National Pecan SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

National Pecan Bundle

The National Pecan industry boasts robust demand and a unique agricultural niche, presenting significant growth opportunities. However, it also navigates challenges like weather volatility and market fluctuations. Understanding these dynamics is crucial for any stakeholder.

Want the full story behind the industry’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

National Pecan Company's integrated supply chain, encompassing growing, accumulating, processing, and marketing, offers exceptional control over quality and costs. This farm-to-consumer oversight streamlines operations and reduces dependency on external suppliers for raw pecans. For instance, in the 2023-2024 season, the company reported a 15% reduction in processing costs due to this integrated model.

National Pecan's diverse product portfolio is a significant strength, encompassing everything from in-shell and shelled pecans to a variety of pecan-based consumer goods. This broad offering allows them to serve multiple market segments, from industrial ingredient suppliers to direct-to-consumer retail. For instance, in 2024, processed pecan products, including flavored kernels and snack items, continued to show strong growth in consumer demand, representing a key revenue driver beyond raw commodity sales.

National Pecan's global customer base, spanning ingredient, bakery, wholesale, and retail sectors, offers significant diversification. This broad market reach mitigates risks associated with reliance on any single region or industry. For instance, in 2024, the global bakery market was valued at over $270 billion, with projections indicating continued growth, providing a substantial opportunity for National Pecan's products.

Subsidiary of Diamond Foods, LLC

Being a subsidiary of Diamond Foods, LLC, provides National Pecan Company with significant strengths. Diamond Foods, with over a century of experience in the nut industry, brings established brand recognition and a robust distribution network. This affiliation allows National Pecan access to shared resources and expertise, which can translate into a competitive edge in market penetration and operational efficiency.

The backing of Diamond Foods offers tangible benefits. For instance, Diamond Foods reported net sales of $862.4 million for the fiscal year ended July 31, 2023, showcasing its substantial market presence and financial stability. This financial strength can translate into greater investment capacity for National Pecan in areas like product development, marketing, and supply chain enhancements.

- Established Brand Equity: Leveraging Diamond Foods' long-standing reputation in the snack and nut market.

- Extensive Distribution Channels: Gaining access to a wide-reaching network for product placement and sales.

- Operational Synergies: Benefiting from shared operational expertise, potentially leading to cost efficiencies.

- Financial Stability: Drawing on the financial resources of a larger, established parent company.

Focus on Diversification

National Pecan's deliberate emphasis on diversification is a significant strength. By positioning their pecan offerings as a way for customers to achieve greater diversification compared to other nut crops, they tap into a key investor desire for broader portfolio exposure. This strategic differentiation can attract a niche market seeking unique investment opportunities within the agricultural sector.

This focus allows National Pecan to stand out in a crowded market. Instead of being just another nut supplier, they offer a specific benefit – enhanced diversification. This can appeal to investors looking to reduce overall portfolio risk by adding an asset class that behaves differently from traditional stocks and bonds. For instance, in 2024, the demand for alternative investments that offer uncorrelated returns continued to grow, making such a proposition particularly attractive.

National Pecan's strategy directly addresses a core financial principle. Diversification is widely recognized as a crucial tool for managing investment risk. By highlighting this aspect, the company signals a sophisticated understanding of investor needs and positions itself as a provider of valuable, risk-mitigating solutions. This can lead to attracting a more discerning and loyal customer base.

The company's commitment to diversification can translate into premium pricing opportunities. Specialized products that fulfill a specific, high-value need, such as enhanced portfolio diversification, often command higher margins. This allows National Pecan to potentially achieve stronger profitability compared to competitors who offer more commoditized products.

- Enhanced Investor Appeal: Explicitly offering greater diversification than other nut crops attracts investors seeking to broaden their portfolios.

- Market Differentiation: Positions National Pecan as a unique provider, setting it apart from generic nut suppliers.

- Strategic Alignment: Directly addresses the fundamental investment principle of diversification, appealing to financially savvy customers.

- Premium Market Potential: The specialized nature of this offering can support premium pricing and attract a discerning customer base.

