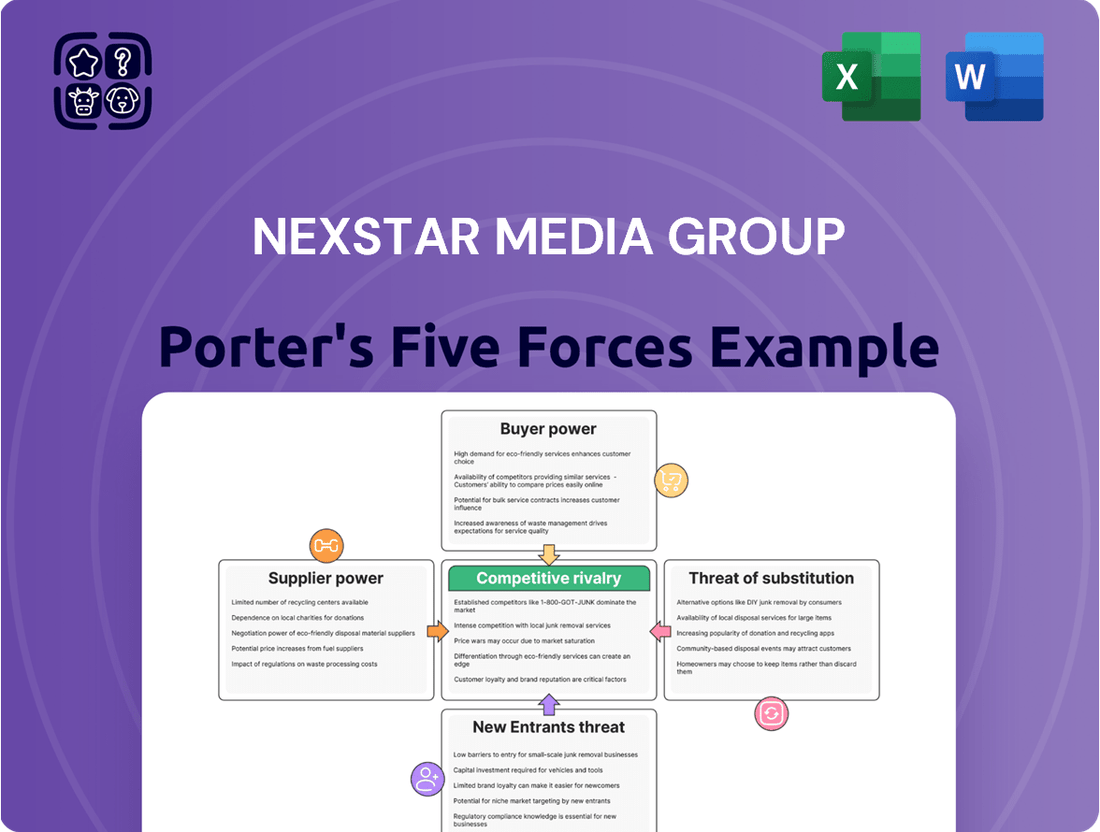

Nexstar Media Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nexstar Media Group Bundle

Nexstar Media Group operates in a dynamic media landscape, where the threat of new entrants is moderate due to high capital requirements and regulatory hurdles, but digital platforms lower some barriers. Buyer power, particularly from large advertisers and cable distributors, exerts significant pressure on pricing and content distribution.

The bargaining power of suppliers, including content creators and technology providers, is a key consideration for Nexstar, impacting programming costs and operational efficiency. Rivalry among existing competitors is intense, with broadcasters, cable networks, and digital streaming services all vying for audience share and advertising revenue.

The threat of substitute products, primarily from emerging streaming services and digital content platforms, presents a significant challenge to Nexstar's traditional broadcast model. Understanding these forces is crucial for navigating the evolving media industry.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Nexstar Media Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Nexstar Media Group's reliance on major broadcast networks like CBS, NBC, and ABC for a substantial portion of its content grants these networks considerable leverage, particularly when affiliation agreements are up for renewal. This dependence means Nexstar must often accept terms dictated by these powerful content providers.

The situation with The CW is evolving, as Nexstar's majority ownership provides more direct control over its programming supply for that specific network. This shift could potentially lessen the bargaining power of external content suppliers for The CW's broadcast schedule.

