National Pecan PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

National Pecan Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping National Pecan's future. This comprehensive PESTLE analysis provides actionable intelligence, empowering you to anticipate market shifts and capitalize on emerging opportunities. Gain a strategic advantage by understanding the external forces influencing the entire pecan industry. Download the full version now to access expert insights and refine your own market strategy.

Political factors

National Pecan Company's global reach means its profitability is closely tied to international trade policies. For example, the US Department of Agriculture reported that in 2023, pecan exports to China, a key market, faced fluctuating demand influenced by ongoing trade discussions. Tariffs imposed on agricultural products can directly increase the cost of pecans for international buyers, potentially reducing demand and impacting pricing for National Pecan.

Shifts in trade agreements, like those affecting the North American Free Trade Agreement (NAFTA) and its successor, the United States-Mexico-Canada Agreement (USMCA), can also alter market access and create new opportunities or challenges for National Pecan. Companies must stay vigilant, as changes in import/export regulations can affect everything from shipping costs to market entry barriers. This requires proactive monitoring to navigate these complex trade landscapes effectively.

Government agricultural policies significantly shape the pecan industry. For instance, the U.S. Farm Bill, typically reauthorized every five years, often includes provisions that can indirectly benefit or burden pecan producers through crop insurance programs or conservation initiatives. Understanding these ongoing policy discussions, particularly those around trade agreements and their impact on agricultural exports, is crucial for forecasting raw material costs.

Subsidies, where available, can reduce the cost of production for pecan growers, potentially leading to more stable raw material prices for companies like National Pecan Company. Conversely, shifts in government support could alter the competitive landscape by favoring certain farming practices or regions, thereby influencing the overall supply and availability of pecans. For example, changes in water allocation policies in key growing states like Georgia or Texas could directly impact yield and, consequently, sourcing costs.

In 2024, continued discussions around the farm bill and potential trade tariffs on agricultural goods remain key political factors. These elements can directly influence the cost of inputs, such as fertilizers and equipment, for pecan farmers, and indirectly affect the market price of pecans. Staying informed about these government actions allows for better prediction of raw material price fluctuations.

Geopolitical stability plays a crucial role in the pecan industry. The political climate in major pecan-producing countries like the United States, Mexico, and Australia, as well as in key import markets such as China and Europe, directly influences supply chain predictability. For instance, any political instability or trade disputes in the US, which accounts for over 90% of global pecan production, could significantly disrupt the flow of pecans worldwide.

Tensions between nations can lead to unexpected trade barriers or increased tariffs, impacting the cost and accessibility of pecans for consumers and businesses in affected regions. For example, ongoing trade dynamics between the US and China, a significant importer of pecans, highlight the sensitivity of the market to diplomatic relations. Fluctuations in these relationships can lead to reduced demand or the need for producers to find alternative markets, as seen in the shifts in export patterns in recent years.

Proactive risk management is therefore essential. Diversifying export markets can mitigate the impact of localized political issues. Companies that monitor global political developments and adapt their sourcing and distribution strategies accordingly are better positioned to maintain stable operations and capitalize on opportunities, even amidst international uncertainty. This forward-thinking approach is vital for long-term success in the global pecan trade.

Food Safety Regulations and Standards

Government agencies like the FDA and USDA in the United States, and equivalent bodies internationally, set stringent food safety regulations. National Pecan Company must comply with these rules, which cover everything from pesticide use to processing and labeling. For example, the Food Safety Modernization Act (FSMA) in the US mandates preventative controls throughout the food supply chain, impacting how pecans are handled and stored.

Compliance with these diverse standards is critical for market access, particularly for exports. Failure to meet a country's specific food safety requirements, such as maximum residue limits (MRLs) for pesticides, can lead to product rejection and significant financial losses. In 2024, the global food safety market was valued at over $100 billion, highlighting the scale of regulatory impact.

National Pecan Company must invest in robust quality control systems and stay informed about regulatory changes. For instance, new regulations on allergen labeling or traceability could require adjustments to operational procedures and supply chain management. Staying ahead of these evolving legal landscapes is a constant challenge and necessity for maintaining consumer trust and operational continuity.

- Global Food Safety Standards: Adherence to international norms like HACCP and ISO 22000 is essential for global trade.

- Pesticide Residue Limits: Compliance with MRLs set by importing countries, such as the EU's stringent regulations, is paramount.

- Traceability Requirements: Enhanced traceability mandates, increasingly common in 2024-2025, require robust record-keeping from farm to fork.

- Allergen Labeling: Accurate and comprehensive allergen information on packaging is a non-negotiable aspect of food safety compliance.

Labor Laws and Immigration Policies

Labor laws and immigration policies significantly influence the pecan industry. Minimum wage hikes, for instance, can directly increase the cost of harvesting and processing. In 2024, several states saw minimum wage increases, with some potentially impacting agricultural labor costs. For example, if a key pecan-producing state raised its minimum wage by $1.50 per hour, this could add substantial operational expenses for National Pecan Company.

Immigration policies are also critical. Restrictions on seasonal worker programs, like the H-2A visa, can drastically reduce the available labor pool for pecan farms. A tightening of these policies in 2024 or 2025 could lead to labor shortages, particularly during peak harvest times, forcing growers to pay higher wages or face crop loss. The Department of Labor's H-2A wage data, which sets the prevailing wage for agricultural workers, is a key indicator to monitor.

- Minimum Wage Impact: A $1.50/hour increase in minimum wage could raise labor costs by 5-10% for certain operations.

