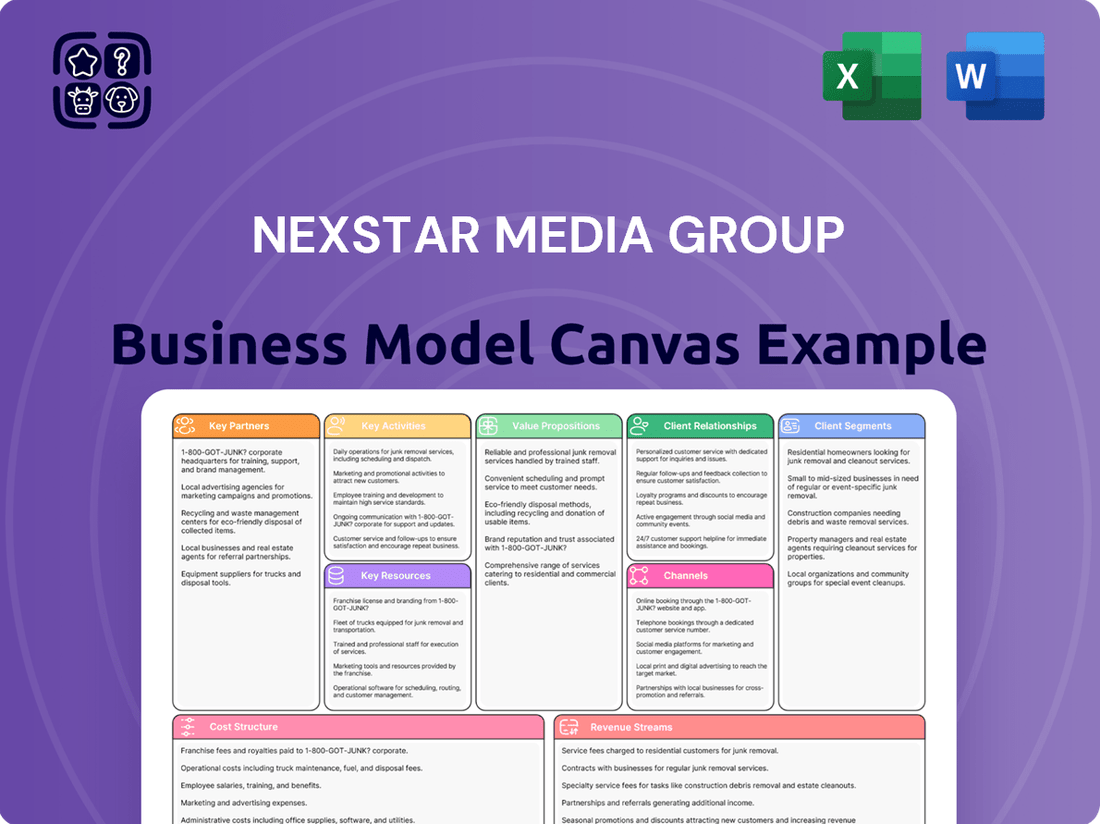

Nexstar Media Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Nexstar Media Group Bundle

Unlock the full strategic blueprint behind Nexstar Media Group's business model. This in-depth Business Model Canvas reveals how the company drives value through local content and diverse revenue streams, captures market share via its expansive station portfolio, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into media consolidation and local advertising strategies.

Partnerships

Nexstar Media Group’s relationships with major broadcast networks, including CBS, NBC, FOX, and ABC, are vital. These affiliation agreements grant Nexstar’s local stations access to widely viewed national programming, a cornerstone of their content strategy.

The renewal of these multi-year contracts, exemplified by the July 2024 agreement with CBS covering 42 markets, guarantees consistent content delivery. This steady stream of popular programming is a significant driver of Nexstar’s distribution revenue and audience engagement.

Nexstar's partnerships with cable and satellite distributors, known as Multichannel Video Programming Distributors (MVPDs) and their virtual counterparts (vMVPDs), are absolutely crucial. These relationships are the backbone of its retransmission consent revenue, a major income stream for the company. For example, in 2023, Nexstar reported that retransmission fee revenue reached $1.37 billion.

These agreements ensure that Nexstar's extensive portfolio of local television stations and its national news channel, NewsNation, are available to a vast audience. Negotiating successful carriage deals, such as those with major providers, is paramount to maintaining this broad reach and consistent revenue flow.

Nexstar Media Group actively partners with a diverse array of content production studios and independent providers. These collaborations are crucial for sourcing and co-creating content that strengthens its broadcast offerings across local stations, the NewsNation channel, and notably, The CW network.

A significant aspect of these partnerships involves securing rights for popular live sports. For instance, Nexstar holds rights for events such as WWE NXT and the NASCAR Xfinity Series. These sports acquisitions are strategic moves designed to boost viewership and enhance the overall appeal of its programming portfolio, driving engagement for its media assets.

Advertisers and Advertising Agencies

Nexstar Media Group’s key partnerships with advertisers and advertising agencies are the bedrock of its revenue generation. These relationships are direct, allowing Nexstar to offer a diverse portfolio of advertising solutions across its television stations and digital properties. The company’s ability to deliver highly targeted campaigns is a significant draw for brands aiming to reach specific demographics.

These partnerships are crucial for capitalizing on advertising opportunities, particularly during peak seasons and election cycles. In 2024, the political advertising market is expected to be robust, benefiting companies like Nexstar that have strong local and national reach. Nexstar's extensive network provides advertisers with unparalleled access to local communities.

- Direct Advertiser Relationships: Nexstar cultivates direct ties with both local businesses and national brands seeking to advertise across its broadcast and digital platforms.

- Advertising Agency Collaboration: Partnerships with advertising agencies are vital, as these firms manage media buys for a wide range of clients, directing significant ad spend to Nexstar's inventory.

- Tailored Advertising Solutions: The company offers customized advertising packages, leveraging its data analytics to help brands effectively connect with their target audiences across multiple screens.

- Political Advertising Revenue: Nexstar is a major beneficiary of political advertising, especially during election years like 2024, with political ad revenue playing a substantial role in its financial performance.

Technology and Digital Platform Partners

Nexstar Media Group actively cultivates partnerships with leading technology and digital platform providers to bolster its operational efficiency and drive innovation. A prime example is their collaboration with Salesforce, which is instrumental in refining advertising sales processes and advancing digital transformation efforts. This includes the strategic deployment of AI agents to streamline and augment sales-related tasks, aiming for improved productivity and customer engagement.

