Nexstar Media Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nexstar Media Group Bundle

Curious about Nexstar Media Group's market positioning? Our BCG Matrix analysis reveals key insights into their portfolio, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Understand where their diverse media assets, from local broadcasting to digital platforms, truly stand in terms of market share and growth potential. This preview offers a glimpse into the strategic landscape, but to truly unlock actionable intelligence and make informed decisions, you need the full picture.

Purchase the complete Nexstar Media Group BCG Matrix to gain a clear, quadrant-by-quadrant breakdown. Discover which segments are driving revenue and which require strategic re-evaluation. Our detailed report provides the data-driven insights necessary to optimize your investment and product strategies within the dynamic media industry. Don't miss out on the complete strategic roadmap.

Stars

NewsNation, a key component of Nexstar Media Group, is exhibiting robust growth within the BCG matrix. Its prime time ratings have seen triple-digit increases since its March 2021 rebranding and the June 2024 transition to 24/7 programming. This expansion highlights its potential to capture a more substantial portion of the national news audience, directly challenging established networks.

The network's increasing viewership and its distinct non-partisan stance are positioning NewsNation as a significant growth engine for Nexstar. This momentum suggests it could evolve from a question mark to a star in Nexstar's portfolio, representing a strong investment for the company's future.

Nexstar's digital advertising solutions are a clear star in its BCG Matrix. This segment, encompassing digital publishing and advertising, is experiencing robust growth. Nexstar is strategically investing in and expanding these digital offerings, capitalizing on its vast local media footprint to boost digital ad revenue.

While precise market share figures for Nexstar's digital advertising might not dominate every niche, the segment's strong market growth, coupled with Nexstar's dedicated strategic focus, positions it as a star with significant future potential. For instance, the digital advertising market as a whole saw continued expansion through 2024, with local digital ad spending projected to reach new heights, benefiting companies like Nexstar that have strong local ties.

Nexstar Media Group is actively engaged in the Advanced Television Systems Committee (ATSC) 3.0 initiative, also branded as NextGen TV. This commitment positions them at the forefront of broadcast technology evolution, offering significant advancements over current standards. Nexstar's early adoption and leadership in this space are strategic moves to capitalize on the future of television broadcasting.

NextGen TV promises a richer viewing experience with features like superior video and audio quality, enhanced interactivity, and the ability to deliver personalized content and targeted advertising. Industry projections suggest this technological shift could unlock substantial new revenue opportunities, with estimates pointing towards an annual market potential of up to $15 billion by 2030. Nexstar’s proactive investment in ATSC 3.0 infrastructure and deployment is designed to secure a significant portion of this emerging market.

Expansion of The CW Network's Sports Programming

The CW Network's expansion into live sports, particularly with NASCAR Xfinity Series and WWE NXT, represents a strategic move by Nexstar Media Group to capture a more affluent and older demographic. This pivot is designed to enhance profitability by tapping into the lucrative sports advertising market.

- Increased Viewership: New sports programming has seen double-digit percentage increases in viewership compared to their previous cable homes. For example, WWE NXT's debut on The CW in January 2024 drew over 1 million viewers, a significant uptick.

- Advertising Revenue Potential: Live sports are a major draw for advertisers, with a 30-second ad slot during The CW's NASCAR Xfinity Series races in 2024 commanding an average of $60,000-$80,000, reflecting the growing demand.

- Audience Demographics: The strategy aims to attract a broader, older audience, which is typically more desirable for advertisers seeking to reach established consumer bases.

- Network Profitability: By focusing on content with strong advertising appeal, Nexstar anticipates improved profitability for The CW, aligning with its long-term growth objectives.

Targeted Local Digital Content and Streaming Apps

Nexstar is actively expanding its digital footprint by launching free live local news apps in all 116 of its television markets. This move is designed to deliver both live and on-demand content directly to viewers via popular smart TV platforms such as Roku, Fire TV, and Apple TV. This strategy leverages Nexstar's extensive local news library, making it accessible to a wider audience beyond traditional over-the-air broadcasts.

By aligning with changing consumer viewing habits, Nexstar's free streaming apps aim to capture a significant share of the digital news consumption market. This initiative is particularly crucial as more households cut the cord on traditional cable. For instance, in 2024, streaming services continued to see robust growth, with projections indicating that over 70% of US households will subscribe to at least one streaming service by year-end.