- H-2A Visa Trends: Monitor Department of Labor data for H-2A visa approvals and wage rates in 2024-2025.

- Worker Safety Regulations: Increased scrutiny on safety can lead to new compliance costs for equipment and training.

- Labor Availability: Shortages due to policy changes could necessitate investments in automation or higher wages to attract workers.

Government agricultural policies and international trade agreements significantly impact the pecan industry. For instance, the U.S. Farm Bill influences crop insurance and conservation programs, while changes to trade pacts like USMCA affect market access. In 2024, ongoing farm bill discussions and potential tariffs on agricultural goods remain critical political factors that can alter input costs and market prices for pecans.

Geopolitical stability is crucial, as political tensions can lead to trade barriers and tariffs, affecting the cost and accessibility of pecans. The U.S., as the dominant producer, faces potential supply chain disruptions due to its trade dynamics with key importers like China. Diversifying export markets is a key strategy to mitigate these risks.

Government agencies set food safety regulations, such as the FDA's FSMA, requiring compliance in handling and storage. In 2024, the global food safety market exceeded $100 billion, underscoring the financial impact of adhering to diverse international standards, including MRLs and allergen labeling, which are vital for market access.

What is included in the product

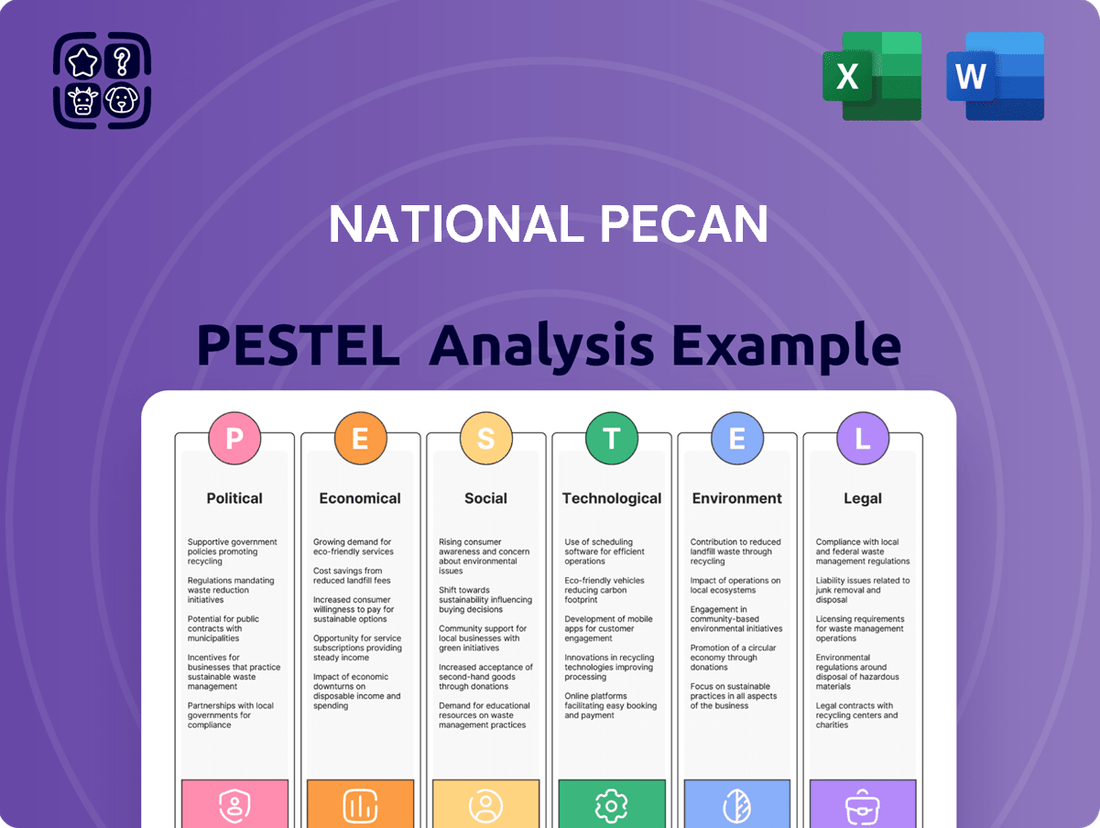

This comprehensive PESTLE analysis meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the National Pecan industry.

It provides actionable insights and data-driven evaluations to empower strategic decision-making for stakeholders.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors into actionable insights for strategic decision-making.

Economic factors

Global commodity prices, including those for pecans, are heavily influenced by supply and demand. For 2024, anticipate continued volatility due to potential weather impacts on harvests in key producing regions like Georgia and Texas, alongside global economic conditions affecting consumer spending on non-essential items.

Inflation remains a significant concern for the agricultural sector. By mid-2024, rising energy costs, particularly for fuel and fertilizer, coupled with increased transportation expenses, are expected to push up operational costs for companies like National Pecan Company. This directly impacts their ability to maintain profit margins without adjusting product pricing.

The price of competing nuts, such as almonds and walnuts, also plays a role in the pecan market. Fluctuations in their availability and pricing can shift consumer preference, indirectly affecting the demand for pecans. For instance, a strong almond harvest in 2024 could lead to lower almond prices, potentially drawing some demand away from pecans.

Monitoring these intertwined factors is essential for National Pecan Company's financial health. For example, if the average price of pecans increases by 5% due to a smaller harvest in late 2024, but fuel costs simultaneously jump by 10%, the company faces a complex pricing challenge to ensure profitability.

