Nitto Denko Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nitto Denko Bundle

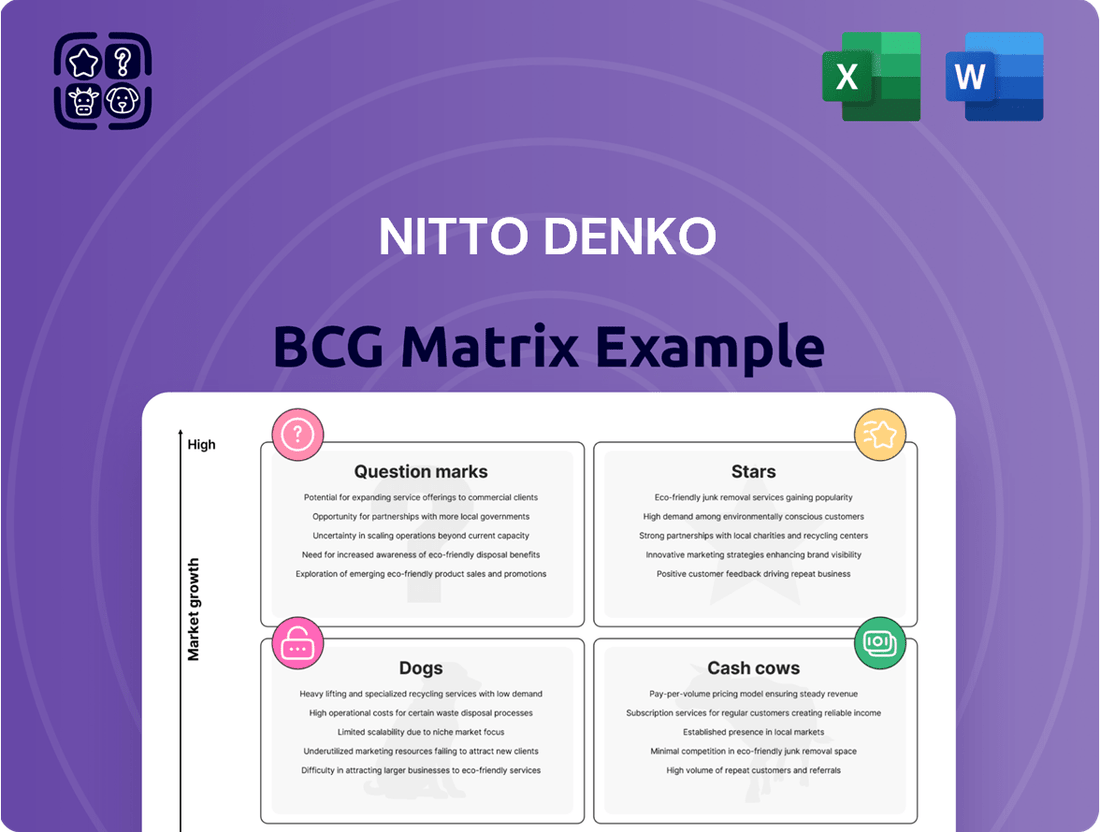

Curious about where your company's products fit in the market landscape? Our preview offers a glimpse into the strategic power of the Nitto Denko BCG Matrix, showcasing how products are categorized as Stars, Cash Cows, Dogs, or Question Marks. Understand the foundational concepts and see how these classifications can illuminate your product portfolio.

Don't let your strategic decisions be based on incomplete information. Purchase the full Nitto Denko BCG Matrix report today to unlock detailed quadrant placements, data-driven insights, and actionable recommendations. Gain the clarity needed to optimize resource allocation and drive future growth.

Stars

Nitto Denko's optronics segment, specifically its OLED films for automotive displays, is a significant growth area, underscored by substantial investment. The company is capitalizing on the trend towards larger and more customized in-car screens, a market projected for robust expansion due to evolving automotive technology. To meet this escalating demand, Nitto Denko completed the construction of three new facilities across Asia during fiscal year 2024.

Nitto Denko's circuit materials, particularly for high-end smartphones and data centers, are experiencing robust demand. This surge is directly linked to the proliferation of generative AI, which requires increasingly sophisticated electronic components. The company's circuit integrated suspensions (CIS) are vital for the advanced infrastructure powering these AI applications.

