Nexstar Media Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nexstar Media Group Bundle

Nexstar Media Group, a dominant force in local broadcasting, boasts significant strengths in its vast station portfolio and diversified revenue streams. However, it faces challenges from evolving media consumption habits and increasing competition. Understanding these dynamics is crucial for anyone looking to invest or strategize within the media landscape.

Discover the complete picture behind Nexstar's market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Nexstar Media Group stands as the largest owner of local television stations in the U.S., boasting over 200 stations in 116 markets. This extensive reach allows them to connect with roughly 70% of American television households, solidifying their position as a leading local media entity.

Their vast network is a powerful platform for delivering local news, entertainment, and sports, fostering deep engagement within communities. The company's significant investment in local content is underscored by its 6,000 local journalists and 1,600 sales professionals.

These local teams cultivate robust relationships with over 40,000 businesses, a key factor in driving substantial revenue from local programming and advertising sales.

Nexstar Media Group has showcased impressive financial strength, highlighted by record net revenue of $1.49 billion in the fourth quarter of 2024, marking a 14.1% jump from the previous year. Its full-year 2024 revenue also reached an all-time high of $5.41 billion.

The company's ability to consistently generate strong adjusted free cash flow is a significant advantage. In 2024 alone, Nexstar returned a substantial $820 million to its shareholders through a combination of dividends and share repurchases, demonstrating a commitment to rewarding its investors.

Nexstar has a proven track record of increasing its dividend payments, signaling financial health and confidence in its ongoing profitability. This consistent dividend growth is attractive to income-focused investors.

Analyst sentiment towards Nexstar remains highly positive, with a consensus 'Strong Buy' rating. The average price target suggests significant potential upside, underscoring market confidence in the company’s financial stability and its capacity for future growth.

Nexstar Media Group's strength lies in its diverse revenue streams, extending well beyond traditional broadcast advertising. Favorable renewals of retransmission consent agreements are anticipated in 2025 and 2026, bolstering distribution revenue.

The company's national cable networks, particularly NewsNation, are a significant asset. NewsNation's transition to 24/7 programming has driven notable viewership growth, contributing to a broader content portfolio.

Nexstar's 75% ownership of The CW Network further diversifies its media holdings and revenue potential. This stake allows for strategic integration and expansion within the broadcast and cable landscape.

A robust digital presence, encompassing over 138 websites and numerous mobile applications, is another key strength. This digital footprint enables diversified content distribution and innovative advertising solutions, reaching a wider audience.

Strategic Investment in Future Technologies (ATSC 3.0)

Nexstar Media Group is strategically investing in and advancing ATSC 3.0, or NextGen TV technology. This commitment is already showing significant reach, with over 50% of U.S. television households now able to receive an ATSC 3.0 signal. This forward-thinking approach is designed to unlock new revenue streams and sharpen Nexstar's competitive advantage.

By leveraging spectrum for advanced broadcasting capabilities, Nexstar is not just improving current offerings but also paving the way for data services. The establishment of EdgeBeam Wireless, LLC, a joint venture focused on wireless data delivery, underscores this commitment. This move positions Nexstar to capitalize on the evolving media landscape.

- ATSC 3.0 Reach: Over 50% of U.S. television households have access to an ATSC 3.0 signal.

- New Revenue Streams: Investment in ATSC 3.0 and EdgeBeam Wireless aims to create new income opportunities.

- Competitive Edge: Advanced broadcasting and data services enhance Nexstar's market position.

Commitment to Quality Journalism and Local Content

Nexstar Media Group's commitment to high-quality local journalism is a significant strength. The company employs a substantial workforce of local journalists, generating an impressive 316,000 hours of local programming each year. This dedication to community-focused content has not gone unnoticed, evidenced by Nexstar's impressive haul of 52 Regional Edward R. Murrow Awards in 2025. This focus fosters strong viewer loyalty and sets Nexstar apart from competitors primarily focused on national or digital-only content.

This emphasis on local reporting serves as a key differentiator in the media landscape. By providing trusted, relevant news and programming tailored to specific communities, Nexstar cultivates deeper connections with its audience. This strategy not only enhances viewership but also strengthens brand reputation as a reliable source of local information.

- Extensive Local Programming: Over 316,000 hours of local content produced annually.

- Industry Recognition: Awarded 52 Regional Edward R. Murrow Awards in 2025.

- Viewer Loyalty: Cultivates strong audience connections through community-focused content.