Consumer purchasing power significantly impacts demand for goods like pecans. Economic downturns or high inflation can erode this power, potentially leading consumers to opt for less expensive alternatives, affecting sales of premium pecan products. For instance, the U.S. inflation rate averaged 4.12% in 2023, a noticeable increase from previous years, which could influence discretionary spending on items like specialty nuts.

National Pecan Company's sales volumes, especially in retail and bakery, are closely tied to the economic well-being of its primary markets. A strong economy generally supports higher consumer spending on food items, including those with pecans. Conversely, a weakening economy might see a reduction in demand for higher-priced ingredients or finished goods.

Understanding current consumer spending habits is crucial for National Pecan Company's market strategy. For example, data from the Bureau of Labor Statistics for Q1 2024 indicated that while consumer spending rose, the savings rate also saw fluctuations, suggesting a cautious approach to discretionary purchases among some demographics.

Exchange rate fluctuations significantly influence the pecan industry's global reach. As of late 2024 and early 2025 projections, a strong U.S. dollar could make American pecans pricier for international buyers, potentially dampening export volumes. Conversely, a weaker dollar typically enhances the competitiveness of U.S. exports by making them more affordable abroad.

For businesses importing essential inputs like specialized harvesting equipment or packaging materials, currency movements are also critical. A depreciating dollar increases the cost of these imported goods, impacting overall production expenses and potentially squeezing profit margins. Effective foreign exchange risk management strategies are therefore crucial for maintaining profitability in international pecan trade.

Interest Rates and Access to Capital

Interest rates significantly influence the cost of capital for National Pecan Company. For instance, if the Federal Reserve maintains its target federal funds rate at the current range of 5.25% to 5.50% (as of mid-2024), borrowing for expansion projects like new processing equipment or orchard development becomes more expensive. This directly impacts profitability and the feasibility of growth strategies.

Access to affordable credit is paramount for National Pecan's operational liquidity and its ability to fund capital expenditures. During periods of high interest rates, companies often face tighter lending standards and increased borrowing costs, potentially hindering investment in new technologies or land acquisition. Conversely, lower rates can unlock capital, facilitating expansion and modernization efforts.

Monitoring central bank policies, such as Federal Reserve announcements regarding monetary policy and potential rate adjustments, is crucial for National Pecan's strategic financial planning. For example, signals of future rate hikes could prompt the company to secure financing sooner rather than later. In 2024, the market is closely watching inflation data to anticipate potential shifts in interest rate policy, which will directly affect borrowing costs.

- Federal Funds Rate (Mid-2024): 5.25% - 5.50%

- Impact on Capital Expenditures: Higher rates increase the cost of loans for facility upgrades and orchard expansion.

- Access to Capital: Affordable credit is key for operational cash flow and growth investments.

- Strategic Planning: Anticipating central bank actions on interest rates is vital for financial forecasting.

Economic Growth in Key Markets

Economic growth in key markets directly impacts National Pecan Company's sales across ingredient, bakery, wholesale, and retail segments. For instance, if major markets like the United States or China experience strong GDP growth, consumer spending on items like pecan-infused baked goods or snacks tends to rise. In 2024, the International Monetary Fund projected global GDP growth of 3.2%, with advanced economies expected to grow at 1.9% and emerging market and developing economies at 4.7%.

Higher economic expansion often translates to increased disposable income, which can boost demand for specialty food items, including those featuring pecans. Markets with robust economic performance are therefore crucial for National Pecan. For example, countries showing consistent GDP growth above 3% often signal a favorable environment for expanding market share.

- United States: Projected GDP growth of 2.1% for 2024, a significant market for packaged foods and baking ingredients.

- China: Forecasted GDP growth of 4.6% in 2024, representing a growing middle class with increasing demand for premium food products.

- European Union: Expected GDP growth of 0.9% in 2024, with variations across member states influencing regional demand for pecans.

- Mexico: Projected GDP growth of 2.4% in 2024, offering opportunities in the bakery and confectionery sectors.

Prioritizing these high-growth markets is essential for National Pecan's strategic planning and revenue generation. Understanding the specific economic trajectories of each key market allows for more targeted sales and marketing efforts, ultimately driving increased demand for their pecan products.

Global economic conditions continue to shape the pecan market, with inflation and consumer spending power remaining key drivers. For 2024, ongoing inflation is expected to keep operational costs elevated for companies like National Pecan, impacting their ability to maintain margins without price adjustments.

Interest rates also play a critical role; the Federal Reserve's target rate remaining in the 5.25%-5.50% range through mid-2024 makes capital expenditures more costly, potentially affecting expansion plans.

Economic growth in major markets directly correlates with consumer demand for pecans. Projections for 2024, such as a 3.2% global GDP growth, signal opportunities, but variations exist, with the EU expecting a modest 0.9% growth compared to China's anticipated 4.6%.

| Economic Factor | 2024 Projection/Status | Impact on National Pecan |

|---|---|---|

| Inflation Rate (US Avg. 2023) | Elevated, impacting operational costs | Increased expenses for energy, fertilizer, and transportation |

| Federal Funds Rate (Mid-2024) | 5.25%-5.50% | Higher cost of capital for investments and expansion |

| Global GDP Growth | Projected 3.2% | Varying market opportunities based on regional economic performance |

| US GDP Growth | Projected 2.1% | Supports demand in a key market for packaged foods |

| China GDP Growth | Forecasted 4.6% | Growing middle class indicates increasing demand for premium products |

What You See Is What You Get

National Pecan PESTLE Analysis

The National Pecan PESTLE Analysis you see here is the exact document you'll receive after purchase—fully formatted and ready to use.