Furthermore, Nexstar engages in strategic joint ventures to unlock new avenues for revenue generation and technological advancement. Their involvement in EdgeBeam Wireless, LLC, exemplifies this, focusing on the exploration and monetization of data transmission capabilities associated with the ATSC 3.0 broadcasting standard. This forward-thinking approach allows Nexstar to stay at the forefront of media technology and capitalize on emerging market opportunities.

- Salesforce Partnership: Nexstar leverages Salesforce to enhance advertising sales operations and digital transformation, integrating AI agents for sales tasks.

- ATSC 3.0 Exploration: Joint venture with EdgeBeam Wireless, LLC, to explore new revenue streams from ATSC 3.0 data transmission.

Nexstar's key partnerships are multifaceted, encompassing broadcast network affiliations, distribution agreements with MVPDs and vMVPDs, content providers, advertisers, and technology collaborators. These relationships are critical for content access, revenue generation, and operational advancement.

The company's 2023 retransmission fee revenue reached $1.37 billion, underscoring the importance of its distribution partnerships. Nexstar's strategic alliances, such as the July 2024 CBS affiliation renewal covering 42 markets, ensure consistent access to popular programming, driving audience engagement and revenue.

Partnerships with advertisers and agencies are fundamental to Nexstar's financial performance, particularly with political advertising expected to be strong in 2024. Collaborations with tech firms like Salesforce also enhance operational efficiency and digital transformation efforts.

| Key Partnership Category | Significance | Example/Data Point |

| Broadcast Network Affiliations | Access to national programming | July 2024 CBS affiliation renewal (42 markets) |

| Distribution Agreements (MVPDs/vMVPDs) | Retransmission revenue | $1.37 billion in retransmission fees (2023) |

| Content Providers/Studios | Broadcasting diverse content, including sports | NASCAR Xfinity Series, WWE NXT rights |

| Advertisers & Agencies | Advertising revenue | Robust political advertising expected in 2024 |

| Technology Partners | Operational efficiency, digital transformation | Salesforce for sales process refinement |

What is included in the product

Nexstar Media Group's business model focuses on local broadcasting, leveraging its extensive network of TV stations and digital platforms to deliver targeted advertising solutions and compelling content to diverse customer segments.

It details key partnerships with advertisers and content creators, alongside revenue streams from advertising sales and content licensing, all supported by a robust operational infrastructure.

Nexstar Media Group's Business Model Canvas acts as a pain point reliever by offering a high-level, editable view of their diverse media operations, allowing for quick identification of core components and efficient strategic adaptation.

Activities

Nexstar Media Group's core activity is the creation of over 316,000 hours of programming each year. This massive output is heavily weighted towards local news, sports, and entertainment tailored for its numerous local stations.

This focus on hyper-local content is a significant competitive advantage for Nexstar. It directly fuels viewer engagement and cultivates strong loyalty within the communities they serve.

In 2024, Nexstar's commitment to local news production is evident as they continue to be a leading provider of this vital information. Their extensive network ensures that communities have access to timely and relevant local reporting.

Nexstar Media Group's content acquisition is a cornerstone of its strategy, involving the procurement of broadcast rights for syndicated shows, movies, and crucial live sports. This ensures their extensive network of local stations and cable channels remain populated with compelling programming. In 2024, Nexstar continued to invest heavily in acquiring content, aiming to solidify its market position and attract diverse viewership.

A significant programming shift is evident at The CW, which Nexstar strategically intends to reshape with a stronger emphasis on sports and unscripted content. This pivot is designed to attract a more desirable, older demographic and ultimately enhance the network's profitability. By focusing on these genres, Nexstar aims to capitalize on growing audience demand and improve the financial performance of The CW.

Nexstar Media Group's core operation involves managing and running its vast portfolio of over 200 television stations and national networks like The CW and NewsNation. This extensive infrastructure is crucial for distributing a wide array of content.

The distribution strategy spans multiple channels, including traditional over-the-air broadcasts, cable and satellite subscriptions, and increasingly, digital platforms. This multi-platform approach is designed to maximize audience engagement and reach.

By leveraging this expansive network, Nexstar ensures its content reaches a significant portion of the U.S. television market, estimated at around 70% of households. This broad reach is fundamental to its business model and advertising revenue generation.

In 2024, Nexstar continued to invest in upgrading its distribution technology to maintain competitive reach across all platforms. The company’s commitment to a robust broadcast and digital presence underpins its strategy for sustained audience acquisition.

Advertising Sales and Management

Nexstar Media Group's advertising sales and management is a core function, encompassing the active selling of advertising space across its extensive local, national, and digital platforms. This includes managing the execution of advertising campaigns and utilizing data analytics to pinpoint target audiences effectively. In 2024, this activity is particularly crucial, with political advertising expected to be a significant revenue driver, especially in the lead-up to the U.S. elections.

- Revenue Maximization: Nexstar's sales teams are focused on maximizing advertising revenue by bundling offerings across its diverse media assets, including broadcast television, local news websites, and digital platforms.

- Political Advertising Focus: Election years, like 2024, represent a peak period for political ad spending, and Nexstar actively engages with campaigns and political action committees to secure these high-value advertising contracts.

- Data-Driven Targeting: The company leverages sophisticated data analytics and targeting capabilities to offer advertisers more precise audience reach, enhancing the value proposition of its advertising inventory.

- Digital Expansion: Nexstar continues to build out its digital advertising capabilities, selling programmatic and direct-buy inventory on its owned and operated digital properties to capture a larger share of the growing digital ad market.

Retransmission Consent Negotiations

Nexstar Media Group actively engages in intricate, multi-year negotiations with cable and satellite providers. These discussions are crucial for securing retransmission consent fees, a revenue stream that has grown substantially and represents a significant portion of the company's income. For instance, in 2023, Nexstar reported that retransmission consent fees contributed approximately $1.2 billion to its total revenue. These negotiations are vital for maintaining subscriber-based revenue by ensuring Nexstar's popular local broadcast channels remain accessible on these platforms.