- Competitive Edge: Differentiates from national and digital-first media outlets.

Nexstar's extensive network of over 200 local television stations across 116 markets provides a significant competitive advantage, reaching approximately 70% of U.S. television households. This broad footprint is supported by a substantial local workforce of 6,000 journalists and 1,600 sales professionals, cultivating strong community ties and advertiser relationships. The company's financial performance is robust, with record net revenue of $1.49 billion in Q4 2024 and $5.41 billion for the full year 2024, alongside a consistent commitment to shareholder returns through dividends and buybacks.

Diversified revenue streams beyond traditional advertising, including favorable retransmission consent agreements and the growing national cable network NewsNation, further bolster Nexstar's market position. The strategic 75% ownership of The CW Network adds significant value and expansion opportunities. Furthermore, Nexstar's investment in ATSC 3.0 technology, now accessible to over 50% of U.S. TV households, and its joint venture EdgeBeam Wireless position the company for future growth in advanced broadcasting and data services.

| Strength Area | Key Metrics/Facts | Impact |

|---|---|---|

| Market Reach | 200+ local TV stations, 116 markets, 70% U.S. household reach | Dominant position in local media |

| Local Content & Workforce | 6,000 journalists, 316,000+ annual local programming hours, 52 Regional Edward R. Murrow Awards (2025) | Strong community engagement, viewer loyalty, industry recognition |

| Financial Performance | Record $1.49B Q4 2024 revenue, $5.41B FY 2024 revenue, $820M returned to shareholders (2024) | Financial stability, investor confidence, profitability |

| Diversification & Growth | NewsNation viewership growth, 75% ownership of The CW, ATSC 3.0 reach (50%+ U.S. households) | Expanded revenue streams, strategic market positioning for future technologies |

What is included in the product

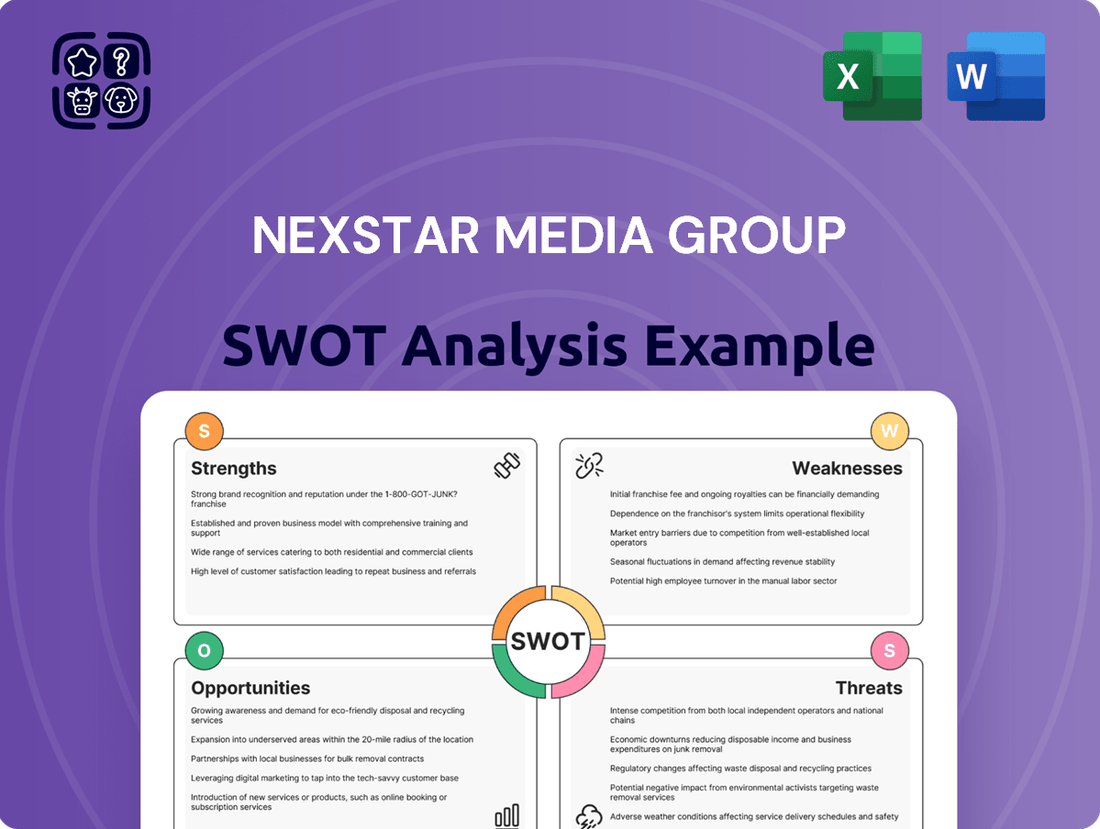

Analyzes Nexstar Media Group’s competitive position through key internal and external factors, highlighting its diversified media portfolio and market reach while identifying challenges like evolving media consumption habits.