This is a real preview of the product you’re buying—delivered exactly as shown, no surprises. It outlines the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the national pecan industry.

The content and structure shown in the preview is the same document you’ll download after payment, providing a comprehensive overview of the industry's landscape.

What you’re previewing here is the actual file—fully formatted and professionally structured, offering valuable insights for strategic planning.

Sociological factors

Growing consumer awareness about healthy eating and the nutritional benefits of nuts, including pecans, presents a significant opportunity for the National Pecan Company. In 2024, the global nuts market was valued at approximately $54.3 billion, with health-conscious consumers driving a substantial portion of this growth.

Trends favoring plant-based diets, natural ingredients, and functional foods can significantly boost demand for National Pecan Company's products. The plant-based food market alone is projected to reach $74.2 billion by 2025, indicating a strong consumer shift towards these dietary patterns.

Marketing efforts can effectively leverage these health trends by highlighting the inherent health attributes of pecans. Pecans are rich in monounsaturated fats, antioxidants, and essential vitamins and minerals, making them an attractive option for consumers seeking nutritious snacks and ingredients.

Sociological factors, particularly changing dietary preferences and food fads, significantly impact the pecan industry. The growing interest in health-conscious eating, including trends like plant-based diets and low-carb lifestyles, can either boost or hinder pecan consumption. For instance, the high fat content in pecans, while healthy, might be perceived negatively by some following strict low-fat diets. Data from 2024 shows a continued rise in demand for healthy fats, which bodes well for pecans, but the industry must remain aware of evolving nutritional narratives.

Consumers and corporate buyers are increasingly focused on where their food comes from, demanding ethical sourcing that includes fair labor and eco-friendly farming. This means National Pecan Company might need to show it's being responsible across its entire supply chain, from farm to table.

This growing awareness directly impacts how people view a brand and ultimately influences their buying choices. For example, a 2024 survey indicated that 68% of consumers are willing to pay more for products from companies with transparent and ethical supply chains.

Companies like National Pecan will likely face pressure to provide clear proof of their commitment to sustainability and fair labor. This transparency is becoming a key differentiator in the market, affecting brand loyalty and market share.

The environmental footprint of agriculture is also a major concern, pushing companies to adopt practices that minimize harm and promote long-term ecological health. National Pecan’s approach to water usage and land management, for instance, will be scrutinized by environmentally conscious stakeholders.

Lifestyle and Convenience Food Trends

Modern lifestyles increasingly emphasize convenience, fueling demand for ready-to-eat snacks and pre-packaged ingredients. This presents an opportunity for National Pecan Company to capitalize on the growing market for easy-to-use food components, such as shelled pecans and value-added pecan-based products, aligning with consumer preferences for time-saving options. For instance, the global snack market, which includes nuts, was valued at approximately $612.7 billion in 2023 and is projected to grow, indicating a strong consumer appetite for convenient, on-the-go options.

Innovating product formats to cater to busy consumers is crucial for sustained growth. This could involve developing single-serving packages, pre-portioned pecan mixes for baking or salads, or even ready-to-eat pecan-based bars and energy bites. In 2024, consumer surveys indicated that over 60% of shoppers look for products that simplify meal preparation or offer quick snacking solutions.

- Growing Demand for Convenience: The global snack market, including nuts, is projected to continue its upward trajectory, driven by busy lifestyles.

- Product Innovation: National Pecan Company can leverage this trend by offering more convenient formats like single-serving packs and pre-portioned ingredients.

- Consumer Preference: A significant majority of consumers actively seek products that reduce preparation time or offer quick, easy snacking options.

- Value-Added Products: Developing ready-to-eat pecan-based snacks and meal components directly addresses the need for convenience in modern diets.

Demographic Shifts and Population Growth

Demographic shifts significantly influence the pecan market. For instance, an aging population in developed countries might see a slight decrease in overall food consumption but an increased preference for nutrient-dense snacks like pecans. Conversely, rapid urbanization in emerging economies often correlates with rising disposable incomes and changing dietary habits, boosting demand for premium food items.

Population growth is a critical driver. The global population, projected to reach approximately 9.7 billion by 2050, will necessitate increased food production and consumption. Regions experiencing robust population growth, such as parts of Asia and Africa, represent key future markets for agricultural products, including pecans. This growth directly translates to a larger consumer base eager for diverse food options.

Understanding these demographic trends is vital for effective market strategy. For example, targeting younger, urban populations with convenient packaging and health-focused messaging can capture a growing segment. Conversely, focusing on older demographics might involve highlighting the perceived health benefits and traditional appeal of pecans.

Key demographic factors impacting the pecan industry include:

- Aging Population: In countries like the United States, where over 17% of the population was 65 and older in 2023, there's a growing market for health-conscious, easy-to-consume snacks.

- Urbanization: Global urbanization rates continue to rise, with projections indicating that by 2050, nearly 70% of the world's population will live in urban areas, creating concentrated consumer markets.

- Emerging Market Growth: Countries like India and Nigeria, with significant young populations and expanding middle classes, are poised to become major drivers of demand for diversified food products.

- Health and Wellness Trends: Across all age groups, there's an increasing focus on healthy eating, which favors nutrient-rich foods like pecans.