However, Nexstar still faces intense competition when acquiring sought-after sports rights and premium entertainment content. This competition, which includes aggressive bids from streaming services, can significantly inflate acquisition costs, thereby increasing the bargaining power of the rights holders.

For instance, in 2024, the escalating costs of live sports rights, driven by demand from both traditional broadcasters and digital platforms, demonstrate how competitive content acquisition impacts supplier power. Companies like Nexstar must navigate these rising expenses to secure the popular programming that drives viewership.

Nexstar Media Group, despite being the largest owner of local TV stations, also functions as a supplier to cable and satellite companies, demanding retransmission fees. This puts them in a supplier role for these distributors. The company is slated to renew a substantial portion of its retransmission consent agreements in 2025, a critical period for securing favorable terms.

However, Nexstar's supplier power is tempered by its reliance on major networks like CBS and NBC for programming. Without these popular networks, Nexstar's ability to attract viewers and, consequently, generate retransmission revenue diminishes significantly. This interdependence highlights a complex power dynamic where Nexstar is simultaneously a supplier and a customer.

Suppliers of essential broadcasting equipment, transmission towers, and digital infrastructure generally possess moderate bargaining power over Nexstar Media Group. While the market offers a range of vendors, the significant investment in established infrastructure means switching costs can be substantial, limiting Nexstar's ability to easily change providers.

Furthermore, the specialized nature of certain broadcasting technologies can restrict the pool of available suppliers, thereby increasing their leverage. The industry-wide shift towards advanced transmission standards like ATSC 3.0 (NextGen TV) is creating a growing demand for specific, often proprietary, technologies.

This technological evolution can elevate the bargaining power of suppliers who offer these cutting-edge solutions. For instance, companies specializing in ATSC 3.0 encoding and decoding hardware or advanced broadcast transmitters may command higher prices due to the limited number of qualified providers meeting Nexstar's evolving technical requirements.

Talent and Production Labor

The bargaining power of journalists, on-air talent, and production staff within Nexstar Media Group is a critical factor, often varying significantly by geographic market and the specific skills required. In smaller, less competitive markets, Nexstar might hold more sway in negotiations with its employees. However, for highly sought-after national anchors, investigative journalists, or specialized production roles, the competition for talent intensifies, naturally driving up compensation and empowering these individuals to make greater demands.

Challenges in attracting and retaining skilled labor, particularly in mid-market and smaller stations where wages may be less competitive, can amplify the bargaining power of the available talent. This scarcity can force companies like Nexstar to offer more attractive compensation and benefits packages to secure and keep essential personnel. For instance, as of early 2024, the average salary for broadcast journalists in the US hovered around $60,000, but top-tier talent in major markets could command significantly more, reflecting their market value and bargaining leverage.

- Talent Specialization: Highly specialized roles in broadcast journalism or production (e.g., experienced investigative reporters, skilled camera operators) often possess greater bargaining power due to limited supply.

- Market Competition: In markets with numerous media outlets, competition for experienced on-air personalities and technical staff increases employee leverage.

- Unionization: Where unions represent broadcast employees, collective bargaining agreements can significantly strengthen the bargaining power of talent and labor.

- Industry Demand: Overall demand for broadcast content and the specific skills needed to produce it directly impacts the bargaining power of the workforce.

Digital Content and Data Providers

As Nexstar Media Group (NXST) strategically broadens its digital presence, particularly with outlets like The Hill and NewsNationNow.com, the suppliers of essential digital content platforms, advanced data analytics tools, and robust cybersecurity solutions become increasingly significant. These providers hold a moderate to considerable degree of bargaining power, especially when their offerings are unique or proprietary. This leverage is amplified as Nexstar places a greater emphasis on digital innovation and expanding its revenue streams beyond traditional broadcasting.

The increasing reliance on specialized digital tools and data for audience engagement and advertising optimization means Nexstar may face more demanding terms from these suppliers. For instance, in 2024, the demand for sophisticated AI-driven content personalization tools and real-time audience analytics platforms has surged across the media industry, potentially increasing the cost of acquiring and retaining these services.

- Digital Platform Providers: Suppliers of content management systems (CMS), digital advertising platforms, and website hosting services can wield influence due to the critical nature of these infrastructures for Nexstar's digital operations.

- Data Analytics and Insights Firms: Companies offering specialized data analytics, audience segmentation, and market research tools possess bargaining power if their insights are crucial for Nexstar's strategic decision-making and revenue generation.