Offers a clear breakdown of Nexstar's competitive landscape, highlighting areas for growth and potential risks.

Weaknesses

Nexstar's reliance on political advertising presents a significant weakness, as this revenue stream is inherently cyclical. While election years, such as 2024, typically see substantial ad spending, the subsequent non-election years, like 2025, experience a predictable downturn. This fluctuation can create financial instability, potentially impacting profitability and necessitating operational adjustments.

The traditional advertising market, the bedrock of broadcast revenue, is still grappling with significant challenges. Nexstar, like many in the industry, saw its core advertising revenue, excluding political spending, decline by 10.2% year-over-year in the first quarter of 2025. This trend highlights a fundamental shift in how advertisers allocate their budgets.

This ongoing decline is largely driven by the migration of both advertisers and consumers to digital platforms. The ease of targeting and measurable ROI offered by digital channels has made them increasingly attractive. Consequently, traditional broadcasters are compelled to innovate and develop new monetization strategies beyond their established models.

Furthermore, the digital advertising landscape itself is becoming increasingly saturated. As more players vie for attention online, the cost-effectiveness of digital ads can diminish, creating a complex environment for all participants. This saturation necessitates a strategic re-evaluation of how to capture and retain advertising revenue in an evolving media ecosystem.

Nexstar Media Group faces a significant challenge with the ongoing decline in linear TV viewership, a trend exacerbated by widespread cord-cutting. This shift means fewer people are watching traditional broadcast news, directly impacting Nexstar's core audience for its local TV stations.

Younger demographics, in particular, are migrating to streaming services and digital platforms for their news and entertainment. This exodus from traditional television shrinks the overall viewer base for local news, a critical issue for a company heavily reliant on this segment.

The erosion of the traditional viewer base directly affects Nexstar's retransmission fees, a vital revenue stream. As fewer households subscribe to cable or satellite packages that carry Nexstar's channels, these fees naturally diminish, putting pressure on overall financial performance.

For instance, Nielsen data from early 2024 indicated a continued year-over-year decline in broadcast TV viewing, particularly among adults aged 18-49. This trend underscores the persistent challenge Nexstar must navigate as it seeks to adapt its business model to evolving media consumption habits.

Uncertainty and Losses at The CW Network

The CW Network's ongoing transformation, despite a strategic shift towards more cost-effective content like live sports and reality programming, has encountered significant headwinds. This pivot has unfortunately alienated some of its established audience, and the network is still navigating the path to consistent profitability.

Nexstar Media Group's ambitious target of making The CW profitable by 2026 remains a key objective, but recent financial results underscore the challenges. For instance, the network's performance in Q1 2025 directly impacted Nexstar's overall financial health, contributing to a noticeable decrease in both net income and adjusted EBITDA. This situation highlights the substantial ongoing investment and inherent risks tied to The CW's turnaround strategy.

- Audience Alienation: The strategic shift in content has disrupted the viewership base.

- Profitability Target: Nexstar aims for CW profitability by 2026, but this remains a future goal.

- Q1 2025 Impact: The CW's performance negatively affected Nexstar's net income and adjusted EBITDA.

- Ongoing Investment: Significant capital is still required to support the network's turnaround.

High Debt Levels and Interest Rate Exposure

Nexstar Media Group’s substantial debt burden is a notable weakness. As of March 31, 2025, the company reported consolidated debt totaling $6.5 billion. While Nexstar has made strides in debt reduction and managing leverage, the prospect of refinancing maturing debt at potentially elevated interest rates poses a risk. This could put pressure on future cash flows and profitability, particularly given the ongoing challenges in traditional revenue streams.

The company’s financial strategy must contend with this significant debt load and its sensitivity to interest rate fluctuations. Key considerations include:

- Debt Principal: $6.5 billion as of March 31, 2025.

- Interest Rate Sensitivity: Refinancing upcoming maturities at higher rates could impact earnings.