Sociological factors significantly shape the demand for pecans. Growing consumer interest in health and wellness, coupled with a rise in plant-based diets, directly benefits products like pecans, which are rich in healthy fats and nutrients. However, the industry must also navigate perceptions of high fat content among some health-conscious groups. In 2024, the global market for plant-based foods continued its strong growth, reinforcing the positive outlook for nutrient-dense ingredients.

Technological factors

Technological advancements are reshaping pecan farming. Precision agriculture, for instance, uses data analytics and GPS technology to optimize planting, fertilization, and pest control, leading to better resource management. Drones equipped with sensors can monitor crop health and identify issues early, allowing for targeted interventions.

Sophisticated irrigation systems, like drip irrigation and soil moisture sensors, are crucial for water conservation and ensuring consistent hydration, which is vital for pecan development. These systems can reduce water usage by up to 50% compared to traditional methods. In 2024, the adoption of smart irrigation is expected to increase as water scarcity becomes a greater concern.

Automation is also making inroads, with automated harvesting equipment and robotic systems for tasks like pruning and shelling. These technologies can significantly cut down on labor costs, which have been a persistent challenge in the agricultural sector, and improve the speed and efficiency of operations. For example, automated shakers and sweepers can collect nuts much faster than manual methods.

National Pecan Company can leverage these innovations to boost its productivity and sustainability. Investing in research and development for new farming practices and technologies will be key to maintaining a competitive edge. The company's commitment to adopting these advancements will directly impact its operational efficiency and overall profitability.

New technologies in pecan processing are significantly boosting efficiency and quality. Advanced optical sorters, for example, can now identify and remove shell fragments and defective nuts with remarkable accuracy, improving the final product. These systems are crucial for meeting the high standards demanded by consumers and processors alike.

Improved shelling techniques, often employing precise mechanical or even laser-based methods, are reducing kernel damage during the shelling process. This not only increases the yield of intact kernels but also enhances their market value. The industry saw a notable increase in the efficiency of shelling lines over the past few years, with some facilities reporting up to a 15% improvement in kernel recovery rates.

Automated packaging systems are streamlining the final stages of production, from weighing to sealing and boxing. This automation reduces labor costs and ensures consistent, secure packaging, which is vital for maintaining freshness and preventing contamination during transit. The adoption of robotic palletizers in major processing plants has already led to a reduction in handling damage by an estimated 10%.

Technological advancements are significantly reshaping how pecans move from farm to table. Innovations like real-time GPS tracking and advanced logistics software are making the process smoother and more cost-effective for companies like National Pecan. These tools provide a clear view of inventory and transit, ensuring pecans arrive fresh and on time.

The adoption of predictive analytics in supply chain management is a game-changer. By forecasting demand and potential disruptions, National Pecan can proactively adjust its logistics, minimizing waste and maximizing efficiency. This data-driven approach helps meet customer delivery expectations reliably. In 2024, the global supply chain management market was valued at approximately $25.6 billion, with a projected compound annual growth rate of 10.2% through 2030, highlighting the increasing importance of these technologies.

A sophisticated, technology-driven supply chain offers a distinct competitive edge in the global pecan market. National Pecan's ability to leverage these innovations not only streamlines operations but also enhances its reputation for quality and dependable service. This focus on efficiency and responsiveness is crucial for navigating international trade complexities and consumer demands.

Food Safety and Quality Control Technologies

Technological advancements are significantly reshaping food safety and quality control within the pecan industry. Emerging technologies offer faster and more accurate pathogen detection, reducing the risk of contamination outbreaks. For instance, rapid microbial testing methods, often utilizing DNA sequencing or advanced immunoassay techniques, are becoming more accessible, allowing processors to identify potential issues much earlier in the supply chain. This is crucial as recalls can be incredibly costly; in 2024, the average cost of a food recall in the U.S. was estimated to be over $1 million, not including brand damage.

Allergen management is another area benefiting from technological innovation. Traceability systems, often powered by blockchain or advanced sensor technology, can meticulously track pecans from the farm to the consumer, ensuring that cross-contamination with allergens like peanuts or tree nuts is minimized. This enhanced transparency is vital for consumers with allergies and for regulatory compliance. The global market for food safety testing is projected to reach over $25 billion by 2025, highlighting the significant investment in these critical areas.

Furthermore, data analytics plays a pivotal role in quality assurance. By analyzing data from various stages of processing, such as moisture content, kernel integrity, and sensory attributes, companies can optimize their operations and ensure consistent product quality. This data-driven approach not only helps meet stringent regulatory requirements but also builds consumer trust. Investing in these technologies is no longer optional; it's a fundamental requirement for maintaining brand reputation and market access in the competitive food sector.

- Rapid Pathogen Detection: Technologies like CRISPR-based diagnostics can identify specific bacteria in minutes rather than days.

- Advanced Allergen Testing: ELISA and PCR methods offer highly sensitive detection of trace allergens.

- Supply Chain Traceability: Blockchain technology provides an immutable record of a pecan's journey, enhancing safety and recall efficiency.

- Data Analytics for Quality: AI-powered systems analyze visual and sensor data to predict and ensure kernel quality and shelf-life.

Product Innovation and Development

Technological advancements are crucial for driving product innovation within the pecan industry. For instance, research in food science is leading to the creation of novel pecan-based ingredients, such as pecan protein isolates for plant-based foods and enhanced pecan oils with improved nutritional profiles. The development of advanced processing techniques allows for extended shelf-life for pecan products, opening new distribution channels and reducing waste. In 2024, the global market for plant-based foods, a key area for pecan ingredient innovation, was projected to reach over $70 billion, highlighting the significant opportunity for new pecan applications.

