pose a significant threat to Nitto Denko, a Japanese multinational with extensive global operations. As a Japanese company, its reported earnings are directly impacted by the strength of the Japanese yen against other major currencies like the US dollar.

A strengthening yen can reduce the value of overseas profits when translated back into yen, thereby negatively affecting operating income margins. For instance, while yen depreciation generally supported Nitto Denko's growth trajectory in the fiscal years 2021 through 2024, a reversal of this trend, with a stronger yen, could present headwinds.

- Yen Volatility: Nitto Denko's significant overseas sales mean that currency swings directly impact profitability.

- Impact on Margins: A stronger yen can compress operating income margins for Japanese companies with substantial foreign revenue.

- Historical Trend Reversal: While recent years (FY2021-2024) saw beneficial yen weakness, future appreciation threatens this advantage.

- Competitive Pricing: Exchange rate shifts can also affect the competitiveness of Nitto Denko's products in international markets.

Intensified competition from both established players and emerging market entrants presents a continuous threat to Nitto Denko's market share and pricing power. For example, in the advanced adhesive tape market, rivals are increasingly developing comparable high-performance products, often at lower price points, which could erode Nitto Denko's premium positioning. The rapid growth of Asian manufacturers, particularly in electronics components, means that Nitto Denko must constantly innovate and maintain cost efficiencies to remain competitive.

The increasing reliance on specialized, high-performance materials means that a failure to adapt to evolving material science breakthroughs could leave Nitto Denko behind. For instance, if competitors develop superior alternatives for optical films or semiconductor packaging materials, demand for Nitto Denko's current offerings could decline significantly. The company's commitment to R&D is crucial, but the pace of innovation in materials science, as seen with developments in graphene-based applications by 2025, demands constant vigilance and strategic investment to avoid obsolescence.

The dynamic nature of the global regulatory environment, particularly concerning environmental standards and chemical usage, poses a significant challenge for Nitto Denko. For example, evolving regulations around per- and polyfluoroalkyl substances (PFAS) could impact materials used in various products, necessitating costly reformulation or sourcing of alternatives. Failure to comply with these stringent, often country-specific, environmental mandates could lead to increased operational costs, market access restrictions, and potential reputational damage.

SWOT Analysis Data Sources

This analysis is built upon a foundation of verified financial reports, comprehensive market research from reputable industry analysts, and expert opinions from leading figures in the materials science sector.