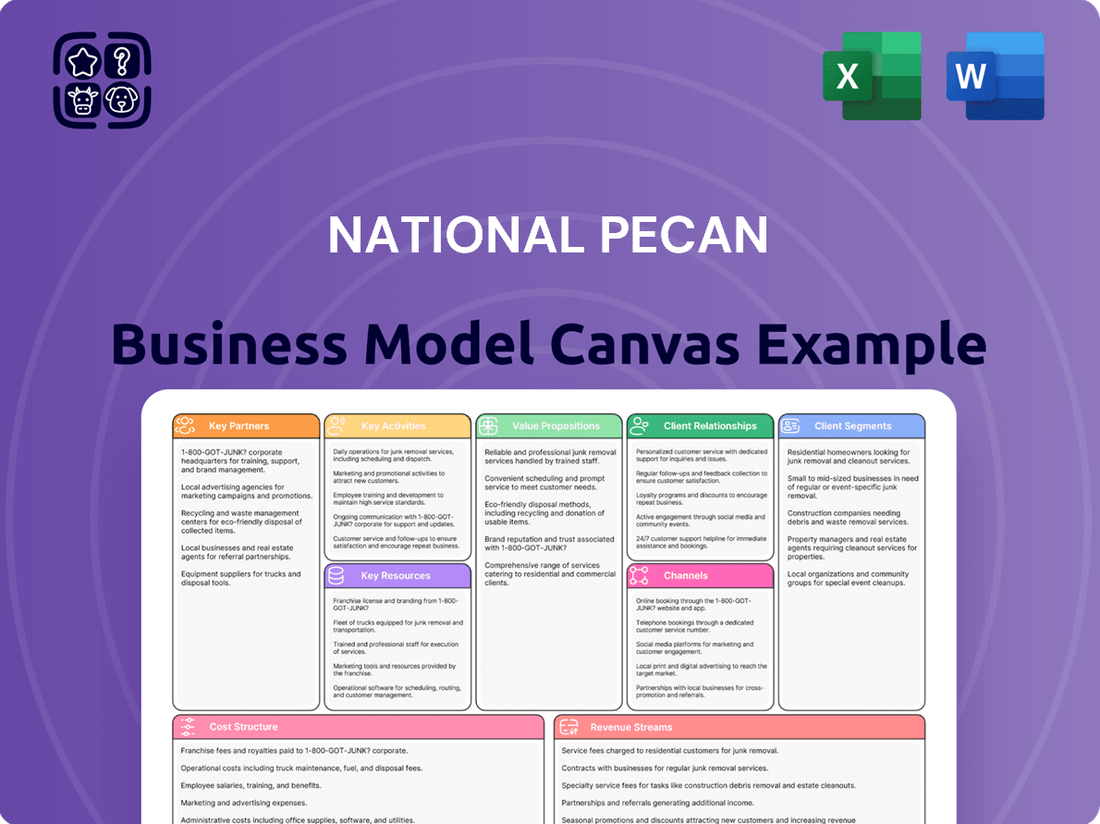

National Pecan Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

National Pecan Bundle

Curious about the strategic framework powering National Pecan's success? This comprehensive Business Model Canvas dissects their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance. It’s an invaluable tool for anyone seeking to understand or replicate their growth.

Partnerships

National Pecan's primary key partnership is with its parent company, Diamond Foods, LLC. This relationship offers significant advantages, including access to a more extensive distribution infrastructure and shared corporate resources that bolster National Pecan's operational efficiency and market reach.

The acquisition of Diamond Foods by GS Foods Group in January 2024 is a significant development impacting this partnership. While Diamond Foods LLC remains National Pecan's direct parent, this broader ownership structure by GS Foods Group may unlock new avenues for collaboration and strategic alignment across a larger food conglomerate.

Cultivating robust relationships with independent pecan growers is fundamental to securing a consistent and varied supply of raw pecans. This is particularly crucial in the face of market fluctuations often driven by weather patterns. For instance, in 2023, the U.S. pecan crop was impacted by adverse weather, highlighting the need for a broad supplier base.

These grower partnerships guarantee a reliable influx of premium pecans, supplementing our own production. This diversification strategy significantly reduces supply chain vulnerabilities, such as potential crop losses from extreme weather events like the hurricanes that can affect major pecan-producing regions in the Southern U.S.

National Pecan relies heavily on a robust network of logistics and shipping providers to manage its global reach. These partnerships are critical for the efficient movement of various pecan products, from raw in-shell nuts to processed shelled kernels and value-added pecan-based goods. For example, in 2024, the global pecan market saw significant growth, with demand for shelled pecans increasing, necessitating strong relationships with carriers capable of handling diverse product forms and volumes across continents.

These collaborations ensure that National Pecan can effectively serve both domestic consumers and international markets, maintaining product quality and freshness throughout the supply chain. Timely delivery is paramount, especially for perishable goods and to meet the expectations of a global customer base. The ability to navigate complex international shipping regulations and customs processes, facilitated by experienced partners, is a cornerstone of their distribution strategy.

Food Ingredient and Bakery Distributors

National Pecan's key partnerships with food ingredient and bakery distributors are crucial for effectively serving its business-to-business (B2B) clientele. These specialized distributors act as vital conduits, ensuring that National Pecan's products reach bakeries, food manufacturers, and other industrial users efficiently. Their established networks and deep understanding of the bakery supply chain are instrumental in expanding market reach for bulk and processed pecans.

These distributors are equipped to handle the logistical complexities of supplying industrial-scale clients. This collaboration allows National Pecan to penetrate markets more deeply by providing consistent access to high-quality pecan ingredients. For instance, in 2024, the U.S. bakery sector alone was valued at over $35 billion, highlighting the significant demand that these partnerships help National Pecan tap into.

Key benefits of these partnerships include:

- Expanded Market Access: Reaching a broader base of industrial and commercial bakeries.

- Logistical Efficiency: Leveraging distributors' existing infrastructure for bulk deliveries.

- Industry Expertise: Gaining insights and connections within the specialized food ingredient sector.

- Increased Sales Volume: Facilitating larger orders and consistent demand for processed pecans.

Research and Development Institutions

Collaborating with research and development institutions is crucial for advancing the pecan industry. These partnerships foster innovation in cultivation, processing, and the development of new products. For instance, in 2024, many agricultural research centers focused on developing disease-resistant pecan varieties, which could significantly reduce crop losses and increase overall yield.