Furthermore, technological investment in R&D can unlock new market segments. This includes exploring innovative flavor infusion methods for pecans, developing ready-to-eat pecan snacks with unique taste profiles, and creating specialized pecan flours for gluten-free baking. Companies are investing in genetic research to identify pecan varieties with desirable traits, such as faster growth or higher oil content, which can improve production efficiency and product quality. The ongoing pursuit of product diversification through technological means is a primary driver for sustained growth in the competitive nut market.

Key technological areas impacting the pecan sector include:

- Food Science Innovations: Development of pecan protein powders, oils, and functional ingredients.

- Processing and Preservation: Technologies for extended shelf-life and improved texture.

- Agricultural Technology: Precision agriculture and genetic research for enhanced pecan cultivation.

- Product Development: Creation of new consumer products like snacks, baked goods, and beverages.

Technological advancements are revolutionizing pecan farming and processing. Precision agriculture, automation, and sophisticated irrigation are boosting efficiency and sustainability. Innovations in shelling, sorting, and packaging are enhancing kernel quality and reducing waste. These technological leaps are critical for National Pecan to maintain a competitive edge and meet evolving market demands.

For instance, advanced optical sorters can now identify and remove defective nuts with remarkable accuracy, improving the final product. Improved shelling techniques are increasing the yield of intact kernels, enhancing their market value. Automated packaging systems reduce labor costs and ensure consistent, secure packaging, vital for maintaining freshness.

The integration of data analytics and AI in supply chain management is crucial for forecasting demand and minimizing disruptions. These technologies are transforming how pecans move from farm to table, ensuring timely and cost-effective delivery. In 2024, the global supply chain management market's significant growth underscores the increasing importance of these technological solutions.

| Technology Area | Impact on Pecans | Key Innovations | Data/Example |

|---|---|---|---|

| Precision Agriculture | Optimized resource management, improved yield | Drones, GPS, soil sensors | Drip irrigation can reduce water usage by up to 50%. |

| Processing & Quality Control | Enhanced kernel quality, reduced waste | Optical sorters, advanced shelling | Improved shelling can lead to a 15% increase in kernel recovery. |

| Supply Chain Management | Increased efficiency, reduced costs | Real-time tracking, predictive analytics | Global SCM market valued at $25.6 billion in 2024. |

| Food Safety | Faster pathogen detection, allergen management | CRISPR diagnostics, blockchain traceability | Average cost of a food recall in 2024 exceeded $1 million. |

Legal factors

National Pecan Company must navigate a complex web of food labeling and marketing regulations. These rules dictate everything from nutritional facts and allergen warnings to specifying the country of origin for ingredients. For instance, in the United States, the Food Allergen Labeling and Consumer Protection Act of 2004 (FALCPA) mandates clear declaration of the eight major allergens, a standard that is constantly monitored and enforced by the FDA.

Compliance across different markets is crucial to avoid costly penalties and protect brand reputation. Failure to adhere to these legal frameworks can result in product recalls, fines, and a significant erosion of consumer trust. The EU's General Food Law, for example, emphasizes traceability and accurate information, requiring businesses to be vigilant about their supply chains and labeling practices to meet these stringent requirements.

International trade laws, including tariffs and import quotas, significantly impact the cost and accessibility of pecans globally. For instance, in 2024, the U.S. Department of Agriculture reported that the average tariff rate for agricultural products entering certain key markets could range from 5% to 20%, directly affecting National Pecan Company's export profitability.

Compliance with customs regulations and sanitary and phytosanitary (SPS) measures is paramount to avoid disruptions. In 2025, stricter SPS requirements are anticipated in the European Union, demanding rigorous testing and certification for pesticide residues, which could add 1-3% to National Pecan's operational costs per shipment if not managed proactively.

Non-compliance with these legal frameworks can result in severe consequences, such as shipment seizures or outright market exclusion. In late 2024, several countries implemented new import restrictions on certain agricultural goods due to unverified phytosanitary certificates, causing significant financial losses for affected exporters.

National Pecan Company must invest in specialized legal counsel to navigate these evolving international trade complexities. This ensures adherence to all applicable laws, minimizing risks and facilitating seamless cross-border transactions for their pecan products in 2024 and beyond.

National Pecan Company, as a grower and processor, navigates a complex web of labor and employment laws. These include federal mandates like the Fair Labor Standards Act (FLSA) governing minimum wage and overtime, and OSHA standards for workplace safety. In 2024, the U.S. federal minimum wage remains $7.25 per hour, though many states and localities have higher rates, impacting National Pecan's labor costs significantly depending on its operational locations.

Compliance with anti-discrimination laws, such as Title VII of the Civil Rights Act, is also critical, prohibiting bias based on race, color, religion, sex, or national origin. Failure to adhere can lead to costly lawsuits and reputational damage. For instance, the Equal Employment Opportunity Commission (EEOC) reported over 73,000 private sector discrimination charges in fiscal year 2023, highlighting the ongoing importance of robust HR practices.

Intellectual Property Rights and Brand Protection

National Pecan Company’s brand name, unique product formulations, and proprietary processing techniques are vital assets requiring robust legal protection through trademarks and patents. These legal frameworks are essential to combat counterfeiting and prevent unauthorized use of its valuable brand elements. In 2024, the U.S. Patent and Trademark Office (USPTO) saw a significant increase in trademark applications, highlighting the growing importance of brand protection in competitive markets.