This strategic push into streaming apps allows Nexstar to monetize its local content in new ways and build direct relationships with its audience. The company aims to increase digital engagement and provide a valuable, free resource for local information, thereby strengthening its competitive edge. This approach is a key component of Nexstar's broader strategy to diversify revenue streams and adapt to the evolving media landscape.

- Market Penetration: Nexstar's 116 markets represent a vast potential audience for its digital news offerings.

- Platform Reach: Availability on Roku, Fire TV, and Apple TV ensures access across a majority of smart TV households.

- Audience Engagement: Free access fosters goodwill and encourages consistent viewership, building a loyal digital base.

- Revenue Diversification: Digital advertising and potential subscription tiers for premium content offer new income streams.

The CW Network's strategic shift into live sports, including NASCAR Xfinity Series and WWE NXT, is successfully elevating its viewership and advertising appeal. The January 2024 debut of WWE NXT on The CW drew over 1 million viewers, significantly outperforming its prior cable performance. This growth in viewership, coupled with strong advertising rates for sports programming—with a 30-second ad slot during NASCAR Xfinity races in 2024 averaging $60,000-$80,000—positions The CW as a star within Nexstar's portfolio.

What is included in the product

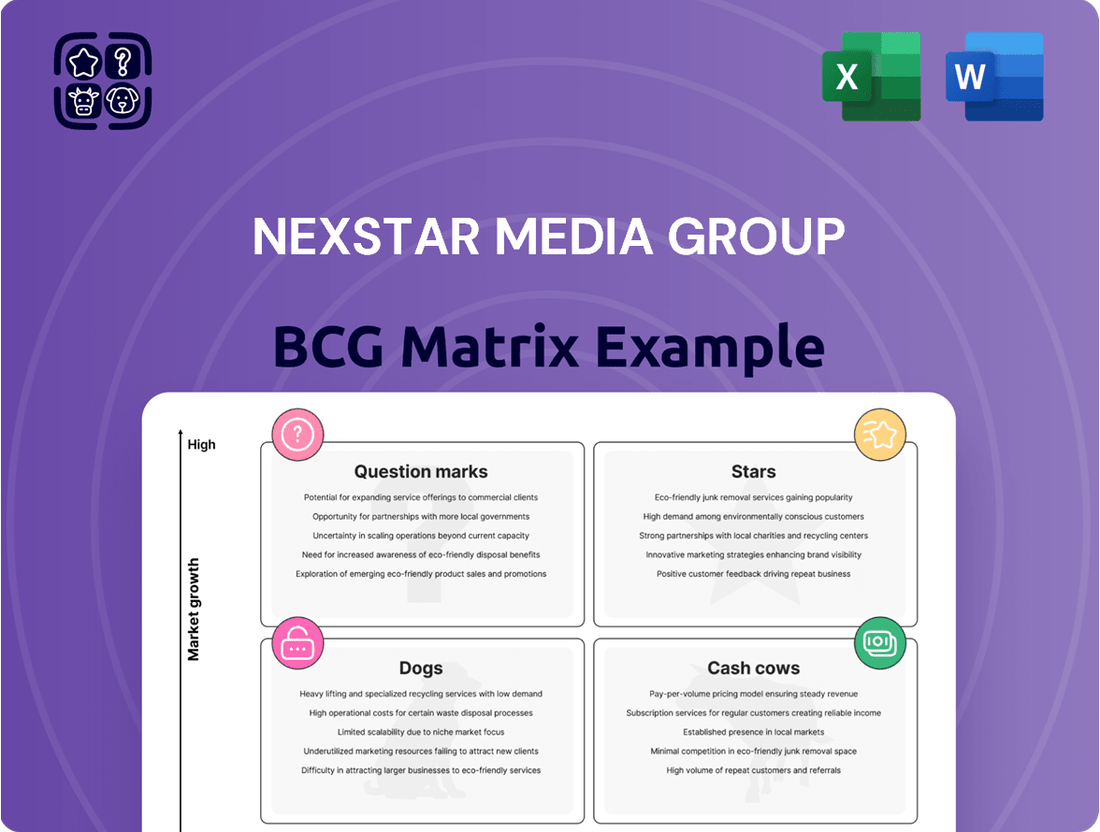

The Nexstar Media Group BCG Matrix analyzes its diverse media assets, categorizing them into Stars, Cash Cows, Question Marks, and Dogs to inform strategic investment decisions.