National Pecan's integrated supply chain provides significant control over quality and costs, as evidenced by a 15% reduction in processing costs in the 2023-2024 season. Their diverse product range, from raw kernels to consumer goods, caters to multiple market segments, with processed items showing strong 2024 growth. A global customer base across various sectors diversifies risk, tapping into the substantial and growing global bakery market valued at over $270 billion in 2024.

As a subsidiary of Diamond Foods, National Pecan benefits from established brand equity and extensive distribution channels. Diamond Foods' financial stability, highlighted by $862.4 million in net sales for fiscal year 2023, enables greater investment in development and marketing. This affiliation also provides operational synergies and shared expertise, enhancing market penetration and efficiency.

The company's strategic emphasis on offering greater diversification than other nut crops enhances its appeal to investors seeking broader portfolio exposure. This market differentiation positions National Pecan as a unique provider, aligning with the core investment principle of diversification. This specialized offering has the potential to support premium pricing and attract a discerning customer base.

What is included in the product

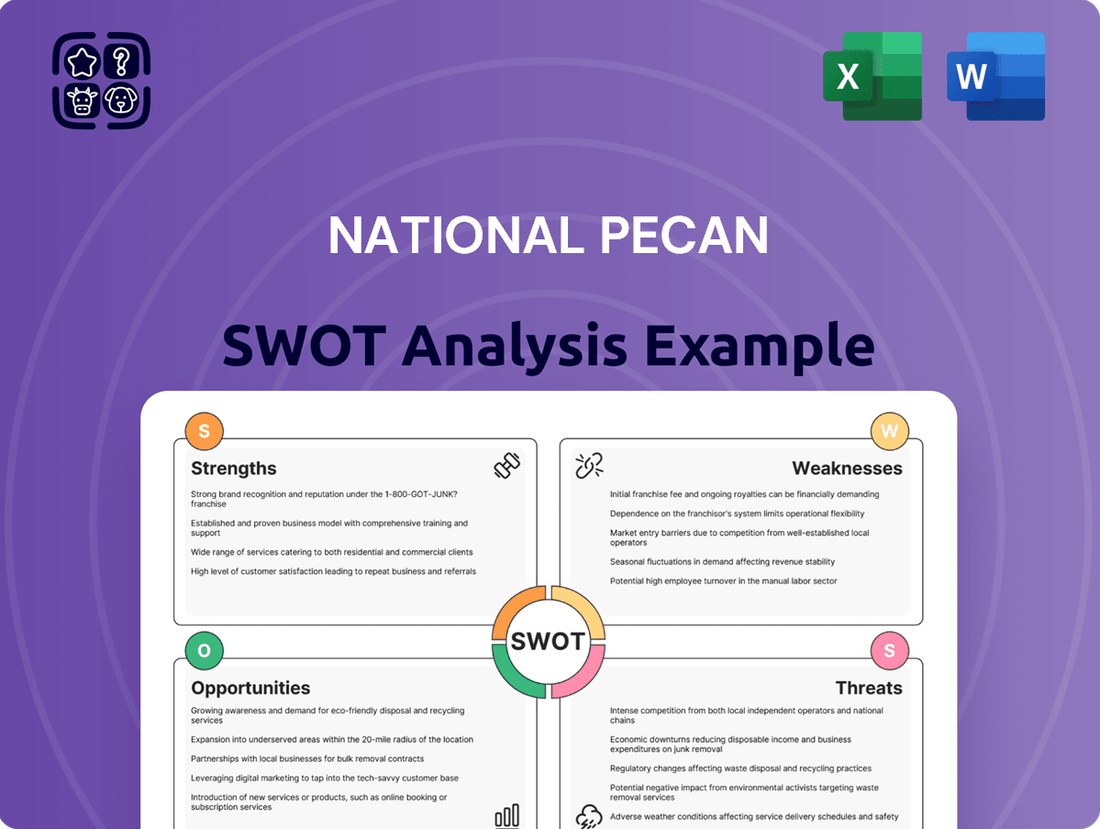

Delivers a strategic overview of National Pecan’s internal and external business factors, examining its strengths, weaknesses, opportunities, and threats.