- Cybersecurity Solution Vendors: With the growing threat landscape, suppliers of cybersecurity services and software are essential, giving them significant leverage to negotiate terms that protect Nexstar's digital assets and sensitive data.

Nexstar Media Group's bargaining power with its suppliers is a mixed bag, heavily influenced by the nature of the supply and the competitive landscape. While Nexstar is a large entity, its dependence on certain content providers and specialized technologies can shift leverage towards its suppliers.

The company’s reliance on major networks for programming, such as CBS and NBC, means these networks hold significant sway, especially during affiliation agreement renewals. This dependence limits Nexstar's ability to dictate terms for essential content. For example, the rising costs of live sports rights in 2024, driven by competition from streaming services, directly illustrate how content holders can exert greater bargaining power over broadcasters like Nexstar.

Suppliers of specialized broadcasting equipment and advanced digital solutions, particularly those related to evolving standards like ATSC 3.0, also gain leverage. The limited number of providers for cutting-edge technologies means Nexstar faces higher costs and less flexibility in negotiations. Similarly, the demand for skilled talent, especially in competitive markets, empowers journalists and production staff, forcing Nexstar to offer more attractive compensation to retain them, with top-tier talent in major markets commanding significantly higher salaries than the early 2024 US average of around $60,000 for broadcast journalists.

| Supplier Category | Bargaining Power Influence | Key Factors | Example Trend (2024) |

|---|---|---|---|

| Major Content Networks (CBS, NBC) | High | Dependence on programming, affiliation renewals | Rising costs for sports rights |

| Specialized Tech Providers (ATSC 3.0) | Moderate to High | Limited supply, proprietary technology, switching costs | Increased demand for advanced transmission hardware |

| Skilled Talent (Journalists, Production) | Moderate to High | Market competition, talent scarcity, specialization | Higher compensation for top talent in major markets |

| Digital Platform & Data Providers | Moderate | Criticality of services, proprietary analytics | Surge in demand for AI-driven personalization tools |

What is included in the product

This analysis tailors Porter's Five Forces to Nexstar Media Group, revealing the intensity of rivalry, buyer and supplier power, threat of substitutes, and barriers to entry within the broadcast and digital media sectors.

Nexstar Media Group's Porter's Five Forces Analysis provides a clear, actionable framework to navigate intense industry competition, helping leadership identify and address key threats to profitability and market share.

Customers Bargaining Power

Advertisers, both local and national, wield considerable influence in the media market. This power stems from the wide array of advertising options available, including a growing number of digital and streaming platforms that compete for marketing budgets. Nexstar's advertising revenue, as demonstrated in early 2025, experienced a dip, partly due to a slowdown in both political and non-political ad spending, highlighting advertiser sensitivity to economic conditions.

Despite this, Nexstar's significant market presence, reaching approximately 85% of key election markets, provides a degree of leverage, particularly during peak political advertising seasons. This extensive reach makes Nexstar a crucial partner for national campaigns, thereby moderating some of the advertisers' bargaining power when political advertising is strong.

Cable, satellite, and vMVPD providers hold significant bargaining power as key customers for Nexstar Media Group. These distributors are responsible for paying retransmission consent fees, a crucial revenue stream for Nexstar, making up a substantial portion of its income. For instance, Nexstar is focused on renewing distribution contracts covering about 60% of its subscriber base in 2025, highlighting the ongoing importance of these negotiations.

The bargaining power of these distributors is amplified by two major trends: declining subscriber numbers in traditional pay-TV packages and ongoing consolidation within the provider industry. This consolidation means fewer, larger entities are negotiating with Nexstar, giving them more leverage. The shift towards streaming services also puts pressure on traditional distributors, potentially impacting their willingness or ability to pay the same retransmission fees.

The bargaining power of viewers, or consumers, significantly impacts Nexstar Media Group. While direct payment for broadcast content isn't the norm, viewer numbers directly influence advertising revenue and retransmission fees Nexstar negotiates with distributors. For instance, in 2023, Nexstar's total revenue was $4.6 billion, with retransmission and political advertising being substantial contributors, both heavily reliant on viewership.

The proliferation of alternative content sources, such as streaming services and social media platforms, amplifies viewer power. Consumers can easily shift their attention and time away from traditional broadcast television, forcing Nexstar to compete for eyeballs. This shift presents a constant challenge to maintaining audience engagement.