Nexstar's BCG Matrix provides a clear, one-page overview, relieving the pain of deciphering complex business unit performance.

Cash Cows

Nexstar Media Group's extensive network of over 200 local television stations across 116 U.S. markets positions it as a dominant force in a mature industry. This vast reach, covering roughly 70% of television households, translates into a stable and predictable advertising revenue stream, a hallmark of a cash cow. The sheer scale of operations allows for significant operational efficiencies, further bolstering profitability.

In 2024, Nexstar continued to leverage its strong market position. The company reported robust advertising revenue growth in its core local broadcasting segment, driven by political advertising cycles and consistent demand from local businesses. This consistent cash generation underpins Nexstar’s ability to fund other growth initiatives within its diversified media portfolio.

Retransmission consent fees represent a significant cash cow for Nexstar Media Group. In 2024, these fees, a core component of distribution revenue, accounted for a substantial 54% of the company's total income. This reliance highlights the stability and predictability of this revenue stream.

These fees are secured through contractual agreements negotiated with cable and satellite providers, ensuring a consistent and reliable cash flow for Nexstar. The company's track record of successfully renewing these contracts, often with built-in annual rate increases, further solidifies their status as a mature and robust revenue source.

Political advertising revenue is a significant Cash Cow for Nexstar Media Group, particularly during election years. Its broad reach across competitive U.S. markets ensures a predictable surge in income.

In 2024, Nexstar achieved a record $500 million in political advertising revenue. This substantial influx directly bolsters the company's profitability, showcasing the sector's strong financial impact.

While this revenue is cyclical, tied to election cycles, it represents a high-margin stream that consistently injects considerable cash into the business. This reliable cash generation solidifies its Cash Cow status within Nexstar's portfolio.

Established Local News Brands

Nexstar's established local news brands are firmly in the Cash Cows quadrant of the BCG Matrix. These stations are vital to communities, producing over 316,000 hours of local news, sports, and entertainment yearly. This extensive local content fosters deep viewer loyalty, creating a stable and reliable advertising revenue stream.

The consistent demand for local advertising, which represents a substantial portion of Nexstar's overall revenue, highlights the maturity and profitability of these operations. Their strong market share in local markets is a testament to their enduring appeal and consistent performance.

- High Viewer Loyalty: Established brands benefit from decades of trust and community integration.

- Consistent Advertising Revenue: Local news platforms are a primary channel for local businesses.

- Resilient Market Share: Deep roots in communities insulate them from broader media shifts.

- Profitability: Mature operations with low investment needs generate significant cash flow.

The CW Network's Established Presence

The CW Network, now 75% owned by Nexstar Media Group, represents an established national broadcast presence. Despite strategic shifts, it continues to generate distribution and advertising revenue, benefiting from its existing affiliate network.

Nexstar is targeting profitability for The CW by 2026, but the network already plays a role in bolstering Nexstar's overall revenue streams. Its infrastructure and brand recognition are key assets as the company navigates this transition.

- Established National Reach: The CW Network operates as a significant broadcast entity in the United States.

- Revenue Contribution: It contributes to Nexstar's distribution and advertising revenue.

- Strategic Importance: Nexstar aims for The CW to achieve profitability by 2026, underscoring its strategic value.

- Leveraging Existing Assets: The network utilizes its established affiliate base and infrastructure.

Nexstar's local television stations are the bedrock of its Cash Cow status. These stations consistently generate substantial revenue through a combination of local advertising and retransmission fees. In 2024, Nexstar's local broadcasting segment demonstrated this strength, with advertising revenue benefiting from political cycles and consistent local business demand.

Retransmission consent fees are a significant driver of Nexstar's cash flow, representing a substantial 54% of its total income in 2024. These fees, secured through contracts with distributors, provide a stable and predictable revenue stream with built-in annual increases.

Political advertising is another key Cash Cow, especially in election years. Nexstar reported a record $500 million in political advertising revenue in 2024, a high-margin segment that reliably injects significant cash into the business.

