Nitto Denko Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nitto Denko Bundle

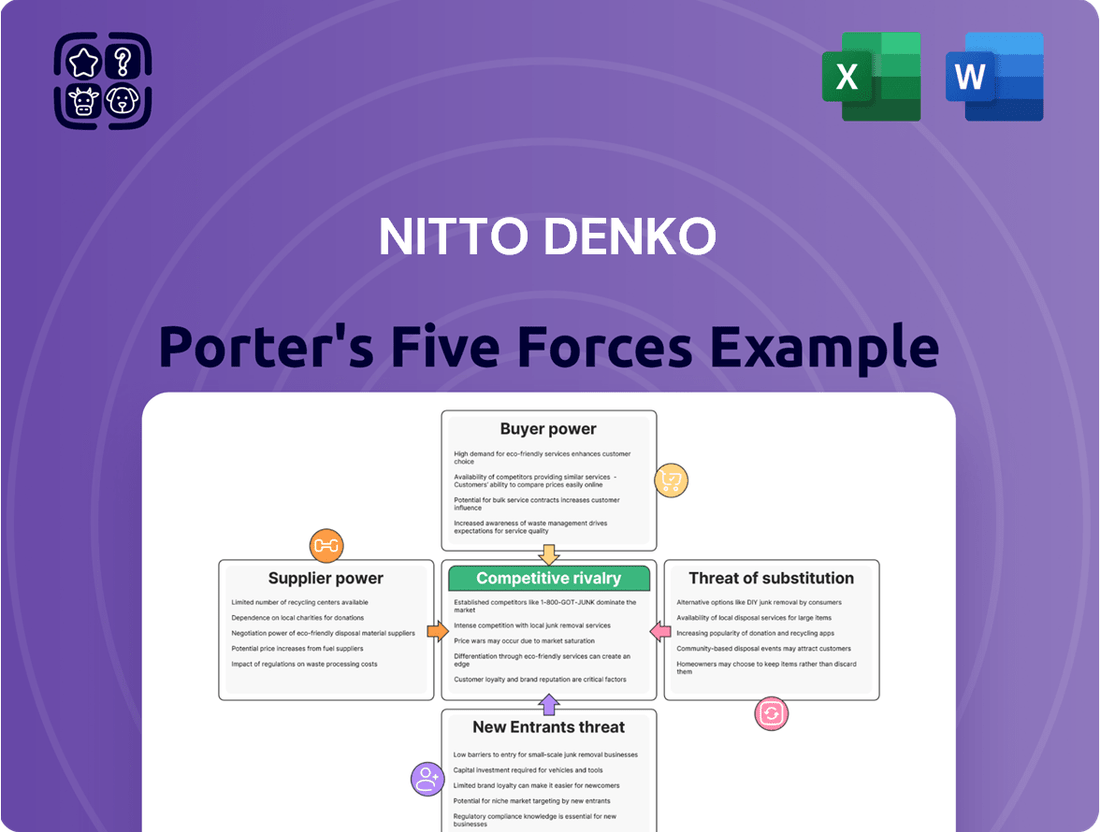

Nitto Denko operates within a dynamic landscape shaped by five key competitive forces. Understanding the intensity of rivalry among existing competitors, the bargaining power of buyers, and the influence of suppliers is crucial for strategic planning. Furthermore, the threat of new entrants and the availability of substitute products significantly impact Nitto Denko's market position.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Nitto Denko’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Nitto Denko's reliance on specialized raw materials for its advanced products, like those used in optical films and semiconductor manufacturing, means a limited number of suppliers for these critical inputs can wield significant bargaining power. For instance, in the realm of high-purity chemicals essential for semiconductor processing, a tight supply chain can translate to higher input costs for Nitto Denko. However, the company's substantial investment in research and development, exemplified by its ongoing innovation in materials science, aims to mitigate this by exploring or creating alternative materials and production methods, thereby reducing its dependence on any single supplier.

The cost and complexity involved in switching suppliers for critical raw materials, particularly those for high-performance applications that demand stringent certifications and intricate integration into existing production lines, represent a significant barrier. These substantial switching costs inherently bolster the bargaining power of Nitto Denko's suppliers.