Nexstar actively works to retain and grow its viewer base by investing in its national networks, including The CW and NewsNation. Furthermore, Nexstar emphasizes the unique value of local news programming, which often fosters a stronger, more loyal audience compared to national or global content.

Digital Advertising Clients

Digital advertising clients wield significant bargaining power over Nexstar Media Group. The digital advertising landscape is intensely competitive and constantly evolving, offering clients numerous alternatives. In 2024, digital ad spending globally was projected to reach over $600 billion, highlighting the vast number of platforms vying for client budgets.

Clients can readily reallocate their advertising investments to major players like Google, Meta, or emerging platforms such as TikTok, especially if Nexstar's digital offerings fail to deliver compelling reach and engagement. This ease of switching means Nexstar must continuously innovate its digital advertising solutions to prove its value and retain these crucial relationships.

- Highly Competitive Digital Market: The digital advertising sector, valued in the hundreds of billions of dollars, presents clients with a wide array of platform choices.

- Ease of Switching Ad Spend: Clients can quickly shift their advertising budgets to competing platforms like Google, Meta, or TikTok if better value or performance is perceived.

- Demand for Innovation: Nexstar must consistently enhance its digital products and services to meet client expectations for effective reach and audience engagement.

- Demonstrating ROI: Proving a strong return on investment is critical for Nexstar to counter client price sensitivity and retain their business in a dynamic market.

Content Buyers (for syndicated content)

The bargaining power of content buyers, like other media outlets or digital platforms seeking syndicated content from Nexstar Media Group, is influenced by several factors. If Nexstar's content is highly unique and in strong demand, buyer power diminishes. Conversely, if similar content is readily available from competitors, buyers gain leverage. Nexstar's extensive content creation capabilities and the sheer volume of its library provide a degree of negotiation strength.

Nexstar's 2024 financial performance, with revenues reaching approximately $4.7 billion for the fiscal year 2023, demonstrates its significant production output. This scale can reduce the impact of individual buyer demands. However, the fragmentation of the media landscape means buyers can often source content from multiple providers, potentially increasing their bargaining power.

- Content Differentiation: The uniqueness and perceived value of Nexstar's syndicated content directly impact buyer leverage.

- Availability of Substitutes: The presence of alternative content providers weakens buyer bargaining power.

- Buyer Concentration: A few large buyers could wield more influence than many smaller ones.

- Switching Costs: The ease or difficulty for a buyer to switch to another content provider affects their negotiating position.

Distributors like cable, satellite, and vMVPD providers hold substantial bargaining power as Nexstar Media Group's key customers, influencing crucial retransmission consent fees. With Nexstar aiming to renew contracts covering about 60% of its subscriber base in 2025, these negotiations are central to its revenue. Consolidation among distributors amplifies their leverage, as fewer, larger entities negotiate, while the shift to streaming adds further pressure on traditional pay-TV providers' ability to pay these fees.

Nexstar's viewers, while not directly paying for broadcast content, significantly influence advertising revenue and retransmission fees through their viewership numbers. The proliferation of streaming services and social media intensifies competition for audience attention, forcing Nexstar to actively invest in its national networks and local news to maintain engagement. In 2023, Nexstar's total revenue was $4.6 billion, underscoring the importance of viewership for its financial health.

Digital advertising clients possess considerable bargaining power due to the highly competitive and dynamic digital landscape. With global digital ad spending projected to exceed $600 billion in 2024, clients can easily shift budgets to dominant platforms like Google and Meta, or emerging ones like TikTok, if Nexstar's offerings lack reach or engagement. This necessitates continuous innovation from Nexstar to demonstrate value and retain these clients.

| Customer Segment | Bargaining Power Factors | Nexstar's Position/Mitigation | 2024/2025 Data Points |

|---|---|---|---|

| Distributors (Cable, Satellite, vMVPD) | Declining traditional subscribers, industry consolidation, shift to streaming | Negotiating retransmission fees for ~60% of subscriber base in 2025; reliance on these fees. | Retransmission fees a substantial revenue stream; consolidation increases buyer leverage. |

| Viewers/Consumers | Proliferation of alternative content sources (streaming, social media) | Investing in national networks (The CW, NewsNation) and local news to retain audience. | Total revenue $4.6 billion in 2023; viewership drives ad and retransmission revenue. |

| Digital Advertising Clients | Highly competitive digital market, ease of switching platforms | Need for continuous innovation in digital offerings; focus on reach and engagement. | Global digital ad spend >$600 billion in 2024; clients can shift to Google, Meta, TikTok. |

Preview Before You Purchase

Nexstar Media Group Porter's Five Forces Analysis

You're previewing the final version—precisely the same document that will be available to you instantly after buying. This comprehensive Porter's Five Forces analysis for Nexstar Media Group meticulously details the competitive landscape, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the broadcast and digital media industry.