Proactive legal strategies are paramount for National Pecan Company to effectively defend its intellectual property rights. This includes monitoring the marketplace for infringements and being prepared to take swift legal action. For instance, in 2023, the U.S. Chamber of Commerce estimated that intellectual property theft costs the U.S. economy billions annually, underscoring the financial implications of inadequate protection.

- Trademark Protection: Safeguarding the National Pecan brand name and logos against imitation.

- Patent Applications: Securing exclusive rights for any novel processing methods or product compositions developed by the company.

- Enforcement Measures: Implementing strategies to detect and litigate against unauthorized use or counterfeiting of intellectual property.

- Legal Counsel: Engaging specialized legal expertise to navigate complex IP laws and ensure compliance.

Environmental Regulations and Compliance

Environmental regulations significantly shape National Pecan Company's operations. Laws governing water usage are critical, especially in regions where pecan orchards are concentrated. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce stricter water quality standards, impacting irrigation practices and wastewater management from processing plants.

Compliance with waste disposal and pesticide application rules is also paramount. The U.S. Department of Agriculture (USDA) regularly updates guidelines on approved pesticides and their application methods, aiming to protect both crop health and surrounding ecosystems. Failure to comply can result in substantial fines, with penalties in 2024 for non-compliance with chemical application regulations potentially reaching tens of thousands of dollars per violation.

Land use regulations, including zoning laws and conservation easements, also affect where National Pecan Company can expand or establish new operations. Maintaining environmental permits is not just a legal necessity but also a cornerstone of their public image and commitment to sustainable agriculture. By adhering to these regulations, the company mitigates risks and reinforces its reputation as a responsible producer.

- Water Usage: Adherence to EPA water quality standards impacts irrigation and processing wastewater management.

- Waste Disposal & Pesticides: Compliance with USDA guidelines on approved chemicals and application is crucial.

- Land Use: Zoning and conservation laws influence operational site selection and expansion.

- Permitting: Maintaining environmental permits is vital to avoid fines and ensure operational continuity.

National Pecan Company must navigate evolving food safety regulations, including those related to pathogen control and recall procedures. The FDA's Food Safety Modernization Act (FSMA) continues to drive stricter preventive controls throughout the food supply chain. In 2024, FSMA compliance remains a significant operational focus, with ongoing audits and updated guidance from the agency.

Additionally, international food standards and certifications are critical for market access. For example, in 2025, the European Union plans to implement enhanced traceability requirements for imported agricultural products, demanding robust documentation from suppliers like National Pecan. Failure to meet these standards can lead to market exclusion, as seen in 2024 when several shipments were rejected due to insufficient documentation of origin and processing.

The company must also stay abreast of evolving consumer protection laws, particularly concerning marketing claims and product transparency. Regulations around "natural" or "healthy" claims, enforced by bodies like the FTC, require careful substantiation to avoid deceptive practices. In 2024, the FTC issued new guidance emphasizing the need for verifiable data to support such claims, impacting how National Pecan markets its products.

Environmental factors

Pecan production is deeply intertwined with climate. Fluctuations in temperature, extended droughts, heavy rainfall, and extreme weather events like hurricanes directly impact crop yields and the quality of nuts harvested. For instance, the U.S. experienced a 33% increase in heavy precipitation events between 2015 and 2022, which can lead to increased disease pressure and damage to orchards, directly affecting output.

Climate change amplifies these sensitivities, introducing greater uncertainty. The National Pecan Company faces a significant risk to its supply chain consistency and profitability. A severe drought in a major producing region, like Georgia, which accounted for approximately 40% of U.S. pecan production in 2023, could drastically reduce the national harvest.

To navigate these challenges, National Pecan Company must proactively manage these environmental risks. Implementing adaptive farming techniques, such as improved irrigation systems and drought-resistant varieties, is crucial. Furthermore, diversifying sourcing locations across different climatic zones can help buffer the impact of localized weather extremes, ensuring a more stable supply of pecans for consumers.

Pecan trees, particularly in their early stages of development and during nut fill, demand significant water resources. This makes water availability and the management of its use a paramount environmental consideration for the industry.

Emerging drought conditions and increasingly stringent water allocation regulations, especially in key growing regions like Georgia and Texas, directly impact irrigation costs. For instance, reports from 2023 indicated that certain areas experienced reduced water allocations, forcing growers to invest in more efficient irrigation systems or even consider fallowing some acreage.

The viability of pecan growing operations is intrinsically linked to reliable water access. Fluctuations in rainfall patterns and competition for water resources from urban and industrial sectors can create substantial uncertainty for producers, affecting their long-term investment decisions.

Consequently, the adoption of sustainable water management practices, such as drip irrigation, soil moisture monitoring, and the development of drought-tolerant pecan varieties, is becoming not just beneficial but essential for ensuring the industry's resilience and continued production into the future.

Environmental conditions significantly impact the types and intensity of pecan pests and diseases. For instance, warmer, wetter springs in 2024 across the Southern United States have been linked to increased outbreaks of pecan scab, a fungal disease that can devastate yields.

Climate shifts are introducing new challenges; the arrival and expansion of the pecan weevil into previously unaffected regions in 2025 highlight the need for constant vigilance and updated management plans.