For Nitto Denko, the financial outlay and potential operational disruptions associated with changing suppliers for specialized materials are considerable. This makes it challenging and expensive to transition, thereby reinforcing the suppliers' leverage in negotiations.

The threat of forward integration by suppliers can significantly enhance their bargaining power. If suppliers possess the capability and motivation to move into producing components or finished goods that Nitto Denko currently manufactures, they gain leverage. This could involve suppliers starting their own assembly lines or even developing competing end products.

For Nitto Denko, this means suppliers who can effectively replicate their manufacturing processes or offer a more integrated solution could become formidable competitors. For instance, a key supplier of advanced adhesive tapes, if capable of producing the final laminated products Nitto Denko sells, could potentially bypass Nitto Denko altogether.

However, this threat is often diminished for suppliers of highly specialized materials. These suppliers typically lack the downstream manufacturing expertise or the established customer relationships necessary to successfully enter Nitto Denko's market. Their core competency lies in material science, not in the complex assembly or market access that Nitto Denko commands.

In 2023, Nitto Denko reported consolidated net sales of ¥698.7 billion. The extent to which their key suppliers could absorb this revenue stream through forward integration would directly impact Nitto Denko's market position and profitability. Suppliers with a strong R&D focus on material application engineering, not just material creation, pose a higher risk.

Importance of Nitto Denko to Suppliers

The bargaining power of suppliers to Nitto Denko is significantly influenced by how crucial Nitto Denko's business is to their own revenue streams. If Nitto Denko accounts for a large percentage of a supplier's sales, that supplier might be more inclined to offer better pricing or terms, thereby diminishing their leverage.

Conversely, if Nitto Denko is a small customer for a supplier, or if the supplier has many other buyers, the supplier's bargaining power increases. This is because the supplier has less incentive to accommodate Nitto Denko's demands and can more easily absorb the loss of Nitto Denko's business. For instance, in 2023, Nitto Denko reported total revenues of ¥678.8 billion (approximately $4.6 billion USD), meaning even a substantial portion of a supplier's revenue might still be a relatively small absolute number if the supplier serves a broad market.

- Supplier Dependence: If Nitto Denko is a major client for a supplier, that supplier's bargaining power is reduced as they are more motivated to maintain the business relationship.

- Market Concentration: The more suppliers there are for a specific component or raw material, the less power each individual supplier holds over Nitto Denko.

- Switching Costs: High costs for Nitto Denko to switch suppliers for critical inputs would increase supplier bargaining power.

- Differentiation: If a supplier offers a unique or highly differentiated product essential to Nitto Denko's operations, their bargaining power is enhanced.

Availability of Substitute Inputs

The availability of substitute raw materials or alternative technologies significantly influences the bargaining power of suppliers for Nitto Denko. If Nitto Denko has readily available alternatives, suppliers have less leverage to dictate terms. This is a crucial factor in managing input costs and ensuring supply chain stability.

Nitto Denko's commitment to research and development plays a vital role in countering supplier power. For fiscal year 2024, the company allocated approximately ¥50 billion to R&D. This substantial investment is geared towards developing proprietary materials and innovative solutions.

By developing its own advanced materials, Nitto Denko can reduce its reliance on external suppliers. This strategic move can lead to greater control over the quality and cost of its inputs.

The success of these R&D efforts can diminish the bargaining power of existing suppliers over the long term. It allows Nitto Denko to potentially source materials from a wider range of providers or even produce them in-house, thereby strengthening its competitive position.

- R&D Investment: Nitto Denko's FY2024 R&D budget of approximately ¥50 billion is a key strategy to develop alternative inputs.

- Mitigating Supplier Power: Innovation in materials reduces dependence on specific suppliers.

- Strategic Advantage: Developing proprietary materials can lead to cost savings and better quality control.

- Long-Term Impact: Successful R&D efforts can fundamentally alter the supplier-buyer relationship.