The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. It provides actionable insights into how these forces shape Nexstar's strategic decisions and profitability, offering a deep dive into market dynamics and competitive pressures.

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The analysis within thoroughly evaluates each force, explaining their impact on Nexstar's market position and future growth prospects, making it an essential tool for stakeholders.

Rivalry Among Competitors

Nexstar Media Group, as the largest owner of local television stations, encounters significant competitive rivalry within the markets it serves. This competition primarily stems from other local station groups vying for advertising dollars and local audience attention. For instance, in 2024, while Nexstar's reach is extensive across 116 U.S. markets, it still contends with well-established regional broadcasters in each of those areas.

The intensity of this rivalry is largely fueled by the ongoing battle for advertising revenue, a critical component of local television station profitability. Stations compete fiercely to attract and retain advertisers by offering attractive viewership demographics and effective advertising packages. This dynamic ensures that even with Nexstar's considerable scale, local market competition remains a persistent challenge.

Nexstar's strategic approach, including its numerous acquisitions, provides a substantial competitive edge. By consolidating its presence across a wide array of markets, Nexstar can leverage its size for programming, sales, and operational efficiencies. This scale, reaching over 65% of U.S. households, allows Nexstar to negotiate more effectively with advertisers and content providers, thus mitigating some of the direct rivalry pressure.

Nexstar Media Group faces intense competitive rivalry in the national broadcast space, not only through its affiliations but also by owning and operating The CW and NewsNation. This puts it directly against established giants like FOX News, CNN, and MSNBC. The battle is fierce for viewers, valuable sports broadcasting rights, and a significant share of national advertising revenue, a critical component for profitability.

Nexstar's strategic investments in The CW, aiming to boost its profitability, and its push to grow NewsNation's audience underscore the direct and aggressive competition. In 2023, the U.S. advertising market saw broadcast television advertising revenue projected to reach approximately $33.5 billion, highlighting the substantial financial stakes involved in capturing audience attention.

The media industry is incredibly competitive, with streaming giants like Netflix and Disney+ capturing significant market share. These platforms, along with social media channels such as TikTok, are drawing viewers and, crucially, advertising dollars away from traditional broadcasters. This intense rivalry forces companies like Nexstar Media Group to innovate and adapt their strategies to reach audiences across multiple platforms, a challenge they are actively addressing by growing their digital footprint.

Other Traditional Media (Radio, Print, Outdoor)

While Nexstar's primary competition comes from digital platforms, it also contends with traditional media like radio, print, and outdoor advertising for local advertising dollars. This competition, though less intense than in the past, still fragments the available advertising spend in many markets.

The ongoing decline of print media, with numerous local newspapers ceasing operations, creates a void in local news coverage. This presents Nexstar's local television stations with an opportunity to capture a larger share of advertising revenue by becoming the primary source of local information.

- Advertising Revenue Shift: While digital advertising spending continues to grow, traditional media like radio and print still capture a portion of local ad budgets. In 2024, local advertising spending across all media is projected to reach tens of billions of dollars, with Nexstar vying for a significant share.

- Print Media Decline: Many local newspapers have faced significant financial challenges, leading to reduced staff and even closures, creating 'news deserts'. This trend, which has been ongoing for years, intensified in the early 2020s and continues to impact local information ecosystems.

- Opportunity for Local TV: Nexstar's local stations can capitalize on the weakening of print rivals by offering comprehensive local news, weather, and sports, thereby attracting both viewers and advertisers seeking reliable local content.

Sports and Live Event Broadcasters

The competitive rivalry among sports and live event broadcasters is fierce. Streaming giants and traditional networks are locked in a constant battle, aggressively bidding for exclusive rights to major sporting events, driving up costs significantly. This intense competition means that securing and retaining popular sports content is a critical challenge for any broadcaster. For instance, in 2024, the National Football League (NFL) continued its lucrative media deals, with Amazon Prime Video paying a reported $1 billion annually for exclusive rights to Thursday Night Football, highlighting the high stakes involved.