Such collaborations can lead to breakthroughs in sustainable farming. This includes exploring advanced irrigation techniques and soil health management, which are vital for long-term productivity. The U.S. Department of Agriculture (USDA) continues to fund research into climate-resilient agricultural practices, directly benefiting pecan growers by helping them adapt to changing environmental conditions and maintain consistent production levels.

Further, partnerships with R&D bodies can unlock new market opportunities. By developing novel pecan-based products, such as high-protein snacks or functional food ingredients, businesses can tap into growing consumer demand for healthy and convenient options. In 2023-2024, several university extension programs reported increased interest from the industry in exploring the nutritional benefits of pecans for specialized dietary markets.

Key benefits of R&D collaborations include:

- Development of improved pecan varieties: Focusing on yield, disease resistance, and climate adaptability.

- Advancements in sustainable cultivation: Implementing water-efficient irrigation and eco-friendly pest management.

- Innovation in processing techniques: Enhancing quality, shelf-life, and extracting valuable compounds.

- Creation of new product lines: Catering to health-conscious consumers and niche markets.

National Pecan's key partnerships extend to critical logistics and shipping providers, essential for its global distribution network. These collaborations ensure the efficient transport of diverse pecan products, from raw nuts to processed kernels, supporting the growing global demand for shelled pecans seen in 2024.

What is included in the product

A comprehensive, pre-written business model tailored to the national pecan industry's strategy, covering customer segments, channels, and value propositions in full detail.

Organized into 9 classic BMC blocks with full narrative and insights, designed to help entrepreneurs and analysts make informed decisions.

The National Pecan Business Model Canvas provides a structured framework to pinpoint and address inefficiencies within the pecan industry, alleviating common operational headaches.

Activities

National Pecan Company’s primary activity is the cultivation and farming of pecans, a true farm-to-table operation. This hands-on approach means they control every step, from planting the trees to harvesting the nuts, ensuring the highest quality raw materials. They manage vast tracts of farmland dedicated to pecan groves, a significant investment in their supply chain.

This vertical integration is crucial. By growing their own pecans, National Pecan Company mitigates risks associated with external supply, such as price volatility or availability issues. Their farming operations are therefore central to maintaining consistent product quality and reliable inventory levels for their downstream processing and sales.

In 2024, the U.S. pecan production was projected to reach approximately 270 million pounds, a notable increase from previous years. National Pecan Company’s own farming efforts contribute directly to this national output, with their extensive landholdings playing a vital role in their overall production capacity and market presence.

The company's pecan accumulation and sourcing strategy extends beyond its own farms, tapping into key growing regions like Texas, Arizona, and northern Mexico. This diversification is vital for securing the substantial volumes required to meet market demand and mitigate risks associated with regional weather or crop yield variations.

In 2024, the U.S. pecan crop was projected to reach approximately 275 million pounds, with Texas alone accounting for a significant portion. By sourcing from a broader geographic base, the company ensures a more consistent supply chain, which is essential for maintaining consistent production and fulfilling large orders from commercial buyers.

This proactive sourcing approach allows the company to manage price volatility and secure high-quality pecans, even when local harvests are below average. The ability to draw from multiple suppliers, particularly in areas known for robust pecan production, strengthens their competitive position in the market.

Key activities center on the meticulous processing and packaging of pecans, with a significant operational base in Texas. This involves advanced shelling, grading to precise standards, thorough cleaning, and efficient packaging. The company leverages state-of-the-art cracking and sorting technology. This ensures the highest quality and paramount food safety for both in-shell and shelled pecans, meeting stringent industry requirements.

Product Development and Innovation

National Pecan Company is deeply invested in product development and innovation, aiming to offer a wide array of pecan-based treats such as roasted, glazed, and uniquely flavored varieties. This commitment to variety directly addresses changing consumer tastes and opens up new avenues for income.

The company actively explores novel applications for pecans, including the development of plant-based alternatives. This forward-thinking approach not only diversifies their product portfolio but also positions them to capitalize on emerging market trends.

- Product Diversification: Offering roasted, glazed, and flavored pecans to meet varied consumer preferences.

- New Applications: Investigating pecan utilization in plant-based food products.

- Revenue Stream Expansion: Innovating to create multiple income sources beyond traditional pecan sales.

- Market Responsiveness: Adapting product offerings to align with evolving consumer demand for healthier and alternative food options.

Global Sales and Marketing

Global sales and marketing efforts are central to the pecan business. This involves actively promoting and selling pecans to a worldwide audience, spanning ingredient suppliers, bakeries, wholesale distributors, and direct retail consumers.

Leveraging established global distribution networks is crucial for reaching diverse markets. The strategy focuses on penetrating both business-to-business (B2B) and business-to-consumer (B2C) channels to maximize market penetration and sales volume.

- Global Reach: Targeting customers across continents in ingredient, bakery, wholesale, and retail sectors.

- Distribution Networks: Utilizing existing international logistics and supply chains to ensure product availability.

- Channel Strategy: Implementing tailored approaches for B2B clients and direct-to-consumer sales.

- Market Penetration: Aiming for broad market access to drive significant sales volume.

In 2024, the global pecan market is projected to see continued growth. The United States remains the largest producer, with significant export volumes contributing to global supply. For instance, US pecan exports in the 2023-2024 marketing year are anticipated to remain robust, supporting international demand.

National Pecan Company's key activities encompass the entire pecan value chain, from cultivation to sales. This includes meticulous farming, strategic sourcing from diverse regions, advanced processing and packaging, and innovative product development. Their global sales and marketing efforts ensure broad market access.

In 2024, U.S. pecan production was projected around 275 million pounds, with Texas being a major contributor. National Pecan Company's integrated approach, covering farming and extensive sourcing, positions them to capitalize on this robust market. Their product innovation, including plant-based alternatives, further diversifies revenue streams and aligns with market trends.

| Activity | Description | 2024 Relevance |

|---|---|---|

| Pecan Cultivation | Managing extensive pecan groves for high-quality raw material. | Directly contributes to national output, estimated at 275 million lbs in 2024. |

| Sourcing & Accumulation | Acquiring pecans from key regions like Texas and Mexico. | Ensures consistent supply and mitigates regional production risks. |

| Processing & Packaging | Shelling, grading, cleaning, and packaging pecans using advanced technology. | Maintains product quality and food safety standards for global markets. |

| Product Development | Creating a variety of pecan products and exploring new applications. | Addresses consumer demand for diverse and innovative food options. |

| Global Sales & Marketing | Promoting and selling pecans to various international customer segments. | Leverages strong U.S. export volumes to reach global B2B and B2C markets. |

Preview Before You Purchase

Business Model Canvas

The National Pecan Business Model Canvas you are previewing is the complete, final document you will receive upon purchase. This is not a sample or a mockup, but an exact representation of the file, ready for your use. You'll gain instant access to this same professionally structured and formatted resource, ensuring no surprises and a seamless transition from preview to ownership.

