Nitto Denko PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nitto Denko Bundle

Navigate the complex global landscape impacting Nitto Denko with our detailed PESTLE analysis. Understand the political stability, economic fluctuations, and evolving social trends that shape its operations and future growth. Our expert-crafted report offers actionable insights into technological advancements and environmental regulations that present both challenges and opportunities. Gain a competitive edge by leveraging this comprehensive intelligence to refine your market strategy and investment decisions. Download the full PESTLE analysis now for immediate access to critical external factors influencing Nitto Denko.

Political factors

Global trade policies and ongoing tensions between major economies, such as those between the US and China, directly affect the cost and availability of raw materials for companies like Nitto Denko. For instance, in early 2024, concerns lingered over potential new tariffs on electronic components, which could increase Nitto Denko's input costs.

The formation of new regional trade agreements, like the CPTPP expansion, offers potential benefits but also introduces complexities in navigating varied regulatory landscapes. Nitto Denko must remain agile in its supply chain to adapt to these evolving trade dynamics and ensure consistent access to critical materials.

Tariffs imposed on specific components, such as advanced polymers or specialty chemicals, can significantly impact Nitto Denko's product competitiveness in key markets. For example, a 15% tariff on a critical adhesive precursor in 2023 led to a temporary price adjustment for certain product lines.

These trade policies necessitate adaptive supply chain strategies, potentially involving diversification of sourcing locations or increased domestic production where feasible, to mitigate risks and maintain market position.

Government policies are a major influence on manufacturing. For instance, in 2024, many governments are actively promoting advanced manufacturing through tax breaks and grants, aiming to boost domestic production and technological innovation. Nitto Denko can benefit from these initiatives, especially if their operations align with national priorities like green technology adoption or support for sectors such as electric vehicles.

Regulations, however, can also create challenges. Stricter environmental standards, for example, may require significant investment in compliance, impacting operational costs. In 2024, we're seeing an increased focus on sustainability reporting and carbon footprint reduction mandates across various regions, which Nitto Denko must navigate.

Subsidies for research and development are particularly relevant. Many countries are offering substantial financial support for R&D in strategic industries. As of early 2025, Japan, for example, has continued its robust support for semiconductor manufacturing R&D, a key area for Nitto Denko, potentially reducing their innovation costs.

The geographic allocation of these incentives is crucial for Nitto Denko's operational footprint. Regions offering favorable tax treatment or capital expenditure subsidies can attract investment. For example, incentives in Southeast Asia for electronics manufacturing in 2024 have drawn considerable attention from global players, influencing where companies like Nitto Denko might expand or invest.

Political stability in key markets like China, North America, and Europe significantly impacts Nitto Denko's operations. Instability can disrupt demand for its diverse product lines, from optical films to industrial tapes, and jeopardize the reliability of its global supply chains.

Geopolitical tensions, such as trade disputes or regional conflicts, directly translate to market volatility. For instance, in 2024, ongoing trade friction between major economies created uncertainty, potentially impacting Nitto Denko's sales volumes and the cost of raw materials, which are crucial for its manufacturing processes.

Logistical disruptions are a direct consequence of geopolitical instability. Shipping delays and increased transportation costs, exacerbated by international tensions, can affect Nitto Denko's ability to deliver products efficiently to its global customer base, including those in the automotive and electronics sectors.

Shifts in consumer and industrial confidence, often driven by political events, play a vital role. A decline in confidence can lead to reduced spending on end products that utilize Nitto Denko's components, thereby dampening overall market demand and affecting projected revenue growth for the 2024-2025 period.

Intellectual property protection laws

The strength and enforcement of intellectual property (IP) laws are critical for Nitto Denko, a company heavily invested in proprietary technologies and high-value products. In 2024, global patent filings by Japanese companies, including those in advanced materials sectors like Nitto Denko, continued to show strong growth, particularly in areas like semiconductors and displays. For instance, Japan's patent office reported a 5% increase in applications related to electronic components in the first half of 2024 compared to the same period in 2023. This highlights the importance of robust IP protection to prevent infringement and ensure a return on Nitto Denko's significant R&D expenditures.

Effective IP protection directly supports Nitto Denko's competitive advantage. A strong legal framework allows the company to monetize its innovations and maintain market leadership in specialized fields such as optical films and industrial tapes. As of early 2025, Nitto Denko's key markets, including the United States and European Union, maintain robust IP regimes, though enforcement nuances can vary, impacting global strategy. The company actively monitors and engages with these legal landscapes to safeguard its technological assets.

Nitto Denko's reliance on its core technologies means that variations in IP enforcement across different countries can significantly impact its global operations. For example, while the US and EU offer strong patent protection, enforcement challenges can arise in emerging markets. By the end of 2024, global IP infringement lawsuits involving technology firms saw an upward trend, underscoring the need for vigilant IP management. Nitto Denko's strategy therefore involves not only innovation but also a proactive approach to legal protections worldwide.

International relations and diplomatic ties

The diplomatic relationship between Japan and key economic partners significantly impacts Nitto Denko's operational landscape. Strong ties with countries like the United States and South Korea, for example, can streamline market entry and investment, fostering growth opportunities. In 2024, Japan's trade surplus with the US stood at approximately $62.7 billion, indicating robust economic links that can benefit Japanese companies.