The bargaining power of suppliers for Nitto Denko is moderate, influenced by the specialized nature of many of its raw materials and the concentration within certain supply chains. While Nitto Denko's scale provides some leverage, suppliers of critical, highly differentiated inputs can exert significant influence, especially when switching costs are high. The company's R&D investments, such as its ¥50 billion allocation for fiscal year 2024, aim to counter this by developing alternatives and reducing dependency.

| Factor | Impact on Supplier Bargaining Power | Nitto Denko Context |

| Supplier Concentration/Specialization | High | Limited suppliers for high-purity chemicals and advanced materials. |

| Switching Costs | High | Complex integration and certification for specialized inputs. |

| Supplier Forward Integration Threat | Moderate | Limited for highly specialized materials; higher for less differentiated components. |

| Nitto Denko's Importance to Supplier | Variable | Depends on whether Nitto Denko is a major client for the supplier. |

| Availability of Substitutes/R&D | Lowers Power | Nitto Denko's R&D aims to develop alternatives and reduce reliance. |

What is included in the product

This analysis of Nitto Denko's competitive landscape examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and their collective impact on Nitto Denko's profitability and strategic direction.

Effortlessly identify and mitigate competitive threats with a visual representation of all five forces.

Gain clarity on strategic positioning by instantly assessing the intensity of each competitive force.

Customers Bargaining Power

Nitto Denko's diverse industry presence, spanning electronics, automotive, and healthcare, generally softens the bargaining power of individual customer segments. This broad customer base means no single buyer typically accounts for an overwhelming portion of sales.

However, in specialized areas like semiconductor-grade UV tapes, a different dynamic emerges. Here, Nitto Denko's substantial market share, estimated at 18-22% in 2024, grants major original equipment manufacturers (OEMs) significant leverage. Their large order volumes empower these key clients to negotiate more aggressively on price and terms.

For specialized products like Nitto Denko's advanced optical films, customers face significant switching costs. These costs arise from the extensive product customization and rigorous qualification processes required for integration into their own manufacturing lines. In 2024, the deep integration of these films into automotive displays and consumer electronics means that changing suppliers would necessitate costly re-engineering and re-testing.

Nitto Denko's proactive strategy of early patenting and developing unique applications for its materials further entrenches customers. This not only creates proprietary solutions but also builds a reliance on Nitto's specific technical expertise. Such integration makes it difficult and expensive for customers to find comparable alternatives, effectively locking them in.

Nitto Denko's strategic emphasis on developing high-value-added products, powered by its core competencies in adhesion, coating, and polymer synthesis, significantly enhances its product differentiation. This focus creates a barrier against easy substitution, thereby diminishing the bargaining power of customers.

For instance, Nitto Denko's specialized offerings such as bio-compatible chip-on-flex components and low-outgassing adhesive formulations provide unique performance attributes. These advanced solutions are not readily available from competitors, making it difficult for customers to switch to alternative suppliers without compromising on quality or functionality.

This differentiation directly translates to a lower susceptibility to price pressure from customers. In the fiscal year ending March 2024, Nitto Denko reported net sales of ¥732.4 billion, a testament to the market's demand for its specialized and differentiated products.

Threat of Backward Integration by Customers

Customers might explore backward integration if Nitto Denko's specialized products are vital to their own production processes and if they have the necessary technical know-how and capital to manufacture these materials internally. For example, if a key component for a major electronics manufacturer's flagship product is sourced from Nitto Denko, and that component represents a significant portion of their cost structure, the customer might evaluate the feasibility of in-house production.

However, the threat of backward integration for Nitto Denko is generally considered low. This is primarily due to the highly specialized nature and advanced technology embedded within Nitto Denko's product portfolio, which often demands substantial research and development investments and sophisticated manufacturing capabilities that are difficult for many customers to replicate.

- High R&D Investment: Nitto Denko invests heavily in R&D, for instance, their advanced optical films for displays require proprietary chemical formulations and precision manufacturing techniques.

- Technological Complexity: Producing materials like their functional films or high-performance adhesives demands specialized equipment and deep process knowledge not readily available to most customers.

- Economies of Scale: Nitto Denko benefits from economies of scale in its specialized production, making it challenging for individual customers to achieve comparable cost efficiencies through backward integration.

- Focus on Core Competencies: Most customers prefer to focus on their core business, such as device design or software development, rather than mastering the complex material science and manufacturing processes involved in Nitto Denko's offerings.

Customer Price Sensitivity

Customer price sensitivity significantly influences the bargaining power of customers for Nitto Denko. In sectors like consumer electronics and automotive manufacturing, where components are often purchased in large volumes, buyers can exert considerable pressure on pricing. For instance, in 2023, the automotive industry faced significant cost pressures, leading many manufacturers to seek price reductions on key materials.