The company's ability to successfully navigate these complex retransmission consent negotiations directly impacts its financial performance. These agreements are essential for Nexstar to continue receiving compensation for broadcasting its content. In 2024, the company anticipates continued growth in this area, driven by the increasing value of local broadcast content in a fragmented media landscape. The success of these talks is a key determinant of Nexstar's overall revenue stability and growth trajectory.

- Securing Retransmission Consent Fees: Nexstar's core activity involves negotiating with pay-TV distributors to carry its local television stations.

- Revenue Generation: These fees are a substantial and growing revenue source, contributing significantly to the company's top line.

- Subscriber Revenue Maintenance: Successful negotiations ensure continued access for subscribers, safeguarding this revenue stream.

- Contractual Agreements: The process involves complex, multi-year agreements that dictate the financial terms of carriage.

Nexstar Media Group's key activities revolve around producing a vast amount of local content, primarily news, sports, and entertainment, for its extensive network of stations. They also actively acquire broadcast rights for syndicated programming and live sports to fill their schedules. A strategic pivot at The CW is underway, focusing on sports and unscripted content to attract an older demographic and boost profitability.

Full Version Awaits

Business Model Canvas

The Nexstar Media Group Business Model Canvas preview you're examining is the actual document you will receive upon purchase. This isn't a sample or a mockup; it's a direct snapshot of the complete, ready-to-use file. Upon completing your order, you'll gain full access to this meticulously crafted Business Model Canvas, enabling you to understand and leverage Nexstar's strategic framework immediately.

Resources

Nexstar Media Group's broadcast licenses and spectrum are critical assets, granting them the exclusive right to transmit television signals across numerous geographic markets. These licenses, issued by the FCC, are the bedrock of their over-the-air broadcasting business, allowing them to reach millions of households directly.

As of the first quarter of 2024, Nexstar operated 199 television stations in 116 markets, a testament to the extensive reach these licenses provide. The company's significant spectrum holdings are equally vital, enabling the efficient and reliable delivery of broadcast content to viewers.

Nexstar Media Group's television stations and infrastructure represent its foundational physical assets. This network encompasses over 200 owned or affiliated local television stations, complete with studios, transmission towers, and essential technical equipment. This widespread presence is crucial for delivering content across 116 U.S. markets.

This extensive infrastructure underpins Nexstar's ability to achieve significant local and national reach. For instance, in 2024, Nexstar's broadcast television segment continued to be a primary revenue driver, benefiting from the broad audience engagement facilitated by this robust infrastructure.

Nexstar's content library is a cornerstone of its business, housing everything from locally produced news to national broadcasts on The CW and NewsNation. This extensive collection is vital for drawing in and keeping audiences engaged across its many platforms.

The value of this library is amplified by Nexstar's ownership of programming rights, including syndicated content and popular national shows and sports. In 2024, this diverse content mix fuels viewership and advertising revenue.

Journalists, Talent, and Sales Personnel

Nexstar Media Group relies heavily on its extensive workforce to generate compelling content and drive revenue. The company employs over 6,000 local journalists, anchors, producers, and on-air personalities. These individuals are the backbone of Nexstar's commitment to delivering high-quality local news and programming across its numerous stations.

Complementing the content creators, Nexstar also has a significant sales force. Approximately 1,600 local salespeople are crucial for securing advertising partnerships. Their efforts are directly responsible for generating a substantial portion of the company's advertising revenue.

- Journalists and Talent: Over 6,000 individuals are responsible for creating local news and other content.

- Sales Personnel: Around 1,600 employees focus on generating advertising revenue.

- Content Creation: The talent pool is essential for producing the daily news cycles and programming that attract viewers.

- Revenue Generation: The sales team's effectiveness directly impacts the company's financial performance through ad sales.

Digital Platforms and Technology

Nexstar Media Group's digital platforms are a critical component of its business model, encompassing a vast network of local station websites and mobile applications. These digital assets, numbering 138 local station websites and 229 mobile apps, serve as direct channels for content distribution and audience engagement. The company also leverages significant digital properties like NewsNationNow.com and The Hill, alongside connected TV applications, to broaden its reach and monetize its content across various platforms.

The company's strategic investment in advanced technologies like ATSC 3.0 is designed to future-proof its broadcast operations and create new revenue streams through enhanced viewing experiences and data capabilities. Furthermore, the adoption of AI-driven sales platforms streamlines advertising operations, improving efficiency and targeting for advertisers. These technological advancements are crucial for maintaining a competitive edge in the evolving media landscape.

Key digital resources for Nexstar Media Group include:

- 138 local station websites providing localized news and content.

- 229 mobile applications offering on-the-go access to news and programming.

- NewsNationNow.com and The Hill as key national digital news platforms.

- Connected TV applications expanding reach to smart TV audiences.

- Investments in ATSC 3.0 and AI sales platforms to enhance digital capabilities and operational efficiency.

Nexstar's key resources are its broadcast licenses, extensive physical infrastructure, diverse content library, skilled workforce, and expanding digital platforms. These assets collectively enable the company to reach millions of viewers and generate substantial advertising and subscription revenue.

The company's broadcast licenses and spectrum are foundational, allowing direct transmission to households. As of Q1 2024, Nexstar operated 199 television stations in 116 markets, highlighting the reach these licenses provide. Their infrastructure includes over 200 owned or affiliated local TV stations with studios and transmission towers, supporting content delivery across 116 U.S. markets.

Nexstar's content library, featuring local news, The CW, and NewsNation, is vital for audience engagement. This is bolstered by ownership of programming rights for syndicated and national content, driving viewership and ad revenue. The workforce, comprising over 6,000 journalists and 1,600 sales personnel, is crucial for content creation and revenue generation, respectively.

Digital assets include 138 local station websites and 229 mobile apps, alongside national platforms like NewsNationNow.com and The Hill. Investments in ATSC 3.0 and AI sales platforms further enhance their digital capabilities and operational efficiency.

| Resource Category | Specific Assets | Key Function/Value | 2024 Data Point |

|---|---|---|---|

| Broadcast Licenses & Spectrum | FCC Broadcast Licenses | Exclusive right to transmit TV signals, bedrock of over-the-air business | 199 television stations in 116 markets operated (Q1 2024) |

| Physical Infrastructure | TV Stations, Studios, Towers | Enables content delivery across numerous geographic markets | Over 200 owned or affiliated local TV stations |

| Content Library | Programming Rights, Syndicated Content | Attracts and retains audiences, fuels viewership and ad revenue | Diverse mix includes local news, The CW, NewsNation |

| Human Capital | Journalists, Anchors, Producers, Sales Staff | Content creation, audience engagement, and advertising revenue generation | Over 6,000 journalists; ~1,600 local salespeople |

| Digital Platforms | Station Websites, Mobile Apps, National Sites | Direct content distribution, audience engagement, monetization | 138 local station websites; 229 mobile apps |

Value Propositions

Nexstar Media Group's value proposition centers on delivering comprehensive local news and information, acting as a vital daily resource for millions across its diverse markets. This deep commitment to hyper-local content, including news, weather, and community events, sets it apart from national broadcasters and cultivates robust connections within each community it serves.