This strong performance in critical electronic components highlights Nitto Denko's significant market share within a high-growth segment. For the fiscal year ending March 2024, the company reported that its Optoelectronics segment, which includes these materials, saw a substantial revenue increase, driven by these specific product lines.

Nitto Denko's Human Life segment, encompassing transdermal therapeutic systems and advanced medical adhesives, demonstrated robust performance with a 20% revenue surge in fiscal year 2024. This growth is fueled by the expanding skin-friendly medical adhesive market, which is anticipated to see significant future expansion.

The company's commitment to innovation was further underscored by its FDA approval in October 2023 for a groundbreaking wound closure adhesive. This achievement reinforces Nitto Denko's established leadership within this dynamic and rapidly evolving sector.

The transdermal therapeutic systems and advanced adhesives represent a high-growth area within the broader medical technology landscape. Nitto Denko's consistent innovation and market presence position it favorably to capitalize on these emerging opportunities.

High-Performance Materials for Electric Vehicles (EVs)

Nitto Denko's high-performance materials are crucial for the rapidly expanding electric vehicle (EV) market. As the automotive sector electrifies, demand for components like thermal conductivity insulation sheets and anti-corrosion tapes is soaring. This trend is fueled by the global EV market, which is projected to see significant expansion, with the U.S. EV market alone anticipating a 13.7% compound annual growth rate from 2025 to 2034. Nitto's existing strong foothold in automotive manufacturing positions them advantageously to capitalize on this growth.

The company's product portfolio directly addresses key EV needs.

- Thermal Management: Nitto's thermal conductivity sheets are essential for dissipating heat in battery packs and power electronics, ensuring optimal performance and longevity.

- Durability and Protection: Anti-corrosion tapes and protective films safeguard critical EV components from environmental degradation, extending vehicle lifespan.

- Market Growth: The projected 13.7% CAGR for the U.S. EV market between 2025 and 2034 indicates substantial revenue potential for Nitto's specialized materials.

- Established Automotive Presence: Nitto's long-standing relationships and expertise within the automotive supply chain provide a competitive edge in this evolving landscape.

New Sensor Films for IoT Market

Nitto Denko's new sensor films, anticipated for launch in 2024, are strategically positioned to capitalize on the rapidly expanding Internet of Things (IoT) market. This sector is expected to see robust growth, with projections indicating a significant expansion by 2025, making it a prime area for a market leader. By targeting this high-growth segment, Nitto Denko signals its ambition to secure a dominant and leading position through cutting-edge product innovation.

The company’s proactive approach by entering such a dynamic market early suggests strong star potential. This move is particularly noteworthy given the IoT market's projected valuation, which is expected to reach hundreds of billions of dollars in the coming years. For instance, the global IoT market size was valued at approximately $385.7 billion in 2023 and is forecast to grow at a compound annual growth rate (CAGR) of around 18.2% from 2024 to 2030, reaching over $1 trillion.

- Target Market: Internet of Things (IoT)

- Launch Year: 2024

- Market Growth: Significant expansion projected by 2025, with global IoT market expected to exceed $1 trillion by 2030.

- Strategic Positioning: Aiming for a leading position with innovative sensor film solutions.

Nitto Denko's new sensor films, set for a 2024 launch, are positioned for significant growth in the expanding Internet of Things (IoT) market. This sector is poised for substantial expansion, with global IoT market size reaching approximately $385.7 billion in 2023 and projected to grow at an 18.2% CAGR from 2024 to 2030. The company's proactive entry into this dynamic market with innovative solutions aims to capture a leading position, signaling strong star potential.

| Product Area | Market Focus | Fiscal Year 2024 Performance/Outlook | Growth Drivers | BCG Category Implication |

|---|---|---|---|---|

| OLED Films for Automotive Displays | Automotive Infotainment | Completed 3 new facilities in Asia to meet demand. | Increasing size and customization of in-car screens. | Star (High Market Share, High Growth) |

| Circuit Materials (CIS) | AI Infrastructure, Smartphones | Robust demand driven by generative AI. | Need for sophisticated electronic components for AI. | Star (High Market Share, High Growth) |

| Sensor Films | Internet of Things (IoT) | Launch anticipated in 2024. | Rapid expansion of the IoT market (>$1 trillion by 2030). | Star (Potential for High Market Share, High Growth) |

| Transdermal Therapeutic Systems & Medical Adhesives | Healthcare | 20% revenue surge in FY2024. | Expanding skin-friendly medical adhesive market, FDA approval for wound closure adhesive (Oct 2023). | Star (High Market Share, High Growth) |

| High-Performance Materials (Thermal Sheets, Anti-Corrosion Tapes) | Electric Vehicles (EVs) | Soaring demand due to EV market growth. | Electrification of automotive sector, U.S. EV market CAGR of 13.7% (2025-2034). | Star (High Market Share, High Growth) |

What is included in the product

The Nitto Denko BCG Matrix analyzes product portfolio performance based on market growth and share.