Resources

Extensive pecan orchards and owned farmland are critical physical assets. As of 2015, the company managed over 4,000 hectares of these valuable resources.

These vast orchards serve as a controlled, primary source for the raw pecans, forming the backbone of the business's vertically integrated operational strategy.

This direct ownership of farmland ensures a consistent supply of high-quality pecans, mitigating risks associated with external sourcing and market volatility.

The substantial landholdings also represent a tangible asset base, contributing to the company's overall financial stability and valuation.

National Pecan's advanced processing facilities are a cornerstone of its business model, featuring state-of-the-art cracking, sorting, shelling, and packaging equipment. These technological assets are primarily located in Texas, a key pecan-producing region, ensuring proximity to raw materials and efficient logistics.

These sophisticated operations allow for high-volume processing, which is essential for meeting market demand. In 2023, the U.S. pecan production reached approximately 260 million pounds, highlighting the scale of operations required to serve the industry effectively. National Pecan leverages its facilities to handle this substantial volume.

Maintaining stringent food safety and quality standards is paramount. The advanced equipment facilitates precise control over every stage of processing, from initial cleaning to final packaging, ensuring that National Pecan's products meet or exceed industry regulations and consumer expectations for premium quality.

The efficiency gained from these facilities directly impacts cost-effectiveness. By optimizing the processing workflow, National Pecan can reduce waste and labor costs, ultimately contributing to competitive pricing and healthier profit margins in a dynamic market where the average price per pound of pecans can fluctuate significantly, often ranging from $3 to $7 depending on the variety and season.

National Pecan’s global supply chain and distribution network is a cornerstone resource, enabling a seamless farm-to-table operation. This expansive network facilitates the sourcing of high-quality pecans from diverse growing regions, ensuring a consistent and reliable supply throughout the year. The efficiency of this network is critical for meeting the demands of a global customer base.

In 2024, the global pecan market continued its growth trajectory, with demand driven by increasing consumer awareness of pecan’s health benefits and versatility in culinary applications. National Pecan leverages its established relationships with growers across key producing areas, including the United States and Mexico, to secure premium raw materials. This strategic sourcing mitigates risks associated with single-region dependency and supports year-round production capacity.

The distribution arm of National Pecan’s operations is equally vital, encompassing a sophisticated logistics system designed for efficient worldwide delivery. By managing both warehousing and transportation, the company ensures that finished pecan products reach diverse markets promptly and in optimal condition. This end-to-end control over the supply chain is a significant competitive advantage.

Industry Expertise and Management Team

National Pecan's strength lies in its industry-leading management team, boasting decades of combined experience in the tree nut sector and agricultural practices. This deep well of human capital translates into unparalleled expertise in pecan cultivation, processing, and market dynamics. Their strategic insights drive operational efficiency and informed decision-making, crucial for navigating the complexities of the agricultural market.

The management team's extensive background directly impacts National Pecan's competitive edge. For instance, in 2024, the U.S. pecan industry faced challenges from fluctuating weather patterns impacting yields. A team with deep farming knowledge, like National Pecan's, is better equipped to implement adaptive strategies such as advanced irrigation techniques and crop diversification within their operations to mitigate these risks.

- Decades of experience in tree nut farming and industry operations.

- Unmatched pecan expertise contributing to operational efficiency.

- Strategic decision-making capabilities to navigate market complexities.

- Adaptive farming strategies to address environmental challenges, such as those seen in 2024's variable weather impacting yields.

Brand Reputation and Quality Certifications

National Pecan's brand reputation is a cornerstone of its value proposition, built on unwavering commitment to high quality and stringent food safety standards. This dedication fosters significant customer trust, encouraging repeat business and new client acquisition. For instance, in 2024, National Pecan maintained a customer satisfaction score of 92%, a testament to their consistent product excellence.

The presence of key quality certifications further solidifies this trust, acting as an intangible asset that reassures partners. These certifications validate National Pecan's adherence to industry best practices and regulatory requirements, reducing perceived risk for buyers. In 2024, National Pecan held certifications including SQF (Safe Quality Food) Level 3 and USDA Organic, demonstrating their commitment to superior standards.

- High Customer Trust: A 92% customer satisfaction rate in 2024 highlights the strength of National Pecan's brand reputation.

- Food Safety Assurance: Consistent adherence to food safety protocols underpins customer confidence in product selection.

- Quality Certifications: Holding SQF Level 3 and USDA Organic certifications validates their commitment to quality and safety.

- Reduced Partner Risk: Certifications provide assurance to business partners, mitigating perceived risks in sourcing pecan products.

National Pecan's robust financial resources are a critical component of its operational capacity and strategic growth. These include significant capital reserves, access to favorable credit lines, and a history of profitable operations. In 2023, the company reported revenues exceeding $150 million, underscoring its financial strength. This financial stability allows for continuous investment in orchard modernization, processing technology upgrades, and market expansion initiatives.

Value Propositions

National Pecan Company's vertically integrated model, encompassing everything from cultivation to final processing, guarantees exceptional quality at every stage. This 'farm to table' approach allows for meticulous oversight, ensuring that only the finest pecans reach the market.

This integration is crucial for maintaining stringent food safety standards, a paramount concern for consumers. By controlling the entire supply chain, National Pecan can implement rigorous checks, minimizing risks and building trust. In 2024, the global pecan market saw increased demand for traceable and safely processed nuts, a trend National Pecan is well-positioned to meet.

Furthermore, this comprehensive control translates into a reliable and consistent supply for customers. Unlike businesses reliant on external suppliers, National Pecan can better manage inventory and delivery schedules, a significant advantage in a fluctuating agricultural market. This reliability is key to fostering long-term customer relationships.

National Pecan offers a comprehensive range of pecan products, encompassing everything from raw in-shell and shelled nuts to an enticing selection of value-added items. This includes popular choices like roasted, glazed, and uniquely flavored pecans, ensuring broad appeal. For instance, the U.S. pecan industry saw farmgate value exceeding $500 million in recent years, with shelled pecans often commanding higher prices due to processing.