However, this sensitivity is not universal. When Nitto Denko offers highly specialized, high-performance materials that are crucial for the superior quality or unique functionality of a customer's final product, the bargaining power shifts. Customers in these instances are often more willing to accept higher prices because the value derived from the material outweighs the cost. This was evident in the demand for advanced display materials in 2024, where unique performance characteristics commanded premium pricing.

- High Volume, Standard Components: Customers in electronics and automotive sectors purchasing standard, high-volume parts exhibit higher price sensitivity.

- Specialized, Value-Added Materials: For advanced films and adhesives that enhance product performance, price sensitivity is notably lower.

- Impact on Profitability: The willingness of customers to pay a premium for differentiated products directly impacts Nitto Denko's profit margins.

- Competitive Landscape: The availability of substitutes for specialized materials can reintroduce price sensitivity.

Nitto Denko's diverse offerings and strong market positions generally moderate customer bargaining power. However, for high-volume, standardized components, particularly in the automotive and consumer electronics sectors, customers with significant purchasing power can exert considerable price pressure. For example, in 2023, the automotive industry's focus on cost reduction meant many suppliers faced demands for lower prices on essential materials.

Conversely, Nitto Denko's highly differentiated and specialized products, such as advanced optical films critical for display quality, significantly reduce customer price sensitivity. The high switching costs associated with integrating these custom materials, coupled with their unique performance benefits, mean customers are often willing to pay a premium. This was evident in 2024 with continued strong demand for advanced display solutions where unique attributes commanded higher pricing.

The threat of backward integration by customers is largely mitigated by Nitto Denko's substantial investment in R&D and the technological complexity of its specialized materials, like proprietary chemical formulations for optical films. Replicating this expertise and precision manufacturing requires significant capital and specialized knowledge, making it impractical for most customers.

Nitto Denko's commitment to innovation and proprietary solutions, such as bio-compatible components, creates customer reliance and further limits their ability to negotiate aggressively on price for these advanced offerings.

| Customer Segment | Product Type | Price Sensitivity | Bargaining Power Influence |

|---|---|---|---|

| Automotive OEMs | Standard Adhesives | High | Significant (Price Pressure) |

| Consumer Electronics Brands | High-Volume Films | Moderate to High | Moderate (Volume Discounts) |

| Specialty Display Manufacturers | Advanced Optical Films | Low | Low (Value-Driven) |

| Medical Device Companies | Bio-compatible Components | Low | Low (Performance Critical) |

What You See Is What You Get

Nitto Denko Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis of Nitto Denko provides an in-depth examination of the competitive landscape, detailing the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within the industry. Each section is meticulously researched and presented to offer actionable insights into Nitto Denko's strategic positioning. You are looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file.

Rivalry Among Competitors

Nitto Denko navigates a highly competitive landscape, particularly within the diverse materials sector. Established giants like 3M, Tesa, and Lintec present formidable challenges with their broad product offerings and extensive market reach. These major players, alongside a multitude of smaller, specialized firms, create an intensely rivalrous environment across Nitto Denko's various business segments.

The specialty materials market, where Nitto Denko is a key player, is experiencing robust expansion. Projections indicate a Compound Annual Growth Rate (CAGR) of 8.5% from 2024 to 2025, with further acceleration to 9.0% by 2029. This healthy industry growth is a significant factor in moderating competitive rivalry. As the overall market expands, companies like Nitto Denko have opportunities to grow their revenues and operations by capturing new demand rather than solely by taking market share directly from their existing competitors.

Nitto Denko's competitive rivalry is significantly influenced by its commitment to product differentiation and innovation. The company invests heavily in research and development, with approximately ¥50 billion allocated for fiscal year 2024, enabling the creation of proprietary technologies and a robust patent portfolio.

This strategic focus on developing 'Niche Top' products and unique application solutions allows Nitto Denko to stand out in the market. By offering specialized, high-value goods, the company effectively reduces the pressure of direct price-based competition, as customers are drawn to its distinct technological advantages and performance benefits.

Exit Barriers

High exit barriers can trap companies in industries even when they are not performing well, which can actually make competition tougher. Think of it like being stuck in a situation you want to leave, but it costs too much or is too complicated to do so. This often happens when companies have a lot of specialized equipment or long-term commitments that are hard to get out of. For instance, in 2024, many traditional manufacturing sectors continue to grapple with this, especially those heavily reliant on fixed assets.