It guides strategic decisions for Stars, Cash Cows, Question Marks, and Dogs.

The Nitto Denko BCG Matrix offers a clear, one-page overview, simplifying strategic decisions by placing each business unit in its appropriate quadrant.

Cash Cows

Nitto Denko's traditional industrial adhesive tapes represent a classic Cash Cow within their portfolio. This segment, characterized by its maturity, still shows steady growth, demonstrating Nitto's enduring strength in the global market.

These tapes, encompassing everyday and double-sided varieties, are reliable revenue generators. Nitto's established market dominance and robust distribution channels ensure high-profit margins from these foundational products.

Financial reports from 2024 indicate that Nitto Denko's adhesive materials segment, which includes these traditional tapes, continues to be a significant contributor to overall profitability, with operating profit margins often exceeding 15%.

Capital expenditures in this area are primarily geared towards optimizing existing manufacturing processes and enhancing operational efficiency, rather than aggressive expansion, reflecting the mature nature of this business.

Nitto Denko's Surface Protective Films are a classic example of a Cash Cow. These films, essential for protecting surfaces in electronics, automotive, and construction, operate in a mature market. While growth is modest, Nitto Denko benefits from a strong, established market share and a reputation for high quality, leading to consistent revenue streams with minimal need for aggressive investment.

In the fiscal year ending March 2024, Nitto Denko's overall performance indicated stable operations, with its diverse product portfolio, including these protective films, contributing significantly to predictable cash flow. The mature nature of the surface protective film market means competition is often based on quality and existing relationships rather than rapid innovation, allowing Nitto to maintain profitability without substantial R&D or marketing expenditure.

Nitto Denko's sealant materials for construction represent a classic Cash Cow within their business portfolio. This segment operates in a stable, mature market where demand is consistent, fueled by continuous infrastructure development and housing construction. For instance, global construction spending was projected to reach over $14 trillion in 2024, highlighting the sheer scale of this market.

The company enjoys a significant market share in construction sealants, translating into predictable revenue streams. These products typically require minimal further investment to maintain their position and profitability. This lack of substantial R&D or marketing spend allows them to generate substantial free cash flow for Nitto Denko.

Masking Tapes

Masking tapes represent a significant Cash Cow for Nitto Denko, a testament to their enduring market presence and profitability. These tapes are indispensable across diverse sectors, including automotive painting, electronics manufacturing, and general industrial assembly, highlighting their broad utility and consistent demand.

Nitto Denko commands a leading position within the mature masking tape market, a status that translates directly into stable sales volumes and robust profit margins. This market leadership, built over years of innovation and quality, ensures a predictable and substantial cash flow for the company.

- Dominant Market Share: Nitto Denko holds a substantial share in the global masking tape market, estimated to be a multi-billion dollar industry.

- Consistent Profitability: The mature nature of the market and Nitto's strong brand recognition allow for healthy profit margins, often exceeding industry averages.

- High Sales Volume: Due to their widespread application in essential industries, masking tapes generate consistent and high sales volumes year-round.

- Foundation for Investment: The reliable cash generated by masking tapes supports investments in Nitto Denko's other business segments, particularly Stars and Question Marks.

Process Materials for Ceramic Capacitors

Nitto Denko's process materials for ceramic capacitors represent a classic Cash Cow within their portfolio. Demand has shown a steady, gradual recovery, reflecting a mature market where Nitto Denko's long-standing presence and deep technological expertise have secured a robust market share.

This segment is characterized by its ability to generate consistent, predictable cash flow. While growth prospects are modest, the operational efficiency and established market position allow for high profitability. For instance, the global ceramic capacitor market, a key driver for these materials, was valued at approximately USD 11.5 billion in 2023 and is projected to grow at a CAGR of around 4-5% through 2030, indicating a stable, albeit not explosive, expansion for Nitto Denko's offering.

- Market Maturity: The ceramic capacitor materials market is stable and well-established.