The CW Network, despite being a strategic investment for future growth, also contributes to Nexstar's revenue. Its established national reach and existing affiliate network provide a baseline of distribution and advertising income as the company works towards its profitability goals for the network by 2026.

| Revenue Source | 2024 Contribution (Approx.) | Key Characteristic |

|---|---|---|

| Local Advertising | Significant portion of total | Stable, driven by local businesses & political cycles |

| Retransmission Fees | 54% of total income | Predictable, contractual, annual increases |

| Political Advertising | Record $500 million | High-margin, cyclical but reliable cash infusion |

| The CW Network | Contributes to overall revenue | Established national presence, strategic asset |

What You See Is What You Get

Nexstar Media Group BCG Matrix

The Nexstar Media Group BCG Matrix preview you're viewing is the complete, unedited document you will receive upon purchase. This means you get the full strategic analysis, exactly as it was designed by industry experts, ready for immediate implementation without any watermarks or altered content.

What you see now is the identical Nexstar Media Group BCG Matrix report that will be delivered to you after completing your purchase. This ensures you're acquiring a fully realized strategic tool, meticulously formatted and packed with actionable insights for informed decision-making.

This preview accurately represents the final Nexstar Media Group BCG Matrix you will download once your purchase is confirmed. You can be confident that the entire, professionally crafted report, free from any demo restrictions, will be yours to utilize for strategic planning and competitive evaluation.

The Nexstar Media Group BCG Matrix you are currently reviewing is the genuine article, the exact file you'll obtain after purchase. This guarantees you receive a comprehensive and analysis-ready report, immediately available for your business strategy needs.

Dogs

Certain niche or older cable channels within Nexstar Media Group's extensive portfolio may be classified as dogs in the BCG Matrix. While Nexstar boasts successful multicast networks like Antenna TV and REWIND TV, these smaller cable assets might be experiencing slow growth and hold a limited market share.

These channels could be generating minimal cash flow, effectively tying up valuable resources without delivering substantial returns. Their appeal is often confined to a smaller, dedicated audience, and with viewership steadily declining in today's highly fragmented media environment, their future prospects appear dim.

Nexstar Media Group's portfolio might include legacy digital platforms that are struggling. These platforms, perhaps acquired years ago or experimental projects, likely haven't evolved with changing technology or what users want online. This means they probably have a small user base and aren't very popular anymore.

These underperforming digital assets, sometimes called "dogs" in the BCG matrix framework, contribute minimally to Nexstar's overall income. For instance, if a specific local news app from a past acquisition has seen user numbers drop significantly, it would fit this category. Such platforms can tie up valuable resources for upkeep without offering any real benefit or opportunity for growth.

By 2024, the digital media landscape is highly competitive. Platforms that don't offer a seamless user experience or up-to-date content will fall behind. Nexstar's focus would be on either revitalizing these assets, if feasible, or divesting them to concentrate on core, high-growth digital initiatives.

Even with Nexstar Media Group's strong national presence, certain local stations, particularly those in smaller markets facing economic headwinds or intense media fragmentation, can lag behind. These stations often find it difficult to attract substantial local advertising dollars or secure robust retransmission fees, impacting their profitability and growth potential.

For instance, a small-market Nexstar affiliate in a region with a declining industrial base and a population under 50,000 might see its advertising revenue stagnate or even decrease. This contrasts sharply with larger markets where Nexstar stations benefit from higher population density and more diverse economic activity. In 2024, the average advertising revenue per local station can vary dramatically, with stations in the top 10 DMAs potentially generating millions more than those in the bottom 100 DMAs.

These underperforming stations, despite being part of Nexstar's extensive portfolio, could be classified as 'dogs' in the BCG matrix. Their limited revenue streams and growth prospects necessitate a close examination, potentially leading to decisions about divestiture to reallocate resources to more promising assets within the Nexstar network.

Non-Strategic Acquired Assets

Occasionally, companies acquire assets that don't quite fit their main strategy or don't perform as expected after the purchase. If Nexstar Media Group has such non-strategic assets, these might not be generating substantial returns or showing much growth. Such holdings could be classified as Dogs in the BCG Matrix.

These underperforming assets might be prime candidates for divestiture. Selling them off can help Nexstar streamline its operations and concentrate resources on more promising and strategically aligned ventures. This pruning allows for a sharper focus on areas with higher growth potential and better integration with the company's core business.

- Divestiture of Non-Strategic Assets: In 2023, Nexstar’s strategic focus included integrating its acquired assets, with particular attention to optimizing performance across its broadcasting and digital platforms.