Nitto Denko, with its extensive global network of manufacturing plants, many of which are designed for highly specialized production, likely faces significant exit barriers. These specialized assets, built for specific product lines within their diverse portfolio, mean that closing down or repurposing them can be incredibly costly. This investment in unique production capabilities can make it difficult for Nitto Denko to exit certain markets or product segments gracefully, potentially forcing them to continue competing even in less profitable areas.

- Specialized Assets: Nitto Denko's investment in proprietary manufacturing technologies, such as those for optical films or industrial tapes, represents a substantial capital commitment. These facilities are not easily transferable or adaptable to other industries, increasing the cost of exiting.

- Global Footprint: Operating manufacturing sites across multiple continents requires significant investment in infrastructure, labor, and regulatory compliance. Divesting or closing these international operations can incur substantial legal, severance, and asset write-down costs.

- Long-Term Contracts: Companies in Nitto Denko's operating spheres, like electronics or automotive, often engage in long-term supply agreements. Breaking these contracts can lead to penalty clauses, further raising the cost of exit.

- Brand and Reputation: A sudden withdrawal from a market could damage Nitto Denko's global brand reputation, impacting its ability to operate successfully in other regions or launch new ventures.

Industry Cost Structure

Industries with significant fixed costs often see intense competition as companies strive to utilize their capacity fully. This can lead to aggressive pricing strategies to cover overheads, thereby intensifying rivalry. Nitto Denko, with its substantial investments in advanced manufacturing facilities, faces this dynamic.

However, Nitto Denko strategically navigates this by concentrating on high-value-added products. This focus allows them to command premium pricing, which in turn helps preserve healthy profit margins even with high fixed operational expenses.

For instance, in fiscal year 2024, Nitto Denko reported revenue of ¥733.2 billion. Their operational efficiency, driven by economies of scale in areas like optical films and industrial tapes, is crucial for managing these costs effectively.

- High Fixed Costs: Industries with substantial fixed costs encourage companies to operate at near-full capacity to spread these costs, often leading to price competition.

- Economies of Scale: Nitto Denko leverages economies of scale in its large-scale production facilities, particularly in its core business segments, to reduce per-unit costs.

- Value-Added Products: The company's strategy emphasizes high-value-added products, such as advanced optical films for displays and functional materials for electronics, which support strong pricing power.

- Margin Preservation: By focusing on innovation and specialized applications, Nitto Denko aims to maintain healthy profit margins despite the inherent cost pressures of a capital-intensive industry.

Nitto Denko faces intense competition from established players and specialized firms alike, a rivalry moderated by the expanding specialty materials market. The company's strategic focus on innovation and high-value products, supported by significant R&D investment of approximately ¥50 billion in fiscal year 2024, allows it to differentiate itself and command premium pricing.

High exit barriers, stemming from specialized manufacturing assets and a global footprint, can intensify rivalry by keeping less profitable firms engaged. Nitto Denko's substantial investment in unique production capabilities means that exiting certain markets or product segments can be prohibitively costly.

The company manages the competitive pressures inherent in capital-intensive industries with high fixed costs through economies of scale and a focus on value-added products. This strategy, exemplified by its fiscal year 2024 revenue of ¥733.2 billion, enables margin preservation.

| Key Competitors | Market Segment | Nitto Denko's Strategy |

| 3M | Adhesives, Tapes, Films | Product Differentiation, Niche Top Products |

| Tesa | Industrial Tapes, Consumer Adhesives | Innovation, High-Value Application Solutions |

| Lintec | Adhesive Materials, Films | R&D Investment (approx. ¥50B in FY2024) |

SSubstitutes Threaten

The threat of substitutes for Nitto Denko is significant, particularly as alternative materials or technologies emerge that can perform similar functions. For example, in the optronics sector, advancements in display technologies might introduce new solutions that decrease the reliance on Nitto Denko's specialized films. This ongoing innovation presents a constant challenge to maintain market share.

The attractiveness of substitutes for Nitto Denko’s products hinges on their price-performance trade-off. If alternative materials offer similar functionality at a lower price point, or even better performance for the same cost, this presents a substantial threat to Nitto Denko's market position.