Nexstar Media Group is actively navigating this competitive landscape. Their strategy involves acquiring secondary sports rights and integrating popular sports programming onto The CW. This includes broadcasts of events like the NASCAR Xfinity Series and WWE NXT, aiming to draw in a dedicated viewership and create a unique selling proposition. These moves demonstrate a clear understanding of the intense competition for live sports audiences.

- High Bidding for Rights: Streaming services and broadcasters are in a costly race for exclusive sports broadcasting rights, increasing operational expenses.

- Audience Acquisition: The primary battleground is the live sports audience, where loyalty can be hard-won and easily lost to competing platforms.

- Nexstar's Approach: Nexstar is strategically acquiring less prominent rights and leveraging The CW to build a sports portfolio, aiming for differentiation.

- Programming Examples: The inclusion of NASCAR Xfinity Series and WWE NXT on The CW are key initiatives to attract and retain sports fans in a crowded market.

Nexstar Media Group faces intense competition from other local broadcasters, digital streaming services, and national news networks. This rivalry is particularly sharp in the fight for advertising revenue, where traditional media competes with digital platforms for viewer attention. The ongoing consolidation of local television ownership by companies like Nexstar aims to leverage scale, but it doesn't eliminate the fundamental competition for eyeballs and ad dollars in each market.

The media landscape is increasingly fragmented, with streaming services like Netflix and Disney+ vying for viewership alongside social media platforms. This trend diverts advertising spend from traditional broadcasters, forcing companies like Nexstar to adapt by expanding their digital presence. For instance, in 2024, broadcast television advertising revenue, while substantial, faces increasing pressure from digital channels.

Nexstar's ownership of The CW and NewsNation places it in direct competition with established national news giants like CNN and FOX News, intensifying the battle for national audiences and advertising. The acquisition of sports broadcasting rights, such as the NFL's Thursday Night Football deal with Amazon for $1 billion annually in 2024, further highlights the high stakes and fierce competition for premium live content.

SSubstitutes Threaten

Streaming Video-on-Demand (SVOD) services like Netflix, Disney+, and Max present a substantial threat to Nexstar Media Group. These platforms offer extensive libraries of content accessible anytime, directly competing with Nexstar’s traditional broadcast and cable offerings. For instance, as of early 2024, Netflix alone boasts over 260 million subscribers globally, highlighting the massive shift in consumer viewing habits away from linear television.

The convenience and ad-free experience provided by SVOD services are significant draws for consumers, particularly younger demographics. This directly impacts Nexstar's advertising revenue model, as viewers increasingly opt for content without commercial interruptions. This shift means fewer eyeballs are available for traditional ad slots, a core revenue stream for Nexstar.

Platforms such as YouTube, TikTok, and Instagram present a significant threat of substitution for Nexstar Media Group. These platforms thrive on user-generated content, offering a vast and constantly updated stream of news and entertainment that directly competes for audience attention, especially with younger demographics. For instance, TikTok's user base reached over 1 billion monthly active users globally by late 2023, showcasing its immense reach.

The ease with which these digital platforms can disseminate information and entertainment diverts both audience engagement and, crucially, advertising revenue away from Nexstar's traditional broadcast and digital properties. In 2024, digital advertising spending continues its upward trajectory, with social media platforms capturing a substantial portion of this growth, posing a direct challenge to Nexstar's revenue streams.

Online news portals, blogs, and aggregators offer instant news delivery and diverse viewpoints, directly competing with Nexstar's broadcast model. These platforms provide immediate access, often with more in-depth analysis than traditional television news. Nexstar's own digital ventures, such as The Hill, strive to capture this audience, but the vast and easily accessible nature of online content remains a significant substitute threat.

Podcasts and Audio-Only Content

The growing popularity of podcasts and audio-only content presents a significant threat of substitutes for traditional television news and entertainment. These platforms offer consumers a flexible and on-demand way to consume information and enjoy programming, often while engaging in other activities.

For Nexstar Media Group, particularly its NewsNation channel, podcasts compete directly for audience attention in news and talk-show formats. This shift in consumption habits means viewers might opt for a podcast discussing current events over a live television broadcast.

- Podcast Listenership Growth: In 2024, estimates suggest over 150 million Americans listen to podcasts regularly, a figure that has steadily climbed over the past decade.