- Performance Evaluation: Assets that fail to meet expected performance benchmarks post-acquisition, showing low market share and low growth, would typically be categorized as Dogs.

- Resource Reallocation: The decision to divest such assets allows Nexstar to reallocate capital and management attention towards its Stars and Question Marks, maximizing overall portfolio efficiency.

Linear Advertising in Declining Categories

Certain traditional linear television advertising categories are indeed facing secular decline. This is largely due to consumers and advertisers shifting their focus and budgets towards digital platforms. For Nexstar Media Group, this means that segments of their business heavily reliant on these declining categories might show slow growth and a shrinking market share.

This trend necessitates a careful strategic look at how resources are allocated. Nexstar needs to consider re-evaluating its approach or shifting investments towards advertising channels that are proving more robust and are experiencing growth.

For instance, in 2024, the overall linear TV ad market continued to face pressure, with certain categories like automotive and retail seeing shifts. While Nexstar’s diverse portfolio offers some resilience, specific program genres or demographic targets within their linear offerings might reflect this broader industry trend.

- Declining Categories: Sectors like traditional spot advertising for certain consumer goods may see reduced spending.

- Digital Shift: Advertisers are increasingly prioritizing digital channels, impacting linear revenue streams.

- Strategic Response: Nexstar must adapt by focusing on growth areas and potentially divesting or minimizing investment in declining segments.

- Market Share Impact: Continued reliance on these categories could lead to a decrease in Nexstar's relative market share within those specific advertising segments.

Within Nexstar Media Group's vast portfolio, certain legacy cable channels or niche digital platforms may be classified as Dogs. These assets typically exhibit low market share and slow growth, often stemming from evolving consumer preferences or increased competition. For example, a specific local news app acquired in a past deal that hasn't kept pace with user experience trends would fit this profile.

These underperforming assets contribute minimally to Nexstar's overall revenue and can tie up valuable resources without offering significant returns. In 2024, the highly competitive digital media landscape means platforms lacking modern features or up-to-date content are particularly vulnerable to this classification. Nexstar's strategy would involve either revitalization or divestiture of such assets to reallocate capital to more promising ventures.

Small-market local stations facing economic headwinds or intense media fragmentation can also fall into the Dog category. These stations often struggle to attract substantial local advertising revenue or secure robust retransmission fees. By 2024, a Nexstar affiliate in a declining economic region with a population under 50,000 might see stagnant advertising revenue, contrasting sharply with stations in larger markets.

| Category | Characteristics | Example for Nexstar | 2024 Outlook |

|---|---|---|---|

| Dogs | Low Market Share, Low Growth | Niche cable channel with declining viewership; legacy digital platform with minimal user engagement. | Continued pressure from digital alternatives; potential for divestiture to focus on core assets. |

Question Marks

Nexstar Media Group's expansion into direct-to-consumer streaming, exemplified by its recent launch of free local news apps, targets a segment with substantial growth potential. However, Nexstar faces intense competition from deeply entrenched streaming services where its market share is still developing.

These burgeoning DTC efforts necessitate considerable capital allocation for technological infrastructure, content creation, and aggressive marketing campaigns aimed at capturing and retaining audience attention. The financial viability of these ventures is contingent upon achieving swift user acquisition and effective monetization strategies to prevent them from becoming a drain on resources without generating adequate returns.

Nexstar Media Group's investment in advanced advertising technologies like addressable TV represents a potential "Question Mark" in the BCG matrix. These technologies offer significant growth opportunities within the rapidly changing advertising landscape, tapping into a market that is increasingly seeking more targeted and measurable campaigns.

While the potential is high, Nexstar's current market share in these nascent segments is likely low, reflecting the early stage of adoption and market penetration for technologies like addressable TV. This means that while the future revenue stream could be substantial, the immediate contribution is limited.

Significant upfront investment in research and development is necessary to refine these advanced advertising solutions. Furthermore, educating clients on the benefits and implementation of these technologies is crucial for driving broader adoption and ultimately realizing their revenue-generating potential.

For instance, the addressable TV market in the US was projected to grow significantly, with some estimates suggesting it could reach billions of dollars by 2025. However, realizing this potential requires ongoing innovation and a strategic approach to market development.