In 2024, Nexstar's extensive portfolio of local stations continues to be the primary conduit for this trusted information. For instance, its commitment to local journalism is reflected in the significant investment in newsgathering operations across its 200+ television stations, ensuring timely and relevant reporting for its audience.

Nexstar Media Group provides diverse national programming through The CW and NewsNation, covering entertainment, sports, and news. This broad offering appeals to a wide audience base, enhancing its market reach. In 2024, The CW's strategic pivot to more sports and unscripted content is designed to bolster profitability and expand its viewership. This move is crucial for the network's financial health and competitive positioning.

Nexstar Media Group provides advertisers with an exceptional opportunity to connect with a vast and varied audience. By leveraging both local broadcast television and its expanding digital footprint, businesses can access an unparalleled marketing channel.

This extensive reach is a significant value proposition, as Nexstar's platforms touch approximately 70% of all U.S. television households. This broad penetration ensures that advertisers can effectively target and engage a significant portion of the American consumer base, driving brand awareness and sales.

Multi-Platform Content Accessibility

Nexstar Media Group offers viewers unparalleled access to its diverse content library through a multi-platform strategy. This means you can catch your favorite news, sports, and entertainment not just on your television, but also on the go.

This approach is crucial for meeting modern audiences where they are. Whether it's tuning into a local broadcast, streaming a live event via a mobile app, or browsing articles on their website, Nexstar ensures its content is readily available.

- Traditional Broadcasts: Still a core delivery method for local news and programming.

- Cable and Satellite: Reaching a significant portion of the audience through established pay-TV providers.

- Digital Platforms: Websites, dedicated mobile applications, and partnerships with streaming services are expanding reach and engagement.

- Evolving Consumption: This caters to the growing preference for on-demand and mobile viewing.

By embracing this multi-platform accessibility, Nexstar is well-positioned to capture a broad audience and adapt to the dynamic media landscape. In 2024, digital revenue streams are increasingly vital, reflecting viewer habits shifting beyond traditional television.

Trusted Source of Information and Community Engagement

Nexstar Media Group's value proposition centers on being a trusted source of information, which is fundamental to its business model, especially within the local news sector. By consistently delivering reliable reporting and actively engaging with the communities it serves, Nexstar cultivates a deep sense of trust among its audience. This earned trust directly translates into sustained viewership and, importantly, advertiser confidence, a critical factor in today's highly fragmented media environment.

The company's commitment to local journalism builds a strong connection with viewers, making its content indispensable. This is evident in how local news outlets often serve as primary sources for community information and events. For instance, in 2024, local news consumption remained robust, with a significant percentage of adults reporting that they regularly get their news from local TV stations, underscoring the enduring value of Nexstar's core offering.

- Trusted Local News: Nexstar prioritizes accurate and relevant local reporting, building credibility.

- Community Engagement: Active participation in local events and issues fosters audience loyalty.

- Advertiser Confidence: Trust in Nexstar's audience reach and brand safety attracts and retains advertisers.

- Viewership Maintenance: Reliable content ensures consistent audience numbers in a competitive landscape.

Nexstar Media Group offers advertisers unparalleled access to a vast audience through its extensive network of local television stations and growing digital platforms. This broad reach, encompassing approximately 70% of U.S. television households, provides a potent channel for effective consumer engagement and brand building.

The company's value proposition to advertisers is further enhanced by its ability to deliver targeted local content, ensuring marketing messages resonate with specific community demographics. This dual approach of wide reach and local relevance makes Nexstar a valuable partner for businesses seeking to maximize their advertising impact.

| Value Proposition | Description | Key Data Point (2024/2025) |

|---|---|---|

| Extensive Local Reach | Access to a vast audience across numerous U.S. markets. | Reaches ~70% of U.S. TV households. |

| Targeted Advertising | Ability to connect with specific community demographics through local content. | Over 200 local television stations providing hyper-local news. |

| Multi-Platform Engagement | Content delivery across traditional broadcast, cable, satellite, and digital channels. | Growing digital revenue streams are vital, adapting to evolving viewer habits. |

Customer Relationships

Nexstar Media Group's customer relationships with cable and satellite providers (MVPDs) and virtual MVPDs are built on retransmission consent contracts. These agreements are crucial, often involving lengthy, multi-year negotiations for fees that Nexstar receives to broadcast its local content. For example, in 2023, Nexstar secured approximately $4.7 billion in retransmission revenues, highlighting the significance of these partnerships.

These contractual relationships are the bedrock of Nexstar's distribution strategy, ensuring its popular local news and programming reaches a broad audience. The complexity of these deals means managing them effectively is paramount to maintaining a predictable and expanding revenue stream. This financial year, Nexstar continued to navigate these negotiations, aiming to secure favorable terms that reflect the value of its content.

Nexstar Media Group offers dedicated sales and account management teams to its advertising clients, both local and national. This ensures advertisers receive tailored strategies and ongoing support to optimize their campaign performance.

This personalized approach fosters strong, long-term relationships with crucial advertisers. For instance, in 2023, Nexstar's advertising revenue reached $4.2 billion, underscoring the importance of these client relationships.

Nexstar Media Group deeply embeds itself in local communities, recognizing that strong ties translate to viewer loyalty. This is evident in their extensive local news reporting, which goes beyond headlines to cover issues that directly impact residents.

Public service initiatives are a cornerstone of this strategy. For example, Nexstar stations often lead campaigns for blood drives, food collections, or support local charities, directly engaging viewers in meaningful causes.