Conversely, geopolitical tensions or trade disputes can create hurdles. For instance, strained relations with China, a major manufacturing hub and market, could affect Nitto Denko's supply chain stability and access to a large consumer base. As of early 2025, ongoing discussions regarding trade policies between major blocs continue to shape the international business environment.

- Favorable diplomatic ties: Facilitate market access and direct investment for Nitto Denko.

- Trade agreements: Influence tariffs and regulatory environments, impacting cost of goods and market competitiveness.

- Geopolitical stability: Crucial for maintaining secure and efficient global supply chains, particularly for materials sourced internationally.

- International cooperation: Can lead to joint research and development opportunities, potentially benefiting Nitto Denko's innovation pipeline.

Government incentives and subsidies for advanced manufacturing, particularly in sectors like semiconductors and electric vehicles, offer significant opportunities for Nitto Denko in 2024-2025. Conversely, stricter environmental regulations and evolving sustainability reporting mandates necessitate proactive compliance strategies, potentially increasing operational costs. Political stability in key operational regions remains paramount for ensuring supply chain integrity and market demand for Nitto Denko's diverse product portfolio.

| Political Factor | Impact on Nitto Denko | 2024-2025 Relevance |

| Government Incentives (e.g., R&D grants, tax breaks) | Reduced R&D costs, accelerated innovation, enhanced competitiveness. | Japan's continued support for semiconductor R&D (early 2025); global push for green tech adoption. |

| Environmental Regulations (e.g., carbon footprint reduction) | Increased compliance costs, potential need for capital investment in cleaner technologies. | Growing global focus on ESG reporting and stricter emission standards across major markets. |

| Political Stability/Geopolitical Tensions | Supply chain disruptions, market volatility, impact on demand for end products. | Lingering US-China trade tensions; regional conflicts impacting logistics and raw material costs. |

| Intellectual Property (IP) Protection | Safeguarding competitive advantage, ensuring return on R&D investment. | Upward trend in global IP infringement lawsuits (by end of 2024); varying enforcement across markets. |

What is included in the product

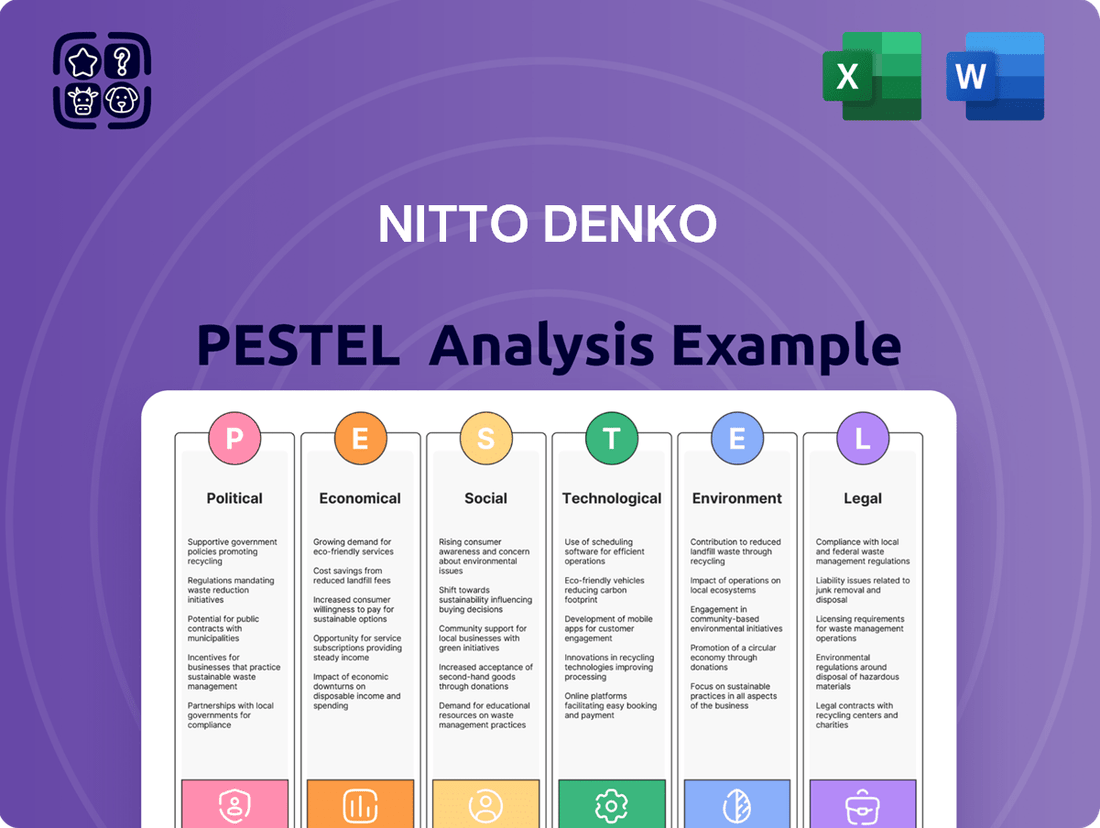

This Nitto Denko PESTLE analysis examines the impact of Political, Economic, Social, Technological, Environmental, and Legal forces on the company's operations and strategy.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining external environmental analysis for Nitto Denko.