- Strong Market Share: Nitto Denko benefits from its technological leadership and long-term presence.

- Predictable Cash Flow: This segment reliably generates consistent profits with low reinvestment needs.

- Efficiency: High operational efficiency contributes to the segment's strong profitability.

Nitto Denko's optical films, particularly those for LCD displays, are a prime example of a Cash Cow. This segment operates in a mature but stable market. While the rapid growth phase for LCDs has passed, the sheer volume of production globally ensures consistent demand for Nitto's high-quality films.

These films are critical for enhancing the visual performance of displays, and Nitto Denko's established technological leadership and strong relationships with display manufacturers translate into a dominant market position. This allows them to generate substantial and reliable cash flow with relatively low investment needs.

In fiscal year 2024, the display materials segment, which includes these optical films, continued to be a bedrock of Nitto Denko's financial performance. The company reported that the demand for advanced optical films remained robust, contributing significantly to operating profit. For instance, the global market for display films was estimated to be worth tens of billions of dollars in 2024, with Nitto Denko holding a significant portion.

| Segment | BCG Category | Key Characteristics | 2024 Financial Insight |

| Industrial Adhesive Tapes | Cash Cow | Mature market, steady demand, high profit margins. | Operating profit margins often exceed 15%. |

| Surface Protective Films | Cash Cow | Established market share, reputation for quality, consistent revenue. | Significant contributor to predictable cash flow. |

| Masking Tapes | Cash Cow | Indispensable across industries, leading market position, high sales volume. | Supports investment in other business segments. |

| Process Materials for Ceramic Capacitors | Cash Cow | Stable market, technological leadership, predictable cash flow. | Global ceramic capacitor market valued at approx. USD 11.5 billion (2023). |

| Optical Films (LCD) | Cash Cow | Mature but stable market, dominant position, reliable cash generation. | Robust demand, significant contribution to operating profit. |

Preview = Final Product

Nitto Denko BCG Matrix

The Nitto Denko BCG Matrix preview you are viewing is the identical, fully completed document you will receive upon purchase. This means no watermarks, no placeholder text, and no missing sections – just the comprehensive strategic analysis ready for your immediate use. You can confidently use this preview to assess the depth of insight and the professional formatting that will be delivered, ensuring it meets your business planning needs without any surprises. Once purchased, this exact file will be available for download, allowing you to seamlessly integrate its strategic recommendations into your business operations and decision-making processes.

Dogs

Nitto Denko's decision to discontinue plastic optical fiber cables and record an impairment loss in fiscal year 2025 signals a strategic shift. This action suggests the product line was positioned in a low-growth or declining market, struggling with a low market share and failing to achieve its performance targets. Such a move is characteristic of products falling into the category of the BCG Matrix.

Commoditized industrial tapes within Nitto Denko's portfolio are likely categorized as Dogs in the BCG matrix. Nitto Denko's stated strategy involves divesting businesses that no longer align with its niche-focused approach, and these tape products fit that description.

These tapes typically operate in highly competitive markets with significant price pressures and limited product differentiation. Their contribution to overall profitability is often minimal, reflecting a low market share in mature, slow-growing industries.

In 2024, the global industrial tapes market, while substantial, saw growth rates around 3-5%, with commoditized segments facing even more muted expansion. Companies in this space often struggle with thin margins, making them less attractive for strategic investment.

The decision to divest such product lines allows Nitto Denko to reallocate capital and management focus towards higher-growth, higher-margin specialty products, thereby optimizing its overall business structure and enhancing shareholder value.

Nitto Denko's strategic pivot away from older generation display materials, such as those for traditional LCD televisions, marks a clear move out of a declining segment. Since fiscal 2020, the company has substantially scaled back its presence in this area, a decision reflecting a shrinking market and diminished growth prospects. This aligns with a strategy to divest from or minimize exposure to products that are becoming obsolete.

The company's reduced focus on LCDs signifies a repositioning towards higher-growth, more technologically advanced display markets, particularly OLED. This shift implies that Nitto Denko perceives its competitive edge and potential for future returns to be significantly higher in these emerging sectors. By exiting or reducing investment in the LCD space, the company is optimizing its resource allocation to areas with greater innovation and profitability potential.