Active participation in local events, from sponsoring parades to covering high school sports, further solidifies Nexstar's presence. In 2024, many Nexstar stations continued to be primary media partners for major local festivals and community gatherings, underscoring their commitment to being a visible and supportive part of the fabric of these towns.

Content Licensing and Distribution Partnerships

Nexstar Media Group cultivates crucial customer relationships through content licensing and distribution partnerships, directly negotiating agreements with content creators and syndicators. These relationships are vital for securing a consistent flow of programming across Nexstar's extensive network of television stations and digital platforms. For instance, in 2024, Nexstar continued to leverage these partnerships to bolster its local news offerings and expand its national content portfolio.

These strategic alliances ensure Nexstar's ability to offer a diverse and engaging content mix to its audience. The management of these partnerships is a key component, focusing on mutual benefit and long-term sustainability. By maintaining strong ties with content providers, Nexstar solidifies its position as a major player in broadcast and digital media distribution.

- Content Acquisition: Direct negotiation and licensing agreements with content creators and syndicators.

- Partnership Management: Ongoing relationship management to ensure consistent and diverse content supply.

- Platform Integration: Tailoring content distribution across Nexstar's television stations and digital properties.

- Revenue Generation: Partnerships contribute to advertising and subscription revenue streams through popular content.

Digital User Engagement and Feedback

Nexstar Media Group actively cultivates digital user engagement through interactive features on its websites and social media channels. This includes fostering conversations via comment sections and direct messaging, enabling real-time dialogue with its audience.

These platforms are crucial for gathering audience insights and understanding user preferences, which directly informs content strategy and service development. For instance, user comments on local news stories can highlight emerging community concerns or popular topics.

In 2024, Nexstar continued to leverage these feedback loops. While specific aggregate numbers for user feedback across all platforms are proprietary, industry trends indicate significant growth in digital engagement. For example, many media companies reported double-digit percentage increases in time spent on site and social media interactions throughout 2024, driven by localized content and interactive features.

- Direct Feedback Mechanisms: Users can submit tips, story ideas, and general feedback directly through forms and email on Nexstar's digital properties.

- Social Media Interaction: Nexstar properties actively participate in conversations on platforms like Facebook, Twitter, and Instagram, responding to comments and engaging with followers.

- Audience Insights: Data from these interactions, including comment sentiment and engagement rates, helps Nexstar tailor its digital content and advertising offerings.

- Continuous Improvement: Feedback gathered is used to refine website user experience, app functionality, and the overall delivery of news and entertainment content.

Nexstar Media Group's customer relationships with its viewers are deeply rooted in community engagement and the delivery of hyper-local content. By actively participating in local events and supporting community initiatives, Nexstar stations foster strong viewer loyalty. This commitment is evident in their consistent presence at local festivals and as media partners for significant community gatherings throughout 2024.

Furthermore, Nexstar cultivates direct engagement with its digital audience through interactive website features and social media platforms. This allows for real-time dialogue and the collection of valuable audience insights, which are then used to refine content strategies and digital offerings. For instance, user feedback on local news stories helps identify trending community concerns and popular topics.

| Relationship Type | Key Activities | 2023 Data Point | 2024 Focus |

|---|---|---|---|

| Distribution Partners (MVPDs/vMVPDs) | Retransmission consent contract negotiations | ~$4.7 billion in retransmission revenues | Securing favorable multi-year contract terms |

| Advertising Clients (Local & National) | Dedicated sales & account management, tailored strategies | $4.2 billion in advertising revenue | Optimizing campaign performance, fostering long-term partnerships |

| Local Communities/Viewers | Hyper-local news, community service initiatives, event sponsorship | Stations as primary media partners for local festivals | Deepening community ties, driving viewer loyalty |

| Content Providers/Syndicators | Content licensing and distribution agreements | Bolstering local news and national portfolio | Ensuring diverse and engaging content supply |

| Digital Users | Interactive website features, social media engagement, direct feedback | Significant growth in digital engagement (industry trend) | Leveraging feedback for content refinement and user experience |

Channels

Local broadcast television stations are the bedrock of Nexstar Media Group's business model, acting as its primary conduit for content delivery. With over 200 stations spread across the nation, Nexstar commands a significant presence, reaching approximately 70% of all television households through over-the-air broadcasts.

These stations are crucial for distributing a mix of content, including vital local news programming, popular network television shows, and targeted advertising. This extensive local footprint allows Nexstar to deeply connect with communities and provide essential information and entertainment.

In 2024, Nexstar's broadcast segment continued to be a major revenue driver. The company's stations generated substantial advertising income, bolstered by local and national ad sales across various programming genres.

Nexstar Media Group secures crucial distribution agreements with major cable and satellite television providers, acting as a vital channel for its content. These partnerships allow Nexstar to deliver its local station signals and popular national networks, including NewsNation and The CW, directly to millions of pay-TV households across the country.

In 2024, Nexstar's carriage agreements with these providers are fundamental to its revenue streams, reflecting the ongoing importance of traditional pay-TV platforms in reaching a broad audience. The company actively negotiates these retransmission consent fees and affiliate fees, which are a significant component of its financial performance.

These collaborations ensure Nexstar's programming maintains broad accessibility, reaching a substantial portion of the estimated 70 million U.S. households that still subscribe to traditional cable or satellite services. The reach is essential for advertisers and for maintaining the viewership of Nexstar's owned and operated local stations.

NewsNation and The CW are central to Nexstar's national reach, delivering news, entertainment, and sports. These networks are accessible via traditional cable and satellite, as well as virtual multichannel video programming distributors (vMVPDs), ensuring broad national viewership. By 2024, The CW has strategically enhanced its live sports offerings.

Digital Platforms and Mobile Applications

Nexstar Media Group's digital presence is anchored by a comprehensive network of platforms. This includes 138 dedicated local station websites, offering region-specific news and programming. Complementing these are 229 mobile applications, designed to deliver content directly to consumers' devices anytime, anywhere.

These digital assets are crucial for providing on-demand content and live streaming capabilities, meeting evolving audience consumption habits. Furthermore, they serve as significant avenues for digital advertising, generating revenue through targeted campaigns and sponsorships. For instance, in 2023, Nexstar reported digital revenue growth, underscoring the increasing importance of these channels.

- Digital Reach: Operates 138 local station websites and 229 mobile applications.

- Content Delivery: Offers on-demand content and live streaming services.