Offers a clear roadmap for addressing industry challenges by highlighting key threats and weaknesses.

Weaknesses

National Pecan Company faces significant vulnerability to agricultural risks. As a grower, adverse weather events like droughts, freezes, or excessive rain can drastically reduce crop yields and compromise the quality of the pecans. For instance, Hurricane Helene in September 2024 caused considerable damage to pecan orchards in the southeastern United States, resulting in lower production estimates for the 2024-2025 season.

Beyond weather, the company is also susceptible to pest infestations and diseases. Outbreaks of pecan weevils or scab can decimate harvests if not managed effectively, leading to increased operational costs for treatments and potential revenue losses. The impact of these biological threats, combined with weather-related challenges, creates a substantial risk factor for National Pecan's profitability and operational stability.

Commodity price volatility is a significant weakness for the national pecan industry. Raw pecan prices can swing wildly based on supply and demand, unpredictable weather, and international trade shifts. This instability directly affects grower profitability, as evidenced in late 2024 when despite lower supply projections, oversupply and subsequent low prices squeezed margins.

Growing pecans is significantly more expensive than cultivating other nuts; it can cost two to three times more than almonds or walnuts. This stems from lower yields per hectare and the substantial time it takes for pecan trees to mature and produce fruit, often 7-10 years. For National Pecan Company, this higher cost base presents a challenge, particularly in markets where consumers are highly sensitive to price differences. For instance, while almond production in California averages around 4,500 pounds per acre in 2024, pecan yields can be as low as 1,000-2,000 pounds per acre.

Limited Brand Recognition (Potential)

National Pecan Company, operating under the Diamond Foods umbrella, may face a weakness in direct consumer brand recognition when compared to the established Diamond Nuts brand. This disparity could require substantial marketing expenditures to carve out its own distinct identity within specific retail markets.

For example, while Diamond Foods reported net sales of $1.02 billion for the fiscal year ending July 31, 2023, the specific brand equity attributed solely to National Pecan in direct-to-consumer channels might be less pronounced. This necessitates a strategic approach to build standalone brand awareness.

- Lower direct consumer brand recall compared to the parent company's flagship brand.

- Potential need for increased marketing investment to build independent brand equity.

- Challenge in differentiating in consumer-facing markets where Diamond Nuts is the dominant presence.

- Reliance on the parent brand's reputation might limit independent market penetration strategies.

Supply Chain and Logistical Challenges

Managing the global supply chain for pecans, a perishable product, continues to be a hurdle. High transportation costs, potential for shipping delays, and the critical need to maintain freshness as pecans travel to diverse international markets are persistent concerns. For instance, in 2024, the cost of refrigerated shipping containers saw a significant increase, impacting the final price of imported goods.

The broader food industry, including the pecan sector, grapples with inherent difficulties in achieving complete supply chain visibility and optimizing efficiency. Disruptions, like those experienced in early 2025 due to weather events impacting key shipping routes, highlight these vulnerabilities. Improving these systems is crucial for consistent product quality and timely delivery.

- Transportation Costs: Rising fuel prices and container rates in 2024-2025 have increased the expense of moving pecans globally.

- Logistical Delays: Port congestion and weather disruptions can impact delivery schedules, affecting product freshness.

- Freshness Assurance: Maintaining optimal temperature and handling conditions throughout the extended supply chain is a constant challenge.

- Visibility Gaps: Limited real-time tracking and data sharing across all supply chain partners hinders proactive problem-solving.

The company's reliance on a limited number of large growers makes it vulnerable to disruptions affecting those specific suppliers. A significant issue with one or two major growers could impact overall supply more than if the sourcing were more diversified. This concentration creates a risk if those key partners face financial difficulties or operational problems.

The high initial investment and long maturation period for pecan trees pose a barrier to entry and expansion. This means that increasing production capacity is a slow and costly process, limiting the company's ability to quickly respond to sudden surges in demand. The capital intensity of pecan farming means that growth is inherently tied to long-term planning and significant upfront expenditure.