- Time Allocation: Consumers are increasingly allocating their limited free time to audio content, potentially reducing the hours spent watching traditional television.

- Content Overlap: Many podcasts offer in-depth analysis and commentary on news topics, directly mirroring and sometimes surpassing the depth of coverage found on broadcast news channels.

- Accessibility: The ease of accessing podcasts through smartphones and smart speakers further enhances their appeal as a convenient alternative.

Over-the-Top (OTT) Devices and Smart TVs

The proliferation of over-the-top (OTT) devices like Roku, Apple TV, and Amazon Fire Stick, alongside smart TVs, presents a significant threat of substitutes for Nexstar Media Group. These platforms enable viewers to directly access a vast array of content over the internet, bypassing traditional pay-TV providers. This shift is fundamentally altering how consumers consume media.

This trend directly fuels cord-cutting, where households cancel their cable or satellite subscriptions, and the rise of cord-nevers, individuals who never subscribe to traditional pay TV in the first place. For Nexstar, this means a substantial erosion of its distribution revenue, historically reliant on carriage fees from Multichannel Video Programming Distributors (MVPDs). Data from 2024 indicates that U.S. pay-TV subscriptions continued their decline, with millions of households cutting the cord annually, a trend accelerated by the accessibility and affordability of OTT alternatives. This forces Nexstar to increasingly pivot towards its own direct-to-consumer (DTC) digital strategies to capture audience engagement and revenue.

- Growing OTT Penetration: By the end of 2024, an estimated 80% of U.S. broadband households owned at least one streaming device, up from 70% in 2023.

- Cord-Cutting Acceleration: Projections for 2024 suggested that the number of U.S. households cancelling traditional pay-TV services would exceed 7 million for the year.

- Shift in Advertising Spend: Digital video advertising, largely dominated by OTT platforms, saw significant growth in 2024, with an estimated 25% year-over-year increase, diverting ad dollars from traditional broadcast.

- Content Diversification: The availability of exclusive content on various streaming services, from major studios to niche providers, directly competes with Nexstar's broadcast offerings, forcing it to innovate its content delivery and monetization models.

The threat of substitutes for Nexstar Media Group is multifaceted, encompassing streaming services, social media platforms, online news sources, podcasts, and Over-The-Top (OTT) devices. These substitutes offer convenience, diverse content, and immediate access, directly competing for audience attention and advertising revenue that traditionally flowed to Nexstar's broadcast and cable operations.

The shift in consumer behavior towards digital-first consumption models is a primary driver of this threat. For instance, the growing popularity of SVOD services and short-form video platforms means Nexstar's linear television offerings face increasing competition for viewership, impacting its advertising-centric business model.

| Substitute Category | Key Characteristics | Impact on Nexstar | 2024 Data/Projections |

|---|---|---|---|

| Streaming Video-on-Demand (SVOD) | Ad-free, extensive libraries, on-demand access | Reduces traditional TV viewership, impacts ad revenue | Netflix subscribers > 260 million globally (early 2024) |

| Social Media Platforms (e.g., TikTok) | User-generated content, short-form video, news dissemination | Diverts younger audiences and ad spend from broadcast | TikTok monthly active users > 1 billion (late 2023) |

| Online News Portals & Blogs | Instant news, diverse viewpoints, in-depth analysis | Competes for news consumption, challenges broadcast news format | Digital ad spending continues upward trend in 2024 |

| Podcasts | On-demand audio, flexible consumption, topical discussions | Competes for audience time and news engagement | > 150 million Americans listen to podcasts regularly (2024) |

| OTT Devices & Smart TVs | Internet-based content delivery, bypasses traditional distributors | Accelerates cord-cutting, erodes distribution revenue | ~80% of U.S. broadband households own streaming devices (end 2024) |

Entrants Threaten

Launching a new local television station demands immense upfront capital for essential infrastructure like transmitters and studios, often running into millions of dollars. Furthermore, navigating the complex web of regulatory approvals, particularly securing Federal Communications Commission (FCC) licenses, presents a significant challenge, as these are not easily obtainable.

These substantial capital requirements and stringent regulatory prerequisites effectively deter many potential new entrants from establishing a traditional broadcast presence. The FCC's ownership limitations, specifically the national television ownership cap, further restrict the scale of operations for any new player, reinforcing existing market structures and making it harder for new entities to gain significant traction.