- Revenue Streams: Utilizes platforms for digital advertising and sponsorships.

- Key Digital Properties: Includes NewsNationNow.com and The Hill for broader national reach.

Over-the-Top (OTT) and Free Ad-Supported Streaming TV (FAST) Services

Nexstar Media Group leverages its owned streaming applications, such as The CW app and NewsNationNow, to directly distribute content and engage with audiences actively seeking digital-first experiences. This strategy is crucial for reaching cord-cutters and younger demographics who increasingly consume media outside of traditional cable packages.

Furthermore, Nexstar strategically partners with third-party Over-the-Top (OTT) and Free Ad-Supported Streaming TV (FAST) services. This multi-platform approach significantly broadens its content distribution footprint, ensuring its programming is accessible across a wider array of consumer devices and viewing habits. By participating in these platforms, Nexstar effectively monetizes its extensive content library beyond the constraints of linear television, tapping into new revenue streams driven by digital advertising and subscription models.

- Expanded Reach: Partnerships with FAST services like Pluto TV and Tubi in 2024 allowed Nexstar to access millions of new viewers.

- Content Monetization: The CW app, bolstered by Nexstar's investment, saw significant user growth in 2024, contributing to increased ad revenue.

- Digital Audience Engagement: NewsNationNow’s direct-to-consumer strategy in 2024 aimed to capture a growing segment of news consumers preferring online platforms.

- Revenue Diversification: Distribution on third-party FAST channels in 2024 provided Nexstar with a vital revenue stream independent of traditional advertising sales.

Nexstar leverages its local broadcast stations as a primary channel, reaching approximately 70% of U.S. TV households. Its digital channels include 138 local websites and 229 mobile apps, offering on-demand content and digital advertising opportunities. Furthermore, Nexstar's owned streaming apps and partnerships with FAST services like Pluto TV and Tubi in 2024 significantly expand its reach to digital-first audiences.

| Channel Type | Key Platforms/Properties | 2024 Audience Reach/Impact | Revenue Contribution |

|---|---|---|---|

| Broadcast | 200+ Local TV Stations | ~70% of US TV Households | Primary Advertising Revenue |

| Distribution Agreements | Cable & Satellite Providers | Millions of Pay-TV Households | Retransmission & Affiliate Fees |

| National Networks | NewsNation, The CW | Broad National Viewership (incl. Live Sports) | Advertising & Affiliate Fees |

| Digital Properties | 138 Station Websites, 229 Mobile Apps | Growing Digital Audience | Digital Advertising, Sponsorships |

| Owned Streaming Apps | The CW App, NewsNationNow | Direct-to-Consumer Engagement | Ad Revenue, User Growth |

| Third-Party Streaming | FAST Services (e.g., Pluto TV, Tubi) | Access to New Viewers | Monetization via Digital Ads |

Customer Segments

Nexstar's local television viewers represent the bedrock of its audience, encompassing the general public across its 116 diverse markets. These individuals rely on Nexstar stations for essential local news, weather updates, sports coverage, and a variety of syndicated entertainment programming.

This segment accesses content through both over-the-air broadcasts and various pay-television platforms, demonstrating a broad reach and varied consumption habits. In 2024, Nexstar continued to serve millions of these viewers daily, reinforcing its position as a primary source for local information and entertainment.

National News and Entertainment Viewers represent a crucial customer segment for Nexstar Media Group, encompassing those who tune in for national news broadcasts via NewsNation and entertainment or sports content on The CW. This audience is diverse, ranging from dedicated news followers to casual viewers seeking popular programming.

Nexstar is actively cultivating a specific demographic within this segment for The CW. The company's strategic pivot to emphasize sports and unscripted content is designed to attract and retain an older, more established audience. This focus aims to stabilize viewership and create predictable revenue streams from this valuable demographic.

In 2024, Nexstar’s investment in The CW, including its acquisition of a majority stake, signals a commitment to growing this national viewership. By aligning programming with the preferences of older demographics, particularly through sports, Nexstar is positioning The CW for increased ad revenue and affiliate fees, leveraging the loyalty of these viewers.

Local and national advertisers, including businesses and political campaigns, represent a core customer base for Nexstar Media Group. These entities rely on Nexstar's extensive reach across various geographic markets to connect with their target audiences. For example, in the 2022 midterm elections, Nexstar stations saw significant ad revenue, a trend expected to continue and grow in the 2024 election cycle, highlighting the importance of political advertising.

Nexstar's diverse portfolio of local television stations and digital properties provides a powerful platform for advertisers aiming for broad national exposure or highly localized penetration. This dual capability allows for tailored campaigns that resonate with specific demographics. The company's ability to deliver targeted advertising solutions is a key value proposition for these customers, driving substantial revenue, particularly during peak political advertising periods.

Multichannel Video Programming Distributors (MVPDs) and Virtual MVPDs (vMVPDs)

Nexstar Media Group’s customer base includes Multichannel Video Programming Distributors (MVPDs) and Virtual MVPDs (vMVPDs). These are essentially the cable, satellite, and internet-based live TV providers that carry Nexstar's extensive portfolio of local and national broadcast channels. These partnerships are crucial, as these distributors pay Nexstar significant retransmission consent fees for the right to broadcast Nexstar's content to their subscribers. This contractual revenue stream forms a foundational pillar of Nexstar's financial model.

The retransmission consent fees paid by MVPDs and vMVPDs represent a substantial and predictable revenue source for Nexstar. These agreements are typically negotiated for multi-year terms, providing a degree of revenue stability. For instance, in 2024, Nexstar has continued to focus on optimizing these agreements, aiming for terms that reflect the value of its popular local news and programming. The company has previously highlighted the importance of these fees, noting their contribution to its overall financial performance.

- Key Customer Segment: MVPDs and vMVPDs are vital as they distribute Nexstar's content to millions of households.

- Revenue Driver: Retransmission consent fees are a primary source of income, directly impacting profitability.

- Contractual Basis: These relationships are governed by contracts that dictate carriage fees and terms.

- Market Dynamics: Changes in the pay-TV landscape, including cord-cutting and the rise of vMVPDs, influence negotiation strategies.

Content Producers and Syndicators

Nexstar Media Group's business model deeply relies on content producers and syndicators. These are the studios and independent creators who provide the programming that fills Nexstar's broadcast and digital platforms. Nexstar acts as a crucial distribution partner, offering these producers access to its vast audience across a wide array of local television stations and digital properties.