NewsNation's expansion to 24/7 and The CW's content strategy shift highlight new original programming as potential high-growth areas. These initiatives, especially those venturing into less traditional genres, aim to capture new audiences. For instance, The CW's 2024 slate includes new unscripted series, a departure from its traditional scripted drama focus, which could drive engagement.

However, these new ventures currently represent a low market share for both networks. They require significant investment to build viewership and prove their long-term appeal against more established programming. Nexstar's investment in these new shows is crucial for their development and market penetration.

International Content Licensing Ventures

International content licensing ventures represent a potential "Question Mark" for Nexstar Media Group within the BCG Matrix. Exploring opportunities to license Nexstar's original programming and news content globally could unlock access to new, high-growth markets that were previously untapped. This move aligns with the trend of global media consumption, where content is increasingly borderless.

However, Nexstar's current market share in international content distribution is likely modest when compared to established global media giants. Developing these ventures requires significant upfront investment and a willingness to navigate complex international regulations and market dynamics. For instance, in 2023, the global media and entertainment market was valued at over $2.5 trillion, indicating the sheer scale of competition and opportunity.

The success of these ventures hinges on Nexstar's ability to forge new distribution partnerships and adapt its content for diverse international audiences. This strategic pivot demands careful market analysis and a robust understanding of regional media landscapes. Nexstar's broadcast revenue was approximately $4.7 billion for the fiscal year ending December 31, 2023, illustrating the financial resources that would need to be allocated to such international expansion.

- Market Potential: Access to new, rapidly growing global markets for Nexstar's content.

- Current Standing: Likely low existing market share in international content distribution compared to major players.

- Investment & Risk: Requires substantial initial investment and strategic risk to establish partnerships and navigate foreign markets.

- Strategic Importance: Aligns with global media trends but necessitates careful planning and execution to overcome competitive hurdles.

AI-driven Content Personalization and Production Tools

Nexstar Media Group's investment in AI for content personalization and automated production places it at the forefront of a rapidly evolving media landscape. This technological frontier offers significant growth potential by enhancing audience engagement and streamlining operations. While the specific market share of Nexstar in AI-driven media operations is likely still developing, representing a nascent stage of adoption, the company's strategic focus on these areas is clear.

The implementation of AI tools in media is capital-intensive and demands specialized expertise. For Nexstar, this means substantial upfront investment is necessary to build or acquire these capabilities. Success hinges on effectively integrating AI to create a competitive advantage, differentiating its content and audience targeting strategies from rivals.

- AI Investment: Nexstar is exploring AI for personalized content delivery, aiming to boost viewer engagement and loyalty.

- Market Position: As an early adopter, Nexstar's current market share in AI-driven media production is considered low, indicative of a Stars or Question Marks category.

- Cost and Expertise: Significant capital expenditure and specialized AI talent are required for successful implementation and to realize the full potential of these technologies.

- Strategic Importance: These AI tools are crucial for Nexstar to maintain a competitive edge in the digital media space, driving future revenue growth.

Nexstar's foray into advanced advertising technologies, such as addressable TV, positions these as "Question Marks." While the addressable TV market is projected for substantial growth, reaching billions by 2025, Nexstar's current market share in this nascent area is low.

These ventures require significant upfront investment in technology and client education to drive adoption and revenue. The company's broadcast revenue was approximately $4.7 billion for the fiscal year ending December 31, 2023, indicating the scale of investment needed.

Nexstar's expansion of NewsNation to 24/7 and The CW's shift towards new original programming, like unscripted series in its 2024 slate, also fall into the Question Mark category. These initiatives aim for high growth by capturing new audiences but currently hold a low market share.

Significant investment is crucial for building viewership and proving long-term appeal against established programming. The success of these strategic moves depends on Nexstar's ability to cultivate these new content areas effectively.

| BCG Category | Nexstar Initiative | Market Growth Potential | Current Market Share | Investment Required | Key Considerations |

|---|---|---|---|---|---|

| Question Mark | Addressable TV Technologies | High (Billions by 2025 projected) | Low | Significant upfront investment, client education | Market adoption, technological refinement |

| Question Mark | NewsNation 24/7 & The CW New Programming | High (New audience capture) | Low | Substantial investment in content and audience building | Audience engagement, long-term appeal |

BCG Matrix Data Sources

Our Nexstar Media Group BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.