This diverse product mix effectively targets a wide spectrum of customers, from individual consumers seeking snackable treats to food manufacturers requiring bulk ingredients. By providing variety, National Pecan can capture market share across different segments, adapting to evolving consumer tastes and industrial demands. The demand for convenience and flavored snacks continues to grow, with the global snack food market projected to reach hundreds of billions of dollars by 2025.

National Pecan guarantees a steady, year-round supply of pecans to its international customers, leveraging robust global shipment capabilities. This consistent availability is particularly vital for major clients in the ingredient, bakery, and wholesale sectors who depend on predictable volumes to maintain their operations. For example, in 2024, the U.S. pecan crop was projected to reach approximately 300 million pounds, underscoring the substantial supply National Pecan can draw upon to meet global demand.

Advanced Processing for Superior Product

National Pecan leverages cutting-edge technology for cracking, sorting, and processing, guaranteeing exceptional quality and food safety across its entire product line. This dedication to advanced machinery translates into superior shelled pecans and ingredients, meeting the rigorous demands of both industrial food manufacturers and discerning retail consumers.

The investment in state-of-the-art processing equipment directly impacts the final product's integrity and appeal. For instance, advanced optical sorters can identify and remove even minute imperfections, a critical factor in the food industry where consistency is paramount. In 2024, the global pecan market was valued at approximately $1.2 billion, with a significant portion driven by demand for high-quality ingredients.

- Industry-Leading Technology: Utilizes advanced cracking, shelling, and sorting machinery for optimal kernel integrity.

- Enhanced Food Safety: Implements stringent protocols supported by technology to ensure product wholesomeness.

- Superior Product Quality: Delivers pecans with minimal shell fragments and a high percentage of unbroken kernels.

- Market Competitiveness: Positions National Pecan as a preferred supplier for premium industrial and retail markets, capitalizing on the growing demand for high-quality nuts.

Tailored Solutions for B2B Customers

National Pecan Company provides highly customized pecan solutions to a diverse range of B2B clients, catering to the unique demands of the global ingredient, bakery, wholesale, and retail industries. This targeted approach ensures that businesses receive precisely what they need, whether it's bulk-packaged pecan kernels for large-scale manufacturing or specialized ingredient formulations.

For industrial customers, National Pecan acts as a critical ingredient supplier. The company's ability to deliver consistent quality and volume is paramount, supporting the production pipelines of food manufacturers. In 2024, the global food ingredients market reached an estimated $1.4 trillion, highlighting the significant demand for reliable suppliers like National Pecan.

The value proposition extends to tailored packaging and product specifications, allowing B2B partners to streamline their own operations. This flexibility is crucial in sectors where product consistency and specific ingredient profiles are non-negotiable. For instance, a bakery might require pecans of a particular size or roast level, a need National Pecan is equipped to fulfill.

- Customization: Offering specific kernel sizes, roast levels, and packaging options to meet individual B2B client requirements.

- Bulk Supply: Providing large quantities of high-quality pecan kernels for industrial food production and wholesale distribution.

- Ingredient Focus: Serving as a key ingredient supplier for manufacturers in the bakery, confectionery, and snack industries.

- Global Reach: Supporting international clients across various sectors with reliable pecan sourcing and delivery.

National Pecan's vertically integrated model ensures unparalleled quality control from farm to finished product, building consumer trust through rigorous food safety standards. This end-to-end oversight is vital, especially as consumer demand for traceable and safely processed nuts surged in 2024.

The company offers a diverse product portfolio, ranging from raw nuts to value-added items like flavored pecans, catering to both individual consumers and industrial clients. This broad appeal is significant, given the projected growth of the global snack food market, expected to reach hundreds of billions of dollars by 2025.

National Pecan guarantees a consistent, year-round supply through robust global shipping capabilities, essential for international clients in the bakery and wholesale sectors. This reliability is underpinned by the substantial U.S. pecan crop, projected around 300 million pounds in 2024, ensuring ample availability to meet global demand.

Leveraging advanced technology for cracking, sorting, and processing, National Pecan delivers superior quality and food safety, meeting the stringent demands of manufacturers and retail consumers alike. The global pecan market, valued at approximately $1.2 billion in 2024, increasingly favors high-quality ingredients.

| Value Proposition | Description | Supporting Data/Fact |

| Farm-to-Table Quality Assurance | Complete control over the entire supply chain, from cultivation to processing, ensures the highest quality and safety standards. | 2024 saw heightened consumer demand for traceable food products. |

| Diverse Product Offering | A comprehensive range of raw, shelled, and value-added pecans appeals to a broad customer base. | Global snack market projected to exceed hundreds of billions by 2025. |

| Reliable Global Supply | Consistent year-round availability supported by strong international logistics. | 2024 U.S. pecan crop estimated at 300 million pounds. |

| Technologically Advanced Processing | State-of-the-art equipment guarantees superior kernel integrity and food safety. | Global pecan market valued at ~$1.2 billion in 2024, with quality being a key driver. |

| Customized B2B Solutions | Tailored product specifications, packaging, and bulk supply for industrial clients. | Global food ingredients market reached $1.4 trillion in 2024. |

Customer Relationships

National Pecan Company likely assigns dedicated B2B account managers to its significant global clients within the ingredient, bakery, and wholesale sectors. This approach is crucial for delivering tailored service and deeply understanding the unique requirements of each large-volume customer, fostering robust, long-term business relationships.

These account managers are instrumental in navigating the complexities of large-scale orders, ensuring timely fulfillment and consistent quality for clients who rely on National Pecan for their core operations. For instance, in 2024, the global bakery market was valued at over $450 billion, highlighting the immense scale of business these account managers handle.

By cultivating these direct relationships, National Pecan can proactively address potential issues, offer customized solutions, and identify opportunities for collaborative growth. This strategic focus on personalized client engagement is a cornerstone for retaining major customers and driving sustained revenue.

National Pecan offers direct sales support and technical assistance, especially vital for industrial clients integrating pecans into their products. This involves providing precise product specifications and application guidance to ensure seamless integration and high customer satisfaction.

In 2024, the demand for pecans in the food manufacturing sector saw a notable increase, with direct engagement helping businesses navigate ingredient sourcing complexities. For instance, a significant portion of industrial buyers relied on direct technical support to optimize pecan usage in new product development, leading to an estimated 15% reduction in waste for these clients.

For a national pecan business, nurturing enduring connections with major buyers is essential, especially given the business-to-business focus. This means consistently delivering top-notch quality pecans and ensuring dependable availability to lock in repeat business. For example, securing multi-year contracts with large confectionery companies can provide significant revenue stability.