New companies entering the broadcast television market would find it incredibly difficult to match Nexstar Media Group's established distribution channels. Nexstar operates or partners with over 200 stations in 116 U.S. markets, a footprint that took years to build.

Securing retransmission consent agreements with major pay-TV providers, a crucial revenue stream, presents another formidable hurdle. These existing contracts represent significant barriers to entry, as new entrants would need substantial time and negotiation leverage to replicate them.

For instance, in 2023, Nexstar reported approximately $5.0 billion in total revenue, a substantial portion of which is derived from these retransmission fees, highlighting their importance and the difficulty new entrants would face in securing comparable deals.

Nexstar Media Group benefits significantly from its established local news brands across numerous markets, fostering strong community trust and recognition. Furthermore, its strategic investments in national networks, such as NewsNation and The CW, have bolstered its content creation expertise and broadened its brand reach. For instance, NewsNation has been actively expanding its programming and talent roster, aiming to capture a larger share of the national news audience.

New entrants face a substantial hurdle in replicating Nexstar's established brand equity. Building trust and a loyal viewership from the ground up requires immense capital investment and time, particularly in a crowded media landscape. The cost of developing high-quality, engaging content that can compete with established players like Nexstar is a significant barrier.

In 2024, the media industry continues to see consolidation, making it even harder for new entrants to gain a foothold. The ability to produce compelling content across various platforms, from local broadcasts to national cable and streaming, is crucial. Nexstar's existing infrastructure and content production capabilities provide a substantial competitive advantage against any potential new player attempting to enter the market.

Talent Acquisition and Retention

The struggle to attract and keep seasoned journalists, on-air personalities, and technical crews presents a significant hurdle for new media companies aiming to break into local and national broadcasting. For instance, in 2024, the average salary for a broadcast journalist in the US hovered around $60,000, with top talent commanding much higher figures, making it a substantial investment for startups. Nexstar, with its expansive network and established reputation, can leverage its size to offer more competitive compensation and benefits packages, creating a more appealing environment for skilled professionals.

New entrants often find themselves outmatched when competing for specialized talent, particularly in markets where experienced individuals are already established with larger organizations. This disparity in resources can lead to a talent gap, hindering a new player's ability to produce high-quality, engaging content consistently. In 2023, industry reports indicated a notable shortage of experienced broadcast engineers, a critical role for any media operation.

- Talent Cost: High salaries and benefits packages for experienced media professionals are a significant barrier to entry.

- Experience Gap: New entrants may lack the established brand recognition to attract top-tier talent away from incumbents like Nexstar.

- Market Saturation: In many local markets, the pool of highly sought-after broadcast talent is limited, intensifying competition.

Evolving Technology (ATSC 3.0) and Digital Adaptation

The adoption of new technologies like ATSC 3.0, also known as NextGen TV, presents a significant hurdle for potential new entrants into the broadcast media space. Implementing this advanced broadcasting standard requires substantial capital investment and specialized technical expertise, creating a high barrier to entry. For instance, the transition to ATSC 3.0 involves upgrading transmission equipment and ensuring compatibility across various devices, a costly endeavor for any newcomer.

Established players such as Nexstar Media Group are already making strategic investments in these evolving technologies. Nexstar has been actively deploying ATSC 3.0 in numerous markets, demonstrating their commitment to future-proofing their operations. This proactive approach means that new entrants not only face the technological challenge but must also contend with incumbents who are already enhancing their capabilities for multiplatform content delivery and interactive services.

- ATSC 3.0 Investment: New entrants must finance the costly upgrade of transmission infrastructure and associated technologies.

- Digital Platform Development: Competitors need to build sophisticated digital platforms to match established players’ multiplatform content strategies.

- Technical Expertise: Navigating the complexities of ATSC 3.0 and digital integration requires specialized knowledge that is often scarce.

- Incumbent Advantage: Companies like Nexstar, already investing in these areas, possess a significant head start.

The threat of new entrants for Nexstar Media Group is considerably low due to the immense capital required for broadcast infrastructure and FCC licensing, often in the millions. Furthermore, existing regulatory hurdles like national ownership caps and the difficulty of securing retransmission consent agreements with pay-TV providers create significant barriers, making it exceptionally challenging for newcomers to establish a competitive presence.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Nexstar Media Group is built upon comprehensive data from Nexstar's annual reports and SEC filings, alongside industry-specific market research reports and analyses from reputable financial data providers.