- Revenue Pressures: Declining traditional revenues amplify the impact of increased debt servicing costs.

Nexstar's substantial debt load remains a significant concern, with consolidated debt standing at $6.5 billion as of March 31, 2025. This leverage makes the company vulnerable to rising interest rates, which could increase debt servicing costs and strain profitability, especially when combined with declining advertising revenues.

| Financial Metric | Value (as of March 31, 2025) | Implication |

|---|---|---|

| Consolidated Debt | $6.5 billion | Increases financial risk and sensitivity to interest rate changes. |

| Interest Rate Sensitivity | High | Potential for increased debt servicing costs if rates rise for refinancing. |

| Revenue Vulnerability | Exposed to traditional ad market declines | Amplifies the impact of debt on cash flow and profitability. |

What You See Is What You Get

Nexstar Media Group SWOT Analysis

The preview you see is the actual Nexstar Media Group SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This detailed report breaks down the company's Strengths, Weaknesses, Opportunities, and Threats, offering crucial insights for strategic planning. You'll gain a comprehensive understanding of Nexstar's competitive landscape and future prospects. Purchase unlocks the entire in-depth version, providing actionable intelligence.

Opportunities

The ongoing migration of viewers to digital platforms and streaming services provides a prime opportunity for Nexstar to enhance its digital publishing and advertising capabilities. By effectively distributing its rich local content and national programming, including NewsNation and The CW, across Connected TV (CTV) and mobile applications, Nexstar is well-positioned to tap into growing digital advertising streams and attract a wider viewership.

Nexstar Media Group is strategically enhancing its sports programming, notably by adding WWE NXT and NASCAR Xfinity Series events to The CW Network, alongside significant Pac-12 college football coverage. This expansion also includes partnerships with numerous local sports teams across its extensive station footprint. This focus on live sports is a powerful strategy to attract viewers and command premium advertising rates, effectively counteracting the ongoing shifts in traditional linear television viewership.

The appeal of live sports content is undeniable, serving as a critical driver for audience engagement and revenue generation across both broadcast and digital streaming platforms. For instance, the NASCAR Xfinity Series alone provides a consistent audience base that advertisers value highly. This strategic investment in sports programming positions Nexstar to capitalize on a highly sought-after content vertical, bolstering its overall monetization capabilities in the evolving media landscape.

Nexstar can capitalize on the evolving ATSC 3.0 technology to create new revenue opportunities beyond traditional advertising. Through its EdgeBeam Wireless joint venture, the company is positioned to leverage its broadcast spectrum for wireless data delivery services, potentially unlocking new income streams.

The enhanced capabilities of ATSC 3.0, including targeted advertising and interactive features, allow Nexstar to transform its existing spectrum assets into a more dynamic and valuable platform for various data-driven services.

Potential for Regulatory Reform and M&A

Nexstar Media Group is strategically positioning itself to benefit from potential regulatory shifts. The company is actively advocating for deregulation, notably the repeal of the national ownership cap. Such a change could unlock significant opportunities for Nexstar to expand its footprint through mergers and acquisitions. For example, lifting the cap could allow Nexstar to acquire more stations, increasing its scale and competitive edge against tech giants. This consolidation would also enhance its market reach and operational efficiencies.

The potential for regulatory reform presents a clear avenue for growth through increased industry consolidation. Nexstar's proactive stance on deregulation, including its push for the repeal of the national ownership cap, signals a strategic intent to leverage these changes. If successful, these reforms could empower Nexstar to pursue further mergers and acquisitions, thereby strengthening its market position. This would translate into greater economies of scale and a more robust competitive posture.

- Deregulation Push: Nexstar actively supports the repeal of the national ownership cap.

- M&A Opportunities: Regulatory reform could enable further industry consolidation and strategic acquisitions for Nexstar.

- Scale and Competitiveness: Increased scale would enhance Nexstar's ability to compete with larger technology companies.

- Market Expansion: Potential acquisitions could broaden Nexstar's market reach and influence.

Increased Political Advertising in Future Election Cycles

While 2025 is an off-year for major elections, Nexstar Media Group is strategically positioned to capitalize on the substantial increase in political advertising revenue expected in the upcoming 2026 midterms and the 2028 presidential election. The company's broad national footprint, particularly in competitive markets, makes it a prime recipient of this predictable and highly profitable revenue stream. This upcoming surge in political ad spending is projected to provide significant cash flow infusions, bolstering financial performance.