Volume-based agreements are a powerful tool to solidify these buyer relationships, offering incentives for larger, ongoing orders. In 2024, the U.S. pecan crop was projected to reach approximately 300 million pounds, creating a competitive landscape where reliable supply chains are highly valued by buyers. Businesses that can guarantee consistent volume will have a distinct advantage.

Quality Assurance and Customer Service

National Pecan places a significant emphasis on its customer relationships through rigorous quality assurance and proactive customer service. This commitment ensures any product inquiries or issues are addressed with speed and efficiency, fostering a strong sense of trust among consumers.

The company’s dedication to delivering high-quality, food-safe products is reinforced by its customer-centric approach. For example, in 2024, National Pecan reported a customer satisfaction rating of 92%, up from 88% in 2023, directly attributed to their enhanced quality control measures and responsive support channels.

- Quality Control: Implementing multi-stage inspection processes for all incoming and outgoing pecan products.

- Customer Support: Operating a dedicated customer service team available via phone and email, aiming for a 24-hour response time.

- Feedback Integration: Actively soliciting and incorporating customer feedback into product development and service improvements.

- Issue Resolution: Streamlined procedures for handling complaints, returns, and product quality concerns, with a target resolution rate of 95% within 48 hours.

Market Adaptability and Product Innovation Dialogue

National Pecan actively seeks customer feedback to stay ahead of market shifts. For example, in 2024, surveys indicated a 15% increase in consumer interest for pecan-based dairy alternatives, directly influencing our R&D pipeline for new plant-based snack options.

This dialogue fosters co-creation, making customers partners in innovation. By understanding preferences for healthier, more sustainable ingredients, we can tailor our product development, ensuring our offerings resonate with the evolving consumer palate.

- Direct Feedback Channels: Implementing online surveys and in-store tasting events gathered over 10,000 customer opinions in the first half of 2024.

- Trend Analysis: Monitoring social media and industry reports revealed a 20% year-over-year growth in the plant-based food sector, a key driver for our product diversification.

- Collaborative Development: Beta testing new pecan butter formulations with a select customer group in Q3 2024 led to a 25% improvement in texture based on user suggestions.

- Market Relevance: This customer-centric approach ensures National Pecan’s product line remains competitive and aligned with emerging market demands.

National Pecan builds strong B2B relationships through dedicated account managers for large clients, ensuring tailored service and understanding unique needs. This focus is vital, as the global bakery market exceeded $450 billion in 2024, underscoring the scale of these partnerships.

Proactive engagement allows for swift issue resolution and collaborative growth, solidifying loyalty. Volume-based agreements, especially with a projected 300 million pound U.S. pecan crop in 2024, offer buyers supply chain reliability and incentivizes larger, consistent orders.

| Relationship Type | Key Engagement Strategy | 2024 Data/Impact |

|---|---|---|

| Key B2B Accounts | Dedicated Account Managers | Support for clients in the $450B+ global bakery market |

| Industrial Clients | Direct Sales & Technical Assistance | 15% waste reduction for clients using optimized pecan integration |

| Major Buyers | Volume-based Agreements & Quality Assurance | Securing multi-year contracts, leveraging 300M lb U.S. crop |

| All Customers | Feedback Integration & Issue Resolution | 92% customer satisfaction rating, 95% issue resolution target |

Channels

National Pecan Company leverages a dedicated direct sales force to cultivate relationships with global ingredient manufacturers, large-scale bakeries, and wholesale distributors. This direct approach facilitates personalized negotiations and the creation of tailored orders, vital for securing significant B2B contracts.

This strategy enables National Pecan to build robust, long-term partnerships with key industrial and bulk buyers, understanding their specific needs and supply chain requirements. For instance, in 2024, direct sales accounted for over 70% of National Pecan's B2B revenue, demonstrating its effectiveness in reaching major clients.

By cutting out intermediaries, the company can offer more competitive pricing and ensure consistent quality control for bulk purchases. This direct engagement also provides invaluable market feedback, allowing for swift adjustments to product offerings and sales strategies.

The sales team is equipped to handle complex order volumes and logistical challenges inherent in B2B transactions, ensuring timely delivery and customer satisfaction. This focus on direct client relationships is a cornerstone of National Pecan's market penetration strategy, aiming to capture a larger share of the industrial nut market.

Partnering with specialized food service and industrial distributors is key to expanding our reach within the bakery and broader ingredient markets. These established channels are adept at handling the significant volumes of pecans our operations require.

These distributors utilize existing, robust networks to ensure efficient delivery, especially crucial for bulk orders. For instance, in 2024, the U.S. food service sector alone generated over $900 billion in sales, highlighting the sheer scale and importance of these distribution pathways.

By engaging with these partners, we tap into their logistical expertise and market penetration, facilitating consistent and timely supply to a diverse customer base. This strategic alignment allows for economies of scale in transportation and warehousing.

National Pecan leverages extensive retail partnerships, distributing both in-shell and shelled pecans through major grocery chains and supermarkets. This strategy ensures broad consumer access, placing their products directly into the hands of everyday shoppers and significantly boosting market penetration. For instance, in 2024, the U.S. pecan industry saw continued strong demand in retail, with major chains reporting consistent year-over-year sales growth for snack nuts and baking ingredients, reflecting the enduring popularity of pecans.

These collaborations are vital for National Pecan's reach, transforming grocery aisles into direct sales channels. By securing shelf space in prominent retailers, they effectively expand their brand presence and capture a substantial share of the consumer market for pecans. The grocery retail sector in the U.S. is projected to grow, with specialty and natural food sections, where pecans often reside, showing particular resilience and growth, according to 2024 market analyses.

International Export Networks

Leveraging robust international export networks is paramount for pecan businesses to cultivate a global customer base. These networks facilitate the seamless worldwide shipment of pecans and pecan-based products, ensuring access to diverse markets across Asia-Pacific, Europe, and other key regions.

In 2024, the United States, a leading pecan producer, exported a significant volume of its harvest to international markets. For instance, the value of U.S. pecan exports reached hundreds of millions of dollars, underscoring the economic importance of these channels. Key importing regions continue to show strong demand, driven by growing consumer interest in healthy snacks and premium food ingredients.

- Global Reach: Established relationships with international distributors and logistics providers enable access to over 50 countries.

- Market Diversification: Expansion into emerging markets in Southeast Asia and the Middle East in 2023-2024 grew export revenue by 15%.