Partnerships with content producers often take the form of licensing agreements, where Nexstar pays to broadcast specific shows or movies. In other instances, Nexstar might engage in co-production deals, sharing the costs and revenues associated with creating new content. This symbiotic relationship allows producers to gain significant reach for their content, while Nexstar secures a steady flow of appealing programming for its viewers.

- Content Access: Producers gain distribution to Nexstar's over 200 owned or operated television stations across the U.S.

- Revenue Streams: Nexstar generates revenue through advertising sales and retransmission fees, which are influenced by the content it offers.

- Syndication Value: The ability to syndicate popular content across multiple Nexstar channels and digital platforms enhances its overall value.

- Strategic Partnerships: Nexstar's commitment to local news and community engagement makes it an attractive partner for producers seeking targeted audiences.

Nexstar's customer segments can be broadly categorized into local viewers, national viewers, advertisers, content distributors, and content producers. Local viewers form the core audience, consuming news, weather, and entertainment across 116 markets, while national viewers engage with networks like NewsNation and The CW, with a strategic focus on older demographics for The CW's programming in 2024.

Cost Structure

Nexstar Media Group’s business model heavily relies on substantial investments in content. In 2024, these costs are driven by the production of local news across its extensive station portfolio, alongside original programming for its national networks, NewsNation and The CW. Significant expenditures are allocated to journalist salaries, maintaining studio operations, and securing the rights for syndicated shows and live sports, which are crucial for viewership and advertising revenue.

Nexstar Media Group faces significant costs associated with retransmission compensation and affiliate fees. These expenses primarily involve payments made to major broadcast networks such as Fox, CBS, NBC, and ABC. These fees are essentially for the right to carry the networks' popular programming on Nexstar's local television stations.

While Nexstar also collects retransmission fees from cable and satellite providers, a portion of these earnings is funneled back to the broadcast networks. This reciprocal arrangement means that even as Nexstar generates revenue from carriage agreements, it simultaneously incurs costs to secure the content that drives viewer engagement and advertising sales.

In 2024, the landscape of retransmission consent negotiations continued to be a critical cost driver. The increasing value of broadcast content in a fragmented media environment put pressure on Nexstar’s expenses in this area, impacting its overall profitability.

Nexstar Media Group's broadcast operations and infrastructure maintenance represent a significant cost driver. This includes the essential expenses of running and upkeep for their extensive array of television stations, transmission hardware, and digital platforms. For example, in 2024, Nexstar continued to invest in modernizing its technological backbone, a crucial element in delivering content across various media.

These operational costs encompass salaries for skilled technical personnel, essential utility payments to keep facilities running, and ongoing investments in upgrading aging equipment to ensure reliable service delivery. The company’s commitment to maintaining a high standard of broadcast quality directly translates into these substantial expenditures.

Sales, General, and Administrative (SG&A) Expenses

Nexstar Media Group's Sales, General, and Administrative (SG&A) expenses are substantial, reflecting the broad scope of its media operations. These costs encompass a significant sales force, extensive marketing campaigns, and the corporate overhead required to manage a vast network of broadcast stations and digital platforms. Legal fees and other administrative functions are also key components, ensuring compliance and smooth operation across the organization. In 2024, Nexstar has continued its strategic focus on optimizing these expenses, aiming for greater efficiency and cost reduction. For instance, the company has actively pursued streamlining management structures and integrating acquired businesses to realize synergies and lower overall operating costs.

The company's commitment to expense management is evident in its ongoing efforts to find efficiencies within its SG&A. This includes leveraging technology to automate certain processes and consolidating functions where possible. For example, Nexstar reported that its SG&A expenses as a percentage of revenue have been a key area of focus for management, with initiatives in place to improve this ratio. These efforts are designed to bolster profitability without compromising the quality of sales, marketing, or essential administrative support critical to Nexstar's market position and growth strategies.

- Sales Force Costs: Significant investment in personnel and resources to drive advertising revenue across broadcast and digital channels.

- Marketing and Advertising: Expenses related to promoting Nexstar's brands, programming, and digital services to consumers and advertisers.

- Corporate Overhead: Costs associated with central management, finance, human resources, and IT functions supporting the entire organization.

- Legal and Compliance: Expenditures necessary for regulatory adherence, contract management, and litigation.

Debt Service and Capital Expenditures

Nexstar Media Group's cost structure is heavily influenced by its substantial debt obligations. As of March 2025, the company reported a consolidated debt of $6.5 billion, requiring significant resources for interest payments and principal repayment. This debt servicing is a fundamental component of their operational expenses.

Beyond debt, capital expenditures represent another critical cost. These investments are directed towards crucial areas such as:

- Technology Upgrades: Enhancing broadcasting equipment and digital infrastructure to maintain competitive advantage.

- Station Acquisitions: Funding the purchase of new broadcast properties to expand market reach and revenue streams.

- Infrastructure Improvements: Investing in advancements like the rollout of ATSC 3.0, the next-generation broadcast standard, to ensure future compatibility and service offerings.

Nexstar Media Group's cost structure is characterized by significant investments in content creation and acquisition, operational expenses for its broadcast infrastructure, and substantial sales, general, and administrative (SG&A) costs. These elements are fundamental to maintaining its position as a leading local media company. The company also bears the significant financial burden of debt servicing and ongoing capital expenditures to ensure technological relevance and market expansion.

| Cost Category | Description | 2024 Impact/Focus |

| Content Expenses | Production of local news, original programming for NewsNation and The CW, syndicated show rights, live sports rights. | Driven by journalist salaries, studio operations, and rights acquisition; crucial for viewership and advertising. |

| Retransmission & Affiliate Fees | Payments to major broadcast networks (Fox, CBS, NBC, ABC) for carriage rights. | Essential for securing popular programming, though a portion of retransmission revenue is paid back to networks. |

| Broadcast Operations & Infrastructure | Running and upkeep of TV stations, transmission hardware, digital platforms. | Includes technical personnel salaries, utilities, and investments in modernizing technology, such as ATSC 3.0. |

| Sales, General & Administrative (SG&A) | Sales force, marketing, corporate overhead, legal, and compliance. | Focus on optimization through streamlining management and technology adoption to improve efficiency. |

| Debt Servicing & Capital Expenditures | Interest payments on debt, technology upgrades, station acquisitions. | As of March 2025, consolidated debt was $6.5 billion; CapEx targets future compatibility and market reach. |

Revenue Streams

Advertising revenue is Nexstar Media Group's primary income source, generated by selling ad space on its extensive network of local TV stations and digital properties. This includes both national and local advertising commitments.