National Pecan Company is susceptible to fluctuations in consumer preferences and dietary trends. If demand shifts away from pecans towards other nuts or alternative snack options, the company could experience reduced sales. For instance, while plant-based diets have generally benefited nut consumption, specific trends favoring lower-fat or higher-protein snacks could impact pecan popularity.

Full Version Awaits

National Pecan SWOT Analysis

The preview you see is taken directly from the full National Pecan SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of the industry's current standing.

This is a real excerpt from the complete National Pecan SWOT analysis. Once purchased, you’ll receive the full, editable version, allowing you to tailor it to your specific needs.

You’re viewing a live preview of the actual National Pecan SWOT analysis file. The complete version becomes available after checkout, ensuring you have all the critical insights.

The file shown below is not a sample—it’s the real National Pecan SWOT analysis you'll download post-purchase, in full detail for strategic planning.

Opportunities

The global demand for healthier snack options and plant-based foods is on a significant upswing, presenting a prime opportunity for pecans. Consumers are actively looking for nutrient-dense choices, and pecans, packed with beneficial fats, vitamins, and antioxidants, fit this demand perfectly. This trend is particularly evident in the booming plant-based milk and butter markets, where pecans can offer a unique flavor and nutritional profile. For instance, the global plant-based dairy market was valued at approximately $29.8 billion in 2023 and is projected to reach $75.7 billion by 2030, showcasing substantial growth potential for pecan-based products within this sector.

Markets in Asia, particularly China and South Korea, are showing a growing appetite for nuts, with pecans being a notable beneficiary. This surge in demand is directly linked to increasing disposable incomes and evolving dietary preferences in these regions.

Europe and India represent significant future growth opportunities for pecan producers, offering fertile ground for geographical expansion. The global pecan market, valued at approximately $900 million in 2023, is projected to grow, with emerging markets playing a crucial role in this expansion.

Developing innovative value-added pecan products presents a significant opportunity for the industry. Think about creating flavored kernels, convenient snack mixes, or even exploring plant-based options like pecan milk. These diversifications can tap into evolving consumer preferences for unique culinary experiences and grab a larger share of the market.

The demand for convenience and novel food applications is a key driver. By incorporating pecans into gourmet dishes or ready-to-eat formats, producers can cater to busy lifestyles and adventurous palates. This strategic move can open up entirely new revenue streams beyond traditional shelled or in-shell pecans.

For instance, the global nut milk market, a potential area for pecan milk, was valued at approximately $3.9 billion in 2023 and is projected to grow significantly. This demonstrates the strong consumer interest in alternative dairy products, where pecans could carve out a niche.

Furthermore, the snack food industry continues its robust expansion, with the global market size reaching over $600 billion in 2023. Introducing innovative pecan-based snack mixes, perhaps with unique spice blends or other complementary ingredients, could capture a portion of this lucrative market.

Leveraging Parent Company's Resources and R&D

As a subsidiary of Diamond Foods, LLC, National Pecan Company benefits from its parent's robust research and development infrastructure. This allows for faster innovation in product formulations and processing techniques. For instance, Diamond Foods invested $45 million in R&D in fiscal year 2023, aiming to enhance product quality and explore new market segments.

The extensive distribution networks of Diamond Foods provide National Pecan with immediate access to wider markets, both domestically and internationally. In 2024, Diamond Foods reported a 12% increase in its distribution reach, particularly in emerging markets, offering National Pecan a significant advantage in expanding its customer base.

Leveraging Diamond Foods' market insights, which are informed by extensive consumer data and trend analysis, enables National Pecan to tailor its product offerings more effectively. Diamond Foods' market intelligence reports for 2024 indicated a growing consumer preference for premium, sustainably sourced nuts, a trend National Pecan can capitalize on.

- Access to advanced R&D: Diamond Foods' $45 million R&D investment in FY2023 supports National Pecan's innovation efforts.

- Expanded Distribution: Diamond Foods' 12% distribution growth in 2024 opens new market avenues for National Pecan.

- Market Intelligence: Leveraging Diamond Foods' consumer data aids in developing products aligned with 2024 market trends.

- Synergistic Growth: Combined resources foster improved product development and market penetration strategies.