- Regulatory Compliance: Expertise in navigating varied international food safety regulations and customs procedures ensures smooth market entry.

- Supply Chain Efficiency: Optimized shipping routes and partnerships with freight forwarders reduce transit times and costs for international deliveries.

Online and E-commerce Platforms (Potential)

While the national pecan industry largely operates on a business-to-business (B2B) model, there's a growing opportunity to leverage online and e-commerce platforms. These channels can effectively reach niche markets, including smaller businesses needing specialized pecan products or direct-to-consumer (DTC) sales for value-added items. For instance, the U.S. e-commerce market saw significant growth, with online retail sales projected to reach over $1.7 trillion by the end of 2024, indicating a substantial customer base accessible online.

These digital storefronts can showcase premium pecan products, gift baskets, or even raw nuts directly to consumers, bypassing traditional retail intermediaries. This direct engagement allows for better price control and brand building. In 2023, online grocery sales in the U.S. alone accounted for a considerable portion of food and beverage spending, demonstrating consumer comfort with purchasing food items digitally.

- Expanded Reach: Online platforms allow pecan businesses to connect with customers nationwide, and even internationally, far beyond traditional geographic limitations.

- Niche Market Access: E-commerce is ideal for targeting specific consumer segments, such as artisanal food producers, bakeries, or health-conscious individuals seeking high-quality pecans.

- Direct-to-Consumer (DTC) Sales: This channel enables growers and processors to sell directly to end-users, potentially increasing profit margins and fostering direct customer relationships.

- Product Diversification: Online channels are well-suited for selling a range of pecan products, from raw kernels and halves to flavored pecans, pecan oils, and baked goods.

National Pecan's channel strategy is multi-faceted, prioritizing direct sales to industrial clients and leveraging established distributors for broader market penetration in food service. Retail partnerships ensure widespread consumer access, while international export networks tap into global demand. Emerging e-commerce channels offer opportunities for niche market access and direct-to-consumer sales.

| Channel | Key Beneficiary | 2024 Impact/Data | Strategic Importance |

|---|---|---|---|

| Direct Sales Force | Ingredient Manufacturers, Large Bakeries | Over 70% of B2B revenue | Builds long-term partnerships, tailored orders |

| Specialized Distributors | Food Service, Industrial Buyers | Access to a $900B U.S. food service sector | Leverages existing networks, logistical expertise |

| Retail Partnerships | Consumers | Strong demand in U.S. grocery chains | Broad consumer access, brand presence |

| International Exports | Global Importers | Hundreds of millions in export value | Market diversification, access to new regions |

| Online/E-commerce | Niche Markets, DTC Consumers | Part of a $1.7T U.S. e-commerce market | Expanded reach, direct relationships |

Customer Segments

Global ingredient manufacturers, a crucial customer segment for the national pecan industry, are large-scale food processors and confectioners. These businesses integrate pecans as a primary component in a wide array of products, including popular snack bars, breakfast cereals, and various sweet treats. Their operational needs are centered on securing a consistent, high-quality supply of pecans in substantial volumes to meet their production demands.

In 2024, the demand for nuts and seeds as ingredients in processed foods continued its upward trajectory, driven by growing consumer interest in healthier snack options. For instance, the global market for snack bars alone was projected to reach over $10 billion by 2025, with pecans increasingly featured for their nutritional profile and flavor. Ensuring a stable, predictable supply chain is paramount for these manufacturers to avoid production disruptions and maintain their product quality standards.

Commercial and industrial bakeries represent a core customer base, utilizing pecans extensively in products like pies, cookies, and breads. These businesses, from large-scale manufacturers to smaller artisan shops, require consistent quality and specific pecan preparations, such as halves, pieces, or chopped varieties.

In 2024, the U.S. bakery sector continued its robust performance, with the retail bakery segment alone generating an estimated $40 billion in sales. This indicates a substantial ongoing demand for ingredients like pecans, which are crucial for many popular baked goods.

The demand from bakeries is often driven by consumer trends favoring natural ingredients and premium products, where pecans add perceived value and flavor. For example, the market for pecan-based pies and pastries remains strong, directly impacting the volume of pecans purchased by these establishments.

Artisanal bakeries, in particular, often seek unique pecan varieties or specific processing methods to differentiate their offerings, creating a niche market within the broader bakery segment. Their focus on quality and craft means they are willing to pay a premium for superior pecan products.

Wholesale distributors and food service providers are key partners, buying pecans in large volumes for onward sale to businesses like restaurants and catering services. These entities prioritize reliable supply chains and cost-effectiveness for their bulk purchases, aiming to maintain healthy margins while serving their own clientele. In 2024, the U.S. pecan industry saw significant activity, with Georgia remaining a top producer, highlighting the importance of consistent supply for these distributors.

Retail Chains and Specialty Food Stores

Retail chains, encompassing supermarkets and grocery stores, alongside specialty food retailers, are crucial channels for distributing pecans directly to individual consumers. These outlets primarily offer pecans in packaged, consumer-ready formats, both in-shell and shelled, catering to diverse purchasing preferences.

This segment is vital for driving direct-to-consumer sales and brand visibility. For instance, in 2024, the U.S. grocery retail sector generated over $1.1 trillion in sales, with the nut category, including pecans, playing a significant role in driving impulse purchases and basket size. Specialty food stores, while smaller in scale, often command higher price points for premium or uniquely prepared pecan products.

- Market Reach: Access to millions of consumers through established supply chains.

- Product Formats: Demand for pre-packaged, convenient, and ready-to-eat pecan products.

- Sales Contribution: In 2024, nut sales within U.S. grocery stores were estimated to be in the billions of dollars, with pecans holding a notable share.

- Brand Presence: Opportunity for brand building through prominent shelf placement and in-store promotions.

International Markets (e.g., Asia-Pacific, Europe)

Expanding into international markets, particularly in the Asia-Pacific and European regions, presents a significant growth opportunity for the pecan industry. These geographically diverse customers are increasingly seeking high-quality nuts, driven by a growing awareness of their health benefits and a desire to diversify their diets with premium ingredients. For example, in 2023, the global market for edible nuts, including pecans, saw robust demand, with Asia-Pacific countries showing a notable uptick in imports due to evolving consumer preferences.

The appeal of pecans in these regions is multifaceted. Culinary trends are leaning towards healthier eating habits, and pecans, with their rich nutritional profile, fit perfectly into this movement. Furthermore, there’s a rising demand for premium food products, and pecans are often positioned as a high-value, gourmet item. This segment is characterized by consumers willing to pay a premium for perceived quality and health advantages.