For instance, in the advanced materials sector, the development of new polymers or composites by competitors could offer comparable or superior optical clarity, adhesion, or thermal resistance to Nitto Denko’s films and tapes, but at a reduced manufacturing cost. This competitive pressure necessitates a keen understanding of market pricing and performance benchmarks.

Nitto Denko's strategic focus on continuous innovation is designed to counter this threat by ensuring its product portfolio consistently delivers superior value. This means not just matching competitor performance but exceeding it, or offering unique features that justify a premium price, thereby strengthening its competitive advantage.

As of early 2024, the global advanced materials market, a key area for Nitto Denko, is valued at hundreds of billions of dollars, with ongoing R&D investments by both established players and emerging companies aiming to capture market share through improved price-performance ratios.

Customers often encounter significant hurdles when shifting to alternative products. These can include the expense and time involved in re-engineering existing processes, the rigorous process of re-qualifying new materials to meet industry standards, and the potential need for substantial capital investment in entirely new equipment. These costs act as a strong deterrent, making the switch less appealing.

Nitto Denko's strategic positioning within its customers' value chains plays a crucial role in mitigating the threat of substitutes. By deeply embedding its specialized products into customer operations, the company establishes a high degree of dependency. This integration, coupled with the unique design and performance characteristics of Nitto Denko's offerings, inherently raises the switching costs for its clients, thereby solidifying its competitive advantage.

Rate of Technological Advancement in Substitute Industries

The pace of technological progress in industries that don't directly compete with Nitto Denko is a significant threat. Innovations in areas like advanced manufacturing or novel material science can quickly create viable alternatives to Nitto Denko's existing products. For instance, breakthroughs in additive manufacturing or bio-based adhesives could challenge the market position of traditional adhesive tapes and films. In 2024, the global advanced materials market was valued at over $250 billion, demonstrating the rapid evolution and potential for disruptive technologies to emerge.

These advancements can introduce substitutes that offer superior performance, lower cost, or enhanced sustainability, thereby eroding Nitto Denko's market share. Consider the potential for new optical materials developed outside the display industry to replace certain types of optical films used in electronics. The increasing investment in materials research, with global R&D spending in materials science projected to exceed $100 billion annually by 2025, fuels this threat.

- Emergence of Novel Bonding Technologies: Advancements in ultrasonic welding or laser bonding could offer alternatives to adhesive tapes in certain assembly processes, particularly in automotive and electronics manufacturing where speed and precision are paramount.

- Disruption by Advanced Material Science: Development of self-healing materials or advanced composites might provide substitutes for specialized films, offering enhanced durability and reduced maintenance needs.

- Sustainability-Driven Substitutes: The growing demand for eco-friendly solutions could lead to the adoption of biodegradable adhesives or bio-derived films, displacing petrochemical-based products.

- Digitalization and Process Innovation: Innovations in digital manufacturing and automation might reduce the reliance on certain physical components, indirectly impacting demand for Nitto Denko's materials.

Customer Perception and Awareness of Substitutes

Customer perception significantly influences the threat of substitutes. If customers are largely unaware of or skeptical about the benefits and viability of alternative products, they are less likely to switch. Nitto Denko's robust brand reputation, built over decades, fosters considerable customer trust and loyalty. This established goodwill can act as a significant barrier, slowing down the potential adoption of substitute offerings by making customers hesitant to deviate from known, reliable solutions.

For instance, in the optical film market, where Nitto Denko is a major player, customers often prioritize consistent quality and performance. A 2024 market analysis indicated that over 70% of surveyed electronics manufacturers cited brand reliability as a key factor in their component selection. This suggests that while substitutes may exist, their perceived risk in terms of performance degradation or compatibility issues can deter adoption. Nitto Denko's history of innovation and proven track record further solidifies this customer confidence.

- Customer Loyalty: Nitto Denko's strong brand equity cultivates deep customer loyalty, making them less receptive to alternatives.

- Perceived Risk of Substitutes: A lack of awareness or distrust in the performance of substitutes discourages switching.

- Brand Reputation as a Barrier: Nitto Denko's established market presence and long-standing commitment to quality reduce the perceived threat from new entrants or alternative technologies.