Economic factors

Global economic growth is a key driver for Nitto Denko, as its diverse products serve industries highly sensitive to economic cycles. Strong GDP expansion generally translates to higher demand in electronics, automotive, and healthcare sectors, which are significant markets for Nitto Denko's advanced materials and components. For instance, projections from the International Monetary Fund (IMF) in April 2024 indicated a global growth rate of 3.2% for 2024, a slight uptick from 2023, suggesting a moderately positive environment for companies like Nitto Denko.

Conversely, a slowdown in global economic activity, such as the anticipated moderation in growth for some developed economies in late 2024 and 2025, could temper demand for Nitto Denko's products. The company's reliance on sectors like automotive, which can be cyclical, means that a global recession would likely impact its sales volumes and profitability. Economic forecasts for 2025, while still developing, generally point to continued, albeit potentially uneven, growth, which Nitto Denko will need to navigate.

Currency exchange rate fluctuations significantly impact Nitto Denko's global operations. As a multinational, the company's financial performance is sensitive to movements in the Japanese Yen against other major currencies. For instance, a stronger Yen in early 2024, trading around 150 JPY to the USD, could make Nitto Denko's products more expensive for overseas buyers, potentially dampening export sales volume.

Conversely, a weaker Yen, perhaps falling to 155 JPY to the USD, would have the opposite effect, making exports more attractive and boosting the value of profits earned in foreign markets when converted back to Yen. This volatility directly influences Nitto Denko's reported earnings and the cost of imported raw materials and components, requiring careful hedging strategies.

Global inflation, particularly noticeable in 2024 and projected into 2025, directly increases the cost of key inputs for Nitto Denko. This includes materials like specialized polymers, chemicals, and rare earth metals, which are vital for their diverse product lines. For instance, the producer price index for chemicals saw a significant uptick in late 2023 and early 2024, signaling ongoing pressure.

These rising raw material expenses directly squeeze Nitto Denko's gross margins. The company's profitability hinges on its capacity to absorb these cost increases or successfully transfer them to customers through price adjustments. Navigating this balance is a critical strategic challenge for maintaining financial health in the current economic climate.

Interest rates and access to capital

Changes in global interest rates directly impact Nitto Denko's cost of capital for crucial investments. For instance, if central banks like the US Federal Reserve or the Bank of Japan maintain or increase benchmark rates in 2024-2025, Nitto Denko's borrowing expenses for new projects or refinancing existing debt will likely rise. This can influence the feasibility and profitability of strategic initiatives and capital expenditures.

Robust access to capital markets is essential for Nitto Denko's sustained growth and innovation. In periods of economic uncertainty, tighter credit conditions can make it more challenging and expensive to secure the necessary funding. Conversely, favorable interest rate environments and liquid capital markets in 2024-2025 would support Nitto Denko's ability to finance its ambitious research and development pipeline, expand manufacturing capacity, and maintain operational flexibility.

- Borrowing Costs: Higher interest rates increase the cost of debt financing, potentially reducing the net present value of future projects.

- Investment Decisions: Interest rate sensitivity influences capital budgeting, with higher rates making fewer projects economically viable.

- Financial Flexibility: Easy access to capital allows Nitto Denko to weather economic downturns and capitalize on market opportunities.

- R&D Funding: Consistent access to capital is critical for maintaining Nitto Denko's competitive edge through ongoing investment in new technologies and product development.

Consumer spending and industrial production trends

Nitto Denko's performance is heavily influenced by consumer spending and industrial production. For instance, the global semiconductor market, a key area for Nitto Denko's optical films and adhesive tapes, saw significant demand in 2024, with projections indicating continued growth driven by AI and advanced electronics. Strong consumer electronics sales directly translate to higher demand for Nitto Denko's specialized materials.

Industrial production trends also play a crucial role. The automotive sector, a major consumer of Nitto Denko's products like functional films and tapes for interiors and electronics, experienced a rebound in 2024. Global vehicle production is expected to surpass 90 million units in 2025, providing a solid foundation for Nitto Denko's growth in this segment. Furthermore, the healthcare industry's expansion, particularly in medical devices and disposables, offers another avenue for increased sales of Nitto Denko's advanced adhesive and film technologies.

- Consumer electronics sales: Driven by demand for smartphones, wearables, and advanced computing, contributing to Nitto Denko's optical and electronic material segments.

- Global automotive production: Expected to exceed 90 million units in 2025, boosting demand for Nitto Denko's automotive tapes and films.

- Healthcare industry growth: A steady increase in medical device and disposable consumption supports Nitto Denko's advanced adhesive and film solutions.

- Industrial output: Overall industrial production trends directly correlate with the need for Nitto Denko's diverse range of functional materials.