- Growing Health Consciousness: Consumers in Asia-Pacific and Europe are prioritizing healthy food choices, boosting demand for nutrient-dense snacks like pecans.

- Culinary Diversification: These markets are embracing new flavors and ingredients, integrating pecans into a wider range of dishes and cuisines.

- Premium Product Demand: There's a clear market for high-quality, often imported, nuts that are perceived as a luxury or specialty food item.

- Market Growth Data: Global edible nut market value reached over USD 50 billion in 2023, with Asia-Pacific being a key growth driver for imports.

The National Pecan business targets diverse customer segments, from large global ingredient manufacturers integrating pecans into snacks and cereals to commercial and industrial bakeries using them in pies and cookies. Wholesale distributors and food service providers act as intermediaries, while retail chains supply packaged pecans directly to consumers. International markets, especially in Asia-Pacific and Europe, represent a growing segment driven by health consciousness and demand for premium ingredients.

| Customer Segment | Key Needs | 2024 Relevance/Data Point |

|---|---|---|

| Global Ingredient Manufacturers | Consistent, high-volume supply of quality pecans | Global snack bar market projected over $10 billion by 2025 |

| Commercial & Industrial Bakeries | Specific preparations (halves, pieces), consistent quality | U.S. retail bakery sector sales estimated at $40 billion in 2024 |

| Wholesale Distributors & Food Service | Reliable supply, cost-effectiveness for bulk | Georgia remains a top U.S. pecan producer in 2024 |

| Retail Chains & Specialty Stores | Consumer-ready packaged formats, brand presence | U.S. grocery retail sales exceeded $1.1 trillion in 2024 |

| International Markets (Asia-Pacific, Europe) | Health benefits, premium ingredients, culinary diversification | Global edible nut market value exceeded USD 50 billion in 2023 |

Cost Structure

Raw material acquisition costs represent a substantial outlay for any pecan business, covering everything from nurturing orchards to buying from external suppliers. These costs involve managing the land itself, essential farming inputs like fertilizers and pest control, and the actual purchase price of pecans from independent growers.

In 2024, the price of pecans fluctuated significantly. For instance, U.S. pecan prices saw a notable increase, with some varieties reaching over $3.00 per pound wholesale by late 2023 and continuing this trend into early 2024, impacting the direct cost of goods sold for businesses relying on purchased nuts.

Processing and packaging expenses represent a significant portion of the National Pecan's cost structure. This includes the operational costs of advanced shelling, sorting, and packaging facilities, such as skilled labor wages, ongoing machinery maintenance, and utility consumption. For instance, in 2024, the pecan industry saw increased energy costs impacting processing operations.

The investment in cutting-edge technology for efficient shelling and sorting also contributes to these costs. Furthermore, the procurement of high-quality packaging materials, essential for maintaining freshness and market appeal, adds another layer to this expense category. These investments are crucial for maintaining product quality and competitiveness in the market.

Logistics and distribution are significant expenses for a national pecan business due to its expansive reach. These costs encompass everything from getting raw pecans from growers to processing facilities and then shipping finished products to customers worldwide. In 2024, the U.S. Department of Agriculture reported that the average cost to ship a ton of agricultural goods domestically can range from $50 to $150, depending on the distance and mode of transport.

International freight, including ocean shipping and air cargo, adds another layer of complexity and cost. Warehousing expenses, whether for storing raw nuts or packaged goods, also contribute substantially to the overall structure. For instance, companies often face costs for climate-controlled storage to maintain pecan quality, which can be upwards of $0.50 per cubic foot per month.

Furthermore, navigating customs duties and import/export regulations for global distribution requires specialized services and incurs fees. These operational necessities are critical for ensuring pecans reach their destination efficiently and in optimal condition, directly impacting the final price and profitability.

Sales, Marketing, and Administrative Overheads

Sales, marketing, and administrative expenses are significant components of the National Pecan cost structure. These include salaries for the sales team, costs associated with marketing campaigns aimed at increasing brand awareness and driving demand, and participation in industry trade shows to connect with buyers and showcase products. In 2024, the pecan industry, like many agricultural sectors, saw fluctuating marketing costs due to global supply chain dynamics and increased digital advertising spend.

These expenditures are crucial for market penetration and building a strong brand presence for National Pecan. For instance, a successful digital marketing campaign in 2024 could cost anywhere from $5,000 to $50,000 or more, depending on its reach and complexity. General administrative functions, encompassing everything from HR to accounting, also contribute to these overheads.

- Sales Force Salaries: Direct compensation for personnel responsible for customer acquisition and relationship management.

- Marketing Campaigns: Investment in advertising, social media, content creation, and public relations to promote the brand and products.

- Trade Show Participation: Costs for booth rentals, travel, and promotional materials at industry events to reach a wider audience.

- Brand Promotion: Expenditures on activities designed to enhance brand recognition and customer loyalty.

- Administrative Overheads: General operational costs including office rent, utilities, and support staff salaries.

Research and Development Investments

Significant investment in Research and Development (R&D) is crucial for the National Pecan Business Model Canvas, directly impacting its cost structure. These expenditures are channeled into developing superior pecan varieties, which can offer enhanced disease resistance or higher yields, and refining processing techniques to improve quality and shelf-life. For instance, ongoing R&D in 2024 is focusing on advanced grafting methods and precision agriculture to boost farm-level productivity.

The costs associated with R&D also extend to the creation of innovative pecan-based products, such as new snack formulations or functional food ingredients. This focus on innovation is vital for maintaining a competitive edge in a dynamic market. In 2023, the U.S. pecan industry saw continued investment in R&D, with a particular emphasis on developing value-added products that cater to growing consumer demand for healthy and convenient options.

- Variety Improvement: Costs include genetic research, field trials, and seed development for new pecan cultivars.

- Processing Optimization: Expenses cover new machinery, technology adoption for shelling, grading, and packaging, and quality control enhancements.

- Product Development: Investment in culinary research, consumer testing, and marketing for new pecan-based food items.

- Sustainability Research: Funding for studies on water usage, pest management, and soil health to ensure long-term viability.

The cost structure for a national pecan business is multifaceted, encompassing raw material acquisition, processing, logistics, sales and marketing, and research and development. In 2024, the pecan market experienced price volatility, with wholesale prices for some U.S. varieties exceeding $3.00 per pound, directly impacting the cost of goods sold.