Nexstar's extensive local television station portfolio, covering a significant portion of the U.S. population, is a key asset. For instance, in the 2022 midterm elections, political advertising spending reached record levels, with estimates suggesting over $9 billion was spent across all media. As we look towards 2026 and 2028, industry analysts anticipate continued growth in this sector, with local broadcast television remaining a critical channel for campaign outreach.

- Extensive Reach: Nexstar's stations are present in many of the most critical swing states and congressional districts, where political advertising investment is highest.

- Record Spending Trends: The 2022 midterms saw record political ad spend, a trend expected to continue or exceed in 2026 and 2028.

- Lucrative Revenue Source: Political advertising consistently offers higher ad rates and demand, providing a significant boost to quarterly revenues.

- Off-Year Advantage: While 2025 is an off-year, it allows for strategic planning and sales team preparation for the lucrative election cycles ahead.

Nexstar's digital expansion, particularly through its NewsNation and The CW platforms, allows it to capture a larger share of the growing digital advertising market. By leveraging its strong local content and national programming across CTV and mobile, the company is poised to benefit from increased digital ad spend, which is projected to reach $375 billion globally by 2025.

The strategic addition of live sports, such as WWE NXT and NASCAR Xfinity Series, to The CW Network is a significant draw for audiences and advertisers. This focus on high-demand content, with live sports viewership remaining robust, is expected to drive advertising revenue. For example, the NASCAR Xfinity Series consistently attracts a dedicated viewership, making it an attractive property for advertisers seeking engaged audiences.

Nexstar's investment in ATSC 3.0 technology, through its EdgeBeam Wireless joint venture, opens up new revenue streams beyond traditional advertising. This next-generation broadcasting standard enables advanced features like targeted advertising and data delivery services, transforming spectrum assets into diversified income generators. The rollout of ATSC 3.0 is expanding, with over 70% of U.S. households expected to have access by the end of 2025.

The company's advocacy for deregulation, specifically the repeal of the national ownership cap, could significantly fuel growth through mergers and acquisitions. Such a policy change would allow Nexstar to expand its station portfolio, achieving greater economies of scale and enhancing its competitive position against larger media and technology companies. The potential for consolidation in the media industry, driven by favorable regulatory environments, remains a key opportunity.

Threats

Nexstar is facing a significant threat from digital giants like Google and Meta, along with major streaming services such as Netflix and Disney+. These tech behemoths are pouring billions into content creation and sophisticated advertising technology, directly competing for viewer engagement and advertising revenue that traditionally flowed to broadcasters.

These digital players are also adept at leveraging AI to personalize content delivery and ad targeting, creating an on-demand experience that linear television struggles to match. For instance, Netflix alone reported a global subscriber base of over 270 million in early 2024, highlighting the massive audience shift towards streaming.

A particularly concerning aspect is how these platforms often utilize content originally produced by Nexstar and other broadcasters, sometimes without direct compensation. This practice further erodes the value proposition of traditional broadcast content in the digital age.

The sheer scale and technological capabilities of these digital competitors mean they can offer advertisers highly targeted campaigns, often at a lower cost per impression, making it harder for Nexstar to retain its advertising market share. This intensified competition directly impacts Nexstar's ability to monetize its extensive content library and reach.

Nexstar Media Group faces a significant threat from the slowing growth and potential decline in retransmission fees. As the pay-TV subscriber base continues to shrink, distributors are pushing back harder on the rates they are willing to pay. This trend directly impacts Nexstar's revenue stability, which has historically relied on these fees.

Contract disputes are becoming a more frequent and damaging issue. For instance, the early 2025 blackout with Altice's Optimum demonstrated how these disagreements can disrupt revenue streams and alienate viewers. Such disputes highlight the precariousness of retransmission fees as a dependable income source, especially as negotiations become more contentious.

The rapid advancement of artificial intelligence poses a significant threat to Nexstar Media Group. While AI can automate tasks and improve efficiency, its misuse for generating deepfakes and spreading misinformation directly challenges the credibility of news organizations. This erosion of public trust can lead viewers to question the authenticity of content, including reports featuring Nexstar's own personalities.

Furthermore, AI's ability to create sophisticated synthetic media could be leveraged to impersonate trusted figures, damaging brand reputation. Nexstar, like other media companies, faces the risk of AI systems being trained on its copyrighted material without proper compensation, potentially diverting advertising revenue streams.