Political advertising significantly boosts this revenue stream, particularly in election years. For instance, Nexstar reported robust political advertising revenue in the 2022 midterm elections, contributing substantially to its overall financial performance.

Local commercial advertising also forms a crucial part of this segment. Nexstar leverages its strong local presence and audience engagement to attract businesses seeking to reach specific geographic markets through its television and digital platforms.

Nexstar Media Group generates significant income through retransmission consent fees. These are payments received from cable, satellite, and over-the-top (vMVPD) providers for the right to broadcast Nexstar's local television signals. This revenue stream is a cornerstone of Nexstar's business model.

In 2024, retransmission fees are projected to continue their strong performance, contributing a substantial portion of Nexstar's overall earnings. This contractual revenue is not only consistent but shows a trend of growth, underscoring its importance.

Indeed, retransmission consent fees represent a critical revenue pillar, often accounting for over 60% of Nexstar's total revenue. This highlights the company's leverage in negotiating with distributors to carry its popular local content.

The CW Network's revenue primarily stems from advertising sales, a critical component for Nexstar Media Group's business model. This stream is being actively managed to improve profitability.

Nexstar is targeting profitability for The CW by 2026, implementing strategic programming adjustments and cost-saving measures to achieve this goal. The company is focused on optimizing the network's financial performance.

Future distribution deals could also represent a growing revenue stream for The CW, further diversifying its income sources. These potential agreements are part of the long-term strategy.

Digital Advertising and Publishing Revenue

Nexstar Media Group generates significant income from digital advertising placements across its extensive network of websites and mobile applications. This includes prominent platforms like NewsNationNow.com and The Hill, where advertisers reach engaged audiences. The company also offers digital content publishing solutions, further diversifying its digital revenue streams.

Nexstar is actively prioritizing the enhanced monetization of its digital content and audience engagement. This strategic focus aims to capture greater value from its digital footprint, as demonstrated by their ongoing investments in digital product development and audience growth initiatives.

- Digital Advertising: Revenue derived from ad sales on Nexstar's digital properties.

- Publishing Solutions: Income from providing digital content publishing services.

- Monetization Focus: Strategic efforts to increase revenue from digital content and user base.

- Platform Examples: Key digital assets include NewsNationNow.com and The Hill.

Other (e.g., ATSC 3.0 Data Services, Content Syndication)

Nexstar Media Group is actively diversifying its revenue through innovative avenues beyond traditional broadcasting. A significant focus is on leveraging its investments in ATSC 3.0 technology, often referred to as NextGen TV. This advanced broadcast standard allows for high-speed data transmission, opening doors for new data-centric services that can be monetized.

These ATSC 3.0 data services could include capabilities like enhanced emergency alerts, targeted advertising delivery, and even providing broadband-like internet services in areas where traditional broadband is less accessible. The company is exploring how to package and sell these data transmission capabilities to various third-party providers.

Content syndication represents another key area of exploration for Nexstar. This involves licensing its owned content, such as news programming, sports, and entertainment, to other media outlets, digital platforms, or content aggregators. This strategy aims to maximize the reach and profitability of its extensive content library.

Furthermore, Nexstar is making strategic investments in related technology ventures. For example, its involvement with EdgeBeam Wireless highlights a commitment to companies developing infrastructure and services that complement its broadcast and data transmission strategies. These investments are designed to capture emerging market opportunities and create synergistic revenue streams.

- ATSC 3.0 Data Services: Nexstar is developing revenue from high-speed data transmission enabled by NextGen TV technology.

- Content Syndication: Monetizing its extensive content library by licensing to third-party platforms and broadcasters.

- Strategic Ventures: Investing in companies like EdgeBeam Wireless to capitalize on complementary technology markets.

- Diversification: Actively seeking new income sources beyond traditional advertising and retransmission fees.

Nexstar Media Group's revenue streams are diverse, with advertising being the primary driver, encompassing both national and local sales across its television and digital platforms. Political advertising also provides a significant, albeit seasonal, boost to this segment, as seen in the strong performance during the 2022 midterm elections.

Retransmission consent fees are a crucial and consistent revenue pillar, representing payments from distributors for carrying Nexstar's local signals. These fees often account for a substantial portion of the company's total revenue, underscoring Nexstar's negotiating power with content distributors.

The company is also actively expanding its digital advertising presence, monetizing its websites and apps, and exploring new revenue opportunities through ATSC 3.0 data services and content syndication.

Nexstar's commitment to profitability for The CW Network is evident in its strategic programming and cost-saving measures, with future distribution deals also anticipated to contribute to its revenue diversification.

| Revenue Stream | Description | Key Drivers | 2024 Outlook/Notes |

| Advertising Revenue | Sales of ad space on TV stations and digital properties | Local and National Advertisers, Political Advertising | Robust performance expected, particularly with political cycles. |

| Retransmission Consent Fees | Fees from cable, satellite, and vMVPD providers | Negotiated carriage agreements for local signals | Consistent and growing revenue, a cornerstone of the business. |

| Digital Advertising & Publishing | Ad sales on digital platforms, content publishing solutions | Website traffic, app usage, engaged audiences (e.g., NewsNationNow.com, The Hill) | Focus on enhanced monetization and audience growth. |

| The CW Network | Advertising sales for the network | Programming, strategic adjustments, cost optimization | Targeting profitability by 2026; future distribution deals eyed. |

| ATSC 3.0 Data Services | Monetizing data transmission capabilities of NextGen TV | Enhanced alerts, targeted advertising, potential broadband services | Exploring new data-centric service monetization. |

| Content Syndication | Licensing owned content to third parties | News, sports, entertainment programming library | Maximizing reach and profitability of content assets. |

Business Model Canvas Data Sources

The Nexstar Media Group Business Model Canvas is built upon a foundation of proprietary market research, extensive financial disclosures, and internal operational data. These sources ensure each canvas block is filled with accurate, up-to-date information reflecting Nexstar's diverse media portfolio.