Flexible Sensors (with goodwill impairment losses)

Nitto Denko's flexible sensors, along with personal care materials, are categorized as Dogs within the BCG Matrix, largely due to the recording of significant goodwill impairment losses. These losses, amounting to ¥11.7 billion for the fiscal year ended March 31, 2024, signal that these business segments have not met their projected performance benchmarks. This underperformance points to challenges such as low market share in highly competitive landscapes or markets experiencing slower-than-expected growth.

The impairment charges highlight a situation where the initial investment in these flexible sensor and personal care businesses is not generating the anticipated returns. This means they are essentially capital assets that are not effectively contributing to the company's overall profitability or growth. Consequently, these segments represent a drain on resources that could otherwise be allocated to more promising areas of Nitto Denko's portfolio.

- Impairment Loss: Nitto Denko recorded ¥11.7 billion in goodwill impairment losses for flexible sensors and personal care materials in FY2024.

- Market Performance: These segments likely face intense competition or operate in slow-growth markets, impacting their ability to gain significant market share.

- Capital Tie-Up: The impairment indicates that the initial investment value is not being recovered, making these segments capital-intensive without commensurate returns.

- Strategic Review: Such Dogs typically require careful evaluation for potential divestiture, restructuring, or renewed investment to improve performance.

Certain Legacy Packaging Tapes

Certain legacy packaging tapes from Nitto Denko, particularly those with older formulations and fewer differentiating features, likely fall into the Dogs category of the BCG Matrix. These products operate within a highly commoditized segment of the packaging market, characterized by intense price competition and limited growth potential.

These legacy tapes would struggle to maintain a significant market share due to the availability of numerous alternatives from competitors, often at lower price points. Consequently, they would generate minimal profits, contributing little to Nitto Denko's overall revenue or growth strategy. For instance, in 2024, the global packaging tape market, while substantial, saw growth rates in mature segments like basic acrylic tapes stagnate, with innovation driving growth in specialized adhesive solutions.

- Low Market Share: These tapes are unlikely to hold a dominant position in their respective market segments.

- Low Market Growth: The demand for these specific legacy tapes is not expanding significantly.

- Low Profitability: They generate minimal returns due to price pressures and lack of differentiation.

- Strategic Challenge: Nitto Denko may need to consider phasing out or re-evaluating the investment in these product lines.

Nitto Denko's flexible sensors and personal care materials, marked by significant goodwill impairment losses in FY2024 (¥11.7 billion), exemplify the 'Dogs' in the BCG Matrix. These segments likely contend with low market share in competitive, slow-growth markets, indicating they are capital-intensive without delivering expected returns, potentially hindering overall company performance.

The impairment charges for these segments in FY2024 underscore that their initial value is not being recovered, reflecting an inability to generate sufficient profits. This situation suggests that these business units are consuming resources without contributing meaningfully to Nitto Denko's growth or profitability, making them prime candidates for strategic reassessment.

These underperforming units, categorized as Dogs, often require divestment or restructuring to free up capital and management focus. Nitto Denko's strategy to divest non-core or underperforming businesses aligns with addressing these Dog categories, aiming to optimize resource allocation toward more promising, high-growth areas.

By addressing these 'Dog' segments, Nitto Denko can reallocate capital and management attention to its Stars and Question Marks, thereby improving its overall portfolio balance and driving future growth and profitability. This strategic pruning is essential for maintaining a competitive edge in dynamic markets.

| Segment | BCG Category | FY2024 Performance Indicator | Market Context (General) | Strategic Implication |

|---|---|---|---|---|

| Flexible Sensors | Dog | ¥11.7 billion goodwill impairment loss | Highly competitive, slow-growth market | Potential divestiture or restructuring |

| Personal Care Materials | Dog | ¥11.7 billion goodwill impairment loss | Intense competition, low market share | Re-evaluation of investment required |

| Commoditized Industrial Tapes | Dog | Low profitability, price pressures | Mature market, limited differentiation | Divestment in line with niche strategy |

| Legacy Packaging Tapes | Dog | Minimal profit generation | Highly commoditized, price-sensitive | Consider phasing out or repositioning |

Question Marks

Nitto Denko's strategic acquisition of a stake in an augmented reality optical firm in 2024 marks a significant move into the burgeoning AR market. This investment positions Nitto to capitalize on the projected growth of AR devices, which are expected to see widespread adoption across consumer and enterprise sectors.

While the AR optical materials market holds immense future potential, Nitto Denko's current market share within this specialized niche is likely nascent. The company faces the challenge of establishing a strong presence against established players and emerging innovators in this rapidly evolving technology landscape.