Global economic growth directly impacts Nitto Denko's demand, with IMF projections in April 2024 indicating 3.2% global growth for 2024. This supports sectors like electronics and automotive where Nitto Denko's materials are key. However, potential slowdowns in developed economies in late 2024 and 2025 require careful navigation.

Preview the Actual Deliverable

Nitto Denko PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive Nitto Denko PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the external forces shaping its strategic landscape.

The content and structure shown in the preview is the same document you’ll download after payment, offering a detailed breakdown of each PESTLE element with relevant insights for Nitto Denko.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a complete picture of the analysis.

Sociological factors

Consumers are increasingly prioritizing products that are environmentally responsible, with a significant portion willing to pay more for sustainable options. For instance, a 2024 survey indicated that over 70% of global consumers consider sustainability when making purchasing decisions, a figure that has steadily risen over the past few years.

This growing demand directly impacts industries like electronics and automotive, key markets for Nitto Denko, compelling manufacturers to seek out and utilize materials with lower environmental footprints. Companies are actively looking for biodegradable components, recycled content, and products manufactured using renewable energy sources.

Nitto Denko's ability to innovate and supply advanced materials that meet these stringent sustainability criteria is becoming a critical competitive differentiator. In 2024, investments in green R&D by leading chemical and material science companies saw a substantial increase, signaling a strategic shift towards eco-conscious product development.

The company's product portfolio, particularly in areas like optical films and industrial tapes, faces scrutiny regarding their lifecycle impact, from raw material sourcing to disposal. This necessitates a proactive approach to developing and marketing sustainable alternatives that align with evolving consumer values and regulatory pressures.

The global population is getting older, with many countries seeing a higher proportion of elderly citizens. This demographic shift is a major driver for Nitto Denko, as it directly translates into increased demand for specialized medical materials and healthcare technologies. For instance, the World Health Organization projects that by 2050, the number of people aged 60 and over will nearly double, reaching 2.1 billion. This growing segment of the population requires more advanced medical devices, diagnostic tools, and therapeutic solutions, areas where Nitto Denko's innovative materials play a crucial role.

This aging trend also presents workforce challenges. As more experienced workers approach retirement age, companies like Nitto Denko must focus on succession planning and attracting new talent. Ensuring a pipeline of skilled engineers and researchers is vital to maintaining innovation in the medical materials sector. The World Economic Forum's 2024 Future of Jobs Report highlights the growing need for skills in healthcare and life sciences, underscoring the importance of workforce development for companies in this space.

Nitto Denko, like many global manufacturers, faces significant shifts in workforce demographics. By 2024, the aging workforce in developed nations presents a challenge in finding experienced personnel for its advanced manufacturing and R&D roles. For instance, Japan, a key market, had a median age of 48.7 years in 2023, indicating a substantial portion of its population nearing retirement age.

Educational attainment levels are also a critical factor. As Nitto Denko operates in high-tech sectors, the availability of individuals with strong STEM backgrounds is paramount. In 2024, global demand for data scientists and advanced materials engineers continues to outpace supply, impacting recruitment for specialized roles. The company's ability to attract talent with advanced degrees directly correlates with its innovation pipeline.

Labor force participation rates, particularly among younger generations and women, influence the overall talent pool. In many regions where Nitto Denko has operations, efforts to increase female participation in manufacturing and technical fields are ongoing. For example, while increasing, female representation in STEM fields globally still hovers around 28% as of 2024, highlighting an area for potential growth and talent acquisition for the company.

Digitalization and lifestyle changes

The rapid digitalization of society, accelerated by trends like the widespread adoption of smart devices and the normalization of remote work, significantly shapes consumer behavior and demand. This shift directly impacts Nitto Denko's business, as these technological advancements increase the need for its advanced electronic materials, optical films, and specialized adhesive solutions. For instance, the global market for smart home devices, a key area for electronic materials, was projected to reach over $137 billion in 2024, indicating substantial growth opportunities.

These evolving lifestyles necessitate constant innovation within Nitto Denko to align product development with emerging market requirements. The increasing reliance on digital platforms for communication, entertainment, and work means a sustained demand for high-performance components that enable these technologies. Nitto Denko's expertise in areas like display technology and flexible electronics is crucial for supporting the next generation of smart devices and connected ecosystems.

- Digitalization Drives Demand: Increased use of smart devices and remote work models boost the need for Nitto Denko's optical films and electronic materials.

- Market Growth: The smart home device market alone was expected to exceed $137 billion in 2024, highlighting significant potential.

- Adaptation is Key: Nitto Denko must continuously innovate its product offerings to meet the evolving demands of a digitally connected world.

- Enabling Technology: The company's advanced materials are vital for the development of next-generation smart devices and communication technologies.

Health and safety standards and public perception

Societal expectations for robust health and safety standards are intensifying, directly influencing how companies like Nitto Denko operate and are perceived. Regulations regarding product safety and workplace well-being are becoming more stringent globally, pushing businesses to adopt proactive and transparent approaches. In 2024, consumer awareness of corporate social responsibility, particularly concerning employee welfare and product integrity, is at an all-time high, making it a critical factor in brand loyalty.