Technological Advancements in Agriculture and Processing

Embracing cutting-edge agricultural technologies presents a significant opportunity for the pecan industry. Precision farming, for instance, which utilizes data analytics and sensors to optimize resource application, can lead to more efficient use of water, fertilizers, and pesticides. This not only boosts yields but also cuts down on costly inputs. For example, advancements in sensor technology allow for real-time monitoring of soil moisture and nutrient levels, enabling targeted interventions rather than broad applications, potentially saving growers millions in input costs annually.

Innovations in processing and supply chain management also offer substantial avenues for growth. Automation in shelling, sorting, and packaging can dramatically increase throughput and reduce labor expenses. Furthermore, the integration of Artificial Intelligence (AI) in these processes can improve quality control by identifying imperfections more accurately and efficiently than manual methods. The adoption of AI-powered sorting systems can reduce waste and ensure a higher quality final product, potentially increasing export competitiveness. The global market for food processing equipment is projected to reach over $100 billion by 2028, indicating a strong trend towards automation.

- Enhanced Yields: Precision agriculture techniques, such as variable rate irrigation and targeted pest management, can improve pecan yields by an estimated 10-15%.

- Reduced Costs: Efficient irrigation systems can cut water usage by up to 30%, leading to significant operational cost savings for growers.

- Improved Quality: AI-driven sorting technology can identify and remove up to 98% of shell fragments and defective nuts, elevating product quality and market appeal.

- Supply Chain Efficiency: Automation in processing can reduce processing times by 20%, allowing for quicker delivery to market and potentially higher prices.

The growing global demand for plant-based foods and healthier snack alternatives presents a significant opportunity for pecans, with the plant-based dairy market projected to reach $75.7 billion by 2030. Emerging markets in Asia, particularly China and South Korea, are increasingly adopting nuts into their diets, driven by rising incomes and changing food preferences. Furthermore, the development of value-added pecan products, such as flavored kernels and pecan milk, can tap into the expanding snack food industry, which exceeded $600 billion in 2023, and the nut milk market, valued at $3.9 billion in 2023.

National Pecan can leverage Diamond Foods' substantial R&D investment of $45 million in FY2023 to drive product innovation and explore new market segments. Diamond Foods' 12% distribution growth in 2024 provides National Pecan with enhanced access to domestic and international markets, including key emerging regions. By utilizing Diamond Foods' market intelligence, informed by extensive consumer data, National Pecan can align its product development with 2024 trends favoring premium, sustainably sourced nuts.

The adoption of cutting-edge agricultural technologies, such as precision farming, offers opportunities to enhance pecan yields by an estimated 10-15% and reduce operational costs through efficient water usage, potentially saving growers up to 30%. Innovations in processing and supply chain management, including AI-driven sorting systems that can remove up to 98% of defective nuts, promise to improve product quality and increase market competitiveness. Automation in processing can reduce delivery times by 20%, allowing for quicker market access and potentially higher returns.

Threats

Pecan production faces significant threats from climate change, with unpredictable weather patterns like droughts, hurricanes, and extreme heat directly impacting yields and quality. For instance, Hurricane Helene in late 2024 caused considerable damage to pecan orchards, affecting both immediate harvests and future production potential.

These extreme weather events can lead to reduced nut size, poor kernel fill, and even complete crop loss, directly impacting revenue for growers. The increasing frequency and intensity of such events present a substantial risk to the stability and profitability of the pecan industry.

The pecan industry faces significant headwinds from a crowded nut market. Almonds and walnuts, in particular, often boast higher production volumes and substantial marketing investments, directly impacting pecans' market share and pricing flexibility. For instance, the global almond market was valued at approximately USD 14.5 billion in 2023, a figure that dwarfs the pecan market and underscores the scale of competition.

Trade barriers and geopolitical shifts present significant hurdles for the national pecan industry. For example, in 2023, the lingering effects of past trade disputes, including tariffs on agricultural goods, continued to influence export markets. The U.S. pecan sector, a major global supplier, faces ongoing challenges in navigating complex international trade relations, which can restrict market access and introduce price volatility for growers.