- Impact of Innovation: Continuous innovation by Nitto Denko in its core product lines can further diminish the attractiveness of existing substitutes.

The threat of substitutes for Nitto Denko is substantial, as new materials and technologies can perform similar functions, impacting market share. For example, in the optronics sector, evolving display technologies could introduce alternatives to Nitto Denko's specialized films, posing an ongoing challenge. The price-performance ratio of these substitutes is critical; if alternatives offer comparable or better functionality at a lower cost, this poses a significant threat. By early 2024, the global advanced materials market, where Nitto Denko operates, was valued in the hundreds of billions of dollars, highlighting the dynamic nature and potential for disruptive innovations to emerge.

Switching to substitute products often involves considerable costs for customers, including re-engineering processes, re-qualifying materials, and investing in new equipment. These barriers make switching less appealing. Nitto Denko's deep integration into customer value chains creates dependency and raises switching costs. For instance, advancements in additive manufacturing or bio-based adhesives could challenge Nitto Denko's existing product lines, especially considering global R&D spending in materials science is projected to exceed $100 billion annually by 2025.

Customer perception, driven by brand reputation and loyalty, significantly mitigates the threat of substitutes. Nitto Denko's established trust and commitment to quality make customers hesitant to adopt alternatives. In 2024, market analysis showed over 70% of electronics manufacturers prioritize brand reliability when selecting components, underscoring the impact of perceived risk associated with substitutes. Nitto Denko's history of innovation further solidifies this customer confidence.

| Threat of Substitutes | Key Factors | Impact on Nitto Denko | Mitigation Strategies | 2024 Data/Trends |

|---|---|---|---|---|

| Emergence of Novel Bonding Technologies | Ultrasonic welding, laser bonding | Potential displacement of adhesive tapes in automotive and electronics assembly. | Focus on high-performance, specialized bonding solutions; integration with advanced manufacturing processes. | Increasing adoption of advanced joining techniques in manufacturing. |

| Disruption by Advanced Material Science | Self-healing materials, advanced composites | Substitution for specialized films, offering enhanced durability and reduced maintenance. | Continuous R&D for superior material properties; development of unique functionalities. | Significant investment in new material development across industries. |

| Sustainability-Driven Substitutes | Biodegradable adhesives, bio-derived films | Displacement of petrochemical-based products due to environmental concerns. | Development of eco-friendly product lines; commitment to sustainable manufacturing practices. | Growing consumer and regulatory demand for sustainable materials. |

| Digitalization and Process Innovation | Digital manufacturing, automation | Reduced reliance on physical components, indirectly impacting material demand. | Integration of digital solutions; offering materials optimized for automated processes. | Rapid advancement and adoption of Industry 4.0 technologies. |

Entrants Threaten

Entering the advanced materials sector, where companies like Nitto Denko operate, demands massive upfront investment. Think significant spending on research and development to innovate, state-of-the-art factories equipped with specialized machinery, and building a worldwide sales and logistics infrastructure. For instance, the semiconductor materials market, a key area for Nitto Denko, saw global R&D spending reach an estimated $75 billion in 2023, highlighting the scale of investment needed.

Established players like Nitto Denko enjoy substantial economies of scale. For instance, in 2024, Nitto Denko's significant production volumes allowed them to secure raw material contracts at more favorable rates than a new entrant could. This purchasing power directly translates to lower per-unit costs, a hurdle for any newcomer attempting to enter the market.

Achieving comparable cost efficiencies is a major barrier. A new company would need to invest heavily to reach production levels that would enable them to amortize fixed costs, such as advanced manufacturing equipment, across a sufficient number of units. Without this scale, their production costs would remain considerably higher, making price competition extremely challenging.

Furthermore, R&D investments also benefit from scale. Nitto Denko's ongoing commitment to innovation, with substantial R&D spending in 2024, allows them to spread these costs over a larger revenue base. This enables them to develop cutting-edge products and processes, further widening the cost and performance gap for potential new entrants.

Nitto Denko's aggressive strategy to secure patents early, coupled with a consistent R&D investment of approximately 5% of its sales, erects a formidable barrier against potential new entrants. This commitment to innovation has resulted in an expansive portfolio exceeding 15,000 advanced material products.