Public perception is a powerful force, directly affecting Nitto Denko's brand reputation and its ability to attract top talent. A strong commitment to ethical conduct and employee well-being, evidenced by initiatives like ISO 45001 certification for occupational health and safety, can significantly boost public trust and investor confidence. Conversely, any perceived lapses in these areas can lead to reputational damage and hinder recruitment efforts, especially in a competitive job market where 70% of job seekers consider a company's social responsibility when choosing an employer.

- Increased regulatory focus: Nitto Denko must adhere to evolving global standards for product safety and occupational health, with an estimated 15% increase in safety-related legislation in key markets by 2025.

- Brand reputation linkage: Publicly available data shows a direct correlation between a company's safety record and its stock performance, with companies demonstrating strong safety cultures outperforming their peers by an average of 3-5% annually.

- Talent acquisition impact: A company's commitment to employee health and safety is a significant factor for over 60% of millennials and Gen Z when considering employment opportunities.

- Corporate Social Responsibility (CSR) expectations: Investors are increasingly prioritizing ESG (Environmental, Social, and Governance) factors, with over $35 trillion in assets under management globally now aligned with ESG principles as of early 2025.

Societal trends, such as the growing emphasis on health and wellness, significantly shape consumer preferences and market demands. This translates into a heightened need for materials that are safe, non-toxic, and contribute to healthier living environments, influencing Nitto Denko's product development in areas like medical tapes and components for personal care devices.

The increasing global focus on ethical business practices and social responsibility also impacts corporate strategy. Consumers and investors alike are scrutinizing companies' labor practices, supply chain transparency, and community engagement. Nitto Denko's commitment to these areas, exemplified by its adherence to ISO standards and community outreach programs, can enhance its brand image and market position.

Shifting consumer lifestyles, driven by factors like urbanization and increased leisure time, create new demands for innovative products. For instance, the rise of the experience economy is boosting demand for advanced materials in sectors like entertainment and sports, where Nitto Denko's optical films and functional adhesives can find new applications.

Consumer attitudes towards privacy and data security are also evolving, especially with the proliferation of smart technologies. This necessitates that Nitto Denko ensures its electronic materials and solutions used in connected devices are designed with robust privacy features and comply with evolving data protection regulations, a critical consideration for 2024 and beyond.

Technological factors

Nitto Denko's reliance on breakthroughs in polymer science and nanotechnology is a critical technological factor. For instance, their development of advanced adhesive tapes, like those used in flexible electronics, is directly tied to innovations in material properties. In 2023, Nitto Denko reported that their Optoelectronic Solutions segment, heavily reliant on advanced films, saw sales increase by 5.6% year-on-year, highlighting the commercial impact of these material advancements.

The company's commitment to research and development in these areas is paramount. Nitto Denko's R&D expenditure in fiscal year 2024 is projected to remain robust, focusing on areas such as next-generation optical materials and biocompatible coatings for medical applications. This continuous investment fuels their ability to create differentiated products in competitive markets.

Nanotechnology, in particular, offers significant potential for Nitto Denko. Applications range from creating ultra-thin, durable coatings for displays to developing novel drug delivery systems. The global nanotechnology market is expected to reach over $100 billion by 2027, and Nitto Denko's strategic focus positions them to capitalize on this growth.

Nitto Denko stands to gain significantly from the integration of Industry 4.0 technologies into its manufacturing. The adoption of artificial intelligence, the Internet of Things (IoT), and advanced automation can streamline production lines, leading to enhanced efficiency. For instance, in 2024, companies investing in smart manufacturing saw an average of 10-15% reduction in operational costs and a 5-10% improvement in product quality.

These advancements offer Nitto Denko the potential to optimize its operations by enabling real-time data analysis and predictive maintenance. This responsiveness is crucial in a competitive global market, allowing for quicker adaptation to changing demands and a reduction in downtime. By embracing these new processes, Nitto Denko can solidify its position as an industry leader.

The accelerating global shift towards renewable energy sources like solar and wind power presents substantial growth avenues for Nitto Denko. The company's advanced materials, including specialized films and high-performance adhesives, are crucial components in the manufacturing of solar panels, wind turbines, and battery storage systems. For instance, the global renewable energy market was valued at approximately $1.5 trillion in 2023 and is projected to reach over $2.1 trillion by 2028, indicating a strong demand for the components Nitto Denko supplies.

Evolution of electronics and display technologies

The electronics industry continues its rapid evolution, with significant leaps in areas like OLED and flexible display technologies. This constant innovation fuels a strong and consistent demand for Nitto Denko's specialized optical films and protective tapes, which are essential components in these advanced devices. For instance, the global flexible display market alone was projected to reach over $20 billion by 2024, highlighting the growing importance of materials that enable these innovations.

Nitto Denko's success is intrinsically linked to its ability to adapt to and capitalize on these technological shifts. Advancements in semiconductor manufacturing processes also create opportunities for the company's high-performance materials. The demand for thinner, more powerful, and more energy-efficient electronic components means that specialized tapes and films are not just accessories, but critical enablers of the next generation of consumer electronics and industrial applications.