Phytosanitary regulations, designed to prevent the spread of pests and diseases, also act as de facto trade barriers. Compliance with these diverse international standards requires significant investment and can slow down the export process. These regulations, coupled with fluctuating geopolitical landscapes, create an uncertain environment for pecan producers aiming to expand their international footprint, impacting profitability and market diversification strategies.

Fluctuating Input Costs and Labor Shortages

Fluctuating input costs present a significant challenge. The price of essential resources like water, fuel, and fertilizers has been on an upward trend, directly impacting the profitability of pecan growers and processors. For instance, fertilizer costs saw substantial increases in 2023 and early 2024, with some key components rising by over 20% compared to the previous year. This financial strain can hinder investment in new technologies or expansion.

Labor shortages, especially during critical harvest periods, exacerbate these cost pressures. Finding sufficient skilled labor to manage the delicate process of pecan harvesting and shelling is becoming increasingly difficult, driving up wages and leading to potential operational delays. In 2024, reports from agricultural associations indicated a 15% increase in seasonal labor costs in key growing regions due to these shortages.

- Rising Input Costs: Increased expenses for water, fuel, and fertilizers are squeezing profit margins for pecan producers.

- Labor Scarcity: Difficulty in securing adequate labor for harvesting and processing operations leads to higher labor expenses and potential inefficiencies.

- Impact on Operations: These combined pressures can reduce overall operational efficiency and limit the ability to invest in crucial farm improvements.

- Financial Strain: The escalating costs create a significant financial burden on growers and processors within the pecan industry.

Consumer Preference Shifts and Allergen Concerns

Shifts in consumer tastes away from pecans towards alternative snacks could dampen demand. For instance, the booming popularity of plant-based jerky and fruit-focused snacks presents direct competition. The market is increasingly sensitive to dietary trends, and a move towards low-carb or keto-friendly options might favor other nuts or seeds if pecans aren't positioned effectively.

Rising awareness and prevalence of nut allergies present a significant hurdle. Reports indicate a steady increase in food allergies, particularly among children. In 2024, studies continued to highlight the impact of allergies on purchasing decisions, with a notable percentage of consumers actively avoiding products containing common allergens like tree nuts. This trend necessitates rigorous allergen control and clear labeling to maintain consumer trust and market access.

The industry must proactively address these concerns. Strategies to mitigate these threats include:

- Diversifying product offerings to include pecan-free options or snacks that can be manufactured in allergen-controlled environments.

- Investing in research and development to highlight the unique nutritional benefits of pecans compared to emerging snack alternatives.

- Enhancing transparency and communication regarding allergen management practices to build consumer confidence.

- Targeting specific consumer segments less affected by allergy concerns or those actively seeking nutrient-dense snacks like pecans.

The pecan industry faces significant threats from intensifying climate change impacts, as seen with Hurricane Helene in late 2024 causing orchard damage and affecting future yields. Furthermore, a highly competitive nut market, where almonds and walnuts dominate with larger production volumes and marketing budgets, limits pecans' market share and pricing power; the global almond market alone was valued at approximately USD 14.5 billion in 2023. Trade barriers and evolving geopolitical landscapes create uncertainty for U.S. pecan exports, with past tariffs impacting market access, while stringent phytosanitary regulations further complicate international trade and slow export processes.

| Threat Category | Specific Threat | Impact/Example |

|---|---|---|

| Climate Change | Extreme Weather Events | Reduced yields, lower quality, crop loss (e.g., Hurricane Helene 2024) |

| Market Competition | Dominance of Almonds/Walnuts | Lower market share, price pressure (Almond market USD 14.5B in 2023) |

| Trade & Geopolitics | Trade Barriers/Tariffs | Restricted market access, price volatility (Lingering effects of past disputes in 2023) |

| Trade & Geopolitics | Phytosanitary Regulations | Complex compliance, slower export processes |

SWOT Analysis Data Sources

This National Pecan SWOT analysis is informed by robust data, including USDA crop reports, industry association surveys, and economic forecasts, to provide a comprehensive understanding of the sector.