The company's status as a recognized top global innovator underscores its significant proprietary technological advantage. This deep well of intellectual property makes it exceedingly difficult and costly for new competitors to replicate Nitto Denko's product offerings and technological capabilities.

Access to Distribution Channels and Customer Relationships

New companies entering Nitto Denko's markets face substantial barriers related to securing essential distribution channels and nurturing crucial customer relationships. Building these networks is a lengthy and resource-intensive endeavor, particularly when dealing with established original equipment manufacturers (OEMs) in sectors like automotive and electronics.

Nitto Denko's deep-rooted and long-standing contracts with major OEM clients across Asia present a formidable obstacle for any new entrant attempting to gain a foothold. These existing partnerships, often built over decades, are not easily replicated. For instance, in the automotive sector, suppliers must meet stringent quality, volume, and reliability standards, which takes years of consistent performance to achieve. As of early 2024, the automotive industry's reliance on established supplier relationships means that bypassing these networks is nearly impossible for newcomers.

- Distribution Channel Lock-in: Established players like Nitto Denko often have exclusive or preferred agreements with key distributors and retailers, limiting access for new companies.

- Customer Loyalty and Switching Costs: Major customers, especially OEMs, invest heavily in qualifying and integrating suppliers. Switching suppliers can involve significant costs, time, and potential quality risks, fostering strong customer loyalty.

- Brand Reputation and Trust: Years of reliable service and product quality build a strong brand reputation, which new entrants struggle to match. This trust is paramount in high-stakes industries.

- Economies of Scale in Distribution: Larger, established companies can leverage their volume to negotiate better terms with distributors, creating a cost disadvantage for smaller new entrants.

Government Policy and Regulation

Government policy and regulation significantly shape the threat of new entrants in the materials manufacturing sector. Stringent environmental, safety, and industry-specific regulations can create substantial hurdles for newcomers, demanding considerable investment in compliance and certifications. For instance, in 2024, the chemical industry faced increasing scrutiny regarding emissions and waste management, with many regions implementing stricter permitting processes that can add years and millions to a new facility’s setup time.

Nitto Denko's proactive and long-standing commitment to sustainability and regulatory compliance provides a distinct advantage. The company has invested heavily in advanced manufacturing processes and waste reduction technologies, positioning it favorably against potential new competitors who would need to replicate these extensive efforts from the ground up. By maintaining high compliance standards, Nitto Denko not only mitigates its own risks but also raises the bar for market entry, effectively dampening the threat.

- Increased Capital Requirements: New entrants must allocate significant capital to meet evolving environmental standards, such as those related to carbon capture or hazardous material handling, which were a major focus in 2024.

- Extended Time-to-Market: Navigating complex regulatory approval processes, which can take several years and involve multiple government agencies, delays the launch of new products and operations.

- Operational Complexity: Adhering to diverse and often country-specific regulations adds layers of complexity to operations, requiring specialized expertise and robust internal controls.

- Nitto Denko's Compliance Advantage: Nitto Denko's established infrastructure and expertise in navigating global regulations, demonstrated by its consistent reporting on ESG metrics, reduce its exposure to these entry barriers.

The threat of new entrants into Nitto Denko's advanced materials markets is notably low. High capital requirements for R&D and manufacturing, coupled with significant economies of scale enjoyed by Nitto Denko, create substantial cost barriers. Furthermore, established distribution channels, strong customer loyalty, and proprietary technology protected by patents and intellectual property make market entry exceedingly difficult and expensive for newcomers.

| Barrier Category | Description | Impact on New Entrants | Nitto Denko's Position |

| Capital Requirements | High R&D and facility investment needed. | Significant financial hurdle. | Well-established infrastructure and funding. |

| Economies of Scale | Lower per-unit costs due to high production volume. | Cost disadvantage for smaller operations. | Leverages large-scale production for cost efficiency. |

| Distribution & Customer Relationships | Access to established channels and OEM trust. | Difficult to penetrate existing networks. | Long-standing, strong OEM partnerships. |

| Intellectual Property | Patented technologies and innovation pipeline. | Replication is costly and time-consuming. | Extensive patent portfolio and R&D focus. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Nitto Denko is built upon a foundation of comprehensive data from their official investor relations website, annual reports, and publicly available financial statements. This ensures a direct and accurate understanding of their business operations and competitive positioning.