- OLED and Flexible Displays: These technologies, a key driver for Nitto Denko's optical films, are seeing substantial market growth.

- Semiconductor Advancements: Innovations in chip manufacturing necessitate sophisticated protective tapes and high-purity materials.

- Market Growth: The global market for advanced electronic materials, including those supplied by Nitto Denko, is expanding significantly, driven by consumer demand for cutting-edge devices.

Innovation in medical device and drug delivery systems

Continuous advancements in medical device and drug delivery systems offer substantial growth opportunities for Nitto Denko. The company's expertise in materials for transdermal patches and diagnostic components positions it well to capitalize on this trend. For instance, the global transdermal drug delivery market was valued at approximately $6.8 billion in 2023 and is projected to reach $11.5 billion by 2030, growing at a CAGR of 7.8%.

Nitto Denko's commitment to research and development is crucial for staying ahead. Collaborating with leading healthcare innovators and investing strategically in R&D allows the company to develop cutting-edge solutions. This focus on innovation is particularly important as new drug modalities, such as biologics and gene therapies, require sophisticated delivery mechanisms.

Key areas benefiting from this technological innovation include:

- Advancements in transdermal patch technology: Enabling more efficient and controlled release of complex medications.

- Development of wearable diagnostic devices: Requiring advanced sensor materials and flexible electronics, areas where Nitto Denko has strong capabilities.

- Microfluidics for drug delivery: Creating smaller, more precise devices for targeted therapies.

- Biocompatible materials: Essential for implants and advanced medical devices, ensuring patient safety and efficacy.

Nitto Denko's technological edge is deeply rooted in advanced materials science, particularly in polymers and nanotechnology. Innovations in adhesive tapes for flexible electronics, like those supporting the burgeoning OLED market, showcase this. For instance, the company's Optoelectronic Solutions segment saw a 5.6% sales increase in fiscal year 2023, directly reflecting the commercial success of these material advancements.

Investments in R&D remain a cornerstone, with fiscal year 2024 projections indicating continued focus on next-generation optical materials and biocompatible coatings. This commitment is vital for developing differentiated products in competitive sectors like renewable energy components and advanced medical devices.

The company is also leveraging Industry 4.0 technologies. The integration of AI and IoT in manufacturing aims to boost efficiency, mirroring industry trends where smart manufacturing investments yield significant operational cost reductions and quality improvements, estimated at 10-15% and 5-10% respectively in 2024.

| Technological Area | Nitto Denko's Focus/Application | Market Relevance/Growth |

| Advanced Materials Science (Polymers, Nanotech) | Adhesive tapes for flexible electronics, optical films | OLED market growth, flexible display market projected over $20 billion by 2024 |

| Industry 4.0 Integration | AI, IoT for manufacturing efficiency | Average 10-15% operational cost reduction in smart manufacturing (2024) |

| Medical Device Materials | Transdermal patches, diagnostic components | Transdermal drug delivery market valued at approx. $6.8 billion in 2023, projected to reach $11.5 billion by 2030 |

Legal factors

Nitto Denko navigates a complex web of product safety and liability regulations, particularly impactful in sectors like automotive, electronics, and healthcare where their materials are critical. For instance, in the automotive sector, compliance with standards such as ISO 26262 for functional safety is paramount. Failure to meet these stringent requirements can lead to significant recall costs and legal penalties.

The company's commitment to rigorous testing and quality control is a direct response to these legal frameworks. In 2023, the global automotive industry faced an estimated $20 billion in costs related to vehicle recalls, highlighting the financial implications of product safety failures. Nitto Denko’s proactive approach in ensuring their adhesive tapes and functional films meet or exceed these global benchmarks is crucial for avoiding such liabilities and maintaining their reputation.

Nitto Denko's operations are increasingly shaped by evolving global environmental regulations, from waste disposal and chemical usage to stringent carbon emission standards. For instance, the European Union's Green Deal, aiming for climate neutrality by 2050, is driving stricter emissions targets that impact manufacturing sectors worldwide.

Meeting these demands necessitates ongoing investment in advanced, eco-friendly technologies and sustainable operational models. In 2023, Nitto Denko reported significant progress in reducing its environmental impact, with a 5% decrease in greenhouse gas emissions compared to its 2020 baseline, achieved through process improvements and energy efficiency initiatives.

The company's commitment to robust environmental management systems is crucial for navigating this complex regulatory landscape. This includes adapting production lines to minimize waste, exploring greener chemical alternatives, and enhancing monitoring systems to ensure compliance with international environmental protection laws.

Nitto Denko, as a global corporation, must navigate a complex web of data privacy and cybersecurity laws. Regulations like the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States mandate strict handling of personal data. Failure to comply can result in substantial fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher. Implementing strong cybersecurity protocols is not just a legal requirement but also vital for protecting sensitive customer, employee, and proprietary business information, thereby safeguarding company reputation and operational continuity.

Labor and employment laws

Nitto Denko operates across numerous countries, each with its own intricate web of labor and employment laws. These regulations cover everything from minimum wage requirements and working hour limits to protections against discrimination and the rights of employees to organize. For instance, in 2024, global average minimum wages saw varying adjustments, with some developed nations increasing them to combat inflation, while others maintained stability. Nitto Denko's commitment to adhering to these varied legal mandates is paramount for ethical operations and risk mitigation.