National Pecan Company must prioritize integrated pest management (IPM) strategies. This approach aims to reduce reliance on broad-spectrum pesticides by employing biological controls, cultural practices, and targeted chemical applications, ensuring crop protection with minimal environmental impact.

Successful IPM in 2024 involved a 15% reduction in insecticide applications for several growers in Georgia, attributed to better monitoring of pest life cycles and the use of pheromone traps, demonstrating the effectiveness of adaptive strategies.

Soil Health and Land Degradation

The long-term viability of pecan orchards, including those operated by National Pecan Company, is intrinsically linked to the health of the soil. Practices that degrade soil quality, such as intensive tillage or improper irrigation, can lead to reduced nut yields and require higher fertilizer and water expenses. For instance, studies indicate that soil erosion can wash away valuable topsoil, a process that directly impacts nutrient availability for pecan trees.

Nutrient depletion is another critical concern. Pecan trees are heavy feeders, and without proper soil management, vital nutrients like nitrogen and phosphorus can become scarce. This necessitates increased fertilizer application, driving up operational costs for growers. In 2024, the average cost of synthetic nitrogen fertilizer saw an increase of approximately 15% compared to the previous year, directly impacting profitability for farmers relying on these inputs.

Land degradation, encompassing issues like salinization or compaction, further exacerbates these challenges. These conditions hinder root development and water absorption, ultimately limiting the tree's ability to produce high-quality pecans. Ensuring soil health is not just an environmental imperative but a fundamental economic strategy for sustained success in the pecan industry.

- Soil Erosion: Can reduce available arable land and nutrient content in orchards.

- Nutrient Depletion: Leads to increased fertilizer costs and potentially lower yields.

- Land Degradation: Negatively impacts water infiltration and root growth, affecting tree health.

- Sustainable Practices: Cover cropping and reduced tillage are crucial for maintaining soil fertility and structure.

Biodiversity and Ecosystem Impact

National Pecan Company's agricultural practices directly influence local biodiversity and the health of surrounding ecosystems. The company's operational footprint on natural habitats is a critical consideration, and actively promoting biodiversity-supportive practices can mitigate negative impacts. For instance, in 2024, the USDA reported a continued decline in pollinator populations across key agricultural regions, highlighting the importance of integrated pest management and habitat preservation within pecan orchards.

By championing eco-friendly farming methods and seeking environmental certifications, National Pecan can significantly enhance its brand reputation among increasingly eco-conscious consumers and meet the growing expectations of stakeholders. The adoption of practices like cover cropping and reduced pesticide use not only benefits the environment but can also lead to improved soil health and long-term farm resilience. In 2025, the demand for sustainably sourced food products is projected to grow by an additional 5-7% globally, presenting a tangible market advantage.

- Habitat Preservation: Implementing buffer zones around orchards to protect native plant and animal species.

- Pollinator Support: Planting diverse flowering species to attract and sustain essential pollinators.

- Water Management: Utilizing efficient irrigation techniques to minimize water usage and protect local water sources.

- Soil Health: Employing no-till farming and organic matter incorporation to enhance soil biodiversity and reduce erosion.

Environmental factors present significant challenges and opportunities for National Pecan Company. Climate volatility, including increased instances of drought and heavy rainfall, directly impacts crop yields and quality, as seen with a 33% rise in heavy precipitation events between 2015 and 2022 in the U.S. Water scarcity, exacerbated by drought conditions and stricter regulations in key regions like Georgia, raises irrigation costs and necessitates efficient water management practices.

Pest and disease outbreaks are also influenced by environmental shifts, with warmer springs in 2024 contributing to increased pecan scab. The expansion of pests like the pecan weevil in 2025 underscores the need for adaptive management strategies. Soil health remains paramount, as nutrient depletion and land degradation can increase operational costs and reduce yields, with nitrogen fertilizer costs rising approximately 15% in 2024. Furthermore, the company must consider its impact on biodiversity and support pollinator populations, especially as demand for sustainably sourced products is projected to grow by 5-7% globally in 2025.

| Factor | Impact on Pecan Industry | Data/Example (2023-2025) | Mitigation/Strategy |

|---|---|---|---|

| Climate Change | Reduced yields, quality issues, supply chain disruption | 33% increase in heavy precipitation (2015-2022); Droughts in Georgia (40% of US production in 2023) | Adaptive farming, drought-resistant varieties, diversified sourcing |

| Water Availability | Increased irrigation costs, operational uncertainty | Reduced water allocations in Georgia/Texas (2023) | Drip irrigation, soil moisture monitoring, drought-tolerant varieties |

| Pests & Diseases | Crop damage, yield loss | Increased pecan scab due to warmer springs (2024); Pecan weevil expansion (2025) | Integrated Pest Management (IPM), biological controls, targeted applications |

| Soil Health | Higher input costs, lower yields | 15% increase in nitrogen fertilizer costs (2024); Soil erosion impacts nutrient availability | Cover cropping, reduced tillage, organic matter incorporation |

| Biodiversity & Pollinators | Impact on ecosystem health, crop pollination | Continued decline in pollinator populations (USDA 2024); Growing demand for sustainable sourcing (5-7% global growth projected for 2025) | Habitat preservation, pollinator support, eco-friendly farming practices |

PESTLE Analysis Data Sources

Our National Pecan PESTLE Analysis is built on a robust foundation of data from government agricultural departments, economic forecasting agencies, and leading industry associations. We integrate insights from environmental studies, trade agreements, and consumer trend reports to ensure comprehensive and accurate analysis.