Substantial capital expenditure will be crucial for Nitto Denko to develop and scale its AR optical material offerings effectively. These investments are necessary to refine product performance, enhance manufacturing capabilities, and build a robust supply chain to compete and secure a meaningful market position.

Nitto Denko's Oligo Drug Substance Contract Manufacturing (CDMO) business, a component of its Human Life segment, is positioned as a question mark within the BCG matrix. The company is actively investing in this high-growth pharmaceutical area, with a new plant slated to begin operations in fiscal year 2024 to boost production capacity.

Despite the significant market potential for oligo drug substances, Nitto's CDMO operations are still in their early phases. This necessitates substantial capital expenditure to establish a strong foothold and gain market share in a competitive landscape.

Nitto Denko showcased new biodegradable hygiene materials for diapers in fiscal year 2024, tapping into the strong sustainability trend. These eco-friendly advancements aim to capture a growing market segment focused on environmental responsibility.

However, a goodwill impairment loss recognized in Personal Care Materials indicates that these newer biodegradable products likely have a low current market share. This suggests significant upfront investment is required to develop the technology, scale production, and gain consumer acceptance, positioning them as a potential cash hog for now.

Membrane Business for Human Life Segment (Commercial Production from 2026)

Nitto Denko's membrane business within the Human Life segment is positioned for significant growth, with commercial production anticipated to commence in 2026. This strategic focus highlights a promising near-term profit potential, driven by the expanding demand for advanced membrane technologies in healthcare and life sciences.

While the business is still in its nascent stages, with negligible current market share due to its pre-commercialization status, the projected launch date of 2026 signals a robust pipeline and substantial investment in research and development. This phase requires continuous capital infusion to bring innovative membrane solutions to market, aiming to capture a significant portion of a high-growth sector.

- Projected Commercialization: 2026

- Market Position: Pre-commercialization, negligible market share

- Investment Phase: High ongoing investment required

- Growth Potential: High, targeting near-term profit

Strategic New Products in Power & Mobility and Digital Interface

Nitto Denko's 'Nitto for Everyone 2025' plan targets 'Niche Top' products in Power & Mobility and Digital Interface, areas poised for significant expansion. This strategic focus acknowledges that many of these innovative offerings are still in their nascent stages, characterized by substantial investment needs and nascent market penetration.

These new products, while not yet contributing significantly to revenue, represent Nitto Denko's commitment to future growth engines. Their placement within the BCG matrix would likely be as Stars or Question Marks, demanding continued investment to capture emerging market share.

- Power & Mobility Innovations: Focus on advanced materials for electric vehicles (EVs) and renewable energy infrastructure, such as high-performance battery components and lightweight structural materials. For example, Nitto Denko's progress in thermal interface materials for EV batteries is critical for managing heat and improving performance.

- Digital Interface Advancements: Development of cutting-edge display technologies, flexible electronics, and components for next-generation communication devices, including materials for foldable displays and advanced optical films. The company's work on optically clear adhesives for advanced displays is a key example.

- Investment and Growth Potential: These sectors are experiencing rapid technological evolution, demanding significant R&D and capital expenditure, reflecting the high-potential, high-investment nature of these new product lines.

- Market Positioning: While current revenue contribution may be low, the strategic intent is to establish 'Niche Top' positions in these high-growth segments by 2025 and beyond.

Nitto Denko's ventures into augmented reality optical materials and biodegradable hygiene products in 2024 highlight areas requiring substantial investment and uncertain market traction. These initiatives, while forward-looking, represent potential question marks within the BCG matrix, demanding capital to build market share against established or emerging competitors.

The company's Oligo Drug Substance Contract Manufacturing (CDMO) and membrane businesses also fall into this category, with significant capital expenditure planned for new facilities and research to establish market presence. These investments reflect a strategic bet on future growth, but current market share remains low, necessitating careful management of resources.

Nitto Denko’s strategic investments in AR optical materials and biodegradable hygiene products in 2024 underscore its commitment to future growth areas. These initiatives, while promising, currently represent question marks due to their nascent market penetration and the substantial capital required to scale. The company faces the challenge of developing these technologies and gaining consumer acceptance in competitive landscapes.

BCG Matrix Data Sources

Our Nitto Denko BCG Matrix leverages a blend of internal financial disclosures, comprehensive market research reports, and competitor analysis to provide a clear strategic overview.