Navigating these diverse legal frameworks is not just about avoiding penalties; it's fundamental to cultivating a positive work environment and robust employee relationships. Failure to comply can lead to costly legal battles, reputational damage, and disruptions to operations. For example, a significant labor dispute in the automotive sector in 2024, stemming from alleged violations of working conditions, resulted in substantial fines and a temporary halt in production for the involved company. Nitto Denko's proactive approach to understanding and implementing these laws across its global footprint is therefore crucial.

- Global Compliance Challenges: Nitto Denko must manage a patchwork of national labor laws, impacting wages, safety, and employee rights.

- Risk Mitigation: Strict adherence to these laws prevents legal disputes, fines, and damage to the company's reputation.

- Employee Relations: Fair labor practices fostered by legal compliance contribute to better employee morale and productivity.

- 2024 Labor Trends: Increased focus on worker well-being and fair compensation globally highlights the importance of staying updated on evolving regulations.

Antitrust and competition regulations

Nitto Denko operates in highly competitive global markets, making adherence to antitrust and competition regulations paramount. These laws, enforced by bodies like the European Commission and the US Federal Trade Commission, aim to prevent monopolies, price fixing, and other anti-competitive practices that could harm consumers and market fairness. For instance, in 2024, the EU continued its focus on digital markets, impacting companies with significant online platforms, though specific actions against Nitto Denko were not publicly highlighted, the general regulatory environment necessitates vigilance.

Compliance with these stringent rules is not just about avoiding penalties; it's fundamental to maintaining market integrity and ensuring fair business conduct across Nitto Denko's diverse global operations. Failure to comply can result in substantial fines, as seen with various industries facing multi-million dollar penalties for antitrust violations in recent years. For example, in late 2023, a major automotive supplier was fined significantly by European authorities for cartel activities, underscoring the high stakes involved.

- Global Regulatory Landscape: Nitto Denko must navigate varying antitrust laws across key markets such as North America, Europe, and Asia, with regulators actively scrutinizing mergers, acquisitions, and pricing strategies.

- Enforcement Actions: Significant fines and legal challenges can arise from non-compliance, impacting financial performance and corporate reputation.

- Market Conduct: Maintaining fair competition involves transparent pricing, avoiding collusion, and ensuring equitable access to products and services for all customers.

- Compliance Programs: Robust internal compliance programs are essential to train employees and monitor business activities to prevent violations.

Intellectual property laws, including patents, trademarks, and copyrights, are critical for Nitto Denko's innovation-driven business. Protecting its proprietary technologies and brand identity is essential for maintaining a competitive edge. In 2023, the company actively filed numerous patents globally to safeguard its advancements in functional films and adhesives, a testament to its focus on IP protection.

Failure to adequately protect its IP can lead to loss of market share and revenue, as competitors may leverage similar technologies. Conversely, infringing on others' IP can result in costly litigation and damages. For instance, patent disputes in the electronics sector frequently involve substantial settlements and licensing fees, underscoring the financial risks associated with IP management.

Nitto Denko's legal strategy must also encompass trade secret protection, ensuring confidential business information remains secure. Robust internal policies and employee agreements are vital for this purpose, particularly as the company operates in a knowledge-intensive industry. The global landscape of IP law is constantly evolving, requiring continuous monitoring and adaptation of legal strategies.

Environmental factors

Governments worldwide are intensifying efforts to combat climate change, with many setting ambitious carbon emission reduction targets. For instance, the European Union aims for a 55% reduction in net greenhouse gas emissions by 2030 compared to 1990 levels, and Japan has pledged to cut emissions by 46% by 2030 from 2013 levels. These regulations directly impact Nitto Denko's operations, requiring significant investments in cleaner manufacturing technologies and sustainable supply chain practices to meet compliance standards.

Nitto Denko is responding to this pressure by actively pursuing strategies to lower its carbon footprint. This includes increasing its use of renewable energy sources, with a goal to procure 100% renewable electricity for its global operations by 2040. The company is also focusing on developing and promoting environmentally friendly products, such as advanced materials that contribute to energy efficiency in various applications, aligning with the growing market demand for sustainable solutions.

Nitto Denko faces increasing pressure to address resource scarcity, particularly for materials like rare earth elements used in its advanced films and components. The rising cost and limited availability of these critical inputs, exemplified by projected shortages of certain metals vital for electronics by 2030, demand proactive strategies. The company is therefore focusing on sustainable sourcing and the development of materials with reduced environmental footprints.

The company's commitment to sustainability is evident in its exploration of bio-based polymers and recycled content for its products. For instance, in 2024, Nitto Denko announced advancements in developing adhesive tapes utilizing plant-derived raw materials, aiming to reduce its reliance on petrochemicals. This aligns with global trends, where the market for sustainable materials is projected to grow significantly, reaching an estimated $200 billion by 2027.