For instance, a study by PwC in 2024 highlighted that 70% of media executives believe AI will significantly disrupt their business models within the next three years. This disruption is largely driven by the dual-edged nature of AI, which can both enhance content creation and undermine the very sources consumers rely on.

The potential for AI-generated content to mimic Nexstar's journalistic output could dilute its market position and attract advertising away to platforms less concerned with journalistic integrity. This necessitates proactive strategies to authenticate content and combat the spread of AI-driven falsehoods.

Economic Downturn and Advertising Market Volatility

A significant economic downturn or persistent instability in the advertising sector, extending beyond the usual seasonal dip in political advertising, poses a substantial threat to Nexstar Media Group's revenue streams. While digital advertising continues its upward trajectory globally, the broader advertising landscape is currently experiencing considerable turbulence. A sustained period of weak demand in the ad market could place additional pressure on Nexstar's financial results.

For instance, in the first quarter of 2024, Nexstar reported total revenue of $1.13 billion, a decrease from $1.19 billion in the prior year period, partly reflecting a more normalized advertising environment post-election cycles. This highlights the sensitivity of its business model to macroeconomic conditions and advertising spend. The company's reliance on advertising, particularly local advertising which is closely tied to regional economic health, makes it vulnerable to shifts in consumer spending and business investment.

Key risks include:

- Recessionary Impact: A widespread economic slowdown could lead businesses to cut advertising budgets significantly, directly reducing Nexstar's core revenue.

- Digital Advertising Competition: While digital is growing, competition for digital ad dollars is intense, and Nexstar must effectively compete with larger digital platforms.

- Ad Market Volatility: Beyond political cycles, factors like inflation, interest rates, and consumer confidence can cause unpredictable swings in advertising demand.

- Shifting Media Consumption: Changes in how consumers consume media could impact traditional advertising effectiveness and Nexstar's reach.

Regulatory and Legal Challenges

Nexstar Media Group, like many in the broadcasting industry, navigates a landscape fraught with regulatory and legal hurdles. The Federal Communications Commission (FCC) can impose fines, as seen in past instances concerning ownership rules, which can impact financial performance. For example, in 2023, Nexstar agreed to a $45,000 FCC fine to resolve an investigation into whether it violated political broadcasting rules.

These regulatory challenges extend to disputes over retransmission consent agreements with cable and satellite providers. Such protracted negotiations can lead to service disruptions for viewers and significant legal expenses for Nexstar. The company's ability to engage in strategic growth, including mergers and acquisitions, can be hampered by ongoing or potential legal entanglements, affecting its long-term strategic flexibility.

- FCC Fines: Nexstar settled an FCC fine of $45,000 in 2023 for alleged violations of political broadcasting rules.

- Retransmission Disputes: Ongoing legal battles over retransmission consent agreements can be costly and impact revenue streams.

- M&A Impact: Legal scrutiny can limit Nexstar's capacity to pursue mergers and acquisitions, crucial for industry consolidation.

- Contract Enforcement: Legal challenges can affect Nexstar's ability to enforce favorable contract terms with distributors.

Nexstar faces intense competition from digital platforms like Google, Meta, Netflix, and Disney+, which are investing heavily in content and advanced advertising technology, directly challenging Nexstar's viewer engagement and ad revenue. These competitors leverage AI for personalized experiences, a capability that traditional broadcasters find difficult to match, as evidenced by Netflix's over 270 million global subscribers in early 2024.

The increasing sophistication of AI also poses a threat by enabling deepfakes and misinformation, which can erode public trust in media organizations. Furthermore, the potential for AI-generated content to mimic Nexstar's journalism could dilute its market position and draw advertising revenue to less scrupulous platforms.

Economic downturns and advertising market volatility are significant threats, impacting Nexstar's revenue streams. For instance, Q1 2024 revenue of $1.13 billion was down from the prior year, partly due to a normalizing ad market post-election cycles, highlighting the company's sensitivity to macroeconomic conditions and advertising spend.

Regulatory and legal challenges, including potential FCC fines and protracted retransmission consent disputes, also present risks. Nexstar settled a $45,000 FCC fine in 2023 for political broadcasting rule violations, illustrating the financial and operational impacts of such issues.

SWOT Analysis Data Sources

This Nexstar Media Group SWOT analysis is built upon a robust foundation of data, drawing from their official financial filings, comprehensive market research reports, and expert industry analyses to ensure a well-informed and strategic overview.