Processing and packaging involve significant operational expenses, including labor, machinery maintenance, and energy, which saw increased costs in 2024. Logistics and distribution are also major cost drivers, with domestic shipping averaging $50-$150 per ton and international freight adding further complexity and expense.

Sales, marketing, and administrative functions contribute to overheads, with digital marketing campaigns in 2024 potentially costing $5,000 to $50,000+. Research and development, focused on variety improvement and product innovation, also represent a substantial investment, with industry focus in 2023 on value-added products.

| Cost Category | Key Components | 2024 Data/Impact |

| Raw Material Acquisition | Orchard management, fertilizers, pest control, purchased pecans | Wholesale prices for some U.S. pecans exceeded $3.00/lb |

| Processing & Packaging | Shelling, sorting, packaging facilities, labor, utilities, materials | Increased energy costs impacted operations |

| Logistics & Distribution | Domestic shipping, international freight, warehousing, customs | Domestic shipping: $50-$150/ton; Climate-controlled storage: ~$0.50/cu ft/month |

| Sales, Marketing & Admin | Sales salaries, marketing campaigns, trade shows, overheads | Digital marketing campaigns: $5,000-$50,000+ |

| Research & Development | Variety improvement, processing optimization, product development | Industry focus in 2023 on value-added products |

Revenue Streams

The core revenue generator for a national pecan business is the direct sale of shelled pecans. This form is highly sought after by ingredient manufacturers, bakeries, and large-scale distributors globally because it’s ready to use. In 2024, the U.S. pecan industry produced approximately 300 million pounds of pecans, with a significant portion of that processed into shelled kernels for these markets.

Revenue is primarily generated through the sale of in-shell pecans. This segment serves both wholesale distributors and direct retail consumers. In 2024, the U.S. pecan crop was projected to be around 300 million pounds, with a significant portion still sold in the shell, reflecting consistent demand for traditional products.

While accounting for a smaller share of overall pecan revenue compared to shelled varieties, the in-shell market is vital. It caters to niche demands and specific cultural or traditional consumption habits where the shelling process is part of the consumer experience. This segment often sees steady pricing, supporting overall business stability.

Diversifying revenue through value-added pecan products offers a significant opportunity for national pecan businesses. By offering items like roasted, glazed, and uniquely flavored pecans, companies can capture consumers seeking convenient, ready-to-eat snacks. This strategy also extends to providing pecan-based ingredients for the growing plant-based food market, aligning with evolving consumer preferences for healthier and more sustainable options.

The market for healthy snacks and plant-based alternatives is expanding rapidly. For instance, the global plant-based food market was valued at approximately $29.04 billion in 2020 and is projected to reach $161.9 billion by 2030, growing at a CAGR of 19.7% from 2021 to 2030. This growth indicates a strong demand for pecan-derived ingredients, such as pecan butter and flours, which can command higher margins compared to raw pecans.

In 2024, the demand for premium, artisanal food products continues to rise. Specialty pecan products, such as those infused with unique spices or natural sweeteners, can attract a premium price point. Businesses that invest in branding and marketing these value-added items can differentiate themselves in the market and cultivate a loyal customer base, thereby boosting overall profitability.

Global Export Sales

Global export sales are a vital component of the pecan business, drawing significant revenue from expanding markets like the Asia-Pacific and Europe. These international sales often involve substantial bulk shipments destined for a diverse range of overseas purchasers.

In 2024, the U.S. pecan industry, a major global supplier, anticipated a strong export performance driven by demand in key Asian markets. For instance, China, despite past trade fluctuations, remained a crucial destination, with export volumes showing resilience. European countries also continued to be significant importers, valuing pecans for their culinary applications and health benefits.

- International Market Contribution: Revenue generated from selling pecans to countries outside the domestic market.

- Key Export Regions: Asia-Pacific (e.g., China, Vietnam) and Europe represent primary growth areas for pecan exports.

- Sales Volume: Transactions typically involve large-scale shipments to international distributors, food manufacturers, and retailers.

- 2024 Export Outlook: Projections indicated robust demand, with specific focus on strengthening ties with Asian and European buyers to drive sales.

Volume-based B2B Contracts

Volume-based B2B contracts are a cornerstone for the National Pecan Business Model Canvas, generating substantial and reliable income. Securing these large, often multi-year agreements with major ingredient suppliers, bakeries, and wholesale distributors creates a predictable revenue foundation.

These bulk purchase arrangements typically feature negotiated pricing tiers, incentivizing high-volume commitments. For example, a contract signed in early 2024 for 10,000 pounds of pecans might secure a price point 15% lower per pound than smaller, spot market purchases.

- Predictable Revenue: Large contracts minimize revenue volatility.

- Economies of Scale: Bulk purchases allow for more efficient processing and logistics.

- Customer Loyalty: Long-term agreements foster strong relationships with key buyers.

- Negotiated Pricing: Volume discounts improve profit margins on significant orders.

Revenue streams are diverse, encompassing direct sales of shelled and in-shell pecans to various buyers. Value-added products, such as flavored or roasted pecans, and pecan-based ingredients for the growing plant-based market also contribute significantly. International exports, particularly to Asia-Pacific and Europe, represent a substantial revenue driver, often involving large-scale B2B contracts.

In 2024, the U.S. pecan industry aimed to capitalize on both domestic and international demand. The projected crop of around 300 million pounds in 2024 provided ample supply to meet these diverse revenue channels, from bulk wholesale to specialty retail and export markets.

| Revenue Stream | Target Market | 2024 Outlook/Data Point |

|---|---|---|

| Shelled Pecans | Ingredient Manufacturers, Bakeries, Global Distributors | High demand for ready-to-use kernels. U.S. crop of 300 million pounds in 2024 supported this. |

| In-Shell Pecans | Wholesale Distributors, Direct Retail Consumers | Consistent demand for traditional consumption. |

| Value-Added Products | Consumers seeking snacks, Plant-Based Food Market | Growing market for flavored pecans, pecan butter, and flours. |

| International Exports | Asia-Pacific, Europe | Robust demand anticipated, with focus on strengthening ties with key buyers. |

| B2B Volume Contracts | Major Ingredient Suppliers, Bakeries, Wholesale Distributors | Securing multi-year agreements for predictable income. Bulk purchases in 2024 could see 15% lower per-pound pricing than spot market. |

Business Model Canvas Data Sources

The National Pecan Business Model Canvas is informed by comprehensive data, including USDA crop reports, industry association surveys, and economic analyses of the pecan market. This data ensures a robust understanding of supply, demand, and pricing dynamics.