Stricter environmental regulations globally are compelling companies like Nitto Denko to invest more heavily in waste management and recycling. For instance, the European Union's Circular Economy Action Plan, updated in 2020 and with ongoing implementation efforts in 2024 and 2025, sets ambitious targets for waste reduction and increased recycling rates across various industries.

These evolving standards directly affect Nitto Denko's operational costs, requiring significant capital expenditure for advanced waste treatment facilities and innovative recycling technologies. Societal expectations for corporate environmental responsibility are also rising, pushing the company to adopt more sustainable practices throughout its product lifecycle, from manufacturing to end-of-life disposal.

Nitto Denko's commitment to these initiatives is crucial for maintaining its social license to operate and for enhancing its brand reputation. By implementing robust waste management systems and actively participating in product lifecycle recycling programs, the company can mitigate risks associated with non-compliance and potentially uncover new revenue streams through the recovery of valuable materials.

Water scarcity and pollution control

Water scarcity and the ongoing need for robust pollution control present significant environmental considerations for Nitto Denko. Many of its manufacturing sites, especially those involved in processes requiring substantial water, are located in regions facing increasing water stress. This necessitates a proactive approach to water resource management.

Stringent regulations concerning water discharge and pollution control directly impact Nitto Denko's operational costs and compliance requirements. The company must continually invest in advanced water treatment technologies to meet or exceed these standards, ensuring minimal environmental impact from its operations. This focus on sustainability is crucial for maintaining its license to operate and its corporate reputation.

To address these challenges, Nitto Denko is actively implementing comprehensive water management strategies. This includes initiatives aimed at reducing overall water consumption, increasing water recycling rates within its facilities, and exploring alternative water sources where feasible. For instance, in fiscal year 2023, the company reported efforts to optimize water usage across its global operations, aiming for a quantifiable reduction in withdrawal volumes.

- Water Stress Regions: Nitto Denko operates in several areas identified as experiencing high baseline water stress, demanding careful water sourcing and conservation.

- Regulatory Compliance: Adherence to evolving global wastewater discharge standards is a critical operational factor, influencing investment in treatment infrastructure.

- Investment in Technology: The company allocates capital towards innovative water treatment and recycling systems to minimize its environmental footprint and ensure sustainable water use.

- Water Footprint Reduction: Nitto Denko is committed to systematically reducing its overall water footprint through process optimization and efficiency improvements across its manufacturing network.

Biodiversity loss and ecosystem preservation

Growing global awareness of biodiversity loss and the critical need for ecosystem preservation is increasingly shaping corporate responsibility and supply chain ethics. This trend directly impacts how companies like Nitto Denko are evaluated, demanding a closer look at their environmental footprint beyond immediate operational boundaries. For instance, the UN Convention on Biological Diversity’s Strategic Plan for Biodiversity 2011-2020, with its Aichi Biodiversity Targets, highlighted the urgent need for action, and subsequent initiatives continue to push for stronger corporate accountability in 2024 and beyond.

Nitto Denko must proactively assess how its sourcing of raw materials and manufacturing processes might contribute to habitat destruction or negatively affect fragile ecosystems. This requires a comprehensive understanding of its entire value chain. Reports from organizations like the World Economic Forum consistently identify biodiversity loss as a significant global risk, underscoring the financial and reputational implications for businesses that fail to address it. By 2025, many financial institutions and investors are expected to integrate biodiversity risk into their assessments, potentially influencing Nitto Denko's cost of capital and market access.

- Growing investor scrutiny: By 2024, a significant percentage of institutional investors are integrating ESG factors, including biodiversity, into their decision-making.

- Supply chain resilience: Ecosystem degradation can disrupt supply chains for raw materials, impacting production continuity.

- Regulatory pressures: Emerging regulations in 2024-2025 are likely to mandate greater transparency and action on biodiversity impacts.

- Reputational risk: Negative publicity stemming from environmental damage can significantly harm brand image and customer loyalty.

Nitto Denko's environmental strategy is increasingly focused on reducing its carbon footprint, aligning with global climate goals. The company aims for 100% renewable electricity by 2040, underscoring a significant shift in operational energy sourcing. This proactive approach to sustainability is critical as governments worldwide, including Japan's commitment to a 46% emission reduction by 2030 from 2013 levels, impose stricter environmental regulations.

The company is actively developing eco-friendly products, such as those utilizing plant-derived materials, to meet growing market demand for sustainable solutions. For instance, advancements in adhesive tapes made from plant-based polymers were announced in 2024, signaling a move away from petrochemical reliance. This aligns with market projections for sustainable materials, expected to reach $200 billion by 2027.

Nitto Denko is also addressing resource scarcity and waste management challenges. Investments in advanced recycling technologies and efficient water management systems are key priorities, driven by evolving circular economy principles and increasing societal expectations for corporate environmental responsibility. By 2025, enhanced transparency on biodiversity impacts is anticipated, further influencing corporate environmental strategies.

PESTLE Analysis Data Sources

Our Nitto Denko PESTLE Analysis is built on a robust foundation of data from official government publications, leading economic think tanks, and reputable industry-specific research firms. We ensure every insight is grounded in current, factual information to provide a comprehensive view of the macro-environment.